UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x Annual Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

For the fiscal year ended December 31, 2006

o Transition Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

For the transition period from to

Commission File Number 1-7234

GP STRATEGIES CORPORATION

(Exact name of Registrant as specified in its charter)

Delaware |

| 13-1926739 |

(State of Incorporation) |

| (I.R.S. Employer Identification No.) |

|

|

|

6095 Marshalee Drive, Suite 300, Elkridge, MD |

| 21075 |

(Address of principal executive offices) |

| (Zip Code) |

(410) 379-3600

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Name of each exchange on which registered: |

Common Stock, $.01 par value |

| New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer x | Non-accelerated filer o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12(b)-2 of the Exchange Act). Yes o No x

The aggregate market value of the outstanding shares of the Registrant’s Common Stock, par value $.01 per share, held by non-affiliates as of June 30, 2006 was approximately $110,447,000.

The number of shares outstanding of the registrant’s Common Stock as of February 28, 2007:

Class |

| Outstanding |

Common Stock, par value $.01 per share |

| 16,423,493 shares |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2007 Annual Meeting of Stockholders are incorporated herein by reference into Part III hereof.

Table of Contents

Cautionary Statement Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward looking statements. Forward—looking statements are not statements of historical facts, but rather reflect our current expectations concerning future events and results. We use words such as “expects”, “plans”, “intends”, “believes”, “may”, “will” and “anticipates” to indicate forward-looking statements. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including, but not limited to, those factors set forth under Item 1A - Risk Factors and those other risks and uncertainties detailed in the Company’s periodic reports and registration statements filed with the Securities and Exchange Commission. We caution that these risk factors may not be exhaustive. We operate in a continually changing business environment, and new risk factors emerge from time to time. We cannot predict these new risk factors, nor can we assess the effect, if any, of the new risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ from those expressed or implied by these forward-looking statements.

If any one or more of these expectations and assumptions proves incorrect, actual results will likely differ materially from those contemplated by the forward-looking statements. Even if all of the foregoing assumptions and expectations prove correct, actual results may still differ materially from those expressed in the forward-looking statements as a result of factors we may not anticipate or that may be beyond our control. While we cannot assess the future impact that any of these differences could have on our business, financial condition, results of operations and cash flows or the market price of shares of our common stock, the differences could be significant. We do not undertake to update any forward-looking statements made by us, whether as a result of new information, future events or otherwise. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented in this report.

General Development of Business

GP Strategies Corporation (“GP Strategies” or the “Company”) was incorporated in Delaware in 1959. The Company is a New York Stock Exchange (NYSE) listed company traded under the symbol GPX. The Company’s business consists of its training, engineering, and consulting business operated by its subsidiary, General Physics Corporation (“General Physics” or “GP”). General Physics is a workforce development company that seeks to improve the effectiveness of organizations by providing training, management consulting, e-Learning solutions and engineering services that are customized to meet the specific needs of clients. References in this report to the “Company,” “we” and “our” are to GP Strategies and its subsidiaries, collectively.

On January 23, 2007, General Physics completed the acquisition of certain operating assets and the business of Sandy Corporation, a leader in custom product sales training and part of the ADP Dealer Services division of ADP, Inc. (“ADP”). The Sandy Corporation business (“Sandy Corporation”) is run as an unincorporated division of General Physics. Sandy Corporation offers custom sales training and print-based and electronic publications primarily to the automotive industry. The purchase price at closing consisted of approximately $5.2 million in cash paid to ADP with cash on hand and the assumption of certain liabilities by General Physics to complete contracts, subject to post-closing adjustments. The Company currently anticipates that the final cash purchase price will be approximately $4.4 millio n after post-closing adjustments, based on the final closing balance sheet of Sandy Corporation as of the effective date of the acquisition. In addition, General Physics may be required to pay ADP up to an additional $8.0 million, contingent upon Sandy Corporation achieving certain revenue targets

1

(as defined in the purchase agreement) during the two twelve-month periods following the completion of the acquisition.

On January 19, 2006, the Company completed a restructuring of its capital stock, which included the repurchase of 2,121,500 shares of its Common Stock at a price of $6.80 per share, the repurchase of 600,000 shares of its Class B Capital Stock (“Class B Stock”) at a price of $8.30 per share, and the exchange of 600,000 shares of its Class B Stock into 600,000 shares of Common Stock for a cash premium of $1.50 per exchanged share. The repurchase prices and exchange premium were based on a fairness opinion rendered by an independent third party valuation firm. The repurchase and exchange transactions were negotiated and approved by a Special Committee of the Board of Directors and had the effect of eliminating all outstanding shares of the Company’s Class B Stock.

On September 30, 2005, the Company completed a taxable spin-off of its 57% interest in GSE Systems, Inc. (“GSE”) through a dividend to the Company’s stockholders. GSE is a stand alone public company which provides simulation solutions and services to energy, process and manufacturing industries worldwide. On September 30, 2005, stockholders received in the spin-off 0.283075 shares of GSE common stock for each share of the Company’s Common Stock or Class B Stock held on the record date of September 19, 2005. Following the spin-off, the Company ceased to have any ownership interest in GSE and the operations of GSE have been reclassified as discontinued in the Company’s consolidated statements of operations for 2005 and prior periods presented herein. The Company provided corporate support services to GSE pursuant to a management services agreement which extended through December 31, 2006 (see Note 16 to the accompanying Consolidated Financial Statements).

On November 24, 2004, the Company completed the tax-free spin-off of National Patent Development Corporation (“NPDC”). NPDC is a stand alone public company owning all of the stock of MXL Industries, Inc. (“MXL”), an interest in Five Star Products, Inc. (“Five Star”), and certain other non-core assets. Subsequent to the spin-off, the results of operations of NPDC are presented as discontinued in the Company’s consolidated statements of operations for 2004 and prior periods presented herein. The Company provides certain corporate support services to NPDC pursuant to a management services agreement (see Note 16 to the accompanying Consolidated Financial Statements).

Organization and Operations

Through its General Physics subsidiary, the Company provides training, engineering, consulting and technical services to leading companies in the automotive, steel, power, oil and gas, chemical, energy, electronics and semiconductor, pharmaceutical and food and beverage industries, as well as to the government sector, and focuses on developing long-term relationships with Fortune 500 companies, their suppliers and government agencies. General Physics is a global leader in performance improvement, with four decades of experience in providing solutions to optimize workforce performance. Since its incorporation in 1966, General Physics has provided clients with the products and services they need to successfully integrate their people, processes and technology.

As of December 31, 2006, the Company operated through General Physics’ two reportable business segments: 1) Process, Energy & Government; and 2) Manufacturing & Business Process Outsourcing (BPO). The Company is organized by operating group, primarily based upon the services performed and markets served by each group. Each operating group consists of strategic business units (SBUs) and business units (BUs) which are focused on providing specific products and services to certain classes of customers or within targeted markets. Across operating groups, SBUs and BUs, the Company integrates similar service lines, technology, information, work products, client management and other resources. Communications and market research, accounting, finance, legal, human resources, information systems and other administrative services are organized at the corporate level. Business development and sales resources are aligned with operating groups to support existing customer

2

accounts and new customer development. The Company’s reportable business segments represent an aggregation of its operating groups in accordance with the aggregation criteria in Statement of Financial Accounting Standards (SFAS) No. 131, Disclosures about Segments of an Enterprise and Related Information (SFAS No. 131). Further information regarding the Company’s business segments is discussed below.

