UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

ý QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 2018

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From to

_________________________________________

Commission File Number 1-3157

INTERNATIONAL PAPER COMPANY

(Exact name of registrant as specified in its charter)

| New York | 13-0872805 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation of organization) | Identification No.) |

| 6400 Poplar Avenue, Memphis, TN | 38197 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (901) 419-7000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (paragraph 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ý | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

| Emerging growth company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange

Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The number of shares outstanding of the registrant’s common stock, par value $1.00 per share, as of October 26, 2018 was 405,028,470.

INDEX

| PAGE NO. | ||

| Condensed Consolidated Statement of Operations - Three Months and Nine Months Ended September 30, 2018 and 2017 | ||

| Condensed Consolidated Statement of Comprehensive Income - Three Months and Nine Months Ended September 30, 2018 and 2017 | ||

| Condensed Consolidated Balance Sheet - September 30, 2018 and December 31, 2017 | ||

| Condensed Consolidated Statement of Cash Flows - Nine Months Ended September 30, 2018 and 2017 | ||

PART I. FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS |

INTERNATIONAL PAPER COMPANY

Condensed Consolidated Statement of Operations

(Unaudited)

(In millions, except per share amounts)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2018 | 2017 | 2018 | 2017 | ||||||||||||

| Net Sales | $ | 5,901 | $ | 5,517 | $ | 17,355 | $ | 16,032 | |||||||

| Costs and Expenses | |||||||||||||||

| Cost of products sold | 3,887 | 3,713 | 11,757 | 11,100 | |||||||||||

| Selling and administrative expenses | 405 | 401 | 1,277 | 1,187 | |||||||||||

| Depreciation, amortization and cost of timber harvested | 335 | 350 | 990 | 1,004 | |||||||||||

| Distribution expenses | 397 | 354 | 1,166 | 1,061 | |||||||||||

| Taxes other than payroll and income taxes | 44 | 41 | 130 | 124 | |||||||||||

| Restructuring and other charges | — | — | 48 | (16 | ) | ||||||||||

| Net (gains) losses on sales and impairments of businesses | 122 | — | 122 | 9 | |||||||||||

| Litigation settlement | — | — | — | 354 | |||||||||||

| Net bargain purchase gain on acquisition of business | — | — | — | (6 | ) | ||||||||||

| Interest expense, net | 133 | 152 | 401 | 431 | |||||||||||

| Non-operating pension expense | 25 | 49 | 65 | 133 | |||||||||||

| Earnings (Loss) From Continuing Operations Before Income Taxes and Equity Earnings | 553 | 457 | 1,399 | 651 | |||||||||||

