UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

Commission file number 1-44

ARCHER-DANIELS-MIDLAND COMPANY

(Exact name of registrant as specified in its charter)

|

| |

| Delaware | 41-0129150 |

| (State or other jurisdiction of | (I. R. S. Employer |

| incorporation or organization) | Identification No.) |

| | |

77 West Wacker Drive, Suite 4600 Chicago, Illinois | 60601 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| 312-634-8100 |

| (Registrant's telephone number, including area code) |

| | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of each class | Name of each exchange on which registered |

| | |

| Common Stock, no par value | New York Stock Exchange |

| | Frankfurt Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer x Accelerated Filer o

Non-accelerated Filer o Smaller Reporting Company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Common Stock, no par value--$28.0 billion

(Based on the closing sale price of Common Stock as reported on the New York Stock Exchange

as of June 30, 2014)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

Common Stock, no par value—634,287,854 shares

(January 30, 2015)

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the annual meeting of stockholders to be held May 7, 2015, are incorporated by reference into Part III

SAFE HARBOR STATEMENT

This Form 10-K contains forward-looking information that is subject to certain risks and uncertainties that could cause actual results to differ materially from those projected, expressed, or implied by such forward-looking information. In some cases, you can identify forward-looking statements by our use of words such as “may, will, should, anticipates, believes, expects, plans, future, intends, could, estimate, predict, potential or contingent,” the negative of these terms or other similar expressions. The Company’s actual results could differ materially from those discussed or implied herein. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Form 10-K for the year ended December 31, 2014. Among these risks are legislative acts; changes in the prices of food, feed, and other commodities, including gasoline; and macroeconomic conditions in various parts of the world. To the extent permitted under applicable law, the Company assumes no obligation to update any forward-looking statements as a result of new information or future events.

Table of Contents

|

| | | |

| Item No. | Description | Page No. |

| | | |

| | Part I | |

| 1. | | |

| 1A. | | |

| 1B. | | |

| 2. | | |

| 3. | | |

| 4. | | |

| | | |

| | Part II | |

| 5. | | |

| 6. | | |

| 7. | | |

| 7A. | | |

| 8. | | |

| 9. | | |

| 9A. | | |

| 9B. | | |

| | | |

| | Part III | |

| 10. | | |

| 11. | | |

| 12. | | |

| 13. | | |

| 14. | | |

| | | |

| | Part IV | |

| 15. | | |

| | | |

PART I

Company Overview

Archer-Daniels-Midland Company (the Company) was incorporated in Delaware in 1923, successor to the Daniels Linseed Co. founded in 1902. The Company is one of the world’s largest processors of oilseeds, corn, wheat, cocoa, and other agricultural commodities and is a leading manufacturer of protein meal, vegetable oil, corn sweeteners, flour, biodiesel, ethanol, and other value-added food and feed ingredients. The Company also has an extensive global grain elevator and transportation network to procure, store, clean, and transport agricultural commodities, such as oilseeds, corn, wheat, milo, oats, and barley, as well as processed agricultural commodities. The Company has significant investments in joint ventures. The Company expects to benefit from these investments, which typically aim to expand or enhance the Company’s market for its products or offer other benefits including, but not limited to, geographic or product line expansion.

The Company’s vision is to be the most admired global agribusiness while creating value and growing responsibly. The Company’s strategy involves expanding the volume and diversity of crops that it merchandises and processes, expanding the global reach of its core model, and expanding its value-added product portfolio. The Company seeks to serve vital needs by connecting the harvest to the home and transforming crops into food and energy products. The Company desires to execute this vision and these strategies by conducting its business in accordance with its core values of operating with integrity, treating others with respect, achieving excellence, being resourceful, displaying teamwork, and being responsible.

On May 3, 2012, the Board of Directors of the Company determined that, in accordance with its Bylaws and upon the recommendation of the Audit Committee, the Company’s fiscal year shall begin on January 1 and end on December 31 of each year, starting on January 1, 2013. The required transition period of July 1, 2012 to December 31, 2012 is included in this Form 10-K report. Amounts included in this report for the six months ended December 31, 2011 are unaudited.

On August 25, 2014, the Company opened its new global headquarters and customer center at 77 West Wacker Drive, Suite 4600, Chicago, Illinois, 60601.

Segment Descriptions

Prior to January 1, 2015, the Company’s operations were classified into three reportable business segments: Oilseeds Processing, Corn Processing, and Agricultural Services. Each of these segments is organized based upon the nature of products and services offered. The Company’s remaining operations are not reportable business segments, as defined by the applicable accounting standard, and are classified as Other. Financial information with respect to the Company’s reportable business segments is set forth in Note 17 of “Notes to Consolidated Financial Statements” included in Item 8 herein, “Financial Statements and Supplementary Data.”

During the fourth quarter of 2014, the Company completed the acquisitions of the WILD Flavors businesses (Wild Flavors) and Specialty Commodities Inc. (SCI) for a total consideration of $2.9 billion, making the Company one of the world’s leading flavors and specialty ingredients companies. Effective January 1, 2015, the Company has formed a fourth reportable business segment, Wild Flavors and Specialty Ingredients.

|

| |

| Item 1. | BUSINESS (Continued) |

Oilseeds Processing

The Oilseeds Processing segment includes global activities related to the origination, merchandising, crushing, and further processing of oilseeds such as soybeans and soft seeds (cottonseed, sunflower seed, canola, rapeseed, and flaxseed) into vegetable oils and protein meals. Oilseeds products produced and marketed by the Company include ingredients for the food, feed, energy, and industrial products industries. Crude vegetable oils produced by the segment’s crushing activities are sold “as is” or are further processed by refining, blending, bleaching, and deodorizing into salad oils. Salad oils are sold “as is” or are further processed by hydrogenating and/or interesterifying into margarine, shortening, and other food products. Partially refined oils are used to produce biodiesel or are sold to other manufacturers for use in chemicals, paints, and other industrial products. Oilseed protein meals are principally sold to third parties to be used as ingredients in commercial livestock and poultry feeds. In Europe and South America, the Oilseeds Processing segment includes origination and merchandising activities as adjuncts to its oilseeds processing assets. These activities include a network of grain elevators, port facilities, and transportation assets used to buy, store, clean, and transport grains and oilseeds. The Oilseeds Processing segment produces natural health and nutrition products and other specialty food and feed ingredients. In North America, cottonseed flour is produced and sold primarily to the pharmaceutical industry and cotton cellulose pulp is manufactured and sold to the chemical, paper, and filter markets. Prior to December 2014, the Oilseeds Processing segment operated fertilizer blending facilities in South America. In December 2014, the Company completed the sale of its fertilizer blending business.

The Company has a 17.3% ownership interest in Wilmar International Limited (Wilmar), a Singapore publicly listed company. Wilmar, a leading agribusiness group in Asia, is engaged in the businesses of oil palm cultivation, oilseeds crushing, edible oils refining, sugar milling and refining, specialty fats, oleo chemicals, biodiesel and fertilizers manufacturing, and grains processing.

The Oilseeds Processing segment also includes activities related to the procurement, transportation and processing of cocoa beans into cocoa liquor, cocoa butter, cocoa powder, chocolate, and various compounds in North America, South America, Europe, Asia, and Africa for the food industry. On September 2, 2014, the Company announced the sale of its global chocolate business to Cargill, Inc. for $440 million, subject to regulatory approval and customary conditions. On December 15, 2014, the Company also announced that it has reached an agreement to sell its global cocoa business to Olam International Limited for $1.3 billion, subject to customary conditions. Both transactions are expected to close in 2015. The chocolate and cocoa businesses are classified as held for sale as of December 31, 2014.

