Hawaiian Electric Exhibit 10.1(j)

EXECUTION VERSION

Amended and Restated

Power Purchase Agreement

For

Firm Dispatchable Capacity

And Energy

Kalaeloa Partners L.P.

a Delaware limited partnership Dated: October 29, 2021

TABLE OF CONTENTS OF ATTACHMENTS

| | | | | |

| Attachment A. | Facility Description |

| Attachment B. | Facility Owned by Seller |

| Attachment C. | Methods and Formulas for Measuring Performance Standards/Selected Portions

of NERC GADS |

| Attachment D. | Consultants List – Qualified Independent Engineering Companies |

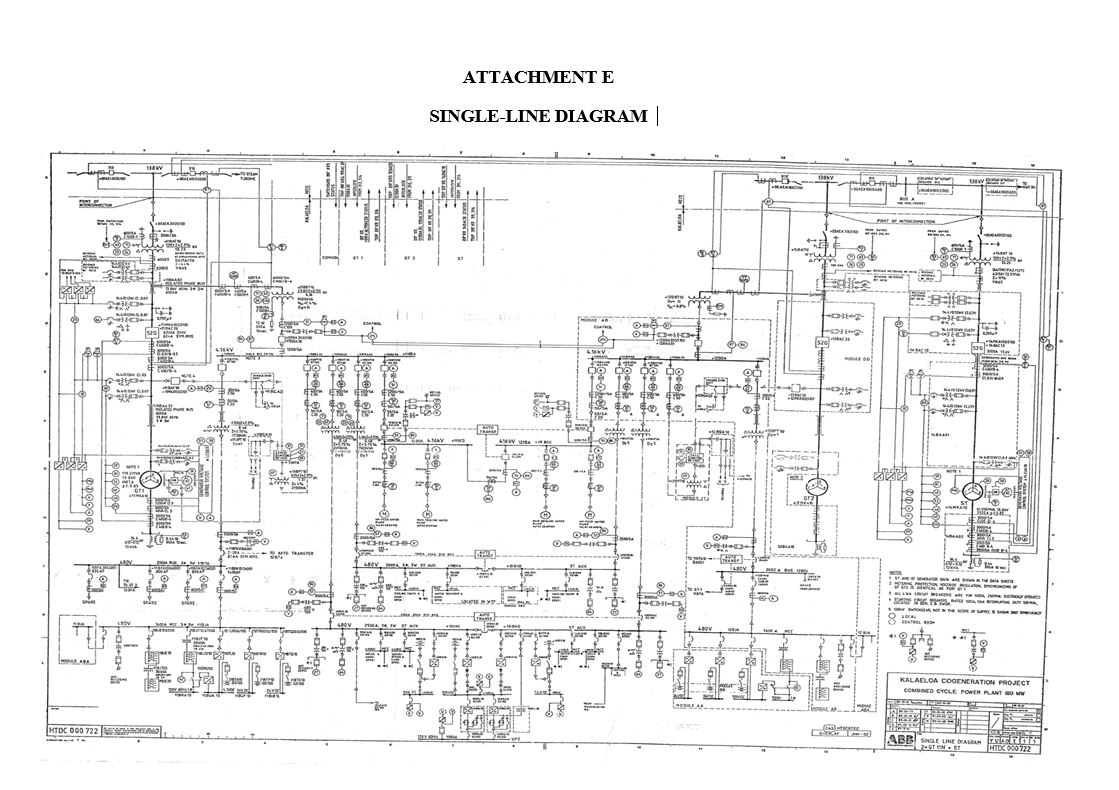

| Attachment E. | Single-Line Diagram |

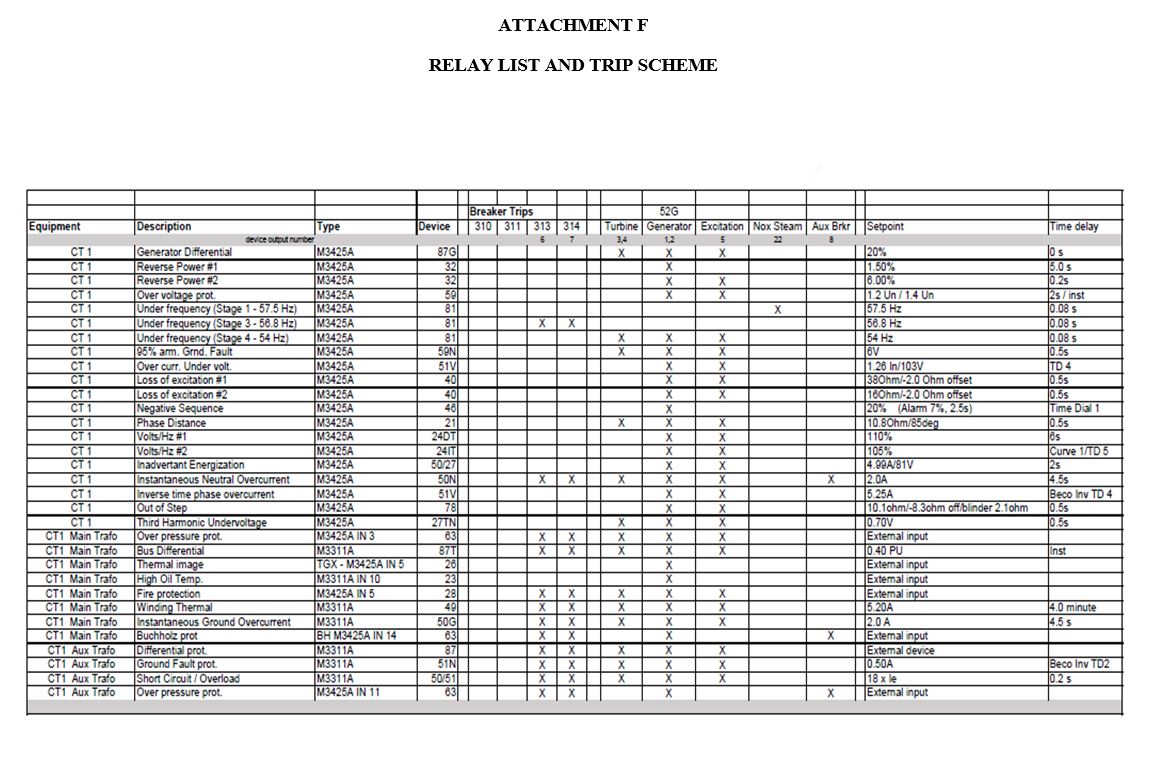

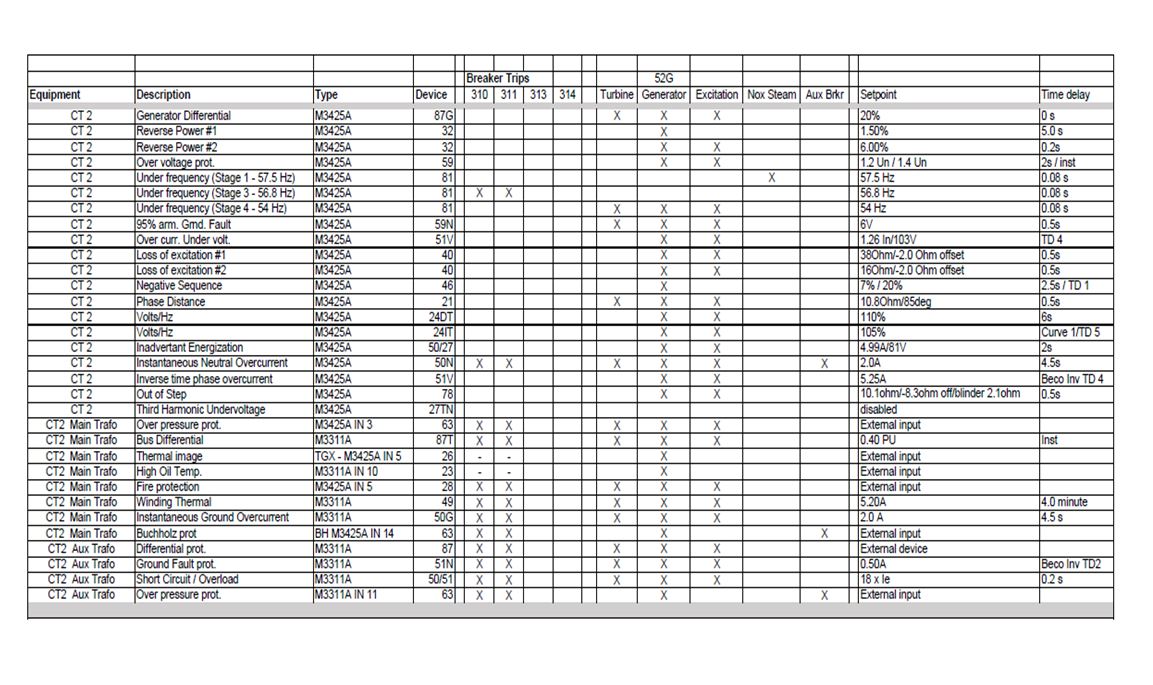

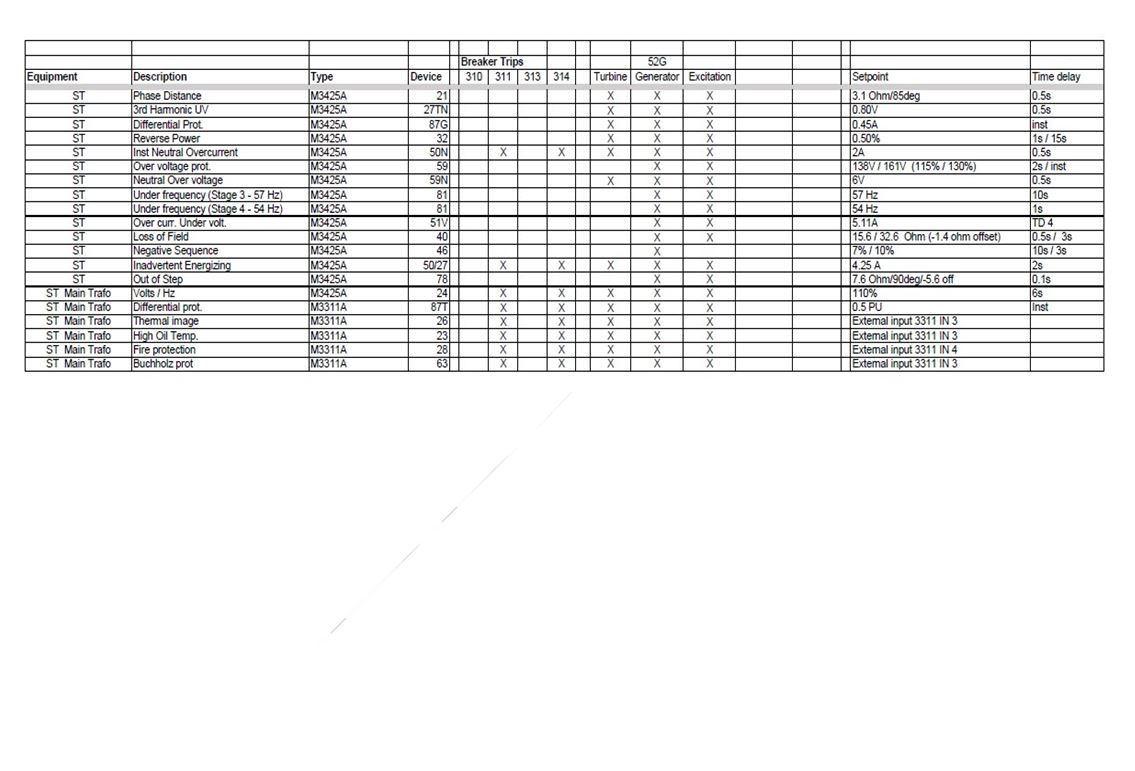

| Attachment F. | Relay List and Trip Scheme |

| Attachment G. | Company-Owned Interconnection Facilities |

| Attachment H. | [Intentionally Omitted] |

| Attachment I. | [Intentionally Omitted] |

| Attachment J. | Energy Charge and Capacity Charge Payment Formulas |

| Attachment K. | [Intentionally Omitted] |

| Attachment L. | [Intentionally Omitted] |

| Attachment M. | Form of Standby Letter of Credit |

| Attachment N. | [Intentionally Omitted] |

| Attachment O. | Control System Acceptance Test Criteria |

| Attachment P. | Sale of Facility by Seller |

| Attachment Q. | Form of Security Agreement |

| Attachment R. | Required Insurance |

| Attachment S. | [Intentionally Omitted] |

| Attachment T. | [Intentionally Omitted] |

| Attachment U. | Adjustment of Charges |

| Attachment V. | Summary of Maintenance and Inspection Performed |

| Attachment W. | [Intentionally Omitted] |

| Attachment X. | Unit Incident Report |

| Attachment Y. | Operation and Maintenance of the Facility |

| Attachment Z. | Critical Spare Parts |

| Attachment AA. | Seller’s Government Approvals |

| Attachment BB. | Option for Conversion to Alternative Fuel |

AMENDED AND RESTATED POWER PURCHASE AGREEMENT

For Firm Dispatchable Energy and Capacity

