UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 |

For the Fiscal Year Ended December 31, 2006

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 1-13652

First West Virginia Bancorp, Inc.

(Exact name of registrant as specified in its charter)

| | |

| West Virginia | | 55-6051901 |

| (State or other jurisdiction | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

1701 Warwood Avenue

Wheeling, West Virginia 26003

(Address of principal executive offices)

Registrant’s telephone number, including area code: (304) 277-1100

Securities to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock $5.00 Par Value | | American Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d)of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check-mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated filer ¨ Accelerated filer ¨ Non-Accelerated filer x

The aggregate market value of the voting stock held by non-affiliates of the registrant, calculated by reference to the closing sale price of First West Virginia Bancorp’s common stock on the AMEX on March 26, 2007, was $22,939,079. (Registrant has assumed that all of its executive officers and directors are affiliates. Such assumption shall not be deemed to be conclusive for any other purpose):

The number of shares outstanding less treasury shares of the issuer’s common stock as of March 26, 2007:

Common Stock, $5.00 Par Value 1,528,443 shares

DOCUMENTS INCORPORATED BY REFERENCE

| | |

| Part of Form 10-K | | |

| into which Document | | |

Documents | | is incorporated |

| |

| Portions of the Annual Report to Shareholders | | Part II, Items 6, 7, 7A, |

| of First West Virginia Bancorp, Inc. for the | | 8 and 9A; |

| year ended December 31, 2006. | | Part III, Item 13; |

| | Part IV, Item 15 |

| |

| Portions of First West Virginia Bancorp, Inc.’s | | Part III, Items 10, |

| Proxy statement for the 2007 Annual Meeting | | 11, 12, 13 and 14 |

| of Shareholders. | | |

2

FORM 10-K INDEX

3

PART 1

General

First West Virginia Bancorp, Inc. (“Holding Company”), was organized as a West Virginia business corporation on July 1, 1973 at the request of the Boards of Directors of the Bank of Warwood, N.A. and Community Savings Bank, N.A. for the purpose of becoming a bank holding company, under the Bank Holding Company Act of 1956, as amended. On December 30, 1974 the shareholders of those banks voted to become constituent banks of the Holding Company, which reorganization was subsequently accomplished in accordance with regulatory procedure, and the Holding Company thus became the first bank holding company in the state of West Virginia. Those banks later merged on June 30, 1984 under the name “First West Virginia Bank, N.A.” In November, 1995, the subsidiary banks of the Holding Company adopted the Common Name of “Progressive Bank, N.A.”

At December 31, 2006, First West Virginia Bancorp, Inc. had one wholly-owned banking subsidiary, Progressive Bank, N.A. in Wheeling, West Virginia.

Progressive Bank, N. A. is a community bank serving all of Ohio, Brooke, Marshall, Upshur, Lewis and Wetzel counties in the state of West Virginia, and a portion of the west bank of the Ohio River, located in the State of Ohio. Progressive Bank, N.A. operates three full-service offices in Ohio county, Wheeling, West Virginia, one full-service office in Brooke county, Wellsburg, West Virginia, two full-service offices in Marshall county, Moundsville, West Virginia, one full-service office in Wetzel county, New Martinsville, West Virginia, one full-service office in Upshur county, Buckhannon, West Virginia, one full-service office in Lewis county, Weston, West Virginia, and one full-service office in Bellaire, Ohio. Progressive Bank, N.A. had total assets of approximately $253.9 million as of December 31, 2006.

Total Holding Company assets as of December 31, 2006, which include the assets of its operating subsidiary bank, was $254.4 million. The authorized capital of the Holding Company consists of 2,000,000 shares of capital stock, par value of $5.00 per share, of which 1,538,443 shares less 10,000 treasury shares were issued and outstanding as of December 31, 2006 to 303 registered shareholders. Shareholders' equity at that date was $25,276,954.

General Description of Business

First West Virginia Bancorp, Inc. is dependent upon its subsidiary for cash necessary to pay expenses, and dividends to its stockholders. The Holding Company functions primarily as the holder of the capital stock of its wholly-owned subsidiary bank.

The subsidiary bank of the Holding company is engaged in the business of banking and provides a broad range of consumer and commercial banking products and services to individuals, businesses, professionals and governments. The services and products have been designed in such a manner as to appeal to area consumers and businesses. The loan portfolio of the bank consists primarily of loans secured by real estate to consumers and businesses. The bank also engages in commercial loans and general consumer loans to individuals. The subsidiary bank offers a wide range of both personal and commercial types of deposit accounts and services as a means of gathering funds. Types of deposit accounts and services available include non-interest bearing demand checking, interest bearing checking (NOW accounts), savings, money market, certificates of deposit, individual retirement accounts, and Christmas Club accounts. The customer base for deposits is primarily retail in nature. The majority of the bank's lending is concentrated in the upper Ohio Valley of northern West Virginia and adjacent areas of Ohio and Pennsylvania.

First West Virginia Bancorp, Inc.’s business is not seasonal. As of December 31, 2006, the subsidiary bank was not engaged in any operation in foreign countries and transactions with customers in foreign countries is not material.

Competition

Competition involving the Holding Company is generally felt at the subsidiary level. All phases of the banks’ business are highly competitive. The subsidiary bank encounters competition from other financial institutions and commercial banks. The subsidiary bank also competes with other insurance companies, small loan companies, credit unions with respect to lending activities and also in attracting a variety of deposit related instruments.

Supervision and Regulation

The Holding Company is subject to the provisions of the Federal Bank Holding Company Act of 1956, as amended, and to the supervision of the Board of Governors of the Federal Reserve System. The Bank Holding Company Act requires the Holding Company to secure the prior approval of the Federal Reserve Board before it can acquire all or substantially all of the assets of any bank, or acquire ownership or control of any voting shares of any bank, if, after such acquisition, it would own or control 5% or more of the voting shares of such bank. Similarly, a bank holding company is prohibited under the Act from engaging in, or acquiring direct or indirect control of 5% or more of the voting shares of any company engaged in non-banking activities unless the Federal Reserve Board, by order or regulation, has found such activities to be so closely related to banking or managing or controlling banks as to be a proper incident thereto. In making determinations as to permitted non-banking activities, the Federal Reserve Board considers whether the performance of these activities by a bank holding company would offer benefits to the public which outweigh possible adverse effects.

4

As a bank holding company, the Holding Company is required to file with the Federal Reserve Board reports and any additional information that the Federal Reserve Board may require pursuant to the Bank Holding Company Act. The Federal Reserve Board also makes examinations of the Holding Company. The Holding Company is also required to register with the Office of the Commissioner of Banking of West Virginia and file reports as requested. The Commissioner has the power to examine the Holding Company and its subsidiary.

The Holding Company is also deemed an “affiliate” of its subsidiary bank under the Federal Reserve Act which imposes certain restrictions on loans between the Holding Company and its subsidiary bank, investments by the subsidiary in the stock of the Holding Company, or the taking of stock of the Holding Company by the subsidiary as collateral for loans to any borrower, or purchases by the subsidiary of certain assets from the Holding Company, and the payment of dividends by the subsidiary to the Holding Company.

Federal Reserve Board approval is required before the Holding Company may begin to engage in any permitted non-banking activity. The Federal Reserve Board is empowered to differentiate between activities which are initiated by a bank holding company or a subsidiary and activities commenced by acquisition of a going concern.