| Income tax provision (benefit) | 83 | 136 | 302 | 122 | |||||||||||

| Equity earnings (loss), net of taxes | 92 | 45 | 257 | 113 | |||||||||||

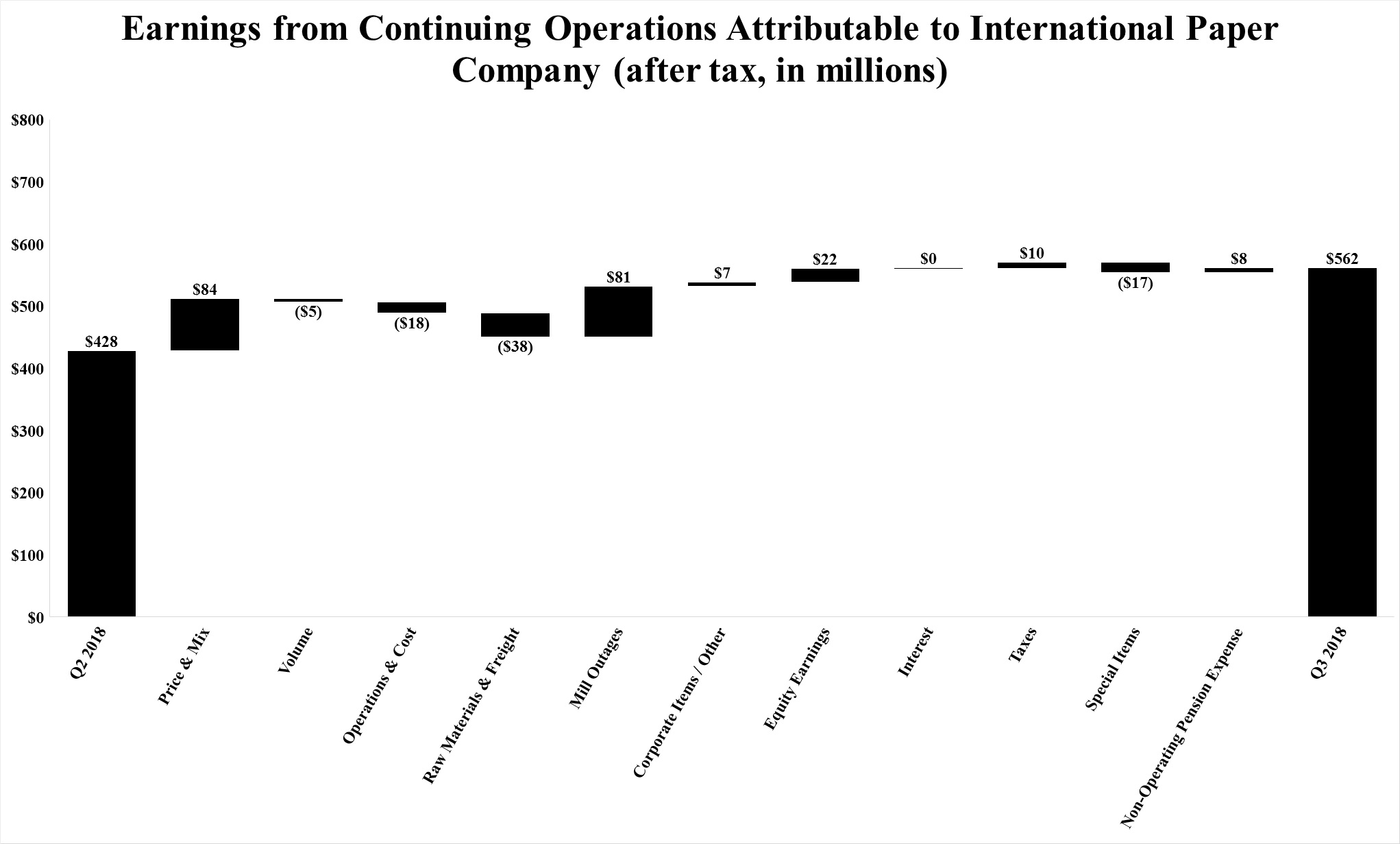

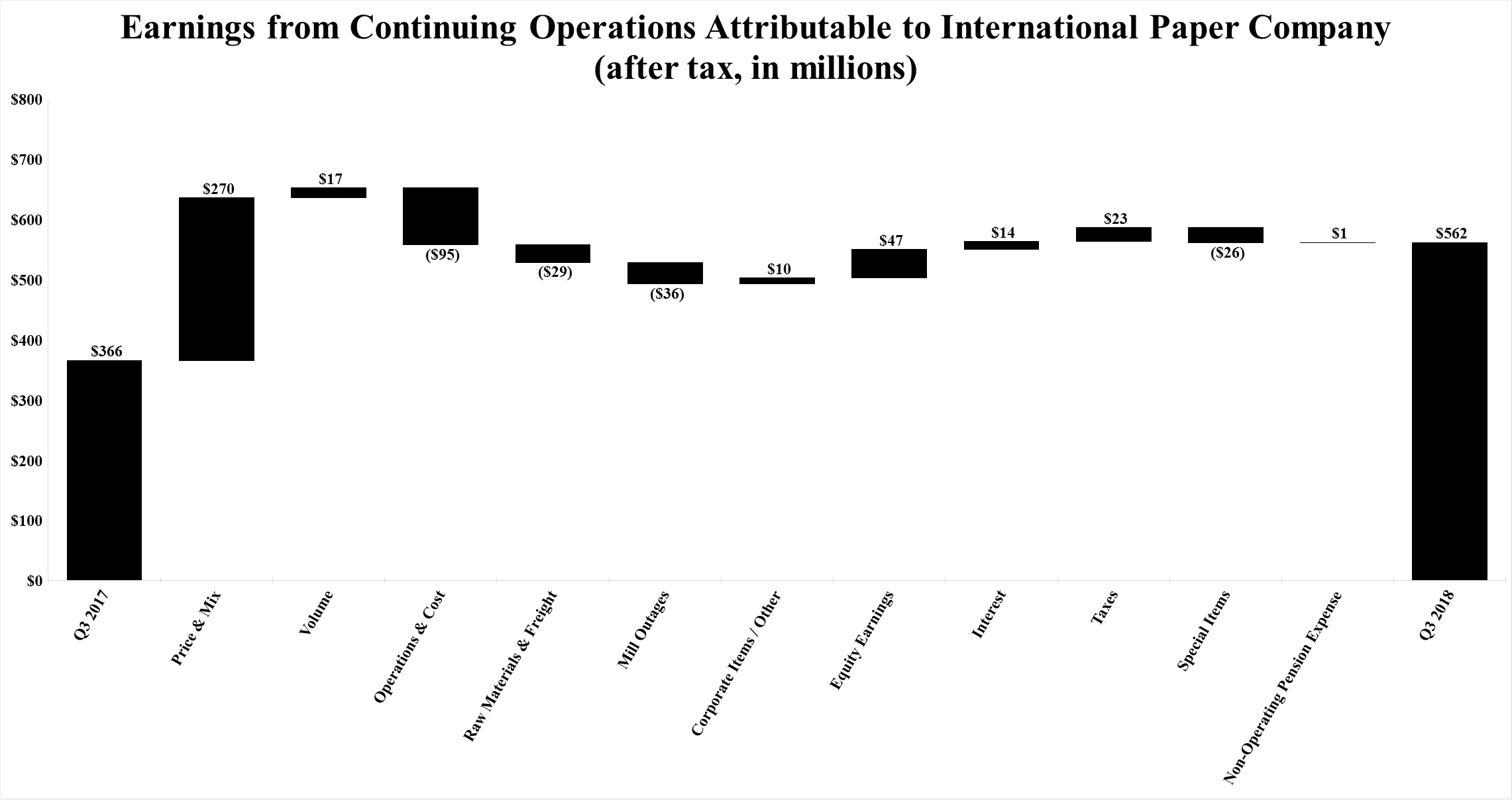

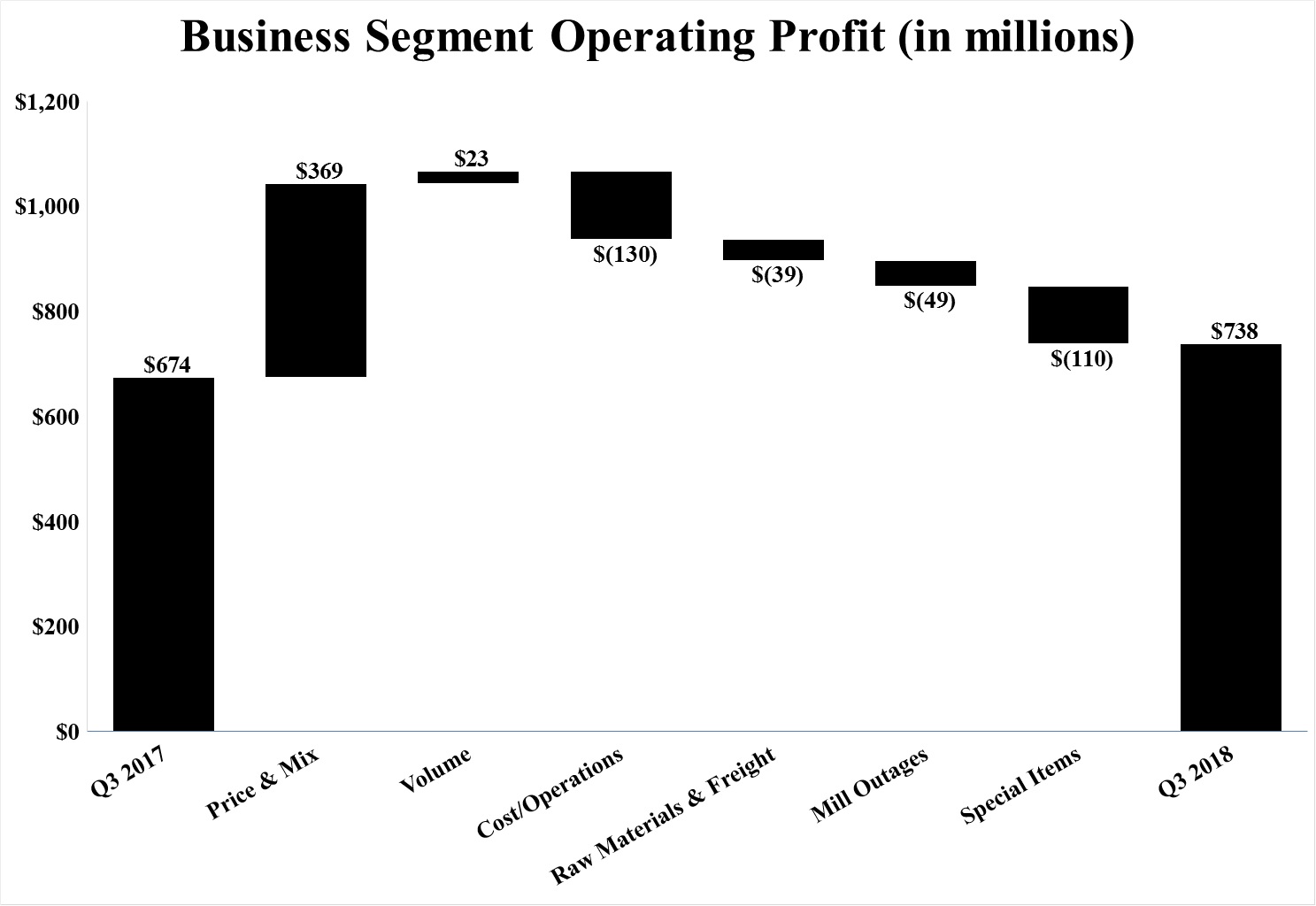

| Earnings (Loss) From Continuing Operations | 562 | 366 | 1,354 | 642 | |||||||||||

| Discontinued operations, net of taxes | — | 29 | 345 | 42 | |||||||||||

| Net Earnings (Loss) | 562 | 395 | 1,699 | 684 | |||||||||||

| Less: Net earnings (loss) attributable to noncontrolling interests | — | — | 3 | — | |||||||||||

| Net Earnings (Loss) Attributable to International Paper Company | $ | 562 | $ | 395 | $ | 1,696 | $ | 684 | |||||||

| Basic Earnings (Loss) Per Share Attributable to International Paper Company Common Shareholders | |||||||||||||||

| Earnings (loss) from continuing operations | $ | 1.38 | $ | 0.89 | $ | 3.28 | $ | 1.55 | |||||||

| Discontinued operations, net of taxes | — | 0.07 | 0.84 | 0.10 | |||||||||||

| Net earnings (loss) | $ | 1.38 | $ | 0.96 | $ | 4.12 | $ | 1.65 | |||||||

| Diluted Earnings (Loss) Per Share Attributable to International Paper Company Common Shareholders | |||||||||||||||

| Earnings (loss) from continuing operations | $ | 1.37 | $ | 0.88 | $ | 3.25 | $ | 1.54 | |||||||

| Discontinued operations, net of taxes | — | 0.07 | 0.83 | $ | 0.10 | ||||||||||

| Net earnings (loss) | $ | 1.37 | $ | 0.95 | $ | 4.08 | $ | 1.64 | |||||||

| Average Shares of Common Stock Outstanding – assuming dilution | 411.4 | 417.4 | 416.3 | 417.4 | |||||||||||

| Cash Dividends Per Common Share | $ | 0.4750 | $ | 0.4625 | $ | 1.4250 | $ | 1.3875 | |||||||

| Amounts Attributable to International Paper Company Common Shareholders | |||||||||||||||

| Earnings (loss) from continuing operations | $ | 562 | $ | 366 | $ | 1,351 | $ | 642 | |||||||

| Discontinued operations, net of taxes | — | 29 | 345 | 42 | |||||||||||

| Net earnings (loss) | $ | 562 | $ | 395 | $ | 1,696 | $ | 684 | |||||||

The accompanying notes are an integral part of these condensed financial statements.

1

INTERNATIONAL PAPER COMPANY

Condensed Consolidated Statement of Comprehensive Income

(Unaudited)

(In millions)

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2018 | 2017 | 2018 | 2017 | ||||||||||||

| Net Earnings (Loss) | $ | 562 | $ | 395 | $ | 1,699 | $ | 684 | |||||||

| Other Comprehensive Income (Loss), Net of Tax: | |||||||||||||||

| Amortization of pension and post-retirement prior service costs and net loss: | |||||||||||||||

| U.S. plans | 76 | 59 | 227 | 176 | |||||||||||

| Pension and postretirement liability adjustments: | |||||||||||||||

| Non-U.S. plans | — | — | — | 1 | |||||||||||

| Change in cumulative foreign currency translation adjustment | (87 | ) | 100 | (467 | ) | 234 | |||||||||

| Net gains/losses on cash flow hedging derivatives: | |||||||||||||||

| Net gains (losses) arising during the period | 1 | 1 | (20 | ) | 9 | ||||||||||

| Reclassification adjustment for (gains) losses included in net earnings (loss) | 2 | (2 | ) | 2 | (6 | ) | |||||||||

| Total Other Comprehensive Income (Loss), Net of Tax | (8 | ) | 158 | (258 | ) | 414 | |||||||||

| Comprehensive Income (Loss) | 554 | 553 | 1,441 | 1,098 | |||||||||||

| Net (earnings) loss attributable to noncontrolling interests | — | — | (3 | ) | — | ||||||||||

| Other comprehensive (income) loss attributable to noncontrolling interests | 2 | 1 | 4 | (1 | ) | ||||||||||

| Comprehensive Income (Loss) Attributable to International Paper Company | $ | 556 | $ | 554 | $ | 1,442 | $ | 1,097 | |||||||

The accompanying notes are an integral part of these condensed financial statements.

