UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| |

| (Mark One) | |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2018 |

| or |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission file number: 0-10546

LAWSON PRODUCTS, INC.

LAWSON PRODUCTS, INC.(Exact Name of Registrant as Specified in Charter)

|

| | |

| Delaware | | 36-2229304 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

8770 W. Bryn Mawr Avenue, Suite 900, Chicago, Illinois 60631

(Address of principal executive offices)

Registrant’s telephone number, including area code:

(773) 304-5050

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, $1.00 par value | | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No þ

Indicate by check mark whether the registrant (l) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" Rule 12b-2 of the Exchange Act. (Check one) |

| |

Large accelerated filer o | Accelerated filer þ |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting Company þ |

| | Emerging Growth Company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Yes o No þ

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act).

Yes o No þ

The aggregate market value of the registrant’s voting stock held by non-affiliates on June 29, 2018 (based upon the per share closing price of $24.35) was

approximately $116,844,000.

As of January 31, 2019, 8,962,450 shares of Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents are incorporated into this Form 10-K by reference:

Part III incorporates information by reference to the registrant’s definitive proxy statement, to be filed with the Securities and Exchange Commission within 120 days after the close of the fiscal year.

TABLE OF CONTENTS

“Safe Harbor” Statement under the Securities Litigation Reform Act of 1995: This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. The terms “may,” “should,” “could,” “anticipate,” “believe,” “continues,” “estimate,” “expect,” “intend,” “objective,” “plan,” “potential,” “project” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions or beliefs and are subject to a number of factors, assumptions and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include the risk factors set forth in Item 1A of this Form 10-K.

The Company undertakes no obligation to update any such factors, assumptions and uncertainties or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events or otherwise. Any references to our website in this Annual Report on Form 10-K are not and should not be considered an incorporation of information including on our website into this Annual Report on Form 10-K.

PART I

ITEM 1. BUSINESS.

Lawson Products, Inc. (“Lawson”, the “Company”, “we”, “our”, or “us”) was incorporated in Illinois in 1952, and reincorporated in Delaware in 1982. Lawson serves the industrial, commercial, institutional and government Maintenance, Repair and Operations ("MRO") market.

Vision

Our vision is to be our customers' first choice for maintenance, repair and operational solutions that improve their operating performance. We plan to achieve our vision by working closely with our customers to maintain and enhance their operations by providing them with quality products, superior service and innovative solutions.

Industry and Competition

The MRO industrial distribution industry is comprised of companies that buy and stock products in bulk and supply these products to customers on an as needed basis. The customer benefits from our knowledge and the convenience of ordering smaller quantities maintained by MRO suppliers. We estimate that total annual revenue generated by the North American MRO marketplace exceeds $130 billion.

There is a significant amount of competitive fragmentation by geography and product within the industry. We encounter competition from several national distributors and manufacturers and a large number of regional and local distributors. Some competitors have greater financial and personnel resources, handle more extensive lines of merchandise, operate larger facilities and price some merchandise more competitively than we do.

Segments

With the acquisition of The Bolt Supply House Ltd. ("Bolt") in 2017, we now operate in two reportable segments, the Lawson operating segment and the Bolt operating segment.

Lawson Segment

Through the Lawson operating segment, we deliver quality products to our customers and offer them extensive product knowledge, product application expertise and Vendor Managed Inventory ("VMI") services. Our broad geographic sales coverage allows us to serve large multi-location customers. We compete for business primarily by offering a value-added service approach in which our highly trained sales representatives manage the product inventory for our customers. The VMI model makes it less likely that our customers will unintentionally run out of a product while optimizing their inventory levels.

Sales orders are primarily generated from our sales representatives; however, customers can also order directly from our website or through our customer service team via fax or phone. We ship products to customers in all 50 states, Puerto Rico, Canada, Mexico and the Caribbean. We normally ship to our customers within one day of order placement.

Our MRO distribution process normally entails the purchase of product from suppliers in bulk for delivery to our packaging and distribution facility in McCook, Illinois (“McCook Facility”) for possible repackaging, labeling or cross-docking. Product is then either stocked at the McCook Facility or delivered to one of our strategically located distribution centers. As orders are received, product is picked, packed and shipped to our customers. Many factors affect the efficiency of this process including the physical design of the distribution centers, routing logistics, the number of times the product needs to be handled, transportation costs and the flexibility to meet the specific requirements of our customers.

On October 1, 2018 we acquired Screw Products, Inc. ("SPI"), a regional distributor of bulk industrial products to large manufacturers and job shops. SPI, with revenues of less than 1% of the Company's total revenues, will be reported as part of the Lawson MRO reporting segment.

Bolt Segment

The Bolt operating segment primarily delivers products to its customers through 14 branches located in Alberta, Saskatchewan, Manitoba, and British Columbia, Canada. Bolt generates sales from walk up business at its branch locations and through its sales team, phone, fax or the Internet. Bolt inventory is delivered to the packaging and distribution facility in Calgary, Alberta, and then distributed to each branch location. Sales generated via its sales team or through phone, fax or Internet orders are primarily shipped from one of the branch locations to the customer. The majority of Bolt's customers are located in the geographic vicinity of the retail branches. Bolt generally does not offer VMI service to its customers. Bolt generated 10.5% of the Company's annual 2018 sales. Bolt product offerings are listed on the Bolt website and are available in each of the retail branch locations.

Purchased inventory is delivered to the packaging and distribution center in Calgary, Alberta. Based on forecasted demand, product is picked, packed and shipped to the branch locations where the product is available for sale to customers.

Smaller Company Reporting Status

In 2018 the SEC revised the requirements to be qualified as a smaller reporting company. The Company meets the revised smaller reporting company requirements, and elected to be classified as a smaller reporting company. The Company will report its results in this Annual Report on Form 10-K in accordance with the smaller reporting company requirements and in its reports filed with the SEC going forward.

Customers

During 2018, the Lawson segment sold products to over 71,000 identified customers and the Bolt segment sold products to over 11,000 identified customers in addition to the walk up customers at its 14 branch locations. Our largest customer accounted for approximately three percent of net sales. In 2018, approximately 80% of our net sales were generated in the United States and approximately 20% in Canada. The percentage of sales in Canada increased in 2018 compared to 2017 due to the ownership of Bolt for an entire year. Our customers operate in a variety of industries including automotive repair, commercial vehicle maintenance, government, manufacturing, food processing, distribution, construction, oil and gas, mining, wholesale, service and others. Although seasonality is not significant in our business, due to fewer selling days during the holiday season, net sales in the fourth quarter are historically slightly lower than the first three quarters of the year.

Our customers include a wide range of purchasers of industrial supply products from small repair shops to large national and governmental accounts. Historically, we have been very effective selling to and servicing small and medium sized customer locations that value our service approach.

Products

Our product offerings are listed on our websites and in catalogs distributed to our customers. Sales percentages by broad product categories of our product mix in 2018 were as follows:

|

| | |

| Product Category | | Percentage |

| Fastening systems | | 24% |

| Cutting tools and abrasives | | 15% |

| Fluid power | | 14% |

| Specialty chemicals | | 12% |

| Electrical | | 11% |

| Aftermarket automotive supplies | | 8% |

| Safety | | 5% |

| Welding and metal repair | | 2% |

| Other | | 9% |

| | | 100% |

The Lawson segment offers over 160,000 different products for sale of which over 72,000 products are maintained in our distribution centers. We strive to carry sufficient inventory to ensure product availability and rapid processing of customer orders. Accurate forecasting of customer demand is essential to establish the proper level of inventory for each product. Inventory levels need to be sufficient to meet customer demand while avoiding the costs of stocking excess items.

