UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2012 |

| OR |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-07541

THE HERTZ CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation or organization) |

| 13-1938568 (I.R.S. Employer Identification Number) |

225 Brae Boulevard

Park Ridge, New Jersey 07656-0713

(201) 307-2000

(Address, including Zip Code, and telephone number,

including area code, of registrant's principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

The registrant meets the conditions as set forth in General Instructions I(1)(a) and (b) of Form 10-K and is therefore filing this Form with the reduced disclosure format as permitted.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | |

| Large accelerated filer | ¨ | Accelerated filer | o | Non-accelerated filer | x | Smaller reporting company | o |

| | | | | (Do not check if a smaller

reporting company) | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

No voting or non-voting common equity of the registrant was held by non-affiliates of the registrant as of June 30, 2012. As of March 4, 2013, all of the common stock of the registrant was owned by its affiliate, Hertz Investors, Inc. As of March 4, 2013, 100 shares of the registrant's common stock (par value $0.01) were outstanding.

Documents incorporated by reference: None

THE HERTZ CORPORATION AND SUBSIDIARIES

TABLE OF CONTENTS

|

| | |

| | | Page |

| |

| | |

| | |

| ITEM 1A. | | |

| ITEM 1B. | | |

| ITEM 2. | | |

| ITEM 3. | | |

| ITEM 4. | | |

| | |

| ITEM 5. | | |

| ITEM 6. | | |

| ITEM 7. | | |

| ITEM 7A. | | |

| ITEM 8. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| ITEM 9. | | |

| ITEM 9A. | | |

| ITEM 9B. | | |

| | |

| ITEM 10. | | |

| ITEM 11. | | |

| ITEM 12. | | |

| ITEM 13. | | |

| ITEM 14. | | |

| | |

| ITEM 15. | | |

| |

| |

INTRODUCTORY NOTE

Unless the context otherwise requires, in this Annual Report on Form 10-K, or “Annual Report,” (i) “we,” “us,” “our,” “Hertz,” or the “Company,” mean The Hertz Corporation, Hertz Holdings' primary operating company and a direct wholly‑owned subsidiary of Hertz Investors, Inc., which is wholly‑owned by Hertz Holdings, and its consolidated subsidiaries, (ii) “Hertz Holdings” means Hertz Global Holdings, Inc., our top-level holding company, (iii) “HERC” means Hertz Equipment Rental Corporation, our wholly‑owned equipment rental subsidiary, together with our various other wholly‑owned international subsidiaries that conduct our industrial, construction and material handling equipment rental business, (iv) “cars” means cars, crossovers and light trucks (including sport utility vehicles and, outside North America, light commercial vehicles), (v) “program cars” means cars purchased by car rental companies under repurchase or guaranteed depreciation programs with car manufacturers, (vi) “non-program cars” means cars not purchased under repurchase or guaranteed depreciation programs for which the car rental company is exposed to residual risk and (vii) “equipment” means industrial, construction and material handling equipment.

Cautionary Note Regarding Forward‑Looking Statements

Certain statements contained or incorporated by reference in this Annual Report and in reports we subsequently file with the United States Securities and Exchange Commission, or the “SEC,” on Forms 10-K, 10-Q and file or furnish on Form 8-K, and in related comments by our management, include “forward‑looking statements.” Forward‑looking statements include information concerning our liquidity and our possible or assumed future results of operations, including descriptions of our business strategies. These statements often include words such as “believe,” “expect,” “project,” “anticipate,” “intend,” “plan,” “estimate,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecasts” or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate in these circumstances. We believe these judgments are reasonable, but you should understand that these statements are not guarantees of performance or results, and our actual results could differ materially from those expressed in the forward‑looking statements due to a variety of important factors, both positive and negative, that may be revised or supplemented in subsequent reports on SEC Forms 10-K, 10-Q and 8-K. Some important factors that could affect our actual results include, among others, those that may be disclosed from time to time in subsequent reports filed with the SEC, those described under “Risk Factors” set forth in Item 1A of this Annual Report, and the following, which were derived in part from the risks set forth in Item 1A of this Annual Report:

| |

| • | our ability to integrate the car rental operations of Dollar Thrifty and realize operational efficiencies from the acquisition; |

| |

| • | the operational and profitability impact of the Advantage divestiture and the divestiture of the Initial airport locations and the Secondary airport locations that we agreed to undertake in order to secure regulatory approval for the Dollar Thrifty acquisition; |

| |

| • | levels of travel demand, particularly with respect to airline passenger traffic in the United States and in global markets; |

| |

| • | the impact of pending and future U.S. governmental action to address budget deficits through reductions in spending and similar austerity measures, which could materially adversely affect unemployment rates and consumer spending levels; |

| |

| • | significant changes in the competitive environment, including as a result of industry consolidation, and the effect of competition in our markets, including on our pricing policies or use of incentives; |

| |

| • | occurrences that disrupt rental activity during our peak periods; |

| |

| • | our ability to achieve cost savings and efficiencies and realize opportunities to increase productivity and profitability; |

| |

| • | an increase in our fleet costs as a result of an increase in the cost of new vehicles and/or a decrease in the price at which we dispose of used vehicles either in the used vehicle market or under repurchase or guaranteed depreciation programs; |

| |

| • | our ability to accurately estimate future levels of rental activity and adjust the size and mix of our fleet accordingly; |

| |

| • | our ability to maintain sufficient liquidity and the availability to us of additional or continued sources of financing for our revenue earning equipment and to refinance our existing indebtedness; |

| |

| • | safety recalls by the manufacturers of our vehicles and equipment; |

| |

| • | a major disruption in our communication or centralized information networks; |

| |

| • | financial instability of the manufacturers of our vehicles and equipment; |

| |

| • | any impact on us from the actions of our licensees, franchisees, dealers and independent contractors; |

| |

| • | our ability to maintain profitability during adverse economic cycles and unfavorable external events (including war, terrorist acts, natural disasters and epidemic disease); |

| |

| • | shortages of fuel and increases or volatility in fuel costs; |

| |

| • | our ability to successfully integrate acquisitions and complete dispositions; |

| |

| • | our ability to maintain favorable brand recognition; |

| |

| • | costs and risks associated with litigation; |

| |

| • | risks related to our indebtedness, including our substantial amount of debt, our ability to incur substantially more debt and increases in interest rates or in our borrowing margins; |

| |

| • | our ability to meet the financial and other covenants contained in our Senior Credit Facilities, our outstanding unsecured Senior Notes and certain asset‑backed and asset‑based arrangements; |

| |

| • | changes in accounting principles, or their application or interpretation, and our ability to make accurate estimates and the assumptions underlying the estimates, which could have an effect on earnings; |

| |

| • | changes in the existing, or the adoption of new laws, regulations, policies or other activities of governments, agencies and similar organizations where such actions may affect our operations, the cost thereof or applicable tax rates; |

| |

| • | changes to our senior management team; |

| |

| • | the effect of tangible and intangible asset impairment charges; |

| |

| • | the impact of our derivative instruments, which can be affected by fluctuations in interest rates and commodity prices; |

| |

| • | our exposure to fluctuations in foreign exchange rates; and |

| |

| • | other risks described from time to time in periodic and current reports that we file with the SEC. |

You should not place undue reliance on forward‑looking statements. All forward‑looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and we undertake no obligation to update or revise publicly any forward‑looking statements, whether as a result of new information, future events or otherwise.

