UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | December 31, 2015 |

Item 1. Reports to Stockholders

ContentsPerformance: The Bottom LineManagement's Discussion of Fund PerformanceShareholder Expense ExampleInvestment Changes (Unaudited)Investments December 31, 2015Financial StatementsNotes to Financial StatementsReport of Independent Registered Public Accounting FirmTrustees and OfficersDistributions (Unaudited)Board Approval of Investment Advisory Contracts and Management FeesContentsPerformance: The Bottom LineManagement's Discussion of Fund PerformanceShareholder Expense ExampleInvestment Changes (Unaudited)Investments December 31, 2015Financial StatementsNotes to Financial StatementsReport of Independent Registered Public Accounting FirmTrustees and OfficersDistributions (Unaudited)Board Approval of Investment Advisory Contracts and Management Fees

(Fidelity Investment logo)(registered trademark)

Fidelity Advisor®

Emerging Markets Income

Fund - Class A, Class T, Class B

and Class C

Annual Report

December 31, 2015

(Fidelity Cover Art)

Contents

Performance | (Click Here) | How the fund has done over time. |

Management's Discussion of Fund Performance | (Click Here) | The Portfolio Manager's review of fund performance and strategy. |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

Trustees and Officers | (Click Here) | |

Distributions | (Click Here) | |

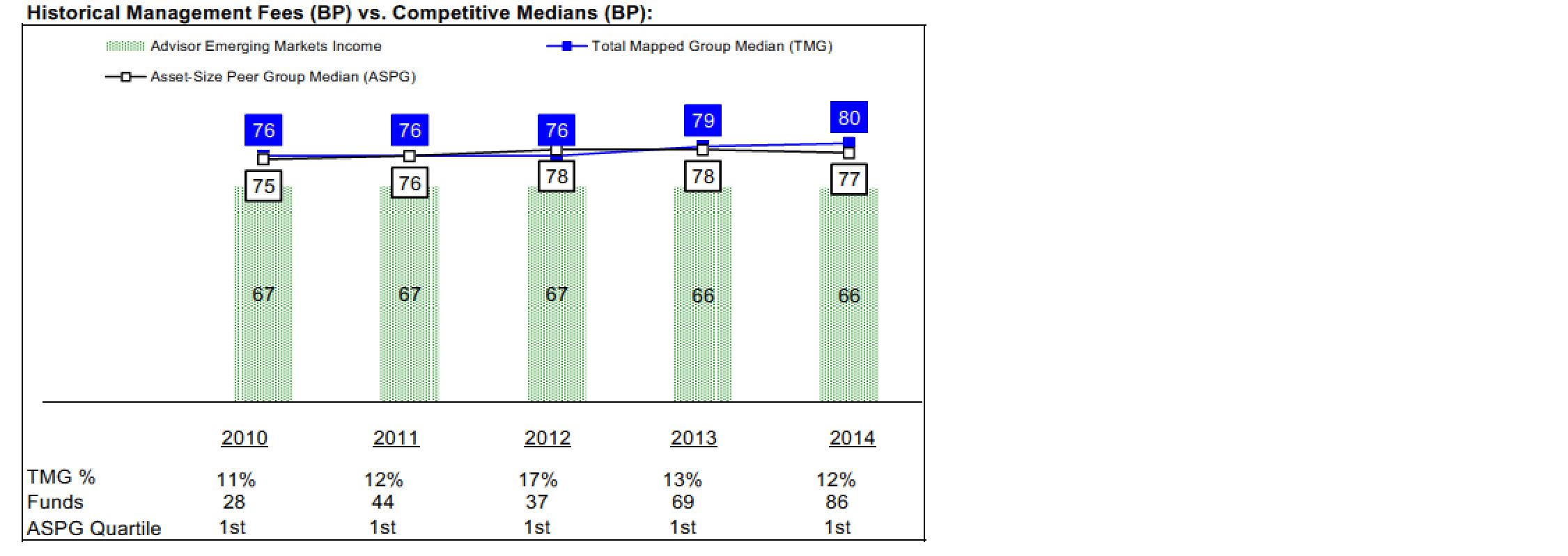

Board Approval of Investment Advisory Contracts and Management Fees | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2016 FMR LLC. All rights reserved.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

