UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-18561

AMERICANWEST BANCORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Washington | | 91-1259511 |

(State or other jurisdiction

of incorporation) | | (IRS Employer

Identification No.) |

41 West Riverside Avenue, Suite 400

Spokane, Washington 99201

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code (509) 467-6993

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class: | | Name of each exchange on which registered: |

| None | | |

Securities registered pursuant to section 12(g) of the Act:

Common Stock, no par value

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by a check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Exchange Act Rule 12b-2). Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act. YES ¨ NO x

The aggregate market value of the common stock held by non-affiliates of the registrant is approximately $254,153,000 based on the June 30, 2006 closing price of the registrant’s common stock as quoted on the Nasdaq National Market of $22.55.

The number of shares of the registrant’s common stock outstanding at March 1, 2007 was 11,419,628.

DOCUMENTS INCORPORATED BY REFERENCE

| | |

Documents of the Registrant | | Form 10-K Reference Locations |

Portions of the Proxy Statement for the 2007

Annual Meeting of Shareholders | | PART III |

AMERICANWEST BANCORPORATION

ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR

ENDED DECEMBER 31, 2006

TABLE OF CONTENTS

2

PART I

Forward Looking Statements.

Certain matters discussed or incorporated by reference in this Annual Report on Form 10-K including, but not limited to, matters described in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (PSLRA). Such forward looking statements include statements about the business strategy, financial condition, results of operations, future financial targets and earnings outlook of the Company. The forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Those factors include, but are not limited to, impact of the current national and regional economy on small business loan demand in the Company’s market, loan delinquency rates, changes in portfolio composition, the Company’s ability to increase market share, the Company’s ability to attract quality commercial business, the Company’s ability to expand its markets through new branches and acquisitions, interest rate movements and the impact on net interest margins such movement may cause, changes in the demographic make-up of the Company’s market, the Company’s products and services, the Company’s ability to attract and retain qualified people, regulatory changes, competition with other banks and financial institutions, and other factors. Words such as “targets,” “expects,” “anticipates,” “believes,” other similar expressions or future or conditional verbs such as “will,” “may,” “should,” “would,” and “could” are intended to identify such forward-looking statements. Readers should not place undue reliance on the forward-looking statements, which reflect management’s view only as of the date hereto. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect subsequent events or circumstances. This statement is included for the express purpose of protecting the Company under PSLRA’s safe harbor provisions.

Item 1. Business.

AmericanWest Bancorporation

AmericanWest Bancorporation (Company) is a Washington corporation registered as a bank holding company under the Bank Holding Company Act of 1956. The Company is headquartered in Spokane, Washington. The Company’s wholly-owned subsidiary is AmericanWest Bank (Bank), a Washington state chartered bank that operates in Eastern and Central Washington and Northern Idaho. Additionally, the Bank has a loan production office in the Salt Lake City, Utah, metropolitan area doing business as Precision Bank. Unless otherwise indicated, reference to the Company shall include its wholly-owned subsidiary. The Company’s unconsolidated information will be referred to as the Parent Company. At December 31, 2006, the Company had total assets of $1.4 billion, net loans of $1.2 billion, deposits of $1.1 billion and stockholders’ equity of $152.0 million. The Company also has three statutory trust subsidiaries.

The holding company was formed in 1983 as United Security Bancorporation, with its initial subsidiary, United Security Bank, founded in 1974. The Initial Public Offering of the holding company’s common stock occurred in 1994. In 2001, the Company’s five subsidiary bank charters (United Security Bank, Home Security Bank, Bank of Pullman, Grant National Bank and AmericanWest Bank) were consolidated into the AmericanWest Bank charter and the holding company name changed to AmericanWest Bancorporation. The Company’s stock trades on the NASDAQ Global Select market under the symbol AWBC. The discussion in this Annual Report of the Company and its financial statements reflects the Company’s acquisition of Columbia Trust Bancorp (CTB) and its subsidiaries on March 15, 2006. Latah Bancorporation, Inc. merged into the Company on July 31, 2002, and its subsidiary, Bank of Latah (BOL), was operated as a subsidiary of the Company until it was merged with and into AmericanWest Bank on March 19, 2003.

Available Information

The Company’s internet address is www.awbank.net. Copies of the following documents, free of charge, are available from the Company’s website by using the “Investor Relations” hyperlink on that website:

| | • | | Annual Reports on Form 10-K; |

3

| | • | | Quarterly Reports on Form 10-Q; and |

| | • | | Current Reports on Form 8-K. |

The Company makes these reports and certain other information that it files with the Securities and Exchange Commission (SEC) available on the Company’s website as soon as reasonably practicable after filing or furnishing them electronically with the SEC. These and other SEC filings of the Company are also available, free of charge, from the SEC on its website at www.sec.gov. The information contained on the Company’s website is not incorporated by reference into this document and should not be considered a part of this Annual Report. The Company’s website address is included in this document as an inactive textual reference only.

Business Strategy

AmericanWest Bank pursues a profit-based growth strategy, the key components of which include:

| | • | | Increasing market share in communities within the Bank’s current markets by being a trustworthy community partner with an entrepreneurial spirit and a relationship-based model for providing financial services. |

| | • | | Enhancing customer relationships with high quality products and services to meet the needs of existing and new customers. |

| | • | | Providing service through a team that works together to assist customers in identifying and implementing financial solutions. |

| | • | | Improving the efficiency of operations through higher revenues based on enhanced production levels as compared to the increase in costs to support this growth. |

| | • | | Profitably expanding the markets served through new locations and acquisitions. |

Increasing market share in communities within the Bank’s current markets by being a trustworthy community partner with an entrepreneurial spirit and a relationship-based model for providing financial services. Bank management strives to be active in each community and have a positive impact on that community’s quality of life. The Bank’s position as a local, community bank sends a powerful message that distinguishes it immediately in the minds of customers, prospects and community leaders. The Bank is more adaptable than national or large-scale regional banks and extends this financial flexibility and commitment to its customers. This commitment is evident not only through the services offered, but also through active participation in causes that contribute to quality of life, especially in the areas of housing, youth and education.

Enhancing customer relationships with high quality products and services to meet the needs of existing and new customers.Since its formation, the Bank has focused on commercial banking for small and medium-sized businesses. The Bank has ongoing initiatives to enhance its commercial products, including its commercial and industrial lending, business deposits and cash management services. Since 2005, the Bank has also offered a more complete line of retail financial products and services that help consumers use, save and manage their money in both their personal and business lives. Management believes that the Bank can gain market share by expanding its retail and commercial product offerings for consumers and businesses.

Providing service through a team that works together to assist customers in identifying and implementing financial solutions. The Bank’s focus is on offering customers greater value than the larger regional and national banks through responsive and reliable service from experts throughout the Bank. The Bank’s customers and communities know the Bank as a local provider and trust it to provide banking products and services that are helping them achieve their financial goals. The Bank places a strong emphasis on maintaining a relationship banking culture where service includes recommending additional products and services that can benefit a customer. In addition, support activities have been centralized to enable the Bank’s production groups to focus on service and to improve compliance and enhance efficiencies.

4

Improving the efficiency of operations through higher revenues based on enhanced production levels as compared to the increase in costs to support this growth.Management anticipates achieving greater market share in the Bank’s current markets based on a knowledgeable and experienced team throughout the Bank that works together to provide high quality products and service to customers. Management and support staff have the capability to support additional production teams, expanded activities and growth in our market areas. Ongoing improvements related to the design of new locations, technology and ongoing centralization also support improved efficiency.

Profitably expanding the markets served through new locations and acquisitions. The Bank intends to expand its presence in its existing and contiguous markets by opening new locations and acquiring other financial institutions that will be accretive to earnings within a reasonable timeframe. Management considers a variety of criteria in evaluating potential expansion opportunities, including the demographics and growth prospects for the market area, the degree to which the geographic diversity of the Bank would be enhanced, the management and other resources needed to integrate the expansion into existing operations, the estimated costs of operating the new locations, and whether risks related to the transactions are reasonable.

