UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED JANUARY 31, 2008

COMMISSION FILE NUMBER 0 – 13442

MENTOR GRAPHICS CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Oregon | | 93-0786033 |

| |

| (State or other jurisdiction of | | (IRS Employer |

| |

| incorporation or organization) | | Identification No.) |

| |

| 8005 SW Boeckman Road | | 97070-7777 |

| |

| Wilsonville, Oregon | | (Zip Code) |

| |

| (Address of principal executive offices) | | |

Registrant’s telephone number, including area code: (503) 685-7000

Securities registered pursuant to Section 12(b) of the Act: Common Stock, without par value

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ X ] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or in any amendment to this Form 10-K. [X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large Accelerated Filer [ X ] | | Accelerated Filer [ ] | | Non-accelerated filer [ ] | | Smaller reporting company [ ] |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ X ]

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $1,067,518,422 on July 31, 2007 based upon the last price of the Common Stock on that date reported in the NASDAQ Stock Market. On March 17, 2008, there were 90,752,315 shares of the Registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

| | |

| Document | | Part of Form 10-K into which incorporated |

| |

| Portions of the 2008 Proxy Statement | | Part III |

Part I

ITEM 1. BUSINESS

This Form 10-K contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those set forth under Part I, Item 1A. “Risk Factors.”

GENERAL

Mentor Graphics Corporation is a technology leader in electronic design automation (EDA). We provide software and hardware design solutions that enable our customers to develop better electronic products faster and more cost effectively. We market our products and services worldwide, primarily to large companies in the military/aerospace, communications, computer, consumer electronics, semiconductor, networking, multimedia and transportation industries.

The electronic systems that our customers create with our products include printed circuit boards (PCBs), integrated circuits (ICs), field programmable gate arrays (FPGAs), embedded software solutions and wire harness systems. Our products are used in the design and development of a diverse set of electronic products, including automotive electronics, video game consoles, digital cameras, cellular telephones, computer network hubs and routers, personal computers and products enabled with the Bluetooth short-range wireless radio and networking technology. As silicon manufacturing process geometries shrink, our customers are creating entire electronic systems on a single IC. These are called system-on-chip (SoC) devices. This trend becomes apparent to the everyday consumer as consumer electronics become smaller and more sophisticated. This trend also poses significant opportunities and challenges for the EDA industry.

We were incorporated in Oregon in 1981 and our common stock is traded on The NASDAQ Stock Market under the symbol “MENT.” Our executive offices are located at 8005 S.W. Boeckman Road, Wilsonville, Oregon 97070-7777. The telephone number at that address is (503) 685-7000. Our website address iswww.mentor.com. Electronic copies of our reports filed with the Securities and Exchange Commission (SEC) are available through our website as soon as reasonably practicable after the reports are filed with the SEC. Our Director Code of Ethics, Standards of Business Conduct, Guidelines for Corporate Disclosure and our Audit, Compensation and Nominating Committee Charters are also posted on our website.

PRODUCTS

Our products enable engineers to overcome increasingly complex electronic design challenges by improving the accuracy of complex designs and shrinking product time-to-market schedules. When designing electronic hardware, a design engineer’s process is typically as follows:

| | • | | Electrical engineers begin the design process by describing and specifying the architectural, behavioral, functional and structural characteristics of an IC, PCB or electronic system and components. |

| | • | | Engineers then create the component designs according to stated specifications. |

| | • | | Engineers verify the design to reveal defects, and then modify the component’s design until it is correct and meets the previously stated specifications. |

| | • | | Engineers assemble and test the assembled components and the entire system. |

| | • | | The system then goes to production. During the manufacturing process, engineers work to identify defective parts and improve yields. “Yields” refers to the percentage of working ICs on a silicon wafer or PCBs working compared to the total of those manufactured. |

Scalable Verification

Our Scalable Verification™ tools allow engineers to verify that their complex IC designs actually function as intended. Functional errors are a leading cause of design revisions that slow down an electronic system’s time-to-market and reduce its profitability. We offer the following digital simulation products:

| | • | | ModelSim® is a leading hardware description language (HDL) mixed-language digital simulator that helps hardware designers verify that their IC design functions correctly before the design is completed, and is used for application-specific integrated circuits (ASICs), SoCs, FPGAs and other IC design verification, as well as verification of entire systems. |

| | • | | The Questa™ functional verification platform includes support for HDL, simulation and new verification methodologies including assertions and formal methods. Questa is used for more extended verification of systems and ICs including ASICs, SoCs and FPGAs. |

Along with digital simulation products, we offer analog/mixed-signal simulators. Complex electronic designs often require different types of circuits, such as analog and digital, to work together. An example is a CD or DVD player which uses a digital input and produces an analog output of sounds or images. Our analog/mixed signal simulation offerings include the Eldo®, ADVance MS™, and ADiT tools.

Our SoC verification products include the Seamless® hardware/software co-verification product family. Our tools allow designers to verify software early in the system design process instead of waiting until the hardware design has been completed, verified and manufactured into a prototype.

We provide emulation hardware systems, such as our Veloce® product, which allow users to create functional and logical equivalent models of actual electronic circuits to verify the function and timing of those circuits. Hardware emulation systems typically allow faster verification of complex electronic circuits when compared to software simulation tools. Our Veloce® product allows customers to verify complex designs containing up to 128 million logic gates. Logic gates are switches that produce a single logic output from one or more logic inputs.

IC Design to Silicon

Shrinking geometries and increasing design size in the nanometer era have enabled ever increasing functionality on a single IC. A nanometer (nm) is one billionth of a meter; a human hair is about 100,000 nanometers wide. Nanometer process geometries create design challenges in silicon which were not present at larger geometries. As a result, nanometer process technologies, used to deliver the vast majority of today’s ICs, are the product of careful design and precision manufacturing. The increasing complexity of designs has changed how those responsible for the physical layout of an IC design deliver their design to the IC manufacturer. In older technologies, this handoff was a relatively simple layout database check when the design went to manufacturing. Now it is a multi-step process where the layout database is modified so the design can be manufactured with cost-effective yields of ICs.

To address these challenges, we offer our Calibre® tool family, which is the standard for many of the world’s largest integrated device manufacturers (IDMs) and foundries:

| | • | | The Calibre physical verification tool suite, Calibre DRC™ and Calibre LVS™, helps ensure that IC physical designs incorporate the customer’s intended functionality while conforming to stringent foundry manufacturing rules at foundries where ICs are manufactured. |

| | • | | The Calibre xRC™ product, a transistor-level extraction and device modeling tool, computes the values of detailed circuit parameters including interconnect resistances, and parasitic capacitances and inductances to enable customers to more accurately simulate the performance of a design. |

| | • | | Calibre tools allow engineers to model, enhance and verify layouts using lithography resolution enhancement techniques, including optical and process correction, phase-shift mask, scattering bars and off-axis illumination. Use of these tools can substantially increase the yields of ICs. |

| | • | | In the DFM area, the Calibre LFD™ product can help customers produce higher yields at small geometries at 65nm and below where variations in manufacturing can cause yield reductions. |

| | • | | The Calibre YieldAnalyzer™ product provides manufacturing teams with a method of communicating information about manufacturing yield limiters to design teams to help them identify targeted improvements that can increase yield. |

| | • | | The Calibre YieldEnhancer™ product identifies and communicates layout enhancement opportunities to the user’s place-and-route tools intended to improve the design for increased yield. |

We also offer the Olympus-SoC™ place and route product targeted at customers creating ICs using geometries of 65nm and below. The Olympus-SoC™ solution addresses IC design challenges such as manufacturing variability, design size and complexity and low power requirements. The Olympus-SoC™ place and route solution addresses these issues with technology such as DRC-, DFM- and power-aware routing, lithography-friendly layout and multi-corner multi-mode timing analysis, which concurrently optimizes for timing, power and signal integrity across multiple process corners and design modes.