Golden Peanut and Tree Nuts (Golden Peanut), a wholly owned subsidiary of the Company, is a major supplier of peanuts and tree nuts to both the U.S. and international markets and operator of a peanut shelling facility in Argentina.

Stratas Foods LLC, a joint venture between the Company and ACH Jupiter, LLC, a subsidiary of Associated British Foods, procures, packages, and sells edible oils in North America. The Company has a 50% ownership interest in this joint venture.

The Company has a 50% interest in Edible Oils Limited, a joint venture between the Company and Princes Limited to procure, package, and sell edible oils in the United Kingdom. The Company also formed a joint venture with Princes Limited in Poland to procure, package, and sell edible oils in Poland, Czech Republic, Slovakia, Hungary, and Austria.

The Company is a major supplier of agricultural commodity raw materials to Wilmar, Stratas Foods LLC, and Edible Oils Limited.

|

| |

| Item 1. | BUSINESS (Continued) |

Corn Processing

The Company’s Corn Processing segment is engaged in corn wet milling and dry milling activities, with its asset base primarily located in the central part of the United States. The Corn Processing segment converts corn into sweeteners and starches, and bioproducts. Its products include ingredients used in the food and beverage industry including sweeteners, starch, syrup, glucose, and dextrose. Dextrose and starch are used by the Corn Processing segment as feedstocks for its bioproducts operations. By fermentation of dextrose, the Corn Processing segment produces alcohol, amino acids, and other specialty food and animal feed ingredients. Ethyl alcohol is produced by the Company for industrial use as ethanol or as beverage grade. Ethanol, in gasoline, increases octane and is used as an extender and oxygenate. The Corn Processing segment also includes amino acids such as lysine and threonine that are vital compounds used in swine feeds to produce leaner animals and in poultry feeds to enhance the speed and efficiency of poultry production. Corn gluten feed and meal, as well as distillers’ grains, are produced for use as animal feed ingredients. Corn germ, a by-product of the wet milling process, is further processed into vegetable oil and protein meal. Other Corn Processing products include citric and lactic acids, lactates, sorbitol, xanthan gum, and glycols which are used in various food and industrial products. The Corn Processing segment includes the activities of a propylene and ethylene glycol facility and the Company’s Brazilian sugarcane ethanol plant and related activities.

Almidones Mexicanos S.A., in which the Company has a 50% interest, operates a wet corn milling plant in Mexico.

Eaststarch C.V. (Netherlands), in which the Company has a 50% interest, owns interests in companies that operate wet corn milling plants in Bulgaria, Hungary, Slovakia, and Turkey.

Red Star Yeast Company, LLC produces and sells fresh and dry yeast in the United States and Canada. The Company has a 40% ownership interest in this joint venture.

Agricultural Services

The Agricultural Services segment utilizes its extensive U.S. grain elevator, global transportation network, and port operations to buy, store, clean, and transport agricultural commodities, such as oilseeds, corn, wheat, milo, oats, rice, and barley, and resells these commodities primarily as food and feed ingredients and as raw materials for the agricultural processing industry. Agricultural Services’ grain sourcing, handling, and transportation network provides reliable and efficient services to the Company’s customers and agricultural processing operations. Agricultural Services’ transportation network capabilities include barge, ocean-going vessel, truck, and rail freight services.

The Company has a 32.2% interest in Pacificor (formerly Kalama Export Company LLC). Pacificor owns and operates a grain export elevator in Kalama, WA and a grain export elevator in Portland, OR.

Alfred C. Toepfer International became a wholly owned subsidiary on June 4, 2014, when the Company completed its acquisition of the remaining 20% interest, making the Company an integrated global merchandiser of agricultural commodities and processed products. This global merchandising business operates a network of 36 sales offices worldwide and inland, river, and export facilities in Argentina, Hungary, Romania, Ukraine, and the United States.

The Agricultural Services segment also includes the activities related to the origination and processing of wheat into wheat flour, the processing and distribution of formula feeds and animal health and nutrition products, and the procurement, processing, and distribution of edible beans.

The Company has a 19.8% interest in GrainCorp Limited (GrainCorp), a publicly-listed company on the Australian Stock Exchange. GrainCorp is engaged in grain receival and handling, transportation, port operations, oilseed processing, malt processing, flour processing, and grain marketing activities.

Prior to December 2012, the Company had a 23.2% interest in Gruma S.A.B. de C.V. (Gruma), the world’s largest producer and marketer of corn flour and tortillas. Additionally, the Company had joint ventures in corn flour and wheat flour mills with and through Gruma. In December 2012, the Company sold its 23.2% interest in Gruma and the Gruma-related joint ventures.

|

| |

| Item 1. | BUSINESS (Continued) |

Other

Prior to January 1, 2015, Other includes the post-acquisition results of Wild Flavors and SCI.

On October 1, 2014, the Company completed the acquisition of Wild Flavors, making the Company one of the world’s leading flavors and specialty ingredients companies. Wild Flavors' products include flavors, colors, sweeteners and health ingredients as well as ready-to-market concepts and complete solutions. These products create value and innovation for customers in the beverage, dairy, savory, confectionery, baked goods, ice cream, cereal, snack and oral care markets.

On November 18, 2014, the Company completed the acquisition of SCI, a leading originator, processor and distributor of healthy ingredients, including nuts, fruits, seeds, legumes and ancient grains. SCI provides high-quality, safe ingredients to snack food, dairy, bakery, cereal, energy bar, confectionery and pet food companies throughout the world.

Other also includes the operations of the Company's financial business units, related principally to futures commission merchant activities and captive insurance.

ADM Investor Services, Inc., a wholly owned subsidiary of the Company, is a registered futures commission merchant and a clearing member of all principal commodities exchanges in the U.S. ADM Investor Services International, Limited., a member of several commodity exchanges and clearing houses in Europe, ADMIS Hong Kong Limited, and ADMIS Singapore Pte. Limited, are wholly owned subsidiaries of the Company offering broker services in Europe and Asia. ADMISI Commodities Private Limited, in which the Company owns a 51% interest, and ADMISI Forex India Private Limited, a wholly owned subsidiary of the Company, offer broker services in India.

Captive insurance includes Agrinational Insurance Company (Agrinational) and its subsidiaries. Agrinational, a wholly owned subsidiary of the Company, provides insurance coverage for certain property, casualty, marine, credit, and other miscellaneous risks of the Company. Agrinational also participates in certain third-party reinsurance arrangements and retains a portion of the crop insurance risk written by ADM Crop Risk Services, a wholly owned subsidiary. ADM Crop Risk Services is a managing general agent which sells and services crop insurance policies to farmers.

Corporate

Compagnie Industrielle et Financiere des Produits Amylaces SA (Luxembourg) and affiliates (CIP), of which the Company has a 43.7% interest, is a joint venture which targets investments in food, feed ingredients and bioproducts businesses.

Methods of Distribution

The Company’s products are distributed mainly in bulk from processing plants or storage facilities directly to customers’ facilities. The Company has developed a comprehensive transportation capability to efficiently move both commodities and processed products virtually anywhere in the world. The Company owns or leases large numbers of the trucks, trailers, railroad tank and hopper cars, river barges, towboats, and ocean-going vessels used to transport the Company’s products to its customers.

