| UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM 10-K |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended June 30, 2013 | Commission file number 1-5128 |

| MEREDITH CORPORATION | |

| (Exact name of registrant as specified in its charter) | |

| Iowa | 42-0410230 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 1716 Locust Street, Des Moines, Iowa | 50309-3023 |

| (Address of principal executive offices) | (ZIP Code) |

Registrant's telephone number, including area code: (515) 284-3000 | |

| Securities registered pursuant to Section 12(b) of the Act: | ||||

| Title of each class | Name of each exchange on which registered | |||

| Common Stock, par value $1 | New York Stock Exchange | |||

| Securities registered pursuant to Section 12(g) of the Act: | ||||||||

| Title of class | ||||||||

| Class B Common Stock, par value $1 | ||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes S No £

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No S

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes S No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes S No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer S Accelerated filer £ Non-accelerated filer £ Smaller reporting company £

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No S

The registrant estimates that the aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant at December 31, 2012, was $1,177,000,000 based upon the closing price on the New York Stock Exchange at that date.

| Shares of stock outstanding at July 31, 2013 | ||

| Common shares | 36,257,472 | |

| Class B shares | 8,324,023 | |

| Total common and Class B shares | 44,581,495 | |

| DOCUMENT INCORPORATED BY REFERENCE | ||||

Certain portions of the Registrant's Proxy Statement for the Annual Meeting of Shareholders to be held on November 6, 2013, are incorporated by reference in Part III to the extent described therein. | ||||

| TABLE OF CONTENTS | ||||

| Page | ||||

| Part I | ||||

| Business | ||||

| Description of Business | ||||

| National Media | ||||

| Local Media | ||||

| Executive Officers of the Company | ||||

| Employees | ||||

| Other | ||||

| Available Information | ||||

| Forward Looking Statements | ||||

| Risk Factors | ||||

| Unresolved Staff Comments | ||||

| Properties | ||||

| Legal Proceedings | ||||

| Mine Safety Disclosures | ||||

| Part II | ||||

| Market for Registrant's Common Equity, Related Shareholder | ||||

| Matters, and Issuer Purchases of Equity Securities | ||||

| Selected Financial Data | ||||

| Management's Discussion and Analysis of Financial | ||||

| Condition and Results of Operations | ||||

| Quantitative and Qualitative Disclosures About Market Risk | ||||

| Financial Statements and Supplementary Data | ||||

| Changes in and Disagreements with Accountants on | ||||

| Accounting and Financial Disclosure | ||||

| Controls and Procedures | ||||

| Other Information | ||||

| Part III | ||||

| Directors, Executive Officers, and Corporate Governance | ||||

| Executive Compensation | ||||

| Security Ownership of Certain Beneficial Owners and | ||||

| Management and Related Stockholder Matters | ||||

| Certain Relationships and Related Transactions and | ||||

| Director Independence | ||||

| Principal Accounting Fees and Services | ||||

| Part IV | ||||

| Exhibits and Financial Statement Schedules | ||||

Meredith Corporation and its consolidated subsidiaries are referred to in this Annual Report on Form 10-K (Form 10-K) as Meredith, the Company, we, our, and us. | ||||

| PART I | ||

ITEM 1. BUSINESS

GENERAL

Meredith Corporation is the leading media and marketing company serving American women. Meredith began in 1902 as an agricultural publisher. In 1924, the Company published the first issue of Better Homes and Gardens. The Company entered the television broadcasting business in 1948. Today Meredith engages in magazine publishing and related brand licensing, television broadcasting, digital and customer relationship marketing, digital and mobile media, and video creation operations. The Company is incorporated under the laws of the State of Iowa. Our common stock is listed on the New York Stock Exchange under the ticker symbol MDP.

The Company operates two business segments: national media and local media. The national media segment includes magazine publishing, brand licensing, digital and customer relationship marketing, digital and mobile media, database-related activities, and other related operations. The local media segment consists of the operations of network-affiliated television stations, related digital and mobile media, and video creation operations. Financial information about industry segments can be found in Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations and in Item 8-Financial Statements and Supplementary Data under Note 16.

Our national media segment includes leading national consumer media brands delivered via multiple media platforms, brand licensing activities, and business-to-business marketing products and services. It focuses on the home and family market and is a leading publisher of magazines serving women. In fiscal 2013, we published in print twenty subscription magazines, including Better Homes and Gardens, Family Circle, Ladies' Home Journal, Parents, FamilyFun, American Baby, EveryDay with Rachael Ray, and Fitness, and approximately 120 special interest publications. Twenty of our brands are also available as digital editions on various platforms. The national media segment's extensive digital media presence consists of over 40 websites, almost 30 mobile-optimized websites, and about 30 applications (apps). Of those websites and apps, the Allrecipes' brand accounts for 18 websites, 18 mobile sites serving 23 countries in 12 languages, and 11 mobile apps. The national media segment also includes digital and customer relationship marketing, which provides specialized marketing products and services to some of America's leading companies; a large consumer database; brand licensing activities; and other related operations.

Our local media segment consists of 12 network-affiliated television stations located across the United States (U.S.) in mostly fast growing markets and a national video creation unit. The television stations consist of six CBS affiliates, three FOX affiliates, two MyNetworkTV affiliates, and one NBC affiliate. Local media's digital presence includes 20 websites and mobile websites and 36 apps focused on news, sports, and weather-related information.

The Company's largest revenue source is advertising. National and local economic conditions affect the magnitude of our advertising revenues. Both national media and local media revenues and operating results can be affected by changes in the demand for advertising and consumer demand for our products. Magazine circulation revenues are generally affected by national and regional economic conditions and competition from other forms of media. Television advertising is seasonal and cyclical to some extent, traditionally generating higher revenues in the second and fourth fiscal quarters and during key political contests and major sporting events.

1

BUSINESS DEVELOPMENTS

In May 2013, Meredith acquired Parenting and Babytalk magazines and their related digital assets. Under the agreement, readers of Parenting will receive either Parents or FamilyFun magazine effective with the September issue. Similarly, readers of Babytalk will receive American Baby magazine effective with the September issue. The companion digital site, www.parenting.com, will operate as a part of the Parents network of digital media.

In April 2013, Meredith announced the expansion of the Meredith Sales Guarantee program. This program proves quantitatively that advertising in our titles increases retail sales. Brands that participated in our first year realized an average return on their investment of $7.81 for every $1.00 invested in advertising in our magazines. Currently we have 26 brands participating in the program – double the number from last year – and we are adding new categories for measurement, including pharmaceuticals and retail.

In fiscal 2013, we successfully renewed most of our agreements with cable and satellite television providers. Additionally, we successfully completed new network affiliation agreements with CBS and Fox, our major network partners.

During fiscal 2013, Meredith entered into several agreements that expanded the reach of our popular media brands in Turkey and Italy. In Turkey, Istanbul-based Dinosaurs Yayincilik ve Dijital Medya Ltd. launched local editions of three Meredith brands: Better Homes and Gardens, Parents, and More. All three are currently published under license in the Turkish language, and are distributed via subscriptions and newsstands throughout the country. In Italy, Allrecipes.com launched Allrecipes.it, a localized site dedicated to Italian cooks.

The Company began offering digital editions of our most popular magazines, including such well-known titles as Family Circle, EveryDay with Rachael Ray, Ladies' Home Journal, Midwest Living, and MORE, as magazines on Google Play. On Google Play, consumers can buy new or back issues of magazines and customize their reading experiences on their Android tablets or phones. Purchased magazines are stored and accessible using cloud technology, enabling consumers to keep their favorite titles organized and easily browsed in a digital carousel. They are then able to access these titles using the Google Play Magazines app for Android devices.

