Income Taxes — Xcel Energy accounts for income taxes using the asset and liability method, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements. Xcel Energy defers income taxes for all temporary differences between pretax financial and taxable income, and between the book and tax bases of assets and liabilities. Xcel Energy uses the tax rates that are scheduled to be in effect when the temporary differences are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period that includes the enactment date.

Deferred tax assets are reduced by a valuation allowance if, based on the weight of available evidence, it is more likely than not that some portion or all of the deferred tax asset will not be realized. In making such a determination, all available positive and negative evidence, including scheduled reversals of deferred tax liabilities, projected future taxable income, tax planning strategies and recent financial operations, is considered.

Due to the effects of past regulatory practices, when deferred taxes were not required to be recorded, the reversal of some temporary differences are accounted for as current income tax expense. Investment tax credits are deferred and their benefits amortized over the book depreciable lives of the related property. Utility rate regulation also has resulted in the recognition of certain regulatory assets and liabilities related to income taxes, which are summarized in Note 15.

Xcel Energy follows the applicable accounting guidance to measure and disclose uncertain tax positions that it has taken or expects to take in its income tax returns. Xcel Energy recognizes a tax position in its consolidated financial statements when it is more likely than not that the position will be sustained upon examination based on the technical merits of the position. Recognition of changes in uncertain tax positions are reflected as a component of income tax.

Xcel Energy reports interest and penalties related to income taxes within the other income and interest charges sections in the consolidated statements of income.

Xcel Energy Inc. and its subsidiaries file consolidated federal income tax returns as well as combined or separate state income tax returns. Federal income taxes paid by Xcel Energy Inc., as parent of the Xcel Energy consolidated group, are allocated to Xcel Energy Inc.’s subsidiaries based on separate company computations of tax. A similar allocation is made for state income taxes paid by Xcel Energy Inc. in connection with combined state filings. Xcel Energy Inc. also allocates its own income tax benefits to its direct subsidiaries based on the relative positive tax liabilities of the subsidiaries.

See Note 6 for further discussion of income taxes.

Types of and Accounting for Derivative Instruments — Xcel Energy uses derivative instruments in connection with its interest rate, utility commodity price, vehicle fuel price, short-term wholesale and commodity trading activities, including forward contracts, futures, swaps and options. All derivative instruments not designated and qualifying for the normal purchases and normal sales exception, as defined by the accounting guidance for derivatives and hedging, are recorded on the consolidated balance sheets at fair value as derivative instruments. This includes certain instruments used to mitigate market risk for the utility operations and all instruments related to the commodity trading operations. The classification of changes in fair value for those derivative instruments is dependent on the designation of a qualifying hedging relationship. Changes in fair value of derivative instruments not designated in a qualifying hedging relationship are reflected in current earnings or as a regulatory asset or liability. The classification as a regulatory asset or liability is based on commission approved regulatory recovery mechanisms.

Gains or losses on hedging transactions for the sale of energy or energy-related products are primarily recorded as a component of revenue; hedging transactions for fuel used in energy generation are recorded as a component of fuel costs; hedging transactions for natural gas purchased for resale are recorded as a component of natural gas costs; hedging transactions for vehicle fuel costs are recorded as a component of capital projects or O&M costs; and interest rate hedging transactions are recorded as a component of interest expense. Certain utility subsidiaries are allowed to recover in electric or natural gas rates the costs of certain financial instruments purchased to reduce commodity cost volatility.

Cash Flow Hedges — Certain qualifying hedging relationships are designated as a hedge of a forecasted transaction, or future cash flow (cash flow hedge). Changes in the fair value of a derivative designated as a cash flow hedge, to the extent effective, are included in OCI, or deferred as a regulatory asset or liability based on recovery mechanisms until earnings are affected by the hedged transaction.

Normal Purchases and Normal Sales — Xcel Energy enters into contracts for the purchase and sale of commodities for use in its business operations. Derivatives and hedging accounting guidance requires a company to evaluate these contracts to determine whether the contracts are derivatives. Certain contracts that meet the definition of a derivative may be exempted from derivative accounting as normal purchases or normal sales.

Xcel Energy evaluates all of its contracts at inception to determine if they are derivatives and if they meet the normal purchases and normal sales designation requirements. None of the contracts entered into within the commodity trading operations qualify for a normal purchases and normal sales designation.

See Note 11 for further discussion of Xcel Energy’s risk management and derivative activities.

Commodity Trading Operations — All applicable gains and losses related to commodity trading activities, whether or not settled physically, are shown on a net basis in electric operating revenues in the consolidated statements of income.

Xcel Energy’s commodity trading operations are conducted by NSP-Minnesota, PSCo and SPS. Commodity trading activities are not associated with energy produced from Xcel Energy’s generation assets or energy and capacity purchased to serve native load. Commodity trading contracts are recorded at fair market value and commodity trading results include the impact of all margin-sharing mechanisms. See Note 11 for further discussion.

Fair Value Measurements — Xcel Energy presents cash equivalents, interest rate derivatives, commodity derivatives and nuclear decommissioning fund assets at estimated fair values in its consolidated financial statements. Cash equivalents are recorded at cost plus accrued interest; money market funds are measured using quoted net asset values. For interest rate derivatives, quoted prices based primarily on observable market interest rate curves are used as a primary input to establish fair value. For commodity derivatives, the most observable inputs available are generally used to determine the fair value of each contract. In the absence of a quoted price for an identical contract in an active market, Xcel Energy may use quoted prices for similar contracts or internally prepared valuation models to determine fair value. For the nuclear decommissioning fund, published trading data and pricing models, generally using the most observable inputs available, are utilized to estimate fair value for each class of security. See Note 11 for further discussion.

Cash and Cash Equivalents — Xcel Energy considers investments in certain instruments, including commercial paper and money market funds, with a remaining maturity of three months or less at the time of purchase, to be cash equivalents.

Accounts Receivable and Allowance for Bad Debts — Accounts receivable are stated at the actual billed amount net of an allowance for bad debts. Xcel Energy establishes an allowance for uncollectible receivables based on a policy that reflects its expected exposure to the credit risk of customers.

Inventory — All inventory is recorded at average cost.

Renewable Energy Credits — RECs are marketable environmental commodities that represent proof that energy was generated from eligible renewable energy sources. RECs are awarded upon delivery of the associated energy and can be bought and sold. RECs are typically used as a form of measurement of compliance to RPS enacted by those states that are encouraging construction and consumption from renewable energy sources, but can also be sold separately from the energy produced. Currently, utility subsidiaries acquire RECs from the generation or purchase of renewable power.

When RECs are acquired in the course of generation or purchased as a result of meeting load obligations, they are recorded as inventory at cost. The cost of RECs that are utilized for compliance purposes is recorded as electric fuel and purchased power expense. As a result of state regulatory orders, Xcel Energy reduces recoverable fuel costs for the value of certain RECs and records the cost of future compliance requirements that are recoverable in future rates as regulatory assets.

Sales of RECs that are acquired in the course of generation or purchased as a result of meeting load obligations are recorded in electric utility operating revenues on a gross basis. The cost of these RECs, related transaction costs, and amounts credited to customers under margin-sharing mechanisms are recorded in electric fuel and purchased power expense. RECs acquired for trading purposes are recorded as other investments and are also recorded at cost. The sales of RECs for trading purposes are recorded in electric utility operating revenues, net of the cost of the RECs, transaction costs, and amounts credited to customers under margin-sharing mechanisms.

Emission Allowances — Emission allowances, including the annual SO2 and NOx emission allowance entitlement received at no cost from the EPA, are recorded at cost plus associated broker commission fees. Xcel Energy follows the inventory accounting model for all emission allowances. The sales of emission allowances are included in electric utility operating revenues and the operating activities section of the consolidated statements of cash flows.

Environmental Costs — Environmental costs are recorded when it is probable Xcel Energy is liable for the costs and the liability can be reasonably estimated. Costs are deferred as a regulatory asset if it is probable that the costs will be recovered from customers in future rates. Otherwise, the costs are expensed. If an environmental expense is related to facilities currently in use, such as emission-control equipment, the cost is capitalized and depreciated over the life of the plant.

Estimated remediation costs, excluding inflationary increases, are recorded. The estimates are based on experience, an assessment of the current situation and the technology currently available for use in the remediation. The recorded costs are regularly adjusted as estimates are revised and remediation proceeds. If other participating PRPs exist and acknowledge their potential involvement with a site, costs are estimated and recorded only for Xcel Energy’s expected share of the cost. Any future costs of restoring sites where operation may extend indefinitely are treated as a capitalized cost of plant retirement. The depreciation expense levels recoverable in rates include a provision for removal expenses, which may include final remediation costs. Removal costs recovered in rates are classified as a regulatory liability.

See Note 13 for further discussion of environmental costs.

Benefit Plans and Other Postretirement Benefits — Xcel Energy maintains pension and postretirement benefit plans for eligible employees. Recognizing the cost of providing benefits and measuring the projected benefit obligation of these plans under applicable accounting guidance requires management to make various assumptions and estimates.

Based on the regulatory recovery mechanisms of Xcel Energy Inc.’s utility subsidiaries, certain unrecognized actuarial gains and losses and unrecognized prior service costs or credits are recorded as regulatory assets and liabilities, rather than OCI.