2

INTERNATIONAL PAPER COMPANY

Condensed Consolidated Balance Sheet

(In millions)

| September 30, 2018 | December 31, 2017 | ||||||

| (unaudited) | |||||||

| Assets | |||||||

| Current Assets | |||||||

| Cash and temporary investments | $ | 1,026 | $ | 1,018 | |||

| Accounts and notes receivable, net | 3,580 | 3,287 | |||||

| Contract assets | 383 | — | |||||

| Inventories | 2,130 | 2,313 | |||||

| Assets held for sale | — | 1,377 | |||||

| Other current assets | 199 | 282 | |||||

| Total Current Assets | 7,318 | 8,277 | |||||

| Plants, Properties and Equipment, net | 13,088 | 13,265 | |||||

| Forestlands | 388 | 448 | |||||

| Investments | 1,615 | 390 | |||||

| Financial Assets of Special Purpose Entities (Note 15) | 7,065 | 7,051 | |||||

| Goodwill | 3,371 | 3,411 | |||||

| Deferred Charges and Other Assets | 958 | 1,061 | |||||

| Total Assets | $ | 33,803 | $ | 33,903 | |||

| Liabilities and Equity | |||||||

| Current Liabilities | |||||||

| Notes payable and current maturities of long-term debt | $ | 555 | $ | 311 | |||

| Accounts payable | 2,510 | 2,458 | |||||

| Accrued payroll and benefits | 484 | 485 | |||||

| Liabilities held for sale | — | 805 | |||||

| Other accrued liabilities | 1,054 | 1,043 | |||||

| Total Current Liabilities | 4,603 | 5,102 | |||||

| Long-Term Debt | 10,700 | 10,846 | |||||

| Nonrecourse Financial Liabilities of Special Purpose Entities (Note 15) | 6,296 | 6,291 | |||||

| Deferred Income Taxes | 2,512 | 2,291 | |||||

| Pension Benefit Obligation | 1,785 | 1,939 | |||||

| Postretirement and Postemployment Benefit Obligation | 305 | 326 | |||||

| Other Liabilities | 544 | 567 | |||||

| Equity | |||||||

| Common stock, $1 par value, 2018 – 448.9 shares and 2017 – 448.9 shares | 449 | 449 | |||||

| Paid-in capital | 6,256 | 6,206 | |||||

| Retained earnings | 7,353 | 6,180 | |||||

| Accumulated other comprehensive loss | (4,887 | ) | (4,633 | ) | |||

| 9,171 | 8,202 | ||||||

| Less: Common stock held in treasury, at cost, 2018 – 43.9 shares and 2017 – 36.0 shares | 2,131 | 1,680 | |||||

| Total International Paper Shareholders’ Equity | 7,040 | 6,522 | |||||

| Noncontrolling interests | 18 | 19 | |||||

| Total Equity | 7,058 | 6,541 | |||||

| Total Liabilities and Equity | $ | 33,803 | $ | 33,903 | |||

The accompanying notes are an integral part of these condensed financial statements.

3

INTERNATIONAL PAPER COMPANY

Condensed Consolidated Statement of Cash Flows

(Unaudited)

(In millions)

| Nine Months Ended September 30, | |||||||

| 2018 | 2017 | ||||||

| Operating Activities | |||||||

| Net earnings (loss) | $ | 1,699 | $ | 684 | |||

| Depreciation, amortization and cost of timber harvested | 990 | 1,075 | |||||

| Deferred income tax provision (benefit), net | 163 | 295 | |||||

| Restructuring and other charges | 48 | (16 | ) | ||||

| Pension plan contributions | — | (1,250 | ) | ||||

| Net gain on transfer of North American Consumer Packaging business | (488 | ) | — | ||||

| Net bargain purchase gain on acquisition of business | — | (6 | ) | ||||

| Net (gains) losses on sales and impairments of businesses | 122 | 9 | |||||

| Equity method dividends received | 130 | 129 | |||||

| Equity (earnings) loss, net | (257 | ) | (113 | ) | |||

| Periodic pension expense, net | 172 | 237 | |||||

| Other, net | 75 | 92 | |||||

| Changes in current assets and liabilities | |||||||

| Accounts and notes receivable | (441 | ) | (293 | ) | |||

| Contract assets | (20 | ) | — | ||||

| Inventories | (120 | ) | (70 | ) | |||

| Accounts payable and accrued liabilities | 301 | 5 | |||||

| Interest payable | (33 | ) | (11 | ) | |||

| Other | 64 | (198 | ) | ||||

| Cash Provided By (Used For) Operations | 2,405 | 569 | |||||

| Investment Activities | |||||||

| Invested in capital projects | (1,286 | ) | (935 | ) | |||

| Acquisitions, net of cash acquired | — | (45 | ) | ||||

| Net settlement on transfer of North American Consumer Packaging business | (40 | ) | — | ||||

| Proceeds from divestitures, net of cash divested | — | 4 | |||||

| Proceeds from sale of fixed assets | 12 | 22 | |||||

| Other | 4 | (54 | ) | ||||

| Cash Provided By (Used For) Investment Activities | (1,310 | ) | (1,008 | ) | |||

| Financing Activities | |||||||

| Repurchases of common stock and payments of restricted stock tax withholding | (532 | ) | (46 | ) | |||

| Issuance of debt | 349 | 1,366 | |||||

| Reduction of debt | (242 | ) | (369 | ) | |||

| Change in book overdrafts | (33 | ) | 5 | ||||

| Dividends paid | (588 | ) | (573 | ) | |||

| Debt tender premiums paid | — | (1 | ) | ||||

| Other | — | (2 | ) | ||||

| Cash Provided By (Used For) Financing Activities | (1,046 | ) | 380 | ||||

| Effect of Exchange Rate Changes on Cash | (41 | ) | 24 | ||||

| Change in Cash and Temporary Investments | 8 | (35 | ) | ||||

| Cash and Temporary Investments | |||||||

| Beginning of period | 1,018 | 1,033 | |||||

| End of period | $ | 1,026 | $ | 998 | |||

The accompanying notes are an integral part of these condensed financial statements.

4

INTERNATIONAL PAPER COMPANY

Condensed Notes to Consolidated Financial Statements

(Unaudited)

The accompanying unaudited condensed financial statements have been prepared in conformity with accounting principles generally accepted in the United States and in accordance with the instructions to Form 10-Q and, in the opinion of management, include all adjustments that are necessary for the fair presentation of International Paper Company’s (International Paper’s, the Company’s or our) financial position, results of operations, and cash flows for the interim periods presented. Except as disclosed herein, such adjustments are of a normal, recurring nature. Results for the first nine months of the year may not necessarily be indicative of full year results. It is suggested that these condensed financial statements be read in conjunction with the audited financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, which have previously been filed with the Securities and Exchange Commission.

Intangibles

In August 2018, the FASB issued ASU 2018-15, "Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Customer's Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract." The guidance aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software (and hosting arrangements that include an internal use software license). The accounting for the service element of a hosting arrangement that is a service contract is not affected by the amendments in this guidance. This guidance is effective for annual reporting periods beginning after December 15, 2019, and interim periods within those fiscal years. Early adoption is permitted. The Company is currently evaluating the provisions of this guidance.

In January 2017, the FASB issued ASU 2017-04, "Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment." This guidance eliminates the requirement to calculate the implied fair value of goodwill under Step 2 of today's goodwill impairment test to measure a goodwill impairment charge. Instead, entities will record an impairment charge based on the excess of a reporting unit's carrying amount over its fair value. This guidance should be applied prospectively and is effective for annual reporting periods beginning after December 15, 2019, for any impairment test performed in 2020. Early adoption is permitted for annual and interim goodwill impairment testing dates after January 1, 2017. The Company is currently evaluating the provisions of this guidance; however, we do not anticipate adoption having a material impact on the financial statements.

Fair Value Measurement

In August 2018, the FASB issued ASU 2018-13, "Fair Value Measurement (Topic 820): Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement." The new guidance modifies disclosure requirements related to fair value measurement. This guidance is effective for annual reporting periods beginning after December 15, 2019, and interim periods within those years. Implementation on a prospective or retrospective basis varies by specific disclosure requirement. Early adoption is permitted. The Company is currently evaluating the provisions of this guidance.

Comprehensive Income

In February 2018, the FASB issued ASU 2018-02, "Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income." This guidance gives entities the option to reclassify stranded tax effects caused by the newly-enacted U.S. Tax Cuts and Jobs Act from accumulated other comprehensive income to retained earnings. This guidance is effective for annual reporting periods beginning after December 15, 2018, and interim periods within those years. Early adoption is permitted. The Company is currently evaluating the provisions of this guidance.

Derivatives and Hedging

In August 2017, the FASB issued ASU 2017-12, "Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities." The objective of this new guidance is the improvement of the financial reporting of hedging relationships to better portray the economic results of an entity’s risk management activities in its financial statements. In addition to that main objective, the amendments in this guidance make certain targeted improvements to simplify the

5

application of the hedge accounting guidance in current GAAP. This guidance is effective for annual reporting periods beginning after December 15, 2018, and interim periods within those years. Early adoption is permitted. The Company early adopted the provisions of this guidance on January 1, 2018, with no material impact on the financial statements.

Retirement Benefits

In August 2018, the FASB issued ASU 2018-14, "Compensation - Retirement Benefits - Defined Benefit Plans - General (Topic 715-20): Disclosure Framework — Changes to the Disclosure Requirements for Defined Benefit Plans." This guidance adds, removes, and clarifies disclosure requirements related to defined benefit pension and other postretirement plans. This guidance is effective for annual reporting periods beginning after December 15, 2020. Early adoption is permitted. This guidance should be applied on a retrospective basis to all periods presented. The Company is currently evaluating the provisions of this guidance.

The Company adopted the provision of ASU 2017-07, "Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost," on January 1, 2018. Under this new guidance, employers present the service costs component of the net periodic benefit cost in the same income statement line

items as other employee compensation costs arising from services rendered during the period. In addition, only the service cost component is eligible for capitalization in assets. Employers present the other components separately from the line items that includes the service cost and outside of any subtotal of operating income. In addition, disclosure of the lines used to present the other components of net periodic benefit cost are required if the components are not presented separately in the income statement. The following table details the impact of the retrospective adoption of this standard on the three months and nine months ended September 30, 2017, reported in the accompanying condensed consolidated statement of operations. The retrospective adoption had no impact on Net earnings (loss).

| Condensed Consolidated Statement of Operations | ||||||||||||

| Three Months Ended September 30, 2017 | ||||||||||||

| In millions | Previously Reported | Impact of Adoption Increase/(Decrease) | As Revised | |||||||||

| Cost of products sold | $ | 3,756 | $ | (43 | ) | $ | 3,713 | |||||

| Selling and administrative expenses | 407 | (6 | ) | 401 | ||||||||

| Non-operating pension expense | — | 49 | 49 | |||||||||

| Nine Months Ended September 30, 2017 | ||||||||||||

| In millions | Previously Reported | Impact of Adoption Increase/(Decrease) | As Revised | |||||||||

| Cost of products sold | $ | 11,214 | $ | (114 | ) | $ | 11,100 | |||||

| Selling and administrative expenses | 1,206 | (19 | ) | 1,187 | ||||||||

| Non-operating pension expense | — | 133 | 133 | |||||||||

Business Combinations

In January 2017, the FASB issued ASU 2017-01, "Business Combinations (Topic 805): Clarifying the Definition of a Business." Under the new guidance, an entity must first determine whether substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets. If this threshold is met, the set of transferred assets and activities is not a business. If this threshold is not met, the entity then evaluates whether the set meets the requirement that a business include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs. This guidance was effective for annual reporting periods beginning after December 15, 2017, and interim periods within those years. The Company adopted the provisions of this guidance on January 1, 2018, with no material impact on the financial statements.