Process, Energy & Government

The Process, Energy & Government segment provides engineering consulting, design and evaluation services involving facilities, the environment, processes and systems, staff augmentation, curriculum design and development, and training and technical services primarily to federal and state governmental agencies, large government contractors, petroleum and chemical refining companies, and electric power utilities.

Manufacturing & BPO

The Manufacturing & BPO segment provides training, curriculum design and development, staff augmentation, e-Learning services, system hosting, integration and help desk support, business process and training outsourcing, and consulting and technical services to large companies in the automotive, steel, pharmaceutical, electronics, and other industries as well as to governmental clients.

Business Segment Information

For financial information about the Company’s segments and geographic operations and revenue, see Note 15 to the accompanying Consolidated Financial Statements.

Products and Services

For businesses, government agencies and other organizations, General Physics offers services and products spanning the entire lifecycle of production facilities. General Physics’ products and services include plant, equipment and process launch assistance; operations and maintenance practice training and consulting services; curriculum development and delivery; facility and enterprise change and configuration management; lean enterprise consulting; plant and process engineering review and re-design; business continuity planning and support services; alternative fuels engineering consulting, facility design and construction services; business process outsourcing; training outsourcing; e-Learning hosting, consulting and systems implementation; and development and delivery of information technology (IT) training on an enterprise-wide scale. General Physics’ personnel bring a wide variety of professional, technical and military backgrounds together to create cost-effective solutions for modern business and governmental challenges. The Company’s primary product and service categories are discussed in more detail below.

Training and Performance Improvement. General Physics provides training services and products to support existing, as well as the launch of new, plants, products, equipment, technologies and processes. The range of services includes fundamental analysis of a client’s training needs, curriculum design, instructional material development (in hard copy, electronic/software or other format), information technology service support and delivery of training. Training products include instructor and student training manuals, and instructional materials suitable for web-based and blended learning solutions. General Physics’ instructional delivery capabilities include traditional classroom, structured on-the-job training (OJT), just-in-time methods, computer-based, web-based, video-based and the full spectrum of e-Learning technologies. General Physics’ e-Learning services enable the Company to function as a single-source e-Learning solutions provider through its integration services and hosting, the development and provisioning of proprietary content and the aggregation and distribution of third party content.

3

Business Process Outsourcing. General Physics provides end-to-end business process outsourcing solutions, including the management of its customers’ training departments, as well as administrative processes, such as tuition assistance program management, vendor management, call center / help desk administration and learning management system (LMS) administration. General Physics automates much of its customers’ tuition reimbursement programs by utilizing its own proprietary software, Tuition Outsourced Processing Services (TOPS). GP also provides meeting and event planning services, including needs assessment, site selection, contract negotiations, logistics and room setup, onsite coordination and support, accommodations management and pre and post-event reporting.

Consulting. Consulting services include not only training-related consulting services, but also more traditional business management, engineering and other disciplines. General Physics is able to provide high-level lean enterprise consulting services, as well as training in the concept, methods and application of lean enterprise and other quality practices, organizational development and change management. General Physics also provides engineering consulting services to support regulatory and environmental compliance, modification of facilities and processes, plant performance improvement, reliability-centered maintenance practices and plant start-up activities. Consulting services also include operations continuity assessment, planning, training and procedure development. Consulting products include proprietary training and reference materials.

Technical Support and Engineering. General Physics is staffed and equipped to provide engineering and technical support services and products to clients. General Physics has civil, mechanical and electrical engineers who provide consulting, design and evaluation services regarding facilities, processes and systems. General Physics believes that it is a leader in the design and construction of alternative fuel stations, cryogenic systems and high pressure systems. Technical support services include procedure writing and configuration control for capital intensive facilities, plant start-up assistance, logistics support (e.g., inventory management and control), implementation and engineering assistance for facility or process modifications, facility management for high technology training environments, staff augmentation and help-desk support for standard and customized client desktop applications. Technical support products include General Physics’ proprietary EtaPRO™ and Virtual Plant software applications that serve the power generation and petrochemical industries.

Company Information Available on the Internet

The Company’s internet address is www.gpstrategies.com. Additional information about General Physics may be found at www.gpworldwide.com. The Company makes available free of charge through its internet site, its annual reports on Form 10-K; quarterly reports on Form 10-Q; current reports on Form 8-K; and any amendment to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, (the “Exchange Act”) as soon as reasonably practicable after such material is electronically filed with, or furnished to, the U.S. Securities and Exchange Commission.

Contracts

Through General Physics, the Company currently performs under fixed price (including fixed-fee per transaction), time-and-materials and cost-reimbursable contracts. General Physics’ contracts with the U.S. Government have predominantly been cost-reimbursable contracts and fixed-price contracts. General Physics is required to comply with Federal Acquisition Regulations and Government Cost Accounting Standards with respect to services provided to the U.S. Government and its agencies. These Regulations and Standards govern the procurement of goods and services by the U.S. Government and the nature of costs that can be charged with respect to such goods and services. All such contracts are subject to audit by a designated government audit agency, which in most cases is the Defense Contract Audit Agency (the DCAA). The DCAA has audited the Company’s contracts through 2003 without any material disallowances.

4

The following table illustrates the Company’s percentage of total revenue attributable to each type of contract for the year ended December 31, 2006:

Fixed-price (including fixed-fee per transaction) |

| 65 | % |

Time-and-materials, including fixed rate |

| 22 |

|

Cost-reimbursable |

| 13 |

|

Total revenue |

| 100 | % |

Fixed-price contracts provide for payment to the Company of pre-determined amounts as compensation for the delivery of specific products or services, without regard to the actual costs incurred. The Company bears the risk that increased or unexpected costs required to perform the specified services may reduce the Company’s profit or cause the Company to sustain a loss, but the Company has the opportunity to derive increased profit if the costs required to perform the specified services are less than expected. Fixed-price contracts generally permit the client to terminate the contract on written notice; in the event of such termination the Company would typically be paid a proportionate amount of the fixed price.

Time-and-materials contracts generally provide for billing of services based upon the hourly billing rates of the employees performing the services and the actual expenses incurred multiplied by a specified mark-up factor up to a certain aggregate dollar amount. The Company’s time-and-materials contracts include certain contracts under which the Company has agreed to provide training, engineering and technical services at fixed hourly rates. Time-and-materials contracts generally permit the client to control the amount, type and timing of the services to be performed by the Company and to terminate the contract on written notice. If a contract is terminated, the Company is typically paid for the services it has provided through the date of termination.

Cost-reimbursable contracts provide for the Company to be reimbursed for its actual direct and indirect costs plus a fee. These contracts also are generally subject to termination at the convenience of the client. If a contract is terminated, the Company is typically reimbursed for its costs through the date of termination, plus the cost of an orderly termination and paid a proportionate amount of the fee.