Integrated System Design

As ICs grow in complexity and function and PCB fabrication technology advances to include embedded components and high-density interconnect layers within the PCB, the design of PCBs is reaching new levels of complexity. This complexity can be a source of design bottlenecks.

Our PCB-FPGA Systems Design software products support the PCB design process from schematic entry, where the electronic circuit is defined by engineers, through physical layout of the PCB, to providing digital output data for manufacturing, assembly and test. Most types of designs, including analog, RF and high-speed digital and mixed signal, are supported by our PCB design tools. We have specific integrated software tool flows for process management, component library creation, simulation and verification of the PCB design:

| | • | | The Board Station® and Expedition™ series are the two main PCB design families of products used typically by large enterprise customers. |

| | • | | We also offer a “ready to use” PADS® product line which provides a lower cost Windows-based PCB design and layout solution. |

| | • | | Our I/O Designer™ product integrates FPGA input/output planning with our PCB design tools resulting in improved routing in large complex designs. |

| | • | | XtremePCB™ offers a method for simultaneous design where multiple designers can edit the same design at the same time and view each others’ edits in real-time. |

| | • | | XtremeAR™ is a PCB routing product that improves the routing time of large designs. This product allows improved designs by running more routing iterations during the design cycle. |

Our AutoActive® place and route technology is available on both UNIX and Windows platforms and is used to replace older generation routers in our PCB design flows and in flows created by Cadence Design Systems, Inc. and others. The AutoActive technology, which is incorporated into both the Board Station and Expedition product lines, is intended to help improve design quality, shorten design cycles and increase manufacturability. Our Hyperlynx® and ICX® high-speed design technology tools address signal integrity and timing challenges of complex, high-speed PCB designs to help make simulation more efficient and accurate.

Our Precision® Synthesis product family is created to maximize the performance of FPGAs. Our Precision product is also used for FPGA-based ASIC prototyping to enable cost effective ASIC verification prior to the availability of silicon.

New and Emerging Products

Engineers are trying to reduce the level of complexity of design and verification by moving to higher levels of design abstraction, allowing them to be more productive. One response to this trend is leading designers toward methodologies based on the C programming language which can offer a more efficient way to create designs. Our Catapult® C design tool can help engineering teams to produce ASIC or FPGA hardware that can be smaller in size in a reduced amount of time.

In the cabling area, our Integrated Electrical Systems business unit provides specialized software for design, analysis, manufacture and data management of complex wire harness systems used by automotive, aerospace and other industries. The Capital Harness™ tool flow integrates and interconnects electrical systems and associated harness designs within transportation systems.

Also targeting the automotive market are tools that focus on the functional design of the electronic components of cars. The SystemVision™ product family addresses challenges associated with design and verification of electro-mechanical systems. Volcano™, our automotive networking product line, assists car manufacturers and their suppliers to design, analyze and validate the increasingly complex network-based control systems found in today’s automobiles.

Our Data Management Systems applications address the systems design and manufacturing cycle by providing electronics systems designers with relevant design information from enterprise product lifecycle management and enterprise resource planning.

We offer a suite of products for companies developing embedded software for products such as cell phones. Our offerings in this area are real-time operating systems, middleware and associated development tools.

We also offer tools to test IC designs. Our suite of integrated Design-for-Test products is used to test a design’s logic and memories

after manufacturing to ensure that a manufactured IC is functioning correctly. Our suite of tools includes scan insertion, automatic test pattern generation, logic and memory built-in self-test, and our patented TestKompress® product for Embedded Deterministic Test (EDT™).

PLATFORMS

Our software products are available on UNIX, Windows and LINUX platforms in a broad range of price and performance levels. Customers purchase platforms from leading workstation and personal computer suppliers. These computer manufacturers have a substantial installed base and make frequent introductions of new products.

MARKETING AND CUSTOMERS

Our marketing emphasizes a direct sales force and large corporate account penetration in the military/aerospace, communications, computer, consumer electronics, semiconductor, networking, multimedia and transportation industries. We license our products worldwide through our direct sales force, sales representatives and distributors. During the year ended January 31, 2008, revenues outside of North America accounted for 55% of total revenues as compared to 54% for the year ended December 31, 2006 and 57% for the year ended December 31, 2005. See “Geographic Revenues Information” in Part II, Item 7. “Management Discussion and Analysis of Financial Condition and Results of Operations” and the footnotes to our financial statements included in Part II, Item 8. “Financial Statements and Supplementary Data” for more information. We enter into foreign currency forward and option contracts in an effort to help mitigate the impact of foreign currency fluctuations. See “Effects of Foreign Currency Fluctuations” in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a discussion of the effect foreign currency fluctuation may have on our business and operating results.

We segregate revenue into six categories of similar products and services. These categories include Integrated System Design, IC Design to Silicon, Scalable Verification, New and Emerging Products, Services and Other, and Finance Fees. Each category, with the exception of Finance Fees, includes both product and support revenues. See the discussion in the Note 24 “Segment Reporting” in Part II, Item 8. “Financial Statements and Supplementary Data” for further detail of revenue by product and service category.

No material portion of our business is dependent on a single or a few customers, the loss of any one or more of which would have a material adverse effect on revenues. We have traditionally experienced some seasonal fluctuations of orders, with orders typically stronger in the fourth quarter of each year. Due to the complexity of our products, the selling cycle can be three to six months or longer. During the selling cycle our account managers, application engineers and technical specialists make technical presentations and product demonstrations to the customer. At some point during the selling cycle, our products may also be loaned to customers for short-term on-site evaluation. We generally ship our products to customers within 180 days after receipt of an order and a substantial portion of quarterly shipments tend to be made in the last month of each quarter. We license our products and some third-party products pursuant to end-user license agreements.

BACKLOG

Our backlog of firm orders was approximately $71 million at January 31, 2008 as compared to $103 million at December 31, 2006. This backlog includes products requested for delivery within six months and unfulfilledprofessional services and training requested for delivery within one year. We do not track backlog for support services. Support services are typically delivered under annual contracts that are accounted for on a ratable basis over the twelve-month term of each contract. The January 31, 2008 backlog of orders is expected to ship before the end of our fiscal year ending January 31, 2009.

FISCAL YEAR CHANGE

On July 19, 2006, we changed our fiscal year to January 31 from December 31, effective for the fiscal year ended January 31, 2008. This report includes financial information for the transition period from January 1 to January 31, 2007. We believe that the twelve months ended December 31, 2006 and 2005 provide a meaningful comparison to the twelve months ended January 31, 2008. There are no factors of which we are aware, seasonal or otherwise, that would impact the comparability of information or trends if results for the twelve months ended January 31, 2007 and 2006 were presented in lieu of results for the twelve months ended December 31, 2006 and 2005. References in this document to fiscal 2008 represent the twelve months ended January 31, 2008. References to 2006 and 2005 represent the twelve months ended December 31, 2006 and 2005.