Income Taxes

In October 2016, the FASB issued ASU 2016-16, "Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory." This ASU requires companies to recognize the income tax effects of intercompany sales and transfers of assets other than inventory in the period in which the transfer occurs rather than defer the income tax effects which is current practice. This new guidance was effective for annual reporting periods beginning after December 15, 2017, and interim periods within

6

those years. The guidance requires companies to apply a modified retrospective approach with a cumulative catch-up adjustment to opening retained earnings in the period of adoption. The Company adopted the provisions of this guidance on January 1, 2018, with no material impact on the financial statements.

Stock Compensation

In May 2017, the FASB issued ASU 2017-09, "Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting." This guidance clarifies when changes to the terms or conditions of a share-based payment award must be accounted for as modifications. Under this guidance, entities will apply the modification accounting guidance if the value, vesting conditions or classification of the award changes. This guidance was effective for annual reporting periods beginning after December 15, 2017, and interim periods within those years. The Company adopted the provisions of this guidance on January 1, 2018, with no material impact on the financial statements.

Leases

In February 2016, the FASB issued ASU 2016-02, "Leases Topic (842): Leases." This ASU will require most leases to be recognized on the balance sheet which will increase reported assets and liabilities. Lessor accounting will remain substantially similar to current U.S. GAAP. This ASU is effective for annual reporting periods beginning after December 15, 2018, and interim periods within those years, and mandates a modified retrospective transition method for all entities. In July 2018, the FASB issued ASU 2018-11, "Leases Topic (842): Targeted Improvements." This ASU provides companies an option to apply the transition provisions of the new lease standard at its adoption date instead of at the earliest comparative period presented in its financial statements. The Company expects to adopt the new lease guidance using the newly approved transition method. We expect to recognize a liability and corresponding asset associated with in-scope operating and finance leases but are still in the process of determining those amounts and the processes required to account for leasing activity on an ongoing basis.

The Company has formed a global implementation team, including representatives from accounting, tax, legal, global sourcing, information technology, policies and controls and operations. Surveys were developed and utilized to gather initial information regarding existing leases and the various processes that currently exist to procure, track and account for leases globally. The implementation team has selected and begun working with a third-party vendor to implement a lease accounting solution to deliver the accounting and disclosures required under the new lease accounting guidance. Initial data loads are substantially complete and preliminary testing in the system is underway.

Revenue Recognition

On January 1, 2018, the Company adopted the new revenue recognition standard ASC 606, "Revenue from Contracts With Customers," (new revenue standard) and all related amendments, using the modified retrospective method. We recognized the cumulative effect of initially applying the new revenue standard as an adjustment to the opening balance of Retained earnings. The comparative information has not been restated and continues to be reported under the accounting standards in effect for those periods.

The Company recorded a net increase to opening Retained earnings of $73 million as of January 1, 2018, due to the cumulative impact of adopting the new revenue standard, with the impact primarily related to our customized products. The impacts of the adoption of the new revenue standard on the Company's condensed consolidated financial statements were as follows:

7

| Condensed Consolidated Statement of Operations | ||||||||||||

| Three Months Ended September 30, 2018 | ||||||||||||

| In millions, except per share amounts | As Reported | Balances Without Adoption of ASC 606 | Impact of Adoption Increase/(Decrease) | |||||||||

| Net sales | $ | 5,901 | $ | 5,898 | $ | 3 | ||||||

| Cost of products sold | 3,887 | 3,885 | 2 | |||||||||

| Distribution expenses | 397 | 396 | 1 | |||||||||

| Income tax provision (benefit), net | 83 | 83 | — | |||||||||

| Earnings (loss) from continuing operations | 562 | 562 | — | |||||||||

| Net earnings (loss) | 562 | 562 | — | |||||||||

| Earnings per share attributable to International Paper Company Shareholders | ||||||||||||

| Basic | $ | 1.38 | $ | 1.38 | $ | — | ||||||

| Diluted | 1.37 | 1.37 | — | |||||||||

| Condensed Consolidated Statement of Operations | ||||||||||||

| Nine Months Ended September 30, 2018 | ||||||||||||

| In millions, except per share amounts | As Reported | Balances Without Adoption of ASC 606 | Impact of Adoption Increase/(Decrease) | |||||||||

| Net sales | $ | 17,355 | $ | 17,335 | $ | 20 | ||||||

| Cost of products sold | 11,757 | 11,748 | 9 | |||||||||

| Distribution expenses | 1,166 | 1,163 | 3 | |||||||||

| Income tax provision (benefit), net | 302 | 300 | 2 | |||||||||

| Earnings (loss) from continuing operations | 1,354 | 1,348 | 6 | |||||||||

| Net earnings (loss) | 1,699 | 1,693 | 6 | |||||||||

| Earnings per share attributable to International Paper Company Shareholders | ||||||||||||

| Basic | $ | 4.12 | $ | 4.10 | $ | 0.02 | ||||||

| Diluted | 4.08 | 4.06 | 0.02 | |||||||||

| Condensed Consolidated Balance Sheet | ||||||||||||

| September 30, 2018 | ||||||||||||

| In millions, except per share amounts | As Reported | Balances Without Adoption of ASC 606 | Impact of Adoption Increase/(Decrease) | |||||||||

| Contract assets | $ | 383 | $ | — | $ | 383 | ||||||

| Inventories | 2,130 | 2,389 | (259 | ) | ||||||||

| Other current assets | 199 | 213 | (14 | ) | ||||||||

| Other accrued liabilities | 1,054 | 1,035 | 19 | |||||||||

| Deferred income taxes | 2,512 | 2,500 | 12 | |||||||||

| Retained earnings | 7,353 | 7,274 | 79 | |||||||||

| Condensed Consolidated Statement of Cash Flows | ||||||||||||

| Nine Months Ended September 30, 2018 | ||||||||||||

| In millions, except per share amounts | As Reported | Balances Without Adoption of ASC 606 | Impact of Adoption Increase/(Decrease) | |||||||||

| Net earnings (loss) | $ | 1,699 | $ | 1,693 | $ | 6 | ||||||

| Deferred income tax provision (benefit), net | 163 | 175 | (12 | ) | ||||||||

| Contract assets | (20 | ) | — | (20 | ) | |||||||

| Inventories | (120 | ) | (128 | ) | 8 | |||||||

| Accounts payable and accrued liabilities | 301 | 298 | 3 | |||||||||

| Other | 64 | 49 | 15 | |||||||||

Historically, the Company has recognized all of its revenue on a point-in-time basis across its businesses. The trigger for International Paper's point-in-time recognition is when the customer takes title to the goods and assumes the risks and rewards

8

for the goods. As such, the adoption of ASC 606 did not have a material impact on the Company's revenue recognition for point-in-time goods. However, across the majority of our businesses, there are certain goods designed to customers' unique specifications, including customer logos and labels (customized goods). Due to the manually intensive process and significant costs that would be required to rework these products, and in many cases contractual restrictions, the Company has determined that these products do not have an alternative future use under ASC 606.

The majority of the customized goods discussed above are covered by non-cancelable purchase orders or customer agreements and the Company has determined that in most cases, it does have an enforceable right to payment for these goods. As such, the Company's adoption of ASC 606 resulted in the acceleration of revenue for customized products without an alternative future use and where the Company has a legally enforceable right to payment for production of products completed to date. The Company now records a contract asset for revenue recognized on our customized products prior to having an unconditional right to payment from the customer, which generally does not occur until title and risk of loss for the products passes to the customer.

Disaggregated Revenue

A geographic disaggregation of revenues across our company segmentation in the following tables provide information to assist in evaluating the nature, timing and uncertainty of revenue and cash flows and how they may be impacted by economic factors.

| Three Months Ended September 30, 2018 | ||||||||||||||||||||

| In millions | Industrial Packaging | Global Cellulose Fibers | Printing Papers | Corporate and Inter-segment Sales | Total | |||||||||||||||

| Primary Geographical Markets (a) | ||||||||||||||||||||

| United States | $ | 3,394 | $ | 602 | $ | 482 | $ | 52 | $ | 4,530 | ||||||||||

| EMEA | 396 | 77 | 328 | (4 | ) | 797 | ||||||||||||||

| Pacific Rim and Asia | 40 | 35 | 62 | 6 | 143 | |||||||||||||||

| Americas, other than U.S. | 204 | — | 230 | (3 | ) | 431 | ||||||||||||||

| Total | $ | 4,034 | $ | 714 | $ | 1,102 | $ | 51 | $ | 5,901 | ||||||||||

| Operating Segments | ||||||||||||||||||||

| North American Industrial Packaging | $ | 3,653 | $ | — | $ | — | $ | — | $ | 3,653 | ||||||||||

| EMEA Industrial Packaging | 311 | — | — | — | 311 | |||||||||||||||

| Brazilian Industrial Packaging | 57 | — | — | — | 57 | |||||||||||||||

| European Coated Paperboard | 87 | — | — | — | 87 | |||||||||||||||

| Global Cellulose Fibers | — | 714 | — | — | 714 | |||||||||||||||

| North American Printing Papers | — | — | 492 | — | 492 | |||||||||||||||

| Brazilian Papers | — | — | 255 | — | 255 | |||||||||||||||

| European Papers | — | — | 311 | — | 311 | |||||||||||||||

| Indian Papers | — | — | 47 | — | 47 | |||||||||||||||

| Intra-segment Eliminations | (74 | ) | — | (3 | ) | — | (77 | ) | ||||||||||||

| Corporate & Inter-segment Sales | — | — | — | 51 | 51 | |||||||||||||||

| Total | $ | 4,034 | $ | 714 | $ | 1,102 | $ | 51 | $ | 5,901 | ||||||||||

(a) Net sales are attributed to countries based on the location of the seller.

