HEI Exhibit 13

Hawaiian Electric Industries, Inc.

2007 Annual Report to Shareholders (Selected Sections)

| Contents | ||

| 2 | Forward-Looking Statements | |

| 3 | Selected Financial Data | |

| 4 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| 4 | HEI Consolidated | |

| 14 | Electric Utility | |

| 42 | Bank | |

| 50 | Quantitative and Qualitative Disclosures about Market Risk | |

| 53 | Index to Consolidated Financial Statements | |

| 54 | Annual Report of Management on Internal Control Over Financial Reporting | |

| 55 | Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting | |

| 56 | Report of Independent Registered Public Accounting Firm | |

| 57 | Consolidated Financial Statements | |

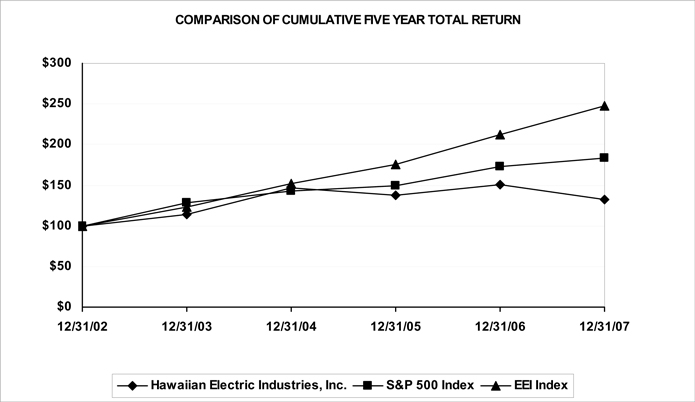

| 107 | Shareholder Performance Graph | |

1

Forward-Looking Statements

This report and other presentations made by Hawaiian Electric Industries, Inc. (HEI) and Hawaiian Electric Company, Inc. (HECO) and their subsidiaries contain “forward-looking statements,” which include statements that are predictive in nature, depend upon or refer to future events or conditions, and usually include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “predicts,” “estimates” or similar expressions. In addition, any statements concerning future financial performance, ongoing business strategies or prospects and possible future actions are also forward-looking statements. Forward-looking statements are based on current expectations and projections about future events and are subject to risks, uncertainties and the accuracy of assumptions concerning HEI and its subsidiaries (collectively, the Company), the performance of the industries in which they do business and economic and market factors, among other things.These forward-looking statements are not guarantees of future performance.

Risks, uncertainties and other important factors that could cause actual results to differ materially from those in forward-looking statements and from historical results include, but are not limited to, the following:

| • | the effects of international, national and local economic conditions, including the state of the Hawaii tourist and construction industries, the strength or weakness of the Hawaii and continental U.S. real estate markets (including the fair value and/or the actual performance of collateral underlying loans and mortgage-related securities held by American Savings Bank, F.S.B. (ASB)) and decisions concerning the extent of the presence of the federal government and military in Hawaii; |

| • | the effects of weather and natural disasters, such as hurricanes, earthquakes, tsunamis and the potential effects of global warming; |

| • | global developments, including the effects of terrorist acts, the war on terrorism, continuing U.S. presence in Iraq and Afghanistan, potential conflict or crisis with North Korea and in the Middle East, Iran’s nuclear activities and potential avian flu pandemic; |

| • | the timing and extent of changes in interest rates and the shape of the yield curve; |

| • | the ability of the Company to access the credit markets to obtain financing; |

| • | the risks inherent in changes in the value of and market for securities available for sale and in the value of pension and other retirement plan assets; |

| • | changes in assumptions used to calculate retirement benefits costs and changes in funding requirements; |

| • | increasing competition in the electric utility and banking industries (e.g., increased self-generation of electricity may have an adverse impact on HECO’s revenues and increased price competition for deposits, or an outflow of deposits to alternative investments, may have an adverse impact on ASB’s cost of funds); |

| • | capacity and supply constraints or difficulties, especially if generating units (utility-owned or independent power producer (IPP)-owned) fail or measures such as demand-side management (DSM), distributed generation (DG), combined heat and power (CHP) or other firm capacity supply-side resources fall short of achieving their forecasted benefits or are otherwise insufficient to reduce or meet peak demand; |

| • | increased risk to generation reliability as generation peak reserve margins on Oahu continue to be strained; |

| • | fuel oil price changes, performance by suppliers of their fuel oil delivery obligations and the continued availability to the electric utilities of their energy cost adjustment clauses (ECACs); |

| • | the ability of IPPs to deliver the firm capacity anticipated in their power purchase agreements (PPAs); |

| • | the ability of the electric utilities to negotiate, periodically, favorable fuel supply and collective bargaining agreements; |

| • | new technological developments that could affect the operations and prospects of HEI and its subsidiaries (including HECO and its subsidiaries and ASB and its subsidiaries) or their competitors; |

| • | federal, state and international governmental and regulatory actions, such as changes in laws, rules and regulations applicable to HEI, HECO, ASB and their subsidiaries (including changes in taxation, environmental laws and regulations, the potential regulation of greenhouse gas emissions and governmental fees and assessments); decisions by the Public Utilities Commission of the State of Hawaii (PUC) in rate cases (including decisions on ECACs) and other proceedings and by other agencies and courts on land use, environmental and other permitting issues (such as required corrective actions, restrictions and penalties that may arise, for example with respect to environmental conditions or renewable portfolio standards (RPS)); enforcement actions by the Office of Thrift Supervision (OTS) and other governmental authorities (such as consent orders, required corrective actions, restrictions and penalties that may arise, for example, with respect to compliance deficiencies under the Bank Secrecy Act or other regulatory requirements or with respect to capital adequacy); |

| • | increasing operation and maintenance expenses for the electric utilities, resulting in the need for more frequent rate cases, and increasing noninterest expenses at ASB; |

| • | the risks associated with the geographic concentration of HEI’s businesses; |

| • | the effects of changes in accounting principles applicable to HEI, HECO, ASB and their subsidiaries, including the adoption of new accounting principles (such as the effects of Statement of Financial Accounting Standards (SFAS) No. 158 regarding employers’ accounting for defined benefit pension and other postretirement plans and Financial Accounting Standards Board (FASB) Interpretation No. (FIN) 48 regarding uncertainty in income taxes), continued regulatory accounting under SFAS No. 71, “Accounting for the Effects of Certain Types of Regulation,” and the possible effects of applying FIN 46R, “Consolidation of Variable Interest Entities,” and Emerging Issues Task Force Issue No. 01-8, “Determining Whether an Arrangement Contains a Lease,” to PPAs with independent power producers; |

| • | the effects of changes by securities rating agencies in their ratings of the securities of HEI and HECO and the results of financing efforts; |

| • | faster than expected loan prepayments that can cause an acceleration of the amortization of premiums on loans and investments and the impairment of mortgage servicing assets of ASB; |

| • | changes in ASB’s loan portfolio credit profile and asset quality which may increase or decrease the required level of allowance for loan losses; |

| • | changes in ASB’s deposit cost or mix which may have an adverse impact on ASB’s cost of funds; |

| • | the final outcome of tax positions taken by HEI, HECO, ASB and their subsidiaries; |

| • | the ability of consolidated HEI to generate capital gains and utilize capital loss carryforwards on future tax returns; |

| • | the risks of suffering losses and incurring liabilities that are uninsured; and |

| • | other risks or uncertainties described elsewhere in this report and in other periodic reports (e.g., “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K) previously and subsequently filed by HEI and/or HECO with the Securities and Exchange Commission (SEC). |

Forward-looking statements speak only as of the date of the report, presentation or filing in which they are made. Except to the extent required by the federal securities laws, HEI, HECO, ASB and their subsidiaries undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

2

Selected Financial Data

Hawaiian Electric Industries, Inc. and Subsidiaries

Years ended December 31 | 2007 | 2006 | 2005 | 2004 | 2003 | |||||||||||||||

| (dollars in thousands, except per share amounts) | ||||||||||||||||||||

Results of operations | ||||||||||||||||||||

Revenues | $ | 2,536,418 | $ | 2,460,904 | $ | 2,215,564 | $ | 1,924,057 | $ | 1,781,316 | ||||||||||

Net income (loss) | ||||||||||||||||||||

Continuing operations | $ | 84,779 | $ | 108,001 | $ | 127,444 | $ | 107,739 | $ | 118,048 | ||||||||||

Discontinued operations | — | — | (755 | ) | 1,913 | (3,870 | ) | |||||||||||||

| $ | 84,779 | $ | 108,001 | $ | 126,689 | $ | 109,652 | $ | 114,178 | |||||||||||

