Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 27, 2008

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-10245

RCM TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified in its Charter)

Nevada | | 95-1480559 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

2500 McClellan Avenue, Suite 350,

Pennsauken, New Jersey | | 08109-4613 |

(Address of Principal Executive Offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code: (856) 356-4500 |

|

Securities registered pursuant to Section 12(b) of the Act: | | |

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| | |

Common Stock, par value $0.05 per share | | The NASDAQ Stock Market LLC |

| | |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. (See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act). (Check one):

Large Accelerated Filer o | | Accelerated Filer o | | Non-Accelerated Filer o

(Do not check if a smaller reporting company) | | Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES o NO x

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $52,668,000 based upon the closing price of $4.31 per share of the registrant’s common stock on June 27, 2008 on The NASDAQ Global Market. The information provided shall in no way be construed as an admission that any person whose holdings are excluded from the figure is an affiliate or that any person whose holdings are included is not an affiliate and any such admission is hereby disclaimed. The information provided is included solely for record keeping purposes of the Securities and Exchange Commission.

The number of shares of registrant’s common stock (par value $0.05 per share) outstanding as of March 23, 2009: 12,813,522.

Documents Incorporated by Reference

Portions of the definitive proxy statement for the registrant’s 2009 Annual Meeting of Stockholders (the “2009 Proxy Statement”) are incorporated by reference into Items 10, 11, 12, 13 and 14 in Part III of this Annual Report on Form 10-K. If the 2009 Proxy Statement is not filed by April 26, 2009, an amendment to this annual report on Form 10-K setting forth this information will be duly filed with the Securities and Exchange Commission.

Table of Contents

PART I

Private Securities Litigation Reform Act Safe Harbor Statement

Certain statements included herein and in other reports and public filings made by RCM Technologies, Inc. (“RCM” or the “Company”) are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding the adoption by businesses of new technology solutions; the use by businesses of outsourced solutions, such as those offered by the Company in connection with such adoption; and the outcome of litigation (at both the trial and appellate levels) involving the Company. Readers are cautioned that such forward-looking statements, as well as others made by the Company, which may be identified by words such as “may,” “will,” “expect,” “anticipate,” “continue,” “estimate,” “project,” “intend,” “believe,” and similar expressions, are only predictions and are subject to risks and uncertainties that could cause the Company’s actual results and financial position to differ materially from such statements. Such risks and uncertainties include, without limitation: (i) unemployment and general economic conditions affecting the provision of information technology and engineering services and solutions and the placement of temporary staffing personnel; (ii) the Company’s ability to continue to attract, train and retain personnel qualified to meet the requirements of its clients; (iii) the Company’s ability to identify appropriate acquisition candidates, complete such acquisitions and successfully integrate acquired businesses; (iv) uncertainties regarding pro forma financial information and the underlying assumptions relating to acquisitions and acquired businesses; (v) uncertainties regarding amounts of deferred consideration and earnout payments to become payable to former shareholders of acquired businesses; (vi) adverse effects on the market price of the Company’s common stock due to the potential resale into the market of significant amounts of common stock; (vii) the adverse effect a potential decrease in the trading price of the Company’s common stock would have upon the Company’s ability to acquire businesses through the issuance of its securities; (viii) the Company’s ability to obtain financing on satisfactory terms; (ix) the reliance of the Company upon the continued service of its executive officers; (x) the Company’s ability to remain competitive in the markets that it serves; (xi) the Company’s ability to maintain its unemployment insurance premiums and workers compensation premiums; (xii) the risk of claims being made against the Company associated with providing temporary staffing services; (xiii) the Company’s ability to manage significant amounts of information and periodically expand and upgrade its information processing capabilities; (xiv) the Company’s ability to remain in compliance with federal and state wage and hour laws and regulations; (xv) uncertainties in predictions as to the future need for the Company’s services; (xvi) uncertainties relating to the allocation of costs and expenses to each of the Company’s operating segments; (xvii) the costs of conducting and the outcome of litigation involving the Company, (xviii) obligations relating to indemnities and similar agreements entered into in connection with the Company’s business activities, and (xix) other economic, competitive and governmental factors affecting the Company’s operations, markets, products and services. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to publicly release the results of any revision of these forward-looking statements to reflect these trends or circumstances after the date they are made or to reflect the occurrence of unanticipated events.

1

Table of Contents

ITEM 1. BUSINESS

General

RCM Technologies is a premier provider of business and technology solutions designed to enhance and maximize the operational performance of its customers through the adaptation and deployment of advanced information technology and engineering services. RCM has been an innovative leader in the design, development, and delivery of these services to commercial and government sectors for more than 35 years. Over the years, the Company has developed and assembled an attractive, diverse and extensive portfolio of capabilities, service offerings and delivery options, established a proven record of performance and credibility, and built an efficient pricing structure. This combination offers clients a compelling value proposition with the potential to substantially accelerate the successful attainment of their business objectives.

RCM consists of three operating segments: Information Technology, Engineering and Commercial Services. The Company’s Information Technology, or IT, segment provides enterprise business solutions, application services, infrastructure solutions, competitive advantage & productivity solutions, life sciences solutions and other selected vertical market specific offerings. RCM’s Engineering segment provides engineering and design, engineering analysis, technical writing and technical support services. The Company’s Commercial Services segment provides health care professionals as well as clerical and light industrial temporary personnel.

The Company services some of the largest national and international companies in North America as well as a lengthy roster of Fortune 1000 and mid-sized businesses in such industries as Aerospace/Defense, Energy, Financial Services, Life Sciences, Manufacturing & Distribution, the Public Sector and Technology. RCM believes it offers a range of solutions that fosters long-term client relationships, affords cross-selling opportunities, and minimizes the Company’s dependence on any single technology or industry sector. RCM sells and delivers its services through a network of 35 offices in selected regions throughout North America.

The Company is a Nevada corporation organized in 1971. The address of its principal executive office is 2500 McClellan Avenue, Suite 350, Pennsauken, NJ 08109-4613.

During the year ended December 27, 2008, approximately 49.4% of RCM’s total revenues were derived from IT services, 28.3% from Engineering services, and the remaining 22.3% from Commercial services.

Demand for the Company’s services can be significantly impacted by changes in the general level of economic activity and particularly technology spending. During periods of reduced economic activity, such as the environment in the United States and the world in general since approximately mid-2007 and continuing into 2009, the Company may also be subject to increased competition and pricing pressure in its markets. Extended periods of weakness in the economy can have a material adverse impact on the Company’s business and results of operations.

Industry Overview

Businesses today face intense competition, the challenge of constant technological change and the ongoing need for business process optimization. To address these issues and to compete more effectively, companies are continually evaluating the need for implementing innovative solutions to upgrade their systems, applications, and processes. As a result, the ability of an organization to integrate and align advanced technologies with new business objectives is critical.

Although most companies recognize the importance of optimizing their systems, applications and processes to compete in today’s challenging environment, the process of designing, developing and implementing business and technology solutions is becoming increasingly complex. The Company believes that many businesses are focused on return on investment analysis in prioritizing their initiatives. Consequently, over the past few years, companies have elected to defer, redefine or cancel investments in new systems, software, and solutions and have focused on making more effective use of previous technological investments.