9

| Nine Months Ended September 30, 2018 | ||||||||||||||||||||

| In millions | Industrial Packaging | Global Cellulose Fibers | Printing Papers | Corporate & Intersegment | Total | |||||||||||||||

Primary Geographical Markets (a) | ||||||||||||||||||||

| United States | $ | 9,832 | $ | 1,720 | $ | 1,399 | $ | 163 | $ | 13,114 | ||||||||||

| EMEA | 1,275 | 222 | 988 | (13 | ) | 2,472 | ||||||||||||||

| Pacific Rim and Asia | 110 | 140 | 185 | 35 | 470 | |||||||||||||||

| Americas, other than U.S. | 666 | 1 | 643 | (11 | ) | 1,299 | ||||||||||||||

| Total | $ | 11,883 | $ | 2,083 | $ | 3,215 | $ | 174 | $ | 17,355 | ||||||||||

| Operating Segments | ||||||||||||||||||||

| North American Industrial Packaging | $ | 10,604 | $ | — | $ | — | $ | — | $ | 10,604 | ||||||||||

| EMEA Industrial Packaging | 1,017 | — | — | — | 1,017 | |||||||||||||||

| Brazilian Industrial Packaging | 175 | — | — | — | 175 | |||||||||||||||

| European Coated Paperboard | 265 | — | — | — | 265 | |||||||||||||||

| Global Cellulose Fibers | — | 2,083 | — | — | 2,083 | |||||||||||||||

| North American Printing Papers | — | — | 1,443 | — | 1,443 | |||||||||||||||

| Brazilian Papers | — | — | 706 | — | 706 | |||||||||||||||

| European Papers | — | — | 932 | — | 932 | |||||||||||||||

| Indian Papers | — | — | 150 | — | 150 | |||||||||||||||

| Intra-segment Eliminations | (178 | ) | — | (16 | ) | — | (194 | ) | ||||||||||||

| Corporate & Inter-segment Sales | — | — | — | 174 | 174 | |||||||||||||||

| Total | $ | 11,883 | $ | 2,083 | $ | 3,215 | $ | 174 | $ | 17,355 | ||||||||||

(a) Net sales are attributed to countries based on the location of the seller.

The nature of the Company's contracts can vary based on the business, customer type and region; however, in all instances it is International Paper's customary business practice to receive a valid order from the customer, in which each parties' rights and related payment terms are clearly identifiable.

Revenue Contract Balances

The opening and closing balances of the Company's contract assets and current contract liabilities are as follows:

| In millions | Contract Assets (Short-Term) | Contract Liabilities (Short-Term) | ||||||

| Beginning Balance - January 1, 2018 | $ | 366 | $ | 53 | ||||

| Ending Balance - September 30, 2018 | 383 | 25 | ||||||

| Increase / (Decrease) | $ | 17 | $ | (28 | ) | |||

A contract asset is created when the Company recognizes revenue on its customized products prior to having an unconditional right to payment from the customer, which generally does not occur until title and risk of loss passes to the customer.

A contract liability is created when customers prepay for goods prior to the Company transferring those goods to the customer. The contract liability is reduced once control of the goods is transferred to the customer. The majority of our customer prepayments are received during the fourth quarter each year for goods that will be transferred to customers over the following twelve months.

The difference between the opening and closing balances of the Company's contract assets and contract liabilities primarily results from the timing difference between the Company's performance and the point at which we have an unconditional right to payment or receive pre-payment from the customer, respectively.

10

Performance Obligations and Significant Judgments

International Paper's principal business is to manufacture and sell fiber-based packaging, pulp and paper goods. As a general rule, none of our businesses provide equipment installation or other ancillary services outside producing and shipping packaging, pulp and paper goods to customers.

The Company's revenue is primarily derived from fixed consideration; however, we do have contract terms that give rise to variable consideration, primarily cash discounts and volume rebates. International Paper offers early payment discounts to customers across the Company's businesses. The Company estimates the expected cash discounts and other customer refunds based on the historical experience across the Company's portfolio of customers to record reductions in revenue which is consistent with the most likely amount method outlined in ASC 606. Management has concluded that this method is the best estimate of the consideration the Company will be entitled to from its customers.

Contracts or purchase orders with customers could include a single type of product or it could include multiple types/grades of products. Regardless, the contracted price with the customer is agreed to at the individual product level outlined in the customer contracts or purchase orders. The Company does not bundle prices; however, we do negotiate with customers on pricing and rebates for the same products based on a variety of factors (e.g. level of contractual volume, geographical location, etc.). Management has concluded that the prices negotiated with each individual customer are representative of the stand-alone selling price of the product.

Generally, the Company recognizes revenue on a point in time basis when the customer takes title to the goods and assumes the risks and rewards for the goods. For customized goods where the Company has a legally enforceable right to payment for the goods, the Company recognizes revenue over time which in this case, is generally as the goods are produced.

Practical Expedients and Exemptions

As part of our adoption of the new revenue standard, the Company has elected to present all sales taxes on a net basis, account for shipping and handling activities as fulfillment activities, recognize the incremental costs of obtaining a contract as expense when incurred if the amortization period of the asset the Company would recognize is one year or less and not record interest income or interest expense when the difference in timing of control transfer and customer payment is one year or less. The election of these practical expedients results in accounting treatments consistent with our historical accounting policies and therefore, these elections and expedients do not have a material impact on comparability of our financial statements.

A summary of the changes in equity for the nine months ended September 30, 2018 and 2017 is provided below:

| Nine Months Ended September 30, | |||||||||||||||||||||||

| 2018 | 2017 | ||||||||||||||||||||||

| In millions, except per share amounts | Total International Paper Shareholders’ Equity | Noncontrolling Interests | Total Equity | Total International Paper Shareholders’ Equity | Noncontrolling Interests | Total Equity | |||||||||||||||||

| Balance, January 1 | $ | 6,522 | $ | 19 | $ | 6,541 | $ | 4,341 | $ | 18 | $ | 4,359 | |||||||||||

| Adoption of ASC 606 revenue from contracts with customers | 73 | — | 73 | — | — | — | |||||||||||||||||

| Issuance of stock for various plans, net | 112 | — | 112 | 130 | — | 130 | |||||||||||||||||

| Repurchase of stock | (532 | ) | — | (532 | ) | (46 | ) | — | (46 | ) | |||||||||||||

| Common stock dividends ($1.4250 per share in 2018 and $1.3875 per share in 2017) | (596 | ) | — | (596 | ) | (584 | ) | — | (584 | ) | |||||||||||||

| Transactions of equity method investees | 19 | — | 19 | (24 | ) | — | (24 | ) | |||||||||||||||

| Comprehensive income (loss) | 1,442 | (1 | ) | 1,441 | 1,097 | 1 | 1,098 | ||||||||||||||||

| Ending Balance, September 30 | $ | 7,040 | $ | 18 | $ | 7,058 | $ | 4,914 | $ | 19 | $ | 4,933 | |||||||||||

11

The following table presents changes in accumulated other comprehensive income (AOCI) for the three months and nine months ended September 30, 2018 and 2017:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| In millions | 2018 | 2017 | 2018 | 2017 | ||||||||||||

| Defined Benefit Pension and Postretirement Adjustments | ||||||||||||||||

| Balance at beginning of period | $ | (2,376 | ) | $ | (2,954 | ) | $ | (2,527 | ) | $ | (3,072 | ) | ||||

| Other comprehensive income (loss) before reclassifications | — | — | — | 1 | ||||||||||||

| Amounts reclassified from accumulated other comprehensive income | 76 | 59 | 227 | 176 | ||||||||||||

| Balance at end of period | (2,300 | ) | (2,895 | ) | (2,300 | ) | (2,895 | ) | ||||||||

| Change in Cumulative Foreign Currency Translation Adjustments | ||||||||||||||||

| Balance at beginning of period | (2,489 | ) | (2,155 | ) | (2,111 | ) | (2,287 | ) | ||||||||

| Other comprehensive income (loss) before reclassifications | (87 | ) | 101 | (469 | ) | 235 | ||||||||||

| Amounts reclassified from accumulated other comprehensive income | — | (1 | ) | 2 | (1 | ) | ||||||||||

| Other comprehensive income (loss) attributable to noncontrolling interest | 2 | 1 | 4 | (1 | ) | |||||||||||

| Balance at end of period | (2,574 | ) | (2,054 | ) | (2,574 | ) | (2,054 | ) | ||||||||

| Net Gains and Losses on Cash Flow Hedging Derivatives | ||||||||||||||||

| Balance at beginning of period | (16 | ) | 1 | 5 | (3 | ) | ||||||||||

| Other comprehensive income (loss) before reclassifications | 1 | 1 | (20 | ) | 9 | |||||||||||

| Amounts reclassified from accumulated other comprehensive income | 2 | (2 | ) | 2 | (6 | ) | ||||||||||

| Balance at end of period | (13 | ) | — | (13 | ) | — | ||||||||||

| Total Accumulated Other Comprehensive Income (Loss) at End of Period | $ | (4,887 | ) | $ | (4,949 | ) | $ | (4,887 | ) | $ | (4,949 | ) | ||||