DESCRIPTION OF BUSINESS

National Media

National media represented 74 percent percent of Meredith's consolidated revenues in fiscal 2013. Better Homes and Gardens magazine, our flagship brand, continues to account for a significant percentage of revenues and operating profit of the national media segment and the Company.

2

Magazines

Information for our major magazine titles as of June 30, 2013, follows:

| Title | Description | Frequency per Year | Year-end Rate Base | 1 | |

| Better Homes and Gardens | Women's service | 12 | 7,600,000 | ||

| Family Circle | Women's service | 12 | 4,000,000 | ||

| Ladies' Home Journal | Women's service | 11 | 3,200,000 | ||

| Parents | Parenthood | 12 | 2,200,000 | ||

| FamilyFun | Parenthood | 10 | 2,100,000 | ||

| American Baby | Parenthood | 12 | 2,000,000 | ||

| EveryDay with Rachael Ray | Women's lifestyle and food | 10 | 1,700,000 | ||

| Fitness | Women's lifestyle | 10 | 1,500,000 | ||

| More | Women's lifestyle (age 40+) | 10 | 1,300,000 | ||

| Midwest Living | Travel and lifestyle | 6 | 950,000 | ||

| Ser Padres | Hispanic parenthood | 8 | 850,000 | ||

| Traditional Home | Home decorating | 8 | 850,000 | ||

| EatingWell | Women's lifestyle and food | 6 | 750,000 | ||

| Siempre Mujer | Hispanic women's lifestyle | 6 | 550,000 | ||

| Wood | Woodworking | 7 | 450,000 | ||

| Successful Farming | Farming business | 13 | 420,000 | ||

| 1 | Rate base is the circulation guaranteed to advertisers. Actual circulation generally exceeds rate base and for most of the Company's titles is tracked by the Audit Bureau of Circulations, which issues periodic statements for audited magazines. | |

In addition to these major magazine titles, we published approximately 120 special interest publications under approximately 75 titles in fiscal 2013, primarily under the Better Homes and Gardens brand. The titles are issued from one to six times annually and sold primarily on newsstands. A limited number of subscriptions are also sold to certain special interest publications. The following titles were published quarterly or more frequently: American Patchwork & Quilting, Country Gardens, Diabetic Living, Do It Yourself, Kitchen and Bath Ideas, and Quilts & More.

Magazine Advertising—Advertising revenues are generated primarily from sales to clients engaged in consumer marketing. Many of Meredith's larger magazines offer regional and demographic editions that contain similar editorial content but allow advertisers to customize messages to specific markets or audiences. The Company sells two primary types of magazine advertising: display and direct-response. Advertisements are either run-of-press (printed along with the editorial portions of the magazine) or inserts (preprinted pages). Most of the national media segment's advertising revenues are derived from run-of-press display advertising. Meredith also possesses a strategic marketing unit, Meredith 360°, which provides clients and their agencies with access to the full range of media products and services Meredith has to offer, including many media platforms. Our team of creative and marketing experts delivers innovative solutions across multiple media channels that meet each client's unique advertising and promotional requirements.

Magazine Circulation—Subscriptions obtained through direct-mail solicitation, agencies, insert cards, the Internet, and other means are Meredith's largest source of circulation revenues. All of our subscription magazines, except American Baby, Ser Padres, and Successful Farming, are also sold by single copy. Single copies sold on newsstands are distributed primarily through magazine wholesalers, who have the right to receive credit from the Company for magazines returned to them by retailers.

3

Digital and Mobile Media

We have 20 of our brands available as digital tablet editions, with an audience of approximately 600,000. Paid digital customers represent about 2 percent of our total rate base. For four of our brands, we offer digital editions that are enhanced for the tablet to include bonus content.

In fiscal 2013, we launched seven new apps. National media now has 22 apps focused on food, parenthood, and health. Our cumulative downloads have reached nearly 25 million. We generated 5.5 million digital orders for print magazine subscriptions in fiscal 2013, an increase of nearly 70 percent over the prior year. We now receive about one-third of our orders from digital sources.

National media's 30 websites and 10 mobile-optimized websites provide ideas and inspiration. These branded websites focus on the topics that women care about most—food, home, entertaining, and meeting the needs of moms—and on delivering powerful content geared toward lifestyle topics such as health, beauty, style, and wellness. Digital traffic was 45 million unique average monthly visitors in fiscal 2013, helped by the acquisition of Allrecipes.com, Inc. (Allrecipes) and aggressive digital marketing initiatives.

Other Sources of Revenues

Other revenues are derived from digital and customer relationship marketing, other custom publishing projects, brand licensing agreements, ancillary products and services, and book sales.

Meredith Xcelerated Marketing—Meredith Xcelerated Marketing (MXM) is a digital and customer relationship marketing agency with the proven ability to create measurable programs that are focused on building customer engagement for corporate clients through the use of content and innovation. MXM's marketing capabilities include digital, social media, customer relationship management, database analytics, healthcare, and mobile media. MXM provides clients with in-depth knowledge, resources, and expertise in core areas including loyalty, consumer research, database management and analytics, mobile, campaign management, social, and digital. MXM uses these capabilities together with its editorial talent to create content that is relevant, measurable, and on-target. Its revenue is independent of advertising and circulation, though sometimes its services are sold as part of larger programs that include advertising components. In fiscal 2013, major clients included Kraft, Nestlé, Lowe's, Honda, Chrysler, State Farm, and Allergan.

MXM possesses six offices in the U.S.: New York; Los Angeles; Washington, D.C.; Dallas; Detroit; and Des Moines metro areas. In addition, the Meredith-iris Global Network, Meredith's partnership with iris Nation Worldwide Limited, serves the increasing global needs of MXM's domestic clients while also opening the doors to new clients in the European and Asia-Pacific markets.

Brand Licensing—Brand licensing consists of the licensing of various proprietary trademarks in connection with retail programs conducted through a number of retailers and manufacturers, and multiple licensing agreements that extend several of Meredith's brands internationally.

Meredith's largest licensing agreement is for Better Homes and Gardens branded products at Wal-Mart Stores, Inc. (Walmart). Other licensing activities include a long-term agreement to license the Better Homes and Gardens brand to Realogy Corporation (Realogy), which continues to build a residential real estate franchise system based on the Better Homes and Gardens brand; and a licensing agreement with Universal Furniture International, which includes a full line of wooden and upholstered furniture for living rooms, bedrooms, and dining rooms.

During fiscal 2013, we expanded and enhanced the scope of Better Homes and Gardens branded products at Walmart stores. This included linens and towels for bedrooms and bathrooms, as well as a broader offering of home décor products. Our current licensing agreement with Walmart continues through 2016.

Our Better Homes and Gardens real estate program with Realogy continues to grow, and is now represented in 26 states by more than 8,000 agents.

4

Meredith's titles are currently distributed in nearly 60 countries - including more than 25 licensed local editions in countries such as Australia, China, Indonesia, Italy, Russia, and Turkey. During fiscal 2013, Meredith entered into several agreements that expanded the reach of our popular media brands in Turkey and Italy. In Turkey, local editions of three Meredith brands: Better Homes and Gardens, Parents, and More launched in April 2013. In Italy, Allrecipes.com recently launched Allrecipes.it, a localized site dedicated to Italian cooks.

The Company continues to pursue brand extensions that will serve consumers and advertisers alike and also extend and strengthen the reach and vitality of our brands.

Meredith Books—Meredith has licensed exclusive global rights to publish and distribute books based on our consumer-leading brands, including the powerful Better Homes and Gardens imprint, to a book publisher. Meredith creates book content and retains all approval and content rights while the publisher is responsible for book layout and design, printing, sales and marketing, distribution, and inventory management. Meredith receives royalties based on net sales subject to a guaranteed minimum.

Production and Delivery

Paper, printing, and postage costs accounted for 32 percent of the national media segment's fiscal 2013 operating expenses.