Recent Events

During 2006, the Bank opened new financial centers in Coeur d’Alene and Sandpoint, Idaho and in West Plains and Yakima, Washington. The Bank also opened a loan production office in the Salt Lake City, Utah area during 2006. Additionally, on March 15, 2006, the Company acquired Columbia Trust Bancorp and its principal operating subsidiary, Columbia Trust Bank (CTB) in Pasco, Washington. CTB had branches located in Pasco, Kennewick, Sunnyside and Yakima, Washington through which it provided commercial banking services.

In October, 2006 the Company and Utah-based Far West Bancorporation (Far West) announced the signing of a definitive agreement for Far West to merge with and into the Company, followed by the merger of Far West’s principal operating subsidiary, Far West Bank (FWB) with and into the Bank, in a transaction valued at approximately $150 million. The transaction is subject to approval by shareholders’ of both companies and other customary conditions for closing, and is expected to be completed on or about April 1, 2007. As of December 31, 2006, Far West had total assets of $429 million, total gross loans of $344 million and total deposits of $361 million. Upon closing this transaction, the Bank will operate with 64 locations in three states, Washington, Idaho and Utah.

The Company’s ability to make future acquisitions depends on several factors such as the availability of suitable acquisition candidates, necessary regulatory and shareholder approval, compliance with applicable capital requirements and, in the case of cash acquisitions, on its cash assets or ability to acquire cash. The Company may need to obtain additional debt or equity capital to pursue an acquisition strategy. Its access to capital markets or the costs of this capital could be affected by economic, financial, competitive and other conditions beyond its control. Further, acquisition candidates may not be available in the future on favorable terms. Therefore, no assurance can be made that additional acquisitions will occur.

Products and Services

The Bank’s business consists mainly of gathering deposits and providing loans to enable its customers to meet their financial objectives.

The Bank offers a variety of deposit accounts designed to attract both short term and long term deposits from its retail and business customers. These accounts include checking accounts, negotiable order of withdrawal (NOW) accounts, money market demand accounts (MMDA), savings accounts and time deposits. Interest bearing accounts earn interest at rates established by the Bank’s management based on competitive market factors and management’s desire to increase or decrease certain deposit types or maturities of deposits based on anticipated future funding needs. The bank places significant emphasis on attracting low cost-of-funds deposits through targeted marketing for checking and money market balances.

5

In addition, the Bank offers numerous services that provide customers convenient access, provide the Bank with cost effective delivery channels and have a positive impact on the Bank’s noninterest income through fee generation. Commercial services include ACH origination, merchant bankcard services, sweep accounts and currency services. Additional services offered to both consumers and business customers include ATM and debit cards, wire transfers, official checks and money orders, online banking and bill payment, safe deposit boxes, night deposit boxes and traveler’s checks. In addition, the Bank generates noninterest income by offering both consumers and business credit card products through a third-party provider, who holds the Bank-branded credit card portfolio.

The Bank’s loan portfolio consists of commercial real estate loans, commercial and industrial loans, agricultural loans, residential mortgage loans, residential construction loans and installment and other loans. The majority of the loans held by the Bank were to borrowers within the Bank’s principal market areas.

Commercial Real Estate Loans.Commercial real estate loans primarily consist of loans to purchase, refinance or construct commercial and multifamily properties. Loans are also provided for land acquisition and development. These loans are secured by real estate, generally mature in one to ten years and can be fixed or adjustable rate. Commercial construction loans may involve additional risks because loan funds are collateralized by the project under construction, which is of uncertain value prior to completion. Delays may arise from labor problems, material shortages, and other unpredictable contingencies that may occur. It is important to evaluate accurately the total loan funds required to complete a project and related loan-to-value ratios. Because of these factors, the analysis of prospective construction loan projects requires an expertise that is different in significant respects from the expertise required for other commercial real estate lending. The Bank’s underwriting criteria are designed to evaluate and minimize the risks of each commercial construction loan. Among other things, the Bank’s management considers evidence of the availability of permanent financing for the borrower, the reputation of the borrower, the amount of the borrower’s equity in the project, the independent appraisal and review of cost estimates, the pre-construction sale and leasing information, and the cash flow projections of the borrower.

Commercial and Industrial Loans. Commercial and industrial loans primarily consist of loans to businesses for various purposes, including term loans, revolving lines of credit, equipment financing loans and letters of credit. These loans generally mature within one to five years, have adjustable rates and are secured by inventory, accounts receivable or equipment, although certain loans are unsecured. Commercial lending risk results from dependence on income production for future repayment and, in certain circumstances, the lack of tangible collateral. Commercial and industrial loans are underwritten based on the financial strength and repayment ability of the borrower, as well as the value of any collateral securing the loans. Commercial lending operations rely on a strong credit culture that combines prudent credit policies and individual lender accountability.

Agricultural Loans.Agricultural loans primarily consist of farm loans to finance operating expenses. These loans generally mature within one year, have adjustable rates and are secured by farm real estate, equipment, crops or livestock. Since agricultural loans present risks not associated with other types of lending, such as weather, the policy of the Bank is to make such loans only to agricultural producers that carry crop insurance, thereby mitigating the risk of loss attributable to a crop failure caused by weather factors.

Residential Mortgage Loans. Residential mortgage loans include various types of loans for which residential real property is held as collateral. These loans include adjustable and fixed rate first mortgage loans secured by one to four family residential properties, second mortgage loans secured by one to four family residential properties and home equity lines of credit. Mortgage loans that are held in portfolio typically mature or reprice in one to five years and require payments on amortization schedules ranging from one year to 30 years. The Bank sells most of its fixed rate real estate mortgage loans with maturities of more than ten years.

Residential Construction Loans.Construction loans are primarily made to individuals and contractors to construct single family residences. These loans typically have maturities of one year and variable interest rates.

6

The Bank’s policies generally require that a permanent financing commitment be in place before a construction loan is made to an individual borrower. Construction loans have unique risks because loan funds are collateralized by the project under construction, which is of uncertain value prior to completion. Delays may arise from labor problems, material shortages and other unpredictable contingencies that may occur. It is important to evaluate accurately the total loan funds required to complete a project and related loan-to-value ratios. Because of these factors, the analysis of prospective construction loan projects requires an expertise that is different in significant respects from the expertise required for real estate mortgage lending. Construction lending is generally considered to involve a higher degree of collateral risk than long term financing of residential properties. The Bank’s underwriting criteria are designed to evaluate and minimize the risks of each real estate construction loan. Among other things, the Bank’s management considers evidence of the availability of permanent financing for the borrower, the reputation of the borrower, the amount of the borrower’s equity in the project, the independent appraisal and review of cost estimates, pre-construction sale and leasing information, and the cash flow projections of the borrower.

Installment and Other Loans.Installment and other loans are primarily automobile and personal loans, otherwise known as consumer loans. These loans generally have maturities of five years or less, and are offered at adjustable and fixed interest rates. Consumer lending may involve special risks, including decreases in the value of collateral and transaction costs associated with foreclosure and repossession.

Principal Market Area and Competition

The Bank’s financial centers are located in the four largest metropolitan areas in Eastern and Central Washington: Spokane, Yakima, Walla Walla and the Tri-Cities area (comprised of Pasco, Kennewick and Richland), and in suburban and rural communities in Eastern and Central Washington and Northern Idaho. Additionally, a loan production office (doing business as Precision Bank) was opened during 2006 in the Salt Lake City, Utah, metropolitan area.

The Bank competes primarily with large national and regional banks, as well as community banks, credit unions, savings and loans, mortgage companies and other financial service providers. Management also believes that its competitive position has been strengthened by the continued consolidation in the banking industry, which has resulted in many independent community banks becoming part of large national or regional banks. The Bank’s strategy, by contrast, is to remain closely tied to a community banking model with strong local connections.