During 2018, our Lawson segment purchased products from approximately 2,500 suppliers and no single supplier accounted for more than six percent of our purchases. The loss of one of our core suppliers could affect our operations by hindering our ability to provide full service to our customers.

Our quality control department tests our product offerings to ensure they meet our customers' specifications. We recommend solutions to help customers maximize product performance and avoid costly product failures. Our engineering department provides technical support for our products and offers on-site problem solutions. It also develops and presents product safety and technical training seminars tailored to meet our customers' needs. Safety Data Sheets are maintained electronically and are available to our customers on our website.

Bolt offers over 36,000 different core products for sale of which over 19,000 products are maintained in the Calgary distribution center. The majority of inventory is kept in the Calgary distribution center, with each retail branch maintaining appropriate inventory levels for their business needs.

Employees

Our organization supports a culture of continuous improvement and emphasizes the importance of addressing the needs of our customers. We require our employees to act with integrity in every aspect of our business while encouraging them to be results driven, team oriented and progressive.

On December 31, 2018, our combined workforce included approximately 1,740 individuals, comprised of approximately 1,230 in sales and marketing, approximately 400 in operation and distribution and approximately 110 in management and administration. Approximately 1,610 of the 1,740 individuals are within the Lawson segment and the remaining are within Bolt. Approximately 9% of the workforce is covered by three collective bargaining agreements. We believe that our relations with our employees and their collective bargaining organizations are good.

Sales Team

On December 31, 2018, the Lawson sales and marketing team consisted of approximately 1,230 individuals focused on servicing existing customers, identifying new customers, providing customer service support and providing on-site customer service. Of the total sales team, 994 are sales representatives who are primarily organized into geographical regions. The performance of each region is the responsibility of a Regional Sales Director. Each region is further divided into geographically defined districts. The performance of each district is the responsibility of a District Sales Manager who reports to the Regional Sales Director. Our District Sales Managers work with the sales representatives to generate sales from new and existing customers. Lawson also has a team dedicated to the acquisition of larger national and mid-market accounts and a team dedicated to serving governmental accounts. The national accounts are comprised of multi-location customers with a national scope.

The Lawson sales team receives education in the best uses of products, enabling them to provide customized solutions to address customers' needs including technical expertise and on-site problem resolution. The VMI services Lawson offers consist of managing customers' inventory, ordering the right products in the optimal quantity and stocking the product for customers when the product is delivered. The sales team also periodically provides product presentations to customers that are designed to demonstrate how the products can improve their productivity. Additionally, Lawson sales representatives offer customized storage systems for improved organization and a more efficient work-flow.

The majority of Bolt sales are made from its 14 branch locations. Bolt has approximately 30 sales territory managers who serve companies and professional tradespeople throughout Western Canada. In 2017, Bolt began requiring members of the sales teams to be certified as Certified Sales Professionals for the Canadian Professional Sales Association. All newly-hired sales team members are required to receive and maintain the same certification.

Strategic Focus

In 2019, we intend to grow our sales organically and through acquisitions and further improve our operations to make Lawson our customers' first choice for products, services and solutions that improve their operating performance.

Our sales are impacted by the size of our sales team and its territorial coverage. Our plan to expand the sales force is designed to identify under served territories that offer the greatest potential growth opportunity, locate and recruit talented sales representatives, provide them with the proper training, and successfully integrate them into our organization.

To acquire the best new sales talent and prepare them for success, we have developed an extensive talent acquisition strategy. We use both internal and external resources to identify and recruit the best available sales talent. Our training program is intended to provide new sales representatives with the tools they need to maximize their sales potential. As we increase our sales coverage, we anticipate a short-term decrease in average sales per day per sales representative, as new representatives build up customer relationships in their territories. However, we believe that these short-term investments will result in future opportunities as we leverage the positive impact of top-line growth against our operating costs which are fixed to a significant extent.

We are also focused on increasing the productivity of our sales representatives. We strive to empower our sales representatives with the training, technology and support they need to maximize their sales potential while providing our customers with superior service and making it easy for them to do business with us.

In addition to organic growth, we plan to continue to actively pursue acquisition opportunities that we believe are financially accretive to our organization. As with Bolt and SPI, Lawson will continue to explore growth opportunities in the MRO space that provide different channels to reach customers, increase sales and generate positive results.

In order to improve our operations, we utilize a Lean Six Sigma approach, which is a set of tools that allow a project team to analyze and improve selected business processes. The project teams work with the process owners to develop statistical measures to evaluate the effectiveness of the process, document the current components and process flow, examine the root cause of defects

and effect of current operations, design and implement new ways to improve performance and then measure the results for effectiveness. The Lean Six Sigma process is ingrained in our culture as we have had over 100 employees complete Lean Six Sigma training over the past four years and plan to continue this training program in the years to come.

We believe our emphasis on continuous improvement will lead to further reductions in error rates, increased processing speed, reduction in cycle times, standardization of procedures and elimination of waste. This will enable us to become a more efficient and effective organization which provides our customers with the best purchasing experience possible.

Available Information

We file or furnish annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and file or furnish amendments to those reports pursuant to Section 13(a) or 15(d) of the Exchange Act and Section 16 reports with the Securities and Exchange Commission (“SEC”). The public can obtain copies of these materials by accessing the SEC's website at http://www.sec.gov. In addition, as soon as reasonably practicable after such materials are filed with or furnished to the SEC, we make copies available to the public free of charge through our website at www.lawsonproducts.com or by calling (773) 304-5050. Information on our website is not incorporated by reference into this report. We also make available on our website our Code of Ethics, Corporate Governance Principles and the charters of the committees of our Board of Directors.

Executive Officers of the Registrant

The executive officers of Lawson as of February 1, 2019 were as follows:

|

| | | | | | |

| Name | | Age | | Year First Elected to Present Office | | Position |

| Michael G. DeCata | | 61 | | 2012 | | President and Chief Executive Officer |

| Neil E. Jenkins | | 69 | | 2004 | | Executive Vice President, Secretary and General Counsel |

| Ronald J. Knutson | | 55 | | 2014 | | Executive Vice President, Chief Financial Officer, Treasurer and Controller |

| Matthew J. Brown | | 55 | | 2017 | | Senior Vice President, Sales |

| Shane T. McCarthy | | 50 | | 2015 | | Senior Vice President, Supply Chain and Business Development |

Biographical information for the past five years relating to each of our executive officers is set forth below.

Mr. DeCata was elected President and Chief Executive Officer in September 2012. Mr. DeCata previously served in a consulting capacity for several private equity firms, including Hamilton Robinson Capital Partners from 2009 until 2012. Mr. DeCata previously served on the Board of Directors of Crescent Electric Supply Company from 2008 to 2013.

Mr. Jenkins was elected Executive Vice President, Secretary and General Counsel in 2004.

Mr. Knutson was elected Executive Vice President, Chief Financial Officer, Treasurer and Controller in April 2014 and has served as Executive Vice President, Chief Financial Officer since July 2012.

Mr. Brown was elected Senior Vice President, Sales in March 2017 and served as Vice President of Field Sales since January 2016. Mr. Brown held several levels of sales leadership roles for the Company over the last 18 years with the most recent title of Senior Director of Sales from 2014 to 2016.

