UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the year ended December 31, 2006 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from |

to

Commission File Number 1-6780

RAYONIER INC.

Incorporated in the State of North Carolina

I.R.S. Employer Identification No. 13-2607329

50 NORTH LAURA STREET,

JACKSONVILLE, FL 32202

(Principal Executive Office)

Telephone Number: (904) 357-9100

Securities registered pursuant to Section 12(b) of the Exchange Act,

all of which are registered on the New York Stock Exchange:

Common Shares

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. YESx NO¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large accelerated filerx Accelerated filer¨ Non-accelerated filer¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES¨ NOx

The aggregate market value of the Common Shares of the registrant held by non-affiliates at the close of business on June 30, 2006 was $2,823,845,652 based on the closing sale price as reported on the New York Stock Exchange.

As of February 19, 2007, there were outstanding 77,240,771 Common Shares of the registrant.

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission in connection with the 2007 annual meeting of the shareholders of the registrant scheduled to be held May 17, 2007, are incorporated by reference in Part III hereof.

TABLE OF CONTENTS

| * | Included pursuant to Instruction 3 to Item 401(b) of Regulation S-K. |

i

INDEX TO FINANCIAL STATEMENTS

ii

PART I

When we refer to “we”, “us”, “our”, “the Company”, or “Rayonier”, we mean Rayonier Inc. and its consolidated subsidiaries. References herein to “Notes to Financial Statements” refer to the Notes to the Consolidated Financial Statements of Rayonier Inc. included in Item 8 of this Report.

Except for historical information, the statements made in this Annual Report on Form 10-K are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements, which may include statements regarding anticipated earnings, revenues, volumes, pricing, costs and other statements relating to Rayonier’s financial and operational performance and business strategies, in some cases are identified by the use of words such as “may”, “will”, “should”, “expect”, “estimate”, “believe”, “anticipate” and other similar language. The following important factors, among others, could cause actual results to differ materially from those expressed in the forward-looking statements contained in this release; changes in global market trends and world events; interest rate and currency movements; changes in key management personnel; fluctuations in demand for, or supply of, cellulose specialty products, absorbent materials, timber, wood products or real estate and entry of new competitors into these markets; adverse weather conditions affecting products or performance fibers, particularly for raw materials such as wood, energy and chemicals; unexpected delays in the entry into or closing of real estate sale transactions; changes in law, policy or political environment that might condition, limit or restrict the development of real estate; the ability of the company to identify and complete timberland and higher-value real estate acquisitions; the company’s ability to continue to qualify as a REIT; the ability of the company to complete tax-efficient exchanges of real estate; and implementation or revision of governmental policies, laws and regulations affecting the environment, endangered species, timber harvesting, import and export controls or taxes, including changes in tax laws that could reduce the benefits associated with REIT status. For additional factors that could impact future results, please see Item 1A-Risk Factors. Rayonier assumes no obligation to update these statements except as may be required by law. You are advised, however, to review any further disclosures we make on related subjects in our Form 10-Q and Form 8-K reports to the SEC.

General

We are a leading international forest products company primarily engaged in activities associated with timberland management, the sale and development of real estate, and the production and sale of high value specialty cellulose fibers. We own, lease or manage approximately 2.7 million acres of timberland and real estate located in the United States, New Zealand and Australia. We believe that Rayonier is the fifth largest private timberland owner in the U.S. Included in this property is over 200,000 acres of high value real estate located primarily along the coastal corridor from Savannah, Georgia to Daytona Beach, Florida. We often refer to this as the “coastal corridor.” We also own and operate two specialty cellulose mills in the United States. Our corporate strategy is to pursue strategic growth opportunities in our Timber segment, further develop the Real Estate segment, and strengthen our position as a premier worldwide supplier of high value specialty cellulose products in the Performance Fibers segment primarily through cost reduction investments and product enhancements. In addition, we manufacture lumber in three sawmills in Georgia and engage in the trading of logs and wood products. For information on sales, operating income and identifiable assets by reportable segment, see Item 7 —Management’s Discussion and Analysis of Financial Condition and Results of Operationsand Note 3 —Segment and Geographical Information.

We originated as the Rainier Pulp & Paper Company founded in Shelton, WA in 1926. In 1937, we became “Rayonier Incorporated,” a public company traded on the New York Stock Exchange (NYSE), until 1968 when we became a wholly-owned subsidiary of ITT Corporation (ITT). On February 28, 1994, Rayonier again became an independent public company after ITT distributed all of Rayonier’s Common Shares to ITT stockholders. Our shares are publicly traded on the NYSE under the symbolRYN. We are a North Carolina corporation with executive offices located at 50 North Laura Street, Jacksonville, FL 32202. Our telephone number is (904) 357-9100.

Effective January 1, 2004, we restructured the Company as a real estate investment trust (REIT). Under this structure, we are generally not required to pay federal income taxes on our earnings from timber harvest operations and other REIT-qualifying activities contingent upon meeting applicable distribution, income, asset, shareholder and other tests. However, we are subject to corporate taxes on built-in gains (the excess of fair market value over tax basis at January 1, 2004) on taxable sales of property by our REIT during the first ten years following our election to be taxed as a REIT. Our principal businesses are conducted through two entities. Our U.S. timber operations are conducted by a wholly-owned REIT subsidiary, Rayonier Forest Resources, L.P. (RFR). Our non REIT-qualifying operations, which continue to pay corporate-level tax on earnings, are held under our wholly-owned taxable subsidiary, Rayonier TRS Holdings Inc. (TRS). These operations include our Performance Fibers, Wood Products and trading businesses, as well as the sale and development of high value real estate (referred to as higher and better use, or “HBU properties”).

1

A significant portion of our acreage has become, or is emerging as, more valuable for development, recreational or conservation purposes than for growing timber. To maximize the value of these properties, we expanded our focus from sales of medium and large tracts of land to include more value-added activities such as seeking entitlements in participation with other developers. Our real estate operations are considered a separate operating and reportable business segment.

In 2006, we acquired 228,000 acres of timberland in six states for an aggregate $272 million, which increased our geographic footprint and species mix.

In 2005, we entered into a joint venture (JV) with RREEF Infrastructure, the global infrastructure investing arm of Deutsche Asset Management, under which the JV purchased approximately 354,000 acres of New Zealand timberlands, including 118,000 acres from Rayonier. Our initial investment of approximately $122 million, representing a 49.7 percent equity interest, was made primarily by our REIT. In June 2006, AMP Capital Investors Limited, a subsidiary of the Australian corporation AMP Limited, purchased a total interest in the JV of 35 percent, of which 9.7 percent was from Rayonier and the remainder from RREEF, thereby reducing our investment in the JV from 49.7 percent to 40 percent. The JV’s timber harvest operations are subject to New Zealand income taxes; however, they are REIT-qualifying and therefore we will generally not be required to pay U.S. federal income taxes on our equity earnings. In addition to having an equity investment in the JV, we manage its timberlands for which we receive a management fee.

Timber

Our Timber segment owns, leases or manages approximately 2.6 million acres of timberlands, sells standing timber (primarily at auction to third parties) and delivered logs. See chart in Item 2 –Properties for additional information.

Timberland purchases in 2006 expanded our Southern U.S. timberland holdings to 1.7 million acres in Georgia, Florida, Alabama, Oklahoma, Arkansas, Texas and Louisiana. Their proximity to pulp, paper and wood products facilities results in significant demand for our timber. Approximately 50 percent of the timber harvest represents high-value timber sold primarily to lumber and plywood mills. The balance is used for making pulp, paper, and oriented strand board. Softwoods are the predominant species on our Southern U.S. timberlands and include loblolly and slash pine. Hardwoods on our Southern U.S. timberlands include red oak, sweet gum, black gum, red maple, cypress, green ash, and black cherry.

