UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________

FORM 10-K

__________________________________________________________________________

| | | | | |

| ☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2024

or

| | | | | |

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from _______ to _______

Commission File Number 1-2376

__________________________________________________________________________

FMC CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________________________________________________ | | | | | | | | | | | |

| Delaware | | 94-0479804 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| 2929 Walnut Street | Philadelphia | Pennsylvania | 19104 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: 215-299-6000

__________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | | FMC | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | | | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

| | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | |

| ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

| | | | | | | | |

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | | ☐ |

| | |

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). | | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2024, the last day of the registrant’s second fiscal quarter, was $7,145,820,070. The market value of voting stock held by non-affiliates excludes the value of those shares held by executive officers and directors of the registrant.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

As of December 31, 2024, there were 124,840,902 of the registrant's common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

| | | | | | | | |

| DOCUMENT | | FORM 10-K REFERENCE |

| Portions of Proxy Statement for 2025 Annual Meeting of Stockholders | | Part III |

FMC Corporation

2024 Form 10-K

Table of Contents

PART I

FMC Corporation was incorporated in 1928 under Delaware law and has its principal executive offices at 2929 Walnut Street, Philadelphia, Pennsylvania 19104. Throughout this annual report on Form 10-K, except where otherwise stated or indicated by the context, "FMC", the "Company", "We," "Us," or "Our" means FMC Corporation and its consolidated subsidiaries and their predecessors. Copies of the annual, quarterly and current reports we file with the Securities and Exchange Commission ("SEC"), and any amendments to those reports, are available on our website at www.fmc.com as soon as practicable after we furnish such materials to the SEC.

ITEM 1. BUSINESS

General

FMC Corporation is a global agricultural sciences company dedicated to providing farmers innovative solutions that increase the productivity and resilience of their land. From our industry-leading development pipeline to novel biologicals and precision technologies, we are passionate about the power of science to solve agriculture’s biggest challenges. FMC’s innovative crop protection solutions help growers produce food, feed, fiber and fuel for an expanding world population while adapting to a changing environment. FMC is committed to discovering new insecticide, herbicide and fungicide active ingredients, product formulations and pioneering technologies that are consistently better for the planet.

FMC Strategy

We are a tier-one leader and the fifth largest global innovator in the agrochemicals/crop protection market. Our strong competitive position is driven by our technology and innovation, as well as our geographic balance and crop diversity.

FMC is guided by our strategic plan which aims to transform our relationship with growers to become a trusted source for technical expertise and innovative solutions, to deliver superior growth and returns to our stakeholders, and to lead the crop protection industry in safety, talent, sustainability, and innovation. FMC expects to deliver on its growth ambitions by accelerating development and commercialization of our pipeline, driving profitability and competitiveness of our diamides brands and core synthetic portfolio, and growing the leading plant health business driven by our pheromones platform. To enable our growth and help achieve our ambitions, FMC is implementing strategies to be a trusted advisor to the grower through dedicated technical personnel and events, expanded precision technologies, and other digital and communication tools. We believe that expanded business development activities will capture local market innovation in new and existing geographies and further accelerate FMC’s growth.

FMC’s strategy also includes a focus on increasing operating leverage, optimizing functional costs, and driving a fit-for-purpose and resilient supply network. In 2024, FMC’s restructuring efforts generated $165 million in cost benefits and helped shape an FMC that is focused, efficient, and strong in the near-term, and structured to deliver sustained growth and superior results in the long-term. Our supply network is rigorously maintained to balance risk, cost, and quality to enable FMC to generate the greatest possible competitive advantage and profitability from our portfolio.

FMC remains committed to leading the industry in safety, inclusion, and sustainability. We are collectively committed to working safely every day to ensure the safety of our people and products. We also strive to create an environment that fosters a culture of belonging across our team of 5,700 global employees. Additionally, we are committed to delivering products that improve agricultural productivity while protecting the environment for future generations. Our focus on sustainability covers both the impacts of climate change on our business as well as our business on the climate. These values of safety, inclusion, and sustainability define FMC and guide how we do business.

Acquisitions and Divestitures

Through FMC Ventures, our venture capital arm, we have made strategic investments in start-ups and early-stage companies that are developing and applying emerging technologies in the agricultural industry. On November 1, 2024, we completed the sale of the non-core Global Specialty Solutions ("GSS") business to Environmental Science US, LLC d/b/a Envu ("Envu"). We received proceeds, net of the preliminary working capital adjustment, of approximately $340 million in connection with the completion of the sale. The GSS business did not qualify for discontinued operations during 2024.

Financial Information About Our Business

(Financial Information in Millions)

The following table shows the principal products produced by our business, its raw materials and uses:

| | | | | | | | |

| Product | Raw Materials | Uses |

| Insecticides | Synthetic chemical intermediates | Protection of crops, including soybean, corn, fruits and vegetables, cotton, sugarcane, rice, and cereals, from insects and for non-agricultural applications including pest control for home, garden and other specialty markets |

| Herbicides | Synthetic chemical intermediates | Protection of crops, including cotton, sugarcane, rice, corn, soybeans, cereals, fruits and vegetables from weed growth and for non-agricultural applications including turf and roadsides |

| Fungicides | Synthetic chemical intermediates | Protection of crops, including cereals, fruits and vegetables from fungal disease |

| Plant Health | Biological intermediates | Protection of crops, including soybean, corn, fruits and vegetables, cotton, sugarcane, rice, and cereals, from insects and diseases and enhancement of yields |