See Note 9 for further discussion of benefit plans and other postretirement benefits.

Guarantees — Xcel Energy recognizes, upon issuance or modification of a guarantee, a liability for the fair market value of the obligation that has been assumed in issuing the guarantee. This liability includes consideration of specific triggering events and other conditions which may modify the ongoing obligation to perform under the guarantee.

The obligation recognized is reduced over the term of the guarantee as Xcel Energy is released from risk under the guarantee. See Note 13 for specific details of issued guarantees.

Subsequent Events — Management has evaluated the impact of events occurring after Dec. 31, 2011 up to the date of issuance of these consolidated financial statements. These statements contain all necessary adjustments and disclosures resulting from that evaluation.

2. Accounting Pronouncements

Recently Adopted

Multiemployer Plans — In September 2011, the FASB issued Multiemployer Plans (Subtopic 715-80) — Disclosures about an Employer’s Participation in a Multiemployer Plan (ASU No. 2011-09), which updates the Codification to require certain disclosures about an entity’s involvement with multiemployer pension and other postretirement benefit plans. These updates do not affect recognition and measurement guidance for an employer’s participation in multiemployer plans, but rather require additional disclosure such as the nature of multiemployer plans and the employer’s participation, contributions to the plans and details regarding any significant plans. These updates to the Codification are effective for annual periods ending after Dec. 15, 2011. Xcel Energy implemented the annual disclosure guidance effective Jan. 1, 2011, and the implementation did not have a material impact on its consolidated financial statements. For further information and required disclosures, see Note 9.

Recently Issued

Fair Value Measurement — In May 2011, the FASB issued Fair Value Measurement (Topic 820) — Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS (ASU No. 2011-04), which provides additional guidance for fair value measurements. These updates to the Codification include clarifications regarding existing fair value measurement principles and disclosure requirements, and also specific new guidance for items such as measurement of instruments classified within stockholders’ equity. These updates to the Codification are effective for interim and annual periods beginning after Dec. 15, 2011. Xcel Energy does not expect the implementation of this guidance to have a material impact on its consolidated financial statements.

Comprehensive Income — In June 2011, the FASB issued Comprehensive Income (Topic 220) — Presentation of Comprehensive Income (ASU No. 2011-05), which updates the Codification to require the presentation of the components of net income, the components of OCI and total comprehensive income in either a single continuous statement of comprehensive income or in two separate, but consecutive statements of net income and comprehensive income. These updates do not affect the items reported in OCI or the guidance for reclassifying such items to net income. These updates to the Codification are effective for interim and annual periods beginning after Dec. 15, 2011. Xcel Energy does not expect the implementation of this presentation guidance to have a material impact on its consolidated financial statements.

Balance Sheet Offsetting — In December 2011, the FASB issued Balance Sheet (Topic 210) — Disclosures about Offsetting Assets and Liabilities (ASU No. 2011-11), which updates the Codification to require disclosures regarding netting arrangements in agreements underlying derivatives, certain financial instruments and related collateral amounts, and the extent to which an entity’s financial statement presentation policies related to netting arrangements impact amounts recorded to the financial statements. These updates to the disclosure requirements of the Codification do not affect the presentation of amounts in the consolidated balance sheets, and are effective for annual reporting periods beginning on or after Jan. 1, 2013, and interim periods within those periods. Xcel Energy does not expect the implementation of this disclosure guidance to have a material impact on its consolidated financial statements.

3. Selected Balance Sheet Data

| (Thousands of Dollars) | | Dec. 31, 2011 | | | Dec. 31, 2010 | |

| Accounts receivable, net | | | | | | |

| Accounts receivable | | $ | 811,685 | | | $ | 773,037 | |

| Less allowance for bad debts | | | (58,565 | ) | | | (54,563 | ) |

| | | $ | 753,120 | | | $ | 718,474 | |

| Inventories | | | | | | | | |

| Materials and supplies | | $ | 202,699 | | | $ | 196,081 | |

| Fuel | | | 236,023 | | | | 188,566 | |

| Natural gas | | | 179,510 | | | | 176,153 | |

| | | $ | 618,232 | | | $ | 560,800 | |

| Property, plant and equipment, net | | | | | | | | |

| Electric plant | | $ | 27,254,541 | | | $ | 24,993,582 | |

| Natural gas plant | | | 3,676,754 | | | | 3,463,343 | |

| Common and other property | | | 1,546,643 | | | | 1,555,287 | |

Plant to be retired (a) | | | 151,184 | | | | 236,606 | |

| Construction work in progress | | | 1,085,245 | | | | 1,186,433 | |

| Total property, plant and equipment | | | 33,714,367 | | | | 31,435,251 | |

| Less accumulated depreciation | | | (11,658,351 | ) | | | (11,068,820 | ) |

| Nuclear fuel | | | 1,939,299 | | | | 1,837,697 | |

| Less accumulated amortization | | | (1,641,948 | ) | | | (1,541,046 | ) |

| | | $ | 22,353,367 | | | $ | 20,663,082 | |

| (a) | In 2010, in response to the CACJA, the CPUC approved the early retirement of Cherokee Units 1, 2 and 3, Arapahoe Unit 3 and Valmont Unit 5 between 2011 and 2017. Amounts are presented net of accumulated depreciation. See Item 1 – Public Utility Regulation for further discussion. |

4. Borrowings and Other Financing Instruments

Short-Term Borrowings

Money Pool — Xcel Energy Inc. and its utility subsidiaries have established a money pool arrangement that allows for short-term investments in and borrowings between the utility subsidiaries. NSP-Wisconsin does not participate in the money pool. Xcel Energy Inc. may make investments in the utility subsidiaries at market-based interest rates; however, the money pool arrangement does not allow the utility subsidiaries to make investments in Xcel Energy Inc. The money pool balances are eliminated upon consolidation.

Commercial Paper — Xcel Energy Inc. and its utility subsidiaries meet their short-term liquidity requirements primarily through the issuance of commercial paper and borrowings under their credit facilities. Commercial paper outstanding for Xcel Energy was as follows:

| | | Three Months Ended | |

| (Amounts in Millions, Except Interest Rates) | | Dec. 31, 2011 | |

| Borrowing limit | | $ | 2,450 | |

| Amount outstanding at period end | | | 219 | |

| Average amount outstanding | | | 165 | |

| Maximum amount outstanding | | | 241 | |

| Weighted average interest rate, computed on a daily basis | | | 0.35 | % |

| Weighted average interest rate at end of period | | | 0.40 | |

| | | Twelve Months Ended | | | Twelve Months Ended | | | Twelve Months Ended | |

| (Amounts in Millions, Except Interest Rates) | | Dec. 31, 2011 | | | Dec. 31, 2010 | | | Dec. 31, 2009 | |

| Borrowing limit | | $ | 2,450 | | | $ | 2,177 | | | $ | 2,177 | |

| Amount outstanding at period end | | | 219 | | | | 466 | | | | 459 | |

| Average amount outstanding | | | 430 | | | | 263 | | | | 406 | |

| Maximum amount outstanding | | | 824 | | | | 653 | | | | 675 | |

| Weighted average interest rate, computed on a daily basis | | | 0.36 | % | | | 0.36 | % | | | 0.95 | % |

| Weighted average interest rate at end of period | | | 0.40 | | | | 0.40 | | | | 0.36 | |

Credit Facilities — In order to use their commercial paper programs to fulfill short-term funding needs, Xcel Energy Inc. and its utility subsidiaries must have revolving credit facilities in place at least equal to the amount of their respective commercial paper borrowing limits and cannot issue commercial paper in an aggregate amount exceeding available capacity under these credit agreements.

During 2011, NSP-Minnesota, NSP-Wisconsin, PSCo, SPS and Xcel Energy Inc. executed new four-year credit agreements. The total size of the credit facilities is $2.45 billion and each credit facility terminates in March 2015. Xcel Energy Inc. and its utility subsidiaries have the right to request an extension of the revolving termination date for two additional one-year periods, subject to majority bank group approval.

