UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO

Commission File No. 1-15579

MSA SAFETY INCORPORATED

(Exact name of registrant as specified in its charter)

|

| | | |

| Pennsylvania | | 46-4914539 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| | | |

| 1000 Cranberry Woods Drive | | |

| Cranberry Township, | Pennsylvania | | 16066-5207 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (724) 776-8600

|

| | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Common Stock, no par value | MSA | New York Stock Exchange |

| (Title of each class) | (Trading symbol(s)) | (Name of each exchange on which registered) |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | |

| Large Accelerated Filer | x | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ý

The aggregate market value of voting stock held by non-affiliates as of June 30, 2019 was approximately $3.7 billion. As of February 17, 2020, there were outstanding 38,858,321 shares of common stock, no par value.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the May 12, 2020 Annual Meeting of Shareholders are incorporated by reference into Part III.

Table of Contents

|

| | |

| Item No. | | Page |

| Part I | | |

| 1. | | |

| 1A. | | |

| 1B. | | |

| 2. | | |

| 3. | | |

| 4. | | |

| | | |

| Part II | | |

| 5. | | |

| 6. | | |

| 7. | | |

| 7A. | | |

| 8. | | |

| 9. | | |

| 9A. | | |

| 9B. | | |

| Part III | | |

| 10. | | |

| 11. | | |

| 12. | | |

| 13. | | |

| 14. | | |

| Part IV | | |

| 15. | | |

| 16. | | |

| | | |

Forward-Looking Statements

This report may contain (and verbal statements made by MSA® Safety Incorporated (MSA) may contain) forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks and other factors include, but are not limited to, those listed in this report under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this report. In some cases, you can identify forward-looking statements by words such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or other comparable words. Actual results, performance or outcomes may differ materially from those expressed or implied by these forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We are under no duty to update publicly any of the forward-looking statements after the date of this report, whether as a result of new information, future events or otherwise.

PART I

Item 1. Business

Overview—Established in 1914, MSA Safety Incorporated is the global leader in the development, manufacture and supply of safety products that protect people and facility infrastructures. Recognized for their market leading innovation, many MSA products integrate a combination of electronics, mechanical systems and advanced materials to protect users against hazardous or life-threatening situations. The Company's comprehensive product line, which is governed by rigorous safety standards across highly regulated industries, is used by workers around the world in a broad range of markets, including the oil, gas and petrochemical industry, fire service, construction, industrial manufacturing applications, utilities, mining and the military. The Company's core products include breathing apparatus where self-contained breathing apparatus ("SCBA") is the principal product, fixed gas and flame detection systems, portable gas detection instruments, industrial head protection products, firefighter helmets and protective apparel and fall protection devices.

The Company’s leading market positions across nearly all of its core products are supported and enabled by a strong commitment to investing in new product development that continually raises the bar for safety equipment performance, all while upholding an unwavering commitment to integrity. We dedicate significant resources to research and development, which allows us to produce innovative safety products that are often first to market. Our global product development teams include cross-functional associates throughout the Company, including research and development, marketing, sales, operations and quality management. Our engineers and technical associates work closely with the safety industry’s leading standards-setting groups and trade associations to develop industry specific product standards and to anticipate their impact on our product lines.

Segments—We tailor our product offerings and distribution strategy to satisfy distinct customer preferences that vary across geographic regions. To best serve these customer preferences, we have organized our business into six geographic operating segments that are aggregated into three reportable geographic segments: Americas, International and Corporate. Segment information is presented in Note 7 of the consolidated financial statements in Part II Item 8 of this Form 10-K.

Because our financial statements are stated in U.S. dollars and much of our business is conducted outside the U.S., currency fluctuations may affect our results of operations and financial position and may affect the comparability of our results between financial periods.

Products—We manufacture and sell a comprehensive line of safety products to protect the health and safety of workers and facility infrastructures around the world in the oil, gas and petrochemical industry, fire service, construction, industrial manufacturing applications, utilities, mining and the military. Our products protect people against a wide variety of hazardous or life-threatening situations.

The following is a brief description of each of our product categories:

Core products. MSA's corporate strategy includes a focus on driving sales of core products, where we have leading market positions and a distinct competitive advantage. Core products, as mentioned above, include breathing apparatus where SCBA is the principal product, fixed gas and flame detection systems, portable gas detection instruments, industrial head protection products, firefighter helmets and protective apparel and fall protection devices. Core products comprised approximately 88% and 87% of sales in 2019 and 2018, respectively.

The following is a brief description of our core product offerings:

Breathing apparatus products. Breathing apparatus products include SCBA, face masks and respirators. SCBA is the primary product offering. SCBA are used by first responders, petrochemical plant workers and anyone entering an environment deemed immediately dangerous to life and health. Our primary breathing apparatus product in the Americas segment, the MSA G1 SCBA, is a revolutionary platform that offers many customizable and differentiated features, including the first and only Integrated Thermal Imaging Camera available on the market. We currently have 12 patents issued and an additional 2 patents pending for the MSA G1 SCBA. Our newest breathing apparatus product, the MSA M1 SCBA, represents the most advanced and ergonomic SCBA we have ever launched for our International markets. We sell breathing apparatus across both the Americas and International segments.

Fixed gas and flame detection instruments ("FGFD"). Our permanently installed fixed gas and flame detection instruments are used in oil, gas and petrochemical applications, wastewater, HVAC and general industrial production facilities to detect the presence or absence of various gases in the air. Typical applications of these instruments include the detection of an oxygen deficiency in confined spaces or the presence of combustible or toxic gases. FGFD product lines generate a meaningful portion of overall revenue from recurring business including replacement components and related service. We sell these instruments in both our Americas and International segments. Key products include:

| |

| • | Permanently installed gas detection monitoring systems. This product line is used to monitor for combustible and toxic gases and oxygen deficiency in virtually any application where continuous monitoring is required. Our systems are used for gas detection in the oil and gas industry, petrochemical, pulp and paper, wastewater, refrigerant monitoring, pharmaceutical production and general industrial applications. These systems utilize a wide array of sensor technologies including electrochemical, catalytic, infrared and ultrasonic. During 2017, we launched a new line of advanced gas detection monitors. The Ultima®X5000 and S5000 gas monitors enhance facility and worker safety while lowering overall cost of ownership for our customers through differentiated sensor technology. |

| |

| • | Flame detectors and open-path infrared gas detectors. These instruments are used for plant-wide monitoring of toxic gases and for detecting the presence of flames. These systems use infrared optics to detect potentially hazardous conditions across long distances, making them suitable for use in such applications as offshore oil rigs, storage vessels, refineries, pipelines and ventilation ducts. |

Portable gas detection instruments. Our hand-held portable gas detection instruments are used to detect the presence or absence of various gases in the air. The product is used by oil, gas and petrochemical workers, general industrial workers, miners, utility workers, first responders or anyone working in a confined space environment. Typical applications of these instruments include the detection of an oxygen deficiency in confined spaces or the presence of combustible or toxic gases. Our single- and multi-gas detectors provide portable solutions for detecting the presence of oxygen, combustible gases and various toxic gases, including hydrogen sulfide, carbon monoxide, ammonia and chlorine, either singularly or up to six gases at once. Our ALTAIR® 2X, ALTAIR 4XR and ALTAIR 5X Multigas Detectors, with our internally developed XCell® sensor technology, provide faster response times and unsurpassed durability. We sell portable gas detection instruments in both our Americas and International segments.