2

Table of Contents

The current economic environment challenges many companies to integrate and manage computing environments consisting of multiple computing platforms, operating systems, databases and networking protocols and off-the-shelf software applications to support business objectives. Companies also need to keep pace with new technology developments, which often rapidly render existing equipment and internal skills obsolete. At the same time, external economic factors have caused many organizations to focus on core competencies and trim workforces in the IT management area. Accordingly, these organizations often lack the quantity, quality and variety of IT skills necessary to design and support IT solutions. IT managers are charged with supporting increasingly complex systems and applications of significant strategic value, while working under budgetary, personnel and expertise constraints within their own organizations.

The Company believes its target market for IT services is among middle-market companies, which typically lack the time and technical resources to satisfy all of their IT needs internally. These companies commonly require sophisticated, experienced IT assistance to achieve their business objectives and often rely on IT service providers to help implement and manage their systems. However, many middle-market companies rely on multiple providers for their IT needs. Generally, the Company believes that this reliance on multiple providers results from the fact that larger IT service providers do not target these companies, while smaller IT service providers, which do target these companies, lack sufficient breadth of services or industry knowledge to satisfy all of these companies’ needs. The Company believes this reliance on multiple service providers creates multiple relationships that are more difficult and less cost-effective to manage than a single relationship and can adversely influence the quality and compatibility of IT solutions. RCM is structured to provide middle-market companies a single source for their IT needs.

The Company’s Engineering group continues to focus on areas of growth within the energy and aerospace industries. In recent years, many businesses have been adversely impacted by higher oil prices, and for that and various other reasons, there has been growing sentiment around the world for the development of alternative sources of energy, including a renewed interest in nuclear power. Over the same period, there has been a significant increase in spending in the United States in the aerospace and defense industries due largely to a strengthening of the military and homeland security in response to geo-political unrest and the threat of terrorism. The combination of higher energy prices and increased military spending has created numerous business opportunities for service providers, especially those engaged in engineering operations in North America and abroad.

In the healthcare services industry, a shortage of nurses and other medical personnel in the United States has led to increases in business activity for health care service companies, including the Company’s Specialty Healthcare Group. Due in part to an aging population and improved medical technology, the demand for selected health care professionals is expected to continue over the next several years.

Meanwhile, the general economy of the United States over the past several years has negatively affected temporary staffing businesses which are providers of light industrial and clerical help. Generally, demand for lower-skilled workers is weakened in a general economy that is in a downward cycle.

Business Strategy

RCM is dedicated to providing solutions to meet its clients’ business needs by delivering information technology and engineering services. The Company’s objective is to be a recognized leader of specialized professional consulting services and solutions in major markets throughout North America. The Company has developed operating strategies to achieve this objective. Key elements of its growth and operating strategies are as follows:

3

Table of Contents

Growth Strategy

Promote Full Life Cycle Solution Capability

The Company promotes a full life cycle solution capability to its customers. The goal of the full life cycle solution strategy is to fully address a client’s project implementation cycle at each stage of its development and deployment. This entails the Company working with its clients from the initial conceptualization of a project through its design and project execution, and extending into ongoing management and support of the delivered product. RCM’s strategy is to build projects and solutions offerings selectively, utilizing its extensive resource base.

The Company believes that the effective execution of this strategy will generate improved margins on the existing resources. The completion of this service-offering continuum is intended to afford the Company the opportunity to strengthen long-term client relationships that will further contribute to a more predictable revenue stream.

In addition to a full life cycle solution offering, the Company continues to focus on transitioning into higher value oriented services in an effort to increase its margins on its various service lines (relative to lower value services) and generate revenue that is more sustainable. The Company believes this transition is accomplished by pursuing additional vertical market specific solutions in conjunction or combination with longer-term based solutions, through expansion of its client relationships and by pursuing strategic alliances and partnerships.

Achieve Internal Growth

The Company continues to promote its internal growth strategies. Its growth strategy is designed to better serve the Company’s customers, generate higher revenues, and achieve greater operating efficiencies. National and regional sales management programs were designed and implemented to segregate clients by vertical market and national accounts to advance our value added services focus. This process is improving account coordination so clients can benefit from deeper industry knowledge as well as maximizing our major account opportunities.

RCM provides a company orientation program in which sales managers and professionals receive relevant information about company operations.

RCM has adopted an industry-centric approach to sales and marketing. This initiative contemplates that clients within the same industry sectors tend to have common business challenges. It therefore allows the Company to present and deliver enhanced value to those clients in the vertical markets in which RCM has assembled the greatest work experience. RCM’s consultants continue to acquire project experience that offers differentiated awareness of the business challenges that clients in that industry are facing. This alignment also facilitates and creates additional cross-selling opportunities. The Company believes this strategy will lead to greater account penetration and enhanced client relationships.

Operational strategies contributing to RCM’s internal productivity include the delineation of certain new solutions practice areas in markets where its clients had historically known the Company as a contract service provider. The formation of these practice areas will facilitate the flow of project opportunities and the delivery of project-based solutions.

4

Table of Contents

Continue Selective Strategic Acquisitions

The industry in which the Company operates continues to be highly fragmented, and the Company plans to continue to selectively assess opportunities to make strategic acquisitions as such opportunities are presented to the Company. The Company’s past acquisition strategy was designed to broaden the scope of services and technical competencies and grow its full life cycle solution capabilities, and the Company would continue to consider such goals in any future acquisitions. In considering acquisitions, the Company focuses principally on companies with (i) technologies or market segments RCM has targeted for strategic value enhancement, (ii) margins that will not dilute the margins now being delivered, (iii) experienced management personnel, (iv) substantial growth prospects and (v) sellers who desire to join the Company’s management team. To retain and provide incentives for management of its acquired companies, the Company has generally structured a significant portion of the acquisition price in the form of multi-tiered consideration based on growth of operating profitability of the acquired company over a two to three-year period.

Operating Strategy

Develop and Maintain Strong Customer Relationships

The Company seeks to develop and maintain strong interactive customer relationships by anticipating and focusing on its customers’ needs. The Company emphasizes a relationship-oriented approach to business, rather than the transaction or assignment-oriented approach that the Company believes is used by many of its competitors. This industry-centric strategy is designed to allow RCM to expand further its relationships with clients in RCM’s targeted sectors.

To develop close customer relationships, the Company’s practice managers regularly meet with both existing and prospective clients to help design solutions and identify the resources needed to execute their strategies. The Company’s managers also maintain close communications with their customers during each project and on an ongoing basis after its completion. The Company believes that this relationship-oriented approach can result in greater customer satisfaction. Additionally, the Company believes that by collaborating with its customers in designing business solutions, it can generate new opportunities to cross-sell additional services that the Company has to offer. The Company focuses on providing customers with qualified individuals or teams of experts compatible with the business needs of our customers and makes a concerted effort to follow the progress of such relationships to ensure their continued success.

Attract and Retain Highly Qualified Consultants and Technical Resources

The Company believes it has been successful in attracting and retaining qualified consultants and contractors by (i) providing stimulating and challenging work assignments, (ii) offering competitive wages, (iii) effectively communicating with its candidates, (iv) providing selective training to maintain and upgrade skills and (v) aligning the needs of its customers with appropriately skilled personnel. The Company believes it has been successful in retaining these personnel due in part to its use of practice managers who are dedicated to maintaining contact with, and monitoring the satisfaction levels of, the Company’s consultants while they are on assignment.