In 2006, we also acquired approximately 75,000 acres of timberland in New York State, located within the boundaries of the Adirondack State Park. The timber on this property is predominantly (90 percent) hardwood, including high-value black cherry, sugar maple sawtimber and a variety of other species. Spruce, fir and hemlock are the predominant softwood species on the property which are intermingled with the hardwood trees.

Our Northwestern U.S. timberlands are approximately 370,000 acres of primarily softwood second growth timber on the Olympic Peninsula in Western Washington State with approximately 60 percent hemlock and the remainder Douglas fir, western red cedar and spruce. Our hardwood timber stands consist principally of red alder and maple.

On June 30, 2006, we reduced the investment in our New Zealand JV from 49.7 percent to 40 percent. In addition to the New Zealand JV, our New Zealand subsidiary also manages a 114,000 acre 50/50 softwood joint venture estate in Tasmania, Australia owned by Forestry Tasmania and GMO, a U.S. based Timber Investment Management Organization (TIMO).

We use advanced forest management practices to maximize the value of our timberlands. The average rotation (harvest) age for timber from the Southern U.S. (primarily Southern pine), is between 21 to 24 years. Our Southern U.S. timber is primarily a mix of sawtimber and pulpwood with a higher concentration of sawtimber due to the 2006 timberland acquisitions. The average harvest age for timber from the Northwestern U.S. (primarily hemlock and Douglas fir) is 50 years with a target age of 40 years. Timber in the Northwest is primarily sawtimber. The average harvest age for the New York timberlands is estimated to be between 60 to 80 years and is comprised of both pulpwood and sawtimber.

We manage timberlands in conformity with the requirements of the Sustainable Forestry Initiative® (SFI) program. A key to success is the application of our extensive stand level silvicultural expertise for species selection, soil preparation, fertilization, herbaceous weed control, pruning of selected species, and careful timing of the harvest, all of which are designed to maximize value while complying with environmental requirements. Through such practices, we have increased volume per acre of managed timber available for harvest from our Southern U.S. timberlands which has been a primary factor behind an increasing pine harvest trend over the past 15 years.

2

Below is a table that sets forth timberland acres (in thousands) as of December 31, 2006, by region and by timber classification. Non-Forest acres include those acres unavailable for commercial timberland use and are primarily comprised of roads, regulatory restricted riparian management zones and wetlands.

| | | | | | | | |

Location | | Softwood

Plantations | | Hardwood

Lands | | Non-Forest | | Total |

Southern U.S.* | | 1,152 | | 492 | | 49 | | 1,693 |

Northwest U.S. | | 283 | | — | | 87 | | 370 |

New Zealand ** | | 346 | | 5 | | — | | 351 |

Australia *** | | 114 | | — | | — | | 114 |

New York | | — | | 68 | | 7 | | 75 |

| | | | | | | | |

Total | | 1,895 | | 565 | | 143 | | 2,603 |

| | | | | | | | |

| * | Excludes approximately 38 thousand leased acres that are held for sale at December 31, 2006. |

| ** | Acres under Rayonier management, owned and leased by the New Zealand JV. |

| *** | Acres under Rayonier management. |

Softwood merchantable timber inventory is an estimate of timber volume based on the earliest economically harvestable age. Hardwood inventory is an estimate of timber volume available for harvest. Estimates are based on an inventory system that continually involves periodic statistical sampling. Adjustments are made on the basis of growth estimates, harvest information, environmental restrictions and market conditions. Timber located in swamplands, restricted or environmentally sensitive areas is not included in the merchantable inventory shown below.

Effective January 1, 2007, Rayonier’s Northwest timber business unit decreased the age at which it moves timber into its merchantable timber pool from 41 to 35 years. This change added 338 million board feet (36 percent) of timber to the merchantable pool. The anticipated impact of this change on 2007 depletion expense is an increase of $0.5 million.

The following table sets forth the estimated volumes of merchantable timber by location and type, as of December 31, 2006:

| | | | | | | | | | |

Location | | Softwood | | Hardwood | | Total* | | Equivalent total,

in thousands of

short green tons | | % |

Southern, in thousands of short green tons | | 33,490 | | 19,229 | | 52,719 | | 52,719 | | 80 |

Northwest, in millions of board feet | | 1,200 | | 89 | | 1,289 | | 9,281 | | 14 |

New York, in thousands of short green tons | | 369 | | 3,340 | | 3,709 | | 3,709 | | 6 |

| | | | | | | | | | |

| | | | | | | | 65,709 | | 100 |

| | | | | | | | | | |

| * | Excludes merchantable standing timber on acres held for sale as of December 31, 2006. |

Real Estate

Our HBU real estate holdings are primarily in the Southern U.S. We segregate these real estate holdings into two groups: development and rural properties. Development properties are predominantly located in the eleven coastal counties between Savannah, GA and Daytona Beach, FL, while the rural properties essentially include the balance of our ownership in the South. Our real estate holdings in the Northwest comprise the Other category in the following table.

In 2006, TerraPointe LLC (TerraPointe), our real estate development subsidiary closed two “participation” transactions implementing our strategy to increase value by partnering with developers and participating in the downstream revenues of property development. For the first transaction, the Company received $10 million in cash at closing and has the option to receive $17.5 million when the property is entitled, or at that time, to convert the balance ($17.5 million) to a participation arrangement where Rayonier would receive a percentage of gross revenue from the sales of home lots. The second transaction was for $28.3 million, of which $22.6 million was received at closing and the remaining $5.7 million will be earned when the purchaser builds and sells homes to third parties. Both of these transactions involved approximately 2,000 acres in North Florida and were with southeastern U.S. developers.

3

Sales for the three years ended December 31, 2006, are summarized in the following table:

| | | | | | | | | | | | | | | |

| | | 2006 | | 2005 | | 2004 |

| | | Acres

Sold | | Average

Price/Acre | | Acres

Sold | | Average

Price/Acre | | Acres

Sold | | Average

Price/Acre |

Development | | 9,377 | | $ | 7,713 | | 6,036 | | $ | 6,943 | | 4,786 | | $ | 5,110 |

Rural | | 16,099 | | $ | 2,297 | | 23,587 | | $ | 1,797 | | 29,282 | | $ | 2,278 |

Other | | 775 | | $ | 3,510 | | 403 | | $ | 3,805 | | 1,838 | | $ | 2,661 |

| | | | | | | | | | | | | | | |

Total Acres Sold | | 26,251 | | | | | 30,026 | | | | | 35,906 | | | |

| | | | | | | | | | | | | | | |

Performance Fibers

We are a leading manufacturer of high value specialty cellulose fibers with production facilities in Jesup, GA and Fernandina Beach, FL, which have a combined annual capacity of approximately 740,000 metric tons. To meet customers’ needs, these facilities are capable of manufacturing more than 25 different grades of performance fibers. The Jesup facility can produce approximately 590,000 metric tons, or 80 percent of our total capacity and the Fernandina Beach facility can produce approximately 150,000 metric tons, or 20 percent of our total capacity. Sixty-one percent of Performance Fibers sales are exported, primarily to customers in Asia, Europe and Latin America. Eighty-nine percent of Performance Fibers sales are made directly by Rayonier personnel, with the remainder through independent sales agents. In July 2006, we entered into long-term contracts with the world’s largest manufacturers of acetate-based products and other key customers that extend into 2011 and represent nearly 80 percent of our high value cellulose specialties production.

This segment includes two major product lines — Cellulose Specialties and Absorbent Materials.

Cellulose Specialties— We are one of the world’s leading producers of specialty cellulose products, most of which are used in dissolving chemical applications that require a highly purified form to produce cellulose acetate and ethers that create high value, technologically demanding products. Our products are used in a wide variety of end uses such as: acetate textile fibers, cigarette filters, rigid packaging, liquid crystal display (LCD) screens, photographic film, impact-resistant plastics, high-tenacity rayon yarn for tires and industrial hoses, pharmaceuticals, cosmetics, detergents, food casings, food products, thickeners for oil well-drilling muds, lacquers, paints, printing inks, and explosives. In addition, cellulose specialties include high value specialty paper applications used for decorative laminates, automotive air and oil filters, shoe innersoles, battery separators, circuit boards and filter media for the food industry.