Mr. McCarthy was elected Senior Vice President, Supply Chain and Business Development in December 2015 and previously served as Senior Vice President, Supply Chain since June 2014. Mr. McCarthy served as Senior Vice President, Operations from July 2012 to June 2014.

ITEM 1A. RISK FACTORS.

In addition to the other information in this Annual Report on Form 10-K for the fiscal year ended December 31, 2018, the following factors should be considered in evaluating Lawson's business. Our operating results depend upon many factors and are subject to various risks and uncertainties. The material risks and uncertainties known to us and described below may negatively affect our business operations or affect our financial results. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations or affect our financial results.

Our results of operations may be adversely impacted by a downturn in the economy or in certain sectors of the economy.

Any decline or uncertainty in the strength of the economy may lead to a decrease in customer spending and may cause certain customers to cancel or delay placing orders. Some of our customers may file for bankruptcy protection, preventing us from collecting on accounts receivable and may result in our stocking excess inventory. Contractions in the credit markets may also cause some of our customers to experience difficulties in obtaining financing, leading to lower sales, delays in the collection of receivables and result in an increase in bad debt expense.

Adverse economic conditions could also affect our key suppliers and contractors. This could lead to us incurring additional expenses or result in delays in shipping products to our customers. Economic uncertainty can make it difficult for us to accurately predict future order activity and affect our ability to effectively manage inventory levels. There are no assurances that we would be able to establish alternative financing or obtain financing with terms similar to our present Loan Agreements.

Failure to adequately fund our operating and working capital needs through cash generated from operations and cash available through our Loan Agreements could negatively impact our ability to invest in the business and maintain our capital structure.

Our business requires investment in working capital and fixed assets. We fund these investments from cash generated from operations and funds available from our Loan Agreements. Failure to generate sufficient cash flow from operations or from our Loan Agreements could cause us to have insufficient funds to operate our business. Adequate funds may not be available when needed or may not be available on favorable terms.

Failure to meet the covenant requirements of our Loan Agreements could lead to higher financing costs, increased restrictions and reduce or eliminate our ability to borrow funds.

Our Loan Agreements contain financial and other restrictive covenants. These covenants could adversely affect us by limiting our financial and operating flexibility as well as our ability to plan for and react to market conditions and to meet our capital needs. Failure to meet these covenant requirements could lead to higher financing costs, increased restrictions, reduce or eliminate our ability to borrow funds, or accelerate the payment of our existing indebtedness. If we require more liquidity than is currently available to us under our Loan Agreements, we may need to raise additional funds through debt or equity offerings which may not be available when needed or may not be available on terms favorable to us. Should funding be insufficient at any time in the future, we may be unable to develop or enhance our products or services, take advantage of business opportunities or respond to competitive pressures, any of which could have a material adverse effect on our business, financial condition and results of operations.

The market price of our common stock may decline.

Our stock price could decrease if our financial performance is inadequate or does not meet investors' expectations, if there is deterioration in the overall market for equities, if large amounts of shares are sold in the market, if there is index trading, or if investors have concerns that our business, financial condition, results of operations and capital requirements are negatively impacted by an economic downturn.

A significant portion of our inventory may become obsolete.

Our business strategy requires us to carry a significant amount of inventory in order to meet rapid processing of customer orders. If our inventory forecasting and production planning processes result in inventory levels exceeding the levels demanded by customers or should our customers decrease their orders with us, our operating results could be adversely affected due to costs of carrying the inventory and additional inventory write-downs for excess and obsolete inventory.

Work stoppages and other disruptions at transportation centers or shipping ports may adversely affect our ability to obtain inventory and make deliveries to our customers.

Our ability to rapidly process customer orders is an integral component of our overall business strategy. Interruptions at our company operated facilities or disruptions at a major transportation center or shipping port, due to events such as severe weather, labor interruptions, natural disasters, acts of terrorism or other events, could affect our ability to maintain core products in inventory, deliver products to our customers on a timely basis or adversely affect demand for our products, which may in turn adversely affect our results of operations.

Changes in our customers, product mix and pricing strategy could cause our gross margin percentage to decline in the future.

From time to time, we have experienced overall changes in the product mix demand of our customers. When customers or product mix changes, there can be no assurance that we will be able to maintain our historical gross profit margins. Changes in our customers, product mix, volume of orders, prices charged, additional freight costs or lower productivity levels, could cause our gross profit margin percentage to decline. Our gross margin percentage may also come under pressure in the future if we increase the percentage of national accounts in our customer base, as sales to these customers are generally at lower margins.

Changes in energy costs, tariffs and the cost of raw materials used in our products could impact our cost of goods and distribution and occupancy expenses, which may result in lower operating margins.

Increases in the cost of raw materials used in our products (e.g., steel, brass), tariffs and increases in energy costs raise the production costs of our vendors. Those vendors typically look to pass the higher costs along to us through price increases. If we are unable to fully pass these increased prices and costs through to our customers or to modify our activities, the impact would have an adverse effect on our operating profit margins. Low oil prices may result in weaker demand from oil and gas customers in the future, resulting in lower net sales. Changes in trade policies could affect our sourcing of product, our ability to secure sufficient product and/or impact the cost or price of our products, with potentially negative impacts on our reported gross profits and results of operations.

Disruptions of our information and communication systems could adversely affect the Company.

We depend on our information and communication systems to process orders, purchase and manage inventory, maintain cost-effective operations, sell and ship products, manage accounts receivable collections and serve our customers. Disruptions in the operation of information and communication systems can occur due to a variety of factors including power outages, hardware failure, programming faults and human error. Disruptions in the operation of our information and communication systems, whether over a short or an extended period of time or affecting one or multiple distribution centers, could have a material adverse effect on our business, financial condition and results of operations.

Cyber attacks or other information security breaches could have a material adverse effect on our operating results and financial condition, subject us to additional legal costs and damage our reputation in the marketplace.

We are increasingly dependent on digital technology to process and record financial and operating data and communicate with our employees and business partners. During the normal course of business we receive, retain and transmit certain confidential information that our customers provide to us to purchase products or services or otherwise communicate with us.

Our technologies, systems, networks, and those of our business partners may become the target of cyber attacks or information security breaches that could result in the unauthorized release, misuse, loss or destruction of proprietary and other information, or other disruption of our business operations, subject us to additional legal costs and damage our reputation in the marketplace. As cyber threats continue to evolve, we may be required to expend additional resources to continue to modify or enhance our protective measures or to investigate and fix any information security vulnerabilities.

The inability to successfully recruit, integrate and retain productive sales representatives could adversely affect our operating results.

We have committed to a plan to increase the size of our sales force which we believe will lead to increased sales and improve our long-term financial results. A successful expansion in our sales force requires us to identify under served territories that offer the greatest potential growth opportunity, locate and recruit talented sales representatives, provide them with the proper training, and successfully integrate them into our organization. This expansion plan requires significant investment in capital and resources. The failure to identify the optimal sales territories, recruit and retain quality sales representatives and provide them with sufficient support could adversely affect our operating results. Additionally, we anticipate a short-term decrease in average sales per day per sales representative as new representatives build up customer relationships in their territories.

It is also critical to retain the experienced and productive sales representatives that have historically contributed to our success. Failure to retain a sufficient number of talented, experienced and productive sales representatives could adversely affect our financial and operating results.

Failure to retain talented employees, managers and executives could negatively impact our operating results.

Our success depends on our ability to attract, develop and retain talented employees, including executives and other key managers. The loss of certain key executives and managers or the failure to attract and develop talented employees could have a material adverse effect on our business.

The inability of management to successfully implement changes in operating processes, could lead to disruptions in our operations.