Basic earnings (loss) per common share | ||||||||||||||||||||

Continuing operations | $ | 1.03 | $ | 1.33 | $ | 1.58 | $ | 1.36 | $ | 1.58 | ||||||||||

Discontinued operations | — | — | (0.01 | ) | 0.02 | (0.05 | ) | |||||||||||||

| $ | 1.03 | $ | 1.33 | $ | 1.57 | $ | 1.38 | $ | 1.53 | |||||||||||

Diluted earnings per common share | $ | 1.03 | $ | 1.33 | $ | 1.56 | $ | 1.38 | $ | 1.52 | ||||||||||

Return on average common equity-continuing operations * | 7.2 | % | 9.3 | % | 10.5 | % | 9.4 | % | 11.1 | % | ||||||||||

Return on average common equity | 7.2 | % | 9.3 | % | 10.4 | % | 9.5 | % | 10.7 | % | ||||||||||

Financial position ** | ||||||||||||||||||||

Total assets | $ | 10,293,916 | $ | 9,891,209 | $ | 9,951,577 | $ | 9,719,257 | $ | 9,307,700 | ||||||||||

Deposit liabilities | 4,347,260 | 4,575,548 | 4,557,419 | 4,296,172 | 4,026,250 | |||||||||||||||

Other bank borrowings | 1,810,669 | 1,568,585 | 1,622,294 | 1,799,669 | 1,848,388 | |||||||||||||||

Long-term debt, net | 1,242,099 | 1,133,185 | 1,142,993 | 1,166,735 | 1,064,420 | |||||||||||||||

HEI- and HECO-obligated preferred securities of trust subsidiaries | — | — | — | — | 200,000 | |||||||||||||||

Preferred stock of subsidiaries – not subject to mandatory redemption | 34,293 | 34,293 | 34,293 | 34,405 | 34,406 | |||||||||||||||

Stockholders’ equity | 1,275,427 | 1,095,240 | 1,216,630 | 1,210,945 | 1,089,031 | |||||||||||||||

Common stock | ||||||||||||||||||||

Book value per common share ** | $ | 15.29 | $ | 13.44 | $ | 15.02 | $ | 15.01 | $ | 14.36 | ||||||||||

Market price per common share | ||||||||||||||||||||

High | 27.49 | 28.94 | 29.79 | 29.55 | 24.00 | |||||||||||||||

Low | 20.25 | 25.69 | 24.60 | 22.96 | 19.10 | |||||||||||||||

December 31 | 22.77 | 27.15 | 25.90 | 29.15 | 23.69 | |||||||||||||||

Dividends per common share | 1.24 | 1.24 | 1.24 | 1.24 | 1.24 | |||||||||||||||

Dividend payout ratio | 120 | % | 93 | % | 79 | % | 90 | % | 81 | % | ||||||||||

Dividend payout ratio-continuing operations | 120 | % | 93 | % | 78 | % | 91 | % | 78 | % | ||||||||||

Market price to book value per common share ** | 149 | % | 202 | % | 172 | % | 194 | % | 165 | % | ||||||||||

Price earnings ratio *** | 22.1 | x | 20.4 | x | 16.4 | x | 21.4 | x | 15.0 | x | ||||||||||

Common shares outstanding (thousands) ** | 83,432 | 81,461 | 80,983 | 80,687 | 75,838 | |||||||||||||||

Weighted-average | 82,215 | 81,145 | 80,828 | 79,562 | 74,696 | |||||||||||||||

Shareholders **** | 34,281 | 35,021 | 35,645 | 35,292 | 34,439 | |||||||||||||||

Employees ** | 3,520 | 3,447 | 3,383 | 3,354 | 3,197 | |||||||||||||||

| * | Net income from continuing operations divided by average common equity. |

| ** | At December 31. (Note: Stockholders’ equity and book value per common share since December 31, 2006 includes a charge to AOCI relating to retirement benefits pursuant to SFAS No. 158, as adjusted by the impact of decisions of the PUC. See Note 8, “Retirement benefits,” of HEI’s “Notes to Consolidated Financial Statements.”) |

| *** | Calculated using December 31 market price per common share divided by basic earnings per common share from continuing operations. The principal trading market for HEI’s common stock is the New York Stock Exchange (NYSE). |

| **** | At December 31. Registered shareholders plus participants in the HEI Dividend Reinvestment and Stock Purchase Plan who are not registered shareholders. As of February 14, 2008, HEI had 34,185 registered shareholders and participants. |

The Company discontinued its international power operations in 2001. Also see “Commitments and contingencies” in Note 3 of HEI’s “Notes to Consolidated Financial Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for discussions of certain contingencies that could adversely affect future results of operations and factors that affected reported results of operations.

On April 20, 2004, the HEI Board of Directors approved a 2-for-1 stock split in the form of a 100% stock dividend with a record date of May 10, 2004 and a distribution date of June 10, 2004. All share and per share information has been adjusted to reflect the stock split for all periods presented.

3

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with Hawaiian Electric Industries, Inc.’s (HEI’s) consolidated financial statements and accompanying notes. The general discussion of HEI’s consolidated results should be read in conjunction with the segment discussions of the electric utilities and the bank that follow.

HEI Consolidated

Executive overview and strategy

HEI’s three strategic objectives are to operate the electric utility and bank subsidiaries for long-term growth, maintain HEI’s annual dividend and increase HEI’s financial flexibility by strengthening its balance sheet and maintaining its credit ratings.

HEI, through Hawaiian Electric Company, Inc. (HECO) and HECO’s electric utility subsidiaries, Hawaii Electric Light Company, Inc. (HELCO) and Maui Electric Company, Limited (MECO), provide the only electric public utility service to approximately 95% of Hawaii’s population. HEI and its subsidiaries (collectively, the Company) also provide a wide array of banking and other financial services to consumers and businesses through its bank subsidiary, American Savings Bank, F.S.B. (ASB), Hawaii’s third largest financial institution based on total assets.

In 2007, income from continuing operations was $85 million, compared to $108 million in 2006. Basic earnings per share from continuing operations were $1.03 per share in 2007, down 23% from $1.33 per share in 2006 due to lower earnings for the electric utility and bank segments, partly offset by slightly lower losses for the “other” segment.

The electric utilities’ 2007 earnings were impacted by a refund accrual, a write-down of plant, and higher expenses, but benefited from interim rate relief and slightly higher kilowatthour (KWH) sales. Electric utility net income in 2007 declined 30% from the prior year due primarily to the $16 million ($9 million, net of tax benefits) reserve accrued for the potential refund (with interest) of a portion of HECO’s 2005 test year interim rate increase, higher other operation and maintenance (O&M) and depreciation expenses ($50 million), a first quarter 2007 $12 million ($7 million, net of tax benefits) write-off of plant in service costs associated with the CT-4 and CT-5 generating units at Keahole as part of a settlement in HELCO’s rate case, and the discontinuation of demand-side management (DSM) lost margin recovery and shareholder incentives, partly offset by new DSM utility incentives. Net income for the fourth quarter of 2007 was $28 million and included higher rate relief of $20 million ($11 million, net of taxes), compared to net income of $13 million for the fourth quarter of 2006.

The bank’s earnings in 2007 were hurt by the challenging interest rate environment—a relatively flat yield curve throughout most of 2007, an increased provision for loan losses primarily for one commercial borrower, higher legal expenses, increased costs to strengthen ASB’s risk management and compliance infrastructure and competitive factors impacting its ability to increase loans and attract deposits. Also in 2007, ASB recorded a pension curtailment gain of $5.3 million, net of taxes, due to retirement benefit plan changes. ASB’s future financial results will continue to be impacted by the interest rate environment, the quality of ASB’s assets and its success in operating as a community bank.

The “other” segment’s $20 million loss in 2007 was less than the $23 million loss in 2006 primarily due to the gain on the sale of the remaining shares of a venture capital investment (compared to unrealized and realized losses on this investment in 2006), gains on the sales of leveraged lease investments, and lower funding of the HEI Charitable Foundation, partly offset by higher consulting and interest expenses.

