United States

Securities and Exchange Commission

Washington, DC 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 0-10653

UNITED STATIONERS INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware | | 36-3141189 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

One Parkway North Boulevard

Suite 100

Deerfield, Illinois 60015-2559

(847) 627-7000

(Address, Including Zip Code and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to

Section 12(b) of the Act:

Common Stock, $0.10 par value per share | | Name of Exchange on which registered:

NASDAQ Global Select Market |

(Title of Class) | | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 and Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the common stock of United Stationers Inc. held by non-affiliates as of June 30, 2014 was approximately $1.468 billion.

On February 13, 2015, United Stationers Inc. had 38,563,203 shares of common stock outstanding.

Documents Incorporated by Reference:

Certain portions of United Stationers Inc.’s definitive Proxy Statement relating to its 2015 Annual Meeting of Stockholders, to be filed within 120 days after the end of United Stationers Inc.’s fiscal year, are incorporated by reference into Part III.

UNITED STATIONERS INC.

FORM 10-K

For The Year Ended December 31, 2014

TABLE OF CONTENTS

PART I

General

United Stationers Inc. is a leading national wholesale distributor of workplace essentials, with consolidated net sales of $5.3 billion. United stocks a broad assortment of over 160,000 products, including technology products, traditional office products, office furniture, janitorial and breakroom supplies, industrial supplies, and automotive aftermarket tools and equipment. The Company’s network of 77 distribution centers allows it to ship products to approximately 30,000 reseller customers, enabling the Company to ship most products overnight to more than 90% of the U.S. and next day delivery to major cities in Mexico and Canada. The Company also has operations in Dubai, United Arab Emirates (UAE). The Company also operates as an online retailer which sells direct to end consumers.

Our strategy is comprised of three key elements:

1) Strengthen our core office, janitorial, and breakroom business with a common operating and IT platform, an aligned customer care and sales team, and advanced digital services,

2) Win online by growing our business-to-business (B2B) sales with major e-commerce players and enabling the online success of our resellers by providing digital capabilities and tools to support them, and

3) Expand and diversify our business into higher growth and higher margin channels and categories.

Execution on these priorities will allow us to become the fastest and most convenient solution for workplace essentials.

Except where otherwise noted, the terms “United” and “the Company” refer to United Stationers Inc. and its consolidated subsidiaries. The parent holding company, United Stationers Inc. (USI), was incorporated in 1981 in Delaware. USI’s only direct wholly owned subsidiary—and its principal operating company—is United Stationers Supply Co. (USSC), incorporated in 1922 in Illinois.

Products

United stocks over 160,000 products in these categories:

Janitorial and Breakroom Supplies. United is a leading wholesaler of janitorial and breakroom supplies throughout the nation. The Company holds over 25,000 items in these lines: janitorial supplies (cleaners and cleaning accessories), breakroom items (food and beverage products), foodservice consumables (such as disposable cups, plates and utensils), safety and security items, and paper and packaging supplies. This product category provided about 27.2% of 2014’s net sales primarily from Lagasse, LLC (Lagasse), a wholly owned subsidiary of USSC.

Technology Products. The Company is a leading national wholesale distributor of computer supplies and peripherals. It stocks over 10,000 items, including imaging supplies, data storage, digital cameras, computer accessories and computer hardware items such as printers and other peripherals. United provides these products to value-added computer resellers, office products dealers, drug stores, grocery chains and e-commerce merchants. Technology products generated about 27.0% of the Company’s 2014 consolidated net sales.

Traditional Office Products. The Company is one of the largest national wholesale distributors of a broad range of office supplies. It carries approximately 23,000 brand-name and private label products, such as filing and record storage products, business machines, presentation products, writing instruments, paper products, shipping and mailing supplies, calendars and general office accessories. These products contributed approximately 25.0% of net sales during 2014.

Industrial Supplies. United is a leading wholesaler of industrial supplies in the United States and stocks over 100,000 items including hand and power tools, safety and security supplies, janitorial equipment and supplies, other various industrial MRO (maintenance, repair and operations) items and oil field and welding supplies. With the October 31st, 2014 acquisition of Liberty Bell Equipment Corp., a United States wholesaler of automotive aftermarket tools and supplies, and its affiliates (collectively, MEDCO) including G2S Equipment de Fabrication et d’Entretien ULC, a Canadian wholesaler, United now stocks automotive aftermarket tools and equipment. In 2014, the industrial category accounted for approximately 12.0% of the Company’s net sales.

Office Furniture. United is one of the largest office furniture wholesaler distributors in the nation. It stocks approximately 4,000 products including desks, filing and storage solutions, seating and systems furniture, along with a variety of products for niche markets such as education, government, healthcare and professional services. This product category represented approximately 5.8% of net sales for the year.

1

The remainder of the Company’s consolidated net sales came from freight, advertising and software related revenue.

United offers private brand products within each of its product categories to help resellers provide quality value-priced items to their customers. These include Innovera® technology products, Universal® office products, Windsoft® paper products, Boardwalk® and UniSan® janitorial and sanitation products, Alera® office furniture, and Anchor Brand® and Best Welds® welding, industrial, safety and oil field pipeline products.

During 2014, private brand products accounted for approximately 16.0% of United’s net sales.

Customers

United serves a diverse group of approximately 30,000 reseller customers. They include independent office products dealers; contract stationers; office products superstores; computer products resellers; office furniture dealers; mass merchandisers; mail order companies; sanitary supply, paper and foodservice distributors; drug and grocery store chains; healthcare distributors; e-commerce merchants; oil field, welding supply and industrial/MRO distributors; automotive aftermarket dealers and wholesalers; and other independent distributors. One customer, W.B. Mason Co., Inc., accounted for approximately 12% of its 2014 consolidated net sales. No other single customer accounted for more than 10% of 2014 consolidated net sales.

Sales to independent resellers contributed 88% of consolidated net sales. The Company provides its reseller customers with value-added services designed to help them market their products and services while improving operating efficiencies and reducing costs. National accounts comprised 12% of the Company’s 2014 consolidated net sales.

Many of our resellers have online capabilities. The Company also operates as an online retailer which sells direct to end consumers.

Marketing and Customer Support

United’s marketing and customer care capabilities provide value-added services to resellers. The Company provides comprehensive printed catalogs for easy shopping and reference guides to more promotional materials. Extensive digital content and capabilities are provided to better position resellers on the internet. This ranges from a content database digitized for e-commerce to advanced eBusiness capabilities, website development, analytics and digital promotional campaigns. An important component of the value proposition is that the Company produces the printed and digital items on behalf of resellers and collects fees and/or advertising revenue from resellers in return.

United also provides specific services that enable resellers to improve their business model. These services include primary research efforts, brand strategy and development, campaign development, customer segmentation and cost management, and training programs designed to help resellers improve their sales and marketing techniques.

Distribution

United’s distribution network enables the Company to ship most products on an overnight basis to more than 90% of the U.S. and next day delivery to major cities in Mexico and Canada, with an average line fill rate of approximately 97%. United’s domestic operations generated approximately $5.1 billion of its approximate $5.3 billion in 2014 consolidated net sales, with its international operations contributing another $0.2 billion to 2014 net sales. Efficient order processing resulted in a 99.7% order accuracy rate for the year.

The Company’s network of 77 distribution centers are spread across the nation to facilitate delivery. United has a dedicated fleet of approximately 475 trucks. This enables United to make direct deliveries to resellers from regional distribution centers and local distribution points.

The “Wrap and Label” program is another important service for resellers. It gives resellers the option to receive individually packaged orders ready to be delivered to their end consumers. For example, when a reseller places orders for several individual consumers, United can pick and pack the items separately, placing a label on each package with the consumer’s name, ready for delivery to the end consumer by the reseller. Resellers benefit from the “Wrap and Label” program because it eliminates the need to break down bulk shipments and repackage orders before delivering them to consumers.

In addition to providing value-adding programs for resellers, United also remains committed to reducing its operating costs. These activities include process improvement and work simplification activities that help increase efficiency throughout the business and improve customer satisfaction.

2

Purchasing and Merchandising

As a leading wholesale distributor of workplace essentials, United leverages its broad product selection as a key merchandising strategy. The Company orders products from approximately 1,600 manufacturers. Based on United’s purchasing volume it receives substantial supplier allowances and can realize significant economies of scale in its logistics and distribution activities. In 2014, the Company’s largest supplier was Hewlett-Packard Company, which represented approximately 16% of the Company’s total purchases.