We are continually striving to improve operational efficiencies throughout our organization and to identify and initiate changes intended to improve our internal operations. The implementation of changes to our current operations involve a risk that the changes may not work as intended, may disrupt related processes, may not be properly applied or may not result in accomplishing the intended efficiencies. Failure to successfully manage the implementation of these changes could lead to disruptions in our operations.

The inability to successfully integrate acquisitions into our organization could adversely affect our operations and operating results.

One of our growth strategies is to actively pursue acquisition opportunities which compliment our service oriented business model. Failure to successfully identify the right opportunities and to successfully integrate their operations into our organization could adversely affect our operations and our operating results.

The Company is exposed to the risk of foreign currency changes.

Two of our subsidiaries are located and operate in Canada using the Canadian dollar as its functional currency. Operating results are translated into U.S. dollars when consolidated into our financial statements. Therefore, we are exposed to market risk relating to the change in the value of the Canadian dollar relative to the U.S. dollar that could adversely affect our financial position and operating results.

The Company operates in highly competitive markets.

The MRO marketplace is highly competitive. Our competitors include large and small companies with similar or greater market presence, name recognition, and financial, marketing, and other resources. We believe the competition will continue to challenge our business with their product selection, financial resources and services.

Changes that affect governmental and other tax-supported entities could negatively impact our sales and earnings.

A portion of our sales are derived from the United States military and other governmental and tax-supported entities. These entities are largely dependent upon government budgets and require adherence to certain laws and regulations. A decrease in the levels of defense and other governmental spending or the introduction of more stringent governmental regulations and oversight, could lead to reduced sales or an increase in compliance costs which would adversely affect our financial position and results of operations.

A violation of federal, state or local environmental protection regulations could lead to significant penalties and fines or other remediation costs.

Our product offering includes a wide variety of industrial chemicals and other products which are subject to a multitude of federal, state and local regulations. These environmental protection laws change frequently and affect the composition, handling, transportation, storage and disposal of these products. Failure to comply with these regulations could lead to severe penalties and fines for each violation.

Additionally, a facility we own in Decatur, Alabama, was found to contain hazardous substances in the soil and groundwater as a result of historical operations prior to our ownership. We retained an environmental consulting firm to further investigate the contamination, including measurement and monitoring of the site. The Company has concluded that further remediation will most likely be required, and accordingly, has made an accrual for the estimated cost of this environmental matter. A remediation plan was approved by the Alabama Department of Environmental Management; however, the remediation approach and additional procedures may be required that could negatively impact our operating results.

Our results of operations could be affected by changes in taxation.

Our results of operations could be affected by changes in tax rates, audits by taxing authorities or changes in laws, regulations and their interpretation. Changes in applicable tax laws and regulations could continue to affect our ability to realize the deferred tax assets on our balance sheet, which could affect our results of operations.

Luther King Capital has significant influence over the Company, and this influence could delay or deter a change in control or other business combination or otherwise cause us to take actions with which you may disagree.

In January 2019 LKCM Headwater Investments, an affiliate of Luther King Capital, purchased additional shares of common stock of the Company, and as a result Luther King Capital beneficially owned 48% of the outstanding common stock of the Company. J. Bryan King, a director of the Company, is the Principal of Luther King Capital. As a result, Luther King Capital has significant influence over the outcome of matters requiring a stockholder vote, including the election of directors, and the approval of significant matters and its interests may not align with the interests of other stockholders. This concentration of ownership could also have the effect of delaying, determining or preventing a change of control or other business combination that might be beneficial to our stockholders.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES

At December 31, 2018, we owned or leased the following facilities:

|

| | | | | | | | | | | | |

| Location | | Segment | | Function | | Approximate Square Footage | | Own/Lease | | Lease Expiration |

| | | | | | | | | | | | |

| United States | | | | | | | | | | |

| | Chicago, Illinois (1) | | Lawson | | Headquarters | | 86,300 |

| | Lease | | March 2023 |

| | McCook, Illinois | | Lawson | | Packaging/Distribution | | 306,800 |

| | Lease | | June 2022 |

| | Reno, Nevada | | Lawson | | Distribution | | 105,200 |

| | Lease | | June 2024 |

| | Suwanee, Georgia | | Lawson | | Distribution | | 91,200 |

| | Own | | |

| | Decatur, Alabama (2) | | Lawson | | Lease | | 88,200 |

| | Own | | |

| | Dallas, TX | | Lawson | | Distribution | | 5,000 |

| | Lease | | October 2019 |

| | Dayton, OH | | Lawson | | Distribution | | 4,500 |

| | Lease | | Monthly |

| | | | | | | | | | | | |

| Canada | | | | | | | | | | |

| | Mississauga, Ontario | | Lawson | | Distribution | | 78,000 |

| | Own | | |

| | Calgary, Alberta (3) | | Lawson/Bolt | | Distribution | | 43,700 |

| | Lease | | December 2021 |

| | Calgary, Alberta (Foothills) | | Bolt | | Branch | | 11,200 |

| | Lease | | April 2024 |

| | Calgary, Alberta (South) | | Bolt | | Branch | | 10,300 |

| | Lease | | November 2023 |

| | Calgary, Alberta (North) | | Bolt | | Branch | | 6,900 |

| | Lease | | January 2024 |

| | Edmonton, Alberta (North) | | Bolt | | Branch | | 6,000 |

| | Lease | | February 2022 |

| | Edmonton, Alberta (South) | | Bolt | | Branch | | 5,600 |

| | Lease | | September 2023 |

| | Fort McMurray, Alberta | | Bolt | | Branch | | 7,500 |

| | Lease | | March 2019 |

| | Lethbridge, Alberta | | Bolt | | Branch | | 3,400 |

| | Own | | |

| | Medicine Hat, Alberta | | Bolt | | Branch | | 4,900 |

| | Own | | |

| | Prince Albert, Saskatchewan | | Bolt | | Branch | | 4,300 |

| | Lease | | October 2020 |

| | Red Deer, Alberta | | Bolt | | Branch | | 4,100 |

| | Lease | | July 2020 |

| | Regina, Saskatchewan | | Bolt | | Branch | | 4,800 |

| | Lease | | December 2019 |

| | Saskatoon, Saskatchewan | | Bolt | | Branch | | 10,800 |

| | Lease | | May 2021 |

| | Winnipeg, Manitoba | | Bolt | | Branch | | 7,500 |

| | Lease | | September 2025 |

| | Port Kells, British Columbia | | Bolt | | Branch | | 12,000 |

| | Lease | | August 2023 |

| |

| (1) | We have sub-leased approximately 17,100 feet of the Chicago, Illinois headquarters through June 2019 (see Note 4 - Leases). |

| |

| (2) | In connection with the sale of a discontinued business, we have agreed to lease the Decatur facility prior to the sale of the property (See Note 8 - Property, Plant and Equipment). |

| |

| (3) | Lawson and Bolt manage separate distribution operations out of the same physical location. |

While we believe that our facilities are adequate to meet our current needs, we will continue to assess the location and operation of our facilities to determine whether they meet the strategic needs of our business.

ITEM 3. LEGAL PROCEEDINGS.