The acquisition of Sierra Monitor Corporation ("SMC"), a leading provider of fixed gas and flame detection instruments and Industrial Internet of Things solutions that connect and help protect high-value infrastructure assets, enables MSA to accelerate its strategy to enhance worker safety and accountability through the use of cloud technology and wireless connectivity. This acquisition enhances a key focus of the Company's Safety io® subsidiary, launched in 2018 primarily to leverage the capabilities of its portable gas detection portfolio as it relates to cloud connectivity. Our Safety io Grid product offers fleet management and live monitoring capabilities that interface with MSA's portable gas detection instruments.

Industrial head protection. We offer a complete line of industrial head protection and accessories that includes the iconic V-Gard® helmet brand, a bellwether product in MSA's portfolio for over 50 years. We offer customers a wide range of color choices and we are a world leader in the application of customized logos. Our industrial head protection products have a wide user base, including oil, gas and petrochemical workers, steel and construction workers, miners and industrial workers. Our Fas-Trac® III Suspension system was designed to provide enhanced comfort without sacrificing safety. Our strongest sales of head protection products have historically been in the Americas segment.

Firefighter helmets and protective apparel. We offer a complete line of fire helmets that includes our Cairns® and Gallet® helmet brands. Our Cairns helmets are primarily used by firefighters in North America while the Gallet helmets are primarily used by firefighters across our International segment. The acquisition of Globe® Holding Company, LLC ("Globe"), a leading innovator and provider of firefighter protective clothing and boots, strengthened our position as a leader in the North American market for firefighter personal protective equipment (PPE). MSA's firefighter safety PPE offering protects firefighters from head to toe, with Cairns Helmets, our industry leading G1 SCBA, and Globe turnout gear and boots.

Fall protection. Our broad line of fall protection equipment includes harnesses, lanyards, self-retracting lifelines, engineered systems and confined space equipment. Fall protection equipment is used by workers in the construction industry, oil, gas and petrochemical market, utilities industry, aerospace industry, general industrial applications and anyone working at height. MSA’s new V-Series fall protection equipment has transformed the Company’s harness and self-retracting lanyard portfolio, with approximately 50 new fall protection products launched over the past several years. The V-Series brand of fall protection equipment is inspired by MSA's iconic V-Gard hard hat, which is used by millions of workers around the world.

Non-core products. MSA maintains a portfolio of non-core products. Non-core products reinforce and extend the core offerings, drawing upon our customer relationships, distribution channels, geographical presence and technical experience. These products are complementary to the core offerings and have their roots within the core product value chain. Key non-core products include respirators, eye and face protection, ballistic helmets and gas masks. Ballistic helmet and gas mask sales are the primary sales to our military customers and were approximately $41 million globally in 2019 compared to $47 million in 2018.

Customers—Our customers generally fall into two categories: distributors and end-users. In our Americas segment, the majority of our sales are made through distribution. In our International segment, sales are made through both indirect and direct sales channels. For the year ended December 31, 2019, no individual customer represented more than 10% of our sales.

Sales and Distribution—Our sales and distribution team consists of marketing, field sales and customer service organizations. In most geographic areas, our field sales organizations work jointly with select distributors to call on end-users and educate them about hazards, exposure limits, safety requirements and product applications, as well as the specific performance attributes of our products. We believe that understanding end-user requirements is critical to increasing MSA's market share.

The in-depth customer training and education provided by our sales associates to our customers is critical to ensuring proper use of many of our products, such as SCBA and gas detection instruments. As a result of our sales associates working closely with end-users, they gain valuable insight into customer preferences and needs. To better serve our customers and to ensure that our sales associates are among the most knowledgeable and professional in the industry, we place significant emphasis on training our sales associates in product application, industry standards and regulations.

We believe our sales and distribution strategy allows us to deliver a customer value proposition that differentiates our products and services from those of our competitors, resulting in increased customer loyalty and demand.

In areas where we use indirect selling, we promote, distribute and service our products to general industry through authorized national, regional and local distributors. Some of our key distributors include W.W. Grainger Inc., Airgas, Casco Industries, Witmer Public Safety Group, Vallen Distribution, Ten-8 Fire Equipment, Essendant and Fastenal. We distribute fire service products primarily through specially trained local and regional distributors who provide advanced training and service capabilities to volunteer and paid municipal fire departments. Because of our broad and diverse product line and our desire to reach as many markets and market segments as possible, we have over 3,100 authorized distributor locations worldwide.

Competition—The global safety products market is broad and highly fragmented with few participants offering a comprehensive line of safety products. The sophisticated safety products market in which we compete is comprised of both core and non-core offerings and is a subset of the larger safety market. We maintain leading positions in nearly all of our core products. Over the long-term, we believe global demand for safety products will continue to grow. Purchases of these products are non-discretionary, protecting workers' health in hazardous and life-threatening work environments. Their use is often mandated by government and industry regulations, which are increasingly enforced on a global basis.

The safety products market is highly competitive, with participants ranging in size from small companies focusing on a single type of PPE to several large multinational corporations that manufacture and supply many types of sophisticated safety products. Our main competitors vary by region and product. We believe that participants in this industry compete primarily on the basis of product characteristics (such as functional performance, technology, cost of ownership, comfort, design and style), brand name recognition and after-market service support.

We believe we compete favorably within each of our operating segments as a result of our high quality, innovative offerings and strong brand trust and recognition.

Research and Development—To achieve and maintain our market leading positions, we operate several sophisticated research and development facilities. We believe our dedication and commitment to innovation and research and development allows us to produce state-of-the-art safety products that are often first to market and exceed industry standards. Our primary engineering groups are located in the United States, Germany and China. Our global product development teams include cross-geographic and cross-functional members from various areas throughout the Company, including research and development, marketing, sales, operations and quality management. These teams are responsible for setting product line strategies based on their understanding of customers' needs and available technology, as well as the opportunities and challenges they foresee in each product area. We believe our team-based, cross-geographical and cross-functional approach to new product development is a source of competitive advantage. Our approach to the new product development process allows us to tailor our product offerings and product line strategies to satisfy distinct customer preferences and industry regulations that vary across our operating segments.

We believe another important aspect of our approach to new product development is that our engineers and technical associates work closely with the safety industry’s leading standards-setting groups and trade associations. These organizations include the National Institute for Occupational Safety and Health ("NIOSH"), the National Fire Protection Association ("NFPA"), American National Standards Institute ("ANSI"), International Safety Equipment Association ("ISEA") and their overseas counterparts. Key members of our management team understand the impact that these standard-setting organizations have on our new product development pipeline. As such, management devotes significant time and attention to anticipating a new standard’s impact on our sales and operating results. Because of our understanding of customer needs, membership on global standards-setting bodies, investment in research and development and our unique new product development process, we believe we are well positioned to anticipate and adapt to changing product standards. While the length of the approval process can be unpredictable, we believe that we are well positioned to gain the approvals and certifications necessary to meet new government and multinational product regulations.