The Company’s merchandising department is responsible for selecting merchandise and for managing the entire supplier relationship. Product selection is based on three factors: end-consumer acceptance; anticipated demand for the product; and the manufacturer’s total service, price and product quality.

Competition

The markets in which the Company competes are highly competitive. The Company competes with other wholesale distributors and with the manufacturers of the products the Company sells. In addition, the Company competes with warehouse clubs and the business-to-business sales divisions of national business products resellers. United competes primarily on the basis of breadth of product lines, availability of products, speed of delivery, order fill rates, net pricing to customers, and the quality of marketing and other value-added services.

Seasonality

United’s sales generally are relatively steady throughout the year. However, sales also reflect seasonal buying patterns for consumers of traditional office products. In particular, the Company’s sales of traditional office products usually are higher than average during January, when many businesses begin operating under new annual budgets and release previously deferred purchase orders. Janitorial and breakroom supplies and industrial supplies sales are somewhat higher in the summer months.

Employees

As of February 13, 2015, United employed approximately 6,500 people.

Management believes it has good relations with its associates. Approximately 539 of the shipping, warehouse and maintenance associates at certain of the Company’s Baltimore, Los Angeles and New Jersey distribution centers are covered by collective bargaining agreements. The bargaining agreements in the Los Angeles and New Jersey distribution centers were renegotiated in 2014. The bargaining agreement in Baltimore is scheduled to be renegotiated in August 2015. Additionally, the Company’s warehouse employees in Mexico are covered by a collective bargaining agreement.

3

Executive Officers Of The Registrant

The executive officers of the Company are as follows:

Name, Age and

Position with the Company | | Business Experience |

P. Cody Phipps

53, President and Chief Executive Officer | | P. Cody Phipps was promoted to Chief Executive Officer in May 2011. Prior to that time he served as the Company’s President and Chief Operating Officer from September 2010 and as the Company’s President, United Stationers Supply from October 2006 to September 2010. He joined the Company in August 2003 as its Senior Vice President, Operations. Prior to joining the Company, Mr. Phipps was a partner at McKinsey & Company, Inc., a global management consulting firm where he led the firm’s North American Operations Effectiveness Practice and co-founded and led its Service Strategy and Operations Initiative. Prior to joining McKinsey, Mr. Phipps worked as a consultant with The Information Consulting Group, a systems consulting firm, and as an IBM account marketing representative. |

| |

Todd A. Shelton

48, Senior Vice President and Chief Financial Officer | | Todd A. Shelton was appointed Senior Vice President and Chief Financial Officer in August 2013. Prior to that, Mr. Shelton served as President, United Stationers Supply from September 2010 and President of Lagasse, Inc., a wholly-owned subsidiary of United Stationers Supply Co. Mr. Shelton previously held the position of Chief Operating Officer of Lagasse after joining in 2001 as Vice President, Finance and has held various leadership roles in sales, customer service, operations, and procurement. Before joining Lagasse, Mr. Shelton was a Partner and Vice President at a privately-held manufacturer of retail and medical products. He began his career at Baxter Healthcare with roles in finance, IT, sales and marketing. |

| |

Eric A. Blanchard

58, Senior Vice President, General Counsel and Secretary | | Eric A. Blanchard has served as the Company’s Senior Vice President, General Counsel and Secretary since January 2006. From November 2002 until December 2005, he served as the Vice President, General Counsel and Secretary at Tennant Company. Previously Mr. Blanchard was with Dean Foods Company where he held the positions of Chief Operating Officer, Dairy Division from January 2002 to October 2002, Vice President and President, Dairy Division from 1999 to 2002 and General Counsel and Secretary from 1988 to 1999. |

| |

Timothy P. Connolly

51, President, Business Transformation and Supply Chain | | Timothy P. Connolly was named as the Company’s President, Business Transformation and Supply Chain in October 2013. Prior to this position he served as President, Operations and Logistics Services from January 2011 to October 2013. He also previously served as Senior Vice President, Operations from December 2006 until January 2011. From February 2006 to December 2006, Mr. Connolly was Vice President, Field Operations Support and Facility Engineering. He joined the Company in August 2003 as Region Vice President Operations, Midwest. Before joining the Company, Mr. Connolly was the Regional Vice President, Midwest Region for Cardinal Health where he directed operations, sales, human resources, finance, and customer service for one of Cardinal’s largest pharmaceutical distribution centers. |

| |

Carole Tomko

60, Senior Vice President, Chief Human Resources Officer | | Carole W. Tomko has served as the Company’s Senior Vice President, Chief Human Resources Officer since May 2014. Previously Ms. Tomko was a partner in The Woodmansee Group, an executive search consultancy and human resources consulting firm. Prior to launching her consulting practice, Ms. Tomko held a variety of critical Human Resource leadership positions with Federated Department Stores, The Standard Register Company, The Chemlawn Corporation and Cardinal Health where she led the human resources function. |

4

Name, Age and

Position with the Company | | Business Experience |

| | |

Paul Barrett 56, Chief Operating Officer, Industrial | | Paul Barrett was appointed Chief Operating Officer (COO) of the Company’s Industrial business (including ORS and MEDCO) in August 2014. Mr. Barrett joined USI’s Lagasse business in April of 2007 as Vice President, Sales & Customer Service. In October 2010, he was promoted to President of Lagasse. Prior to joining Lagasse, Mr. Barrett served from May 2003 to March 2007 as Senior Vice President & General Manager of Socrates Media, a venture capital owned multi-media print and internet business. Prior to joining Socrates Media, Mr. Barrett was Group Vice President Marketing and Strategy for APAC Customer Services. Prior to joining APAC, Mr. Barrett spent over seventeen years in positions of increasing responsibility in Sales, Marketing and General management with ACCO World Corporation, the Office Products division of Fortune Brands. |

| | |

Joseph G. Hartsig 51, Senior Vice President, Chief Merchandising Officer | | Joseph G. Hartsig joined the Company in November 2013 as Senior Vice President, Merchandising. Prior to joining United Stationers, he was General Merchandising Manager at Sam’s Club, the wholesale club division of Wal-mart, Inc. Prior to joining Sam’s Club, Mr. Hartsig was a Vice President at Motorola, where he spent eight years in consumer technology product management and sales capacities in Illinois and overseas. Previous to Motorola, Mr. Hartsig held various management and marketing positions with Conagra Foods, Inc., Pillsbury, and S.C. Johnson. |

| |

Richard D. Phillips, 44, President, Online and New Channels | | Richard D. Phillips joined the Company in January 2013 as President, Online and New Channels. Prior to joining the Company, Mr. Phillips spent 14 years at McKinsey & Company, where he was elected Partner in 2005. Prior to joining McKinsey, he spent six years at Baxter Healthcare in finance and sales. |

Executive officers are elected by the Board of Directors. Except as required by individual employment agreements between executive officers and the Company, there exists no arrangement or understanding between any executive officer and any other person pursuant to which such executive officer was elected. Each executive officer serves until his or her successor is appointed and qualified or until his or her earlier removal or resignation.

Availability of the Company’s Reports

The Company’s principal Web site address is www.unitedstationers.com. This site provides United’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as amendments and exhibits to those reports filed or furnished under Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) for free as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). In addition, copies of these filings (excluding exhibits) may be requested at no cost by contacting the Investor Relations Department:

United Stationers Inc.

Attn: Investor Relations Department

One Parkway North Boulevard

Suite 100

Deerfield, IL 60015-2559

Telephone: (847) 627-7000

E-mail: IR@ussco.com

5

Any of the risks described below could have a material adverse effect on the Company’s business, financial condition or results of operations. These risks are not the only risks facing United; the Company’s business operations could also be materially adversely affected by risks and uncertainties that are not presently known to United or that United currently deems immaterial.

Demand for office products may continue to decline.

The overall demand for certain office products may continue to weaken as consumers increasingly create, share, and store documents electronically, without printing or filing them. If demand continues to decline and United is unable to offset lower aggregate demand by increasing market share for these products, finding new markets for these products, increasing sales of products in other categories, and reducing expenses, the Company’s results of operations and financial condition may be adversely affected.

The loss of one or more significant customers could significantly reduce United’s revenues and profitability.

In 2014 United’s largest customer accounted for approximately 12.0% of net sales and United’s top five customers accounted for approximately 28.1% of net sales. Several of United’s current and potential customers were involved in business combinations in 2014 and the Company expects increased customer consolidation in the future. In February 2015 two of United’s five largest customers announced they intend to merge. Following business combinations, the surviving companies often conduct “requests for proposal” or engage in other supplier reviews, which can result in the companies altering their sourcing relationships. Increasing direct purchases by major customers from manufacturers, as well as the loss of one or more key customers, changes in the sales mix or sales volume to key customers, or a significant downturn in the business or financial condition of any of them could significantly reduce United’s sales and profitability.

