UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-08454

ACCO Brands Corporation

(Exact Name of Registrant as Specified in Its Charter)

| | |

| Delaware | | 36-2704017 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

300 Tower Parkway

Lincolnshire, Illinois 60069

(Address of Registrant’s Principal Executive Office, Including Zip Code)

(847) 541-9500

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, par value $.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Noþ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes¨ Noþ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesþ No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yesþ No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

| | | | | | |

| Large accelerated filer¨ | | Accelerated filerþ | | Non-accelerated filer¨ | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes¨ Noþ

As of June 30, 2011, the aggregate market value of the shares of Common Stock held by non-affiliates of the registrant was approximately $282 million.

As of February 1, 2012, the registrant had outstanding 55,480,751 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be issued in connection with registrant’s annual stockholder’s meeting expected to be held on May 15, 2012 are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

PART I

Cautionary Statement Regarding Forward-Looking Statements. Certain statements made in this Annual Report on Form 10-K are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of invoking these safe harbor provisions. These forward-looking statements, which are based on certain assumptions and describe future plans, strategies and expectations of the Company, are generally identifiable by use of the words “will,” “believe,” “expect,” “intend,” “anticipate,” “estimate,” “forecast,” “project,” “plan,” or similar expressions. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Because actual results may differ from those predicted by such forward-looking statements, you should not place undue reliance on such forward-looking statements when deciding whether to buy, sell or hold the Company’s securities. We undertake no obligation to update these forward-looking statements in the future. The factors that could affect our results or cause plans, actions and results to differ materially from current expectations are detailed in this report, including under “Item 1. Business,” “Item 1A. Risk Factors” and the financial statement line item discussions set forth in “Item 7. Management’s Discussion and Analysis of Financial Conditions and Results of Operations” and from time to time in our other SEC filings.

Website Access to Securities and Exchange Commission Reports

The Company’s Internet website can be found atwww.accobrands.com. The Company makes available free of charge on or through its website its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as practicable after the Company files them with, or furnishes them to, the Securities and Exchange Commission. We also make available the following documents on our Internet website: the Audit Committee Charter; the Compensation Committee Charter; the Corporate Governance and Nominating Committee Charter; our Corporate Governance Principles; and our Code of Business Conduct and Ethics. The Company’s Code of Business Conduct and Ethics applies to all of our directors, officers (including the Chief Executive Officer, Chief Financial Officer and Principal Accounting Officer) and employees. You may obtain a copy of any of the foregoing documents, free of charge, if you submit a written request to ACCO Brands Corporation, 300 Tower Parkway, Lincolnshire, IL. 60069, Attn: Investor Relations.

ITEM 1.BUSINESS

Overview

ACCO Brands is one of the world’s largest suppliers of branded office products (excluding furniture, computers, printers and bulk paper) to the office products resale industry. We design, develop, manufacture and market a wide variety of traditional and computer-related office products, supplies, binding and laminating equipment and related consumable supplies, personal computer accessory products, paper-based time management products and presentation aids and products. Through a focus on research, marketing and innovation, we seek to develop new products that meet the needs of our consumers and commercial end-users, which we believe will increase the product positioning of our brands. We compete through a balance of innovation, a low-cost operating model and an efficient supply chain. We sell our products primarily to markets located in North America, Europe and Australia. Our brands include GBC®, Kensington®, Quartet®, Rexel, Swingline®, Wilson Jones®, Marbig, NOBO and Day-Timer®, among others.

The majority of our office products are used by businesses. Most of these end-users purchase our products from our reseller customers, which include commercial contract stationers, retail superstores, wholesalers, mail order and internet catalogs, mass merchandisers, club stores and dealers. We also supply our products directly to

1

commercial and industrial end-users and to the educational market. Historically we have targeted the premium-end of the product categories in which we compete. However, we also supply private label products for our customers where we believe we have an economic advantage or where it is necessary to merchandise a complete category.

Our leading brand positions provide the scale to enable us to invest in product innovation and drive market growth across our product categories. In addition, the expertise we use to satisfy the exacting technical specifications of our more demanding commercial customers is in many instances the basis for expanding our products and innovations to consumer products.

Our strategy centers on a combination of growing sales and market share and generating acceptable profitability and returns. Specifically, we have substantially reduced our operating expenses and seek to leverage our platform for organic growth through greater consumer understanding, product innovation, marketing and merchandising, disciplined category expansion including broader product penetration and possible strategic transactions, and continued cost realignment. To achieve these goals, we plan to continue to execute the following strategies: (1) invest in research, marketing and innovation, (2) penetrate the full product spectrum of our categories and (3) opportunistically pursue strategic transactions.

We utilize a combination of manufacturing and third-party sourcing to procure our products, depending on transportation costs, service needs and direct labor costs associated with each product.

Our priority for cash flow use over the near term, after internal growth, is to fund the reduction of debt and invest in new products through both organic development and acquisitions. For a description of certain factors that may have had, or may in the future have, a significant impact on our business, financial condition or results of operations, see Item 1A, “Risk Factors”.

Reportable Segments

Our Company is organized into three business segments: ACCO Brands Americas, ACCO Brands International and Computer Products Group.

The following table shows the percentages of consolidated revenue from continuing operations derived from each of our reportable segments in the years indicated:

| | | | | | |

Segment | | 2011 | | 2010 | | 2009 |

| ACCO Brands Americas | | 52% | | 53% | | 55% |

| ACCO Brands International | | 34% | | 33% | | 32% |

| Computer Products Group | | 14% | | 14% | | 13% |

ACCO Brands Americas and ACCO Brands International

These two segments manufacture, source and sell traditional office products and supplies and document finishing solutions. ACCO Brands Americas comprises the North, Central and South American markets, and ACCO Brands International comprises the rest of the world, principally Europe, Australia and Asia-Pacific.

Examples of our traditional office products and supplies are staplers, staples, punches, ring binders, trimmers, sheet protectors, hanging file folders, clips and fasteners, dry-erase boards, dry-erase markers, easels, bulletin boards, overhead projectors, transparencies, laser pointers and screens. These products are sold under leading brands including Quartet®, Rexel, Swingline®, Wilson Jones®, Marbig, NOBO, ACCO®, Derwent and Eastlight. Examples of our document finishing solutions are binding, lamination and punching equipment, binding and lamination supplies, report covers, archival report covers and shredders. These products are sold primarily under the GBC® brand. We also provide machine maintenance and repair services sold under the GBC brand. Included in the ACCO Brands Americas segment are our personal organization tools, including time management products, primarily under the Day-Timer® brand name.

2

The customer base to which our products are sold is made up of large global and regional resellers of our products. It is through these large resellers that the Company’s products reach the end consumer. Our customer base includes commercial contract stationers, office products superstores, wholesalers, distributors, mail order and internet catalogs, mass merchandisers, club stores and independent dealers. The majority of sales by our customers are to business end-users, which generally seek office products that have added value or ease of use features and a reputation for reliability, performance and professional appearance. Some of our document finishing products are sold directly to high volume end-users and commercial reprographic centers and indirectly to lower-volume consumers worldwide. Approximately two-thirds of the Day-Timer® business is sold through the direct channel, which markets product through the internet and periodic sales catalogs and ships product directly to our end-user customers. The remainder of the business sells to large resellers and commercial dealers.