The operations of the Holding Company’s subsidiary bank, being a national bank, is subject to the regulations of a number of regulatory agencies including the regulations of a number of regulatory authorities including the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System and the applicable state Department of Banking. Representatives of the Comptroller of the Currency regulate and conduct examinations of the subsidiary bank. The subsidiary bank is required to furnish regular reports to the Comptroller of the Currency and the Federal Deposit Insurance Corporation. The Comptroller of the Currency has the authority to prevent national banks from engaging in an unsafe or unsound bank practice and may remove officers or directors. It may be noted that the subsidiary bank of a bank holding company is subject to certain restrictions imposed by the banking laws on extensions of credit to the bank holding company or its subsidiary.

The Company’s subsidiary bank entered into a Formal Agreement with the Office of the Comptroller of the Currency (OCC) in December 2004. The Formal Agreement contained certain required actions and certain restrictions. This agreement was terminated by the OCC on December 13, 2006. The Company also adopted a resolution with the Federal Reserve Bank of Cleveland, under authority given it by the Board of Governors of the Federal Reserve System, the federal regulatory agency for the Company. As with the agreement of the OCC, the Federal Reserve resolution necessitated certain actions and restrictions. Without prior Federal Reserve approval and a 30 day prior notice requirement, the resolution prohibited the Company from paying dividends, incurring debt, or participating in the acquisition of treasury stock. In addition, prior written approval was required before engaging in any non-bank activities. The resolution was terminated by the Federal Reserve Bank of Cleveland effective as of January 30, 2007.

Being a West Virginia corporation, the Holding Company is also subject to the corporate laws of the State of West Virginia as set forth in the West Virginia Corporation Act.

The Financial Institutions Reform, Recovery, and Enforcement Act (“FIRREA”)was enacted in August, 1989. This legislation created a new liability as a depository institution insured by the Federal Deposit Insurance corporation, (“the FDIC”), can be held liable for any loss incurred by, or reasonably expected to be incurred by, the FDIC after August 9, 1989 in connection with (i) the default of a commonly controlled FDIC-insured depository institution or (ii) any assistance provided by the FDIC to a commonly controlled FDIC-insured depository institution in danger of default. Default is defined generally as the appointment of a conservator or receiver and “in danger of default” is defined generally as the existence of certain conditions indicating that default is likely to occur in the absence of regulatory assistance.

Capital Requirements

The Federal Reserve Board and the Office of the Comptroller of the Currency require a minimum “tier 1” capital to be at least 3% of total assets (“Leverage Ratio”). For all but the most highly rated banks, the minimum Leverage Ratio requirement will be 4% to 5% of total assets. Tier 1 capital consists of: (i) common stockholders’ equity, noncumulative perpetual preferred stock and minority interests in consolidated subsidiaries; (ii) minus intangible assets (other than certain purchased mortgage and credit card servicing rights); and (iii) minus certain losses, and minus investments in certain securities of subsidiaries.

In addition, a national bank also must maintain a “tier 1 risk-based capital ratio” of 4%. The “tier 1 risk-based capital ratio” is defined in OCC regulations as the ratio to tier 1 capital to “risk-weighted assets”. A bank’s total risk-weighted assets are determined by: (i) converting each of its off-balance sheet items to an on-balance sheet credit equivalent amount; (ii) assigning each on-balance sheet asset and the credit equivalent amount of each off-balance sheet item to one of the five risk categories established in the OCC regulations; and (iii) multiplying the amounts in each category by the risk factor assigned to that category. The sum of the resulting amounts constitutes total risk-weighted assets.

A national bank is also required to maintain a “total risk-based capital ratio” of at least 8%. The “total risk-based capital ratio” is defined in the OCC regulations as the ratio of total qualifying capital to risk-weighted assets (as defined before). Total capital, for purposes of the risk-based capital requirement, consists of the sum of tier 1 capital (as defined for purposes of the Leverage Ratio) and supplementary capital. Supplementary capital includes such items as cumulative perpetual preferred stock, long-term and intermediate-term preferred stock, term subordinated debt and general valuation loan and lease loss allowances (but only in an amount of up to 1.25% of total risk-weighted assets). The maximum amount of supplementary capital that may be counted towards satisfaction of the total capital requirement is limited to 100% of core capital. Additionally, term subordinated debt and intermediate-term preferred stock may only be included in supplementary capital up to 50% of tier 1 capital.

Capital requirements higher than the generally applicable minimum requirements may be established for a particular national bank if the OCC determines that the bank's capital is or may become inadequate in view of its particular circumstances. Individual minimum capital requirements may be imposed where a bank is receiving special supervisory attention, has a high degree of exposure to interest rate risk, or poses other safety or soundness concerns. Deficient capital may result in the suspension of an institution's deposit insurance.

5

As of December 31, 2006, the most recent notifications from the Office of the Comptroller of the Currency categorized the bank as well capitalized under the regulatory framework for prompt corrective action. There are no conditions or events since that notification that management believes has changed the capital category.

Federal Deposit Insurance Corporation Improvement Act of 1991

The Holding Company may also be subject to certain provisions of the Federal Deposit Insurance Corporation Improvements Act of 1991 (“FDICIA”). FDICIA requires the Federal Reserve Board of Governors to adopt certain regulations establishing safety and soundness standards for bank holding companies. Many of the provisions of the regulation became effective in December, 1993. Additional provisions will be implemented through the adoption of regulation by various federal banking agencies.

Under OCC regulations, any national bank that receives notice that it is undercapitalized, significantly undercapitalized or critically undercapitalized must file a capital restoration plan with the OCC addressing, among other things, the manner in which the association will increase its capital to comply with all applicable capital standards. Under the prompt corrective action regulations adopted by the OCC, an institution will be considered: (i) “well capitalized” if the institution has a total risk-based capital ratio of 10% or greater, a tier 1 risk-based capital ratio of 6% or greater, and Leverage Ratio of 5% or greater (provided the institution is not subject to an order, written agreement, capital directive or prompt corrective action to meet and maintain a specified capital level for any capital measure); (ii) “adequately capitalized” if the institution has a total risk-based capital ratio of 8% or greater, a tier 1 risk-based capital ratio of 4% or greater, and a Leverage Ratio of 4% or greater (3% or greater if the institution is rated composite 1 in its most recent report of examination); (iii) “undercapitalized” if the institution has a total risk-based capital ratio of less than 8%, or a tier 1 risk-based capital ratio of less than 4%, or a Leverage Ratio of less than 4% (3% if the institution is rated composite 1 in its most recent report of examination); (iv) “significantly undercapitalized” if the institution has a total risk-based capital ratio of less than 6%, or a tier 1 risk-based capital ratio of less than 3%, or a Leverage Ratio that is less than 3%; and (v) “critically undercapitalized” if the institution has a ratio of tangible equity to total assets that is less than 2%. The regulations also permit the OCC to determine that an institution should be placed in a lower category based on the existence of an unsafe and unsound condition or on other information, such as the institution’s examination report, after written notice.