United’s operating results depend on employment rates and the strength of the general economy.

The customers that United serves are affected by changes in economic conditions outside the Company’s control, including national, regional, and local slowdowns in general economic activity and job markets. Demand for the products and services the Company offers, particularly in the office product, technology, and furniture categories, is affected by the number of white collar and other workers employed by the businesses United’s customers serve. The persistent high unemployment rates over the last several years have adversely affected United’s results of operations. If employment rates decline, do not grow, or continue to grow at a slow rate, demand for the products the Company sells could be adversely affected.

United may not achieve its growth, cost-reduction, and margin enhancement goals.

United has set goals to improve its profitability over time by reducing expenses, growing sales to existing and new customers, and increasing sales of higher margin products as a percentage of total sales. There can be no assurance that United will achieve its enhanced profitability goals. Factors that could have a significant effect on the Company’s efforts to achieve these goals include the following:

· | Failure to achieve the Company’s revenue and margin growth objectives in its sales channels and product categories; |

· | Impact on sales and margins from competitive pricing pressures and customer consolidation; |

· | Failure to maintain or improve the Company’s sales mix of higher margin products; |

· | Inability to pass along cost increases from United’s suppliers to its customers; |

· | Failure to increase sales of United’s private brand products; and |

· | Failure of customers to adopt the Company’s product pricing and marketing programs. |

United’s repositioning and restructuring activities may result in disruptions with suppliers and customers.

United is in the process of combining its United Stationers Supply division business and its Lagasse, LLC business onto a common platform with common systems and processes. United also is commencing a repositioning and restructuring initiative that includes rebranding United and its major operating businesses, exiting non-strategic channels, reducing its workforce and consolidating some of its distribution facilities. United is implementing these changes to its structure, corporate brand, organization, business processes, and technology systems to address evolving customer and end-user preferences and needs. These activities could disrupt United’s relationships with customers and suppliers or could impair the Company’s ability to timely and accurately record transactions, which could adversely affect the Company’s results of operations and financial condition.

6

United’s reliance on supplier allowances and promotional incentives could impact profitability.

Supplier allowances and promotional incentives that are often based on volume contribute significantly to United’s profitability. If United does not comply with suppliers’ terms and conditions, or does not make requisite purchases to achieve certain volume hurdles, United may not earn certain allowances and promotional incentives. Additionally, suppliers may reduce the allowances they pay United if they conclude that the value United creates does not justify the allowances. If United’s suppliers reduce or otherwise alter their allowances or promotional incentives, United’s profit margin for the sale of the products it purchases from those suppliers may decline. The loss or diminution of supplier allowances and promotional support could have an adverse effect on the Company’s results of operations.

United relies on independent resellers for a significant percentage of its net sales.

Sales to independent resellers account for a significant portion of United’s net sales. Independent resellers compete with national distributors and retailers that have substantially greater financial resources and technical and marketing capabilities. Financial and technical constraints are increasingly challenging as business increasingly shifts online. Over the years, several of the Company’s independent reseller customers have been acquired by competitors or have ceased operation. If United’s customer base of independent resellers declines, the Company’s business and results of operations may be adversely affected.

United operates in a competitive environment.

The Company operates in a competitive environment. The Company competes with other wholesale distributors and with the manufacturers of the products the Company sells. In addition, the Company competes with warehouse clubs and the business-to-business sales divisions of national business products resellers. Competition is based largely upon service capabilities and price, as the Company’s competitors generally offer products that are the same as or similar to the products the Company offers to the same customers or potential customers. These competitive pressures are exacerbated by the ongoing decline in the overall demand for office products. The competitive arena is also increasingly shifting online. The Company’s financial condition and results of operations depend on its ability to compete effectively on price, product selection and availability, marketing support, logistics, and other ancillary services; diversify its product offering; and provide services and capabilities that enable its customers to succeed online.

Supply chain disruptions or changes in key suppliers’ distribution strategies could decrease United’s revenues and profitability.

United believes its ability to offer a combination of well-known brand name products, competitively priced private brand products, and support services is an important factor in attracting and retaining customers. The Company’s ability to offer a wide range of products and services is dependent on obtaining adequate product supply and services from manufacturers or other suppliers. United’s agreements with its suppliers are generally terminable by either party on limited notice. The loss of, or a substantial decrease in the availability of products or services from key suppliers at competitive prices could cause the Company’s revenues and profitability to decrease. In addition, supply interruptions could arise due to transportation disruptions, labor disputes or other factors beyond United’s control. Disruptions in United’s supply chain could result in a decrease in revenues and profitability.

Some manufacturers refuse to sell their products to wholesalers like United. Other manufacturers only allow United to sell their products to specified customers. If changes in key suppliers’ distribution strategies or practices reduce the breadth of products the Company is able to purchase or the number of customers to whom United can sell key products, the Company’s results of operations and financial condition could be adversely affected.

Many of the Company’s independent resellers use third party technology vendors (“3PVs”) to automate their business operations. The 3PVs play an important role in the independent dealer channel, as most purchase orders, order confirmations, stock availability checks, invoices, and advanced shipping notices are exchanged between United and its independent resellers over 3PV networks. The 3PVs also provide e-commerce portals that United’s customers use to transact online business with their customers. If United is unable to transact business with its customers through one or more 3PVs on terms that are acceptable to United, or if a 3PV fails to provide quality services to United’s customers, United’s business, financial condition, and results of operations could be adversely affected.

A significant disruption or failure of the Company’s information technology systems or in its design, implementation or support of the information technology systems and e-commerce services it provides to customers could disrupt United’s business, result in increased costs and decreased revenues, harm the Company’s reputation, and expose the Company to liability.

The Company relies on information technology in all aspects of its business, including managing and replenishing inventory, filling and shipping customer orders, and coordinating sales and marketing activities. Several of the Company’s software applications are legacy systems which the Company must periodically update, enhance, and replace. A significant disruption or failure of the Company’s existing information technology systems or in the Company’s development and implementation of new systems could put it at a competitive disadvantage and could adversely affect its results of operations.

7

United is exposed to the credit risk of its customers.

United extends credit to its customers. The failure of a significant customer or a significant group of customers to timely pay all amounts due United could have a material adverse effect on the Company’s financial condition and results of operations. The Company’s trade receivables are generally unsecured or subordinated to other lenders, and many of the Company’s customers are highly leveraged. The extension of credit involves considerable judgment and is based on management’s evaluation of a variety of factors, including customers’ financial condition and payment history, the availability of collateral to secure customers’ receivables, and customers’ prospects for maintaining or increasing their sales revenues. There can be no assurance that United has assessed and will continue to assess the creditworthiness of its existing or future customers accurately.

United must manage inventory effectively while minimizing excess and obsolete inventory.

To maximize supplier allowances and minimize excess and obsolete inventory, United must project end-consumer demand for over 160,000 items in stock. If United underestimates demand for a particular manufacturer’s products, the Company will lose sales, reduce customer satisfaction, and earn a lower level of allowances from that manufacturer. If United overestimates demand, it may have to liquidate excess or obsolete inventory at a price that would produce a lower margin, no margin, or a loss.

United is focusing on increasing its sales of private brand products. These products can present unique inventory challenges. United sources some of its private brand products overseas, resulting in longer order-lead times than for comparable products sourced domestically. These longer lead-times make it more difficult to forecast demand accurately and require larger inventory investments to support high service levels.

United may not be successful in identifying, consummating, and integrating future acquisitions.

Historically, part of United’s growth and expansion into new product categories or markets has come from targeted acquisitions. Going forward, United may not be able to identify attractive acquisition candidates or complete the acquisition of any identified candidates at favorable prices and upon advantageous terms. Furthermore, competition for attractive acquisition candidates may limit the number of acquisition candidates or increase the overall costs of making acquisitions. Acquisitions involve significant risks and uncertainties, including difficulties integrating acquired business systems and personnel with United’s business; the potential loss of key employees, customers or suppliers; the assumption of liabilities and exposure to unforeseen liabilities of acquired companies; the difficulties in achieving target synergies; and the diversion of management attention and resources from existing operations. Difficulties in identifying, completing or integrating acquisitions could impede United’s revenues, profitability, and net worth. In addition, some of the Company’s acquisitions have included foreign operations, and future acquisitions may increase United’s international presence. International operations present a variety of unique risks, including the costs and difficulties of managing foreign enterprises, limitations on the repatriation and investment of funds, currency fluctuations, cultural differences that affect customer preferences and business practices, and unstable political or economic conditions.