Computer Products Group

The Computer Products Group designs, distributes, markets and sells accessories for laptop and desktop computers, smart phones and tablets. These accessories primarily include security locks, power adapters, input devices such as mice and keyboards, laptop computer carrying cases, hubs and docking stations, ergonomic devices and technology accessories for smart phones and tablets. The Computer Products Group sells mostly under the Kensington®, Microsaver® and ClickSafe® brand names, with the majority of its revenue coming from the U.S. and Western Europe.

All of our computer products are manufactured by third-party suppliers, principally in Asia, and are stored in and distributed from our regional facilities. Our computer products are sold primarily to consumer electronics retailers, information technology value-added resellers, original equipment manufacturers and office products retailers.

For further information on the Company’s business segments see Note 15,Information on Business Segments, to our consolidated financial statements contained in Item 8 of this report.

Discontinued Operations

On June 14, 2011, the Company announced the disposition of GBC-Fordigraph Pty Ltd (“GBC-Fordigraph Business”). The Australia-based business was formerly part of the ACCO Brands International segment and the results of operations are included in the financial statements as a discontinued operation for all periods presented. The GBC-Fordigraph Business represented $45.9 million in annual net sales for the year ended December 31, 2010. The Company has received final proceeds of $52.9 million inclusive of working capital adjustments and selling costs. In connection with this transaction, in 2011, the Company recorded a gain on sale of $41.9 million ($36.8 million after- tax).

In June 2009, the Company completed the sale of its commercial print finishing business for final gross proceeds of $16.2 million. The results of operations and loss on sale of this business are reported in discontinued operations for all periods presented.

For further information on the Company’s discontinued operations see Note 18,Discontinued Operations, to our consolidated financial statements contained in Item 8 of this report.

Acquisition

On November 17, 2011, the Company announced the signing of a definitive agreement to merge MeadWestvaco Corporation’s Consumer and Office Products business (“Mead C&OP Business”) into the Company in a transaction that was valued at approximately $860 million as of the date the transaction was announced. The Mead C&OP Business is a leading manufacturer and marketer of school supplies, office products, and planning and organizing tools– including the Mead®, Five Star®, Trapper Keeper®, AT-A-GLANCE®, Cambridge®, Day Runner®, Hilroy, Tilibra and Grafons brands in the U.S., Canada and

3

Brazil. Upon completion of the transaction, MeadWestvaco shareholders will own 50.5% of the combined company. The transaction is subject to approval by the Company’s shareholders and the satisfaction of customary closing conditions and regulatory approvals, including a ruling from the U.S. Internal Revenue Service on the tax-free nature of the transaction for MeadWestvaco. The transaction is expected to be completed in the first half of 2012. The Company will be the accounting acquirer in the merger and will apply purchase accounting to the assets and liabilities acquired upon consummation of the merger.

Customers/Competition

Our sales are generated principally in North America, Europe and Australia. For the fiscal year ended December 31, 2011, these markets represented 59%, 25% and 11% of our net sales, respectively. Our top ten customers are Staples, Office Depot, OfficeMax, BPGI, United Stationers, S.P. Richards, Wal-Mart/Sam’s Club, Coles Group, Lyreco and Spicers, together accounting for 51% of our net sales for the fiscal year ended December 31, 2011. Sales to Staples, Inc. and subsidiaries amounted to approximately 13% of consolidated net sales for each of the three years ended 2011, 2010 and 2009. Sales to Office Depot, Inc. and subsidiaries amounted to approximately 11% of consolidated net sales for each of the three years ended 2011, 2010 and 2009. Sales to no other customer exceeded 10% of consolidated sales for any of these periods.

Current trends among our customers include fostering high levels of competition among suppliers, demanding innovative new products and requiring suppliers to maintain or reduce product prices and deliver products with shorter lead times and in smaller quantities. Other trends are for retailers to import generic products directly from foreign sources and sell those products, which compete with our products, under the customers’ own private-label brands. The combination of these market influences, along with a recent and continuing trend of consolidation among resellers, has created an intensely competitive environment in which our principal customers continuously evaluate which products they will offer to their customers. This results in pricing pressures, the need for stronger end-user brands, broader product penetration within categories, the ongoing introduction of innovative new products and continuing improvements in customer service.

Competitors of the ACCO Brands Americas and ACCO Brands International segments include Avery Dennison, Esselte, 3M, Newell Rubbermaid, Hamelin, Smead, Fellowes, MeadWestvaco, Tops Products, Franklin Covey, House of Doolittle, Dominion BlueLine, Carolina Pad, Ampad, Blue Sky, Spiral Binding and numerous private label suppliers and importers. Competitors of the Computer Products Group include Belkin, Logitech, Targus and Fellowes.

Certain financial information for each of our business segments and geographic regions is incorporated by reference to Note 15,Information on Business Segments, to our consolidated financial statements contained in Item 8 of this report.

Product Development and Product Line Rationalization

Our strong commitment to understanding our consumers and defining products that fulfill their needs drives our product development strategy, which we believe is and will continue to be a key contributor to our success in the office products industry. Our new products are developed from our own consumer understanding, our own research and development or through partnership initiatives with inventors and vendors. Costs related to consumer research and product research when paid directly by ACCO Brands are included in marketing costs and research and development expenses, respectively. Research and development expenses amounted to $20.5 million, $24.0 million and $18.6 million for the years ended December 31, 2011, 2010 and 2009, respectively.

Significant product developments include the Computer Products Group development of smart phone and tablet accessory products that now represent 22% of 2011 segment revenue. With respect to office products, the “Stack and Shred” range of shredders was an innovative product line launched at a time when there was disruption in the product market resulting from supply chain limitations suffered by a major competitor. Total shredder sales increased by approximately 74% in 2011. Market acceptance of “Stack and Shred” shredders continues to be favorable.

4

In 2011 the Computer Products Group also launched a new proprietary computer security lock product under the brand name “ClickSafe®” to supplement its well recognized MicroSaver® product line for which most patent protection expired in January 2012. By the end of 2011, ClickSafe® product sales accounted for approximately 12% of our computer security product sales. The ClickSafe® solution has patent protection through 2029.

Our product line strategy emphasizes the divestiture of businesses and rationalization of product offerings that do not meet our long-term strategic goals and objectives. We consistently review our businesses and product offerings, assess their strategic fit and seek opportunities to divest non-strategic businesses. The criteria we use in assessing the strategic fit include: the ability to increase sales for the business; the ability to create strong, differentiated brands; the importance of the business to key customers; the business relationship with existing product lines; the impact of the business to the market; and the business’s actual and potential impact on our operating performance.

As a result of this review process, during 2011 we completed the sale of the GBC-Fordigraph Business, the Company’s former Australian direct sales business that sold mailroom and binding and laminating equipment and supplies. This business represented approximately $46 million in annual net sales for the year ended December 31, 2010. In addition, during 2009 we completed the sale of our former commercial print finishing business. This business represented approximately $100 million in annual net sales for the year ended December 31, 2008.