Concentration of Revenues by Product

The following products account for 10% or more of revenues for the following periods:

|

| | | | | | | | | |

| | % of Revenues |

| | Years Ended December 31, | | Six Months Ended December 31, | | Year Ended June 30, |

| | 2014 | | 2013 | | 2012 | | 2011 | | 2012 |

| Soybeans | 16% | | 18% | | 20% | | 17% | | 19% |

| Corn | 10% | | 9% | | 10% | | 12% | | 11% |

| Soybean Meal | 13% | | 11% | | 11% | | 8% | | 9% |

|

| |

| Item 1. | BUSINESS (Continued) |

Status of New Products

The Company continues to expand the size and global reach of its business through the development of new products. The acquisition of Wild Flavors expands the Company's ability to serve the customers' evolving needs through its offering of natural flavor and ingredient products. The Company does not expect any of its new products to have a significant impact on the Company’s revenues in 2015.

Source and Availability of Raw Materials

Substantially all of the Company’s raw materials are agricultural commodities. In any single year, the availability and price of these commodities are subject to factors such as changes in weather conditions, plantings, government programs and policies, competition, changes in global demand, changes in standards of living, and global production of similar and competitive crops. The Company’s raw materials are procured from thousands of growers, grain elevators, and wholesale merchants in North America, South America, Europe, Asia, Australia, and Africa, pursuant primarily to short-term (less than one year) agreements or on a spot basis. The Company is not dependent upon any particular grower, elevator, or merchant as a source for its raw materials.

Patents, Trademarks, and Licenses

The Company owns patents, trademarks, and licenses, including approximately $240 million of trademarks from the Wild Flavors acquisition in 2014 (see Note 2 in Item 8, Financial Statements and Supplementary Data (Item 8)), but does not consider any segment of its business dependent upon any single or group of patents, trademarks or licenses.

Seasonality, Working Capital Needs, and Significant Customers

Since the Company is widely diversified in global agribusiness markets, there are no material seasonal fluctuations in overall global processing volumes and the sale and distribution of its products and services. There is a degree of seasonality in the growing cycles, procurement, and transportation of the Company’s principal raw materials: oilseeds, corn, wheat, cocoa beans, sugarcane, and other grains.

The price of agricultural commodities, which may fluctuate significantly and change quickly, directly affects the Company’s working capital requirements. Because the Company has a higher portion of its operations in the northern hemisphere, principally North America and Europe, relative to the southern hemisphere, primarily South America, inventory levels typically peak after the northern hemisphere fall harvest and are generally lower during the northern hemisphere summer months. Working capital requirements have historically trended with inventory levels. No material part of the Company’s business is dependent upon a single customer or very few customers. The Company has seasonal financing arrangements with farmers in certain countries around the world. Typically, advances on these financing arrangements occur during the planting season and are repaid at harvest.

Competition

The Company has significant competition in the markets in which it operates based principally on price, quality, and alternative products, some of which are made from different raw materials than those utilized by the Company. Given the commodity-based nature of many of its businesses, the Company, on an ongoing basis, focuses on managing unit costs and improving efficiency through technology improvements, productivity enhancements, and regular evaluation of the Company’s asset portfolio.

Research and Development Expenditures

The Company’s research and development expenditures are focused on responding to demand from customers’ product development or formulation needs, improving processing efficiency, and developing food, feed, fuel, and industrial products from renewable agricultural crops. Research and development expense during the years ended December 31, 2014 and 2013, the six months ended December 31, 2012 and 2011, and the year ended June 30, 2012, net of reimbursements of government grants, was approximately $79 million, $59 million, $28 million, $29 million, and $56 million, respectively. The increase in 2014 is due principally to research and development activities of the recently acquired Wild Flavors.

|

| |

| Item 1. | BUSINESS (Continued) |

The Company is working with the U.S. Department of Energy’s National Energy Technology Laboratory and other key academic and corporate partners on projects to demonstrate carbon capture and sequestration as a viable option for reducing carbon dioxide emissions from manufacturing operations. The first project, Illinois Basin Decatur Project led by Midwest Geological Sequestration Consortium started operations in the first quarter of fiscal year ended June 30, 2012 and successfully completed injecting 1 million tons of CO2 in the fourth quarter of fiscal year ended December 31, 2014. The second project, the Illinois Industrial Carbon Capture & Sequestration commenced construction in the fourth quarter of fiscal year ended June 30, 2012. This facility obtained the underground injection control permit in November 2014 and is expected to be operational in the third quarter of fiscal year 2015.

The Company is continuing to invest in research to develop a broad range of industrial chemicals with an objective to produce key chemical building blocks that serve as a platform for producing a variety of commodity chemicals. The key chemical building blocks are derived from the Company’s starch and oilseed-based feedstocks. Conversion technologies include utilizing expertise in both fermentation and catalysis. The chemicals pipeline includes the development of chemicals and intermediates that are currently produced from petrochemical resources as well as new-to-the-market bio-based products. The Company’s current portfolio includes products that are in the early development phase and those that are close to pilot plant demonstration. In an effort to further advance the development of bio-based chemical technologies, the Company has partnered with the Center for Environmentally Beneficial Catalysis and has added research capabilities at the University of Kansas.

Environmental Compliance

During the year ended December 31, 2014, $50 million was spent specifically to improve equipment, facilities, and programs for pollution control and compliance with the requirements of various environmental agencies.

There have been no material effects upon the earnings and competitive position of the Company resulting from compliance with federal, state, and local laws or regulations enacted or adopted relating to the protection of the environment.

The Company’s business could be affected in the future by national and global regulation or taxation of greenhouse gas emissions. In the United States, the U.S. Environmental Protection Agency (EPA) has adopted regulations requiring the owners and operators of certain facilities to measure and report their greenhouse gas emissions. The U.S. EPA has also begun to regulate greenhouse gas emissions from certain stationary and mobile sources under the Clean Air Act. For example, the U.S. EPA has proposed rules regarding the construction and operation of boilers, which could indirectly affect the Company by limiting the construction of new coal-fired boilers and significantly increasing the complexity and cost of modifying any existing coal-fired boilers. California is also moving forward with various programs to reduce greenhouse gases. Globally, a number of countries that are parties to the Kyoto Protocol have instituted or are considering climate change legislation and regulations. Most notable is the European Union Greenhouse Gas Emission Trading System. The Company has several facilities in Europe that participate in this system. It is difficult at this time to estimate the likelihood of passage, or predict the potential impact, of any additional legislation. Potential consequences could include increased energy, transportation and raw material costs and may require the Company to make additional investments in its facilities and equipment.

Number of Employees

The number of full-time employees of the Company was approximately 33,900 at December 31, 2014 and 31,100 at December 31, 2013. The net increase in the number of full-time employees is primarily related to acquisitions.

Financial Information About Foreign and U.S. Operations

Item 1A, “Risk Factors,” and Item 2, “Properties,” includes information relating to the Company’s foreign and U.S. operations. Geographic financial information is set forth in Note 17 of “Notes to Consolidated Financial Statements” included in Item 8 herein, “Financial Statements and Supplementary Data”.

|

| |

| Item 1. | BUSINESS (Continued) |

Available Information

The Company’s website is http://www.adm.com. The Company makes available, free of charge, through its website, the Company’s annual reports on Form 10-K; quarterly reports on Form 10-Q; current reports on Form 8-K; Directors and Officers Forms 3, 4, and 5; and amendments to those reports, as soon as reasonably practicable after electronically filing such materials with, or furnishing them to, the Securities and Exchange Commission (SEC).

In addition, the Company makes available, through its website, the Company’s Code of Conduct, Corporate Governance Guidelines, and the written charters of the Audit, Compensation/Succession, Nominating/Corporate Governance, and Executive Committees.

References to our website address in this report are provided as a convenience and do not constitute, or should not be viewed as, an incorporation by reference of the information contained on, or available through, the website. Therefore, such information should not be considered part of this report.

The public may read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website which contains reports, proxy and information statements, and other information regarding issuers that file information electronically with the SEC. The SEC’s website is http://www.sec.gov.