The Company is involved in legal actions that arise in the ordinary course of business. It is the opinion of management that the resolution of any currently pending litigation will not have a material adverse effect on the Company’s financial position , results of operations or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Stock Price Data

The Company’s Common Stock is traded on the NASDAQ Global Select Market under the symbol of “LAWS”. The following table sets forth the high and low sale prices as reported on the NASDAQ Global Select Market.

|

| | | | | | | | | | | | | | | |

| | 2018 | | 2017 |

| | High | | Low | | High | | Low |

| First Quarter | $ | 28.00 |

| | $ | 22.25 |

| | $ | 28.10 |

| | $ | 21.40 |

|

| Second Quarter | 26.85 |

| | 21.00 |

| | 24.00 |

| | 18.70 |

|

| Third Quarter | 36.90 |

| | 23.19 |

| | 25.65 |

| | 19.30 |

|

| Fourth Quarter | 34.89 |

| | 28.00 |

| | 26.44 |

| | 22.80 |

|

On January 31, 2019, the closing sales price of our common stock was $29.60 and the number of stockholders of record was 314. We did not issue dividends in either 2018 or 2017 and the Company currently has no plans to issue dividends in the foreseeable future. The amount of dividends we can issue is restricted to $7.0 million annually under our Loan and Security Agreement ("Loan Agreement"). Information about our equity compensation plans may be found in Item 12 of this report which is hereby incorporated by reference.

Repurchased Shares of Stock

The following table summarizes the repurchases of the Company's Common Stock for the three months ended December 31, 2018. These shares were purchased for the sole purpose of satisfying tax withholding obligations of certain employees upon the vesting of market stock units granted to them by the Company. No shares were repurchased in the open market.

|

| | | | | | | | | | | | | |

| Period | | (a) Total number of shares (or units) purchased | | (b) Average price paid per share (or unit) | | (c) Total number of shares (or units) purchased as part of publicly announced plans or programs | | (d) Maximum number (or approximate dollar value) of shares that may yet be purchased under the plans or programs |

| October 1 to October 31, 2018 | | 333 |

| | $ | 29.44 |

| | — |

| | — |

|

| November 1 to November 30, 2018 | | — |

| | — |

| | — |

| | — |

|

| December 1 to December 31, 2018 | | 16,179 |

| | 31.60 |

| | — |

| | — |

|

| Three months ended December 31, 2018 | | 16,512 |

| | | | — |

| | |

Stock Price Performance Chart

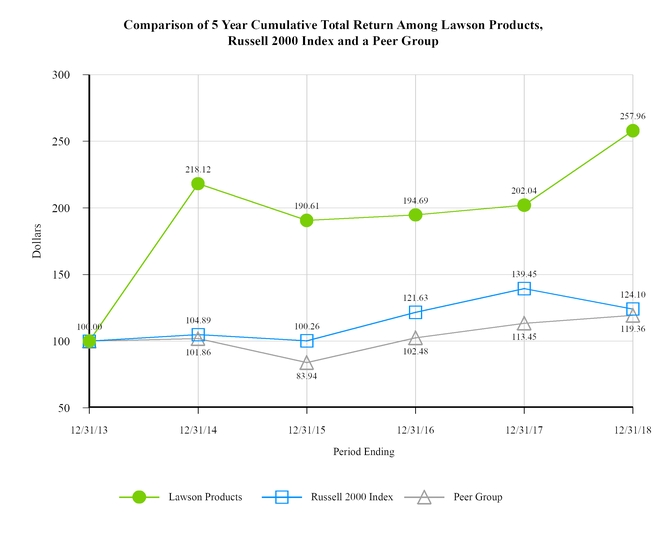

Set forth below is a line graph comparing the yearly change in the cumulative total stockholder return of the Company’s common stock against the cumulative total return of the Russell 2000 Index and a peer group (the “Peer Group”) of the Company for the five prior years. The Company selected the Russell 2000 Index because Lawson is a component of the index and the market capitalization of the other member companies are similar to Lawson’s market capitalization. The Peer Group consists of W.W. Grainger, Inc., Fastenal Company, and MSC Industrial Direct. The Company believes that the Peer Group is representative of the markets it serves in terms of product sales and customers. The chart below represents the hypothetical return, including reinvestment of dividends, on $100 if it was invested on December 31, 2013 in the respective stocks or index fund.

ITEM 6. SELECTED FINANCIAL DATA.

The following selected financial data should be read in conjunction with the Consolidated Financial Statements of the Company and Notes thereto included in Item 8 in this Annual Report. The income statement data and balance sheet data are for, and as of the end of each of the years in the five-year period ended December 31, 2018 and are derived from the audited Consolidated Financial Statements of the Company. The results of discontinued operations have been reclassified from continuing operations for all periods presented.

|

| | | | | | | | | | | | | | | | | | | |

| | (Dollars in thousands, except per share data) |

| | 2018 (1) | | 2017 (2) | | 2016 | | 2015 (3) | | 2014 (4) |

| Net sales | $ | 349,637 |

| | $ | 305,907 |

| | $ | 276,573 |

| | $ | 275,834 |

| | $ | 285,693 |

|

| | | | | | | | | | |

| Income (loss) from continuing operations | $ | 6,214 |

| | $ | 29,688 |

| | $ | (1,629 | ) | | $ | 297 |

| | $ | (6,061 | ) |

| Income from discontinued operations | — |

| | — |

| | — |

| | — |

| | 1,692 |

|

| Net income (loss) | $ | 6,214 |

| | $ | 29,688 |

| | $ | (1,629 | ) | | $ | 297 |

| | $ | (4,369 | ) |

| | | | | | | | | | |

| Diluted income (loss) per share of common stock: | | | | | | | | | |

| Continuing operations | $ | 0.67 |

| | $ | 3.25 |

| | $ | (0.19 | ) | | $ | 0.03 |

| | $ | (0.70 | ) |

| Discontinued operations | — |

| | — |

| | — |

| | — |

| | 0.20 |

|

| Net income (loss) | $ | 0.67 |

| | $ | 3.25 |

| | $ | (0.19 | ) | | $ | 0.03 |

| | $ | (0.50 | ) |

| | | | | | | | | | |

| Total assets | $ | 197,142 |

| | $ | 191,111 |

| | $ | 135,307 |

| | $ | 133,094 |

| | $ | 137,840 |

|

| | | | | | | | | | |

| Noncurrent liabilities | $ | 31,760 |

| | $ | 37,644 |

| | $ | 34,737 |

| | $ | 35,487 |

| | $ | 37,257 |

|

| | | | | | | | | | |

| Stockholders’ equity | $ | 99,173 |

| | $ | 93,490 |

| | $ | 61,133 |

| | $ | 61,264 |

| | $ | 61,855 |

|

Notes:

| |

| (1) | The 2018 results from continuing operations reflect the inclusion of Bolt for the full year, as well as a $0.5 million increase in the estimated future remediation cost of an environmental matter involving land owned in Decatur, Alabama, that was part of a division that was previously sold. |

| |

| (2) | The 2017 results from continuing operations include an income tax benefit of $19.6 million primarily as a result of releasing Deferred Tax Asset ("DTA") valuation reserves of $21.2 million at December 31, 2017. 2017 also includes a $5.4 million gain on the sale of the Fairfield, New Jersey distribution center. |

| |

| (3) | The 2015 results from continuing operations include an expense of $0.9 million related to an increase in the estimated future remediation cost of an environmental matter involving land owned in Decatur, Alabama, that was part of a division that was previously sold. |

| |

| (4) | The 2014 results from continuing operations include a $3.0 million impairment charge related to the Reno, Nevada, distribution center and a charge of $0.3 million related to the initial estimate of remediation of the environmental matter at the Decatur, Alabama, facility. |

IITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Overview

We are a distributor of products and services to the industrial, commercial, institutional, and governmental maintenance, repair and operations ("MRO") marketplace. With the acquisition of Bolt in October 2017, we now operate in two reportable segments. The Lawson operating segment primarily distributes MRO products to its customers through a network of sales representatives throughout the U.S. and Canada. The Bolt operating segment primarily distributes its MRO products through a network of 14 branches located in Alberta, Saskatchewan, Manitoba and British Columbia, Canada.