Patents and Intellectual Property—We own significant intellectual property, including a number of domestic and foreign patents, patent applications and trademarks related to our products, processes and business. Although our intellectual property plays an important role in maintaining our competitive position in a number of markets that we serve, no single patent, or patent application, trademark or license is, in our opinion, of such value to us that our business would be materially affected by the expiration or termination thereof, other than the “MSA” trademark. Our patents expire at various times in the future not exceeding 20 years. Our general policy is to apply for patents on an ongoing basis in the United States and other countries, as appropriate, to perfect our patent development. In addition to our patents, we have also developed or acquired a substantial body of manufacturing know-how that we believe provides a significant competitive advantage over our competitors.

Raw Materials and Suppliers—Many of the components of our products are formulated, machined, tooled or molded in-house from raw materials, which comprise approximately two-thirds of our cost of sales. For example, we rely on integrated manufacturing capabilities for breathing apparatus, gas masks, ballistic helmets, hard hats and circuit boards. The primary raw materials that we source from third parties include electronic components, rubber, high density polyethylene, chemical filter media, eye and face protective lenses, air cylinders, certain metals and ballistic resistant, flame resistant and non-ballistic fabrics. We purchase these materials both domestically and internationally, and we believe our supply sources are both well established and reliable. We have close vendor relationship programs with the majority of our key raw material suppliers. Although we generally do not have long-term supply contracts, thus far we have not experienced any significant problems in obtaining adequate raw materials. Please refer to MSA's Form SD filed on May 31, 2019 for further information on our conflict minerals analysis. Form SD may be obtained free of charge at www.sec.gov.

Associates—At December 31, 2019, we employed approximately 4,800 associates, of which approximately 1,900 were employed by our International segment. None of our U.S. associates are subject to the provisions of a collective bargaining agreement. Some of our associates outside the United States are members of unions. We have not experienced a significant work stoppage in over 10 years and believe our relations with our associates are strong.

Environmental Matters—Our facilities and operations are subject to laws and regulations relating to environmental protection and human health and safety. In the opinion of management, compliance with current environmental protection laws will not have a material adverse effect on our financial condition. See Item 1A, Risk Factors, for further information regarding our environmental risks which could impact the Company.

Seasonality—Our operating results are not significantly affected by seasonal factors. Sales are generally higher during the second and fourth quarters. During periods of economic expansion or contraction and following significant catastrophes, our sales by quarter have varied from this seasonal pattern. Government-related sales tend to increase in the fourth quarter. Americas sales tend to be strong during the oil and gas market turnaround seasons late in the first quarter, early in the second quarter and then again at the end of the third quarter and beginning of the fourth quarter. International segment sales are typically weaker for the Europe region in the summer holiday months of July and August and seasonality can be affected by the timing of delivery of larger orders. Invoicing and the delivery of larger orders can affect sales patterns variably across all reporting segments.

Available Information—Our Internet address is www.MSAsafety.com. We make the following filings available free of charge on the Investor Relations page on our website as soon as reasonably practicable after they have been electronically filed with or furnished to the Securities and Exchange Commission ("SEC"): our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as our proxy statement. Information contained on our website is not part of this annual report on Form 10-K or our other filings with the SEC. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers like us who file electronically with the SEC.

Item 1A. Risk Factors

Claims of injuries from our products, product defects or recalls of our products could have a material adverse effect on our business, operating results, financial condition and liquidity.

MSA and its subsidiaries face an inherent business risk of exposure to product liability claims arising from the alleged failure of our products to prevent the types of personal injury or death against which they are designed to protect. In the event the parties using our products are injured or any of our products prove to be defective, we could be subject to claims with respect to such injuries. In addition, we may be required to or may voluntarily recall or redesign certain products that could potentially be harmful to end users. Any claim or product recall that results in significant expense or negative publicity against us could have a material adverse effect on our business, operating results, financial condition and liquidity, including any successful claim brought against us in excess or outside of available insurance coverage.

Our subsidiary, Mine Safety Appliances Company, LLC, may experience losses from cumulative trauma product liability claims. The inability to collect insurance receivables and the transition to becoming largely self-insured for cumulative trauma product liability claims could have a material adverse effect on our business, operating results, financial condition and liquidity.

Our subsidiary, Mine Safety Appliances Company, LLC (“MSA LLC”) was named as a defendant in 1,605 cumulative trauma lawsuits comprised of 2,456 claims at December 31, 2019. Cumulative trauma product liability claims involve exposures to harmful substances (e.g., silica, asbestos and coal dust) that occurred years ago and may have developed over long periods of time into diseases such as silicosis, asbestosis, mesothelioma or coal worker’s pneumoconiosis. The products at issue were manufactured many years ago and are not currently offered by MSA LLC. A reserve has been established with respect to estimated amounts for cumulative trauma product liability claims currently asserted but not yet resolved and incurred but not reported (“IBNR”) cumulative trauma product liability claims. Because our cumulative trauma product liability risk is subject to inherent uncertainties, including unfavorable trial rulings or developments, an increase in newly filed claims, or more aggressive settlement demands, and since MSA LLC is largely self-insured, there can be no certainty that MSA LLC may not ultimately incur losses in excess of presently recorded liabilities. These losses could have a material adverse effect on our business, operating results, financial condition and liquidity.

We will adjust the reserve from time to time based on whether the actual numbers, types and settlement values of claims asserted differ from current projections and estimates or there are significant changes in the facts underlying the assumptions used in establishing the reserve. Each of these factors may increase or decrease significantly within an individual period depending on, among other things, the timing of claims filings or settlements, or litigation outcomes during a particular period that are especially favorable or unfavorable to MSA LLC. We accordingly consider MSA LLC’s claims experience over multiple periods and/or whether there are changes in MSA LLC’s claims experience and trends that are likely to continue for a significant time into the future in determining whether to make an adjustment to the reserve, rather than evaluating such factors solely in the short term. Any future adjustments to the reserve may be material and could materially impact future periods in which the reserve is adjusted.

In the normal course of business, MSA LLC makes payments to settle these types of cumulative trauma product liability claims and for related defense costs, and records receivables for the amounts believed to be recoverable under insurance. MSA LLC has recorded insurance receivables totaling $63.8 million and notes receivables of $56.0 million at December 31, 2019. Since MSA LLC is now largely self-insured for cumulative trauma claims, additional amounts recorded as insurance receivables will be limited and based on calculating the amounts to be reimbursed pursuant to negotiated Coverage-in-Place Agreements. Various factors could affect the timing and amount of recovery of the insurance receivables, including assumptions regarding claims composition (which are relevant to calculating reimbursement under the terms of certain Coverage-In-Place Agreements) and the extent to which the issuing insurers may become insolvent in the future.

Unfavorable economic and market conditions could materially and adversely affect our business, results of operations and financial condition.

We are subject to risks arising from adverse changes in global economic conditions. We have significant operations in a number of countries outside the U.S., including some in emerging markets. Long-term economic uncertainty in some of the regions of the world in which we operate, such as Asia, Latin America, the Middle East and Europe, could result in declines in revenue, profitability and cash flow due to reduced orders, payment delays, supply chain disruptions or other factors caused by the economic challenges faced by our customers and suppliers.

