UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| For the fiscal year ended December 31, 2023 | |||||

| OR | |||||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

Commission File Number 001-03970

ENVIRI CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 23-1483991 | |||||||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) | |||||||||||||

| Two Logan Square 100-120 North 18th Street, 17th Floor, | Philadelphia, | Pennsylvania | 19103 | |||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

Registrant's telephone number, including area code 267-857-8715

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common stock, par value $1.25 per share | NVRI | New York Stock Exchange | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ý | Accelerated filer | o | ||||||||

| Non-accelerated filer | o | Smaller reporting company | ☐ | ||||||||

| Emerging growth company | ☐ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ý

The aggregate market value of the Company's voting stock held by non-affiliates of the Company as of June 30, 2023 was $763,077,089.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date:

| Class | Outstanding at February 16, 2024 | |||||||

| Common stock, par value $1.25 per share | 79,834,835 | |||||||

DOCUMENTS INCORPORATED BY REFERENCE

Selected portions of the 2024 Proxy Statement are incorporated by reference into Part III of this Report.

ENVIRI CORPORATION

FORM 10-K

INDEX

| Page | ||||||||

| Item 1. | ||||||||

Glossary of Terms

Unless the context requires otherwise, "Enviri," the "Company," "we," "our," or "us" refers to Enviri Corporation on a consolidated basis. Effective June 5, 2023, the Company's corporate name was changed from Harsco Corporation to Enviri Corporation. The Company may use other terms in this Annual Report on Form 10-K, including the Consolidated Financial Statements and Notes, which are defined below:

| Term | Description | ||||||||||

| AOCI | Accumulated Other Comprehensive Income (Loss) | ||||||||||

| AR Facility | Revolving trade receivables securitization facility | ||||||||||

| Board | The Board of Directors of Enviri Corporation | ||||||||||

| CE | Clean Earth reportable business segment | ||||||||||

| CERCLA | Comprehensive Environmental Response, Compensation, and Liability Act of 1980 | ||||||||||

| Clean Earth | CEHI Acquisition Corporation and Subsidiaries | ||||||||||

| Consolidated Adjusted EBITDA | EBITDA as calculated in accordance with the Company's Credit Agreement | ||||||||||

| Credit Agreement | Credit Agreement governing the Senior Secured Credit Facilities | ||||||||||

| DEA | U.S. Drug Enforcement Administration | ||||||||||

| Deutsche Bahn | National railway company in Germany | ||||||||||

| DTSC | California Department of Toxic Substances Control | ||||||||||

| EBITDA | Earnings before interest, tax, depreciation and amortization | ||||||||||

| ESOL | Stericycle Environmental Solutions business | ||||||||||

| EPA | U.S. Environmental Protection Agency | ||||||||||

| FASB | Financial Accounting Standards Board | ||||||||||

| HE | Harsco Environmental reportable business segment | ||||||||||

| ICMS | Type of value-added tax in Brazil | ||||||||||

| IKG | The former Harsco Industrial IKG business | ||||||||||

| ISDA | International Swaps and Derivatives Association | ||||||||||

| LIBOR | London Interbank Offered Rates | ||||||||||

| MEPP | Multiemployer pension plan | ||||||||||

| New Term Loan | $500 million term loan raised in March 2021 under the Senior Secured Credit Facilities, maturing on March 10, 2028 | ||||||||||

| Net Debt | Total debt minus cash and cash equivalents (up to a maximum of $100 million) as defined in the Company's Credit Agreement | ||||||||||

| Network Rail | Infrastructure manager for most of the railway in the U.K. | ||||||||||

| NPPC | Net periodic pension cost (income) | ||||||||||

| OCI | Other Comprehensive Income (Loss) | ||||||||||

| PA DEP | Pennsylvania Department of Environmental Protection | ||||||||||

| Rail | The former Harsco Rail reportable business segment | ||||||||||

| RCRA | Resource Conservation and Recovery Act | ||||||||||

| Revolving Credit Facility | $700 million multi-year revolving credit facility under the Senior Secured Credit Facilities | ||||||||||

| ROU | Right-of-use | ||||||||||

| SBB | Federal railway system of Switzerland | ||||||||||

| SCE | Supreme Council for Environment in Bahrain | ||||||||||

| SEC | Securities and Exchange Commission | ||||||||||

| Senior Notes | 5.75% notes due July 31, 2027 | ||||||||||

| Senior Secured Credit Facilities | Primary source of borrowings comprised of the New Term Loan and the Revolving Credit Facility | ||||||||||

| SOFR | Secured Overnight Financing Rate | ||||||||||

| SPE | The Company’s wholly-owned bankruptcy-remote special purpose entity, which is used in connection with the AR Facility | ||||||||||

| SPRA | State Revenue Authorities from the State of São Paulo, Brazil | ||||||||||

| Tax Act | The U.S. Tax Cuts and Job Act of 2017 | ||||||||||

| TSDF | Treatment, storage, and disposal facility | ||||||||||

| U.S. GAAP | Accounting principles generally accepted in the U.S. | ||||||||||

PART I

Item 1. Business.

OUR COMPANY - OUR VISION

Enviri Corporation is a market-leading, global provider of environmental solutions for industrial and specialty waste streams. Our two reportable business segments are Harsco Environmental and Clean Earth and we are a single-thesis environmental solutions company that is a leader in the markets we serve.

We have worked in recent years to both transform our portfolio and strengthen our financial results, and we have invested to achieve these objectives and to grow the Company. These investments include targeted organic investments, as well as mergers and acquisitions, that have accelerated our business transformation. The purchases of Clean Earth and ESOL, along with the sale of our energy-linked business in 2019 and our plan to sell our Rail business, have been significant strategic steps for our Company. As a result, 100% of our revenues from continuing operations in 2021 through 2023 were generated from our two environmentally-focused segments. It also is important to note that these transactions have reduced the Company’s portfolio complexity and business cyclicality.

More broadly, we are committed to viewing every customer need through a sustainability lens. Our customers expect customizable solutions that address environmental challenges within their industries. The Company is responding to this need by helping our customers build better businesses and, in a larger sense, a better environment. Our go-forward strategy is clear: to continue building a leading, global environmental solutions company.

SEGMENT INFORMATION

The Company’s current operations consist of two reportable business segments: Harsco Environmental and Clean Earth. Until the fourth quarter of 2021, the Company reported the Harsco Rail segment. The Company previously announced its plan to sell the Rail business and the sale process is ongoing. Historical results for Rail are accounted for as discontinued operations.

The Company reports segment information using the “management approach,” based on the way management organizes and reports the segments within the enterprise for making operating decisions, assessing performance and allocating capital. The Company’s reporting segments are identified based upon differences in products, services, and markets served. Financial information concerning segments and international and domestic operations is included in Note 16, Information by Segment and Geographic Area, in Part II, Item 8, Financial Statements and Supplementary Data.