The degree of regulatory intervention mandated by FDICIA and the prompt corrective action regulations are tied to a national bank’s capital category, with increasing scrutiny and more stringent restrictions being imposed as a bank’s capital declines. The prompt corrective actions specified by FDICIA for undercapitalized banks include increased monitoring and periodic review of capital compliance efforts, a requirement to submit a capital restoration plan, restrictions on dividends and total asset growth, and limitations on certain new activities (such as opening new branches and engaging in acquisitions and new lines of business) without OCC approval. Banks that are significantly undercapitalized or critically undercapitalized may be required to raise additional capital so that the bank will be adequately capitalized or be acquired by, or combined with, another bank if grounds exist for appointing a receiver. Further, the OCC may restrict such banks from (i) entering into any material transaction without prior approval of the OCC; (ii) making payments on subordinated debt; (iii) extending credit for any highly leveraged transaction; (iv) making any material change in accounting methods; (v) engaging in certain affiliate transactions; (vi) paying interest on deposits in excess of the prevailing rates of interest in the region where the institution is located; (vii) paying excess compensation or bonuses; and (viii) accepting deposits from correspondent depository institutions. In addition, the OCC may require that such banks; (a) hold a new election for directors, dismiss any director or senior executive officer who held office for more than 180 days immediately before the institution became undercapitalized, or employ qualified senior executive officers; and (b) divest or liquidate any subsidiary which the OCC determines poses a significant risk to the institution.

Any company which controls a significantly undercapitalized national bank may be required to (i) divest or liquidate any affiliate other than an insured depository institution; or (ii) divest the bank if the OCC determines that divestiture would improve the bank’s financial condition and future prospects. Generally a conservator or receiver must be appointed for a critically undercapitalized bank no later than 90 days after the bank becomes critically undercapitalized, subject to a limited exception for banks which are in compliance with an approved capital restoration plan and which the OCC certifies as not likely to fail. Additionally, the OCC may impose such other restrictions on a capital-deficient bank as the OCC deems necessary or appropriate for the safety and soundness of the bank, its depositors and investors, including limitations on investments and lending activities. The failure by a bank to materially comply with an approved capital plan constitutes an unsafe or unsound practice.

FDICIA and the regulations promulgated by the OCC pursuant thereto also require any company that has control of an “undercapitalized” national bank, in conjunction with the submission of a capital restoration plan by the bank, to guarantee that the bank will comply with the plan and provide appropriate assurances of performance. The aggregate liability of any such controlling company under such guaranty is limited to the lesser of: (i) 5% of the bank’s assets at the time it became undercapitalized; or (ii) the amount necessary to bring the bank into capital compliance at the time the bank fails to comply with the terms of its capital plan.

Insurance of Deposits

The subsidiary bank’s deposits are insured by the FDIC through the Bank Insurance Fund (“BIF”) up to a maximum of $250,000 for certain retirement accounts beginning April 1, 2006 and $100,000 for all other insured deposits. The insurance premium payable by each BIF member is based on the institution’s assessment base (generally total deposit accounts subject to certain adjustments). The premiums are paid quarterly based on semiannual assessments.

Under the risk-based assessment system, an institution is assigned to one of four capital groups for purposes of determining an assessment rate. The capital group is determined by the institution’s regulatory capital position, which is based upon supervisory and capital evaluations, which are both established measures of risk. Under this formula, well-capitalized institutions classified as Subgroup “I” (financially sound institutions with only a few minor weaknesses) will pay the most favorable assessment rate while undercapitalized institutions classified as Subgroup “IV” (institutions which pose a substantial probability of loss to the Bank Insurance Fund (BIF) unless corrective action is taken) will pay the least favorable assessment rate.

6

The FDIC Board established a process for increasing and lowering all rates for BIF institutions quarterly, if conditions warrant a change. Under this system, the FDIC Board will have the flexibility to adjust the entire BIF assessment rate schedule four times a year, but only within a range of 3% above or below the premium schedule adopted, without first having to seek public comment. Any adjustments above or below the 3% range requires public comment, prior to adjusting the assessment rate schedule. The BIF assessment schedule of 0% to 27% remains in effect for the first semi annual period of 2007. The BIF assessment annual rate was approximately 3 basis points for the years ended December 31, 2006 and 2005. There was no BIF assessment paid by the subsidiary bank during 2004.

The FDIC Board of Directors collects an additional assessment (termed the FICO assessment) against BIF-assessable deposits as a result of the enactment of the Deposit Insurance Funds Act of 1996. The Deposit Insurance Funds Act of 1996 authorized the Financing Corporation (FICO) to impose periodic assessments on depository institutions that are BIF members in order to spread the cost of interest payments on outstanding FICO bonds over a larger number of institutions. The FICO assessment annual rate was approximately 1.28, 1.39 and 1.51 basis points on BIF-assessable deposits during 2006, 2005 and 2004, respectively.

Monetary Policies

The earnings of the Holding Company are dependent upon the earnings of its wholly-owned subsidiary bank. The earnings of the subsidiary bank is affected by the policies of regulatory authorities, including the Comptroller of the Currency, the Board of Governors of the Federal Reserve System and the Federal Deposit Insurance Corporation. The policies and regulations of the regulatory agencies have had and will continue to have a significant effect on deposits, loans and investment growth, as well as the rate of interest earned and paid, and therefore will affect the earnings of the subsidiary banks and the Holding Company in the future, although the degree of such impact cannot accurately be predicted.

Employees

As of December 31, 2006, the Holding Company had 4 part-time employees. As of December 31, 2006, the subsidiary bank of the Holding Company had a total of 110 full-time employees and 11 part-time employees. No employees are union participants or subject to a collective bargaining agreement.

Interstate Banking

The Bank Holding Company Act prohibits acquisition by the Holding Company of 5% or more of the voting shares of, or interest in, all or substantially all of the assets of any bank without prior approval of the Federal Reserve Board. Regulations in the state of West Virginia have permitted the reciprocal interstate branching or acquisition of banks and bank holding companies since July 1, 1997. Many other states have adopted legislation which would permit interstate acquisitions by their banks and bank holding companies and also permit entry by West Virginia bank holding companies. Such legislation, however, contains various restrictions and conditions.

Securities Laws and Compliance

As of February 13, 1995, the Holding Company’s common stock was registered with the Securities and Exchange commission (“SEC”) under the Securities Exchange Act of 1934, as amended (“1934 Act”). This registration requires ongoing compliance with the 1934 Act and its periodic filing requirements as well as a wide range of Federal and State securities laws. These requirements include, but are not limited to, the filing of annual, quarterly and other reports with the SEC, certain requirements as to the solicitation of proxies from shareholders as well as other proxy rules, and compliance with the reporting requirements and “short-swing” profit rules imposed by section 16 of the 1934 Act.

Acquisitions of or Affiliations With Other Banks or Bank Holding Companies

The Board of Directors of the Company from time to time has had exploratory discussions with other banks and bank holding companies with which an affiliation might be desirable. While all such discussions have been quite amicable, there are presently no understandings, agreements, or letters of intent to affiliate. Undoubtedly, exploratory discussions with other banks and bank holding companies will continue from time to time. The Board of Directors of the Company remains committed to obtaining a high return on the shareholders’ investment, consistent with sound and prudent banking practices, and believes that the acquisition of or affiliation with selected banks, bank holding companies and permitted non-banking activities is a desirable means to accomplish that objective. The Company has authorized but unissued shares of stock which might be issued from time to time to raise additional capital or for other bank affiliations or other corporate purposes.

7

Available Information

The Holding Company’s common stock was registered with the Securities and Exchange commission (“SEC”) under the Securities Exchange Act of 1934, as amended (“1934 Act”). This registration requires periodic reporting and includes, but is not limited to, the filing of annual, quarterly and other reports with the SEC.

The public may read and copy any materials that are filed with SEC at the SEC’s Public Reference Room at 450 Fifth Street, N. W., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site, (http://www.sec.gov), that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

The Company presently has an internet website, (http://www.firstwvbancorp.com). Copies of the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished to the Securities and Exchange Commission are available on the internet website and are also available free of charge upon request.