The availability and prices of the agricultural commodities and agricultural commodity products the Company procures, transports, stores, processes, and merchandises can be affected by weather conditions, disease, government programs, competition, and various other factors beyond the Company’s control and could adversely affect the Company’s operating results.

The availability and prices of agricultural commodities are subject to wide fluctuations due to changes in weather conditions, crop disease, plantings, government programs and policies, competition, changes in global demand, changes in standards of living, and global production of similar and competitive crops. Additionally, the Company depends globally on farmers to ensure an adequate supply of the agricultural commodities used by the Company in its operations is maintained. These factors have historically caused volatility in the availability and prices of agricultural commodities and, consequently, in the Company’s operating results and working capital requirements. Reduced supply of agricultural commodities due to weather-related factors or other reasons could adversely affect the Company’s profitability by increasing the cost of raw materials and/or limiting the Company’s ability to procure, transport, store, process, and merchandise agricultural commodities in an efficient manner. For example, a drought in North America in 2012 reduced the availability of corn and soybean inventories while prices increased. High and volatile commodity prices can adversely affect the Company’s ability to meet its liquidity needs.

|

| |

| Item 1A. | RISK FACTORS (Continued) |

The Company has significant competition in the markets in which it operates.

The Company faces significant competition in each of its businesses and has numerous competitors. The company competes for the acquisition of inputs such as agricultural commodities, workforce, and other materials and supplies. Additionally, competitors offer similar products and services, as well as alternative products and services, to the Company’s customers. The Company is dependent on being able to generate revenues in excess of cost of products sold in order to obtain margins, profits, and cash flows to meet or exceed its targeted financial performance measures and provide cash for operating, working capital, dividend, or capital expenditure needs. Competition impacts the Company’s ability to generate and increase its gross profit as a result of the following factors. Pricing of the Company’s products is partly dependent upon industry processing capacity, which is impacted by competitor actions to bring on-line idled capacity or to build new production capacity. Many of the products bought and sold by the Company are global commodities or are derived from global commodities. The markets for global commodities are highly price competitive and in many cases the commodities are subject to substitution. In addition, continued merger and acquisition activities resulting in further consolidations result in greater cost competitiveness and global scale of certain players in the industry that could impact the relative competitiveness of the Company. To compete effectively, the Company focuses on improving efficiency in its production and distribution operations, developing and maintaining appropriate market share, maintaining a high level of product safety and quality, and working with customers to develop new products and tailored solutions. Competition could increase the Company’s costs to purchase raw materials, lower selling prices of its products, or reduce the Company’s market share, which may result in lower and more inefficient operating rates and reduced gross profit.

Fluctuations in energy prices could adversely affect the Company’s operating results.

The Company’s operating costs and the selling prices of certain finished products are sensitive to changes in energy prices. The Company’s processing plants are powered principally by electricity, natural gas, and coal. The Company’s transportation operations are dependent upon diesel fuel and other petroleum-based products. Significant increases in the cost of these items, including any consequences of regulation or taxation of greenhouse gases, could adversely affect the Company’s production costs and operating results.

The Company has certain finished products, such as ethanol and biodiesel, which are closely related to, or may be substituted for, petroleum products. Therefore, the selling prices of ethanol and biodiesel can be impacted by the selling prices of gasoline and diesel fuel. A significant decrease in the price of gasoline or diesel fuel could result in a significant decrease in the selling price of the Company’s ethanol and biodiesel and could adversely affect the Company’s revenues and operating results.

The Company is subject to economic downturns and regional economic volatilities, which could adversely affect the Company’s operating results.

The Company conducts its business and has substantial assets located in many countries and geographic areas. While 54 percent of the Company’s processing plants and 65 percent of its procurement facilities are located in the United States, the Company also has significant operations in both developed areas (such as Western Europe, Canada, Brazil) and emerging market areas (such as Eastern Europe, Asia, portions of South and Central America, the Middle East, and Africa). One of the Company's strategies is to expand the global reach of its core model which may include expanding or developing its business in emerging market areas such as Asia, Eastern Europe, the Middle East, and Africa. Both developed and emerging market areas are subject to impacts of economic downturns, including decreased demand for the Company’s products, and reduced availability of credit, or declining credit quality of the Company’s suppliers, customers, and other counterparties. In addition, emerging market areas could be subject to more volatile operating conditions including, but not limited to, logistics limitations or delays, labor-related challenges, limitations or regulations affecting trade flows, local currency concerns, and other economic and political instability. Economic downturns and volatile market conditions could adversely affect the Company’s operating results and ability to execute its business strategies.

|

| |

| Item 1A. | RISK FACTORS (Continued) |

Government policies, mandates, and regulations, in general; government policies, mandates, and regulations specifically affecting the agricultural sector and related industries; and political instability and other risks of doing business globally could adversely affect the Company’s operating results.

Agricultural production and trade flows are subject to government policies, mandates, and regulations. Governmental policies affecting the agricultural industry, such as taxes, tariffs, duties, subsidies, incentives, foreign exchange rates, and import and export restrictions on agricultural commodities and commodity products, including policies related to genetically modified organisms, product safety and labeling, renewable fuels, and low carbon fuel mandates, can influence the planting of certain crops, the location and size of crop production, whether unprocessed or processed commodity products are traded, the volume and types of imports and exports, the availability and competitiveness of feedstocks as raw materials, the viability and volume of production of certain of the Company’s products, and industry profitability. For example, changes in government policies or regulations of ethanol and biodiesel, including but not limited to changes in the Renewable Fuel Standard program under the Energy Independence and Security Act of 2007 in the United States, can have a significant impact on the Company’s operating results. International trade regulations can adversely affect agricultural commodity trade flows by limiting or disrupting trade between countries or regions. Regulations of financial markets and instruments, including the Dodd-Frank Wall Street Reform, Consumer Protection Act, and European Market Infrastructure Regulation, create uncertainty and may lead to additional risks and costs, and could adversely affect the Company's agricultural commodity risk management practices as well as the Company's futures commission merchant business. Future government policies may adversely affect the supply of, demand for, and prices of the Company’s products; restrict the Company’s ability to do business in its existing and target markets; and adversely affect the Company’s revenues and operating results.

The Company’s operating results could be affected by changes in other governmental policies, mandates, and regulations including monetary, fiscal and environmental policies, laws, regulations, acquisition approvals, and other activities of governments, agencies, and similar organizations. These risks include but are not limited to changes in a country’s or region’s economic or political conditions, local labor conditions and regulations, reduced protection of intellectual property rights, changes in the regulatory or legal environment, restrictions on currency exchange activities, currency exchange fluctuations, burdensome taxes and tariffs, enforceability of legal agreements and judgments, adverse tax, administrative agency or judicial outcomes, and regulation or taxation of greenhouse gases. International risks and uncertainties, including changing social and economic conditions as well as terrorism, political hostilities, and war, could limit the Company’s ability to transact business in these markets and could adversely affect the Company’s revenues and operating results.

The Company's strategy involves expanding the volume and diversity of crops it merchandises and processes, expanding the global reach of its core model, and expanding its value-added product portfolio. Government policies, including anti-trust and competition law, trade restrictions, food safety regulations, and other government regulations and mandates, can impact the Company's ability to execute this strategy successfully.

The Company is subject to industry-specific risks which could adversely affect the Company’s operating results.

The Company is subject to risks which include, but are not limited to, product safety or quality; shifting consumer preferences; federal, state, and local regulations on manufacturing or labeling; socially acceptable farming practices; environmental, health and safety regulations; and customer product liability claims. The liability which could result from certain of these risks may not always be covered by, or could exceed liability insurance related to product liability and food safety matters maintained by the Company. In addition, negative publicity caused by product liability and food safety matters may damage the Company’s reputation. The occurrence of any of the matters described above could adversely affect the Company’s revenues and operating results.