Centralize Administrative Functions

The Company continues to improve its operational efficiencies by integrating general and administrative functions at the corporate or regional level, and reducing or eliminating redundant functions formerly performed at smaller branch offices. This enables the Company to realize savings and synergies and to control and monitor its operations efficiently, as well as to quickly integrate new acquisitions. It also allows local branches to focus more on growing their local operations.

5

Table of Contents

To accomplish this, the Company’s financial reporting and accounting systems are centralized in the Company’s operational headquarters in Parsippany, NJ. During 2004, the Company upgraded the back office operations to include increased functionality as well as business continuity planning. The systems have been configured to allow the performance of all back office functions, including payroll, project management, project cost accounting, billing, human resource administration and financial reporting and consolidation. The Company believes that this configuration provides a robust and highly scalable platform from which to manage daily operations, and has the capacity to accommodate increased usage.

Information Technology

The Company’s IT segment is comprised of two business groups — the IT Consulting Business Group and the IT Solutions Business Group. The IT Consulting Business Group consists of three business units in North America — the Eastern Region, the Central Region and the Western Region. The Solutions Business Group consists of three business units — IT Enterprise Management, Enterprise Business Solutions and Life Sciences.

The RCM Enterprise Business Solutions Group’s core business mission is to continue its strategic transformation designed to focus the Company on developing proprietary customized solutions and intellectual property by bundling software, systems, tools and services into integrated business and technology solutions.

RCM’s sector knowledge coupled with technical and business process experience enable the Company to provide strategic planning and direction, rigorous project execution, and management and support services for an entire project life cycle. RCM has successfully completed multimillion-dollar projects in a variety of industry verticals using time-tested methodologies that manage strict budgets, timelines and quality metrics.

Among those IT services provided by RCM to its clients are:

· Enterprise Business Solutions

· Application Services

· Infrastructure Solutions

· Competitive Advantage & Productivity Solutions

· Life Sciences Solutions

The Company believes that its ability to deliver information technology solutions across a wide range of technical platforms provides an important competitive advantage. RCM ensures that its consultants have the expertise and skills needed to keep pace with rapidly evolving information technologies. The Company’s strategy is to maintain expertise and acquire knowledge in multiple technologies so it can offer its clients non-biased technology solutions best suited to their business needs.

The Company provides its IT services through a number of flexible delivery methods. These include management consulting engagements, project management of client efforts, project implementation of client initiatives, outsourcing, both on and off site, and a full complement of resourcing alternatives.

As of December 27, 2008, the Company had assigned approximately 780 information technology employees and consultants to its customers.

6

Table of Contents

Engineering

The Company’s Engineering segment consists of three business units — Engineering Services and Projects, Power Systems Services USA and Power Systems Services Canada. The Engineering Services and Projects unit includes Aerospace, Manufacturing and Industrial Engineering divisions. The Power Systems units focus primarily on the nuclear power, fossil fuel and electric utility industries.

RCM provides a full range of Engineering services including Engineering & Design, Engineering Analysis, Engineer-Procure-Construct, Configuration Management, Hardware/Software Validation & Verification, Quality Assurance, Technical Writing & Publications, Manufacturing Process Planning & Improvement, Reliability Centered Maintenance (RCM), Component & Equipment Testing and Risk Management Engineering. Engineering services are provided at the site of the client or, less frequently, at the Company’s own facilities.

The Company believes that the deregulation of the utilities industry and the aging of nuclear power plants offer the Company an opportunity to capture a greater share of professional services and project management requirements of the utilities industry both in engineering services and through cross-selling of its information technology services. Heightened competition, deregulation, and rapid technological advances are forcing the utilities industry to make fundamental changes in its business process. These pressures have compelled the utilities industry to focus on internal operations and maintenance activities and to increasingly outsource their personnel requirements. Additionally, the Company believes that competitive performance demands from deregulation should increase the importance of information technology to this industry. The Company believes that its expertise and strong relationships with certain customers within the utilities industry position the Company to be a leading provider of professional services to the utilities industry.

The Company provides its engineering services through a number of delivery methods. These include managed tasks and resources, complete project services, outsourcing, both on and off-site, and a full complement of resourcing alternatives.

As of December 27, 2008, the Company had assigned approximately 450 engineering and technical employees and consultants to its customers.

Commercial

The Company’s Commercial Services segment consists of the Specialty Health Care and General Support Services groups.

The Company’s Specialty Health Care Group specializes in long-term and short-term staffing as well as executive search and placement for the following fields: rehabilitation (physical therapists, occupational therapists and speech language pathologists), nursing, managed care, allied health care, health care management and medical office support. The specialty health care group provides services to hospitals, long-term care facilities, schools, sports medicine facilities and private practices. Services include in-patient, outpatient, sub-acute and acute care, multilingual speech pathology, rehabilitation, and geriatric, pediatric, and adult day care. Typical engagements either range from three to six months or are on a day-to-day shift basis.

The Company’s General Support Services Group provides contract and temporary services, as well as permanent placement services, for full-time and part-time personnel in a variety of functional areas, including office, clerical, data entry, secretarial, light industrial, shipping, receiving, and general warehouse. Contract and temporary assignments range in length from less than one day to several weeks or months.

As of December 27, 2008, the Company had assigned approximately 410 specialty health care and 490 general support services personnel to its customers.

7

Table of Contents

Branch Offices

The Company’s organization consists of 35 branch offices located in the United States, Puerto Rico and Canada. The locations and services of each of the branch offices are set forth in the table below.

LOCATION | | NUMBER OF

OFFICES | | SERVICES

PROVIDED(1) |

USA | | | | |

| California | | 9 | | IT, C |

| Connecticut | | 2 | | E |

| Florida | | 1 | | C |

| Maryland | | 1 | | IT |

| Michigan | | 4 | | IT, E |

| Minnesota | | 1 | | IT |

| Missouri | | 1 | | IT |

| New Jersey | | 3 | | IT, E |

| New York | | 2 | | IT, E, C |

| Ohio | | 1 | | IT |

| Pennsylvania | | 1 | | C |

| Rhode Island | | 1 | | E |

| Texas | | 2 | | IT |

| Wisconsin | | 2 | | IT, E |

| | 31 | | |

| | | | |

PUERTO RICO | | 1 | | IT |

| | | | |

CANADA | | 3 | | IT, E |

(1) Services provided are abbreviated as follows:

IT - Information Technology

E - Engineering

C - Commercial

Branch offices are primarily located in markets that the Company believes have strong growth prospects for IT and Engineering services. The Company’s branches are operated in a decentralized, entrepreneurial manner with most branch offices operating as independent profit centers. The Company’s branch managers are given significant autonomy in the daily operations of their respective offices and, with respect to such offices, are responsible for overall guidance and supervision, budgeting and forecasting, sales and marketing strategies, pricing, hiring and training. Branch managers are paid on a performance-based compensation system designed to motivate the managers to maximize growth and profitability.

8

Table of Contents

The Company is domiciled in the United States and its segments operate in the United States and Canada. Revenues for the year ended December 27, 2008 and Goodwill and Intangible Assets by geographic area as of December 27, 2008 are as follows (in thousands):

| | Revenues | | Goodwill | | Intangible

Assets | |

United States | | $ | 188,672 | | $ | 6,538 | | $ | 276 | |

Canada | | 20,605 | | — | | — | |

| | $ | 209,277 | | $ | 6,538 | | $ | 276 | |

The Company believes that substantial portions of the buying decisions made by users of the Company’s services are made on a local or regional basis and that the Company’s branch offices most often compete with local and regional providers. Since the Company’s branch managers are in the best position to understand their local markets and customers often prefer local providers, the Company believes that a decentralized operating environment enhances operating performance and contributes to employee and customer satisfaction.