Statistical Information

The statistical information noted below is provided pursuant to Guide 3, Statistical Disclosure by Bank Holding Companies. Page references are to the Annual Report to Shareholders for the year ended December 31, 2006, and such pages are incorporated herein by reference.

| 1. | Distribution of Assets, Liabilities and Stockholders’ equity; |

Interest Rates and Interest Differential

| | | | |

| | | | | Page |

| a. | | Average Balance Sheets | | 24 |

| | |

| b. | | Analysis of Net Interest Earnings | | 24 |

| | |

| c. | | Rate Volume Analysis of Changes in Interest Income and Expense | | 26 |

| | a. | Book Value of Investments |

Book values of investment securities at December 31, 2006

and 2005 are as follows (in thousands):

| | | | | | |

| | | December 31, 2006 | | December 31, 2005 |

Securities held to maturity: | | | | | | |

Obligations of states and political subdivisions | | $ | 973 | | $ | 1,776 |

| | | | | | |

Total held to maturity | | $ | 973 | | $ | 1,776 |

| | | | | | |

Securities available for sale: | | | | | | |

U.S. Treasury securities and obligations of U.S. Government corporations and agencies | | $ | 36,197 | | $ | 40,590 |

Obligations of states and political subdivisions | | | 21,684 | | | 19,988 |

Mortgage-backed securities | | | 51,665 | | | 45,254 |

Equity Securities | | | 375 | | | 390 |

| | | | | | |

Total available for sale | | | 109,921 | | | 106,222 |

| | | | | | |

Total | | $ | 110,894 | | $ | 107,998 |

| | | | | | |

| | | | |

| b. | | Maturity Schedule of Investments | | 28 |

| | |

| c. | | Securities of Issuers Exceeding 10% of Stockholders’ Equity | | N/A |

| | |

| | The Corporation does not have any securities of Issuers, other than U.S. Government and U.S. Government agencies and corporations, which exceed 10% of Stockholders’ Equity. | | |

8

Statistical Information - continued

| | | | | | |

3. | | Loan Portfolio | | |

| | | |

| | a. | | Types of Loans | | 11 |

| | b. | | Maturities and Sensitivity to Changes in Interest Rates | | 29 |

| | c. | | Risk Elements | | 30 |

| | |

1. | | Nonaccrual, Past Due and Restructured Loans | | 30 |

| | |

2. | | Potential problem loans | | 30 |

| | |

3. | | Foreign outstandings | | N/A |

| | |

4. | | Loan concentrations | | 14 |

| | d. | | Other Interest Bearing Assets | | N/A |

| | |

4. | | Summary of Loan Loss Experience | | 12, 31, 32 |

| | |

5. | | Deposits | | |

| | | |

| | a. | | Breakdown of Deposits by Categories, Average Balance and Average Rate Paid | | 24 |

| | | |

| | b. | | Other Deposit categories | | N/A |

| | | |

| | c. | | Foreign depositors with deposits in domestic offices | | N/A |

| | | |

| | d. | | Maturity Schedule of Time Certificates of Deposit and Other Time Deposits of $100,000 or more | | 13 |

| | |

6. | | Return on Equity and Assets | | 22 |

| | |

7. | | Short-Term Borrowings | | 13, 32 |

You should carefully review and consider the following risk factors, together with the other information provided in this Annual Report on Form 10-K.

The Company and its wholly owned subsidiary, Progressive Bank, N.A. (Bank) are subject to an agreement with the Federal Reserve Bank and a Formal Agreement with the Office of the Comptroller of the Currency (OCC).

The Company and its subsidiary Bank are required to comply with certain agreements with the OCC and Federal Reserve Board. The direct costs of compliance include legal and consulting fees, higher FDIC insurance rates, increased examination fees, and staffing costs, which all decrease earnings and reduce the capital base. Other costs include significant dedication of resources that shift the focus of the organization away from growing the customer base to ensuring that past problems of noncompliance with laws and regulations are addressed and controls are put in place to prevent future noncompliance. The agreements include restrictions on the ability of the Company and the Bank to declare dividends, of the Company to acquire treasury stock and the Bank to engage in certain non-bank activities. In addition, the Bank is required to maintain higher levels of capital than other financial institutions without similar regulatory issues. The management team has been actively engaged in addressing the specific issues raised in the agreements and ensuring compliance with all requirements. Noncompliance with such agreements may also have adverse affects upon the Company and the Bank.

9

| Item 1A | Risk Factors - continued |

Due to Increased Competition, the Bank May Not Be Able to Attract and Retain Banking Customers At Current Levels Adversely affecting Company Profits.

If, due to competition from competitors in the Bank’s market areas, the Bank is unable to attract new and retain current customers, loan and deposit growth could decrease causing the Bank’s results of operations and financial condition to be negatively impacted. The Bank faces competition from the following:

| 1. | local, regional and national banks; |

| 7. | brokerage firms serving the Company’s market areas. |

The Bank’s Lending Limit May Prevent It from Making Large Loans.

In the future, the Bank may not be able to attract larger volume customers because the size of loans that the Bank can offer to potential customers is less than the size of the loans that many of the company’s larger competitors can offer. We anticipate that our lending limit will continue to increase proportionately with the Bank’s growth in earnings; however, the Bank may not be able to successfully attract or maintain larger customers.

Certain Loans That the Bank Makes Are Riskier than Loans for Real Estate Lending.

The Bank makes loans that involve a greater degree of risk than loans involving residential real estate lending. Commercial business loans may involve greater risks than other types of lending because they are often made based on varying forms of collateral, and repayment of these loans often depends on the success of the commercial venture. Consumer loans may involve greater risk because adverse changes in borrowers’ incomes and employment after funding of the loans may impact their abilities to repay the loans.

The Bank’s loan portfolio at December 31, 2006, consists of the following:

| | | |

Type of Loan | | Percentage of Portfolio | |

Residential Real Estate | | 35.9 | % |

Commercial, Principally Real Estate Secured | | 36.5 | % |

Consumer | | 11.1 | % |

The Bank Is Subject to Interest Rate Risk.

Aside from credit risk, the most significant risk resulting from the Bank’s normal course of business, extending loans and accepting deposits, is interest rate risk. If market interest rate fluctuations cause the bank’s cost of funds to increase faster than the yield of its interest-earning assets, then its net interest income will be reduced. The Bank’s results of operations depend to a large extent on the level of net interest income, which is the difference between income from interest-earning assets, such as loans and investment securities, and interest expense on interest-bearing liabilities, such as deposits and borrowings. Interest rates are highly sensitive to many factors that are beyond the company’s control, including general economic conditions and the policies of various governmental and regulatory authorities.

10

The Company and the Bank rely heavily on their management team, and the unexpected loss of key management may adversely affect operations.

The success of the Company and the Bank to date has been influenced strongly by their ability to attract and to retain senior management experienced in banking and financial services. The ability to retain executive officers and the current management teams will continue to be important to the successful implementation of their strategies. Neither the Company nor the Bank have employment or non-compete agreements with any of these key employees. The unexpected loss of services of any key management personnel, or the inability to recruit and retain qualified personnel in the future, could have an adverse effect on business and financial results. In the event that approvals by the OCC and the Federal Reserve Board of Sylvan J. Dlesk as President and CEO of the Company and as President of the Bank are not obtained as more particularly detailed at Item 9B, the lack of such executive positions and the expenditure of time and other assets necessary to find and recruit a replacement or replacements for such positions may have an adverse effect on the Company and the Bank.

An Economic Slowdown in the Bank’s Market Area Could Hurt Our Business.