International

The Company also conducts its business outside of the United States in Canada, the United Kingdom, Mexico, Singapore, Malaysia, India and in other countries primarily through its wholly owned subsidiaries General Physics (UK) Ltd., General Physics Corporation Mexico, S.A. de C.V., General Physics Asia, Pte. Ltd., General Physics (Malaysia) Sdn Bhd, and GP Consulting (India) Private Limited. Through these subsidiaries, the Company is capable of providing substantially the same services and products as are available to clients in the United States, although modified as appropriate to address the language, business practices and cultural factors unique to each client and country. In combination with its subsidiaries, the Company is able to coordinate the delivery to multi-national clients of services and products that achieve consistency on a global, enterprise-wide basis. Revenue from operations outside the United States represented approximately 12% of the Company’s consolidated revenue for the year ended December 31, 2006 (see Note 15 to the accompanying Consolidated Financial Statements).

Customers

As of December 31, 2006, the Company provided services to over 500 customers. Significant customers include multinational automotive manufacturers, such as General Motors Corporation, Ford Motor Company, Mercedes-Benz and DaimlerChrysler Corporation; commercial electric power utilities, such as Bruce Power, L.P., First Energy, Mid-American Energy Company, Public Service Electric & Gas Company and Entergy Operations, Inc.; governmental agencies, such as the U.S. Department of Defense, U.S. Department of Treasury, Office of Personnel Management, and U.S. Social Security Administration; U.S. government prime contractors,

5

such as Bechtel National, Inc., Washington Group International, and Unisys Corporation; and other large multinational companies, such as Cisco Systems, Inc., Texas Instruments, Motorola, Eli Lilly & Co., IBM Corporation, United Technologies Corporation, Agilent Technologies, Inc., The Boeing Company, Chevron Texaco, J.B. Poindexter & Co., and United States Steel Corporation. Revenue from the U.S. Government accounted for approximately 29% of the Company’s revenue for the year ended December 31, 2006. Revenue was derived from many separate contracts with a variety of government agencies that are regarded by the Company as separate customers. In 2006, revenue from the Department of the Army, which is included in U.S. Government revenue, accounted for approximately 13% of the Company’s revenue. No other customer accounted for more than 10% of the Company’s revenue in 2006.

Employees

The Company’s principal resource is its personnel, almost all of whom work for General Physics. As of December 31, 2006, the Company had 1,205 employees and over 100 adjunct instructors and consultants. In connection with the acquisition of Sandy Corporation on January 23, 2007, the Company acquired an additional 294 employees. The Company’s future success depends to a significant degree upon its ability to continue to attract, retain and integrate into its operations instructors, engineers, technical personnel and consultants who possess the skills and experience required to meet the needs of its clients.

The Company utilizes a variety of methods to attract and retain personnel. We believe that the compensation and benefits offered to our employees are competitive with the compensation and benefits available from other organizations with which we compete for personnel. In addition, the Company encourages the professional development of its employees, both internally via GP University (its own internal training resource) and through third parties, and also offers tuition reimbursement for job-related educational costs. The Company believes its relations with its employees are good.

Competition

The Company faces a highly competitive environment. The principal competitive factors are the experience and capability of service personnel, performance, quality and functionality of products, reputation and price. Consulting services such as those provided by the Company are performed by many of the customers themselves, large architectural and engineering firms that have expanded their range of services beyond design and construction activities, large consulting firms, information technology companies, major suppliers of equipment, degree-granting colleges and universities, vocational and technical training schools, continuing education programs, small privately held training providers and individuals and independent service companies similar to the Company. The training industry is highly fragmented and competitive, with low barriers to entry and no single competitor accounting for a significant market share. Some of the Company’s competitors offer services and products at lower prices that are similar to those of the Company, and some competitors have significantly greater financial, managerial, technical, marketing and other resources than the Company. There can be no assurance that the Company will be successful against such competition.

Marketing

As of December 31, 2006, the Company had approximately 40 employees dedicated primarily to marketing its services and products. The Company uses attendance at trade shows, presentations of technical papers at industry and trade association conferences, press releases, public courses and workshops given by Company personnel to serve an important marketing function. The Company also does selective advertising and sends a variety of sales literature to current and prospective clients. By staying in contact with clients and looking for opportunities to provide further services, the Company sometimes obtains contract awards or extensions without having to undergo competitive bidding. In other cases, clients request the Company to bid competitively. In both cases, the Company submits proposals to the client for evaluation. The period between submission of a proposal to final

6

award can range from 30 days or less (generally for noncompetitive, short-term contracts), to a year or more (generally for large, competitive multi-year contracts).

Backlog

The Company’s backlog for services under executed contracts and subcontracts was approximately $85.3 million and $78.9 million as of December 31, 2006 and 2005, respectively. The Company anticipates that most of its backlog as of December 31, 2006 will be recognized as revenue during 2007. However, the rate at which services are performed under certain contracts, and thus the rate at which backlog will be recognized, is at the discretion of the client and most contracts are, as mentioned above, subject to termination by the client upon written notice.

Environmental Statutes and Regulations

The Company provides environmental engineering services to its clients, including the development and management of site environmental remediation plans. Due to the increasingly strict requirements imposed by Federal, state and local environmental laws and regulations (including, without limitation, the Clean Water Act, the Clean Air Act, Superfund, the Resource Conservation and Recovery Act and the Occupational Safety and Health Act), the Company’s opportunities to provide such services may increase.

The Company’s activities in connection with providing environmental engineering services may also subject the Company to such Federal, state and local environmental laws and regulations. Although the Company subcontracts most remediation construction activities and all removal and offsite disposal and treatment of hazardous substances, the Company could still be held liable for clean-up or violations of such laws as an “operator” or otherwise under such Federal, state and local environmental laws and regulations with respect to a site where it has provided environmental engineering and support services. The Company believes, however, that it is in compliance in all material respects with such environmental laws and regulations.

Set forth below and elsewhere in this report and in other documents the Company files with the U.S. Securities and Exchange Commission are risks and uncertainties that could cause the Company’s actual results to differ materially from the results contemplated by the forward-looking statements contained in this report and other public statements made by the Company.

Our holding company structure could adversely affect our ability to pay our expenses and long-term debt obligations.

Our principal operations are conducted through our General Physics subsidiary. General Physics’ Credit Agreement currently limits its ability to loan, dividend or otherwise pay funds to us, which could adversely affect our ability to pay our expenses and long-term debt obligations which mature in 2008 (see Note 9 to the accompanying Consolidated Financial Statements).

As of December 31, 2005, we identified a material weakness in our internal control over financial reporting and cannot assure you that we will not find further such weaknesses in the future.

Section 404 of the Sarbanes-Oxley Act of 2002 requires us to conduct an annual review and evaluation of our internal control over financial reporting and to include a report on, and an attestation by our independent registered public accountants, KPMG LLP, of the effectiveness of these controls. In the course of our assessment of the effectiveness of our internal control over financial reporting as of December 31, 2005, we identified a material weakness in our internal control over financial reporting, arising from deficiencies with respect to our accounting for income taxes. To remediate this material weakness, during 2006 we revised our processes and procedures over the accounting for income taxes, hired a new tax director who we believe provides the Company with the necessary technical skills to perform, review and analyze complex tax accounting activities, and implemented an independent review of our annual tax provision computations by an independent registered public accounting firm.

7

We concluded that our internal control over financial reporting was effective as of December 31, 2006. See Item 9A, Controls and Procedures.

