Filed Pursuant to Rule 424(b)(5)

Registration No. 333-222068

The information in this preliminary prospectus supplement is not complete and may be changed. Neither this preliminary prospectus supplement nor the accompanying prospectus is an offer to sell the securities and neither is soliciting any offer to buy the securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated August 11, 2020

PROSPECTUS SUPPLEMENT

(To Prospectus Dated December 14, 2017)

American Electric Power Company, Inc.

15,000,000 Equity Units

(Initially Consisting of 15,000,000 Corporate Units)

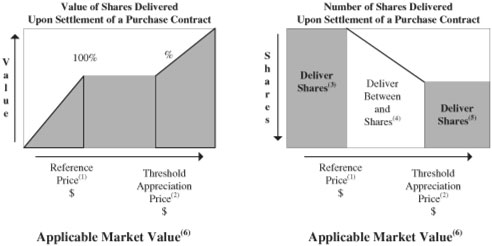

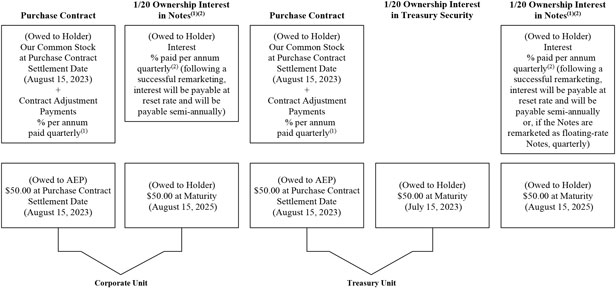

This is an offering of Equity Units (“Equity Units”) by American Electric Power Company, Inc. (“AEP”). Each Equity Unit will have a stated amount of $50.00 and initially will be in the form of a Corporate Unit (“Corporate Unit”) consisting of a purchase contract issued by AEP and a 1/20 undivided beneficial ownership interest in $1,000 principal amount of AEP’s % junior subordinated debentures due 2025, which we refer to as the Notes.

We intend to apply to list the Corporate Units on the New York Stock Exchange and expect trading to commence within 30 days of the date of initial issuance of the Corporate Units under the symbol “AEPPRC” but there is no guarantee that such listing will be approved. Prior to this offering, there has been no public market for the Corporate Units.

Our common stock is listed on the New York Stock Exchange under the symbol “AEP.” On August 10, 2020, the closing price of our common stock on the New York Stock Exchange was $85.94 per share.

INVESTING IN THESE EQUITY UNITS INVOLVES RISKS. SEE THE SECTION ENTITLED “RISK FACTORS” ON PAGE S-29 OF THIS PROSPECTUS SUPPLEMENT FOR MORE INFORMATION.

Each Corporate Unit will be issued in a stated amount of $50.00, for a total stated amount of $750,000,000. The Corporate Units are being offered to the underwriters at a price of $ per Corporate Unit (a discount of $ from the stated amount per Corporate Unit or $ total discount from the total stated amount). The Corporate Units are being offered to the public at a price of $50.00 per Corporate Unit, for a total of $750,000,000. AEP’s proceeds from the offering (after underwriting discounts of $ per Corporate Unit from the public offering price (totaling $ ) and before expenses) will equal $ per Corporate Unit, for a total of $ .

We have granted the underwriters the option to purchase from us, within the 13 day period beginning on the date we first issue the Equity Units, up to an additional 2,000,000 Corporate Units at the public offering price per Corporate Unit, less the underwriting discounts and commissions, solely to cover over-allotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the Corporate Units to purchasers in book-entry form only through The Depository Trust Company for the accounts of its participants on or about , 2020.

Joint Book-Running Managers

| | |

| J.P. Morgan | | Mizuho Securities |

Co-Managers

The date of this prospectus supplement is , 2020.