An economic slowdown in the Bank’s market areas could hurt our business. An economic slowdown could have the following consequences:

| • | | Loan delinquencies may increase; |

| • | | Problem assets and foreclosures may increase; |

| • | | Demand for the products and services of the company may decline; and |

| • | | Collateral (including real estate) for loans made by the company may decline in value, in turn reducing customers’ borrowing power and making existing loans less secure. |

The Company and the Bank are Extensively Regulated.

The operations of the Company are subject to extensive regulation by federal, state and local governmental authorities and are subject to various laws and judicial and administrative decisions imposing requirements and restrictions on them. Policies adopted or required by these governmental authorities can affect the company’s business operations and the availability, growth and distribution of the company’s investments, borrowings and deposits. Proposals to change the laws governing financial institutions are frequently raised in Congress and before bank regulatory authorities. Changes in applicable laws or policies could materially affect the Company’s business, and the likelihood of any major changes in the future and their effects are impossible to determine.

The Bank’s Allowance for Loan Losses May Not Be Sufficient.

In the future, the Bank could experience negative credit quality trends that could head to a deterioration of asset quality. Such deterioration could require the Bank to incur loan charge-offs in the future and incur additional loan loss provision, both of which would have the effect of decreasing earnings. The Bank maintains an allowance for possible loan losses, which is a reserve established through a provision for possible loan losses charged to expense that represents management’s best estimate of probable losses that have been incurred within the existing portfolio of loans. Any increases in the allowance for possible loan losses will result in a decrease in net income and, possibly, capital, and may have a material adverse effect on the Company’s financial condition and results of operation.

11

Shares of the Company’s Common Stock Are Not Insured.

Neither the Federal Deposit Insurance Corporation nor any other governmental agency insures the shares of the Company’s common stock. Therefore, the value of your shares in the Company is based on their market value and may decline.

The Company’s Ability to Pay Dividends Depends Primarily on Dividends Received from the Bank, which is Subject to Regulatory Limits.

The ability of the Company, being a bank holding company, to pay dividends depends on its receipt of dividends from the Bank. Dividend payments from the Bank are subject to legal and regulatory limitations, generally based on net profits and retained earnings, imposed by the various banking regulatory agencies. The ability of the Bank to pay dividends is also subject to its profitability, financial condition, capital expenditures and other cash flow requirements. The payment of dividends is permitted but temporarily subject to the prior approval of the OCC and there is no assurance that the Bank will be permitted to pay dividends in the future. The Corporation’s failure to pay dividends on its common stock could have a material adverse effect on the market price of its common stock.

Customers May Default on the Repayment of Loans.

The Bank’s customers may default on the repayment of loans, which may negatively impact the Company’s earnings due to loss of principal and interest income. Increased operating expenses may result from the allocation of management time and resources to the collection and work-out of the loan. Collection efforts may or may not be successful causing the Bank to write off the loan or repossess the collateral securing the loan which may or may not exceed the balance of the loan.

The Company’s Controls and Procedures May Fail or Be Circumvented.

Management regularly reviews and updates the Company’s internal controls, disclosure controls and procedures, and corporate governance policies and procedures. Any system of controls, no matter how well designed and operated, is based in part on certain assumptions and can provide only reasonable, not absolute, assurances that the objectives of the system are met. Any failure or circumvention of the Company’s controls and procedures or failure to comply with regulations related to controls and procedures could have a material adverse effect on the Company’s business, results of operations and financial conditions.

| Item 1B | Unresolved Staff Comments |

Not Applicable

The Holding Company and its subsidiary bank owned and/or leased property as of December 31, 2006 as described below.

12

Progressive Bank, N.A. presently owns the land and building at 1701 Warwood Avenue, Wheeling, West Virginia where the bank’s Warwood offices are located. The two-story building has been totally renovated and has approximately 15,500 square feet in total area. The office has three drive-in facilities adjacent to the rear of the building and customer parking to the north side of the building. A lot on North Seventeenth Street, southwest of the building, is used for employee parking. A two-story home located at 1709 Warwood Avenue was purchased in 1985 for the purpose of providing rental income and additional employee parking. Progressive Bank, N.A. also owns a lot adjacent to the bank for future expansion.

Progressive Bank, N.A. also owns the building and approximately 50% of the land at 875 National Road, Wheeling, West Virginia at which the Woodsdale branch is located. The Woodsdale branch has expanded its one-story building to a total of approximately 6,050 square feet in area in 1994. This expansion was accomplished by the purchase of approximately 6,600 square feet of land located immediately west of the existing bank office property in 1993. The office has a four lane drive-in facility at the rear of the building and one drive-in automatic teller machine in the front of the building. The remaining portion of the land is leased to the bank until 2013 with 1 ten-year option to renew.

Progressive Bank, N.A. has a lease agreement to rent property for use as a banking premises known as the “Bethlehem branch office.”

The Bethlehem branch office is located at 1090 East Bethlehem Boulevard, Wheeling, West Virginia. The office is a one story building with approximately 3400 square feet of area and has four drive-in lanes. The lease is for a five year term commencing February 1, 2002, with eight successive five year options to renew.

Progressive Bank, N.A. also owns the Wellsburg branch office located at 744 Charles Street, Wellsburg, West Virginia. This office is a 3 story building with over 8,400 square feet of total area. This office includes an on-premises drive-in facility.

Progressive Bank, N.A. has a license agreement to operate the Moundsville supermarket branch office located at 1306 Lafayette Avenue, Moundsville, West Virginia. The license agreement is for a five year term commencing December 1, 1994, with two five year options to renew. The option to renew was exercised to extend the agreement for an additional period of 5 years, beginning January 1, 2005.

Progressive Bank, N.A. owns the building and land located at 809 Lafayette Avenue, Moundsville, West Virginia. The office is a two-story building with approximately 7,430 square feet of total area. This office also has a three lane drive in facility.

Progressive Bank, N.A. owns the New Martinsville branch office located at 425 Third Street, New Martinsville, West Virginia. The office is a single story brick branch bank facility with approximately 3,642 square foot of area. This office also has a two lane drive-in at the rear of the facility.

Progressive Bank, N.A. owns the building and land for the Bellaire branch office located at 426 34th Street, Bellaire, Ohio, including its drive-in facilities at the rear of the building. The bank office is housed in a one-story building, which includes office space in its basement for a total of 4,500 square feet of office area. The bank also owns a lot adjacent to the parking lot.

Progressive Bank, N.A. owns the building and the land for its full-service banking facility in Buckhannon, West Virginia. The Buckhannon office is a one story building with approximately 1,760 square feet of office area. The office has a three lane drive-in facility located at the rear of the building.

Progressive Bank, N.A. has a lease agreement for the building for its Weston branch office. The Weston branch office is located at #10 Market Square Shopping Center, Weston, West Virginia. This lease is for a period of two years commencing April 1, 2006, with two successive two year options to renew followed by two successive five year renewal options.

Progressive Bank, N.A. has a lease agreement for the building used for executive office space. The office space is located at 2B Elm Grove Crossing, Wheeling, West Virginia. This lease is for a period of one year commencing January 1, 2007, with two successive one year options to renew.

Progressive Bank, N.A. owns a tract of real estate of approximately 1.64 acres situated on the waters of Finks run and West Virginia State Route 20, in Buckhannon, West Virginia. The property was purchased and is being held for future banking office expansion.

Progressive Bank, N.A. also owns a tract of land with a building thereon fronting on South Locust Street in the City of Buckhannon, WV. The property was purchased and is being held for future banking office expansion.

13

The Holding Company does not have any encumbrances or capital leases on its personal property.