From its headquarters locations in New Jersey, the Company provides its branch offices with centralized administrative, marketing, finance, MIS, human resources and legal support. Centralized administrative functions minimize the administrative burdens on branch office managers and allow them to spend more time focusing on sales and marketing and practice development activities.

Our principal sales offices typically have one general manager, one sales manager, three to six sales people, several technical delivery or practice managers and several recruiters. The general managers report to regional vice presidents who are responsible for ensuring that performance goals are achieved. The Company’s regional vice presidents meet frequently to discuss “best practices” and ways to increase the Company’s cross selling of its professional services. The Company’s practice managers meet periodically to strategize, maintain continuity, and identify developmental needs and cross-selling opportunities.

Sales and Marketing

Sales and marketing efforts are conducted at the local and or regional level through the Company’s network of branch offices. The Company emphasizes long-term personal relationships with customers that are developed through regular assessment of customer requirements and proactive monitoring of personnel performance. The Company’s sales personnel make regular visits to existing and prospective customers. New customers are obtained through active sales programs and referrals. The Company encourages its employees to participate in national and regional trade associations, local chambers of commerce and other civic associations. The Company seeks to develop strategic partnering relationships with its customers by providing comprehensive solutions for all aspects of a customer’s information technology, engineering and other professional services needs. The Company concentrates on providing carefully screened professionals with the appropriate skills in a timely manner and at competitive prices. The Company regularly monitors the quality of the services provided by its personnel and obtains feedback from its customers as to their satisfaction with the services provided.

The Company has elevated the importance of working with and developing its partner alliances with technology firms. Partner programs are in place with firms RCM has identified as strategically important to the completeness of the service offering of the Company. Relations have been established with firms such as Microsoft, QAD, Mercury, IBM, Harland Financial and Oracle, among others. The partner programs may be managed either at a national level from RCM’s corporate offices or at a regional level from its branch offices.

9

Table of Contents

The Company’s larger representative customers include 3M, ADP, BancTec, Bristol Myers Squibb, Bruce Power, Entergy, FlightSafety International, Lilly del Caribe, Microsoft, MSC Industrial Supply, New York City Department of Education, Ontario Power Group, Schering Plough, United Technologies, U.S. Department of the Treasury, Wyeth and Wells Fargo. The Company serves Fortune 1000 companies and many middle market clients. The Company’s relationships with these customers are typically formed at the customers’ local or regional level and from time to time, when appropriate, at the corporate level for national accounts.

During 2008, United Technologies accounted for 11.1% of the Company’s revenues. No other customer accounted for 10% or more of the Company’s revenues. The Company’s five, ten and twenty largest customers accounted for approximately 27.1%, 33.5% and 44.0%, respectively, of the Company’s revenues for 2008.

Recruiting and Training

The Company devotes a significant amount of time and resources, primarily at the branch level, to locating, training and retaining its professional personnel. Full-time recruiters utilize the Company’s proprietary databases of available personnel, which are cross-indexed by competency and skill to match potential candidates with the specific project requirements of the customer. The qualified personnel in the databases are identified through numerous activities, including networking, referrals, trade shows, job fairs, schools, newspaper and trade journal advertising, Internet recruiting services and the Company’s website.

The Company believes that a significant element of the Company’s success in retaining qualified consultants and contract personnel is the Company’s use of consultant relationship managers and technical practice managers. Consultant relationship managers are qualified Company personnel dedicated to maintaining on-site contact with, and monitoring the satisfaction levels of, the Company’s consultants and contract personnel while they are on assignment. Practice managers are consulting managers responsible for the technical development and career development of the Company’s technical personnel within the defined practice areas. The Company provides technical training and skills development through vendor-sponsored courses, computer-based training tools and on the job mentoring programs.

Information Systems

The Company is continuing to invest in its current ERP installation. During 2004, the Company upgraded the hardware, operating system, and ERP software to accommodate its growing needs. The ERP system is hosted on Windows 2003 enterprise server operating system and on multi redundant Dell PowerEdge servers. The branch offices of the Company are networked to the corporate offices via private circuits, which enable the ERP application to be accessed securely at all operational locations. The ERP system supports Company-wide operations such as payroll, billing, human resources, project systems, accounts receivable, accounts payable, all general ledger accounting and consolidation reporting functionality.

The Company also has Autotime, an automated time and attendance system, which augments the ERP application by catering to the needs of its diverse business offerings and distributed workforce. The system is housed on a three-tiered architecture on DELL PowerEdge 1800 servers and is currently deployed in the Canadian division.

The Company has migrated its Recruiting (e.g. Candidate) and Sales (e.g. Requirement) Tracking to JobDiva, an application service provider (ASP) solution. The integrated solution allows RCM to track all client requirements on an enterprise level. The solution further permits RCM to search multiple sources (e.g. job boards) to identify and match suitable candidates for an opportunity or need. This solution allows RCM to build and maintain a proprietary database of prequalified candidates, thereby enhancing our ability to respond to client demands. Furthermore, the solution increases visibility internally to sales personnel and the management team to manage client priorities no longer on a localized but a national basis. Customized reporting and query capabilities allow RCM management to monitor personnel performance and client responsiveness. All data and information is accessible via the web.

10

Table of Contents

RCM has engaged in three major strategic initiatives to improve upon its ability to secure data, deliver services and improve on its communication infrastructure.

RCM deployed a new mail architecture based on the Microsoft Exchange 2007 platform. The system is comprised of redundant mail routing servers and clustered mailbox servers attached to a Storage Area Network (SAN) This new messaging platform has the current capacity of six Terabytes (TB), with the capability of scaling to 18 Terabytes (TB). In addition to mail storage being sized for VOIP integration, web access to the mail server is only allowed via secure HTTPs protocol.

RCM has upgraded its perimeter network and WAN architecture to a secure centralized model on Private Network Transport (PNT) AT&T circuits, utilizing Multiple Packet Label Switching (MPLS) transport protocol. The hub datacenter at its operational headquarters has been outfitted with redundant fiber circuits from AT&T and Optimum Lightpath utilizing Border gateway Protocol (BGP) for automatic failover. In addition, redundant firewalls, routers and switching architecture should protect against hardware failure.

The move to service oriented architecture facilitated the implementation of the Cisco Voice over IP (VOIP) solution which is currently deployed throughout RCM’s offices. This enterprise solution, based on Cisco Call Manager, Unity voicemail, Mobility Manager, Meeting Place, Fax Server and Video Presence will, when completed, unify all RCM offices in the US and Canada. Summary of benefits include four digit extension calls between RCM offices, email and voicemail unification, soft and mobile phone integration, video and web conferencing, central and email enabled faxing.

The above initiatives have contributed to improved communication within RCM and also to its clients.

Other Information

Safeguards - - Business, Disaster and Contingency Planning

RCM has implemented a number of safeguards to protect the Company from various system-related risks including a warm data center disaster recovery site, redundant telecommunications and server systems architecture, multi-tiered server and desktop backup infrastructure, and data center physical and environmental controls. In addition, RCM has developed disaster recovery / business continuity procedures for all offices.