Despite our remediation of the material weakness in our internal control over financial reporting that was reported for the year ended December 31, 2005, we cannot assure you that deficiencies or weaknesses in our controls and procedures will not be identified in the future. Any such weaknesses or deficiencies could harm our business and operating results, result in adverse publicity and a loss in investor confidence in our financial reports, which in turn could have an adverse effect on our stock price, and, if they are not properly remediated, could adversely affect our ability to report our financial results on a timely and accurate basis.

Failure to continue to attract and retain qualified personnel could harm our business.

Our principal resource is our personnel. A significant portion of our revenue is derived from services and products that are delivered by instructors, engineers, technical personnel and consultants. Our success depends upon our ability to continue to attract and retain instructors, engineers, technical personnel and consultants who possess the skills and experience required to meet the needs of our clients. In order to initiate and develop client relationships and execute our growth strategy, we must maintain and continue to hire qualified salespeople. We must also continue to attract and develop capable management personnel to guide our business and supervise the use of our resources. Competition for qualified personnel can be intense. We cannot assure you that qualified personnel will continue to be available to us. Any failure to attract or retain qualified instructors, engineers, technical personnel, consultants, salespeople and managers in sufficient numbers could adversely affect our business and financial condition.

The loss of our key personnel, including our executive management team, could harm our business.

Our success is largely dependent upon the experience and continued services of our executive management team and our other key personnel. The loss of one or more of our key personnel and a failure to attract, develop or promote suitable replacements for them may adversely affect our business.

Our revenue and financial condition could be adversely affected by the loss of business from significant customers, including the U.S. Government and automotive manufacturers.

For the years ended December 31, 2006, 2005 and 2004, revenue from the U.S. Government represented approximately 29%, 40%, and 38% of our revenue, respectively. However, the revenue was derived from a number of separate contracts with a variety of government agencies we regard as separate customers. Most of our contracts and subcontracts, including those with the U.S. Government, are subject to termination on written notice, and therefore our operations are dependent on our customers’ continued satisfaction with our services and their continued inability or unwillingness to perform those services themselves or to engage other third parties to deliver such services.

Government contracts are also subject to various uncertainties, restrictions and regulations, including oversight audits by government representatives and profit and cost controls. If we fail to comply with all of the applicable regulations, requirements or laws, our existing contracts with the government could be terminated and our ability to seek future government contracts or subcontracts could be adversely affected. In addition, the funding of government contracts is subject to Congressional appropriations. Budget decisions made by the U.S. Government are outside of our control and could result in a reduction or elimination of contract funding. A shift in government spending to other programs in which we are not involved or a reduction in general government spending could have a negative impact on our financial condition. The government is under no obligation to maintain or continue funding our contracts or subcontracts.

Our acquisition of Sandy Corporation on January 23, 2007 resulted in a significant concentration of business in the U.S. automotive industry, and specifically a significant concentration of revenue from one predominant

8

customer, General Motors. The loss of this customer, an economic downturn, continued cost-cutting or other severe impact on the U.S. automotive industry in general could adversely impact our financial condition as well as the profitability of Sandy Corporation and our ability to achieve anticipated benefits of the acquisition.

Our business and financial condition could be adversely affected by government limitations on contractor profitability and the possibility of cost disallowance.

A significant portion of our revenue and profit is derived from contracts and subcontracts with the U.S. Government. The U.S. Government places limitations on contractor profitability; therefore, government related contracts may have lower profit margins than the contracts we enter into with commercial customers. Furthermore, U.S. Government contracts and subcontracts are subject to audit by a designated government agency. Although we have not experienced any material cost disallowances as a result of these audits, we may be subject to material disallowances in the future.

We enter into fixed price contracts which could result in reduced profits or losses if we have cost overruns.

A significant portion of our revenue is attributable to contracts entered into on a fixed-price basis. This allows us to benefit from cost savings, but we carry the burden of cost overruns. If our initial estimates are incorrect, or if unanticipated circumstances arise, we could experience cost overruns which would result in reduced profits or losses on these contracts. Our financial condition is dependent on our ability to maximize our earnings from our contracts. Lower earnings caused by cost overruns could have a negative impact on our financial results.

We maintain a workforce based upon anticipated staffing needs. If we do not receive future contract awards or if these awards are delayed or reduced in scope or funding, we may incur significant costs.

Our estimates of future staffing requirements depend in part on the timing of new contract awards. We make our estimates in good faith, but our estimates could be inaccurate or change based on new information. In the case of larger projects, it is particularly difficult to predict whether we will receive a contract award and when the award will be announced. In some cases the contracts that are awarded require staffing levels that are different, sometimes lower, than the levels anticipated when the work was proposed. The uncertainty of contract award timing and changes in scope or funding can present difficulties in matching our workforce size with our contract needs. If an expected contract award is delayed or not received, or if a contract is awarded for a smaller scope of work than proposed, we could incur significant costs resulting from reductions in staff.

Failure to keep pace with technology and changing market needs could harm our business.

Our future success will depend upon our ability to gain expertise in technological advances rapidly and respond quickly to evolving industry trends and client needs. We cannot assure you that we will be successful in adapting to advances in technology, addressing client needs on a timely basis, or marketing our services and products in advanced formats. In addition, services and products delivered in the newer formats may not provide comparable training results. Furthermore, subsequent technological advances may render moot any successful expansion of the methods of delivering our services and products. If we are unable to develop new means of delivering our services and products due to capital, personnel, technological or other constraints, our business and financial condition could be adversely affected.

Changing economic conditions in the United States or the United Kingdom could harm our business and financial condition.

Our revenues and profitability are related to general levels of economic activity and employment primarily in the United States and the United Kingdom. As a result, any significant economic downturn or recession in one or both of those countries could harm our business and financial condition. A significant portion of our revenues is derived from Fortune 500-level companies and their international equivalents, which historically have adjusted

9

expenditures for external training during economic downturns. If the economies in which these companies operate weaken in any future period, these companies may not increase or may reduce their expenditures on external training, and other products and services supplied by us, which could adversely affect our business and financial condition.

Our financial results are subject to quarterly fluctuations.

We experience, and expect to continue to experience, fluctuations in quarterly operating results. In addition, we provide domestic preparedness and emergency management services, including hurricane and other disaster recovery services, which can result in revenue volatility associated with the unpredictability of certain events occurring and the need for these types of services. Consequently, you should not deem our results for any particular quarter to be necessarily indicative of future results. These fluctuations in our quarterly operating results may vary because of, among other things, the overall level of performance improvement services and products sold, the gain or loss of material clients, the timing, structure and magnitude of acquisitions, the commencement or completion of client engagements or custom services and products in a particular quarter, and the general level of economic activity. Downward fluctuations may result in a decline in the trading price of our Common Stock.

Our revenue and financial condition could be adversely affected by cutbacks by United States domestic automobile manufacturers.

With the acquisition of Sandy Corporation, the Company will substantially increase the percentage of revenue it derives from the U.S. automotive industry. During 2007, we expect that a significant portion of our revenues will be derived from contracts awarded by General Motors Corporation and its affiliates. In recent years, General Motors and other U.S. domestic auto manufacturers have reported substantial losses and reduced vehicle sales, resulting in efforts to restructure their operations to become more competitive. Further cost-cutting, or a decision to cease or reduce awards to General Physics or Sandy Corporation, could adversely affect our business and financial condition.

