UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 28, 2024. |

| or |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to . |

Commission File Number: 000-06217

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | | 94-1672743 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| 2200 Mission College Boulevard, | Santa Clara, | California | | 95054-1549 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (408) 765-8080

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common stock, $0.001 par value | | INTC | | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every interactive data file required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | | Accelerated Filer | | Non-Accelerated Filer | | Smaller Reporting Company | Emerging Growth Company |

| ☑ | | ☐ | | ☐ | | ☐ | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 28, 2024, based upon the closing price of the common stock as reported by the Nasdaq Global Select Market on such date, was $132.4 billion. 4,330 million shares of common stock were outstanding as of January 24, 2025.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's proxy statement related to its 2025 Annual Stockholders' Meeting to be filed subsequently are incorporated by reference into Part III of this Form 10-K. Except as expressly incorporated by reference, the registrant's proxy statement shall not be deemed to be part of this report.

Table of Contents

Organization of Our Form 10-K

The order and presentation of content in our Form 10-K differs from the traditional SEC Form 10-K format. Our format is designed to improve readability and better present how we organize and manage our business. See "Form 10-K Cross-Reference Index" within the Financial Statements and Supplemental Details for a cross-reference index to the traditional SEC Form 10-K format.

We have defined certain terms and abbreviations used throughout our Form 10-K in "Key Terms" within the Financial Statements and Supplemental Details.

The preparation of our Consolidated Financial Statements is in conformity with US GAAP. Our Form 10-K includes key metrics that we use to measure our business, some of which are non-GAAP measures. See "Non-GAAP Financial Measures" within MD&A for an explanation of these measures and why management uses them and believes they provide investors with useful supplemental information.

| | | | | | | | |

| Fundamentals of Our Business | | Page |

| Availability of Company Information | | |

| Fundamental of Our Business | | |

| Our Strategy | | |

| Our Capital | | |

| | |

| Management's Discussion and Analysis | | |

| | |

| Operating Segment Trends and Results | | |

| Consolidated Results of Operations | | |

| Liquidity and Capital Resources | | |

| | |

| Critical Accounting Estimates | | |

| Non-GAAP Financial Measures | | |

| | |

| Risk Factors and Other Key Information | | |

| | |

| | |

| | |

| | |

| Risk Factors | | |

| Sales and Marketing | | |

| Quantitative and Qualitative Disclosures About Market Risk | | |

| Cybersecurity | | |

| Properties | | |

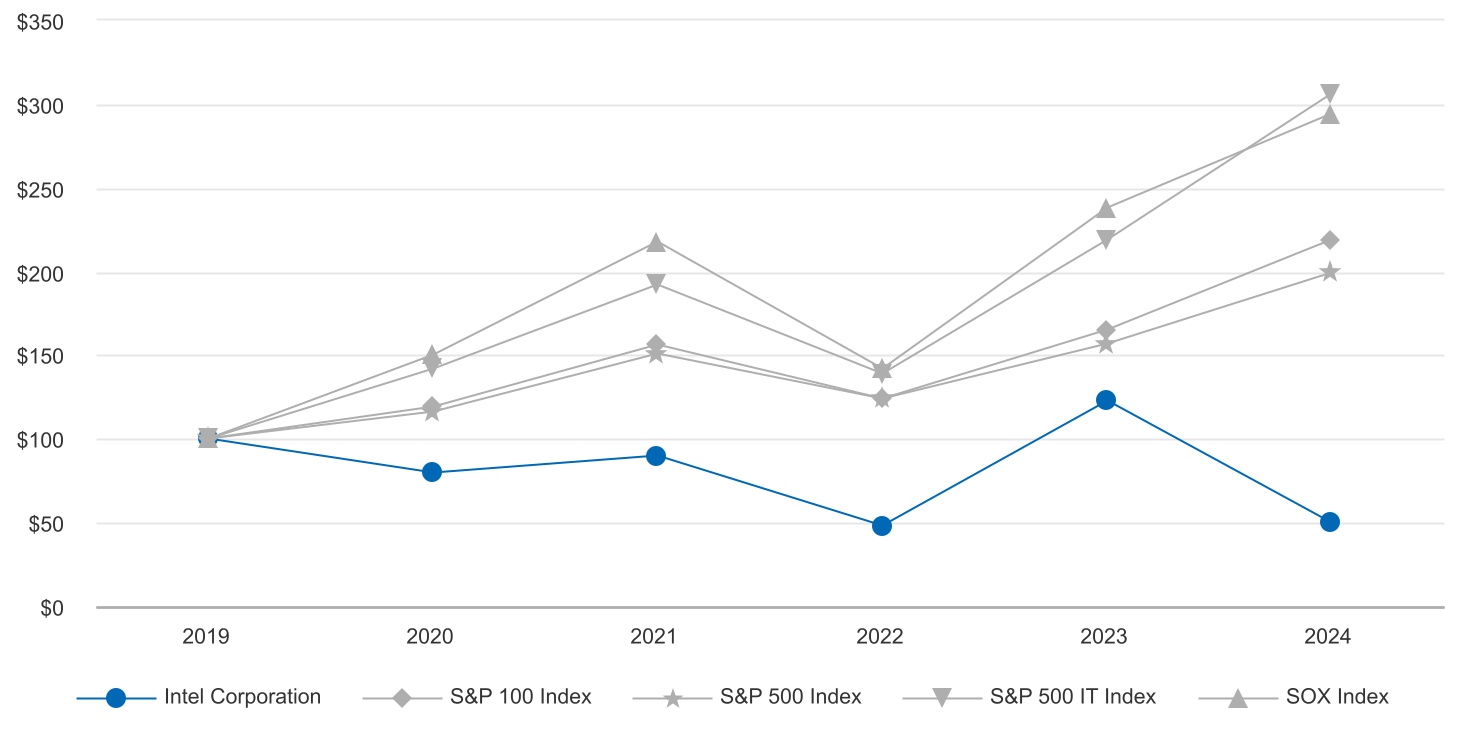

| Market for Our Common Stock | | |

| Stock Performance Graph | | |

| Issuer Purchases of Equity Securities | | |

| Rule 10b5-1 Trading Arrangements | | |

| Information About Our Executive Officers | | |

| Disclosure Pursuant to Section 13(r) of the Securities Exchange Act of 1934 | | |

| | |

| Financial Statements and Supplemental Details | | |

| Auditor's Reports | | |

| Consolidated Financial Statements | | |

| Notes to Consolidated Financial Statements | | |

| Key Terms | | |

| | |

| Controls and Procedures | | |

| Exhibits | | |

| Form 10-K Cross-Reference Index | | |

Forward-Looking Statements

This Form 10-K contains forward-looking statements that involve a number of risks and uncertainties. Words such as "accelerate", "achieve", "aim", "ambitions", "anticipate", "believe", "committed", "continue", "could", "designed", "estimate", "expect", "forecast", "future", "goals", "grow", "guidance", "intend", "likely", "may", "might", "milestones", "next generation", "objective", "on track", "opportunity", "outlook", "pending", "plan", "position", "possible", "potential", "predict", "progress", "ramp", "roadmap", "seek", "should", "strive", "targets", "to be", "upcoming", "will", "would", and variations of such words and similar expressions are intended to identify such forward-looking statements, which may include statements regarding:

▪our business plans, strategy and leadership and anticipated benefits therefrom, including with respect to our foundry strategy, Smart Capital strategy, partnerships with Apollo and Brookfield, AI strategy, organizational structure, and management, including our search for a new CEO;

▪projections of our future financial performance, including future revenue, gross margins, capital expenditures, profitability, and cash flows;

▪future cash requirements, the availability, uses, sufficiency, and cost of capital resources, and sources of funding, including for future capital and R&D investments and for returns to stockholders, and credit ratings expectations;

▪future products, services, and technologies, and the expected goals, timeline, ramps, progress, availability, production, regulation, and benefits of such products, services, and technologies, including future process nodes and packaging technology, product roadmaps, schedules, future product architectures, expectations regarding process performance, per-watt parity, and metrics, and expectations regarding product and process competitiveness;

▪projected manufacturing capacities, volumes, costs, and yield trends;

▪internal and external manufacturing plans, including manufacturing expansion projects and the financing therefor;

▪supply expectations, including regarding constraints, limitations, pricing, and industry shortages;

▪plans and goals related to Intel's foundry business, including with respect to anticipated governance, customers, future manufacturing capacity, and service, technology, and IP offerings;

▪expected timing and impact of acquisitions, divestitures, and other significant transactions, including the sale of our NAND memory business;

▪expected timing, completion and impacts of restructuring activities and cost-saving or efficiency initiatives;

▪future social and environmental performance goals, measures, strategies, and results;

▪our anticipated growth, future market share, and trends in our businesses and operations;

▪projected growth and trends in markets relevant to our businesses;

▪expectations regarding CHIPS Act funding and other governmental awards or potential future governmental incentives;

▪future technology trends and developments, such as AI;

▪future macro environmental and economic conditions;

▪geopolitical tensions and conflicts and their potential impact on our business;

▪tax- and accounting-related expectations;

▪expectations regarding our relationships with certain sanctioned parties; and

▪other characterizations of future events or circumstances.