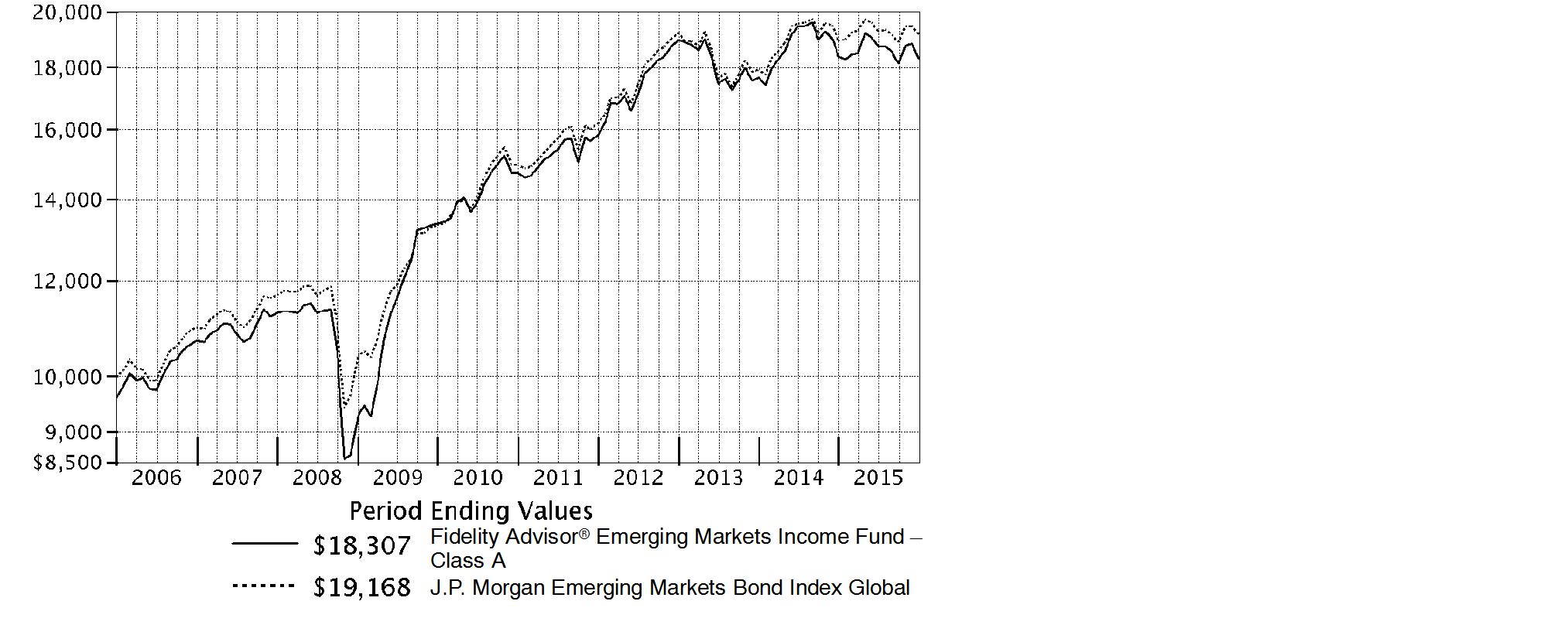

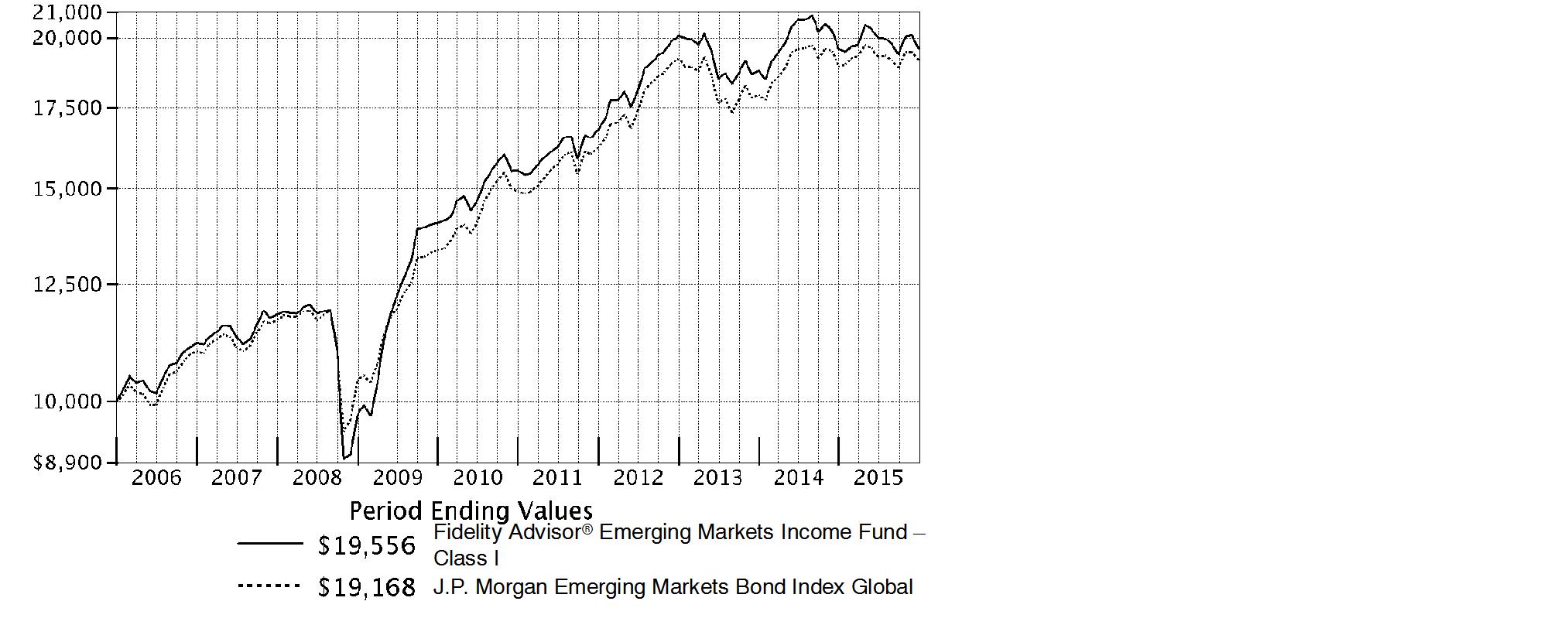

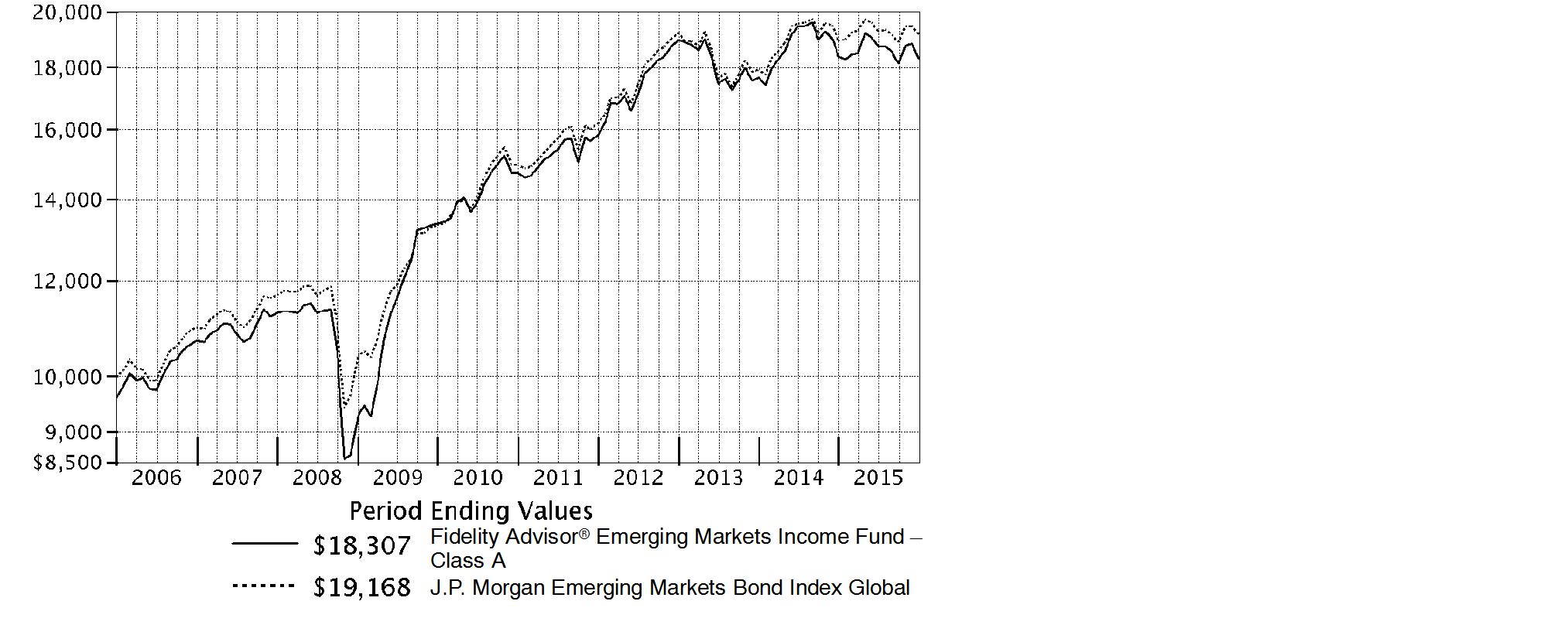

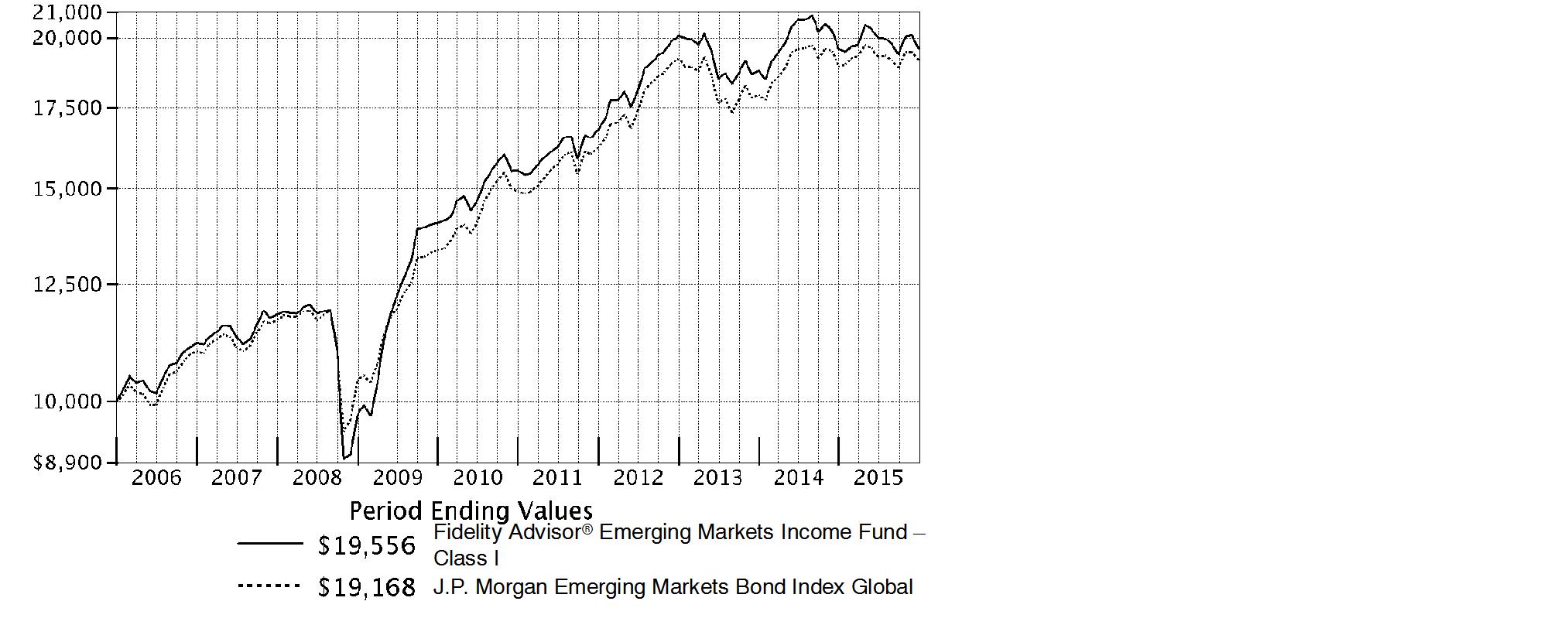

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow. Returns reflect the conversion of Class B shares to Class A shares after a maximum of seven years.

Average Annual Total Returns

Periods ended December 31, 2015 | Past 1

year | Past 5

years | Past 10

years |

Class A (incl. 4.00% sales charge) | -4.32% | 3.58% | 6.23% |

Class T (incl. 4.00% sales charge) | -4.39% | 3.54% | 6.20% |

Class B (incl. contingent deferred sales charge) A | -5.74% | 3.35% | 6.16% |

Class C (incl. contingent deferred sales charge) B | -1.92% | 3.67% | 5.87% |

A Class B shares' contingent deferred sales charges included in the past one year, past five years, and past ten years total return figures are 5%, 2%, and 0%, respectively.

B Class C shares' contingent deferred sales charges included in the past one year, past five years, and past ten years total return figures are 1%, 0%, and 0%, respectively.

Annual Report

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Emerging Markets Income Fund - Class A on December 31, 2005, and the current 4.00% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the J.P. Morgan Emerging Markets Bond Index Global performed over the same period.