A portion of MSA's sales are made to customers in the oil, gas and petrochemical market. We estimate that between 25% - 30% of our global business is sold into the energy market vertical with the most significant exposure in industrial head protection, portable gas detection and FGFD. Approximately 10% - 15% of consolidated revenue, primarily in industrial head protection and portable gas detection, is more exposed to a pullback in employment trends across the energy market. Another 5% - 10% of consolidated revenue, primarily in FGFD is more exposed to a pullback in capital equipment spending within the energy market. It is possible that the volatility in the oil, gas and petrochemical industry could negatively impact our business and could result in declines in our consolidated results of operations and cash flow.

A reduction in the spending patterns of government agencies or delays in obtaining government approval for our products could materially and adversely affect our net sales, earnings and cash flow.

The demand for our products sold to the fire service market, the homeland security market and other government agencies is, in large part, driven by available government funding. Government budgets are set annually and we cannot assure that government funding will be sustained at the same level in the future. A significant reduction in available government funding could result in declines in our consolidated results of operations and cash flow.

Our future results are subject to the risk that purchased components and materials are unavailable or available at excessive cost due to material shortages, excessive demand, currency fluctuation, inflationary pressure and other factors.

We depend on various components and materials to manufacture our products. Although we have not experienced any substantial difficulty in obtaining components and materials, it is possible that any of our supplier relationships could be terminated or otherwise disrupted. Any sustained interruption in our receipt of adequate supplies could have a material adverse effect on our business, results of operations and financial condition. Our inability to successfully manage price fluctuations due to market demand, currency risks or material shortages, or future price fluctuations could have a material adverse effect on our business and our consolidated results of operations and financial condition.

Our plans to continue to improve productivity and reduce complexity may not be successful, which could adversely affect our ability to compete.

MSA has integrated parts of its European operating segment that have historically been individually managed entities, into a centrally managed organization model. We have begun to and plan to continue to leverage the benefits of scale created from this approach and are in the process of implementing a more efficient and cost-effective enterprise resource planning system in additional locations across the International Segment. MSA runs the risk that these and similar initiatives may not be completed substantially as planned, may be more costly to implement than expected, or may not result in the efficiencies or cost savings anticipated. In addition, these various initiatives require MSA to implement a significant amount of organizational change which could divert management’s attention from other concerns, and if not properly managed, could cause disruptions in our day-to-day operations and have a negative impact on MSA's financial results. It is also possible that other major productivity and streamlining programs may be required in the future.

Our plans to improve future profitability through restructuring programs may not be successful and could lead to unintended consequences.

We have incurred and may incur restructuring charges primarily related to severance costs for staff reductions associated with our ongoing initiatives to drive profitable growth and right size our operations. For example in 2016, certain employees in the Americas segment were offered a voluntary retirement incentive package (“VRIP”). Non-cash special termination benefit expense of approximately $11.4 million was recorded in the first quarter of 2017 related to elections under the VRIP. Our cost structure in future periods is somewhat dependent upon our ability to maintain increased productivity without backfilling certain positions. If our programs are not successful, there could be a material adverse effect on our business and consolidated results of operations.

Our inability to successfully identify, consummate and integrate current and future acquisitions or to realize anticipated cost savings and other benefits could adversely affect our business.

One of our operating strategies is to selectively pursue acquisitions. On May 20, 2019, we completed the acquisition of Sierra Monitor Corporation ("SMC"), which is a leading provider of fixed gas and flame detection instruments and Industrial Internet of Things solutions that connect and help protect high-value infrastructure assets. Please refer to Note 13 of the consolidated financial statements in Part II Item 8 of this Form 10-K for further details. Any future acquisitions will depend on our ability to identify suitable acquisition candidates and successfully consummate such acquisitions. Acquisitions involve a number of risks including:

| |

| • | failure of the acquired businesses to achieve the results we expect; |

| |

| • | diversion of our management’s attention from operational matters; |

| |

| • | our inability to retain key personnel of the acquired businesses; |

| |

| • | risks associated with unanticipated events or liabilities; |

| |

| • | potential disruption of our existing business; and |

| |

| • | customer dissatisfaction or performance problems at the acquired businesses. |

If we are unable to integrate or successfully manage businesses that we have recently acquired, including SMC, or may acquire in the future, we may not realize anticipated cost savings, improved manufacturing efficiencies and increased revenue, which may result in material adverse short- and long-term effects on our consolidated operating results, financial condition and liquidity. Even if we are able to integrate the operations of our acquired businesses into our operations, we may not realize the full benefits of the cost savings, revenue enhancements or other benefits that we may have expected at the time of acquisition. In addition, even if we achieve the expected benefits, we may not be able to achieve them within the anticipated time frame, and such benefits may be offset by costs incurred in integrating the acquired companies and increases in other expenses.

A failure of our information systems or a cybersecurity breach could materially and adversely affect our business, results of operations and financial condition.

The proper functioning and security of our information systems is critical to the operation and reputation of our business. Our information systems may be vulnerable to damage or disruption from natural or man-made disasters, computer viruses, power losses or other system or network failures. In addition, hackers, cyber-criminals and other persons could attempt to gain unauthorized access to our information systems with the intent of harming the Company, harming our information systems or obtaining sensitive information such as intellectual property, trade secrets, financial and business development information, and customer and vendor related information. If our information systems or security fail, or if there is any compromise or breach of our security, it could result in a violation of applicable privacy and other laws, legal and financial exposure, remediation costs, negative impacts on our customers' willingness to transact business with us, or a loss of confidence in our security measures, which could have an adverse effect on our business, our reputation and our consolidated results of operations and financial condition.

Like many companies, from time to time, we have experienced attacks on our computer systems by unauthorized outside parties. Because the techniques used by computer hackers and others to access or sabotage networks continually evolve and generally are not recognized until launched against a target, we may be unable to anticipate, prevent or detect these attacks. As a result, the impact of any future incident cannot be predicted, including the failure of our information systems or misappropriation of our technologies and/or processes. Any such system failure or loss of such information could harm our competitive position, or cause us to incur significant costs to remedy the damages caused by the incident. We routinely implement improvements to our network security safeguards as well as cybersecurity initiatives. We also maintain a robust cyber response plan, including an assessment of triggers for internal and external reporting of cyber incidents. We expect to continue devoting substantial resources to the security of our information technology systems. We cannot assure that such system improvements will be sufficient to prevent or limit the damage from any future cyber-attack or disruption to our information systems.

If we lose any of our key personnel or are unable to attract, train and/or retain qualified personnel or plan the succession of senior management, our ability to manage our business and continue our growth could be negatively impacted.

Our success depends in large part on the continued contributions of our key management, engineering and sales and marketing personnel, many of whom are highly skilled and would be difficult to replace. Our success also depends on the abilities of new personnel to function effectively, both individually and as a group. If we are unable to attract, effectively integrate and retain management, engineering or sales and marketing personnel, then the execution of our growth strategy and our ability to react to changing market requirements may be impeded, and our business could suffer as a result.

In addition, hiring, training, and successfully integrating replacement critical personnel could be time consuming, may cause additional disruptions to our operations, and may be unsuccessful, which could negatively impact future revenues. Competition for personnel is intense, and we cannot assure that we will be successful in attracting and retaining qualified personnel. The hiring of new personnel may also result in increased costs and we do not currently maintain key person life insurance.