Such statements involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied, including those associated with:

▪the high level of competition and rapid technological change in our industry;

▪the significant long-term and inherently risky investments we are making in R&D and manufacturing facilities that may not realize a favorable return;

▪the complexities and uncertainties in developing and implementing new semiconductor products and manufacturing process technologies;

▪implementing new business strategies and investing in new businesses and technologies;

▪our ability to time and scale our capital investments appropriately and successfully secure favorable alternative financing arrangements and government grants;

▪changes in demand for our products and the margins we are able to make on them;

▪macroeconomic conditions and geopolitical tensions and conflicts, including geopolitical and trade tensions between the US and China, tensions and conflict affecting Israel and the Middle East, rising tensions between mainland China and Taiwan, and the impacts of Russia's war on Ukraine;

▪the evolving market for products with AI capabilities;

▪our complex global supply chain, including from disruptions, delays, trade tensions and conflicts, or shortages;

▪product defects, errata, and other product issues, particularly as we develop next-generation products and implement next-generation manufacturing process technologies;

▪potential security vulnerabilities in our products;

▪increasing and evolving cybersecurity threats and privacy risks;

▪IP risks, including related litigation and regulatory proceedings;

▪the ongoing need to attract, retain, and motivate key talent, including engineering and management talent, as we have undertaken multiple significant headcount reductions and had significant management changes in the last few years, including our CEO;

▪strategic transactions and investments;

▪sales-related risks, including customer concentration and the use of distributors and other third parties;

▪our debt obligations and our ability to access sources of capital;

▪our having ceased to return capital to stockholders;

▪complex and evolving laws and regulations across many jurisdictions;

▪fluctuations in currency exchange rates;

▪changes in our effective tax rate;

▪catastrophic events;

▪environmental, health, safety, and product regulations;

▪our initiatives and new legal requirements with respect to corporate responsibility matters; and

▪other risks and uncertainties described in this Form 10-K and in other documents we file from time to time with the SEC.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in this Form 10-K and in other documents we file from time to time with the SEC that disclose risks and uncertainties that may affect our business.

Unless specifically indicated otherwise, the forward-looking statements in this Form 10-K do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this filing. In addition, the forward-looking statements in this Form 10-K are based on management's expectations as of the date of this filing, unless an earlier date is specified, including expectations based on third-party information and projections that management believes to be reputable. We do not undertake, and expressly disclaim any duty, to update such statements, whether as a result of new information, new developments, or otherwise, except to the extent that disclosure may be required by law.

Note Regarding Third-Party Information

This Form 10-K includes market data and certain other statistical information and estimates that are based on reports and other publications from industry analysts, market research firms, and other independent sources, as well as management's own good faith estimates and analyses. Intel believes these third-party reports to be reputable, but has not independently verified the underlying data sources, methodologies, or assumptions. The reports and other publications referenced are generally available to the public and were not commissioned by Intel. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances reflected in this information.

Intel, Arc, Intel Atom, Intel Core, Intel Evo, FlexRAN, Gaudi, the Intel logo, Intel Optane, MAX, Movidius, OpenVINO, the OpenVINO logo, Thunderbolt and the Thunderbolt logo, Intel vPro, and Xeon are trademarks of Intel Corporation or its subsidiaries.

* Other names and brands may be claimed as the property of others.

Availability of Company Information

We use our Investor Relations website, www.intc.com, as a routine channel for distribution of important, and often material, information about us, including our quarterly and annual earnings results and presentations; press releases; announcements; information about upcoming webcasts, analyst presentations, and investor days; archives of these events; financial information; corporate governance practices; and corporate responsibility information. We also post our filings on this website the same day they are electronically filed with, or furnished to, the SEC, including our annual and quarterly reports on Forms 10-K and 10-Q and current reports on Form 8-K, our proxy statements, and any amendments to those reports. All such information is available free of charge. Our Investor Relations website allows interested persons to sign up to automatically receive e-mail alerts when we post financial information and issue press releases, and to receive information about upcoming events. We encourage interested persons to follow our Investor Relations website in addition to our filings with the SEC to timely receive information about the company.

| | | | | |

| Fundamentals of Our Business | |

| |

We are a global designer and manufacturer of semiconductor products. The CPUs and other semiconductor solutions that we design, manufacture, market, and sell are incorporated in computing and related end products and services, and utilized globally by consumers, enterprises, governments, and educational organizations. Customers of our semiconductor products primarily include OEMs, ODMs, cloud service providers, and other manufacturers and service providers, such as industrial and communication equipment manufacturers and other cloud service providers who buy our products through distributor, reseller, retail, and OEM channels throughout the world. We market and sell our semiconductor products directly through our global sales and marketing organizations and indirectly through channel partners. We also develop semiconductor fabrication process and packaging technologies and manufacture many of our semiconductor product offerings at our geographically diverse network of fabrication and assembly and test facilities. We are also seeking to expand as a third-party foundry for external customers.

Technology permeates every aspect of our lives and is increasingly central to every aspect of human existence. As we look ahead to the next decade, we expect to see continued demand for processing power. Semiconductors are the underlying technology powering this digital expansion, and we are strategically positioning ourselves to create a resilient global semiconductor supply chain by investing in geographically balanced manufacturing capacity. The demand for compute is being accelerated by five superpowers: ubiquitous compute, pervasive connectivity, cloud-to-edge infrastructure, AI, and sensing. Together, these superpowers combine to amplify and reinforce each other, and increase the world's need for computing by packing even more processing capability onto ever-smaller microchips. We harness these superpowers for our customers' growth and our own.

We are uniquely positioned with the depth and breadth of our silicon, platforms, software, and packaging and process technology with at-scale manufacturing. With these strengths and the tailwinds of the superpowers driving digital disruption, our strategy to win is focused on four key themes: product competitiveness, open platforms, manufacturing at scale, and our people.

Our Priorities

Lead and democratize compute with Intel x86 and xPU. Our product offerings provide end-to-end solutions, scaling from data center to network, PCs, edge computing, and the emerging fields of AI and autonomous driving, to serve an increasingly smart and connected world.

At our core is the x86 ecosystem, which has served as a foundation of modern computing for over four decades. We continue to advance this ecosystem with x86 microarchitectures focused on performance and efficiency. In 2024, we announced the creation of an advisory group to expand the x86 ecosystem by enabling compatibility across platforms, simplifying software development, and providing developers with a platform to identify architectural needs and features to create innovative and scalable solutions for the future.

Beyond the CPU, we deliver a family of xPU products encompassing client and data center GPUs, IPUs, FPGAs, and other accelerators. The xPU approach recognizes that different workloads benefit from different computing architectures, and our broad portfolio helps meet our customers' increasingly diverse computing needs. As part of our strategy, we seek to develop and offer leading products across each of these architectural categories.