The following table presents details of the reclassifications out of AOCI for the three months and nine months ended September 30, 2018 and 2017:

| In millions: | Amounts Reclassified from Accumulated Other Comprehensive Income | Location of Amount Reclassified from AOCI | |||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||

| 2018 | 2017 | 2018 | 2017 | ||||||||||||||||

| Defined benefit pension and postretirement items: | |||||||||||||||||||

| Prior-service costs | $ | (4 | ) | $ | (6 | ) | (11 | ) | (19 | ) | (a) | Non-operating pension expense | |||||||

| Actuarial gains (losses) | (97 | ) | (89 | ) | (291 | ) | (266 | ) | (a) | Non-operating pension expense | |||||||||

| Total pre-tax amount | (101 | ) | (95 | ) | (302 | ) | (285 | ) | |||||||||||

| Tax (expense) benefit | 25 | 36 | 75 | 109 | |||||||||||||||

| Net of tax | (76 | ) | (59 | ) | (227 | ) | (176 | ) | |||||||||||

| Change in cumulative foreign currency translation adjustments: | |||||||||||||||||||

| Business acquisitions/divestitures | — | 1 | (2 | ) | 1 | (b) | Discontinued operations, net of taxes | ||||||||||||

| Tax (expense) benefit | — | — | — | — | |||||||||||||||

| Net of tax | — | 1 | (2 | ) | 1 | ||||||||||||||

| Net gains and losses on cash flow hedging derivatives: | |||||||||||||||||||

| Foreign exchange contracts | (3 | ) | 3 | (3 | ) | 8 | (c) | Cost of products sold | |||||||||||

| Total pre-tax amount | (3 | ) | 3 | (3 | ) | 8 | |||||||||||||

| Tax (expense)/benefit | 1 | (1 | ) | 1 | (2 | ) | |||||||||||||

| Net of tax | (2 | ) | 2 | (2 | ) | 6 | |||||||||||||

| Total reclassifications for the period | $ | (78 | ) | $ | (56 | ) | $ | (231 | ) | $ | (169 | ) | |||||||

12

| (a) | These accumulated other comprehensive income components are included in the computation of net periodic pension cost (see Note 18 for additional details). |

| (b) | Amounts for the three and nine months ended September 30, 2017 were reclassed to Net (gains) losses on sales and impairment of businesses. |

| (c) | This accumulated other comprehensive income component is included in our derivatives and hedging activities (see Note 17 for additional details). |

Basic earnings per common share are computed by dividing earnings by the weighted average number of common shares outstanding. Diluted earnings per common share are computed assuming that all potentially dilutive securities were converted into common shares. There are no adjustments required to be made to net income for purposes of computing basic and diluted earnings per share. A reconciliation of the amounts included in the computation of basic earnings (loss) per share, and diluted earnings (loss) per share is as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| In millions, except per share amounts | 2018 | 2017 | 2018 | 2017 | |||||||||||

| Earnings (loss) from continuing operations attributable to International Paper Company common shareholders | $ | 562 | $ | 366 | $ | 1,351 | $ | 642 | |||||||

| Weighted average common shares outstanding | 407.4 | 412.9 | 411.4 | 412.6 | |||||||||||

| Effect of dilutive securities | |||||||||||||||

| Restricted stock performance share plan | 4.0 | 4.5 | 4.9 | 4.8 | |||||||||||

| Weighted average common shares outstanding – assuming dilution | 411.4 | 417.4 | 416.3 | 417.4 | |||||||||||

| Basic earnings (loss) per share from continuing operations | $ | 1.38 | $ | 0.89 | $ | 3.28 | $ | 1.55 | |||||||

| Diluted earnings (loss) per common share from continuing operations | $ | 1.37 | $ | 0.88 | $ | 3.25 | $ | 1.54 | |||||||

2018: There were no restructuring charges recorded during the three months ended September 30, 2018.

During the three months ended June 30, 2018, the Company recorded a $26 million pre-tax charge, in the Industrial Packaging segment, related to approximately $12 million of severance, $6 million in accelerated depreciation, $2 million in accelerated amortization and $6 million in other charges in conjunction with the optimization of our EMEA Packaging business.

During the three months ended March 31, 2018, the Company recorded a $22 million pre-tax charge, in the Industrial Packaging segment, primarily related to the severance charges in conjunction with the optimization of our EMEA Packaging business.

The majority of the severance charges recorded year to date are expected to be paid over the remainder of the year.

2017: There were no restructuring charges recorded during the three months ended September 30, 2017.

During the three months ended June 30, 2017, restructuring and other charges totaling a $16 million benefit before taxes were recorded. This benefit included a $14 million gain on the sale of the Company's investment in ArborGen and $2 million of other benefits.

There were no restructuring and other charges recorded during the three months ended March 31, 2017.

Tangier, Morocco Facility

On June 30, 2017, the Company completed the acquisition of Europac's Tangier, Morocco facility, a corrugated packaging facility, for €40 million (approximately $46 million using the June 30, 2017 exchange rate). After working capital and other post-closing adjustments, final consideration exchanged was €33 million (approximately $38 million using the June 30, 2017 exchange rate).

13

The following table summarizes the final fair value assigned to assets and liabilities acquired as of June 30, 2017:

| In millions | June 30, 2017 | ||

| Cash and temporary investments | $ | 1 | |

| Accounts and notes receivable | 7 | ||

| Inventory | 3 | ||

| Plants, properties and equipment | 31 | ||

| Goodwill | 4 | ||

| Other intangible assets | 5 | ||

| Deferred charges and other assets | 4 | ||

| Total assets acquired | 55 | ||

| Accounts payable and accrued liabilities | 4 | ||

| Long-term debt | 11 | ||

| Other long-term liabilities | 2 | ||

| Total liabilities assumed | 17 | ||

| Net assets acquired | $ | 38 | |

Pro forma information related to the acquisition of the Europac business has not been included as it is impractical to obtain the information due to the lack of availability of U.S. GAAP financial data and does not have a material effect on the Company’s consolidated results of operations.

The Company has accounted for the above acquisition under ASC 805, "Business Combinations" and the results of operations have been included in International Paper's financial statements beginning with the date of acquisition.

Discontinued Operations

On January 1, 2018, the Company completed the transfer of its North American Consumer Packaging business, which included its North American Coated Paperboard and Foodservice businesses, to a subsidiary of Graphic Packaging Holding Company in exchange for a 20.5% ownership interest in a subsidiary of Graphic Packaging Holding Company that holds the assets of the combined business. International Paper is accounting for its ownership interest in the combined business under the equity method. The Company determined the fair value of its investment in the combined business and recorded a pre-tax gain of $516 million ($385 million, net of tax) on the transfer in the first quarter of 2018, subject to final working capital settlement. During the second quarter of 2018, the Company recorded a pre-tax charge of $28 million ($21 million after tax) to adjust the previously recorded gain on the transfer. See Note 11 for further discussion on the Company's investment in a subsidiary of Graphic Packaging Holding Company.

14

All historical operating results for North American Consumer Packaging are included in Discontinued operations, net of tax in the accompanying consolidated statement of operations. The following summarizes the major classes of line items comprising Earnings (Loss) Before Income Taxes and Equity Earnings reconciled to Discontinued operations, net of tax, related to the transfer of the North American Consumer Packaging business for all periods presented in the consolidated statement of operations:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| In millions | 2018 | 2017 | 2018 | 2017 | |||||||||||

| Net Sales | $ | — | $ | 397 | $ | — | $ | 1,165 | |||||||

| Costs and Expenses | |||||||||||||||

| Cost of products sold | — | 268 | — | 855 | |||||||||||

| Selling and administrative expenses | — | 24 | 25 | 69 | |||||||||||

| Depreciation, amortization and cost of timber harvested | — | 24 | — | 72 | |||||||||||

| Distribution expenses | — | 32 | — | 94 | |||||||||||

| Taxes other than payroll and income taxes | — | 3 | — | 8 | |||||||||||

| (Gain) loss on transfer of business | — | — | (488 | ) | — | ||||||||||

| Earnings (Loss) Before Income Taxes and Equity Earnings | — | 46 | 463 | 67 | |||||||||||

| Income tax provision (benefit) | — | 17 | 118 | 25 | |||||||||||

| Discontinued Operations, Net of Taxes | $ | — | $ | 29 | $ | 345 | $ | 42 | |||||||

Total cash provided by (used for) operations related to the North American Consumer Packaging business of $(25) million and $137 million for the nine months ended September 30, 2018 and September 30, 2017 is included in Cash Provided By (Used For) Operations in the consolidated statement of cash flows. Total cash provided by (used for) investing activities related to the North American Consumer Packaging business of $(40) million and $(77) million for the nine months ended September 30, 2018 and September 30, 2017, is included in Cash Provided By (Used For) Investing Activities in the consolidated statement of cash flows.

Impairments

During the third quarter of 2018, a determination was made that the current carrying value of the long-lived assets of the Brazil Packaging business exceeded their estimated fair value due to a change in the outlook for the business. Management engaged a third party to assist with determining the fair value of the business and the fixed assets. The fair value of the business was calculated using a probability-weighted approach based on discounted future cash flows, market multiples, and transaction multiples and the fair value of the fixed assets was determined using a market approach. As a result, a pre-tax charge of $122 million ($81 million, net of tax) was recorded related to the impairment of an intangible asset and fixed assets. This charge is included in Net (gains) losses on sales and impairments of businesses in the accompanying consolidated statement of operations and is included in the results for the Industrial Packaging segment. On October 25, 2018, the Company announced that it was exploring strategic options for its Brazil Packaging business.

Temporary Investments

Temporary investments with an original maturity of three months or less are treated as cash equivalents and are stated at cost. Temporary investments totaled $628 million and $661 million at September 30, 2018 and December 31, 2017, respectively.

Accounts and Notes Receivable

| In millions | September 30, 2018 | December 31, 2017 | |||||

| Accounts and notes receivable, net: | |||||||

| Trade | $ | 3,333 | $ | 3,017 | |||

| Other | 247 | 270 | |||||

| Total | $ | 3,580 | $ | 3,287 | |||

15

The allowance for doubtful accounts was $81 million and $73 million at September 30, 2018 and December 31, 2017, respectively.