Our success also depends on effective succession planning. Failure to ensure effective transfer of knowledge and smooth transitions involving senior management could hinder our strategic planning and execution. From time to time, senior management or other key employees may leave the Company. While we strive to reduce the negative impact of such changes, the loss of any key employee could result in significant disruptions to our operations, including adversely affecting the timeliness of product releases, the successful implementation and completion of company initiatives, the effectiveness of our disclosure controls and procedures and our internal control over financial reporting, and the results of our operations.

If we fail to introduce successful new products or extend our existing product lines, we could lose our market position and our financial performance could be materially and adversely affected.

In the safety products market, there are frequent introductions of new products and product line extensions. If we are unable to identify emerging consumer and technological trends, maintain and improve the competitiveness of our products and introduce new products, we may lose our market position, which could have a material adverse effect on our business, financial condition and results of operations. We continue to invest significant resources in research and development and market research. However, continued product development and marketing efforts are subject to the risks inherent in the development process. These risks include delays, the failure of new products and product line extensions to achieve anticipated levels of market acceptance and the risk of failed product introductions.

Damage to the reputation of MSA or to one or more of our product brands could adversely affect our business.

Developing and maintaining our reputation, as well as the reputation of our brands, is a critical factor in our relationship with customers, distributors and others. Our inability to address negative publicity or other issues, including concerns about product safety or quality, real or perceived, could negatively impact our business which could have a material adverse effect on our business, consolidated results of operations and financial condition.

Our ability to market and sell our products is subject to existing government regulations and standards. Changes in such regulations and standards or our failure to comply with them could materially and adversely affect our results of operations.

Most of our products are required to meet performance and test standards designed to protect the safety of people and infrastructures around the world. Our inability to comply with these standards could result in declines in revenue, profitability and cash flow. Changes in regulations could reduce the demand for our products or require us to re-engineer our products, thereby creating opportunities for our competitors. Regulatory approvals for our products may be delayed or denied for a variety of reasons that are outside of our control. Additionally, market anticipation of significant new standards can cause customers to accelerate or delay buying decisions.

The markets in which we compete are highly competitive, and some of our competitors have greater financial and other resources than we do. The competitive pressures faced by us could materially and adversely affect our business, results of operations and financial condition.

The safety products market is highly competitive, with participants ranging in size from small companies focusing on single types of safety products, to large multinational corporations that manufacture and supply many types of safety products. Our main competitors vary by region and product. We believe that participants in this industry compete primarily on the basis of product characteristics (such as functional performance, technology, cost of ownership, comfort, design and style), price, service and delivery, customer support, the ability to meet the special requirements of customers, brand name trust and recognition, and e-business capabilities. Some of our competitors have greater financial and other resources than we do and our business could be adversely affected by competitors’ new product innovations, technological advances made to competing products and pricing changes made by us in response to competition from existing or new competitors. We may not be able to compete successfully against current and future competitors and the competitive pressures faced by us could have a material adverse effect our business, consolidated results of operations and financial condition. In addition, e-business is a rapidly developing area, and the execution of a successful e-business strategy involves significant time, investment and resources. If we are unable to successfully expand e-business capabilities in support of our customer needs, our brands may lose market share, which could negatively impact revenue and profitability.

We are subject to various federal, state and local laws and regulations across our global organization and any violation of these laws and regulations could adversely affect our results of operations.

We are subject to numerous, and sometimes conflicting, laws and regulations on matters as diverse as anti-corruption, import/export controls, product content requirements, trade restrictions, tariffs, taxation, sanctions, internal and disclosure control obligations, securities regulation, anti-competition, data privacy and labor relations, among others. This includes laws and regulations in emerging markets where legal systems may be less developed or familiar to us. Compliance with diverse legal requirements is costly, time consuming and requires significant resources. Violations of one or more of these laws or regulations in the conduct of our business could result in significant fines, criminal sanctions against us or our officers, prohibitions on doing business and damage to our reputation. These actions could result in liability for significant monetary damages, fines and/or criminal prosecution, unfavorable publicity and other reputational damage and have a material adverse effect on our business, consolidated results of operations and financial condition.

We are subject to various environmental laws and any violation of these laws could adversely affect our results of operations.

Included in the extensive laws, regulations and ordinances, to which we are subject, are those relating to the protection of the environment. Examples include those governing discharges to air and water, handling and disposal practices for solid and hazardous wastes and the maintenance of a safe workplace. These laws impose penalties for noncompliance and liability for response costs and certain damages resulting from past and current spills, disposals, or other releases of hazardous materials. We could incur substantial costs as a result of noncompliance with or liability for cleanup pursuant to these environmental laws. Such laws continue to change, and we may be subject to more stringent environmental laws in the future. If more stringent environmental laws are enacted, these future laws could have a material adverse effect on our business, consolidated results of operations and financial condition.

We benefit from free trade laws and regulations, such as the United States-Mexico-Canada Agreement and any changes to these laws and regulations could adversely affect our results of operations.

Existing free trade laws and regulations, such as the United States-Mexico-Canada Agreement, provide certain beneficial duties and tariffs for qualifying imports and exports, subject to compliance with the applicable classification and other requirements. Changes in laws or policies governing the terms of foreign trade, and in particular increased trade restrictions, tariffs or taxes on imports from countries where we manufacture products, such as China and Mexico, could have a material adverse effect on our business, consolidated results of operations and financial condition.

We are subject to various U.S and foreign tax laws and any changes in these laws related to the taxation of businesses and resolutions of tax disputes could adversely affect our results of operations.

The U.S. Congress, the Organization for Economic Co-operation and Development (or, OECD) and other government agencies in jurisdictions in which we and our affiliates invest or do business have maintained a focus on issues related to the taxation of multinational companies. The OECD has changed numerous long-standing tax principles through its base erosion and profit shifting (“BEPS”) project which could adversely impact our effective tax rate.

We are subject to regular review and audit by both foreign and domestic tax authorities. While we believe our tax positions will be sustained, the final outcome of tax audits and related litigation may differ materially from the tax amounts recorded in our consolidated financial statements, which could have a material adverse effect on our consolidated results of operations, financial condition and cash flows.

We have significant international operations and are subject to the risks of doing business in foreign countries.

We have business operations in approximately 40 foreign countries. In 2019, approximately half of our net sales were made by operations located outside the United States. Those operations are subject to various political, economic and other risks and uncertainties, which could have a material adverse effect on our business. These risks include the following:

| |

| • | unexpected changes in regulatory requirements; |

| |

| • | changes in trade policy or tariff regulations; |

| |

| • | changes in tax laws and regulations; |

| |

| • | unintended consequences due to changes to the Company's legal structure; |

| |

| • | additional valuation allowances on deferred tax assets due to an inability to generate sufficient profit in certain foreign jurisdictions; |

| |

| • | intellectual property protection difficulties or intellectual property theft; |

| |

| • | difficulty in collecting accounts receivable; |

| |

| • | complications in complying with a variety of foreign laws and regulations, some of which may conflict with U.S. laws; |

| |

| • | foreign privacy laws and regulations; |

| |

| • | trade protection measures and price controls; |

| |

| • | trade sanctions and embargoes; |

| |

| • | nationalization and expropriation; |

| |

| • | increased international instability or potential instability of foreign governments; |

| |

| • | effectiveness of worldwide compliance with MSA's anti-bribery policy, the U.S. Foreign Corrupt Practices Act, and similar local laws; |

| |

| • | difficulty in hiring and retaining qualified employees; |

| |

| • | the ability to effectively negotiate with labor unions in foreign countries; |

| |

| • | the need to take extra security precautions for our international operations; |

| |

| • | costs and difficulties in managing culturally and geographically diverse international operations; |

| |

| • | pandemics and similar disasters; and |

| |

| • | risks associated with the United Kingdom's decision to exit the European Union, including disruptions to trade and free movement of goods, services and people to and from the United Kingdom; increased foreign exchange volatility with respect to the British pound; and additional legal and economic uncertainty. |

Any one or more of these risks could have a negative impact on the success of our international operations and, thereby, have a material adverse effect our business, consolidated results of operations and financial condition.