Absorbent Materials — We are a producer of performance fibers for absorbent hygiene products. These fibers are typically referred to as fluff fibers and are used as an absorbent medium in products such as disposable baby diapers, feminine hygiene products, incontinence pads, convalescent bed pads, industrial towels and wipes and non-woven fabrics.

Wood Products

Our Wood Products business segment manufactures and sells dimension lumber. We operate three lumber manufacturing facilities in the U.S. that produce Southern pine lumber, which is generally used for residential and industrial construction. Located in Baxley, Swainsboro and Eatonton, GA, the mills have a combined annual capacity of approximately 390 million board feet of lumber and 750,000 tons of wood chips. Lumber sales are primarily made by Rayonier personnel to customers in the Southeastern U.S. Approximately 75 percent of our lumber mills’ wood chip production is sold at market prices to our Jesup, GA performance fibers facility. In 2006, these purchases represented approximately 16 percent of that facility’s total wood consumption.

On August 28, 2005, we completed the sale of our MDF business to Dongwha Hong Kong International Limited for approximately $40 million. As a result, the Wood Products segment has been restated to exclude the operations and assets of MDF in all periods presented.

Other

The primary business of our Other segment is trading logs, lumber and wood panel products. We operate domestic and export log trading businesses in the Northwest U.S., New Zealand and Chile. All of the sales from our Northwest U.S. and New Zealand log trading operations are sourced externally. Our Chilean log trading activity includes domestic purchases and sales. We also purchase and trade lumber and wood products in both domestic and export markets. The Other segment has historically included royalty income from coal mining activity on our timberlands in Lewis County, Washington. In 2006, the amount of royalty income included in this segment totaled $3.0 million. Effective November 2006, TransAlta, the third party operator of the mine, ceased their operations in Lewis County; therefore, future periods will not include royalty income.

4

Discontinued Operations and Dispositions

Discontinued operations include our MDF business sold in 2005. The Consolidated Statements of Income and Comprehensive Income and the Consolidated Statements of Cash Flows and the related Notes have been reclassified to present the results of these operations as discontinued operations.

Dispositions and other discontinued operations include our Port Angeles, WA performance fibers mill that was closed in 1997; our wholly-owned subsidiary, Southern Wood Piedmont Company (SWP), which ceased operations other than environmental remediation activities in 1989; our Eastern Research Division (ERD), which ceased operations in 1981; and other miscellaneous assets held for disposition. See Note 15 —Reserves for Dispositions and Discontinued Operations for additional information.

Foreign Sales and Operations

Sales by geographical destination for the three years ended December 31, 2006 were as follows (in millions):

| | | | | | | | | | | | | | | |

| | | Sales by Destination |

| | | 2006 | | % | | 2005 | | % | | 2004 | | % |

United States | | $ | 777 | | 63 | | $ | 739 | | 63 | | $ | 736 | | 63 |

Europe | | | 167 | | 14 | | | 161 | | 14 | | | 134 | | 11 |

Japan | | | 88 | | 7 | | | 72 | | 6 | | | 80 | | 7 |

China | | | 79 | | 6 | | | 61 | | 5 | | | 66 | | 6 |

Other Asia | | | 37 | | 3 | | | 52 | | 4 | | | 54 | | 5 |

Latin America | | | 30 | | 2 | | | 37 | | 3 | | | 31 | | 3 |

New Zealand | | | 21 | | 2 | | | 30 | | 2 | | | 30 | | 2 |

Canada | | | 12 | | 1 | | | 20 | | 2 | | | 20 | | 2 |

All other | | | 19 | | 2 | | | 9 | | 1 | | | 12 | | 1 |

| | | | | | | | | | | | | | | |

| | $ | 1,230 | | 100 | | $ | 1,181 | | 100 | | $ | 1,163 | | 100 |

| | | | | | | | | | | | | | | |

A large majority of sales to foreign countries are denominated in U.S. dollars. Sales from non-U.S. operations comprised approximately 4 percent of total 2006 sales. See Note 3— Segment and Geographical Informationfor additional information.

Intellectual Property

We own numerous patents, trade secrets and know-how, particularly relating to our Performance Fibers business. We intend to continue to take such steps as are necessary to protect our products and processes, including filing patent applications for future inventions that are deemed important to our business operations. Our U.S. patents have a duration of 20 years from the date of filing.

Competition

Our timberlands are located in three major timber-growing regions (the Northwest, Northeast and Southern U.S.), where timber markets are fragmented. In the Northwest, The Campbell Group, Hancock Timber Resource Group, Green Diamond Resource Company, Weyerhaeuser, Longview Fibre, Port Blakely Tree Farms, and Washington State (Department of Natural Resources) are significant competitive suppliers. Other competition in the Northwest arises from log imports from Canada. In the Southern region, we compete with Plum Creek Timber Company, Weyerhaeuser, TIMOs such as Timberstar and Resource Management Services, who purchased large portions of the timberland sold by International Paper in 2006, and many small, non-industrial land owners. In all markets, price is the principal method of competition.

In Performance Fibers, we market high purity, specialty cellulose fibers worldwide against strong competition from domestic and foreign producers. Major competitors include Buckeye Technologies Inc., Borregaard, and Sappi Saiccor. Pricing, product performance, and technical service are principal methods of competition. During 2005, Sappi Saiccor announced a 200,000 ton per year expansion at one of its cellulose specialty pulp mills in South Africa, and Sateri International announced construction of a 360,000 ton per year cellulose specialty pulp mill in Bahia, Brazil. The status of these projects is currently unclear, although it is possible that one or both of them could be producing product in 2007. In May 2006, Neucel Specialty Cellulose Ltd. restarted a 160,000 ton cellulose specialty mill located in Port Alice, British Columbia. In September 2006, Weyerhauser closed its 155,000 metric ton cellulose specialty pulp mill located in Cosmopolis, Washington; however, in January 2007 they announced a potential sale of the mill to private investors which, if consummated, could return the mill to cellulose specialty production. The aggregate impact of facility closures and potential new market capacity is not expected to

5

adversely affect the results of our Performance Fibers segment in 2007; however, it is likely that these market dynamics will impact our business in 2008 and beyond.

Our Wood Products business competes with a number of lumber producers throughout the U.S. and Canada, but particularly with sawmills throughout Georgia and Florida. Our lumber business represents less than one-half of one percent of North American capacity.

Customers

In 2006, a group of customers under the common control of Eastman Chemical Company and its affiliates represented approximately 20 percent of the Performance Fibers segment’s sales and 11 percent of our consolidated sales. Another customer of the Performance Fibers segment comprised 12 percent of the segment’s sales. In the Wood Products segment, one customer comprised 11 percent of segment sales and in the Trading segment, 18 percent of its sales were to a single customer. The loss of any of these customers could have a material adverse effect on these segments’ results of operations.

Backlogged Orders

We do not consider backlog to be a significant indicator of the level of future Performance Fibers sales. We manufacture our products based on existing orders as well as projections of future orders. Therefore, we believe that backlog information is not material to understanding our overall business and should not be considered an indicator of our ability to achieve any particular level of revenue.

Seasonality

Our Timber segment sales are generally lower in the third quarter due to greater availability of non-Rayonier timber during the drier summer harvesting period, particularly in the Northwestern U.S. Our Wood Products segment may experience higher seasonal demand in the second quarter primarily due to increased new housing construction. Our Performance Fibers and Real Estate segments’ results are normally not impacted by seasonal changes.