Inventories

| In millions | September 30, 2018 | December 31, 2017 | |||||

| Raw materials | $ | 287 | $ | 274 | |||

| Finished pulp, paper and packaging | 1,109 | 1,337 | |||||

| Operating supplies | 609 | 615 | |||||

| Other | 125 | 87 | |||||

| Total | $ | 2,130 | $ | 2,313 | |||

Depreciation

Accumulated depreciation was $21.0 billion and $20.5 billion at September 30, 2018 and December 31, 2017, respectively. Depreciation expense was $315 million and $317 million for the three months ended September 30, 2018 and 2017, respectively and $930 million and $926 million for the nine months ended September 30, 2018 and 2017, respectively.

Interest

Interest payments made during the nine months ended September 30, 2018 and 2017 were $606 million and $600 million, respectively.

Amounts related to interest were as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| In millions | 2018 | 2017 | 2018 | 2017 | |||||||||||

| Interest expense | $ | 184 | $ | 198 | $ | 547 | $ | 571 | |||||||

| Interest income | 51 | 46 | 146 | 140 | |||||||||||

| Capitalized interest costs | 9 | 6 | 26 | 18 | |||||||||||

Asset Retirement Obligations

The Company had recorded liabilities of $86 million related to asset retirement obligations at September 30, 2018 and December 31, 2017.

The Company accounts for the following investments in affiliated companies under the equity method of accounting.

Graphic Packaging International, LLC

On January 1, 2018, the Company completed the transfer of its North American Consumer Packaging business, which includes its North American Coated Paperboard and Foodservice businesses, to a subsidiary of Graphic Packaging International Partners, LLC (GPIP), a subsidiary of Graphic Packaging Holding Company, in exchange for a 20.5% ownership interest in GPIP. GPIP subsequently transferred the North American Consumer Packaging business to Graphic Packaging International, LLC (GPI), a wholly-owned subsidiary of GPIP that holds the assets of the combined business. The Company recorded equity earnings of $19 million and $36 million for the three months and nine months ended September 30, 2018, respectively. The Company received cash dividends from GPIP of $12 million during the first nine months of 2018. At September 30, 2018, the Company's investment in GPI was $1.1 billion, which was $519 million more than the Company's proportionate share of the entity's underlying net assets. The difference primarily relates to the basis difference between the fair value of our investment and the underlying net assets and is generally amortized in equity earnings over a period consistent with the underlying long-lived assets. The Company is party to various agreements with GPI under which it sells fiber and other products to GPI. Sales under these agreements were $62 million and $180 million for the three months and nine months ended September 30, 2018, respectively.

16

Summarized financial information for GPI is presented in the following tables:

Balance Sheet

| In millions | September 30, 2018 | ||

| Current assets | $ | 1,943 | |

| Noncurrent assets | 5,347 | ||

| Current liabilities | 1,143 | ||

| Noncurrent liabilities | 3,150 | ||

Income Statement

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||

| In millions | 2018 | 2018 | |||||

| Net sales | $ | 1,530 | $ | 4,515 | |||

| Gross profit | 256 | 714 | |||||

| Income from continuing operations | 135 | 278 | |||||

| Net income | 135 | 278 | |||||

Ilim Holding S.A.

The Company has a 50% equity interest in Ilim Holding S.A. (Ilim), which has subsidiaries whose primary operations are in Russia. The Company recorded equity earnings (losses), net of taxes, of $74 million and $48 million for the three months ended September 30, 2018 and 2017, respectively and $223 million and $119 million for the nine months ended September 30, 2018 and 2017, respectively. The Company received cash dividends from the joint venture of $118 million and $129 million during the first nine months of 2018 and 2017, respectively. At September 30, 2018 and December 31, 2017, the Company's investment in Ilim was $440 million and $338 million, respectively, which was $153 million and $154 million, respectively, more than the Company's proportionate share of the joint venture's underlying net assets. The differences primarily relate to currency translation adjustments and the basis difference between the fair value of our investment at acquisition and the underlying net assets. The Company is party to a joint marketing agreement with JSC Ilim Group, a subsidiary of Ilim, under which the Company purchases, markets and sells paper produced by JSC Ilim Group. Purchases under this agreement were $50 million and $52 million for the three months ended September 30, 2018 and 2017, respectively, and $159 million and $151 million for the nine months ended September 30, 2018 and 2017, respectively.

Summarized financial information for Ilim is presented in the following tables:

Balance Sheet

| In millions | September 30, 2018 | December 31, 2017 | |||||

| Current assets | $ | 741 | $ | 689 | |||

| Noncurrent assets | 1,702 | 1,696 | |||||

| Current liabilities | 393 | 1,039 | |||||

| Noncurrent liabilities | 1,460 | 972 | |||||

| Noncontrolling interests | 17 | 6 | |||||

Income Statement

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| In millions | 2018 | 2017 | 2018 | 2017 | |||||||||||

| Net sales | $ | 655 | $ | 523 | $ | 2,030 | $ | 1,518 | |||||||

| Gross profit | 376 | 252 | 1,152 | 715 | |||||||||||

| Income from continuing operations | 149 | 99 | 454 | 249 | |||||||||||

| Net income | 143 | 95 | 438 | 237 | |||||||||||

17

Goodwill

The following table presents changes in goodwill balances as allocated to each business segment for the nine-months ended September 30, 2018:

| In millions | Industrial Packaging | Global Cellulose Fibers | Printing Papers | Total | |||||||||||

| Balance as of January 1, 2018 | |||||||||||||||

| Goodwill | $ | 3,382 | $ | 52 | $ | 2,150 | $ | 5,584 | |||||||

| Accumulated impairment losses (a) | (296 | ) | — | (1,877 | ) | (2,173 | ) | ||||||||

| 3,086 | 52 | 273 | 3,411 | ||||||||||||

| Currency translation and other (b) | — | — | (38 | ) | (38 | ) | |||||||||

| Additions/reductions | (2 | ) | (c) | — | — | (2 | ) | ||||||||

| Balance as of September 30, 2018 | |||||||||||||||

| Goodwill | 3,380 | 52 | 2,112 | 5,544 | |||||||||||

| Accumulated impairment losses (a) | (296 | ) | — | (1,877 | ) | (2,173 | ) | ||||||||

| Total | $ | 3,084 | $ | 52 | $ | 235 | $ | 3,371 | |||||||

| (a) | Represents accumulated goodwill impairment charges since the adoption of ASC 350, "Intangibles-Goodwill and Other" in 2002. |

| (b) | Represents the effects of foreign currency translations and reclassifications. |

(c) Reflects a reduction from tax benefits generated by the deduction of goodwill amortization for tax purposes in the US.

Other Intangibles

Identifiable intangible assets comprised the following:

| September 30, 2018 | December 31, 2017 | ||||||||||||||||||||||

| In millions | Gross Carrying Amount | Accumulated Amortization | Net Intangible Assets | Gross Carrying Amount | Accumulated Amortization | Net Intangible Assets | |||||||||||||||||

| Customer relationships and lists | $ | 540 | $ | 238 | $ | 302 | $ | 610 | $ | 247 | $ | 363 | |||||||||||

| Non-compete agreements | 65 | 65 | — | 72 | 72 | — | |||||||||||||||||

| Tradenames, patents and trademarks, and developed technology | 173 | 85 | 88 | 172 | 72 | 100 | |||||||||||||||||

| Land and water rights | 8 | 2 | 6 | 8 | 2 | 6 | |||||||||||||||||

| Software | 27 | 25 | 2 | 24 | 23 | 1 | |||||||||||||||||

| Other | 36 | 28 | 8 | 38 | 26 | 12 | |||||||||||||||||

| Total | $ | 849 | $ | 443 | $ | 406 | $ | 924 | $ | 442 | $ | 482 | |||||||||||

The Company recognized the following amounts as amortization expense related to intangible assets:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| In millions | 2018 | 2017 | 2018 | 2017 | |||||||||||

| Amortization expense related to intangible assets | $ | 15 | $ | 27 | $ | 44 | $ | 60 | |||||||

International Paper made income tax payments, net of refunds, of $195 million and $122 million for the nine months ended September 30, 2018 and 2017, respectively.

The Company currently estimates, that as a result of ongoing discussions, pending tax settlements and expirations of statutes of limitations, the amount of unrecognized tax benefits could be reduced by approximately $2 million during the next 12 months.

International Paper uses the flow-through method to account for investment tax credits earned on eligible open loop-biomass facilities and Combined Heat and Power system expenditures. Under this method, the investment tax credits are recognized as a reduction to income tax expense in the year they are earned rather than a reduction in the asset basis. The Company recorded a

18

tax benefit of $6 million and $29 million for the nine months ended September 30, 2018 and 2017, respectively. The 2017 amount includes $2 million which is now reported as discontinued operations.

On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the Tax Act). The Tax Act makes broad and complex changes to the U.S. tax code, including, but not limited to, (1) reducing the U.S. federal corporate tax rate from 35% to 21%; (2) requiring companies to pay a one-time deemed repatriation transition tax (the Transition Tax) on certain earnings of foreign subsidiaries; (3) generally eliminating U.S. federal income taxes on dividends from foreign subsidiaries; (4) requiring a current inclusion in U.S. federal taxable income of certain earnings of controlled foreign corporations; (5) eliminating the corporate alternative minimum tax (AMT) and changing how AMT credits can be realized; (6) capital expensing; (7) eliminating the deduction on U.S. manufacturing activities; and (8) creating new limitations on deductible interest expense and executive compensation.