Coated publication paper is the major raw material essential to the national media segment. We directly purchase all of the paper for our magazine production and custom publishing business. The Company has contractual agreements with major paper manufacturers to ensure adequate supplies for planned publishing requirements. The price of paper is driven by overall market conditions and is therefore difficult to predict. In fiscal 2013, average paper prices decreased 5 percent. Average paper prices increased 3 percent in fiscal 2012 and fiscal 2011. Management anticipates paper prices will rise in the low to mid-single digits during fiscal 2014 and that fiscal 2014 average paper prices will be flat compared to fiscal 2013.

Meredith has printing contracts with several major domestic printers for our magazines.

Postage is a significant expense of the national media segment. We continually seek the most economical and effective methods for mail delivery, including cost-saving strategies that leverage work-sharing opportunities offered within the postal rate structure. Periodical postage accounts for approximately 75 percent of Meredith's postage costs, while other mail items—direct mail, replies, and bills—account for approximately 25 percent. The Governors of the United States Postal Service (USPS) review prices for mailing services annually and adjust postage rates periodically. Though prices and price increases for various USPS products vary, overall average price increases are capped by law at the rate of inflation as measured by the Consumer Price Index, which was 2.57 percent. Postage prices have risen in each of Meredith's last three fiscal years. Over the longer term, prices have increased in seven of the last eight years for Meredith.

Meredith continues to work independently and with others to encourage and help the USPS find and implement efficiencies to contain rate increases. We cannot, however, predict future changes in the postal rates or the impact they will have on our national media business.

Subscription fulfillment services for Meredith's national media segment are provided by third parties. National magazine newsstand distribution services are provided by third parties through multi-year agreements.

Competition

Publishing is a highly competitive business. The Company's magazines and related publishing products and services compete with other mass media, including the Internet and many other leisure-time activities. Competition for advertising dollars is based primarily on advertising rates, circulation levels, reader demographics, advertiser results, and sales team effectiveness. Competition for readers is based principally on editorial content, marketing skills, price, and customer service. While competition is strong for established titles, gaining readership for newer magazines and specialty publications is especially competitive.

5

Local Media

Local media represented 26 percent of Meredith's consolidated revenues in fiscal 2013. Information about the Company's television stations at June 30, 2013, follows:

Station, Market | DMA National Rank 1 | Network Affiliation | Channel | Expiration Date of FCC License | Average Audience Share 2 |

| WGCL-TV | 9 | CBS | 46 | 4-1-2005 (3 | 5.1 % |

| Atlanta, GA | |||||

| KPHO-TV | 13 | CBS | 5 | 10-1-2006 3) | 6.4 % |

| Phoenix, AZ | |||||

| KPTV | 22 | FOX | 12 | 2-1-2007 (3) | 6.2 % |

| Portland, OR | |||||

| KPDX-TV | 22 | MyNetworkTV | 49 | 2-1-2007 (3) | 2.2 % |

| Portland, OR | |||||

| WSMV-TV | 29 | NBC | 4 | 8-1-2005 (3) | 7.9 % |

| Nashville, TN | |||||

| WFSB-TV | 30 | CBS | 3 | 4-1-2007 (3) | 11.4 % |

| Hartford, CT | |||||

| New Haven, CT | |||||

| KCTV | 31 | CBS | 5 | 2-1-2006 (3) | 10.7 % |

| Kansas City, MO | |||||

| KSMO-TV | 31 | MyNetworkTV | 62 | 2-1-2006 (3) | 1.0 % |

| Kansas City, MO | |||||

| WHNS-TV | 37 | FOX | 21 | 12-1-2004 (3) | 4.0 % |

| Greenville, SC | |||||

| Spartanburg, SC | |||||

| Asheville, NC | |||||

| Anderson, SC | |||||

| KVVU-TV | 40 | FOX | 5 | 10-1-2006 (3) | 4.7 % |

| Las Vegas, NV | |||||

| WNEM-TV | 67 | CBS | 5 | 10-1-2005 (3) | 15.9 % |

| Flint, MI | |||||

| Saginaw, MI | |||||

| Bay City, MI | |||||

| WSHM-LP | 114 | CBS | 3 | 4-1-2007 (3) | 6.9 % |

| Springfield, MA | |||||

| Holyoke, MA | |||||

| 1 | Designated Market Area (DMA) is a registered trademark of, and is defined by, Nielsen Media Research. The national rank is from the 2012-2013 DMA ranking. |

| 2 | Average audience share represents the estimated percentage of households using television tuned to the station in the DMA. The percentages shown reflect the average total day shares (6:00 a.m. to 2:00 a.m.) for the November 2012, February 2013, and May 2013 measurement periods. |

| 3 | Renewal application pending. Under FCC rules, a license is automatically extended pending FCC processing and granting of the renewal application. We have no reason to believe that these licenses will not be renewed by the FCC. |

6

Operations

The principal sources of the local media segment's revenues are: 1) local advertising focusing on the immediate geographic area of the stations; 2) national advertising; 3) retransmission of our television signal to satellite and cable systems; 4) advertising on the stations' websites and mobile websites; 5) station operation management fees; and 6) payments by advertisers for other services, such as the production of advertising materials.

The stations sell commercial time to both local/regional and national advertisers. Rates for spot advertising are influenced primarily by the market size, number of in-market broadcasters, audience share, and audience demographics. The larger a station's audience share in any particular daypart, the more leverage a station has in setting advertising rates. Generally, as the market fluctuates with supply and demand, so do a station's advertising rates. Most national advertising is sold by an independent representative firm. The sales staff at each station generates local/regional advertising revenues.

Typically 30 to 40 percent of a market's television advertising revenue is generated by local newscasts. Station personnel are continually working to grow their news ratings, which in turn will augment revenues. The Company broadcasts local newscasts in high definition in six of our markets and in wide screen format in our other four markets.

The national network affiliations of Meredith's 12 television stations also influence advertising rates. Generally, a network affiliation agreement provides a station the exclusive right to broadcast network programming in its local service area. In return, the network has the right to sell most of the commercial advertising aired during network programs.

The affiliation agreement for our NBC affiliate expires at the end of December 2013. Our two MyNetworkTV affiliation agreements expire in September 2014. Our CBS affiliation agreements expire in April 2016 and August 2017 and our Fox affiliation agreements expire in December 2017. Programming fees paid to CBS and Fox increased significantly in fiscal 2013. These payments are in essence a portion of the retransmission fees that Meredith receives from cable, satellite, and telecommunications firms, which pay Meredith to carry our local television programming in their markets. These stations generally also pay networks for certain programming and services such as marquee sports (professional football, college basketball, and Olympics) and news services. The Company's Fox affiliates also pay the Fox network for additional advertising spots during prime-time programming. While Meredith's relations with the networks historically have been very good, the Company can make no assurances they will remain so over time.

Retransmission revenue is generated from cable, satellite and internet-based television service providers who pay Meredith for access to our television station signals so that they may rebroadcast our signals and charge their subscribers for this programming. These fees increased significantly in fiscal 2013 as many agreements were renewed.

The Federal Communications Commission (FCC) has permitted broadcast television station licensees to use their digital spectrum for a wide variety of services such as high-definition television programming, audio, data, mobile applications, and other types of communication, subject to the requirement that each broadcaster provide at least one free video channel equal in quality to the current technical standards. Several of our stations are broadcasting a second programming stream on their digital channel. Our Las Vegas, Phoenix, and Hartford stations currently broadcast a news/weather channel, Flint-Saginaw has a MyNetworkTV affiliate, and Kansas City airs Bounce TV, a network with African American focused programming.

The costs of television programming are significant. In addition to network affiliation fees, there are two principal programming costs for Meredith: locally produced programming, including local news; and purchased syndicated programming. The Company continues to increase our locally produced news and entertainment programming to control content and costs and to attract advertisers. Syndicated programming costs are based largely on demand from stations in the market and can fluctuate significantly.

