Table of Contents

Index to Financial Statements

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission File Number 1-6780

RAYONIER INC.

Incorporated in the State of North Carolina

I.R.S. Employer Identification No. 13-2607329

50 NORTH LAURA STREET,

JACKSONVILLE, FL 32202

(Principal Executive Office)

Telephone Number: (904) 357-9100

Securities registered pursuant to Section 12(b) of the Exchange Act,

all of which are registered on the New York Stock Exchange:

Common Shares

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YESx NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YESx NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES¨ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | |

Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES¨ NO x

The aggregate market value of the Common Shares of the registrant held by non-affiliates at the close of business on June 30, 2009 was $2,848,218,208 based on the closing sale price as reported on the New York Stock Exchange.

As of February 19, 2010, there were outstanding 79,909,191 Common Shares of the registrant.

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission in connection with the 2010 annual meeting of the shareholders of the registrant scheduled to be held May 20, 2010, are incorporated by reference in Part III hereof.

Table of Contents

Index to Financial Statements

Item | Page | |||

| PART I | ||||

1. | 1 | |||

1A. | 6 | |||

1B. | 13 | |||

2. | 14 | |||

3. | 14 | |||

4. | 15 | |||

| PART II | ||||

5. | 16 | |||

6. | 18 | |||

7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 | ||

7A. | 36 | |||

8. | 37 | |||

9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 37 | ||

9A. | 37 | |||

9B. | 37 | |||

| PART III | ||||

10. | 38 | |||

11. | 38 | |||

12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 38 | ||

13. | Certain Relationships and Related Transactions, and Director Independence | 38 | ||

14. | 38 | |||

| PART IV | ||||

15. | 39 | |||

i

Table of Contents

Index to Financial Statements

| Page | ||

Management’s Report on Internal Control over Financial Reporting | F-1 | |

| F-2 | ||

| F-4 | ||

| F-5 | ||

Consolidated Statements of Cash Flows for the Three Years Ended December 31, 2009 | F-6 | |

| F-7 | ||

| INDEX TO FINANCIAL STATEMENT SCHEDULES | ||

| F-46 | ||

All other financial statement schedules have been omitted because they are not applicable, the required matter is not present, or the required information has been otherwise supplied in the financial statements or the notes thereto. | ||

| F-47 | ||

Exhibit Index | ||

ii

Table of Contents

Index to Financial Statements

PART I

When we refer to “we,” “us,” “our,” “the Company,” or “Rayonier,” we mean Rayonier Inc. and its consolidated subsidiaries. References herein to “Notes to Financial Statements” refer to the Notes to the Consolidated Financial Statements of Rayonier Inc. included in Item 8 of this Report.

| Item 1. | BUSINESS |

General

We are a leading international forest products company primarily engaged in activities associated with timberland management, the sale and entitlement of real estate, and the production and sale of high value specialty cellulose fibers and fluff pulp. We own, lease or manage approximately 2.5 million acres of timberland and real estate located in the United States and New Zealand. We believe that Rayonier is the seventh largest private timberland owner in the U.S. Included in this property is approximately 0.2 million acres of high value real estate located primarily along the coastal corridor from Savannah, Georgia to Daytona Beach, Florida. We own and operate two specialty cellulose mills in the United States. In addition, we manufacture lumber in three sawmills in Georgia and engage in the trading of logs. For information on sales, operating income and identifiable assets by reportable segment, see Item 7 —Management’s Discussion and Analysis of Financial Condition and Results of Operationsand Note 4 —Segment and Geographical Information.

Our corporate strategy is to:

| • | Increase the size and quality of our timberland holdings through cash-accretive timberland acquisitions while selling timberland that no longer meets our strategic or financial return requirements. |

| • | Extract maximum value from our higher and better use (“HBU”) properties. We pursue entitlement activity on development property while maintaining a rural HBU program of sales for conservation, recreation and industrial uses. |

| • | Differentiate our Performance Fibers business by developing and improving customer specific applications. We emphasize operational excellence to ensure quality, reliability and efficiency. |

We originated as the Rainier Pulp & Paper Company founded in Shelton, WA in 1926. In 1937, we became “Rayonier Incorporated,” a public company traded on the New York Stock Exchange (“NYSE”), until 1968 when we became a wholly-owned subsidiary of ITT Corporation (“ITT”). On February 28, 1994, Rayonier again became an independent public company after ITT distributed all of Rayonier’s Common Shares to ITT stockholders. Our shares are publicly traded on the NYSE under the symbolRYN. We are a North Carolina corporation with executive offices located at 50 North Laura Street, Jacksonville, FL 32202. Our telephone number is (904) 357-9100.

The Company is a real estate investment trust (“REIT”). Under this structure, we are generally not required to pay federal income taxes on our earnings from timber harvest operations and other REIT-qualifying activities contingent upon meeting applicable distribution, income, asset, shareholder and other tests.

Our principal businesses are conducted through two entities. Our U.S. timber operations are primarily conducted by a wholly-owned REIT subsidiary, Rayonier Forest Resources, L.P. Our non REIT-qualifying operations, which are subject to corporate-level tax, are held by our wholly-owned taxable REIT subsidiary, Rayonier TRS Holdings Inc. (“TRS”). These operations include our Performance Fibers, Wood Products and trading businesses, as well as the sale and entitlement of HBU properties.

Timber

Our Timber segment owns, leases or manages approximately 2.4 million acres of timberlands, and sells standing timber (primarily at auction to third parties) and delivered logs. We also generate non-timber income from other land related activities. See chart in Item 2 —Properties for additional information.

Our Eastern U.S. timberland holdings consist of approximately 1.7 million acres in Alabama, Arkansas, Florida, Georgia, Louisiana, New York, Oklahoma and Texas. End-use markets for this timber include pulp, paper and wood products facilities. The predominant tree species across these timberlands are loblolly and slash pine. Hardwoods include red oak, sweet gum, black gum, red maple, cypress, black cherry, sugar maple and yellow birch.

1

Table of Contents

Index to Financial Statements

Our Western U.S. timberlands consist of approximately 0.4 million acres of primarily softwood second and third growth timber in western Washington with approximately 52 percent hemlock, 35 percent Douglas-fir and the remainder western red cedar, spruce and red alder.

In addition at December 31, 2009, we had a 40 percent interest in a New Zealand joint venture (“JV”) which owns or leases approximately 0.3 million acres of primarily radiata pine timberland, which we manage. In February 2010, Phaunos Timber Fund (“Phaunos”) invested NZ$167 million to acquire a 35 percent interest in the JV which reduced our ownership interest to 26 percent. Phaunos’ investment was used entirely to reduce the JV’s debt. We will continue to manage the JV.

We manage our U.S. timberlands in accordance with the requirements of the Sustainable Forestry Initiative® (“SFI”) program, a comprehensive system of environmental principles, objectives and performance measures that combines the perpetual growing and harvesting of trees with the protection of wildlife, plants, soil and water quality. Through application of our site-specific silvicultural expertise and financial discipline, we manage timber in a way that optimizes site preparation, tree species selection, competition control, use of fertilization and timing of thinning and final harvest. We also have a genetic tree improvement program aimed to enhance the productivity and quality of our timber. In addition, non-timber income opportunities associated with our timberlands such as recreational licenses and specialty forest products, as well as considerations for the future higher and better uses of the land, are integral parts of our site-specific management philosophy. All these activities are designed to maximize value while complying with SFI requirements.