The following table presents the Bank’s market share percentage and rank for total deposits in each county where it has financial center operations. The table also indicates the ranking by deposit size in each market. All information in the table was obtained from SNL Financial of Charlottesville, Virginia, which compiles deposit data published by the FDIC as of June 30, 2006 and updates the information for any bank mergers completed subsequent to the reporting date. The number of financial centers is as of December 31, 2006.

| | | | | | | |

| | | Idaho | | Number of

Financial

Centers |

County | | Market

Share | | | Market

Rank | |

Benewah | | 36.1 | % | | 2 | | 2 |

Bonner | | 0.2 | % | | 6 | | 1 |

Clearwater | | 45.5 | % | | 1 | | 1 |

Kootenai | | 1.1 | % | | 12 | | 2 |

Latah | | 7.2 | % | | 4 | | 1 |

Nez Perce | | 2.4 | % | | 7 | | 1 |

Shoshone | | 21.2 | % | | 3 | | 2 |

| | | | | | | |

Total | | | | | | | 10 |

| | | | | | | |

| | | | | | | |

| | | Washington | | Number of

Financial

Centers |

County | | Market

Share | | | Market

Rank | |

Benton | | 5.6 | % | | 7 | | 3 |

Columbia | | 26.1 | % | | 2 | | 1 |

Franklin | | 17.2 | % | | 2 | | 1 |

Grant | | 8.2 | % | | 6 | | 2 |

Lincoln | | 10.6 | % | | 5 | | 1 |

Spokane | | 4.2 | % | | 8 | | 9 |

Stevens | | 30.2 | % | | 1 | | 3 |

Walla Walla | | 6.4 | % | | 4 | | 3 |

Whitman | | 12.4 | % | | 3 | | 7 |

Yakima | | 7.1 | % | | 6 | | 6 |

| | | | | | | |

Total | | | | | | | 36 |

| | | | | | | |

7

Employees

As of December 31, 2006, the Company had 508 full-time equivalent employees, none of which are covered by a collective bargaining agreement. Management believes employee relations are currently good.

Supervision and Regulation

The laws and regulations applicable to the Company and the Bank are primarily intended to protect depositors of the Bank and not shareholders. Proposals to change the laws and regulations governing the banking industry are frequently introduced in Congress, in state legislatures and by various bank regulatory agencies. Changes in applicable laws and regulations or in the policies of banking and other government regulators may have a material effect on the business and prospects of the Company or the Bank. The likelihood and timing of any such proposals or legislation and the impact they might have on the Company or the Bank cannot be determined.

Bank Holding Company Regulation. As a bank holding company, AmericanWest Bancorporation is subject to the Bank Holding Company Act of 1956 (BHCA), as amended, which places it under the supervision of the Board of Governors of the Federal Reserve System (FRB). The Company must file periodic reports with the FRB and must provide it with such additional information as it may require. In addition, the FRB periodically examines the Company.

The BHCA limits bank holding company business to owning or controlling banks and engaging in other banking-related activities. Bank holding companies must obtain the FRB’s approval before they: (1) acquire direct or indirect ownership or control of any voting shares of any bank that results in total ownership or control, directly or indirectly, of more than 5% of the voting shares of such bank, (2) merge or consolidate with another bank holding company; or (3) acquire substantially all of the assets of any additional bank. Subject to certain state laws, a bank holding company that is adequately capitalized and adequately managed may acquire the assets of both in-state and out-of-state banks.

Under the Financial Modernization Act of 1999, a bank holding company may apply to the FRB to become a financial holding company, and thereby engage (directly or through a subsidiary) in certain activities deemed financial in nature, such as securities brokerage and insurance underwriting. The Company has not made this application and is not currently engaged in such activities.

State Law Restrictions. As a Washington business corporation, the Company is subject to certain limitations and restrictions as provided under applicable Washington corporate law. In addition, Washington banking law may restrict certain activities of the Company.

Transactions with Affiliates.The Parent Company and the Bank are deemed affiliates within the meaning of the Federal Reserve Act, and transactions between affiliates are subject to restrictions including compliance with Sections 23A and 23B of the Federal Reserve Act. Generally, Sections 23A and 23B: (1) limit the extent to which a financial institution or its subsidiaries may engage in covered transactions with an affiliate, as defined, to an amount equal to 10% of such institution’s capital and surplus and an aggregate limit on all such transactions with all affiliates to an amount equal to 20% of such capital and surplus, and (2) require all transactions with an affiliate, whether or not covered transactions, to be on terms substantially the same, or at least as favorable to the institution or subsidiary, as those provided to a nonaffiliate. The term covered transaction includes the making of loans, purchase of assets, issuance of a guarantee and other similar types of transactions.

Bank Regulation.AmericanWest Bank is a Washington state-chartered commercial bank operating in Washington, Idaho and Utah subject to regulation by the Washington Department of Financial Institutions (DFI) and the Federal Deposit Insurance Corporation (FDIC). The federal and state laws that apply to the Bank regulate, among other things, the scope of its business, its investments, its reserves against deposits, the timing of the availability of deposited funds and the nature and amount of and collateral for loans.

8

Premiums for Deposit Insurance.The deposits of the Bank are currently insured to a maximum amount allowable per depositor through the Deposit Insurance Fund (DIF) administered by the FDIC. The FDIC has implemented a new risk-based insurance premium system effective January 1, 2007 under which banks are assessed insurance premiums based on how much risk they present to the DIF. Banks with higher levels of capital and a lower degree of supervisory risk are assessed lower premium rates than banks with lower levels of capital and/or a higher degree of supervisory risk. These premium rates are applied to the average balance of deposits in the prior quarter. The FDIC has provided a one time assessment credit to eligible institutions based on the assessment base of the institution as of December 31, 1996, as compared to the combined aggregate assessment base of all eligible institutions as of that date. This one time assessment credit is expected to offset most of the deposit insurance premiums of the Bank during 2007. The FDIC may increase or decrease the assessment rate schedule in order to manage the DIF to prescribed statutory target levels. An increase in the assessment rate could have an adverse effect on the Bank’s earnings, depending upon the amount of the increase. The FDIC may terminate deposit insurance if it determines the institution involved has engaged in or is engaging in unsafe or unsound banking practices, is in unsafe or unsound condition, or has violated applicable laws, regulations or orders.

Community Reinvestment Act. The Community Reinvestment Act (CRA) requires that, in connection with examinations of financial institutions within their jurisdiction, regulators must evaluate the records of the financial institutions in meeting the credit needs of their local communities, including low and moderate income neighborhoods, consistent with the safe and sound operation of those banks. These factors are also considered in evaluating mergers, acquisitions and applications to open a branch or facility. As of the Bank’s most recent CRA examination in 2005, the Bank’s rating was “satisfactory.”

Insider Credit Transactions.Banks are also subject to certain restrictions imposed by the Federal Reserve Act on extensions of credit to executive officers, directors, principal shareholders and any related interests of such persons. Extensions of credit: (1) must be made on substantially the same terms, including interest rates and collateral, and follow credit underwriting procedures that are not less stringent than those prevailing at the time for comparable transactions with persons not covered above and who are not employees; and (2) must not involve more than the normal risk of repayment or present other unfavorable features. Banks are also subject to certain lending limits and restrictions on overdrafts to such persons. A violation of these restrictions may result in the assessment of substantial civil monetary penalties on the affected bank or any officer, director, employee, agent or other person participating in the conduct of the affairs of that bank, the imposition of a cease and desist order and other regulatory sanctions.

Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA). Under FDICIA, each federal banking agency has prescribed, by regulation, non-capital safety and soundness standards for institutions under its authority. These standards cover internal controls, information and internal audit systems, loan documentation, credit underwriting, interest rate exposure, asset growth, compensation, fees and benefits, such other operational and managerial standards as the agency determines to be appropriate, and standards for asset quality, earnings and stock valuation. An institution which fails to meet these standards must develop a plan acceptable to the agency, specifying the steps that the institution will take to meet the standards. Failure to submit or implement such a plan may subject the institution to regulatory sanctions. Management believes that the Bank meets all such standards and, therefore, does not believe that these regulatory standards materially affect its business operations.