Competition could adversely affect our performance.

The training industry is highly fragmented and competitive, with low barriers to entry and no single competitor accounting for a significant market share. Our competitors include several large publicly traded and privately held companies, vocational and technical training schools, degree-granting colleges and universities, continuing education programs and thousands of small privately held training providers and individuals. In addition, many of our clients maintain internal training departments. Some of our competitors offer similar services and products at lower prices, and some competitors have significantly greater financial, managerial, technical, marketing and other resources. Moreover, we expect to face additional competition from new entrants into the training and performance improvement market due, in part, to the evolving nature of the market and the relatively low barriers to entry. We cannot provide any assurance that we will be able to compete successfully, and the failure to do so could adversely affect our business and financial condition.

We are subject to potential liabilities which are not covered by our insurance.

We engage in activities in which there are substantial risks of potential liability. We provide services involving electric power distribution and generation, nuclear power, chemical weapons destruction, environmental remediation, engineering design and construction management. We maintain a consolidated insurance program (including general liability coverage) covering companies we currently own, including General Physics, as well as certain risks associated with companies we no longer own, including GSE and NPDC. Claims by or against any covered insured could reduce the amount of available insurance coverage for the other insureds and for other claims. In addition, certain liabilities may not be covered at all, such as deductibles, self-insured retentions, amounts in excess of applicable insurance limits and claims that fall outside the coverage of our policies.

10

Although we believe that we currently have appropriate insurance coverage, we do not have coverage for all of the risks to which we are subject and we may not be able to obtain appropriate coverage on a cost-effective basis in the future.

Our policies exclude coverage for incidents involving nuclear liability and we may not be covered by United States laws or industry programs providing liability protection for licensees of the Nuclear Regulatory Commission (typically utilities) for damages caused by nuclear incidents; we are not a licensee and few of our contracts with clients have contained provisions waiving or limiting their liability. Therefore, we could be materially and adversely affected by a nuclear incident.

Certain environmental risks, such as liability under the Comprehensive Environmental Response, Compensation and Liability Act, as amended (“Superfund”), also may not be covered by our insurance. We provide environmental engineering services, including the development and management of site environmental remediation plans. Although we subcontract most remediation construction activities, and in all cases subcontract the removal and off-site disposal and treatment of hazardous substances, we could be subject to liability relating to the environmental services we perform directly or through subcontracts. Specifically, if we were deemed under federal or state laws, including Superfund, to be an “operator” of sites to which we provide environmental engineering and support services, we could be subject to liability. Our insurance policies may not provide coverage for these risks. Various mechanisms exist whereby the U.S. Government may limit liability for environmental claims and losses or indemnify us for such claims or losses under governmental contracts. Nonetheless, incurrence of any substantial Superfund or other environmental liability could adversely affect our business and financial condition by reducing profits or causing us to incur losses related to the cost of resolving such liability.

Some of our policies, such as our professional liability insurance policy, provide coverage on a “claims made” basis covering only claims actually made during the policy period currently in effect. To the extent that a risk is not insured within our then available coverage limits, insured under a low-deductible policy, indemnified against by a third party or limited by an enforceable waiver or limitation of liability, claims could be material and adversely affect our financial condition.

Acquisitions are part of our growth strategy and may not be successful.

We expect to continue to pursue selective acquisitions of businesses as part of our growth strategy. Acquisitions may bring us into businesses we have not previously conducted and expose us to risks that are different than those we have traditionally experienced. We can provide no assurances that we will be able to find suitable acquisitions or that we will be able to consummate them on terms and conditions favorable to us, or that we will successfully integrate and manage acquired businesses.

On January 23, 2007, we completed the acquisition of certain assets and the business of Sandy Corporation. While we believe that this acquisition will be accretive to our earnings and we will be able to successfully integrate its operations into our business, we can provide no assurances that our expectations will prove to be accurate. Sandy Corporation’s business is heavily oriented toward providing sales training to auto manufacturers in the U.S. domestic automotive industry. Developments in that industry, as well as differences between General Physics and Sandy Corporation’s cultures and, certain unforeseen factors or other risks may cause our actual results to differ from our expectations.

We are subject to potential liabilities related to operations we have discontinued.

In November 2004, we completed the spin-off to our stockholders of the shares of stock we owned in NPDC. Prior to the spin-off, we provided certain financial guarantees and entered into transactions involving assets owned by NPDC or subsequently contributed by us to NPDC. We also have outstanding debt that is

11

collateralized by certain real property which was transferred to NPDC in connection with the spin-off. We also continued to guarantee certain lease obligations and indebtedness of NPDC subsequent to the spin-off. We no longer have the assets of NPDC available to us to use to satisfy these obligations, and if NPDC fails to satisfy obligations for which we continue to guarantee, we could be responsible for satisfying those obligations, which could materially and adversely impact our financial condition.

Our stockholder rights plan and authorized preferred stock could make a third-party acquisition of us difficult.

We have a stockholder rights plan. Our stockholder rights plan would cause substantial dilution to any person or group that attempts to acquire us on terms not approved in advance by our Board of Directors. In addition, our certificate of incorporation allows us to issue up to 5,000,000 shares of preferred stock, the rights, preferences, qualifications, limitations and restrictions of which may be fixed by the Board of Directors without any further vote or action by the stockholders. The stockholder rights plan, the ability to issue preferred stock and certain provisions in our by-laws may have the effect of delaying, discouraging or preventing a change in control that might otherwise be beneficial to stockholders and might adversely affect the market price of our Common Stock.

Our certificate of incorporation may discourage foreign ownership of our Common Stock.

The United States Departments of Energy and Defense have policies regarding foreign ownership, control or influence over government contractors who have access to classified information, and inquire as to whether any foreign interest has beneficial ownership of 5% or more of a contractor’s or subcontractor’s voting securities. If either Department determines that an undue risk to the defense and security of the United States exists, it may, among other things, terminate the contractor’s or subcontractor’s existing contracts. Our certificate of incorporation allows us to redeem or require the prompt disposition of all or any portion of the shares of our Common Stock owned by a foreign stockholder beneficially owning 5% or more of the outstanding shares of our Common Stock if either Department threatens termination of any of our contracts as a result of such an ownership interest. These provisions may have the additional effect of delaying, discouraging or preventing a change in control and might adversely affect the market price of our Common Stock.

Item 1B: Unresolved Staff Comments

None.

The following information describes the material physical properties owned or leased by the Company and its subsidiaries.

As of December 31, 2006, the Company had leases for approximately 30,700 square feet in an office building in Elkridge, Maryland for its corporate headquarters office and approximately 128,000 square feet of office, classroom and warehouse space at various other locations throughout the United States, the United Kingdom, Canada, Mexico, Malaysia, India and China.

Effective January 23, 2007 in connection with the acquisition of Sandy Corporation, the Company assumed leases for approximately 71,600 square feet of office space in Troy, Michigan and Long Beach, California and approximately 4,800 square feet of warehouse space in Long Beach, California.

The facilities owned or leased by the Company are considered to be suitable and adequate for their intended uses and are considered to be well maintained and in good condition.

12

We discuss our legal proceedings in Note 18 to the accompanying Consolidated Financial Statements.