We did not experience a significant amount of business activity or product shipment in January 2007 and have reported a loss for that period. The low level of business activity and product shipment resulted in part from the historical pattern of low levels of business activity in January, and in part because we did not implement significant sales incentive compensation programs for that one-month period.

MANUFACTURING OPERATIONS

Our manufacturing operations primarily consist of reproduction of our software and documentation. In North America, manufacturing is substantially outsourced with distribution to North and South American and Japanese customers occurring primarily from Wilsonville, Oregon. Our line of emulation products, which has a large hardware component, is manufactured in the United States and France on an outsourced basis. Mentor Graphics (Ireland) Limited, a wholly owned subsidiary of Mentor Graphics Corporation, manufactures, or contracts with third-parties to manufacture, our products and distributes these products to markets outside North America through our established sales channels. See the discussion in the Note 24 “Segment Reporting” in Part II, Item 8. “Financial Statements and Supplementary Data” for further detail of the location of property, plant and equipment.

PRODUCT DEVELOPMENT

Our research and development is focused on continued improvement of our existing products and the development of new products. During the year ended January 31, 2008, we expensed $249 million related to product research and development as compared to $227 million for 2006 and $213 million for 2005. We also seek to expand existing product offerings and pursue new lines of business through acquisitions. During the year ended January 31, 2008, we recorded purchased technology and in-process research and development charges from acquisitions of $14 million as compared to $16 million for 2006 and $12 million for 2005. Our future success depends on our ability to develop or acquire competitive new products that satisfy customer requirements.

CUSTOMER SUPPORT AND CONSULTING

We have a worldwide support organization to meet our customers’ needs for software support, hardware support and customer training. Most of our customers enter into support contracts that deliver regular software

updates and technical assistance. Hardware support is available for emulation products. In addition to being certified worldwide through the Support Center Practices certification program, our support centers have won five Software Technical Assistance Recognition Awards and a Lifetime Achievement Award from the Software Support Professionals Association for service excellence in the Complex Support category. Mentor Graphics Education Services offers a wide range of learning solutions developed specifically for electronics designers and engineers.

Mentor Consulting, our professional services division, is comprised of a worldwide team of consulting professionals. The services provided to customers are concentrated around our products. In addition, Mentor Consulting provides methodology development and refinement services that help customers improve product development process.

COMPETITION

The markets for our products are characterized by price competition, rapid technological advances in application software, operating systems and hardware and by new market entrants. The EDA industry tends to be labor intensive rather than capital intensive. This means that the number of actual and potential competitors is significant. While our two principal competitors are large companies with extensive capital and marketing resources, we also compete with small companies with little capital but innovative ideas. Our principal competitors are Cadence Design Systems, Inc. and Synopsys, Inc.

We believe the main competitive factors affecting our business are breadth and quality of application software, product integration, ability to respond to technological change, quality of a company’s sales force, price, size of the installed base, level of customer support and professional services. We believe that we generally compete favorably in these areas. We can give no assurance, however, that we will have financial resources, marketing, distribution and service capability, depth of key personnel or technological knowledge to compete successfully in our markets.

EMPLOYEES

We employed approximately 4,358 people full time as of January 31, 2008. Our success will depend in part on our ability to attract and retain employees. None of our United States (U.S.) employees are covered by collective bargaining agreements. Employees in some jurisdictions outside the U.S. are represented by local or national union organizations. We continue to have satisfactory employee relations.

PATENTS AND LICENSES

We regard our products as proprietary and protect our rights in our products and technology in a variety of ways.

We currently own approximately 300 U.S. and 90 non-U.S. patents on inventions embodied in our products or that are otherwise relevant to EDA technology. In addition, we own approximately 460 patent applications pending in the U.S. and abroad. While we believe the patent applications relate to patentable technology, we can not predict whether any patent will issue on a pending application, nor can we assure that any patent can be successfully defended. We believe that the importance of patents in the EDA industry continues to increase.

We also rely on contractual and technical safeguards to protect our proprietary rights in our products. We typically include restrictions on disclosure, use and transferability in our agreements with customers and other parties. In addition, we use our trademark, copyright and trade secret rights to protect our interests in our products and technology.

Some of our products include software or other intellectual property licensed from other parties. We also license software from other parties for internal use. We may have to seek new licenses or renew these licenses in the future.

ITEM 1A. RISK FACTORS

The forward-looking statements contained under “Outlook for Fiscal 2009” in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and all other statements contained in this report that are not statements of historical fact, including without limitation, statements containing the words “believes,” “expects,” “projections” and words of similar meaning, constitute forward-looking statements that involve a number of risks and uncertainties that are difficult to predict. Moreover, from time to time, we may issue other forward-looking statements. Forward-looking statements regarding financial performance in future periods, including the statements under “Outlook for Fiscal 2009,” do not reflect potential impacts of mergers or acquisitions or other significant transactions or events that have not been announced as of the time the statements are made. Actual outcomes and results may differ materially from what is expressed or forecast in forward-looking statements. We disclaim any obligation to update forward-looking statements to reflect future events or revised expectations. Our business faces many risks, and set forth below are some of the factors that could cause actual results to differ materially from the results expressed or implied by our forward-looking statements. Forward-looking statements should be considered in light of these factors.

We face intense competition in the EDA industry.

Competition in the EDA industry is intense, which can lead to, among other things, price reductions, longer selling cycles, lower product margins, loss of market share and additional working capital requirements. If our competitors offer significant discounts on certain products, we may need to lower our prices or offer other favorable terms in order to compete successfully. Any such changes would likely reduce margins and could materially adversely impact our operating results. Any broad-based changes to our prices and pricing policies could cause new software license and service revenues to decline or be delayed as the sales force implements and our customers adjust to the new pricing policies. Some of our competitors may bundle certain software products at low prices for promotional purposes or as a long-term pricing strategy. These practices could significantly reduce demand for our products or constrain prices we can charge.

We currently compete primarily with two large companies: Cadence Design Systems, Inc. and Synopsys, Inc. We also compete with numerous smaller companies and compete with manufacturers of electronic devices that have developed their own EDA products internally.

Weakness in the U.S. and international economies may harm our business.

The U.S. and international economies are cyclical and experience periodic economic downturns, which could have a material adverse affect on our results of operations. Weakness in these economies could materially adversely impact the timing and receipt of orders for our products and our results of operations. Revenue levels are dependent on the level of technology capital spending, which includes worldwide expenditures for EDA software, hardware and consulting services.

Our international operations and the effects of foreign currency fluctuations expose us to additional risks.

We obtain more than half of our revenues from customers outside the U.S. and we generate approximately one-third of our expenses outside the U.S. Significant changes in currency exchange rates could have an adverse impact on us. For further discussion of foreign currency effects, see “Effects of Foreign Currency Fluctuations” discussion in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In addition, international operations subject us to other risks including longer receivables collection periods, changes in a specific country’s or region’s economic or political conditions, trade protection measures, local labor laws, import or export licensing requirements, loss or modification of exemptions for taxes and tariffs, limitations on repatriation of earnings and difficulties with licensing and protecting our intellectual property rights.