The credit facilities provide short-term financing in the form of notes payable to banks, letters of credit and back-up support for commercial paper borrowings. Other features of the credit facilities include:

| | · | Each of the credit facilities, other than NSP-Wisconsin’s, may be increased by up to $200 million for Xcel Energy Inc., $100 million each for NSP-Minnesota and PSCo, and $50 million for SPS. |

| | · | Each credit facility has a financial covenant requiring that the debt-to-total capitalization ratio of each entity be less than or equal to 65 percent. Each entity was in compliance at Dec. 31, 2011 as evidenced by the table below: |

| | | Debt-to-Total Capitalization Ratio | |

| Xcel Energy | | | 55 | % |

| NSP-Wisconsin | | | 50 | |

| NSP-Minnesota | | | 48 | |

| SPS | | | 48 | |

| PSCo | | | 45 | |

If Xcel Energy Inc. or any of its utility subsidiaries do not comply with the covenant, an event of default may be declared, and if not remedied, any outstanding amounts due under the facility can be declared due by the lender.

| | · | The Xcel Energy Inc. credit facility has a cross-default provision that provides Xcel Energy Inc. will be in default on its borrowings under the facility if it or any of its subsidiaries, except NSP-Wisconsin as long as its total assets do not comprise more than 15 percent of Xcel Energy’s consolidated total assets, default on certain indebtedness in an aggregate principal amount exceeding $75 million. |

| | · | The interest rates under these lines of credit are based on the Eurodollar rate or an alternate base rate, plus a borrowing margin of 0 to 200 basis points per year based on the applicable credit ratings. |

| | · | The commitment fees, also based on applicable long-term credit ratings, are calculated on the unused portion of the lines of credit at a range of 10 to 35 basis points per year. |

| | · | NSP-Wisconsin’s intercompany borrowing arrangement with NSP-Minnesota was subsequently terminated. |

At Dec. 31, 2011, Xcel Energy Inc. and its utility subsidiaries had the following committed credit facilities available:

| (Millions of Dollars) | | Facility | | | Drawn (a) | | | Available | |

| Xcel Energy Inc. | | $ | 800.0 | | | $ | 127.1 | | | $ | 672.9 | |

| PSCo | | | 700.0 | | | | 4.9 | | | | 695.1 | |

| NSP-Minnesota | | | 500.0 | | | | 33.7 | | | | 466.3 | |

| SPS | | | 300.0 | | | | - | | | | 300.0 | |

| NSP-Wisconsin | | | 150.0 | | | | 66.0 | | | | 84.0 | |

| Total | | $ | 2,450.0 | | | $ | 231.7 | | | $ | 2,218.3 | |

| (a) | Includes outstanding commercial paper and letters of credit. |

All credit facility bank borrowings, outstanding letters of credit and outstanding commercial paper reduce the available capacity under the respective credit facilities. Xcel Energy Inc. and its subsidiaries had no direct advances on the credit facilities outstanding at Dec. 31, 2011 and 2010.

Letters of Credit — Xcel Energy Inc. and its subsidiaries use letters of credit, generally with terms of one year, to provide financial guarantees for certain operating obligations. At Dec. 31, 2011 and 2010, there were $12.7 million and $10.1 million of letters of credit outstanding, respectively, under the credit facilities. An additional $1.1 million of letters of credit not issued under the credit facilities were outstanding at Dec. 31, 2011 and 2010, respectively. The contract amounts of these letters of credit approximate their fair value and are subject to fees determined in the marketplace.

Long-Term Borrowings and Other Financing Instruments

Generally, all real and personal property of NSP-Minnesota and NSP-Wisconsin and all real and personal property used in or in connection with the electric utility business of PSCo and SPS are subject to the liens of their first mortgage indentures. Additionally, debt premiums, discounts and expenses are amortized over the life of the related debt. The premiums, discounts and expenses associated with refinanced debt are deferred and amortized over the life of the related new issuance, in accordance with regulatory guidelines.

Maturities of long-term debt are as follows:

| (Millions of Dollars) | | | |

| 2012 | | $ | 1,060 | |

| 2013 | | | 257 | |

| 2014 | | | 282 | |

| 2015 | | | 256 | |

| 2016 | | | 207 | |

Xcel Energy has entered into a Replacement Capital Covenant (RCC). Under the terms of the RCC, Xcel Energy has agreed not to redeem or repurchase all or part of the $400 million of 7.6 percent junior subordinated notes due 2068 (Junior Subordinated Notes) prior to 2038 unless qualifying securities are issued to non-affiliates in a replacement offering in the 180 days prior to the redemption or repurchase date. Qualifying securities include those that have equity-like characteristics that are the same as, or more equity-like than, the applicable characteristics of the Junior Subordinated Notes at the time of redemption or repurchase.

During 2011, Xcel Energy Inc. and its utility subsidiaries completed the following financings:

| | · | In September 2011, Xcel Energy Inc. issued $250 million of 4.80 percent senior unsecured notes due Sept. 15, 2041. |

| | · | In August 2011, PSCo issued $250 million of 4.75 percent first mortgage bonds due Aug. 15, 2041. |

| | · | In August 2011, SPS issued $200 million of 4.50 percent first mortgage bonds due Aug. 15, 2041. |

During 2010, Xcel Energy Inc. and its utility subsidiaries completed the following financings:

| | · | In May 2010, Xcel Energy Inc. issued $550 million of 4.70 percent unsecured senior notes, due May 15, 2020. |

| | · | In August 2010, NSP-Minnesota issued $250 million of 1.95 percent first mortgage bonds, due Aug. 15, 2015 and $250 million of 4.85 percent first mortgage bonds, due Aug. 15, 2040. |

| | · | In November 2010, PSCo issued $400 million of 3.2 percent first mortgage bonds, due Nov. 15, 2020. |

Deferred Financing Costs — Other assets included deferred financing costs of approximately $75 million and $74 million, net of amortization, at Dec. 31, 2011 and 2010, respectively. Xcel Energy is amortizing these financing costs over the remaining maturity periods of the related debt.

Capital Stock — Xcel Energy Inc. has authorized 7,000,000 shares of preferred stock with a $100 par value. At Dec. 31, 2011, there were no shares of preferred stock outstanding and at Dec. 31, 2010, Xcel Energy Inc. had six series of preferred stock outstanding, redeemable at its option at prices ranging from $102 to $103.75 per share plus accrued dividends. Xcel Energy Inc. redeemed all series of its preferred stock on Oct. 31, 2011, at an aggregate purchase price of $108 million, plus accrued dividends. As such, the redemption premium of $3.3 million and accrued dividends are reflected as reductions of Xcel Energy’s earnings available to common shareholders in the consolidated statements of income.

The charters of some of Xcel Energy Inc.’s subsidiaries also authorize the issuance of preferred stock. However, at Dec. 31, 2011 and 2010, there were no preferred shares of subsidiaries outstanding. The following table lists preferred shares by subsidiary at Dec. 31, 2011 and 2010:

| | | Preferred Shares Authorized | | | Par Value | |

| SPS | | | 10,000,000 | | | $ | 1.00 | |

| PSCo | | | 10,000,000 | | | | 0.01 | |

Xcel Energy Inc. has authorized 1,000,000,000 shares of common stock. Outstanding shares at Dec. 31, 2011 and 2010 were 486,493,933 and 482,333,750, respectively.

Dividend and Other Capital-Related Restrictions — Xcel Energy Inc.’s Articles of Incorporation place restrictions on the amount of common stock dividends it can pay when preferred stock is outstanding. As there was no preferred stock outstanding at Dec. 31, 2011, the restrictions did not place any effective limit on Xcel Energy Inc.’s ability to pay dividends at Dec. 31, 2011.

All of Xcel Energy’s utility subsidiaries’ dividends are subject to the FERC’s jurisdiction under the Federal Power Act, which prohibits the payment of dividends out of capital accounts; payment of dividends is allowed out of retained earnings only.

NSP-Minnesota’s first mortgage indenture places certain restrictions on the amount of cash dividends it can pay to Xcel Energy Inc., the holder of its common stock. Even with these restrictions, NSP-Minnesota could have paid more than $1.1 billion in additional cash dividends on common stock at Dec. 31, 2010, or $1.2 billion at Dec. 31, 2011.

NSP-Minnesota’s state regulatory commissions indirectly limit the amount of dividends NSP-Minnesota can pay to Xcel Energy Inc. by requiring an equity-to-total capitalization ratio between 47.07 percent and 57.53 percent. NSP-Minnesota’s equity-to-total capitalization ratio was 52.1 percent at Dec. 31, 2011. Total capitalization for NSP-Minnesota cannot exceed $8.25 billion.

NSP-Wisconsin shall not pay dividends if its calendar year average equity-to-total capitalization ratio is or falls below the state commission authorized level of 52.5 percent. NSP-Wisconsin’s calendar year average equity-to-total capitalization ratio was 55.1 percent at Dec. 31, 2011.

SPS’ state regulatory commissions indirectly limit the amount of dividends that SPS can pay Xcel Energy Inc. by requiring an equity-to-total capitalization ratio (excluding short-term debt) between 45.0 percent and 55.0 percent. In addition, SPS may not pay a dividend that would cause it to lose its investment grade bond rating. SPS’ equity-to-total capitalization ratio (excluding short-term debt) was 52.0 percent at Dec. 31, 2011.

The issuance of securities by Xcel Energy Inc. generally is not subject to regulatory approval. However, utility financings and certain intra-system financings are subject to the jurisdiction of the applicable state regulatory commissions and/or the FERC under the Federal Power Act.

| | · | PSCo currently has authorization to issue up to $1.15 billion of long-term debt and up to $800 million of short-term debt. |

| | · | SPS currently has authorization to issue up $400 million of short-term debt. |

| | · | NSP-Wisconsin currently has authorization to issue up to $150 million of long-term debt and up to $150 million of short-term debt. |

| | · | NSP-Minnesota has authorization to issue long-term securities provided the equity-to-total capitalization ratio remains between 47.07 percent and 57.53 percent and to issue short-term debt provided it does not exceed 15 percent of total capitalization. Total capitalization for NSP-Minnesota cannot exceed $8.25 billion. |

Xcel Energy believes these authorizations are adequate and will seek additional authorization when necessary; however, there can be no assurance that additional authorization will be granted on the timeframe or in the amounts requested.