Item 4: Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of security holders during the fourth quarter of the fiscal year covered by this report.

Item 5: Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s Common Stock, $0.01 par value, is traded on the New York Stock Exchange. The following table presents the Company’s high and low market prices for the last two fiscal years. During the periods presented below, the Company has not paid any cash dividends.

|

| 2006 |

| ||||

Quarter |

| High |

| Low |

| ||

First |

| $ | 8.15 |

| $ | 6.97 |

|

Second |

| 7.88 |

| 6.60 |

| ||

Third |

| 7.75 |

| 7.05 |

| ||

Fourth |

| 8.45 |

| 7.26 |

| ||

|

| 2005 |

| ||||

Quarter |

| High |

| Low |

| ||

First |

| $ | 8.60 |

| $ | 6.92 |

|

Second |

| 8.39 |

| 7.00 |

| ||

Third |

| 9.01 |

| 7.58 |

| ||

Fourth |

| 9.06 |

| 6.90 |

| ||

The number of shareholders of record of the Common Stock as of February 28, 2007 was 1,222 and the closing price of the Common Stock on the New York Stock Exchange on that date was $8.96.

The Company has not declared or paid any cash dividends on its Common Stock during the two most recent fiscal years. The Company does not anticipate paying cash dividends on its Common Stock in the foreseeable future and intends to retain future earnings to finance the growth and development of its business, as well as to continue to fund the repurchase of its Common Stock in the open market, as authorized in connection with the share repurchase and exchange transaction on January 19, 2006 (see Note 14 to the accompanying Consolidated Financial Statements). In addition, the General Physics Credit Agreement (see Item 7) contains restrictive covenants, including a prohibition on the payment of dividends. General Physics is currently restricted under the Credit Agreement from paying dividends or management fees to the Company in excess of $1.0 million in any fiscal year, with the exception of a waiver by the lender which permits General Physics to provide cash to the Company to repurchase up to $5 million of additional shares of its outstanding common stock, of which approximately $1,880,000 remains available.

13

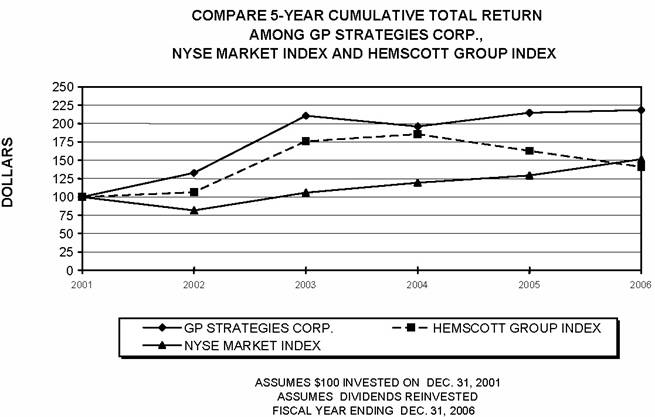

Performance Graph

The following graph assumes $100 was invested on December 31, 2001 in GP Strategies Common Stock, and compares the share price performance with the Education Training Services Index (Hemscott Group Index) and the NYSE Market Index. This chart does not reflect the Company’s dividend to its shareholders of shares of NPDC in November 2004 and shares of GSE in September 2005. Values are as of December 31 of the specified year assuming that all dividends were reinvested.

Company / |

| December 31, |

| December 31, |

| December 31, |

| December 31, |

| December 31, |

| December 31, |

| ||||||

GP Strategies |

| $ | 100.00 |

| $ | 132.89 |

| $ | 210.53 |

| $ | 196.05 |

| $ | 214.74 |

| $ | 218.42 |

|

Education & Training Services |

| 100.00 |

| 106.49 |

| 175.70 |

| 185.60 |

| 162.68 |

| 141.11 |

| ||||||

NYSE Market Index |

| 100.00 |

| 81.69 |

| 105.82 |

| 119.50 |

| 129.37 |

| 151.57 |

| ||||||

14

Issuer Purchases of Equity Securities

The following table provides information about the Company’s share repurchase activity for the three months ended December 31, 2006:

|

| Issuer Purchases of Equity Securities |

| ||||||||

|

|

|

|

|

| Total number |

| Approximate |

| ||

|

|

|

|

|

| of shares |

| dollar value of |

| ||

|

| Total number |

| Average |

| purchased as |

| shares that may yet |

| ||

|

| of shares |

| price paid |

| part of publicly |

| be purchased under |

| ||

Month |

| purchased (1) |

| per share |

| announced program (2) |

| the program |

| ||

October 1-31, 2006 |

| — |

| — |

| — |

| — |

| ||

November 1-30, 2006 |

| — |

| — |

| — |

| — |

| ||

December 1-31, 2006 |

| 401,967 |

| $ | 8.30 |

| 144,039 |

| $ | 1,880,000 |

|

(1) Includes 257,928 shares surrendered by employees and directors to exercise stock options and satisfy the related tax withholding obligations.

(2) Represents shares repurchased in the open market in connection with the Company’s share repurchase program which was authorized by the Company’s Board of Directors and publicly announced on January 19, 2006. The repurchase program permits the Company to repurchase up to $5 million of its Common Stock from time to time in the open market subject to prevailing business and market conditions and other factors. There is no expiration date for the repurchase program.

15

Item 6: Selected Financial Data

The selected financial data presented below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and our consolidated financial statements and the notes thereto included elsewhere in this report. Our consolidated statement of operations data for the years ended December 31, 2006, 2005, and 2004 and our consolidated balance sheet data as of December 31, 2006 and 2005 have been derived from our audited consolidated financial statements included elsewhere in this report. Our consolidated statement of operations data for the years ended December 31, 2003 and 2002 and our consolidated balance sheet data as of December 31, 2004, 2003, and 2002 have been derived from audited consolidated financial statements, which are not presented in this report.

On September 30, 2005, we completed the spin-off of our majority ownership interest in GSE, and on November 24, 2004, we completed the spin-off of NPDC. The results of operations of GSE and NPDC have been reclassified as discontinued in the consolidated statements of operations for all periods presented.

|

| Years ended December 31, |

| |||||||||||||

Statement of Operations Data |

| 2006 |

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| |||||

|

| (In thousands, except per share amounts) |

| |||||||||||||

Revenue |

| $ | 178,783 |

| $ | 175,555 |

| $ | 164,458 |

| $ | 133,875 |

| $ | 142,237 |

|

Gross profit |

| 26,566 |

| 24,991 |

| 19,339 |

| 15,401 |

| 15,366 |

| |||||

Interest expense |

| 1,558 |

| 1,518 |

| 1,937 |

| 2,903 |

| 2,467 |

| |||||

Gain on litigation settlement, net |

| — |

| 5,552 |

| — |

| — |

| — |

| |||||

Gain on arbitration award, net |

| — |

| — |

| 13,660 |

| — |

| — |

| |||||

Income (loss) from continuing operations before income taxes |

| 11,710 |

| 15,224 |

| 14,017 |

| (6,691 | ) | (3,590 | ) | |||||

Income (loss) from continuing operations (1) |

| 6,642 |

| 8,457 |

| 22,266 |

| (7,839 | ) | (3,766 | ) | |||||

Income (loss) from discontinued operations, net of income taxes |

| — |

| (1,244 | ) | 254 |

| (437 | ) | (1,462 | ) | |||||

Net income (loss) |

| 6,642 |

| 7,213 |

| 22,520 |

| (8,276 | ) | (5,228 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Diluted income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