Our forecasts of our revenues and earnings outlook may be inaccurate.

Our revenues, particularly new software license revenues, are difficult to forecast. We use a “pipeline” system, a common industry practice, to forecast revenues and trends in our business. Sales personnel monitor the status of potential business and estimate when a customer will make a purchase decision, the dollar amount of the sale and the products or services to be sold. These estimates are aggregated periodically to generate a sales pipeline. Our pipeline estimates may prove to be unreliable either in a particular quarter or over a longer period of time, in part because the “conversion rate” of the pipeline into contracts can be very difficult to estimate and requires management judgment. A variation in the conversion rate could cause us to plan or budget incorrectly and materially adversely impact our business or our planned results of operations. In particular, a slowdown in customer spending or weak economic conditions generally can reduce the conversion rate in a particular quarter as purchasing decisions are delayed, reduced in amount or cancelled. The conversion rate can also be affected by the tendency of some of our customers to wait until the end of a fiscal quarter attempting to obtain more favorable terms.

Our business could be impacted by fluctuations in quarterly results of operations due to customer seasonal purchasing patterns, the timing of significant orders and the mix of licenses and products requested by our customers.

We have experienced, and may continue to experience, varied quarterly operating results. Various factors affect our quarterly operating results and some of these are not within our control, including customer demand and the timing of significant orders. We experience seasonality in demand for our products, due to the purchasing cycles of our customers, with revenues in the fourth quarter generally being the highest. We receive a majority of our software revenues from current quarter order performance, of which a substantial amount is usually booked in the last few weeks of each quarter. A significant portion of our revenues come from multi-million dollar contracts, the timing of the completion of and the terms of delivery of which can have a material impact on revenue for a given quarter. If we fail to receive expected orders, particularly large orders, our revenues for that quarter could be materially adversely impacted. In such an event, we could fail to meet investors’ expectations, which could have a material adverse impact on our stock price.

Our revenues are also affected by the mix of licenses entered into where we recognize software revenues as payments become due and payable,on a cash basis, or ratably over the license term as compared to revenues recognized at the beginning of the license term. We recognize revenues ratably over the license term, for instance, when the customer is provided with rights to unspecified or unreleased future products. A shift in the license mix toward increased ratable, due and payable and/or cash-based revenue recognition could result in increased deferral of software revenues to future periods and would decrease current revenues, which could result in us not meeting near-term revenue expectations.

The gross margin on our software is greater than that for our hardware emulation system, software support and professional services. Therefore, our gross margin may vary as a result of the mix of products and services sold. Additionally, the gross margin on software varies year to year depending on the amount of royalties due to third parties for the mix of products sold. We also have a significant amount of fixed or relatively fixed costs, such as employee costs and purchased technology amortization, and costs which are committed in advance and can only be adjusted periodically. As a result, a small failure to reach planned revenues would likely have a relatively large negative effect on resulting earnings. If anticipated revenues do not materialize as expected, our gross margins and operating results could be materially adversely impacted.

We derive a substantial portion of our revenues from relatively few product groups.

We derive a substantial portion of our revenues from sales of relatively few product groups and related support services. As such, any factor adversely affecting sales of these products, including the product release cycles, market acceptance, product competition, performance and reliability, reputation, price competition and economic and market conditions, would likely harm our operating results.

We are subject to the cyclical nature of the IC and electronics systems industries.

Purchases of our products and services are highly dependent upon new design projects initiated by customers in the IC and electronics systems industries. These industries are highly cyclical and are subject to constant and rapid technological change, rapid product obsolescence, price erosion, evolving standards, short product life cycles and wide fluctuations in product supply and demand. The IC and electronics systems industries regularly experience significant downturns, often connected with, or in anticipation of, maturing product cycles within such companies or a decline in general economic conditions. These downturns can cause diminished product demand, production overcapacity, high inventory levels and accelerated erosion of average selling prices. Customers also appear to be reducing the number of EDA vendors with which they do business. If this trend continues, we may have more difficulty obtaining new customers and increasing our market share.

Customer payment defaults could harm our business.

We use fixed-term license agreements as a standard business practice with customers we believe are credit-worthy. These multi-year, multi-element term license agreements are typically three years in length and have payments spread over the license term. The complexity of these agreements tends to increase the risk associated with collectibility from customers that can arise for a variety of reasons including ability to pay, product dissatisfaction, disagreements and disputes. If we are unable to collect under these agreements, our results of operations could be

materially adversely impacted. We use these fixed-term license agreements as a standard business practice and have a history of successfully collecting under the original payment terms without making concessions on payments, products or services. If we no longer had a history of collecting without providing concessions on the terms of the agreements, then revenue would be required to be recognized as the payments become due and payable over the license term. This change could have a material impact on our results.

IC and PCB technology evolves rapidly.

The complexity of ICs and PCBs continues to rapidly increase. In response to this increasing complexity, new design tools and methodologies must be invented or acquired quickly to remain competitive. If we fail to quickly respond to new technological developments, our products could become obsolete or uncompetitive, which could materially adversely impact our business.

Errors or defects in our products and services could expose us to liability and harm our reputation.

Our customers use our products and services in designing and developing products that involve a high degree of technological complexity and have unique specifications. Due to the complexity of the systems and products with which we work, some of our products and designs can be adequately tested only when put to full use in the marketplace. As a result, our customers or their end users may discover errors or defects in our software or the systems we design, or the products or systems incorporating our designs and intellectual property may not operate as expected. Errors or defects could result in:

| | • | | loss of current customers and loss of, or delay in, revenue and loss of market share; |

| | • | | failure to attract new customers or achieve market acceptance; |

| | • | | diversion of development resources to resolve the problems resulting from errors or defects; and |

| | • | | increased support or service costs. |

In addition, we include third party technology in our products and we rely on those third parties to provide support services to us. Failure of those third parties to provide necessary support services could materially adversely impact our business.

Long sales cycles and delay in customer completion of projects make the timing of our revenues difficult to predict.

We have a lengthy sales cycle that generally extends between three and six months. A lengthy customer evaluation and approval process is generally required due to the complexity and expense associated with our products and services. Consequently, we may incur substantial expenses and devote significant management effort and expense to develop potential relationships that do not result in agreements or revenues and may prevent us from pursuing other opportunities. In addition, sales of our products and services may be delayed if customers delay approval or commencement of projects due to customers’ budgetary constraints, internal acceptance review procedures, timing of budget cycles or timing of competitive evaluation processes.

Disruptions of our indirect sales channel could affect our future operating results.

Our indirect sales channel is comprised primarily of independent distributors and sales representatives. Our relationships with these channel participants are important elements of our marketing and salesefforts. Our financial results could be adversely affected if our contracts with channel participants were terminated, if our relationships with channel participants were to deteriorate, if any of our competitors enter into strategic relationships with or acquire a significant channel participant or if the financial condition of our channel participants were to weaken.

Any loss of our leadership position in certain segments of the EDA market could harm our business.

The industry in which we compete is characterized by very strong leadership positions in specific segments of the EDA market. For example, one company may enjoy a large percentage of sales in the physical verification segment of the market while another will have a similarly strong position in mixed-signal simulation. These strong leadership positions can be maintained for significant periods of time as the software is difficult to master and customers are disinclined to make changes once their employees, as well as others in the industry, have developed familiarity with a particular software product. For these reasons, much of our profitability arises from niche areas in which we are the leader. Conversely, it is difficult for us to achieve significant profits in niche areas where other companies are the leaders. If for any reason we lose our leadership position in a niche, we could be materially adversely impacted.