Given the significant amount of data generated in the Company’s key processes including recruiting, sales, payroll and customer invoicing, RCM has established redundant procedures, functioning on a daily basis, within the Company’s primary data center. This redundancy should mitigate the risks related to hardware, application and data loss by utilizing the concept of live differential backups of servers and desktops to Storage Area (SAN) devices on its backup LAN, culminating in offsite tape storage at an independent facility. Besides the local tape backup rotation of branch office systems, data is also replicated to SAN devices in Parsippany to achieve business continuity. Controls within the data center environment ensure that all systems are proactively monitored and data is properly archived.

Additionally, RCM has contracted and brokered strategic relationships with third-party vendors to meet its recovery objectives in the event of a system disruption. For example, comprehensive service level agreements provided by AT&T and Cisco for RCM’s data circuits and network devices, guarantee minimal outages as well as network redundancy and scalability. The Disaster Recovery site, located at the corporate office in Pennsauken, NJ, provides WAN, ERP and messaging services should the primary data center facility at Parsippany, NJ, become inoperable.

11

Table of Contents

Safeguards - - Business, Disaster and Contingency Planning (Continued)

The Company’s ability to protect its data assets against damage from fire, power loss, telecommunications failures, and facility violations is critical. The Company uses Postini mail management service to filter all emails destined for the RCMT domain before being delivered to the corporate mail servers. Websense, web filtering has also been deployed to safeguard the enterprise from malicious internet content. The deployment of virus, spam, and patch management controls extends from the perimeter network to all desktops and is centrally monitored and managed. In addition to the virus and malware controls, an Intrusion Protection System (IPS) monitors and alerts on changes in network traffic patterns as well as known hostile signatures.

The Company maintains a disaster recovery plan that outlines the recovery organization structure, roles and procedures, including site addendum disaster plans for all of its key operating offices. Corporate IT personnel regulate the maintenance and integrity of backed-up data throughout the Company.

Competition

The market for IT and engineering services is highly competitive and is subject to rapid change. As the market demand has shifted, many software companies have adopted tactics to pursue services and consulting offerings making them direct competitors when in the past they may have been alliance partners. Primary competitors include participants from a variety of market segments, including publicly and privately held firms, systems consulting and implementation firms, application software firms, service groups of computer equipment companies, facilities management companies, general management consulting firms and staffing companies. In addition, the Company competes with its clients’ internal resources, particularly where these resources represent a fixed cost to the client. Such competition may impose additional pricing pressures on the Company.

The Company believes its principal competitive advantages in the IT and engineering services market include: strong relationships with existing clients, a long-term track record with over 1,000 clients, a broad range of services, technical expertise, knowledge and experience in multiple industry sectors, quality and flexibility of service, responsiveness to client needs and speed in delivering IT solutions.

Additionally, the Company competes for suitable acquisition candidates based on its differentiated acquisition model, its entrepreneurial and decentralized operating philosophy, and its strong corporate-level support and resources.

Seasonality

The Company’s operating results can be affected by the seasonal fluctuations in corporate IT and engineering expenditures. Generally, expenditures are lowest during the first quarter of the year when clients are finalizing their IT and engineering budgets. In addition, quarterly results may fluctuate depending on, among other things, the number of billing days in a quarter and the seasonality of clients’ businesses. The business is also affected by the timing of holidays and seasonal vacation patterns, generally resulting in lower revenues and gross profit in the fourth quarter of each year. Extreme weather conditions may also affect demand in the first and fourth quarters of the year as certain clients’ facilities are located in geographic areas subject to closure or reduced hours due to inclement weather. In addition, the Company generally experiences an increase in its cost of sales and a corresponding decrease in gross profit and gross margin percentage in the first and second fiscal quarters of each year as a result of resetting certain state and federal employment tax rates and related salary limitations.

12

Table of Contents

Employees

As of December 27, 2008, the Company employed an administrative staff of approximately 250 people, including certified IT specialists and licensed engineers who, from time to time, participate in IT and engineering design projects undertaken by the Company. As of December 27, 2008, there were approximately 780 information technology and 450 engineering and technical employees and consultants assigned by the Company to work on client projects for various periods. As of December 27, 2008, there were approximately 410 specialty health care and 490 general support services employees and consultants. None of the Company’s employees is represented by a collective bargaining agreement. The Company considers its relationship with its employees to be good.

Access to Company Information

RCM electronically files its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports with the Securities and Exchange Commission (“SEC”). The public may read and copy any of the reports that are filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxies, information statements, and other information regarding issuers that file electronically.

RCM makes available on its website or by responding free of charge to requests addressed to the Company’s Corporate Secretary, its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed by the Company with the SEC pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended. These reports are available as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission. The Company’s website is http://www.rcmt.com. The information contained on the Company’s website, or on other websites linked to the Company’s website, is not part of this document. Reference herein to the Company’s website is an inactive text reference only.

RCM has adopted a Code of Conduct applicable to all of its directors, officers and employees. In addition, the Company has adopted a Code of Ethics, within the meaning of applicable SEC rules, applicable to its Chief Executive Officer, Chief Financial Officer and Controller. Both the Code of Conduct and Code of Ethics are available, free of charge, by sending a written request to the Company’s Corporate Secretary. If the Company makes any amendments to either of these Codes (other than technical, administrative, or other non-substantive amendments), or waive (explicitly or implicitly) any provision of the Code of Ethics to the benefit of our Chief Executive Officer, Chief Financial Officer or Controller, it intends to disclose the nature of the amendment or waiver, its effective date and to whom it applies in the investor relations portion of the website, or in a report on Form 8-K filed with the SEC.

13

Table of Contents

ITEM 1A. RISK FACTORS

The Company’s business involves a number of risks, some of which are beyond its control. The risk and uncertainties described below are not the only ones the Company faces. Management believes that the most significant of these risks and uncertainties are as follows:

Economic Trends

The recent global economic crisis has caused, among other things, a general tightening in the credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy, and extreme volatility in credit, equity and fixed income markets. Any or all of these developments could negatively affect our business, operating results or financial condition in a number of ways. For example, current or potential customers may be unable to fund capital spending programs, new product launches or other similar activities on which they might otherwise use us, and therefore delay, decrease or cancel purchases or our services or not pay us or to delay paying us for previously purchased services. In addition, financial institution failures may cause us to incur increased expenses or make it more difficult either to utilize our existing debt capacity or otherwise obtain financing for our operations, investing activities (including the financing of any future acquisitions), or financing activities.

Government Regulations

Staffing firms and employment service providers are generally subject to one or more of the following types of government regulation: (1) regulation of the employer/employee relationship between a firm and its employees, including tax withholding or reporting, social security or retirement, benefits, workplace compliance, wage and hour, anti-discrimination, immigration and workers’ compensation; (2) registration, licensing, record keeping and reporting requirements; and (3) federal contractor compliance. Failure to comply with these regulations could result in the Company incurring penalties and other liabilities, monetary and otherwise.

Highly Competitive Business

The staffing services and outsourcing markets are highly competitive and have limited barriers to entry. RCM competes in global, national, regional, and local markets with numerous temporary staffing and permanent placement companies. Price competition in the staffing industry is significant and pricing pressures from competitors and customers are increasing. In addition, there is increasing pressure on companies to outsource certain areas of their business to low cost offshore outsourcing firms. RCM expects that the level of competition will remain high in the future, which could limit RCM’s ability to maintain or increase its market share or profitability.