7

Meredith Video Studios (MVS) is our development, production, and multiplatform distribution company that produces video for use by Meredith's television stations and our local and national media websites, and is producing custom video for clients as well. Sponsorship opportunities include video billboards, product integration, channel sponsorships, and custom videos.

Produced by MVS, The Better Show, our daily lifestyle television show, currently airs every weekday in more than 160 markets reaching 80 percent of U.S. television households, including New York, Los Angeles, Chicago, and Philadelphia, the country's top four television markets. Meredith recently renewed The Better Show for a seventh season. Beginning in the fall of 2013, The Better Show will air every weekday on the Hallmark Channel during its daytime programming block. Each episode will air on the Hallmark Channel a day following the original nationally syndicated show. It is the first cable network distribution agreement for Meredith Video Studios.

Competition

Meredith's television stations compete directly for advertising dollars and programming in their respective markets with other local television stations, radio stations, and cable television providers. Other mass media providers such as newspapers and their websites are also competitors. Advertisers compare market share, audience demographics, and advertising rates, and take into account audience acceptance of a station's programming, whether local, network, or syndicated.

Regulation

The ownership, operation, and sale of broadcast television and radio stations, including those licensed to the Company, are subject to the jurisdiction of the FCC, which engages in extensive regulation of the broadcasting industry under authority granted by the Communications Act of 1934, as amended (Communications Act), including authority to promulgate rules and regulations governing broadcasting. The Communications Act requires broadcasters to serve the public interest. Among other things, the FCC assigns frequency bands; determines stations' locations and operating parameters; issues, renews, revokes, and modifies station licenses; regulates and limits changes in ownership or control of station licenses; regulates equipment used by stations; regulates station employment practices; regulates certain program content, including commercial matters in children's programming; has the authority to impose penalties for violations of its rules or the Communications Act; and imposes annual fees on stations. Reference should be made to the Communications Act, as well as to the FCC's rules, public notices, and rulings for further information concerning the nature and extent of federal regulation of broadcast stations.

Broadcast licenses are granted for eight-year periods. The Communications Act directs the FCC to renew a broadcast license if the station has served the public interest and is in substantial compliance with the provisions of the Communications Act and FCC rules and policies. Management believes the Company is in substantial compliance with all applicable provisions of the Communications Act and FCC rules and policies and knows of no reason why Meredith's broadcast station licenses will not be renewed.

The FCC has, on occasion, changed the rules related to local ownership of media assets, including rules relating to the ownership of one or more television stations in a market. The FCC's media ownership rules are subject to further review by the FCC, various court appeals, petitions for reconsideration before the FCC, and possible actions by Congress. We cannot predict the impact of any of these developments on our business.

The Communications Act and the FCC also regulate relationships between television broadcasters and cable and satellite television providers. Under these provisions, most cable systems must devote a specified portion of their channel capacity to the carriage of the signals of local television stations that elect to exercise this right to mandatory carriage. Alternatively, television stations may elect to restrict cable systems from carrying their signals without their written permission, referred to as retransmission consent. Congress and the FCC have established and implemented generally similar market-specific requirements for mandatory carriage of local television stations by satellite television providers when those providers choose to provide a market's local television signals.

The FCC has enacted a proposed plan, called the National Broadband Plan, to increase the amount of spectrum available in the United States for wireless broadband use. In furtherance of the National Broadband Plan, Congress

8

enacted and the President signed into law legislation authorizing the FCC to conduct a “reverse auction” for which television broadcast licensees could submit bids to receive compensation in return for relinquishing all or a portion of their rights in the television spectrum of their full service and/or Class A stations. Under the new law, the FCC may hold one reverse auction, and another auction for the newly freed spectrum. The FCC must complete both auctions by 2022.

Even if a television licensee does not participate in the reverse auction, the results of the auction could materially impact a station's operations. The FCC has the authority to force a television station to change channels and/or modify its coverage area to allow the FCC to rededicate certain channels within the television band for wireless broadband use. We cannot predict whether or how this will affect the Company or its television stations.

In addition to the National Broadband Plan, Congress and the FCC have under consideration, and in the future may adopt, new laws, regulations, and policies regarding a wide variety of other matters that also could affect, directly or indirectly, the operation, ownership transferability, and profitability of the Company's broadcast stations and affect the ability of the Company to acquire additional stations. In addition to the matters noted above, these could include spectrum usage fees, regulation of political advertising rates, restrictions on the advertising of certain products (such as alcoholic beverages), program content restrictions, and ownership rule changes.

Other matters that could potentially affect the Company's broadcast properties include technological innovations and developments generally affecting competition in the mass communications industry for viewers or advertisers, such as home video recording devices and players, satellite radio and television services, cable television systems, newspapers, outdoor advertising, and Internet delivered video programming services.

The information provided in this section is not intended to be inclusive of all regulatory provisions currently in effect. Statutory provisions and FCC regulations are subject to change, and any such changes could affect future operations and profitability of the Company's local media segment. Management cannot predict what regulations or legislation may be adopted, nor can management estimate the effect any such changes would have on the Company's television and radio broadcasting operations.

EXECUTIVE OFFICERS OF THE COMPANY

Executive officers are elected to one year terms each November. The current executive officers of the Company are:

Stephen M. Lacy—Chairman, President, and Chief Executive Officer (2010 - present) and a director of the Company since 2004. Formerly President and Chief Executive Officer (2006 - 2010). Age 59.

Thomas H. Harty—President-National Media Group (2010 - present). Formerly President-Consumer Magazines (2009 - 2010) and Vice President-Magazine Group (2004 - 2009). Age 50.

Paul A. Karpowicz—President-Local Media Group (2005 - present). Age 60.

Joseph H. Ceryanec—Vice President-Chief Financial Officer (2008 - present). Age 52.

John S. Zieser—Chief Development Officer/General Counsel and Secretary (2006 - present). Age 54.

EMPLOYEES

As of June 30, 2013, the Company had approximately 3,250 full-time and 100 part-time employees. Only a small percentage of our workforce is unionized. We consider relations with our employees to be good.

9

OTHER

Name recognition and the public image of the Company's trademarks (e.g., Better Homes and Gardens and Parents) and television station call letters are vital to the success of our ongoing operations and to the introduction of new businesses. The Company protects our brands by aggressively defending our trademarks and call letters.

The Company had no material expenses for research and development during the past three fiscal years. Revenues from individual customers and revenues, operating profits, and identifiable assets of foreign operations were not significant. Compliance with federal, state, and local provisions relating to the discharge of materials into the environment and to the protection of the environment had no material effect on capital expenditures, earnings, or the Company's competitive position.

AVAILABLE INFORMATION

The Company's corporate website is meredith.com. The content of our website is not incorporated by reference into this Form 10-K. Meredith makes available free of charge through our website our Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished to the Securities and Exchange Commission (SEC) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practical after such documents are electronically filed with or furnished to the SEC. Meredith also makes available on our website our corporate governance information including charters of all of our Board Committees, our Corporate Governance Guidelines, our Code of Business Conduct and Ethics, our Code of Ethics for CEO and Senior Financial Officers, and our Bylaws. Copies of such documents are also available free of charge upon written request.