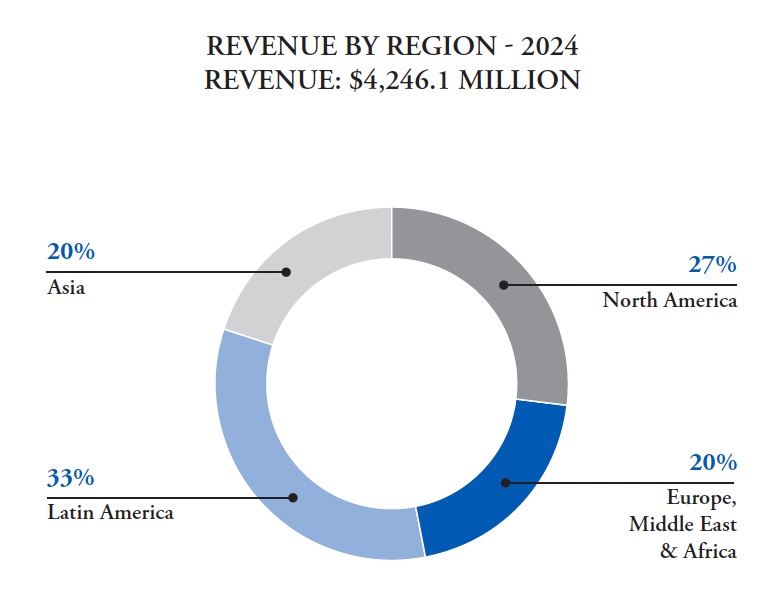

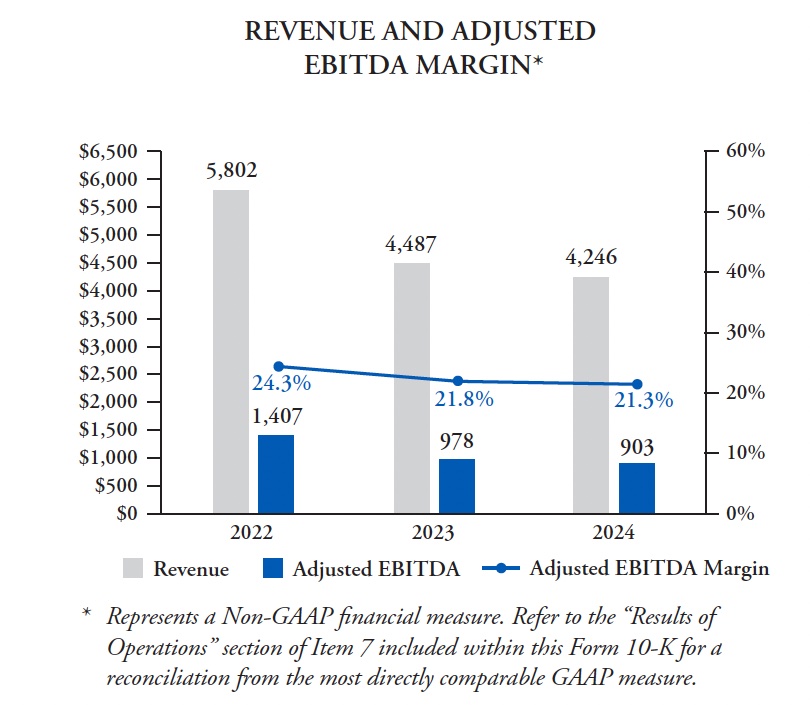

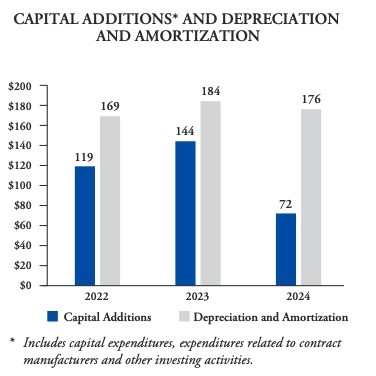

The following charts detail our sales by major geographic region and major product category.

The following table provides our long-lived assets by major geographical region:

| | | | | | | | | | | |

| (in Millions) | December 31, |

| 2024 | | 2023 |

Long-lived assets (1) | | | |

| North America | $ | 956.0 | | | $ | 1,063.4 | |

| Latin America | 278.8 | | | 714.8 | |

Europe, Middle East, and Africa (2) | 3,685.4 | | | 1,718.2 | |

| Asia | 251.0 | | | 1,964.1 | |

| Total | $ | 5,171.2 | | | $ | 5,460.5 | |

________________

(1)Geographic long-lived assets exclude long-term deferred income taxes.

(2)In connection with our plans to establish a global technology and innovation center in Switzerland, we completed intra-entity transfers of certain intellectual property to one of the Company's Swiss subsidiaries during 2024.

Products and Markets

Our portfolio is comprised of three major pesticide categories: insecticides, herbicides and fungicides. The majority of our product lines consist of insecticides and herbicides, and we have a growing portfolio of fungicides mainly used in high value crop segments. Our insecticides are used to control a wide spectrum of pests, while our herbicide portfolio primarily targets a large variety of difficult-to-control weeds. In addition, we are also investing substantially in our Plant Health program which includes biologicals, crop nutrition, and seed treatment products. Biological technologies offer excellent sustainability profiles and serve as strong complements to our synthetic products. Our biologicals feature attributes that exceed the competition, such as high stability, long shelf life, low use rates and compatibility with other chemistries.

We have our own sales and marketing organizations and access the market through a combination of distributors, retailers and co-ops in all four regions. In addition, we sell directly to large growers in select countries such as Brazil. Through these and other alliances, along with our own targeted marketing efforts, access to novel technologies and our innovation initiatives, we expect to maintain and enhance our access in key agricultural and non-crop markets and develop new products that will help us continue to compete effectively.

Industry Overview

The three principal categories of agricultural and non-crop chemicals are: herbicides, insecticides, and fungicides, representing approximately 41 percent, 29 percent and 27 percent of global agricultural crop protection market value, respectively.

The agrochemicals industry is more consolidated following several mergers of the leading crop protection companies, which now include FMC, ChemChina (owner of Syngenta Group, which includes the former Syngenta and Adama), Bayer AG (acquired Monsanto in 2018), BASF AG and Corteva Agriscience. These five innovation companies currently represent approximately 72 percent of the crop protection industry’s global sales. The next group of agrochemical producers include UPL Ltd., Sumitomo Chemical Company Ltd., and Nufarm Ltd. FMC employs various differentiated strategies and competes with unique technologies focusing on certain crops, markets and geographies, while also being supported by a low-cost manufacturing model.

Growth

We are among the leading agrochemical producers in the world. Several products from our portfolio are based on proprietary active ingredients with a range of intellectual property protections which should position us to grow well above market patterns. Our complementary technologies combine improved formulation capabilities and a broader innovation pipeline, resulting in new and differentiated products. We continue to take advantage of enhanced market access positions and an expanded portfolio to deliver near-term growth.

We have a growth strategy driven by obtaining new and improved uses for existing product lines and developing, acquiring, accessing, marketing, distributing and/or selling complementary chemistries, biologicals, and related technologies to strengthen our product portfolio and our capabilities to effectively service our target markets and customers.

Our growth efforts focus on developing environmentally compatible and sustainable solutions that can effectively increase farmers’ yields and provide alternatives to products which may be prone to resistance. We are committed to providing unique, differentiated products to our customers by acquiring and further developing technologies as well as investing in innovation to extend product life cycles, introduce new modes of action, and enter new market segments. Our external growth efforts include product acquisitions, in-licensing of chemistries and technologies and alliances that bolster our market access, complement our existing product portfolio or provide entry into adjacent spaces. We have entered into a range of development and distribution agreements with other companies that provide access to new technologies and products which we can subsequently commercialize.

In FMC Precision Agriculture, we are broadening our award-winning Arc™ farm intelligence platform, a proprietary mobile solution that helps farmers better understand and manage pest pressure through predictive modeling based on real-time and historical data, entomological models, hyper-local weather information and in-field sensors. Arc™ farm intelligence, which is now available in over 25 countries across 20 million acres, allows growers to address pest pressure more efficiently, manage infestations before they escalate and target applications in a more sustainable manner.

Our venture capital arm, FMC Ventures, continued to build its portfolio in 2024 with new collaborations and strategic investments in start-ups and early-stage companies working on new or disruptive technologies. These engagements, which support or augment our internal capabilities, span several important technology segments, including robotics, drone technology, Ag-FinTech, pathogen detection, soil health, peptides and pheromones.

Core Portfolio Strategy

Our core portfolio includes one of our two diamide-class molecules – Rynaxypyr® (chlorantraniliprole) active, the world’s leading insect control technology – with annual revenues of approximately $1.0 billion in 2024. The core portfolio also includes our long standing synthetic herbicides and insecticides which continue to deliver strong performance across a variety of crops around the world. Our current diamide pipeline contains approximately eleven new products containing Rynaxypyr® active to be launched this decade and we expect Rynaxypyr® active to continue a steady growth trajectory notwithstanding the expiration of composition of matter patents covering Rynaxypyr® active in certain countries which started in late 2022. Our growth strategy for Rynaxypyr® active includes the introduction of novel formulations and mixture products as well as lower cost solo formulations. The first of these Rynaxypyr® active containing products, under the trademarks Elevest®, Vantacor®, and Altacor® eVo, were launched in the US and other countries, including Canada and Australia, starting in late 2020 and will be launched in additional countries in 2025 onward. In 2023, Premio® Star insect control formulation was launched in Brazil and launches in other Latin American countries starting in 2025. The implementation of our lower cost diamide manufacturing strategy will also support our ability to compete with expected generic competitors.