The nature of the business of the Holding Company's subsidiary generates a certain amount of litigation involving matters arising in the ordinary course of business. The Company is unaware of any litigation other than ordinary routine litigation incidental to the business of the Company, to which it or its subsidiary is a party or of which any of their property is subject.

| Item 4 | Submission of Matters to Vote of Security Holders |

No matters were submitted to a vote of security holders during the fourth quarter of the fiscal year covered by this report.

14

PART II

| Item 5 | Market for Registrant’s Common Stock and Related Stockholder Matters |

On February 13, 1995, the Holding Company’s common stock was filed and became effective under section 12(g) of the Securities and Exchange Act of 1934. On February 21, 1995, the Holding Company was approved for listing its securities on the American Stock Exchange’s Emerging Company Marketplace and began trading under the symbol FWV.EC on March 8, 1995. The Holding Company subsequently filed Form 8A to register its common stock under Section 12(b) of the Securities and Exchange Act of 1934 which became effective on March 1, 1995. On June 16, 1995, the Holding Company was approved for listing its securities on the American Stock Exchange primary list and began trading under the symbol FWV on June 20, 1995.

As of December 31, 2006, the Holding Company had 303 registered shareholders of record who collectively held 1,528,443 of the 2,000,000 authorized shares of the Holding Company, par value $5.00 per share. The Holding Company held 10,000 treasury shares.

The following table sets forth the high and low sales prices of the common stock of the Holding Company as reported by the American Stock Exchange for each quarter in 2006 and 2005.

| | | | | | | | | | | | | | |

| | | | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter |

2006 | | High | | $ | 19.40 | | $ | 19.20 | | $ | 20.25 | | $ | 20.80 |

| | Low | | $ | 18.75 | | $ | 18.65 | | $ | 18.70 | | $ | 19.60 |

2005 | | High | | $ | 23.90 | | $ | 21.40 | | $ | 20.07 | | $ | 19.35 |

| | Low | | $ | 20.81 | | $ | 19.51 | | $ | 18.10 | | $ | 17.40 |

Dividends

The ability of the Holding Company to pay dividends will depend on the earnings of its subsidiary bank and its financial condition, as well as other factors such as market conditions, interest rates and regulatory requirements. Therefore, no assurances may be given as to the continuation of the Holding Company’s ability to pay dividends or maintain its present level of earnings. See Note 17 of the Notes to Consolidated Financial Statements appearing at Page 16 of the Annual Report to Shareholders for the year ended December 31, 2006, included in this report asExhibit 13.1, and incorporated herein by reference, for a discussion on subsidiary dividends.

The Holding Company has paid regular quarterly cash dividends since it became a bank holding company in 1975. Total dividends declared and paid by the Holding Company in 2006 and 2005 were $.76 per share each year.

The following table sets forth annual dividend, net income and ratio of dividends to net income of the Holding Company for 2006, 2005 and 2004.

DIVIDEND HISTORY OF HOLDING COMPANY

(per share)

| | | | | | | | | |

| | | Dividend | | Net Income | | Ratio - Dividends to

Net Income | |

2006 | | $ | .76 | | $ | 1.40 | | 54.3 | % |

2005 | | $ | .76 | | $ | 1.48 | | 51.4 | % |

2004 | | $ | .76 | | $ | 1.73 | | 43.9 | % |

The common stock of the Holding Company is not subject to any redemption provisions or restrictions on alienability. The common stock is entitled to share pro rata in dividends and in distributions in the event of dissolution or liquidation. There are no options, warrants, privileges or other rights with respect to Holding Company stock at the present time, nor are any such rights proposed to be issued.

15

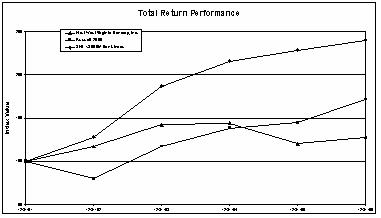

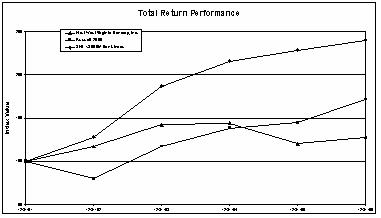

Performance Graph

Period Ending

| | | | | | | | | | | | |

Index | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 |

First West Virginia Bancorp, Inc. | | 100.00 | | 117.15 | | 142.16 | | 143.84 | | 120.57 | | 127.95 |

Russell 2000 Index | | 100.00 | | 79.52 | | 117.09 | | 138.55 | | 144.86 | | 171.47 |

SNL <500M Bank Asset-Size Index | | 100.00 | | 128.07 | | 186.94 | | 215.79 | | 228.47 | | 240.01 |

Set forth above is a line graph prepared by SNL Securities L.C. (“SNL”), which compares the percentage change in the cumulative total shareholder return on the Company’s common stock against the cumulative total shareholder return on stocks included on the SNL Index for banks with assets under $500 million and the Russell 2000 Index for the period December 31, 2001 through December 31, 2006. An initial investment of $100.00 (Index value equals $100.00) and ongoing dividend reinvestment is assumed throughout.

| Item 6 | Selected Financial Data |

Selected Financial Data on page 22 of the Annual Report to Shareholders of First West Virginia Bancorp, Inc. for the year ended December 31, 2006, included in this report asExhibit 13.1, is incorporated herein by reference.

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Management’s Discussion and Analysis of Financial Condition and Results of Operations on Pages 23 through 35 of the Annual Report to Shareholders of First West Virginia Bancorp, Inc. for the year ended December 31, 2006, included in this report asExhibit 13.1, is incorporated herein by reference.

| Item 7A | Quantitative and Qualitative Disclosures About Market Risk |

The information required by Item 7A is noted in part in Management’s Discussion and Analysis of Financial Condition and Results of Operations - Interest Rate Risk on pages 33 through 34 of the Annual Report to Shareholders of First West Virginia Bancorp, Inc. for the year ended December 31, 2006, included in this report asExhibit 13.1, is incorporated herein by reference.

| Item 8 | Financial Statements and Supplementary Data |

The report of independent registered public accounting firm and consolidated financial statements, included on pages 2 through 21 of the Annual Report to Shareholders of First West Virginia Bancorp, Inc. for the year ended December 31, 2006, included in this report asExhibit 13.1, are incorporated herein by reference.

Selected quarterly financial data included on page 35 of the Annual Report to Shareholders of First West Virginia Bancorp, Inc. for the year ended December 31, 2006, included in this report asExhibit 13.1, is incorporated herein by reference.

16

| Item 9 | Changes In and Disagreements with Accountants on Accounting and Financial Disclosure |

Not Applicable

| Item 9A | Controls and Procedures |

Evaluation of Disclosure Controls and Procedures

The Company’s Chief Executive Officer and Chief Financial Officer, have evaluated the effectiveness of the design and operation of the corporation’s disclosure controls and procedures within 90 days of the filing of this annual report, and based on their evaluation, the Chief Executive Officer and the Chief Financial Officer have concluded that these disclosure controls and procedures are effective. There were no significant changes in the corporation’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation.

Changes in Internal Controls

There was no change in the Company’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting as of the period covered by this Annual Report which is included in this report asExhibit 13.1, is incorporated herein by reference.