5. Joint Ownership of Generation, Transmission and Gas Facilities

Following are the investments by Xcel Energy Inc.’s utility subsidiaries in jointly owned generation, transmission and gas facilities and the related ownership percentages as of Dec. 31, 2011:

| | | | | | | | | Construction | | | | |

| | | Plant in | | | Accumulated | | | Work in | | | | |

| (Thousands of Dollars) | | Service | | | Depreciation | | | Progress | | | Ownership % | |

| NSP-Minnesota | | | | | | | | | | | | |

| Electric Generation: | | | | | | | | | | | | |

| Sherco Unit 3 | | $ | 565,832 | | | $ | 358,907 | | | $ | 3,731 | | | | 59.0 | % |

| Sherco Common Facilities Units 1, 2 and 3 | | | 138,790 | | | | 82,229 | | | | 531 | | | | 80.0 | |

| Sherco Substation | | | 4,790 | | | | 2,621 | | | | - | | | | 59.0 | |

| Electric Transmission: | | | | | | | | | | | | | | | | |

| Grand Meadow Line and Substation | | | 11,204 | | | | 855 | | | | - | | | | 50.0 | |

| CapX2020 Transmission | | | 57,856 | | | | 8,899 | | | | 74,404 | | | | 49.6 | |

| Total NSP-Minnesota | | $ | 778,472 | | | $ | 453,511 | | | $ | 78,666 | | | | | |

| | | | | | | | | Construction | | | | |

| | | Plant in | | | Accumulated | | | Work in | | | | |

| (Thousands of Dollars) | | Service | | | Depreciation | | | Progress | | | Ownership % | |

| PSCo | | | | | | | | | | | | |

| Electric Generation: | | | | | | | | | | | | |

| Hayden Unit 1 | | $ | 88,337 | | | $ | 60,549 | | | $ | 830 | | | | 75.5 | % |

| Hayden Unit 2 | | | 119,621 | | | | 55,126 | | | | 722 | | | | 37.4 | |

| Hayden Common Facilities | | | 34,558 | | | | 14,155 | | | | 1 | | | | 53.1 | |

| Craig Units 1 and 2 | | | 54,058 | | | | 33,225 | | | | 193 | | | | 9.7 | |

| Craig Common Facilities 1, 2 and 3 | | | 35,241 | | | | 15,896 | | | | 2,863 | | | | 6.5 - 9.7 | |

| Comanche Unit 3 | | | 867,976 | | | | 28,973 | | | | 1,014 | | | | 66.7 | |

| Comanche Common Facilities | | | 12,628 | | | | 219 | | | | 169 | | | | 82.0 | |

| Electric Transmission: | | | | | | | | | | | | | | | | |

| Transmission and other facilities, including substations | | | 150,420 | | | | 56,654 | | | | 449 | | | Various | |

| Gas Transportation: | | | | | | | | | | | | | | | | |

| Rifle to Avon | | | 16,278 | | | | 6,333 | | | | - | | | | 60.0 | |

| Total PSCo | | $ | 1,379,117 | | | $ | 271,130 | | | $ | 6,241 | | | | | |

NSP-Minnesota and PSCo have approximately 500 MW and 820 MW of jointly owned generating capacity, respectively. NSP-Minnesota’s and PSCo’s share of operating expenses and construction expenditures are included in the applicable utility accounts. Each of the respective owners is responsible for providing its own financing.

NSP-Minnesota is part owner of Sherco Unit 3, an 860 MW, coal-fueled electric generating unit. NSP-Minnesota is the operating agent under the joint ownership agreement. In November 2011, Sherco Unit 3 experienced a significant failure of its turbine, generator, and exciter systems. The facility was immediately shut down and isolated for investigation of the cause of the failure, which is still uncertain. It is unknown when Sherco Unit 3 will recommence operations. NSP-Minnesota maintains insurance policies for the entire unit, inclusive of the other joint owner’s proportionate share. Replacement and repair of damaged systems, and other significant costs of the failure in excess of a $1.5 million deductible are expected to be recovered through these insurance policies. For its proportionate share of possible expenditures in excess of insurance recoveries for components of the jointly owned facility, NSP-Minnesota will recognize additions to property, plant and equipment and O&M. Sherco Units 1 and 2, wholly owned by NSP-Minnesota, continue to operate.

6. Income Taxes

COLI — In 2007, Xcel Energy Inc., PSCo and the U.S. government settled an ongoing dispute regarding PSCo’s right to deduct interest expense on policy loans related to its COLI program that insured lives of certain PSCo employees. These COLI policies were owned and managed by PSRI. Xcel Energy Inc. and PSCo paid the U.S. government a total of $64.4 million in settlement of the U.S. government’s claims for tax, penalty and interest for tax years 1993 through 2007. Xcel Energy Inc. and PSCo surrendered the policies to its insurer on Oct. 31, 2007, without recognizing a taxable gain. As a result of the settlement, the lawsuit filed by Xcel Energy Inc. and PSCo in the U.S. District Court was dismissed and the Tax Court proceedings were dismissed in December 2010 and January 2011.

As part of the Tax Court proceedings, during 2010, an agreement in principle of Xcel Energy Inc.’s and PSCo’s statements of account was reached, dating back to tax year 1993. Upon completion of this review, PSRI recorded a net non-recurring tax and interest charge of approximately $9.4 million. Upon final cash settlement in 2011, Xcel Energy received $0.7 million and recognized a further reduction of expense of $0.3 million. A closing agreement covering tax years 2003 through 2007 was finalized with the IRS in January 2012.

In 2010, Xcel Energy Inc., PSCo and PSRI entered into a settlement agreement with Provident related to all claims asserted by Xcel Energy Inc., PSCo and PSRI against Provident in a lawsuit associated with the discontinued COLI program. Under the terms of the settlement, Xcel Energy Inc., PSCo and PSRI were paid $25 million by Provident and Reassure America Life Insurance Company in 2010. The $25 million proceeds were not subject to income taxes.

Medicare Part D Subsidy Reimbursements — In March 2010, the Patient Protection and Affordable Care Act was signed into law. The law includes provisions to generate tax revenue to help offset the cost of the new legislation. One of these provisions reduces the deductibility of retiree health care costs to the extent of federal subsidies received by plan sponsors that provide retiree prescription drug benefits equivalent to Medicare Part D coverage, beginning in 2013. Based on this provision, Xcel Energy became subject to additional taxes and was required to reverse previously recorded tax benefits in the period of enactment. Xcel Energy expensed approximately $17 million of previously recognized tax benefits relating to Medicare Part D subsidies during the first quarter of 2010. Xcel Energy does not expect the $17 million of additional tax expense to recur in future periods.

Federal Audit — Xcel Energy files a consolidated federal income tax return. The statute of limitations applicable to Xcel Energy’s 2007 federal income tax return expired in September 2011. The statute of limitations applicable to Xcel Energy’s 2008 federal income tax return expires in September 2012. The IRS commenced an examination of tax years 2008 and 2009 in the third quarter of 2010. In December 2011, Xcel Energy finalized the Revenue Agent Report and signed the Waiver of Assessment for tax years 2008 and 2009. The total assessment for these tax years was $1.4 million, including tax and interest.

State Audits — Xcel Energy files consolidated state tax returns based on income in its major operating jurisdictions of Colorado, Minnesota, Texas, and Wisconsin, and various other state income-based tax returns. As of Dec. 31, 2011, Xcel Energy’s earliest open tax years that are subject to examination by state taxing authorities in its major operating jurisdictions were as follows:

| State | | Year | |

| Colorado | | 2006 | |

| Minnesota | | 2007 | |

| Texas | | 2007 | |

| Wisconsin | | 2007 | |

As of Dec. 31, 2011, there were no state income tax audits in progress.

Unrecognized Tax Benefits —The unrecognized tax benefit balance includes permanent tax positions, which if recognized would affect the annual ETR. In addition, the unrecognized tax benefit balance includes temporary tax positions for which the ultimate deductibility is highly certain but for which there is uncertainty about the timing of such deductibility. A change in the period of deductibility would not affect the ETR but would accelerate the payment of cash to the taxing authority to an earlier period.