Privacy. The FDIC and other bank regulatory agencies, pursuant to the Financial Modernization Act of 1999, have published guidelines and adopted final regulations (Privacy Rules) which, among other things, require each financial institution to: (1) develop, implement and maintain, under the supervision and ongoing oversight of its Board of Directors or committee thereof, a comprehensive written information security program designed to ensure the security and confidentiality of customer information, protect against anticipated threats to the security or integrity of such information, and protect against unauthorized access to or use of such information; and (2) provide notice to customers (and other consumers under certain circumstances) about its privacy policies,

9

describe the conditions under which the institution may disclose nonpublic information to nonaffiliated third parties and provide a method for consumers to prevent the institution from disclosing that information to most nonaffiliated third parties by opting out of its disclosure policy, subject to certain exceptions. In addition, sections 501 and 505(b) of the Gramm-Leach-Bliley Act (GLBA) require financial institutions to establish appropriate policies, procedures and processes relating to administrative, technical and physical safeguards for customer records and information. Management believes the Bank is currently in substantive compliance with the Privacy Rules and the GLBA.

Dividends.The Bank is subject to restrictions on the payment of cash dividends to the Parent Company. The principal sources of the Parent Company’s cash are dividends received from its subsidiary bank, the issuance of junior subordinated debentures and cash received from the exercise of stock options. Regulatory authorities may prohibit banks and bank holding companies from paying dividends which would constitute an unsafe or unsound banking practice. In addition, a bank may not pay cash dividends if that payment could reduce the amount of its capital below that necessary to meet the adequately capitalized level in accordance with regulatory capital requirements. Also, the payment of cash dividends by the Bank must satisfy a net profits test and an undivided profits test or the Bank must obtain prior approval of its regulators before such dividend is paid. The net profits test limits the dividend declared in any calendar year to the net profits of the current year plus retained net income of the preceding two years. The undivided profits test limits the dividends declared to the undivided profits on hand after deducting bad debts in excess of the allowance for loan and lease losses. Based on the regulatory restrictions noted above, the Bank could pay up to $52.8 million in dividends as of December 31, 2006, and remain adequately capitalized, but regulatory approval would be required to pay more than $24.3 million. The Company is not currently subject to any regulatory restrictions on dividends other than those noted above.

Capital Adequacy.Federal bank regulatory agencies use capital adequacy guidelines in the examination and regulation of banks and bank holding companies. If capital falls below minimum guideline levels, a bank or bank holding company may be denied approval, among other things, to acquire or establish additional banks or non-bank businesses or to open new facilities.

The FDIC and FRB use risk-based capital guidelines for banks and bank holding companies. These are designed to make such capital requirements more sensitive to differences in risk profiles among banks and bank holding companies, to account for off-balance sheet exposure and to minimize disincentives for holding liquid assets. Assets and off-balance sheet items are assigned to broad risk categories, using a formula that assigns specific risk weights to different groups of assets and off-balance sheet items. The resulting capital ratios represent capital as a percentage of total risk-weighted assets.

Federal regulations establish minimum requirements for the capital adequacy of depository institutions, such as banks and bank holding companies. The FRB may require that a banking organization maintain ratios in excess of the minimums, particularly organizations contemplating significant expansion programs. Current guidelines require all bank holding companies and federally regulated banks to maintain a minimum risk-based total capital ratio equal to 8%, of which at least 4% must be Tier I capital. Tier I capital for bank holding companies includes common shareholders’ equity, certain qualifying perpetual preferred stock and minority interests in equity accounts of consolidated subsidiaries, less specified intangible assets and accumulated other comprehensive income or loss. The Company’s and Bank’s regulatory capital ratios are reported in Note 22 to the Consolidated Financial Statements in Item 8.

The FRB also employs a leverage ratio, which is Tier I capital as a percentage of total average assets less intangibles, as a supplement to risk-based guidelines. The principal objective of the leverage ratio is to constrain the maximum degree to which a bank holding company may leverage its equity capital base. The FRB requires a minimum leverage ratio of 3%. However, for all but the most highly rated bank holding companies and for bank holding companies seeking to expand, the FRB generally expects an additional amount of capital of at least 1% to 2%.

10

FDICIA created a statutory framework of supervisory actions indexed to the capital level of the individual institution. Under regulations adopted by the FDIC, an institution is assigned to one of five capital categories depending on its total risk-based capital ratio, Tier I risk-based capital ratio and leverage ratio, together with certain subjective factors. The Bank is considered well capitalized as of December 31, 2006, which is the highest of the five categories. Institutions which are deemed to be undercapitalized may be subject to certain mandatory supervisory corrective actions.

Effects of Government Monetary Policy.The earnings and growth of the Company are affected not only by general economic conditions, but also by the fiscal and monetary policies of the federal government, particularly the FRB. The FRB can and does implement national monetary policy for such purposes as curbing inflation and combating recession, but its open market operations in U.S. government securities, control of the discount rate applicable to borrowings from the FRB, and establishment of reserve requirements against certain deposits, also influence the growth of bank loans, investments and deposits and affect interest rates charged on loans or paid on deposits. The nature and impact of future changes in monetary policies and their impact on the Company and the Bank cannot be predicted with certainty.

Sarbanes-Oxley Controls and Procedures. The Sarbanes-Oxley Act of 2002 and related rulemaking by the Securities and Exchange Commission (SEC), which effected sweeping corporate disclosure and financial reporting reform, generally require public companies to maintain and carefully monitor a system of disclosure and internal controls and procedures. As a result, public companies such as AmericanWest Bancorporation must make disclosures about the adequacy of controls and procedures in periodic SEC reports (i.e., Forms 10-K and 10-Q) and their chief executive and chief financial officers must certify in these filings, among other things, that they are responsible for establishing and maintaining disclosure controls and procedures and disclose their conclusions about the effectiveness of such controls and procedures based on their evaluation as of the end of the period covered by the relevant report. Additionally, as a result, most public companies have enhanced controls and procedures. The Company is monitoring the status of other related ongoing rulemaking by the SEC and other regulatory entities. Management believes that the Company is in compliance with the Sarbanes-Oxley Act of 2002.

Anti-Terrorism Legislation. The Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT Act), designed to deny terrorists and others the ability to obtain anonymous access to the U.S. financial system, had a significant impact on depository institutions. The USA PATRIOT Act, together with the implementing regulations of various federal regulatory agencies, required financial institutions to implement additional or amend existing policies and procedures with respect to, among other things, anti-money laundering compliance, suspicious activity and currency transaction reporting and due diligence on customers. They also permit information sharing for counter-terrorist purposes between federal law enforcement agencies and financial institutions, as well as among financial institutions, subject to certain conditions, and require the FRB and other federal banking agencies to evaluate the effectiveness of an applicant in combating money laundering activities when considering applications filed under Section 3 of the BHCA or the Bank Merger Act. Management believes that the Bank is currently in compliance with all effective requirements prescribed by the USA PATRIOT Act.

Item 1A. Risk Factors.

The following risk factors are not listed in any particular order and should not be considered to include all risks to the Company.

The Company’s business is subject to interest rate risk, and variations in interest rates may harm financial performance.Unfavorable changes in the interest rate environment may reduce profits. It is expected that the Company will continue to realize income from the differential, or spread, between the interest earned on loans, securities and other interest earning assets and the interest paid on deposits, borrowings and other interest bearing liabilities. Net interest spreads are affected by the difference between the maturities and repricing

11

characteristics of interest earning assets and interest bearing liabilities. In addition, loan volume and yields are affected by market interest rates on loans, and rising interest rates generally are associated with a lower volume of loan originations. An increase in the general level of interest rates may increase the net interest margin and loan yield, but it may adversely affect the ability of borrowers with variable rate loans to pay the interest on and principal of their obligations. The Company does not have control of these factors. Accordingly, changes in levels of market interest rates could materially harm the net interest spread, asset quality, loan origination volume and overall profitability.