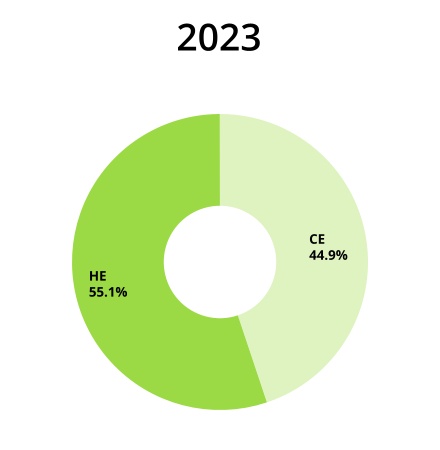

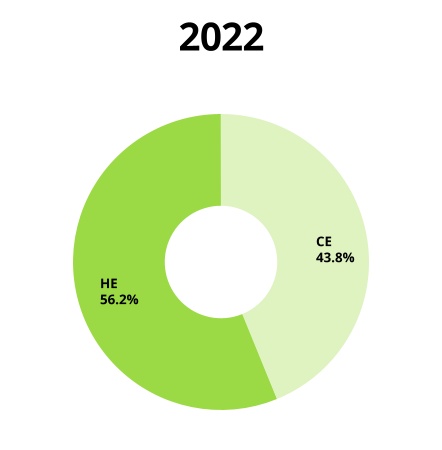

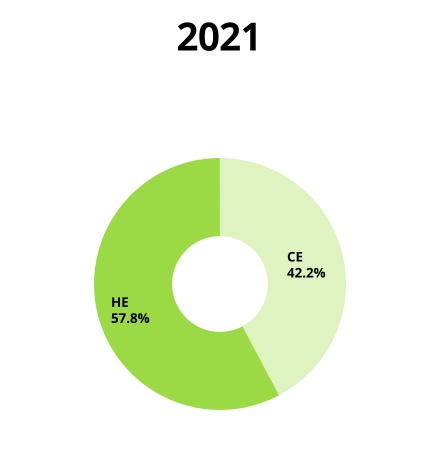

Our revenues by business segment are as follows, and a further description of the products and services offered through these business segments is presented below.

HARSCO ENVIRONMENTAL

BUSINESS OVERVIEW

Our Harsco Environmental segment can trace its heritage back to the earliest efforts in industrial recycling and environmental resource management. Where others only saw waste and expense, we saw opportunity and value nearly 100 years ago. HE was founded upon market insights, grounded in respect for the environment, efficient use of resources, and optimism for the future.

1

Today, HE is a premier, global provider of environmental services and material processing to the global steel and metals industries. HE partners with its global customer base to deliver production-critical on-site operational support and resource recovery services, through management of our customers’ primary waste or byproduct streams. Our services support the metal manufacturing process, generating significant operational and financial efficiencies for our customers and allowing them to focus on their core steelmaking businesses.

HE serves approximately 70 mill services customers at approximately 150 sites in approximately 30 countries. Our diversified customer base includes the largest steel producers in the regions where we operate, serving a mix of mini-mill and integrated operations. In recent years, HE has extended its reach, signing new services contracts in bellwether emerging markets like India, and further strengthening our footprint in the Americas and Europe. As a result, our global portfolio is balanced and diversified, with foreign currency risk partially mitigated by the fact that our operating costs and revenues are regularly denominated in local currencies.

In addition to providing critical services to our customers, we provide zero-waste solutions for relevant waste or byproduct streams - an important component of our value proposition. We repurpose processed material for alternative uses and/or convert this material into viable products to be sold in other markets via our ecoproducts™ offerings and capabilities. Our ecoproductsTM portfolio includes road and roofing materials, abrasives, agriculture products and aggregates. This expertise is important to our customers as environmental regulations increase and the marketplace grows more averse to landfilling waste.

CUSTOMERS AND SERVICE CONTRACTS

We offer our customers a suite of more than 30 services, and our on-site work is largely performed under long-term contracts. These contracts typically include fixed fees or minimum billings, which de-risk our investment during periods of economic weakness, and variable fees often linked to the amount of metal produced or waste processed at a site. Our variable fees under contracts are, importantly, not linked to steel prices. Additionally, in recent years, we have strengthened our contract terms and underwriting practices in an effort to earn a sufficient and timely return on our investments, as well as achieve other objectives. These measures, along with various improvement initiatives, have boosted our site portfolio results and driven more consistent performance across our operations.

Our contract renewal rates are high, with many customer relationships that span decades. Our largest customers today include ArcelorMittal, Gerdau, Tata Steel Group, Taiyuan Iron & Steel and Ternium. We serve most of our major customers at multiple sites, often under multiple contracts. The length of our customer relationships reflects our value proposition. Customers choose the Company to (1) achieve operational and financial efficiencies; (2) concentrate their efforts on metal manufacturing and supporting end-market product demands; (3) gain access to process innovations and technologies developed by the Company; and (4) leverage our downstream product applications and know-how. HE had one customer in each of the past three years that provided more than 10% of this segment's revenues, again under many long-term contracts at multiple sites.

On December 31, 2023, the Company's service contracts had estimated future revenues of $3.1 billion at current production levels, which is consistent with 2022 after excluding the impacts of foreign currency translation. These contract values provide the Company with a substantial base of anticipated long-term revenues. Approximately 23% of these revenues are expected to be recognized by December 31, 2024; approximately 43% of these revenues are expected to be recognized between January 1, 2025 and December 31, 2027; approximately 19% of these revenues are expected to be recognized between January 1, 2028 and December 31, 2030; and the remaining revenues are expected to be recognized thereafter. Estimated future revenues are exclusive of anticipated contract renewals, projected volume increases and ad-hoc services, as well as future revenues from roofing granules, abrasives products, roadmaking materials, additives and specialty recovery technology services.

LINES OF BUSINESS

HE provides a broad range of services, most of which address our customers’ environmental challenges. In total, these services reduce both landfill waste and the carbon footprint of our customers’ sites. In 2023, on-site services represented approximately 83% of HE’s revenues. A summary of our most significant services is as follows:

Resource Recovery, Metal Recycling and Slag Optimization

Resource recovery, metal recycling and slag optimization is the core component of our service offerings. We capture liquid steel waste or byproduct (slag) and transport it for cooling, treatment and conditioning. We then recover valuable metal from the waste-stream, which is returned to our customer in a form suitable for recycling through the customers’ manufacturing process. Finally, the residual non-metallic processed material is transformed into environmental products that create new and additional revenue streams.

2

Scrap Management

We manage customer scrap inventories and upgrade scrap by making it cleaner and denser. Improved scrap characteristics reduce electricity usage which, combined with the usage of recycled material, provides sustainability benefits to our customers.

Materials Handling and Logistics

We transport materials, including semi-finished and finished products, safely and efficiently for our customers. Our tracking technology also provides real-time analysis of material location, quantities and product quality.

Meltshop and Furnace Services

Meltshop and furnace services allow the molten metal production process to run smoothly and efficiently. These services include under-vessel cleaning and the removal of ladle slag (waste) and general melt shop debris.