The Securities Exchange Commission staff issued Staff Accounting Bulletin (SAB) 118 which provides guidance on accounting for the tax effects of the Tax Act. SAB 118 provides a measurement period that should not extend beyond one year from the Tax Act enactment date for companies to complete the accounting under ASC 740. In accordance with SAB 118, a company must reflect the income tax effects of those aspects of the Tax Act for which the accounting under ASC 740 is complete. To the extent that a company’s accounting for certain income tax effects of the Tax Act is incomplete but it is able to determine a reasonable estimate, it must record a provisional estimate in the financial statements. If a company cannot determine a provisional estimate to be included in the financial statements, it should continue to apply ASC 740 on the basis of the provisions of the tax laws that were in effect immediately before the enactment of the Tax Act.

In connection with our initial analysis of the impact of the Tax Act, we recorded a provisional net tax benefit of $1.22 billion in the period ending December 31, 2017. The net tax benefit primarily consisted of a net tax benefit for the re-measurement of U.S. deferred taxes of $1.454 billion and an expense for the Transition Tax of $231 million. For various reasons that are discussed more fully below, as of the quarter ended September 30, 2018, we have not completed our accounting for the income tax effects of the Tax Act. However, in the third quarter, we have updated certain estimates and recorded a beneficial adjustment of $36 million to our provisional estimate.

The provisional estimates and related adjustments relate to the following:

Reduction of U.S. federal corporate tax rate: The Tax Act reduced the corporate tax rate to 21%, effective January 1, 2018. For certain of our deferred tax assets and liabilities, we recorded a provisional net decrease of $1.451 billion with a corresponding adjustment to deferred income tax benefit in the same amount for the year ended December 31, 2017. After the completion of the federal income tax return during the reporting period, we recognized a beneficial adjustment of $11 million from the remeasurement of certain temporary differences. The effect of the measurement-period adjustment on the 2018 third quarter effective tax rate was approximately 2.0%. A total decrease to the deferred tax liabilities to date of $1.462 billion has been recorded with a corresponding adjustment of $1.462 billion to income tax benefit. However, our accounting for these items is not yet complete because the state tax effect of adjustments made to federal temporary differences is not yet finalized. We will complete our accounting in the fourth quarter.

Deemed Repatriation Transition Tax: This is a tax on previously untaxed accumulated and current earnings and profits (“E&P”) of foreign subsidiaries. To determine the amount of the transition tax, we must determine, in addition to other factors, the amount of post-1986 E&P of the relevant subsidiaries, as well as the amount of non-U.S. income taxes paid on such earnings. We were able to make a reasonable estimate of the Transition Tax and recorded a provisional Transition Tax obligation of $231 million in the tax period ending December 31, 2017. On the basis of revised E&P computations that were calculated during the reporting period, as well as the impacts of guidance received from the IRS pertaining to the Transition Tax computation, we recognized an income tax benefit adjustment of $25 million related to the Transition Tax obligation. The effect of the measurement-period adjustment on the 2018 third quarter effective tax rate was approximately 4.5%. A total Transition Tax obligation to date of $206 million has been recorded as of September 30, 2018. Due to the fiscal year end of several significant foreign subsidiaries, we are continuing to gather additional information necessary to complete the calculation of the Transition Tax, and our accounting for this item is not yet complete. We will complete our accounting in the fourth quarter.

Our accounting for the following elements of the Tax Act is incomplete as of September 30, 2018. The estimates reported in the period ending December 31, 2017, were not adjusted in the period ending September 30, 2018. As of September 30, 2018, there has been no change in previous estimates made and reported in the period ending December 31, 2017.

Valuation Allowances: The Company has assessed whether its U.S. state and local income tax valuation allowance analysis is affected by various aspects of the Tax Act (e.g. deemed repatriation of foreign income, acceleration of cost recovery). Since, as discussed herein, the Company has recorded provisional amounts related to elements of the Tax Act, any corresponding determination of the need for a change in a valuation allowance is also provisional. For certain of our state deferred tax assets, we recorded a net $3 million provisional decrease in the recorded valuation allowance with a corresponding adjustment to deferred income tax benefit in the same amount for the year ended December 31, 2017. While we are able to make a reasonable

19

estimate of the impact of the Tax Act on state attributes, the resolution of, or changes from, other factors noted herein may result in changes in our recorded valuation allowance.

The Tax Act may impact decisions surrounding the Company’s permanent reinvestment assertions related to its foreign investments and could have an impact on the Company’s accounting for untaxed outside basis differences. We previously considered the earnings in our non-U.S. subsidiaries to be permanently reinvested, and, accordingly deferred income taxes were not provided for such basis differences. While the transition tax resulted in a reduction in these basis differences, an actual repatriation from our non-U.S. subsidiaries could still be subject to additional taxes, including, but not limited to, foreign withholding taxes and U.S. state income taxes. In light of the Tax Act, the Company is evaluating its global cash management and non-U.S. repatriation strategy but we have yet to determine whether we plan to change our prior assertion. Accordingly, we have not recorded any deferred taxes attributable to our investments in our non-U.S. subsidiaries.

These estimates may change materially due to, among other things, further clarification of existing guidance that may be issued by U.S. taxing authorities or regulatory bodies and/or changes in interpretations and assumptions we have preliminarily made. We will continue to analyze the Tax Act to finalize its financial statement impact, including the mandatory deemed repatriation of foreign earnings, re-measurement of deferred taxes and all other provisions of the legislation and will record the effects of any changes to provisional amounts in the fourth quarter as required by SAB 118.

Because of the complexity of the new Global Intangible Low Tax Income (GILTI) rules, we are continuing to evaluate this provision of the Act and the application of ASC 740. Under U.S. GAAP, we are allowed to make an accounting policy choice of either (1) treating taxes due on future U.S. inclusions in taxable income related to GILTI as a current-period expense when incurred (the “period cost method”) or (2) factoring such amounts into a company’s measurement of its deferred taxes (the “deferred method”). Our selection of an accounting policy related to the new GILTI tax rules will depend, in part, on analyzing our global income to determine whether we expect to have future U.S. inclusions in taxable income related to GILTI and, if so, what the impact is expected to be. Because whether we expect to have future U.S. inclusions in taxable income related to GILTI depends on a number of different aspects of our estimated future results of global operations, we are not yet able to reasonably estimate the long-term effects of this provision of the Act. Therefore, we have not recorded any potential deferred tax effects related to GILTI in our financial statements and have not made a policy decision regarding whether to record deferred taxes on GILTI or use the period cost method. We expect to complete our accounting within the prescribed measurement period.

Environmental

International Paper has been named as a potentially responsible party (PRP) in environmental remediation actions under various federal and state laws, including the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA). Many of these proceedings involve the cleanup of hazardous substances at large commercial landfills that received waste from many different sources. While joint and several liability is authorized under CERCLA and equivalent state laws, as a practical matter, liability for CERCLA cleanups is typically allocated among the many PRPs. There are other remediation costs typically associated with the cleanup of hazardous substances at the Company’s current, closed or formerly-owned facilities, and recorded as liabilities in the balance sheet.

Remediation costs are recorded in the consolidated financial statements when they become probable and reasonably estimable. International Paper has estimated the probable liability associated with these matters to be approximately $131 million ($142 million undiscounted) in the aggregate at September 30, 2018. Other than as described below, completion of required remedial actions is not expected to have a material effect on our consolidated financial statements.

Cass Lake: One of the matters included above arises out of a closed wood-treating facility located in Cass Lake, Minnesota. In June 2011, the United States Environmental Protection Agency (EPA) selected and published a proposed soil remedy at the site with an estimated cost of $46 million. The overall remediation reserve for the site is currently $50 million to address the selection of an alternative for the soil remediation component of the overall site remedy, which includes the ongoing groundwater remedy. In October 2011, the EPA released a public statement indicating that the final soil remedy decision would be delayed. In March 2016, the EPA issued a proposed plan concerning clean-up standards at a portion of the site, the estimated cost of which is included within the reserve referenced above. In October 2012, the Natural Resource Trustees for this site provided notice to International Paper and other PRPs of their intent to perform a Natural Resource Damage Assessment. It is premature to predict the outcome of the assessment or to estimate a loss or range of loss, if any, which may be incurred.

Kalamazoo River: The Company is a PRP with respect to the Allied Paper, Inc./Portage Creek/Kalamazoo River Superfund Site in Michigan. The EPA asserts that the site is contaminated by polychlorinated biphenyls (PCBs) primarily as a result of

20

discharges from various paper mills located along the Kalamazoo River, including a paper mill (the Allied Paper Mill) formerly owned by St. Regis Paper Company (St. Regis). The Company is a successor in interest to St. Regis.

| • | In March 2016, the Company and other PRPs received a special notice letter from the EPA (i) inviting participation in implementing a remedy for a portion of the site known as Operable Unit 5, Area 1, and (ii) demanding reimbursement of EPA past costs totaling $37 million, including $19 million in past costs previously demanded by the EPA. The Company responded to the special notice letter. In December 2016, the EPA issued a unilateral administrative order to the Company and other PRPs to perform the remedy. The Company responded to the unilateral administrative order, agreeing to comply with the order subject to its sufficient cause defenses. |

| • | In April 2016, the EPA issued a separate unilateral administrative order to the Company and certain other PRPs for a time-critical removal action (TCRA) of PCB-contaminated sediments from a different portion of the site. The Company responded to the unilateral administrative order and agreed along with two other parties to comply with the order subject to its sufficient cause defenses. |

| • | In October 2016, the Company and another PRP received a special notice letter from the EPA inviting participation in the remedial design component of the landfill remedy for the Allied Paper Mill. The record of decision establishing the final landfill remedy for the Allied Paper Mill was issued by the EPA in September 2016. The Company responded to the Allied Paper Mill special notice letter in late December 2016. In February 2017, the EPA informed the Company that it would make other arrangements for the performance of the remedial design. |

The Company’s CERCLA liability has not been finally determined with respect to these or any other portions of the site, and except as noted above, the Company has declined to perform any work or reimburse the EPA at this time.