Raw Materials

The primary materials used in the manufacturing of many of our products are plastics, resin, polyester and polypropylene substrates, paper, steel, wood, aluminum, melamine, zinc and cork. These materials are available from a number of suppliers, and we are not dependent upon any single supplier for any of these materials. In general, our gross profit may be affected from time to time by fluctuations in the prices of these materials because our customers require advance notice and negotiation to pass through raw material price increases, giving rise to a delay before cost increases can be passed on to our customers. See Item 1A, “Risk Factors.” The raw materials and labor costs we incur are subject to price increases that could adversely affect our profitability. Based on experience, we believe that adequate quantities of these materials will be available in the foreseeable future. In addition, a significant portion of the products we sell in our international markets are sourced from China and other Asia-Pacific countries and are paid for in U.S. dollars. Thus, movements of their local currency to the U.S. dollar have the same impacts as raw material price changes and we adjust our pricing in these markets to reflect these currency changes.

Supply

Our products are either manufactured or sourced to ensure that we supply our customers with appropriate customer service, quality products, innovative solutions and attractive pricing. We have built a customer-focused business model with a flexible supply chain to ensure that these factors are appropriately balanced. Using a combination of manufacturing and third-party sourcing also enables us to reduce our costs and effectively manage our production assets by lowering our capital investment and working capital requirements. Our strategy is to manufacture those products that would incur a relatively high freight expense or have high service needs and source those products that have a high proportion of direct labor cost. Low-cost sourcing mainly comes from China, but we also source from other Asian countries and Eastern Europe. Where freight costs or service issues are significant, we source from factories located in or near to our domestic markets.

Seasonality

Our business, as it concerns both historical sales and profit, has experienced increased sales volume in the third and fourth quarters of the calendar year. Two principal factors have contributed to this seasonality: the

5

office products industry, its customers and ACCO Brands specifically are major suppliers of products related to the “back-to-school” season, which occurs principally during June, July, August and September for our North American business and during November, December and January for our Australian business; and our offering includes several products which lend themselves to calendar year-end purchase timing, including Day-Timer planners, paper organization and storage products (including bindery) and Kensington computer accessories, which increase with traditionally strong fourth-quarter sales of personal computers.

Intellectual Property

We have many patents, trademarks, brand names and trade names that are, in the aggregate, important to our business. The loss of any individual patent or license, however, would not be material to us taken as a whole, even though there can be no assurance that the royalty income we have received pursuant to license agreements covering patents that have expired can be replaced, or that we will not experience a decline in gross profit margin on related products that no longer have patent protection. Many of our trademarks are only important in particular geographic markets or regions. Our principal registered trademarks are: GBC®, Kensington®, Quartet®, Rexel, Swingline®, Wilson Jones®, Marbig, NOBO, Day-Timer®, Microsaver®, ClickSafe® and ACCO®.

Certain of our patents covering MicroSaver branded products in the computer security category expired in January 2012. We recognized approximately $5.4 million, $7.5 million and $4.6 million in royalty revenue related to these patents in the years ended December 31, 2011, 2010 and 2009, respectively. As these patents have expired, competitors may be able to legally utilize the technology that was protected by those patents and competition could increase, resulting in the Company realizing lower gross margin from the loss of royalty receipts and possibly lower gross margin for MicroSaver branded products. The development of the ClickSafe® product will enable the Company to continue to offer a proprietary computer security product although no license agreements have yet been entered into for the patents related to ClickSafe®. See “Product Development and Product Line Rationalization.”

Environmental Matters

We are subject to federal, state and local laws and regulations concerning the discharge of materials into the environment and the handling, disposal and clean-up of waste materials and otherwise relating to the protection of the environment. It is not possible to quantify with certainty the potential impact of actions regarding environmental matters, particularly remediation and other compliance efforts that we may undertake in the future. In the opinion of our management, compliance with the present environmental protection laws, before taking into account estimated recoveries from third parties, will not have a material adverse effect upon our capital expenditures, financial condition, results of operations or competitive position. See Item 1A, “Risk Factors.”

Employees

As of December 31, 2011, the Company had approximately 3,800 full-time and part-time employees. There have been no strikes or material labor disputes at any of our facilities during the past five years. We consider our employee relations to be good.

6

ITEM 1A.RISK FACTORS

The factors that are discussed below, as well as the matters that are generally set forth in this report on Form 10-K and the documents incorporated by reference herein, could materially and adversely affect the Company’s business, results of operations and financial condition.

Risks Related to Our Business

Sales of our products may be adversely affected by issues that affect business, commercial and consumer spending decisions during periods of economic uncertainty or weakness.

Sales of our products can be very sensitive to uncertain U.S. and global economic conditions, particularly in categories where we compete against private label, other branded and/or generic products that are competitive on price, quality, service or other grounds. In periods of economic uncertainty or weakness, the demand for our products may be adversely affected, as businesses and consumers may seek or be forced to purchase more lower cost, private label or other economy brands, may more readily switch to electronic, digital or web-based products serving similar functions, or may forego certain purchases altogether. As a result, adverse changes in the U.S. or global economy or sustained periods of economic uncertainty or weakness could negatively affect our earnings and could have a material adverse effect on our business, results of operations, cash flows and financial position.

Challenges related to the highly competitive business segments in which we operate could have a negative effect on our ongoing operations, revenues, results, cash flows or financial position.

We operate in highly competitive business segments that face a number of challenges, including competitors with strong brands or brand recognition, significant private label producers, imports from a range of countries, low entry barriers, sophisticated and large buyers of office products, and potential substitution from a range of products and services including electronic, digital or web-based products that can replicate or render obsolete or less desirable some of the products we sell. In particular, our business is likely to be affected by: (1) the decisions and actions of our major customers, including their decisions on whether to increase their purchases of private label products; (2) decisions of current and potential suppliers of competing products on whether to take advantage of low entry barriers to expand their production; and (3) the decisions of end-users of our products to expand their use of substitute products and, in particular, to shift their use of time management and planning products toward electronic and other substitutes. In addition, our competitive position depends on continued investment in innovation and product development, manufacturing and sourcing, quality standards, marketing and customer service and support. Our success will depend in part on our ability to anticipate and offer products that appeal to the changing needs and preferences of our customers in a market where many of our product categories are affected by continuing improvements in technology and shortened product lifecycles. We may not have sufficient resources to make the investments that may be necessary to anticipate those changing needs and may not anticipate, identify, develop and market products successfully or otherwise be successful in maintaining their competitive position.

Our business depends on a limited number of large and sophisticated customers, and a substantial reduction in sales to these customers could significantly impact our operating results.

The office products industry is characterized by a small number of major customers, principally office products superstores (which combine contract stationers, retail and mail order), office products resellers and mass merchandisers. A relatively limited number of customers account for a large percentage of our total net sales. Our top ten customers accounted for 51% of our net sales for the fiscal year ended December 31, 2011. Sales to Staples, Inc. and Office Depot, Inc. and subsidiaries during the same period amounted to approximately 13% and 11%, respectively, of our 2011 net sales. Our large customers have the ability to obtain favorable terms, to directly source their own private label products and to create and support new and competing suppliers. The loss of, or a significant reduction in, business from one or more of our major customers could have a material adverse effect on our business, financial condition and results of operations.

7

Our substantial indebtedness may adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, expose us to interest rate risk to the extent of our variable rate debt, prevent us from meeting our obligations under our indebtedness and otherwise adversely affect our results of operations and financial condition.