Ecoproducts™

HE creates value-added downstream products from industrial waste-streams. Our experience in manufacturing these products and successfully penetrating relevant end-markets is an important differentiator for the Company. These zero-waste solutions preserve our natural resources and reduce or eliminate landfill disposal. Ecoproducts in 2023 represented approximately 14% of HE’s revenues, and our major ecoproducts include the following:

•Road Surfacing and Materials - Because of its natural shape and interlocking properties, steel slag holds many advantages when used in asphalt roadway surfaces, ranging from high skid resistance to better durability. The Company’s slag-based asphalt product, developed and sold as SteelPhalt™, maintains positive surface characteristics throughout the life of the road, allowing longer replacement intervals and lower maintenance costs. In 2023, SteelPhalt™ launched a carbon-negative asphalt product, using a renewable bio-based substance to bind the asphalt. This is an alternative to bitumen and reduces the product's carbon footprint. The Company also sells a slag aggregate that is a sustainable and cost-effective alternative to natural stone. This aggregate is often used as unbound road base material for secondary roads and sub-base material elsewhere.

•Abrasives and Roofing Materials - Our Reed Minerals business is among the largest roofing granule suppliers in the U.S., partnering with the country's leading shingle manufacturers. Nearly 100 years ago, we pioneered a process of recycling coal combustion waste from power plants. Through the Company's proprietary process, we create premium quality roofing granules that are a critical raw material in asphalt roofing shingles. Reed is also one of the largest U.S. manufacturers of abrasives, using coal, as well as copper and nickel slag, and crushed glass, for the surface preparation market. Our BLACK BEAUTY® and SURE/CUT™ abrasives are well-recognized within the industry and are used as blast material to remove paint, rust, and other coatings from surfaces, prior to applying a new finish.

•Metallurgical Additives - The Company’s custom-designed steelmaking additives facilitate fluid slag formation in the steelmaking process, thus improving customer productivity and helping achieve the steel product specifications required for today’s premium applications.

•Agriculture and Turf Products - We produce soil conditioners and fertilizers, principally from stainless steel slag that optimize crop yields and turf performance. CrossOver® and AgrowSil® products are our leading silicon, calcium and magnesium-based product brands, sold mainly in the Americas. These products are formulated to address nutrient deficiencies and toxicity issues in soil as well as to help plants withstand outside pressures and disease.

•Cement Additives - Steel slag is naturally cementitious and commonly blended with other materials to produce environmentally-friendly, high-performing cement products. Cement made with slag aggregate can achieve permeabilities and other attributes that compare favorably to concrete made with conventional aggregates.

Altek Group

Altek is a UK-based manufacturer of market-leading products that enable aluminum producers and recyclers to manage and extract value from critical waste streams, reduce waste generation, and improve operating productivity. The cost-efficient recovery of metal and other valuable materials is increasingly important to the aluminum industry. Altek’s products and technologies address this challenge, and its AluSalt® innovation offers customers an innovative technology that converts salt slag waste into valuable products, addressing one of the largest environmental concerns within the aluminum market.

GROWTH STRATEGY

We have identified attractive opportunities that meet our return thresholds to expand our service portfolio, and our pipeline of opportunities remains significant. Additionally, we have initiated efforts to expand our downstream products business and plan to continue investing in innovation to support our business sustainability.

A summary of our key growth initiatives is as follows:

•Further Penetrate Existing Sites. Given our broad services capabilities, we see potential for add-on services contracts at existing sites.

3

•New Sites. We continue to pursue new services contracts in certain markets, particularly in emerging economies where out-sourcing opportunities are significant because of increased environmental awareness or where steel consumption (production) is set to grow.

•Investment in Downstream Products. We see opportunities to expand certain products businesses, and our investment in new SteelPhalt™ (road materials) plants in Europe is a recent example.

•Innovation. We are at the forefront of innovation in our industry. Our innovation programs are specifically focused on helping our customers solve their most pressing environmental challenges amid ever-increasing regulation. This initiative includes developing new customer or industry solutions, either in-house or externally, and expanding the usage of technologies that already exist within our business.

COMPETITION

HE competes principally with a small number of privately-held businesses for services outsourced by customers on a global basis. We also compete with numerous smaller, privately-held businesses in each of our regional markets and, to some degree, customers that may decide to perform certain services themselves.

We believe that HE differentiates itself from its competition through innovative technologies that support our service offerings, and through the operating expertise developed by sharing best practices across our global portfolio. Our safety practices and performance also support our business, as do our long-standing relationships and our downstream product solutions.

CLEAN EARTH

BUSINESS OVERVIEW

CE provides specialty waste processing, treatment, recycling, and beneficial reuse solutions for customers in the industrial, retail, healthcare, and construction industries across a variety of waste needs, including hazardous, non-hazardous, and contaminated soils and dredged materials. CE currently operates 18 RCRA Part B permitted TSDFs, wastewater treatment facilities and supporting 10-day transfer facilities across the U.S., serving approximately 90,000 customer locations, while utilizing a fleet of over 700 vehicles. It also holds a portfolio of approximately 600 critically-important permits, and the majority of waste handled by CE is recycled or beneficially reused.

Specialty-waste permits have considerable value, and CE is positioned to take advantage of increasingly stringent regulations on the handling of this waste. These dynamics provide recurring revenues and support attractive underlying growth. CE also operates in a fragmented market where acquisition opportunities are likely to develop. As a result, we see CE as a platform for growth as we continue to expand our focus as an environmental solutions company.

CUSTOMERS

CE provides regulatory-compliant solutions with a high quality of customer service to a diverse set of customers. These customers include waste generators in numerous industries, including chemicals, power, aerospace, medical, retail and metals, as well as integrated waste companies and brokers. CE also services federal, state and local governments, as well as developers linked to large infrastructure and redevelopment projects. CE had one customer in 2023, 2022 and 2021 that provided more than 10% of this segment's revenues.

LINES OF BUSINESS

Hazardous Waste

CE provides testing, tracking, processing, recycling, and disposal services for hazardous waste and it operates 18 RCRA Part B permitted TSDFs and several wastewater processing permits that enable the Company to process a variety of complex hazardous wastes, consisting of toxic, reactive and flammable materials such as industrial wastewater, manufacturing sludge, oily-mixtures, chemicals, pesticides, asbestos, pharmaceutical waste, and landfill leachate with per- and polyfluoroalkyl substances ("PFAS"). The remaining facilities handle a limited number of other wastes, including electronics, batteries and light bulbs. These operations possess unique and differentiated processing technologies, such as applications for aerosol can, medical waste recycling, fuel blending, household hazardous waste and lead contaminated soils. In 2023, this line of business represented approximately 83% of CE’s revenues.

4

Soil and Dredged Materials

CE processes approximately 3.4 million tons per year of contaminated soil and 0.3 million cubic yards of dredged material at seventeen locations, which includes fixed-based locations and mobile plants. These soils are contaminated with heavy metals, polychlorinated biphenyls ("PCBs"), pesticides, PFAS or other chemicals, and the related clean-up work is often the result of infrastructure improvements, private redevelopment, industrial site remediation and/or underground storage tank removal. CE treats and recycles this soil through various processes, after which the material is suitable for beneficial reuse as construction fill material or landfill capping. CE also operates one facility to treat dredged material, the sediment accumulated at the bottom of waterways that is removed for environmental (clean-up) or maintenance (maintain depth) purposes. After treatment, these materials are also beneficially reused as fill material. In 2023, this line of business represented approximately 17% of CE’s revenues.

OPERATIONS AND PERMITS

CE provides a suite of regulation-compliant treatment solutions for hazardous and non-hazardous wastes that can be tailored to

meet customer-specific requirements. The solutions include soil remediation and recycling including thermal desorption, dredged material stabilization and beneficial reuse, hazardous and non-hazardous waste stabilization and solidification, fuel blending, management and recycling, battery and electronic waste recycling, and secure electronic data destruction.