The North American MRO industry is highly fragmented. We compete for business with several national distributors as well as a large number of regional and local distributors. The MRO business is influenced by the overall strength of the manufacturing sector of the U.S. economy. One measure used to evaluate the strength of the industrial products market is the PMI index published by the Institute for Supply Management. The PMI index is a composite index of economic activity in the United States manufacturing sector and is available at https://www.instituteforsupplymanagement.org. A measure of that index above 50 generally indicates expansion of the manufacturing sector while a measure below 50 generally represents contraction. The average monthly PMI was 59.0 for the year ended December 31, 2018 compared to 57.5 for the year ended December 31, 2017 indicating improvement in 2018 in the U.S. manufacturing economy compared to the prior year.

Our sales are also affected by the number and effectiveness of sales representatives and the amount of sales each representative can generate from providing products and services to our customers, which we measure as average sales per day per sales representative. We had an average of 994 sales representatives working for us in 2018 which was approximately the same as the number we had in 2017.

Results of operations are examined in detail following a recap of our major activities in 2018.

2018 Activities

| |

| • | Acquisitions - On October 1st, we acquired Screw Products, Inc., a regional MRO distributor with a presence in the Dallas, TX and Dayton, OH areas. We also completed the integration of Bolt Supply House, Ltd into our operations, including the opening of a new branch. |

| |

| • | Lean Six Sigma - Over the past four years we have had over 100 employees complete Lean Six Sigma training, which is a systematic data driven approach to analyzing and improving business processes. |

| |

| • | Improved Operational Performance - We continued to improve the fundamentals of our business, measured as improved customer service levels to our customers. |

We believe we have created a scalable infrastructure that will allow us to take advantage of future growth opportunities. We continue to strive to be our customers' first choice for maintenance, repair and operational solutions.

RESULTS OF OPERATIONS FOR 2018 AS COMPARED TO 2017

|

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | Year-to-Year |

| | 2018 | | 2017 | | Change |

| (Dollars in thousands) | Amount | | % of Net Sales | | Amount | | % of Net Sales | | Amount | | % |

| | | | | | | | | | | | |

| Net sales | $ | 349,637 |

| | 100.0 | % | | $ | 305,907 |

| | 100.0 | % | | $ | 43,730 |

| | 14.3 | % |

| Cost of goods sold | 160,097 |

| | 45.8 |

| | 122,889 |

| | 40.2 |

| | 37,208 |

| | 30.3 |

|

| Gross profit | 189,540 |

| | 54.2 |

| | 183,018 |

| | 59.8 |

| | 6,522 |

| | 3.6 |

|

| | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Selling expenses | 87,642 |

| | 25.1 |

| | 98,025 |

| | 32.0 |

| | (10,383 | ) | | (10.6 | ) |

| General and administrative expenses | 92,688 |

| | 26.5 |

| | 80,479 |

| | 26.4 |

| | 12,209 |

| | 15.2 |

|

| Total SG&A | 180,330 |

| | 51.6 |

| | 178,504 |

| | 58.4 |

| | 1,826 |

| | 1.0 |

|

| Gain on sale of property | — |

| | — |

| | (5,422 | ) | | (1.8 | ) | | 5,422 |

| | (100.0 | ) |

| Total operating expenses | 180,330 |

| | 51.6 |

| | 173,082 |

| | 56.6 |

| | 7,248 |

| | 4.2 |

|

| | | | | | | | | | | | |

| Operating income | 9,210 |

| | 2.6 |

| | 9,936 |

| | 3.2 |

| | (726 | ) | |

|

|

| | | | | | | | | | | | |

| Interest expense | (1,009 | ) | | (0.2 | ) | | (622 | ) | | (0.2 | ) | | (387 | ) | | |

| Other (expense) income, net | (1,338 | ) | | (0.4 | ) | | 780 |

| | 0.3 |

| | (2,118 | ) | |

|

|

| | | | | | | | | | | | |

| Income before income taxes | 6,863 |

| | 2.0 |

| | 10,094 |

| | 3.3 |

| | (3,231 | ) | |

|

|

| Income tax (benefit) expense | 649 |

| | 0.2 |

| | (19,594 | ) | | (6.4 | ) | | 20,243 |

| |

|

|

| | | | | | | | | | | | |

| Net income | $ | 6,214 |

| | 1.8 | % | | $ | 29,688 |

| | 9.7 | % | | $ | (23,474 | ) | |

|

|

Sales and Gross Profits

Sales and gross profit results by operating segment for the years ended December 31, 2018 and 2017 were as follows:

|

| | | | | | | | | | | | | | |

| | Year Ended December 31, | | Increase (Decrease) |

| (Dollars in thousands) | 2018 | | 2017 | | Amount | | % |

| | | | | | | | |

| Net sales | | | | | | | |

| Lawson | $ | 313,095 |

| | $ | 297,953 |

| | $ | 15,142 |

| | 5.1 | % |

Bolt (1) | 36,542 |

| | 7,954 |

| | 28,588 |

| | 359.4 | % |

| Consolidated | $ | 349,637 |

| | $ | 305,907 |

| | $ | 43,730 |

| | 14.3 | % |

| | | | | | | | |

| Gross profit | | | | | | | |

| Lawson | $ | 175,517 |

| | $ | 179,578 |

| | $ | (4,061 | ) | | (2.3 | )% |

Bolt (1) | 14,023 |

| | 3,440 |

| | 10,583 |

| | 307.6 | % |

| Consolidated | $ | 189,540 |

| | $ | 183,018 |

| | $ | 6,522 |

| | 3.6 | % |

| | | | | | | | |

| Gross profit margin | | | | | | | |

| Lawson | 56.1 | % | | 60.3 | % | | | | |

Bolt (1) | 38.4 | % | | 43.2 | % | | | | |

| Consolidated | 54.2 | % | | 59.8 | % | | | | |

(1) Results for Bolt only reflect the period subsequent to the acquisition date of October 3, 2017.

Net sales increased 14.3% in 2018 to $349.6 million from $305.9 million in 2017. Lawson segment sales increased 5.1% over the prior year primarily due to increased productivity of sales representatives and the strength of the MRO marketplace, as well as the acquisition of Screw Products on October 1, 2018. The Company experienced growth in all major categories including regional, large strategic national, Kent Automotive and governmental accounts. There was one less selling day in 2018 compared to 2017. Average daily sales grew to $1.393 million in 2018 compared to $1.214 million in 2017 driven by a full year of Bolt Supply, improved sales rep productivity and the acquisition of Screw Products in 2018 which generated $0.6 million of sales for the year.

Gross profit increased to $189.5 million in 2018 from $183.0 million in 2017 and decreased to 54.2% of net sales from 59.8% of net sales a year ago. The decrease in the gross margin percentage was primarily a result of the effect of the adoption of ASC 606 and the inclusion of Bolt for the entire year and Screw Products for three months. Bolt and SPI historically have had lower gross margins than Lawson MRO. The Lawson gross margin decreased as a percentage of sales primarily due to the adoption of ASC 606 which reclassified $14.6 million of service related costs from selling expenses to service cost included in gross profit and higher sales to larger national customers, who typically generate lower product margin.