Growth Portfolio Strategy

FMC’s growth portfolio includes products under patent or data protection in important markets and/or providing novel modes of action. We believe that FMC has one of the most productive crop protection pipelines in agriculture. The pipeline is highly valuable because it is biased toward new modes of action. The current R&D pipeline features over 20 new active areas in discovery and 18 new active ingredients in development.

The growth portfolio includes our second diamide-class molecule, Cyazypyr® active (cyantraniliprole), which supports a portfolio of products that generated revenues of approximately $0.5 billion in 2024. The Cyazypyr® product portfolio continues to be protected by patents and data protection for key global markets. Cyazypyr® active-containing brands, under the trademarks Verimark®, Benevia®, and Exirel® were launched in certain southern European countries starting in 2023. Our current diamide pipeline contains approximately nine new products containing Cyazypyr® active expected to be launched this decade and we continue to explore further innovations based on this diamide chemistry. We anticipate strong growth of Cyazypyr® active due to its patent portfolio, complex manufacturing profile and regulatory data protection in key markets. Additionally, we are developing novel formulations containing Cyazypyr® active which are intended to expand the spectrum of pest control and provide growers with lower cost in use. We also expect that implementation of our lower cost diamide manufacturing strategy will allow for continued competitiveness of Cyazypyr® active as generic entry begins following patent and data protection expiry.

Our growth portfolio also includes herbicide pipeline products featuring three molecules - Dodhylex™ active, Isoflex™ active and rimisoxafen. Isoflex™ active offers a new mode of action against weeds in cereals. We have launched herbicide brands powered by Isoflex™ active for cereals in Australia, Argentina, China, India and Pakistan. In Brazil, we have launched for use in cotton and rice and will expand into wheat. We anticipate launching other herbicide brands powered by Isoflex™ active in Chile and Uruguay during 2025 and we expect to significantly expand sales of these products to other parts of our EMEA and NA regions over the next five years.

Dodhylex™ active is the first active ingredient in the HRAC/ WSSA Group 28 and the first new herbicide with a novel mode of action in the industry in over three decades. This new mode of action herbicide was discovered at the FMC Stine Research Center and is a testament to FMC's commitment to innovation and our disciplined approach to advancing the most promising new molecules. FMC is working towards registering Dodhylex™ active for use in all major rice-growing countries across the globe and other additional crops. Dodhylex™ active is not currently registered and is not available for sale in any country. We have, however, received a conditional registration for Dodhylex™ active in the Philippines and anticipate first sales later in 2025. The registration dossier for Dodhylex™ active and products containing Dodhylex™ active were submitted for review in India, Brazil, the United States, Colombia, South Korea, Peru, Taiwan, Japan, and Malaysia.

Rimisoxafen is a new dual mode of action herbicide for resistant broadleaf weeds including Palmer amaranth, a fast growing and harmful weed that has developed resistance to most herbicides on the market. Rimisoxafen provides excellent control of key Amaranthus species (Palmer, waterhemp, redroot pigweed) with outstanding residual performance. Rimisoxafen is in the development phase of our pipeline and we are conducting regulatory studies at this time.

Our fungicide pipeline portfolio includes fluindapyr. Fluindapyr controls a variety of key diseases in row and specialty crops around the world. Fluindapyr formulations are registered in the U.S., Brazil, Paraguay, Mexico and Argentina. Key crops include soybeans, corn, cotton, cereals, oilseed rape, fruits & vegetables, tree nuts and peanuts. Onsuva™ fungicide is available in Argentina and Brazil to prevent and control diseases affecting soybean, corn and peanut crops. Adastrio™ fungicide is registered in the U.S. for use in corn, grain sorghum, wheat, triticale and barley against anthracnose leaf blight, common rust, gray leaf spot, Northern corn leaf blight and Southern rust.

Pipeline Growth Strategy

As an agricultural sciences company, FMC believes in innovation and in protecting that innovation through intellectual property rights. We own and license a significant number of U.S. and foreign patents, trademarks, trade secrets and other intellectual property that are cumulatively important to our business. In addition, we seek to license our proprietary technologies through partnering arrangements that effectively allow us to capitalize from our intellectual property. The FMC intellectual property estate provides us with a significant competitive advantage which we seek to expand and renew on a continual basis. We manage our technology investment to discover and develop new active ingredients and biological products, as well as to continue to improve manufacturing processes and existing active ingredients through new formulations, mixtures or other concepts. FMC’s technology innovation processes capture those innovations and protect them through the most appropriate form of intellectual property rights. We also in-license certain active ingredients and other technologies under patents held by third parties, and have granted licenses to certain of our patents to third parties.

Our patents cover many aspects of our business, including our chemical and biological active ingredients, intermediate chemicals, manufacturing processes to produce such active ingredients or intermediates, formulations, and product uses, as well as many aspects of our research and development activities that support the FMC new product pipeline. Patents are granted by individual jurisdictions and the duration of our patents depends on their respective jurisdictions and payment of annuities.

As of December 31, 2024, the Company owned a total of approximately 170 active granted U.S. patents and 2,531 active granted foreign patents (includes Supplemental Patent Certificates); we also have approximately 1,863 patent applications pending globally.

More details regarding our granted patent estate are set forth in the tables below:

Diamides

| | | | | | | | | | | |

| Numbers of active Granted Patents by type, as of December 31, 2024: |

| United States | | Foreign |

| Active Ingredients | — | | | 100 | |

| Intermediates/ Method of Manufacturing | 17 | | | 283 | |

| Formulations/ Mixtures/ Applications | 7 | | | 308 | |

| Total | 24 | | | 691 | |

| | | | | | | | | | | |

| Remaining life of Granted Patents, as of December 31, 2024: |

| United States | | Foreign |

| Through December 31, 2029 (i.e., 2025-2029) | 14 | | | 527 | |

| 2030 - 2034 | 6 | | | 52 | |

| 2035 - 2039 | 2 | | | 23 | |

| 2040 - 2044 | 2 | | | 89 | |

| Total | 24 | | | 691 | |

Pipeline

| | | | | | | | | | | |

| Numbers of active Granted Patents by type, as of December 31, 2024: |

| United States | | Foreign |

| Active Ingredients | 8 | | | 187 | |

| Intermediates/ Method of Manufacturing | 11 | | | 134 | |

| Formulations/ Mixtures/ Applications | 10 | | | 242 | |

| Total | 29 | | | 563 | |

| | | | | | | | | | | |

| Remaining life of Granted Patents, as of December 31, 2024: |

| United States | | Foreign |

| Through December 31, 2029 (i.e., 2025-2029) | — | | | — | |

| 2030 - 2034 | 10 | | | 269 | |

| 2035 - 2039 | 19 | | | 289 | |

| 2040 - 2044 | — | | | 5 | |

| Total | 29 | | | 563 | |

We also own many trademarks that are well recognized by customers or product end-users. Unlike patents, ownership rights in trademarks can be continued indefinitely so long as the trademarks are properly used, and renewal fees are paid.