A reconciliation of the amount of unrecognized tax benefit is as follows:

| (Millions of Dollars) | | Dec. 31, 2011 | | | Dec. 31, 2010 | |

| Unrecognized tax benefit - Permanent tax positions | | $ | 4.3 | | | $ | 5.9 | |

| Unrecognized tax benefit - Temporary tax positions | | | 30.4 | | | | 34.6 | |

| Unrecognized tax benefit balance | | $ | 34.7 | | | $ | 40.5 | |

A reconciliation of the beginning and ending amount of unrecognized tax benefit is as follows:

| (Millions of Dollars) | | 2011 | | | 2010 | | | 2009 | |

| Balance at Jan. 1 | | $ | 40.5 | | | $ | 30.3 | | | $ | 42.1 | |

| Additions based on tax positions related to the current year - continuing operations | | | 11.9 | | | | 13.4 | | | | 12.6 | |

| Reductions based on tax positions related to the current year - continuing operations | | | (1.9 | ) | | | (0.6 | ) | | | (1.8 | ) |

| Additions for tax positions of prior years - continuing operations | | | 14.0 | | | | 5.5 | | | | 6.8 | |

| Reductions for tax positions of prior years - continuing operations | | | (2.4 | ) | | | (1.8 | ) | | | (2.3 | ) |

| Reductions for tax positions of prior years - discontinued operations | | | - | | | | (6.3 | ) | | | - | |

| Settlements with taxing authorities - continuing operations | | | (27.3 | ) | | | - | | | | (27.1 | ) |

| Lapse of applicable statutes of limitations - continuing operations | | | (0.1 | ) | | | - | | | | - | |

| Balance at Dec. 31 | | $ | 34.7 | | | $ | 40.5 | | | $ | 30.3 | |

The unrecognized tax benefit amounts were reduced by the tax benefits associated with NOL and tax credit carryforwards. The amounts of tax benefits associated with NOL and tax credit carryfowards are as follows:

| (Millions of Dollars) | | Dec. 31, 2011 | | | Dec. 31, 2010 | |

| NOL and tax credit carryforwards | | $ | (33.6 | ) | | $ | (38.0 | ) |

The decrease in the unrecognized tax benefit balance of $5.8 million in 2011 was due to the resolution of certain federal audit matters, partially offset by an increase due to the addition of uncertain tax positions related to current and prior years’ activity. Xcel Energy’s amount of unrecognized tax benefits could change in the next 12 months as the IRS and state audits resume. At this time, due to the uncertain nature of the audit process, it is not reasonably possible to estimate an overall range of possible change. However, Xcel Energy does not anticipate total unrecognized tax benefits will significantly change within the next 12 months.

The payable for interest related to unrecognized tax benefits is substantially offset by the interest benefit associated with NOL and tax credit carryforwards. A reconciliation of the beginning and ending amount of the payable for interest related to unrecognized tax benefits reported is as follows:

| (Millions of Dollars) | | 2011 | | | 2010 | | | 2009 | |

| Payable for interest related to unrecognized tax benefits at Jan. 1 | | $ | (0.3 | ) | | $ | (0.2 | ) | | $ | (0.4 | ) |

| Interest income (expense) related to unrecognized tax benefits - continuing operations | | | 0.9 | | | | (0.6 | ) | | | 1.5 | |

| Interest (expense) income related to unrecognized tax benefits - discontinued operations | | | (0.8 | ) | | | 0.5 | | | | (1.3 | ) |

| Payable for interest related to unrecognized tax benefits at Dec. 31 | | $ | (0.2 | ) | | $ | (0.3 | ) | | $ | (0.2 | ) |

No amounts were accrued for penalties related to unrecognized tax benefits as of Dec. 31, 2011, 2010 or 2009.

Other Income Tax Matters — NOL amounts represent the amount of the tax loss that is carried forward and tax credits represent the deferred tax asset. NOL and tax credit carryforwards as of Dec. 31 were as follows:

| (Millions of Dollars) | | 2011 | | | 2010 | |

| Federal NOL carryforward | | $ | 1,710 | | | $ | 989 | |

| Federal tax credit carryforwards | | | 232 | | | | 205 | |

| State NOL carryforwards | | | 1,707 | | | | 1,363 | |

| Valuation allowances for state NOL carryforwards | | | (51 | ) | | | (32 | ) |

State tax credit carryforwards, net of federal detriment (a) | | | 22 | | | | 21 | |

| Valuation allowances for state tax credit carryforwards, net of federal benefit | | | (2 | ) | | | - | |

| (a) | State tax credit carryforwards are net of federal detriment of $12 million and $11 million as of Dec. 31, 2011 and 2010, respectively. |

The federal carryforward periods expire between 2021 and 2031. The state carryforward periods expire between 2012 and 2031.

Total income tax expense from continuing operations differs from the amount computed by applying the statutory federal income tax rate to income before income tax expense. The following reconciles such differences for the years ending Dec. 31:

| | | 2011 | | | 2010 | | | 2009 | |

| Federal statutory rate | | | 35.0 | % | | | 35.0 | % | | | 35.0 | % |

| Increases (decreases) in tax from: | | | | | | | | | | | | |

| State income taxes, net of federal income tax benefit | | | 4.2 | | | | 3.9 | | | | 4.0 | |

| Resolution of income tax audits and other | | | 0.3 | | | | 0.6 | | | | 0.8 | |

| Tax credits recognized, net of federal income tax expense | | | (2.6 | ) | | | (1.8 | ) | | | (2.0 | ) |

| Regulatory differences — utility plant items | | | (0.8 | ) | | | (1.1 | ) | | | (2.0 | ) |

| Change in unrecognized tax benefits | | | (0.1 | ) | | | 0.1 | | | | (0.5 | ) |

| Life insurance policies | | | (0.1 | ) | | | (0.8 | ) | | | (0.2 | ) |

| Previously recognized Medicare Part D subsidies | | | - | | | | 1.4 | | | | - | |

| Other, net | | | (0.1 | ) | | | (0.6 | ) | | | - | |

| Effective income tax rate from continuing operations | | | 35.8 | % | | | 36.7 | % | | | 35.1 | % |

The components of Xcel Energy’s income tax expense for the years ending Dec. 31 were:

| (Thousands of Dollars) | | 2011 | | | 2010 | | | 2009 | |

| Current federal tax expense (benefit) | | $ | 3,399 | | | $ | 16,657 | | | $ | (39,886 | ) |

| Current state tax expense | | | 9,971 | | | | 12,580 | | | | 8,672 | |

| Current change in unrecognized tax benefit | | | (8,266 | ) | | | (2,982 | ) | | | (7,627 | ) |

| Current tax credits | | | - | | | | (944 | ) | | | - | |

| Deferred federal tax expense | | | 410,794 | | | | 376,073 | | | | 360,252 | |

| Deferred state tax expense | | | 80,670 | | | | 52,543 | | | | 69,947 | |

| Deferred change in unrecognized tax expense | | | 6,705 | | | | 4,641 | | | | 2,387 | |

| Deferred tax credits | | | (28,763 | ) | | | (15,580 | ) | | | (16,005 | ) |

| Deferred investment tax credits | | | (6,194 | ) | | | (6,353 | ) | | | (6,426 | ) |

| Total income tax expense from continuing operations | | $ | 468,316 | | | $ | 436,635 | | | $ | 371,314 | |

The components of Xcel Energy’s net deferred tax liability (current and noncurrent) at Dec. 31 were as follows:

| (Thousands of Dollars) | | 2011 | | | 2010 | |

| Deferred tax liabilities: | | | | | | |

| Differences between book and tax bases of property | | $ | 4,558,951 | | | $ | 3,853,425 | |

| Regulatory assets | | | 253,162 | | | | 242,760 | |

| Other | | | 279,162 | | | | 219,035 | |

| Total deferred tax liabilities | | $ | 5,091,275 | | | $ | 4,315,220 | |

| | | | | | | | | |

| Deferred tax assets: | | | | | | | | |

| NOL carryforward | | $ | 696,435 | | | $ | 425,620 | |

| Tax credit carryforward | | | 254,157 | | | | 226,057 | |

| Unbilled revenue - fuel costs | | | 73,912 | | | | 69,358 | |

| Environmental remediation | | | 45,551 | | | | 41,696 | |

| Rate refund | | | 37,443 | | | | 8,971 | |

| Deferred investment tax credits | | | 37,425 | | | | 39,916 | |

| Regulatory liabilities | | | 37,012 | | | | 51,600 | |

| Accrued liabilities and other | | | 73,092 | | | | 58,891 | |

| NOL and tax credit valuation allowances | | | (5,683 | ) | | | (1,927 | ) |

| Total deferred tax assets | | $ | 1,249,344 | | | $ | 920,182 | |

| Net deferred tax liability | | $ | 3,841,931 | | | $ | 3,395,038 | |

7. Earnings Per Share

Basic EPS was computed by dividing the earnings available to Xcel Energy Inc.’s common shareholders by the weighted average number of common shares outstanding during the period. Diluted EPS was computed by dividing the earnings available to Xcel Energy Inc.’s common shareholders by the diluted weighted average number of common shares outstanding during the period. Diluted EPS reflects the potential dilution that could occur if securities or other agreements to issue common stock (i.e., common stock equivalents), such as equity forward agreements or stock options and other share-based compensation awards were settled.

Common Stock Equivalents — Xcel Energy Inc. currently has common stock equivalents consisting of 401(k) equity awards and stock options, and in 2010, also had equity forward instruments. The weighted average number of potentially dilutive shares outstanding used to calculate Xcel Energy Inc.’s diluted EPS is calculated based on the treasury stock method.

Equity Forward Agreements

In August 2010, Xcel Energy Inc. entered into equity forward agreements in connection with a public offering of 21.85 million shares of its common stock. Under the equity forward agreements (Forward Agreements), Xcel Energy Inc. agreed to issue to the banking counterparty 21.85 million shares of its common stock.

The equity forward instruments were accounted for as equity and recorded at fair value at the execution of the Forward Agreements, and were not subsequently adjusted for changes in fair value until settlement. Based upon the market terms of the equity forward instruments, including initial pricing of $20.855 per share determined based on the August 2010 offering price of Xcel Energy Inc.’s common stock of $21.50 per share less underwriting fees of $0.645 per share, and as no premium on the transaction was owed either party to the Forward Agreements at execution, no fair value was recorded to equity for the instruments when the Forward Agreements were entered. The Forward Agreements settled on Nov. 29, 2010 and the proceeds of $449.8 million were recorded to common stock and additional paid in capital.