We also seek to address every phase of the AI continuum, from the largest, most challenging GenAI and large language models to emerging usages like AI PCs and AI at the edge. We believe AI represents a generational shift in computing by expanding human abilities and solving the most challenging problems. We are in the early stages of realizing AI's full potential. Our strategy is to bring AI to where the data is being generated and used. We believe we have a full spectrum of hardware and software platforms that offer the open and modular solutions for competitive total cost of ownership and time to value that customers need to win in this era of exponential growth and AI everywhere. We are infusing AI into Intel technologies, supporting today's GenAI workloads, fueling emerging usages like AI PC and AI at the edge, and pioneering innovations that we believe will help advance the future of AI in the next decade.

Our product offerings are predominantly manufactured in our own manufacturing facilities using our proprietary process technologies. In recent years, however, we have strategically utilized third-party foundry manufacturing capacity where advantageous for cost, performance, schedule, or other reasons. This provides increased flexibility and scale, including in recent years the ability to continue to offer various products at the most performant end of the product spectrum where we did not yet have comparable process technologies in-house.

We aim to deliver open software and hardware platforms with industry-defining standards. Around the globe, companies are building their networks, systems, and solutions on open standards-based platforms. We have helped set the stage for this movement, with our historic contributions in developing standards such as CXL, Thunderbolt™, and PCI Express. We also contributed to the design, build, and validation of open-source products in the industry such as Linux, Android, and others.

We deliver open-source code and optimizations that are designed for projects across numerous platforms and usage models. We are committed to co-engineering and jointly designing, building, and validating new products with software industry leaders to accelerate mutual technology advancements and help software and hardware work better together.

We manufacture a majority of our products in our own manufacturing facilities using our proprietary process technologies. This enables us to optimize performance, shorten time-to-market for new product introductions, and more quickly scale products in high volume.

Process technology. We continue to develop new generations of manufacturing process technology as we seek to realize the benefits from Moore’s Law, a law of economics predicted by Intel’s cofounder Gordon Moore more than 50 years ago. Realizing Moore’s Law results in economic benefits as we are able to either reduce a chip's cost as we shrink its size or increase functionality and performance of a chip while maintaining the same cost with higher density. This makes possible the innovation of new products with higher performance while balancing power efficiency, cost, and size to meet customers' needs. As of the end of 2024, our core products were manufactured on 300mm wafers, with a significant majority manufactured using our Intel 7 process node while we ramped our Intel 4 and Intel 3 process nodes into high volume.

Factory network. Our global factory network has been foundational to our success, enabling product optimization, improved economics, and supply resilience. We operate wafer manufacturing facilities in the United States (Oregon and Arizona), Ireland, and Israel, assembly and testing facilities in Costa Rica, China, Malaysia, and Vietnam, and packaging facilities in the United States (New Mexico), Costa Rica, Vietnam, and Malaysia. We intend to remain a leading developer of process technology and a major manufacturer of semiconductors and we plan to continue to build the majority of our products in our factories.

Foundry services. The very high capital requirements of modern leading-edge semiconductor process technology development and manufacturing, especially those nodes requiring EUV lithography such as Intel 4, Intel 3, Intel 18A and future nodes, require us to expand the use of our process technologies as they mature and grow the number of wafers produced beyond the expected growth for our own products. To this end, we are seeking to build a world-class foundry business also serving external customers and have made significant investments in ecosystem support to enable the usage of our manufacturing network by external customers. Our foundry offerings include four components: wafer fabrication, packaging, chiplets, and software and services. We intend to build our customers' silicon designs and deliver full end-to-end customizable products built with our advanced packaging technology. We plan to differentiate our foundry offerings from those of others through a combination of leading-edge packaging and process technology, committed capacity in the US and Europe available for customers globally, and a world-class IP portfolio that will include x86 cores, as well as other ecosystem IP.

Our world-class talent is at the heart of everything we do. Together we strive to have a positive effect on business, society, and the planet. Delivering on our strategy and growth ambitions requires attracting, developing, and retaining top talent from across the world. Our people build our technology, unlock new business opportunities, and work with our partners and customers to create global impact.

Fostering a culture of empowerment, inclusion, and accountability is also core to our strategy. We are committed to creating an inclusive workplace where the world’s best engineers and technologists can fulfill their dreams and create technology that improves the life of every person on the planet.

Focus on Innovation and Execution

We are focused on executing our product and process roadmaps and our cadence of innovation. We have set a detailed process and packaging technology roadmap and announced key architectural innovations to further our goal of delivering competitive products in every area in which we compete.

We leverage our Smart Capital approach to help us adjust quickly to opportunities in the market while managing our margin structure and capital spending. The key elements of Smart Capital include:

▪Smart capacity investments. We are building out future manufacturing shell space, which gives us flexibility in how and when we bring additional capacity online based on milestone triggers such as product readiness, market conditions, and customer commitments.

▪Government incentives. We work with governments to advance and benefit from incentives for domestic manufacturing capacity for leading-edge semiconductors.

▪SCIP. We access strategically aligned private capital to increase our flexibility and help efficiently accelerate and scale manufacturing build-outs. Our SCIP program has supported the period of accelerated manufacturing investment that commenced in early 2021. We signed our latest SCIP agreement in the second quarter of 2024 and are not contemplating further transactions in the near term.

▪Customer commitments. Our foundry business works closely with potential customers to obtain advance payments to secure capacity and participate in manufacturing capacity build-outs. This provides us with the advantage of committed volume, derisking investments while providing capacity corridors for our foundry customers.

▪External foundries. We intend to continue our use of external foundries where their capabilities or capacities support our Intel Products businesses offerings.

We deploy various forms of capital to execute our strategy in a way that seeks to reflect our corporate values, help our customers succeed, and create value for our stakeholders.

| | | | | | | | | | |

| | | | |

| Capital | Strategy | Value |

| | | | |

| Financial |

| | | Leverage financial capital to invest in ourselves and optimize our portfolio, both to drive our strategy and long-term value creation. | We strategically invest financial capital to continue to build our business and create long-term value for our stockholders. |

| | | | |

| | | | |

| Intellectual |

| | | Invest significantly in R&D and IP to enable us to deliver on our accelerated process technology roadmap and introduce leading x86 and xPU products. | We develop IP to enable next-generation products, create synergies across our businesses, expand into new markets, and establish and support our brands. |

| | | | |

| | | | |

| Manufacturing |

| | | Build manufacturing capacity efficiently to meet the growing long-term global demand for semiconductors. | Our geographically balanced manufacturing scope and scale enable us to provide our customers with a broad range of leading-edge products and foundry capabilities. |

| | | | |

| Human |

| | | Build a diverse, inclusive, and safe work environment to attract, develop, and retain top talent needed to build transformative products. | Our talented employees enable the development of solutions and enhance the intellectual and manufacturing capital critical to helping our customers. |

| | | | |

| | | | |

| Social and Relationship |

| | | Build trusted relationships for both Intel and our stakeholders, including employees, suppliers, customers, local communities, and governments. | We collaborate to empower communities through education and technology and advance accountability and capabilities across our global supply chain. |

| | | | |

| | | | |

| Natural |

| | | Strive to reduce our environmental footprint through efficient and responsible use of natural resources and materials used to create our products. | We seek to mitigate climate and water impacts, achieve efficiencies, lower costs, and position ourselves to respond to the expectations of our stakeholders. |

We take a disciplined approach to our financial capital allocation strategy, which continues to focus on building stakeholder value and is driven by our priority to invest in the business. We also seek to optimize our portfolio, look for innovative ways to unlock value across our assets, and, from time-to-time, engage in mergers and acquisitions.