THIS AMENDED AND RESTATED POWER PURCHASE AGREEMENT FOR FIRM DISPATCHABLE ENERGY AND CAPACITY (“Agreement”) is made this 29th day of October, 2021 (“Execution Date”), by and between Hawaiian Electric Company, Inc. (“Company”), a Hawai‘i corporation, with principal offices in Honolulu, Hawai‘i, and Kalaeloa Partners L.P. (“Seller”), a Delaware limited partnership, with principal offices in North Brunswick, New Jersey, doing business at 91-111 Kalaeloa Boulevard, Kapolei, Hawai‘i 96707.

BACKGROUND :

A. Company is an operating electric public utility on the Island of O‘ahu, subject to the Hawai‘i Public Utilities Law (Hawai‘i Revised Statutes, Chapter 269) and the rules and regulations of the Hawai‘i Public Utilities Commission (hereinafter called the “PUC”).

B. Company operates the Company System as an independent power grid and must maximize system reliability for its customers by ensuring that sufficient generation is available and that its system (including transmission and distribution) meets the requirements for voltage stability, frequency stability, and reliability standards.

C. Company desires to minimize fluctuations in its purchased power costs by acquiring dispatchable generation at a generally fixed energy price subject to limited fluctuation based on changes to the GDPIPD (as defined herein) on an annual basis.

D. Seller is organized for the purpose of planning, designing, constructing, owning, operating, and maintaining a combined cycle facility on property currently leased from Company at Kapolei, O‘ahu, Hawai‘i.

E. Seller understands the need to use commercially reasonable efforts to maximize the overall reliability of the Facility and the Company System.

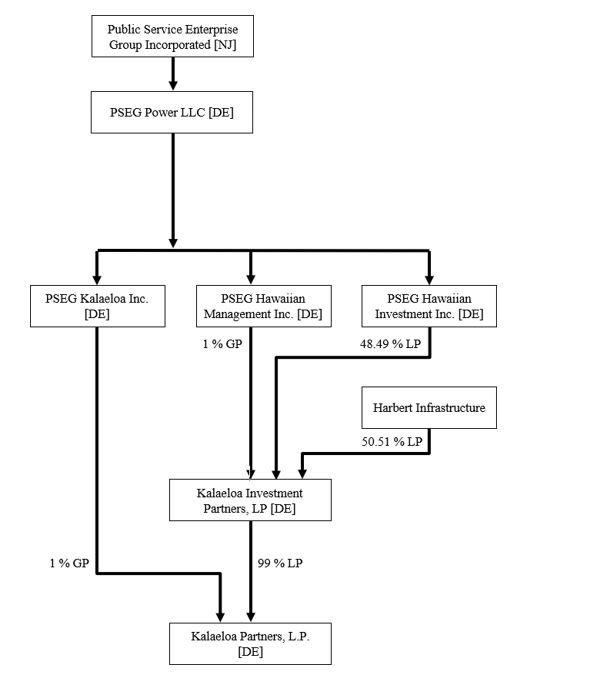

F. Seller is a limited partnership (the “Partnership”) whose general partner is PSEG Kalaeloa, Inc. and whose limited partner is Kalaeloa Investment Partners, L.P.

G. PSEG Kalaeloa, Inc., a corporation with principal offices in Wilmington, Delaware, is indirectly wholly-owned by PSEG Power LLC.

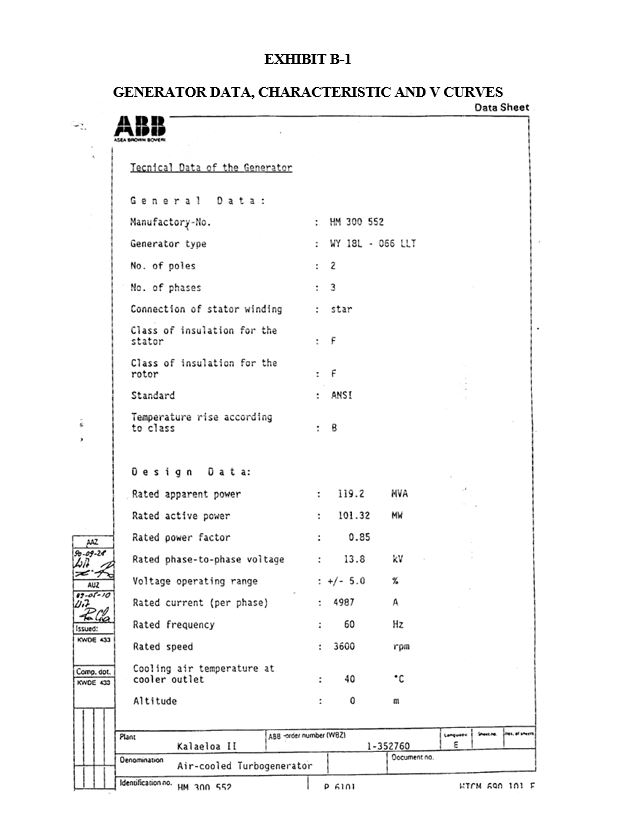

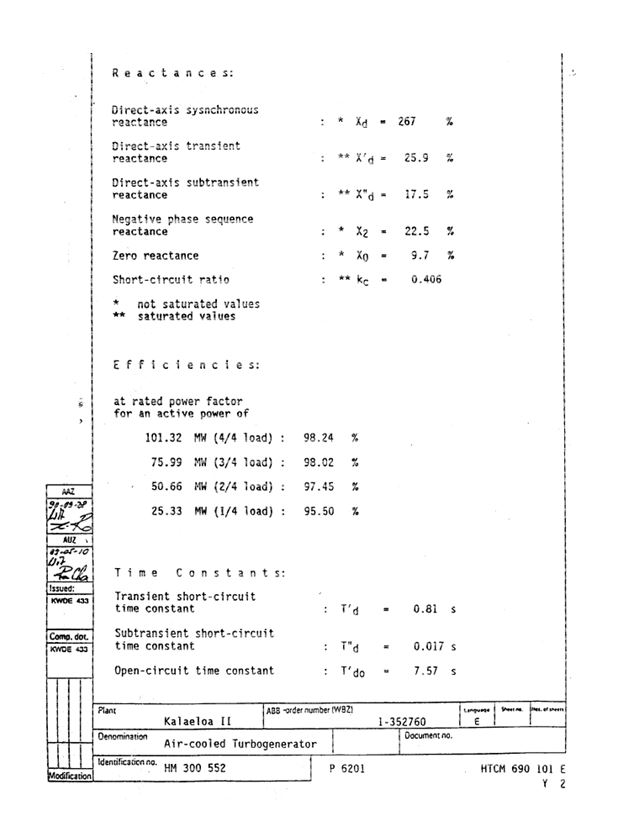

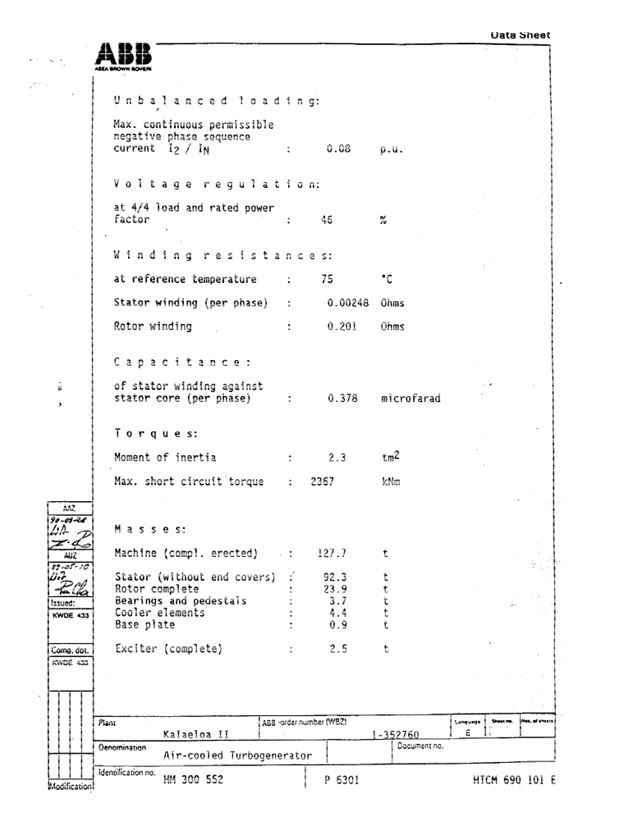

H. Seller and ABB Energy Services, Inc. (“ABB Energy”) had previously entered into a turnkey Design/Build Contract, dated October 14, 1988 under which the Facility was constructed on the Site and commenced commercial operations in May 1991.