Not Applicable

PART III

| Item 10 | Directors, Executive Officers and Corporate Governance |

| (a) | Directors of the Registrant |

The information required byItem 10 of FORM 10-K related to Directors of the Registrant appears in the First West Virginia Bancorp, Inc.’s 2007 Proxy Statement dated March 13, 2007 for Annual Meeting of Stockholders to be held April 10, 2007, included in this report asExhibit 99, is incorporated herein by reference.

| (b) | Executive Officers of the Registrant |

The following table sets forth selected information about the principal officers of the Holding Company.

TABLE

| | | | |

Name | | Age | | All Positions with Holding Company and Subsidiary(1) (2) |

| Sylvan J. Dlesk | | 68 | | Chairman of the Board of the Holding Company since 2004; President & CEO of the Company since June 2006; Interim President and Chief Executive Officer of the Company from April 2005 to June 2006; Vice Chairman of the Board of the Holding Company 2000-2004; President and CEO since June 2006; Interim President and Chief Executive Officer of Progressive Bank, N.A. from April 2005 to February 2006; Director of Holding Company and Director of Progressive Bank N.A. since 1988. |

| | |

| Laura G. Inman | | 65 | | Vice Chairman of the Board of the Holding Company since 2004; Chairman of the Board of the Holding Company 1998-2004; Vice Chairman of the Board of the Holding Company 1995-1998; Senior Vice President of the Holding Company 1993-1995; Senior Vice President of Progressive Bank, N.A. from 1993-2001; Director of the Holding Company and Director of Progressive Bank, N.A. from 1993. |

17

| | | | |

| Francie P. Reppy | | 46 | | Executive Vice President, Chief Administrative Officer, Chief Financial Officer and Treasurer of the Holding Company since 2005; Senior Vice President, Chief Financial Officer and Treasurer of the Holding Company 2004-2005; Senior Vice President and Chief Financial Officer of the Holding Company 2000-2004; Controller of the Holding Company 1992-2000; Executive Vice President, Chief Administrative Officer, and Chief Financial Officer since 2005; Senior Vice President, Chief Financial Officer and Cashier of Progressive Bank, N.A. 2004-2005; Senior Vice President and Chief Financial Officer of Progressive Bank, N.A. 2000-2004; Controller of Progressive Bank, N.A. 1992-2000. |

| | |

| Nancy J. Ritter | | 53 | | Vice President of the Holding Company since 2004; Senior Vice President/Operations Officer and Cashier of Progressive Bank, N.A. since 2005. Senior Vice President of Progressive Bank, N.A. 2004-2005. |

| | |

| Connie R. Tenney | | 51 | | Vice President of the Holding Company since 1996; Senior Vice President of Progressive Bank, N.A. since 2003; President, Chief Executive Officer, Cashier and Secretary of Progressive Bank, N.A.- Buckhannon 1995-2003; Director of Progressive Bank, N.A. - Buckhannon 1990-2003; Executive Vice President, Cashier and Secretary of Progressive Bank, N.A.- Buckhannon 1990-1995; Cashier and Secretary 1986-1990 |

Notes:

(1) | With the exception of Nancy J. Ritter and Sylvan J. Dlesk, each of the executive officers has been employed as an officer or an employee for the Company for more than 5 years. Mr. Dlesk serves as President and Chief Executive Officer of the Company; Chairman of the Board of the Company and as a Director of the Bank, having been affiliated with the Company since 1988. Nancy J. Ritter has been employed by the Company since April 2004 and was previously employed by WesBanco Bank as Senior Vice President Branch Administration from 2001 until 2004 and was employed by the former Wheeling National Bank from 1984, until its merger with WesBanco Bank. Mrs. Ritter held various operational positions at Wheeling National Bank and served as Senior Vice President of Branch Administration and Operations from 1998 until 2004. |

(2) | With the exception of Connie R. Tenney, all the principal officers of the Holding Company reside in or near Wheeling, West Virginia. Connie R. Tenney resides near Buckhannon, West Virginia. |

18

PART III

| Item 11 | Executive Compensation |

The information required byItem 11 of FORM 10-K related to Executive Compensation appears in the First West Virginia Bancorp, Inc.’s 2007 Proxy Statement dated March 13, 2007 for Annual Meeting of Stockholders to be held April 10, 2007, included in this report asExhibit 99, is incorporated herein by reference.

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

The information required byItem 12 of FORM 10-K appears in the First West Virginia Bancorp, Inc.’s 2007 Proxy Statement dated March 13, 2007 for Annual Meeting of Stockholders to be held April 10, 2007, included in this report asExhibit 99, is incorporated herein by reference.

| Item 13 | Certain Relationships and Related Transactions, and Director Independence |

The information required byItem 13 of FORM 10-K appears in the First West Virginia Bancorp, Inc.’s 2007 Proxy Statement dated March 13, 2007 for Annual Meeting of Stockholders to be held April 10, 2007, included in this report asExhibit 99, is incorporated herein by reference and in Note 11 of the Notes to Consolidated Financial Statements appearing at Page 14 of the Annual Report to Shareholders for the year ended December 31, 2006, included in this report asExhibit 13.1, and incorporated herein by reference.

The Company follows a written policy for the granting of loans to directors and executive officers. This policy is as follows: With the exception of the items specifically identified below, all loans to Board of Directors and Executive Officers will be reported to the subsidiary bank board in a timely manner. Credit extensions and terms for any of the above will be: (1) made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions by the bank for those who are not recognized as any of the above mentioned individuals and (2) does not involve more than the normal risk of repayment of present other unfavorable features:

1. Any executive officer, director, or principal shareholder requesting a loan is to submit a written application containing the purpose of the credit, and/or a financial statement depending upon the nature of the credit to the bank.

2. Loans to an Executive Officer are permitted in an aggregate amount that equals the higher of$25,000 or 2.5% of the bank’s capital. However, in no event shall the aggregate outstanding amount of these loans exceed $100,000.00. Executive Officers have been defined by the Board of Directors to include Chairman, President & CEO, Executive Vice President and COO, Senior V.P. & CFO.

3. Extensions of credit shall not be made to any of the bank’s Directors, or principal shareholders or to any related interest of that person in an amount that when aggregated with the amount of all other extensions of credit to that person and all related interests of that person exceeds thehigher of $25,000 or 5% of the bank’s capital, and unimpaired surplus unless:

(1) The extension of credit or line of credit has been approved in advance by a majority of the entire Board of Directors, and

| (2) | The interested party has abstained from participating directly or indirectly in the vote. |

(3) All loans exceeding the aggregate of $500,000 must be approved according to steps 1 and 2. Payment of an overdraft of an executive officer or director is not permitted unless the funds are made in accordance with 1) a written, preauthorized, interest bearing extension of credit plan that specifies a method of repayment or, 2) a written preauthorized transfer of funds from another account of the account holder at the bank. This prohibition does not apply to payment of inadvertent overdrafts on an account in an aggregate amount of $1,000 or less provided 1) the account is not overdrawn for more than 5 business days, and 2) the bank assess the usual fee charged any other customer of the bank in similar circumstances.

4. There are no limits on loans to Executive Officers of the Bank when the loan is for the purpose of educating dependent children or to purchase, refinance (or improve) that Officer’s principal residence. These loans, of course, must comply with all other bank policy, may not be at preferential rates and must be approved by the Board of Directors if they exceed the limits outlined in item (3) above. Loans to executive officers will be made subject to the condition that the loan will, at the option of the bank, become due and payable at any time that the officer is indebted to this and other financial institutions in an aggregate amount greater than the amount specified in the preceding paragraph.