As of December 31, 2011, we had $669.0 million of outstanding debt. This indebtedness could have negative consequences to us, such as:

| | • | | requiring us to dedicate a substantial portion of our cash flow from operating activities to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts, potential strategic acquisitions and other general corporate purposes; |

| | • | | limiting our ability to obtain additional financing to fund growth, working capital or capital expenditures, or to fulfill debt service requirements or other cash requirements; |

| | • | | increasing our vulnerability to economic downturns and changing market conditions; |

| | • | | limiting our operational flexibility due to the covenants contained in our debt agreements; |

| | • | | placing us at a competitive disadvantage relative to competitors that have less debt; |

| | • | | to the extent that our debt is subject to floating interest rates, increasing our vulnerability to fluctuations in market interest rates; and |

| | • | | limiting our ability to buy back our stock or pay cash dividends |

The agreements governing our indebtedness contain financial and other restrictive covenants that limit our ability to engage in activities that may be in our long-term best interests. Our ability to meet our expense and debt service obligations will depend on our future performance, which will be affected by financial, business, economic and other factors, including potential changes in customer preferences, the success of product and marketing innovation and pressure from competitors. Should our sales decline, we may not be able to generate sufficient cash flow to pay our debt service obligations when due. If we are unable to meet our debt service obligations or should we fail to comply with our financial and other restrictive covenants, we may be required to refinance all or part of our existing debt (in all likelihood on terms less favorable than our current terms), sell important strategic assets at unfavorable prices or borrow more money. We may not be able to, at any given time, refinance our debt, sell assets or borrow more money on terms acceptable to us or at all. The inability to refinance our debt could have a material adverse effect on our financial condition and results from operations.

Our failure to comply with certain restrictive debt covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all of our debts.

Certain covenants we have made in connection with our existing borrowings restrict our ability to, among other things, incur additional indebtedness, incur certain liens on our assets, issue preferred stock or certain disqualified stock, pay dividends on capital stock, make other restricted payments, including investments, sell our assets, and enter into consolidations or mergers or other transactions with affiliates. Our asset-based revolving credit facility also requires us to maintain specified financial ratios under certain conditions and satisfy financial condition tests. Our ability to meet those financial ratios and tests and otherwise comply with our financial covenants may be affected by events beyond our control, and we may not be able to continue to meet those ratios, tests and covenants. Our ability to generate sufficient cash from operations to meet our debt obligations will depend upon our future operating performance, which will be affected by general economic, financial, competitive, legislative, regulatory, business and other factors beyond our control. A breach of any of these covenants, ratios, tests or restrictions, as applicable, or any inability to pay interest on, or principal of, our outstanding debt as it becomes due could result in an event of default under any of the agreements governing any

8

of our debt obligations, in which case our lenders could elect to declare all amounts outstanding to be immediately due and payable. If the lenders accelerate the payment of any of our indebtedness, our assets may not be sufficient to repay in full such indebtedness and any other indebtedness that would become due as a result of such acceleration and, if we were unable to obtain replacement financing or any such replacement financing was on terms that were less favorable than the indebtedness being replaced, our liquidity and results of operations would be materially and adversely affected. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

We require a significant amount of cash to service our debt. Our ability to meet our cash requirements and service our debt could be impacted by many factors that are outside our control, including global economic conditions and access to credit markets.

Our future operating performance is dependent on many factors, some of which are beyond our control, including prevailing economic, financial and industry conditions. Worsening global economic conditions would adversely impact commercial spending and our sales would likely decline or become increasingly concentrated in lower margin products, and our business, financial condition, results of operations and/or cash flows could be materially adversely affected.

The impact of any negative global economic conditions and the ability of our suppliers and customers to access credit markets is also unpredictable, and may create additional risks for us, both directly and indirectly. The inability of suppliers to access financing or the insolvency of one or more of our suppliers could lead to disruptions in our supply chain, which could adversely impact our sales and/or increase our costs. Our suppliers may require us to pay cash in advance or obtain letters of credit for their benefit as a condition to selling us their products and services. If one or more of our principal customers were to file for bankruptcy, our sales could be adversely impacted and our ability to collect outstanding accounts receivable from any such customer could be limited. Any of these risks and uncertainties could have a material adverse effect on our business, financial condition, results of operations and/or cash flows.

Our operating performance and ability to comply with covenants under our borrowing arrangements are dependent on our continued ability to access funds under our credit and loan agreements, including under our asset-based revolving credit facility, and from cash on hand, maintain sales volumes, drive profitable growth, realize cost savings and generate cash from operations. The financial institutions that fund our asset-based revolving credit facility are also impacted by any volatility in the credit markets, and if one or more of them cannot fulfill our revolving credit requests, our operations may be adversely impacted.

During the third quarter of 2009, the Company completed a series of transactions to refinance its indebtedness. These transactions resulted in both an increased amount of indebtedness as well as an increase to the weighted average interest rate on our indebtedness. As such, these transactions have increased the cost of servicing our debt, which has negatively impacted our results of operations and cash flows.

Despite current indebtedness levels, we and our subsidiaries may still be able to incur substantially more debt. This could further exacerbate the risks associated with our substantial leverage.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future because the terms of our existing indebtedness do not prohibit us or our subsidiaries from doing so, within certain limits. Based on our borrowing base, as of December 31, 2011 our revolving credit facility permitted borrowing of up to an additional $165.5 million. If new indebtedness is added to our and our subsidiaries’ current debt levels, the related risks that we and they now face could intensify.

Failure to maintain our credit ratings could limit our access to the capital markets, adversely affect the cost and terms upon which we are able to obtain additional financing and negatively impact our business.

Although we believe existing cash, funds generated by operations and amounts available under our asset-based revolving credit facility will collectively provide adequate resources to fund our ongoing operating

9

requirements, we may be required to seek additional financing to compete effectively in our market. In light of the current difficulties in the financial markets, there can be no assurance that we will be able to maintain our credit ratings. We have experienced downgrades in the past and may experience further downgrades. Failure to maintain these credit ratings could, among other things, limit our access to the capital markets and adversely affect the cost and terms upon which we are able to obtain additional financing, including any financing from our suppliers, which could negatively impact our business.

A bankruptcy of one or more of our major customers could have a material adverse effect on our financial condition and results of operations.

Our concentrated customer base increases our customer credit risk. Were any of our major customers to make a bankruptcy filing, we could be adversely impacted due to not only a reduction in future sales but also losses associated with the potential inability to collect any outstanding accounts receivable from such customer. Such a result could negatively impact our financial results and cash flows.

Our pension costs could substantially increase as a result of volatility in the equity markets or interest rates.

The difference between plan obligations and assets, or the funded status of our defined benefit pension plans, is a significant factor in determining the net periodic benefit costs of our pension plans and the ongoing funding requirements of those plans. Changes in interest rates and the market value of plan assets impact the funded status of these plans and cause volatility in the net periodic benefit cost and future funding requirements of these plans. The exact amount of cash contributions made to pension plans in any year is dependent upon a number of factors, including the investment returns on pension plan assets, and a significant increase in our pension funding requirements could have a negative impact on our cash flow and financial condition.

Impairment charges could have a material adverse effect on our financial results.

In prior years we have recorded significant amounts of goodwill and other asset impairment charges adversely affecting financial results. Future events may occur that may also adversely affect the reported value of our assets and require impairment charges, which could further adversely affect our financial results. Such events may include, but are not limited to, a sustained decline in our stock price, strategic decisions made in response to changes in economic and competitive conditions, the impact of the economic environment on our customer base or a material adverse change in our relationship with significant customers.