Accounting rules governing revenue recognition are complex and may change.

The accounting rules governing software revenue recognition are complex and have been subject to authoritative interpretations that have generally made it more difficult to recognize software revenues at the beginning of the license period. If this trend continues, new and revised standards and interpretations could materially adversely impact our ability to meet near-term revenue expectations.

If our goodwill or amortizable intangible assets become impaired, we may be required to record a significant charge to earnings.

Under U.S. generally accepted accounting principles, we review our amortizable intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill is tested for impairment at least annually. Factors that may be considered a change in circumstances indicating that the carrying value of our goodwill or amortizable intangible assets may not be recoverable include a decline in stock price and market capitalization, reduced future cash flow estimates, and slower growth rates in our industry. We could be required to record a significant charge to earnings in our financial statements during the period in which any impairment of our goodwill or amortizable intangible assets is determined, which could materially adversely impact our results of operations.

We may have additional tax liabilities.

Significant judgments and estimates are required in determining the provision for income taxes and other tax liabilities. For example, our interim tax provision expense is based on our expectation of profit and loss by jurisdiction. If the mix of profit and loss by jurisdiction is different from our estimates our actual tax expense could be materially different. Our tax expense may also be impacted if our intercompany transactions, which are required to be computed on an arm’s-length basis, are challenged and successfully disputed by the tax authorities. Also, our tax expense could be impacted depending on the applicability of withholding taxes on term-based licenses and related intercompany

transactions in certain jurisdictions. In determining the adequacy of income taxes, we assess the likelihood of adverse outcomes resulting from the Internal Revenue Service (IRS) and other tax authorities’ examinations. The IRS and tax authorities in countries where we do business regularly examine our tax returns. The ultimate outcome of these examinations cannot be predicted with certainty. Should the IRS or other tax authorities assess additional taxes as a result of examinations, we may be required to record charges to operations that could have a material impact on the results of operations, financial position or cash flows. We were issued a Revenue Agent’s Report in March 2007. See “Provision for Income Taxes” in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional discussion.

Forecasting our tax rate is complex and subject to uncertainty.

Forecasts of our income tax position and resultant effective tax rate are complex and subject to uncertainty as our tax position for each year combines: (i) the effects of a mix of profits (losses) earned by us and our subsidiaries in tax jurisdictions with a broad range of income tax rates, (ii) changes in valuation allowances on our deferred tax assets, (iii) the resolution of issues arising from tax audits with various tax authorities and (iv) changes in the tax laws or the interpretation of such tax laws. In order to forecast our global tax rate, we estimate pre-tax profits and losses by jurisdiction and calculate tax expense by jurisdiction. If the mix of profits and losses or effective tax rates by jurisdiction are different than those estimates, our actual tax rate could be materially different than forecast.

There are limitations on the effectiveness of controls.

We do not expect that disclosure controls or internal control over financial reporting will prevent all error and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. Failure of our control systems to prevent error or fraud could materially adversely impact us.

We may not realize revenues as a result of our investments in research and development.

We incur substantial expense to develop new software products. Research and development activities are often performed over long periods of time. This effort may not yield a successful product offering or the product may not satisfy customer requirements. As a result, we could realize little or no revenues related to our investment in research and development.

We may acquire other companies and may not successfully integrate them.

The industry in which we compete has seen significant consolidation in recent years. During this period, we have acquired numerous businesses and have frequently been in discussions with potential acquisition candidates, and we may acquire other businesses in the future. While we expect to carefully analyze all potential transactions before committing to them, we cannot assure that any transaction that is completed will result in long-term benefits to us or our shareholders or that we will be able to manage the acquired businesses effectively. Inaddition, growth through acquisition involves a number of risks. If any of the following events occurs after we acquire another business, it could materially adversely impact us:

| | • | | difficulties in combining previously separate businesses into a single unit; |

| | • | | the substantial diversion of management’s attention from ongoing business when integrating the acquired business; |

| | • | | the discovery after the acquisition has been completed of previously unknown liabilities assumed with the acquired business; |

| | • | | the failure to realize anticipated benefits, such as cost savings and increases in revenues; |

| | • | | the failure to retain key personnel of the acquired business; |

| | • | | difficulties related to assimilating the products of an acquired business in, for example, distribution, engineering and customer support areas; |

| | • | | unanticipated litigation in connection with or as a result of an acquisition, including claims from terminated employees, customers or third parties; |

| | • | | adverse impacts on existing relationships with suppliers and customers; and |

| | • | | failure to understand and compete effectively in markets in which we have limited experience. |

Acquired businesses may not perform as projected, which could result in impairment of acquisition-related intangible assets. Additional challenges include integration of sales channels, training and education of the sales force for new product offerings, integration of product development efforts, integration of systems of internal controls and integration of information systems. Accordingly, in any acquisition there will be uncertainty as to the achievement and timing of projected synergies, cost savings and sales levels for acquired products. All of these factors could impair our ability to forecast, meet revenues and earnings targets and manage effectively our business for long-term growth. We cannot assure that we can effectively meet these challenges.

Mergers of our customers appear to be increasing.

A significant number of mergers in the semiconductor and electronics industries have occurred and we believe more are likely. Mergers of our customers can reduce the total level of purchases of our software and services, and in some cases, increase customers’ bargaining power in negotiations with their suppliers, including us.

Supply problems for our emulation hardware systems could harm our business.

The success of our emulation hardware systems depends on our ability to: (i) procure hardware components on a timely basis from a limited number of suppliers, (ii) create stable software for use on the product, (iii) assemble and ship hardware and software systems on a timely basis with appropriate quality control, (iv) develop distribution and shipment processes, (v) manage inventory and related obsolescence issues and (vi) develop processes to deliver customer support for hardware. Our inability to be successful in any of the foregoing could materially adversely impact us.

We generally commit to purchase component parts from suppliers based on sales forecasts of our emulation hardware system. If we cannot change or be released from these non-cancelable purchase commitments, and if orders for our products do not materialize, we

could incur significant costs related to the purchase of excess components which could become obsolete before we could use them. Additionally, a delay in production of the components or inaccuracy in our sales forecast could materially adversely impact our operating results if we are unable to timely ship ordered products or provide replacement parts under warranty or maintenance contracts.

We may not adequately protect our proprietary rights or we may fail to obtain software or other intellectual property licenses.

Our success depends, in large part, upon our proprietary technology. We generally rely on patents, copyrights, trademarks, trade secret laws, licenses and restrictive agreements to establish and protect our proprietary rights in technology and products. Despite precautions we may take to protect our intellectual property, we cannot assure that third parties will not try to challenge, invalidate or circumvent these protections. The companies in the EDA industry, as well as entities and persons outside the industry, are obtaining patents at a rapid rate. Many of these entities have substantially larger patent portfolios than we have. As a result, we may on occasion be forced to engage in costly patent litigation to protect our rights or defend our customers’ rights. We may also need to settle these claims on terms that are unfavorable; such settlements could result in the payment of significant damages or royalties, or force us to stop selling or redesign one or more products. We cannot assure that the rights granted under our patents will provide us with any competitive advantage, that patents will be issued on any of our pending applications or that future patents will be sufficiently broad to protect our technology. Furthermore, the laws of foreign countries may not protect our proprietary rights in those countries to the same extent as U.S. law protects these rights in the U.S.