The security of private information United’s customers provide could be compromised.

Through United’s sales, marketing, and e-commerce activities, the Company collects and stores personally identifiable information and credit card data that customers provide when they buy products or services, enroll in promotional programs, or otherwise communicate with United. United also gathers and retains information about its employees in the normal course of business. United uses vendors to assist with certain aspects of United’s business and, to enable the vendors to perform services for United, the Company shares some of the information provided by customers and employees. Similarly, to enable United to provide goods and services to its customers, United’s customers share with United information their customers provide to them. Loss or breaches in security that result in disclosure of customer or business information by United or its vendors could disrupt the Company’s operations and expose United to claims from customers, financial institutions, regulators, payment card associations, and other persons, any of which could have an adverse effect on the Company’s business, financial condition, and results of operations. In addition, compliance with more stringent privacy and information security laws and standards may result in significant expense due to increased investment in technology and the development of new operational processes.

The Company is subject to costs and risks associated with laws, regulations, and industry standards affecting United’s business.

United is subject to a wide range of state, federal, and foreign laws and industry standards, including laws and standards regarding labor and employment, government contracting, product liability, the storage and transportation of hazardous materials, privacy and data security, imports and exports, tax, and intellectual property, as well as laws relating to the Company’s international operations, including the Foreign Corrupt Practices Act and foreign tax laws. These laws, regulations, and standards may change, sometimes significantly, as a result of political or economic events. The complex legal and regulatory environment exposes United to compliance and litigation costs and risks that could materially affect United’s operations and financial results.

8

United’s financial condition and results of operations depend on the availability of financing sources to meet its business needs.

The Company depends on various external financing sources to fund its operating, investing, and financing activities. The Company’s financing agreements include covenants by the Company to maintain certain financial ratios and comply with other obligations. If the Company violates a covenant or otherwise defaults on its obligations under a financing agreement, the Company’s lenders may refuse to extend additional credit, demand repayment of outstanding indebtedness, and terminate the financing agreements. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” included below under Item 7.

The Company’s primary external financing sources terminate or mature in three to six years. If the Company defaults on its obligations under a financing agreement or is unable to obtain or renew financing sources on commercially reasonable terms, its business and financial condition could be materially adversely affected.

The Company relies heavily on the ability to recruit, retain, and develop high-performing managers and the lack of execution in these areas could harm the Company’s ability to carry out its business strategy.

United’s ability to implement its business strategy depends largely on the efforts, skills, abilities, and judgment of the Company’s executive management team. United’s success also depends to a significant degree on its ability to recruit and retain sales and marketing, operations, and other senior managers. The Company may not be successful in attracting and retaining these employees, which may in turn have an adverse effect on the Company’s results of operations and financial condition.

Unexpected events could disrupt normal business operations, which might result in increased costs and decreased revenues.

Unexpected events, such as hurricanes, fire, war, terrorism, and other natural or man-made disruptions, may adversely impact United’s ability to serve its customers and increase the cost of doing business or otherwise impact United’s financial performance. In addition, damage to or loss of use of significant aspects of the Company’s infrastructure due to such events could have an adverse effect on the Company’s operating results and financial condition.

ITEM 1B. | UNRESOLVED COMMENT LETTERS. |

None.

The Company considers its properties to be suitable with adequate capacity for their intended uses. The Company evaluates its properties on an ongoing basis to improve efficiency and customer service and leverage potential economies of scale. As of December 31, 2014, the Company’s properties consisted of the following:

Offices. The Company leases approximately 205,000 square feet for its corporate headquarters in Deerfield, Illinois. Additionally the Company owns 49,000 square feet of office space in Orchard Park, New York and leases 58,000 square feet of office space in Tulsa, Oklahoma, and 10,000 square feet in Pasadena, California.

Distribution Centers. The Company utilizes 77 distribution centers totaling approximately 12.7 million square feet of warehouse space. Of the 12.7 million square feet of distribution center space, 2.1 million square feet are owned and 10.6 million square feet are leased.

ITEM 3. | LEGAL PROCEEDINGS. |

The Company is involved in legal proceedings arising in the ordinary course of or incidental to its business. The Company has established reserves, which are not material, for potential losses that are probable and reasonably estimable that may result from those proceedings. In many cases, however, it is difficult to determine whether a loss is probable or even possible or to estimate the amount or range of potential loss, particularly where proceedings may be in relatively early stages or where plaintiffs are seeking substantial or indeterminate damages. Matters frequently need to be more developed before a loss or range of loss can reasonably be estimated. The Company believes that pending legal proceedings will be resolved with no material adverse effect upon its financial condition or results of operations.

ITEM 4. | MINE SAFETY DISCLOSURE. |

Not applicable.

9

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Common Stock Information

USI’s common stock is quoted through the NASDAQ Global Select Market (“NASDAQ”) under the symbol USTR. The following table shows the high and low closing sale prices per share for USI’s common stock as reported by NASDAQ:

| | | | | | | |

| High | | | Low | |

2014 | | | | | | | |

First Quarter | $ | 45.88 | | | $ | 39.56 | |

Second Quarter | 42.18 | | | | 37.00 | |

Third Quarter | 42.49 | | | 37.57 | |

Fourth Quarter | 43.05 | | | 36.72 | |

| | | | | | | |

2013 | | | | | | | |

First Quarter | $ | 39.15 | | | $ | 31.86 | |

Second Quarter | 38.74 | | | | 31.50 | |

Third Quarter | | 43.90 | | | | 34.50 | |

Fourth Quarter | 46.02 | | | 42.24 | |

On February 13, 2015, the closing sale price of Company’s common stock as reported by NASDAQ was $44.16 per share. On February 13, 2015, there were approximately 698 holders of record of common stock. A greater number of holders of USI common stock are “street name” or beneficial holders, whose shares are held of record by banks, brokers and other financial institutions.