Environmental Matters

See Item 7 —Management’s Discussion and Analysis of Financial Condition and Results of Operations — Environmental Regulationand Note 16 —Contingencies.

Raw Materials

The manufacture of our performance fibers products and lumber requires significant amounts of wood. Timber harvesting can be restricted by adverse weather conditions, legal challenges and pressure from various environmental groups. The supply of timber is directly affected by price and demand fluctuations in wood products and in pulp and paper markets.

In 2006, hardwood pricing decreased modestly from 2005 levels, primarily due to ample supply caused by favorable weather conditions. Our Performance Fibers and lumber mills obtain their logs through open market purchases made by our wood procurement organization, which negotiates prices and volumes with independent third party suppliers who deliver to our facilities. In some cases, third party logging contractors may have purchased timber cutting rights from our timberlands in Georgia and Florida (generally through a sealed bid process).

Performance Fibers manufacturing also requires significant amounts of fuel oil and natural gas. These raw materials are subject to significant changes in prices and availability, which could adversely impact our future operating results. With the recent surge in energy prices, we initiated a number of capital projects to reduce fossil fuel consumption, including a recently completed power boiler replacement which is expected to consume primarily wood waste and will significantly reduce oil usage. We continually pursue reductions in usage and costs of other key raw materials, supplies and contract services at our Performance Fibers and lumber mills and do not foresee any material constraints in the near term from pricing or availability.

Research and Development

In Jesup, GA, at our research and development facility, our research and development efforts are directed primarily at further developing existing core products and technologies, improving the quality of cellulose fiber grades, absorbent materials and related products, improving manufacturing efficiency and environmental controls, and reducing fossil fuel consumption.

The research and development activities of our timber operations include genetic tree improvement and applied silvicultural programs to identify management practices that will improve financial returns from our timber assets.

6

Our research and development expenditures were approximately $6 million in both 2006 and 2005, and $7 million in 2004.

Employee Relations

We currently employ approximately 2,000 people, of whom approximately 1,900 are in the United States. Approximately 900 of our hourly Performance Fibers employees are covered by labor contracts. The majority of our hourly employees are represented by one of several labor unions. We believe relations with our employees are satisfactory.

In August and December 2001, labor agreements covering approximately 660 hourly employees at our Jesup mill were extended through June 30, 2008. In December of 2005, two labor unions representing approximately 220 hourly employees at our Fernandina mill approved a four-year contract, which expires on April 30, 2010. There were no changes to our labor contracts in 2006.

Sustainable Forestry

While it is our objective to maximize future wood supply through forest management programs that increase timberland productivity, we have a longstanding commitment to meet the highest levels of forest stewardship and to promote sustainable forestry practices throughout the industry. As a member of the American Forest and Paper Association, we subscribe to the SFI program, a comprehensive system of environmental principles, objectives and performance measures that combines the perpetual growing and harvesting of trees with the protection of wildlife, plants, soil and water quality. Most of our U.S. timberlands and wood procurement practices have been audited and certified by an independent third party under the SFI program. The recently purchased properties in Texas, Louisiana, Oklahoma, Arkansas, Alabama and New York have been managed to be compliant with SFI standards by the prior owners, but were not audited or certified under the SFI program. It is our intent, and efforts are currently underway, to have these properties audited and certified by an independent third party under the SFI program by the end of 2007. The independent certification verifies that we meet strict requirements for growing and harvesting trees in an environmentally responsible manner that protects natural resources, renews forests, creates biological diversity, and enhances wildlife protection. In addition, our New Zealand JV participates in various environmental initiatives such as the Forest Owners Association, the New Zealand Forest Accord and the Forest Stewardship Council.

Availability of Reports and Other Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments to those reports filed or furnished pursuant to Sections 13(a) or 14 of the Securities Exchange Act of 1934 are made available to the public free of charge in the Investor Relations section of our website (www.rayonier.com), shortly after we electronically file such material with, or furnish them to, the SEC. Our corporate governance guidelines and charters of all Committees of our Board of Directors are also available on our website. These documents are also available in print, free of charge, to any investor upon request to: Investor Relations Department, Rayonier Inc., 50 North Laura Street, Jacksonville, Florida 32202.

Our operations are subject to a number of risks, including those listed below. When considering an investment in our securities, you should carefully read and consider these risks, together with all other information in this report. If any of the events described in the following risk factors actually occur, our business, financial condition or operating results, as well as the market price of our securities, could be materially adversely affected.

Business and Operating Risks

The cyclical nature of our businesses could adversely affect our results of operations.

Our financial performance is affected by the cyclical nature of the forest products and real estate industries. The markets for timber, real estate, performance fibers and wood products are influenced by a variety of factors beyond our control. For example, the demand for real estate can be affected by changes in interest rates, local economic conditions, population growth and demographics. The demand for sawtimber is primarily affected by the level of new residential and commercial construction activity. The supply of timber and logs has historically increased during favorable pricing environments, which then causes downward pressure on prices.

The forest products and real estate industries are highly competitive.

Many of our competitors in the forest products businesses have substantially greater financial and operating resources and own more timberlands than we do. Some of our forest products competitors may also be lower-cost producers in some

7

of the businesses in which we operate. In addition, wood products are subject to significant competition from a variety of non-wood and engineered wood products. We are also subject to competition from various forest products, including logs, imported from foreign countries to the United States as well as to the export markets served by us. To the extent there is a significant increase in competitive pressures from substitute products or other domestic or foreign suppliers, our business could be substantially adversely affected. With respect to our real estate business, we are continuing the transition from a bulk land seller to engaging in value-added real estate development activities, including obtaining entitlements and entering into joint venture, participation and other development-related arrangements. Many of our competitors in this segment have greater experience in real estate development than we do.

Changes in energy and raw materials prices could impact our operating results and financial condition.

Energy and raw material costs, such as oil, natural gas, wood, and chemicals are a significant operating expense, particularly for the Performance Fibers and Wood Products businesses. The prices of raw materials and energy can be volatile and are susceptible to rapid and substantial increases due to factors beyond our control such as changing economic conditions, political unrest and instability in energy-producing nations, and supply and demand considerations. For example, oil and natural gas costs have increased substantially in recent years and we have experienced, at times, a limited availability of hardwood which has resulted in increased production costs for some Performance Fibers products. Increases in production costs could have a material adverse effect on our business, financial condition and results of operations.

Changes in global market trends and world events could impact customer demand.

The global reach of our business, particularly the Performance Fibers business and our interest in the New Zealand JV, causes us to be subject to unexpected, uncontrollable and rapidly changing events and circumstances in addition to those experienced in the U.S. Adverse changes in the following factors, among others, could have a negative impact on our business and results of operations:

| | • | | effects of exposure to currencies other than the United States dollar; |

| | • | | regulatory, social, political, labor or economic conditions in a specific country or region; and |

| | • | | trade protection laws, policies and measures and other regulatory requirements affecting trade and investment, including loss or modification of exemptions for taxes and tariffs, and import and export licensing requirements. |

Our businesses are subject to extensive environmental laws and regulations that may restrict or adversely impact our ability to conduct our business.

If regulatory and environmental permits are delayed, restricted or rejected, a variety of operations could be delayed or restricted. In connection with a variety of operations on our properties, we are required to seek permission from agencies in the states and countries in which we operate to perform certain activities. Any of these agencies could delay review of, or reject, any of our filings. In our Timber business, any delay associated with a filing could result in a delay or restriction in replanting, thinning, insect control, fire control or harvesting, any of which could have an adverse effect on our operating results. For example, in Washington State, we are required to file a Forest Practice Application for each unit of timberland to be harvested. These applications may be denied, conditioned or restricted by the regulatory agency or appealed by other parties, including citizen groups. Appeals or actions of the regulatory agencies could delay or restrict timber harvest activities pursuant to these permits. Delays or harvest restrictions on a significant number of applications could have an adverse effect on our operating results. In our Performance Fibers and Wood Products businesses, many modifications and capital projects at our manufacturing facilities require an environmental permit, or an amendment to an existing permit. Delays in obtaining these permits could have an adverse effect on our results of operations.