The Company faces strong competition from financial services companies and other companies that offer banking services, which could harm business.The Company currently conducts its banking operations primarily in Central and Eastern Washington and Northern Idaho. In 2006, the Company opened a loan production office in the Salt Lake City, Utah area and expects to continue its expansion into Utah during 2007. Increased competition in our markets may result in reduced loans and deposits. Ultimately, the Company may not be able to compete successfully against current and future competitors. Many competitors offer the same banking services within the market area of the Bank. These competitors include national banks, regional banks and other community banks. The Company also faces competition from many other types of financial institutions including, without limitation, savings and loan institutions, finance companies, brokerage firms, insurance companies, credit unions, mortgage banks and other financial intermediaries. In particular, the competitors include several major financial companies whose greater resources may afford them a marketplace advantage by enabling them to maintain numerous banking locations and ATMs and conduct extensive promotional and advertising campaigns.

Additionally, banks and other financial institutions with larger capitalization and financial intermediaries not subject to bank regulatory restrictions have larger lending limits and are thereby able to serve the credit needs of larger customers. Areas of competition include interest rates for loans and deposits, efforts to obtain deposits, and range and quality of products and services provided, including new technology-driven products and services. Technological innovation continues to contribute to greater competition in domestic and international financial services markets as technological advances enable more companies to provide financial services. The Company also faces competition from out-of-state financial intermediaries that have opened low-end production offices or that solicit deposits in the Bank’s market areas. If the Bank is unable to attract and retain banking customers, the Company may be unable to continue to grow the loan and deposit portfolios, and results of operations and financial condition may otherwise be harmed.

Changes in economic conditions, in particular an economic slowdown in the Company’s market area, could harm business. The Company’s business is directly impacted by factors such as economic, political and market conditions, broad trends in industry and finance, legislative and regulatory changes, changes in government monetary and fiscal policies and inflation, all of which are beyond the Company’s control. A deterioration in economic conditions, whether caused by national or local concerns, in particular an economic slowdown in Central and Eastern Washington and Northern Idaho, could result in the following consequences, any of which could materially hurt the business of the Company: loan delinquencies may increase; problem assets and foreclosures may increase; demand for products and services may decrease; low cost or noninterest bearing deposits may decrease; and collateral for loans made by the Bank, especially real estate, may decline in value, in turn reducing customers’ borrowing power and reducing the value of assets and collateral associated with existing loans. The States of Washington and Idaho and certain local governments in the market area presently face fiscal challenges the long term impact of which on either State’s or the local economy cannot be predicted.

A downturn in the real estate market could harm business. A significant downturn in the real estate market, especially in those markets served by the Bank, could harm business because a significant portion of the Bank’s loans are secured by real estate. The ability to recover on defaulted loans by selling the real estate collateral would then be diminished, and the Bank would be more likely to suffer losses on defaulted loans.

12

A substantial amount of the Bank’s real property collateral is located in Central and Eastern Washington. The bank has significant concentrations of credit in commercial real estate loans. Real estate values could be affected by, among other things, an economic slowdown, an increase in interest rates, drought and other natural disasters, specific to Washington.

The Company is dependent on key personnel and the loss of one or more of those key personnel may harm prospects. The Company currently depends heavily on the services of its president and chief executive officer, Robert M. Daugherty, and a number of other key management personnel. The loss of Mr. Daugherty’s services or that of other key personnel could harm the results of operations and financial condition. Success also depends in part on the ability to attract and retain additional qualified management personnel. Competition for such personnel is strong in the banking industry, and the Company may not be successful in attracting or retaining the personnel required.

The Company is subject to extensive regulation which could harm business. The operations are subject to extensive regulation by federal, state and local governmental authorities and to various laws and judicial and administrative decisions imposing requirements and restrictions on part or all of its operations. Because the banking business is highly regulated, the laws, rules and regulations applicable to the Company are subject to frequent change. There are typically proposed laws, rules and regulations that, if adopted, would adversely impact operations. These proposed laws, rules and regulations, or any other laws, rules or regulations, could (1) make compliance more difficult or expensive, (2) restrict the ability to originate, broker or sell loans or accept certain deposits, (3) further limit or restrict the amount of commissions, interest or other charges earned on loans originated or sold, or (4) otherwise harm business or prospects for business.

The Company is exposed to risk of environmental liabilities with respect to properties to which it takes title.In the ordinary course of business, the Bank may own or foreclose and take title to real estate and could be or become subject to environmental liabilities with respect to these properties. The Bank may be held liable to a governmental entity or to third parties for property damage, personal injury, investigation and clean-up costs incurred by these parties in connection with environmental contamination, or may be required to investigate or clean up hazardous or toxic substances, or chemical releases at a property. The costs associated with investigation or remediation activities could be substantial. In addition, as the owner or former owner of a contaminated site, the Company may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from the property. If the Company ever became subject to significant environmental liabilities, the business, financial condition, liquidity and results of operations could be harmed.

The allowance for credit losses may not be adequate to cover actual losses.In accordance with generally accepted accounting principles in the United States of America (GAAP), the Company maintains an allowance for credit losses. The allowance for credit losses may not be adequate to cover actual loan losses, and future provisions for credit losses could harm operating results. The allowance for credit losses is based on prior experience, as well as an evaluation of the risks in the current portfolio. The amount of future losses is susceptible to changes in economic, operating and other conditions, including changes in interest rates that may be beyond the Company’s control, and these losses may exceed current estimates. Federal regulatory agencies, as an integral part of their examination process, review the loans and allowance for credit losses. While management believes that the allowance for credit losses is adequate to cover current losses, management may decide to increase the allowance for credit losses or regulators may require the Company to increase this allowance. Either of these occurrences could reduce future earnings.

If the Company is unable to consummate the pending merger transaction with Far West Bancorporation (FWB) or successfully integrate FWB’s operations, its business and earnings may be negatively affected. The merger with FWB is expected to be completed on or about April 1, 2007, but is subject to shareholder approval, which may not be received, and customary closing conditions, which may not be satisfied. If the Company cannot complete the merger, it will have incurred expenses and will never see the

13

benefits anticipated from the merger. If the merger is complete, the Company will integrate two companies that have previously operated independently. Successful integration of FWB operations will depend primarily on the Company’s ability to consolidate operations, systems and procedures and to eliminate redundancies and costs. It is possible that the Company might not be able to integrate its post-merger operations without encountering difficulties including, without limitation, the loss of key employees and customers, the disruption of its respective ongoing businesses or possible inconsistencies in standards, controls, procedures and policies. If the Company has difficulties with the integration, it might not fully achieve the economic benefits it expects from the merger. In addition, the Company may experience greater than expected costs or difficulties related to the integration of the business of FWB, and/or may not realize expected cost savings from the merger within the expected time frame.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

At December 31, 2006, the Bank had 47 banking locations including 36 in Eastern and Central Washington, ten in Northern Idaho and a loan production office (doing business as Precision Bank) in the Salt Lake City, Utah area. The Company’s main office is located in downtown Spokane, Washington, which is leased. The Bank owns 23 banking facilities, leases 15 banking facilities and has 9 owned buildings on leased land at which banking services are provided. About 8,200 square feet is used for the Administrative Offices. In addition, the Bank leases approximately 9,000 square feet for its Data Processing Center.

Item 3. Legal Proceedings.

Periodically and in the ordinary course of business, various claims and lawsuits are brought against the Company or the Bank, such as claims to enforce liens, condemnation proceedings on properties in which the Bank held a security interest, claims involving the making and servicing of real property loans, actions relating to employee claims and other issues incident to the business of the Company and the Bank. In the opinion of management, the ultimate liability, if any, resulting from current claims or lawsuits will not have a material adverse effect on the financial position or results of operations of the Company.

Item 4. Submission of Matters to a Vote of Security Holders.

No matters were submitted to a vote of the Company’s shareholders during the fourth quarter of 2006.

14

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters.