10

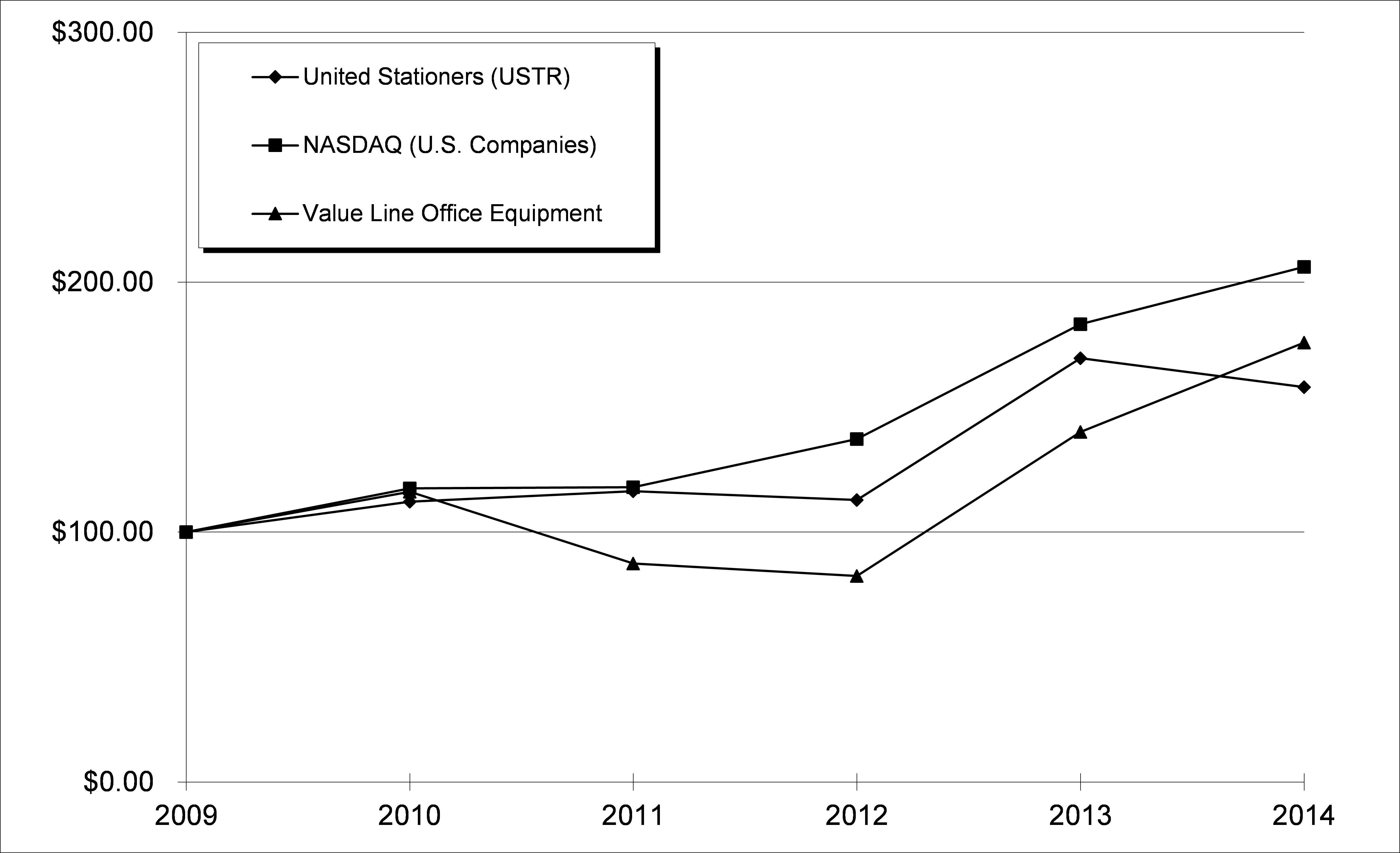

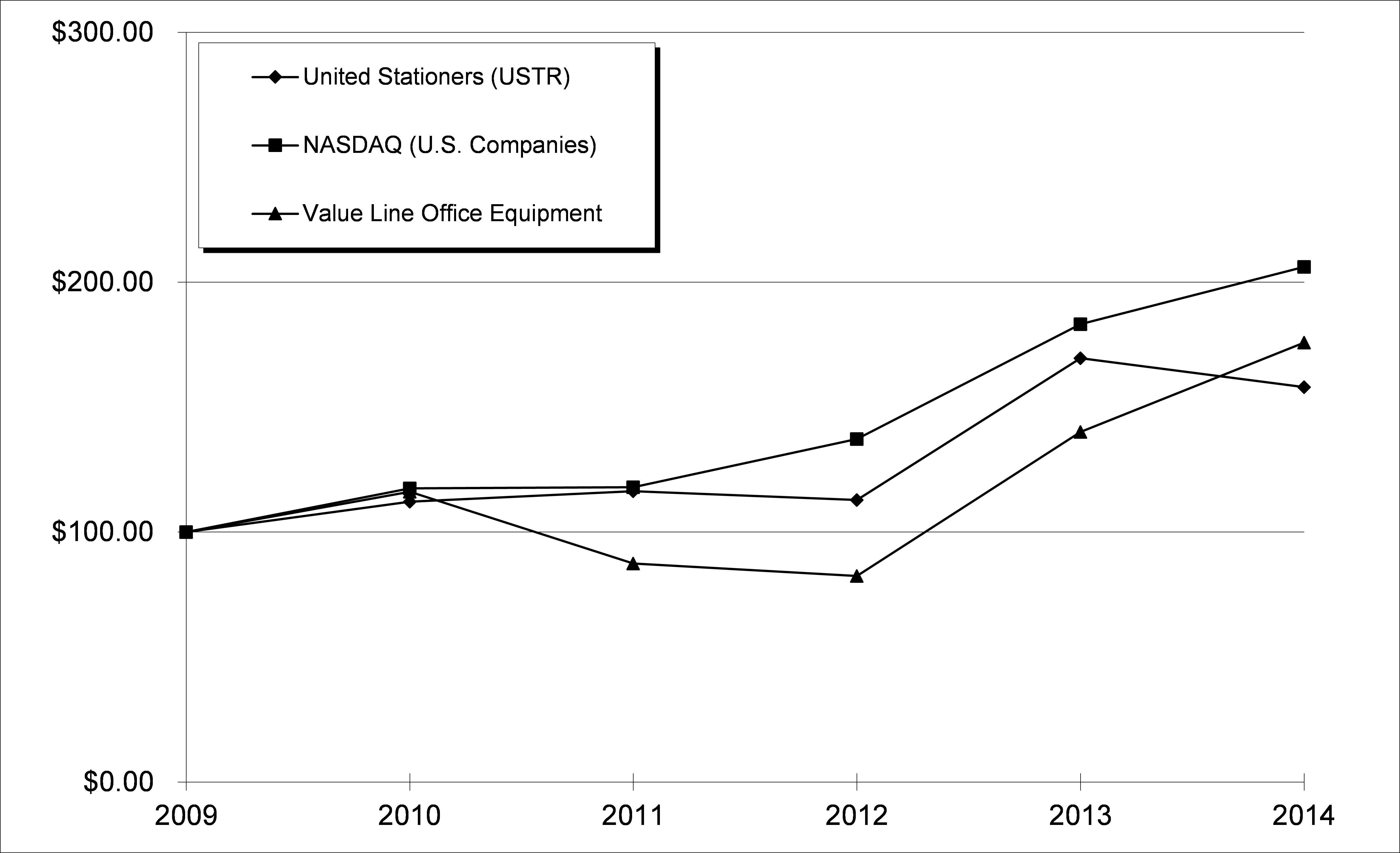

Stock Performance Graph

The following graph compares the performance of the Company’s common stock over a five-year period with the cumulative total returns of (1) The NASDAQ Stock Market Index (U.S. companies), and (2) a group of companies included within Value Line’s Office Equipment Industry Index. The graph assumes $100 was invested on December 31, 2009 in the Company’s common stock and in each of the indices and assumes reinvestment of all dividends (if any) at the date of payment. The following stock price performance graph is presented pursuant to SEC rules and is not meant to be an indication of future performance.

| | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | |

| | | | | | | | | | | | | | | | | | | |

United Stationers (USTR) | | $ | 100.00 | | $ | 112.18 | | $ | 116.38 | | $ | 112.88 | | $ | 169.62 | | $ | 157.98 | |

NASDAQ (U.S. Companies) | | $ | 100.00 | | $ | 117.55 | | $ | 117.91 | | $ | 137.29 | | $ | 183.25 | | $ | 206.09 | |

Value Line Office Equipment | | $ | 100.00 | | $ | 116.15 | | $ | 87.43 | | $ | 82.49 | | $ | 140.04 | | $ | 175.83 | |

Common Stock Repurchases

During 2014, the Company repurchased 1.3 million shares of common stock at an aggregate cost of $50.6 million. During 2013, the Company repurchased 1.7 million shares of common stock at an aggregate cost of $62.1 million. On February 11, 2015, the Board of Directors authorized the Company to purchase an additional $100 million of common stock. As of February 13, 2015, the Company had approximately $136.4 million remaining under share repurchase authorizations from its Board of Directors.

Purchases may be made from time to time in the open market or in privately negotiated transactions. Depending on market and business conditions and other factors, the Company may continue or suspend purchasing its common stock at any time without notice.

Acquired shares are included in the issued shares of the Company and treasury stock, but are not included in average shares outstanding when calculating earnings per share data.

11

The following table reports purchases of equity securities during the fourth quarter of fiscal year 2014 by the Company and any affiliated purchasers pursuant to SEC rules, including any treasury shares withheld to satisfy employee withholding obligations upon vesting of restricted stock and the execution of stock option exercises.

Period | | Total Number of Shares Purchased | | | Average Price Paid per Share | | | Total Number of Shares Purchased as Part of a Publicly Announced Program | | | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Program | |

October 1, 2014 to October 31, 2014 | | | - | | | $ | - | | | | - | | | $ | 50,000,029 | |

November 1, 2014 to November 30, 2014 | | | 72,867 | | | | 42.24 | | | | 72,867 | | | | 46,921,899 | |

December 1, 2014 to December 31, 2014 | | | 108,264 | | | | 41.35 | | | | 108,264 | | | | 42,445,422 | |

Total Fourth Quarter | | | 181,131 | | | $ | 41.71 | | | | 181,131 | | | $ | 42,445,422 | |

Stock and Cash Dividends

The Company declares and pays dividends on a quarterly basis. During 2013 and 2014, the Company declared and paid a dividend of $0.14 per share per quarter. In the aggregate, the Company declared dividends of $21.8M and $22.4M in 2014 and 2013, respectively.

Securities Authorized for Issuance under Equity Compensation Plans

The information required by Item 201(d) of Regulation S-K (Securities Authorized for Issuance under Equity Compensation Plans) is included in Item 12 of this Annual Report.