I. Seller and ABB Energy had previously entered into an Operating Maintenance and Repair Agreement dated November 8, 1988 (the “O&M Agreement”), for the Facility under

which ABB Energy operated and maintained the Facility for the benefit of Seller, as subsequently amended by Amendment No. 1, dated as of March 31, 1997, pursuant to which, among other things, ABB Power Generation Inc. (“ABB Power”) succeeded to the interests of ABB Energy under the O&M Agreement. Thereafter, effective as of June 22, 2000, ABB Power merged into ABB Alstom Power Inc., which subsequently changed its name to Alstom Power Inc. On November 2, 2015, General Electric Company (“GE”) acquired ABB Alston Power Inc.’s power division and continued operation under the O&M Agreement. The O&M Agreement was further amended by Amendment No. 2, effective December 22, 2015, and by Amendment No. 3, effective as of December 26, 2016, which extended the term thereof to May 22, 2022. As a result, GE continues to operate and maintain the Facility for the benefit of Seller through May 22, 2022.

J. Seller has been providing through the Facility firm capacity of two hundred eight thousand (208,000) kilowatts to Company pursuant to that certain Power Purchase Agreement, dated as of October 14, 1988, as amended and clarified by (i) Amendment No. 1 to Power Purchase Agreement dated as of June 15, 1989, (ii) Restated and Amended Amendment No. 2 to Power Purchase Agreement dated as of February 9, 1990, (iii) Amendment No. 3 to Power Purchase Agreement dated as of December 10, 1991, (iv) Agreement to Clarify and Interpret dated as of March 31, 1997, (v) Amendment No. 4 to Power Purchase Agreement dated as of October 1, 1999, (vi) Confirmation Agreement Concerning Section 5.2B(2) of Power Purchase Agreement and Amendment No. 5 to Power Purchase Agreement dated as of October 12, 2004 (“Amendment No. 5”), and (vii) Agreement for Increment Two Capacity and Amendment No. 6 to Power Purchase Agreement dated as of October 12, 2004 (as so amended and clarified, the “Original Power Purchase Agreement”).

K. Seller has operated, and continues to operate, the Facility as a Qualifying Facility (“QF”) as defined in the Public Utility Regulatory Policies Act of 1978 (“PURPA”), in 18 Code of Federal Regulations (“CFR”) Part 292, and Title 6, Chapter 74 of the Hawaii Administrative Rules, as amended from time to time.

L. Seller undertook certain physical modifications to the Facility (the M Upgrade) pursuant to the Consent and Agreement dated as of December 31, 2003, by Company and Seller.

M. The Original Power Purchase Agreement provided that its terms shall expire on May 23, 2016. However, pursuant to Decision and Order No. 30380, issued by the PUC on May 14, 2012, the Commission granted an exemption to the Parties to negotiate an extension of the Original Power Purchase Agreement, subject to certain conditions. On August 1, 2016, Company and Seller agreed that neither Party would give written notice of termination resulting in the termination of the Original Power Purchase Agreement prior to the end of October 31, 2017. This agreement has been extended without lapse, with the most recent extension being made on May 31, 2021, where Company and Seller extended the agreement that neither party would give written notice of termination resulting in the termination of the Original Power Purchase Agreement prior to the end of October 31, 2021.

N. Company will not commit to purchase capacity from the Facility for an extended term unless this Agreement and the Facility (a) provide Company with the flexibility to

accommodate the substantial level of intermittent renewable energy resources that have been or are expected to be added to its system in 2020-2030 time frame, (b) help to ensure continued reliable operation of its system, and (c) afford Company the option of requiring that the Facility convert to alternative fuel generation as more fully set forth in Background Section P.

O. Seller had engaged 1898 & Co., a division of Burns & McDonnell Engineering Company, Inc. to undertake a condition assessment of the Facility to identify and plan for a multi-year program to recondition and replace major equipment components of the Facility during Seller’s normally scheduled overhaul and maintenance schedule over several years (collectively, the “Life Extension Program” or “LEP”) that will (a) enhance and thereby extend the operating life of the Facility in order to maintain performance guarantees during an extension of the Original Power Purchase Agreement, as restated and amended by this Agreement, (b) provide Company with the flexibility to accommodate the substantial level of intermittent renewables that have been or are expected to be added to its system in the 2020-2030 time frame and (c) help to ensure continued reliable operation of the Company System. As set forth above, the Life Extension Program will be implemented over several years during the Term during Seller’s normally scheduled overhaul and maintenance schedule for the Facility.

P. Company will not commit to purchase energy from Seller over the Term of this Agreement without assurance that the Facility, at Company’s election or if required by law, will be converted to alternative fuel generation as needed to help Company meet its obligations to achieve the levels mandated under Hawai‘i’s Renewable Portfolio Standards Law (codified in HRS §§ 269-91 through -95 (the “RPS Law”)).

Q. Seller has informed Company that the Facility can burn a wide variety of liquid fuels, including (1) low sulfur residual fuel oil (LSFO), as it presently does, (2) ultra-low sulfur diesel fuel oil (ULSO), (3) alternative fuel substitutes for LSFO, (4) biodiesel substitutes for ULSO and (5) LSFO/alternative fuel or ULSO/biodiesel blends.

R. Seller has informed Company that Seller has taken several steps in support of getting ready for the burning of alternative fuels, including test burn of palm based alternative fuel in January 2010, and assessment for the existing plant equipment that would require upgrading to facilitate operation on alternative fuel full time.

S. Seller determined that it is capable of blending certain alternative fuels.

T. Company desires the right to require Seller to convert the Facility, in whole or in part, from LSFO generation to alternative fuel generation, and Seller desires to grant Company that right, subject to the terms and conditions stated herein.

U. Company and Seller desire to amend and restate the Original Power Purchase Agreement, to incorporate certain modifications to the Original Power Purchase Agreement and to extend the term of the Original Power Purchase Agreement to enable Company to acquire energy and capacity over a longer term (provided, however, that the Original Power Purchase Agreement shall continue to be effective with respect to certain obligations of Seller and Company as provided herein).

V. Seller and Company have completed negotiations for Company’s purchase of the electric output from the Facility for a term further described in Section 2.2(A) of this Agreement, under terms and conditions that are anticipated to provide benefits to both Seller and Company.

W. Seller represents that it is equipped and has or will contract for the expertise and manpower, and has or will obtain the financial backing necessary to perform all of the obligations required under this Agreement.

X. Each Party's willingness to enter into this Agreement is based upon the Parties' respective covenants, warranties and representations set forth herein.

Y. The Facility is located at 91-111 Kalaeloa Boulevard, Kapolei, Hawai‘i 96707, and is more fully described in Attachment A (Facility Description) attached hereto and made a part hereof.

Z. Seller desires to continue to sell to Company electric capacity and energy generated by the Facility, and Company, at its dispatch and subject to PUC approval, agrees to purchase such capacity and energy from Seller, upon the terms and conditions set forth herein.

AGREEMENT:

In light of the foregoing and in consideration of the premises and the respective promises herein, Company and Seller hereby agree that the following terms and conditions shall govern the sale and delivery of electric capacity and energy by Seller and the purchase and acceptance of such electric capacity and energy by Company and other related transactions.

ARTICLE 1

DEFINITIONS

For the purposes of this Agreement, the following capitalized terms shall have the meanings as set forth below:

“ABB Energy” – Shall have the meaning set forth in Background Section H.

“ABB Power” – Shall have the meaning set forth in Background Section I.

"Acceptance Notice" – Shall have the meaning set forth in Section 1(a)(ii) of Attachment P (Sale of Facility by Seller) to this Agreement.

"Active Power Control Interface" – Shall have the meaning set forth in Section 1(b)(iii)(I) (Active Power Control Interface) of Attachment B (Facility Owned by Seller) of this Agreement.

“Agreement” – Shall have the meaning set forth in the preamble to this agreement.

“Appeal Period” – Shall have the meaning set forth in Section 25.12(B) (Non-Appealable PUC Approval Order).

“Appraised Fair Market Value of the Facility” – Shall have the meaning set forth in Section 3(d) of Attachment P (Sale of Facility by Seller).

“Attachments” – Shall have the meaning set forth in Section 25.21 (Attachments).

“Business Day” – Any Day other than a Saturday, Sunday or a federal or Hawai‘i state holiday.

“Capacity Charge” – The monetary rate in $/kW per month to be paid by Company to Seller pursuant to Section 5.1(D) (Capacity Charge) of this Agreement based on the net capacity available to the Company System from the Facility.

“Capacity Rate Inclusion Date” – The earlier of (i) the effective date of an interim or final rate increase authorized by an interim or final order (whichever is first) of the PUC in a Company general rate case that includes in Company’s electric rates the additional purchased power costs (including the costs incurred as a result of the Capacity Charge and the Variable O&M Component of the Energy Charge) incurred by Company pursuant to this Agreement that are not recovered through the Energy Cost Recovery Clause, or equivalent; (ii) the date upon which Company is allowed to begin recovering such additional purchased power costs through the Purchased Power Adjustment Clause; (iii) the date upon which Company is allowed to begin recovering such additional purchased power costs through the Energy Cost Recovery Clause, or equivalent, or (iv) the effective date of an interim increase in rates authorized by the PUC pursuant to HRS § 269-27.2(d) by which the Company begins recovering such additional purchased power costs.