We actively monitor and manage our patents and trademarks to maintain our rights in these assets and we strategically act when we believe our intellectual property rights are being infringed. Since 2022, continuing through 2024, we initiated proceedings to enforce several of our patents and trademarks against generic producers and infringers, resulting in multiple favorable judgments and settlements in several countries, including in the United States, India, and China. Patent challenges in response to enforcement efforts are expected as an ordinary defense tactic in patent enforcement cases and have been raised in several of our enforcement cases to date; we intend to defend vigorously any patents that are challenged. While we believe that the invalidity or loss of any particular patent, trademark or licenses after appeal would be an unlikely possibility, our patent and trademark estate related to our diamide insect control products based on Rynaxypyr® and Cyazypyr® active ingredients in the aggregate are of material importance to our operations. The composition of matter patent that covers chlorantraniliprole (also known as Rynaxypyr® active) expired in a number of countries in August 2022; this patent protection for composition will end in 2027 across all geographies. The composition of matter patent that covers cyantraniliprole (also known as Cyazypyr® active) expired in a number of countries starting in January 2024; this patent will continue to remain in force in other countries throughout the world, expiring on a country-by-country basis at various dates through January 2029.

Generic competitors have, in some countries, registered and launched generic versions of our Rynaxypyr® -based products. We continue to deploy a multi-pronged strategy to defend that business after active ingredient patent expiration, including enforcement of our patents in many countries which continue to cover chemical intermediates and manufacturing processes that are essential in the production of chlorantraniliprole.

In June 2024, FMC initiated a lawsuit against Sharda USA LLC in the U.S. District Court for the Eastern District of Pennsylvania (Philadelphia) for infringing two US Patents directed to insecticidal compositions containing the combination of bifenthrin and zeta-cypermethrin. FMC requested a preliminary injunction be granted preventing Sharda from selling its generic WINNER product in the US and causing damage to the market for FMC’s HERO® insecticide. In August 2024, FMC successfully obtained a preliminary injunction in the form of a Temporary Restraining Order (TRO). The TRO is currently being appealed.

FMC filed a patent infringement case against Albaugh in the US District Court (Iowa), based on public information disclosed in Albaugh’s EPA dossier. In the lawsuit, FMC alleged that Albaugh imported, made, or used products containing chlorantraniliprole made in violation of FMC’s U.S. patent rights protecting FMC’s processes for manufacturing chlorantraniliprole. In November 2024, FMC and Albaugh reached an agreement to resolve the case. As part of that agreement, Albaugh has agreed to pay FMC for a license to FMC’s patented technology used in the manufacture of chlorantraniliprole for agricultural uses in the United States. The specific terms of the agreement are confidential.

In December 2024, Atticus LLC filed a declaratory judgment case against FMC in the US District Court for the Western District of North Carolina. Atticus requested the Court declare that Atticus’s contemplated formulated products containing chlorantraniliprole do not infringe FMC’s patents directed to certain chlorantraniliprole product formulations. As of the date of the lawsuit, Atticus has not received EPA approval for the products at issue but Atticus nevertheless alleged that approval was expected in the coming months. Atticus has not requested declaratory relief with respect to any of FMC’s patents covering processes to manufacture chlorantraniliprole. In early February 2025, FMC filed a motion to dismiss Atticus' complaint for failure to state a case or controversy.

Patents involve complex factual and legal issues and thus each case is being litigated on the merits; we often seek preliminary injunctive relief to stop sales of products which we believe to be infringing – since equitable relief at the early stage of a litigation is subject to a higher standard of proof than decisions made after a trial on the merits, we may have difficulty prevailing in all cases at that preliminary stage, and in a number of cases in India and China, we have not obtained that requested relief, allowing products to be launched while the underlying cases on the merits continue. Even in situations in which we are not able to prevail on interim relief, we intend to continue litigating in such cases and seek permanent injunctive relief and recovery of damages after a full trial. Patent challenges in response to enforcement efforts are expected as an ordinary defense tactic in patent enforcement cases; we intend to defend vigorously any diamide patents that are challenged.

In early 2022, we received notice that certain third parties were seeking to invalidate our Chinese patents on a certain intermediate involved in producing chlorantraniliprole and a process to produce chlorantraniliprole and cyantraniliprole. During the third quarter of 2022, the China Patent Review Board ("Review Board") issued rulings which held that the two challenged patents were not valid in China. In 2023, we appealed the Review Board's decision to the Beijing IP Court. The Beijing IP Court upheld the decisions of the Review Board. We believe that the Beijing IP Court’s decisions were seriously flawed both on procedural and substantive grounds and we have appealed the Review Board's decision to the People’s Supreme Court of China. Under Chinese law, the patents remain valid but are not enforceable pending appeal. As of the date of this Form 10-K, we are awaiting a decision from the People’s Supreme Court of China. Given the unique and specific Chinese patent law issues involved, we do not believe the decisions of the lower courts in China would materially adversely impact our enforcement of similar patents in other countries.

In several of our pending India patent enforcement cases, defendant infringers have sought to invalidate the asserted FMC patent(s), but as of the date of this Form 10- K no such infringer has prevailed in an invalidation claim.

Seasonality

The seasonal nature of the crop protection market and the geographic spread of our business can result in significant variations in quarterly earnings among geographic locations. Our products sold in the northern hemisphere (North America, Europe and parts of Asia) serve seasonal agricultural markets from March through September, generally resulting in significant earnings in the first and second quarters, and to a lesser extent in the fourth quarter. Markets in the southern hemisphere (Latin America and parts of the Asia Pacific region, including Australia) are served from July through February, generally resulting in earnings in the third, fourth and first quarters.

Competition

We encounter substantial competition in our business. We market our products through our own sales organization and through alliance partners, independent distributors and sales representatives. The number of our principal competitors varies from market to market. In general, we compete by providing advanced technology, high product quality, reliability, quality customer and technical service, and by operating in a cost-efficient manner.

Our business competes primarily in the global crop protection market for insecticides, herbicides and fungicides. Industry products include crop protection chemicals and biologicals, for certain major competitors, genetically engineered (crop biotechnology) products. Competition from generic agrochemical producers is significant as a number of key product patents have expired in the last two decades. In general, we compete as an innovator by focusing on product development, including novel formulations, proprietary mixes, and advanced delivery systems and by acquiring or licensing (mostly) proprietary chemistries or technologies that complement our product and geographic focus. We also differentiate ourselves by our global cost-competitiveness through our manufacturing strategies, establishing effective product stewardship programs and developing strategic alliances that strengthen market access in key countries and regions.

Research and Development Expense

The R&D efforts in our business focus on discovering and developing environmentally sound solutions — both new active ingredients and new product formulations — that meet the needs of farmers to maximize yields and control pests. We are focused on maintaining the site infrastructure at our FMC Stine Research Center in Newark, Delaware, and continuously investing in high-quality equipment.

Environmental Laws and Regulations

A discussion of environmental related factors can be found in Item 7 "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and in Note 10 "Environmental Obligations" in the notes to our consolidated financial statements included in this Form 10-K.

Human Capital

At FMC, employees are guided by our purpose: Innovation for agriculture; Solutions for the planet. We provide farmers innovative solutions that increase the productivity and resilience of their land. From our industry-leading discovery pipeline to novel biologicals and precision technologies, we are passionate about the power of science to solve agriculture's biggest challenges. Our employees’ belief in this purpose and commitment to our core values are key to the Company’s success.