PART I

ITEM 1. BUSINESS

Our Company

Hertz operates its car rental business through the Hertz, Dollar and Thrifty brands from approximately 10,270 corporate, licensee and franchisee locations in North America, Europe, Latin America, Asia, Australia, Africa, the Middle East and New Zealand. Hertz is the largest worldwide airport general use car rental brand, operating from approximately 8,860 corporate and licensee locations in approximately 150 countries. Our Dollar and Thrifty brands have approximately 1,410 corporate and franchisee locations in 83 countries. Our Hertz brand name is one of the most recognized in the world, signifying leadership in quality rental services and products. We are one of the only car rental companies that has an extensive network of company‑operated rental locations both in the United States and in all major European markets. We believe that we maintain the leading airport car rental brand market share, by overall reported revenues, in the United States and at 120 major airports in Europe where we have company‑operated locations and where data regarding car rental concessionaire activity is available. We believe that we also maintain the second largest market share, by overall reported revenues, in the off-airport car rental market in the United States. In our equipment rental business segment, we rent equipment through approximately 340 branches in the United States, Canada, France, Spain, China and Saudi Arabia, as well as through our international licensees. We and our predecessors have been in the car rental business since 1918 and in the equipment rental business since 1965. We also own Donlen Corporation, or "Donlen," based in Northbrook, Illinois, which is a leader in providing fleet leasing and management services. We have a diversified revenue base and a highly variable cost structure and are able to dynamically manage fleet capacity, the most significant determinant of our costs. Our revenues have grown at a compound annual growth rate of 6.0% over the last 20 years, with year-over-year growth in 17 of those 20 years.

Corporate History

Hertz Holdings was incorporated in Delaware in 2005 to serve as the top-level holding company for the consolidated Hertz business. Hertz was incorporated in Delaware in 1967. Hertz is a successor to corporations that have been engaged in the car and truck rental and leasing business since 1918 and the equipment rental business since 1965. Ford Motor Company acquired an ownership interest in Hertz in 1987. Prior to this, Hertz was a subsidiary of United Continental Holdings, Inc. (formerly Allegis Corporation), which acquired Hertz's outstanding capital stock from RCA Corporation in 1985.

On December 21, 2005, investment funds associated with or designated by:

| |

| • | Clayton, Dubilier & Rice, Inc., which was succeeded by Clayton, Dubilier & Rice, LLC, or “CD&R,” |

| |

| • | The Carlyle Group, or “Carlyle,” and |

| |

| • | Merrill Lynch & Co., Inc., or "Merrill Lynch," |

or collectively the “Sponsors,” acquired all of Hertz's common stock from Ford Holdings LLC. We refer to the acquisition of all of Hertz's common stock by the Sponsors as the “Acquisition.”

In January 2009, Bank of America Corporation, or “Bank of America,” acquired Merrill Lynch. Accordingly, Bank of America is now an indirect beneficial owner of our common stock held by Merrill Lynch and certain other investment funds and affiliates of Merrill Lynch.

On September 1, 2011, Hertz completed the acquisition of Donlen Corporation, or "Donlen," a leading provider of fleet leasing and management services. See Note 4 to the Notes to our consolidated financial statements included in this Annual Report under the caption "Item 8—Financial Statements and Supplementary Data."

In December 2011, Hertz purchased the noncontrolling interest of Navigation Solutions, L.L.C., thereby increasing its ownership interest from 65% to 100%.

On November 19, 2012, Hertz completed the acquisition of Dollar Thrifty Automotive Group, Inc., or "Dollar Thrifty," a car and truck rental and leasing business. See Note 4 to the Notes to our consolidated financial statements included in this Annual Report under the caption "Item 8—Financial Statements and Supplementary Data."

On December 12, 2012, Hertz completed the sale of Simply Wheelz LLC, a wholly owned subsidiary of Hertz that operated our Advantage Rent A Car business. See Note 4 to the Notes to our consolidated financial statements included in this Annual Report under the caption "Item 8—Financial Statements and Supplementary Data."

ITEM 1. BUSINESS (Continued)

In December 2012, the Sponsors sold 50,000,000 shares of their Hertz Holdings common stock to J.P. Morgan as the sole underwriter in the registered public offering of those shares.

As a result of our initial public offering in November 2006 and subsequent offerings in June 2007, May 2009, June 2009, March 2011 and December 2012, the Sponsors reduced their holdings to approximately 26% of the outstanding shares of common stock of Hertz Holdings.

Our Markets

We are engaged principally in the global car rental industry and in the equipment rental industry.

Worldwide Car Rental

We believe that the global car rental industry exceeds $37 billion in annual revenues. According to Auto Rental News, car rental industry revenues in the United States were estimated to be approximately $24 billion for 2012 and grew in 2012 by 3.9%. We believe car rental revenues in Europe account for over $13 billion in annual revenues, with the airport portion of the industry comprising approximately 37% of the total. Within Europe, the largest markets are Germany, France, Spain, Italy and the United Kingdom. We believe total rental revenues for the car rental industry in Europe in 2012 were approximately $10.8 billion in 10 countries-France, Italy, the United Kingdom, Germany, Spain, the Netherlands, Belgium, the Czech Republic, Slovakia and Luxembourg-where we have company-operated rental locations and approximately $2.8 billion in 11 other countries-Ireland, Portugal, Sweden, Greece, Austria, Denmark, Poland, Finland, Hungary, Malta and Romania-where our Hertz brand is present through our licensees.

Rentals by airline travelers at or near airports, or “airport rentals,” are significantly influenced by developments in the travel industry and particularly in airline passenger traffic, or “enplanements,” as well as the Gross Domestic Product, or “GDP.” We believe domestic enplanements in 2012 approximated 2011 levels, however, we expect it to increase by 1.8% in 2013. Current data suggests that U.S. GDP decreased in the fourth quarter of 2012 at an annual rate of approximately 0.1%. The International Air Transport Association, or “IATA,” stated in December 2012 that annual global enplanements increased by 5.3% in 2012 and is expected to increase by 4.5% in 2013.

The off-airport portion of the industry has rental volume primarily driven by local business use, leisure travel and the replacement of cars being repaired. Because Europe has generally demonstrated a lower historical reliance on air travel, the European off-airport car rental market is significantly more developed than it is in the United States. However, we believe that in recent years, industry revenues from off-airport car rentals in the United States have grown faster than revenues from airport rentals.

We provide commercial fleet leasing and management services to national corporate customers throughout the United States and Canada through Donlen, a wholly owned subsidiary of Hertz. Donlen is a fully integrated fleet management services provider with a comprehensive suite of product offerings ranging from leasing and managing vehicle fleets to providing other fleet management services to reduce fleet operating costs.

Worldwide Equipment Rental

We estimate the size of the U.S. equipment rental industry, which is highly fragmented with few national competitors and many regional and local operators, increased to approximately $31 billion in annual revenues for 2012, but the part of the rental industry dealing with equipment of the type HERC rents is somewhat smaller than that. We believe that the industry is expected to grow at a 10.6% compound annual growth rate between 2013 and 2016. Other market data indicates that the equipment rental industries in China, France, Spain and Saudi Arabia generate approximately $5.1 billion, $4.5 billion, $2.5 billion and $0.5 billion in annual revenues, respectively, although the portions of those markets in which HERC competes are smaller.

The equipment rental industry serves a broad range of customers from small local contractors to large industrial national accounts and encompasses a wide range of rental equipment from small tools to heavy earthmoving equipment. We believe U.S. non-residential construction spending declined at an annual rate of approximately 7% in 2012 but is projected to increase at an annual rate of 6% in 2013. We also believe that rental equipment will account for approximately 50% of all equipment sold into the U.S. construction industry in 2012, up from approximately 5% in 1993. In addition, we believe that the trend toward rental instead of ownership of equipment in the U.S. construction industry will continue and that as much as 50% of the equipment used in the industry could be rental equipment by 2015.