“Catastrophic Equipment Failure” – Either (i) a sudden, unexpected failure of a major piece of equipment which (A) substantially reduces or eliminates the capability of the Facility to produce power, (B) is beyond the reasonable control of Seller and could not have been prevented by the exercise of due diligence by Seller and, (C) despite the exercise of all reasonable efforts, actually requires more than sixty (60) Days to repair (if the determination of whether a Catastrophic Equipment Failure has occurred is being made more than sixty (60) Days after the failure) or is reasonably expected to require more than sixty (60) Days to repair (if such determination is being made within sixty (60) Days after the failure); or (ii) a sudden, unexpected failure of a combustion turbine blade, a compressor vane or a steam turbine blade which requires opening a gas turbine (or compressor) or steam turbine casing to repair and which meets the criteria in both (A) and (B) above. For purposes of this definition, a reduction in capability to produce power must be at least fifty (50) MW to be considered substantial.

“Cause” – Shall have the meaning set forth in Section 3.3(A)(2) (Demonstration of Loading and Unloading Ramp Rates).

"Change in Control" – Shall have the meaning set forth in Section 1(b) (Change in Ownership Interests and Control of Seller) of Attachment P (Sale of Facility by Seller) to this Agreement.

“Claim” – Any claim, suit, action, demand or proceeding.

“Collateral” – Shall have the meaning set forth in the Security Agreement, as such may be subsequently amended, modified or replaced.

“Company” – Shall have the meaning set forth in the preamble to this Agreement.

“Company Dispatch” – Company’s right, through supervisory equipment or otherwise, to direct or control both the capacity and the energy output of the Facility from its minimum output rating to its maximum output rating consistent with this Agreement (including, without limitation, Good Engineering and Operating Practices and the requirements set forth in Section 3 (Performance Standards) of Attachment B (Facility Owned by Seller) to this Agreement), which dispatch shall include real power, reactive power, voltage, frequency, the determination to cycle a unit off-line or to restart a unit and require the plant to run in simple cycle mode when not able to run in combined cycle mode, the droop control setting, the ramp rate setting, and other characteristics of such electric energy output whose parameters are normally controlled or accounted for in a utility dispatching system.

“Company-Owned Interconnection Facilities” – Shall have the meaning set forth in Section 1(a) (General) of Attachment G (Company-Owned Interconnection Facilities).

“Company Site Representative” – Company’s representative as described in Section 10.5 (Company Site Representative).

“Company System” – The electric system owned and operated by Company (to include any non-utility owned facilities) consisting of power plants, transmission and distribution lines, and related equipment for the production and delivery of electric power to the public.

“Company System Operator” – The authorized representative of Company who is responsible for carrying out Company dispatch and curtailment of electric energy generation interconnected to the Company System.

“Competitive Bidding Framework” – The Framework for Competitive Bidding contained in Decision and Order No. 23121 issued by the PUC on December 8, 2006 and any subsequent orders providing for modifications from those set forth in the order issued December 8, 2006.

“Conditions Precedent” – The conditions listed in Section 2.3(A) (Seller Conditions Precedent).

“Consents” – All necessary consents to be executed in favor of Company in order for Company to establish, exercise and enforce its rights under the Security Agreement and the other Security Documents, as such consents may be amended from time to time in accordance with the terms thereof.

“Consumer Advocate” – Shall have the meaning set forth in Section 3.2(I)(2) (Confidentiality).

“Consumer Price Index” – The Consumer Price Index for All Urban Consumers (CPI-U).

“Contract Firm Capacity” – Shall have the meaning set forth in Section 5(b) of Attachment A (Facility Description) to this Agreement.

“Contract Year” – A twelve (12) calendar month period commencing on either (i) the Effective Date (if the Effective Date occurs on the first Day of a calendar month) and thereafter on each anniversary of the Effective Date; or (ii) the first Day of the calendar month following the month during which the Effective Date occurs, and thereafter on each anniversary of the first Day of such month; provided, however, that, in the latter case, the initial Contract Year shall also include the Days from the Effective Date to the first Day of the succeeding month.

"Contractors" – Seller’s Third Party consultants or contractors.

“Control System Acceptance Test” or “CSAT” – A test or tests performed on the centralized and collective control systems and Active Power Control Interface of the Facility, which includes successful completion of the Control System Telemetry and Control List, in accordance with procedures set forth in Section 1(b)(iii)(J) (Control System Acceptance Test Procedures) of Attachment B (Facility Owned by Seller). Attachment O (Control System Acceptance Test Criteria) provides general criteria to be included in the written protocol for the Control System Acceptance Test.

“Control System Telemetry and Control List” – The Control System Telemetry and Control List includes, but is not limited to, all of the Facility’s equipment and generation performance/quality parameters that will be monitored, alarmed and/or controlled by Company’s Energy Management System (EMS) throughout the Term of this Agreement.

Examples of the Control System Telemetry and Control List include:

•Seller’s substation/equipment status – breaker open/closed status, equipment normal/alarm operating status, etc.

•Seller’s generation data (analog values) – number of generators available/online, voltage, current, MW, MVAR, etc.

•Seller’s generation performance (status and/or analog values) – ramp rate, generator frequency, etc.

•Active Power control interface – dispatch MW setpoint, etc.

•Voltage control interface – voltage kV setpoint, etc.

•Power factor control interface – power factor setpoint, etc.

“Day” – A calendar day.

"Defaulting Party" – The Party whose failure, action or breach of its obligations under this Agreement results in an Event of Default under Article 8 (Default) of this Agreement.

"Degradation Exemption" - The exemption of degradation from the calculations of the Equivalent Availability Factor, the Equivalent Forced Outage Rate or the Capacity Charge pursuant to and under the conditions set forth in Section 8.e (Degradation Exemption) of Attachment Y (Operation and Maintenance of the Facility).

"Delay Degradation" - Any degradation in Facility performance occurring under the conditions set forth in Section 8.e (Degradation Exemption) of Attachment Y (Operation and Maintenance of the Facility) for the period that Seller is entitled to such Degradation Exemption.

“Dispatch Forecast” – The notice given to Seller by Company in accordance with Section 3.3(A)(3) (Dispatch Forecast).

“Dispatch Range” – The range of real power output through which the Facility can be dispatched by remote control under Company’s EMS, in accordance with Section 3.3(A) (Dispatch of Facility Power). Notwithstanding anything to the contrary, the Dispatch Range shall be provided between 60 MW and the Contract Firm Capacity.

“Dispute” – Shall have the meaning set forth in Section 17.1 (Good Faith Negotiations).

“Dollars” – The lawful currency of the United States of America.

“DPR” – Shall have the meaning set forth in Section 17.2(A) (Mediation).

"E-mail" – Shall have the meaning set forth in Section 25.1 (Notices).

“EAF” or “Equivalent Availability Factor” – The ratio (in percent) calculated in accordance with the formula, terms and concepts defined by NERC GADS, as set forth in Attachment C (Methods and Formulas for Measuring Performance Standards/Selected Portions of NERC GADS), based on the Net Maximum Capacity of the Facility, unless otherwise defined in this Agreement.

“Effective Date” – The Non-appealable PUC Approval Order Date.

“EFOR” or “Equivalent Forced Outage Rate” – The ratio (in percent) calculated in accordance with the formula, terms and concepts defined by NERC GADS, as set forth in Attachment C (Methods and Formulas for Measuring Performance Standards/Selected Portions of NERC GADS), based on the Net Maximum Capacity of the Facility, unless otherwise defined in this Agreement.

“EMS” or “Energy Management System” – The real-time, computer-based control system, or any successor thereto, used by Company to manage the supply and delivery of electric energy to its consumers. It provides the Company System Operator with an integrated set of manual and automatic functions necessary for the operation of the Company System under both normal and emergency conditions. The EMS provides the interfaces for the Company System Operator to perform real-time monitoring and control of the Company System, including but not limited to monitoring and control of the Facility for system balancing, supplemental frequency control and economic dispatch as prescribed in this Agreement.

“Energy Charge” – The amount to be paid by Company to Seller pursuant to Section 5.1(C) (Energy Charge) of this Agreement for the Net Electric Energy Output.

“Energy Cost Recovery Clause” – The provision in Company’s rate schedules that allows Company to pass through to its customers Company’s costs of fuel and purchased power.

"Environment" – Shall have the meaning set forth in Section 1(b)(iii)(G)(iii) (Endpoint and Server Security) of Attachment B (Facility Owned by Seller) to this Agreement.

“Event of Default” – An event or occurrence specified in Section 8.1(A) (Default by Seller) or Section 8.1(B) (Default by Company).

“Exclusive Negotiation Period” – Shall have the meaning set forth in Section 2(b) (Negotiations) of Attachment P (Sale of Facility by Seller).

“Execution Date” – The date designated as such on the first page of this Agreement or, if no date is so designated, the date the Parties exchanged executed signature pages to this Agreement.

"Exempt Sales" – Shall have the meaning set forth in Section 1(c) (Exempt Sales) of Attachment P (Sale of Facility by Seller) to this Agreement.

“Extension Term” – Shall have the meaning set forth in Section 2.2(A) (Extension Term).

“Facility” – Seller’s LSFO-fired combined cycle electrical cogeneration facility owned and operated under this Agreement by Seller on property leased from Company by Seller at 91- 111 Kalaeloa Boulevard, Kapolei, Hawai‘i 96707, as more fully described in Attachment A (Facility Description), including the Seller-Owned Interconnection Facilities, Seller’s Fuel supply facilities (including all facilities required for importation, receipt, storage and handling of Fuel, waste collection, interim and final waste disposal, cooling water and any other facilities necessary for proper operation of the Facility), the Fuel, the Site, the Land Rights and all other real property, equipment, fixtures and personal property owned, leased, controlled, operated or managed in connection with the production and delivery of electric energy by Seller to the Company System.

“FASB” – Shall have the meaning set forth in Section 3.2(I)(1) (Financial Compliance).

“FASB ASC 810” – Shall have the meaning set forth in Section 3.2(I)(1) (Financial Compliance).

“FASB ASC 842” – Shall have the meaning set forth in Section 3.2(I)(1) (Financial Compliance).

"Final Non-appealable Order from the PUC" – Shall have the meaning set forth in Section 5(d) of Attachment P (Sale of Facility by Seller) to this Agreement.

“Financial Compliance Information” – Shall have the meaning set forth in Section 3.2(I)(1) (Financial Compliance).

"Financing Debt" – The financing obligations of Seller and its affiliates to any lender pursuant to the Financing Documents, including without limitation, principal of, premium and interest on indebtedness, fees, expenses or penalties, amounts due upon acceleration, prepayment or restructuring, swap or interest rate hedging breakage costs and any claims or interest due with respect to any of the foregoing.