Our Eastern U.S. timber is primarily a mix of sawtimber and pulpwood. The average rotation (harvest) age for timber from the Eastern U.S. (primarily Southern pine), excluding New York, is between 21 and 24 years. Due to slower timber growth rates, the harvest age on the New York timberlands (primarily specialty hardwoods) ranges widely from 40 to 80 years. Rotation age for timber from the Western U.S. ranges from 40 to 50 years, and is primarily composed of sawtimber.

Softwood merchantable timber inventory is an estimate of timber volume based on the earliest economically harvestable age. Hardwood inventory is an estimate of timber volume available for harvest. Estimates are based on an inventory system that involves periodic statistical sampling. Adjustments are made on the basis of growth estimates, harvest information, environmental restrictions and market conditions. Timber located in swamplands, restricted or environmentally sensitive areas is not included in the merchantable inventory shown below.

The following table sets forth the estimated volumes of merchantable timber in the U.S. by location and type, as of December 31, 2009:

Location | Softwood | Hardwood | Total | Equivalent total, in thousands of short green tons | % | |||||

Eastern, in thousands of short green tons | 31,094 | 21,067 | 52,161 | 52,161 | 84 | |||||

Western, in millions of board feet | 1,279 | 81 | 1,360 | 9,791 | 16 | |||||

| 61,952 | 100 | |||||||||

Real Estate

Our Real Estate subsidiary owns approximately 0.1 million acres of land. We segregate our real estate holdings into three groups: HBU development, HBU rural and non-strategic timberlands. Development properties are predominantly located in the 11 coastal counties between Savannah, Georgia and Daytona Beach, Florida. Our strategy is to pursue and obtain entitlements for selected development properties, to sell rural properties at a premium to timberland values and to divest non-strategic timberland holdings that do not meet our investment criteria.

Performance Fibers

We are a leading manufacturer of high value specialty cellulose fibers and absorbent materials with production facilities in Jesup, Georgia and Fernandina Beach, Florida, which have a combined annual capacity of approximately 740,000 metric tons. These facilities manufacture more than 25 different grades of fibers. The Jesup facility can produce approximately 590,000 metric tons, or 80 percent of our total capacity, and the Fernandina Beach facility can produce approximately 150,000 metric tons, or 20 percent of our total capacity. This segment has two major product lines:

Cellulose specialties— We are a leading producer of specialty cellulose products, most of which are used in dissolving chemical applications that require a highly purified form to produce cellulose acetate and ethers that create

2

Table of Contents

Index to Financial Statements

high value, technologically demanding products. Our products are used in a wide variety of end uses such as: cigarette filters, liquid crystal display screens, acetate textile fibers, pharmaceuticals, cosmetics, rigid packaging, photographic film, impact-resistant plastics, high-tenacity rayon yarn for tires and industrial hoses, detergents, food casings, food products, thickeners for oil well-drilling muds, lacquers, paints, printing inks, and explosives. In addition, cellulose specialties include high value specialty paper applications used for decorative laminates, automotive air and oil filters, shoe innersoles, battery separators, circuit boards and filter media for the food industry.

Absorbent materials — We are a producer of fibers for absorbent hygiene products. These fibers are typically referred to as fluff fibers and are used as an absorbent medium in products such as disposable baby diapers, feminine hygiene products, incontinence pads, convalescent bed pads, industrial towels and wipes, and non-woven fabrics.

Approximately 61 percent of Performance Fibers sales are exported, primarily to customers in Asia and Europe. Approximately 95 percent of Performance Fibers sales are made directly by Rayonier personnel, with the remainder through independent sales agents. We have long-term contracts with the world’s largest manufacturers of acetate-based products and other key customers that extend into 2011 and represent nearly all of our high value cellulose specialties production.

Wood Products

Our Wood Products business segment manufactures and sells dimension lumber. We operate three lumber manufacturing facilities in the U.S. that produce Southern pine lumber, which is generally used for residential and industrial construction. Located in Baxley, Swainsboro and Eatonton, Georgia, the mills have a combined annual capacity of approximately 370 million board feet of lumber and 700,000 short green tons of wood chips. In 2009, we continued to operate at reduced production levels due to decreased demand from a weak housing market and expect to operate at reduced production levels in 2010 unless market conditions improve.

Lumber sales are primarily made by Rayonier personnel to customers in the southeastern U.S. Approximately 80 percent of our lumber mills’ wood chip production is sold at market prices to our Jesup, Georgia performance fibers facility. In 2009, these purchases represented approximately 11 percent of that facility’s total wood consumption.

Other

The primary business of our Other segment is trading logs.

Discontinued Operations and Dispositions

Included in the Consolidated Balance Sheets are environmental liabilities relating to prior dispositions and discontinued operations, which includes our Port Angeles, WA performance fibers mill that was closed in 1997; our wholly-owned subsidiary, Southern Wood Piedmont Company (“SWP”), which ceased operations other than environmental investigation and remediation activities in 1989; our Eastern Research Division, which ceased operations in 1981; and other miscellaneous assets held for disposition. See Note 16 —Liabilities for Dispositions and Discontinued Operations for additional information.

Foreign Sales and Operations

Sales from non-U.S. operations comprised approximately three percent of consolidated 2009 sales. See Note 4— Segment and Geographical Informationfor additional information.

Intellectual Property

We own numerous patents, trademarks and trade secrets, and have developed significant know-how, particularly relating to our Performance Fibers business. We intend to continue to take such steps as are necessary to protect our intellectual property, including filing patent applications for inventions that are deemed important to our business operations. Our U.S. patents generally have a duration of 20 years from the date of filing.

3

Table of Contents

Index to Financial Statements

Competition

Our U.S. timberlands are located in three major timber-growing areas (the northwest U.S., known as our Western region and the northeast and the southern U.S., known as our Eastern region), where timber markets are fragmented. In the Western region, Weyerhaeuser, Hancock Timber Resource Group, Green Diamond Resource Company, Longview Timber, The Campbell Group, Port Blakely Tree Farms, Pope Resources and the State of Washington Department of Natural Resources are significant competitors. Other competition in the Western region arises from log imports from Canada. In the Eastern region, we compete with Plum Creek Timber Company, Timberland Investment Management Organizations such as Hancock Timber Resource Group, Resource Management Services, Forest Investment Associates and The Campbell Group, and other numerous large and small privately held timber companies. In all markets, price is the principal method of competition.

In Performance Fibers, we market high purity, specialty cellulose fibers worldwide against competition from domestic and foreign producers. Major competitors include Buckeye Technologies, Borregaard, Neucel, Sappi Saiccor and Sateri International. Product performance, technical service and price are principal methods of competition. Sappi Saiccor, which expanded its cellulose specialty pulp mill in South Africa, and Sateri International, which completed an expansion of its pulp mill in Bahia, Brazil in 2008, began providing limited quantities of acetate primarily for testing and qualification purposes to customers during 2009. The new market capacity is not expected to adversely affect the results of our Performance Fibers segment in 2010. However, it is difficult to determine how market dynamics may impact our business in 2011 and beyond.

Additionally, in Performance Fibers we market absorbent materials against competition from domestic and foreign producers. Major competitors include Weyerhaeuser, GP Cellulose and International Paper. Price and customer service are the principal methods of competition.

Our Wood Products business competes with a number of lumber producers throughout the U.S. and Canada, but particularly with sawmills throughout Georgia and Florida. Our Wood Products business represents a de minimus amount of North American capacity.

Customers

In 2009, a group of customers under the common control of Eastman Chemical Company (and its affiliates), Celanese and Nantong Cellulose represented approximately 18, 17 and 16 percent of our Performance Fibers segment’s sales, respectively, and 13, 12 and 11 percent of consolidated sales, respectively. The loss of any of these customers could have a material adverse effect on the Company and the Performance Fibers segment’s results of operations.