Shareholder dividends are declared and paid quarterly by HEI at the discretion of HEI’s Board of Directors. HEI and its predecessor company, HECO, have paid dividends continuously since 1901. The dividend has been stable at $1.24 per share annually since 1998 (adjusted for a 2-for-1 stock split in 2004). The indicated dividend yield as of December 31, 2007 was 5.4%. HEI’s Board believes that HEI should have a payout ratio of 65% or lower on a sustainable basis and that cash flows should support an increase before it considers increasing the common stock dividend above its current level. The dividend payout ratios based on net income for 2007, 2006 and 2005 were 120%, 93% and 79%, respectively. The payout ratios for 2007 and 2006 were higher than in 2005 primarily due to lower net income in those years.

4

HEI’s subsidiaries from time to time consider various strategies designed to enhance their competitive positions and to maximize shareholder value. These strategies may include the formation of new subsidiaries or the acquisition or disposition of businesses. The Company may from time to time be engaged in preliminary discussions, either internally or with third parties, regarding potential transactions. Management cannot predict whether any of these strategies or transactions will be carried out or, if so, whether they will be successfully implemented.

See the discussions below of the Electric Utility and Bank segments for the respective executive overviews and strategies.

Economic conditions

Note: The statistical data in this section is from public third party sources (e.g., Department of Business, Economic Development and Tourism (DBEDT), U.S. Census Bureau and Bloomberg).

Because its core businesses provide local electric utility and banking services, the Company’s operating results are influenced by the strength of Hawaii’s economy.

In recent years, Hawaii’s economy experienced strong growth fueled by increases in tourism, military spending by the federal government to expand and revitalize its facilities, strength in the housing market and increases in residential and commercial construction. Growth in 2004 and 2005 was 5.6% and 4.3%, respectively. In 2006, Hawaii started to see a moderating of the growth rate to 3.0% and the most recent outlook by local economists is for further slowing of the growth rate by 0.1% per year for 2007, 2008 and 2009. This growth translated into rising demand for electricity between 2000 and 2004 and a stabilization of demand at high levels through 2007.

Tourism saw record levels of growth in 2004 and 2005, but stabilized in 2006 and 2007. Visitor days in 2007 were slightly lower than in 2006 due to lower arrivals. Visitor expenditures were modestly higher due largely to increases in hotel room rates. State economists expect growth in 2008 with projected increases of 1% in visitor days and 4% in visitor expenditures. Historically, tourism has been affected by the health of the U.S and Japanese economies. The real gross domestic product (GDP) growth in the U.S. is estimated to have been 2.2% in 2007 and to be 2.2% in 2008. For Japan, real GDP is estimated to have been 1.8% in 2007 and to be 1.5% in 2008, compared to 2.4% in 2006 and 1.9% in 2005.

Hawaii’s real estate market followed a pattern similar to tourism, showing record growth in 2004 and 2005 and slowing in 2006 and 2007. Values on Oahu, the most populous of the five major islands, have held with the average median price for a single-family home of $643,500, slightly higher than the median for 2006 of $630,000. Values on the Big Island, Maui, Molokai and Kauai have not held up as well. The strength of the Hawaii real estate market has supported historically low delinquency rates in the bank’s loan portfolio. The slowing of the residential housing market has been accompanied by an increase in foreclosure activity, but not to levels seen in many mainland markets. According to a national real estate research firm, Hawaii had one of the lowest foreclosure rates in the nation in 2007, ranking 43rd among the 50 states.

The outlook for the construction industry in Hawaii remains positive. Construction activity, as measured by permitting activity, peaked in 2006 and stabilized in 2007. Residential construction activity declined in 2007, as rising costs met flattening demand. Military, industrial and commercial construction activity were stabilizing factors in 2007 as increased activity in those sectors helped offset the decline in residential construction. Local economists expect the overall level of construction activity to remain fairly stable, as military and industrial and commercial construction will continue to be stabilizing factors. Risks to this outlook include whether reduced market liquidity will impact funding of commercial construction projects in Hawaii and whether the Federal government will reduce spending on new military projects.

While the overall outlook for Hawaii is for continued moderate growth, factors such as a U.S. economic recession, inflation, and availability of credit could negatively impact the outlook for key industries such as tourism and construction. Although Hawaii unemployment remains low and well-below national averages, recent data indicates an upward trend. High energy costs also continue to contribute to inflation rates in Hawaii that are higher than the national inflation rate, which will in turn stress Hawaii consumers.

Management also monitors (1) oil prices because of their impact on the rates the utilities charge for electricity and the potential effect of increased electricity prices on usage, and (2) interest rates because of their potential impact on ASB’s earnings, HEI’s and HECO’s cost of capital and pension costs, and HEI’s stock price. Crude oil

5

prices continued to push higher through the end of the year amid strong global demand and a weaker dollar. Crude oil traded at an average price of $74.21 per barrel during 2007 based on West Texas Intermediate markets, compared to an average price of $70.52 per barrel in 2006, and is expected to continue trading at a premium into 2008 due to continued geopolitical instability and tight refining capacity. The average fuel oil cost per barrel for the electric utilities, however, increased only 1% in 2007 compared to 2006.

Volatility in the interest rate environment during the second half of 2007 was primarily due to the credit issues arising from the subprime mortgage crisis and concerns about the health of the economy. Although the overall level of Treasury rates started to decline in the second half of 2007, ASB continued to face margin pressure as wholesale borrowing costs and deposit rates, which are generally correlated with the 3-month Libor rate, did not decline accordingly. As of December 31, 2007, the spread between the 3-month Treasury and 3-month Libor swap rate was 1.46%, compared to the December 31, 2006 spread of 0.34%.

Results of Operations

(dollars in millions, except per share amounts) | 2007 | % change | 2006 | % change | 2005 | |||||||||||||

Revenues | $ | 2,536 | 3 | $ | 2,461 | 11 | $ | 2,216 | ||||||||||

Operating income | 204 | (15 | ) | 239 | (12 | ) | 271 | |||||||||||

Income from continuing operations | $ | 85 | (22 | ) | $ | 108 | (15 | ) | $ | 128 | ||||||||

Loss from discontinued operations | — | NM | — | NM | (1 | ) | ||||||||||||

Net income | $ | 85 | (22 | ) | $ | 108 | (15 | ) | $ | 127 | ||||||||

Electric utility | $ | 52 | (30 | ) | $ | 75 | 3 | $ | 73 | |||||||||

Bank | 53 | (5 | ) | 56 | (14 | ) | 65 | |||||||||||

Other | (20 | ) | NM | (23 | ) | NM | (10 | ) | ||||||||||

Income from continuing operations | $ | 85 | (22 | ) | $ | 108 | (15 | ) | $ | 128 | ||||||||

Basic earnings (loss) per share | ||||||||||||||||||

Continuing operations | $ | 1.03 | (23 | ) | $ | 1.33 | (16 | ) | $ | 1.58 | ||||||||

Discontinued operations | — | NM | — | NM | (0.01 | ) | ||||||||||||

| $ | 1.03 | (23 | ) | $ | 1.33 | (15 | ) | $ | 1.57 | |||||||||

Dividends per share | $ | 1.24 | — | $ | 1.24 | — | $ | 1.24 | ||||||||||

Weighted-average number of common shares outstanding (millions) | 82.2 | 1 | 81.1 | — | 80.8 | |||||||||||||

Dividend payout ratio | 120 | % | 93 | % | 79 | % | ||||||||||||

NM Not meaningful.

Retirement benefits. The Company’s reported costs of providing retirement benefits are dependent upon numerous factors resulting from actual plan experience and assumptions about future experience. For example, retirement benefits costs are impacted by actual employee demographics (including age and compensation levels), the level of contributions to the plans, plus earnings and realized and unrealized gains and losses on plan assets, and changes made to the provisions of the plans. (See Note 8 of HEI’s “Notes to Consolidated Financial Statements” for a description of ASB’s retirement benefit plan changes that become effective on December 31, 2007. No other changes were made to the retirement benefit plans’ provisions in 2007, 2006 and 2005 that have had a significant impact on costs.) Costs may also be significantly affected by changes in key actuarial assumptions, including the expected return on plan assets and the discount rate. The Company accounts for retirement benefits in accordance with Statement of Financial Accounting Standards (SFAS) No. 87, “Employers’ Accounting for Pensions,” SFAS No. 106, “Employers’ Accounting for Postretirement Benefits Other Than Pensions” and SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R),” as adjusted by the impact of decisions by the Public Utilities Commission of the State of Hawaii (PUC), and thus, changes in obligations associated with the factors noted above may not be immediately recognized as costs on the income statement, but generally are recognized in future years over the remaining average service period of plan participants.