| | | |

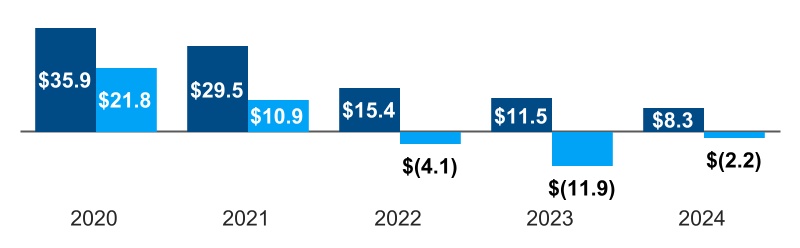

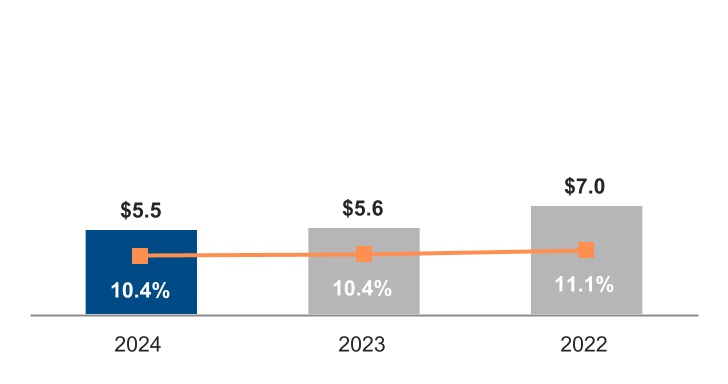

| Cash from Operating Activities $B |

| | | | | | | | |

| ■ Cash from Operating Activities | ■ Adjusted Free Cash Flow1 |

Our Financial Capital Allocation Strategy

Invest in the Business

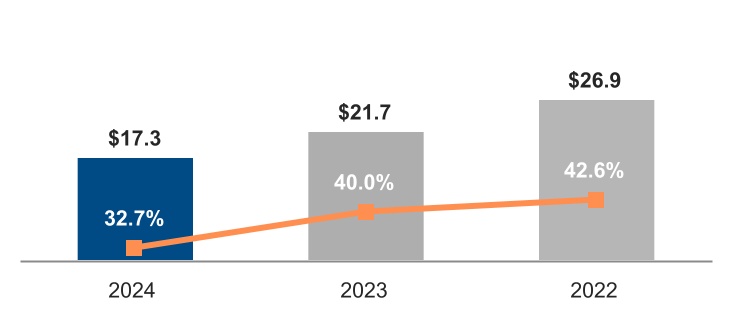

Our first allocation priority is to invest in R&D and capital spending to capitalize on the opportunity presented by the world's demand for semiconductors. In 2024, we continued our focus on capital investment and the deployment of our Smart Capital strategy.

Return Excess Cash to Stockholders

Our capital allocation strategy historically included returning excess cash to stockholders through dividends and stock repurchases. Our most recent stock repurchase was in the first quarter of 2021 and we suspended the declaration of quarterly dividends starting with the fourth quarter of 2024. We agreed under our commercial CHIPS Act agreement to forgo paying dividends for the next two years, and agreed to limitations on the payment of dividends for the three years thereafter. Further, we do not expect to pay dividends or make stock repurchases until our cash flows improve as we focus on the critical investments needed to execute our business strategy and create long-term value.

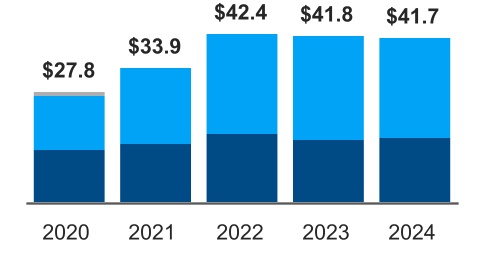

| | | | | | | | | |

| R&D and Capital Investments $B | | Cash to Stockholders $B |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | ■ R&D | ■ Logic | ■ Memory2 | | | ■ Repurchases | ■ Dividend | | |

| | |

Optimize our Portfolio and Unlock Value

We seek to drive value creation through transactions such as the 2022 IPO and 2023 secondary offering of Mobileye stock, the 2023 minority stake sales in IMS, and the 2023 announcement of our intent to operate Altera as a standalone business, which we expect to enable potential private and public equity investments. Transactions like these provide additional capital to support the critical investments needed to advance our business strategy.

Our capital allocation strategy also includes opportunistic investment in and acquisition of companies that complement our strategic objectives. We look for acquisitions that supplement and strengthen our capital and R&D investments.

Lastly, we take action when investments do not strategically align to our key priorities or provide adequate returns to our stakeholders. In the last few years, we exited numerous businesses, including our NAND Memory business (first closing in 2021 and second closing expected in March 2025) and our Intel® Optane™ memory business (2022).

1 See "Non-GAAP Financial Measures" within MD&A.

2 2021-2024 capital investments in Memory are not presented due to the divestiture of the NAND memory business which we deconsolidated upon closing the first phase of the transaction on December 29, 2021. 2020 capital investments presented include Memory.

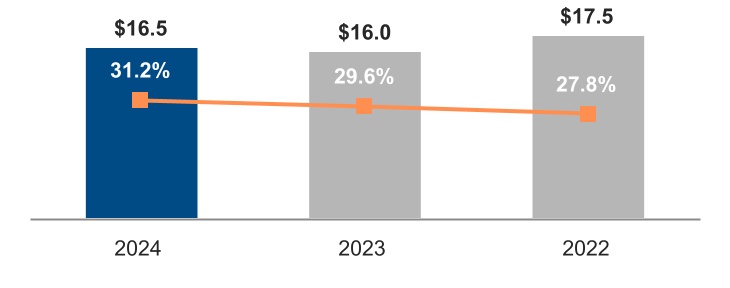

Research and Development

R&D investment is critical to enable us to deliver on our technology roadmap, introduce leading products, and develop new businesses and capabilities in the future. We seek to protect our R&D efforts through our IP rights and may augment R&D initiatives by, from time-to-time, acquiring or investing in companies, entering into R&D agreements, and directly purchasing or licensing technology.

Areas Key to Product Competitiveness

We have intensified our focus and investment on areas key to product competitiveness. Our objective with each new generation of products is to improve user experiences and value through advances in performance, power, cost, connectivity, security, form factor, and other features. We also focus on reducing our design complexity, re-using IP, and increasing ecosystem collaboration to improve our efficiency.

xPU. We believe the future is with xPU across a diverse mix of scalar, vector, matrix, and spatial architectures deployed in CPU, GPU, NPU, IPU, accelerators, and FPGA sockets, enabled by a scalable software stack and integrated into systems by advanced packaging technology. We are building processors that span several major computing architectures, moving toward an era of heterogeneous computing:

▪Client CPUs. In 2024, we ramped sales of the Intel® Core™ Ultra Series 1, our first product with an integrated neural processing unit for efficient processing of AI workload. The Intel Core Ultra Series 1, manufactured on the Intel 4 process, introduced the first AI PCs to the market. We also launched the Intel Core Ultra 200V Series, showcasing power efficiency and long-lasting battery life. The 200V Series, manufactured by an external foundry, leverages our Xe2 GPU architecture, bringing improved efficiency, second-generation ray tracing units and XMX AI acceleration to thin and light notebooks. During 2024, a significant majority of our client sales consisted of our 13th and 14th Gen Intel Core processors, manufactured on Intel 7, which allow us to serve the breadth of customer and computing needs in the client market.

▪Data center CPUs. We launched our Intel® Xeon® 6 processors for the data center, utilizing the Intel 3 process, including our first Intel Xeon processor using Efficient cores (E-cores). The Intel Xeon 6 family is designed to address the growing diversity in workloads and deployments in the data center environments. Our 5th Gen Intel Xeon Scalable processors, based on Intel 7, were launched in 2023, and continued to ramp throughout 2024.

▪Discrete client GPUs. The Intel® Arc™ graphics family offers modern GPU features to power immersive games, creator applications, and AI workloads. In 2024, we launched the Intel Arc B-Series based on the latest Xe2 GPU architecture. The compute engine of the Intel Arc B-Series is our second-generation Xe-core, which delivers 70% more performance per core and is 50% more power efficient than the Intel Arc A750.

▪Edge computing. We recently launched a suite of processors for edge computing. This includes the Intel Core Ultra 200S Series, bringing the NPU IP to desktops and reducing package power. These hybrid designs utilize our most advanced performance cores and power-efficient cores, as well as the latest packaging technology.

▪Datacenter AI accelerators and GPUs. In 2024, we launched the Intel® Gaudi® 3 AI accelerators offering significant price-performance advantages for AI inference applications.

Software. Software unleashes the potential of our hardware platforms across all workloads, domains, and architectures.