Seasonality

Our Western region’s timber sales are generally lower in the third quarter due to greater availability of non-Rayonier timber during the drier summer harvesting period. Our Wood Products segment may experience higher seasonal demand in the second and third quarters when demand for new housing has typically increased. Our Performance Fibers and Real Estate segments’ results are normally not impacted by seasonal changes.

Environmental Matters

See Item 7 —Management’s Discussion and Analysis of Financial Condition and Results of Operations— Environmental Regulation, Note 16 —Liabilities for Dispositions and Discontinued Operations, and Item 3 —Legal Proceedings.

Raw Materials

The manufacturing of our performance fibers products and lumber requires significant amounts of wood. Timber harvesting can be restricted by stringent regulatory requirements, adverse weather conditions and legal challenges from various environmental groups. The supply of timber is directly affected by price and demand fluctuations in wood products, pulp and paper markets and by weather.

4

Table of Contents

Index to Financial Statements

Our Performance Fibers and lumber mills obtain their logs primarily through open market purchases made by our wood procurement organization, which negotiates prices and volumes with independent third party suppliers who deliver to our facilities. A limited amount of Performance Fibers log purchases are made directly from the Timber segment at prevailing market prices.

Performance Fibers manufacturing uses a substantial amount of residual biomass to produce its own energy, but also requires significant amounts of fuel oil and natural gas. These raw materials are subject to significant changes in prices and availability. To reduce cost, we completed a number of capital projects to reduce fossil fuel consumption, including a power boiler replacement at our Fernandina Beach, Florida facility, which now consumes primarily wood waste. We continually pursue reductions in usage and costs of other key raw materials, supplies and contract services at our Performance Fibers and lumber mills and do not foresee any material constraints in the near term from pricing or availability.

Research and Development

The research and development efforts of our Performance Fibers business are primarily directed at further developing existing core products and technologies, improving the quality of cellulose fiber grades, absorbent materials and related products, improving manufacturing efficiency and environmental controls, and reducing fossil fuel consumption.

The research and development activities of our timber operations include genetic tree improvement and applied silvicultural programs to identify management practices that will improve financial returns from our timberlands.

Employee Relations

We currently employ approximately 1,800 people, of whom approximately 1,700 are in the United States. Approximately 900 of our hourly Performance Fibers employees are covered by collective bargaining agreements. The majority of our hourly employees are represented by one of several labor unions. We believe relations with our employees are satisfactory.

Sustainable Forestry

While it is our objective to maximize future wood supply through forest management programs that increase timberland productivity, we have a longstanding commitment to meet the highest levels of forest stewardship and to promote sustainable forestry practices throughout the industry. Most of our U.S. timberlands and wood procurement practices have been audited and certified by an independent third party under the SFI program. We have over 2 million acres enrolled in the SFI program. This independent certification verifies that we meet strict requirements for growing and harvesting trees in an environmentally responsible manner that protects natural resources, renews forests, ensures sustainable harvest levels, creates biological diversity, and enhances wildlife protection.

Availability of Reports and Other Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments to those reports filed or furnished pursuant to Sections 13(a) or 14 of the Securities Exchange Act of 1934 are made available to the public free of charge in the Investor Relations section of our Web sitewww.rayonier.com, shortly after we electronically file such material with, or furnish them to, the Securities and Exchange Commission (“SEC”). Our corporate governance guidelines and charters of all Committees of our Board of Directors are also available on our Web site.

5

Table of Contents

Index to Financial Statements

| Item 1A. | RISK FACTORS |

Certain statements in this document regarding anticipated financial outcomes including earnings guidance, if any, business and market conditions, outlook and other similar statements relating to Rayonier’s future financial and operational performance, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “should,” “expect,” “estimate,” “believe,” “anticipate” and other similar language. Forward-looking statements are not guarantees of future performance and undue reliance should not be placed on these statements. The following risk factors, among others, could cause actual results to differ materially from those expressed in forward-looking statements that are made in this document.

Forward-looking statements are only as of the date they are made, and the Company undertakes no duty to update its forward- looking statements except as required by law. You are advised, however, to review any further disclosures we make on related subjects in our subsequent Forms 10-Q, 10-K, 8-K and other reports to the SEC.

Our operations are subject to a number of risks, including those listed below. When considering an investment in our securities, you should carefully read and consider these risks, together with all other information in this Report. If any of the events described in the following risk factors actually occur, our business, financial condition or operating results, as well as the market price of our securities, could be materially adversely affected.

Business and Operating Risks

The cyclical nature of our businesses could adversely affect our results of operations.

Our financial performance is affected by the cyclical nature of the forest products and real estate industries. The markets for timber, real estate, performance fibers and wood products are influenced by a variety of factors beyond our control. For example, the demand for real estate can be affected by changes in interest rates, availability and terms of financing, local economic conditions, new housing starts, population growth and demographics. The demand for sawtimber is primarily affected by the level of new residential and commercial construction activity, and currently sawtimber pricing is below historic levels. Both our Real Estate and Timber businesses have been negatively impacted by the current economic downturn, primarily due to the decline in housing starts and the tightening of credit availability for real estate and construction related projects. The supply of timber and logs has historically increased during favorable pricing environments, which then causes downward pressure on prices.

The forest products and real estate industries are highly competitive.

Some of our competitors in the forest products businesses have greater financial and operating resources and own more timberlands than we do. Some of our forest products competitors may also be lower-cost producers in some of the businesses in which we operate. In addition, wood products are subject to significant competition from a variety of non-wood and engineered wood products. We are also subject to competition from various forest products, including logs and pulp products imported from foreign countries to the United States as well as to the export markets served by us. To the extent there is a significant increase in competitive pressures from substitute products or other domestic or foreign suppliers, our business could be adversely affected. With respect to our real estate business, one of our key strategies is to engage in activities that add long term value to our properties, including obtaining entitlements. Many of our competitors in this segment have greater experience in real estate entitlement than we do.

Changes in energy and raw material prices could impact our operating results and financial condition.

Energy and raw material costs, such as oil, natural gas, wood, and chemicals are a significant operating expense, particularly for the Performance Fibers and Wood Products businesses. The prices of raw materials and energy can be volatile and are susceptible to rapid and substantial increases due to factors beyond our control such as changing economic conditions, political unrest, instability in energy-producing nations, and supply and demand considerations. For example, in 2008, we experienced significant volatility in energy, chemicals, transportation and other input costs, although in 2009 pricing for some of these inputs has returned to relatively normal levels. Oil and natural gas costs have also substantially increased in recent years and we have experienced, at times, a limited availability of hardwood, primarily due to wet weather conditions which impacts harvesting and results in increased costs for some Performance Fibers products. Increases in production costs could have a material adverse effect on our business, financial condition

6

Table of Contents

Index to Financial Statements

and results of operations. In addition, in our Timber, Performance Fibers and Wood Products businesses, the rising cost of fuel, and its impact on the cost and availability of transportation for our products, both domestically and internationally, and the cost and availability of third party logging and trucking services, could have a material adverse effect on our business, financial condition and results of operations.

Changes in global economic conditions, market trends and world events could impact customer demand.

The global reach of our business, particularly the Performance Fibers business and our interest in the New Zealand joint venture, causes us to be subject to unexpected, uncontrollable and rapidly changing events and circumstances in addition to those experienced in the U.S. The current global economic and financial market situation is an example of such changes. Adverse changes in the following factors, among others, could have a negative impact on our business and results of operations:

| • | exposure to currencies other than the United States dollar; |

| • | regulatory, social, political, labor or economic conditions in a specific country or region; and, |

| • | trade protection laws, policies and measures and other regulatory requirements affecting trade and investment, including loss or modification of exemptions for taxes and tariffs, and import and export licensing requirements. |

Our businesses are subject to extensive environmental laws and regulations that may restrict or adversely impact our ability to conduct our business.