Certain of the Company’s merchandised commodities and finished products are used as ingredients in livestock and poultry feed. The Company is subject to risks associated with economic or other factors which may adversely affect the livestock and poultry businesses, including the outbreak of disease in livestock and poultry. An outbreak of disease could adversely affect demand for the Company’s products used as ingredients in livestock and poultry feed. A decrease in demand for ingredients in livestock and poultry feed could adversely affect the Company’s revenues and operating results.

|

| |

| Item 1A. | RISK FACTORS (Continued) |

The Company is subject to numerous laws, regulations, and mandates globally which could adversely affect the Company’s operating results and forward strategy.

The Company does business globally, connecting crops and markets in 147 countries. The Company is required to comply with the numerous and broad-reaching laws and regulations administered by United States federal, state and local, and foreign governmental authorities. The Company must comply with other general business regulations such as accounting and income taxes, anti-corruption, anti-bribery, global trade, environmental, and handling and production of regulated substances. The Company frequently faces challenges from U.S. and foreign tax authorities regarding the amount of taxes due. These challenges include questions regarding the timing and amount of deductions and the allocation of income among various tax jurisdictions. In evaluating the exposure associated with various tax filing positions, the Company records reserves for estimates of potential additional tax owed by the Company. As examples, the Company has received large tax assessments from tax authorities in Brazil and Argentina challenging income tax positions taken by subsidiaries of the Company covering various prior periods. Any failure to comply with applicable laws and regulations or appropriately resolve these challenges could subject the Company to administrative penalties and injunctive relief, civil remedies including fines, injunctions, and recalls of its products, and damage to its reputation.

The production of the Company’s products requires the use of materials which can create emissions of certain regulated substances, including greenhouse gas emissions. Although the Company has programs in place throughout the organization globally to guard against non-compliance, failure to comply with these regulations can have serious consequences, including civil and administrative penalties as well as a negative impact on the Company’s reputation, business, cash flows, and results of operations.

In addition, changes to regulations or implementation of additional regulations, for example the imposition of regulatory restrictions on greenhouse gases or regulatory modernization of food safety laws, may require the Company to modify existing processing facilities and/or processes which could significantly increase operating costs and adversely affect operating results.

The Company is exposed to potential business disruption, including but not limited to disruption of transportation services, supply of non-commodity raw materials used in its processing operations, and other impacts resulting from acts of terrorism or war, natural disasters, severe weather conditions, and accidents which could adversely affect the Company’s operating results.

The Company’s operations rely on dependable and efficient transportation services. A disruption in transportation services could result in difficulties supplying materials to the Company’s facilities and impair the Company’s ability to deliver products to its customers in a timely manner. The Company relies on access to navigable rivers and waterways in order to fulfill its transportation obligations more effectively. If access to these navigable waters is interrupted, the Company’s operating results could be adversely affected. In addition, if certain non-agricultural commodity raw materials, such as water or certain chemicals used in the Company’s processing operations, are not available, the Company’s business could be disrupted. Any major lack of available water for use in certain of the Company's processing operations could have a material adverse impact on operating results. Certain factors which may impact the availability of non-agricultural commodity raw materials are out of the Company’s control including, but not limited to, disruptions resulting from weather, economic conditions, manufacturing delays or disruptions at suppliers, shortage of materials, and unavailable or poor supplier credit conditions.

The assets and operations of the Company could be subject to extensive property damage and business disruption from various events which include, but are not limited to, acts of terrorism, for example, economic adulteration of the Company's products, or war, natural disasters and severe weather conditions, accidents, explosions, and fires. The potential effects of these conditions could adversely affect the Company’s revenues and operating results.

|

| |

| Item 1A. | RISK FACTORS (Continued) |

The Company’s business is capital-intensive in nature and the Company relies on cash generated from its operations and external financing to fund its growth and ongoing capital needs. Limitations on access to external financing could adversely affect the Company’s operating results.

The Company requires significant capital, including access to credit markets from time to time, to operate its current business and fund its growth strategy. The Company’s working capital requirements, including margin requirements on open positions on futures exchanges, are directly affected by the price of agricultural commodities, which may fluctuate significantly and change quickly. The Company also requires substantial capital to maintain and upgrade its extensive network of storage facilities, processing plants, refineries, mills, ports, transportation assets and other facilities to keep pace with competitive developments, technological advances, regulations and changing safety standards in the industry. Moreover, the expansion of the Company’s business and pursuit of acquisitions or other business opportunities may require significant amounts of capital. Access to credit markets and pricing of the Company’s capital is dependent upon maintaining sufficient credit ratings from credit rating agencies. Sufficient credit ratings allow the Company to access tier one commercial paper markets. If the Company is unable to maintain sufficiently high credit ratings, access to these commercial paper and other debt markets and costs of borrowings could be adversely affected. If the Company is unable to generate sufficient cash flow or maintain access to adequate external financing, including as a result of significant disruptions in the global credit markets, it could restrict the Company’s current operations and its growth opportunities which could adversely affect the Company’s operating results.

The Company’s risk management strategies may not be effective.

The Company’s business is affected by fluctuations in agricultural commodity cash prices and derivative prices, transportation costs, energy prices, interest rates, and foreign currency exchange rates. The Company has processes in place to monitor exposures to these risks and engages in strategies to manage these risks. The Company’s monitoring efforts may not be successful at detecting a significant risk exposure. If these controls and strategies are not successful in mitigating the Company’s exposure to these fluctuations, it could adversely affect the Company’s operating results.

The Company has limited control over and may not realize the expected benefits of its equity investments and joint ventures.

The Company has $3.9 billion invested in or advanced to joint ventures and investments over which the Company has limited control as to the governance and management activities of these investments. Net sales to unconsolidated affiliates during the year ended December 31, 2014 was $5.8 billion. The Company faces certain risks, including risks related to the financial strength of the investment partner; loss of revenues and cash flows to the investment partner and related gross profit; the inability to implement beneficial management strategies, including risk management and compliance monitoring, with respect to the investment’s activities; and the risk that the Company may not be able to resolve disputes with the investment partner. The Company may encounter unanticipated operating issues or financial results related to these investments that may impact the Company’s revenues and operating results.

The Company’s information technology (IT) systems, processes, and sites may suffer interruptions, security breaches, or failures which may affect the Company’s ability to conduct its business.

The Company’s operations rely on certain key IT systems, some of which are dependent on services provided by third parties, to provide critical data connectivity, information and services for internal and external users. These interactions include, but are not limited to, ordering and managing materials from suppliers, risk management activities, converting raw materials to finished products, inventory management, shipping products to customers, processing transactions, summarizing and reporting results of operations, human resources benefits and payroll management, complying with regulatory, legal or tax requirements, and other processes necessary to manage the business. Increased IT security threats and more sophisticated computer crime, including advanced persistent threats, pose a potential risk to the security of the Company's IT systems, networks, and services, as well as the confidentiality, availability, and integrity of the Company's data. The Company has put in place security measures to protect itself against cyber-based attacks and disaster recovery plans for its critical systems. However, if the Company’s IT systems are breached, damaged, or cease to function properly due to any number of causes, such as catastrophic events, power outages, security breaches, or cyber-based attacks, and the Company’s disaster recovery plans do not effectively mitigate on a timely basis, the Company may suffer interruptions in its ability to manage its operations, loss of valuable data, and damage to its reputation, which may adversely impact the Company’s revenues, operating results, and financial condition.

|

| |

| Item 1B. | UNRESOLVED STAFF COMMENTS |

The Company has no unresolved staff comments.