The common stock of AmericanWest Bancorporation is quoted on the Nasdaq Global Select Market (NASDAQ) under the symbol “AWBC”. The following table sets out the high and low prices per share for the common stock for each quarter of 2006 and 2005 as reported by NASDAQ. The following quotes reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions:

| | | | | | | | | |

Quarter Ended | | High | | Low | | Cash Dividends

Declared Per

Share |

December 31, 2006 | | $ | 25.09 | | $ | 19.98 | | $ | 0.03 |

September 30, 2006 | | $ | 23.33 | | $ | 20.18 | | $ | 0.03 |

June 30, 2006 | | $ | 26.65 | | $ | 21.54 | | $ | 0.03 |

March 31, 2006 | | $ | 26.86 | | $ | 23.30 | | | — |

December 31, 2005 | | $ | 24.43 | | $ | 22.36 | | | — |

September 30, 2005 | | $ | 24.55 | | $ | 19.83 | | | — |

June 30, 2005 | | $ | 20.88 | | $ | 17.54 | | | — |

March 31, 2005 | | $ | 20.50 | | $ | 17.85 | | | — |

As of March 1, 2007, the Company’s common stock was held by approximately 1,577 shareholders, a number that does not include beneficial owners who hold shares in a street name. As of December 31, 2006, a total of 444,049 stock options and 79,333 unvested restricted stock shares were outstanding. Additional information about stock options and restricted shares is included in Note 15 of the Notes to Consolidated Financial Statements in Item 8.

The payment of future cash dividends is at the discretion of the Board of Directors and is subject to a number of factors, including results of operations, general business conditions, growth, financial condition and other factors deemed relevant. Further, the Company’s ability to pay future cash dividends is subject to certain regulatory requirements and restrictions discussed in theSupervision and Regulation section in Item 1 above. The dividend rate will be reassessed on a quarterly basis by the Board of Directors in accordance with the capital and dividend policy.

During the year ended December 31, 2006, the Board of Directors authorized the repurchase of up to 250,000 shares. No shares were repurchased under this authorization during 2006.

The following table provides information as of December 31, 2006 with respect to the Company’s compensation plans under which shares of the Company’s common stock are authorized for issuance:

| | | | | | | |

Plan Category | | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights | | Weighted average

exercise price of

outstanding

options, warrants

and rights | | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a) |

| | | (a) | | (b) | | (c) |

Equity compensation plans approved by security holders | | 444,049 | | $ | 16.51 | | 285,073 |

Equity compensation plans not approved by security holders | | — | | | — | | — |

Total | | 444,049 | | $ | 16.51 | | 285,073 |

15

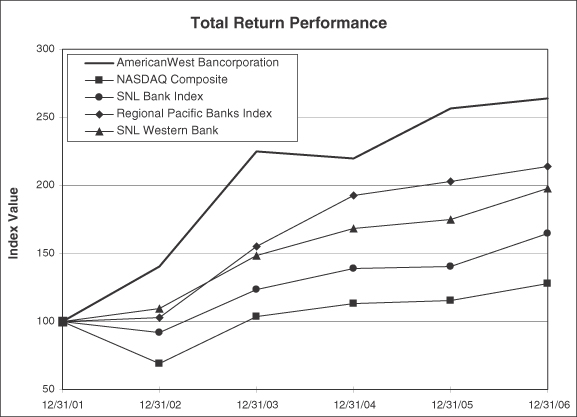

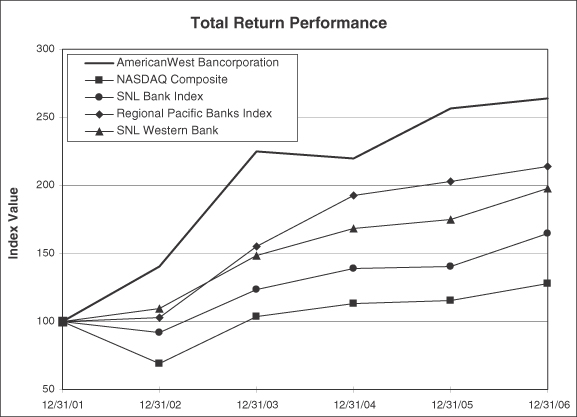

The following graph, which is “furnished” not “filed,” compares the cumulative total shareholder return on the Company’s common stock during the period beginning December 31, 2001, and ending December 31, 2006, with cumulative total returns on the NASDAQ Composite, Regional Pacific Banks Index and the SNL Bank Index for the same period. The graph and table assume that $100 was invested on December 31, 2001, and that all dividends were reinvested during each year presented. The information shown on the graph is not necessarily indicative of future performance. The source for the information is SNL Financial LC, Charlottesville, VA.

| | | | | | | | | | | | | | | | | | |

| | | Period Ending |

Index | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 |

AmericanWest Bancorporation | | $ | 100.00 | | $ | 140.35 | | $ | 225.21 | | $ | 220.02 | | $ | 256.75 | | $ | 264.25 |

NASDAQ Composite | | $ | 100.00 | | $ | 68.76 | | $ | 103.67 | | $ | 113.16 | | $ | 115.57 | | $ | 127.58 |

SNL Bank Index | | $ | 100.00 | | $ | 91.69 | | $ | 123.69 | | $ | 138.61 | | $ | 140.50 | | $ | 164.35 |

SNL Western Bank | | $ | 100.00 | | $ | 109.41 | | $ | 148.21 | | $ | 168.43 | | $ | 175.36 | | $ | 197.86 |

Regional Pacific Banks Index | | $ | 100.00 | | $ | 103.19 | | $ | 155.44 | | $ | 192.46 | | $ | 203.22 | | $ | 213.74 |

16

Item 6. Selected Financial Data.

The following table sets forth certain selected consolidated financial data of the Company at and for the years ended December 31:

| | | | | | | | | | | | | | | | | | | | |

($ in thousands, except per share amounts) | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Statements of Income | | | | | | | | | | | | | | | | | | | | |

Net interest income | | $ | 60,286 | | | $ | 53,987 | | | $ | 59,720 | | | $ | 55,618 | | | $ | 43,280 | |

Provision for credit losses | | | 5,791 | | | | 2,365 | | | | 13,046 | | | | 6,324 | | | | 5,663 | |

Noninterest income | | | 9,275 | | | | 8,383 | | | | 9,247 | | | | 7,320 | | | | 6,196 | |

Noninterest expense | | | 51,783 | | | | 41,135 | | | | 42,746 | | | | 35,120 | | | | 27,560 | |

| | | | | | | | | | | | | | | | | | | | |

Income before provision for income tax | | | 11,987 | | | | 18,870 | | | | 13,175 | | | | 21,494 | | | | 16,253 | |

| | | | | | | | | | | | | | | | | | | | |

Provision for income tax | | | 4,357 | | | | 4,998 | | | | 3,670 | | | | 7,508 | | | | 5,354 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 7,630 | | | $ | 13,872 | | | $ | 9,505 | | | $ | 13,986 | | | $ | 10,899 | |

| | | | | | | | | | | | | | | | | | | | |

Basic earnings per common share | | $ | 0.68 | | | $ | 1.33 | | | $ | 0.93 | | | $ | 1.39 | | | $ | 1.13 | |

Diluted earnings per common share | | $ | 0.67 | | | $ | 1.31 | | | $ | 0.91 | | | $ | 1.34 | | | $ | 1.10 | |

Basic weighted average shares outstanding | | | 11,182,526 | | | | 10,407,180 | | | | 10,185,246 | | | | 10,045,836 | | | | 9,625,038 | |

Diluted weighted average shares outstanding | | | 11,354,654 | | | | 10,593,903 | | | | 10,478,969 | | | | 10,473,852 | | | | 9,915,354 | |

| | | | | |

Statements of Condition | | | | | | | | | | | | | | | | | | | | |

Securities | | $ | 39,518 | | | $ | 31,364 | | | $ | 28,511 | | | $ | 38,163 | | | $ | 43,609 | |

Total assets | | | 1,416,528 | | | | 1,109,600 | | | | 1,048,994 | | | | 1,023,907 | | | | 917,141 | |

Gross loans: | | | | | | | | | | | | | | | | | | | | |

Commercial and industrial, including commercial real estate | | | 935,275 | | | | 728,292 | | | | 695,165 | | | | 645,156 | | | | 540,467 | |