We aim to optimize AI frameworks and middleware, such as PyTorch, TensorFlow, vLLM, Hugging Face and WebNN to run efficiently on our hardware. Our OpenVINO™ toolkit is an open source toolkit that accelerates deep learning inference on our processors across various use cases, such as generative AI, computer vision, audio, and language with industry standard models. It is used in domains from edge to AI PC to cloud and is the leading inferencing library on our silicon.

In 2024 we launched the Open Platform for Enterprise AI under the Linux Foundation to accelerate deployment of generative AI use cases through industry standard modular microservice architecture. Since launch, the ecosystem has been actively engaged, with an expanding network of partners enhancing features and developing new capabilities.

Most of these frameworks and middleware are built from our oneAPI, which enables developers to create performant cross-architecture applications using a single code base across CPUs, GPUs, and other accelerators. We contributed our oneAPI specifications and implementations to the UXL Foundation under the Linux Foundation. By doing so, oneAPI delivers an open and multi-vendor programming model enabling choice and code re-use across the accelerator hardware ecosystem.

This software stack is designed to preserve the usability of existing tools and software while accommodating future developments, enabling continuity for users and developers.

Areas Key to Process and Packaging Competitiveness

Our leading-edge process and packaging technology continues to be key to the success of our strategy.

▪Intel 7 process node continues in production for our 13th and 14th Gen Intel Core processors. Intel 7 was utilized for a significant majority of our processor production and products in 2024, and is expected to continue to be utilized for a significant portion of our processor production and products in 2025.

▪Intel 4, our first EUV lithography node, delivers significant density scaling and approximately 20% performance-per-watt improvement over Intel 7. The Intel Core Ultra processor is our first high-volume client product on Intel 4 and began shipping to customers in 2023. Intel 4 moved to high-volume manufacturing in Ireland in 2024, and is expected to represent an increasing portion of our processor production and products in 2025.

▪Intel 3, our second EUV lithography node, delivers further logic scaling and up to 18% performance-per-watt improvement over Intel 4. Intel 3 is offered to external foundry customers and is optimized for the needs of data center products. This node, which is produced in the same facilities as Intel 4, was in high-volume manufacturing in Oregon during 2024, with high-volume manufacturing shifted to Ireland for 2025. Intel’s Xeon 6 Scalable server processor offerings are built on this technology.

▪Intel 18A is our next generation leading-edge process technology and has been designed to incorporate the first high volume commercial implementation of two breakthrough technologies: gate-all-around transistors and backside power. RibbonFET, our implementation of a gate-all-around transistor, is designed to deliver faster transistor switching speeds while achieving the same drive current as multiple fins, but in a smaller footprint. PowerVia is our unique industry-first implementation of backside power delivery that is designed to optimize signal transmission by eliminating the need for power routing on the front side of the wafer. Intel 18A is offered to external foundry customers and is designed to deliver improvements in performance per watt and density scaling over Intel 3. We expect to commence high-volume manufacturing of Panther Lake, our new client family of products and our first processors on Intel 18A, in 2025.

▪Intel 14A, our third advanced process technology offering to external customers, is in active development with performance-per-watt and density scaling improvements over Intel 18A.

IP Rights

We own and develop significant IP and related IP rights around the world that support our products, services, R&D, and other activities and assets. Our IP portfolio includes patents, copyrights, trade secrets, trademarks, mask works, and other rights. We actively seek to protect our global IP rights and deter unauthorized use of our IP and other assets.

We have obtained patents in the US and other countries. Because of the fast pace of innovation and product development, our products are often obsolete before the patents related to them expire, and in some cases our products may be obsolete before the patents are granted. As we expand our product offerings, particularly around our foundry business, we also seek to extend our patent development efforts. In addition to developing patents based on our own R&D efforts, we may purchase or license patents from third parties.

The software that we distribute, including software embedded in our products, is entitled to copyright and other IP protection. To distinguish our products from our competitors' products, we have obtained trademarks and trade names for our products, and we maintain cooperative advertising programs with customers to promote our brands and to identify products containing genuine Intel components. We also protect details about our processes, products, and strategies as trade secrets, keeping confidential the information that we believe provides us with a competitive advantage.

Efforts to protect our IP can be difficult, particularly in countries that provide less protection to IP rights and in the absence of harmonized international IP standards. Competitors and others may already have IP rights covering similar products. There is no assurance that we will be able to obtain IP rights covering our own products or that we will be able to obtain IP licenses from other companies on favorable terms or at all. For a discussion of IP-related risks, see "Risk Factors" within Risk Factors and Other Key Information. While our IP rights are important to our success, our business as a whole is not significantly dependent on any single patent, copyright, or other IP right.

We are one of only a few companies in the world with the process technology and manufacturing facilities to produce leading-edge semiconductor logic chips.

Process Technology

Our technology development group, with its R&D and semiconductor fabrication facilities in Oregon, designs and develops each new process technology node before high-volume production is shifted to one of our high-volume manufacturing sites. With each new node, we seek improvements in performance, power efficiency, cost, and size to meet the needs of our products and of external foundry customers. The continued development of leading-edge nodes that are competitive with the offerings of other foundries requires significant ongoing capital investment as we pursue incremental improvements and refinements of existing transistor and layout designs and manufacturing technologies, such as EUV lithography, while also pursuing new transistor and layout designs, such as gate-all-around and backside power in our upcoming Intel 18A process node, and new manufacturing technologies, such as high-NA EUV lithography for use in our upcoming Intel 14A process node.

As of the end of 2024, a significant majority of our products were manufactured using our Intel 7 process node in Arizona and Israel, we successfully ramped our Intel 4 and Intel 3 process nodes as our first EUV lithography nodes and shifted high-volume production of those nodes to Ireland, and we canceled the productization of our Intel 20A process node to focus efforts on the improved version of the node, Intel 18A, that we expect to put into high-volume production in 2025 with our new client family of products code-named Panther Lake.

Manufacturing Facilities

Our geographically distributed network of semiconductor manufacturing facilities and assembly and test facilities allows us to produce advanced semiconductor logic chips in high volume. After a process technology node is developed by our technology development group, we seek to shift production to one or more high-volume manufacturing facilities. Maintaining reliable production capacity is of critical importance. Wafer and packaging manufacturing facilities take a number of years to build, making it prudent to build space ahead of demand. We refer to this strategy as "shell ahead.” As a result of the supply shocks driven by the Covid-19 pandemic and the projected growth of our products businesses, we set out to expand our capacity network beyond our existing wafer production facilities in Oregon (mostly utilized for technology development and early production on new nodes), Arizona, Ireland, and Israel to meet this demand and get to “shell ahead” status. We are in the later stages of an expansion of our wafer fabrication facilities in Ireland for our Intel 4 and Intel 3 process nodes and undertaking a significant expansion of our Arizona facility for our upcoming Intel 18A process node. We are building a new wafer production facility in Ohio and have plans for an additional new wafer production facility in Germany, but have slowed the completion of the Ohio facility and put the plans for the facility in Germany on hold as we have reassessed demand and our "shell ahead" status and sought to limit our capital expenditures given recent financial results. We have assembly and test facilities in Costa Rica, China, Malaysia, New Mexico, and Vietnam. We are expanding our facilities in New Mexico and Malaysia, though we recently reduced the extent of the expansion plans for Malaysia. We have plans for an additional assembly and test facility in Poland, but have put those plans on hold in conjunction with the delay of the facility in Germany.

Semiconductor manufacturing requires extremely sophisticated equipment, and we work closely with the tool vendors to align their roadmaps to our needs. In 2024, we made the transition from non-EUV lithography to EUV lithography with the Intel 4 and Intel 3 process nodes. EUV lithography equipment drives a higher capital investment than the preceding lithography technology.

Semiconductor manufacturing is a capital-intensive industry. Over the past four years, we have made outsized investments across three categories—technology development, manufacturing facility shells, and advanced production tools—as we aim to catch up with our leading third-party manufacturing competitor on process technology, get to "shell ahead" for our and potential future foundry customer needs, and adopt EUV lithography for our leading process nodes. In 2024, our manufacturing capital expenditures, inclusive of technology development, were distributed 55% in manufacturing facility space and 45% in equipment.