Our customers may further consolidate, which could adversely impact our margins and sales.

Customers within our customer base have steadily consolidated over the last two decades. If that trend continues, it is likely to result in further pricing pressures on us that could result in reduced margin and sales. Further, there can be no assurance that following consolidation large customers will continue to buy from us across different product segments or geographic regions, which could negatively impact our financial results.

Our business is subject to risks associated with seasonality, which could adversely affect our cash flow, financial condition or results of operations.

Our business, as it concerns both historical sales and profit, has experienced higher sales volume in the third and fourth quarters of the calendar year. Two principal factors have contributed to this seasonality: the office products industry’s customers and our product line. We are major suppliers of products related to the “back-to-school” season, which occurs principally during June, July, August and September for our North American business and November, December and January for our Australian business; and our product line includes several products that lend themselves to calendar year-end purchase timing. If either of these typical seasonal increases in sales of certain portions of our product line does not materialize, we could experience a material adverse effect on our business, financial condition and results of operations.

10

The raw materials and labor costs we incur are subject to price increases that could adversely affect our profitability.

The primary materials used in the manufacturing of many of our products are resin, plastics, polyester and polypropylene substrates, paper, steel, wood, aluminum, melamine, zinc and cork. In general, our gross profit may be affected from time to time by fluctuations in the prices of these materials because our customers require advance notice and negotiation to pass through raw material price increases, giving rise to a delay before cost increases can be passed to our customers. We attempt to reduce our exposure to increases in these costs through a variety of measures, including periodic purchases, future delivery contracts and longer-term price contracts together with holding our own inventory; however, these measures may not always be effective. Inflationary and other increases in costs of materials and labor have occurred in the past and may recur, and raw materials may not continue to be available in adequate supply in the future. Shortages in the supply of any of the raw materials we use in our products and other factors, such as inflation, could result in price increases that could have a material adverse effect on our financial condition or results of operations.

We are subject to supplier credit and order fulfillment risk.

We purchase products for resale under credit arrangements with our vendors. In weak global markets, vendors may seek credit insurance to protect against non-payment of amounts due to them. During any period of declining operating performance, or should we experience severe liquidity challenges, vendors may demand that we accelerate our payment for their products. Also, credit insurers may curtail or eliminate coverage to the vendors. If vendors begin to demand accelerated payment of amounts due to them or if they begin to require advance payments or letters of credit before goods are shipped to us, these demands could have a significant adverse impact on our operating cash flow and result in a severe drain on our liquidity. In addition, if our vendors are unable to access liquidity or become insolvent, they could be unable to supply us with product. Also, some of our vendors are dependent upon other industries for raw materials and other products and services necessary to produce and provide the products they supply to us. Any adverse impacts to those industries could have a ripple effect on these vendors, which could adversely impact their ability to supply us at levels we consider necessary or appropriate for our business, or at all. Any such disruptions could negatively impact our ability to deliver products and services to our customers, which in turn could have an adverse impact on our business, operating results, financial condition or cash flow.

Risks associated with currency volatility could harm our sales, profitability and cash flows.

Approximately 53% of our net sales for the fiscal year ended December 31, 2011 were from foreign sales. While the recent relative volatility of the U.S. dollar to other currencies has impacted our businesses’ sales, profitability and cash flows as the results of non-U.S. operations have increased when reported in U.S. dollars, we cannot predict the rate at which the U.S. dollar will trade against other currencies in the future. If the U.S. dollar were to substantially strengthen, making the dollar significantly more valuable relative to other currencies in the global market, such an increase could harm our ability to compete, and therefore, materially and adversely affect our financial condition and our results of operations. More specifically, a significant portion of the products we sell are sourced from China and other Asia-Pacific countries and are paid for in U.S. dollars. Thus, movements of their local currency to the U.S. dollar have the same impacts as raw material price changes in addition to the currency translation impact noted above.

Risks associated with outsourcing the production of certain of our products could materially and adversely affect our business, financial condition and results of operations.

Historically, we have outsourced certain manufacturing functions to third-party service providers in China and other Asia-Pacific countries. Outsourcing generates a number of risks, including decreased control over the manufacturing process potentially leading to production delays or interruptions, inferior product quality control and misappropriation of trade secrets. In addition, performance problems by these third-party service providers

11

could result in cost overruns, delayed deliveries, shortages, quality issues or other problems, which could result in significant customer dissatisfaction and could materially and adversely affect our business, financial condition and results of operations.

If one or more of these third-party service providers becomes insolvent or unable or unwilling to continue to provide services of acceptable quality, at acceptable costs, in a timely manner or any combination thereof, our ability to deliver our products to our customers could be severely impaired. Furthermore, the need to identify and qualify substitute service providers or increase our internal capacity could result in unforeseen operational problems and additional costs. Substitute service providers might not be available or, if available, might be unwilling or unable to offer services on acceptable terms. Moreover, if customer demand for our products increases, we may be unable to secure sufficient additional capacity from our current service providers, or others, on commercially reasonable terms, if at all.

Any inability to secure, protect and maintain rights to intellectual property could have material adverse impact on our business.

We own and license many patents, trademarks, brand names and trade names that are, in the aggregate, important to our business. The loss of any individual patent or license may not be material to us taken as a whole, but the loss of a number of patents or licenses that represent principal portions of our business, or expenses related to defending or maintaining the patents or licenses, could have a material adverse effect on our business.

We may become involved in intellectual property claims being asserted against us that could cause us to incur substantial costs, divert the efforts of our management, and require us to pay substantial damages or require us to obtain a license, which might not be available on reasonable terms, if at all. We could also incur substantial costs to pursue legal actions relating to the unauthorized use by third parties of our intellectual property, which could have a material adverse effect on our business, results of operation or financial condition. If our brands become diluted, if our patents are infringed or if our competitors introduce brands and products that cause confusion with our brands in the marketplace, the value that our consumers associate with our brands may become diminished, which could negatively impact our sales. If third parties assert claims against our intellectual property rights and we are not able to successfully resolve those claims, or our intellectual property becomes invalidated, we could lose our ability to use the technology, brand names or other intellectual property that were the subject of those claims, which, if such intellectual property is material to the operation of our business or our financial results, could have a material adverse effect on our business, financial condition and results from operations.

Our success depends on our ability to attract and retain qualified personnel.

Our success will depend on our ability to attract and retain qualified personnel, including executive officers and other key management personnel. We may not be able to attract and retain qualified management and other personnel necessary for the development, manufacture and sale of our products, and key employees may not remain with us in the future. If we fail to retain our key employees, we may experience substantial disruption in our businesses. The loss of key management personnel or other key employees or our potential inability to attract such personnel may adversely affect our ability to manage our overall operations and successfully implement our business strategy.

We are subject to global environmental regulation and environmental risks.

We and our operations, both in the U.S. and abroad, are subject to national, state, provincial and/or local environmental laws and regulations that impose limitations and prohibitions on the discharge and emission of, and establish standards for the use, disposal and management of, certain materials and waste. We are also subject to laws regulating the content of toxic chemicals and materials in the products we sell. Environmental and product content laws and regulations can be complex and may change often. Capital and operating expenses required to comply with environmental and product content laws and regulations can be significant, and violations may result in substantial fines, penalties and civil damages. The costs of complying with

12

environmental and product content laws and regulations and any claims concerning noncompliance, or liability with respect to contamination in the future could have a material adverse effect on our financial condition or results of operations.