“Financing Documents” – The loan and credit agreements, notes, indentures, security agreements and other agreements, lease financing agreements, mortgages, deeds of trust, interest rate exchanges, swap agreements and other documents and instruments relating to the development, bridge, construction and/or permanent debt financing for the Facility, including any credit enhancement, credit support, working capital financing, tax equity financing or refinancing documents, and any and all amendments, modifications, or supplements to the foregoing that may be entered into from time to time by and at the discretion of Seller and/or its affiliates in connection with financing for the development, construction, ownership, leasing, operation or maintenance of the Facility.

“Financing Parties” – Any and all lenders and tax equity financing parties providing any Financing Debt and any successor(s) or assigns thereto.

"Financing Purposes" – Shall have the meaning set forth in Section 1(c) (Exempt Sales) of Attachment P (Sale of Facility by Seller) to this Agreement.

“Fixed O&M Component Rate” – Shall have the meaning set forth in Section (B)(2) (Fixed O&M Component Rate) of Attachment J (Energy Charge and Capacity Charge Payment Formulas).

“Force Majeure” – An event that satisfies the requirements of Section 18.1 (Definition of Force Majeure), Section 18.2 (Events That Could Qualify as Force Majeure) and Section 18.3 (Exclusions From Force Majeure).

“Fuel” – The fuel for the Facility shall be LSFO. The type of fuel to be used in the Facility shall be specified in Seller’s fuel report. The fuel shall be suitable for the operation of the Facility in accordance with this Agreement, applicable Governmental Approvals and equipment manufacturer specifications relating to the Facility.

“Fuel Component” – Shall have the meaning set forth in Section (A)(1) (Energy Charge Formula) of Attachment J (Energy Charge and Capacity Charge Payment Formulas).

“Fuel Conversion Option” – Shall have the meaning set forth in Section 2.1(G) (Fuel Option).

“Fuel Report” – The annual fuel plan which shall be delivered in a format acceptable to Company pursuant to Section 2.3(A)(4)(a) (Executed Project Documents) and which demonstrates that Seller has secured sufficient Fuel to support the operation of the Facility pursuant to the terms and conditions of the Agreement for the Term. Where the Fuel for the Facility is biogas, biofuel, or hydrogen produced from renewable energy sources, the Fuel Report shall include but not be limited to, as applicable, any and all Fuel supply agreements and/or agreements for the supply of the raw material required to produce the Fuel.

“Fuel Supply Agreements” – The agreements, a copy of which are delivered to Company pursuant to Section 2.3(A)(4)(a) (Executed Project Documents), under which Seller obtains Fuel for the Facility.

“Full Plant Trip” – The Unplanned Removal From Service of the Facility’s two combustion turbine generators in circumstances in which the Facility had, at any point during the sixty (60) minutes preceding the Unplanned Removal From Service of the first of the combustion turbines to be so removed, been operating with a Net Electric Energy Output (a) up to August 31, 2022, above one hundred eighty thousand kilowatts (180,000 kW); (b) from and after September 1, 2022, above one hundred thirty-five thousand kilowatts (135,000 kW).

“Full Plant Trip (Category I)” – A Full Plant Trip in which not more than twenty-five

(25) minutes and no seconds elapse between the Unplanned Removal From Service of the first of the combustion turbines to be so removed during such Full Plant Trip and the Unplanned Removal From Service of the second of the combustion turbines to be so removed.

“Full Plant Trip (Category II)” – A Full Plant Trip (other than a Full Plant Trip (Category I) in which not more than one hundred eighty (180) minutes and no seconds elapse between the Unplanned Removal From Service of the first of the combustion turbines to be so removed during such Full Plant Trip and the Unplanned Removal From Service of the second of the combustion turbines to be so removed.

"GAAP" – Shall have the meaning set forth in Section 3.2(I)(5)(a) (Consolidation).

“GE” – Shall have the meaning set forth in Background Section I.

“GDPIPD” or “Gross Domestic Product Implicit Price Deflator” – The value shown in the United States Department of Commerce, Bureau of Economic Analysis’ publication entitled “Survey of Current Business” for the percentage change in prices over each quarter of the calendar year associated with the Gross Domestic Product for the immediately preceding quarter, or, a successor publication or index.

“Good Engineering and Operating Practices” – The practices, methods and acts engaged in or approved by a significant portion of the electric utility industry for similarly situated U.S. facilities, considering Company’s isolated island setting, that at a particular time, in the exercise of reasonable judgment in light of the facts known or that reasonably should be known at the time a decision is made, would be expected to accomplish the desired result in a manner consistent with law, regulation, reliability for an island system, safety, and expedition. With respect to the Facility, Good Engineering and Operating Practices include, but are not limited to, taking reasonable steps to ensure that:

1. Adequate materials, resources and supplies, including Fuel, are available to meet the Facility’s needs under normal conditions and reasonably foreseeable abnormal conditions.

2. Sufficient operating personnel are available and are adequately experienced and trained to operate the Facility properly, efficiently and within manufacturer’s guidelines and specifications and are capable of responding to emergency conditions.

3. Preventive, predictive, routine and non-routine maintenance and repairs are performed on a basis that ensures reliable, long-term and safe operation, and are performed by knowledgeable, trained and experienced personnel utilizing proper equipment, tools, and procedures.

4. Appropriate monitoring and testing is done to ensure that equipment is functioning as designed and to provide assurance that equipment will function properly under both normal and reasonably foreseeable abnormal conditions.

5. Equipment is operated in a manner safe to workers, the general public and the environment and in accordance with equipment manufacturer’s specifications, including, without limitation, defined limitations such as steam pressure,

temperature, moisture content, chemical content, quality of make-up water, operating voltage, current, frequency, rotational speed, polarity, synchronization, control system limits, etc.

"Governmental Approvals" – All permits, licenses, approvals, certificates, entitlements and other authorizations issued by Governmental Authorities, as well as any agreements with Governmental Authorities, required to fulfill its obligations under this Agreement, including the construction, ownership, operation and maintenance of the Facility and the Company-Owned Interconnection Facilities, and all amendments, modifications, supplements, general conditions and addenda thereto. A complete list of all anticipated Governmental Approvals shall be set forth in Attachment AA (Seller’s Government Approvals).

“Governmental Authority” – Any federal, state, local or municipal governmental body; any governmental, quasi-governmental, regulatory or administrative agency, commission, body or other authority exercising or entitled to exercise any administrative, executive, judicial, legislative, policy, regulatory or taxing authority or power; or any court or governmental tribunal.

"HEI" – Shall have the meaning set forth in Section 20.7 (Assignment by Company).

“HERA” – The Hawaii Electricity Reliability Administrator.

“HERA Law” – Act 166 (Haw. Leg. 2012), which was passed by the 27th Hawaii Legislature in the form of S.B. No. 2787, S.D. 2, H.D.2, C.D.1 on May 2, 2012 and signed by the Governor on June 27, 2012. The effective date for the law is July 1, 2012. The HERA Law authorizes (i) the PUC to develop, adopt, and enforce reliability standards and interconnection requirements, (ii) the PUC to contract for the performance of related duties with a party that will serve as the HERA, and (iii) the collection of a Hawaii electricity reliability surcharge to be collected by Hawaii's electric utilities and used by the HERA. Reliability standards and interconnection requirements adopted by the PUC pursuant to the HERA Law will apply to any electric utility and any user, owner, or operator of the Hawaii electric system. The PUC also is provided with the authority to monitor and compel the production of data, files, maps, reports, or any other information concerning any electric utility, any user, owner or operator of the Hawaii electric system, or other person, business, or entity, considered by the PUC to be necessary for exercising jurisdiction over interconnection to the Hawaii electric system, or for administering the process for interconnection to the Hawaii electric system.

“HST” – Hawai‘i Standard Time.

“HRS” – Means the Hawaii Revised Statutes, as may be amended.

“Indemnified Company Party” – Shall have the meaning set forth in Section 13.1(A) (Indemnification Against Third Party Claims).

“Indemnified Seller Party” – Shall have the meaning set forth in Section 13.2(A) (Indemnification Against Third Party Claims).

“Independent Engineering Assessment” – The determination and recommendations made by a Qualified Independent Engineering Company regarding the operation and maintenance practices of Seller at the Facility pursuant to Section 3.3(D)(1) (Implementation of Independent Engineering Assessment).

"Independent Evaluator" – A person empowered, pursuant to Section 24.5 (Failure to Reach Agreement) and Section 24.10 (Dispute) of this Agreement, to resolve disputes due to failure of the Parties to agree on a Performance Standards Revision Document.

“Initial Term” – Shall have the meaning set forth in Section 2.2(A) (Term).

“Interconnection Facilities” – The equipment and devices required to permit the Facility to operate in parallel with, and deliver electric energy to the Company System and provide reliable and safe operation of, and power quality on, the Company System (in accordance with the PUC’s General Order No. 7, Company tariffs, operational practices and planning criteria), such as, but not limited to, transmission lines, transformers, switches, circuit breakers and telecommunication, as may be further described in the Attachment B (Facility Owned by Seller) and Attachment G (Company-Owned Interconnection Facilities).

"Interface Block Diagram" – The visual representation of the signals between Seller and Company, including but not limited to, Telemetry and Control points, digital fault recorder settings, telecommunications and protection signals.

“kVAr” – Kilovar(s).

“kVArh” – Kilovarhour(s).

“kW” – Kilowatt(s). Unless expressly provided otherwise, all kW values stated in this Agreement are alternating current values and not direct current values.

“kWh” – Kilowatthour(s).

“Land Rights” – All easements, rights of way, licenses, leases, surface use agreements and other interests or rights in real estate, excluding the lease for the Site between Seller and Company.

“Laws” – Shall have the meaning set forth in Section 3.2(E) (Compliance with Laws).

“Life Extension Program” or “LEP” – Shall have the meaning set forth in the Background Section O.

“Liquidated Damages” – Any of the damages provided for in Article 9 (Liquidated Damages).

“Losses” – Any and all direct, indirect or consequential damages, fines, penalties, deficiencies, losses, liabilities (including settlements and judgments), costs, expenses (including reasonable attorneys' fees and court costs) and disbursements.

“LSFO” – Low sulphur fuel oil.

“Major Generating Equipment Overhaul” – Overhaul, replacement or other major scheduled maintenance of the major generating equipment component of the Facility, e.g., steam and combustion turbine, conducted (i) in accordance with the equipment manufacturer’s recommendations or (ii) otherwise in the judgment of Seller in accordance with Good Engineering and Operating Practices.