The Company owns or leases, under operating leases, the following processing plants and procurement facilities:

|

| | | | | | | | | | | | | | | | | |

| | Processing Plants | | Procurement Facilities |

| | Owned | | Leased | | Total | | Owned | | Leased | | Total |

| U.S. | 157 |

| | 5 |

| | 162 |

| | 283 |

| | 22 |

| | 305 |

|

| International | 124 |

| | 14 |

| | 138 |

| | 130 |

| | 31 |

| | 161 |

|

| | 281 |

| | 19 |

| | 300 |

| | 413 |

| | 53 |

| | 466 |

|

The Company’s operations are such that most products are efficiently processed near the source of raw materials. Consequently, the Company has many plants strategically located in agricultural commodity producing areas. The annual volume of commodities processed will vary depending upon availability of raw materials and demand for finished products. The Company also owns approximately 250 warehouses and terminals primarily used as bulk storage facilities and 39 innovation centers. Warehouses, terminals, corporate, and sales offices are not included in the tables above. Processing plants and procurement facilities owned or leased by unconsolidated joint ventures are also not included in the tables above.

To enhance the efficiency of transporting large quantities of raw materials and finished products between the Company’s procurement facilities and processing plants and also the final delivery of products to our customers around the world, the Company owns approximately 2,100 barges, 13,500 rail cars, 300 trucks, 1,300 trailers, and 9 ocean going vessels; and leases, under operating leases, approximately 500 barges, 14,600 railcars, 300 trucks, and 32 ocean going vessels.

|

| |

| Item 2. | PROPERTIES (Continued) |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Oilseeds Processing Plants |

| | Owned | | Leased |

| | Crushing & Origination | | Refining, Packaging, Biodiesel, & Other | | Cocoa & Other | | Asia | | Total | | Cocoa & Other | | Asia | | Total |

| North America | | | | | | | | | | | | | | | |

| U.S.* | 25 |

| | 27 |

| | 18 |

| | — |

| | 70 |

| | — |

| | — |

| | — |

|

| Canada | 3 |

| | 5 |

| | 1 |

| | — |

| | 9 |

| | 1 |

| | — |

| | 1 |

|

| Mexico | 1 |

| | — |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Total | 29 |

| | 32 |

| | 19 |

| | — |

| | 80 |

| | 1 |

| | — |

| | 1 |

|

| Daily capacity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Metric tons (in 1,000's) | 55 |

| | 17 |

| | 13 |

| | — |

| | 85 |

| | — |

| | — |

| | — |

|

| South America | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Argentina | — |

| | — |

| | 1 |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Bolivia | 1 |

| | 2 |

| | — |

| | — |

| | 3 |

| | — |

| | — |

| | — |

|

| Brazil | 6 |

| | 9 |

| | 1 |

| | — |

| | 16 |

| | — |

| | — |

| | — |

|

| Paraguay | 1 |

| | — |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Peru | — |

| | 1 |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Total | 8 |

| | 12 |

| | 2 |

| | — |

| | 22 |

| | — |

| | — |

| | — |

|

| Daily capacity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Metric tons (in 1,000's) | 18 |

| | 4 |

| | — |

| | — |

| | 22 |

| | — |

| | — |

| | — |

|

| Europe | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Belgium | — |

| | — |

| | 1 |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Czech Republic | 1 |

| | 1 |

| | — |

| | — |

| | 2 |

| | — |

| | — |

| | — |

|

| France | — |

| | 1 |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Germany | 4 |

| | 12 |

| | 2 |

| | — |

| | 18 |

| | — |

| | — |

| | — |

|

| Netherlands | 1 |

| | 3 |

| | 2 |

| | — |

| | 6 |

| | — |

| | — |

| | — |

|

| Poland | 2 |

| | 5 |

| | — |

| | — |

| | 7 |

| | — |

| | — |

| | — |

|

| Switzerland | — |

| | 1 |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Ukraine | 2 |

| | — |

| | — |

| | — |

| | 2 |

| | — |

| | — |

| | — |

|

| U.K. | 1 |

| | 3 |

| | — |

| | — |

| | 4 |

| | 1 |

| | — |

| | 1 |

|

| Total | 11 |

| | 26 |

| | 5 |

| �� | — |

| | 42 |

| | 1 |

| | — |

| | 1 |

|

| Daily capacity | | | | | | | | | | | | | | | |

| Metric tons (in 1,000's) | 34 |

| | 16 |

| | 1 |

| | — |

| | 51 |

| | — |

| | — |

| | — |

|

| Asia | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| India | — |

| | — |

| | — |

| | 4 |

| | 4 |

| | — |

| | 2 |

| | 2 |

|

| Singapore | — |

| | — |

| | — |

| | — |

| | — |

| | 1 |

| | — |

| | 1 |

|

| Total | — |

| | — |

| | — |

| | 4 |

| | 4 |

| | 1 |

| | 2 |

| | 3 |

|

| Daily capacity | | | | | | | | | | | | | | | |

| Metric tons (in 1,000's) | — |

| | — |

| | — |

| | 3 |

| | 3 |

| | — |

| | 2 |

| | 2 |

|

| Africa/Middle East | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Ghana | — |

| | — |

| | 1 |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Ivory Coast | — |

| | — |

| | 1 |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| South Africa | — |

| | — |

| | 3 |

| | — |

| | 3 |

| | — |

| | — |

| | — |

|

| Total | — |

| | — |

| | 5 |

| | — |

| | 5 |

| | — |

| | — |

| | — |

|

| Daily capacity | | | | | | | | | | | | | | | |

| Metric tons (in 1,000's) | — |

| | — |

| | 2 |

| | — |

| | 2 |

| | — |

| | — |

| | — |

|

| Grand Total | 48 |

| | 70 |

| | 31 |

| | 4 |

| | 153 |

| | 3 |

| | 2 |

| | 5 |

|

| Total daily capacity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Metric tons (in 1,000's) | 107 |

| | 37 |

| | 16 |

| | 3 |

| | 163 |

| | — |

| | 2 |

| | 2 |

|

|

| |

| Item 2. | PROPERTIES (Continued) |

*The U.S. plants in the table above are located in Alabama, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Carolina, North Dakota, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, and Wisconsin.

|

| | | | | | | | | | | | | | | | | |

| | Oilseeds Processing Procurement Facilities |

| | Owned | | Leased |

| | Crushing & Origination | | Cocoa & Other | | Total | | Crushing & Origination | | Cocoa & Other | | Total |

| North America | | | | | | | | | | | |

| U.S.* | 9 |

| | 70 |

| | 79 |

| | — |

| | — |

| | — |

|

| Canada | 6 |

| | — |

| | 6 |

| | — |

| | — |

| | — |

|

| Total | 15 |

| | 70 |

| | 85 |

| | — |

| | — |

| | — |

|

| Storage capacity | | | | | | | | | | | |

| Metric tons (in 1,000's) | 338 |

| | 300 |

| | 638 |

| | — |

| | — |

| | — |

|

| South America | |

| | |

| | |

| | |

| | |

| | |

|

| Argentina | — |

| | 1 |

| | 1 |

| | — |

| | 1 |

| | 1 |

|

| Bolivia | 8 |

| | — |

| | 8 |

| | 7 |

| | — |

| | 7 |

|

| Brazil | 35 |

| | — |

| | 35 |

| | 3 |

| | 1 |

| | 4 |

|

| Paraguay | 28 |

| | — |

| | 28 |

| | 7 |

| | — |

| | 7 |

|

| Uruguay | 1 |

| | — |

| | 1 |

| | 6 |

| | — |

| | 6 |

|

| Total | 72 |

| | 1 |

| | 73 |

| | 23 |

| | 2 |

| | 25 |

|

| Storage capacity | | | | | | | | | | | |

| Metric tons (in 1,000's) | 2,270 |

| | 6 |

| | 2,276 |

| | 524 |

| | 2 |

| | 526 |

|

| Europe | |

| | |

| | |

| | |

| | |

| | |

|

| Netherlands | 1 |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| Germany | 5 |