Events Affecting our Significant Customers

As disclosed in Item 1, “Business,” our five, ten and twenty largest customers accounted for approximately 27.1%, 33.5% and 44.0%, respectively, of our revenues for 2008. Some of these customers may be affected by the current state of the economy or developments in the credit markets. For example, United Technologies, which accounted for 11.1% of the Company’s revenues in 2008, announced on March 10, 2009 that it had reduced its 2009 profit forecast 13 % and will eliminate 11,600 jobs, or 5% of its global work force. In addition, our customers may engage in mergers or similar transactions; for example, Wyeth recently announced that it expects to be acquired by Pfizer, and Schering Plough, recently announced that it expects to be acquired by Merck. Should any of our significant customers experience a downturn in its business that weakens its financial condition or merge with another company or otherwise cease independent operation, it is possible that the business that the customer does with us would be reduced or eliminated, which could adversely affect our financial results.

Additionally, the Company estimates to its best ability that the automobile and financial services industries each represented approximately 3.7% or 7.5% combined of the Company’s total revenues in 2008. The automobile and financial services industries are two industries that have been severely impacted by recent national and global economic malaise.

14

Table of Contents

Dependence Upon Personnel

The Company’s operations depend on the continued efforts of its officers and other executive management. The loss of key officers and members of executive management may cause a significant disruption to the Company’s business. RCM also depends on the performance and productivity of its local managers and field personnel. The Company’s ability to attract and retain new business is significantly affected by local relationships and the quality of service rendered. The loss of key managers and field personnel may also jeopardize existing client relationships with businesses that continue to use our services based upon past relationships with local managers and field personnel.

Revolving Credit Facility and Liquidity

If we are unable to borrow under our Revolving Credit Facility, it may adversely affect our liquidity, results of operations and financial condition. Our liquidity depends on our ability to generate sufficient cash flows from our operations and, from time to time, borrowings under our Revolving Credit Facility with our agent lender Citizens Bank of Pennsylvania. The Company believes that Citizens Bank is liquid and is not aware of any current risk that they will become illiquid. At December 27, 2008, we had outstanding borrowings under the Revolving Credit Facility of $4.9 million, and letters of credit outstanding for $1.6 million.

The Revolving Credit Facility contains various financial and non-financial covenants. At December 27, 2008, we were in compliance with the covenants and other provisions of the Credit Facility. Any failure to be in compliance could have a material adverse effect on our liquidity, results of operations and financial condition.

Goodwill and Intangible Impairments May Have an Adverse Effect on our Financial Statements

As of December 27, 2008, we had $6.5 million of goodwill and $0.3 million intangible assets on our balance sheet, which represents 8.6% of our total assets. Goodwill represents the premium paid over the fair value of the net tangible and intangible assets we have acquired in business combinations. SFAS No. 142 “Goodwill and Other Intangible Assets” (“SFAS 142”) requires the Company to perform a goodwill and intangible asset impairment test on at least an annual basis. Application of the goodwill and intangible asset impairment test requires significant judgments including estimation of future cash flows, which is dependent on internal forecasts, estimation of the long-term rate of growth for the businesses, the useful life over which cash flows will occur and determination of our weighted average cost of capital. Changes in these estimates and assumptions could materially affect the determination of fair value and/or conclusions on goodwill and intangible asset impairment for each reporting unit. The Company conducts its annual goodwill and intangible asset impairment test as of the last day of the Company’s fiscal November each year, or more frequently if indicators of impairment exist. We periodically analyze whether any such indicators of impairment exist. A significant amount of judgment is involved in determining if an indicator of impairment has occurred. Such indicators may include a sustained, significant decline in our share price and market capitalization, a decline in our expected future cash flows, a significant adverse change in legal factors or in the business climate, unanticipated competition and/or slower than expected growth rates, among others. The Company compares the fair value of each of its reporting units to their respective carrying values, including related goodwill and intangible assets. Future changes in our industries could impact the results of future annual impairment tests. There can be no assurance that future tests of goodwill and intangible asset impairment will not result in impairment charges. If we are required to write down goodwill or intangible assets, the related charge could materially reduce reported net income or result in a net loss for the period in which the write down occurs.

Workers’ Compensation and Employee Medical Insurance

The Company self-insures a portion of the exposure for losses related to workers’ compensation and employees’ medical insurance. The Company has established reserves for workers’ compensation and employee medical insurance claims based on historical loss statistics and periodic independent actuarial valuations. Significant differences in actual experience or significant changes in assumptions may materially affect the Company’s future financial results.

15

Table of Contents

Improper Activities of Our Temporary Professionals Could Result in Damage to Our Business Reputation, Discontinuation of Our Client Relationships and Exposure to Liability

The Company may be subject to claims by our clients related to errors and omissions, misuse of proprietary information, discrimination and harassment, theft and other criminal activity, malpractice, and other claims stemming from the improper activities or alleged activities of our temporary professionals. There can be no assurance that our current liability insurance coverage will be adequate or will continue to be available in sufficient amounts to cover damages or other costs associated with such claims.

Claims raised by clients stemming from the improper actions of our temporary professionals, even if without merit, could cause us to incur significant expense associated with the costs or damages related to such claims. Furthermore, such claims by clients could damage our business reputation and result in the discontinuation of client relationships.

Our Acquisitions May Not Succeed

The Company reviews prospective acquisitions as an element of its growth strategy. The failure of any acquisition to meet the Company’s expectations, whether due to a failure to successfully integrate any future acquisition or otherwise, may result in damage to the Company’s financial performance and/or divert management’s attention from its core operations or could negatively affect the Company’s ability to meet the needs of its customers promptly.

Foreign Currency Fluctuations and Changes in Exchange Rates

The Company is exposed to risks associated with foreign currency fluctuations and changes in exchange rates. RCM’s exposure to foreign currency fluctuations relates to operations in Canada, principally conducted through its Canadian subsidiary. Exchange rate fluctuations affect the U.S. dollar value of reported earnings derived from the Canadian operations as well as the carrying value of our investment in the net assets related to these operations. The Company does not engage in hedging activities with respect to foreign operations.

Trademarks

Management believes the RCM Technologies, Inc. name is extremely valuable and important to its business. The Company endeavors to protect its intellectual property rights and maintain certain trademarks, trade names, service marks and other intellectual property rights, including The Source of Smart Solutions®. The Company is not currently aware of any infringing uses or other conditions that would be reasonably likely to materially and adversely affect our use of our proprietary rights.

Data Center Capacity and Telecommunication Links

Uninterruptible Power Supply (UPS), card key access, fire suppression, and environmental control systems protect RCM’s datacenter. All systems are monitored on a 24/7 basis with alerting capabilities via voice or email. The telecommunications architecture at RCM utilizes managed private circuits from AT&T, which encompasses provisioning redundancy and diversity.

RCM’s ability to protect its data center against damage from fire, power loss, telecommunications failure and other disasters is critical to business operations. In order to provide many of its services, RCM must be able to store, retrieve, process and manage large databases and periodically expand and upgrade its capabilities. Any damage to the Company’s data centers or any failure of the Company’s telecommunication links that interrupts its operations or results in an inadvertent loss of data could adversely affect RCM’s ability to meet its customers’ needs and their confidence in utilizing RCM for future services.