Additionally, CE holds a portfolio of approximately 600 process, treatment and operating permits, including the ones mentioned above. This permit portfolio is difficult to duplicate, making these permits valuable and critically-important assets in this heavily-regulated industry. CE’s ability to secure new permits or permit modifications for new waste streams or processes in the future remains an important growth lever for the business.

GROWTH STRATEGY

Favorable underlying market dynamics, driven by increased regulation and a growing list of contaminants and hazardous materials, and investment are anticipated to fuel CE’s growth in the coming years. We also anticipate introducing newer technologies into the market with new treatment solutions and expansion of existing technologies, including permit modifications and applications in new geographic markets. Lastly, CE is well-positioned to benefit from a positive outlook for maintenance and environmental dredging, as well as emerging PFAS markets, and over time, we expect acquisitions to be an important growth lever for CE. CE operates in a very fragmented, regionally-driven market, and as a result, we expect to pursue acquisition opportunities that may provide increased scale and/or new capabilities, along with synergies and attractive financial returns to the Company.

COMPETITION

Given the fragmented nature of the specialty waste industry, CE competes with numerous companies. Our larger peers within the hazardous materials line of business include Clean Harbors, Republic Services, which acquired U.S. Ecology in 2022, Veolia and Covanta, which acquired Circon Holdings, Inc. in 2023 and also recently announced, through its parent company, EQT Infrastructure, its intent to acquire a major stake in Heritage Environmental Services in 2024. Our larger peers within the soil and dredged materials market include GFL Environmental, Impact Environmental and Bayshore Recycling. CE differentiates itself from competitors through service reliability and responsiveness, its diverse operating capabilities and regulatory compliant solutions, and the value it provides through providing environmentally superior solutions relative to other disposal alternatives in the regions where it operates.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG")

We are committed to building a global, market-leading environmental solutions company that preserves our environment, adheres to ethical and responsible business practices, and supports our customers as they do the same. ESG is central to our business strategy and operations - our employees are inspired to develop innovative products and services that positively impact the environment and support the Company’s growth.

Our ESG focus areas include:

•Innovative Solutions. We help our customers solve their most pressing sustainability challenges by providing services and products that meet their environmental and business objectives. We deliver solutions for treating, recycling and repurposing materials across a wide range of customers, industries, and industrial by-products and specialty and hazardous wastes, including steel, aluminum, soils, water, electronics, fuel, batteries and more.

•Thriving Environment. We strive to reduce or eliminate our global environmental impacts by providing the highest-quality environmental management in our operations and improving our environmental footprint through continuous improvement efforts. Our Corporate Environmental Policy outlines our environmental stewardship commitments. We also expect all third parties that do business with the Company to share our environmental standards.

5

•Safe Workplaces. Safety is of paramount importance in everything we do - our goal, each and every day, is that our people return home unharmed. We have built a best-in-class safety culture, and our cross-divisional Executive Safety Committee is responsible for implementing best practices with a goal of eliminating all incidents within our business activities.

•Inspired People. We invest in the career development of our employees, knowing that diversity of perspective, backgrounds and talents strengthens our business. We are also committed to building strong, sustainable communities where we live and work.

•Excellence in Corporate Governance. Excellence in corporate governance is fundamental to how we manage and operate the Company, from our everyday business to ESG issues. Our Code of Conduct and our Core Values lie at the center of all we do. Through these policies and guidelines, we have equipped every employee with the tools, training, and guidance to always do the right things, the right way. Oversight of our ESG practices is provided by the Governance Committee of the Company’s Board.

Further details on our ESG initiatives and accomplishments can be found in our latest ESG Report. This report, published in October 2023, is our most comprehensive sustainability report to date and can be found on the Company’s website (www.enviri.com/sustainability) along with other related policies. Unless specifically stated herein, documents and information on the Company's website are not incorporated by reference into this document.

ENVIRI BUSINESS SYSTEM ("EBS")

Our EBS is a shared set of processes that reflect and support our corporate strategy. These repeatable and replicable standards and practices are the hallmark of a high-performing company. There is intrinsic value in a common language, and a defined business system does away, in large part, with ambiguity about what constitutes success. The elements of our EBS are:

Safety, Continuous Improvement and Talent Development.

ACQUISITIONS AND DIVESTITURES

Given the Company’s evolution to a single-thesis environmental solutions company, acquisitions and divestitures have been an important element of our business strategy. These actions support the Company’s growth ambitions, while reducing business cyclicality and portfolio complexity.

The Company is in the process of selling the Rail business. The intention to sell the business was first announced in the fourth quarter of 2021. The sales process was delayed due to certain macroeconomic conditions, including rising interest rates. Rail is classified as held for sale and reported as discontinued operations for all years presented.

In June 2019, the Company acquired Clean Earth which provided the Company entry into the specialty waste market. In April 2020, the Company acquired ESOL, an established waste transportation, processing and services provider with a comprehensive portfolio of disposal solutions for customers across industrial, retail and healthcare markets. The acquisition of ESOL furthered our transformation into a market-leading, single-thesis environmental solutions platform with its combination with Clean Earth.

SEASONALITY

The Company's businesses can be subject to seasonal fluctuations. Demand for services and solutions provided by HE are subject to seasonal changes related to weather conditions, inventory management through the steel-industry supply chain, and customer operating outages. The timing of these impacts varies by region, however, overall customer demand for HE across its global footprint tend to be strongest in the second quarter and third quarter of each year. CE, meanwhile, provides services that can also fluctuate seasonally with weather, construction activity, industrial production, retail spending and municipal waste collection programs. As a result, demand for CE services tends to be weakest in the first and fourth quarters of each year.

Due to these factors, the Company’s revenues and earnings are usually higher during the second and third quarters of each year relative to the first and fourth quarters of the year. Additionally, the Company’s cash flows are also influenced by seasonality. The Company’s cash flow from operations has historically been higher in the second half of the year, compared with the first half, due to working capital management, receivable collections during the fourth quarter as a result of higher revenues in preceding quarters and the timing of certain cash payments in the first half of the year, including for incentive compensation and pension contributions.

6

ENVIRONMENTAL COMPLIANCE

The Company is subject to various environmental regulations within its global operations, and the scope of relevant environmental regulation expanded following the Company’s acquisitions of Clean Earth and ESOL in 2019 and 2020, respectively. CE operates within an industry that is subject to stringent environmental regulations by federal, state and local authorities, which regulate the treatment and disposal of specialty waste. Facility and operating permits, or approvals from these authorities, are required to maintain operations. The nature of these permits varies by jurisdiction and are based on the activities at a particular site. These permits are generally difficult to obtain. This dynamic, along with increased regulation on the treatment and disposal of specialty waste, is beneficial to our CE business.

The most significant U.S. federal environmental regulation that impacts our business is the RCRA. RCRA created a cradle-to-grave system which governs the transportation, treatment, storage and disposal of hazardous waste. Under RCRA, each hazardous waste processing facility must maintain a RCRA permit and comply with defined operating practices. This legislation is administered by the EPA, although its authority may be delegated to a State EPA with similar or more stringent environmental standards.