“Malware” – Shall have the meaning set forth in Section 1(b)(iii)(G)(iii) (Endpoint and Server Security) of Attachment B (Facility Owned by Seller), examples of which include computer software, code or instructions that: (a) intentionally, and with malice intent by a third party, adversely affect the operation, security or integrity of a computing, telecommunications or other digital operating or processing system or environment, including without limitation, other programs, data, databases, computer libraries and computer and communications equipment, by altering, destroying, disrupting or inhibiting such operation, security or integrity; (b) without functional purpose, self-replicate written manual intervention; (c) purport to perform a useful function but which actually performs either a destructive or harmful function, or perform no useful function other than utilize substantial computer, telecommunications or memory resources with the intent of causing harm; or (d) without authorization collect and/or transmit to third parties any information or data; including such software, code or instructions commonly known as viruses, Trojans, logic bombs, worms, adware and spyware.

“Management Meeting” – Shall have the meaning set forth in Section 17.1 (Good Faith Negotiations).

“Metering Point(s)” – The physical point(s) located on the high side of the step up transformer(s), as depicted in Attachment E (Single-Line Diagram), at which Company’s metering is connected to the Facility for the purpose of measuring the output of the Facility in kW, kWh, kVAr and kVArh.

“Minimum Thermal Threshold” – For any Contract Year, shall be an Operating Thermal Threshold of twelve percent (12%); provided, however, that in the event that Company determines, in its sole discretion, that the Agreement is likely to be deemed to be an arrangement containing a lease within the scope of FASB ASC 842, by reason of the Minimum Thermal Threshold being 12%, then the Minimum Thermal Threshold shall upon written notice by Company to Seller be increased to an Operating Thermal Threshold of fifteen percent (15%) for the next Contract Year and subsequent years.

“Monthly Invoice” – Shall have the meaning set forth in Section 6.1 (Monthly Invoice).

"MVAR” – Megavar(s).

“MW” – Megawatt(s). Unless expressly provided otherwise, all MW values stated in this Agreement are alternating current values and not direct current values.

“MWh” – Megawatthour(s).

“NERC GADS” or “North American Electric Reliability Council Generating Availability Data System” – The data collection system called “Generating Availability Data System” which is utilized by the North American Electric Reliability Council, a voluntary organization formed by the electric utility industry to promote the reliability and adequacy of the bulk power supply of the electric utility systems in North America. For purposes of this Agreement, the most current version of NERC GADS (selected portions of which are attached hereto as Attachment C (Methods and Formulas for Measuring Performance Standards/Selected Portions of NERC GADS)) shall be used whenever reference is made to NERC GADS. If the definition of a term contained in this Article 1 (Definitions) is inconsistent with the definition of the term under NERC GADS, the definition contained in this Article 1 (Definitions) shall control.

“Net Electric Energy Output” – For any period of time, the total electric energy output of the Facility in kWh (net of auxiliaries and transformer losses) delivered to Company as measured at the Metering Point of the Facility.

“Net Maximum Capacity” – The maximum capacity the Facility can sustain over a specified period of time when not restricted by seasonal or other deratings less capacity utilized for the Facility’s station service or auxiliaries and less transformer losses, as measured at the Metering Point.

“Non-appealable PUC Approval Order” – Shall have the meaning set forth in Section 25.12(B) (Non-appealable PUC Approval Order).

“Non-appealable PUC Approval Order Date” – Shall have the meaning set forth in Section 25.12(D) (Non-appealable PUC Approval Order Date).

“O&M Agreement” – Shall have the meaning set forth in Background Section I.

"Offer Date" – Shall have the meaning set forth in Section 1(a)(i) of Attachment P (Sale of Facility by Seller) to this Agreement.

"Offer Materials" – Shall have the meaning set forth in Section 1(a)(i) of Attachment P (Sale of Facility by Seller) to this Agreement.

"Offer Notice" – Shall have the meaning set forth in Section 1(a)(i) of Attachment P (Sale of Facility by Seller) to this Agreement.

"Offer Price" – Shall have the meaning set forth in Section 1(a)(i) of Attachment P (Sale of Facility by Seller) to this Agreement.

"On-peak EFOR" - For each Contract Year, the ratio for the Equivalent Forced Outage Rate for the On-peak Period hours during such Contract Year (expressed as a percent) set forth

in Attachment C (Methods and Formulas for Measuring Performance Standards/Selected Portions of NERC GADS), which represents the time (in hours) during the On-peak Period hours during such Contract Year that the Facility is unavailable for service, either totally or partially due to forced outages or deratings (other than Delay Degradation) to the total On-peak Period hours during such Contract Year calculated in accordance with the most current formula defined by NERC GADS (less adjustment for unplanned (forced) derated hours during reserve shutdown).

"On-peak Monthly Steam Average" - Shall have the meaning set forth in Section 25.24 (Steam Sales Contract Monthly Report).

“On-peak Period” – The fourteen (14) hour period from and including 7:00 a.m. through and including 8:59 p.m. each Day.

“Operating Thermal Threshold” – The ratio, for the Contract Year in question, of the Facility’s useful thermal output for such Contract Year divided by the sum of (i) the useful electrical output for such Contract Year plus (ii) the useful thermal output for such Contract Year. This ratio is to be expressed as a percentage.

“Original Power Purchase Agreement” – Shall have the meaning set forth in Background Section J.

“Party” – Each of Seller or Company.

“Parties” – Seller and Company, collectively.

“Partnership Agreement” – The agreement entitled “Kalaeloa Partners, L.P. Partnership Agreement,” dated October 13, 1988, as amended from time to time in accordance with that agreement and this Agreement.

“Per Hour Variable Component” – Shall have the meaning set forth in Attachment J (Energy Charge and Capacity Charge Payment Formulas).

“Performance Standards” – The various performance standards for the operation of the Facility and the delivery of electric energy from the Facility to the Company specified in Section 3 (Performance Standards) of Attachment B (Facility Owned by Seller), as such standards may be revised from time to time pursuant to Article 24 (Process for Addressing Revisions to Performance Standards) of this Agreement.

“Performance Standards Information Request” – A written notice from Company to Seller proposing revisions to one or more of the Performance Standards then in effect and requesting information from Seller concerning such proposed revision(s).

“Performance Standards Modifications” – For each Performance Standards Revision, any capital improvements, additions, enhancements, replacements, repairs or other operational modifications to the Facility and/or to changes in Seller's operations or maintenance practices necessary to enable the Facility to achieve the performance requirements of such Performance Standards Revision.

“Performance Standards Pricing Impact” – Any adjustment in rates for purchase set forth in Article 5 (Rates for Purchase) in $/kWh and/or $/kW per month necessary to specifically reflect the recovery of the net costs and/or net lost revenues specifically attributable to any Performance Standards Modification necessary to comply with a Performance Standard Revision, which shall consist of the following: (i) recovery of, and return on, any capital investment (aa) made over a cost recovery period starting after the Performance Standards Revision is made effective following a PUC Performance Standards Revision Order through the end of the Initial Term and (bb) based on a proposed capital structure that is commercially reasonable for such an investment and the return on investment is at market rates for such an investment or similar investment); (ii) recovery of reasonably expected net additional operating and maintenance costs; and (iii) an adjustment in pricing or warranties of performance under Section 3.2(B) (Warranties and Guarantees of Performance), as applicable, necessary to compensate Seller for a reasonably expected reduction, if any, in the delivery of electric energy to Company under this Agreement, or reasonably expected increases in Liquidated Damages under Section 9.2 (Calculation and Payment of Liquidated Damages) directly related to the Performance Standards Modification or Performance Standards Revision.

“Performance Standards Proposal” – A written communication from Seller to Company detailing the following with respect to a proposed Performance Standards Revision: (i) a statement as to whether Seller believes that it is technically feasible to comply with the Performance Standards Revision and the basis therefor; (ii) the Performance Standards Modifications proposed by Seller to comply with the Performance Standards Revision; (iii) the capital and incremental operating costs of any necessary technical improvements, and any other incremental net operating or maintenance costs associated with any necessary operational changes, and any expected lost revenues associated with expected reductions in electric energy delivered to Company; (iv) the Performance Standards Pricing Impact of such costs and/or lost revenues; (v) information regarding the effectiveness of such technical improvements or operational modifications; (vi) proposed contractual consequences for failure to comply with the Performance Standard Revision that would be commercially reasonable under the circumstances; and (vii) such other information as may be reasonably required by Company to evaluate Seller's proposals. A Performance Standards Proposal may be issued either in response to a Performance Standards Information Request or on Seller's own initiative.

“Performance Standards Revision” – A revision, as specified in a Performance Standards Information Request or a Seller-initiated Performance Standards Proposal, to the Performance Standards in effect as of the date of such request or proposal.

“Performance Standards Revision Document” – A document specifying one or more Performance Standards Revisions and setting forth the changes to the Agreement necessary to implement such Performance Standards Revision(s). A Performance Standards Revision Document may be either a written agreement executed by Company and Seller or as directed by the Independent Evaluator pursuant to Section 24.10 (Dispute) of this Agreement, in the absence of such written agreement.

"Permitted Lien" – Shall have the meaning set forth in Section 4 (Purchase and Sale Agreement) of Attachment P (Sale of Facility by Seller) to this Agreement.

“Per kWh Variable Component” – Shall have the meaning set forth in Attachment J (Energy Charge and Capacity Charge Payment Formulas).

“Point of Interconnection” of “POI” – The point of delivery of electric energy and/or capacity supplied by Seller to Company, depicted on Attachment E (Single-Line Diagram), where the Facility owned by Seller interconnects with the Company System. Seller shall own and maintain the facilities from the Facility to the Point of Interconnection, excluding any Company-Owned Interconnection Facilities located on the Site. Company shall own and maintain the facilities from the Point of Interconnection to the Company System. The Point of Interconnection is set forth in Attachment E (Single-Line Diagram).

“Prime Rate” – The "prime rate" of interest, as published from time to time by The Wall Street Journal in the “Money Rates” section of its Western Edition Newspaper (or the average prime rate if a high and a low prime rate are therein reported). The Prime Rate shall change without notice with each change in the prime rate reported by The Wall Street Journal, as of the date such change is reported. Any such rate is a general reference rate of interest, may not be related to any other rate, may not be the lowest or best rate actually charged by any lender to any customer or a favored rate and may not correspond with future increases or decreases in interest rates charged by lenders or market rates in general.

"Project" – The Facility as described in Attachment A (Facility Description).

“Project Documents” – This Agreement, any ground lease or other lease in respect of the Site and/or Land Rights, all contracts for implementing the Fuel Conversion Option to which Seller is or becomes a party, the Fuel Supply Agreement to which Seller is or becomes a party, operation and maintenance agreements, and all other agreements, documents and instruments to which Seller is or becomes a party thereto in respect of the Facility, other than the Financing Documents and the Security Documents, as the same may be modified or amended from time to time in accordance with the terms thereof.