Agricultural | | | 141,646 | | | | 119,355 | | | | 122,735 | | | | 124,395 | | | | 121,279 | |

Residential mortgage | | | 74,222 | | | | 58,803 | | | | 31,406 | | | | 37,508 | | | | 46,399 | |

Residential construction | | | 47,235 | | | | 33,906 | | | | 45,908 | | | | 32,236 | | | | 29,303 | |

Installment and other | | | 22,508 | | | | 22,527 | | | | 31,363 | | | | 36,528 | | | | 36,917 | |

| | | | | | | | | | | | | | | | | | | | |

Total gross loans | | | 1,220,886 | | | | 962,883 | | | | 926,577 | | | | 875,823 | | | | 774,365 | |

| | | | | | | | | | | | | | | | | | | | |

Deposits | | | 1,123,939 | | | | 897,430 | | | | 894,798 | | | | 871,125 | | | | 766,335 | |

Borrowings | | | 126,686 | | | | 81,847 | | | | 40,933 | | | | 47,781 | | | | 64,006 | |

Stockholders’ equity | | $ | 152,037 | | | $ | 121,477 | | | $ | 105,075 | | | $ | 96,198 | | | $ | 81,130 | |

| | | | | |

Financial Ratios | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.58 | % | | | 1.29 | % | | | 0.88 | % | | | 1.47 | % | | | 1.41 | % |

Return on average equity | | | 5.33 | % | | | 12.34 | % | | | 9.37 | % | | | 15.87 | % | | | 15.08 | % |

Net interest margin (1) | | | 5.06 | % | | | 5.47 | % | | | 6.04 | % | | | 6.36 | % | | | 6.08 | % |

Noninterest income to average assets | | | 0.71 | % | | | 0.78 | % | | | 0.85 | % | | | 0.77 | % | | | 0.80 | % |

Noninterest expense to average assets | | | 3.96 | % | | | 3.84 | % | | | 3.94 | % | | | 3.70 | % | | | 3.55 | % |

Efficiency ratio | | | 73.0 | % | | | 66.0 | % | | | 62.0 | % | | | 55.8 | % | | | 55.7 | % |

| | | | | |

Cash dividends declared per share | | $ | 0.09 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Cash dividend payout ratio | | | 13.2 | % | | | — | | | | — | | | | — | | | | — | |

Book value per share | | $ | 13.35 | | | $ | 11.58 | | | $ | 10.23 | | | $ | 10.45 | | | $ | 10.03 | |

Tangible book value per share | | $ | 9.79 | | | $ | 10.20 | | | $ | 8.80 | | | $ | 8.83 | | | $ | 8.15 | |

| | | | | |

Average equity to average assets ratio | | | 10.95 | % | | | 10.50 | % | | | 9.36 | % | | | 9.28 | % | | | 9.32 | % |

Ending tangible equity to tangible assets | | | 8.10 | % | | | 9.77 | % | | | 8.74 | % | | | 8.05 | % | | | 7.31 | % |

Nonperforming loans to gross loans (2) | | | 0.94 | % | | | 1.50 | % | | | 2.62 | % | | | 1.43 | % | | | 1.75 | % |

Allowance for credit losses to gross loans | | | 1.31 | % | | | 1.49 | % | | | 1.99 | % | | | 1.42 | % | | | 1.33 | % |

| (1) | Tax-exempt securities included using a tax equivalent basis and an assumed tax rate of 34%. |

| (2) | Ratio shown net of government guarantees. |

17

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The reader should read the following discussion together with the Company’s consolidated financial statements, related notes and supplementary data of the Company and its subsidiaries, which are included under Item 8. The following discussion contains forward-looking statements that reflect plans, estimates and beliefs. The actual results of the Company could differ materially from those discussed in the forward-looking statements.

AmericanWest Bancorporation (Company) is a bank holding company with a single banking subsidiary, AmericanWest Bank (Bank) which operates full service financial centers located in Eastern and Central Washington and Northern Idaho. The Bank also has loan production offices in Ellensburg, Washington and in the Salt Lake City, Utah area (doing business as Precision Bank). Unless otherwise indicated, reference to the Company shall include its wholly-owned subsidiary the Bank.

Critical Accounting Policies

The Company must manage and control certain inherent risks in the normal course of business. These include credit risk, fraud risk, operations and settlement risk, and interest rate risk. The Company has established an allowance for loan losses which represents an estimate of the probable amount of loans that the Bank will be unable to collect as of the date of the financial statements. Refer to Note 1 of the Consolidated Financial Statements included in Item 8 and the Analysis of Allowance for Loan Losses section within this Item for further information.

Executive Overview

Results of Operations

| | | | | | | | | | | | | | | |

| | | | | | | | | % Change | |

($ in thousands, except per share) | | 2006 | | 2005 | | 2004 | | 2006 | | | 2005 | |

Interest income | | $ | 93,853 | | $ | 72,320 | | $ | 73,679 | | 30 | % | | -2 | % |

Interest expense | | | 33,567 | | | 18,333 | | | 13,959 | | 83 | % | | 31 | % |

| | | | | | | | | | | | | | | |

Net interest income | | | 60,286 | | | 53,987 | | | 59,720 | | 12 | % | | -10 | % |

Provision for credit losses | | | 5,791 | | | 2,365 | | | 13,046 | | 145 | % | | -82 | % |

| | | | | | | | | | | | | | | |

Net interest income after provision for credit losses | | | 54,495 | | | 51,622 | | | 46,674 | | 6 | % | | 11 | % |

Noninterest income | | | 9,275 | | | 8,383 | | | 9,247 | | 11 | % | | -9 | % |

Noninterest expense | | | 51,783 | | | 41,135 | | | 42,746 | | 26 | % | | -4 | % |

| | | | | | | | | | | | | | | |

Income before provision for income tax | | | 11,987 | | | 18,870 | | | 13,175 | | -36 | % | | 43 | % |

Provision for income tax | | | 4,357 | | | 4,998 | | | 3,670 | | -13 | % | | 36 | % |

| | | | | | | | | | | | | | | |

Net income | | $ | 7,630 | | $ | 13,872 | | $ | 9,505 | | -45 | % | | 46 | % |

| | | | | | | | | | | | | | | |

Basic earnings per common share | | $ | 0.68 | | $ | 1.33 | | $ | 0.93 | | -49 | % | | 43 | % |

Diluted earnings per common share | | $ | 0.67 | | $ | 1.31 | | $ | 0.91 | | -49 | % | | 44 | % |

The Company’s net income was $7.6 million in 2006 which was $6.2 million less than 2005 and $1.9 million lower than 2004. Basic earnings per share in 2006 of $0.68 was $0.65 lower than 2005 and $0.25 lower than 2004. Diluted earnings per share in 2006 of $0.67 was $0.64 lower than 2005 and $0.24 lower than 2004.

The return on average assets of 0.58% in 2006 was 71 basis points lower than in 2005 and 30 basis points lower than in 2004. The return on average equity for 2006 was 5.33%, as compared to 12.34% and 9.37% for 2005 and 2004, respectively.