Annual Report

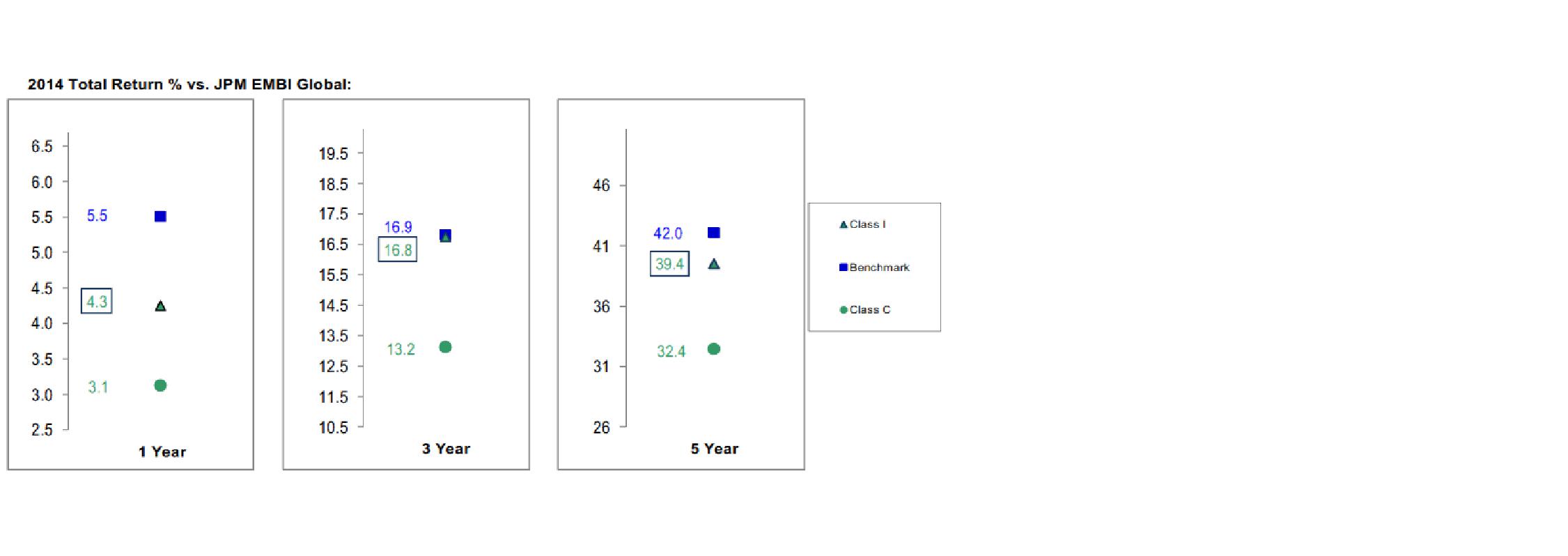

Market Recap: Even against a number of macroeconomic challenges, the emerging-markets (EM) debt asset class, as measured by the J.P. Morgan Emerging Markets Bond Index Global, returned 1.23% for the 12 months ending December 31, 2015. Of the five regions that make up the EM debt universe, Europe strongly outpaced the benchmark return. This was driven by strength across most Eastern European credits, such as Hungary (+6%) and Poland (+3%), which were viewed as safe havens amid volatile markets. Also driving the outperformance of this region were Russia (+21%) and Ukraine (+42%) None of the other regions outperformed the benchmark, but there were select areas of strength among individual countries. Argentina (+27%) and Venezuela (+17%) both helped to drive the outperformance of the non-investment grade portion of the benchmark. Turning to laggards, Latin America and Africa underperformed by a wide margin. Brazil (-14%) was the main factor in the former region's underperformance, but several countries here also experienced weakness, including Colombia (-7%), Mexico (-6%) and Chile (-3%). Within Africa, most countries in the sub-Saharan region underperformed. A number of these countries are dependent on resources to fund their budgets and experienced budget difficulties during the past year, including South Africa (-5%).