To moderate the impact to our balance sheet and cash flows, we’ve implemented what we call Smart Capital. Smart Capital includes maintaining a "shell ahead" on the longer lead time space and delaying tool purchases as long as possible ahead of high confidence demand signals while leveraging capital offsets from governments, financial partners, and customers.

We work closely with governments in the regions where we operate to obtain government incentives to support leading-edge semiconductor R&D and manufacturing in those regions. Such incentives are often needed to offset the higher costs of operations in such regions, and support a more geographically balanced and risk-tolerant semiconductor supply chain. We worked closely with the US federal government on the implementation of the CHIPS Act in support of the semiconductor industry and American technological leadership and innovation. In 2024, we signed an agreement with the US Federal Department of Commerce for the award of up to $7.9 billion in direct funding under the commercial CHIPS Act program, which is designed to support leading-edge semiconductor manufacturing in the US, as well as an agreement under which we may receive up to $3 billion in direct funding under the CHIPS Act's Secure Enclave program, which is designed to expand the trusted manufacturing of leading-edge semiconductors for the US government. We also expect and have begun to benefit significantly from the Advanced Manufacturing Investment Credit, given that the significant portion of our R&D and manufacturing investments are made in the United States.

In 2024, as part of our SCIP program, we entered into an arrangement with Apollo in which we received a one-time capital infusion in exchange for an interest in the rights to operate Fab 34 in Leixlip, Ireland. This follows our first SCIP agreement, with Brookfield, completed in 2022 and relating to our Arizona facility expansion. In total, we expect greater than $25 billion of capital offsets through these partnerships.

Finally, as we build out our external foundry services, we expect to receive customer pre-payments to secure capacity and other benefits. Customer pre-payments are a standard practice for semiconductor manufacturers.

Supply Chain

Our supply chain is a cornerstone of our success and a critical enabler of our mission to deliver cutting-edge technology solutions to our customers. Our global supply chain supports internal partners across architecture, product design, technology development, manufacturing and operations, and sales and marketing. It encompasses thousands of suppliers worldwide, forming a robust supply ecosystem designed to enable product and process competitiveness, deliver industry-leading total cost of ownership, and enable on-time, uninterrupted supply in a responsible and sustainable manner.

Our global supply chain strategy is focused on driving a resilient, diverse, and responsible supply chain that meets the needs of our customers while upholding the highest standards of safety, quality, technology, availability, and sustainability. We work tirelessly across our supply chain to minimize disruptions, improve productivity, and optimize capacity utilization and output to meet customer expectations.

Our human capital strategy is grounded in our belief that our people are fundamental to our success. Delivering on our strategy and growth ambitions requires attracting, developing, and retaining top talent across the world. We are committed to creating an inclusive workplace where the world's best engineers and technologists can fulfill their dreams and create technology that improves the life of every person on the planet. We invest in our highly skilled workforce, which was comprised of 108,900 people as of December 28, 2024, by creating practices, programs, and benefits that support the evolving world of work and our employees' needs.

Our values—customer first, fearless innovation, results driven, one Intel, inclusion, quality, and integrity—inspire us and are key to delivering on our purpose. All employees are responsible for upholding these values, the Intel Code of Conduct, and Intel's Global Human Rights Principles, which form the foundation of our policies and practices and ethical business culture.

Talent Management

We continue to see significant competition for talent throughout the semiconductor industry. Our hiring was limited in 2024, in line with macroeconomic forecasts, financial performance, and cost-reduction measures, and we took headcount actions in connection with our 2024 Restructuring Plan that are expected to result in an approximate 15% decrease in our core Intel workforce by early 2025. However, the investments we are making to accelerate our process technology require continued and focused efforts to attract and retain talent—especially technical talent. Our undesired turnover rate1 was 5.9% in 2024 and 5.6% in 2023.

We invest resources to develop the talent needed to remain at the forefront of innovation and make Intel an employer of choice. We offer training programs and provide rotational assignment opportunities and have updated our job architecture to help employees create custom learning curricula for building skills and owning their careers. To further support the growth and development of our people, we offer mentoring in our technical community, drive engagement through employee resource groups, and promote health and wellness resources to all our people. Through our annual employee experience survey, employee inclusion survey, and manager development feedback survey, employees can voice their perceptions of the company, their managers, their work experiences, and their learning and development opportunities. Our employees' voices are important to enable our culture of continuous improvement, and as a result, we link a portion of our executive and employee performance bonus to year-over-year improvements of our employee experience survey results. Our performance management system is designed to support our cultural evolution and to increase our focus on disciplined execution.

Inclusion

Inclusion is a core element of Intel's values and instrumental to driving innovation and positioning us for growth. Over the past decade, we have taken actions to integrate diversity and inclusion expectations into our culture, performance and management systems, leadership expectations, and annual bonus metrics. Through our annual employee inclusion survey, employees can voice their experiences at Intel and provide feedback on how we can continue to improve. To drive accountability, we linked a portion of our executive and employee compensation to diversity and inclusion metrics in 2024.

In 2024, women represented 27.9% of our global employees, 18.3% of our senior leadership positions2, and 25.3% of our technical positions. Underrepresented minorities3, including Black/African American employees, Hispanic, and Native American employees, represented 17.8% of our US employees and 8.7% of our US senior leadership positions.

1 Undesired turnover includes all regular Intel employees who voluntarily left Intel, but does not include Intel contract employees, interns, or employees who separated from Intel due to divestiture, retirement, voluntary separation packages, death, job elimination, or redeployment, or Mobileye and other non-integrated subsidiaries employees.

2 Senior leadership is defined as salary grades 10+ or equivalent grades. Population includes all regular Intel employees but does not include Mobileye and other non-integrated subsidiaries employees.

3 Underrepresented minority population includes all regular Intel employees but does not include Mobileye and other non-integrated subsidiaries employees.

Compensation and Benefits

We structure pay, benefits, and services to meet the varying needs of our employees, helping support employee financial well-being with competitive compensation, investment opportunities, and financial resources. Our total rewards package includes market-competitive pay, broad-based stock grants and bonuses, an employee stock purchase plan, healthcare and retirement benefits, paid time off and family leave, parent reintegration, family expansion assistance, flexible work schedules, sabbaticals, and on-site services. Since 2019, we have achieved gender pay equity globally and we continue to maintain race/ethnicity pay equity in the US. We achieve pay equity by closing the gap in average pay between employees of different genders or race/ethnicity in the same or similar roles after accounting for legitimate business factors that can explain differences, such as location, time at grade level, and tenure. We have also advanced transparency in our pay and representation data by publicly releasing our EEO-1 survey pay data since 2019. We believe that our holistic approach toward pay equity, representation, and creating an inclusive culture enables us to cultivate a workplace that helps employees develop and progress in their careers at all levels. Our "hybrid-first" approach to working was informed by employees surveyed around the globe and involves the majority of our employees splitting their time between working remotely and in the office. Hybrid-first and remote work options cast a wider recruitment net and support our ambition to hire the best global talent. Currently, there is no company-wide mandate on the number of days per week employees should be on site or how they should collaborate. Our goal is to enable remote and on-site work where it drives the best output, while providing our employees with equitable access to systems, resources, and opportunities that allow them to succeed.

Health, Safety, and Wellness

We are committed to providing a safe and injury-free workplace. We regularly invest in programs designed to improve physical, mental, and social well-being. We provide access to a variety of innovative, flexible, and convenient health and wellness programs, including on-site health centers, and we aim to increase awareness of and support for mental and behavioral health. We intend to continue our efforts to build our strong safety culture and drive the global expansion of our corporate wellness program through employee education and engagement activities.

| | | | | |

| Social and Relationship Capital |

We are committed to engaging in initiatives that support our communities and help us develop trusted relationships with our stakeholders. Proactive engagement with our stakeholders and investments in social impact initiatives, including those aligned with the United Nations Sustainable Development Goals, advance our position as a leading corporate citizen and create shared value for Intel, our global supply chain, and our communities.