Environmental groups and interested individuals may seek to delay or prevent a variety of operations. We expect that environmental groups and interested individuals will intervene with increasing frequency in the regulatory processes in the states and countries where we own, lease or manage timberlands, and operate mills. For example, in Washington State, environmental groups and interested individuals may appeal individual forest practice applications or file petitions with the Forest Practices Board to challenge the regulations under which forest practices are approved. These and other challenges could materially delay or prevent operations on our properties. Delays or restrictions due to the intervention of environmental groups or interested individuals could adversely affect our operating results. In addition to intervention in regulatory proceedings, interested groups and individuals may file or threaten to file lawsuits that seek to prevent us from obtaining permits or implementing capital improvements or our operating plans. Any lawsuit or even a threatened lawsuit could delay harvesting on our timberlands. Among the remedies that could be enforced in a lawsuit is a judgment preventing or restricting harvesting on a portion of our timberlands, or adversely affecting the projected operating benefits or cost of capital projects at our mills.

8

The impact of existing regulatory restrictions on future harvesting activities may be significant. Federal, state and local laws and regulations, as well as those of other countries, which are intended to protect threatened and endangered species, as well as waterways and wetlands, limit and may prevent timber harvesting, road building and other activities on our timberlands. The threatened and endangered species restrictions apply to activities that would adversely impact a protected species or significantly degrade its habitat. The size of the area subject to restriction will vary depending on the protected species at issue, the time of year and other factors, but can range from less than one to several thousand acres. A number of species that naturally live on or near our timberlands, including the northern spotted owl, marbled murrelet, bald eagle, several species of salmon and trout in the Northwest, and the red cockaded woodpecker, bald eagle, wood stork, red hill salamander, and flatwoods salamander in the Southeast, are protected under the Federal Endangered Species Act or similar state laws. As we gain additional information regarding the presence of threatened or endangered species on our timberlands, or if regulations become more restrictive, the amount of our timberlands subject to harvest restrictions could increase.

Our manufacturing operations, and in particular our Performance Fibers and Wood Products mills, are subject to stringent environmental laws and regulations concerning air emissions, wastewater discharge, water usage and waste handling and disposal.Many of our operations are subject to stringent environmental laws and regulations and permits which contain conditions that govern how we operate our facilities and, in many cases, how much product we can produce. These laws, regulations and permits, now and in the future, may restrict our current production and limit our ability to increase production, and impose significant costs on our operations with respect to environmental compliance. It is expected that, overall, these costs will likely increase over time as environmental laws, regulations and permit conditions become more stringent, and as the expectations of the communities in which we operate become more demanding.

We currently own or may acquire properties which may require environmental remediation or otherwise be subject to environmental and other liabilities.We currently own, or formerly operated, manufacturing facilities and discontinued operations, or may acquire timberlands and other properties, which are subject to environmental liabilities, such as cleanup of hazardous material contamination and other existing or potential liabilities of which we are not currently aware. The cost of investigation and remediation of contaminated properties could increase operating costs and adversely affect financial results. Although we believe we have adequate reserves for the investigation and remediation of our current properties, there can be no assurance that actual expenditures will not exceed our expectations.

Environmental laws and regulations are constantly changing, and are generally becoming more restrictive.Laws, regulations and related judicial decisions and administrative interpretations affecting our business are subject to change and new laws and regulations that may affect our business are frequently enacted. These changes may adversely affect our ability to harvest and sell timber, operate our manufacturing facilities and/or develop real estate. These laws and regulations may relate to, among other things, the protection of timberlands, endangered species, timber harvesting practices, recreation and aesthetics, protection and restoration of natural resources, air and water quality, and remedial standards for contaminated property and groundwater. Over time, the complexity and stringency of these laws and regulations have increased markedly and the enforcement of these laws and regulations has intensified. We believe that these laws and regulations will continue to become more restrictive and over time could adversely affect our operating results.

Development of real estate entails a lengthy, uncertain and costly approval process.

Development of real estate entails extensive approval processes involving multiple regulatory jurisdictions. It is common for a project to require various approvals, permits and consents from federal, state and local governing and regulatory bodies. For example, in Florida, real estate projects must generally comply with the provisions of the Local Government Comprehensive Planning and Land Development Regulation Act (the “Growth Management Act”) and local land use and development regulations. In addition, in Florida, development projects that exceed certain specified regulatory thresholds require approval of a comprehensive Development of Regional Impact (DRI) application. Compliance with the Growth Management Act, local land development regulations and the DRI process is usually lengthy and costly and significant conditions can be imposed on a developer with respect to a particular project. In addition, development of properties containing delineated wetlands may require one or more permits from the federal government. Any of these issues can materially affect the cost and timing of our real estate development activities.

The real estate development and entitlement process is frequently a political one, which involves uncertainty and often extensive negotiation and concessions in order to secure the necessary approvals and permits. A significant amount of our development property is located in counties in which local governments face challenging issues relating to growth and development, including zoning and future land use, public services, infrastructure and funding for same, and the requirements of state law, especially in the case of Florida under the Growth Management Act and DRI process.

9

Other issues affecting real estate development include the availability of potable water for new development projects. For example, in Georgia, the Legislature recently enacted the Comprehensive Statewide Watershed Management Planning Act (the “Watershed Management Act”), which, among other things, created a governmental entity called the Georgia Water Council which is charged with preparing a comprehensive water management plan for the state and presenting it to the Georgia Legislature for adoption no later than 2008. It is unclear at this time what this plan will provide or how it will affect the cost and timing of real estate development along the I-95 coastal corridor in southern Georgia, where the Company has significant real estate holdings.

Changes in the interpretation or enforcement of these laws, the enactment of new laws regarding the use and development of real estate, changes in the political composition of state and local governmental bodies, and the identification of new facts regarding our properties could lead to new or greater costs, delays and liabilities that could materially adversely affect our business, profitability or financial condition.

Changes in demand for our real estate and delays in the timing of real estate transactions may affect our revenues and operating results.

A number of factors, including changes in demographics, and a slowing of commercial or residential real estate development, particularly along the I-95 coastal corridor in Florida and Georgia, could reduce the demand for such properties and negatively affect our results of operations.

In addition, there are inherent uncertainties in the timing of real estate transactions that could adversely affect our operating results. Delays in the completion of transactions or the termination of potential transactions can be caused by factors beyond our control. These events have in the past and may in the future adversely affect our operating results.

Our joint venture partners may have interests that differ from ours and may take actions that adversely affect us.

We participate in a joint venture in New Zealand, and may enter into other joint venture projects; for example, as part of our real estate development strategy. A joint venture involves potential risks such as:

| | • | | not having voting control over the joint venture; |

| | • | | the venture partner at any time may have economic or business interests or goals that are inconsistent with ours; |

| | • | | the venture partner may take actions contrary to our instructions or requests, or contrary to our policies or objectives with respect to the investment; and |

| | • | | the venture partner could experience financial difficulties. |

Actions by our venture partners may subject property owned by the joint venture to liabilities greater than those contemplated by the joint venture agreement or have other adverse consequences.

We may be unsuccessful in carrying out, our acquisition strategy.

We intend to pursue acquisitions of strategic timberland and real estate properties. Our timberland and real estate acquisitions may not perform in accordance with our expectations. We anticipate financing any such acquisitions through cash from operations, borrowings under our credit facilities, proceeds from equity or debt offerings or proceeds from asset dispositions, or any combination thereof. The failure of any acquisitions to perform to our expectations could adversely affect our operating results.

Our failure to maintain satisfactory labor relations could have a material adverse effect on our business.