Our Business Segments

Our business consists of two reportable segments: rental and leasing of cars, crossovers and light trucks, or “car rental,” and rental of industrial, construction and material handling equipment, or “equipment rental.” General corporate

ITEM 1. BUSINESS (Continued)

expenses, certain interest expense (including net interest on corporate debt), as well as other business activities, such as fees and certain cost reimbursements from our licensees are included as “other reconciling items.”

Car Rental: Our “company‑operated” rental locations are those through which we, or an agent of ours, rent cars that we own or lease. We maintain a substantial network of company‑operated car rental locations both in the United States and internationally, and what we believe to be the largest number of company‑operated airport car rental locations in the world, enabling us to provide consistent quality and service worldwide. Our licensees and associates also operate rental locations in approximately 145 countries and jurisdictions, including most of the countries in which we have company‑operated rental locations.

Equipment Rental: We believe, based on an article in Rental Equipment Register published in May 2012, that HERC is one of the largest equipment rental companies in the United States and Canada combined. HERC rents a broad range of earthmoving equipment, material handling equipment, aerial and electrical equipment, air compressors, generators, pumps, small tools, compaction equipment and construction‑related trucks. HERC also derives revenues from the sale of new equipment and consumables as well as through its Hertz Entertainment Services division, which rents lighting and related aerial products used primarily in the U.S. entertainment industry.

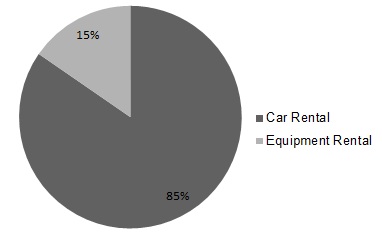

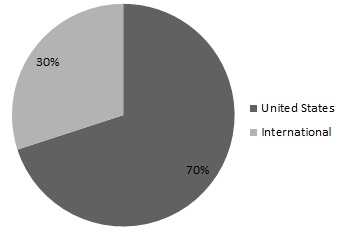

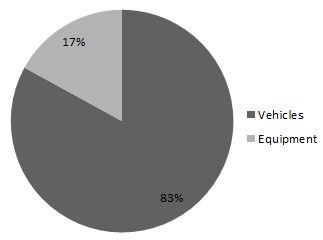

Set forth below are charts showing revenues by reportable segment, and revenues by geographic area, both for the year ended December 31, 2012 and revenue earning equipment at net book value as of December 31, 2012 (the majority of our international operations are in Europe).

|

| |

Revenues by Segment for Year Ended December 31, 2012(1)

$9.0 billion | Revenues by Geographic Area for Year Ended December 31, 2012

$9.0 billion |

| |

| |

Revenue Earning Equipment at net book value as of December 31, 2012

$12.9 billion |

|

| | |

_______________________________________________________________________________

| |

| (1) | Car rental segment revenue includes fees and certain cost reimbursements from licensees. See Note 11 to the Notes to our consolidated financial statements included in this Annual Report under the caption “Item 8—Financial Statements and Supplementary Data.” |

For further information on our business segments, including financial information for the years ended December 31, 2012, 2011 and 2010, see Note 11 to the Notes to our consolidated financial statements included in this Annual Report under the caption “Item 8—Financial Statements and Supplementary Data.”

ITEM 1. BUSINESS (Continued)

Worldwide Car Rental

Our worldwide car rental segment generated $7,633.0 million in revenues during the year ended December 31, 2012.

Our Brands

Our car rental business is primarily operated through three brands - Hertz, Dollar and Thrifty. Each of our brands generally maintains separate airport counters, reservations and reservation systems, marketing and all other customer contact activities, however a single management team manages all three brands. As we integrate the Dollar and Thrifty brands into our operations, we expect to eliminate many of the duplicative functions previously performed separately by Dollar Thrifty and identify synergies through combined fleet management, insurance, information technology functions, back office processing and procurement.

The Hertz brand is one of the most recognized brands in the world. Our customer surveys, in the United States, indicate that Hertz is the car rental brand most associated with the highest quality service. This is consistent with numerous published best-in class car rental awards that we have won, both in the United States and internationally, over many years. We have sought to support our reputation for quality and customer service in car rental through a variety of innovative service offerings, such as our customer loyalty program (Gold Plus Rewards), our global expedited rental program (Hertz #1 Club Gold), our one-way rental program (Rent-it-Here/Leave-it-There), our national‑scale luxury rental program (Prestige Collection), our sports car rental program (Adrenaline Collection), our environmentally friendly rental program (Green Traveler Collection), our car sharing service (Hertz On Demand) and our in-car navigational services (Hertz NeverLost). We intend to maintain our position as a premier provider of rental services through an intense focus on service, quality and product innovation.

Based on the latest available data, in the United States, the Hertz brand had the highest market share, by revenues, in 2010, 2011 and in the first eleven months of 2012 at approximately 200 of the largest airports where we have company‑operated locations. Out of the approximately 200 major European airports at which we have company‑operated rental locations, data regarding car rental concessionaire activity during 2012 was available at 120 of these airports. Based upon the latest available data, we believe that we were the largest airport car rental company, measured by aggregate airport rental revenues, at those 120 airports taken together. In the United States, we intend to maintain or expand our market share in the airport rental business. For a further description of our competitors, market share and competitive position see “—Competition” below.

Dollar and Thrifty are positioned as value car rental brands in the travel industry. The Dollar brand's main focus is serving the airport vehicle rental market, which is comprised of business and leisure travelers. The majority of its locations are on or near airport facilities. Dollar operates primarily through company-owned locations in the United States and Canada, and also licenses to independent franchisees which operate as a part of the Dollar brand system. Thrifty serves both the airport and local markets through company-owned locations and its franchisees which derive approximately 90% of their combined rental revenues from the airport market and approximately 10% from the local market.

In April 2009, we acquired certain assets of Advantage Rent A Car, or “Advantage” a brand focused on price‑oriented customers at key leisure travel destinations, and began operating the Advantage brand as part of our business. On November 19, 2012, we entered into an agreement with the Federal Trade Commission in connection with our acquisition of Dollar Thrifty to divest the Advantage brand and selected Dollar Thrifty airport concessions. On December 12, 2012, we divested the Simply Wheelz subsidiary, which owned and operated the Advantage brand, to Adreca Holdings Corp., a subsidiary of Macquarie Capital which is expected to be operated by Franchise Services of North America Inc. Immediately prior to the divestiture, Advantage was operating at 62 U.S. locations, including 35 on-airport locations where Advantage held concessions.

Operations

Locations

Airport Locations

As of December 31, 2012, we had approximately 3,210 staffed rental locations in the United States, of which approximately one-fifth were airport locations and four-fifths were off-airport locations, and we regularly rent cars from approximately 1,360 other locations that are not staffed. As of December 31, 2012, we had approximately 1,215 staffed rental locations internationally, of which approximately one-fourth were airport locations and three-fourths were off-airport locations, and we regularly rent cars from approximately 150 other locations that are not staffed. Our international car rental operations have company‑operated locations in France, Australia, Italy, the United Kingdom, Germany, Spain, Canada, Brazil, the Netherlands, New Zealand, Belgium, Puerto Rico, the Czech Republic, China, Luxembourg, Slovakia and the U.S. Virgin Islands. We believe that our extensive U.S. and international network of company‑operated

ITEM 1. BUSINESS (Continued)

locations contributes to the consistency of our service, cost control, fleet utilization, yield management, competitive pricing and our ability to offer one-way rentals.