12

ITEM 6. | SELECTED FINANCIAL DATA. |

The selected consolidated financial data of the Company for the years ended December 31, 2010 through 2014 have been derived from the Consolidated Financial Statements of the Company, which have been audited by Ernst & Young LLP, an independent registered public accounting firm. The adoption of new accounting pronouncements, changes in certain accounting policies, and reclassifications are reflected in the financial information presented below. The selected consolidated financial data below should be read in conjunction with, and is qualified in its entirety by, Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Consolidated Financial Statements of the Company included in Items 7 and 8, respectively, of this Annual Report. Except for per share data, all amounts presented are in thousands:

| Years Ended December 31, | |

| 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010(4) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | |

Net sales | $ | 5,327,205 | | | $ | 5,085,293 | | | $ | 5,080,106 | | | $ | 5,005,501 | | | $ | 4,832,237 | |

Cost of goods sold | | 4,516,704 | | | | 4,295,715 | | | | 4,305,502 | | | | 4,265,422 | | | | 4,101,682 | |

Gross profit | | 810,501 | | | | 789,578 | | | | 774,604 | | | | 740,079 | | | | 730,555 | |

Operating expenses(1) | | | | | | | | | | | | | | | | | | | |

Warehousing, marketing and administrative expenses | | 592,050 | | | | 580,428 | | | | 573,693 | | | | 541,752 | | | | 520,754 | |

Loss on disposition of business | | 8,234 | | | | - | | | | - | | | | - | | | | - | |

Operating income | | 210,217 | | | | 209,150 | | | | 200,911 | | | | 198,327 | | | | 209,801 | |

Interest expense | | 16,234 | | | | 12,233 | | | | 23,619 | | | | 27,592 | | | | 26,229 | |

Interest income | | (500 | ) | | | (593 | ) | | | (343 | ) | | | (223 | ) | | | (237 | ) |

Other (income) expense, net(2) | | - | | | | - | | | | - | | | | (1,918 | ) | | | 809 | |

Income before income taxes | | 194,483 | | | | 197,510 | | | | 177,635 | | | | 172,876 | | | | 183,000 | |

Income tax expense | | 75,285 | | | | 74,340 | | | | 65,805 | | | | 63,880 | | | | 70,243 | |

Net income | $ | 119,198 | | | $ | 123,170 | | | $ | 111,830 | | | $ | 108,996 | | | $ | 112,757 | |

Net income per share: | | | | | | | | | | | | | | | | | | | |

Net income per common share—basic | $ | 3.08 | | | $ | 3.11 | | | $ | 2.77 | | | $ | 2.49 | | | $ | 2.43 | |

Net income per common share—diluted | $ | 3.05 | | | $ | 3.06 | | | $ | 2.73 | | | $ | 2.42 | | | $ | 2.34 | |

Cash dividends declared per share | $ | 0.56 | | | $ | 0.56 | | | $ | 0.53 | | | $ | 0.52 | | | $ | - | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | |

Working capital | $ | 981,344 | | | $ | 835,285 | | | $ | 755,578 | | | $ | 767,761 | | | $ | 750,653 | |

Total assets | | 2,370,217 | | | | 2,116,194 | | | | 2,075,204 | | | | 1,994,882 | | | | 1,908,663 | |

Total debt(3) | | 713,909 | | | | 533,697 | | | | 524,376 | | | | 496,757 | | | | 441,800 | |

Total stockholders’ equity | | 856,118 | | | | 825,514 | | | | 738,092 | | | | 704,679 | | | | 759,598 | |

Statement of Cash Flows Data: | | | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | $ | 77,133 | | | $ | 74,737 | | | $ | 189,814 | | | $ | 130,363 | | | $ | 114,823 | |

Net cash used in investing activities | | (183,633 | ) | | | (30,273 | ) | | | (107,266 | ) | | | (27,918 | ) | | | (42,745 | ) |

Net cash used in provided by financing activities | | 105,968 | | | | (53,060 | ) | | | (63,457 | ) | | | (111,929 | ) | | | (69,355 | ) |

(1) 2014—$8.2 million loss on disposition of business. 2013—$13.0 million charge for a workforce reduction and facility closures and a $1.2 million asset impairment charge. 2012—$6.2 million charge for a distribution network optimization and cost reduction program. 2011—$0.7 million reversal of a charge for early retirement/workforce realignment, $4.4 million charge for a transition agreement with the company’s former Chief Executive Officer, and a $1.6 million asset impairment charge. 2010—$11.9 million liability reversal for vacation pay policy change, $8.8 million liability reversal for Retiree Medical Plan termination, and $9.1 million charge for early retirement/workforce realignment.

(2) 2011—a reversal of prior acquisition earn-out and deferred payment liabilities. 2010—an accounting charge to bring prior acquisition earn-out liabilities to fair value.

(3) Total debt includes current maturities where applicable.

(4) 2010 share and per share amounts reflect a two-for-one stock split in May 2011.

13

FORWARD LOOKING INFORMATION

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act. Forward-looking statements often contain words such as “expects”, “anticipates”, “estimates”, “intends”, “plans”, “believes”, “seeks”, “will”, “is likely”, “scheduled”, “positioned to”, “continue”, “forecast”, “predicting”, “projection”, “potential” or similar expressions. Forward-looking statements include references to goals, plans, strategies, objectives, projected costs or savings, anticipated future performance, results or events and other statements that are not strictly historical in nature. These forward-looking statements are based on management’s current expectations, forecasts and assumptions. This means they involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied here. These risks and uncertainties include, without limitation, those set forth above under the heading “Risk Factors.”

Readers should not place undue reliance on forward-looking statements contained in this Annual Report on Form 10-K. The forward-looking information herein is given as of this date only, and the Company undertakes no obligation to revise or update it.

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

The following discussion should be read in conjunction with both the information at the end of Item 6 of this Annual Report on Form 10-K appearing under the caption, “Forward Looking Information”, and the Company’s Consolidated Financial Statements and related notes contained in Item 8 of this Annual Report.

Company Overview

The Company is a leading supplier of workplace essentials, with 2014 net sales of approximately $5.3 billion. The Company sells its products through a national distribution network of 77 distribution centers to over 30,000 resellers, who in turn sell directly to end consumers.

Our strategy is comprised of three key elements:

1) Strengthen our core office, janitorial, and breakroom business with a common operating and IT platform, an aligned customer care and sales team, and advanced digital services;

2) Win online by growing our business-to-business (B2B) sales with major e-commerce players, and by enabling the online success of our resellers by providing digital capabilities and tools to support them; and

3) Expand and diversify our business into higher growth and higher margin channels and categories.

Execution on these priorities will help us achieve our goal of becoming the fastest and most convenient solution for workplace essentials.

Key Trends and Recent Results

The following is a summary of selected trends, events or uncertainties that the Company believes may have a significant impact on its future performance.

Recent Results

· | Diluted earnings per share for 2014 were $3.05 compared to $3.06 in 2013. Adjusted earnings per share in 2014 was $3.26 compared to adjusted earnings per share of $3.29 in 2013. Refer to the Adjusted Operating Income, Adjusted Net Income and Adjusted Earnings Per Share table included later in this section for more detail on the adjustments. |

· | Sales increased 4.8% to $5.3 billion comprised of organic sales representing 2.9% and the acquisitions of CPO and MEDCO adding 1.9% of the increase. This included 23.4% growth in the industrial supplies product category, with our 2014 acquisitions of CPO and MEDCO accounting for almost 19.0% of the growth. The janitorial and breakroom supplies category sales also grew by over 8.0% versus 2013. Sales in the traditional office product category were up 1.0% over 2013. These results were impacted by softening market conditions but aided by continued implementation of strategic initiatives including expanding market coverage and growing wholesale penetration in these categories. This growth was partially offset by a decline in technology products of nearly 2.0%. The furniture category sales were down approximately 1.0% compared with the prior year. |

· | Gross margin as a percent of sales for 2014 was 15.2% versus 15.5% in 2013. Gross margin included a favorable 10 basis points from acquisitions. Excluding the acquisitions, gross margin declined due to a shift in customer and product mix and higher net freight costs. |

14

· | Operating expenses in 2014 totaled $600.3 million or 11.3% of sales compared with $580.4 or 11.4% of sales in 2013. Adjusted operating expenses in 2014 were $592.0 million or 11.1% of sales, excluding the effects of an $8.2 million charge related to a loss on disposition of MBS Dev. Adjusted operating expenses in 2013 were $566.3 million or 11.1% of sales, which excluded a $13.0 million charge related to workforce reduction and facility closures, and a $1.2 million non-tax deductible asset impairment charge. |