Approximately 45 percent of our work force is unionized. These workers are almost exclusively in our Performance Fibers business. As a result, we are required to negotiate the wages, benefits and other terms with many of our employees collectively. Our financial results could be adversely affected if labor negotiations were to restrict the efficiency of our operations. Our inability to negotiate acceptable contracts with any of these unions as existing agreements expire could result in strikes or work stoppages by the affected workers. If the unionized employees were to engage in a strike or other work stoppage, or other employees were to become unionized, we could experience a significant disruption of our operations, which could have a material adverse effect on our business, results of operations and financial condition.

Weather and other natural conditions may limit our timber harvest and sales.

Weather conditions, timber growth cycles and restrictions on access may limit harvesting of our timberlands, as may other factors, including damage by fire, insect infestation, disease, prolonged drought and natural disasters.

10

We do not insure against losses of timber from any causes, including fire.

The volume and value of timber that can be harvested from our timberlands may be reduced by fire, insect infestation, severe weather, disease, natural disasters, and other causes beyond our control. A reduction in our timber inventory could adversely affect our financial results and cash flows. As is typical in the industry, we do not maintain insurance for any loss to our timber, including losses due to these causes.

A significant portion of the timberland that we own, lease or manage is concentrated in limited geographic areas.

We own, lease or manage approximately 2.7 million acres of timberland and real estate located primarily in the United States and New Zealand. Approximately 1.7 million acres are located in Georgia, Florida, Alabama, Arkansas, Louisiana, Texas and Oklahoma. Accordingly, if the level of production from these forests substantially declines, or if the demand for timber in those regions declines, it could have a material adverse effect on our overall production levels and our revenues.

We are dependent upon attracting and retaining key personnel.

We believe that our success depends, to a significant extent, upon our ability to attract and retain key senior management and operations management personnel. Our failure to recruit and retain these key personnel could adversely affect our financial condition or results of operations. Our Chairman, President and Chief Executive Officer, W. Lee Nutter has publicly announced his plan to retire in 2007. Although a search is currently underway for Mr. Nutter’s successor, no assurances can be given to the effect his replacement will have on our results of operations, financial condition, or stock price.

Market interest rates may influence the price of our common shares.

One of the factors that may influence the price of our common shares will be the annual dividend yield as compared to yields on other financial instruments. Thus, an increase in market interest rates will result in higher yields on other financial instruments, which could adversely affect the price of our common shares.

We have a significant amount of debt and the capacity to incur significant additional debt.

As of December 31, 2006, we had $661 million of debt outstanding. See Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations — Contractual Financial Obligations and Off-Balance Sheet Arrangementsfor the payment schedule of our long-term debt obligations. We expect that existing cash, cash equivalents, marketable securities, cash provided from operations, and our bank credit facilities will be sufficient to meet ongoing cash requirements. Moreover, we have the borrowing capacity to incur significant additional debt and may do so if we enter into one or more strategic, merger, acquisition or other corporate or investment opportunities, or otherwise invest capital in one or more of our businesses. However, failure to generate sufficient cash as our debt becomes due, or to renew credit lines prior to their expiration, may adversely affect our business, financial condition, operating results, and cash flow.

REIT and Tax-Related Risks

If we fail to qualify as a REIT or fail to remain qualified as a REIT, we will have reduced funds available for distribution to our shareholders because our income will be subject to taxation at regular corporate rates.

We intend to operate in accordance with REIT qualifications under the Internal Revenue Code of 1986, as amended (the “Code”). As a REIT, we generally will not pay corporate-level tax on income we distribute to our shareholders (other than the income of TRS) as long as we distribute at least 90 percent of our REIT taxable income (determined without regard to the dividends paid deduction and by excluding net capital gain). Qualification as a REIT involves the application of highly technical and complex provisions of the Code, which are subject to change, perhaps retroactively, and which are not entirely within our control. We cannot assure that we will qualify as a REIT or be able to remain so qualified or that new legislation, U.S. Treasury regulations, administrative interpretations or court decisions will not significantly affect our ability to qualify as a REIT or the federal income tax consequences of such qualification.

If in any taxable year we fail to qualify as a REIT, we will suffer the following negative results:

| | • | | we will not be allowed a deduction for dividends paid to shareholders in computing our taxable income; and |

| | • | | we will be subject to federal income tax on our REIT taxable income at regular corporate rates. |

In addition, we will be disqualified from treatment as a REIT for the four taxable years following the year during which the qualification was lost, unless we are entitled to relief under certain provisions of the Code. As a result, our net income and the cash available for distribution to our shareholders could be reduced for up to five years or longer.

11

If we fail to qualify as a REIT, we may need to borrow funds or liquidate some investments or assets to pay the additional tax liability. Accordingly, cash available for distribution to our shareholders would be reduced.

The extent of our use of taxable REIT subsidiaries may affect the price of our common shares relative to the share price of other REITs.

We conduct a portion of our business activities through one or more taxable REIT subsidiaries. Our use of taxable REIT subsidiaries enables us to engage in non-REIT qualifying business activities such as the production and sale of performance fibers and wood products, real estate development, sales and development of HBU property and timberlands (as a dealer) and sales of logs. Taxable REIT subsidiaries are subject to corporate-level tax. Therefore, we pay income taxes on the income generated by our taxable REIT subsidiaries. Under the Code, no more than 20 percent of the value of the gross assets of a REIT may be represented by securities of one or more taxable REIT subsidiaries. This limitation may affect our ability to increase the size of our taxable REIT subsidiaries’ operations. Furthermore, our use of taxable REIT subsidiaries may cause the market to value our common shares differently than the shares of other REITs, which may not use taxable REIT subsidiaries as extensively as we use them.

Lack of shareholder ownership and transfer restrictions in our articles of incorporation may affect our ability to qualify as a REIT.

In order to qualify as a REIT, an entity cannot have five or fewer individuals who own, directly or indirectly after applying attribution of ownership rules, 50 percent or more of its outstanding voting shares during the last six months in each calendar year. Although it is not required by law or the REIT provisions of the Code, almost all REITs have adopted ownership and transfer restrictions in their articles of incorporation or organizational documents which seek to assure compliance with that rule. While we are not in violation of the ownership rules, we do not have, nor do we have any current plans to adopt, share ownership and transfer restrictions. As such, the possibility exists that five or fewer individuals could acquire 50 percent or more of our outstanding voting shares, which could result in our disqualification as a REIT.

We may be limited in our ability to fund distributions using cash generated through our taxable REIT subsidiaries.

The ability for the REIT to receive dividends from taxable REIT subsidiaries is limited by the rules with which we must comply to maintain our status as a REIT. In particular, at least 75 percent of gross income for each taxable year as a REIT must be derived from sales of our standing timber and other types of qualifying real estate income and no more than 25 percent of our gross income may consist of dividends from our taxable REIT subsidiaries and other non-qualifying income.

This limitation on our ability to receive dividends from our taxable REIT subsidiaries may impact our ability to fund distributions to stockholders using cash flows from our taxable REIT subsidiaries. The net income of our taxable REIT subsidiaries is not required to be distributed, and income that is not distributed will not be subject to the 90 percent income distribution requirement.

Certain of our business activities are potentially subject to prohibited transactions tax.

As a REIT, we will be subject to a 100 percent tax on any net income from “prohibited transactions.” In general, prohibited transactions are sales or other dispositions of property to customers in the ordinary course of business. Sales of performance fibers and wood products which we produce and sales of logs constitute prohibited transactions. In addition, sales of timberlands or other real estate (as a dealer) and certain development activities relating to real estate could, in certain circumstances, constitute prohibited transactions.