FORWARD LOOKING STATEMENTS

This Form 10-K, including the sections titled Item 1-Business, Item 1A-Risk Factors, and Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements that relate to future events or our future financial performance. We may also make written and oral forward-looking statements in our SEC filings and elsewhere. By their nature, forward-looking statements involve risks, trends, and uncertainties that could cause actual results to differ materially from those anticipated in any forward-looking statements. Such factors include, but are not limited to, those items described in Item 1A-Risk Factors below, those identified elsewhere in this document, and other risks and factors identified from time to time in our SEC filings. We have tried, where possible, to identify such statements by using words such as believe, expect, intend, estimate, may, anticipate, will, likely, project, plan, and similar expressions in connection with any discussion of future operating or financial performance. Any forward-looking statements are and will be based upon our then-current expectations, estimates, and assumptions regarding future events and are applicable only as of the dates of such statements. Readers are cautioned not to place undue reliance on such forward-looking statements that are part of this filing; actual results may differ materially from those currently anticipated. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

ITEM 1A. RISK FACTORS

In addition to the other information contained or incorporated by reference into this Form 10-K, investors should consider carefully the following risk factors when investing in our securities. In addition to the risks described below, there may be additional risks that we have not yet perceived or that we currently believe are immaterial.

10

Advertising represents the largest portion of our revenues. In fiscal 2013, 56 percent of our revenues were derived from advertising. Advertising constitutes almost half of our national media revenues and approximately 80 percent of our local media revenues. Demand for advertising is highly dependent upon the strength of the U.S. economy. During an economic downturn, demand for advertising may decrease. The growth in alternative forms of media, for example the Internet, has increased the competition for advertising dollars, which could in turn reduce expenditures for magazine and television advertising or suppress advertising rates.

Technology in the media industry continues to evolve rapidly. Advances in technology have led to an increasing number of alternative methods for the delivery of content and have driven consumer demand and expectations in unanticipated directions. If we are unable to exploit new and existing technologies to distinguish our products and services from those of our competitors or adapt to new distribution methods that provide optimal user experiences, our business, financial condition, and prospects may be adversely affected. Technology developments also pose other challenges that could adversely affect our revenues and competitive position. New delivery platforms may lead to pricing restrictions, the loss of distribution control, and the loss of a direct relationship with consumers. We may also be adversely affected if the use of technology developed to block the display of advertising on websites proliferates.

Circulation revenues represent a significant portion of our revenues. Magazine circulation is another significant source of revenue, representing 22 percent of total revenues and 29 percent of national media revenues. Preserving circulation is critical for maintaining advertising sales. Magazines face increasing competition from alternative forms of media and entertainment. As a result, sales of magazines through subscriptions and at the newsstand could decline. As publishers compete for subscribers, subscription prices could decrease and marketing expenditures may increase.

Client relationships are important to our brand licensing and consumer relationship marketing businesses. Our ability to maintain existing client relationships and generate new clients depends significantly on the quality of our products and services, our reputation, and the continuity of Company and client personnel. Dissatisfaction with our products and services, damage to our reputation, or changes in key personnel could result in a loss of business.

Paper and postage prices are difficult to predict and control. Paper and postage represent significant components of our total cost to produce, distribute, and market our printed products. In fiscal 2013, these expenses accounted for 23 percent of national media's operating costs. Paper is a commodity and its price has been subject to significant volatility. All of our paper supply contracts currently provide for price adjustments based on prevailing market prices; however, we historically have been able to realize favorable paper pricing through volume discounts. The USPS distributes substantially all of our magazines and many of our marketing materials. Postal rates are dependent on the operating efficiency of the USPS and on legislative mandates imposed upon the USPS. Although we work with others in the industry and through trade organizations to encourage the USPS to implement efficiencies that will minimize rate increases, we cannot predict with certainty the magnitude of future price changes for paper and postage. Further, we may not be able to pass such increases on to our customers.

World events may result in unexpected adverse operating results for our local media segment. Our local media results could be affected adversely by world events such as wars, political unrest, acts of terrorism, and natural disasters. Such events can result in significant declines in advertising revenues as the stations will not broadcast or will limit broadcasting of commercials during times of crisis. In addition, our stations may have higher newsgathering costs related to coverage of the events.

Our local media operations are subject to FCC regulation. Our broadcasting stations operate under licenses granted by the FCC. The FCC regulates many aspects of television station operations including employment practices, political advertising, indecency and obscenity, programming, signal carriage, and various technical matters. Violations of these regulations could result in penalties and fines. Changes in these regulations could impact the results of our operations. The FCC also regulates the ownership of television stations. Changes in the ownership rules could affect our ability to consummate future transactions. Details regarding regulation and its impact on our local media operations are provided in Item 1-Business beginning on page 8.

11

Loss of or changes in affiliation agreements could adversely affect operating results for our local media segment. Our broadcast television station business owns and operates 12 television stations. Six are affiliated with CBS, three with Fox, two with MyNetworkTV, and one with NBC. These television networks produce and distribute programming in exchange for each of our stations' commitment to air the programming at specified times and for commercial announcement time during the programming. The non-renewal or termination of any of our network affiliation agreements would prevent us from being able to carry programming of the affiliate network. This loss of programming would require us to obtain replacement programming, which may involve higher costs and/or which may not be as attractive to our audiences, resulting in reduced revenues. The affiliation agreement for our NBC affiliate expires at the end of December 2013. Our two MyNetworkTV affiliation agreements expire in September 2014. Our CBS affiliation agreements expire in April 2016 and August 2017 and our Fox affiliation agreements expire in December 2017. In conjunction with these renegotiations, the television networks sought arrangements with their affiliates to change the structure of network compensation, including payment from affiliates for the network’s programming. Programming fees paid to CBS and Fox have increased significantly in fiscal 2013. These payments are in essence a portion of the retransmission fees that Meredith receives from cable, satellite, and telecommunications firms, which pay Meredith to carry its local television programming in their markets.

Acquisitions pose inherent financial and other risks and challenges. As a part of our strategic plan, we have acquired businesses and we expect to continue acquiring businesses in the future. These acquisitions can involve a number of risks and challenges, any of which could cause significant operating inefficiencies and adversely affect our growth and profitability. Such risks and challenges include underperformance relative to our expectations and the price paid for the acquisition; unanticipated demands on our management and operational resources; difficulty in integrating personnel, operations, and systems; retention of customers of the combined businesses; assumption of contingent liabilities; and acquisition-related earnings charges. If our acquisitions are not successful, we may record impairment charges. Our ability to continue to make acquisitions will depend upon our success at identifying suitable targets, which requires substantial judgment in assessing their values, strengths, weaknesses, liabilities and potential profitability, as well as the availability of suitable candidates at acceptable prices, and whether restrictions are imposed by regulations. Moreover, competition for certain types of acquisitions is significant, particularly in the fields of broadcast stations and interactive media. Even if successfully negotiated, closed, and integrated, certain acquisitions may not advance our business strategy and may fall short of expected return on investment targets.

Impairment of goodwill and intangible assets is possible, depending upon future operating results and the value of the Company's stock. We test our goodwill and intangible assets, including FCC licenses, for impairment during the fourth quarter of every fiscal year and on an interim basis if indicators of impairment exist. Factors which influence the evaluation include the Company's stock price and expected future operating results. If the carrying value of a reporting unit or an intangible asset is no longer deemed to be recoverable, a potentially material impairment charge could be incurred. Although these charges would be non-cash in nature and would not affect the Company's operations or cash flow, they would adversely affect stockholders' equity and reported results of operations in the period charged.

We have two classes of stock with different voting rights. We have two classes of stock: common stock and Class B stock. Holders of common stock are entitled to one vote per share and account for approximately 30 percent of the voting power. Holders of Class B stock are entitled to ten votes per share and account for the remaining 70 percent of the voting power. There are restrictions on who can own Class B stock. The majority of Class B shares are held by members of Meredith's founding family. Control by a limited number of holders may make the Company a less attractive takeover target, which could adversely affect the market price of our common stock. This

voting control also prevents other shareholders from exercising significant influence over certain of the Company's business decisions.

The preceding risk factors should not be construed as a complete list of factors that may affect our future operations and financial results. | ||

12

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Meredith is headquartered in Des Moines, IA. The Company owns buildings at 1716 and 1615 Locust Street and is the sole occupant of these buildings. The Company believes these facilities are adequate for their intended use.