In order to operate airport rental locations, we have obtained concessions or similar leasing, licensing or permitting agreements or arrangements, or “concessions,” granting us the right to conduct a car rental business at all major, and many other airports in each country where we have company‑operated rental locations, except for airports where our licensees operate rental locations. Our concessions were obtained from the airports' operators, which are typically governmental bodies or authorities, following either negotiation or bidding for the right to operate a car rental business there. The terms of an airport concession typically require us to pay the airport's operator concession fees based upon a specified percentage of the revenues we generate at the airport, subject to a minimum annual guarantee. Under most concessions, we must also pay fixed rent for terminal counters or other leased properties and facilities. Most concessions are for a fixed length of time, while others create operating rights and payment obligations that are terminable at any time.

The terms of our concessions typically do not forbid us from seeking, and in a few instances actually require us to seek, reimbursement from customers of concession fees we pay; however, in certain jurisdictions the law limits or forbids our doing so. Where we are required or permitted to seek such reimbursement, it is our general practice to do so. The number of car rental concessions available at airports varies considerably, but, except at small, regional airports, it is rarely less than four. Certain of our concession agreements require the consent of the airport's operator in connection with material changes in our ownership. A growing number of larger airports are building consolidated airport rental car facilities to alleviate congestion at the airport. These consolidated rental facilities may eliminate certain competitive advantages among the brands as competitors operate out of one centralized facility for both customer rental and return operations, share consolidated bussing operations and maintain image standards mandated by the airports. See “Item 1A—Risk Factors” in this Annual Report.

Off-Airport Locations

In addition to our airport locations, we operate off-airport locations offering car rental services to a variety of customers. Our off-airport rental customers include people wishing to rent cars closer to home for business or leisure purposes, as well as those needing to travel to or from airports. Our off-airport customers also include people who have been referred by, or whose rental costs are being wholly or partially reimbursed by, insurance companies following accidents in which their cars were damaged, those expecting to lease cars that are not yet available from their leasing companies and those needing cars while their vehicle is being repaired or is temporarily unavailable for other reasons; we call these customers “replacement renters.” At many of our off-airport locations we will provide pick-up and delivery services in connection with rentals.

When compared to our airport rental locations, an off-airport rental location typically services the same variety of customers, uses smaller rental facilities with fewer employees, conducts pick-up and delivery services and deals with replacement renters using specialized systems and processes. In addition, on average, off-airport locations generate fewer transactions per period than airport locations. At the same time, though, our airport and off-airport rental locations employ common car fleets, are supervised by common country, regional and local area management, use many common systems and rely on common maintenance and administrative centers. Moreover, airport and off-airport locations, excluding replacement rentals, benefit from many common marketing activities and have many of the same customers. As a consequence, we regard both types of locations as aspects of a single, unitary, car rental business.

We believe that the off-airport portion of the car rental market offers opportunities for us on several levels. First, presence in the off-airport market can provide customers a more convenient and geographically extensive network of rental locations, thereby creating revenue opportunities from replacement renters, non-airline travel renters and airline travelers with local rental needs. Second, it can give us a more balanced revenue mix by reducing our reliance on airport travel and therefore limiting our exposure to external events that may disrupt airline travel trends. Third, it can produce higher fleet utilization as a result of the longer average rental periods associated with off-airport business, compared to those of airport rentals. Fourth, replacement rental volume is far less seasonal than that of other business and leisure rentals, which permits efficiencies in both fleet and labor planning. Finally, cross‑selling opportunities exist for us to promote off-airport rentals among frequent airport Hertz #1 Club Gold program renters and, conversely, to promote airport rentals to off-airport renters. In view of those benefits, along with our belief that our market share for off-airport rentals is generally smaller than our market share for airport rentals, we intend to seek profitable growth in the off-airport rental market, both in the United States and internationally.

Since January 1, 2009, we increased the number of our off-airport rental locations in the United States by 53% to approximately 2,520 locations. Our strategy includes selected openings of new off-airport locations, the disciplined evaluation of existing locations and the pursuit of same-store sales growth. We anticipate that same-store sales growth will be driven by our traditional leisure and business traveler customers and by increasing our market share in the

ITEM 1. BUSINESS (Continued)

insurance replacement market, in which we currently have a relatively low market share. In the United States during the year ended December 31, 2012, approximately one-third of our rental revenues at off-airport locations were related to replacement rentals. We believe that if we successfully pursue our strategy of profitable off-airport growth, the proportion of replacement rental revenues will increase. As we move forward, our determination of whether to continue to expand our U.S. off-airport network will be based upon a combination of factors, including, commercial activity and potential profitability as well as the concentration of target insurance company policyholders, car dealerships and auto body shops. We also intend to increase the number of our staffed off-airport rental locations internationally based on similar criteria.

Rates

We rent a wide variety of makes and models of cars. We rent cars on an hourly (in select markets), daily, weekend, weekly, monthly or multi‑month basis, with rental charges computed on a limited or unlimited mileage rate, or on a time rate plus a mileage charge. Our rates vary at different locations depending on local market conditions and other competitive and cost factors. While cars are usually returned to the locations from which they are rented, we also allow one-way rentals from and to certain locations. In addition to car rentals and licensee fees, we generate revenues from reimbursements by customers of airport concession fees and vehicle licensing costs, fueling charges, and charges for ancillary customer products and services such as supplemental equipment (child seats and ski racks), loss or collision damage waiver, theft protection, liability and personal accident/effects insurance coverage, Hertz NeverLost navigation systems and satellite radio services.

Reservations

We accept reservations for our cars on a brand-by-brand basis, with each of our brands maintaining, and accepting reservations through, an independent Internet site. Our brands generally accept reservations only for a class of vehicles, although Hertz accepts reservations for specific makes and models of vehicles in our Prestige Collection, our Adrenaline Collection, our Green Traveler Collection and a limited number of models in high-volume, leisure‑oriented destinations. Beginning in December 2010, we made the next generation of electric vehicles available to the general public, initially through our Hertz On Demand car sharing service. Electric vehicles have been added to our fleet and are available at various cities across the U.S. such as New York, Washington D.C. and San Francisco, in Europe and in China. We plan continued deployment of electric vehicles and plug-in hybrid electric vehicles in both the U.S. and other countries throughout 2013.

When customers reserve cars for rental from us and our licensees, they may seek to do so through travel agents or third‑party travel websites. In many of those cases, the travel agent or website will utilize a third‑party operated computerized reservation system, also known as a Global Distribution System, or “GDS,” to contact us and make the reservation.

In major countries, including the United States and all other countries with company‑operated locations, customers may also reserve cars for rental from us and our licensees worldwide through local, national or toll-free telephone calls to our reservations center, directly through our rental locations or, in the case of replacement rentals, through proprietary automated systems serving the insurance industry. Additionally, we accept reservations for rentals worldwide through our websites, for us and our licensees. We also offer the ability to reserve cars through our smartphone apps for the Hertz, Dollar and Thrifty brands.

For the year ended December 31, 2012, approximately 32% of the worldwide reservations we accepted came through travel agents using GDSs, while 30% came through our websites, 17% through phone calls to our reservations center, 15% through third‑party websites and 6% through local booking sources and tour reservations. Our Dollar and Thrifty brands have historically used the Internet as their primary source of reservations. As a result, we expect the percent of our reservations that come through the Internet, particularly through our websites and third-party websites, to increase as a result of our acquisition of Dollar Thrifty.