2006 financial results were shaped by the following:

| | • | | Merger with Columbia Trust Bancorp (CTB) in the first quarter which added $145.5 million of gross loans and $175.9 million of deposits. |

18

| | • | | 12% organic loan growth and 6% organic deposit growth. |

| | • | | Noninterest expense increased $10.6 million, or 26%, mainly due to the following items: |

| | • | | Salary and employee benefits expense increased $6.8 million, or 29%, related to an increase in full time equivalent employees. |

| | • | | Other increases related mainly to occupancy, equipment and other are due to growth initiatives. |

| | • | | Opening of five financial centers and a loan production office. |

| | • | | Provision for credit losses of $5.8 million included the impact of charge-offs related to one borrower of $4.8 million during the year. |

| | • | | The net interest margin compressed 41 basis points due primarily to higher cost of funds. |

| | • | | Noninterest income increased $0.9 million, or 11%, mainly due to increases in fees and service charges on deposits of $0.6 million and fees on mortgage loan sales of $0.4 million. |

| | • | | The Company paid cash dividends of $0.09 per share. |

2005 financial results were shaped by the following:

| | • | | Asset quality improvement including a decrease of nonperforming assets of $11.8 million, or 41%, and a decrease in the provision for credit losses of $10.7 million. |

| | • | | Decreased net interest income due to margin compression of 57 basis points. |

| | • | | Loan growth of $36.3 million or 3.9% and deposit growth of $2.6 million. |

| | • | | Noninterest expense decline of $1.6 million, or 3.8%, mainly due to foreclosed real estate and other foreclosed assets write-downs in 2004 of $4.8 million. |

| | • | | Noninterest income decline of $0.9 million, or 9.3%, due to a reduction in gains on the sale of assets compared to 2004. |

Net Interest Income.Net interest income increased 11.7% to $60.3 million in 2006 compared to $54.0 million in 2005. The 2005 results were a 9.6% decrease over 2004 results. The increase in 2006 is due mainly to the growth in average earning assets, including the impact of the CTB merger, partially offset by the reduction in the net interest margin.

The Company’s net interest margin was 5.06% in 2006. This is a decline from 5.47% and 6.04% in 2005 and 2004, respectively. During 2006, the net interest margin compressed as the cost of funds increased more than the earning assets yield. The cost of funds increased to 3.59% for 2006 as compared to 2.38% and 1.71% for 2005 and 2004, respectively. The primary drivers of the compression were higher market interest rates during the recent years and heightened competition for deposits. The earning assets yield increased to 7.86% as compared to 7.33% and 7.45% for 2005 and 2004, respectively. The slower rise in the earning assets yield is attributable in part to deliberate changes made by management to improve the credit quality of the loan portfolio with the result that although loan yields may be lower they are expected to be offset by a reduction in future loan losses. Another factor is that fixed rate term loans repriced at similar or lower rates during the year due to the flat-to-inverted yield curve. Additionally, the loan spreads compressed due to increased competition. The net interest income decrease in 2005 was also principally attributable to an increase in market interest rates which caused the deposit and borrowing costs to increase over the year without a corresponding increase in interest income.

19

The following table sets forth information with regard to average balances of assets and liabilities, and interest income from interest earning assets and interest expense on interest bearing liabilities, resultant yields or costs, net interest income, net interest spread (the difference between the average yield on interest earning assets and the average cost of interest bearing liabilities) and the net interest margin:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2006 | | | 2005 | | | 2004 | |

($ in thousands) | | Average

Balance | | Interest | | % | | | Average

Balance | | Interest | | % | | | Average

Balance | | Interest | | % | |

| Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans (1) | | $ | 1,145,558 | | $ | 91,743 | | 8.01 | % | | $ | 952,151 | | $ | 70,898 | | 7.45 | % | | $ | 913,844 | | $ | 70,565 | | 7.72 | % |

Taxable securities | | | 31,069 | | | 1,504 | | 4.84 | % | | | 17,805 | | | 820 | | 4.61 | % | | | 57,297 | | | 2,535 | | 4.42 | % |

Nontaxable securities (2) | | | 9,919 | | | 601 | | 6.06 | % | | | 8,536 | | | 538 | | 6.30 | % | | | 9,070 | | | 523 | | 5.77 | % |

Federal Home Loan Bank stock | | | 6,122 | | | 6 | | 0.10 | % | | | 5,392 | | | 22 | | 0.41 | % | | | 4,018 | | | 104 | | 2.59 | % |

Overnight deposits with other banks | | | 3,945 | | | 203 | | 5.15 | % | | | 5,533 | | | 224 | | 4.05 | % | | | 6,118 | | | 84 | | 1.37 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest earning assets | | | 1,196,613 | | | 94,057 | | 7.86 | % | | | 989,417 | | | 72,502 | | 7.33 | % | | | 990,347 | | | 73,811 | | 7.45 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest earning assets | | | 110,739 | | | | | | | | | 81,872 | | | | | | | | | 93,777 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 1,307,352 | | | | | | | | $ | 1,071,289 | | | | | | | | $ | 1,084,124 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest bearing demand deposits | | $ | 88,936 | | $ | 650 | | 0.73 | % | | $ | 67,700 | | $ | 278 | | 0.41 | % | | $ | 62,046 | | $ | 159 | | 0.26 | % |

Savings deposits | | | 351,697 | | | 10,246 | | 2.91 | % | | | 343,574 | | | 6,858 | | 2.00 | % | | | 384,064 | | | 5,544 | | 1.44 | % |

Time deposits | | | 376,340 | | | 15,947 | | 4.24 | % | | | 283,639 | | | 8,087 | | 2.85 | % | | | 282,182 | | | 6,110 | | 2.17 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest bearing deposits | | | 816,973 | | | 26,843 | | 3.29 | % | | | 694,913 | | | 15,223 | | 2.19 | % | | | 728,292 | | | 11,813 | | 1.62 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Overnight borrowings | | | 39,056 | | | 2,019 | | 5.17 | % | | | 30,727 | | | 970 | | 3.16 | % | | | 34,187 | | | 501 | | 1.47 | % |

Other borrowings (3) | | | 79,934 | | | 4,705 | | 5.89 | % | | | 44,737 | | | 2,140 | | 4.78 | % | | | 52,786 | | | 1,645 | | 3.12 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest bearing liabilities | | | 935,963 | | | 33,567 | | 3.59 | % | | | 770,377 | | | 18,333 | | 2.38 | % | | | 815,265 | | | 13,959 | | 1.71 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest bearing demand deposits | | | 218,230 | | | | | | | | | 179,115 | | | | | | | | | 159,704 | | | | | | |

Other noninterest bearing liabilities | | | 9,955 | | | | | | | | | 9,341 | | | | | | | | | 7,665 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 1,164,148 | | | | | | | | | 958,833 | | | | | | | | | 982,634 | | | | | | |

| | | | | | | | | |

| Stockholders’ Equity | | | 143,204 | | | | | | | | | 112,456 | | | | | | | | | 101,490 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 1,307,352 | | | | | | | | $ | 1,071,289 | | | | | | | | $ | 1,084,124 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income and spread | | | | | $ | 60,490 | | 4.27 | % | | | | | $ | 54,169 | | 4.95 | % | | | | | $ | 59,852 | | 5.74 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest margin to average earning assets | | | | | | | | 5.06 | % | | | | | | | | 5.47 | % | | | | | | | | 6.04 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

20

The following table sets forth a summary of changes in the components of net interest income due to changes in average interest earning assets and interest earning liabilities and the resultant changes in interest income and interest expense:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2006 vs 2005 | | | 2005 vs 2004 | |

| | | Increase (decrease) in net interest income due to changes in | |

($ in thousands) | | Volume | | | Rate | | | Total | | | Volume | | | Rate | | | Total | |

| Interest earning assets | | | | | | | | | | | | | | | | | | | | | | | | |

Loans (1) | | $ | 14,409 | | | $ | 6,436 | | | $ | 20,845 | | | $ | 2,958 | | | $ | (2,625 | ) | | $ | 333 | |

Securities (2) | | | 756 | | | | (9 | ) | | | 747 | | | | (1,844 | ) | | | 144 | | | | (1,700 | ) |

Overnight deposits with other banks and FHLB stock | | | (19 | ) | | | (18 | ) | | | (37 | ) | | | 14 | | | | 44 | | | | 58 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total interest earning assets | | $ | 15,146 | | | $ | 6,409 | | | $ | 21,555 | | | $ | 1,128 | | | $ | (2,437 | ) | | $ | (1,309 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Interest bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

Interest bearing demand deposits | | $ | 87 | | | $ | 285 | | | $ | 372 | | | $ | 14 | | | $ | 105 | | | $ | 119 | |

Savings deposits | | | 162 | | | | 3,226 | | | | 3,388 | | | | (584 | ) | | | 1,898 | | | | 1,314 | |

Time deposits | | | 2,642 | | | | 5,218 | | | | 7,860 | | | | 32 | | | | 1,945 | | | | 1,977 | |