The national media segment operates mainly from the Des Moines offices and from a leased facility in New York, NY. The New York facility is used primarily as advertising sales offices for all Meredith magazines and as headquarters for Family Circle, Ladies' Home Journal, Parents, FamilyFun, American Baby, EveryDay with Rachael Ray, Fitness, More, and Siempre Mujer properties. Allrecipes.com operates out of leased space in Seattle, WA. We have also entered into leases for magazine editorial offices, customer relationship marketing operations, and national media sales offices in the states of California, Illinois, Massachusetts, Michigan, Texas, Vermont, and Virginia. The Company believes these facilities are sufficient to meet our current and expected future requirements.

The local media segment operates from facilities in the following locations: Atlanta, GA; Phoenix, AZ; Beaverton, OR; Rocky Hill, CT; Nashville, TN; Fairway, KS; Greenville, SC; Henderson, NV; Springfield, MA; Saginaw, MI; and New York, NY. The Company believes these properties are adequate for their intended use. The properties in Springfield and New York are leased, while the other properties are owned by the Company. Each of the broadcast stations also maintains one or more owned or leased transmitter sites.

ITEM 3. LEGAL PROCEEDINGS

There are various legal proceedings pending against the Company arising from the ordinary course of business. In the opinion of management, liabilities, if any, arising from existing litigation and claims will not have a material effect on the Company's earnings, financial position, or liquidity.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

13

| PART II | ||

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

MARKET INFORMATION, DIVIDENDS, AND HOLDERS

The principal market for trading Meredith's common stock is the New York Stock Exchange (trading symbol MDP). There is no separate public trading market for Meredith's Class B stock, which is convertible share for share at any time into common stock. Holders of both classes of stock receive equal dividends per share.

The range of trading prices for the Company's common stock and the dividends per share paid during each quarter of the past two fiscal years are presented below.

| High | Low | Dividends | |||||||||

| Fiscal 2013 | |||||||||||

| First Quarter | $ | 37.84 | $ | 30.00 | $ | 0.3825 | |||||

| Second Quarter | 35.79 | 29.27 | 0.3825 | ||||||||

| Third Quarter | 45.95 | 33.52 | 0.4075 | ||||||||

| Fourth Quarter | 48.37 | 36.06 | 0.4075 | ||||||||

| High | Low | Dividends | |||||||||

| Fiscal 2012 | |||||||||||

| First Quarter | $ | 32.10 | $ | 21.16 | $ | 0.2550 | |||||

| Second Quarter | 33.14 | 21.10 | 0.3825 | ||||||||

| Third Quarter | 35.00 | 30.52 | 0.3825 | ||||||||

| Fourth Quarter | 32.98 | 26.89 | 0.3825 | ||||||||

Meredith stock became publicly traded in 1946, and quarterly dividends have been paid continuously since 1947. Meredith has increased our dividend in each of the last 20 years. It is currently anticipated that comparable dividends will continue to be paid in the future.

On July 31, 2013, there were approximately 1,210 holders of record of the Company's common stock and 645 holders of record of Class B stock.

14

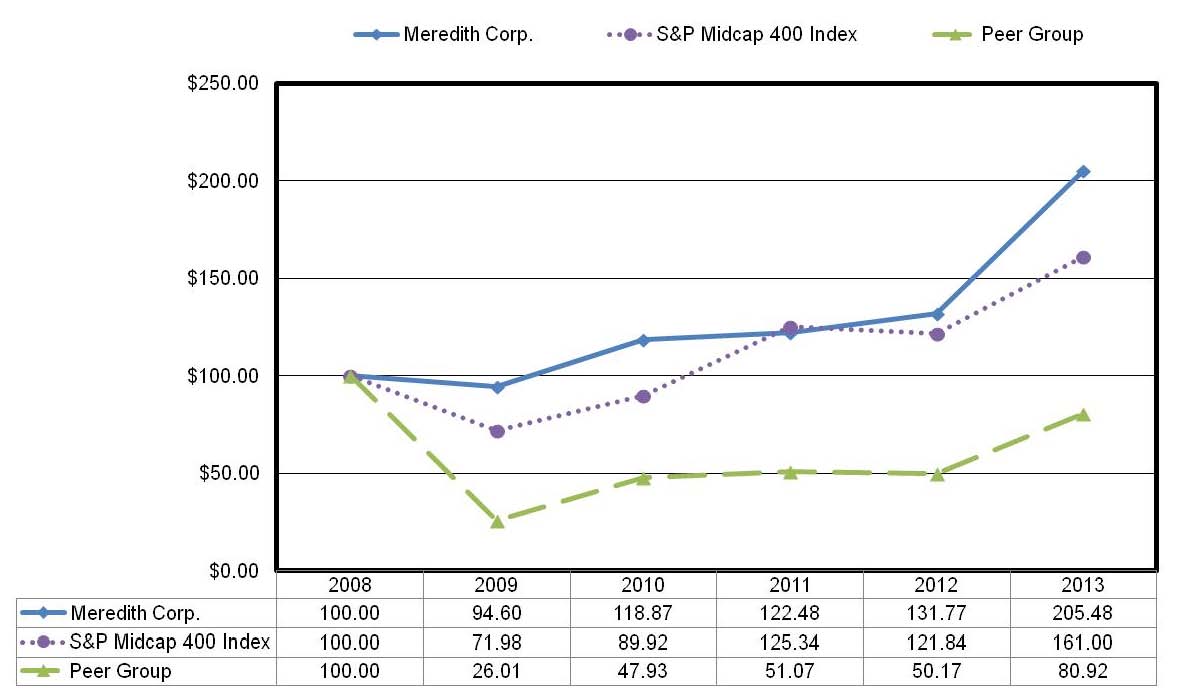

COMPARISON OF SHAREHOLDER RETURN

The following graph compares the performance of the Company's common stock during the period July 1, 2008, to June 30, 2013, with the Standard and Poor's (S&P) MidCap 400 Index and with a peer group of companies engaged in multimedia businesses primarily with publishing and/or television broadcasting in common with the Company.

The S&P MidCap 400 Index is comprised of 400 mid-sized U.S. companies with a market cap in the range of $1.0 billion to $4.4 billion in the financial, information technology, industrial, and consumer discretionary industries covering approximately 7 percent of the U.S. equities market and is weighted by market capitalization. The Peer Group selected by the Company for comparison, which is also weighted by market capitalization, is comprised of Belo Corp.; Gannett Co., Inc.; Martha Stewart Living Omnimedia, Inc.; Media General, Inc.; The E.W. Scripps Company; and The Washington Post Company.

The graph depicts the results for investing $100 in the Company's common stock, the S&P MidCap 400 Index and the Peer Group at closing prices on June 30, 2008, assuming dividends were reinvested.

15

ISSUER PURCHASES OF EQUITY SECURITIES

The following table sets forth information with respect to the Company's repurchases of common stock during the quarter ended June 30, 2013.

| Period | (a) Total number of shares purchased 1 | (b) Average price paid per share | (c) Total number of shares purchased as part of publicly announced programs | (d) Approximate dollar value of shares that may yet be purchased under the programs | |||||||||||

| (in thousands) | |||||||||||||||

April 1 to April 30, 2013 | 245 | $ | 38.84 | 245 | $ | 47,219 | |||||||||

May 1 to May 31, 2013 | 297,602 | 42.42 | 297,602 | 34,595 | |||||||||||

June 1 to June 30, 2013 | 47,755 | 45.91 | 47,755 | 32,403 | |||||||||||

| Total | 345,602 | 42.90 | 345,602 | ||||||||||||

1 | The number of shares purchased includes 245 shares in April 2013, 281,702 shares in May 2013, and 47,755 shares in June 2013, delivered or deemed to be delivered to us on tender of stock in payment for the exercise price of options and shares reacquired pursuant to tax withholding on option exercises and the vesting of restricted shares. These shares are included as part of our repurchase program and reduce the repurchase authority granted by our Board. The number of shares repurchased excludes shares we reacquired pursuant to forfeitures of restricted stock. |

In October 2011, the Board of Directors authorized the repurchase of up to $100.0 million in additional shares of the Company's stock through public and private transactions.