The assumptions used by management in making benefit and funding calculations are based on current economic conditions. Changes in economic conditions will impact the underlying assumptions in determining retirement benefits costs on a prospective basis. The Company based its selection of an assumed discount rate for

6

2008 net periodic cost and December 31, 2007 disclosure on the plans’ actuarial consultant’s cashflow matching analysis that utilized bond information provided by Standard & Poor’s for all non-callable, high quality bonds (i.e., rated AA- or better) as of December 31, 2007. In selecting an assumed rate of return on plan assets, the Company considers economic forecasts for the types of investments held by the plans (primarily equity and fixed income investments), the plans’ asset allocations and the past performance of the plans’ assets.

For 2007, the Company’s retirement benefit plans’ assets generated a total return, net of investment management fees, of 8.6%, resulting in earnings and realized and unrealized gains of $87 million, compared to $122 million for 2006 and $65 million for 2005. The market value of the retirement benefit plans’ assets as of December 31, 2007 was $1.1 billion. See “Liquidity and Capital Resources” below for the Company’s cash contributions to the retirement benefit plans.

Based on various assumptions in Note 8 of HEI’s “Notes to Consolidated Financial Statements” and assuming no further changes in retirement benefit plan provisions, consolidated HEI’s, consolidated HECO’s and ASB’s (i) accumulated other comprehensive income (AOCI) balance, net of tax benefits, related to the liability for retirement benefits, (ii) retirement benefits expense, net of income tax benefits and (iii) retirement benefits paid and plan expenses were, or are estimated to be, as follows as of the dates or for the periods indicated:

| AOCI balance, net of tax benefits | Retirement benefits expense, net of tax benefits | Retirement benefits paid and plan expenses | ||||||||||||||||||||||||||||

| December 31 | Years ended December 31 | Years ended December 31 | ||||||||||||||||||||||||||||

| 2007 1 | 2006 | (Estimated) 20081, 2 | 2007 1 | 2006 | 2005 3 | 2007 | 2006 | 2005 | ||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||||||

Consolidated HEI | $ | (4 | ) | $ | (140 | ) | $ | 17 | $ | 20 | $ | 17 | $ | 11 | $ | 57 | $ | 55 | $ | 51 | ||||||||||

Consolidated HECO | 1 | (127 | ) | 17 | 16 | 13 | 8 | 53 | 51 | 50 | ||||||||||||||||||||

ASB | — | (8 | ) | (1 | ) | 2 | 3 | 2 | 2 | 2 | 1 | |||||||||||||||||||

1 | Includes impact of 2007 decisions by the PUC. |

2 | Forward-looking statements subject to risks and uncertainties, including the impact of plan changes during the year, if any, and the impact of actual information when received (e.g., actual participant demographics as of January 1, 2008). |

3 | Does not include impact of the Medicare Prescription Drug, Improvement and Modernization Act of 2003. |

The following table reflects the sensitivities of the projected benefit obligation (PBO) and accumulated postretirement benefit obligation (APBO) as of December 31, 2007, associated with a change in certain actuarial assumptions by the indicated basis points and constitute “forward-looking statements.” Each sensitivity below reflects the impact of a change in that assumption.

Actuarial assumption | Change in assumption in basis points | Impact on PBO or APBO | ||

| (dollars in millions) | ||||

Pension benefits | ||||

Discount rate | +/– 50 | $(62)/$68 | ||

Other benefits | ||||

Discount rate | +/– 50 | (11)/12 | ||

Health care cost trend rate | +/– 100 | 3/(4) |

Baseline assumptions: 6.125% discount rate; 8.5% asset return rate; 10% medical trend rate for 2008, grading down to 5% for 2013 and thereafter; 5% dental trend rate; and 4% vision trend rate.

The impact on 2008 net income for changes in actuarial assumptions should be immaterial based on the adoption by the electric utilities of pension and OPEB tracking mechanisms approved by the PUC on an interim basis. See Note 8 of HEI’s “Notes to Consolidated Financial Statements” for further retirement benefits information.

7

“Other” segment

(dollars in millions) | 2007 | % change | 2006 | % change | 2005 | |||||||||||

Revenues1 | $ | 5 | NM | $ | (2 | ) | NM | $ | 21 | |||||||

Operating income (loss) | (11 | ) | NM | (16 | ) | NM | 5 | |||||||||

Net loss | (20 | ) | NM | (23 | ) | NM | (10 | ) | ||||||||

1 | Including writedowns of and net gains and losses from investments. |

NM Not meaningful.

The “other” business segment includes results of operations of HEI Investments, Inc. (HEIII), a company previously holding investments in leveraged leases; Pacific Energy Conservation Services, Inc., a contract services company primarily providing windfarm operational and maintenance services to an affiliated electric utility; HEI Properties, Inc. (HEIPI), a company holding passive, venture capital investments; The Old Oahu Tug Service, Inc. (TOOTS), a maritime freight transportation company that ceased operations in 1999; HEI and HEI Diversified, Inc. (HEIDI), holding companies; and eliminations of intercompany transactions.

• HEIII recorded net income of $4.8 million in 2007, including intercompany interest income, income from leveraged lease investments and a net after-tax gain of $1.3 million on the sale of leveraged lease investments (the last of which was sold in November 2007). HEIII recorded net income of $3.5 million in 2006, including intercompany interest income and income from leveraged leases. HEIII recorded net income of $16.2 million in 2005, including a gain of $14 million on the sale of its approximate 25% interest in a trust that is the owner/lessor of a 60% undivided interest in a coal-fired electric generating plant in Georgia. Most of the approximately $5 million of income taxes on the sale were recorded at HEI in accordance with the Company’s tax allocation policy. Since HEIII has now sold substantially all of its investments, the Company currently plans to wind up HEIII’s affairs during 2008.

• HEIPI recorded net income of $1.0 million in 2007, net losses of $1.8 million in 2006 and net income of $3.5 million in 2005, which amounts include income and losses from and/or writedowns of venture capital investments. In 2005, HEIPI recognized a $4.6 million unrealized gain ($2.9 million after-tax) on its investment in Hoku Scientific, Inc. (Hoku), a materials science company focused on clean energy technologies. HEIPI began selling Hoku stock in February 2006 when its lock-up agreement expired. In 2006, HEIPI recognized $2.6 million in unrealized and realized losses ($1.6 million after-tax) on its investment in Hoku. In January 2007, HEIPI sold its remaining investment in Hoku for a net after-tax gain of $0.9 million. As of December 31, 2007, HEIPI’s venture capital investments amounted to $1.6 million.

• HEI Corporate operating, general and administrative expenses (including labor, employee benefits, incentive compensation, charitable contributions, legal fees, consulting, rent, supplies and insurance) were $14.0 million in 2007, compared to $12.1 million in 2006 and $14.8 million in 2005. In 2007 consulting expenses were higher, but funding of the HEI Charitable Foundation was lower. In 2006, incentive and share-based compensation was lower than in 2005. HEI Corporate and the other subsidiaries’ net loss was $25.8 million in 2007, $24.5 million in 2006 and $30.0 million in 2005, the majority of which is comprised of financing costs. The results for 2005 include most of the $5 million of income taxes on the $14 million gain on sale by HEIII of the 25% interest in the trust described above.

• The “other” segment’s interest expenses were $25.3 million in 2007, $23.1 million in 2006 and $25.9 million in 2005. In 2007, financing costs increased primarily due to higher medium-term note interest. In 2006, financing costs decreased due to the use of lower-costing short-term commercial paper borrowings to replace or temporarily refinance maturing medium-term notes.

8

Effects of inflation

U.S. inflation, as measured by the U.S. Consumer Price Index (CPI), averaged 4.1% in 2007, 2.5% in 2006 and 3.4% in 2005. Hawaii inflation, as measured by the Honolulu CPI, was 5.9% in 2006 and 3.8% in 2005. DBEDT estimates average Honolulu CPI to have been 4.5% in 2007 and forecasts it to be 3.8% for 2008. Inflation continues to have an impact on HEI’s operations.

Inflation increases operating costs and the replacement cost of assets. Subsidiaries with significant physical assets, such as the electric utilities, replace assets at much higher costs and must request and obtain rate increases to maintain adequate earnings. In the past, the PUC has granted rate increases in part to cover increases in construction costs and operating expenses due to inflation.

Recent accounting pronouncements

See “Recent accounting pronouncements and interpretations” in Note 1 of HEI’s “Notes to Consolidated Financial Statements.”