Some of our products include software or other intellectual property licensed from third parties, and we may have to seek new licenses or renew existing licenses for software and other intellectual property in the future. Failure to obtain software or other intellectual property licenses or rights from third parties on favorable terms could materially adversely impact us.

Litigation may materially adversely impact us.

Litigation may result in monetary damages, injunctions against future product sales and substantial unanticipated legal costs and divert the efforts of management personnel, any and all of which could materially adversely impact us.

Third parties may claim infringement or misuse of intellectual property rights.

We periodically receive notices from others claiming infringement, or other misuse of their intellectual property rights or breach of our agreements with them. We expect the number of such claims will increase as the number of products and competitors in our industry segments grows, the functionality of products overlap, the use and support of third-party code (including open source code) becomes more prevalent in the software industry and the volume of issued software patents continues to increase. Responding to any such claim, regardless of its validity, could:

| | • | | be time-consuming, costly and/or result in litigation; |

| | • | | divert management’s time and attention from developing our business; |

| | • | | require us to pay monetary damages or enter into royalty and licensing agreements that we would not normally find acceptable; |

| | • | | require us to stop selling or to redesign certain of our products; |

| | • | | require us to release source code to third parties, possibly under open source license terms; |

| | • | | require us to satisfy indemnification obligations to our customers; or |

| | • | | otherwise adversely affect our business, results of operations, financial condition or cash flows. |

Our failure to attract and retain key employees may harm us.

We depend on the efforts and abilities of our senior management, our research and development staff and a number of other key management, sales, support, technical and services personnel. Competition for experienced, high-quality personnel is intense, and we cannot assure that we can continue to recruit and retain such personnel. Our failure to hire and retain such personnel could impair our ability to develop new products and manage our business effectively.

Terrorist attacks and other acts of violence or war may materially adversely impact the markets on which our securities trade, the markets in which we operate, our operations and our profitability.

Terrorist attacks may negatively affect our operations and investment in our business. These attacks or armed conflicts may directly impact our physical facilities or those of our suppliers or customers. Furthermore, these attacks may make travel more difficult and expensive and ultimately affect our revenues.

Any armed conflict entered into by the U.S. could have an adverse impact on our revenues and our ability to deliver products to our customers. Political and economic instability in some regions of the world may also result from an armed conflict and could negatively impact our business. We currently have operations in Pakistan, Egypt and Israel, countries that may be particularly susceptible to this risk. The consequences of any armed conflict are unpredictable, and we may not be able to foresee events that could have an adverse impact on us.

More generally, any of these events could cause consumer confidence and spending to decrease or result in increased volatility in the U.S. and worldwide financial markets and economy. They also could result in economic recession in the U.S. or abroad. Any of these occurrences could have a significant impact on our operating results, revenues and costs and could result in volatility of the market price for our common stock.

Our articles of incorporation, Oregon law and our shareholder rights plan may have anti-takeover effects.

Our board of directors has the authority, without action by the shareholders, to designate and issue up to 1,200,000 shares of incentive stock in one or more series and to designate the rights, preferences and privileges of each series without any further vote or action by the shareholders. Additionally, the Oregon Control Share Act and the Business Combination Act limit the ability of parties who acquire a significant amount of voting stock to exercise control over us. These provisions may have the effect of lengthening the time required to acquire control of us through a proxy contest or the election of a majority of the board of directors. In February 1999, we adopted a shareholder rights plan, which has the effect of making it more difficult for a person to acquire control of us in a transaction not approved by our board of directors. The potential issuance of incentive stock, the provisions of the Oregon Control Share Act and the Business Combination Act and our shareholder rights plan could have the effect of delaying, deferring or

preventing a change of control of us, could discourage bids for our common stock at a premium over the market price of our common stock and could materially adversely impact the market price of, and the voting and other rights of the holders of, our common stock.

We have a substantial level of indebtedness.

As of January 31, 2008, we had $215 million of outstanding indebtedness, which includes $36 million of Floating Rate Convertible Subordinated Debentures (Floating Rate Debentures) due 2023, $165 million of 6.25% Convertible Subordinated Debentures (6.25% Debentures) due 2026 and $14 million in short-term borrowings. This level of indebtedness among other things could:

| | • | | make it difficult for us to satisfy our payment obligations on our debt; |

| | • | | make it difficult for us to incur additional indebtedness or obtain any necessary financing in the future for working capital, capital expenditures, debt service, acquisitions or general corporate purposes; |

| | • | | limit our flexibility in planning for or reacting to changes in our business; |

| | • | | reduce funds available for use in our operations; |

| | • | | make us more vulnerable in the event of a downturn in our business; |

| | • | | make us more vulnerable in the event of an increase in interest rates if we must incur new debt to satisfy our obligations under the Floating Rate Debentures and 6.25% Debentures; or |

| | • | | place us at a possible competitive disadvantage relative to less leveraged competitors and competitors that have greater access to capital resources. |

If we experience a decline in revenues, we could have difficulty paying amounts due on our indebtedness. Any default under our indebtedness could have a material adverse impact on our business, operating results and financial condition.

Our stock price could become more volatile, and your investment could lose value.

All of the factors discussed in this section could affect our stock price. The timing of announcements in the public market regarding new products, product enhancements or technological advances by our competitors or us, and any announcements by us of acquisitions, major transactions, or management changes could also affect our stock price. Our stock price is subject to speculation in the press and the analyst community, changes in recommendations or earnings estimates by financial analysts, changes in investors’ or analysts’ valuation measures for our stock, our credit ratings and market trends unrelated to our performance. A significant drop in our stock price could also expose us to the risk of securities class actions lawsuits, which could result in substantial costs and divert management’s attention and resources, which could adversely affect our business.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We own six buildings on 43 acres of land in Wilsonville, Oregon. We occupy approximately 405,000 square feet in four of those buildings, as our corporate headquarters. We also own an additional 69 acres of undeveloped land adjacent to our headquarters. Most administrative functions and a significant amount of our domestic research and development operations are located at the Wilsonville site.

We lease additional space in San Jose, California; Longmont, Colorado; Huntsville and Mobile, Alabama; and Marlboro and Waltham, Massachusetts where some of our domestic research and development takes place; and in various locations throughout the United States and in other countries, primarily for sales and customer service operations. Additional research and development is done in locations outside the United States including locations in Egypt, France, India, Pakistan, Poland, Sweden, Finland, Germany, Russia, Hungary, Austria, Taiwan and the United Kingdom. We believe that we will be able to renew or replace our existing leases as they expire and that our current facilities will be adequate through at least the year ending January 31, 2009.

ITEM 3. LEGAL PROCEEDINGS

From time to time, we are involved in various disputes and litigation matters that arise from the ordinary course of business. These include disputes and lawsuits relating to intellectual property rights, licensing, contracts and employee relations matters.

We believe that the outcome of current litigation, individually and in the aggregate, will not have a material effect on our financial position or results of operations.