We intend to avoid the 100 percent prohibited transactions tax by conducting activities that would otherwise be prohibited transactions through one or more taxable REIT subsidiaries. We may not, however, always be able to identify timberland properties that will become part of our “dealer” real estate sales business. Therefore, if we sell timberlands which we incorrectly identify as property not held for sale to customers in the ordinary course of business or which subsequently become properties held for sale to customers in the ordinary course of business, we face the potential of being subject to the 100 percent prohibited transactions tax.

We may have adjustments to deferred and contingent tax liabilities.

We will be subject to a federal corporate-level tax at the highest regular corporate rate (currently 35 percent) on any gain recognized from a taxable sale of any asset which we held at January 1, 2004, the effective date of our REIT election,

12

that occurs within ten years of that date. However, we will be subject to such tax only to the extent of the difference between our tax basis and the fair market value of those assets as of January 1, 2004 (the “built-in-gain”). Gain from a taxable sale of those assets occurring more than ten years after January 1, 2004 will not be subject to this corporate-level tax.

In addition, the IRS may assert liabilities against us for corporate income taxes for taxable years prior to the time we qualified as a REIT, in which case we will owe these taxes plus interest and penalties, if any. Moreover, any increase in taxable income for those years will result in an increase in accumulated earnings and profits, or E&P, which could cause us to pay an additional taxable distribution to our then-existing shareholders within 90 days of the relevant determination.

Our cash dividends are not guaranteed and may fluctuate.

Generally, REITs are required to distribute 90 percent of their taxable income. However, REITs are required to distribute only their ordinary taxable income and not their net capital gains income. Accordingly, we do not believe that we are required to distribute material amounts of cash since substantially all of our taxable income is treated as capital gains income. Our Board of Directors, in its sole discretion, determines the amount of quarterly dividends to be provided to our stockholders based on consideration of a number of factors. These include, but are not limited to, our results of operations, cash flow and capital requirements, economic conditions, tax considerations, borrowing capacity and other factors, including debt covenant restrictions that may impose limitations on cash payments, future acquisitions and divestitures, harvest levels, changes in the price and demand for our products and general market demand for timberlands including those timberland properties that have higher and better uses. Consequently, our dividend levels may fluctuate.

We may not be able to complete desired like-kind exchange transactions for timberlands and real estate we sell.

When we sell timberlands and real estate, we generally seek to match these sales with the acquisition of suitable replacement real estate. This allows us to claim “like-kind exchange” treatment for these transactions under section 1031 and related regulations of the Code. This matching of sales and purchases provides us with significant tax benefits, most importantly the deferral of any gain on the property sold until ultimate disposition of the replacement property. For example, we frequently utilize like-kind exchanges to transfer HBU properties from RFR to TerraPointe. While we attempt to complete like-kind exchanges wherever practical, we will not be able to do so in all instances due to various factors, including the lack of availability of suitable replacement property on acceptable terms, inability to complete a qualifying like-kind exchange transaction within the timeframes required by the Code and if we incorrectly identify real estate as property not held for sale to customers in the ordinary course of business or which subsequently becomes real estate held for sale to customers in the ordinary course of business. The inability to obtain like-kind exchange treatment would result in the payment of taxes with respect to the property sold, and a corresponding reduction in earnings and cash available for distribution to shareholders as dividends.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

13

The following table details the significant properties we own, lease, or manage by reportable segment:

| | | | | | | | | | |

Segment | | Location | | Total Acres | | Fee-Owned Acres | | Long-Term

Leased Acres | | Managed Acres |

Timber | | Southern U.S. | | 1,693,077 | | 1,445,654 | | 247,423 | | — |

| | Northwest U.S. | | 370,446 | | 370,446 | | — | | — |

| | New Zealand * | | 350,938 | | — | | — | | 350,938 |

| | Australia ** | | 113,793 | | — | | — | | 113,793 |

| | New York | | 75,133 | | 75,133 | | — | | — |

| | | | | | | | | | |

Total Timber Acres | | 2,603,387 | | 1,891,233 | | 247,423 | | 464,731 |

Real Estate | | Southeast U.S. | | 40,090 | | 40,090 | | — | | — |

Leased Timberlands-Held For Sale | | 37,725 | | — | | 37,725 | | — |

| | | | | | | | | | |

Total Timberland and Real Estate Acres | | 2,681,202 | | 1,931,323 | | 285,148 | | 464,731 |

| | | | | | | | | | |

| | | | | | |

| | | |

| | | | | Capacity/Function | | Owned/Leased |

Performance Fibers | | Jesup, Georgia | | 590,000 metric tons of pulp | | Owned |

| | Fernandina Beach, Florida | | 150,000 metric tons of pulp | | Owned |

| | Jesup, Georgia | | Research Facility | | Owned |

| | | |

Wood Products*** | | Baxley, Georgia | | 180 million board feet of lumber | | Owned |

| | Swainsboro, Georgia | | 120 million board feet of lumber | | Owned |

| | Eatonton, Georgia | | 90 million board feet of lumber | | Owned |

| | | |

Corporate and Other | | Jacksonville, FL | | Corporate Headquarters | | Leased |

| * | Acres under Rayonier management, owned by the New Zealand JV (Rayonier owns a 40 percent interest). |

| ** | Acres under Rayonier management. |

| *** | These locations also have a combined annual capacity of approximately 750,000 tons of wood chips for pulp and paper manufacturing. |

Our manufacturing facilities are maintained through ongoing capital investments, regular maintenance and equipment upgrades. During 2006, our manufacturing facilities generally produced at planned capacity levels and there were no unplanned material idle times.

We also own a wood fiber facility in Jarratt, Virginia which has an annual capacity of 250,000 short green tons of chips. In January 2007, we purchased wood fiber facilities in Eastman, GA, Barnesville, GA and Offerman, GA, with the capacity to produce 2.3 million short green tons of wood chips.

In addition, our wholly-owned subsidiary, SWP, which ceased operations in 1989 except for environmental remedial activities, owns 864 acres of land.

We are engaged in various legal actions, including certain environmental proceedings that are discussed more fully in Note 15 —Reserves for Dispositions and Discontinued Operations and Note 16 —Contingencies.

The Company has been named as a defendant in various other lawsuits and claims arising in the normal course of business. While we have procured reasonable and customary insurance covering risks normally occurring in connection with our businesses, we have in certain cases retained some risk through the operation of self-insurance, primarily in the areas of workers compensation, property insurance, and general liability. In our opinion, these other lawsuits and claims, either individually or in the aggregate, are not expected to have a material effect on our financial position, results of operations, or cash flow.

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matter was submitted to a vote of security holders of Rayonier during the fourth quarter of 2006.

| Item 4A. | EXECUTIVE OFFICERS OF RAYONIER |

W. Lee Nutter, 63, Chairman, President and Chief Executive Officer—Mr. Nutter joined Rayonier in 1967 in the Northwest Forest Operations and was named Vice President, Timber and Wood in 1984, Vice President, Forest Products in 1985, Senior Vice President, Operations in 1986 and Executive Vice President in 1987. He was elected President and Chief

14

Operating Officer and a director of Rayonier in 1996 and to his current position effective January 1999. Mr. Nutter serves on the Board of Directors of Republic Services, Inc. and the J. M. Huber Corporation, a privately-held diversified supplier of engineered materials, natural resources and technology services. Mr. Nutter also serves on the Board of Directors of the National Council for Air and Stream Improvement and the American Forest and Paper Association. He is also a member of the North Florida Regional Board of SunTrust Bank. Mr. Nutter holds a B.A. in Business Administration from the University of Washington and graduated from the Harvard University Graduate School of Business Advanced Management Program.

Paul G. Boynton, 42, Senior Vice President, Performance Fibers—Mr. Boynton joined Rayonier in 1999 as Director, Specialty Pulp Marketing and Sales. He was elected Vice President, Performance Fibers Marketing and Sales in October 1999, Vice President, Performance Fibers in January 2002, and to his current position effective July 2002. Prior to joining Rayonier, he held positions with 3M Corporation from 1990 to 1999, most recently as Global Brand Manager, 3M Home Care Division (global manufacturer and marketer of cleaning tool products). He holds a B.S. in mechanical engineering from Iowa State University, an M.B.A. from the University of Iowa, and graduated from the Harvard University Graduate School of Business Advanced Management Program.