RCM’s ability to protect its data, provide services and safeguard its installations, as it relates to the IT infrastructure, is in part dependent on several outside vendors with whom the Company maintains service level agreements.

16

Table of Contents

Accrued Bonuses

The Company pays bonuses to certain executive management, field management and corporate employees based on, or after giving consideration to, a variety of financial performance measures. Executive management, field management, and certain corporate employees’ bonuses are accrued throughout the year for payment during the first quarter of the following year, based in part upon actual annual results as compared to annual budgets. Variances in actual results versus budgeted amounts can have a significant impact on the calculations and therefore the estimates of the required accruals. Accordingly, the actual earned bonuses may be materially different from the estimates used to determine the quarterly accruals.

Litigation

The Company is currently, and may in the future become, involved in legal proceedings and claims arising from time to time in the course of its business, including the litigation described in Note 15 (Contingencies) to the consolidated financial statements. An adverse outcome to the referenced litigation or other cases arising in the future could have an adverse impact on the consolidated financial position and consolidated results of operations of the Company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

The Company provides specialty professional consulting services, principally performed at various client locations, through 35 administrative and sales offices located in the United States, Puerto Rico, and Canada. The majority of the Company’s offices typically consist of 1,000 to 6,000 square feet and are leased by the Company for terms of one to three years. Offices in larger or smaller markets may vary in size from the typical office. The Company does not expect that it will be difficult to maintain or find suitable lease space at reasonable rates in its markets or in areas where the Company contemplates expansion.

The Company’s executive office is located at 2500 McClellan Avenue, Suite 350, Pennsauken, New Jersey 08109-4613. These premises consist of approximately 10,200 square feet and are leased at a rate of $13.89 per square foot per annum for a term ending on January 31, 2011.

The Company’s operational office is located at 20 Waterview Boulevard, 4th Floor, Parsippany, NJ 07054-1271. These premises consist of approximately 28,000 square feet and are leased at a rate of $29.00 per square foot per annum for a term ending on June 30, 2012.

ITEM 3. LEGAL PROCEEDINGS

See discussion of Legal Proceedings in Note 15 (Contingencies) to the consolidated financial statements included in Item 8 of this Report.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

There were no matters submitted to a vote of security holders during the quarter ended December 27, 2008.

17

Table of Contents

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Shares of the Company’s common stock are traded on The NASDAQ Global Market under the Symbol “RCMT.” The following table sets forth approximate high and low sales prices for the two years in the period ended December 27, 2008 as reported by The NASDAQ Global Market:

| | Common Stock | |

| | High | | Low | |

Fiscal 2007 | | | | | | | |

First Quarter | | $ | 7.90 | | $ | 5.75 | |

Second Quarter | | 8.80 | | 5.86 | |

Third Quarter | | 10.30 | | 6.47 | |

Fourth Quarter | | $ | 8.36 | | $ | 4.93 | |

| | | | | |

Fiscal 2008 | | | | | |

First Quarter | | $ | 6.51 | | $ | 3.82 | |

Second Quarter | | 4.81 | | 3.75 | |

Third Quarter | | 4.57 | | 2.00 | |

Fourth Quarter | | $ | 2.24 | | $ | 0.77 | |

Holders

As of February 12, 2009, the approximate number of holders of record of the Company’s Common Stock was 513. Based upon the requests for proxy information in connection with the Company’s 2008 Annual Meeting of Stockholders, the Company believes the number of beneficial owners of its Common Stock is approximately 2,512.

Dividends

The Company has never declared or paid a cash dividend on the Common Stock and does not anticipate paying any cash dividends in the foreseeable future. It is the current policy of the Company’s Board of Directors to retain all earnings to finance the development and expansion of the Company’s business. Any future payment of dividends will be at the discretion of the Board of Directors and will depend upon, among other things, the Company’s earnings, financial condition, capital requirements, level of indebtedness, contractual restrictions, and other factors that the Board of Directors deems relevant. The Revolving Credit Facility (as defined in Item 7 hereof) prohibits the payment of dividends or distributions on account of the Company’s capital stock without the prior consent of the majority of the Company’s lenders.

18

Table of Contents

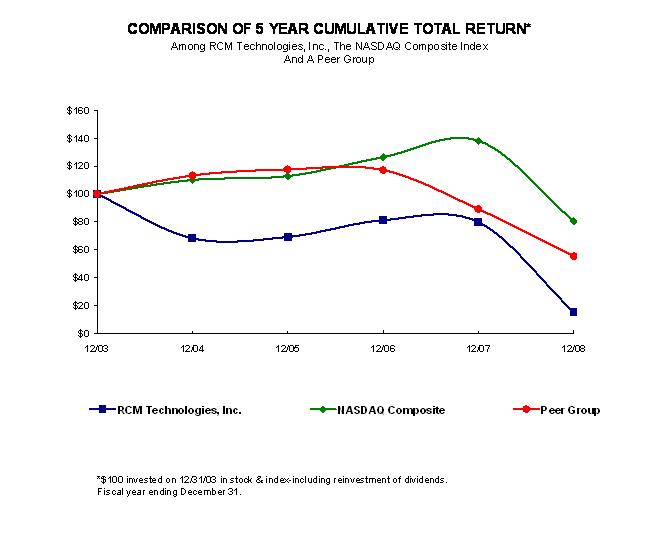

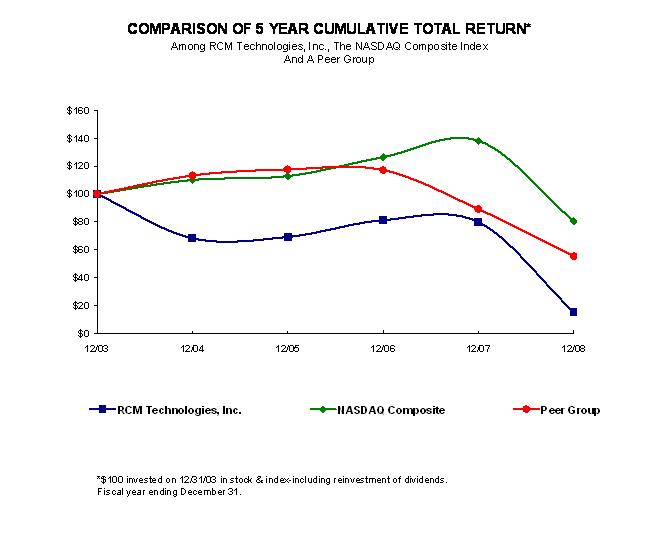

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURNS

The graph below is presented in accordance with SEC requirements. You should not draw any conclusions from the data in the graph, because past results do not necessarily predict future stock price performance. The graph does not represent our forecast of future stock price performance.

The following graph compares the cumulative 5-year total return provided shareholders on RCM Technologies, Inc.’s common stock relative to the cumulative total returns of the NASDAQ Composite index, and a customized peer group of four companies that includes: Butler International, Kelly Services Inc, MPS Group Inc and Spherion Corp. Management believes this peer group conducts its business operations in the same industry group as RCM Technologies, Inc. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock, in the peer group, and the index on December 31, 2003 and its relative performance is tracked through December 31, 2008.