Environmental laws and regulations are constantly changing, and are generally becoming more restrictive.Laws, regulations and related judicial decisions, and administrative interpretations affecting our business are subject to change and new laws and regulations that may affect our business are frequently enacted. These changes may adversely affect our ability to harvest and sell timber, operate our manufacturing facilities, remediate contaminated properties and/or develop real estate. These laws and regulations may relate to, among other things, the protection of timberlands, endangered species, timber harvesting practices, recreation and aesthetics, protection and restoration of natural resources, air and water quality, and remedial standards for contaminated property and groundwater. Over time, the complexity and stringency of these laws and regulations have increased markedly and the enforcement of these laws and regulations has intensified. Moreover, environmental policies of the current administration are in the aggregate, more restrictive for industry and landowners than those of the previous administration. For example, in 2009, the U.S. Environmental Protection Agency (“EPA”) proposed a number of initiatives which could, if implemented, impose additional operational and pollution control obligations on industrial facilities like those of Rayonier, especially in the area of air emissions and wastewater and stormwater control. Nonetheless, irrespective of any particular presidential administration, environmental laws and regulations will likely continue to become more restrictive and over time could adversely affect our operating results.

If regulatory and environmental permits are delayed, restricted or rejected, a variety of our operations could be adversely affected. In connection with a variety of operations on our properties, we are required to seek permission from government agencies in the states and countries in which we operate to perform certain activities. Any of these agencies could delay review of, or reject, any of our filings. In our Timber business, any delay associated with a filing could result in a delay or restriction in replanting, thinning, insect control, fire control or harvesting, any of which could have an adverse effect on our operating results. For example, in Washington State, we are required to file a Forest Practice Application for each unit of timberland to be harvested. These applications may be denied, conditioned or restricted by the regulatory agency or appealed by other parties, including citizen groups. Appeals or actions of the regulatory agencies could delay or restrict timber harvest activities pursuant to these permits. Delays or harvest restrictions on a significant number of applications could have an adverse effect on our operating results. In our Performance Fibers and Wood Products businesses, many modifications and capital projects at our manufacturing facilities require an environmental permit, or an amendment to an existing permit. Delays in obtaining these permits could have an adverse effect on our results of operations.

Environmental groups and interested individuals may seek to delay or prevent a variety of operations. We expect that environmental groups and interested individuals will intervene with increasing frequency in the regulatory processes in the states and countries where we own, lease or manage timberlands, and operate mills. For example, as described in more detail in Item 3 —Legal Proceedings, the Altamaha Riverkeeper, a non-profit environmental group, has alleged noncompliance by our Jesup mill with certain laws relating to its effluent discharge, and has threatened to file a “citizen suit” against

7

Table of Contents

Index to Financial Statements

Rayonier pursuant to the provisions of the Clean Water Act if the group’s concerns are not addressed to their satisfaction. In Washington State, environmental groups and interested individuals may appeal individual forest practice applications or file petitions with the Forest Practices Board to challenge the regulations under which forest practices are approved. These and other challenges could materially delay or prevent operations on our properties. Delays or restrictions due to the intervention of environmental groups or interested individuals could adversely affect our operating results. In addition to intervention in regulatory proceedings, interested groups and individuals may file or threaten to file lawsuits that seek to prevent us from obtaining permits, implementing capital improvements or pursuing operating plans. Any lawsuit or even a threatened lawsuit could delay harvesting on our timberlands, impact how we operate or our ability to invest in our mills. Among the remedies that could be enforced in a lawsuit is a judgment preventing or restricting harvesting on a portion of our timberlands, or adversely affecting the projected operating benefits or cost of capital projects at our mills.

The impact of existing regulatory restrictions on future harvesting activities may be significant. Federal, state and local laws and regulations, as well as those of other countries, which are intended to protect threatened and endangered species, as well as waterways and wetlands, limit and may prevent timber harvesting, road building and other activities on our timberlands. The threatened and endangered species restrictions apply to activities that would adversely impact a protected species or significantly degrade its habitat. The size of the area subject to restriction will vary depending on the protected species at issue, the time of year and other factors, but can range from less than one to several thousand acres. A number of species that naturally live on or near our timberlands, including the northern spotted owl, marbled murrelet, bald eagle, several species of salmon and trout in the Northwest, and the red cockaded woodpecker, bald eagle, wood stork, red hill salamander, and flatwoods salamander in the Southeast, are protected under the Federal Endangered Species Act or similar state laws. Other species, such as the gopher tortoise, are currently under review for possible protection. As we gain additional information regarding the presence of threatened or endangered species on our timberlands, or if other regulations, such as those that require buffers to protect water bodies, become more restrictive, the amount of our timberlands subject to harvest restrictions could increase.

Our Performance Fibers and Wood Products mills are subject to stringent environmental laws and regulations concerning air emissions, wastewater discharge, water usage and waste handling and disposal.Many of our operations are subject to stringent environmental laws, regulations and permits which contain conditions that govern how we operate our facilities and, in many cases, how much product we can produce. These laws, regulations and permits, now and in the future, may restrict our current production and limit our ability to increase production, and impose significant costs on our operations with respect to environmental compliance. For example, the U.S. EPA has recently proposed regulations governing the emission of certain air pollutants from industrial boilers, and the discharge of certain pollutants into Florida’s waterways. It is expected that, overall, these costs will likely increase over time as environmental laws, regulations and permit conditions become more stringent, and as the expectations of the communities in which we operate become more demanding.

We currently own or may acquire properties which may require environmental remediation or otherwise be subject to environmental and other liabilities.We currently own, or formerly operated, manufacturing facilities and discontinued operations, or may acquire timberlands and other properties, which are subject to environmental liabilities, such as remediation of hazardous material contamination and other existing or potential liabilities. For more detail, see Note 16 —Liabilities for Dispositions and Discontinued Operations. The cost of investigation and remediation of contaminated properties could increase operating costs and adversely affect financial results. Although we believe we currently have adequate reserves for the investigation and remediation of our properties, there can be no assurance that actual expenditures will not exceed our expectations, or that other unknown liabilities will not be discovered in the future.

Entitlement and development of real estate entails a lengthy, uncertain and costly approval process.

Entitlement and development of real estate entails extensive approval processes involving multiple regulatory jurisdictions. It is common for a project to require multiple approvals, permits and consents from federal, state and local governing and regulatory bodies. For example, in Florida, real estate projects must generally comply with the provisions of the Local Government Comprehensive Planning and Land Development Regulation Act (the “Growth Management Act”) and local land use and development regulations. In addition, in Florida, development projects that exceed certain specified regulatory thresholds require approval of a comprehensive Development of Regional Impact (“DRI”) application. Compliance with the Growth Management Act, local land development regulations and the DRI process is

8

Table of Contents

Index to Financial Statements

usually lengthy and costly and significant conditions can be imposed on a developer with respect to a particular project. In addition, development of properties containing delineated wetlands may require one or more permits from the federal government. Any of these issues can materially affect the cost and timing of our real estate projects.

The real estate entitlement process is frequently a political one, which involves uncertainty and often extensive negotiation and concessions in order to secure the necessary approvals and permits. A significant amount of our development property is located in counties in which local governments face challenging issues relating to growth and development, including zoning and future land use, public services, water availability, infrastructure and funding for same, and the requirements of state law, especially in the case of Florida under the Growth Management Act and DRI process. In addition, anti-development groups are active, especially in Florida, in seeking constitutional amendments, legislation and other anti-growth limitations on real estate development activities. For example, it is expected that a proposed constitutional amendment, called “Amendment 4,” will appear on the Florida ballot in November 2010, which, if enacted, will impose significant limitations on the ability of Florida municipalities to change the approved uses of property. We expect that this type of anti-growth activity may continue in the future.