· | Operating income in 2014 was $210.2 million or 3.9% of sales, compared with $209.1 million or 4.1% of sales in the prior year. Adjusted operating income was $218.5 million or 4.1% of sales, compared with $223.3 million or 4.4% of sales in 2013, reflecting the lower gross margin rate in 2014. |

· | Operating cash flows for 2014 were $77.1 million versus $74.7 million in 2013. 2014 operating cash flows were impacted by increased inventory levels, lower accounts payable and higher accounts receivable. Cash flow used in investing activities for capital expenditures, excluding acquisitions, totaled $25.0 million in 2014 compared with $33.8 million in 2013. Net of cash acquired, we used $161.4 million in 2014 to acquire CPO and MEDCO. |

· | During 2014, the Company repurchased 1.3 million shares for $50.6 million and also paid $21.8 million in dividends during the year. |

· | The Company had approximately $1.05 billion of total committed debt capacity at December 31, 2014. Outstanding debt at December 31, 2014 and 2013 was $713.9 million and $533.7 million, respectively. Debt-to-total capitalization at the end of 2014 increased to 45.5% from 39.3% for the prior year due to the acquisition of MEDCO in the fourth quarter of 2014. |

Repositioning for Sustained Success

2014

· | On May 30, 2014, we acquired CPO, a leading e-retailer of brand name power tools and equipment. The purchase price was $37.4 million, which includes $5.1 million related to the estimated fair value of contingent consideration which will be paid, to the extent earned based on sales conditions, by the end of the three year earn-out period. The earn-out payment will be between zero and $10.0 million. This transaction significantly expanded United’s digital resources and capabilities to support resellers as they transition to an increasingly online environment. CPO’s expertise will strengthen United’s ability to deliver such features as improved product content, real-time access to inventory and pricing, and digital marketing and merchandising. CPO also provides an enhanced digital platform to our manufacturing partners. In 2014, CPO profitability was neutral to earnings per share and operating income. During the first year of ownership, we expect this acquisition to positively impact gross margin as a percent of sales and to have a slightly accretive impact on earnings per share. |

· | On October 31, 2014, we acquired Liberty Bell Equipment Corp, a United States wholesaler of automotive aftermarket tools and supplies, and its affiliates (collectively MEDCO) including G2S Equipment de Fabrication et d'Entretien ULC, a Canadian wholesaler. The purchase price was $150.0 million, which includes $4.8 million related to the estimated fair value of contingent consideration which will be paid, to the extent earned based on sales and margin conditions, by the end of the three year earn-out period. The earn-out payment will be between zero and $10.0 million. MEDCO advances a key pillar of our strategy, diversification into higher growth and margin channels and categories. In 2014, MEDCO was accretive to earnings per share. During the first year of ownership, we expect this acquisition to add over $250.0 million in revenue, $13.0 million to $15.0 million of operating income, and be accretive to earnings per share. |

· | On December 16, 2014, we sold MBS Dev, a subsidiary focused on software solutions for distribution companies. In conjunction with this sale, we recognized an $8.2 million loss on the disposition of the business. This consisted of a $9.0 million goodwill impairment and a $0.8 million gain on disposal as the carrying value of the entity was less than the total value of the consideration received. |

2015

· | Our initiative to combine the office products and janitorial operating platforms will help us become the fastest most convenient solution for our customers’ workplace essentials through our nationwide distribution network and logistics capabilities, order efficiency with enhanced ecommerce capabilities, broad product portfolio, superior product category knowledge and commercial expertise. Implementation will begin in mid-2015 and will cascade into the first half of 2016. This initiative had a cost of approximately $4.0 million in 2014 and is expected to be approximately $15.0 million in 2015. Upon completion, we expect operating cost savings through continued network consolidation and reduced expenses of $15.0 to $20.0 million on an annual basis beginning in 2016. |

· | Restructuring actions will be taken in 2015 to improve our operational utilization, labor spend and inventory performance. This will include workforce reductions and facility consolidations, cascading over five quarters beginning in the first quarter of 2015. The estimated expense impact is approximately $7.0 million in the first quarter of 2015 and approximately $9.0 million for the full year of 2015. We expect these actions will produce cost savings of approximately $6.0 million, for a net cost of $3.0 million, in 2015 and approximately $10.0 million in savings in 2016. |

· | Exiting non-strategic channels and categories will continue during 2015 to further align our portfolio of product categories and channels with our strategies. In the first quarter of 2015, we began active sales efforts for a non-strategic subsidiary. We currently are estimating a $12.0 to $16.0 million non-cash charge in the first quarter of 2015 relating to |

15

| classifying the entity as held-for-sale, with possible additional impacts during 2015 related to transaction costs and foreign exchange volatility. This subsidiary had sales of $104.0 million in 2014 and had no impact on earnings per share. |

· | We will change our Company name and brand to consistently communicate our purpose and vision. The non-cash impairment is expected to be approximately $10.0 million in the first quarter of 2015 and $12.0 million for the full year of 2015. |

· | As we accelerate our strategy by executing these repositioning actions, we expect the percentage growth of earnings per share to be in the low single-digits in 2015. |

Critical Accounting Policies, Judgments and Estimates

The Company’s significant accounting policies are more fully described in Note 2 of the Consolidated Financial Statements. As described in Note 2, the preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions about future events that affect the amounts reported in the financial statements and accompanying notes. Future events and their effects cannot be determined with absolute certainty. Therefore, the determination of estimates requires the exercise of judgment. Actual results may differ from those estimates.

The Company’s critical accounting policies are most significant to the Company’s financial condition and results of operations and require especially difficult, subjective or complex judgments or estimates by management. In most cases, critical accounting policies require management to make estimates on matters that are uncertain at the time the estimate is made. The basis for the estimates is historical experience, terms of existing contracts, observance of industry trends, information provided by customers or vendors, and information available from other outside sources, as appropriate. These critical accounting policies include the following:

Supplier Allowances

Supplier allowances are common practice in the business products industry and have a significant impact on the Company’s overall gross margin. Receivables related to supplier allowances totaled $124.4 million and $103.2 million as of December 31, 2014 and 2013, respectively.

The majority of the Company’s annual supplier allowances and incentives are variable, based solely on the volume and mix of the Company’s product purchases from suppliers. These variable allowances are recorded based on the Company’s annual inventory purchase volumes and product mix and are included in the Company’s Consolidated Financial Statements as a reduction to cost of goods sold, thereby reflecting the net inventory purchase cost. The potential amount of variable supplier allowances often differs based on purchase volumes by supplier and product category. Changes in the Company’s sales volume (which can increase or reduce inventory purchase requirements), changes in product sales mix (especially because higher-margin products often benefit from higher supplier allowance rates), or changes in the amount of purchases United makes to attain supplier allowances can create fluctuations in future results.

Customer Rebates

Customer rebates and discounts are common practice in the business products industry and have a significant impact on the Company’s overall sales and gross margin. Accrued customer rebates were $63.2 million and $52.6 million as of December 31, 2014 and 2013, respectively.

Customer rebates include volume rebates, sales growth incentives, advertising allowances, participation in promotions and other miscellaneous discount programs. Estimates for volume rebates and growth incentives are based on estimated annual sales volume to the Company’s customers. The aggregate amount of customer rebates depends on product sales mix and customer mix changes. Reported results reflect management’s current estimate of such rebates. Changes in estimates of sales volumes, product mix, customer mix or sales patterns, or actual results that vary from such estimates may impact future results.

Allowance for doubtful accounts

Management estimates an allowance for doubtful accounts, which addresses the collectability of trade accounts receivable. This allowance adjusts gross trade accounts receivable downward to its estimated collectible or net realizable value. To determine the allowance for doubtful accounts, management reviews specific customer risks and the Company’s trade accounts receivable aging. Uncollectible trade receivable balances are written off against the allowance for doubtful accounts when it is determined that the trade receivable balance is uncollectible. Allowance for doubtful accounts totaled $19.7 million and $20.6 million as of December 31, 2014 and 2013, respectively.

16

Goodwill and Intangible Assets

The Company tests goodwill for impairment annually as of October and whenever events or circumstances indicate that an impairment may have occurred, such as a significant adverse change in the business climate, loss of key personnel or a decision to sell or dispose of a reporting unit. Determining whether an impairment has occurred requires valuation of the respective reporting unit, which the Company estimates using forecasted future results and a discounted cash flow method. When available and as appropriate, comparative market multiples are used to corroborate discounted cash flow results.