Because we derive a significant portion of our sales from the operations of our foreign subsidiaries, future currency exchange rate fluctuations could adversely affect our results of operations and financial condition, and could affect the comparability of our results between financial periods.

In 2019, our operations outside of the United States accounted for approximately one-half of our net sales. The results of our foreign operations are generally reported in local currency and then translated into U.S. dollars at the applicable exchange rates for inclusion in our consolidated financial statements. The exchange rates between some of these currencies and the U.S. dollar have fluctuated significantly in recent years and may continue to do so in the future. A weakening of the currencies in which sales are generated relative to the currencies in which costs are denominated would decrease our results of operations and cash flow. Although the Company uses instruments to hedge certain foreign currency risks, these hedges only offset a portion of the Company’s exposure to foreign currency fluctuations.

In addition, because our consolidated financial statements are stated in U.S. dollars, such fluctuations may affect our consolidated results of operations and financial position, and may affect the comparability of our results between financial periods. Our inability to effectively manage our exchange rate risks or any volatility in currency exchange rates could have a material adverse effect on our business, consolidated results of operations and financial condition.

Our continued success depends on our ability to protect our intellectual property. If we are unable to protect our intellectual property, our business could be materially and adversely affected.

Our success depends, in part, on our ability to obtain and enforce patents, maintain trade secret protection and operate without infringing on the proprietary rights of third parties. We have been issued patents and have registered trademarks with respect to many of our products, but our competitors could independently develop similar or superior products or technologies, duplicate any of our designs, trademarks, processes or other intellectual property or design around any processes or designs on which we have or may obtain patents or trademark protection. In addition, it is possible that third parties may have, or will acquire, licenses for patents or trademarks that we may use or desire to use, so that we may need to acquire licenses to, or to contest the validity of, such patents or trademarks of third parties. Such licenses may not be made available to us on acceptable terms, if at all, and we may not prevail in contesting the validity of third party rights.

We also protect trade secrets, know-how and other confidential information against unauthorized use by others or disclosure by persons who have access to them, such as our employees, through contractual arrangements. These agreements may not provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. Our inability to maintain the proprietary nature of our technologies could have a material adverse effect on our consolidated results of operations and financial condition.

If our goodwill, other intangible assets and long-lived assets become impaired, we may be required to record significant charges to earnings.

We review our long-lived assets for impairment when events or changes in circumstances indicate the carrying amount may not be recoverable. Goodwill and indefinite-lived intangible assets are required to be assessed for impairment at least annually. Factors that may be considered a change in circumstances, indicating that the carrying amount of our goodwill, indefinite-lived intangible assets or long-lived assets may not be recoverable, include slower growth rates in our markets, reduced expected future cash flows, increased country risk premiums as a result of political uncertainty and a decline in stock price and market capitalization. We consider available current information when calculating our impairment charge. If there are indicators of impairment, our long-term cash flow forecasts for our operations deteriorate or discount rates increase, we may be required to recognize additional impairment charges in later periods. See Note 12 of the consolidated financial statements in Part II Item 8 of this Form 10-K for the carrying amounts of goodwill in each of our reporting segments and details on indefinite-lived intangible assets that we hold.

Risks related to our defined benefit pension and other post-retirement plans could adversely affect our results of operations and cash flow.

Significant changes in actual investment return on pension assets, discount rates, and other factors could adversely affect our results of operations and pension contributions in future periods. U.S. generally accepted accounting principles require that we calculate income or expense for the plans using actuarial valuations. These valuations reflect assumptions about financial markets and interest rates, which may change based on economic conditions. Funding requirements for our pension plans may become more significant. However, the ultimate amounts to be contributed are dependent upon, among other things, interest rates, underlying asset returns and the impact of legislative or regulatory changes related to pension funding obligations. For further information regarding our pension plans, refer to "Pensions and Other Post-retirement Benefits" in Note 14 of the consolidated financial statements in Part II Item 8 of this Form 10-K.

If we fail to meet our debt service requirements or the restrictive covenants in our debt agreements or if interest rates increase, our results of operations and financial condition could be materially and adversely affected.

We have a substantial amount of debt upon which we are required to make scheduled interest and principal payments and we may incur additional debt in the future. A significant portion of our debt bears interest at variable rates that may increase in the future.

The potential discontinuance of LIBOR is one such risk that could cause market volatility or disruption. In July 2017, the chief executive of the United Kingdom Financial Conduct Authority (the “FCA”), which regulates LIBOR, announced that the FCA intends to stop compelling banks to submit rates for the calculation of LIBOR after 2021. It is unknown whether any banks will continue to voluntarily submit rates for the calculation of LIBOR after 2021 or whether LIBOR will continue to be published by its administrator based on these submissions or on any other basis. It is not possible to predict the effect of these changes, other reforms, or the establishment of alternative reference rates, but the potential discontinuance of LIBOR could adversely affect our access to the debt and its cost of funding.

Our debt agreements require us to comply with certain restrictive covenants. If we are unable to generate sufficient cash to service our debt or if interest rates increase, our consolidated results of operations and financial condition could be materially and adversely affected. Additionally, a failure to comply with the restrictive covenants contained in our debt agreements could result in a default, which if not waived by our lenders, could substantially increase borrowing costs and require accelerated repayment of our debt. Please refer to Note 11 of the consolidated financial statements in Part II Item 8 of this Form 10-K for commentary on our compliance with the restrictive covenants.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our principal executive offices are located at 1000 Cranberry Woods Drive, Cranberry Township, PA, United States. We own or lease our primary facilities. Our primary manufacturing locations in the Americas segment are located in Cranberry Township, PA; Murrysville, PA; and Jacksonville, NC, and our primary distribution center is located in New Galilee, PA. The primary manufacturing locations in the International segment are located in Berlin, Germany; Suzhou, China; Devizes, United Kingdom; and Châtillon-sur-Chalaronne, France. Our primary research and development centers are located in Cranberry Township, PA; Berlin, Germany; and Suzhou, China.

We believe that all of our facilities, including the manufacturing facilities, are in good repair and in suitable condition for the purposes for which they are used.

Item 3. Legal Proceedings

Please refer to Note 19 to the consolidated financial statements in Part II Item 8 of this Form 10-K.

Item 4. Mine Safety Disclosures

Not applicable.