Liquidity and capital resources

Selected contractual obligations and commitments. The following tables present information about total payments due during the indicated periods under the specified contractual obligations and commercial commitments:

December 31, 2007 | Payment due by period | ||||||||||||||

(in millions) | 1 year or less | 2-3 years | 4-5 years | More than 5 years | Total | ||||||||||

Contractual obligations | |||||||||||||||

Deposit liabilities | |||||||||||||||

Commercial checking | $ | 306 | $ | — | $ | — �� | $ | — | $ | 306 | |||||

Other checking | 860 | — | — | — | 860 | ||||||||||

Savings | 1,402 | — | — | — | 1,402 | ||||||||||

Money market | 175 | — | — | — | 175 | ||||||||||

Term certificates | 1,250 | 297 | 50 | 7 | 1,604 | ||||||||||

Total deposit liabilities | 3,993 | 297 | 50 | 7 | 4,347 | ||||||||||

Other bank borrowings | 578 | 543 | 340 | 350 | 1,811 | ||||||||||

Long-term debt, net | 50 | — | 215 | 1,001 | 1,266 | ||||||||||

Operating leases, service bureau contract and maintenance agreements | 26 | 34 | 16 | 33 | 109 | ||||||||||

Open purchase order obligations | 86 | 29 | 1 | — | 116 | ||||||||||

Fuel oil purchase obligations (estimate based on January 1, 2008 fuel oil prices) | 898 | 1,793 | 1,795 | 1,793 | 6,279 | ||||||||||

Power purchase obligations– minimum fixed capacity charges | 119 | 237 | 234 | 1,015 | 1,605 | ||||||||||

Liabilities for uncertain tax positions (FIN 48 liability) | — | 9 | 3 | — | 12 | ||||||||||

Total (estimated) | $ | 5,750 | $ | 2,942 | $ | 2,654 | $ | 4,199 | $ | 15,545 | |||||

December 31, 2007 | |||

| (in millions) | |||

Other commercial commitments to ASB customers | |||

Loan commitments (primarily expiring in 2008) | $ | 94 | |

Loans in process | 71 | ||

Unused lines and letters of credit | 1,053 | ||

Total | $ | 1,218 | |

The tables above do not include other categories of obligations and commitments, such as deferred taxes, interest (on deposit liabilities, other bank borrowings, long-term debt and uncertain tax positions), trade payables, amounts that will become payable in future periods under collective bargaining and other employment agreements and employee benefit plans, obligations that may arise under indemnities provided to purchasers of discontinued operations and potential refunds of amounts collected under interim decision and orders (D&Os) of the PUC. As of December 31, 2007, the fair value of the assets held in trusts to satisfy the obligations of the qualified pension plans exceeded the pension plans’ accumulated benefit obligation. Thus, no minimum funding requirements for retirement

9

benefit plans have been included in the tables above. The funding requirements of the Pension Protection Act become effective in 2008, but the Company does not expect those requirements to cause an increase in its estimated qualified pension plans contribution in 2008.

See Note 3 of HEI’s “Notes to Consolidated Financial Statements” for a discussion of fuel and power purchase commitments.

The Company believes that its ability to generate cash, both internally from electric utility and banking operations and externally from issuances of equity and debt securities, commercial paper and bank borrowings, is adequate to maintain sufficient liquidity to fund its contractual obligations and commercial commitments in the tables above, its forecasted capital expenditures and investments, its expected retirement benefit plan contributions and other cash requirements in the foreseeable future.

The Company’s total assets were $10.3 billion as of December 31, 2007 and $9.9 billion as of December 31, 2006.

The consolidated capital structure of HEI (excluding ASB’s deposit liabilities and other borrowings) was as follows:

December 31 | 2007 | 2006 | ||||||||||

| (dollars in millions) | ||||||||||||

Short-term borrowings—other than bank | $ | 92 | 4 | % | $ | 177 | 7 | % | ||||

Long-term debt, net—other than bank | 1,242 | 47 | 1,133 | 47 | ||||||||

Preferred stock of subsidiaries | 34 | 1 | 34 | 1 | ||||||||

Common stock equity1 | 1,275 | 48 | 1,095 | 45 | ||||||||

| $ | 2,643 | 100 | % | $ | 2,439 | 100 | % | |||||

1 | Includes AOCI charge for retirement benefit plans in accordance with SFAS No. 158, as adjusted by the impact of decisions of the PUC in 2007. |

As of February 14, 2008, the Standard & Poor’s (S&P) and Moody’s Investors Service’s (Moody’s) ratings of HEI securities were as follows:

| S&P | Moody’s | |||

Commercial paper | A-2 | P-2 | ||

Medium-term notes | BBB | Baa2 |

The above ratings are not recommendations to buy, sell or hold any securities; such ratings may be subject to revision or withdrawal at any time by the rating agencies; and each rating should be evaluated independently of any other rating.

HEI’s overall S&P corporate credit rating is BBB/stable/A-2.

The rating agencies use a combination of qualitative measures (i.e., assessment of business risk that incorporates an analysis of the qualitative factors such as management, competitive positioning, operations, markets and regulation) as well as quantitative measures (e.g., cash flow, debt, interest coverage and liquidity ratios) in determining the ratings of HEI securities. In May 2007, S&P affirmed its corporate credit ratings of HEI and lifted the outlook on HEI from “negative” to “stable” and in September 2007, S&P maintained its stable outlook. S&P’s ratings outlook “assesses the potential direction of a long-term credit rating over the intermediate term (typically six months to two years).”

S&P also ranks business profiles from “1” (excellent) to “10” (vulnerable). In May 2007, S&P changed HEI’s business profile rank from “6” to “5.” In September 2007, S&P maintained HEI’s rating and business profile rank of “5” and stated that HEI has somewhat weak financial measures. S&P indicated that unsupportive rate treatment that would result in the erosion of key financial parameters, especially cash flow coverage of debt, and a slump in the state economy could lead to downward rating pressure.

See the electric utilities’ “Liquidity and capital resources” section below for the May 2007 downgrades by S&P of certain HECO, HELCO and MECO ratings.

10

In December 2007, Moody’s confirmed its ratings and stable outlook for HEI. Moody’s indicated that the rating could be downgraded should weaker than expected regulatory support emerge at HECO, which ultimately causes earnings and sustainable cash flow to suffer. Consequently, a shift in Moody’s expectations regarding the Company’s future sustainable levels of consolidated financial ratios such as Adjusted Cash Flow (net cash flow from operations less net changes in working capital items) to Adjusted Debt below 16% (16% as of September 30, 2007-latest reported by Moody’s) or Adjusted Cash Flow to Adjusted Interest of less than 3.5x (4.0x as of September 30, 2007-latest reported by Moody’s) could result in a lowering of the Company’s ratings.

As of December 31, 2007, $96 million of debt, equity and/or other securities were available for offering by HEI under an omnibus shelf registration and an additional $50 million principal amount of Series D notes were available for offering by HEI under its registered medium-term note program. These registrations will expire to the extent the registered securities have not been issued by November 30, 2008.

HEI utilizes short-term debt, principally commercial paper, to support normal operations and for other temporary requirements. HEI also periodically makes short-term loans to HECO to meet HECO’s cash requirements, including the funding of loans by HECO to HELCO and MECO. HEI had an average outstanding balance of commercial paper for 2007 of $67.6 million and had $63.0 million outstanding as of December 31, 2007. Management believes that if HEI’s commercial paper ratings were to be downgraded, it might not be able to sell commercial paper under current market conditions.

Effective April 3, 2006, HEI entered into a revolving unsecured credit agreement establishing a line of credit facility of $100 million, with a letter of credit sub-facility, expiring on March 31, 2011, with a syndicate of eight financial institutions. Effective February 19, 2008, HEI entered into a short-term, unsecured credit agreement establishing a line of credit facility of $50 million, expiring on November 18, 2008, with William Street LLC, an affiliate of Goldman, Sachs & Co. See Note 6 of HEI’s “Notes to Consolidated Financial Statements” for a description of the credit facilities. In the future, the Company may seek to enter into new lines of credit and may also seek to increase the amount of credit available under such lines as management deems appropriate.

Operating activities provided net cash of $217 million in 2007, $286 million in 2006 and $218 million in 2005. Investing activities used net cash of $222 million in 2007, $141 million in 2006 and $202 million in 2005. In 2007, net cash was used in investing activities primarily for HECO’s consolidated capital expenditures, net of contributions in aid of construction, and net increases in loans held for investment, partly offset by repayments of investment and mortgage-related securities and sales of mortgage-related securities, net of purchases. Financing activities used net cash of $43 million in 2007 and $105 million in 2006 and provided net cash of $22 million in 2005. In 2007, net cash used in financing activities was affected by several factors, including payment of common stock dividends and net decreases in deposits and short-term borrowings, partly offset by net increases in other bank borrowings and long-term debt and proceeds from the issuance of common stock.