Product liability claims or regulatory actions could adversely affect our financial results or harm our reputation or the value of our end-user brands.

Claims for losses or injuries purportedly caused by some of our products arise in the ordinary course of our business. In addition to the risk of substantial monetary judgments, product liability claims or regulatory actions could result in negative publicity that could harm our reputation in the marketplace or the value of our end-user brands. We also could be required to recall and possibly discontinue the sale of possible defective or unsafe products, which could result in adverse publicity and significant expenses. Although we maintain product liability insurance coverage, potential product liability claims are subject to a self-insured deductible or could be excluded under the terms of the policy.

We may not consummate our acquisition of the Mead C&OP Business or realize the anticipated benefits if we do complete the acquisition.

Our proposed acquisition of the Mead C&OP Business may not be consummated in a timely manner or at all. If we are unable to complete the proposed acquisition, we will have incurred substantial expenses and diverted significant management time and resources from our ongoing business. Even if we consummate the proposed acquisition, we will still have incurred substantial expenses but may not realize the anticipated cost synergies and other benefits of the acquisition. Given the size and significance of the acquisition, we may encounter difficulties in the integration of the operations of the Mead C&OP Business, which could adversely affect our combined business and financial performance.

If the proposed transaction is not completed the price of the our common stock may decline to the extent that the market price of the Company’s common stock reflects positive market assumptions that the proposed acquisition will be completed and the related anticipated benefits will be realized. We also may be subject to additional risks if the proposed transaction is not completed, including, depending on the reasons for termination of the merger agreement, the requirement that we pay MeadWestvaco Corporation a termination fee of $15.0 million or reimburse MeadWestvaco Corporation for their expenses in connection with the transactions in an amount up to $5.0 million.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

13

ITEM 2.PROPERTIES

We have manufacturing facilities in North America, Europe and Australia, and maintain distribution centers in relation to the regional markets we service. We lease our principal U.S. headquarters in Lincolnshire, Illinois. The following table indicates the principal manufacturing and distribution facilities of our subsidiaries as of December 31, 2011:

| | | | |

Location | | Functional Use | | Owned/Leased |

U.S. Properties: | | | | |

| Ontario, California | | Distribution/Manufacturing | | Leased |

| Booneville, Mississippi | | Distribution/Manufacturing | | Owned/Leased |

| Ogdensburg, New York | | Distribution/Manufacturing | | Owned/Leased |

| East Texas, Pennsylvania | | Distribution/Manufacturing/Office | | Owned |

| Pleasant Prairie, Wisconsin | | Distribution/Manufacturing | | Leased |

Non-U.S. Properties: | | | | |

| Sydney, Australia | | Distribution/Manufacturing | | Owned |

| Brampton, Canada | | Distribution/Manufacturing/Office | | Leased |

| Tabor, Czech Republic | | Manufacturing | | Owned |

| Denton, England | | Manufacturing | | Owned |

| Halesowen, England | | Distribution | | Owned |

| Lillyhall, England | | Manufacturing | | Leased |

| Tornaco, Italy | | Distribution | | Leased |

| Lerma, Mexico | | Manufacturing/Office | | Owned |

| Born, Netherlands | | Distribution | | Leased |

| Wellington, New Zealand | | Distribution/Office | | Owned |

| Arcos de Valdevez, Portugal | | Manufacturing | | Owned |

We believe that the properties are suitable to the respective businesses and have production capacities adequate to meet the needs of the businesses.

ITEM 3.LEGAL PROCEEDINGS

We are, from time to time, involved in routine litigation incidental to our operations. None of the legal proceedings in which we are currently involved, individually or in the aggregate, is material to our consolidated financial condition or results of operations nor are we aware of any material pending or contemplated proceedings. We intend to vigorously defend, or resolve by settlement, any such matters as appropriate.

ITEM 4.(REMOVED AND RESERVED)

14

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock is traded on the New York Stock Exchange (“NYSE”) under the symbol “ABD.” The following table sets forth, for the periods indicated, the high and low sales prices for our common stock as reported on the NYSE for 2010 and 2011:

| | | | | | | | |

| | | High | | | Low | |

2010 | | | | | | | | |

First Quarter | | $ | 8.62 | | | $ | 5.92 | |

Second Quarter | | $ | 9.47 | | | $ | 4.93 | |

Third Quarter | | $ | 6.81 | | | $ | 4.63 | |

Fourth Quarter | | $ | 8.89 | | | $ | 5.52 | |

2011 | | | | | | | | |

First Quarter | | $ | 9.66 | | | $ | 7.77 | |

Second Quarter | | $ | 10.39 | | | $ | 6.91 | |

Third Quarter | | $ | 8.89 | | | $ | 4.62 | |

Fourth Quarter | | $ | 10.20 | | | $ | 4.33 | |

As of February 1, 2012, the Company had approximately 11,459 registered holders of its common stock.

Dividend Policy

We have not paid any dividends on our common stock since becoming a public company. We intend to retain any future earnings to fund the development and growth of our business and reduce our indebtedness. Currently our debt agreements restrict our ability to make dividend payments and we do not anticipate paying any cash dividends in the foreseeable future. Any determination as to the declaration of dividends is at our board of directors’ sole discretion based on factors it deems relevant.

15

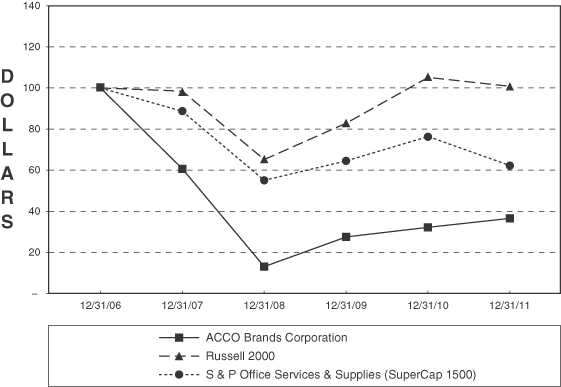

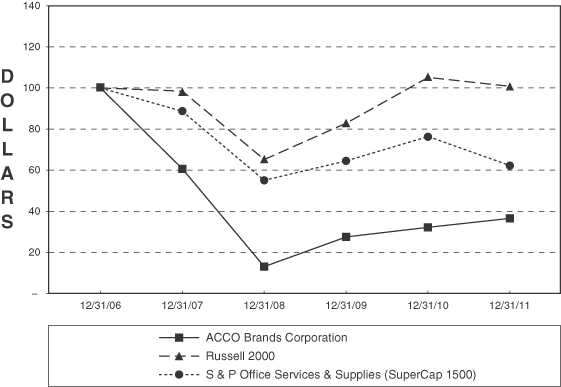

STOCK PERFORMANCE GRAPH

The following graph compares the cumulative total stockholder return on our common stock to that of the S&P Office Services and Supplies (SuperCap1500) Index and the Russell 2000 Index assuming an investment of $100 in each from December 31, 2006 through December 31, 2011.