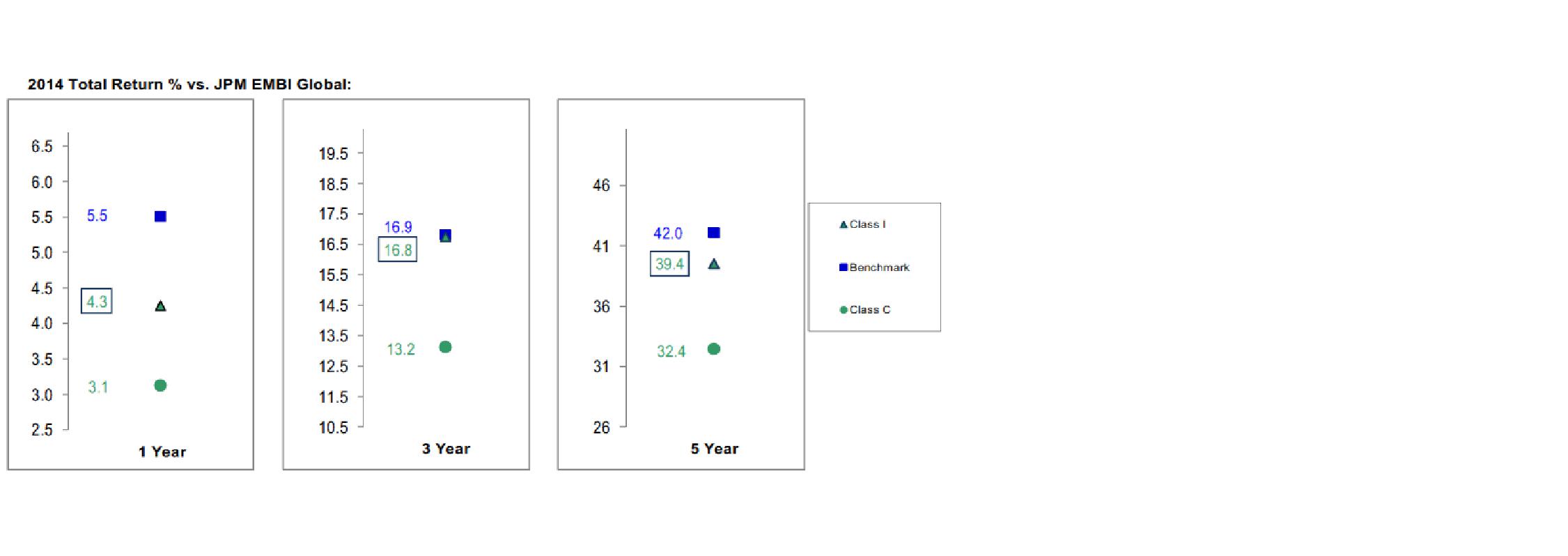

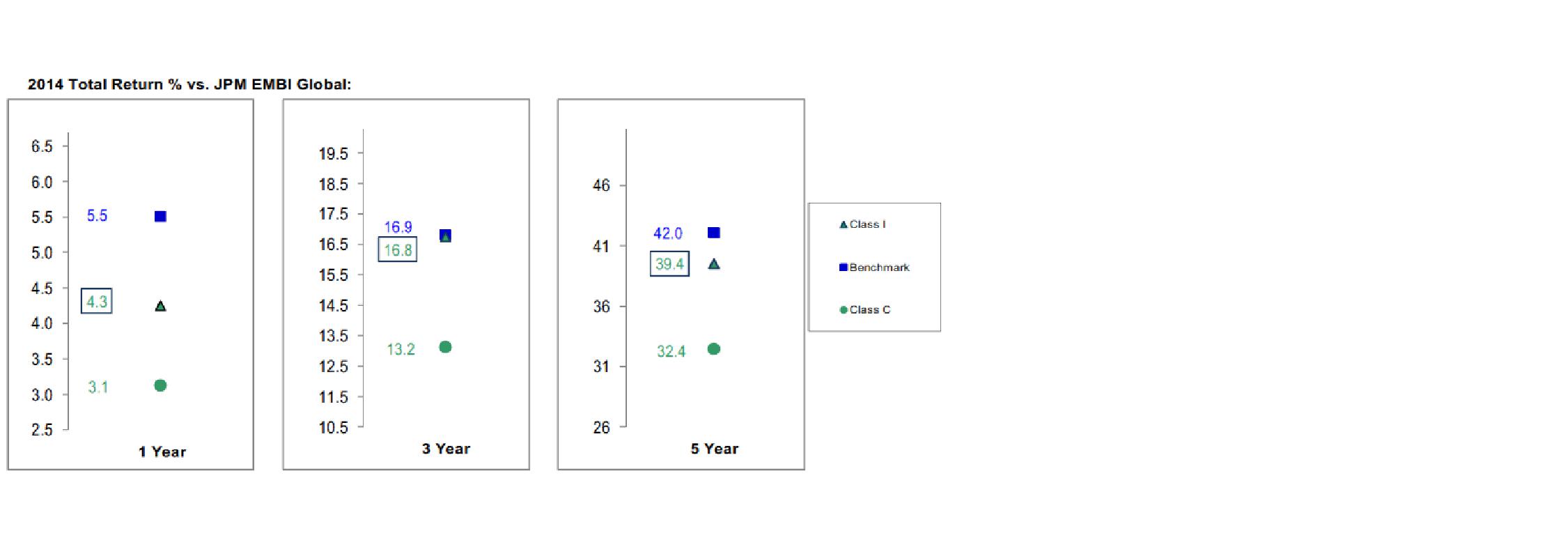

Comments from Portfolio Manager John Carlson: The fund's share classes (excluding sales charges, if applicable) underperformed the J.P. Morgan index during the past year. Positioning in in Brazil and security selection in China detracted from relative performance. Standard & Poor's downgraded Brazil's debt to below investment grade due to the country's economic and political issues. In concert with this, bond prices weakened to the point that Brazilian debt began to trade as a low single-B credit. In China, holdings of several individual stocks and an exchange-traded fund (ETF) weighed on performance given the decline in EM equities over the period. Elsewhere, a non-benchmark stake in 30-year U.S. Treasury bonds also hurt the funds relative result, as did an underweighting in strong-performing Argentina. Conversely, holding heavier-than-benchmark exposure in the debt of both Venezuelan sovereign bonds and the country's state oil company Petroleos de Venezuela lifted results. Prices of Venezuela bonds declined in the latter part of 2014 at the inception of the bear market in oil, but the Venezuelan government continued to service debt throughout 2015, leading to the bonds' outperformance. An overweighting in Russia and positioning in Ukraine also helped.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2015 to December 31, 2015).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report

| Annualized

Expense RatioB | Beginning

Account Value

July 1, 2015 | Ending

Account Value

December 31, 2015 | Expenses Paid

During PeriodC

July 1, 2015 to

December 31, 2015 |

Class A | 1.14% | | | |

Actual | | $ 1,000.00 | $ 977.20 | $ 5.68 |

HypotheticalA | | $ 1,000.00 | $ 1,019.46 | $ 5.80 |

Class T | 1.18% | | | |

Actual | | $ 1,000.00 | $ 976.70 | $ 5.88 |

HypotheticalA | | $ 1,000.00 | $ 1,019.26 | $ 6.01 |

Class B | 1.84% | | | |

Actual | | $ 1,000.00 | $ 974.30 | $ 9.16 |

HypotheticalA | | $ 1,000.00 | $ 1,015.93 | $ 9.35 |

Class C | 1.88% | | | |

Actual | | $ 1,000.00 | $ 973.90 | $ 9.35 |

HypotheticalA | | $ 1,000.00 | $ 1,015.73 | $ 9.55 |

Class I | .85% | | | |

Actual | | $ 1,000.00 | $ 978.40 | $ 4.24 |

HypotheticalA | | $ 1,000.00 | $ 1,020.92 | $ 4.33 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

C Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Annual Report

Investment Changes (Unaudited)

Top Five Countries as of December 31, 2015 |

(excluding cash equivalents) | % of fund's

net assets | % of fund's net assets

6 months ago |

Mexico | 11.0 | 8.5 |

Venezuela | 7.1 | 6.5 |

Turkey | 5.5 | 5.4 |

United States of America | 5.1 | 4.0 |

Brazil | 5.0 | 4.7 |

Percentages are adjusted for the effect of open futures contracts, if applicable. |