Economic and social. The health of our business and local economies depends in part on continued investments in innovation. We provide high-skill, high-paying jobs around the world, many of which are manufacturing and R&D jobs located in our factories. As we expand operations in both existing and new locations, we are building a pipeline of qualified workers through our talent strategy and the many investments we are making in education. We also benefit economies through our R&D ecosystem spending, sourcing activities, employee spending, and tax payments.

Human rights commitment. We are committed to maintaining and improving systems and processes to avoid causing or contributing to adverse impacts on human rights in our operations, products, and supply chain. We have established an integrated approach to managing human rights across our business, including senior-level management involvement and board-level oversight. We also meet throughout the year with external stakeholders and experts on human rights to continue to inform and evolve our human rights policies and oversight processes. While we do not always know nor can we control what products our customers create or the applications end users may develop, we do not support or tolerate our products being used to adversely impact human rights. Where we become aware of a concern that Intel products are being used by a business partner in connection with abuses of human rights, we intend to evaluate and restrict or cease business with the third party unless and until we have high confidence that Intel's products are not being used to adversely impact human rights.

Supply Chain Responsibility

We actively manage our supply chain to help reduce risk, improve product quality, achieve environmental and social goals, and improve overall performance and value creation for Intel, our customers, and our suppliers. To drive responsible and sustainable practices throughout our supply chain, we have robust programs to educate and engage suppliers that support our global manufacturing operations. We actively collaborate with other companies and lead industry initiatives on key issues such as improving transparency around climate and water impacts in the global electronics supply chain, and we are advancing collaboration across our industry on responsible minerals sourcing. Through these efforts, we help set electronics industry-wide standards, develop audit processes, and conduct training.

Over the past decade, we have directly engaged with suppliers to verify compliance and build operational capacity to address risks of forced and bonded labor and other human rights issues. We perform periodic audits and identify critical direct suppliers to engage through capability-building programs, which help suppliers build sustainability acumen and verify compliance with the Responsible Business Alliance and the Intel Code of Conduct. We also engage with indirect suppliers through our programs on forced and bonded labor, responsible minerals, and supplier diversity.

Reducing our environmental footprint as we grow helps us create efficiencies, support our communities, and respond to the needs of our stakeholders. We invest in environmental projects and set company-wide environmental goals to drive reductions in greenhouse gas emissions, energy and water use, and waste to landfills. We build energy efficiency into our products to help our customers lower their own emissions, energy usage, and costs, and we collaborate with policymakers and other stakeholders to use technology to address environmental challenges.

We continue to take action on emissions reduction strategies focused on emissions abatement, and to make additional investments in renewable electricity, process and equipment optimization, and energy conservation. In 2024, we linked a portion of the executive and employee performance bonus to our goal to reduce our 2024 Scope 1 and 2 greenhouse gas emissions by 25,000 metric tons of carbon dioxide equivalent, compared to 2023. We also focus on addressing climate change impacts upstream and downstream in the value chain. This includes improving product energy efficiency and increasing the positive impact of our products by leveraging opportunities for Intel technologies to enable other sectors of the economy to reduce their climate and energy footprints.

Energy

We focus on reducing our own climate change impact, and over the past two decades have reduced our direct and indirect greenhouse gas emissions associated with energy consumption and invested in renewable electricity and on-site alternative energy projects. In 2024, continuing our practice of linking a portion of our executive and employee performance bonus to our corporate sustainability metrics, we linked a portion of the performance bonus to our 2024 target to reach 95% renewable electricity use globally.

Water Stewardship

Water is essential to the semiconductor manufacturing process. We use ultrapure water to remove impurities from our silicon wafers, and we use fresh and reclaimed water to run our manufacturing facility systems. Our water strategy illustrates our commitment to manage water resources efficiently. In 2024, we linked a portion of our executive and employee performance bonus to our target to conserve and restore 13.5 billion gallons of water during the year.

Circular Economy and Waste Management

We have long been committed to waste management, recycling, and circular economy strategies that enable the recovery and productive re-use of waste streams. We continue to focus on opportunities to upcycle waste by improving waste segregation practices and collaborating with our suppliers to evaluate new technologies for waste recovery. In 2024, we linked a portion of our executive and employee performance bonus to our interim target to achieve a greater than 90% recycling rate of construction waste.

Governance and Disclosure

We are committed to transparency around our carbon footprint and climate risk, and use the framework developed by the TCFD to inform our disclosure on climate governance, strategy, risk management, and metrics and targets. For governance and strategy, we follow an integrated approach to address climate change, with multiple teams responsible for managing climate-related activities, initiatives, and policies, with senior-level management involvement and board-level oversight, including the Corporate Governance and Nominating Committee. We describe our overall risk management processes in our proxy statement, and describe climate-related risks and opportunities in our annual Corporate Responsibility Report, the Intel Climate Change Policy, the Intel Climate Transition Action Plan, and "Risk Factors" within this Form 10-K. In addition, our Corporate Responsibility Report includes a mapping of our disclosure to the TCFD, GRI, and SASB frameworks. The Corporate Responsibility Report and our CDP Climate Change and Water Surveys are available on our website and are published annually.1

1 The contents of our website and our Corporate Responsibility Report, Climate Change Policy, Climate Transition Action Plan, and CDP Climate Change and Water Surveys are referenced for general information only and are not incorporated by reference in this Form 10-K.

| | | | | |

| Management's Discussion and Analysis | |

| |

Overview

We are a global designer and manufacturer of semiconductor products, including CPUs and other solutions, primarily marketed and sold through our Intel Products business and manufactured via our Intel Foundry operations and other suppliers. Our customers primarily include OEMs, ODMs, cloud service providers, and other manufacturers and service providers, such as industrial and communication equipment manufacturers and other cloud service providers who buy our products through distributor, reseller, retail, and OEM channels throughout the world. We market and sell these products directly through our global sales and marketing organizations and indirectly through channel partners. We manufacture our products at our fabrication and assembly and test facilities located throughout the world. We seek to expand our Intel Foundry business as a third-party foundry for external customers.

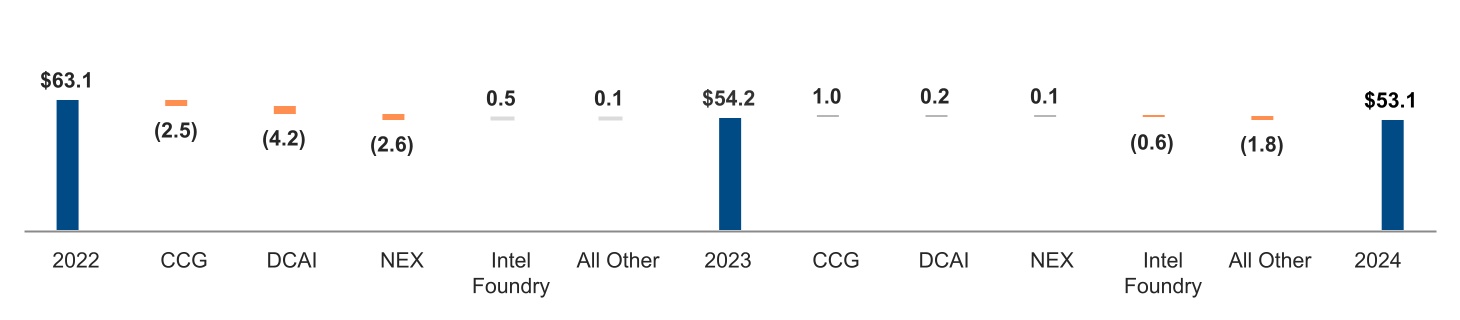

A Year in Review

2024 revenue was $53.1 billion, down $1.1 billion, or 2%, from 2023 due to lower all other revenue and lower Intel Foundry revenue, partially offset by higher Intel Products revenue. All other revenue decreased 32% from 2023, driven by lower Altera revenue due to customers tempering purchases to reduce existing inventories across all product lines and lower Mobileye revenue as customers tempered purchases to reduce existing inventories of EyeQ products. Intel Foundry external revenue decreased 60% from 2023 due to lower traditional packaging services and lower equipment sales. Intel Products revenue increased 3% from 2023 due primarily to higher CCG and DCAI revenue. CCG revenue increased 4% from 2023 primarily due to higher notebook volume compared to 2023 and was partially offset by lower other CCG revenue, which decreased from 2023 due to the exit of legacy businesses, and lower desktop revenue, which decreased on lower demand compared to 2023. DCAI revenue increased 1% from 2023 driven by higher server revenue primarily from high core count products, which increased ASPs and lowered volume compared to 2023.