Customer Service Offerings

At our major airport rental locations, as well as at some smaller airport and off-airport locations, customers participating in our Hertz #1 Club Gold program are able to rent vehicles in an expedited manner. In the United States, participants in our Hertz #1 Club Gold program often bypass the rental counter entirely and proceed directly to their vehicles upon arrival at our facility. Participants in our Hertz #1 Club Gold program are also eligible to earn Gold Plus Rewards points that may be redeemed for free rental days. For the year ended December 31, 2012, rentals by Hertz #1 Club Gold members accounted for approximately 37% of our worldwide rental transactions. We believe the Hertz #1 Club Gold program provides a significant competitive advantage to us, particularly among frequent travelers, and we have, through travel industry relationships, targeted such travelers for participation in the program.

ITEM 1. BUSINESS (Continued)

Hertz has introduced a number of customer service offerings in recent years in order to further differentiate itself from the competition. The most significant new offering was Gold Choice. Hertz Gold Choice now offers our customers an option to choose the car they drive. As is the case with participants in our Hertz #1 Club Gold program, Gold Choice offers customers a preassigned car, but also allows customers to choose a different model and color from those cars available at the new Gold Choice area. This service is free of charge to Hertz #1 Club Gold customers who book a midsize class or above. The Gold Choice program was launched during August 2011 and rolled out to 52 U.S. airport locations and 5 locations in Europe by December 2012. Additionally, in select locations customers can bypass the rental line to rent through our ExpressRent Kiosks.

Global Car-Sharing

In late 2008, we introduced a global car-sharing service, now referred to as Hertz On Demand, which rents cars by the hour and/or by the day, at various locations in the U.S., Canada and Europe. Hertz On Demand allows customers to sign up for free for the service and to rent cars by the hour or by the day. Members reserve vehicles online, then pick up the vehicles at various locations throughout a city, at a university or a corporate campus without the need to visit a Hertz rental office. Customers are charged an hourly or daily car-rental fee which includes fuel, insurance, 24/7 roadside assistance, in-car customer service and 180 miles per 24 hour period.

Fleet Leasing and Management Services

On September 1, 2011, Hertz acquired 100% of the equity of Donlen, a leading provider of fleet leasing and management services for corporate fleets. For the year ended December 31, 2012 and for the four months ended December 31, 2011 (period it was owned by Hertz), Donlen had an average of approximately 150,800 and 137,000 vehicles under lease and management, respectively. Donlen provides Hertz an immediate leadership position in long-term car, truck and equipment leasing and fleet management. Donlen's fleet management programs provide outsource solutions to reduce fleet operating costs and improve driver productivity. These programs include administration of preventive maintenance, advisory services, and fuel and accident management along with other complementary services. This transaction is part of the overall growth strategy of Hertz to provide the most flexible transportation programs for corporate and general consumers. Additionally, Donlen brings to Hertz a specialized consulting and technology expertise that will enable us to model, measure and manage fleet performance more effectively and efficiently.

Customers and Business Mix

We categorize our car rental business based on two primary criteria: the purpose for which customers rent from us (business or leisure) and the type of location from which they rent (airport or off-airport). The table below sets forth, for the year ended December 31, 2012, the percentages of rental revenues and rental transactions in our U.S. and international operations derived from business and leisure rentals and from airport and off-airport rentals. |

| | | | | | | | | | | |

| | Year ended December 31, 2012 |

| | U.S. | | International |

| | Revenues | | Transactions | | Revenues | | Transactions |

| Type of Car Rental | | | | | | | |

| By Customer: | | | | | | | |

| Business | 42 | % | | 44 | % | | 55 | % | | 58 | % |

| Leisure | 58 |

| | 56 |

| | 45 |

| | 42 |

|

| | 100 | % | | 100 | % | | 100 | % | | 100 | % |

| By Location: | | | | | | | |

| Airport | 70 | % | | 73 | % | | 49 | % | | 57 | % |

| Off-airport | 30 |

| | 27 |

| | 51 |

| | 43 |

|

| | 100 | % | | 100 | % | | 100 | % | | 100 | % |

Customers who rent from us for “business” purposes include those who require cars in connection with commercial activities, the activities of governments and other organizations or for temporary vehicle replacement purposes. Most business customers rent cars from us on terms that we have negotiated with their employers or other entities with which they are associated, and those terms can differ substantially from the terms on which we rent cars to the general public. We have negotiated arrangements relating to car rental with many large businesses, governments and other organizations, including most Fortune 500 companies.

Customers who rent from us for “leisure” purposes include not only individual travelers booking vacation travel rentals with us but also people renting to meet other personal needs. Leisure rentals, generally, are longer in duration and generate more revenue per transaction than do business rentals, although some types of business rentals, such as

ITEM 1. BUSINESS (Continued)

rentals to replace temporarily unavailable cars, have a long average duration. Also included in leisure rentals are rentals by customers of U.S. and international tour operators, which are usually a part of tour packages that can also include air travel and hotel accommodations. Business rentals and leisure rentals have different characteristics and place different types of demands on our operations. We believe that maintaining an appropriate balance between business and leisure rentals is important to the profitability of our business and the consistency of our operations. Following our acquisition of Dollar Thrifty, we expect U.S. airport leisure business as a percentage of our worldwide car rental revenue to increase.

Our business and leisure customers rent from both our airport and off-airport locations. Demand for airport rentals is correlated with airline travel patterns, and transaction volumes generally follow enplanement and GDP trends on a global basis. Customers often make reservations for airport rentals when they book their flight plans, which make our strong relationships with travel agents, associations and other partners (e.g., airlines) a key competitive advantage in generating consistent and recurring revenue streams.

Off-airport rentals typically involve people wishing to rent cars closer to home for business or leisure purposes, as well as those needing to travel to or from airports. This category also includes people who have been referred by, or whose rental costs are being wholly or partially reimbursed by, insurance companies because their cars have been damaged. In order to attract these renters, we must establish agreements with the referring insurers establishing the relevant rental terms, including the arrangements made for billing and payment. While we estimate our share of the insurance replacement rental market was approximately 13% of the estimated insurance rental revenue volume for the year ended December 31, 2012, we have identified approximately 200 insurance companies, ranging from local or regional carriers to large, national companies, as our target insurance replacement market. As of December 31, 2012, we were a preferred or recognized supplier of 181 of these approximately 200 insurance companies and a co-primary at 39 of these approximately 200 insurance companies.

We conduct active sales and marketing programs to attract and retain customers. Our commercial and travel industry sales force calls on companies and other organizations whose employees and associates need to rent cars for business purposes. In addition, our sales force works with membership associations, tour operators, travel companies and other groups whose members, participants and customers rent cars for either business or leisure purposes. A specialized sales force calls on companies with replacement rental needs, including insurance and leasing companies and car dealers. We also advertise our car rental offerings through a variety of traditional media channels, such as television and newspapers, direct mail and the Internet. In addition to advertising, we also conduct a variety of other forms of marketing and promotion, including travel industry business partnerships and press and public relations activities.

In almost all cases, when we rent a car, we rent it directly to an individual who is identified in a written rental agreement that we prepare. Except when we are accommodating someone who cannot drive, the individual to whom we rent a car is required to have a valid driver's license and meet other rental criteria (including minimum age and creditworthiness requirements) that vary on the basis of location and type of rental. Our rental agreements permit only licensed individuals renting the car, people signing additional authorized operator forms and certain defined categories of other individuals (such as fellow employees, parking attendants and in some cases spouses or domestic partners) to operate the car.