Issues affecting real estate development also include the availability of potable water for new development projects. For example, in Georgia, the Legislature enacted the Comprehensive Statewide Watershed Management Planning Act, which, among other things, created a governmental entity called the Georgia Water Council which was charged with preparing a comprehensive water management plan for the state and presenting it to the Georgia Legislature. It is unclear at this time how the plan will affect the cost and timing of real estate development along the I-95 coastal corridor in southern Georgia, where the Company has significant real estate holdings.

Changes in the interpretation or enforcement of these laws, the enactment of new laws regarding the use and development of real estate, changes in the political composition of state and local governmental bodies, and the identification of new facts regarding our properties could lead to new or greater costs and delays and liabilities that could materially adversely affect our business, profitability or financial condition.

Changes in demand for our real estate and delays in the timing of real estate transactions may affect our revenues and operating results.

A number of factors, including changes in demographics, tightening of credit, and a slowing of commercial or residential real estate development, particularly along the I-95 coastal corridor in Florida and Georgia, could reduce the demand for our properties and negatively affect our results of operations. The current decline in the economy generally and in the housing market in particular, together with the deterioration of the credit markets, has certainly had such an effect in 2009 and is expected to continue into 2010.

In addition, there are inherent uncertainties in the timing of real estate transactions that could adversely affect our operating results. Delays in the completion of transactions or the termination of potential transactions can be caused by factors beyond our control. These events have in the past and may in the future adversely affect our operating results.

The impacts of climate-related initiatives, at the international, federal and state levels, remain uncertain at this time.

Currently, there are numerous international, federal and state-level initiatives and proposals addressing domestic and global climate issues. Within the U.S., most of these proposals would regulate and/or tax, in one fashion or another, the production of carbon dioxide and other “greenhouse gases” to facilitate the reduction of carbon compound emissions to the atmosphere, and provide tax and other incentives to produce and use more “clean energy.” For example, in 2009 the U.S. House of Representatives passed the Markey-Waxman bill (HR 2454), which would establish a so-called “cap and trade” regime and new permitting requirements to regulate greenhouse gas generation, as well as provide an incentive for the production and use of clean energy. To date, the U.S. Senate has not passed any comparable legislation. In sum, we believe that the potential for climate change legislation on the federal level is unknown. In addition, in late 2009, the U.S. EPA issued an “endangerment finding” under the Clear Air Act (“CAA”) with respect to carbon dioxide, which could lead to the regulation of carbon dioxide as a criteria pollutant under the CAA and have significant ramifications for Rayonier and the industry in general. On the international front, the United Nations Climate Change Conference in Copenhagen, which took place in December 2009, did not result in any significant progress toward a binding agreement to replace the Kyoto Protocol, which expires in 2012.

9

Table of Contents

Index to Financial Statements

Overall, it is likely that future legislative and regulatory activity in this area will in some way impact Rayonier, but it is unclear at this time whether such impact will be, in the aggregate, positive or negative, or material. For example, while Rayonier’s Performance Fibers mills produce greenhouses gases and utilize fossil fuels, they also generate a substantial amount of their energy from wood fiber (often referred to as “biomass”), which is generally favored under most current legislative and regulatory proposals. In addition, our extensive timber holdings and the biomass they produce may provide opportunities for us to benefit from new legislation and regulation, especially due to the potential benefits available from carbon capture and sequestration opportunities, sale of “carbon credits” and “renewable portfolio standards” that mandate the use of non-fossil fuels by electricity generators, which could lead to increased demand for biomass products from our forests. We continue to monitor political and regulatory developments in this area, but their overall impact on Rayonier, from a cost, benefit and financial performance standpoint, is uncertain at this time.

The precipitous decline in the stock market in 2008 impacted our pension plan investment performance and despite partial recovery in 2009, absent additional federal legislation, may require us to make significant additional cash contributions to our plans.

We sponsor several defined benefit pension plans, which cover many of our salaried and hourly employees. Due to the precipitous decline in the stock market (the Dow Jones Industrial Average (“DJIA”) declined approximately 32 percent in 2008), the value of our pension plan equity assets has also dropped significantly. In 2009, the value of our plan’s assets increased as the stock market recovered (the DJIA increased approximately 19 percent in 2009). The Federal Pension Protection Act of 2006 (“PPA”) requires that certain capitalization levels be maintained in each of these plans. Recognizing that this issue affects much of corporate America, in December 2008 federal legislation was passed (as part of the Worker, Retiree, and Employer Recovery Act of 2008) which provides short term relief to plan sponsors by allowing them to phase in the funding requirements of the PPA over three years, among other things. Because it is unknown how the stock market will perform over the next 12 to 24 months and whether additional legislation will be passed to address this issue, no assurances can be given that any additional plan contributions required by applicable law will not be material.

Our joint venture partners may have interests that differ from ours and may take actions that adversely affect us.

We participate in a joint venture in New Zealand, and may enter into other joint venture projects; for example, as part of our real estate strategy. A joint venture involves potential risks such as:

| • | not having voting control over the joint venture; |

| • | the venture partner at any time may have economic or business interests or goals that are inconsistent with ours; |

| • | the venture partner may take actions contrary to our instructions or requests, or contrary to our policies or objectives with respect to the investment; and, |

| • | the venture partner could experience financial difficulties. |

Actions by our venture partners may subject property owned by the joint venture to liabilities greater than those contemplated by the joint venture agreement or to other adverse consequences.

We may be unsuccessful in carrying out our land acquisition strategy.

We have pursued, and intend to continue to pursue, acquisitions of strategic timberland and real estate properties that meet our investment criteria. Our timberland and real estate acquisitions may not perform in accordance with our expectations. We anticipate financing any such acquisitions through cash from operations, borrowings under our credit facilities, proceeds from equity or debt offerings or proceeds from asset dispositions, or any combination thereof. The failure to identify and complete suitable timberland and real estate property acquisitions, and the failure of any acquisitions to perform to our expectations, could adversely affect our operating results.

Our failure to maintain satisfactory labor relations could have a material adverse effect on our business.

Approximately 50 percent of our work force is unionized. These workers are exclusively in our Performance Fibers business. As a result, we are required to negotiate the wages, benefits and other terms with these employees collectively. Our financial results could be adversely affected if labor negotiations were to restrict the efficiency of our operations. In addition, our inability to negotiate acceptable contracts with any of these unions as existing agreements expire could result in strikes or work stoppages by the affected workers. For example, in 2010 we will engage in collective

10

Table of Contents

Index to Financial Statements

bargaining agreement negotiations with unions representing substantially all of the hourly employees at our Fernandina Beach Performance Fibers mill. The mill’s current collective bargaining agreements expire in April 2010. If the unionized employees were to engage in a strike or other work stoppage, or other employees were to become unionized, we could experience a significant disruption of our operations, which could have a material adverse effect on our business, results of operations and financial condition.

Weather and other natural conditions may limit our timber harvest and sales.

Weather conditions, timber growth cycles and restrictions on access may limit harvesting of our timberlands, as may other factors, including damage by fire, insect infestation, disease, prolonged drought and natural disasters such as wind storms and hurricanes.

We do not insure against losses of timber from any causes, including fire.