A portion of the net assets of HECO and ASB is not available for transfer to HEI in the form of dividends, loans or advances without regulatory approval. One of the conditions of the merger and corporate restructuring of HECO and HEI requires that HECO maintain a consolidated common equity to total capitalization ratio of not less than 35% (55% at December 31, 2007), and restricts HECO from making distributions to HEI to the extent it would result in that ratio being less than 35%. In the absence of an unexpected material adverse change in the financial condition of the electric utilities or ASB, such restrictions are not expected to significantly affect the operations of HEI, its ability to pay dividends on its common stock or its ability to meet its debt or other cash obligations. See Note 12 of HEI’s “Notes to Consolidated Financial Statements.”

Forecasted HEI consolidated “net cash used in investing activities” (excluding “investing” cash flows from ASB) for 2008 through 2010 consists primarily of the net capital expenditures of HECO and its subsidiaries. In addition to the funds required for the electric utilities’ construction program (see “Electric utility—Liquidity and capital resources”), approximately $50 million will be required during 2008 through 2010 to repay maturing HEI medium-term notes, which are expected to be repaid with the issuance of commercial paper, and/or common stock under Company plans, and/or dividends from subsidiaries. Additional debt and/or equity financing may be utilized to pay down commercial paper or other short-term borrowings or may be required to fund unanticipated expenditures not included in the 2008 through 2010 forecast, such as increases in the costs of or an acceleration of the construction of capital projects of the utilities, utility capital expenditures that may be required by new environmental laws and regulations, unbudgeted acquisitions or investments in new businesses, significant increases in retirement benefit

11

funding requirements and higher tax payments that would result if tax positions taken by the Company do not prevail. In addition, existing debt may be refinanced prior to maturity (potentially at more favorable rates) with additional debt or equity financing (or both).

As further explained in Notes 1 and 8 of HEI’s “Notes to Consolidated Financial Statements,” the Company maintains pension and other postretirement benefit plans. The Company was not required to make any contributions to the qualified pension plans to meet minimum funding requirements pursuant to ERISA for 2007, 2006 and 2005, but the Company made voluntary contributions in those years. Contributions to the retirement benefit plans totaled $13 million in 2007 (comprised of $12 million made by the utilities and $1 million by ASB), $13 million in 2006 and $24 million in 2005 and are expected to total $14 million in 2008 ($14 million by the utilities and nil by ASB). In addition, the Company paid directly $1 million of benefits in each of 2007, 2006 and 2005 and expects to pay $1 million of benefits in 2008. Depending on the performance of the assets held in the plans’ trusts and numerous other factors, additional contributions may be required in the future to meet the minimum funding requirements of ERISA or to pay benefits to plan participants. The Company believes it will have adequate access to capital resources to support any necessary funding requirements.

Off-balance sheet arrangements

Although the Company has off-balance sheet arrangements, management has determined that it has no off-balance sheet arrangements that either have, or are reasonably likely to have, a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors, including the following types of off-balance sheet arrangements:

| (1) | obligations under guarantee contracts, |

| (2) | retained or contingent interests in assets transferred to an unconsolidated entity or similar arrangements that serves as credit, liquidity or market risk support to that entity for such assets, |

| (3) | obligations under derivative instruments, and |

| (4) | obligations under a material variable interest held by the Company in an unconsolidated entity that provides financing, liquidity, market risk or credit risk support to the Company, or engages in leasing, hedging or research and development services with the Company. |

Certain factors that may affect future results and financial condition

The Company’s results of operations and financial condition can be affected by numerous factors, many of which are beyond its control and could cause future results of operations to differ materially from historical results. The following is a discussion of certain of these factors. Also see “Forward-Looking Statements” and “Certain factors that may affect future results and financial condition” in each of the electric utility and bank segment discussions below.

Economic conditions.Because its core businesses are providing local electric utility and banking services, HEI’s operating results are influenced by the strength of Hawaii’s economy, which in turn is influenced by economic conditions in the mainland U.S. (particularly California) and Asia (particularly Japan) as a result of the impact of those conditions on tourism. See “Economic conditions” above.

U.S. capital markets and credit and interest rate environment. Changes in the U.S. capital markets and credit and interest rate environment can have significant effects on the Company. For example, volatility in U.S. capital markets can affect the fair values of assets available to satisfy retirement benefits obligations. The Company estimates that consolidated retirement benefits expense, net of amounts capitalized and income taxes, will be $17 million in 2008 as compared to $20 million in 2007, partly as a result of the increase in the discount rate from 6% at December 31, 2006 to 6.125% at December 31, 2007. The access to credit markets and the interest rate environment affects the Company’s cost of capital and has a significant impact on ASB’s financial results. As of December 31, 2007, the Company had no floating-rate long-term debt outstanding. As of December 31, 2007, HEI and HECO, in the aggregate, had $92 million of commercial paper outstanding with a weighted-average interest rate of 5.64% and maturities ranging from 2 to 19 days.

12

Limited insurance.In the ordinary course of business, the Company purchases insurance coverages (e.g., property and liability coverages) to protect itself against loss of or damage to its properties and against claims made by third-parties and employees for property damage or personal injuries. However, the protection provided by such insurance is limited in significant respects and, in some instances, the Company has no coverage. For electric utility examples, see “Limited insurance” in Note 3 of HEI’s “Notes to Consolidated Financial Statements.” ASB also has no insurance coverage for business interruption or credit card fraud. Certain of the Company’s insurance has substantial “deductibles” or has limits on the maximum amounts that may be recovered. Insurers also have exclusions or limitations of coverage for claims related to certain perils including, but not limited to, mold and terrorism. If a series of losses occurred, such as from a series of lawsuits in the ordinary course of business each of which were subject to the deductible amount, or if the maximum limit of the available insurance were substantially exceeded, the Company could incur uninsured losses in amounts that would have a material adverse effect on the Company’s results of operations and financial condition.

Environmental matters.HEI and its subsidiaries are subject to environmental laws and regulations that regulate the operation of existing facilities, the construction and operation of new facilities and the proper cleanup and disposal of hazardous waste and toxic substances. These laws and regulations, among other things, may require that certain environmental permits be obtained and maintained as a condition to constructing or operating certain facilities. Obtaining such permits can entail significant expense and cause substantial construction delays. Also, these laws and regulations may be amended from time to time, including amendments that increase the burden and expense of compliance.

Material estimates and critical accounting policies

In preparing financial statements, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities and the reported amounts of revenues and expenses. Actual results could differ significantly from those estimates.

Material estimates that are particularly susceptible to significant change include the amounts reported for investment and mortgage-related securities; property, plant and equipment; pension and other postretirement benefit obligations; contingencies and litigation; income taxes; regulatory assets and liabilities; electric utility revenues; variable interest entities (VIEs); and allowance for loan losses. Management considers an accounting estimate to be material if it requires assumptions to be made that were uncertain at the time the estimate was made and changes in the assumptions selected could have a material impact on the estimate and on the Company’s results of operations or financial condition.

In accordance with Securities and Exchange Commission (SEC) Release No. 33-8040, “Cautionary Advice Regarding Disclosure About Critical Accounting Policies,” management has identified accounting policies it believes to be the most critical to the Company’s financial statements—that is, management believes that the policies below are both the most important to the portrayal of the Company’s financial condition and results of operations, and currently require management’s most difficult, subjective or complex judgments. The policies affecting both of the Company’s two principal segments are below and the policies affecting just one segment are in the respective segment’s section of “Material estimates and critical accounting policies.” Management has reviewed the material estimates and critical accounting policies with the HEI Audit Committee and, as applicable, the HECO Audit Committee.

For additional discussion of the Company’s accounting policies, see Note 1 of HEI’s “Notes to Consolidated Financial Statements” and for additional discussion of material estimates and critical accounting policies, see the electric utility and bank segment discussions below under the same heading.

Pension and other postretirement benefits obligations.Pension and other postretirement benefits (collectively, retirement benefits) costs are material estimates accounted for in accordance with SFAS No. 87, “Employers’ Accounting for Pensions,” SFAS No. 106, “Employers’ Accounting for Postretirement Benefits Other Than Pensions” and SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of Financial Accounting Standards Board (FASB) Statements No. 87, 88, 106, and 132(R).” For a discussion of retirement benefits (including costs, major assumptions, plan assets, other factors affecting costs, AOCI charges and sensitivity analyses), see “Retirement benefits (pension and other postretirement benefits)” in

13

“Consolidated—Results of Operations” above and Notes 1 and 8 of HEI’s “Notes to Consolidated Financial Statements.”