Employees

We employ approximately 5,700 people, which is split across our major geographical regions with 21 percent in North America, 12 percent in Latin America, 26 percent in Europe, Middle East & Africa, and 41 percent in Asia as of December 31, 2024.

We have one collective-bargaining agreement in the US and several collective-bargaining agreements or equivalent agreements in foreign-based locations. None of these agreements are considered material to our operations or financial position. Employees subject to these agreements do not represent a material portion of our overall employee headcount. Over the years, we have successfully renegotiated contracts without any material work stoppages. We cannot predict, however, the outcome of future contract negotiations.

Talent Development and Retention

Developing our talent is critical to FMC’s ability to attract and retain a highly skilled and engaged workforce who can lead competitively, innovate change, improve business performance, and successfully maintain a competitive advantage. We are committed to investing in our employees’ professional development through a range of programs and initiatives, including individual development plans, stretch projects and rotational assignments. We provide all employees with access to a best-in-class on-demand learning platform featuring a vast library of courses, empowering employees to learn on their own schedule, fostering a culture of continuous learning and skill development. We also offer leadership development programs and executive coaching tailored for our leaders to equip them with the skills needed to effectively manage teams, drive performance and inspire innovation.

FMC continually strives to meet the needs of our employees, shareholders, and customers through competitive rewards, policies, and practices designed to attract, retain and motivate exceptional employees and drive both individual and Company performance. Performance-based direct pay programs include competitive base pay, short-term incentives, and long-term incentives. In addition, comprehensive global benefit packages are offered to support the health and well-being of employees and their families enabling FMC to offer a comprehensive total reward package designed for employees throughout their career.

FMC Culture

An important element of our Company’s strategy is our commitment to creating a culture of belonging where every employee can bring their full, authentic selves to work and thrive. We strive to maintain a workforce that mirrors the makeup of our growers by fostering an inclusive environment where we embrace diversity. Our goal is for everyone to feel they have a voice, and their contributions are valued at FMC. As an example of our efforts, we conduct an all-employee engagement survey designed to capture the voice of our employees and provide actionable insights to sustain an inclusive environment and support employees to perform at their best.

Safety

Safety is a core value of FMC. We strive for an injury-free workplace, where every person returns home the same way they arrived. We encourage a culture of open reporting, to learn from our mistakes and work towards continuous improvement in behaviors and processes. As a result of our firm commitment to safety, our Total Recordable Incident Rate of 0.0995 continues to be among the lowest in the industry globally and in the top decile of peer companies in North America, placing our Company among the safest organizations in the chemical industry. This level of performance underscores our collective commitment to work safely every day. We empower our people to always put safety first at work and at home.

Sustainability

We are committed to delivering products that improve agricultural productivity while protecting the environment for future generations. We recognize that sustainability goes beyond reducing emissions, it also encompasses human rights, the importance of nature, including biodiversity and how we utilize scarce resources such as water. FMC is aligned with the UN Sustainable Development Goals #2 (Zero Hunger), #8 (Decent Work and Economic Growth), #13 (Climate Action) and #15 (Life on Land). To reflect this commitment, we have established 2025 and 2035 sustainability goals. Our 2025 goals include: 100 percent research and development spend on sustainably advantaged products, a total recordable incident rate of less than 0.1, and a score of 100 on the Community Engagement Index. Our 2035 goals, include: 100 percent implementation of sustainable water practices at all operating sites, 100 percent waste to beneficial reuse, and net-zero greenhouse gas (“GHG”) emissions across the value chain (Scopes 1, 2 and 3). FMC has worked with to the Science Based Target initiative ("SBTi"), Net-Zero Standard, in line with keeping the global temperature at 1.5°C above pre-industrial time in alignment with the Paris Agreement. FMC received validation on its near-term and net-zero targets in March 2023. We are targeting a 42% reduction in Scopes 1 and 2, and 25% reduction in Scope 3 by 2030, with a net-zero target across the value chain by 2035. FMC continues to make progress towards achieving our 2025 and 2035 environmental goals and our progress is reported annually in our sustainability report.

At FMC, we embed sustainability and stewardship at each stage of the product life cycle, and stewardship priorities are built into the core of research and development, portfolio and marketing strategies. FMC developed and utilizes its Product Sustainability Assessment Tool to evaluate the sustainability attributes of new active ingredients and formulated products in the research and development pipeline. This assessment, along with other product stewardship processes and tools, promotes the introduction and use of sustainably advantaged agricultural solutions. We continue to strive for open and transparent communications about our product stewardship successes and challenges. FMC is continuing to phase out Highly Hazardous Pesticides (“HHPs”) from our product portfolio. In 2024, HHPs accounted for approximately 0.1 percent of our total sales. This reduction of HHPs in our portfolio can be attributed to our internal processes which include continuous evaluation, close monitoring and subsequent phase out along with strong stewardship actions.

SEC Filings

SEC filings are available free of charge on our website, www.fmc.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are posted as soon as practicable after we furnish such materials to the SEC.

REGULATION FD DISCLOSURES

The Company’s investor relations website, located at https://investors.fmc.com, should be considered as a recognized channel of distribution, and the Company may periodically post important information to the web site for investors, including information that the Company may wish to disclose publicly for purposes of complying with the federal securities laws and our disclosure obligations under the SEC's Regulation FD. We encourage investors and others interested in the Company to monitor our investor relations website for material disclosures. Our website address is included in this Form 10-K as a textual reference only and the information on the website is not incorporated by reference into this Form 10-K.

ITEM 1A. RISK FACTORS

Among the factors that could have an impact on our ability to achieve operating results and meet our other goals are:

Industry Risks:

Pricing and volumes in our markets are sensitive to a number of industry specific and global issues and events including:

•Competition and new agricultural technologies – Our business faces competition, which could affect our ability to maintain or raise prices, successfully enter certain markets or retain our market position. Competition for our business includes not only generic suppliers of the same pesticidal active ingredients but also alternative proprietary pesticide chemistries and crop protection technologies that are bred into or applied onto seeds. Increased generic presence in agricultural chemical markets has been driven by the number of significant product patents and product data protections that have expired in the last decade, and this trend is expected to continue. Also, there are changing competitive dynamics in the agrochemical industry as some of our competitors have consolidated, resulting in them having greater scale and diversity, as well as market reach. These competitive differences may not be overcome and may erode our business. Agriculture in many countries is changing and new technologies (e.g., precision pest prediction or application, data management) continue to emerge. At this time, the scope and potential impact of these technologies are largely unknown but could have the potential to disrupt our business.

•Climate conditions – Our markets are affected by climatic conditions, both chronic and acute, which could adversely impact crop yields, pricing and pest infestations. For example, drought may reduce the need for fungicides, which could result in fewer sales and greater unsold inventories in the market, whereas excessive rain could lead to increased plant disease or weed growth requiring growers to purchase and use more pesticides. Drought and/or increased temperatures may change insect pest pressures, requiring growers to use more, less, or different insecticides. Natural disasters can impact production at our facilities in various parts of the world. The nature of these events makes them difficult to predict.

•Geographic cyclicality – While our business is well balanced geographically, in any given calendar quarter a certain geography(ies) may predominate the demand for our products in light of seasonal variations typically associated with the crop protection market and the geographic regions in which we operate. Unexpected market conditions in any such predominating geography, such as adverse weather, pest pressures, or other risks described herein, may impact our business if occurring during a calendar quarter in which such geography is predominating.