The volume and value of timber that can be harvested from our timberlands may be reduced by fire, insect infestation, severe weather, disease, natural disasters, and other causes beyond our control. A reduction in our timber inventory could adversely affect our financial results and cash flows. As is typical in the forestry industry, we do not maintain insurance for any loss to our timber, including losses due to these causes.

A significant portion of the timberland that we own, lease or manage is concentrated in limited geographic areas.

We own, lease or manage approximately 2.5 million acres of timberland and real estate located primarily in the United States and New Zealand. Over 75 percent of our timberlands are located in four states: Alabama, Florida, Georgia and Washington. Accordingly, if the level of production from these forests substantially declines, or if the demand for timber in those regions declines, it could have a material adverse effect on our overall production levels and our revenues.

We are dependent upon attracting and retaining key personnel.

We believe that our success depends, to a significant extent, upon our ability to attract and retain key senior management and operations management personnel. Our failure to recruit and retain these key personnel could adversely affect our financial condition or results of operations.

Market interest rates may influence the price of our common shares.

One of the factors that may influence the price of our common shares is our annual dividend yield as compared to yields on other financial instruments. Thus, an increase in market interest rates will result in higher yields on other financial instruments, which could adversely affect the price of our common shares.

We have a significant amount of debt and the capacity to incur significant additional debt.

As of December 31, 2009, we had $700 million of debt outstanding. See Item 7 —Management’s Discussion and Analysis of Financial Condition and Results of Operations—Contractual Financial Obligationsfor the payment schedule of our long-term debt obligations. We expect that existing cash, cash equivalents, marketable securities, cash provided from operations, and our bank credit facilities will be sufficient to meet ongoing cash requirements. Moreover, we have the borrowing capacity to incur significant additional debt and may do so if we enter into one or more strategic, merger, acquisition or other corporate or investment opportunities, or otherwise invest capital in one or more of our businesses. However, failure to generate sufficient cash as our debt becomes due, or to renew credit lines prior to their expiration, may adversely affect our business, financial condition, operating results, and cash flow.

11

Table of Contents

Index to Financial Statements

REIT and Tax-Related Risks

If we fail to qualify as a REIT or fail to remain qualified as a REIT, we will have reduced funds available for distribution to our shareholders because our timber-related income will be subject to taxation.

We intend to operate in accordance with REIT requirements pursuant to the Internal Revenue Code of 1986, as amended (the “Code”). For example, as a REIT, we generally will not pay corporate-level tax on income we distribute to our shareholders (other than the income of TRS) as long as we distribute at least 90 percent of our REIT taxable income (determined without regard to the dividends paid deduction and by excluding net capital gains). Qualification as a REIT involves the application of highly technical and complex provisions of the Code, which are subject to change, perhaps retroactively, and which are not within our control. We cannot assure that we will qualify as a REIT or be able to remain so qualified or that new legislation, U.S. Treasury regulations, administrative interpretations or court decisions will not significantly affect our ability to qualify as a REIT or the federal income tax consequences of such qualification.

If in any taxable year we fail to qualify as a REIT, we will suffer the following negative results:

| • | we will not be allowed a deduction for dividends paid to shareholders in computing our taxable income; and, |

| • | we will be subject to federal income tax on our REIT taxable income. |

In addition, we will be disqualified from treatment as a REIT for the four taxable years following the year during which the qualification was lost, unless we are entitled to relief under certain provisions of the Code. As a result, our net income and the cash available for distribution to our shareholders could be reduced for up to five years or longer.

If we fail to qualify as a REIT, we may need to borrow funds or liquidate some investments or assets to pay the additional tax liability. Accordingly, cash available for distribution to our shareholders would be reduced.

The extent of our use of taxable REIT subsidiaries may affect the price of our common shares relative to the share price of other REITs.

We conduct a significant portion of our business activities through one or more taxable REIT subsidiaries. Our use of taxable REIT subsidiaries enables us to engage in non-REIT qualifying business activities such as the production and sale of performance fibers and wood products, real estate entitlement activities and sale of HBU property and other real estate (as a dealer) and sale of logs. Taxable REIT subsidiaries are subject to corporate-level tax. Therefore, we pay income taxes on the income generated by our taxable REIT subsidiaries. Under the Code, no more than 25 percent of the value of the gross assets of a REIT may be represented by securities of one or more taxable REIT subsidiaries. This limitation may affect our ability to increase the size of our taxable REIT subsidiaries’ operations. Furthermore, our use of taxable REIT subsidiaries may cause the market to value our common shares differently than the shares of other REITs, which may not use taxable REIT subsidiaries as extensively as we use them.

Lack of shareholder ownership and transfer restrictions in our articles of incorporation may affect our ability to qualify as a REIT.

In order to qualify as a REIT, an entity cannot have five or fewer individuals who own, directly or indirectly after applying attribution of ownership rules, 50 percent or more of the value of its outstanding shares during the last six months in each calendar year. Although it is not required by law or the REIT provisions of the Code, almost all REITs have adopted ownership and transfer restrictions in their articles of incorporation or organizational documents which seek to assure compliance with that rule. While we are not in violation of the ownership rules, we do not have, nor do we have any current plans to adopt, share ownership and transfer restrictions. As such, the possibility exists that five or fewer individuals could acquire 50 percent or more of the value of our outstanding shares, which could result in our disqualification as a REIT.

We may be limited in our ability to fund distributions using cash generated through our taxable REIT subsidiaries.

The ability of the REIT to receive dividends from taxable REIT subsidiaries is limited by the rules with which we must comply to maintain our status as a REIT. In particular, at least 75 percent of gross income for each taxable year as a REIT must be derived from passive real estate sources including sales of our standing timber and other types of qualifying real estate income and no more than 25 percent of our gross income may consist of dividends from our taxable REIT subsidiaries and other non-real estate income.

12

Table of Contents

Index to Financial Statements

This limitation on our ability to receive dividends from our taxable REIT subsidiaries may impact our ability to fund cash distributions to our shareholders using cash flows from our taxable REIT subsidiaries. We can, however, under current law, issue stock dividends for up to 90 percent of our regular dividend distribution for calendar years 2009 through 2011. The net income of our taxable REIT subsidiaries is not required to be distributed, and income that is not distributed will not be subject to the REIT income distribution requirement.

Certain of our business activities are potentially subject to prohibited transactions tax.

As a REIT, we will be subject to a 100 percent tax on any net income from “prohibited transactions.” In general, prohibited transactions are sales or other dispositions of property to customers in the ordinary course of business. Sales of performance fibers and wood products which we produce and sales of logs constitute prohibited transactions. In addition, sales of timberlands or other real estate (as a dealer) constitute prohibited transactions.

We intend to avoid the 100 percent prohibited transactions tax by conducting activities that would otherwise be prohibited transactions through one or more taxable REIT subsidiaries. We may not, however, always be able to identify timberland properties that will become part of our “dealer” real estate sales business. Therefore, if we sell timberlands which we incorrectly identify as property not held for sale to customers in the ordinary course of business or which subsequently become properties held for sale to customers in the ordinary course of business, we face the potential of being subject to the 100 percent prohibited transactions tax.

Our cash dividends are not guaranteed and may fluctuate.

Generally, REITs are required to distribute 90 percent of their ordinary taxable income, but not their net capital gains income. Accordingly, we do not believe that we are required to distribute material amounts of cash since substantially all of our taxable income is treated as capital gains income. Our Board of Directors, in its sole discretion, determines the amount of quarterly dividends to be provided to our shareholders based on consideration of a number of factors. These factors include, but are not limited to, our results of operations, cash flow and capital requirements, economic conditions, tax considerations, borrowing capacity and other factors, including debt covenant restrictions that may impose limitations on cash payments, future acquisitions and divestitures, harvest levels, changes in the price and demand for our products and general market demand for timberlands including those timberland properties that have higher and better uses. Consequently, our dividend levels may fluctuate.