| |||||

Income (loss) from continuing operations |

| $ | 0.40 |

| $ | 0.45 |

| $ | 1.22 |

| $ | (0.46 | ) | $ | (0.24 | ) |

Income (loss) from discontinued operations |

| — |

| (0.07 | ) | 0.01 |

| (0.02 | ) | (0.10 | ) | |||||

Net income (loss) |

| $ | 0.40 |

| $ | 0.38 |

| $ | 1.23 |

| $ | (0.48 | ) | $ | (0.34 | ) |

|

| December 31, |

| |||||||||||||

Balance Sheet Data (2) |

| 2006 |

| 2005 |

| 2004 |

| 2003 |

| 2002 |

| |||||

|

| (In thousands, except per share amounts) |

| |||||||||||||

Cash and cash equivalents (3) |

| $ | 8,660 |

| $ | 18,118 |

| $ | 2,417 |

| $ | 4,416 |

| $ | 1,516 |

|

Short-term borrowings |

| — |

| — |

| 6,068 |

| 26,521 |

| 22,058 |

| |||||

Working capital |

| 23,142 |

| 34,804 |

| 20,601 |

| 17,998 |

| 780 |

| |||||

Total assets |

| 121,400 |

| 134,641 |

| 156,035 |

| 188,323 |

| 144,905 |

| |||||

Long-term debt, including current maturities |

| 10,926 |

| 11,380 |

| 11,051 |

| 14,861 |

| 6,912 |

| |||||

Stockholders’ equity |

| 79,731 |

| 94,342 |

| 91,620 |

| 92,812 |

| 92,982 |

| |||||

(1) During 2004, based upon an assessment of the realizability of the Company’s deferred tax assets, management considered it more likely than not that its deferred tax assets would be realized and reduced its deferred tax valuation allowance by $12.2 million, resulting in a net income tax benefit for the year ended December 31, 2004.

(2) On September 30, 2005, the Company distributed net assets of $6.8 million in connection with the spin-off of its majority ownership interest in GSE. On November 24, 2004, the Company distributed net assets of $26.0 million to NPDC in connection with its spin-off.

(3) Cash and cash equivalents include one-time cash receipts associated with the EDS arbitration award and litigation settlement in 2005.

16

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations

General Overview

The Company’s business consists of its principal operating subsidiary, General Physics, a global training, engineering, and consulting company that seeks to improve the effectiveness of organizations by providing training, management consulting, e-Learning solutions and engineering services and products that are customized to meet the specific needs of clients. Clients include Fortune 500 companies and manufacturing, process and energy companies and other commercial and governmental customers. General Physics is a global leader in performance improvement, with four decades of experience in providing solutions to optimize workforce performance.

As of December 31, 2006, the Company operated through its two reportable business segments:

· Process, Energy & Government — this segment provides engineering consulting, design and evaluation services regarding facilities, the environment, processes and systems, staff augmentation, curriculum design and development, and training and technical services primarily to federal and state governmental agencies, large government contractors, petroleum and chemical refining companies, and electric power utilities.

· Manufacturing & BPO - this segment provides training, curriculum design and development, staff augmentation, e-Learning services, system hosting, integration and help desk support, business process and training outsourcing, and consulting and technical services to large companies in the automotive, steel, pharmaceutical, electronics, and other industries as well as to governmental clients.

We discuss our business in more detail in Item 1.Business and the risk factors affecting our business in Item 1A. Risk Factors.

Strategy

The Company’s primary strategy is the growth of its core businesses within General Physics. The Company plans to execute its growth strategy by focusing on the following key initiatives:

· Sales Training — The Company has historically provided technical training services and believes that there is a significant market demand for custom sales training services. The Company took the first step of this initiative through the completion of its acquisition of Sandy Corporation on January 23, 2007. Sandy Corporation is a leader in custom product sales training and has primarily served manufacturing customers in the U.S. automotive industry for over 30 years. The acquisition will enhance the Company’s existing service offerings by adding custom product sales training to its offering mix. The Company plans to support the needs of Sandy Corporation’s current customers and intends to expand its offerings worldwide and offer its unique innovative solutions to existing clients of the Company. In order to achieve expansion of sales training services, the Company plans to strategically pursue other selected markets where it believes it can leverage its existing capabilities.

· International Expansion — The Company has witnessed an increased demand for additional services in foreign countries from existing multinational customers based in the United States and Europe. The Company believes the greatest area of potential growth is in Asia. The Company has taken steps toward achieving its international growth strategy in the following areas:

· India — In January 2007, the Company opened an office in Chennai, India, to support existing customers and a growing presence in Asia. The Company primarily provides BPO and technical

17

training services to an existing semi-conductor customer through its India office, and plans to expand business in this region.

· China — The Company recently began leasing office space in Shanghai, China and is evaluating several potential opportunities with new and existing customer relationships. The Company believes it can expand its technical training services to the automotive industry in China and plans to leverage the capabilities from its acquisition of Sandy Corporation in this area.

· Singapore — The Company has maintained an office in Singapore for several years and primarily provides training outsourcing services. The Company has added resources there and believes it can expand its existing service offerings in this region to new and existing multinational companies.

· Malaysia — Through its subsidiary in Kuala Lumpur, Malaysia, the Company has provided professional services to the power generation industry in Asia on a continuous basis since at least 1998. During that period, the Company has primarily provided training, operations, maintenance, and engineering services to many of the large fossil power, and steam and power generating facilities. The Company believes it can expand these services and provide training and BPO services in this region as well.

· Training and Business Process Outsourcing (BPO) — The Company has experienced significant growth in recent years in its Manufacturing & BPO group primarily due to the expansion of Training & BPO services, which include the management and administration of customers’ training departments and other administrative functions. The Company believes there is a large potential for additional growth for these service offerings across all industries. The Company plans to continue its focus on marketing these services to new and existing customers, as well as internationally as discussed above.

Significant Events

Acquisitions

On January 23, 2007, General Physics completed the acquisition of certain operating assets and the business of Sandy Corporation, a leader in custom product sales training and part of the ADP Dealer Services division of ADP. The Sandy Corporation business is run as an unincorporated division of General Physics. Sandy Corporation offers custom sales training and print-based and electronic publications primarily to the automotive industry. The purchase price at closing consisted of approximately $5.2 million in cash paid to ADP with cash on hand and the assumption of certain liabilities by General Physics to complete contracts, subject to post-closing adjustments. The Company currently anticipates that the final cash purchase price will be approximately $4.4 million after post-closing adjustments based on the final clos ing balance sheet of Sandy Corporation as of the effective date of the acquisition. In addition, General Physics may be required to pay ADP up to an additional $8.0 million, contingent upon Sandy Corporation achieving certain revenue targets (as defined in the purchase agreement) during the two twelve-month periods following the completion of the acquisition.