5. Any borrowing from a financial institution (this bank, other banks, savings and loans, etc.) by an executive officer of this bank, that is in excess of the established limits, shall be immediately reported to the President, who will then report these loans to the Board of Directors. This report to the President will be in writing and will include the lender’s name, the date and amount of each loan, the security (if any), and the purpose for which the proceeds have been or will be used.

6. In compliance with Regulation O, the total of all loans to Executive Officers, Directors, Principal Shareholders and their related interest of the bank, holding companies and subsidiaries of the holding company, cannot exceed the amount of the bank’s unimpaired capital and unimpaired surplus. This limit will be established by adding the total equity capital shown on the bank’s most recently filed consolidated report of condition and authorized subordinated notes and debentures, and the valuation reserve.

19

The Company also requires all directors to report related interests and to abstain prior to approval of any extensions of credit which are subject to board approval. Board approval is required for loans with aggregate exposure secured by real estate in excess of $300,000, non-real estate secured aggregate loan exposure in excess of $150,000 and aggregate unsecured loan exposure in excess of $25,000 to any related borrower. The reporting and abstention requirements are evidenced by the director signing a form prior to the approval of such loans. This reporting requirement was at the direction of the Corporate Governance, Human Resource and Compensation Committee.

Fees for services to the Company that are provided by any Director are subject to approval by the Board of Directors of the Company or its subsidiary.

| Item 14 | Principal Accountant Fees and Services |

The information required byItem 14 of FORM 10-K appears in the First West Virginia Bancorp, Inc.’s 2007 Proxy Statement dated March 13, 2007 for Annual Meeting of Stockholders to be held April 10, 2007, included in this report asExhibit 99, is incorporated herein by reference.

20

| Item 15 | Exhibits and Financial Statement Schedules |

| (a) | Financial Statements Filed; Financial Statement Schedules |

The following consolidated financial statements of First West Virginia Bancorp, Inc. and its subsidiary, included in the Annual Report to Shareholders for the year ended December 31, 2006, are incorporated by reference inItem 8:

| | |

| | | Exhibit 13.1

Page Number |

Report of Independent Registered Public Accounting Firm | | 21 |

| |

Consolidated Balance Sheet (December 31, 2006 and December 31, 2005) | | 2 |

| |

Consolidated Statements of Income (Years ended December 31, 2006, 2005 and 2004) | | 3 |

| |

Consolidated Statements of Changes in Stockholders’ Equity (Years ended December 31, 2006, 2005 and 2004) | | 4 |

| |

Consolidated Statements of Cash Flows (Years ended December 31, 2006, 2005 and 2004) | | 5 |

| |

Notes to Consolidated Financial Statements (Years ended December 31, 2006, 2005 and 2004) | | 6 - 20 |

On October 31, 2006 a report on Form 8-K was filed which contained a press release dated October 30, 2006 that reported the earnings of First West Virginia Bancorp, Inc. for the third quarter ended September 30, 2006.

The exhibits listed in the Exhibit Index on page 23 of this FORM 10-K are filed herewith or incorporated by reference.

21

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

First West Virginia Bancorp, Inc. (Registrant) |

| |

| By: | | /S/ SYLVAN J. DLESK |

| | Sylvan J. Dlesk Chairman/President and Chief Executive Officer/Director |

| Date: | | March 21, 2007 |

Pursuant to the requirements of the Securities Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| | | | |

Signatures | | Title | | Date |

| | |

/S/ SYLVAN J. DLESK Sylvan J. Dlesk | | Chairman, President and Chief Executive Officer, Director | | March 21, 2007 |

| | |

/S/ FRANCIE P. REPPY Francie P. Reppy | | Executive Vice President, Chief Administrative Officer Chief Financial Officer, Treasurer | | March 21, 2007 |

| | |

/S/ NADA E. BENEKE Nada E. Beneke | | Director | | March 21, 2007 |

| | |

/S/ GARY W. GLESSNER Gary W. Glessner | | Director | | March 21, 2007 |

| | |

/S/ LAURA G. INMAN Laura G. Inman | | Director | | March 21, 2007 |

| | |

/S/ JAMES C. INMAN, JR. James C. Inman, Jr. | | Director | | March 21, 2007 |

| | |

/S/ R. CLARK MORTON R. Clark Morton | | Director | | March 21, 2007 |

| | |

/S/ THOMAS A. NOICE Thomas A. Noice | | Director | | March 21, 2007 |

| | |

/S/ WILLIAM G. PETROPLUS William G. Petroplus | | Director | | March 21, 2007 |

| | |

/S/ THOMAS L. SABLE Thomas L. Sable | | Director | | March 21, 2007 |

22

EXHIBIT INDEX

The following exhibits are filed herewith and/or are incorporated herein by reference.

| | |

Exhibit

Number | | Description |

| |

| 3.1 | | Certificate and Articles of Incorporation of First West Virginia Bancorp, Inc. Incorporated herein by reference. |

| |

| 3.2 | | Bylaws of First West Virginia Bancorp, Inc. Incorporated herein by reference. |

| |

| 10.3 | | Lease dated July 20, 1993 between Progressive Bank, N.A., formerly known as “First West Virginia Bank, N.A.”, and Angela I. Stauver. Incorporated herein by reference. |

| |

| 10.4 | | Banking Services License Agreement dated October 26, 1994 between Progressive Bank, N.A., formerly known as “First West Virginia Bank, N.A.”, and The Kroger Co. Incorporated herein by reference. |

| |

| 10.5 | | Lease dated November 14, 1995 between Progressive Bank, N.A. - Buckhannon and First West Virginia Bancorp, Inc. and O. V. Smith & Sons of Big Chimney, Inc. Incorporated herein by reference. |

| |

| 10.6 | | Lease dated May 12, 2001 between Progressive Bank, N.A. and Sylvan J. Dlesk and Rosalie J. Dlesk doing business as Dlesk Realty & Investment Company. Incorporated herein by reference. |

| |

| 10.7 | | Lease dated January 1, 2005 between Progressive Bank, N.A. and Elm Grove Properties LLC. Incorporated herein by reference. |

| |

| 11.1 | | Statement regarding computation of per share earnings. Filed herewith and incorporated herein by reference. |

| |

| 12.1 | | Statement regarding computation of ratios. Filed herewith and incorporated herein by reference. |

| |

| 13.1 | | Annual Report to Shareholders, as listed in Part II, Item 8 Filed herewith and incorporated herein by reference. |

| |

| 13.2 | | Management’s Report on Financial Statements Filed herewith as part of Exhibit 13.1, Annual Report to Shareholders. |

| |

| 14.1 | | Code of Ethics. Incorporated herein by reference. |

| |

| 21.1 | | Subsidiaries of the Holding Company. Filed herewith and incorporated herein by reference. |

| |

| 23 | | Consent of S.R. Snodgrass, A.C. Filed herewith and incorporated herein by reference. |

| |

| 31 | | Rule 13a-14(a) / 15d/14(a) Certifications - Certification of Chief Executive Officer pursuant to section 302 of the Securities and Exchange Act of 1934. Filed herewith and incorporated herein by reference. |

| |

| 31.1 | | Rule 13a-14(a) / 15d/14(a) Certifications - Certification of Chief Financial Officer pursuant to section 302 of the Securities and Exchange Act of 1934. Filed herewith and incorporated herein by reference. |

| |

| 32 | | Certification pursuant to 18 U.S.C. ‘1350, as adopted pursuant to section 906 of the SARBANES-OXLEY ACT of 2002. Filed herewith and incorporated herein by reference. |

| |

| 99 | | Proxy statement for the Annual Shareholders meeting to be held April 10, 2007 Filed herewith and incorporated herein by reference. |

23