Top Five Holdings as of December 31, 2015 |

(by issuer, excluding cash equivalents) | % of fund's

net assets | % of fund's net assets

6 months ago |

Petroleos Mexicanos | 5.4 | 4.8 |

Turkish Republic | 5.1 | 4.8 |

Russian Federation | 4.8 | 6.1 |

Petroleos de Venezuela SA | 4.1 | 3.8 |

U.S. Treasury Obligations | 4.0 | 3.0 |

| 23.4 | |

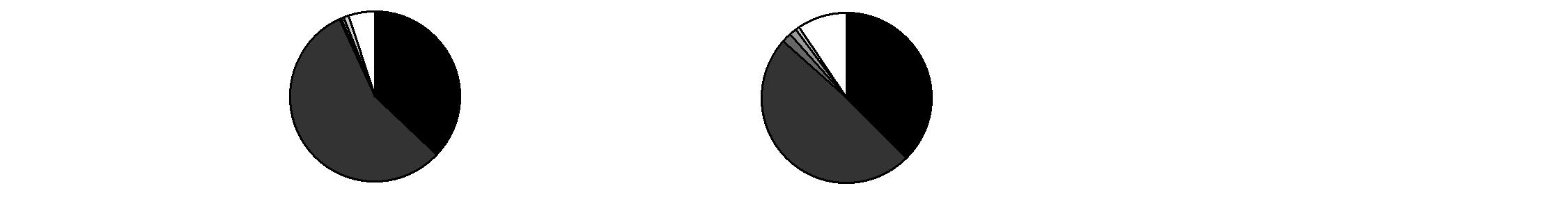

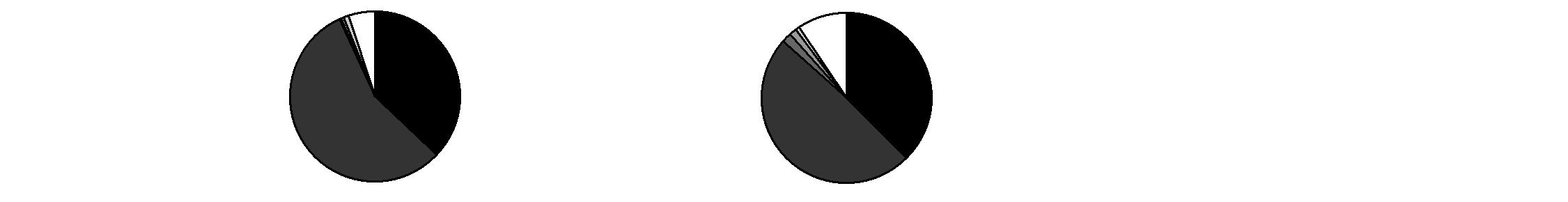

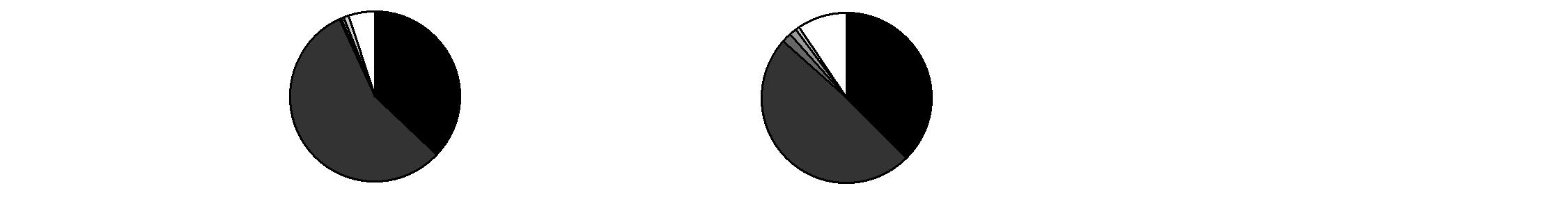

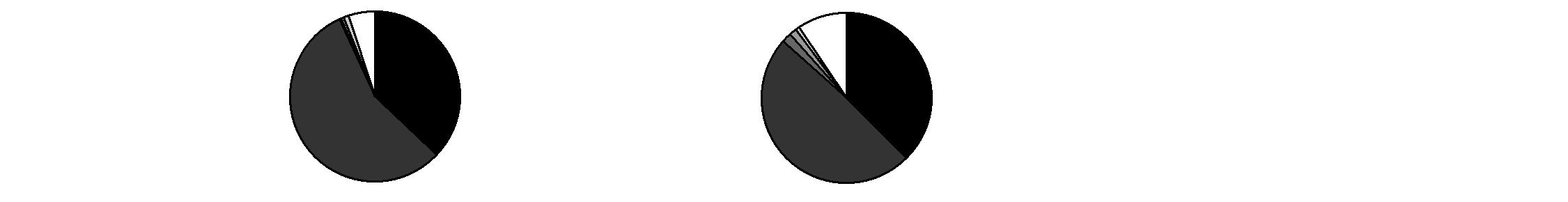

Asset Allocation (% of fund's net assets) |

As of December 31, 2015 | As of June 30, 2015 |

| Corporate Bonds 37.0% | |  | Corporate Bonds 37.6% | |

| Government

Obligations 56.2% | |  | Government

Obligations 49.0% | |

| Stocks 0.2% | |  | Stocks 1.9% | |

| Preferred Securities 0.6% | |  | Preferred Securities 1.3% | |

| Investment

Companies 1.0% | |  | Investment

Companies 0.9% | |

| Short-Term

Investments and

Net Other Assets (Liabilities) 5.0% | |  | Short-Term

Investments and

Net Other Assets (Liabilities) 9.3% | |

Annual Report

Investments December 31, 2015

Showing Percentage of Net Assets

Nonconvertible Bonds - 37.0% |

| Principal

Amount (c) | | Value |

Australia - 0.2% |

CNOOC Curtis Funding No. 1 Pvt Ltd. 4.5% 10/3/23 (f) | | $ 6,260,000 | | $ 6,463,412 |

Azerbaijan - 1.2% |

International Bank of Azerbaijan OJSC 5.625% 6/11/19 (Reg. S) | | 8,345,000 | | 7,579,764 |

State Oil Co. of Azerbaijan Republic: | | | | |

4.75% 3/13/23 (Reg. S) | | 18,225,000 | | 15,395,860 |

5.45% 2/9/17 (Reg. S) | | 9,260,000 | | 9,331,228 |

6.95% 3/18/30 (Reg. S) | | 7,465,000 | | 6,543,819 |

TOTAL AZERBAIJAN | | 38,850,671 |

Bermuda - 0.2% |

Qtel International Finance Ltd. 7.875% 6/10/19

(Reg. S) | | 5,010,000 | | 5,903,363 |

Brazil - 1.1% |

Banco Nacional de Desenvolvimento Economico e Social: | | | | |

6.369% 6/16/18 (f) | | 13,145,000 | | 12,914,963 |

6.5% 6/10/19 (f) | | 7,495,000 | | 7,326,363 |

Caixa Economica Federal: | | | | |

2.375% 11/6/17 (f) | | 3,875,000 | | 3,565,000 |