The Company is also subject to air and water quality control legislation in the U.S. and in foreign countries where the Company operates. The Clean Water Act regulates the discharge of pollutants into waterways and sewers in the U.S, and, where necessary, we obtain and must comply with permits to discharge wastewater from our facilities. Similarly, the Clean Air Act in the U.S. controls emissions of pollutants into the air and requires permits for certain emissions.

The Company regards compliance with all applicable environmental regulations as critical to its business. Historically, the Company has been able to renew and retain all required permits to maintain its operations, and it has not experienced substantial difficulty complying with relevant environmental regulations. The Company also does not anticipate making any material capital expenditures to comply with, or improve, environmental performance in the future. While environmental regulations may increase or expand, we cannot predict the extent of this future environmental regulation, its related costs and the overall effect on the Company’s business.

For additional information regarding environmental matters see Note 12, Commitment and Contingencies, in Part II, Item 8, Financial Statements and Supplementary Data.

HUMAN CAPITAL RESOURCES

As of December 31, 2023, we had almost 13,000 employees, excluding contingent workers, in over 30 countries. The majority of these employees are represented by labor unions, through almost 100 collective bargaining agreements.

Our business relies on our ability to attract and retain talented employees. To attract and retain talent, we strive to create a diverse, inclusive and supportive workplace while providing opportunities for our employees to grow and develop in their careers.

Core Values

Across cultures, time zones and organizational lines, our values are the link that connects us all. As the cornerstone to our shared Company culture, these values reflect our overarching direction and purpose as a business:

•Be Environmental - Have an unwavering determination to make the world cleaner and greener.

•Be Performance Driven - Act with passion to deliver winning results.

•Be Customer Focused - Actively listen to our customers’ needs to exceed their expectations.

•Be Caring - Embed safety into everything we do and treat each other as we’d like to be treated ourselves.

•Be Inclusive - Create a diverse, collaborative and inclusive workplace by embracing differences.

•Be Respectful - Act truthfully and honorably to create a culture where people, opinions, and feelings are respected.

Health, Safety and Wellness

We are committed to the health, safety and wellness of our employees. We are passionate about establishing a culture of ownership and accountability for which all employees are responsible for safety. We evaluate our safety processes, programs and procedures to continuously improve our safety performance. We provide our employees and their families with access to a variety of health and wellness programs globally.

Compensation and Benefits

We provide competitive compensation and benefits programs for our employees. In addition to salaries, these programs, which vary by employee level and by the country where the employees are located, may include, among other items, bonuses, stock awards, retirement programs, health savings and flexible spending accounts, paid-time off, paid parental leave, disability programs, flexible work schedules and employee assistance programs.

7

Belonging Program

In 2023, as part of the Company's rebranding initiatives with the Company's corporate name change to Enviri Corporation, we also implemented our Belonging Program globally, which demonstrates our organization-wide commitment to fostering a diverse, collaborative and inclusive workplace. This program is an integral part of the Company’s values and processes that support recruitment, hiring, training, retention and advancement. In an effort to advance the Company's commitment to these values, the following initiatives were taken:

•Our global Belonging and Inclusion Council, co-chaired by our CEO and Senior Vice President & Chief Human Resources Officer, expanded to include 16 cross-functional leaders from each of our business units. Our Belonging and Inclusion Council's goals include continuing to foster a workplace culture that is aligned with our Corporate Values, as defined above.

•In 2023, the Company's Employee Resource Group, Enviri Women, whose mission is to promote the advancement of women across the Company through personal and professional development, mentorship, and empowerment, continued its efforts by undertaking a number of key initiatives to increase its connections with various communities, expanding its mentorship program and increasing visibility of female leaders by spotlighting their success stories, along with other various activities, in order to attract, retain and promote top talent. Enviri Women expanded to eleven chapters in 2023, inclusive of Latin America, China, South Africa, the U.S. and India.

•The Company continued to include diversity, equity, engagement and inclusion focused goals in key management's incentive compensation program.

Talent Development and Succession

We believe our development processes ensure continuity of leadership over the long term. Thus, annually we undertake a talent review process to access the organizational capabilities required to execute our strategy, create tailored development plans and understand the depth of our succession preparedness. Our objective is to build the readiness of various talent pools within the organization in order to select and promote key talent. In addition, we continue to invest in our employees through technical training, professional development and skills upgrade throughout the year.

CORPORATE INFORMATION

The Company was incorporated in 1956. The Company’s global headquarters and executive offices are located at Two Logan Square, 100-120 North 18th Street, 17th Floor in Philadelphia, PA, and its main telephone number is 267-857-8715.

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to such reports filed with or furnished to the SEC under Sections 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available as soon as reasonably practicable after such reports are electronically filed with the SEC on the Company’s website, under the "Financial Information" subheading under the "Investors" section. Additionally, the SEC maintains a website that contains reports, proxy and other information regarding issuers that electronically file with the SEC at www.sec.gov.

AVAILABLE INFORMATION

Our website address is www.enviri.com. Copies of our key Corporate governance documents, such as our Code of Conduct, as well as our Board's composition and structure, can be viewed on our website under the “Corporate Governance” subheading of the “About” section. Additionally, further information on our Corporate Sustainability initiatives also can be accessed through the “Sustainability” subheading of the "About" section on our website. The information posted on the Company’s website is not incorporated into the Company’s SEC filings.

8

Item 1A. Risk Factors.

Set forth below are risks and uncertainties that could materially and adversely affect the Company's results of operations, financial condition, liquidity and cash flows. The following discussion of risks contains forward-looking statements, and the risks set forth below are not the only risks faced by the Company. The Company's business operations could also be affected by other factors not presently known to the Company or factors that the Company currently does not consider to be material.

STRATEGIC AND OPERATIONAL RISKS

We may be unable to complete a transaction to divest Rail on favorable terms or at all and our pursuit of a divestiture could adversely affect our businesses, results of operations and financial condition.

Our intention to divest the Rail business was first announced in the fourth quarter of 2021. Our announcement and our conducting of a divestiture process for Rail exposes us to various risks and uncertainties, including changes in economic conditions, the risk that we may be unsuccessful in identifying an acquirer for Rail, the risk may be that we may be, unable to enter into an agreement for a transaction and the risk that agreement that we may enter into may not be on favorable terms and/or may not be completed due to regulatory or other factors. Although we currently intend to divest the Rail business, we cannot provide any assurance on the timing or terms of any potential divestiture, or if a divestiture will occur.

Moreover, the announcement and conduct of the divestiture process could cause disruptions in, and create uncertainty surrounding, Rail, including affecting Rail’s relationships with its existing and future customers, suppliers and employees, which could have an adverse effect on the Rail division’s operations and financial condition, potentially making it more difficult to successfully complete a transaction on favorable terms. If we are unable to complete a divestiture of Rail or we complete a transaction on unfavorable terms, we may suffer negative publicity, Rail and other businesses may suffer, our results of operations, financial condition or cash flows may be adversely affected and the market value of our shares may fall. In addition, the divestiture process may require commitments of significant time and resources on the part of management. As a result, the divestiture process may divert management’s attention from overseeing and exploring opportunities that may be beneficial to our other businesses and operations and, as such, adversely affect our other businesses and operations and harm our results of operations, financial condition or cash flows and the market value of our shares.