We may not be able to complete desired like-kind exchange transactions for timberlands and real estate we sell.

When we sell timberlands and real estate, we generally seek to match these sales with the acquisition of suitable replacement timberlands. This allows us “like-kind exchange” treatment for these transactions under section 1031 and related regulations of the Code. This matching of sales and purchases provides us with significant tax benefits, most importantly the deferral of any gain on the property sold until ultimate disposition of the replacement property. While we attempt to complete like-kind exchanges wherever practical, we will not be able to do so in all instances due to various factors, including the lack of availability of suitable replacement property on acceptable terms, our inability to complete a qualifying like-kind exchange transaction within the time frames required by the Code and if we incorrectly identify real estate as property not held for sale to customers in the ordinary course of business. The inability to obtain like-kind exchange treatment would result in the payment of taxes with respect to the property sold, and a corresponding reduction in earnings and cash available for distribution to shareholders as dividends.

Alternative fuel mixture credit.

The Company has disclosed information concerning its eligibility for the alternative fuel mixture credit. See Note 3 —Alternative Fuel Mixture Credit (“AFMC”)for additional information. Under applicable law, which expired on December 31, 2009, the tax credit was earned through the burning of qualifying fuel mixtures on or before such date. There can be no assurance that the IRS will not challenge the Company’s eligibility for, and amount of, such tax credit.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

13

Table of Contents

Index to Financial Statements

| Item 2. | PROPERTIES |

The following table details the significant properties we own, lease, or manage by reportable segment (acres in millions):

Segment/Operations | Location | Total Acres | Fee-Owned Acres | Long-Term Leased Acres | Managed Acres | |||||

Timber | Eastern region | 1.7 | 1.4 | 0.3 | — | |||||

Western region | 0.4 | 0.4 | — | — | ||||||

New Zealand(1) | 0.3 | — | — | 0.3 | ||||||

| Total Timber Acres | 2.4 | 1.8 | 0.3 | 0.3 | ||||||

Real Estate | U.S. | 0.1 | 0.1 | — | — | |||||

Total Timberland and Real Estate Acres | 2.5 | 1.9 | 0.3 | 0.3 | ||||||

Capacity/Function | Owned/Leased | |||||

Performance Fibers | Jesup, Georgia | 590,000 metric tons of pulp | Owned | |||

Fernandina Beach, Florida | 150,000 metric tons of pulp | Owned | ||||

Jesup, Georgia | Research Facility | Owned | ||||

Wood Products(2) | Baxley, Georgia | 160 million board feet of lumber | Owned | |||

Swainsboro, Georgia | 120 million board feet of lumber | Owned | ||||

Eatonton, Georgia | 90 million board feet of lumber | Owned | ||||

Wood Fiber Facilities | Offerman, Georgia | 690,000 short green tons of wood chips | Owned | |||

Eastman, Georgia | 350,000 short green tons of wood chips | Owned | ||||

Barnesville, Georgia | 350,000 short green tons of wood chips | Owned | ||||

Jarratt, Virginia | 250,000 short green tons of wood chips | Owned | ||||

Corporate and Other | Jacksonville, Florida | Corporate Headquarters | Leased | |||

| (1) | Represents acres under Rayonier management, owned by the New Zealand joint venture. Rayonier owned a 40 percent interest at December 31, 2009. See Item 1— Business for information concerning Rayonier’s decrease in ownership of the joint venture to 26 percent in February 2010. |

| (2) | These locations also have a combined annual production capacity of approximately 700,000 short green tons of wood chips. |

Our manufacturing facilities are maintained through ongoing capital investments, regular maintenance and equipment upgrades. During 2009, our Performance Fibers manufacturing facilities produced at or near capacity levels for most of the year. The Wood Products sawmills produced at a reduced capacity due to decreased demand from a weak housing market.

| Item 3. | LEGAL PROCEEDINGS |

The Company has been named as a defendant in various lawsuits and claims arising in the normal course of business. While we have procured reasonable and customary insurance covering risks normally occurring in connection with our businesses, we have in certain cases retained some risk through the operation of self-insurance, primarily in the areas of workers’ compensation, property insurance and general liability. In our opinion, these other lawsuits and claims, either individually or in the aggregate, are not expected to have a material effect on our financial position, results of operations, or cash flow.

Discussed below are certain ongoing environmental proceedings. For further information on our environmental proceedings, see Note 16 —Liabilities for Dispositions and Discontinued Operations.

Jesup Mill Effluent Issue — In March 2008, the Company and the Environmental Protection Division of the Georgia Department of Natural Resources (“EPD”) entered into a consent order to resolve certain potential compliance issues relating to the Jesup mill’s permitted effluent discharged to the Altamaha River. Under the consent order, Rayonier has agreed to implement a color reduction plan which will include installation of additional brown stock washing capacity to better remove residual pulping liquors from cooked wood pulp and oxygen delignification technology which reduces the lignin content in

14

Table of Contents

Index to Financial Statements

the pulp prior to bleaching, spill recovery systems and modifications to certain operating practices. These projects are expected to be completed by the end of 2015, pursuant to a time frame set forth in the consent order, at a total cost of approximately $83.8 million. Through December 31, 2009, approximately $16.5 million has been spent. The consent order also provides for decreasing color limits in the mill’s effluent over the seven year period as projects are completed. No citations, fines or penalties are imposed by the consent order, except that stipulated penalties may be assessed by EPD in the event that the projects are not completed on the agreed schedule.

In December of 2008, Rayonier received a “sixty day letter” from lawyers representing a non-profit environmental organization, Altamaha Riverkeeper, Inc. (“ARK”), threatening a citizen’s suit under the federal Clean Water Act (the “CWA”) and analogous state law if ARK and Rayonier are unable to settle their differences within sixty days of the date of the letter. ARK primarily claims that the color and odor of the mill’s effluent violates provisions of the federal Clean Water Act and the Georgia Water Quality Control Act, and further asserts that the March 2008 consent order between EPD and the Company does not appropriately address the issues of concern. Rayonier believes that it has good defenses to ARK’s claims including, without limitation, that the mill is in compliance with both applicable law and its wastewater discharge permit issued by EPD, and that the consent order constitutes a bar to the threatened citizen suit under the applicable provisions of the CWA. However, to avoid the cost and risks of litigation, the Company has engaged in discussions with ARK to explore whether a settlement is possible. Assuming that no settlement is reached, ARK has the right to file a lawsuit against the Company in respect of its claims, although as of the date of this filing no such suit has been filed.

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matter was submitted to a vote of security holders of Rayonier during the fourth quarter of 2009.

15

Table of Contents

Index to Financial Statements

PART II

| Item 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Prices of our Common Shares; Dividends

The table below reflects the range of market prices of our Common Shares as reported in the consolidated transaction reporting system of the NYSE, the only exchange on which our shares are listed, under the trading symbolRYN.

| High | Low | Dividends | |||||||

2009 | |||||||||

Fourth Quarter | $ | 43.92 | $ | 37.88 | $ | 0.50 | |||

Third Quarter | $ | 45.00 | $ | 33.63 | $ | 0.50 | |||

Second Quarter | $ | 41.79 | $ | 29.35 | $ | 0.50 | |||

First Quarter | $ | 32.40 | $ | 22.28 | $ | 0.50 | |||

2008 | |||||||||

Fourth Quarter | $ | 47.09 | $ | 26.58 | $ | 0.50 | |||

Third Quarter | $ | 49.54 | $ | 40.60 | $ | 0.50 | |||

Second Quarter | $ | 48.00 | $ | 41.88 | $ | 0.50 | |||

First Quarter | $ | 47.37 | $ | 35.36 | $ | 0.50 | |||

For information about covenants of our credit facility that could restrict our ability to pay cash dividends in the future, see Note 13 —Debt — Debt Covenants.