With rare exceptions, individuals renting cars from us are personally obligated to pay all amounts due under their rental agreements. They typically pay us with a charge, credit or debit card issued by a third party, although certain customers use a Hertz charge account that we have established for them, usually as part of an agreement between us and their employer. For the year ended December 31, 2012, all amounts charged to Hertz charge accounts established in the United States and by our international subsidiaries, were billed directly to a company or other organization or were guaranteed by a company. We also issue rental vouchers and certificates that may be used to pay rental charges, mostly for prepaid and tour-related rentals. In addition, where the law requires us to do so, we rent cars on a cash basis. For the year ended December 31, 2012, no customer accounted for more than 7.5% of our car rental revenues.

In the United States for the year ended December 31, 2012, 83% of our car rental revenues came from customers who paid us with third‑party charge, credit or debit cards, while 8% came from customers using Hertz charge accounts or direct billing, 8% came from customers using rental vouchers or another method of payment and 1% came from cash transactions.

In our international operations for the year ended December 31, 2012, 48% of our car rental revenues came from customers who paid us with third‑party charge, credit or debit cards, while 29% came from customers using Hertz charge accounts, 22% came from customers using rental vouchers or another method of payment and 1% came from cash transactions. For the year ended December 31, 2012, bad debt expense represented 0.3% of car rental revenues for our U.S. operations and 0.3% of car rental revenues for our international operations.

ITEM 1. BUSINESS (Continued)

Fleet

We believe we are one of the largest private sector purchasers of new cars in the world. During the year ended December 31, 2012, we operated a peak rental fleet in the United States of approximately 490,700 cars and a combined peak rental fleet in our international operations of approximately 177,900 cars, and in each case exclusive of our licensees' fleet and Donlen's leasing fleet. During the year ended December 31, 2012, our approximate average holding period for a rental car was eighteen months in the United States and fourteen months in our international operations.

Under our repurchase programs, the manufacturers agree to repurchase cars at a specified price or guarantee the depreciation rate on the cars during established repurchase or auction periods, subject to, among other things, certain car condition, mileage and holding period requirements. Repurchase prices under repurchase programs are based on either a predetermined percentage of original car cost and the month in which the car is returned or the original capitalized cost less a set daily depreciation amount. Guaranteed depreciation programs guarantee on an aggregate basis the residual value of the cars covered by the programs upon sale according to certain parameters which include the holding period, mileage and condition of the cars. These repurchase and guaranteed depreciation programs limit our residual risk with respect to cars purchased under the programs and allow us to determine depreciation expense in advance, however, typically the acquisition cost is higher for these program cars.

Program cars as a percentage of all cars purchased by our U.S., International and worldwide operations were as follows:

|

| | | | | | | | | | | | | | |

| | Years ended December 31, |

| | 2012 | | 2011 | | 2010 | | 2009 | | 2008 |

| U.S. | 19 | % | | 45 | % | | 54 | % | | 48 | % | | 55 | % |

| International | 53 | % | | 55 | % | | 56 | % | | 57 | % | | 59 | % |

| Worldwide | 30 | % | | 48 | % | | 55 | % | | 51 | % | | 57 | % |

Within our Donlen subsidiary, revenue earning equipment is under longer term lease agreements with our customers. These leases contain provisions whereby we have a contracted residual value guaranteed to us by the lessee, such that we do not experience any gains or losses on the disposal of these vehicles.

We have purchased a significant percentage of our car rental fleet from the following vehicle manufacturers:

|

| | | | | |

| | For the year ended December 31, 2012 |

| | U.S. | | International |

| General Motors Company | 25 | % | | 21 | % |

| Toyota Motor Company | 13 | % | | 12 | % |

| Ford Motor Company | 16 | % | | 26 | % |

| Nissan Motor Company | 16 | % | | 2 | % |

Purchases of cars are financed through cash from operations and by active and ongoing global borrowing programs. See “Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources,” in this Annual Report.

We maintain automobile maintenance centers at certain airports and in certain urban and off-airport areas, which provide maintenance facilities for our car rental fleet. Many of these facilities, which include sophisticated car diagnostic and repair equipment, are accepted by automobile manufacturers as eligible to perform and receive reimbursement for warranty work. Collision damage and major repairs are generally performed by independent contractors.

We dispose of non-program cars, as well as program cars that become ineligible for manufacturer repurchase or guaranteed depreciation programs, through a variety of disposition channels, including auctions, brokered sales, sales to wholesalers and dealers and, to a lesser extent and primarily in the United States, sales at retail through a network of 26 company‑operated car sales locations dedicated exclusively to the sale of used cars from our rental fleet.

During 2009, we launched Rent2Buy, an innovative program designed to sell used rental cars. The program was licensed to operate in 32 states as of December 31, 2012. Customers have an opportunity for a three-day test rental of a competitively priced car from our rental fleet. If the customer purchases the car, he or she is credited with up to three days of rental charges, and the purchase transaction is completed through the internet and by mail in those states where permitted.

ITEM 1. BUSINESS (Continued)

During the year ended December 31, 2012, of the cars that were not repurchased by manufacturers, we sold approximately 33% at auction, 47% through dealer direct, 13% through our Rent2Buy program or at retail locations and approximately 7% through other channels.

Licensees Under Our Hertz Brand

We believe that our extensive worldwide ownership of car rental operations contributes to the consistency of our high-quality service, cost control, fleet utilization, yield management, competitive pricing and our ability to offer one-way rentals. However, in certain U.S. and international markets, we have found it more efficient to utilize independent licensees, which rent cars that they own. Our licensees operate locations in approximately 145 countries, including most of the countries where we have company‑operated locations. See “Item 1A—Risk Factors” in this Annual Report.

We believe that our licensee arrangements are important to our business because they enable us to offer expanded national and international service and a broader one-way rental program. Licenses are issued principally by our wholly‑owned subsidiaries, under franchise arrangements to independent licensees and affiliates who are engaged in the car rental business in the United States and in many other countries.

Licensees generally pay fees based on a percentage of their revenues or the number of cars they operate. The operations of all licensees, including the purchase and ownership of vehicles, are financed independently by the licensees, and we do not have any investment interest in the licensees or their fleets. Licensees in the U.S. share in the cost of our U.S. advertising program, reservations system, sales force and certain other services. Our European and other international licensees also share in the cost of our reservations system, sales force and certain other services. In return, licensees are provided the use of the Hertz brand name, management and administrative assistance and training, reservations through our reservations channels, the Gold Plus Rewards and #1 Club Gold programs, our “Rent-it-Here/Leave-it-There” one-way rental program and other services. In addition to car rental, certain licensees outside the United States engage in car leasing, chauffeur‑driven rentals and renting camper vans under the Hertz name.

U.S. licensees ordinarily are limited as to transferability without our consent and are terminable by us only for cause or after a fixed term. Licensees in the United States may generally terminate for any reason on 90 days' notice. In Europe and certain other international jurisdictions, licensees typically do not have early termination rights. Initial license fees or the price for the sale to a licensee of a company‑owned location may be payable over a term of several years. We continue to issue new licenses and, from time to time, purchase licensee businesses.

Franchisees Under Our Dollar Thrifty Brands

Both Dollar and Thrifty sell U.S. franchises on an exclusive basis for specific geographic areas, generally outside the top 75 U.S. airport markets. Most franchisees are located at or near airports that generate a lower volume of vehicle rentals than the airports served by company-owned locations. In Canada, Dollar and Thrifty sell franchises in markets generally outside the top eight airport markets. The typical length of a franchise is ten years with a renewal option for five years if certain conditions are met. The franchisee may terminate the franchise for convenience upon 120 days written notice and Dollar and Thrifty may terminate upon breach of the agreement or for cause as defined in the agreement.

