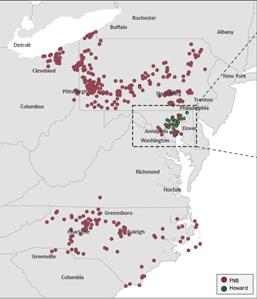

There are many compelling reasons why this partnership with Howard Bancorp, Inc. makes sense for FNB. Howard, which was founded in 2004 in Baltimore, MD, and has approximately $2.6 billion in total assets, operates 13 full-service banking offices in Baltimore and the greater Washington, D.C., area.

This merger will solidify our presence in the Baltimore and greater Washington, D.C., market and strengthen our franchise in our Mid-Atlantic Region with a combined sixth largest deposit share in the Baltimore market, complementary suite of commercial and retail products, and shared commitment to client and community service. In addition, this transaction will drive positive operating leverage through organic growth of middle market commercial and industrial business, consumer banking and fee income as well as focused expense reductions.

I am proud of our proven history of merger successes, which would not have been possible without the expertise and commitment demonstrated by both our support teams and front-line employees. As we embark on this merger, I am confident that the experience and dedication that defines our FNB team will ensure a seamless transition for both customers and employees of Howard Bancorp, Inc.

Merger Communications: What You Need to Know

Following the merger announcement, our goal is to create a streamlined, efficient implementation process. Part of that process entails frequent communications with both FNB and Howard team members so that you are aware of what is happening and can accurately communicate to your customers.

| | • | | Customers: It is critical that we effectively manage all customer interactions — in person, by phone or in writing — in a consistent and confident manner to help assure those customers who may become unsettled about this change. Every communication to a Howard Bank customer must be reviewed and approved by a central merger communications team ensuring that customers do not receive duplicative or conflicting information. |

| | • | | Employees: Please continue to check The Vault for additional for important merger-related updates and information. |

| | • | | Media: You may receive requests for information regarding this announcement from local media. To ensure a timely, consistent and accurate response to these requests, please refer all media calls to Jennifer Reel, Director of Corporate Communications, at reel@fnb-corp.com, 724-983-4856 (office) or 724-699-6389 (cell). |

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act. These forward-looking statements include, but are not limited to, statements about the outlook and expectations of FNB and Howard with respect to their planned merger, the strategic benefits and financial benefits of the merger (including anticipated accretion to earnings per share and other metrics) and the timing of the closing of the transaction.

Forward-looking statements are typically identified by words such as “believe”, “plan”, “expect”, “anticipate”, “intend”, “outlook”, “estimate”, “forecast”, “will”, “should”, “project”, “goal”, and other similar words and expressions. Forward-looking statements are subject to risks, uncertainties and assumptions which may change over time or as a result of unforeseen circumstances. Future events or circumstances may change expectations or outlook and may affect the nature of the assumptions, risks and uncertainties to which forward-looking statements are subject. The forward-looking statements in this communication pertain only to the date hereof, and FNB and Howard disclaim any obligation to update or revise any forward-looking statements, except as required by law. Actual results or future events may differ, possibly materially, from those that are anticipated in these forward-looking statements. Accordingly, we caution against placing undue reliance on any forward-looking statements.

Forward-looking statements contained in this communication are subject to, among others, the following risks, uncertainties and assumptions:

| | • | | The possibility that the anticipated benefits of the transaction, including anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive factors in the areas |