| | | | | | | | | | | | |

| | | Cumulative Total Return |

| | | 12/31/06 | | 12/31/07 | | 12/31/08 | | 12/31/09 | | 12/31/10 | | 12/31/11 |

| ACCO Brands Corporation. | | $100.00 | | $60.60 | | $13.03 | | $27.50 | | $32.19 | | $36.46 |

| Russell 2000 | | 100.00 | | 98.43 | | 65.18 | | 82.89 | | 105.14 | | 100.75 |

S & P Office Services & Supplies

(SuperCap1500)... | | 100.00 | | 88.69 | | 54.96 | | 64.56 | | 76.41 | | 62.19 |

16

ITEM 6.SELECTED FINANCIAL DATA

SELECTED HISTORICAL FINANCIAL DATA

The following table sets forth our selected consolidated financial data. The selected consolidated financial data as of and for the five fiscal years ended December 31 are derived from our consolidated financial statements. The data should be read in conjunction with the consolidated financial statements and related notes included elsewhere in this annual report.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| (in millions of dollars, except per share data) | | | | | | | | | | | | | | | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 1,318.4 | | | $ | 1,284.6 | | | $ | 1,233.3 | | | $ | 1,539.2 | | | $ | 1,798.5 | |

Cost of products sold (1) | | | 903.7 | | | | 887.5 | | | | 868.7 | | | | 1,071.4 | | | | 1,241.2 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 414.7 | | | | 397.1 | | | | 364.6 | | | | 467.8 | | | | 557.3 | |

Operating costs and expenses: | | | | | | | | | | | | | | | | | | | | |

Advertising, selling, general and administrative expenses (1) | | | 293.9 | | | | 281.2 | | | | 263.0 | | | | 367.6 | | | | 422.5 | |

Amortization of intangibles | | | 6.3 | | | | 6.7 | | | | 7.1 | | | | 7.5 | | | | 7.8 | |

Restructuring (income) charges | | | (0.7 | ) | | | (0.5 | ) | | | 17.4 | | | | 28.8 | | | | 21.0 | |

Goodwill and asset impairment charges (2) | | | — | | | | — | | | | 1.7 | | | | 263.8 | | | | 2.3 | |

| | | | | | | | | | | | | | | | | | | | |

Total operating costs and expenses | | | 299.5 | | | | 287.4 | | | | 289.2 | | | | 667.7 | | | | 453.6 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | | 115.2 | | | | 109.7 | | | | 75.4 | | | | (199.9 | ) | | | 103.7 | |

Interest expense, net | | | 77.2 | | | | 78.3 | | | | 67.0 | | | | 63.7 | | | | 64.1 | |

Income (loss) from continuing operations (3) | | | 18.6 | | | | 7.8 | | | | (118.6 | ) | | | (255.1 | ) | | | 31.3 | |

Per common share: | | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations (3) | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.34 | | | $ | 0.14 | | | $ | (2.18 | ) | | $ | (4.71 | ) | | $ | 0.58 | |

Diluted | | $ | 0.32 | | | $ | 0.14 | | | $ | (2.18 | ) | | $ | (4.71 | ) | | $ | 0.57 | |

Balance Sheet Data (at year end): | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 1,116.7 | | | $ | 1,149.6 | | | $ | 1,106.8 | | | $ | 1,282.2 | | | $ | 1,898.5 | |

External debt | | | 669.0 | | | | 727.6 | | | | 725.8 | | | | 708.7 | | | | 775.3 | |

Total stockholders’ equity (deficit) | | | (61.9 | ) | | | (79.8 | ) | | | (117.2 | ) | | | (3.4 | ) | | | 438.3 | |

Other Data: | | | | | | | | | | | | | | | | | | | | |

Cash provided by operating activities | | $ | 61.8 | | | $ | 54.9 | | | $ | 71.5 | | | $ | 37.2 | | | $ | 81.2 | |

Cash provided (used) by investing activities | | | 40.0 | | | | (14.9 | ) | | | (3.9 | ) | | | (18.7 | ) | | | (55.2 | ) |

Cash used by financing activities | | | (63.1 | ) | | | (0.1 | ) | | | (44.5 | ) | | | (37.7 | ) | | | (35.4 | ) |

| (1) | Income (loss) from continuing operations for the years 2009, 2008 and 2007 was impacted by certain other charges that have been recorded within cost of products sold, and advertising, selling, general and administrative expenses. These charges are incremental to the cost of the Company’s underlying restructuring actions and do not qualify as restructuring. These charges include redundant warehousing or storage costs during the transition to new distribution centers, equipment and other asset move costs, ongoing facility overhead and maintenance costs after exit, gains on the sale of exited facilities, certain costs associated with the Company’s debt refinancing and employee retention incentives. Within cost of products sold on the Consolidated Statements of Operations for the years ended December 31, 2009, 2008, and 2007, these charges totaled $3.4 million, $7.5 million, and $17.2 million, respectively. Within advertising, selling, general and administrative expenses on the Consolidated Statements of Operations for the years ended December 31, 2009, 2008, and 2007, these charges totaled $1.2 million, $3.1 million, and $16.3 million, respectively. Included within the 2008 result, is a charge for $4.2 million related to the exit of the |

17

| | Company’s former CEO, a $3.5 million gain on the sale of a manufacturing facility and net gains of $2.4 million on the sale of three additional properties. The Company did not incur these other charges in 2011 and 2010. |

| (2) | The following table sets forth the Company’s pre-tax impacts of the non-cash goodwill and asset impairment charges recorded during 2009, 2008 and 2007, respectively. |

| | | | | | | | | | | | |

| (in millions of dollars) | | 2009 | | | 2008 | | | 2007 | |

Continuing Operations | | | | | | | | | | | | |

Segment: | | | | | | | | | | | | |

ACCO Brands Americas | | $ | 0.9 | | | $ | 160.6 | | | $ | 1.6 | |

ACCO Brands International | | | 0.8 | | | | 100.4 | | | | 0.7 | |

Computer Products Group | | | — | | | | 2.8 | | | | — | |

| | | | | | | | | | | | |

Total Continuing Operations | | $ | 1.7 | | | $ | 263.8 | | | $ | 2.3 | |

| (3) | During 2009, the Company recorded a non-cash charge of $108.1 million to establish a valuation allowance against its U.S. deferred taxes. For a further discussion of the valuation allowance, see Note 10,Income Taxes, to our consolidated financial statements, contained in Item 8 of this report. |

18

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

INTRODUCTION

ACCO Brands is one of the world’s largest suppliers of branded office products (excluding furniture, computers, printers and bulk paper) to the office products resale industry. We design, develop, manufacture and market a wide variety of traditional and computer-related office products, supplies, binding and laminating equipment and related consumable supplies, personal computer accessory products, paper-based time management products and presentation aids and products. Through a focus on research, marketing and innovation, we seek to develop new products that meet the needs of our consumers and commercial end-users, which we believe will increase the product positioning of our brands. We compete through a balance of innovation, a low-cost operating model and an efficient supply chain. We sell products in highly competitive markets, and compete against large international and national companies, regional competitors and against our own customers’ direct sourcing of private-label products. We sell our products primarily to markets located in North America, Europe and Australia. Our brands include GBC®, Kensington®, Quartet®, Rexel, Swingline®, Wilson Jones®, Marbig, NOBO and Day-Timer®, among others.