Contingencies and litigation.The Company is subject to proceedings, lawsuits and other claims, including proceedings under laws and government regulations related to environmental matters. Management assesses the likelihood of any adverse judgments in or outcomes to these matters as well as potential ranges of probable losses, including costs of investigation. A determination of the amount of reserves required, if any, for these contingencies is based on an analysis of each individual case or proceeding often with the assistance of outside counsel. The required reserves may change in the future due to new developments in each matter or changes in approach in dealing with these matters, such as a change in settlement strategy.

In general, environmental contamination treatment costs are charged to expense, unless it is probable that the PUC would allow such costs to be recovered through future rates, in which case such costs would be capitalized as regulatory assets. Also, environmental costs are capitalized if the costs extend the life, increase the capacity, or improve the safety or efficiency of property; the costs mitigate or prevent future environmental contamination; or the costs are incurred in preparing the property for sale. See “Environmental regulation” in Note 3 of HEI’s “Notes to Consolidated Financial Statements” for a description of the Honolulu Harbor investigation.

Income taxes.Deferred income tax assets and liabilities are established for the temporary differences between the financial reporting bases and the tax bases of the Company’s assets and liabilities at enacted tax rates expected to be in effect when such deferred tax assets or liabilities are realized or settled. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible.

Management evaluates its potential exposures from tax positions taken that have or could be challenged by taxing authorities in the evaluation required pursuant to FIN 48. These potential exposures result because taxing authorities may take positions that differ from those taken by management in the interpretation and application of statutes, regulations and rules. Management considers the possibility of alternative outcomes based upon past experience, previous actions by taxing authorities (e.g., actions taken in other jurisdictions) and advice from tax experts. Management believes that the Company’s provision for tax contingencies is reasonable. However, the ultimate resolution of tax treatments disputed by governmental authorities may adversely affect the Company’s current and deferred income tax amounts. See disclosure in Note 1 of HEI’s “Notes to Consolidated Financial Statements” regarding the impact of changes made to estimating the impact of uncertain tax positions under FIN 48, which was adopted on January 1, 2007. Also, see Note 10, “Income taxes,” of HEI’s “Notes to Consolidated Financial Statements.”

Following are discussions of the electric utility and bank segments. Additional segment information is shown in Note 2 of HEI’s “Notes to Consolidated Financial Statements.”

Electric utility

Executive overview and strategy

The electric utilities are vertically integrated and regulated by the PUC. The island utility systems are not interconnected, which requires that additional reliability be built into the systems, but also means that the utilities are not exposed to the risks of inter-ties. The electric utilities’ strategic focus has been to meet Hawaii’s growing energy needs through a combination of diverse activities—modernizing and adding needed infrastructure through capital investment, placing emphasis on energy efficiency and conservation, pursuing renewable energy options and technology opportunities (such as combined heat and power (CHP) and distributed generation (DG)) and taking the necessary steps to secure regulatory support for their plans.

Reliability projects, including projects to increase generation reserves to meet growing peak demand, remain a priority for HECO and its subsidiaries. On Oahu, HECO is making progress in building a new generating unit, which is projected to be placed in service in 2009, and in constructing the East Oahu Transmission Project (EOTP), a needed alternative route to move power from the west side of the island. HECO installed a new Energy Management System in 2006 and completed a new Outage Management System in 2007. On the island of Hawaii, after years of delay, the two 20 megawatt (MW) combustion turbines at Keahole are operating and plans are to add an 18 MW heat recovery steam generator in 2009 to complete a dual-train combined-cycle unit. On the island of Maui, an

14

18 MW steam turbine at the Maalaea power plant site was installed in 2006. Further, the utilities have DSM rebate programs and are considering additional utility-dispatchable DG as another measure to potentially help meet growth in demand.

Major infrastructure projects can have a pronounced impact on the communities in which they are located. The electric utilities continue to expand their community outreach and consultation process so they can better understand and evaluate community concerns early in the process.

With large power users in the electric utilities’ service territories, such as the U.S. military, hotels and state and local government, management believes that retaining customers by maintaining customer satisfaction is a critical component in achieving KWH sales and revenue growth over time. The electric utilities have established programs that offer these customers specialized services and energy efficiency audits to help them save on energy costs.

In November 2004, HECO filed a request with the PUC to increase base rates and interim rate relief was granted in September 2005. The PUC issued a bifurcation order separating HECO’s requests for approval and/or modification of its existing and proposed DSM programs from the rate case proceeding into a new docket (EE DSM Docket). The DSM programs, with certain modifications, were approved in February 2007. See “Most recent rate requests—HECO” and “Other regulatory matters—Demand-side management programs.”

In May 2006, December 2006 and February 2007, HELCO, HECO and MECO filed requests with the PUC to increase base rates and, in April, October and December of 2007, the PUC granted annual interim rate relief of $24.6 million, $70.0 million and $13.2 million, respectively. See “Most recent rate requests.” 2007 revenues of the utilities included $32 million of revenues resulting from these interim increases.

The electric utilities’ long-term plan to meet Hawaii’s future energy needs includes their support of a range of energy choices, including renewable energy and new power supply technologies such as DG. The PUC has issued a decision and framework in a competitive bidding proceeding and a decision in a DG proceeding (see “Certain factors that may affect future results and financial condition—Competition” below). HECO’s subsidiary, Renewable Hawaii, Inc. (RHI), has initial approval from the HECO Board of Directors to fund investments by RHI of up to $10 million in selected renewable energy projects to help bring online commercially feasible renewable energy sources in Hawaii.

Net income for HECO and its subsidiaries was $52 million in 2007 compared to $75 million in 2006 and $73 million in 2005. The decrease in 2007 was primarily due to increased operation and maintenance expenses (including more extensive maintenance on generating units, which are aging and are being run harder to meet the higher demand for electricity, and higher retirement benefits expense), higher depreciation expense due to investments in capital projects, a write-off of plant in service costs associated with the CT-4 and CT-5 generating units at Keahole as part of a settlement in HELCO’s rate case, a reserve accrued for the potential refund of a portion of HECO’s 2005 test year interim rate increase, and the discontinuation of DSM lost margin and shareholder incentives, partly offset by the impact of interim rate increases, proceeds from the sale of non-electric utility property and the accrual of a new HECO DSM utility incentive for meeting customer demand reduction goals.

Renewable energy strategy.The electric utilities are taking actions intended to protect Hawaii’s island ecology and counter global warming, while continuing to provide reliable power to customers. A three-pronged strategy supports attainment of the State of Hawaii renewable portfolio standards (RPS) and the Hawaii Global Warming Solutions Act of 2007 by: 1) the greening of existing assets, 2) the expansion of renewable energy generation and 3) the acceleration of energy efficiency and load management programs. Major initiatives are being pursued in each category.

In its December 19, 2007 filing with the PUC, HECO reported a consolidated RPS of 13.8% in 2006. This was accomplished through a combination of municipal solid waste (395 gigawatthours (GWh)), geothermal (212 GWh), wind (82 GWh), biomass (79 GWh), hydro (56 GWh), photovoltaic (3.4 GWh), and biodiesel (0.2 GWh) renewable generation resources; 95 GWh of renewable energy displacement technologies; and 476 GWh of energy savings from efficiency technologies.

The electric utilities are actively exploring the use of biofuels for all company-owned existing and planned generating units. HECO has committed to using 100% biofuels for its new 110 MW generating unit planned for 2009. HECO is researching the possibility of switching its steam generating units from fossil fuels to biofuels, based upon economic and technical feasibility.

15

In February 2007, BlueEarth Biofuels LLC (BlueEarth) announced plans for a new biodiesel refining plant to be built on the island of Maui by early 2010. The biodiesel plant will be owned by BlueEarth Maui Biofuels LLC (BlueEarth Maui), a joint venture recently formed between BlueEarth and Uluwehiokama Biofuels Corp. (UBC), a non-regulated subsidiary of HECO. In February 2008, an Operating Agreement and an Investment Agreement were executed between BlueEarth and UBC, under which UBC invested $380,000 (with a commitment to invest an additional $20,000) in BlueEarth Maui in exchange for a minority ownership interest. All of UBC’s profits from the project will be directed into a biofuels public trust to be created for the purpose of funding biofuels development in Hawaii. MECO intends to lease to UBC a portion of the land owned by MECO for its future Waena generation station as the site for the biodiesel plant, with lease proceeds to be credited to MECO ratepayers. In addition, MECO is negotiating a fuel purchase contract with BlueEarth Maui for biodiesel to be used in existing diesel-fired units at MECO’s Maalaea plant. Both the land lease agreement and biodiesel fuel contract will require PUC approval. Although not required to do so, BlueEarth Maui has also announced plans to prepare an environmental impact study for the project. HECO, working closely with the Natural Resources Defense Council, developed an environmental policy, which focuses on sustainable palm oil and locally-grown feedstocks, to ensure that the project would procure biofuel and biofuel feedstocks only from sustainable sources.