On February 23, 2010, the Company announced a first quarter dividend of 50 cents per share payable March 31, 2010, to shareholders of record on March 10, 2010. There were approximately 9,883 shareholders of record of our Common Shares on February 19, 2010.

Issuer Repurchases

In 1996, we began a Common Share repurchase program (the “anti-dilutive program”) to minimize the dilutive effect on earnings per share of our employee incentive stock plans. This program limits the number of shares that may be purchased each year to the greater of 1.5 percent of outstanding shares at the beginning of the year or the number of incentive shares issued to employees during the year. In October 2000 and July 2003, our Board of Directors authorized the purchase of additional shares totaling 1.4 million. These shares were authorized separately from the anti-dilutive program, and neither have expiration dates. In 2009, there were no shares repurchased under these plans. As of December 31, 2009, there were 2,472,255 shares available for repurchase.

16

Table of Contents

Index to Financial Statements

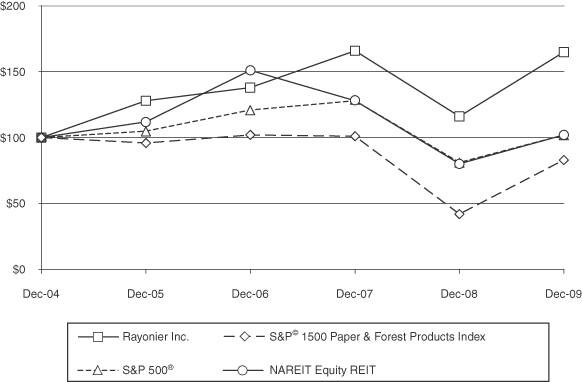

Stock Performance Graph

The following graph compares the performance of Rayonier’s Common Shares (assuming reinvestment of dividends) with a broad-based market index (Standard & Poor’s (“S&P”) 500), and two industry-specific indices (the S&P 1500 Paper and Forest Products Index and the National Association of Real Estate Investment Trusts (“NAREIT”) Equity REIT Index).

The table and related information shall not be deemed to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that the Company specifically incorporates it by reference into such filing.

The data in the following table was used to create the above graph:

| 31-Dec-04 | 31-Dec-05 | 31-Dec-06 | 31-Dec-07 | 31-Dec-08 | 31-Dec-09 | |||||||||||||

Rayonier Inc. | $ | 100 | $ | 128 | $ | 138 | $ | 166 | $ | 116 | $ | 165 | ||||||

S&P 500® | $ | 100 | $ | 105 | $ | 121 | $ | 128 | $ | 81 | $ | 102 | ||||||

S&P© 1500 Paper & Forest Products Index | $ | 100 | $ | 96 | $ | 102 | $ | 101 | $ | 42 | $ | 83 | ||||||

NAREIT Equity REIT | $ | 100 | $ | 112 | $ | 151 | $ | 128 | $ | 80 | $ | 102 | ||||||

17

Table of Contents

Index to Financial Statements

| Item 6. | SELECTED FINANCIAL DATA |

The following financial data should be read in conjunction with our Consolidated Financial Statements.

| At or For the Years Ended December 31, | ||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

| (dollar amounts in millions, except per share data) | ||||||||||||||||||||

Profitability: | ||||||||||||||||||||

Sales | $ | 1,169 | $ | 1,271 | $ | 1,225 | $ | 1,230 | $ | 1,181 | ||||||||||

Operating income before the gain on sale of New Zealand timber assets(1) (2) | 410 | 226 | 247 | 222 | 175 | |||||||||||||||

Operating income(1) (2) | 410 | 226 | 247 | 230 | 212 | |||||||||||||||

Income from continuing operations(3) | 313 | 149 | 174 | �� | 171 | 202 | ||||||||||||||

Net income(3) | 313 | 149 | 174 | 176 | 178 | |||||||||||||||

Diluted earnings per common share: | ||||||||||||||||||||

Continuing operations | 3.91 | 1.87 | 2.20 | 2.19 | 2.61 | |||||||||||||||

Net income | 3.91 | 1.87 | 2.20 | 2.26 | 2.29 | |||||||||||||||

Financial Condition: | ||||||||||||||||||||

Total assets | $ | 2,253 | $ | 2,082 | $ | 2,068 | $ | 1,965 | $ | 1,841 | ||||||||||

Total debt | 700 | 747 | 721 | 659 | 559 | |||||||||||||||

Shareholders’ equity | 1,146 | 939 | 1,000 | 918 | 894 | |||||||||||||||

Shareholders’ equity — per share | 14.41 | 11.91 | 12.78 | 11.94 | 11.74 | |||||||||||||||

Cash Flows: | ||||||||||||||||||||

Cash provided by operating activities | $ | 307 | $ | 340 | $ | 324 | $ | 307 | $ | 262 | ||||||||||

Capital expenditures | 92 | 105 | 97 | 105 | 85 | |||||||||||||||

Purchase of timberlands, real estate and other | — | 234 | 27 | 299 | 24 | |||||||||||||||

Depreciation, depletion and amortization | 158 | 168 | 165 | 136 | 153 | |||||||||||||||

Cash dividends paid | 158 | 157 | 151 | 144 | 129 | |||||||||||||||

Non-GAAP Financial Measures: | ||||||||||||||||||||

EBITDA(4) | ||||||||||||||||||||

Timber | $ | 77 | $ | 116 | $ | 146 | $ | 152 | $ | 147 | ||||||||||

Real Estate | 80 | 101 | 98 | 91 | 68 | |||||||||||||||

Performance Fibers | 242 | 205 | 209 | 153 | 121 | |||||||||||||||

Wood Products | (6 | ) | (1 | ) | (2 | ) | 4 | (12 | ) | |||||||||||

Other Operations | (3 | ) | 3 | (3 | ) | 2 | 2 | |||||||||||||

Corporate and other(1) | 178 | (29 | ) | (36 | ) | (28 | ) | 13 | ||||||||||||

Total EBITDA | $ | 568 | $ | 395 | $ | 412 | $ | 374 | $ | 339 | ||||||||||

Debt to EBITDA | 1.2 to 1 | 1.9 to 1 | 1.8 to 1 | 1.8 to 1 | 1.6 to 1 | |||||||||||||||

Performance Ratios (%): | ||||||||||||||||||||

Operating income to sales | 35 | 18 | 20 | 19 | 18 | |||||||||||||||

Return on equity(5) | 30 | 15 | 18 | 19 | 24 | |||||||||||||||

Return on capital(5) | 18 | 9 | 11 | 11 | 14 | |||||||||||||||

Debt to capital | 38 | 44 | 42 | 42 | 38 | |||||||||||||||

Other: | ||||||||||||||||||||

Timberland and real estate acres — owned, leased, or managed, in millions of acres | 2.5 | 2.6 | 2.5 | 2.7 | 2.5 | |||||||||||||||

Dividends paid — per share | $ | 2.00 | $ | 2.00 | $ | 1.94 | $ | 1.88 | $ | 1.71 | ||||||||||

18

Table of Contents

Index to Financial Statements

| For the Years Ended December 31, | ||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||

Selected Operating Data: | ||||||||||

Timber | ||||||||||

Timber sales volume | ||||||||||

Western U.S. — in millions of board feet | 166 | 232 | 254 | 274 | 263 | |||||