Prior to the completion of the annual goodwill impairment test for MBS Dev, the Company began negotiating the sale of MBS Dev with third parties and concluded that this change in strategy for MBS Dev was an interim indicator of impairment that necessitated an interim test for goodwill impairment. The Company completed a goodwill impairment test as of the date the assets were classified as held for sale, and used a market approach to determine the fair value of the MBS Dev reporting unit. The fair value of the MBS Dev reporting unit did not exceed its carrying value, requiring the Company to determine the amount of goodwill impairment loss by valuing the entity’s assets and liabilities at fair value and comparing the fair value of the implied goodwill to the carrying value of goodwill. Upon completion of this calculation, the carrying amount of the goodwill exceeded the implied fair value of that goodwill, resulting in a goodwill impairment of $9.0 million. The goodwill impairment was partially offset by the fair value of the consideration received for MBS Dev being in excess of the carrying value, leading to a total loss on disposition of MBS Dev of $8.2 million. The recognized and unrecognized intangible assets were valued using the cost method and return on royalty approach using estimates of forecasted future revenues.

Intangible assets are initially recorded at their fair market values determined on quoted market prices in active markets, if available, or recognized valuation models. Intangible assets that have finite useful lives are amortized on a straight-line basis over their useful lives. Intangible assets that have indefinite useful lives are not amortized but are tested at least annually for impairment or whenever events or circumstances indicate impairment may have occurred. The Company makes an annual impairment assessment of its intangibles.

As of December 31, 2014 and 2013, the Company’s Consolidated Balance Sheets reflected $398.0 million and $356.8 million of goodwill, and $112.0 million and $65.5 million in net intangible assets, respectively.

Inventory Reserves

The Company also records adjustments to inventory that is obsolete, damaged, defective or slow moving. Inventory is recorded at the lower of cost or market. These adjustments are determined using historical trends such as age of inventory, market demands, customer commitments, and new products introduced to the market. The reserves are further adjusted, if necessary, as new information becomes available; however, based on historical experience, the Company does not believe the estimates and assumptions will have a material impact on the financial statements.

Income Taxes

The Company accounts for income taxes using the liability method in accordance with the accounting guidance for income taxes. The Company estimates actual current tax expense and assesses temporary differences that exist due to differing treatments of items for tax and financial statement purposes. These temporary differences result in the recognition of deferred tax assets and liabilities. A provision has not been made for deferred U.S. income taxes on the undistributed earnings of the Company’s foreign subsidiaries as these earnings have historically been permanently invested except to the extent a liability was recorded in purchase accounting for the undistributed earnings of the foreign subsidiaries of OKI as of the date of the acquisition. It is not practicable to determine the amount of unrecognized deferred tax liability for such unremitted foreign earnings. The Company accounts for interest and penalties related to uncertain tax positions as a component of income tax expense.

Pension Benefits

To select the appropriate actuarial assumptions when determining pension benefit obligations, the Company relied on current market conditions, historical information and consultation with and input from the Company’s outside actuaries. These actuarial assumptions include discount rates, expected long-term rates of return on plan assets, and rates of increase in compensation and healthcare costs. The expected long-term rate of return on plan assets assumption is based on historical returns and the future expectation of returns for each asset category, as well as the target asset allocation of the asset portfolio. There was no rate of compensation increase in each of the past three fiscal years.

Pension expense for 2014 was $3.6 million, compared to $4.5 million in 2013 and $5.7 million in 2012. A one percentage point decrease in the assumed discount rate would have resulted in an increase in pension expense for 2014 of approximately $2.4 million and increased the year-end projected benefit obligation by $41.1 million. Additionally, a one percentage point decrease in the expected

17

rate of return assumption would have resulted in an increase in the net periodic benefit cost for 2014 of approximately $1.6 million. See Note 11 “Pension Plans and Defined Contribution Plan” for more information.

Results for the Years Ended December 31, 2014, 2013 and 2012

The following table presents the Consolidated Statements of Income as a percentage of net sales:

| Years Ended December 31, | |

| 2014 | | | 2013 | | | 2012 | |

Net sales | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

Cost of goods sold | | 84.8 | | | | 84.5 | | | | 84.8 | |

Gross margin | | 15.2 | | | | 15.5 | | | | 15.2 | |

Operating expenses: | | | | | | | | | | | |

Warehousing, marketing and administrative expenses | | 11.3 | | | | 11.4 | | | | 11.3 | |

Operating income | | 3.9 | | | | 4.1 | | | | 4.0 | |

Interest expense, net | | 0.3 | | | | 0.2 | | | | 0.5 | |

Other (income) expense, net | — | | | — | | | — | |

Income from continuing operations before income taxes | | 3.6 | | | | 3.9 | | | | 3.5 | |

Income tax expense | | 1.4 | | | | 1.5 | | | | 1.3 | |

Net income | | 2.2 | % | | | 2.4 | % | | | 2.2 | % |

18

Adjusted Operating Income and Diluted Earnings Per Share

The following table presents Adjusted Operating Income, Adjusted Net Income and Adjusted Diluted Earnings Per Share for the years ended December 31, 2014 and 2013 (in thousands, except share data). The 2014 results exclude the effect of an $8.2 million loss on disposition of business. This loss was not fully recognizable for tax purposes in 2014. The 2013 results exclude the effects of a $13.0 million charge related to workforce reductions and facility closures and a $1.2 million non-tax deductible asset impairment charge. The 2012 results exclude the effect of a $6.2 million charge related to workforce reductions and facility closures. See “Comparison of Results for the Years Ended December 31, 2014 and 2013” and “Comparison of Results for the Years Ended December 31, 2013 and 2012” below for more detail. Generally Accepted Accounting Principles require that the effects of these items be included in the Consolidated Statements of Income. The Company believes that excluding these items is an appropriate comparison of its ongoing operating results and to the results of the prior year and that it is helpful to provide readers of its financial statements with a reconciliation of these items to its Consolidated Statements of Income reported in accordance with Generally Accepted Accounting Principles.

| For the Years Ended December 31, | |

| 2014 | | | 2013 | | | 2012 | |

| | | | | % to | | | | | | | % to | | | | | | | % to | |

| Amount | | | Net Sales | | | Amount | | | Net Sales | | | Amount | | | Net Sales | |

Net Sales | $ | 5,327,205 | | | | 100.0 | % | | $ | 5,085,293 | | | | 100.0 | % | | $ | 5,080,106 | | | | 100.0 | % |

Gross profit | $ | 810,501 | | | | 15.2 | % | | $ | 789,578 | | | | 15.5 | % | | $ | 774,604 | | | | 15.2 | % |

Operating expenses | $ | 600,284 | | | | 11.3 | % | | $ | 580,428 | | | | 11.4 | % | | $ | 573,693 | | | | 11.3 | % |

Workforce reduction and facility closure charge | | - | | | | - | | | | (12,975 | ) | | | (0.3 | %) | | | (6,247 | ) | | | (0.1 | %) |

Asset impairment charge | | - | | | | - | | | | (1,183 | ) | | | (0.0 | %) | | | - | | | | - | |

Loss on disposition of business | | (8,234 | ) | | | (0.2 | %) | | | - | | | | - | | | | - | | | | - | |

Adjusted operating expenses | $ | 592,050 | | | | 11.1 | % | | $ | 566,270 | | | | 11.1 | % | | $ | 567,446 | | | | 11.2 | % |

Operating income | $ | 210,217 | | | | 3.9 | % | | $ | 209,150 | | | | 4.1 | % | | $ | 200,911 | | | | 4.0 | % |

Operating expense item noted above | | 8,234 | | | | 0.2 | % | | | 14,158 | | | | 0.3 | % | | | 6,247 | | | | 0.1 | % |

Adjusted operating income | $ | 218,451 | | | | 4.1 | % | | $ | 223,308 | | | | 4.4 | % | | $ | 207,158 | | | | 4.1 | % |

Net income | $ | 119,198 | | | | | | | $ | 123,170 | | | | | | | $ | 111,830 | | | | | |

Operating expense item noted above, net of tax | | 8,234 | | | | | | | | 9,227 | | | | | | | | 3,873 | | | | | |

Adjusted net income | $ | 127,432 | | | | | | | $ | 132,397 | | | | | | | $ | 115,703 | | | | | |

Diluted earnings per share | $ | 3.05 | | | | | | | $ | 3.06 | | | | | | | $ | 2.73 | | | | | |

Per share operating expense item noted above | | 0.21 | | | | | | | | 0.23 | | | | | | | | 0.09 | | | | | |