| | — |

| | 5 |

| | — |

| | — |

| | — |

|

| Poland | 5 |

| | — |

| | 5 |

| | — |

| | — |

| | — |

|

| Slovakia | 3 |

| | — |

| | 3 |

| | — |

| | — |

| | — |

|

| Total | 14 |

| | — |

| | 14 |

| | — |

| | — |

| | — |

|

| Storage capacity | | | | | | | | | | | |

| Metric tons (in 1,000's) | 890 |

| | — |

| | 890 |

| | — |

| | — |

| | — |

|

| Asia | |

| | |

| | |

| | |

| | |

| | |

|

| Indonesia | — |

| | 1 |

| | 1 |

| | — |

| | 2 |

| | 2 |

|

| Total | — |

| | 1 |

| | 1 |

| | — |

| | 2 |

| | 2 |

|

| Storage capacity | | | | | | | | | | | |

| Metric tons (in 1,000's) | — |

| | 8 |

| | 8 |

| | — |

| | 7 |

| | 7 |

|

| Africa/Middle East | |

| | |

| | |

| | |

| | |

| | |

|

| Cameroon | — |

| | 1 |

| | 1 |

| | — |

| | — |

| | — |

|

| Ivory Coast | — |

| | 4 |

| | 4 |

| | — |

| | — |

| | — |

|

| Total | — |

| | 5 |

| | 5 |

| | — |

| | — |

| | — |

|

| Storage capacity | | | | | | | | | | | |

| Metric tons (in 1,000's) | — |

| | 83 |

| | 83 |

| | — |

| | — |

| | — |

|

| Grand Total | 101 |

| | 77 |

| | 178 |

| | 23 |

| | 4 |

| | 27 |

|

| Total storage capacity | |

| | |

| | |

| | |

| | |

| | |

|

| Metric tons (in 1,000's) | 3,498 |

| | 397 |

| | 3,895 |

| | 524 |

| | 9 |

| | 533 |

|

*The U.S. procurement facilities are located in Alabama, Florida, Georgia, Illinois, Michigan, Mississippi, North Carolina, Oklahoma, South Carolina, Texas, and Virginia.

|

| |

| Item 2. | PROPERTIES (Continued) |

|

| | | | | | | | | | | | | | |

| | Corn Processing |

| | Processing Plants | | Procurement Facilities |

| | Owned | | Owned |

| | Wet Milling | | Dry Milling | | Other | | Total | | Wet Milling, Dry Milling, & Other |

| North America | | | | | | | | | |

| Illinois | 1 |

| | 1 |

| | 6 |

| | 8 |

| | — |

|

| Iowa | 2 |

| | 1 |

| | 2 |

| | 5 |

| | 1 |

|

| Minnesota | 1 |

| | — |

| | — |

| | 1 |

| | 5 |

|

| Nebraska | 1 |

| | 1 |

| | — |

| | 2 |

| | — |

|

| North Carolina | — |

| | — |

| | 1 |

| | 1 |

| | — |

|

| Total | 5 |

| | 3 |

| | 9 |

| | 17 |

| | 6 |

|

| Daily/Storage capacity | | | | | | | | | |

| Metric tons (in 1,000's) | 43 |

| | 22 |

| | 7 |

| | 72 |

| | 373 |

|

| South America | |

| | |

| | |

| | |

| | |

|

| Brazil | — |

| | — |

| | 1 |

| | 1 |

| | — |

|

| Total | — |

| | — |

| | 1 |

| | 1 |

| | — |

|

| Daily/Storage capacity | | | | | | | | | |

| Metric tons (in 1,000's) | — |

| | — |

| | 4 |

| | 4 |

| | — |

|

| Grand Total | 5 |

| | 3 |

| | 10 |

| | 18 |

| | 6 |

|

| Total daily/storage capacity | |

| | |

| | |

| | |

| | |

|

| Metric tons (in 1,000's) | 43 |

| | 22 |

| | 11 |

| | 76 |

| | 373 |

|

|

| |

| Item 2. | PROPERTIES (Continued) |

|

| | | | | | | | | | | |

| | Agricultural Services Processing Plants |

| | Owned | | Leased |

| | Merchandising & Handling | | Milling & Other | | Total | | Milling & Other |

| North America | | | | | | | |

| U.S.* | 2 |

| | 60 |

| | 62 |

| | — |

|

| Barbados | — |

| | 1 |

| | 1 |

| | — |

|

| Belize | — |

| | 2 |

| | 2 |

| | — |

|

| Canada | — |

| | 12 |

| | 12 |

| | — |

|

| Grenada | — |

| | 2 |

| | 2 |

| | — |

|

| Jamaica | — |

| | 3 |

| | 3 |

| | — |

|

| Puerto Rico | — |

| | 3 |

| | 3 |

| | — |

|

| Trinidad & Tobago | — |

| | 1 |

| | 1 |

| | — |

|

| Total | 2 |

| | 84 |

| | 86 |

| | — |

|

| Daily capacity | | | | | | | |

| Metric tons (in 1,000's) | 2 |

| | 32 |

| | 34 |

| | — |

|

| Europe | |

| | |

| | |

| | |

|

| U.K. | — |

| | 3 |

| | 3 |

| | 4 |

|

| Total | — |

| | 3 |

| | 3 |

| | 4 |

|

| Daily capacity | | | | | | | |

| Metric tons (in 1,000's) | — |

| | 1 |

| | 1 |

| | 1 |

|

| Asia | |

| | |

| | |

| | |

|

| China | — |

| | 3 |

| | 3 |

| | — |

|

| Total | — |

| | 3 |

| | 3 |

| | — |

|

| Daily capacity | | | | | | | |

| Metric tons (in 1,000's) | — |

| | — |

| | — |

| | — |

|

| Grand Total | 2 |

| | 90 |

| | 92 |

| | 4 |

|

| Total daily capacity | |

| | |

| | |

| | |

|

| Metric tons (in 1,000's) | 2 |

| | 33 |

| | 35 |

| | 1 |

|

*The U.S. plants are located in California, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Tennessee, Texas, Washington, and Wisconsin.

|

| |

| Item 2. | PROPERTIES (Continued) |

|

| | | | | |

| | Agricultural Services Procurement Facilities |

| | Merchandising & Handling |

| | Owned | | Leased |

| North America | | | |

| U.S.* | 198 |

| | 22 |

|

| Canada | 1 |

| | — |

|

| Dominican Republic | 1 |

| | — |

|

| Mexico | 4 |

| | — |

|

| Total | 204 |

| | 22 |

|

| Storage capacity | | | |

| Metric tons (in 1,000's) | 12,438 |

| | 752 |

|

| South America | |

| | |

|

| Argentina | 3 |

| | — |

|

| Total | 3 |

| | — |

|

| Storage capacity | |

| | |

|

| Metric tons (in 1,000's) | 477 |

| | — |

|

| Europe | |

| | |

|

| Germany | — |

| | — |

|

| Hungary | 2 |

| | — |

|

| Ireland | 2 |

| | — |

|

| Romania | 10 |

| | 4 |

|

| Ukraine | 8 |

| | — |

|

| Total | 22 |

| | 4 |

|

| Storage capacity | | | |

| Metric tons (in 1,000's) | 582 |

| | 34 |

|

| Grand Total | 229 |

| | 26 |

|

| Total storage capacity | |

| | |

|

| Metric tons (in 1,000's) | 13,497 |

| | 786 |

|

*The U.S. procurement facilities are located in Arkansas, Florida, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Missouri, Montana, Nebraska, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Tennessee, Texas, Wisconsin, and Wyoming.