Total Return Analysis | | 12/03 | | 12/04 | | 12/05 | | 12/06 | | 12/07 | | 12/08 | |

RCM Technologies, Inc. | | $ | 100.00 | | $ | 68.25 | | $ | 69.19 | | $ | 81.26 | | $ | 79.77 | | $ | 15.06 | |

NASDAQ Composite | | $ | 100.00 | | $ | 110.08 | | $ | 112.88 | | $ | 126.51 | | $ | 138.13 | | $ | 80.47 | |

Peer Group | | $ | 100.00 | | $ | 113.31 | | $ | 117.74 | | $ | 117.17 | | $ | 89.17 | | $ | 55.39 | |

19

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA

The selected historical consolidated financial data was derived from the Company’s Consolidated Financial Statements. The selected historical consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements of the Company, and notes thereto, included elsewhere herein. (In thousands, except earnings per share data).

| | Years Ended | |

| | December 27, | | December 29, | | December 30, | | December 31, | | January 1, | |

| | 2008 | | 2007 | | 2006 | | 2005 | | 2005(2) | |

Income Statement | | | | | | | | | | | |

| | | | | | | | | | | |

Revenues | | $ | 209,277 | | $ | 214,209 | | $ | 201,920 | | $ | 180,618 | | $ | 169,277 | |

Gross profit | | 53,975 | | 52,976 | | 50,508 | | 42,683 | | 40,974 | |

(Loss) income before charges listed below | | (1,671 | ) | 7,500 | | 7,622 | | 3,593 | | 4,412 | |

Amortization, net of tax | | (460 | ) | (320 | ) | (310 | ) | (57 | ) | (41 | ) |

Goodwill and intangible asset impairment, net of tax | | (37,574 | ) | — | | — | | — | | (2,164 | ) |

Stock based compensation, net of tax | | (100 | ) | (411 | ) | (956 | ) | — | | — | |

Net (loss) income | | $ | (39,805 | ) | $ | 6,769 | | $ | 6,356 | | $ | 3,536 | | $ | 2,207 | |

Earnings Per Share (1) | | | | | | | | | | | |

Net (loss) income: | | | | | | | | | | | |

Basic | | $ | (3.15 | ) | $ | .57 | | $ | .54 | | $ | .31 | | $ | .19 | |

Diluted | | $ | (3.15 | ) | $ | .54 | | $ | .53 | | $ | .30 | | $ | .19 | |

| | | | | | | | | | | |

| | December 27, | | December 29, | | December 30, | | December 31, | | January 1, | |

| | 2008 | | 2007 | | 2006 | | 2005 | | 2005(2) | |

Balance Sheet | | | | | | | | | | | |

| | | | | | | | | | | |

Working capital | | $ | 42,687 | | $ | 43,541 | | $ | 38,844 | | $ | 33,032 | | $ | 29,545 | |

Total assets | | 78,841 | | 109,714 | | 100,040 | | 106,773 | | 99,388 | |

Long term liabilities | | — | | — | | — | | — | | — | |

Total liabilities | | 23,490 | | 17,666 | | 16,647 | | 31,084 | | 29,443 | |

Stockholders’ equity | | $ | 55,351 | | $ | 92,048 | | $ | 83,393 | | $ | 75,689 | | $ | 69,945 | |

| | | | | | | | | | | |

| |

(1) Shares used in computing earnings per share: | | | | | | | | | | | |

| | | | | | | | | | | |

Basic | | 12,647,127 | | 11,970,042 | | 11,773,601 | | 11,456,757 | | 11,325,626 | |

Diluted | | 12,647,127 | | 12,484,639 | | 12,034,665 | | 11,731,591 | | 11,679,812 | |

(2) Year ended January 1, 2005 had fifty-three weeks and all other years had fifty-two weeks.

20

Table of Contents

ITEM 7. | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

RCM participates in a market that is cyclical in nature and extremely sensitive to economic changes. As a result, the impact of economic changes on revenues and operations can be substantial, resulting in significant volatility in the Company’s financial performance.

After pro forma adjustments to remove the impact of two acquisitions in its Information Technology segment completed in 2008, RCM experienced a significant decline in its 2008 revenues and gross profit as compared to 2007, particularly in its Information Technology and Engineering segments. RCM believes the decline in its Information Technology pro forma revenues was principally due to a deterioration of overall economic conditions in its geographic markets and industry verticals served in 2008. The principal reason for the decline in 2008 Engineering revenues as compared to 2007 was due to the loss of a major customer.

Over the years, RCM has developed and assembled an attractive portfolio of capabilities, established a proven record of performance and credibility and built an efficient pricing structure. The Company is committed to optimizing its business model as a single-source premier provider of business and technology solutions with a strong vertical focus offering an integrated suite of services through a global delivery platform.

The Company believes that most companies recognize the importance of advanced technologies and business processes to compete in today’s business climate. However, the process of designing, developing and implementing business and technology solutions is becoming increasingly complex. The Company believes that many businesses today are focused on return on investment analysis in prioritizing their initiatives. This has an impact on spending by current and prospective clients for many emerging new solutions.

Nonetheless, the Company continues to believe that businesses must implement more advanced IT and engineering solutions to upgrade their systems, applications and processes so that they can maximize their productivity and optimize their performance in order to maintain a competitive advantage. Although working under budgetary, personnel and expertise constraints, companies are driven to support increasingly complex systems, applications, and processes of significant strategic value. This has given rise to a demand for outsourcing. The Company believes that its current and prospective clients are continuing to evaluate the potential for outsourcing business critical systems, applications, and processes.

The Company provides project management and consulting services, which are billed based on either agreed-upon fixed fees or hourly rates, or a combination of both. The billing rates and profit margins for project management and solutions services are higher than those for professional consulting services. The Company generally endeavors to expand its sales of higher margin solutions and project management services. The Company also realizes revenues from client engagements that range from the placement of contract and temporary technical consultants to project assignments that entail the delivery of end-to-end solutions. These services are primarily provided to the client at hourly rates that are established for each of the Company’s consultants based upon their skill level, experience and the type of work performed.

The majority of the Company’s services are provided under purchase orders. Contracts are utilized on certain of the more complex assignments where the engagements are for longer terms or where precise documentation on the nature and scope of the assignment is necessary. Although contracts normally relate to longer-term and more complex engagements, they do not obligate the customer to purchase a minimum level of services and are generally terminable by the customer on 60 to 90 days’ notice. The Company, from time to time, enters into contracts requiring the completion of specific deliverables. Typically these contracts are for less than one year. The Company recognizes revenue on these deliverables at the time the client accepts and approves the deliverables.

21

Table of Contents

Costs of services consist primarily of salaries and compensation-related expenses for billable consultants, including payroll taxes, employee benefits, and insurance. Selling, general and administrative expenses consist primarily of salaries and benefits of personnel responsible for business development, recruiting, operating activities, and training, and include corporate overhead expenses. Corporate overhead expenses relate to salaries and benefits of personnel responsible for corporate activities, including the Company’s corporate marketing, administrative and reporting responsibilities and acquisition program. The Company records these expenses when incurred. Depreciation relates primarily to the fixed assets of the Company. Amortization relates to the allocation of the purchase price of an acquisition, which has been assigned to covenants not to compete, and customer lists. Acquisitions have been accounted for under Financial Accounting Standards Board (“FASB”) Statement of Financial Account Standards (“SFAS”) No. 141, “Business Combinations,” and have created goodwill.

Critical Accounting Policies