Dollar and Thrifty offer franchisees the opportunity to dual franchise in smaller U.S. and Canadian markets. Under a dual franchise, one franchisee can operate both the Dollar and the Thrifty brand, thus allowing them to generate more business in their market while leveraging fixed costs.

Dollar and Thrifty license to franchisees the use of their respective brand service marks in the vehicle rental and leasing and parking businesses. Franchisees of Dollar and Thrifty pay an initial franchise fee generally based on the population, number of airline passengers, total airport vehicle rental revenues and the level of any other vehicle rental activity in the franchised territory, as well as other factors. Dollar and Thrifty offer their respective franchisees a wide range of products and services which may not be easily or cost effectively available from other sources.

System Fees in the U.S.

Dollar - In addition to an initial franchise fee, each Dollar U.S. franchisee generally pays a system fee as a percentage of rental revenue at airport locations and off-airport operations.

Thrifty - In addition to an initial franchise fee, each Thrifty U.S. franchisee generally pays a fee as a percentage of rental revenue.

ITEM 1. BUSINESS (Continued)

System Fees in Canada

All Dollar and Thrifty Canadian franchisees, whether operating a single-brand or co-brand location, pay a monthly fee generally based on a percentage of rental revenue.

Franchisee Services and Products

Dollar and Thrifty provide their U.S. and Canadian franchisees a wide range of products and services, including reservations, marketing programs and assistance, branded supplies, image and standards, rental rate management analysis and customer satisfaction programs. Additionally, Dollar and Thrifty offer their respective franchisees centralized corporate account and tour billing and travel agent commission payments.

International

Dollar and Thrifty offer master franchises outside the U.S. and Canada, generally on a countrywide basis. Each master franchisee is permitted to operate within its franchised territory directly or through subfranchisees. At December 31, 2012, exclusive of the U.S. and Canada, Dollar had franchised locations in 60 countries and Thrifty had franchised locations in 76 countries. These locations are in Latin America, Europe, the Middle East, Africa and the Asia-Pacific regions. The Company offers franchisees the opportunity to license the rights to operate either the Dollar or the Thrifty brand or both brands in certain markets on a dual franchise or co-brand basis.

Competition

In the United States, in addition to local and regional vehicle rental companies, our principal car rental industry competitors are Avis Budget Group, Inc., or “ABG,” which currently operates the Avis and Budget brands and Enterprise Holdings, which operates the Enterprise Rent-A-Car Company, or "Enterprise," National Car Rental and Alamo brands. In the United States, the Hertz brand had the highest market share, by revenues, in 2010, 2011 and in the first eleven months of 2012 at approximately 200 of the largest airports where we have company‑operated locations.

In Europe, in addition to us, the principal pan-European participants in the car rental industry are ABG, operating the Avis and Budget brands, and Europcar. Europcar also operates the National Car Rental and Alamo brands in the United Kingdom and Germany, and through franchises in Spain, Italy and France. In certain European countries, there are also other companies and brands with substantial market shares, including Sixt AG (operating the Sixt brand) in Germany, France, Spain, the United Kingdom, Switzerland, Belgium, Netherlands and Luxembourg; and Enterprise (operating the Enterprise brand) in the United Kingdom, Ireland and Germany. In every European country, there are also national, regional or other, smaller companies operating in the airport and off-airport rentals markets. Apart from Enterprise‑branded operations, all of which Enterprise owns, the other major car rental brands are present in European car rental markets through a combination of company‑operated and franchisee‑ or licensee‑operated locations.

Competition among car rental industry participants is intense and is primarily based on price, vehicle availability and quality, service, reliability, rental locations and product innovation. We believe, however, that the prominence and service reputation of the Hertz brand, our extensive worldwide ownership of car rental operations and our commitment to innovation and service provide us with a competitive advantage. Our acquisition of Dollar and Thrifty brands adds two popular value leisure brands enabling us to compete across multiple market segments.

Worldwide Equipment Rental

Our worldwide equipment rental segment generated $1,385.4 million in revenues during the year ended December 31, 2012.

Operations

Product Offerings

We, through HERC, operate an equipment rental business in the United States, Canada, France, Spain, China and Saudi Arabia. On the basis of total revenues, we believe HERC is one of the largest equipment rental companies in the United States and Canada combined. HERC has operated in the United States since 1965.

HERC's principal business is the rental of equipment. HERC offers a broad range of equipment for rental; major categories include earthmoving equipment, material handling equipment, aerial and electrical equipment, lighting, air compressors, pumps, generators, small tools, compaction equipment and construction‑related trucks.

Ancillary to its rental business, HERC is also a dealer of certain brands of new equipment in the United States and Canada, and sells consumables such as gloves and hardhats at many of its rental locations.

HERC's comprehensive line of equipment enables it to supply equipment to a wide variety of customers from local contractors to large industrial plants. The fact that many larger companies, particularly those with industrial plant

ITEM 1. BUSINESS (Continued)

operations, now require single source vendors, not only for equipment rental, but also for management of their total equipment needs fits well with HERC's core competencies. Arrangements with such companies may include maintenance of the tools and equipment they own, supplies and rental tools for their labor force and custom management reports. HERC supports this through its dedicated in-plant operations, tool trailers and plant management systems.

Locations

As of December 31, 2012, 2011 and 2010, HERC had a total of approximately 340, 320 and 320 branches, respectively, in the U.S., Canada, France, Spain, China and Saudi Arabia.

HERC's rental locations generally are located in industrial or commercial zones. A growing number of locations have highway or major thoroughfare visibility. The typical location includes a customer service center, an equipment service area and storage facilities for equipment. The branches are built or conform to the specifications of the HERC prototype branch, which stresses efficiency, safety and environmental compliance. Most branches have stand‑alone maintenance and fueling facilities and showrooms.

HERC's broad equipment line in the United States and Canada also includes, equipment with an acquisition cost of under $10,000 per unit, ranging from air compressors and generators to small tools and accessories, in order to supply customers who are local contractors with a greater proportion of their overall equipment rental needs. As of December 31, 2012, these activities, referred to as “general rental activities,” were conducted at approximately 28% of HERC's U.S. and Canadian rental locations. Before it begins to conduct general rental activities at a location, HERC typically renovates the location to make it more appealing to walk-in customers and adds staff and equipment in anticipation of subsequent demand.

Business Initiatives

In early 2010, Hertz launched Hertz Entertainment Services, a division which provides single‑source car and equipment rental solutions to the entertainment and special events industries. Hertz Entertainment Services provides customized vehicle and equipment rental solutions to movie, film and television productions, live sports and entertainment events, and all-occasion special events, such as conventions, and fairs. Hertz Entertainment Services are tailored to fit the needs of large and small productions alike with competitive pricing and customized, monthly billing. Hertz delivers vehicles and equipment to production locations and a dedicated staff is available 24/7 to address specific client needs. Productions can also rent equipment for use at special events such as lighting, generators and other machinery.

In February 2010, HERC entered into a joint venture with Saudi Arabia based Dayim Holdings Company, Ltd. to set up equipment rental operations in the Kingdom of Saudi Arabia. The joint venture entity rents and sells equipment and tools to construction and industrial markets throughout the Kingdom of Saudi Arabia.