For more information on the Company's share repurchase program, see Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations, under the heading "Share Repurchase Program" on page 33.

ITEM 6. SELECTED FINANCIAL DATA

Selected financial data for the fiscal years 2009 through 2013 is contained under the heading "Five-Year Financial History with Selected Financial Data" beginning on page 78 and is derived from consolidated financial statements for those years. Information contained in that table is not necessarily indicative of results of operations in future years and should be read in conjunction with Item 7-Management's Discussion and Analysis of Financial Condition and Results of Operations and Item 8-Financial Statements and Supplementary Data of this Form 10-K.

16

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) consists of the following sections:

MD&A should be read in conjunction with the other sections of this Form 10-K, including Item 1-Business, Item 6-Selected Financial Data, and Item 8-Financial Statements and Supplementary Data. MD&A contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and could be affected by many risks, uncertainties, and changes in circumstances including the uncertainties and risk factors described throughout this filing, particularly in Item 1A-Risk Factors. Important factors that could cause actual results to differ materially from those described in forward-looking statements are set forth under the heading “Forward Looking Statements." in Item 1-Business.

EXECUTIVE OVERVIEW

Meredith Corporation is the leading media and marketing company serving American women. Meredith features multiple well-known national brands—including Better Homes and Gardens, Parents, Family Circle, Allrecipes.com, Ladies' Home Journal, Fitness, More, American Baby, EveryDay with Rachael Ray, and FamilyFun—with local television brands in fast growing markets such as Atlanta, Phoenix, and Portland. Meredith is the industry leader in creating content in key consumer interest areas such as home, family, food, health and wellness, and self-development. Meredith uses multiple distribution platforms—including print, television, digital, mobile, tablets, and video—to give consumers content they desire and to deliver the messages of our advertising and marketing partners. Additionally, Meredith uses our many assets to create powerful custom marketing solutions for many of the nation's top brands and companies.

Meredith operates two business segments. The national media segment consists of magazine publishing, digital and mobile media, digital and customer relationship marketing, brand licensing, database-related activities, and other related operations. The local media segment consists of 12 network-affiliated television stations, related digital and mobile media, and video creation operations. Both segments operate primarily in the U.S. and compete against similar media and other types of media on both a local and national basis. In fiscal 2013, the national media segment accounted for 74 percent of the Company's $1.5 billion in revenues while local media segment revenues contributed 26 percent.

The Company continues to take aggressive steps to grow our leading position serving American women and to deliver revenue, profit, and free cash flow growth, and increase shareholder value over time. Strategic actions during fiscal 2013 included:

| • | Increasing its powerful consumer connection—Consumer engagement strengthened across Meredith's media platforms as the Company executed initiatives to refresh and enhance its popular national and local brands. Meredith's monthly magazine audience is an impressive 115 million, while its television stations |

17

continue to deliver strong ratings performances. The Company's digital audience grew to 53 million unique visitors per month.

| • | Strengthening its core magazine and television brands—Advertising rates grew in both businesses as Meredith executed a series of innovative sales programs, including the Meredith Sales Guarantee, which demonstrates quantitatively that advertising in Meredith magazines increases retail sales for clients. The Company also completed a number of initiatives to increase efficiencies, reduce costs, and improve operating profit margins. |

| • | Growing revenues from non-advertising-related activities—Meredith's Brand Licensing activities delivered stronger performance, driven by an expansion of the Better Homes and Gardens line of branded products at Walmart stores across the U.S., and growth in the Better Homes and Gardens real estate network with Realogy. All of MXM's major clients renewed for calendar 2013, and the new business pipeline is very robust. Additionally, retransmission revenues grew as Meredith renewed agreements with cable and satellite providers. |

| • | Making strategic investments to scale the business—Meredith positioned itself for continued growth with the acquisition of the Parenting and BabyTalk brands, and the launch of a magazine based on the Allrecipes digital brand that will debut with the December 2013 issue. |

| • | Expanding digital, mobile, video and social platforms—Meredith continued its rapid expansion across emerging platforms. Highlights included website relaunches; tablet edition expansions; development of new mobile apps; increased video creation; and growth across social media platforms such as Facebook and Pinterest. Meredith also agreed to expand the reach of its daily syndicated The Better Show through cable distribution on the Hallmark Channel. |

| • | Executing its successful Total Shareholder Return strategy—Meredith's stock price increased 49 percent in fiscal 2013, and its dividend yielded approximately 4 percent. Key elements of the strategy are (1) an annual dividend of $1.63 per share; (2) a $100 million share repurchase program; and (3) ongoing investments to scale the business and increase shareholder value over time. |

Meredith has a strong commitment to our shareholders, and a history of returning a meaningful portion of our cash flow from operating activities to our investors in the form of dividends and share repurchases. Going forward, Meredith is focused on four key strategic initiatives designed to accelerate revenue growth and increase operating profit margins and cash flow over time. These include:

•Growing the connection between Meredith's brands and consumers,

•Aggressive expansion of the Company's digital activities,

•Strengthening Meredith's core magazine and television businesses, and

•Extending Meredith's key brands and editorial capabilities to new products and services.

NATIONAL MEDIA

Advertising revenues made up 47 percent of fiscal 2013 national media revenues. These revenues were generated from the sale of advertising space in our magazines and on our websites to clients interested in promoting their brands, products, and services to consumers. Changes in advertising revenues tend to correlate with changes in the level of economic activity in the U.S. Indicators of economic activity include changes in the level of gross domestic product, consumer spending, housing starts, unemployment rates, auto sales, and interest rates. Circulation levels of Meredith's magazines, reader demographic data, and the advertising rates charged relative to other comparable available advertising opportunities also affect the level of advertising revenues.

18

Circulation revenues accounted for 29 percent of fiscal 2013 national media revenues. Circulation revenues result from the sale of magazines to consumers through subscriptions and by single copy sales on newsstands in print form, primarily at major retailers and grocery/drug stores, and in digital form on tablets and other media devices. In the short term, subscription revenues, which accounted for 81 percent of circulation revenues, are less susceptible to economic changes because subscriptions are generally sold for terms of one to three years. The same economic factors that affect advertising revenues also can influence consumers' response to subscription offers and result in lower revenues and/or higher costs to maintain subscriber levels over time. A key factor in our subscription success is our industry-leading database. It contains approximately 100 million entries that include information on about three-quarters of American homeowners, providing an average of 800 data points for each name. The size and depth of our database is a key to our circulation model and allows more precise consumer targeting. Newsstand revenues are more volatile than subscription revenues and can vary significantly month to month depending on economic and other factors.

The remaining 24 percent of national media revenues came from a variety of activities that included the sale of customer relationship marketing products and services and books as well as brand licensing, product sales, and other related activities. MXM offers integrated promotional, database management, relationship, and direct marketing capabilities for corporate customers, both in printed and digital forms. These other revenues are generally affected by changes in the level of economic activity in the U.S. including changes in the level of gross domestic product, consumer spending, unemployment rates, and interest rates.

National media's major expense categories are production and delivery of publications and promotional mailings and employee compensation costs. Paper, postage, and production charges represented 32 percent of the segment's operating expenses in fiscal 2013. The price of paper can vary significantly on the basis of worldwide demand and supply for paper in general and for specific types of paper used by Meredith. The printing of our publications is outsourced. We typically have multi-year contracts for the printing of our magazines, a practice which reduces price fluctuations over the contract term. Postal rates are dependent on the operating efficiency of the USPS and on legislative mandates imposed on the USPS. The USPS increased rates most recently in January 2013. At this time, the USPS has not proposed any future rate increases. Meredith works with others in the industry and through trade organizations to encourage the USPS to implement efficiencies and contain rate increases.