“Proprietary Rights” – Shall have the meaning set forth in Section 25.17 (Proprietary Rights).

"Prorated Shutdown Capacity" - The greater of the capacity of the Facility with one of its combustion turbines not in service or 90,000 kW.

"PSA" – Shall have the meaning set forth in Section 4 (Purchase and Sale Agreement) of Attachment P (Sale of Facility by Seller) to this Agreement.

“PUC” – Shall have the meaning set forth in Background Section A.

“PUC Approval Order” – Shall have the meaning set forth in Section 25.12(A) (PUC Approval Order).

“PUC Approval Order Date” – Shall have the meaning set forth in Section 25.12(C) (Company’s Written Statement).

"PUC Approval Time Period" – Shall have the meaning set forth in Section 2.2(C)(3)(b) (Time Period for PUC Approval).

"PUC Order Appeal Period" – Shall have the meaning set forth in Section 2.2(C)(3)(b) (Time Period for PUC Approval).

“PUC Performance Standards Revision Order” – The decision and order issued by the PUC approving the application or motion by the Parties seeking (i) approval of the Performance Standards Revision in question and the associated Performance Standards Revision Document,

(ii) finding that the impact of the changes to the contract pricing on Company's revenue requirements is reasonable, and (iii) approval to include the costs arising out of pricing changes in Company's Energy Cost Recovery Clause (or equivalent).

“PUC Submittal Date” – The date of submittal of Company’s complete application or motion for a satisfactory PUC Approval Order pursuant to Section 2.2(C) (PUC Approval) of this Agreement.

"PUC's Standards" – Standards for Small Power Production and Cogeneration in the State of Hawai‘i, issued by the Public Utilities Commission of the State of Hawai‘i, Chapter 74 of Title 6, Hawai‘i Administrative Rules, currently in effect and as may be amended from time to time.

“Purchased Power Adjustment Clause” – The Company’s cost recovery mechanism incorporated into Company’s tariff rules as approved by the PUC in Docket No. 2008-0083, in Final Decision and Order filed December 29, 2010 (or such successor provision that may be established from time to time), which permits Company to recover all capacity, operations and maintenance, and other non-energy payments incurred by the Company pursuant to a purchased power agreement.

“PURPA” – Shall have the meaning set forth in Background Section K. "QF" - Shall have the meaning set forth in Background Section K.

“Qualified Independent Engineering Company” – Any company listed on Attachment D (Consultants List - Qualified Independent Engineering Companies), as such list is amended from time to time.

“Qualified Independent Engineers’ List” – The list of Qualified Independent Engineering Companies attached hereto as Attachment D (Consultants List - Qualified Independent Engineering Companies) and created and modified from time to time pursuant to Section 3.3(D)(2) (Qualified Independent Engineering Companies).

“Recipient” – Shall have the meaning set forth in Section 3.2(I)(2) (Confidentiality).

“Reference Year” – Shall have the meaning set forth in Attachment U (Adjustment of Charges).

"Revenue Metering Package" – The primary revenue meter, backup revenue meter (if required by Company), revenue metering PTs and CTs, secondary wiring, terminal blocks, test switches and fuses for secondary wiring.

“Right of First Negotiation Period” – Shall have the meaning set forth in Section 1(a) (Right of First Negotiation) of Attachment P (Sale of Facility By Seller).

“RPS Law” – The Hawai‘i law that mandates that Company and its subsidiaries generate or purchase certain amounts of their net electricity sales over time from qualified renewable resources. The RPS requirements in Hawai‘i are currently codified as HRS §§ 269-91 through - 95.

"SCADA" – The Company system that provides remote control and monitoring of Company's transmission and sub-transmission systems and enables Company to perform real- time control of equipment in the field and to monitor the conditions and status of the Company System.

“Second Notice” – Shall have the meaning set forth in Section 3.3(D)(1)(c) (Implementation of Independent Engineering Assessment).

“Security Agreement” – The Security Agreement dated June 15, 1989, as amended, between Company and Seller, granting Company a security interest in, among other things, all of Seller’s right, title and interest in and to the Facility, the Project Documents, all accounts established pursuant to the Project Documents, all insurance proceeds in respect of the Facility and all proceeds of the foregoing, as the same may be modified or amended from time to time in accordance with the terms thereof.

“Security Documents” – The Security Agreement and the Consents, together with all Uniform Commercial Code financing statements and other agreements, consents, documents and instruments executed or filed in connection therewith, as the same may be modified or amended from time to time in accordance with the terms thereof.

“Seller” – Shall have the meaning set forth in the preamble to this Agreement.

“Seller’s Centralized Control System” – Shall have the meaning set forth in Section 2.a (Seller’s Centralized Control System) of Attachment Y (Operation and Maintenance of the Facility).

“Seller’s General Manager” – The person appointed by Seller to act as the principal on- site person who is responsible for the Facility.

“Seller-Owned Interconnection Facilities” – The Interconnection Facilities constructed and owned by Seller as described in Section 1 (The Facility) of Attachment B (Facility Owned by Seller).

“Site” – The parcel of real property on which the Facility is located, together with any Land Rights reasonably necessary for the ownership, operation and maintenance of the Facility by Seller, as identified in Attachment A (Facility Description).

“SOX 404” – Shall have the meaning set forth in Section 3.2(I)(1) (Financial Compliance).

“Start-up” – The action of bringing the Facility from non-operation to operation at the minimum load capability of 40 MW for the generating unit associated with such Facility, adjusted for ambient conditions. This minimum load capability would be for one (1) combustion turbine only.

“Steam Sales Contract” – The contract between Seller and Par Hawaii Refining, LLC (“Par”) for the sale by Seller of steam to Par, or such supplemental, additional or replacement contracts for the sale of steam necessary to maintain Seller’s QF status.

“Telemetry and Control” – The interface between Company’s EMS and the physical equipment at the Facility.

“Term” – The Initial Term and the Extension Term (if any), collectively.

"Third Party" – Any person or entity other than Company or Seller, and includes, but is not limited to, any subsidiary or affiliate of Seller.

"Total Actual Relocation Cost" – Shall have the meaning set forth in Section 5(b) of Attachment G (Company-Owned Interconnection Facilities) to this Agreement.

"Total Estimated Relocation Cost" – Shall have the meaning set forth in Section 5(a) of Attachment G (Company-Owned Interconnection Facilities) to this Agreement.

"Unfavorable PUC Order" – Shall have the meaning set forth in Section 25.12(E) (Unfavorable PUC Order).

“Unit Trip” – The sudden and immediate removal from service of one of the Facility’s generators as a result of immediate mechanical/electrical/hydraulic control system trips or operator-initiated action which requires Company, in consultation with Seller, to take immediate steps to place an unscheduled generator on-line to make up for the loss of output of the Facility’s generator, provided, however that Unit Trips shall not include: (A) any such removal which occurs within one (1) hour of the time at which a Facility generator is resynchronized following a planned or forced outage (including forced outages resulting from Unit Trips); (B) trips caused or initiated by Company other than pursuant to Section 4.1 (Initiation by Company) in

circumstances described in Section 4.1(D) (Facility Problems); or (C) any such removal caused by events outside of the Facility.

The requirement set forth above in the first sentence of this definition regarding “consultation with Seller” shall, without limitation, be satisfied by any communication either from Seller’s plant operator to Company’s System Operator or vice versa with respect to the trip/shutdown in question regardless of whether or not the communication in question takes place before or after such trip/shutdown event. Such communication (i) need not be made by two-way medium and (ii) shall include any “hot line,” telephone or radio communication. The point of the clarification set forth in this paragraph is that in a trip/shutdown event, it is impracticable to interpret the term “consultation” to require an exchange of views between Seller and Company as a condition to Company action, and that such impracticality should not relieve Seller of the consequences, as set forth elsewhere in this Agreement, of including the trip/shutdown event in question within the definition of “Unit Trip.”

The requirement set forth in the first sentence of this definition that Company “take immediate steps to place an unscheduled generator on-line” shall not operate to exclude from the “Unit Trips” definition a trip/shutdown event if, at the time of the trip/shutdown in question, all generators comprising the Company System that are available to operate are operating and Company would have taken steps to place another generator on-line had another generator been available.

The term “unscheduled generator” set forth in the first sentence of this definition shall be determined immediately prior to the instant of commencement of the trip/shutdown event and means, in the case of a steam generator a generator that had not been scheduled by Company to be on-line for at least another three (3) hours after the time a trip/shutdown event commenced, and in the case of a non-steam generator such as a combustion turbine or internal combustion engine, a generator that had not been scheduled by Company to be online at least another thirty

(30) minutes after the time a trip/shutdown event commenced.

The exclusion from the definition of “Unit Trip” of trips/shutdowns “caused by events outside of the Facility” shall not operate to preclude from the “Unit Trips” definition trips/shutdowns caused by events occurring outside the Facility through which a Facility like the Facility should reasonably be expected, as a result of employing Good Engineering and Operating Practices, to remain synchronized and continue operation without the occurrence of a trip/shutdown event.

The removal from service with less than one (1) hour notice to Company shall be deemed sudden and immediate for purposes of this definition.

“Unplanned Removal From Service” – The unscheduled removal from service, other than for routine scheduled maintenance preapproved by Company, of a combustion turbine generator at the Facility, but not including any such removal caused by a disturbance or condition occurring on the Company System during which the Facility could not reasonably have been expected to remain synchronized and continue operation notwithstanding the employment of Good Engineering and Operating Practices.

(1) For purposes of this definition, Good Engineering and Operating Practices will not require that the Facility remain synchronized and continue operation through the following fault conditions:

(a) three phase fault conditions at the Points of Interconnection lasting more than one hundred twenty (120) milliseconds;

(b) two phase fault conditions at the Points of Interconnection lasting more than one hundred twenty (120) milliseconds); or

(c) single phase fault conditions at the Points of Interconnection lasting more than two (2.0) seconds.

A fault condition event shall be deemed to have ended when the voltage has recovered to and remains above 0.83 per unit (equivalent to 66.1 kV as measured line-to-ground) at Company’s Kalaeloa 138 kV Substation or such other location as close as practicable to the Points of Interconnection as Seller and Company agree in writing. Such voltage level shall be determined by the previously installed model 7100S Power Quality Monitor manufactured by Drantez-BMI (or such other equivalent power quality monitor acceptable to the Parties) at the Points of Interconnection or as close as practicable thereto (i.e., Company’s Kalaeloa 138 kV Substation) at the 138 kV level to measure the parameters necessary to determine whether a fault condition as described herein has occurred and the magnitude thereof. In the case where reliable data is not available from said measurement equipment, such voltage level shall be determined by interpretation or analysis of data collected from other voltage measuring equipment on the Company System and/or at the Facility.