If the Clean Earth Segment fails to comply with applicable environmental laws and regulations, its business could be adversely affected.

The regulatory framework governing CE's business is extensive. The Company could be held liable if its operations cause contamination of air, groundwater or soil or expose its employees or the public to contamination. The Company may be held liable for damage caused by conditions that existed before it acquired the assets, business or operations involved. Also, it may be liable if it generates, transports or arranges for the transportation, disposal or treatment of hazardous substances that cause environmental contamination at facilities operated by others, or if a predecessor generated, transported, or made such arrangements and the Company is a successor. Liability for environmental damage could have a material adverse effect on the Company’s financial condition, results of operations and cash flows. The Company may also be held liable for the mishandling of waste streams resulting from the misrepresentations by a customer as to the nature of such waste streams.

Stringent regulations of federal, state and local governments have a substantial impact on CE’s transportation, treatment, storage, disposal and beneficial use activities. Many complex laws, rules, orders and regulatory interpretations govern environmental protection, health, safety, noise, visual impact, odor, land use, zoning, transportation and related matters. The Company also may be subject to laws concerning the protection of certain marine and bird species, their habitats, and wetlands. It may incur substantial costs in order to conduct its operations in compliance with these environmental laws and regulations. Changes in environmental laws or regulations or changes in the enforcement or interpretation of existing laws, regulations or permitted activities may require the Company to make significant capital or other expenditures, to modify existing operating licenses or permits, or obtain additional approvals or limit operations. New environmental laws or regulations that raise compliance standards or require changes in operating practices or technology may impose significant costs and/or limit the Company’s operations.

CE’s revenue is primarily generated as a result of requirements imposed on its customers under federal, state and local laws and regulations to protect public health and the environment. If requirements to comply with laws and regulations governing management of contaminated soils, dredge material, and hazardous wastes were relaxed or less vigorously enforced at the federal, state and local levels, demand for CE’s services could materially decrease and the Company's revenues and earnings could be reduced.

9

If the Company is unable to obtain, renew, or maintain compliance with its operating permits or license agreements with regulatory bodies, its business would be adversely affected.

The Company's facilities operate using permits and licenses issued by various regulatory bodies at various local, state and federal government levels. Failure to obtain permits and licenses necessary to operate these facilities on a timely basis or failure to renew or maintain compliance with its permits, licenses and site lease agreements on a timely basis could prevent or restrict the Company's ability to provide certain services, resulting in a material adverse effect on its business. There can be no assurance that the Company will continue to be successful in obtaining timely permit or license applications approval, maintaining compliance with its permits, licenses and lease agreements and obtaining timely license renewals.

The waste management industry, in which CE is a participant, is subject to various economic, business, and regulatory risks.

The future operating results of CE may be affected by such factors as its ability to utilize its facilities and workforce profitably in the face of intense price competition, maintain or increase market share during periods of economic contraction or industry consolidation, realize benefits from cost reduction programs, invest in new technologies for treatment of various waste streams, generate incremental volumes of waste to be handled through CE’s facilities from existing and acquired sales offices and service centers, appropriately contract with end disposal sites for the necessary volumes of waste, obtain sufficient volumes of waste at prices which produce revenue sufficient to offset the operating costs of its facilities and minimize downtime and disruptions of operations.

Outdoor construction, which may be limited due to unfavorable weather, and dredging, which may be limited due to environmental restrictions in certain waterways in the Northeastern United States, can be cyclical in nature. If those cyclical industries slow significantly, the business that CE receives from them would likely decrease.

The seasonality of the Company's business may cause quarterly results to fluctuate.

The majority of the Company's cash flows provided by operations has historically been generated in the second half of the year. This is a result of normally higher income during the second and third quarters of the year, as the Company's business tends to follow seasonal patterns. If the Company is unable to successfully manage the cash flow and other effects of seasonality on the business, its results of operations may suffer.

Customer concentration and related credit and commercial risks, together with the long-term nature of contracts, may adversely impact the Company's results of operations, financial condition and cash flows.

For the year ended December 31, 2023, the Company’s top five customers in HE accounted for approximately 31% of revenues in that Segment and 17% of the Company’s consolidated revenues. For the year ended December 31, 2023, the Company’s top five customers in CE accounted for approximately 28% of the revenues in that Segment and 12% of the Company’s consolidated revenues. The Company routinely enters into contracts with its top customers of varying length and scope. Disagreements between the parties can arise as a result of the scope, nature and varying degree of relationship between the Company and these customers and can result in disagreements between the Company and a customer that could impact multiple regions within the Company’s business.

CE may enter into a long-term contract with a customer covering multiple regions in the United States. A dispute with a customer in one region in the United States could impact the Company’s revenues related to that customer in another region. HE may incur capital expenditures or other costs at the beginning of a long-term contract that it expects to recoup through the life of the contract. Some of these contracts provide for advance payments to assist the Company in covering these costs and expenses. A dispute with a customer during the life of a long-term contract could impact the ability of the Company to receive payments or otherwise recoup incurred costs and expenses.

Finally, both HE and CE have several large customers and, if a large customer were to experience financial difficulty or file for bankruptcy or receivership protection, it could adversely impact the Company's results of operations, cash flows and asset valuations.

The Company may lose customers or be required to maintain or reduce prices as a result of competition.

The industries in which the Company operates are highly competitive. Some examples are as follows:

•HE is sustained mainly through contract renewals and new contract signings. The Company may be unable to renew contracts at historical price levels or to obtain additional contracts at historical rates as a result of competition. If the Company is unable to renew its contracts at the historical rates or renewals are made at reduced prices, or if its customers terminate their contracts, revenue and results of operations may decline.

10

•Like HE, CE is sustained primarily through contract renewals and new contract signings. CE faces competition from companies with greater resources than the Company, with closer geographic proximity to waste sites, with captive end disposal assets, and who may provide service offerings that we do not provide. In order to compete, the Company may be required to reduce price levels below historical price levels or obtain additional contracts at rates lower than historical rates.

•The Rail business competes with companies that manufacture similar products both internationally and domestically. Certain international competitors export their products into the U.S. and sell them at lower prices, which can be the result of lower labor costs and government subsidies for exports. In addition, certain competitors may from time to time sell their products below their cost of production in an attempt to increase their market share. Such practices may limit the prices the Rail business can charge for its products and services. Unfavorable foreign exchange rates can also adversely impact the Rail business’s ability to match the prices charged by international competitors. If the Rail business is unable to match the prices charged by competitors, it may lose customers.

Higher than expected claims under insurance policies, under which the Company retains a portion of the risk, could adversely impact results of operations and cash flows.

The Company retains a significant portion of the risk for property, workers' compensation, U.K. employers' liability, automobile and general and product liability losses. Reserves have been recorded that reflect the undiscounted estimated liabilities for ultimate losses, including claims incurred but not reported. Inherent in these estimates are assumptions that are based on the Company's history of claims and losses, a detailed analysis of existing claims with respect to potential value, and current legal and legislative trends. If actual claims are higher than those projected by management, an increase to the Company's insurance reserves may be required and would be recorded as a charge to income in the period the need for the change was determined.

The Company's insurance policies do not cover all losses, costs, or liabilities that it may experience.