Timothy H. Brannon, 59, Senior Vice President, Forest Resources and Wood Products—Mr. Brannon joined Rayonier in 1972 at its Southern Wood Piedmont subsidiary (SWP). He was named Vice President and Chief Operating Officer of SWP in 1983 and President in 1992. Mr. Brannon was elected Rayonier’s Vice President and Director, Performance Fibers Marketing and Sales in 1994, Vice President, Asia Pacific and Managing Director, Rayonier New Zealand in 1998 and to his current position effective March 2002. He holds a B.A. in psychology from Tulane University and graduated from the Harvard University Graduate School of Business Advanced Management Program.

W. Edwin Frazier, III, 49, Senior Vice President, Administration and Corporate Secretary—Mr. Frazier was promoted to his current position in July 2004. He joined Rayonier in 1999 as Assistant General Counsel, was promoted to Associate General Counsel in 2000 and elected Corporate Secretary in 2001. Mr. Frazier was named Vice President Governance and Corporate Secretary in 2003. From 1991 to 1999, Mr. Frazier was with the legal department of Georgia-Pacific Corporation (a global manufacturer and marketer of tissue, packaging, paper, building products and related chemicals), last serving as Chief Counsel – Corporate. Prior to that, he practiced corporate law with Troutman Sanders in Atlanta. Mr. Frazier holds a B.S. in Business Administration from the University of Tennessee, a J.D. from Emory University and graduated from the Harvard University Graduate School of Business Advanced Management Program.

Hans E. Vanden Noort, 48, Senior Vice President and Chief Accounting Officer—Mr. Vanden Noort joined Rayonier as Corporate Controller in 2001, and was elected to his current position in August 2005. Prior to joining Rayonier, he held a number of senior management positions with Baker Process, a division of Baker Hughes, Inc. (manufacturer of oilfield service equipment and supplies), most recently as Vice President of Finance and Administration. Prior to that, he was with the public accounting firm of Ernst & Young. Mr. Vanden Noort holds a B.B.A. in accounting from the University of Cincinnati, an M.B.A. from the University of Michigan and is a Certified Public Accountant.

Carl E. Kraus, 59, Senior Vice President, Finance and Chief Investment Officer of TerraPointe LLC—Mr. Kraus joined Rayonier in 2005, and was elected to his current position in October 2005. Prior to joining Rayonier, he served as Senior Vice President, Chief Financial and Investment Officer and Treasurer of Kramont Realty Trust (a shopping center REIT) from 2002 until it was acquired in 2005 and as Chief Financial Officer for Philips International Realty Corp. (a shopping center REIT) from 1999 to 2002. Mr. Kraus graduated from Temple University and is a Certified Public Accountant.

Michael R. Herman, 44, Vice President, General Counsel and Assistant Secretary—Mr. Herman joined Rayonier in 2003 as Vice President and General Counsel and was elected to his current position in October 2003. Prior to joining Rayonier, he served as Vice President and General Counsel of GenTek Inc. (a publicly-traded global manufacturing conglomerate) and in other positions in GenTek’s legal department from 1992 to August 2003. GenTek Inc. filed a voluntary petition for protection under Chapter 11 of the Federal Bankruptcy Code in the Bankruptcy Court for the District of Delaware in October of 2002, and the Bankruptcy Court approved a plan of reorganization for GenTek in November 2003 which resulted in GenTek’s emergence from bankruptcy. Mr. Herman was previously counsel to IBM’s Integrated Systems Solutions Corporation and an associate with the law firm of Shearman & Sterling. He holds a B.A. in Economics and English from Binghamton University and a J.D. from St. John’s University School of Law.

Charles Margiotta, 54, Senior Vice President, Business Development and President of TerraPointe LLC—Mr. Margiotta joined Rayonier in 1976, was named Managing Director, Rayonier New Zealand in 1992, Vice President, Forest & Wood Products in 1997, Vice President, Corporate Development & Strategic Planning in 1998 and was elected to his current position in May 2005. Mr. Margiotta holds a B.B.A. from Pace University and graduated from the Harvard University Graduate School of Business Advanced Management Program.

15

PART II

| Item 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Prices of our Common Shares; Dividends

The table below reflects the range of market prices of our Common Shares as reported in the consolidated transaction reporting system of the New York Stock Exchange, the only exchange on which our shares are listed, under the trading symbolRYN. Amounts shown below for 2005 have been restated for the October 17, 2005 three-for-two stock split.

| | | | | | | | | |

| 2006 | | High | | Low | | Dividends |

Fourth Quarter | | $ | 42.19 | | $ | 37.68 | | $ | 0.47 |

Third Quarter | | $ | 40.78 | | $ | 36.45 | | $ | 0.47 |

Second Quarter | | $ | 47.50 | | $ | 36.15 | | $ | 0.47 |

First Quarter | | $ | 46.07 | | $ | 39.70 | | $ | 0.47 |

| | | |

2005 | | | | | | | | | |

Fourth Quarter | | $ | 41.68 | | $ | 34.00 | | $ | 0.47 |

Third Quarter | | $ | 38.65 | | $ | 34.79 | | $ | 0.41 |

Second Quarter | | $ | 36.67 | | $ | 32.27 | | $ | 0.41 |

First Quarter | | $ | 33.97 | | $ | 29.01 | | $ | 0.41 |

For information about covenants in our credit facility that could restrict our ability to pay cash dividends in the future, see Item 7 —Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Liquidity Facilities.

On February 27, 2007, the Company announced a first quarter dividend of 47 cents per share payable March 30, 2007, to shareholders of record on March 9, 2007.

There were approximately 11,613 shareholders of record of our Common Shares on February 19, 2007.

Sales of Unregistered Securities

Periodically, we issue shares of our common stock to each of our non-management directors as part of their compensation. These shares are not registered and must be sold in reliance on an exemption from the Securities Act of 1933.

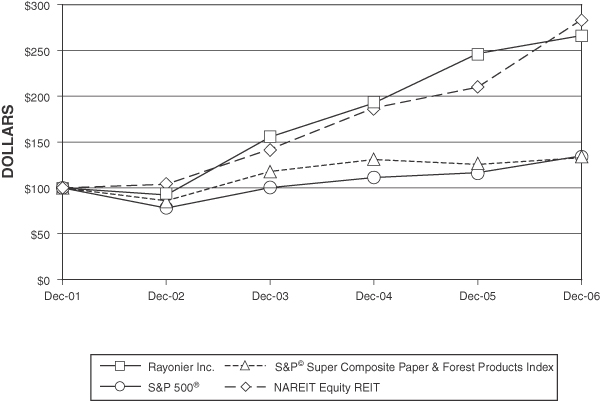

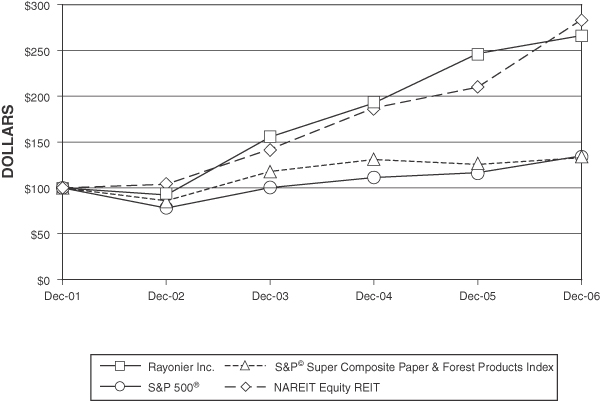

Issuer Repurchases