The majority of our office products are used by businesses. Most of these end-users purchase our products from our reseller customers, which include commercial contract stationers, retail superstores, wholesalers, mail order and internet catalogs, mass merchandisers, club stores and dealers. We also supply our products directly to commercial and industrial end-users and to the educational market. Historically we have targeted the premium-end of the product categories in which we compete. However, we also supply private label products for our customers where we believe we have an economic advantage or where it is necessary to merchandise a complete category.

Our leading brand positions provide the scale to enable us to invest in product innovation and drive market growth across our product categories. In addition, the expertise we use to satisfy the exacting technical specifications of our more demanding commercial customers is in many instances the basis for expanding our product range to include consumer products.

Our strategy centers on a combination of growing sales and market share and generating acceptable profitability and returns. Specifically, we have substantially reduced our operating expenses and seek to leverage our platform for organic growth through greater consumer understanding, product innovation, marketing and merchandising, disciplined category expansion including broader product penetration and possible strategic transactions, and continued cost realignment. To achieve these goals, we plan to continue to execute the following strategies: (1) invest in research, marketing and innovation, (2) penetrate the full product spectrum of our categories and (3) opportunistically pursue strategic transactions.

On November 17, 2011, the Company announced the signing of a definitive agreement to merge the Mead C&OP Business into the Company in a transaction valued at approximately $860 million as of the date the transaction was announced. The Mead C&OP Business is a leading manufacturer and marketer of school supplies, office products, and planning and organizing tools– including the Mead®, Five Star®, Trapper Keeper®, AT-A-GLANCE®, Cambridge®, Day Runner®, Hilroy, Tilibra and Grafons brands in the U.S., Canada and Brazil. Upon completion of the transaction, MeadWestvaco shareholders will own 50.5% of the combined company. The transaction is subject to approval by the Company’s shareholders and the satisfaction of customary closing conditions and regulatory approvals, including a ruling from the U.S. Internal Revenue Service on the tax-free nature of the transaction for MeadWestvaco. The transaction is expected to be completed in the first half of 2012. The Company will be the accounting acquirer in the merger and will apply purchase accounting to the assets and liabilities acquired upon consummation of the merger. In connection with this transaction, in the year ended December 31, 2011, the Company has incurred expenses of $5.6 million.

On June 14, 2011, the Company announced the disposition of GBC-Fordigraph Business. The Australia-based business was formerly part of the ACCO Brands International segment and the results of operations are

19

included in the financial statements as a discontinued operation for all periods presented. The GBC-Fordigraph Business represented $45.9 million in annual net sales for the year ended December 31, 2010. The Company has received final proceeds of $52.9 million inclusive of working capital adjustments and selling costs. In connection with this transaction, in 2011, the Company recorded a gain on sale of $41.9 million ($36.8 million after-tax).

In June 2009, the Company completed the sale of its commercial print finishing business for final gross proceeds of $16.2 million, after final working capital adjustments. As a result of the adjustments, the Company received net cash proceeds before expenses of $12.5 million and a $3.65 million note due from the buyer payable in installments, $1.325 million of which was paid in June, 2011 and $2.325 million that is due June, 2012. Interest on the unpaid balance is payable at the rate of 4.9 percent per annum. The gross proceeds received are before fees and expenses related to the transactions and provisions arising from continuing litigation related to the transaction. The commercial print finishing business has been classified as a discontinued operation in our consolidated financial statements for all periods presented.

For further information on the Company’s discontinued operations see Note 18,Discontinued Operations, to our consolidated financial statements contained in Item 8 of this report.

Management’s discussion and analysis of financial condition and results of operations should be read in conjunction with the consolidated financial statements of ACCO Brands Corporation and the accompanying notes contained therein. Unless otherwise noted, the following discussion pertains only to our continuing operations.

Overview of Company Performance

ACCO Brands’ results are dependent upon a number of factors affecting sales, including pricing and competition. Historically, key drivers of demand in the office products industry have included trends in white collar employment levels, gross domestic product (GDP) and growth in the number of small businesses and home offices together with usage of personal computers. Pricing and demand levels for office products have also reflected a substantial consolidation within the global resellers of office products. This consolidation has led to multiple years of industry pricing pressure and a more efficient level of asset utilization by customers, resulting in lower sales volumes for suppliers of office products.

With 53% of revenues for the fiscal year ended December 31, 2011 arising from foreign operations, exchange rate fluctuations can play a major role in our reported results. Foreign currency fluctuations impact our business in two important ways. The first and more obvious foreign exchange impact comes from the translation of our foreign operations results into U.S. dollars: a weak U.S. dollar therefore benefits ACCO Brands and a strong U.S. dollar will diminish the contribution from our foreign operations. The second, but potentially larger and less obvious impact is from foreign currency fluctuations on our cost of goods sold. A significant portion of the products we sell worldwide are sourced from Asia (approximately 70%) and paid for in U.S. dollars. However, our international operations sell in their local currency, and are exposed to their domestic currency movements against the U.S. dollar. A strong U.S. dollar, therefore, increases our cost of goods sold and a weak U.S. dollar decreases our cost of goods sold for our international operations.

We respond to these market changes by adjusting our sales prices, but this response can be difficult during periods of rapid fluctuation. A significant portion of our foreign-currency cost of goods purchases is hedged with forward foreign currency contracts, which delays the economic effect of a fluctuating U.S. dollar helping us align market pricing changes. The financial impact on our business from foreign exchange movements for cost of goods is also further delayed until we sell the inventory. The two foreign exchange exposures impact the business at different times: the translation of results is impacted immediately when the exchange rates move, whereas the impact on our cost of goods is typically delayed due to a combination of currency hedging and the inventory cycle.

20

During the second half of 2010 and into 2011, the cost of certain commodities used to make our products increased significantly, negatively impacting our cost of goods. We continue to monitor commodity costs andwork with our suppliers and customers to negotiate balanced and fair pricing that best reflect the current economic environment. Select price increases took effect during the third quarter of 2010 and the Company implemented additional price increases in the first and third quarters of 2011. These increases are intended to further help offset our additional cost increases.

The Company did not incur restructuring charges in 2011 and 2010, but adjusted outstanding reserve estimates as necessary. Cash payments related to prior years’ restructuring and integration activities amounted to $3.4 million during 2011. It is expected that additional disbursements of $1.0 million will be completed by the end of 2013 as the Company spends amounts accrued on its balance sheet. Any residual cash payments beyond 2011 are anticipated to be offset by expected proceeds from real estate held for sale. Additionally, in the first quarter of 2011, the Company initiated plans to rationalize its European operations. The associated costs primarily related to employee terminations, which were accounted for as regular business expenses and were primarily incurred in the first half of 2011; these were largely offset by associated savings realized in the second half of 2011. These costs totaled $4.5 million during the year December 31, 2011.

The Company funds liquidity needs for capital investment, working capital and other financial commitments through cash flow from continuing operations and its $175.0 million revolving credit facility. Based on our borrowing base, as of December 31, 2011, approximately $165.5 million remained available for borrowing under our revolving credit facility.

During 2009, the Company determined that it was no longer more likely than not that its U.S. deferred tax assets would be realized, and as a result, the Company recorded a non-cash charge of $108.1 million to establish a valuation allowance against its U.S. deferred tax assets. In addition, during 2009, the Company recorded a non-cash impairment charge of $1.7 million on certain of its trade names.

Refinancing Transactions