ITEM 4. SUBMISSIONS OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

EXECUTIVE OFFICERS OF THE REGISTRANT

The following are the executive officers of Mentor Graphics:

| | | | |

| Name | | Position | | Age |

Walden C. Rhines | | Chairman of the Board and Chief Executive Officer | | 61 |

Gregory K. Hinckley | | President and Director | | 61 |

L. Don Maulsby | | Senior Vice President, World Trade | | 56 |

Jue-Hsien Chern | | Vice President and General Manager Deep Submicron Division | | 53 |

Brian Derrick | | Vice President, Corporate Marketing | | 44 |

Dean Freed | | Vice President, General Counsel and Secretary | | 49 |

Robert Hum | | Vice President and General Manager Design Verification and Test Division | | 55 |

Maria M. Pope | | Vice President, Chief Financial Officer | | 42 |

Henry Potts | | Vice President and General Manager System Design Division | | 61 |

Joseph Sawicki | | Vice President and General Manager Design-to-Silicon Division | | 47 |

Dennis Weldon | | Director of Corporate Development and Investor Relations | | 60 |

The executive officers are elected by our Board of Directors at our annual meeting. Officers hold their positions until they resign, are terminated or their successors are elected. There are no arrangements or understandings between the officers or any other person pursuant to which officers were elected. There are no family relationships among any of our executive officers or directors.

Dr. Rhines has served as our Chairman of the Board and Chief Executive Officer since 2000. Dr. Rhines served as our Director, President and Chief Executive Officer from 1993 to 2000. Dr. Rhines is currently a director of Cirrus Logic, Inc. and Triquint Semiconductor, Inc., both semiconductor manufacturers.

Mr. Hinckley has served as our President since 2000. Mr. Hinckley served as our Executive Vice President, Chief Operating Officer and Chief Financial Officer from 1997 to 2000. Mr. Hinckley is a director of ArcSoft, Inc., a provider of multimedia software and firmware, and Intermec Inc., a provider of integrated systems solutions.

Mr. Maulsby has served as our Senior Vice President, World Trade since 1999. From 1998 to 1999, he was president of Tri-Tech and Associates, a manufacturer’s representative firm.

Dr. Chern has served as Vice President and General Manager of our Deep Submicron Division since joining us in 2000. Dr. Chern is a director of Cardiac Science Corporation, which manufactures diagnostic cardiology systems.

Mr. Derrick has served as our Vice President, Corporate Marketing since 2002. From 2000 to 2001 he was Vice President and General Manager of our PVX Division. From 1998 to 2000, he was the Director of our Calibre and Velocity Strategic Business Unit. From 1997 to 1998, he was marketing manager for our Calibre Business Unit. Mr. Derrick has been with us since 1997. Mr. Derrick has served since 2006 as a director of M2000, Inc., an ASIC and FPGA emulation technology company. Since 2008, Mr. Derrick has served as a director of Calypto Design Systems, Inc., a sequential analysis technology company.

Mr. Freed has served as our Vice President, General Counsel and Secretary since 1995.

Mr. Hum has served as Vice President and General Manager of our Design Verification and Test Division since 2002. From 1997 to 2002, Mr. Hum served as Chief Operating Officer and Vice President of Engineering of IKOS Systems, Inc., a hardware emulation company.

Ms. Pope has served as Vice President, Chief Financial Officer since 2007. Prior to joining us, Ms. Pope was Vice President-General Manager, Wood Products Division of Pope & Talbot, Inc., a forest products company. Prior to that, she served as Vice President, Chief Financial Officer and Secretary of Pope and Talbot from 1999 to 2003. Ms. Pope previously worked for Levi Straus & Co. and Morgan Stanley & Co., Inc. Ms. Pope is a director of Portland General Electric, an Oregon based utility.

Mr. Potts has served as Vice President and General Manager of our System Design Division since joining us in 1999. From 1997 to 1998, Mr. Potts was Vice President of Engineering for Hitachi Micro Systems, a semiconductor research and development company.

Mr. Sawicki has served as Vice President and General Manager of our Design-to-Silicon Division since 2003. From 2002 to 2003, he was General Manager of the Physical Verification (PVX) Division. From 2000 to 2001, Mr. Sawicki served as General Manager of our Calibre business unit. Mr. Sawicki has been with us for 17 years in various roles including applications engineering, sales and marketing and management.

Mr. Weldon has served as Director of Corporate Development and Investor Relations since 2005. Mr. Weldon has also served as Treasurer, Vice President of Corporate Development and Investor Relations, and a number of other positions since joining us in 1988.

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our Common Stock trades on The NASDAQ Stock Market under the symbol “MENT.” The following table sets forth for the periods indicated the high and low sales prices for our Common Stock, as reported by The NASDAQ Stock Market:

| | | | | | | | | | | | |

| Quarter ended | | April 30 | | July 31 | | October 31 | | January 31 |

Fiscal 2008 | | | | | | | | | | | | |

High | | $ | 18.68 | | $ | 15.95 | | $ | 16.19 | | $ | 15.42 |

Low | | $ | 15.40 | | $ | 12.00 | | $ | 11.35 | | $ | 8.25 |

| | | | |

| Quarter ended | | March 31 | | June 30 | | September 30 | | December 31 |

2006 | | | | | | | | | | | | |

High | | $ | 12.16 | | $ | 13.75 | | $ | 15.17 | | $ | 18.42 |

Low | | $ | 10.10 | | $ | 10.50 | | $ | 12.49 | | $ | 13.94 |

As of March 18, 2008, we had 620 stockholders of record.

No dividends were paid in fiscal 2008 or 2006. Our credit facility prohibits the payment of dividends.

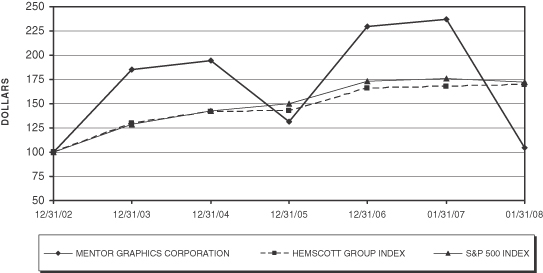

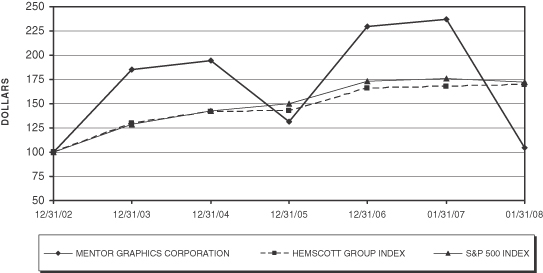

PERFORMANCE GRAPH

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN

AMONG MENTOR GRAPHICS CORP.,

S&P 500 INDEX AND HEMSCOTT GROUP INDEX

Note: the stock price shown on the above graph is not necessarily indicative of future performance