•Changing regulatory environment and public perception – Changes in the regulatory environment, particularly in the U.S., Brazil, China, India, Argentina and the European Union, could adversely impact our ability to continue producing and/or selling certain products in our domestic and foreign markets or could increase the cost of doing so. We are sensitive to regulatory risk given the need to obtain and maintain pesticide registrations in every country in which we sell our products. Moreover, we are required to comply with protocols or applicable regulatory requirements of biological products. Protocols and regulations may change, or regulatory agencies may determine that a biological product is not approvable. There is a risk that future regulatory requirements may lead to delays in development of biologicals or limit growth from biologicals. Many countries require re-registration of pesticides to meet new and more challenging requirements; while we defend our products vigorously, these re-registration processes may result in significant additional data costs, reduced number of permitted product uses, or potential product cancellation. Compliance with changing laws and regulations may involve significant costs or capital expenditures or require changes in business practice that could result in reduced profitability. In the European Union, the regulatory risk specifically includes the chemicals regulation known as REACH (Registration, Evaluation, and Authorization of Chemicals), which requires manufacturers to verify through a special registration system that their chemicals can be marketed safely. Changes to the regulatory environment may be influenced by non-government public pressure as a result of negative perception regarding the use of our crop protection products. Products reviewed by regulators and

labeled safe for use may still be challenged by others which could lead to negative public perception or regulatory action. Competing products labeled safe for use were subject to lawsuits or claims, and a similar situation for our products could result in negative impacts. In addition, climate change may result in changes to the governmental policy around greenhouse gases, including emission caps, trade regulations and other mechanisms to promote reduction of carbon emissions. Depending on their nature and scope, this could subject our manufacturing operations and suppliers to significant additional costs or limits on operations and affect the sources and supply of energy. In addition, corporate Environmental, Social and Governance (“ESG”) commitments and shifting market pressures in response to climate regulation and consumer expectations may influence demand of crop protection products.

•Geographic presence outside of U.S. – We have a strong presence in Latin America, Europe and Asia, as well as in the U.S. We have continued to grow our geographic footprint particularly in Europe and key Asian countries such as India, which means that developments outside the U.S. will generally have a more significant effect on our operations than in the past. Our operations outside the U.S. are subject to special risks and restrictions, including: fluctuations in currency values; exchange control regulations; changes in local political or economic conditions; governmental pricing directives; import and trade restrictions or tariffs; import or export licensing requirements and trade policy; restrictions on the ability to repatriate funds; and other potentially detrimental domestic and foreign governmental practices or policies affecting U.S. companies doing business abroad.

•Climate change and land use impacts – Climate change may impact markets in which we sell our products, where, for example, a prolonged drought may result in decreased demand for our products. The more gradual effects of persistent temperature change in geographies with significant agricultural lands may result in changes in lands suitable for agriculture or changes in the mix of crops suitable for cultivation and the pests that may be present in such geographies. These shifts in pests may become more rapid and persistent with rising temperatures and increasing GHG levels. For example, prolonged increase in average temperature may make northern lands suitable for growing crops not grown historically in such climates, leading growers to shift crop type. It may also result in new or different weed, plant disease or insect pressures and such changes could impact the mix of crop protection products growers would purchase and, depending on the local market and our product offering, may be adverse for us. Growers may need to implement regenerative practices and shift to more climate-adaptive products as climate change impacts global crop yields and shifts harvestable regions and pest pressures.

•Fluctuations in commodity prices – Our operating results could be significantly affected by the cost of commodities such as chemical raw material commodities, energy commodities, and harvested crop commodities. We may not be able to raise prices or improve productivity sufficiently to offset future increases in chemical raw material or energy commodity pricing. Accordingly, increases in such commodity prices may negatively affect our financial results. We use hedging strategies, where available on reasonable terms, to address energy and material commodity price risks. However, we are unable to avoid the risk of medium- and long-term increases. Additionally, fluctuations in harvested crop commodity prices could negatively impact our customers' ability to sell their products at previously forecasted prices resulting in reduced customer liquidity. Inadequate customer liquidity could affect our customers’ abilities to pay for our products and, therefore, affect existing and future sales or our ability to collect on customer receivables.

•Supply arrangements – Certain raw materials are critical to our production processes and our purchasing strategy and supply chain design are complex. Our supply chain and business operations could be disrupted from the temporary closure of third-party supplier and manufacturer facilities, interruptions in product supply or restrictions on the export or shipment of our products. We closely monitor raw material and supply chain costs. We source critical intermediates and finished products from a number of suppliers, largely outside of the U.S. and principally in China and India. There is considerable uncertainty surrounding the trade relationship between the U.S. and trading partners — e.g., the recently announced 10% tariff on goods coming into the U.S. from China, the recent announcement of reciprocal tariffs on goods imported into the U.S. to match tariffs imposed by other nations on goods imported from the U.S., and China’s recently announced tariffs on imports of certain U.S. goods. Such changes may adversely impact our business. Further, while we have made supply arrangements to meet planned operating requirements, an inability to obtain the critical raw materials or operate under contract manufacturing arrangements would adversely impact our ability to produce certain products and could lead to operational disruption and increase uncertainties around business performance. An inability to obtain these products or execute under contract sourcing arrangements would adversely impact our ability to sell products. Any disruption of our suppliers and contract manufacturers could impact our sales and operating results. In recent years, we have seen some logistics challenges, pointed supply chain shortages, and increased cost of goods due to disruptions in energy markets (such as that caused by the Russian war on Ukraine), inflation and tariffs (such as those discussed above).

Operational Risks:

•Global catastrophic events – A global catastrophic event (e.g., nuclear incident, pandemic, natural disaster) could endanger the lives and safety of our employees, limit market access, constrain supply and would require high levels of cross-functional coordination to maintain business continuity. If not properly managed, FMC could suffer substantial

financial losses should the event negatively impact our operations or those of our customers. Global catastrophic events could also result in social, economic, and labor instability in the countries in which we or our customers and suppliers operate. These uncertainties could have a material adverse effect on our business and our results of operation and financial condition. A widespread health crisis could adversely affect the global economy, resulting in an economic downturn that could impact demand for our products.

•Business disruptions – We produce products through a combination of owned facilities and contract manufacturers. We own and operate large-scale active ingredient manufacturing facilities in the U.S. (Mobile), Puerto Rico (Manati), China (Jinshan), Denmark (Ronland), and India (Panoli). Our operating results are dependent in part on the continued operation of these production facilities. Interruptions at these facilities may materially reduce the productivity of a particular manufacturing facility, or the profitability of our business as a whole. Although we take precautions to enhance the safety of our operations and minimize the risk of disruptions, our operations and those of our contract manufacturers are subject to hazards inherent in chemical manufacturing and the related storage and transportation of raw materials, products and waste. These potential hazards include explosions, fires, mechanical failure, unscheduled downtimes, supplier disruptions, labor shortages or other labor difficulties, information technology systems outages, disruption in our supply chain or manufacturing and distribution operations, transportation interruptions, chemical spills, discharges or releases of toxic or hazardous substances or gases, shipment of contaminated or off-specification product to customers, storage tank leaks, other environmental risks, cyberattacks, or other sudden disruption in business operations beyond our control as a result of events such as acts of sabotage, terrorism or war, civil or political unrest, severe weather and natural disasters, large scale power outages and public health epidemics and pandemics. Some of these hazards may cause severe damage to or destruction of property and equipment or personal injury and loss of life and may result in suspension of operations or the shutdown of affected facilities.