Information about our Executive Officers

The following sets forth the names and ages of our executive officers as of February 20, 2020:

|

| | | | | |

| Name | | Age |

| | Title |

Nishan J. Vartanian(a) | | 60 |

| | President and Chief Executive Officer since May 2018. |

Steven C. Blanco(b) | | 53 |

| | Vice President and President, MSA Americas segment since August 2017. |

Kenneth D. Krause(c) | | 45 |

| | Senior Vice President, Chief Financial Officer and Treasurer since February 2018. |

Bob Leenen(d) | | 46 |

| | Vice President and President, MSA International segment since September 2017. |

Stephanie L. Sciullo(e) | | 35 |

| | Vice President and Chief Legal Officer since January 2020. |

| |

| (a) | Prior to his present position, Mr. Vartanian was President and Chief Operating Officer since June 2017; Senior Vice President and President, MSA Americas since July 2015; and prior thereto served as Vice President and President, MSA North America. |

| |

| (b) | Prior to his present position, Mr. Blanco served as Vice President and General Manager, Northern North America since August 2015 and prior thereto was Vice President, Global Operational Excellence. |

| |

| (c) | Prior to his present position, Mr. Krause was Vice President, Chief Financial Officer and Treasurer since December 2015; Vice President, Strategic Finance since August 2015; and prior thereto served as Treasurer and Executive Director, Global Finance and Assistant Treasurer. |

| |

| (d) | Prior to his present position, Mr. Leenen was Regional Chief Financial Officer, MSA International and Finance Director, Europe. |

| |

| (e) | Prior to her present position, Ms. Sciullo served as Deputy General Counsel since 2016 and prior thereto was Associate General Counsel. |

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchange under the symbol “MSA.” On February 17, 2020, there were 177 registered holders of our shares of common stock.

Issuer Purchases of Equity Securities |

| | | | | | | | | | | | |

| Period | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs |

| October 1 — October 31, 2019 | — |

| | $ | — |

| | — |

| | 647,687 |

|

| November 1 — November 30, 2019 | — |

| | — |

| | — |

| | 627,514 |

|

| December 1 — December 31, 2019 | 12,528 |

| | 126.80 |

| | — |

| | 615,447 |

|

The share repurchase program authorizes up to $100.0 million in repurchases of MSA common stock in the open market and in private transactions. The share purchase program has no expiration date. The maximum number of shares that may be purchased is calculated based on the dollars remaining under the program and the respective month-end closing share price. We have purchased a total of 352,406 shares, or $22.2 million, since this program's inception.

The above shares purchased during the quarter relate to stock compensation transactions.

We do not have any other share repurchase programs.

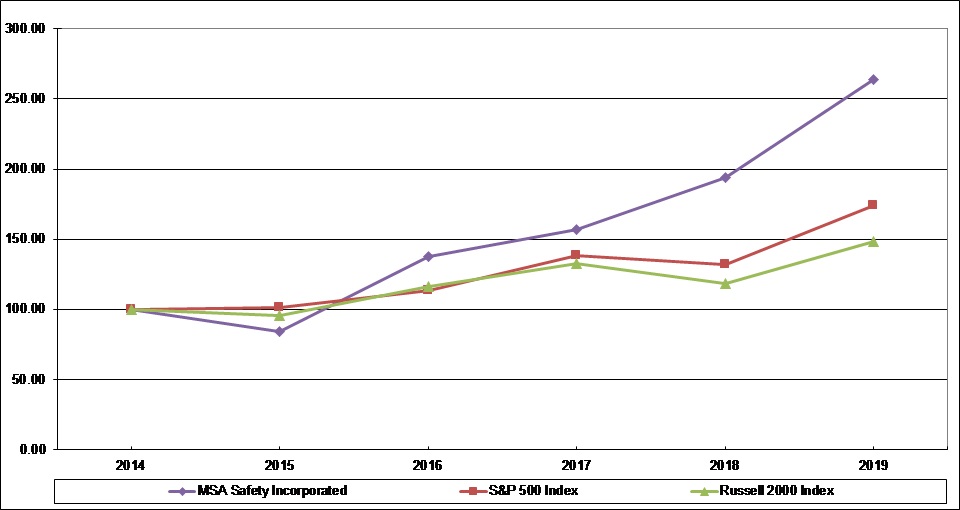

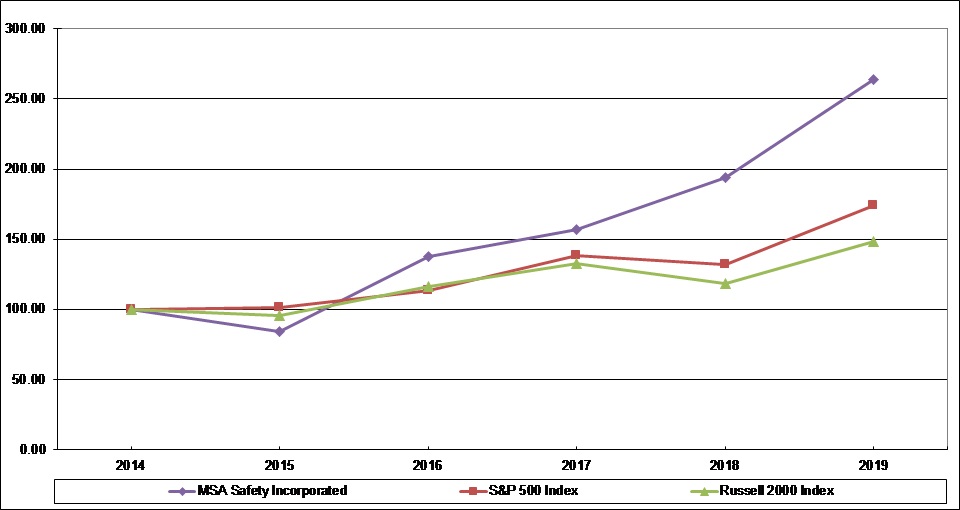

Comparison of Five-Year Cumulative Total Return

The following paragraph compares the most recent five year performance of MSA stock with (1) the Standard & Poor’s 500 Composite Index and (2) the Russell 2000 Index. Because our competitors are principally privately held concerns or subsidiaries or divisions of corporations engaged in multiple lines of business, we do not believe it feasible to construct a peer group comparison on an industry or line-of-business basis. The Russell 2000 Index, while including corporations both larger and smaller than MSA in terms of market capitalization, is composed of corporations with an average market capitalization similar to us.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

ASSUMES INITIAL INVESTMENT OF $100

Among MSA Safety Incorporated, the S&P 500 Index, and the Russell 2000 Index

Assumes $100 invested on December 31, 2014 in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Value at December 31, |

| | 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | 2019 |

| MSA Safety Incorporated | $ | 100.00 |

| | $ | 84.15 |

| | $ | 137.84 |

| | $ | 157.06 |

| | $ | 194.10 |

| | $ | 264.15 |

|

| S&P 500 Index | 100.00 |

| | 101.38 |

| | 113.51 |

| | 138.29 |

| | 132.23 |

| | 173.86 |

|

| Russell 2000 Index | 100.00 |

| | 95.59 |

| | 115.95 |

| | 132.94 |

| | 118.30 |

| | 148.49 |

|

Prepared by Zacks Investment Research, Inc. Used with permission. All rights reserved. Copyright 1980-2020.

Index Data: Copyright Standard and Poor’s, Inc. Used with permission. All rights reserved.

Index Data: Copyright Russell Investments. Used with permission. All rights reserved.