The Company maintains insurance coverage, but these policies do not cover all of its potential losses, costs, or liabilities. The Company could suffer losses for uninsurable or uninsured risks or in amounts in excess of its existing insurance coverage, which would significantly affect its financial performance. The Company's insurance policies have deductibles and self-retention limits that could expose it to significant financial expense. The Company’s ability to obtain and maintain adequate insurance may be affected by conditions in the insurance market over which it has no control. The occurrence of an event that is not fully covered by insurance could have a material adverse effect on the Company’s business, financial condition, and results of operations. In addition, the Company’s business requires that it maintain various types of insurance. If such insurance is not available or not available on economically acceptable terms, the Company’s businesses could be materially and adversely affected.

Increases in purchase prices (or decreases in selling prices) or availability of steel or other materials and commodities may affect the Company's profitability.

The profitability of the Company's products and services may be affected by changing purchase prices of raw material, including steel and other materials and commodities, supplier costs or own labor costs. If raw material costs, supplier or labor costs increase and the costs cannot be transferred to the Company's customers, results of operations would be adversely affected. Additionally, decreased availability of steel or other materials or services could affect the Company's ability to provide products and services in a timely manner. If the Company cannot obtain the necessary raw materials, then revenues and cash flows could be adversely affected.

Certain services performed by HE result in the recovery, processing and sale of recovered metals and minerals and other high-value metal byproducts to its customers. The selling price of the byproducts material is market-based and varies based upon the current fair value of its components. Therefore, the revenue amounts generated from the sale of such byproducts material vary based upon the fair value of the commodity components being sold.

The success of the Company's strategic ventures depends on the satisfactory performance by strategic venture partners of their strategic venture obligations.

The Company enters into various strategic ventures as part of its strategic growth initiatives as well as to comply with local laws. Differences in opinions or views between strategic venture partners can result in delayed decision-making or failure to agree on material issues which could adversely affect the business and operations of the venture. From time to time, in order to establish or preserve a relationship, or to better ensure venture success, the Company may accept risks or responsibilities for the strategic venture that are not necessarily proportionate with the reward it expects to receive. The success of these and other strategic ventures also depends, in large part, on the satisfactory performance by the Company's strategic venture partners of their strategic venture obligations, including their obligation to commit working capital, equity or credit support as required by the strategic venture and to support their indemnification and other contractual obligations.

11

If the Company's strategic venture partners fail to satisfactorily perform their strategic venture obligations as a result of financial or other difficulties, the strategic venture may be unable to adequately perform or deliver its contracted services. Under these circumstances, the Company may be required to make additional investments and provide additional services to ensure the adequate performance and delivery of the contracted services. These additional obligations could result in reduced profits or, in some cases, increased liabilities or significant losses for the Company with respect to the strategic venture. In addition, although the Company generally performs due diligence with regard to potential strategic partners or ventures, a failure by a strategic venture partner to comply with applicable laws, rules or regulations could negatively impact its business and, in the case of government contracts, could result in fines, penalties, suspension or even debarment. Unexpected strategic venture developments could have a material adverse effect on results of operations, financial condition and cash flows.

If the Company fails to maintain safe worksites, it may be subject to significant operating risks and hazards.

The Company operates at facilities that may be inherently dangerous workplaces. CE operates facilities that accept, process and/or treat materials provided by its customers. HE has operations at customers' steel producing sites, which often times involve extreme conditions. If serious accidents or fatalities occur or its safety record was to deteriorate, it may be ineligible to bid on certain work, and existing service arrangements could be terminated. Further, regulatory changes implemented by the Occupational Safety and Health Administration, or similar foreign agencies, could impose additional costs on the Company. Adverse experience with hazards and claims could result in liabilities caused by, among other things, injury or death to persons, which could have a negative effect on the Company’s ability to attract and retain employees or its reputation with its existing or potential new customers and its prospects for future business.

The Company maintains a workforce based upon current and anticipated workload. If the Company does not receive future contract awards or if these awards are delayed, significant cost may result that could have a material adverse effect on results of operations, financial condition, liquidity and cash flows.

The Company's estimates of future performance depend on, among other matters, whether and when the Company will receive certain new contract awards, including the extent to which the Company utilizes its workforce. The rate at which the Company utilizes its workforce is impacted by a variety of factors, including:

•the ability to manage attrition;

•the ability to forecast the need for services, which allows the Company to maintain an appropriately sized workforce;

•the ability to transition employees from completed projects to new projects or between segments; and

•the need to devote resources to non-revenue generating activities such as training or business development.

While the Company's estimates are based upon good faith judgment, these estimates can be unreliable and may frequently change based on newly available information. In the case of large-scale domestic and international projects where timing is often uncertain, it is particularly difficult to predict whether and when the Company will receive a contract award. The uncertainty of contract award timing can present difficulties in matching the Company's workforce size with contract needs. If an expected contract award is delayed or not received, the Company could incur cost resulting from reductions in staff or redundancy of facilities or equipment that could have a material adverse effect on results of operations, financial condition, liquidity and cash flows.

Union disputes or other labor matters could adversely affect the Company's operations and financial results.

A significant portion of the Company's employees are represented by labor unions in a number of countries under various collective bargaining agreements with varying durations and expiration dates. There can be no assurance that any current or future issues with the Company's employees will be resolved or that the Company will not encounter future strikes, work stoppages or other types of conflicts with labor unions or the Company's employees. The Company may not be able to satisfactorily renegotiate collective bargaining agreements in the U.S. and other countries when they expire. If the Company fails to renegotiate existing collective bargaining agreements, the Company could encounter strikes or work stoppages or other types of conflicts with labor unions. In addition, existing collective bargaining agreements may not prevent a strike or work stoppage at the Company's facilities in the future. The Company may also be subject to general country strikes or work stoppages unrelated to the Company's business or collective bargaining agreements. A work stoppage or other limitations on production at the Company's facilities for any reason could have an adverse effect on the Company's business, results of operations, financial condition and cash flows. In addition, many of the Company's customers and suppliers have unionized work forces, and may experience a lack of qualified employees. Strikes or work stoppages, as well as labor shortages, experienced by the Company's customers or suppliers could have an adverse effect on the Company's business and supply chain, results of operations and financial condition.

12

The Company may be unable to adequately protect its intellectual property portfolio or prevent competitors from independently developing similar or duplicative products and services.

The Company's patents and other intellectual property may not prevent competitors from independently developing or selling similar or duplicative products and services, and there can be no assurance that the resources invested by the Company to protect the Company's intellectual property will be sufficient or that the Company's intellectual property portfolio will adequately deter misappropriation or improper use of the Company's technology. The Company could also face competition in some countries where the Company has not protected its intellectual property portfolio. The Company may be unable to secure or retain ownership or rights to use data in certain software analytics or services offerings. In addition, the Company may be the target of aggressive and opportunistic enforcement of patents by third parties, including non-practicing entities. Regardless of the merit of such claims, responding to infringement claims can be expensive and time-consuming. If the Company is found to infringe any third-party rights, the Company could be required to pay substantial damages or could be enjoined from offering some of the Company's products and services. Also, there can be no assurances that the Company will be able to obtain or renew from third parties the licenses needed in the future, and there is no assurance that such licenses can be obtained on reasonable terms.