On February 3, 2006, the Company completed the acquisition of Peters Management Consultancy Ltd. (PMC), a performance improvement and training company in the United Kingdom. The Company acquired 100% ownership of PMC for a purchase price of $1.3 million in cash, plus contingent payments of up to $0.9 million based upon the achievement of certain performance targets during the first year following completion of the acquisition. No contingent payments were paid by the Company as PMC did not achieve the performance targets specified in the purchase agreement during the first year following completion of the acquisition. PMC is included in the Company’s Manufacturing & BPO segment, and its results are included in the accompanying consolidated financial statements since the date of acquisition.

18

Restructuring of Capital Stock

On January 19, 2006, the Company completed a restructuring of its capital stock, which included the repurchase of 2,121,500 shares of its Common Stock at a price of $6.80 per share, the repurchase of 600,000 shares of its Class B Stock at a price of $8.30 per share, and the exchange of 600,000 shares of its Class B Stock into 600,000 shares of Common Stock for a cash premium of $1.50 per exchanged share. The repurchase prices and exchange premium were based on a fairness opinion rendered by an independent third party valuation firm. The repurchase and exchange transactions were negotiated and approved by a Special Committee of the Board of Directors and had the effect of eliminating all outstanding shares of the Company’s Class B Stock.

Prior to the restructuring, the 1,200,000 outstanding shares of C lass B Stock collectively represented approximately 41% of the aggregate voting power of the Company because the Class B Stock had ten votes per share. The repurchase of a total of 2,721,500 shares represented approximately 15% of the total outstanding shares of capital stock of the Company. Approximately $20.3 million of cash on hand was used for the repurchase and exchange transaction.

Elimination of Class B Stock

On January 19, 2006, the Board of Directors also approved, subject to stockholder approval, a proposal to amend the Company’s Amended and Restated Certificate of Incorporation to eliminate the authorized shares of Class B Stock (the “Amendment”). At the Company’s annual meeting on September 14, 2006, the stockholders voted to approve the Amendmen t. The Amendment was filed with the Delaware Secretary of State and was effective September 15, 2006.

Share Repurchase Program

In connection with the capital stock restructuring discussed above, the Company authorized the repurchase of up to $5 million of additional common shares from time to time in the open market, subject to prevailing business and market conditions and other factors. During the year ended December 31, 2006, the Company repurchased approximately 420,000 shares of its Common Stock in the open market for a total cost of approximately $3.1 million. There is no expiration date for the repurchase program.

Results of Operations

Operating Highlights

Year ended December 31, 2006 compared to the year ended December 31, 2005

For the year ended December 31, 2006, the Company had net income of $6.6 million, or $0.40 per diluted share, compared to $7.2 million, or $0.38 per diluted share, for the year ended December 31, 2005. The decrease in net income was primarily due to the gain on litigation settlement net of legal fees and expenses of $5.6 million during 2005 which did not recur in 2006, offset by increased operating income in 2006 of $1.4 million, the components of which are discussed below, and a loss from discontinued operations of $1.2 million, or $0.07 per diluted share, in 2005 which did not recur in 2006. The increase in diluted earnings per share is also partially attributable to the decrease in common shares outstanding during 2006 compared to 2005 as a result of the capital stock restructuring discussed above. Diluted weighted average shares outstanding were 16.7 million in 2006 compared to 18.9 million in 2005.

19

Revenue

|

| Years ended December 31, |

| ||||

|

| 2006 |

| 2005 |

| ||

|

| (Dollars in thousands) |

| ||||

Process, Energy & Government |

| $ | 77,469 |

| $ | 85,953 |

|

Manufacturing & BPO |

| 101,314 |

| 89,602 |

| ||

|

| $ | 178,783 |

| $ | 175,555 |

|

Process, Energy & Government revenue decreased $8.5 million or 9.9% during the year ended December 31, 2006 compared to 2005. The decrease in revenue is primarily due to a $10.7 million decline in government funding for the Domestic Preparedness Equipment Technical Assistance Program (DPETAP) contract during 2006. A scheduling delay on an environmental engineering contract also resulted in a decrease in revenue of $3.7 million in 2006 compared to 2005. In addition, there was a decrease in revenue of $1.9 million due to the completion of a chemical demilitarization project which ended in 2006. These decreases were offset by an increase in hurricane recovery services revenue of $3.1 million, an increase of $1.5 million on construction jobs primarily for wastewater treatment, an increase of $1.4 million in lean six sigma services, an increase of $1.1 million related to a hydrogen fuel station design and construction contract, and an increase of $0.7 million related to a liquefied natural gas (LNG) fueling station project.

Manufacturing & BPO revenue increased $11.7 million or 13.1% during the year ended December 31, 2006 compared to 2005. The increase in revenue is due to the following: a $8.4 million increase due to the expansion of business process outsourcing services with new and existing customers, a $4.1 million increase from our international operations in the United Kingdom (primarily resulting from the PMC acquisition in February 2006 which resulted in a $2.9 million revenue increase as well as an increase in BPO services), a $2.7 million increase in lean manufacturing services, and a $1.8 million increase in other technical services provided primarily to a pharmaceutical customer. These net increases in revenue were offset by the following decreases in revenue: a change in contract scope with a business process outsourcing customer during 2005 which resulted in a decrease in revenue of $2.7 million during the first two quarters of 2006 compared to 2005, a $1.5 million revenue decrease in government e-Learning implementation services due to fewer implementations taking place during the third and fourth quarters of 2006 compared to 2005, and net decreases of $1.1 million on various other contracts.

Gross profit

|

| Years ended December 31, |

| ||||||||

|

| 2006 |

| 2005 |

| ||||||

|

|

|

| % Revenue |

|

|

| % Revenue |

| ||

|

| (Dollars in thousands) |

| ||||||||

Process, Energy & Government |

| $ | 13,188 |

| 17.0 | % | $ | 16,212 |

| 18.9 | % |

Manufacturing & BPO |

| 13,378 |

| 13.2 | % | 8,779 |

| 9.8 | % | ||

|

| $ | 26,566 |

| 14.9 | % | $ | 24,991 |

| 14.2 | % |

Process, Energy & Government gross profit of $13.2 million or 17.0% of revenue for the year ended December 31, 2006 decreased by $3.0 million or 18.7% when compared to gross profit of approximately $16.2 million or 18.9% of revenue for the year ended December 31, 2005. This decrease in gross profit is primarily attributable to a decline in government funding for the DPETAP contract and other decreases in revenue discussed above.

20

Manufacturing & BPO gross profit of $13.4 million or 13.2% of revenue for the year ended December 31, 2006 increased by $4.6 million or 52.4% when compared to gross profit of approximately $8.8 million or 9.8% of revenue for the year ended December 31, 2005. This increase in gross profit is primarily attributable to an increase in revenue from business process outsourcing, lean manufacturing and other technical services, as well as international growth during 2006 compared to 2005. Additionally, infrastructure costs have not increased at the same rate as our revenue growth for this segment, resulting in increased profitability.

Selling, general and administrative expenses

SG&A expenses increased $0.2 million or 1.6% from $14.0 million for the year ended December 31, 2005 to $14.3 million for the year ended December 31, 2006. The increase is primarily due to increases in indirect labor costs, stock-based compensation expense and board of director fees during 2006 compared to 2005, offset by a reversal of a prior restructuring accrual of $0.3 million by our operations in the United Kingdom in 2006 which did not occur in 2005.

Interest expense