Our consolidated results of operations in 2024 were meaningfully impacted by non-cash impairments and the acceleration of depreciation for certain manufacturing assets, restructuring charges resulting from our 2024 Restructuring Plan, non-cash impairments of goodwill and certain other assets, as well as non-cash charges related to a valuation allowance recognized against our US deferred tax assets. In 2024, we invested $16.5 billion in R&D, made gross capital investments of $25.1 billion, and had $8.3 billion in cash from operations and negative $2.2 billion of adjusted free cash flow1.

Our 2024 results reflect the continued advancement of our transformational journey. In 2024, our previously announced internal foundry operating model took effect, creating a foundry relationship between our Intel Products business (collectively CCG, DCAI, and NEX) and the Intel Foundry business (including Foundry Technology Development, Foundry Manufacturing and Supply Chain, and Foundry Services, formerly IFS). The foundry operating model is designed to reshape operational dynamics and drive greater transparency, accountability, and focus on costs and efficiency. In furtherance of our internal foundry operating model, we began separately reporting the financials for our Intel Products and Intel Foundry businesses in Q1 2024 and, in Q3 2024, we announced our intent to establish Intel Foundry as an independent subsidiary. We also made meaningful progress on our previously announced plan to operate Altera® as a standalone business beginning in Q1 2024, readying the business and paving the way for value capture opportunities in early 2025.

Restructuring

In 2024, we announced our intention to implement a series of cost and capital reduction initiatives designed to adjust our spending to current business trends while enabling our new operating model and continuing to fund investments in our core strategy—returning to product and process competitiveness. These initiatives, which we refer to as our 2024 Restructuring Plan, include reducing headcount, consolidating and reducing our global real estate footprint, conducting portfolio reviews of our businesses under a "clean sheet" view, rationalizing capital investments and deployments based upon demand signals and capacity requirements, and reducing our overall operating expenses. The headcount actions in connection with the 2024 Restructuring Plan are expected to result in an approximate 15% decrease in our core Intel workforce by early 2025. As a result of initiating and deploying our 2024 Restructuring Plan, we recognized restructuring charges of $2.8 billion in 2024.

Our 2024 consolidated results of operations were also materially impacted by the following:

■$3.3 billion of charges, substantially all of which were recorded to cost of sales, related to non-cash impairments and the acceleration of depreciation for certain manufacturing assets, a substantial majority of which related to our Intel 7 process node;

■$3.1 billion of non-cash charges associated with the impairment of goodwill for certain of our reporting units as well as certain acquired intangible assets (see "Note 7: Restructuring and Other Charges" within Notes to Consolidated Financial Statements); and

■$9.9 billion of non-cash charges recorded to provision for income taxes that substantially related to valuation allowances recorded to our net deferred tax assets (see "Note 8: Income Taxes" within Notes to Consolidated Financial Statements).

Segments and Prior Year Results

During 2024, we managed our business through the operating segments that are presented below and have included the 2024, 2023, and 2022 segment financial results and related discussions of our segments' results of operations. Our segments' results of operations presented below exclude the $7.0 billion of restructuring and other charges and $9.9 billion of charges resulting from valuation allowances recorded against our net deferred tax assets, in addition to certain other items, as our CODMs receive, view, and use information for decision-making purposes based upon segment results that exclude such items.

We have also included the 2024, 2023, and 2022 consolidated financial results and related discussions of our consolidated results of operations for 2024 relative to 2023 subsequent to the operating segment discussion below. A discussion regarding our consolidated results of operations for 2023 relative to 2022 is included in our 2023 Form 10-K. "Note 3: Operating Segments" within Notes to Consolidated Financial Statements of this Form 10-K reconciles our segment and consolidated results for each of the periods presented.

1 See "Non-GAAP Financial Measures" within MD&A.

| | | | | | | | | | | | | | |

| Operating Segment Trends and Results |

Intel Products

Intel Products consists substantially of the design, development, marketing, sale, support, and servicing of CPUs and related solutions for external customers. Intel Products is composed of three operating segments: CCG, DCAI, and NEX.

Client Computing Group

Market and Business Overview

Overview

We are committed to advancing PC experiences by delivering competitive products and deepening our relationships with industry partners to co-engineer and deliver leading platform innovation. We bring together the operating system, system architecture, hardware, and software application integration to enable industry-leading PC experiences. We embrace these opportunities by focusing on our roadmap, delivering innovative PC capabilities, and designing advanced PC experiences. By doing this, we believe we help fuel innovation across the industry, providing a solid source of IP, scale, and cash flow for Intel.

Market Trends and Strategy

In 2024, the PC market started to stabilize from a soft macroeconomic environment and inflationary pressures, with PC supply and demand levels beginning to normalize. We remain positive on the long-term outlook for PCs, as household density is stable to increasing, educational device penetration rates remain low outside of the US, and PC usage remains elevated compared to pre-pandemic rates1. Commercial growth opportunities also remain as corporations expand the size of their PC fleets, while also replacing older devices. Currently, more than 200 million commercial devices are more than four years old2.

We recently introduced our Intel Core Ultra processor family that serves as the CPU for the AI PC, which enables AI capabilities at the client level. We believe the AI PC is a significant potential driver of PC demand over the coming years, and believe we are well-positioned to capitalize on this trend that we expect will support a long-term PC TAM of 300 million units3.

We deliver value to our customers by leveraging our engineering capabilities and working with our partners across an open, innovative ecosystem to deliver technology that drives every major aspect of the computing experience, including performance, power efficiency, battery life, connectivity, graphics, and form factors, to create the most advanced PC platforms. We design our products with a philosophy of openness and choice, and seek to continually provide more competitive products with more capabilities for customers.

Products and Competition

In 2023, we introduced a significant update to our client compute brands to make it easier for customers to identify the right client solutions for their compute needs. Those brands include Intel, Intel Core and Intel Core Ultra. The Intel and Intel Core brands have been staples of the PC industry for nearly two decades and represented our highest volume products by unit sales in 2024. These products are designed to serve a broad cross-section of the customer and computing needs in the client market.

The Intel Core Ultra processor family, which we launched at the end of 2023, delivers significant advancements in graphics, AI, and multi-threaded CPU performance and introduced the AI PC to the market. In the second half of 2024, the next-generation Intel Core Ultra 200V Series became our highest performance client processors, with increased battery life for mobile PCs. We also introduced the Intel Core Ultra 200S Series processors, catering to the desktop enthusiast market. We remain committed to delivering the most advanced processing power to support the growing demands of AI, graphics, and multi-threaded workloads.

We operate in a particularly competitive market. In processors, we compete with Advanced Micro Devices, Inc. (AMD) and vendors who design applications processors based on ARM architecture, such as Apple Inc. (Apple) with its M series products and Qualcomm Inc. (Qualcomm) with its Snapdragon product. We expect this competitive environment to continue to intensify in 2025.

We remain committed to creating an open ecosystem to foster growth and technology innovations. We embrace and collaborate with a global ecosystem of industry partners to deliver competitive technologies together.

1 Source: Intel calculated PC density from industry analyst reports.

2 Source: Intel calculated volume of devices over four years old from industry analyst reports and internal data.

3 Source: Intel calculated multi-year TAM forecast derived from industry analyst reports.

Data Center and AI

Market and Business Overview

Overview

DCAI delivers innovative workload-optimized solutions to cloud service providers and enterprises, along with silicon devices for communications service providers, network and edge, and HPC customers. Our unique capabilities enable us to help solve our customers' most complex challenges with the depth and breadth of our hardware and software portfolio. Our global customers and partners encompass cloud hyperscalers, multinational corporations, small-and medium-sized enterprises, independent hardware and software vendors, systems integrators, communications service providers, and governments.

Market Trends and Strategy