Share-Based Compensation

Common stock equivalents related to share-based compensation causing dilutive impact to EPS historically have included 401(k) equity awards and stock options. Stock equivalent units granted to Xcel Energy Inc.’s Board of Directors are included in common shares outstanding upon grant date as there is no further service, performance or market condition associated with these awards. Restricted stock, granted to settle amounts due certain employees under the Xcel Energy Inc. Executive Annual Incentive Award Plan, is included in common shares outstanding when granted, pending remaining service conditions.

Share-based compensation arrangements for which there is currently no dilutive impact to EPS include the following:

| | · | RSU equity awards subject to a performance condition; included in common shares outstanding when all necessary conditions for settlement have been satisfied by the end of the reporting period. |

| | · | PSP liability awards subject to a performance condition; any portions settled in shares are included in common shares outstanding upon settlement. |

The dilutive impact of common stock equivalents affecting EPS was as follows for the years ending Dec. 31:

| | | 2011 | | | 2010 | | | 2009 | |

| (Amounts in thousands, except per share data) | | Income | | | Share | | | Per Share Amount | | | Income | | | Share | | | Per Share Amount | | | Income | | | Share | | | Per Share Amount | |

| Net income | | $ | 841,172 | | | | | | | | | | | $ | 755,834 | | | | | | | | | | | $ | 680,887 | | | | | | | | | |

| Less: Dividend requirements on preferred stock | | | (3,534 | ) | | | | | | | | | (4,241 | ) | | | | | | | | | (4,241 | ) | | | | | | |

| Less: Premium on redemption of preferred stock | | | (3,260 | ) | | | | | | | | | - | | | | | | | | | | - | | | | | | | |

| Basic earnings per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings available to common shareholders | | | 834,378 | | | 485,039 | | | $ | 1.72 | | | | 751,593 | | | 462,052 | | | $ | 1.63 | | | | 676,646 | | | 456,433 | | | $ | 1.48 | |

| Effect of dilutive securities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity forward instruments | | | - | | | - | | | | | | | | - | | | 700 | | | | | | | | - | | | - | | | | | |

| 401(k) equity awards | | | - | | | 576 | | | | | | | | - | | | 639 | | | | | | | | - | | | 705 | | | | | |

| Stock options | | | - | | | - | | | | | | | | - | | | - | | | | | | | | - | | | 1 | | | | | |

| Diluted earnings per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings available to common shareholders | | $ | 834,378 | | | 485,615 | | | $ | 1.72 | | | $ | 751,593 | | | 463,391 | | | $ | 1.62 | | | $ | 676,646 | | | 457,139 | | | $ | 1.48 | |

In 2011, 2010 and 2009, Xcel Energy Inc. had approximately 2.1 million, 5.4 million and 7.6 million weighted average options outstanding, respectively, that were antidilutive, and therefore, excluded from the earnings per share calculation.

8. Share-Based Compensation

Stock Options — Xcel Energy Inc. has incentive compensation plans under which stock options and other performance incentives are awarded to key employees. Xcel Energy Inc. has not granted stock options since December 2001.

Activity in stock options was as follows:

| | | 2011 | | | 2010 | | | 2009 | |

| | | | | | Average | | | | | | Average | | | | | | Average | |

| | | | | | Exercise | | | | | | Exercise | | | | | | Exercise | |

| (Awards in Thousands) | | Awards | | | Price | | | Awards | | | Price | | | Awards | | | Price | |

| Outstanding and exercisable at Jan. 1 | | | 2,498 | | | $ | 30.42 | | | | 6,657 | | | $ | 28.17 | | | | 8,460 | | | $ | 27.05 | |

| Exercised | | | (1,173 | ) | | | 25.90 | | | | (51 | ) | | | 19.31 | | | (794 | ) | | | 19.84 | |

| Forfeited | | | - | | | | - | | | | - | | | | - | | | (11 | ) | | | 20.04 | |

| Expired | | | (1,325 | ) | | | 34.42 | | | | (4,108 | ) | | | 26.91 | | | (998 | ) | | | 25.40 | |

| Outstanding and exercisable at Dec. 31 | | | - | | | | - | | | | 2,498 | | | | 30.42 | | | 6,657 | | | | 28.17 | |

The total market value and the total intrinsic value of stock options exercised were as follows for the years ended Dec. 31:

| (Thousands of Dollars) | | 2011 | | | 2010 | | | 2009 | |

| Market value of exercises | | $ | 30,761 | | | $ | 1,087 | | | $ | 16,429 | |

Intrinsic value of options exercised (a) | | | 380 | | | | 93 | | | | 670 | |

| (a) | Intrinsic value is calculated as market price at exercise date less the option exercise price. |

Cash received from stock options exercised and the actual tax benefit realized for the tax deductions from stock options exercised during the years ended Dec. 31 were as follows:

| (Thousands of Dollars) | | 2011 | | | 2010 | | | 2009 | |

| Cash received from stock options exercised | | $ | 30,381 | | | $ | 1,033 | | | $ | 15,759 | |

| Tax benefit realized for the tax deductions from stock options exercised | | | 157 | | | | 40 | | | | 277 | |

Restricted Stock — Certain employees may elect to receive shares of common or restricted stock under the Xcel Energy Inc. Executive Annual Incentive Award Plan. Restricted stock vests and settles in equal annual installments over a three-year period. Xcel Energy Inc. reinvests dividends on the restricted stock it holds while restrictions are in place. Restrictions also apply to the additional shares of restricted stock acquired through dividend reinvestment. If the restricted shares are forfeited, the employee is not entitled to the dividends on those shares. Restricted stock has a fair value equal to the market trading price of Xcel Energy Inc.’s stock at the grant date.

Xcel Energy Inc. granted shares of restricted stock for the years ended Dec. 31 as follows:

| (Shares in Thousands) | | 2011 | | 2010 | | 2009 | |

| Granted shares | | | 15 | | | | 44 | | | | - | |

| Grant date fair value | | $ | 23.62 | | | $ | 20.47 | | | $ | - | |

A summary of the changes of nonvested restricted stock for the year ended Dec. 31, 2011 were as follows:

| (Shares in Thousands) | | Shares | | | Weighted Average Grant Date Fair Value | |

| Nonvested restricted stock at Jan. 1 | | | 55 | | | $ | 20.28 | |

| Granted | | | 15 | | | | 23.62 | |

| Vested | | | (25 | ) | | | 20.53 | |

| Dividend equivalents | | | 2 | | | | 24.37 | |

| Nonvested restricted stock at Dec. 31 | | | 47 | | | | 21.36 | |

Restricted Stock Units (RSUs) — Xcel Energy Inc.’s Board of Directors has granted RSUs under the Xcel Energy Inc. 2005 Long-term Incentive Plan (as amended and restated in 2010). The plan allows the attachment of various performance goals to the RSUs granted. The performance goals may vary by plan year. At the end of the restricted performance period, the grants will be awarded if the performance goals are met. If the goals are not achieved by the end of the restricted performance period, all associated restricted stock units and dividend equivalents are forfeited.

For RSUs issued in 2009 and 2010, if the performance criteria have not been met within four years of the grant date, all RSUs, plus associated dividend equivalents, shall be forfeited. The performance conditions for RSUs granted in 2011 will be measured three years after the grant date, at which time the RSUs, plus associated dividend equivalents, will either be settled or forfeited. Payout of the RSUs and the lapsing of restrictions on the transfer of units are based on one of two separate performance criteria.

The performance conditions for a portion of the awarded units are based on EPS growth, with an additional condition that Xcel Energy Inc.’s annual dividend paid on its common stock remains at a specified amount per share or greater. RSUs issued in 2009 and 2010, plus associated dividend equivalents, will be settled and the restricted period will lapse after Xcel Energy Inc. achieves a specified level of EPS growth. RSUs issued in 2011, plus associated dividend equivalents, will be settled or forfeited and the restricted period will lapse after three years, with potential payouts ranging from 0 percent to 150 percent, depending on the level of EPS growth.

The performance conditions for the remaining awarded units are based on environmental performance. RSUs issued in 2009 and 2010, plus associated dividend equivalents, will be settled and the restricted period will lapse after Xcel Energy Inc. achieves a specified level of environmental performance, based on established indicators. RSUs issued in 2011, plus associated dividend equivalents, will be settled or forfeited and the restricted period will lapse after three years with potential payouts ranging from 0 percent to 150 percent, depending on the level of environmental performance, based on established indicators.

The 2007 environmental RSUs met their target as of Dec. 31, 2009 and were settled in shares in February 2010. The 2007 RSUs measured on EPS growth and all 2008 RSUs met their targets as of Dec. 31, 2010 and were settled in shares in February 2011. The 2010 RSUs measured on EPS growth and all 2009 RSUs met their targets as of Dec. 31, 2011, and will be settled in shares in February 2012.