(2) For purposes of this definition, Good Engineering and Operating Practices do not require that the Facility remain synchronized and continue operation if protection relay devices that are properly set, reviewed and accepted, and which operate in accordance with the specifications provided in this Agreement, have automatically removed all or a part of the Facility from service.

(3) No Unplanned Removal From Service shall be deemed to have occurred if an operator has manually removed one or both combustion turbine generators from service because, in his considered judgment, such condition or disturbance posed an immediate threat of serious damage to an integral part of the Facility despite the fact that none of the Facility’s breakers or protection relay devices automatically removed all or part of the Facility from service, provided that an after-the-fact review of the circumstances verifies that the actions of the operator were consistent with Good Engineer and Operating Practices.

“Unsubordinated Claims” – (i) Liquidated Damages payments in accordance with

Article 9 (Liquidated Damages), (ii) damages payable under Section 8.3 (Equitable Remedies) or under Section 9.5 (Other Rights Upon Default), (iii) amounts to be reimbursed by Seller to Company for costs incurred by Company in connection with effecting a cure of defaults committed by Seller under the Financing Documents (if any) pursuant to Section 20.6 (Reimbursement of Company Costs) or complying with requests of the Financing Parties (if any)

in respect of, the Financing Documents (if any), (iv) payments by Seller for Company-Owned Interconnection Facilities to be installed by Company, (v) insurance premiums and other payments in accordance with Section 6.2 (Payment) and (vi) adjustments in accordance with Section 6.3 (Billing Disputes).

“Variable O&M Component” – Shall have the meaning set forth in Attachment J (Energy Charge and Capacity Charge Payment Formulas).

“Weekly Unit Commitment Schedule” – The written notice delivered in accordance with Section 3.3(A)(3) (Dispatch Forecast), stating for each day of the following week the times at which all generating facilities on the Company System shall start up and shut down.

“60-Month Schedule” – Shall have the meaning set forth in Section 8.a (60-Month Schedule) of Attachment Y (Operation and Maintenance of the Facility).

ARTICLE 2

SCOPE OF AGREEMENT

2.1 General Description of the Facility.

(A) Overview. Seller will permit, own, operate and maintain the Facility in compliance with the terms and conditions of this Agreement. The Contract Firm Capacity and the Net Electric Energy Output of the Facility will be sold to Company under Company Dispatch for use in the Company System in accordance with the terms of this Agreement.

(B) Facility Description. The description of the Facility is attached to this Agreement as Attachment A (Facility Description). The single-line diagrams in Attachment E (Single-Line Diagram) shall expressly identify the Point of Interconnection of the Facility to the Company System.

(C) Interconnection Facilities. A description of the Interconnection Facilities and the terms and conditions related to the Interconnection Facilities shall be set forth in Attachment B (Facility Owned by Seller) and Attachment G (Company-Owned Interconnection Facilities) of this Agreement.

(D) Site. The Site of the Facility is located at 91-111 Kalaeloa Boulevard, Kapolei, Hawai‘i 96707, as more fully described in Attachment A (Facility Description).

(E) Requirements for Electric Energy Supplied by Seller. Electric energy supplied by Seller hereunder shall meet the specifications required by this Agreement. The Facility shall be designed to operate continuously and shall be designed to remain online and available to meet the requirements of Attachment B (Facility Owned by Seller) during events caused by natural forces, including but not limited to tropical storms, hurricanes, floods, earthquakes and volcanic eruptions, unless such events are of a severity as to exceed the specifications the Facility was designed to under Section 2.1(B) (Facility Description) except during planned outages, unplanned outages and outages pursuant to Article 4 (Suspension or Reduction of Deliveries). During events caused by natural forces, it is the intention of the Parties that the Facility shall be online and available to the greatest extent reasonably practicable within the then-existing circumstances and conditions of operation and taking into account the Seller’s determination, consistent with Good Engineering and Operating Practices, of whether the continued operation of the Facility (1) is likely to endanger the safety of persons and or property, and (2) is likely to endanger the integrity of the Facility.

(F) Fuel and Other Expendables. Seller will contract for, acquire or otherwise provide for a reliable supply of Fuel and other expendables necessary to operate the Facility in accordance with Section 14 (Fuel and Other Materials) of Attachment Y (Operation and Maintenance of the Facility).

(G) Fuel Conversion Option. Company shall have the option (the “Fuel Conversion Option”), but not the obligation, to have the Facility converted from generation using LSFO to generation using an alternative fuel as necessary or desirable to allow flexibility with respect to fuels, fuel storage, and fuel inventory to meet changing needs and, as necessary to help Company meet its obligations to achieve the levels mandated under the RPS Law as well as to enable

Seller to contribute to achievement of the State of Hawaiʻi's clean energy goals. If Company chooses to exercise the Fuel Conversion Option, the provisions in Attachment BB (Option for Conversion to Alternative Fuel) shall apply.

(H) It is the intent and expectation of the Parties that the Facility have a plant life equal to at least the Initial Term of this Agreement.

2.2 Term and Effectiveness of Certain Obligations

(A) Term. Subject to Section 2.2(B) (Effectiveness of Certain Obligations) of this Agreement, the initial term of this Agreement shall commence on the Execution Date and shall remain in effect for ten (10) Contract Years following the Effective Date but in no event later than fifteen (15) years from the Execution Date (the “Initial Term”). This Agreement shall automatically terminate upon expiration of the Initial Term. If the Parties desire, the Parties may negotiate terms and conditions of an extension term (“Extension Term”), which terms and conditions (i) shall include reduced contract pricing, (ii) shall be submitted to the PUC by Company for approval no later than one (1) year prior to the expiration of the Initial Term and

(iii) shall have no effect without PUC approval.

(B) Effectiveness of Certain Obligations.

(1) [Reserved]

(2) Other. Prior to the Effective Date (i) in no event shall Seller be obligated to sell capacity or electric energy to Company (except as provided in Section 2.2(B)(3) below), or have any other obligations to Company under this Agreement other than those set forth in this Section 2.2 (Term and Effectiveness of Certain Obligations), Section 2.3(A) (Seller Conditions Precedent), Section 3.2(A)(l) (General) (only as to obligations with respect to design and acquiring Land Rights), Section 3.2(A)(3) (Seller’s Governmental Approvals and Land Rights) and Section 3.2(A)(4) (Review of Facilities), Article 7 (Credit Assurance and Security), Article 13 (Indemnification), Article 15 (Insurance), Article 17 (Dispute Resolution), Article 18 (Force Majeure), Article 20 (Assignments and Financing Debt), Article 21 (Sale of Facility by Seller), and Article 25 (Miscellaneous); and (ii) in no event shall Company be obligated to make any payments provided for herein to Seller or have any other obligations to Seller other than those set forth in this Section 2.2 (Term and Effectiveness of Certain Obligations), Section 2.3(B) (Failure of Seller Conditions Precedent), Section 3.1(E) (Company Security Documents), Section 3.2(A)(3) (Seller’s Governmental Approvals and Land Rights) and Section 3.2(A)(4) (Review of Facilities), and Article 13 (Indemnification), Article 17 (Dispute Resolution), Article 18 (Force Majeure), Article 20 (Assignments and Financing Debt), Article 21 (Sale of Facility by Seller), and Article 25 (Miscellaneous).

(3) Prior to the Effective Date, the terms, conditions and obligations of Seller and Company with respect to the Facility, including the acceptance and payment for energy from the Facility, shall be governed by and in accordance with the Original Power Purchase

Agreement which, notwithstanding the execution of this Agreement, shall continue in full force and effect until the Effective Date.

(4) Upon the Effective Date, the Original Power Purchase Agreement shall be superseded by this Agreement and the terms and conditions of the Original Power Purchase Agreement shall be of no force and effect except for disputes already subject to dispute resolution under the Original Power Purchase Agreement, which shall continue until resolution under the terms of the Original Power Purchase Agreement; provided, however, that any disputes under the Original Power Purchase Agreement for which arbitration under Section 17.2 (Dispute Resolution Procedures) of the Original Power Purchase Agreement has not been invoked prior to the Effective Date shall no longer be subject to arbitration under said Section 17.2 but shall, if the Parties are unable to resolve such dispute by negotiations, be subject to mediation and arbitration under the procedures set forth in Section 17.2 (Dispute Resolution Procedures) of this Agreement.

(C) PUC Approval.

(1) PUC Approval Order.

(a) Notwithstanding any other provisions of this Agreement that might be construed to the contrary, Company’s purchase of electric energy under this Agreement and Company’s payment of the Capacity Charge, and any and all terms and conditions of this Agreement that are ancillary to that purchase and that payment, are all contingent upon obtaining the Non-appealable PUC Approval Order and the occurrence of the Capacity Rate Inclusion Date. Upon the execution of this Agreement, the Parties shall use good faith efforts to obtain, as soon as practicable, a satisfactory PUC Approval Order that satisfies the requirements of Section 25.12(A) (PUC Approval Order). Company shall submit to the PUC an application for a satisfactory PUC Approval Order but does not extend any assurance that a PUC Approval will ultimately be obtained. Seller will provide reasonable cooperation to expedite obtaining a PUC Approval Order including timely providing information requested by Company to support its application, including information for Company and its consultant to conduct a greenhouse gas emissions analysis for the PUC application, as well as information requested by the PUC and parties to the PUC proceeding in which approval is being sought. Seller understands that lack of cooperation may result in Company's inability to file an application with the PUC and/or a failure to receive a PUC Approval Order. For the avoidance of doubt, Company has no obligation to seek reconsideration, appeal, or other administrative or judicial review of any Unfavorable PUC Order. The Parties agree that neither Party has control over whether or not a PUC Approval Order will be issued and each Party hereby assumes any and all risks arising from, or relating in any way to, the inability to obtain a satisfactory PUC Approval Order and hereby releases the other Party from any and all claims relating thereto.

(b) Seller shall seek participation without intervention in the PUC docket for approval of this Agreement pursuant to applicable rules and orders of the PUC. The scope of Seller's participation shall be determined by the PUC. However, Seller expressly agrees to seek participation for the limited purpose and only to the extent necessary to assist the PUC in making an informed decision regarding the approval of this Agreement. If Seller chooses not to seek participation in the docket, then Seller expressly agrees and knowingly waives the right to