Customers

HERC's customers consist predominantly of commercial accounts and represent a wide variety of industries, such as construction, petrochemical, automobile manufacturing, railroad, power generation, shipbuilding and entertainment and special events. Serving a number of different industries enables HERC to reduce its dependence on a single or limited number of customers in the same business and somewhat reduces the seasonality of HERC's revenues and its dependence on construction cycles. HERC primarily targets customers in medium to large metropolitan markets. For the year ended December 31, 2012, no customer of HERC accounted for more than 1.5% of HERC's worldwide rental revenues. Of HERC's combined U.S. and Canadian rental revenues for the year ended December 31, 2012, approximately 37% were derived from customers operating in the construction industry (the majority of which were in the non-residential sector) and approximately 27% were derived from customers in the industrial business, while the remaining revenues were derived from rentals to governmental and other types of customers.

Unlike in our car rental business, where we enter into rental agreements with the end-user who will operate the cars being rented, HERC ordinarily enters into a rental agreement with the legal entity-typically a company, governmental body or other organization-seeking to rent HERC's equipment. Moreover, unlike in our car rental business, where our cars are normally picked up and dropped off by customers at our rental locations, HERC delivers much of its rental equipment to its customers' job sites and retrieves the equipment from the job sites when the rentals conclude. HERC extends credit terms to many of its customers to pay for rentals. Thus, for the year ended December 31, 2012, 95% of HERC's revenues came from customers who were invoiced by HERC for rental charges, while 5% came from customers paying with third‑party charge, credit or debit cards, cash or used another method of payment. For the year ended December 31, 2012, bad debt expense represented 0.4% of HERC's revenues.

ITEM 1. BUSINESS (Continued)

Fleet

HERC acquires its equipment from a variety of manufacturers. The equipment is typically new at the time of acquisition and is not subject to any repurchase program. The per-unit acquisition cost of units of rental equipment in HERC's fleet varies from over $200,000 to under $100. As of December 31, 2012, the average per-unit acquisition cost (excluding small equipment purchased for less than $5,000 per unit) for HERC's fleet in the United States was approximately $38,000. As of December 31, 2012, the average age of HERC's worldwide rental fleet was 43 months.

HERC disposes of its used equipment through a variety of channels, including private sales to customers and other third parties, sales to wholesalers, brokered sales and auctions.

Licensees

HERC licenses the Hertz name to equipment rental businesses in six countries in Europe, in Afghanistan and Chile. The terms of those licenses are broadly similar to those we grant to our international car rental licensees.

Competition

HERC's competitors in the equipment rental industry range from other large national companies to small regional and local businesses. In each of the six countries where HERC operates, the equipment rental industry is highly fragmented, with large numbers of companies operating on a regional or local scale. The number of industry participants operating on a national scale is, however, much smaller. HERC is one of the principal national‑scale industry participants in the U.S., Canada and France. HERC's operations in the United States represented approximately 70% of our worldwide equipment rental revenues during the year ended December 31, 2012. In the United States and Canada, the other top national‑scale industry participants are United Rentals, Inc., or “URI,” Sunbelt Rentals, Home Depot Rentals and Aggreko North America. A number of individual Caterpillar, Inc., or “CAT,” dealers also participate in the equipment rental market in the United States, Canada, France and Spain. In France, the other principal national‑scale industry participants are Loxam, Kiloutou and Laho. Aggreko also participates in the power generation rental markets in France and Spain. In China, the other principal national‑scale industry participants are Zicheng Corporation, Aggreko, Jin He Yuan, Lei Shing Hong and Far East Rental. In Saudi Arabia, the other principal national‑scale industry participants are Bin Quraya, Al Zahid Tractors (CAT), Rapid Access, Eastern Arabia and Rental Solutions & Services (RSS) Saudi Ltd.

Competition in the equipment rental industry is intense, and it often takes the form of price competition. HERC's competitors, some of which may have access to substantial capital, may seek to compete aggressively on the basis of pricing. To the extent that HERC matches downward competitor pricing without reducing our operating costs, it could have an adverse impact on our results of operations. We believe that HERC's competitive success has been primarily the product of its more than 40 years of experience in the equipment rental industry, its systems and procedures for monitoring, controlling and developing its branch network, its capacity to maintain a comprehensive rental fleet, the quality of its sales force and its established national accounts program.

Other Operations

Our wholly‑owned subsidiary, Hertz Claim Management Corporation, or “HCM,” provides claim administration services to us and, to a lesser extent, to third parties. These services include investigating, evaluating, negotiating and disposing of a wide variety of claims, including third‑party, first‑party, bodily injury, property damage, general liability and product liability, but not the underwriting of risks. HCM conducts business at five regional offices in the United States. Separate subsidiaries of ours conduct similar operations in six countries in Europe.

Seasonality

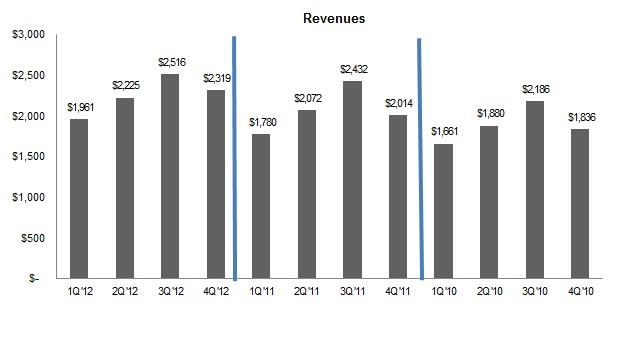

Generally, car rental and equipment rental are seasonal businesses, with decreased levels of business in the winter months and heightened activity during spring and summer. To accommodate increased demand, we increase our available fleet and staff during the second and third quarters of the year. As business demand declines, fleet and staff are decreased accordingly. However, certain operating expenses, including real estate taxes, rent, insurance, utilities, maintenance and other facility‑related expenses, the costs of operating our information technology systems and minimum staffing costs, remain fixed and cannot be adjusted for seasonal demand. Revenues related to our fleet management services are generally not seasonal. See “Item 1A—Risk Factors” in this Annual Report. The following tables set forth this seasonal effect by providing quarterly revenues for each of the quarters in the years ended December 31, 2012, 2011 and 2010 (in millions of dollars).

ITEM 1. BUSINESS (Continued)

Employees

As of December 31, 2012, we employed approximately 30,200 persons, consisting of approximately 22,500 persons in our U.S. operations and 7,700 persons in our international operations. International employees are covered by a wide variety of union contracts and governmental regulations affecting, among other things, compensation, job retention rights and pensions. Labor contracts covering the terms of employment of approximately 5,740 employees in the United States (including those in the U.S. territories) are presently in effect under approximately 145 active contracts with local unions, affiliated primarily with the International Brotherhood of Teamsters and the International Association of Machinists. Labor contracts covering approximately 1,370 of these employees will expire during 2013. We have had no material work stoppage as a result of labor problems during the last ten years, and we believe our labor relations to be good. Nonetheless, we may be unable to negotiate new labor contracts on terms advantageous to us, or without labor interruptions.

In addition to the employees referred to above, we employ a substantial number of temporary workers, and engage outside services, as is customary in the industry, principally for the non-revenue movement of rental cars and equipment between rental locations and the movement of rental equipment to and from customers' job sites.

Risk Management

Three types of generally insurable risks arise in our operations:

| |

| • | legal liability arising from the operation of our cars and on-road equipment (vehicle liability); |

| |

| • | legal liability to members of the public and employees from other causes (general liability/workers' compensation); and |

| |

| • | risk of property damage and/or business interruption and/or increased cost of working as a consequence of property damage. |

In addition, we offer optional liability insurance and other products providing insurance coverage, which create additional risk exposures for us. Our risk of property damage is also increased when we waive the provisions in our rental contracts that hold a renter responsible for damage or loss under an optional loss or damage waiver that we offer. We bear these and other risks, except to the extent the risks are transferred through insurance or contractual arrangements.