•Climate change and physical risk to operation sites – The acute and chronic effects of climate change such as rising sea levels, drought, flooding, hurricanes, excessive heat and general volatility in seasonal temperatures could adversely affect our operations globally. Extreme weather events attributable to climate change may result in, among other things, physical damage to our property and equipment, increased resource scarcity, including water, and interruptions to our supply chain. All of these items may have significant costs or capital expenditures.

•Litigation and environmental risks – Current reserves relating to our ongoing litigation and environmental liabilities may ultimately prove to be inadequate, which may have a material adverse impact on our results of operations. Products reviewed by regulators and labeled safe for use may still be challenged by others which could result in lawsuits or claims.

•Hazardous materials – We manufacture and transport certain materials that are inherently hazardous due to their toxic or volatile nature. While we take precautions to handle and transport these materials in a safe manner, if they are mishandled or released into the environment, they could cause property damage or result in personal injury claims against us.

•Environmental compliance – We are subject to extensive federal, state, local, and foreign environmental and safety laws, regulations, directives, rules and ordinances concerning, among other things, emissions in the air, discharges to land and water, and the generation, handling, treatment, disposal and remediation of hazardous waste and other materials. Governmental agencies may change requirements related to the production, use, emission, disposal or remediation of chemicals or products, including chemicals or products which we may have produced or used in our discontinued operations. We may face liability arising out of the normal course of business or now discontinued operations, including alleged personal injury or property damage due to exposure to chemicals or other hazardous substances at our current or former facilities or chemicals that we manufacture, handle or own. We take our environmental responsibilities very seriously, but there is a risk of environmental impact inherent in our manufacturing operations and transportation of chemicals. Any substantial liability for environmental damage could have a material adverse effect on our financial condition, results of operations and cash flows.

Portfolio Management Risks:

•Portfolio management risks – We continuously review our portfolio which includes the evaluation of potential business acquisitions that may strategically fit our business and strategic growth initiatives. If we are unable to successfully integrate and develop our acquired businesses, we could fail to achieve anticipated synergies including expected cost savings and revenue growth. Failure to achieve these anticipated synergies could materially and adversely affect our financial results. In addition to strategic acquisitions we evaluate the diversity of our portfolio in light of our objectives and alignment with our growth strategy, which may result in divestiture of underperforming or non-strategic assets. In implementing this strategy, we may not be successful and the gains or losses on the divestiture of, or lost operating income from, such assets may affect the Company’s earnings and debt levels. Moreover, we may incur asset impairment charges related to acquisitions or divestitures that negatively impact earnings and our financial position.

•Technological and new product discovery/development – Our ability to compete successfully depends in part upon our ability to maintain a superior technological capability and to continue to identify, develop and commercialize new and

innovative, high value-added products for existing and future customers. Our investment in the discovery and development of new pesticidal active ingredients relies on discovery of new chemical molecules, biological strains or formulations. Such discovery processes depend on our scientists being able to find new molecules, strains and formulations, which are novel and outside of patents held by others, and such molecules/strains/formulations being efficacious against target pests. Our process also depends on our ability to develop those molecules, strains and formulations into new products without creating an undue risk to human health and the environment as well as meeting applicable regulatory criteria. The timeline from active ingredient discovery through full development and product launch averages 8-10 years depending on local regulatory requirements; the complexity and duration of developing new products create risks that product concepts may fail during development or, when launched, may not meet then-current market needs or competitive conditions.

•Innovation and intellectual property – Our innovation efforts are protected by patents, trade secrets and other intellectual property rights that cover many of our current products, manufacturing processes, and product uses, as well as many aspects of our research and development activities supporting our new product pipeline. Trademarks protect valuable brands associated with our products. Patents and trademarks are granted by individual jurisdictions and the duration of our patents depends on their respective jurisdictions and payment of annuities. Our future performance will depend on our ability to address expiration of active ingredient composition of matter patents. We address patent expirations through effective enforcement of our patents that continue to cover key chemical intermediates and process patents, as well as portfolio life cycle management, particularly for our high value diamide insecticides for which our composition of matter patents on the active ingredient itself have expired in most countries and our process manufacturing and chemical intermediate patents only a limited remaining duration. (see "Patents, Trademarks and Licenses" in Item 1 for more details). Patent and trademark enforcement is subject to the risks inherent in litigation, and our product portfolio life cycle management efforts may not be effective in maintaining our products’ market position or profitability. If our innovation efforts fail to result in process improvements to reduce costs, such conditions could impede our competitive position. Some of our competitors may secure patents on production methods or uses of products that may limit our ability to compete cost-effectively.

•Enforcement of intellectual property rights – The composition of matter patents on our Rynaxypyr® and Cyazypyr® active ingredients have expired in all major markets. We have additional patents regarding the production of these diamide active ingredients and chemical intermediates involved in such production, which are expiring in many major markets in December 2025. For these diamide products, we also hold patents on certain formulations (including mixtures), trademark and data exclusivity protection in certain countries which have longer duration. Likewise, for other products in our commercial and development portfolios, we have a broad estate of intellectual property including patents, trademark and data protection. We intend to strategically and vigorously enforce our patents and other forms of intellectual property against suspected infringers and have done so already against several third parties. Other third parties may seek to enter markets with infringing products or may find alternative production methods that avoid infringement. We may not be successful in litigating to enforce our patents due to the risks inherent in any litigation. Patents involve complex factual and legal issues and, thus, the scope, validity or enforceability of any patent claims we have or may obtain cannot be clearly predicted. Patents may be challenged in the courts, as well as in various administrative proceedings before U.S. or foreign patent offices, and may be deemed unenforceable, invalidated or circumvented. We are currently and may in the future be a party to various lawsuits or administrative proceedings involving our patents. (See "Patents, Trademarks and Licenses" in Item 1). Such challenges can result in some or all of the claims of the asserted patent being invalidated or deemed unenforceable. As noted in Item 1 "Business," two such patents have been ruled invalid in China and are currently on appeal. In such circumstances, an adverse patent enforcement decision could lead to the entry of competing products in relevant markets and may result in a material adverse impact our financial results.

•ERP governance – We operate on a single global instance of SAP. Unmanaged or poorly managed system and hardware changes across the enterprise may disrupt operations, introduce vulnerabilities, and result in increased maintenance.

•Potential tax implications of FMC Lithium separation – We received an opinion from outside counsel to the effect that the spin-off of FMC Lithium as a distribution to our stockholders, completed in March 2019, qualified as a non-taxable transaction for U.S. federal income tax purposes. The opinion is based on certain assumptions and representations as to factual matters from both FMC and FMC Lithium, as well as certain covenants by those parties. The opinion cannot be relied upon if any of the assumptions, representations or covenants is incorrect, incomplete or inaccurate or is violated in any material respect. The opinion of counsel is not binding upon the IRS or the courts and there is no assurance that the IRS or a court will not take a contrary position. It is possible that the IRS or a state or local taxing authority could take the position that the aforementioned transaction results in the recognition of significant taxable gain by FMC, in which case FMC may be subject to material tax liabilities.

Financial Risks:

•Foreign exchange rate risks – We are an international company operating in many countries around the world, and thus face foreign exchange rate risks in the normal course of business. We are particularly sensitive to the movements of the Brazilian real, Chinese yuan, Indian rupee, Euro, Mexican peso and Argentine peso. While we engage in hedging and other strategies to mitigate these risks, unexpected severe changes in foreign exchange may create risks that could materially and adversely affect our expected performance.