|

| |

| Item 2. | PROPERTIES (Continued) |

|

| | | | | |

| | Other |

| | Processing Plants |

| | Owned | | Leased |

| North America | | | |

| U.S.* | 8 |

| | 5 |

|

| Total | 8 |

| | 5 |

|

| South America | | | |

| Brazil | 1 |

| | — |

|

| Total | 1 |

| | — |

|

| Europe | | | |

| France | 1 |

| | — |

|

| Germany | 2 |

| | 1 |

|

| Netherlands | — |

| | 1 |

|

| Poland | 2 |

| | — |

|

| Spain | 1 |

| | — |

|

| Switzerland | 1 |

| | — |

|

| Turkey | — |

| | 1 |

|

| Total | 7 |

| | 3 |

|

| Asia/ Middle East | | | |

| India | 2 |

| | 2 |

|

| Total | 2 |

| | 2 |

|

*The U.S. plants are located in California, Idaho, Kentucky, Michigan, New Jersey, North Carolina, Ohio, Oregon, Washington, and Wisconsin.

The Company is routinely involved in a number of actual or threatened legal actions, including those involving alleged personal injuries, employment law, product liability, intellectual property, environmental issues, alleged tax liability (see Note 13 for information on tax matters), and class actions. The Company also routinely receives inquiries from regulators and other government authorities relating to various aspects of our business, including with respect to our compliance with laws and regulations relating to the environment and, at any given time, the Company has matters at various stages of resolution with the applicable government authorities. The outcomes of these matters are not within our complete control and may not be known for prolonged periods of time. In some actions, claimants seek damages, as well as other relief, including injunctive relief, that could require significant expenditures or result in lost revenues. In accordance with applicable accounting standards, the Company records a liability in its consolidated financial statements for material loss contingencies when a loss is known or considered probable and the amount can be reasonably estimated. If the reasonable estimate of a known or probable loss is a range, and no amount within the range is a better estimate than any other, the minimum amount of the range is accrued. If a material loss contingency is reasonably possible but not known or probable, and can be reasonably estimated, the estimated loss or range of loss is disclosed in the notes to the consolidated financial statements. When determining the estimated loss or range of loss, significant judgment is required to estimate the amount and timing of a loss to be recorded. Estimates of probable losses resulting from litigation and governmental proceedings involving the Company are inherently difficult to predict, particularly when the matters are in early procedural stages, with incomplete facts or legal discovery; involve unsubstantiated or indeterminate claims for damages; potentially involve penalties, fines, disgorgement, or punitive damages; or could result in a change in business practice.

On April 22, 2011, certain manufacturers and distributors of sugar cane and beet sugar products filed suit in the U.S. District Court for the Central District of California against the Company, other manufacturers and marketers of high-fructose corn syrup (HFCS), and the Corn Refiners Association, alleging that the defendants falsely claimed that HFCS is "natural" and nutritionally equivalent to sugar. The defendants have filed counterclaims against the plaintiffs. The parties are currently engaged in pretrial proceedings.

|

| |

| Item 4. | MINE SAFETY DISCLOSURES |

None.

PART II

|

| |

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

Common Stock Market Prices and Dividends

The Company’s common stock is listed and traded on the New York Stock Exchange and the Frankfurt Stock Exchange. The following table sets forth, for the periods indicated, the high and low market prices of the common stock as reported on the New York Stock Exchange and common stock cash dividends declared per share.

|

| | | | | | | | | | | |

| | | | | | Cash |

| | Market Price | | Dividends |

| | High | | Low | | Per Share |

| Fiscal Year 2014-Quarter Ended | | | | | |

| December 31 | $ | 53.91 |

| | $ | 41.63 |

| | $ | 0.24 |

|

| September 30 | 52.36 |

| | 44.15 |

| | 0.24 |

|

| June 30 | 45.40 |

| | 41.72 |

| | 0.24 |

|

| March 31 | 43.60 |

| | 37.92 |

| | 0.24 |

|

| Fiscal Year 2013-Quarter Ended | |

| | |

| | |

|

| December 31 | $ | 43.99 |

| | $ | 36.01 |

| | $ | 0.19 |

|

| September 30 | 38.81 |

| | 34.11 |

| | 0.19 |

|

| June 30 | 35.04 |

| | 31.50 |

| | 0.19 |

|

| March 31 | 33.77 |

| | 27.90 |

| | 0.19 |

|

The number of registered shareholders of the Company’s common stock at December 31, 2014, was 11,292. The Company expects to continue its policy of paying regular cash dividends, although there is no assurance as to future dividends because they are dependent on future earnings, capital requirements, and financial condition.

Issuer Purchases of Equity Securities

|

| | | | | | | | | | | | | |

| Period | | Total Number of Shares Purchased (1) | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Program (2) | | Number of Shares Remaining to be Purchased Under the Program (2) |

October 1, 2014 to October 31, 2014 | | 2,115,504 |

| | $ | 46.552 |

| | 2,080,560 |

| | 47,575,761 |

|

November 1, 2014 to November 30, 2014 | | 857,045 |

| | 52.063 |

| | 857,045 |

| | 46,718,716 |

|

December 1, 2014 to December 31, 2014 | | 6,500,414 |

| | 52.213 |

| | 6,500,414 |

| | 40,218,302 |

|

| Total | | 9,472,963 |

| | $ | 50.935 |

| | 9,438,019 |

| | 40,218,302 |

|

(1) Total shares purchased represent those shares purchased in the open market as part of the Company’s publicly announced share repurchase program described below, shares received as payment for the exercise price of stock option exercises, and shares received as payment for the withholding taxes on vested restricted stock awards. During the three-month period ended December 31, 2014, there were 34,944 shares received as payment for the minimum withholding taxes on vested restricted stock awards. During the three-month period ended December 31, 2014, there were no shares received as payment for the exercise price of stock option exercises.

(2) On November 5, 2009, the Company’s Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to 100,000,000 shares of the Company’s common stock during the period commencing January 1, 2010 and ending December 31, 2014. On November 5, 2014, the Company’s Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to 100,000,000 shares of the Company’s common stock during the period commencing January 1, 2015 and ending December 31, 2019.

|

| |

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES (Continued) |

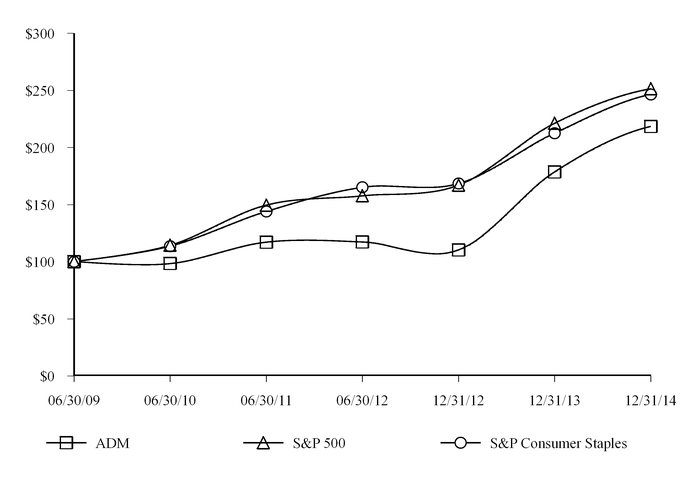

Performance Graph