Increased information technology security threats and more sophisticated computer crime pose a risk to the Company and its vendors, systems, networks, products and services.

The Company relies upon information technology systems and networks in connection with a variety of business activities, some of which are managed by third parties (which we refer to collectively as our “associated third parties”). Additionally, the Company and its associated third parties collect and store data that is of a sensitive nature, which may include names and addresses, bank account information, and other types of personally identifiable information or sensitive business information. The secure operation of these information technology systems and networks, and the processing and maintenance of this data is critical to the Company's business operations and strategy.

The Company may face attempts to gain unauthorized access to the Company's information technology systems or products or those of its associated third parties for the purpose of improperly acquiring trade secrets or confidential business information. The theft or unauthorized use or publication of the Company's trade secrets and other confidential business information as a result of such an incident could adversely affect the Company's competitive position and the value of the Company's investment in research and development.

Threats to our systems and our associated third parties' systems can derive from human error, fraud, or malice on the part of employees or third parties, or may result from accidental technological failure. Globally, these types of threats have increased in number and severity and it is expected that these trends will continue. These threats pose a risk to the security of the Company's systems and networks and the confidentiality, availability and integrity of the Company's data. Should an attack on the Company's or our associated third parties’ information technology systems and networks succeed, it could expose the Company and the Company's employees, customers, dealers and suppliers to misuse of information or systems, the compromising of confidential information, manipulation and destruction of data, production downtimes and operations disruptions.

The occurrence of any of these events could adversely affect the Company's reputation, competitive position, business, results of operations and cash flows. While we have a robust cybersecurity program and maintain cybersecurity insurance related to a breach event covering certain expenses, damages and claims arising from such incidents may not be covered, or may exceed the amount of any insurance available. See Part I. Item 1C. Cybersecurity for additional details on the Company's cybersecurity program.

In addition, various privacy and security laws govern the protection of this information and breaches in security could result in litigation, regulatory action, potential liability and the costs and operational consequences of implementing further data protection measures. For example, the European Union's ("EU") General Data Protection Regulation ("GDPR") extends the scope of the EU data protection laws to all companies processing data of EU residents, regardless of the company’s location. The potential compliance costs with or imposed by new or existing regulations and policies that are applicable to us could have a material impact on our results of operations.

13

MACROECONOMIC AND INDUSTRY RISKS

Negative economic conditions may adversely impact demand for the Company's products and services, as well as the ability of the Company's customers to meet their obligations to the Company on a timely basis.

Negative economic conditions, including the tightening of credit in financial markets, can lead businesses to postpone spending, which may impact the Company's customers, causing them to cancel, decrease or delay their existing and future orders with the Company. In addition, negative economic conditions may adversely impact the Company's customers by causing them to close locations or deteriorate their financial condition to a point where they are unable to meet their obligations to the Company on a timely basis. One or more of these events could adversely impact the Company's operating results and ability to collect its receivables.

Cyclical industry and economic conditions may adversely affect the Company's businesses.

The Company's businesses are subject to general economic slowdowns and cyclical conditions in each of the industries served. Examples are:

•HE may be adversely impacted by prolonged slowdowns in steel mill production, excess production capacity, bankruptcy or receivership of steel producers and changes in outsourcing practices;

•The resource recovery and slag optimization technologies business of HE can also be adversely impacted by prolonged slowdowns in customer production or a reduction in the selling prices of its materials, which are in some cases market-based and vary based upon the current fair value of the components being sold. Therefore, the revenue generated from the sale of such recycled materials varies based upon the fair value of the commodity components being sold;

•The abrasives and roofing materials business of HE may be adversely impacted by economic conditions that slow the rate of residential roof replacement, or by slowdowns in the industrial and infrastructure refurbishment industries;

•Rail may be adversely impacted by developments in the railroad industry that lead to lower capital spending or reduced track maintenance spending;

•Prolonged slowdowns may result in a decrease in the amount of waste generated, resulting in less hazardous waste collected by CE; and

•Capital constraints and increased borrowing costs may also adversely impact the financial position and operations of the Company's customers across all business segments.

Furthermore, utilization of deferred tax assets is ultimately dependent on generating sufficient income in future periods to ensure recovery of those assets. The cyclicality of the Company's end markets and adverse economic conditions may negatively impact the future income levels that are necessary for the utilization of deferred tax assets.

Exchange rate fluctuations may adversely impact the Company's business.

Fluctuations in foreign exchange rates between the U.S. dollar and the approximately 25 other currencies in which the Company currently conducts business may adversely impact the Company's results of operations in any given fiscal period. The Company’s principal foreign currency exposures are in the Euro, the British pound sterling, the Chinese yuan and the Brazilian real. Given the structure of the Company's operations, an increase in the value of the U.S. dollar relative to the foreign currencies in which the Company earns its revenues generally has a negative impact on the translated amounts of the assets and liabilities, results of operations and cash flows. The Company's foreign currency exposures increase the risk of volatility in its financial position, results of operations and cash flows. If currencies in the below regions change materially in relation to the U.S. dollar, the Company's financial position, results of operations, or cash flows may be materially affected.

Compared with the corresponding full-year period in 2022, the average value of major currencies changed as follows in relation to the U.S. dollar during the full-year 2023, impacting the Company's revenues and income:

•British pound sterling strengthened by 1%;

•Euro strengthened by 3%;

•Chinese yuan weakened by 5%; and

•Brazilian real strengthened by 3%

Compared with exchange rates at December 31, 2022, the value of major currencies at December 31, 2023 changed as follows:

•British pound sterling strengthened by 5%;

•Euro strengthened by 3%;

•Chinese yuan weakened by 3%; and

•Brazilian real strengthened by 9%

14

To illustrate the effect of foreign exchange rate changes in certain key markets of the Company, in 2023 revenues would have been less than 1% or $8 million higher and operating income would have been 2% or $3 million higher if the average exchange rates for 2022 were utilized. In a similar comparison for 2022, revenues would have been approximately 4% or $70 million higher and operating income would have been 9% or $5 million higher if the average exchange rates for 2021 were utilized.

Currency changes also result in assets and liabilities denominated in local currencies being translated into U.S. dollars at different amounts than at the prior period end. Generally, if the U.S. dollar weakens in relation to currencies in countries in which the Company does business, the translated amounts of the related assets, liabilities, and therefore stockholders' equity, would increase. Conversely, if the U.S. dollar strengthens in relation to currencies in countries in which the Company does business, the translated amounts of the related assets, liabilities, and therefore stockholders' equity, would decrease.

Although the Company engages in foreign currency exchange forward contracts and other hedging strategies to mitigate foreign exchange transactional risks, hedging strategies may not be successful or may fail to completely offset these risks. In addition, competitive conditions in the Company's manufacturing businesses may limit the Company's ability to increase product prices in the face of adverse currency movement. Sales of products manufactured in the U.S. for the domestic and export markets may be affected by the value of the U.S. dollar relative to other currencies. Any long-term strengthening of the U.S. dollar could depress demand for these products and reduce sales. Conversely, any long-term weakening of the U.S. dollar could improve demand for these products and increase sales.

LEGAL AND REGULATORY RISKS

The Company's global presence subjects it to a variety of risks arising from doing business internationally.