Selling, General and Administrative Expenses

|

| | | | | | | | | | | | | | |

| | Year Ended December 31, | Increase (Decrease) |

| | 2018 | | 2017 | | Amount | | % |

| | | | | | | | |

| Selling expenses | | | | | | | |

| Lawson | $ | 84,536 |

| | $ | 97,376 |

| | $ | (12,840 | ) | | (13.2 | )% |

| Bolt | 3,106 |

| | 649 |

| | 2,457 |

| | 378.6 | % |

| Consolidated | $ | 87,642 |

| | $ | 98,025 |

| | $ | (10,383 | ) | | (10.6 | )% |

| | | | | | | | |

| General and administrative expenses | | | | | | | |

| Lawson | $ | 84,103 |

| | $ | 78,460 |

| | $ | 5,643 |

| | 7.2 | % |

| Bolt | 8,585 |

| | 2,019 |

| | 6,566 |

| | 325.2 | % |

| Consolidated | $ | 92,688 |

| | $ | 80,479 |

| | $ | 12,209 |

| | 15.2 | % |

Selling expenses consist of compensation paid to our sales representatives and related expenses to support our sales efforts. Selling expenses decreased $10.4 million to $87.6 million in 2018 from $98.0 million in 2017 primarily as a result of the adoption of ASC 606, offset by the inclusion of Bolt for the entire year and increased compensation costs on higher sales. As a percent of sales, selling expenses decreased to 25.1% from 32.0% due to the reclassification of certain selling related expenses to gross margin due to the adoption of ASC 606 and the selling expenses being leveraged over a higher sales base.

General and administrative expenses consist of expenses to operate our distribution network and overhead expenses to manage the business, including the 14 branch locations of Bolt. General and administrative expenses increased $12.2 million to $92.7 million in 2018 compared to $80.5 million in 2017, due primarily to increased stock based compensation of $7.5 million, a portion of which is dependent on our stock price, and the inclusion of Bolt for the entire year.

Gain on sale of properties

In 2017, we received net cash proceeds of $6.2 million and recognized a gain of $5.4 million from the sale of our Fairfield, New Jersey distribution center.

Interest Expense

Interest expenses increased $0.4 million in 2018, over the prior year, due primarily to higher average borrowings outstanding.

Other Income, Net

Other income, net decreased $2.1 million in 2018 compared to the prior year, due primarily to the effect of unfavorable changes in the exchange rate on the translation of U.S. dollar denominated receivables from Canada.

Income Tax (Benefit) Expense

In 2012, due to historical cumulative losses, we had determined it was more likely than not that we would not be able to utilize our deferred tax assets to offset future taxable income. Therefore, substantially all of our deferred tax assets were subject to a tax valuation allowance.

In 2017 we had continued to generate pre-tax profits and utilized some of our net operating loss carryforwards over the previous two years and were in a three year cumulative income position in the U.S. Based on available evidence including the utilization of $13.0 million of net operating loss carryforwards in 2017, we reached a point of increased confidence in our ability to sustain profit levels and we believed it was more likely than not that we would be able to utilize a substantial amount of our deferred tax assets to offset future taxable income. Therefore, $21.2 million of our U.S. valuation allowances were released at December 31, 2017.

The benefit generated by the reversal of valuation reserves at December 31, 2017 mainly resulted in the net tax benefit of $19.6 million for 2017 (See Note 11 - Income Taxes in Item 8 for further details).

LIQUIDITY AND CAPITAL RESOURCES

Cash provided by operating activities was $20.3 million and $7.2 million in 2018 and 2017, respectively, primarily reflecting operating results, net of depreciation and amortization.

In 2017, we completed the acquisition of The Bolt Supply House Ltd. for approximately $32.3 million which was paid for by using a combination of cash on hand and borrowings of $16.3 million from our existing revolving credit facility. In 2018, we acquired Screw Products, Inc. for $5.2 million which was funded from our existing line of credit.

In 2017, we completed the sale of our distribution center located in Fairfield, New Jersey, receiving net cash proceeds of $6.2 million. Capital expenditures of $2.5 million and $1.3 million in 2018 and 2017 respectively, were primarily for improvements to our distribution centers and information technology. We invested $5.3 million and $32.3 million in 2018 and 2017 respectively, in business acquisitions.

Lawson Loan Agreement

We have the ability to borrow funds through the Loan Agreement which consists of a $40.0 million revolving credit facility which includes a $10.0 million sub-facility for letters of credit. The terms of the Loan Agreement as amended are more fully detailed in Note 13 - Loan Agreements of the Consolidated Financial Statements included in Item 8 of this Form 10-K.

At December 31, 2018, we had $9.0 million of borrowings on our revolving line of credit under the Loan Agreement and had borrowing availability of $27.7 million. Additionally, we had $1.8 million outstanding under a Commitment Letter ("Bolt Agreement") for aggregate borrowings outstanding of $10.8 million.

In addition to other customary representations, warranties and covenants, and if the excess capacity is below $10.0 million, we are required to meet a minimum trailing twelve month EBITDA to fixed charges ratio, as defined in the amended Loan Agreement. On December 31, 2018, our borrowing capacity exceeded $10.0 million, therefore, we were not subject to these financial covenants, however, we have provided the results of the financial covenants below for informational purposes:

|

| | | | |

| Quarterly Financial Covenants | | Requirement | | Actual |

| EBITDA to fixed charges ratio | | 1.10 : 1.00 | | 3.46 : 1.00 |

Although we have met the minimum financial covenant levels for all quarters since the Loan Agreement was put in place including the quarter ended December 31, 2018, failure to meet these covenant requirements in future quarters could lead to higher financing costs, increased restrictions, or reduce or eliminate our ability to borrow funds.

No cash dividends were paid in the three years ended December, 31 2018 and dividends are currently restricted under our Loan Agreement to amounts not to exceed $7.0 million annually.

Commitment Letter

Bolt has a Commitment letter which allows Bolt to access up to $5.5 million Canadian dollars. The Commitment Letter carries an interest rate of the prime rate plus 0.25%, is subject to certain covenants and is secured by substantially all of Bolt’s assets. The Commitment Letter is subject to a working capital ratio, a maximum ratio of debt to tangible net worth of the Bolt assets and a debt service coverage ratio as defined in the Commitment Letter. At December 31, 2018, Bolt was in compliance with the financial covenants which are subject to periodic review, at least annually, with the next review due by August 31, 2019.

We believe cash expected to be provided by operations and the funds available under our Loan Agreements are sufficient to fund our operating requirements, strategic initiatives and capital improvements throughout 2019.

OFF-BALANCE SHEET ARRANGEMENTS

Of the $10.8 million operating lease obligation, $4.0 million relates to a lease agreement for our headquarters which expires in March 2023, and $2.7 million relates to a lease agreement for our Reno, Nevada, distribution center which expires in June 2024. The remainder of the operating leases relate to the leases of Bolt locations and the land associated with the McCook distribution facility. A portion of the leased headquarters that has been sub-leased through June of 2019.

The majority of our operating leases will be recognized as right of use assets and lease liabilities on the balance sheet upon the adoption of ASU 2016-02, Leases ("ASU 2016-02") in the first quarter of 2019. See Note 4 - Leases for the transition to ASU 2016-02.

Also, as of December 31, 2018, we had contractual commitments to purchase approximately $11.5 million of product from our suppliers and contractors.

CRITICAL ACCOUNTING POLICIES

We have disclosed our significant accounting policies in Note 2 to the consolidated financial statements. The following provides information on the accounts requiring more significant estimates.