The RSUs granted for the years ended Dec. 31 were as follows:

| (Units in Thousands) | | 2011 | | | 2010 | | | 2009 | |

| Granted units | | | 828 | | | | 601 | | | | 597 | |

| Weighted average grant date fair value | | $ | 23.63 | | | $ | 21.26 | | | $ | 18.88 | |

A summary of the changes of nonvested RSUs for the year ended Dec. 31, 2011, were as follows:

| (Units in Thousands) | | Units | | | Weighted Average Grant Date Fair Value | |

| Nonvested restricted stock units at Jan. 1 | | | 1,138 | | | $ | 20.12 | |

| Granted | | | 828 | | | | 23.63 | |

| Forfeited | | | (270 | ) | | | 21.50 | |

| Vested | | | (1,091 | ) | | | 20.45 | |

| Dividend equivalents | | | 68 | | | | 21.18 | |

| Nonvested restricted stock units at Dec. 31 | | | 673 | | | | 23.46 | |

The total fair value of nonvested RSUs as of Dec. 31, 2011 was $18.6 million and the weighted average remaining contractual life was 2.0 years.

Approximately 1.1 million RSUs vested during 2011 at a total fair value of $30.1 million. Approximately 0.6 million RSUs vested during 2010 at a total fair value of $14.8 million. Approximately 0.04 million RSUs vested during 2009 at a total fair value of $0.8 million.

Stock Equivalent Unit Plan — Non-employee members of the Xcel Energy Inc. Board of Directors receive annual awards of stock equivalent units, with each unit having a value equal to one share of Xcel Energy Inc. common stock. The annual grants are vested as of the date of each member’s election to the board of directors; there is no further service or other condition attached to the annual grants after the member has been elected to the board. Additionally, directors may elect to receive their fees in stock equivalent units in lieu of cash, and similarly have no further service or other conditions attached. Dividends on Xcel Energy Inc.’s common stock are converted to stock equivalent units and granted based on the number of stock equivalent units held by each participant as of the dividend date. The stock equivalent units are payable as a distribution of Xcel Energy Inc.’s common stock upon a director’s termination of service.

The stock equivalent units granted for the years ended Dec. 31 were as follows:

| (Units in Thousands) | | 2011 | | | 2010 | | | 2009 | |

| Granted units | | | 60 | | | | 66 | | | | 72 | |

| Grant date fair value | | $ | 25.12 | | | $ | 21.14 | | | $ | 17.87 | |

A summary of the stock equivalent unit changes for the year ended Dec. 31, 2011 are as follows:

| (Units in Thousands) | | Units | | | Weighted Average Grant Date Fair Value | |

| Stock equivalent units at Jan. 1 | | | 471 | | | $ | 19.90 | |

| Granted | | | 60 | | | | 25.12 | |

| Units distributed | | | (29 | ) | | | 20.31 | |

| Dividend equivalents | | | 20 | | | | 24.38 | |

| Stock equivalent units at Dec. 31 | | | 522 | | | | 20.65 | |

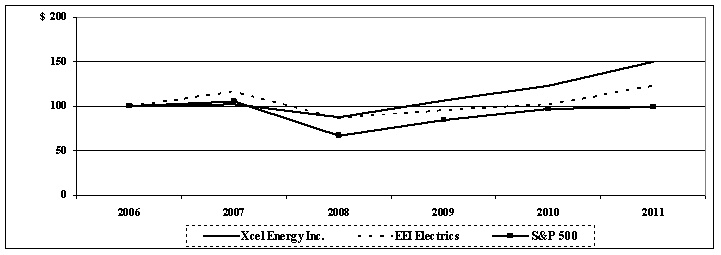

PSP Awards — Xcel Energy Inc.’s Board of Directors has granted PSP awards under the Xcel Energy Inc. 2005 Long-term Incentive Plan (as amended and restated effective in 2010). The plan allows Xcel Energy to attach various performance goals to the PSP awards granted. The PSP awards have been historically dependent on a single measure of performance, Xcel Energy Inc.’s TSR measured over a three-year period. Xcel Energy Inc.’s TSR is compared to the TSR of other companies in the EEI Investor-Owned Electrics index. At the end of the three-year period, potential payouts of the PSP awards range from 0 percent to 200 percent, depending on Xcel Energy Inc.’s TSR compared to the peer group.

The PSP awards granted for the years ended Dec. 31 were as follows:

| (In Thousands) | | 2011 | | | 2010 | | | 2009 | |

| Awards granted | | | 311 | | | | 225 | | | | 207 | |

The total amounts of performance awards settled during the years ended Dec. 31 were as follows:

| (In Thousands) | | 2011 | | | 2010 | | | 2009 | |

| Awards settled | | | 305 | | | | 267 | | | | 293 | |

| Settlement amount (cash and common stock) | | $ | 7,200 | | | $ | 5,460 | | | $ | 5,195 | |

The amount of cash used to settle Xcel Energy’s PSP awards was $3.6 million and $2.7 million in 2011 and 2010, respectively.

Share-Based Compensation Expense — The vesting of the RSUs is predicated on the achievement of a performance condition, which is the achievement of an earnings per share or environmental measures target. RSU awards and restricted stock are considered to be equity awards, since the plan settlement determination (shares or cash) resides with Xcel Energy and not the participants. In addition, these awards have not been previously settled in cash and Xcel Energy plans to continue electing share settlement. The grant date fair value of RSUs and restricted stock is expensed as employees vest in their rights to those awards.

The PSP awards have been historically settled partially in cash, and therefore, do not qualify as an equity award, but rather are accounted for as a liability award. As liability awards, the fair value on which ratable expense is based, as employees vest in their rights to those awards, is remeasured each period based on the current stock price and performance conditions, and final expense is based on the market value of the shares on the date the award is settled.

The compensation costs related to share-based awards for the years ended Dec. 31 were as follows:

| (Thousands of Dollars) | | 2011 | | | 2010 | | | 2009 | |

Compensation cost for share-based awards (a) (b) | | $ | 45,006 | | | $ | 35,807 | | | $ | 29,672 | |

| Tax benefit recognized in income | | | 17,559 | | | | 13,964 | | | | 11,471 | |

| Total compensation cost capitalized | | | 3,857 | | | | 3,646 | | | | 3,636 | |

| (a) | Compensation costs for share-based payment arrangements is included in other O&M expense in the consolidated statements of income. |

| (b) | Included in compensation cost for share-based awards are matching contributions related to the Xcel Energy 401(k) plan, which totaled $21.6 million, $20.7 million and $19.3 million for the years ended 2011, 2010 and 2009, respectively. |

The maximum aggregate number of shares of common stock available for issuance under the Xcel Energy Inc. 2005 Long-term Incentive Plan (as amended and restated effective Feb. 17, 2010) is 8.3 million shares. Under the Xcel Energy Inc. Executive Annual Incentive Award Plan (as amended and restated effective Feb. 17, 2010), the total number of shares approved for issuance is 1.2 million shares.

As of Dec. 31, 2011 and 2010, there was approximately $15.4 million and $18.6 million, respectively, of total unrecognized compensation cost related to nonvested share-based compensation awards. Xcel Energy expects to recognize that cost over a weighted average period of 1.9 years.

9. Benefit Plans and Other Postretirement Benefits

Xcel Energy offers various benefit plans to its employees. Approximately 50 percent of employees that receive benefits are represented by several local labor unions under several collective-bargaining agreements. At Dec. 31, 2011:

| | · | NSP-Minnesota had 2,033 and NSP-Wisconsin had 405 bargaining employees covered under a collective-bargaining agreement, which expires at the end of 2013. NSP-Minnesota also had an additional 228 nuclear operation bargaining employees covered under several collective-bargaining agreements, which expire at various dates in 2012 and 2013. |

| | · | PSCo had 2,122 bargaining employees covered under a collective-bargaining agreement, which expires in May 2014. |

| | · | SPS had 804 bargaining employees covered under a collective-bargaining agreement, which expires in October 2014. |

The plans invest in various instruments which are disclosed under the accounting guidance for fair value measurements which establishes a hierarchal framework for disclosing the observability of the inputs utilized in measuring fair value. The three levels in the hierarchy and examples of each level are as follows:

Level 1 — Quoted prices are available in active markets for identical assets as of the reporting date. The types of assets included in Level 1 are highly liquid and actively traded instruments with quoted prices, such as common stocks listed by the New York Stock Exchange.

Level 2 — Pricing inputs are other than quoted prices in active markets, but are either directly or indirectly observable as of the reporting date. The types of assets included in Level 2 are typically either comparable to actively traded securities or contracts or priced with models using highly observable inputs, such as corporate bonds with pricing based on market interest rate curves and recent trades of similarly rated securities.

Level 3 — Significant inputs to pricing have little or no observability as of the reporting date. The types of assets included in Level 3 are those with inputs requiring significant management judgment or estimation, such as private equity investments and real estate investments, for which the measurement of net asset value requires significant use of unobservable inputs when determining the fair value of the underlying fund investments, including equity in non-publicly traded entities and real estate properties.

Pension Benefits

Xcel Energy has several noncontributory, defined benefit pension plans that cover almost all employees. Benefits are based on a combination of years of service, the employee’s average pay and social security benefits. Xcel Energy’s policy is to fully fund into an external trust the actuarially determined pension costs recognized for ratemaking and financial reporting purposes, subject to the limitations of applicable employee benefit and tax laws.