•Income tax audits and uncertain tax rates – Our future effective tax rates may be materially impacted by numerous items such as: a future change in the composition of earnings from foreign and domestic tax jurisdictions, as earnings in foreign jurisdictions are typically taxed at different statutory rates than the U.S. federal statutory rate; accounting for uncertain tax positions; business combinations; expiration of statute of limitations or settlement of tax audits; changes in valuation allowance; changes in tax law; currency gains and losses; and decisions to repatriate certain future foreign earnings on which U.S. or foreign withholding taxes have not been previously accrued. Additionally, further administrative guidance or other changes to the Global Anti-Base Erosion (GLOBE) rules that cause changes in tax legislation issued by the Organization for Economic Cooperation and Development (“OECD”) could potentially impact certain tax benefits previously received. There is no guarantee that administrative guidance or rules will remain unchanged or that the US government will adopt the global tax rules in accordance with the OECD approach, either of which could impact the value of the incentives granted to us and which could potentially lead to significant future international tax disputes.

•Uncertain recoverability of investments in long-lived assets – We have significant investments in long-lived assets and continually review the carrying value of these assets for recoverability in light of changing market conditions and alternative product sourcing opportunities. We may recognize future impairments of long-lived assets, which could adversely affect our results of operations.

•Pension and postretirement plans – Our U.S. Qualified Plan has been fully funded for the last several years and as such, the primary investment strategy is a liability hedging approach with an objective of maintaining the funded status of the plan such that the funded status volatility is minimized and the likelihood that we will be required to make significant contributions to the plan is limited. The portfolio is comprised of 100 percent fixed income securities and cash. Our plan assets and obligation under our U.S. Qualified Plan is in excess of $1 billion. Additionally, obligations related to our pension and postretirement plans reflect certain assumptions. To the extent actual experience differs from these assumptions, our costs and funding obligations could increase or decrease significantly. While we provide other defined benefit, defined contribution and postretirement benefits to our employees and retirees, our risk is focused on our U.S. Qualified Plan given its size to our consolidated financial position.

General Risk Factors:

•Market access risk – Our results may be affected by changes in distribution channels, which could impact our ability to access the market. Consolidation of the value chain may limit FMC’s access in certain markets. Acquisition of retailers and wholesalers, particularly by competitors, could restrict FMC’s distribution footprint. Failure to adapt to similar trends in business to business and business to consumer could place FMC at a competitive disadvantage.

•Compliance with laws and regulations – The global regulatory environment is becoming increasingly complex and requires more resources to effectively manage, which may increase the potential for misunderstanding or misapplication of regulatory standards.

•Talent engagement and ethics/culture – The inability to recruit and retain key personnel, the unexpected loss of key personnel, or other external and internal factors and events could culminate in employee attrition and may adversely affect our operations. In addition, our future success depends in part on our ability to identify and develop talent to succeed senior management and other key members of the organization. We operate in markets where business ethics and local customs may differ from our company standards, increasing the risk of impropriety and regulatory enforcement. Significant effort will likely be required to ensure that the right mix of resources are trained, engaged and focused on achieving business objectives while adhering to our core values of safety, ethics and compliance.

•Economic and geopolitical change - Our business has been and could continue to be adversely affected by economic and political changes in the markets where we compete including: trade restrictions, tariff increases or potential new tariffs, foreign ownership restrictions and economic embargoes imposed by the U.S. or any of the foreign countries in which we do business; changes in laws, taxation, and regulations and the interpretation and application of these laws, taxes, and regulations; restrictions imposed by the U.S. government or foreign governments through exchange controls or taxation policy; nationalization or expropriation of property, undeveloped property rights, and legal systems or political instability; other governmental actions; inflation rates and inflationary pressures leading to higher input costs, recessions; and other external factors over which we have no control. While inflationary pressures have recently eased, a resurgence of these conditions may negatively impact our revenue, gross and operating margins, and net income. Economic and political conditions within the U.S. and foreign jurisdictions or strained relations between countries could result in fluctuations in demand, price volatility, loss of property, state sponsored cyberattacks, supply

disruptions, or other disruptions. An open conflict or war across any region significant to our business could result in plant closures, employee displacement, and an inability to obtain key supplies and materials. Current U.S. tariff policies may increase the costs of goods being imported into the U.S., and other nations may impose new or different tariffs or other trade sanctions that increase the cost of our importing into those other nations, which we may not be able to mitigate or avoid, leading to increased costs of materials and/or other trade disruptions. The current military conflict between Russia and Ukraine could disrupt or otherwise adversely impact our operations in Ukraine; and related sanctions, export controls or other actions that may be initiated by nations including the U.S., the European Union or Russia (e.g., potential cyberattacks, disruption of energy flows, etc.) could adversely affect our business and/or our supply chain, business partners or customers in other countries beyond Ukraine. In Argentina, continued inflation and foreign exchange controls could adversely affect our business. Losses may be incurred as a result of various government actions in the country such as the devaluation of the Argentine peso, changes in tax policies, and changes in capital controls/policies. Realignment of change in regional economic arrangements could have an operational impact on our businesses. Our enforcement of intellectual property rights in jurisdictions outside of the United States may be impacted by geopolitical tensions between the United States and those other countries. In China, unpredictable enforcement of environmental regulations could result in unanticipated shutdowns in broad geographic areas, impacting our contract manufacturers and raw material suppliers.

•Information technology security and data privacy risks – As with all enterprise information systems, our information technology systems and systems operated by our vendors and third parties could be penetrated by outside parties’ intent on observing or gathering information, extracting information, corrupting information, deploying ransomware, or disrupting business processes. Remote and other work arrangements may leave the Company more vulnerable to a cyberattack. Our systems and those of our vendors and third parties have in the past been, and will likely be in the future, subject to unauthorized access attempts. Implementing system updates or security patches in an untimely manner could leave our company exposed to security breaches. Unauthorized access to our networks or systems could disrupt our business operations and potentially result in failures or interruptions in our information systems, lockouts due to ransomware, or in the loss of assets and could have a material adverse effect on our business, financial condition or results of operations. We engage in response planning, simulations, trainings, tabletop exercises, and other efforts to mitigate risks associated with cybersecurity. Breaches of our security measures or the accidental loss, inadvertent disclosure, or unapproved dissemination of proprietary, sensitive, confidential or personal information about the Company, our employees, our vendors, or our customers, could result in litigation, violations of applicable data privacy regulations, and liability for the Company. We have not experienced a significant or material impact from these events to date and we may need to expend significant resources to maintain or continue to mature our protective and preventative measures to stay abreast of the ever-changing cybersecurity threat landscape. We maintain a multifaceted cybersecurity program designed to identify, protect, detect, respond, and recover from a cybersecurity event. We ensure that the program is aligned with the National Institute of Standards and Technology ("NIST") Cybersecurity Framework. While we have taken measures to assess the requirements of, and to comply with the rapidly growing cybersecurity and data privacy regulations in multiple jurisdictions, these measures may be challenged by authorities that regulate cybersecurity and privacy-related compliance. We could incur significant expense in facilitating and responding to investigations and if the measures we have taken prove to be inadequate, we could face fines or penalties. This could damage our reputation, or otherwise harm our business, financial condition, or results of operations.