Item 6. Selected Financial Data

|

| | | | | | | | | | | | | | | | | | | |

| (In thousands, except as noted) | 2019(a) | | 2018 | | 2017(b) | | 2016(c) | | 2015(d) |

| Statement of Income Data: | | | | | | | | | |

| Net sales | $ | 1,401,981 |

| | $ | 1,358,104 |

| | $ | 1,196,809 |

| | $ | 1,149,530 |

| | $ | 1,130,783 |

|

| Income from continuing operations | 137,649 |

| | 125,115 |

| | 26,956 |

| | 94,107 |

| | 69,590 |

|

| (Loss) income from discontinued operations | — |

| | — |

| | — |

| | (755 | ) | | 1,217 |

|

| Net income attributable to MSA Safety Incorporated | 136,440 |

| | 124,150 |

| | 26,027 |

| | 91,936 |

| | 70,807 |

|

| Earnings per share attributable to MSA common shareholders: | | | | | | | | | |

| Basic per common share (in dollars): | | | | | | | | | |

| Income from continuing operations | $ | 3.52 |

| | $ | 3.23 |

| | $ | 0.68 |

| | $ | 2.47 |

| | $ | 1.86 |

|

| (Loss) income from discontinued operations | — |

| | — |

| | — |

| | (0.02 | ) | | 0.03 |

|

| Net income | 3.52 |

| | 3.23 |

| | 0.68 |

| | 2.45 |

| | 1.89 |

|

| Diluted per common share (in dollars): | | | | | | | | | |

| Income from continuing operations | $ | 3.48 |

| | $ | 3.18 |

| | $ | 0.67 |

| | $ | 2.44 |

| | $ | 1.84 |

|

| (Loss) income from discontinued operations | — |

| | — |

| | — |

| | (0.02 | ) | | 0.03 |

|

| Net income | 3.48 |

| | 3.18 |

| | 0.67 |

| | 2.42 |

| | 1.87 |

|

| Dividends paid per common share (in dollars) | 1.64 |

| | 1.49 |

| | 1.38 |

| | 1.31 |

| | 1.27 |

|

| Weighted average common shares outstanding—basic | 38,653 |

| | 38,362 |

| | 37,997 |

| | 37,456 |

| | 37,293 |

|

| Weighted average common shares outstanding—diluted | 39,189 |

| | 38,961 |

| | 38,697 |

| | 37,986 |

| | 37,710 |

|

| Balance Sheet Data: | | | | | | | | | |

| Total assets | $ | 1,739,693 |

| (e) | $ | 1,608,012 |

| | $ | 1,684,826 |

| | $ | 1,353,920 |

| (f) | $ | 1,422,863 |

|

| Long-term debt, net | 328,394 |

| | 341,311 |

| | 447,832 |

| | 363,836 |

| (f) | 458,022 |

|

| Total MSA Safety Incorporated shareholders’ equity | 725,800 |

| | 633,882 |

| | 597,601 |

| | 558,165 |

| | 516,496 |

|

(a) Includes SMC from the date of acquisition on May 20, 2019.

(b) Includes Globe from the date of acquisition on July 31, 2017. In addition, we were able to reasonably estimate the potential liability for IBNR cumulative trauma product liability claims in the fourth quarter of 2017 and recognized a significant charge which reduced net income by approximately $85 million as compared to prior years as we became substantially self insured for cumulative trauma product liability claims during 2017. See Note 19 to the consolidated financial statements in Part II Item 8 of this Form 10-K for additional information.

(c) Includes Senscient from the date of acquisition on September 19, 2016.

(d) Includes Latchways from the date of acquisition on October 21, 2015.

(e) The Company adopted Accounting Standards Update (ASU) 2016-02, Leases, on January 1, 2019, which requires lessees to record a right-of-use asset and a liability for virtually all leases. The adoption of this ASU increased total assets by $54 million. This ASU was adopted using the modified retrospective transition method and all prior periods were reported in accordance with ASC 840, Leases.

(f) The Company adopted ASU No. 2015-03, Interest - Imputation of Interest and ASU No. 2015-15, Interest - Imputation of Interest on January 1, 2016, which requires an entity to present the debt issuance costs related to a recognized debt liability as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. December 31, 2015 financial information was recast to apply this change in accounting principle retrospectively.

The data presented in the Selected Financial Data table should be read in conjunction with comments provided in Management's Discussion and Analysis of Financial Condition and Results of Operations in Part II Item 7 and the consolidated financial statements in Part II Item 8 of this Form 10-K.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the historical financial statements and other financial information included elsewhere in this annual report on Form 10-K. This discussion may contain forward-looking statements that involve risks and uncertainties. The forward-looking statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about our industry, business and future financial results. Our actual results could differ materially from the results contemplated by these forward-looking statements due to a number of factors, including those discussed in the sections of this annual report entitled “Forward-Looking Statements” and “Risk Factors.”

MSA Safety Incorporated ("MSA") is organized into six geographical operating segments that are aggregated into three reportable geographic segments: Americas, International and Corporate. The Americas segment is comprised of our operations in North America and Latin America geographies. The International segment is comprised of our operations of all geographies outside of the Americas. Certain global expenses are allocated to each segment in a manner consistent with where the benefits from the expenses are derived. Please refer to Note 7—Segment Information of the consolidated financial statements in Part II Item 8 of this Form 10-K for further information.

On July 31, 2017, the Company acquired 100% of the common stock of Globe Holding Company, LLC ("Globe") for $215 million in cash plus a working capital adjustment of $1.4 million. Based in Pittsfield, NH, Globe is a leading innovator and provider of firefighter protective clothing and boots. This acquisition aligns with the Company's corporate strategy in that it strengthened our leading position in the North American fire service market. The transaction was funded through borrowings on our unsecured senior revolving credit facility. The data presented in Part II Item 6 of this Form 10-K should be read in conjunction with the following comments. Additionally, please refer to Note 13—Acquisitions of the consolidated financial statements in Part II Item 8 of this Form 10-K for further information.

On May 20, 2019, the Company acquired 100% of the common stock of Sierra Monitor Corporation ("SMC") in an all-cash transaction valued at $33.2 million, net of cash acquired. Based in Milpitas, California, in the heart of Silicon Valley, SMC is a leading provider of fixed gas and flame detection instruments and Industrial Internet of Things solutions that connect and help protect high-value infrastructure assets. The acquisition enables MSA to accelerate its strategy to enhance worker safety and accountability through the use of cloud technology and wireless connectivity. This acquisition enhances a key focus of the Company's Safety io subsidiary, launched in 2018 primarily to leverage the capabilities of its portable gas detection portfolio as it relates to cloud connectivity. The transaction was funded through borrowings on our unsecured senior revolving credit facility. The data presented in Part II Item 6 of this Form 10-K should be read in conjunction with the following comments. Additionally, please refer to Note 13—Acquisitions of the consolidated financial statements in Part II Item 8 of this Form 10-K for further information.

Year Ended December 31, 2018 Compared to Year Ended December 31, 2017

Discussion of our results; liquidity and capital resources; and cumulative translation adjustments for the year ended December 31, 2018 compared to the year ended December 31, 2017 can be found under Part II Item 7 of our Form 10-K for the year ended December 31, 2018 as filed with the SEC.

BUSINESS OVERVIEW