ASSUMES $100 INVESTED ON DEC. 31, 2002

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDED JAN. 31, 2008

| | | | | | | | | |

| Measurement Period (Fiscal Year Covered) | | MENTOR

GRAPHICS

CORPORATION | | HEMSCOTT

GROUP

INDEX | | S&P 500

INDEX |

Measurement point: 12/31/2002 | | $ | 100.00 | | $ | 100.00 | | $ | 100.00 |

Fiscal year ended: 12/31/2003 | | $ | 184.99 | | $ | 129.31 | | $ | 128.68 |

Fiscal year ended: 12/31/2004 | | $ | 194.53 | | $ | 142.02 | | $ | 142.69 |

Fiscal year ended: 12/31/2005 | | $ | 131.55 | | $ | 142.37 | | $ | 149.70 |

Fiscal year ended: 12/31/2006 | | $ | 229.39 | | $ | 165.30 | | $ | 173.34 |

Month ended: 1/31/2007 | | $ | 236.64 | | $ | 167.25 | | $ | 175.96 |

Fiscal year ended: 1/31/2008 | | $ | 104.96 | | $ | 169.01 | | $ | 171.90 |

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

In thousands, except per share data and percentages

| | | | | | | | | | | | | | | | | | | | |

| Year ended | | January 31,

2008 | | | December 31,

2006 | | | December 31,

2005 | | | December 31,

2004 | | | December 31,

2003 | |

Statement of Operations Data | | | | | |

Total revenues | | $ | 879,732 | | | $ | 802,839 | | | $ | 713,401 | | | $ | 716,893 | | | $ | 680,156 | |

Operating income | | $ | 70,967 | | | $ | 60,453 | | | $ | 26,397 | | | $ | 45,112 | | | $ | 17,142 | |

Net income (loss) | | $ | 28,771 | | | $ | 27,204 | | | $ | 5,807 | | | $ | (20,550 | ) | | $ | 7,933 | |

Gross margin percent | | | 85 | % | | | 86 | % | | | 84 | % | | | 85 | % | | | 83 | % |

Operating income as a percent of revenues | | | 8 | % | | | 8 | % | | | 4 | % | | | 6 | % | | | 3 | % |

Per Share Data | | | | | | | | | |

Net income (loss) per share – basic | | $ | 0.33 | | | $ | 0.33 | | | $ | 0.07 | | | $ | (0.28 | ) | | $ | 0.12 | |

Net income (loss) per share – diluted | | $ | 0.32 | | | $ | 0.33 | | | $ | 0.07 | | | $ | (0.28 | ) | | $ | 0.11 | |

Weighted average number of shares outstanding – basic | | | 88,086 | | | | 81,303 | | | | 78,633 | | | | 72,381 | | | | 67,680 | |

Weighted average number of shares outstanding – diluted | | | 89,981 | | | | 82,825 | | | | 80,133 | | | | 72,381 | | | | 70,464 | |

Balance Sheet Data | | | | | | | | | |

Cash, cash equivalents and short-term investments | | $ | 126,215 | | | $ | 129,857 | | | $ | 114,410 | | | $ | 94,287 | | | $ | 71,324 | |

Working capital | | $ | 187,528 | | | $ | 111,801 | | | $ | 118,348 | | | $ | 97,946 | | | $ | 87,943 | |

Property, plant and equipment, net | | $ | 100,421 | | | $ | 86,100 | | | $ | 81,614 | | | $ | 91,224 | | | $ | 91,350 | |

Total assets | | $ | 1,238,113 | | | $ | 1,126,239 | | | $ | 1,020,937 | | | $ | 1,012,635 | | | $ | 940,688 | |

Short-term borrowings | | $ | 14,178 | | | $ | 7,181 | | | $ | 11,858 | | | $ | 9,632 | | | $ | 6,910 | |

Notes payable, deferred revenue, long-term and other noncurrent liabilities | | $ | 279,993 | | | $ | 269,762 | | | $ | 299,014 | | | $ | 303,081 | | | $ | 309,929 | |

Stockholders’ equity | | $ | 639,167 | | | $ | 533,067 | | | $ | 448,140 | | | $ | 433,715 | | | $ | 374,366 | |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

All numerical references in thousands, except percentages, per share data and number of employees

OVERVIEW

The following discussion should be read in conjunction with the Consolidated Financial Statements and Notes included elsewhere in this Annual Report. Certain of the statements below contain forward-looking statements. These statements are predictions based upon our current expectations about future trends and events. Actual results could vary materially as a result of certain factors, including but not limited to, those expressed in these statements. In particular, we refer you to the risks discussed in “Risk Factors” in this Annual Report and in our other SEC filings, which identify important risks and uncertainties that could cause our actual results to differ materially from those contained in the forward-looking statements.

We urge you to consider these factors carefully in evaluating the forward-looking statements contained in this Annual Report. All subsequent written or spoken forward-looking statements attributable to our company or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. The forward-looking statements included in this Annual Report are made only as of the date of this Annual Report. We do not intend, and undertake no obligation, to update these forward-looking statements.

THE COMPANY

We are a supplier of electronic design automation (EDA) systems — advanced computer software, emulation hardware systems and intellectual property designs and databases used to automate the design, analysis and testing of electronic hardware and embedded systems software in electronic systems and components. We market our products and services worldwide, primarily to large companies in the military/aerospace, communications, computer, consumer electronics, semiconductor, networking, multimedia and transportation industries. Through the diversification of our customer base among these various customer markets, we attempt to reduce our exposure to fluctuations within each market. We sell and license our products through our direct sales force and a channel of distributors and sales representatives. In addition to our corporate offices in Wilsonville, Oregon, we have sales, support, software development and professional service offices worldwide.

On July 19, 2006, we changed our fiscal year to January 31 from December 31, effective for the year ended January 31, 2008. We believe that the twelve months ended December 31, 2006 and 2005 provide a meaningful comparison to the twelve months ended January 31, 2008. There are no factors, of which we are aware, seasonal or otherwise, that would impact the comparability of information or trends, if results for the twelve months ended January 31, 2007 and 2006 were presented in lieu of results for the twelve months ended December 31, 2006 and 2005. References to fiscal 2008 represent the twelve months ended January 31, 2008. References to 2006 and 2005 represent the twelve months ended December 31, 2006 and 2005.

BUSINESS ENVIRONMENT

Business during the year ended January 31, 2008 continued to build on the growth that occurred during 2006, with bookings up 1% compared to the year ended December 31, 2006, led by growth in IC Design to Silicon and New and Emerging Products. Bookings are the value of

executed orders during a period for which revenue has been or will be recognized within six months for products and within twelve months for professional services and training. The ten largest transactions for the fourth quarter of fiscal 2008 accounted for approximately 50% of total system and software bookings compared to 60% for the fourth quarter of 2006. The ten largest transactions for the year ended January 31, 2008 accounted for approximately 32% of total system and software bookings compared to 37% for the year ended December 31, 2006. The number of new customers during the three months ended January 31, 2008 was down 7% from the three months ended December 31, 2006 while the number of new customers for the year ended January 31, 2008 was 4% higher than the year ended December 31, 2006.

During the three months ended January 31, 2008, we experienced a 17% increase in system and software revenues compared to the three months ended December 31, 2006. For the year ended January 31, 2008, system and software revenues increased 11% from the year ended December 31, 2006.

We believe fiscal 2009 will bring overall growth in the EDA industry. For the past two years the EDA industry has experienced significant revenue growth. Early economic indicators suggest that the growth will be more moderate as we look to fiscal 2009. We believe that we are well-positioned among our competitors to continue our trend of growing at, or above, EDA market growth rates.

We will continue our strategy of developing high quality tools with number one market share potential, rather than being a broad-line supplier with undifferentiated product offerings. This strategy allows us to focus investment in areas where customer’s needs are greatest and we have the opportunity to build significant market share.

License Model Mix