Allowance for Doubtful Accounts — We evaluate the collectability of accounts receivable based on a combination of factors. In circumstances where we are aware of a specific customer’s inability to meet its financial obligations (e.g., bankruptcy filings, substantial down-grading of credit ratings), a specific reserve for bad debts is recorded against amounts due to reduce the receivable to the amount we believe will be collected. For all other customers, we recognize reserves for bad debts based on our historical experience of bad debt write-offs as a percent of accounts receivable outstanding. If circumstances change (e.g., higher than expected defaults or an unexpected material adverse change in a major customer’s ability to meet its financial obligations), the estimates of the recoverability of amounts due to us could be revised by a material amount. At December 31, 2018, our reserve was 1.4% of our gross accounts receivable outstanding. A hypothetical change of one percent to our reserve as a percent of our gross accounts receivable would have affected our annual doubtful accounts expense by approximately $0.4 million.

Inventory Reserves — Inventories consist principally of finished goods and are stated at the lower of cost (determined using the first-in-first-out method) or net realizable value. Most of our products are not exposed to the risk of obsolescence due to technology changes. However, some of our products do have a limited shelf life, and from time to time we add and remove items from our catalogs, brochures or website for marketing and other purposes.

To reduce our inventory to a lower of cost or market value, we record a reserve for slow-moving and obsolete inventory based on historical experience and monitoring of our current inventory activity. We use estimates to determine the necessity of recording these reserves based on periodic detailed analysis, using both qualitative and quantitative factors. As part of this analysis, we consider several factors including the inventories’ length of time on hand, historical sales, product shelf life, product life cycle, product category and product obsolescence. In general, depending on the product category, we reserve inventory with low turnover at higher rates than inventory with higher turnover.

At December 31, 2018, our inventory reserve was $5.3 million, equal to approximately 9.2% of our gross inventory. A hypothetical change of one percent to our reserve as a percent of total inventory would have affected our cost of goods sold by $0.6 million.

Income Taxes — Deferred tax assets or liabilities reflect temporary differences between amounts of assets and liabilities for financial and tax reporting. Such amounts are adjusted, as appropriate, to reflect changes in enacted tax rates expected to be in effect when the temporary differences reverse. A valuation allowance is established to offset any deferred tax assets if, based upon the available evidence, it is more likely than not (i.e. greater than 50% likely) that some or all of the deferred tax assets will not be realized. The determination of the amount of a valuation allowance to be provided on recorded deferred tax assets involves estimates regarding (1) the timing and amount of the reversal of taxable temporary differences, (2) expected future taxable income, (3) the impact of tax planning strategies and (4) the ability to carry back deferred tax assets to offset prior taxable income. In assessing the need for a valuation allowance, we consider all available positive and negative evidence, including past operating results, projections of future taxable income and the feasibility of ongoing tax planning strategies. The projections of future taxable income include a number of estimates and assumptions regarding our volume, pricing and costs. Additionally, valuation allowances related to deferred tax assets can be impacted by changes to tax laws. The Company recognizes the benefit of tax positions when a benefit is more likely than not (i.e., greater than 50% likely) to be sustained on its technical merits.

Recognized tax benefits are measured at the largest amount that is more likely than not to be sustained, based on cumulative probability, in final settlement of the position. Significant judgment is required in determining income tax provisions as well as deferred tax asset and liability balances, including the estimation of valuation allowances and the evaluation of uncertain tax positions.

In 2012, due to historical cumulative losses, we had determined it was more likely than not that we would not be able to utilize our deferred tax assets to offset future taxable income. Therefore, substantially all of our deferred tax assets were subject to a tax valuation allowance.

We have continued to generate pre-tax profits and have utilized some of our net operating loss carryforwards over the last two years and are now in a three year cumulative income position in the U.S. Based on available evidence, including the utilization of $13.0 million of net operating loss carryforwards in 2017, we reached a point of increased confidence in our ability to sustain profit levels and we believed it was more likely than not that we would be able to utilize a substantial amount of our deferred tax assets to offset future taxable income. Therefore, $21.2 million of our U.S. valuation allowances were released at December 31, 2017.

Goodwill Impairment – Goodwill is tested annually during the fourth quarter, or when events occur or circumstances change that would more likely than not reduce the fair value of each reporting unit below its carrying value. Qualitative factors are reviewed to determine if it is more likely than not that the fair value of the reporting unit is greater than the carrying value. The Company considers factors such as macroeconomic, industry and market conditions, cost factors, overall financial performance and other relevant factors that would affect the individual reporting segments. If we determine that it is more likely than not that the fair value of the reporting unit is greater than the carrying value of the reporting unit, then no further impairment testing is needed.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

As the Company is a smaller reporting company, this item is not applicable.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The following information is presented in this item:

|

| |

| |

| |

| |

| |

Consolidated Statements of Cash Flows for the Years ended December 31, 2018 and 2017 | |

| |

| |

Report of Independent Registered Public Accounting Firm

Shareholders and Board of Directors

Lawson Products, Inc.

Chicago, Illinois

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated balance sheets of Lawson Products, Inc. (the “Company”) and subsidiaries as of December 31, 2018 and 2017, the related consolidated statements of operations and comprehensive income, changes in stockholders’ equity, and cash flows for each of the two years in the period ended December 31, 2018, and the related notes and financial statement schedule listed in the accompanying index (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company and subsidiaries at December 31, 2018 and 2017, and the results of their operations and their cash flows for each of the two years in the period ended December 31, 2018, in conformity with accounting principles generally accepted in the United States of America.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), the Company's internal control over financial reporting as of December 31, 2018, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) and our report dated March 4, 2019 expressed an unqualified opinion thereon.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/BDO USA, LLP

We have served as the Company's auditors since 2013

Chicago, Illinois

March 4, 2019

Lawson Products, Inc.

Consolidated Balance Sheets

(Dollars in thousands, except share data) |

| | | | | | | |

| | December 31, |

| | 2018 | | 2017 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 11,883 |

| | $ | 4,416 |

|

| Restricted cash | 800 |

| | 800 |

|

| Accounts receivable, less allowance for doubtful accounts of $549 and $476, respectively | 37,682 |

| | 38,575 |

|

| Inventories, net | 52,887 |

| | 50,928 |

|

| Miscellaneous receivables and prepaid expenses | 3,653 |

| | 3,728 |

|

| Total current assets | 106,905 |

| | 98,447 |

|

| | | | |

| Property, plant and equipment, less accumulated depreciation and amortization | 23,548 |

| | 27,333 |

|

| Deferred income taxes | 20,592 |

| | 21,692 |

|

| Goodwill | 20,079 |

| | 19,614 |

|

| Cash value of life insurance | 12,599 |

| | 11,964 |

|

| Intangible assets, net | 13,112 |

| | 11,813 |

|

| Other assets | 307 |

| | 248 |

|

| Total assets | $ | 197,142 |

| | $ | 191,111 |

|

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Revolving lines of credit | $ | 10,823 |

| | $ | 14,543 |

|

| Accounts payable | 15,207 |

| | 12,394 |

|

| Accrued expenses and other liabilities | 40,179 |

| | 33,040 |

|

| Total current liabilities | 66,209 |

| | 59,977 |

|

| | | | |

| Security bonus plan | 12,413 |

| | 12,981 |

|

| Financing lease obligation | 5,213 |

| | 6,420 |

|

| Deferred compensation | 5,304 |

| | 5,476 |