Employee compensation, which includes benefits expense, represented 27 percent of national media's operating expenses in fiscal 2013. Compensation expense is affected by salary and incentive levels, the number of employees, the costs of our various employee benefit plans, and other factors. The remaining 41 percent of fiscal 2013 national media expenses included costs for magazine newsstand and book distribution, advertising and promotional efforts, and overhead costs for facilities and technology services.

LOCAL MEDIA

Local media derives the majority of its revenues—82 percent in fiscal 2013—from the sale of advertising both over the air and on our stations' websites and apps. The remainder comes from television retransmission fees, station operation management fees, television production services, and other services.

The stations sell advertising to both local/regional and national accounts. Political advertising revenues are cyclical in that they are significantly greater during biennial election campaigns (which take place primarily in odd-numbered fiscal years) than at other times. MVS produces video content for Meredith stations, non-Meredith stations, online distribution, and corporate customers. We have generated additional revenues from Internet activities and programs focused on local interests such as community events and college and professional sports.

Changes in advertising revenues tend to correlate with changes in the level of economic activity in the U.S. and in the local markets in which we operate stations, and with the cyclical changes in political advertising discussed previously. Programming content, audience share, audience demographics, and the advertising rates charged

19

relative to other available advertising opportunities also affect advertising revenues. On occasion, unusual events necessitate uninterrupted television coverage and will adversely affect spot advertising revenues.

Local media's major expense categories are employee compensation and programming fees paid to the networks. Employee compensation represented 48 percent of local media's operating expenses in fiscal 2013, and is affected by the same factors noted for national media. Programming fees paid to the networks represented 12 percent of this segment's fiscal 2013 expenses. Sales and promotional activities, costs to produce local news programming, and general overhead costs for facilities and technical resources accounted for most of the remaining 40 percent of local media's fiscal 2013 operating expenses.

FISCAL 2013 FINANCIAL OVERVIEW

| • | Local media revenues increased 19 percent and operating profit rose to $124.1 million from $88.3 million in the prior year reflecting increased cyclical political advertising revenues and higher other revenues. |

| • | National media revenues rose 3 percent and operating profit increased 4 percent primarily reflecting the results of the prior fiscal year acquisitions of EveryDay with Rachael Ray, FamilyFun, and Allrecipes.com and improved results in our licensing operations, which more than offset declines in our core magazine and customer relationship marketing operations. |

| • | Results included a pre-tax charge of $5.1 million for professional fees and expenses related to a strategic transaction that did not materialize. |

| • | Management committed to a performance improvement plan related primarily to business realignments that included selected workforce reductions. In connection with this plan, the Company recorded a pre-tax restructuring charge of $7.8 million. This charge includes $7.4 million for severance and benefit costs and a vacated lease accrual of $0.4 million. The Company also recorded $0.8 million in reversals of excess restructuring reserves accrued in prior years. |

| • | Diluted earnings per share increased 19 percent to $2.74 from $2.31 in fiscal 2012. |

| • | In fiscal 2013, we generated $189.1 million in operating cash flows, invested $50.2 million in acquisitions of and investments in businesses, and invested $26.0 million in capital improvements. |

RESULTS OF OPERATIONS

| Years ended June 30, | 2013 | Change | 2012 | Change | 2011 | ||||||||||||

| (In millions except per share data) | |||||||||||||||||

| Total revenues | $ | 1,471.3 | 7 | % | $ | 1,376.7 | (2 | )% | $ | 1,400.5 | |||||||

| Costs and expenses | 1,215.1 | 6 | % | 1,146.6 | 1 | % | 1,135.7 | ||||||||||

| Depreciation and amortization | 45.4 | 2 | % | 44.3 | 12 | % | 39.5 | ||||||||||

| Total operating expenses | 1,260.5 | 6 | % | 1,190.9 | 1 | % | 1,175.2 | ||||||||||

| Income from operations | $ | 210.8 | 13 | % | $ | 185.8 | (18 | )% | $ | 225.3 | |||||||

| Earnings from continuing operations | $ | 123.7 | 18 | % | $ | 104.4 | (21 | )% | $ | 131.6 | |||||||

| Net earnings | 123.7 | 18 | % | 104.4 | (18 | )% | 127.4 | ||||||||||

| Diluted earnings per share | |||||||||||||||||

| from continuing operations | 2.74 | 19 | % | 2.31 | (20 | )% | 2.87 | ||||||||||

| Diluted earnings per share | 2.74 | 19 | % | 2.31 | (17 | )% | 2.78 | ||||||||||

20

OVERVIEW

Following are brief descriptions of current and prior year acquisitions and of discontinued operations, and a discussion of our rationale for the use of financial measures that are not in accordance with accounting principles generally accepted in the United States of America (GAAP), or non-GAAP financial measures, and a discussion of the trends and uncertainties that affected our businesses. Following the Overview is an analysis of the results of operations for the national media and local media segments and an analysis of our consolidated results of operations for the last three fiscal years.

Acquisitions

In fiscal 2013, the Company acquired Parenting and Babytalk magazines and related digital assets and the remaining interest in Living the Country Life, LLC. These acquisitions were not material to the Company's consolidated financial statements. Effective July 1, 2011, Meredith acquired EatingWell Media Group. Also during fiscal 2012, Meredith completed the following acquisitions: the October 2011 acquisition of EveryDay with Rachael Ray magazine and its related digital assets, the January 2012 acquisition of FamilyFun and its related assets, the March 2012 acquisition of Allrecipes.com, and the May 2012 acquisition of ShopNation. The results of these acquisitions have been included in the Company's consolidated operating results since their respective acquisition dates. See Note 2 to the consolidated financial statements for further information.

Use of Comparable Results

Collectively, all fiscal 2012 acquisitions, including EatingWell Media Group, are referred to as the "Fiscal 2012 Acquisitions." The fiscal 2012 acquisitions acquired at any time other than at the start of the fiscal year (i.e., excluding EatingWell Media Group) are collectively referred to as the "Fiscal 2012 Mid-Year Acquisitions." In MD&A disclosures, references to comparable results for fiscal 2013 as compared to fiscal 2012 exclude the impact of the Fiscal 2012 Mid-Year Acquisitions in both periods and references to comparable results for fiscal 2012 as compared to fiscal 2011 exclude the impact of the Fiscal 2012 Acquisitions.

Discontinued Operations

Unless stated otherwise, as in the section titled Discontinued Operations, all of the information contained in MD&A relates to continuing operations. Therefore, results of ReadyMade magazine, which was closed in fiscal 2011, are excluded for all periods covered by this report.

Use of Non-GAAP Financial Measures

Our analysis of local media results includes references to earnings from continuing operations before interest, taxes, depreciation, and amortization (EBITDA). EBITDA and EBITDA margin are non-GAAP measures. We use EBITDA along with operating profit and other GAAP measures to evaluate the financial performance of our local media segment. EBITDA is a common alternative measure of performance in the broadcasting industry and is used by investors and financial analysts, but its calculation may vary among companies. Local media segment EBITDA is not used as a measure of liquidity, nor is it necessarily indicative of funds available for our discretionary use.

We believe the non-GAAP measures used in MD&A contribute to an understanding of our financial performance and provide an additional analytic tool to understand our results from core operations and to reveal underlying trends. These measures should not, however, be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

Trends and Uncertainties

Advertising demand is the Company's key uncertainty, and its fluctuation from period to period can have a material effect on operating results. Advertising revenues accounted for 56 percent of total revenues in fiscal 2013. Other

21