The electric utilities also support renewable energy through their solar water heating and heat pump programs, and the negotiation and execution of purchased power contracts with non-utility generators using renewable sources (e.g., refuse-fired, geothermal, hydroelectric and wind turbine generating systems). In November 2007, HECO entered into a contract to purchase energy from a photovoltaic system with a generating capacity of up to 300 kilowatts to be located at HECO’s Archer substation. The contract is subject to PUC approval. On September 28, 2007, HECO issued a Solicitation of Interest for its planned Renewable Energy Request for Proposals for combined renewable energy projects up to 100 MW on Oahu. On February 11, 2008, HECO submitted its draft Renewable Energy Request for Proposals for renewable energy projects to the PUC.

HECO’s unregulated subsidiary, Renewable Hawaii, Inc. (RHI), is seeking to stimulate renewable energy initiatives by prospecting for new projects and sites and taking a passive, minority interest in selected third party renewable energy projects. Since 2003, RHI has actively pursued a number of solicited and unsolicited projects, particularly those utilizing wind, landfill gas, and ocean energy. RHI will generally make project investments only after developers secure the necessary approvals and permits and independently execute a PUC-approved PPA with HECO, HELCO or MECO. While RHI has executed some memoranda of understandings with project developers, no investments have been made to date.

The electric utilities promote research and development in the areas of biofuels, ocean energy, battery storage, electronic shock absorber, and integration of non-firm power into the isolated island electric grids.

Energy efficiency and demand-side management programs for commercial and industrial customers, and residential customers, including load control programs, have resulted in reducing system peak load and contribute to the achievement of the RPS.

Also, see “Renewable Portfolio Standard” under “Legislation and regulation” below.

Results of Operations

(dollars in millions, except per barrel amounts) | 2007 | % change | 2006 | % change | 2005 | |||||||||||||

Revenues1 | $ | 2,106 | 3 | $ | 2,055 | 14 | $ | 1,806 | ||||||||||

Expenses | ||||||||||||||||||

Fuel oil | 774 | (1 | ) | 782 | 22 | 640 | ||||||||||||

Purchased power | 537 | 6 | 507 | 11 | 458 | |||||||||||||

Other | 664 | 11 | 599 | 10 | 546 | |||||||||||||

Operating income | 131 | (22 | ) | 167 | 3 | 162 | ||||||||||||

Allowance for funds used during construction | 8 | (16 | ) | 9 | 30 | 7 | ||||||||||||

Net income | 52 | (30 | ) | 75 | 3 | 73 | ||||||||||||

Return on average common equity | 5.0 | % | 7.5 | % | 7.1 | % | ||||||||||||

Average price per barrel of fuel oil1 | $ | 69.08 | 1 | $ | 68.13 | 20 | $ | 56.61 | ||||||||||

Kilowatthour sales (millions) | 10,118 | — | 10,116 | — | 10,090 | |||||||||||||

Cooling degree days (Oahu) | 4,835 | 7 | 4,520 | (9 | ) | 4,971 | ||||||||||||

Number of employees (at December 31) | 2,145 | 3 | 2,085 | 1 | 2,066 | |||||||||||||

1 | The rate schedules of the electric utilities currently contain ECACs through which changes in fuel oil prices and certain components of purchased energy costs are passed on to customers. |

16

• In 2007, the electric utilities’ revenues increased by 2.5%, or $51 million, from 2006 primarily due to higher fuel prices ($21 million); interim rate relief granted by the PUC to HECO (2007 test year), HELCO (2006 test year) and MECO (2007 test year) in October 2007, April 2007 and December 2007, respectively ($32 million) (see “Most recent rate requests” below); higher DSM program recovery revenues ($7 million); a gain from the sale of non-electric utility property (see Note 3 in HEI’s “Notes to Consolidated Financial Statements”) and the accrual of utility incentives ($4 million) (see “Other Regulatory Matters – Demand-side management programs” below); partly offset by a reserve accrued for the potential refund of a portion of HECO’s 2005 test year interim rate increase ($16 million) and lower shareholder incentives and lost margins ($7 million). KWH sales for 2007 were basically flat when compared to 2006, with only 0.02% growth, primarily due to new load growth (i.e., increase in number of customers) and the impact of warmer weather, largely offset by the impact of commercial (including large light and power) customer conservation efforts. Cooling degree days for Oahu were 7% higher in 2007 compared to 2006. The electric utilities are currently estimating KWH sales for 2008 and 2009 to increase over the prior year by 1.2% and 1.1%, respectively.

Operating income in 2007 was $36 million lower than in 2006 due primarily to higher other expenses, including a $12 million ($7 million, net of tax benefits) write-off of plant in service costs associated with the CT-4 and CT-5 generating units at Keahole as part of a settlement in HELCO’s rate case, higher maintenance and retirement benefit expenses, a reserve accrued for the potential refund of a portion of HECO’s 2005 test year interim rate increase and the discontinuation of the recovery of DSM lost margins and shareholder incentives, partly offset by the impact of interim rate increases for HECO, HELCO and MECO, proceeds from the sale of non-electric utility property and the accrual of a new HECO DSM utility incentive for meeting customer demand reduction goals.

Fuel oil expense in 2007 decreased by 1% due primarily to lower KWHs generated, mostly offset by higher fuel costs. Purchased power expenses in 2007 increased by 6% due primarily to higher KWHs purchased, higher purchased energy costs, and higher capacity and non-fuel charges. Higher fuel costs are generally passed on to customers.

Other expenses increased 11% in 2007 due to a 15% (or $28 million) increase in “other operation” expense; a 17% (or $15 million) increase in maintenance expense; a 5% (or $7 million) increase in depreciation expense; and a 2% (or $4 million) increase in taxes, other than income taxes, primarily due to the increase in revenues. “Other operation” expenses increased by $28 million in 2007 when compared to 2006 due primarily to higher administrative and general expense, including employee benefits expense ($6 million, of which $5 million was higher retirement benefits expense), DSM expenses that are generally passed on to customers through a surcharge ($7 million) and increased staffing and other costs to ensure reliable operation. Retirement benefits expenses for the electric utilities increased $5 million over 2006 due in part to the adoption of a 50 basis points lower asset return rate as of December 31, 2006 and expenses related to the adoption of the pension and OPEB tracking mechanisms, including the amortization of HELCO’s prepaid pension asset (approved on an interim basis by the PUC; see “Most recent rate requests”). Maintenance expenses increased 17%, or $16 million over 2006, due to $12 million higher production maintenance expense (primarily due to generating plant maintenance and the greater scope and increased number of generating unit overhauls) and $4 million higher transmission and distribution maintenance expense (including higher substation maintenance, vegetation management, storm repairs and distribution line maintenance expenses). Higher depreciation expense was attributable to $268 million of additions to plant in service in 2006 (including HECO’s new Dispatch Center and Energy Management System and Ford Island Substation, and MECO’s M18 generating unit).

• In 2006, the electric utilities’ revenues increased by 14%, or $249 million, from 2005 primarily due to higher fuel prices ($200 million), interim rate relief granted by the PUC in late September 2005 ($30 million), slightly higher KWH sales ($13 million), and higher DSM program recovery revenues ($6 million), partly offset by lower shareholder incentives and lost margins ($4 million), including the surcharge transferred to base rates in the interim rate relief granted in September 2005. Since May 26, 2006, HECO and, since September 26, 2006, HELCO and MECO, have discontinued their recovery of lost margins and shareholder incentives for their DSM programs, which has resulted in reduced revenues. KWH sales increased 0.3% from 2005 primarily due to new load growth (i.e., increase in number of customers), largely offset by the impacts of cooler and less humid weather and customer conservation. Cooling degree days for Oahu were 9% lower in 2006 compared to 2005. The higher fuel prices are also reflected in the higher amount of customer accounts receivable and accrued unbilled revenues.

17