Xcel Energy bases the investment-return assumption on expected long-term performance for each of the investment types included in its pension asset portfolio. Xcel Energy considers the actual historical returns achieved by its asset portfolio over the past 20-year or longer period, as well as the long-term return levels projected and recommended by investment experts. The historical weighted average annual return for the past 20 years for the Xcel Energy portfolio of pension investments is 8.73 percent, which is greater than the current assumption level. The pension cost determination assumes a forecasted mix of investment types over the long term. Investment returns were above the assumed levels of 7.50, 7.79 and 8.50 percent in 2011, 2010 and 2009, respectively. Xcel Energy continually reviews its pension assumptions. In 2012, Xcel Energy’s expected investment return assumption is 7.10 percent.

The assets are invested in a portfolio according to Xcel Energy’s return, liquidity and diversification objectives to provide a source of funding for plan obligations and minimize the necessity of contributions to the plan, within appropriate levels of risk. The principal mechanism for achieving these objectives is the projected allocation of assets to selected asset classes, given the long-term risk, return, and liquidity characteristics of each particular asset class. There were no significant concentrations of risk in any particular industry, index, or entity; however, as Xcel Energy has experienced in recent years, unusual market volatility can impact even well-diversified portfolios and significantly affect the return levels achieved by pension assets in any year.

The following table presents the target pension asset allocations for Xcel Energy:

| | | 2011 | | | 2010 | |

| Domestic and international equity securities | | | 27 | % | | | 24 | % |

| Long-duration fixed income securities | | | 31 | | | | 41 | |

| Short-to-intermediate fixed income securities | | | 12 | | | | 11 | |

| Alternative investments | | | 27 | | | | 17 | |

| Cash | | | 3 | | | | 7 | |

| Total | | | 100 | % | | | 100 | % |

Xcel Energy’s ongoing investment strategy is based on plan-specific investment recommendations that seek to minimize potential investment and interest rate risk as a plan’s funded status increases over time. The investment recommendations result in a greater percentage of long-duration fixed income securities being allocated to specific plans having relatively higher funded status ratios, and a greater percentage of growth assets being allocated to plans having relatively lower funded status ratios. The aggregate projected asset allocation presented in the table above for the master pension trust results from the plan-specific strategies.

Pension Plan Assets

The following tables present, for each of the fair value hierarchy levels, Xcel Energy’s pension plan assets that are measured at fair value as of Dec. 31, 2011 and 2010:

| | | Dec. 31, 2011 | |

| (Thousands of Dollars) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Cash equivalents | | $ | 147,590 | | | $ | - | | | $ | - | | | $ | 147,590 | |

| Derivatives | | | - | | | | 8,011 | | | | - | | | | 8,011 | |

| Government securities | | | - | | | | 301,999 | | | | - | | | | 301,999 | |

| Corporate bonds | | | - | | | | 606,001 | | | | - | | | | 606,001 | |

| Asset-backed securities | | | - | | | | - | | | | 31,368 | | | | 31,368 | |

| Mortgage-backed securities | | | - | | | | - | | | | 73,522 | | | | 73,522 | |

| Common stock | | | 68,553 | | | | - | | | | - | | | | 68,553 | |

| Private equity investments | | | - | | | | - | | | | 159,363 | | | | 159,363 | |

| Commingled funds | | | - | | | | 1,292,569 | | | | - | | | | 1,292,569 | |

| Real estate | | | - | | | | - | | | | 37,106 | | | | 37,106 | |

| Securities lending collateral obligation and other | | | - | | | | (55,802 | ) | | | - | | | | (55,802 | ) |

| Total | | $ | 216,143 | | | $ | 2,152,778 | | | $ | 301,359 | | | $ | 2,670,280 | |

| | | Dec. 31, 2010 | |

| (Thousands of Dollars) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Cash equivalents | | $ | 122,643 | | | $ | 135,710 | | | $ | - | | | $ | 258,353 | |

| Derivatives | | | - | | | | 8,140 | | | | - | | | | 8,140 | |

| Government securities | | | - | | | | 117,522 | | | | - | | | | 117,522 | |

| Corporate bonds | | | - | | | | 641,807 | | | | - | | | | 641,807 | |

| Asset-backed securities | | | - | | | | - | | | | 26,986 | | | | 26,986 | |

| Mortgage-backed securities | | | - | | | | - | | | | 113,418 | | | | 113,418 | |

| Common stock | | | 117,899 | | | | - | | | | - | | | | 117,899 | |

| Private equity investments | | | - | | | | - | | | | 122,223 | | | | 122,223 | |

| Commingled funds | | | - | | | | 1,152,386 | | | | - | | | | 1,152,386 | |

| Real estate | | | - | | | | - | | | | 73,701 | | | | 73,701 | |

| Securities lending collateral obligation and other | | | - | | | | (91,727 | ) | | | - | | | | (91,727 | ) |

| Total | | $ | 240,542 | | | $ | 1,963,838 | | | $ | 336,328 | | | $ | 2,540,708 | |

The following tables present the changes in Xcel Energy’s Level 3 pension plan assets for the years ended Dec. 31, 2011, 2010 and 2009:

| | | | | | | | | | | | Purchases, | | | | |

| | | | | | Net Realized | | | Net Unrealized | | | Issuances, and | | | | |

| (Thousands of Dollars) | | Jan. 1, 2011 | | | Gains (Losses) | | | Gains (Losses) | | | Settlements, Net | | | Dec. 31, 2011 | |

| Asset-backed securities | | $ | 26,986 | | | $ | 2,391 | | | $ | (2,504 | ) | | $ | 4,495 | | | $ | 31,368 | |

| Mortgage-backed securities | | | 113,418 | | | | 1,103 | | | | (5,926 | ) | | | (35,073 | ) | | | 73,522 | |

| Real estate | | | 73,701 | | | | (629 | ) | | | 20,271 | | | | (56,237 | ) | | | 37,106 | |

| Private equity investments | | | 122,223 | | | | 3,971 | | | | 12,412 | | | | 20,757 | | | | 159,363 | |

| Total | | $ | 336,328 | | | $ | 6,836 | | | $ | 24,253 | | | $ | (66,058 | ) | | $ | 301,359 | |

| | | | | | | | | | | | Purchases, | | | | |

| | | | | | Net Realized | | | Net Unrealized | | | Issuances, and | | | | |

| (Thousands of Dollars) | | Jan. 1, 2010 | | | Gains (Losses) | | | Gains (Losses) | | | Settlements, Net | | | Dec. 31, 2010 | |

| Asset-backed securities | | $ | 47,825 | | | $ | 3,400 | | | $ | (7,078 | ) | | $ | (17,161 | ) | | $ | 26,986 | |

| Mortgage-backed securities | | | 144,006 | | | | 13,719 | | | | (19,095 | ) | | | (25,212 | ) | | | 113,418 | |

| Real estate | | | 66,704 | | | | (1,135 | ) | | | 8,235 | | | | (103 | ) | | | 73,701 | |

| Private equity investments | | | 82,098 | | | | (1,008 | ) | | | (24 | ) | | | 41,157 | | | | 122,223 | |

| Total | | $ | 340,633 | | | $ | 14,976 | | | $ | (17,962 | ) | | $ | (1,319 | ) | | $ | 336,328 | |

| | | | | | | | | | | | Purchases, | | | | |

| | | | | | Net Realized | | | Net Unrealized | | | Issuances, and | | | | |

| (Thousands of Dollars) | | Jan. 1, 2009 | | | Gains (Losses) | | | Gains (Losses) | | | Settlements, Net | | | Dec. 31, 2009 | |

| Asset-backed securities | | $ | 77,398 | | | $ | 2,365 | | | $ | 45,920 | | | $ | (77,858 | ) | | $ | 47,825 | |

| Mortgage-backed securities | | | 166,610 | | | | 5,531 | | | | 97,939 | | | | (126,074 | ) | | | 144,006 | |

| Real estate | | | 109,289 | | | | (569 | ) | | | (42,638 | ) | | | 622 | | | | 66,704 | |

| Private equity investments | | | 81,034 | | | | - | | | | (5,682 | ) | | | 6,746 | | | | 82,098 | |

| Total | | $ | 434,331 | | | $ | 7,327 | | | $ | 95,539 | | | $ | (196,564 | ) | | $ | 340,633 | |

Benefit Obligations — A comparison of the actuarially computed pension benefit obligation and plan assets for Xcel Energy is presented in the following table:

| (Thousands of Dollars) | | 2011 | | | 2010 | |

| Accumulated Benefit Obligation at Dec. 31 | | $ | 3,073,637 | | | $ | 2,865,845 | |

| | | | | | | | | |

| Change in Projected Benefit Obligation: | | | | | | | | |

| Obligation at Jan. 1 | | $ | 3,030,292 | | | $ | 2,829,631 | |

| Service cost | | | 77,319 | | | | 73,147 | |

| Interest cost | | | 161,412 | | | | 165,010 | |

| Plan amendments | | | - | | | | 18,739 | |

| Actuarial loss | | | 195,369 | | | | 169,203 | |

| Benefit payments | | | (238,173 | ) | | | (225,438 | ) |

| Obligation at Dec. 31 | | $ | 3,226,219 | | | $ | 3,030,292 | |

| (Thousands of Dollars) | | 2011 | | | 2010 | |

| Change in Fair Value of Plan Assets: | | | | | | |