4.25% 5/13/19 (f) | | 10,425,000 | | 9,252,188 |

7.25% 7/23/24 (f)(h) | | 1,715,000 | | 1,256,238 |

TOTAL BRAZIL | | 34,314,752 |

British Virgin Islands - 1.7% |

Arcos Dorados Holdings, Inc. 10.25% 7/13/16 (f) | BRL | 20,415,000 | | 4,734,474 |

Sinochem Overseas Capital Co. Ltd. 4.5% 11/12/20 (f) | | 6,515,000 | | 6,829,929 |

Sinopec Group Overseas Development 2012 Ltd.: | | | | |

3.9% 5/17/22 (f) | | 7,010,000 | | 7,131,329 |

4.875% 5/17/42 (f) | | 3,375,000 | | 3,446,506 |

Sinopec Group Overseas Development 2014 Ltd. 4.375% 4/10/24 (f) | | 4,930,000 | | 5,093,395 |

Sinopec Group Overseas Development Ltd.: | | | | |

4.375% 10/17/23 (f) | | 6,010,000 | | 6,214,659 |

5.375% 10/17/43 (f) | | 2,285,000 | | 2,502,527 |

State Grid Overseas Investment 2013 Ltd.: | | | | |

3.125% 5/22/23 (f) | | 3,900,000 | | 3,821,528 |

4.375% 5/22/43 (f) | | 2,700,000 | | 2,700,859 |

Nonconvertible Bonds - continued |

| Principal

Amount (c) | | Value |

British Virgin Islands - continued |

State Grid Overseas Investment 2014 Ltd.: | | | | |

4.125% 5/7/24 (f) | | $ 7,010,000 | | $ 7,341,874 |

4.85% 5/7/44 (f) | | 2,700,000 | | 2,889,726 |

TOTAL BRITISH VIRGIN ISLANDS | | 52,706,806 |

Canada - 0.2% |

First Quantum Minerals Ltd.: | | | | |

6.75% 2/15/20 (f) | | 555,000 | | 357,975 |

7% 2/15/21 (f) | | 1,460,000 | | 916,150 |

7.25% 10/15/19 (f) | | 1,755,000 | | 1,140,750 |

7.25% 5/15/22 (f) | | 2,595,000 | | 1,602,283 |

Pacific Rubiales Energy Corp. 5.125% 3/28/23 (f) | | 10,095,000 | | 2,019,000 |

TOTAL CANADA | | 6,036,158 |

Cayman Islands - 3.2% |

Alibaba Group Holding Ltd. 3.125% 11/28/21 | | 14,625,000 | | 14,184,422 |

Brazil Minas SPE 5.333% 2/15/28 (f) | | 6,985,000 | | 5,256,213 |

Lamar Funding Ltd. 3.958% 5/7/25 (f) | | 8,030,000 | | 7,134,655 |

Petrobras International Finance Co. Ltd.: | | | | |

3.5% 2/6/17 | | 13,990,000 | | 13,080,650 |

5.375% 1/27/21 | | 24,420,000 | | 18,192,900 |

6.125% 10/6/16 | | 6,855,000 | | 6,786,450 |

6.75% 1/27/41 | | 19,275,000 | | 12,336,000 |

8.375% 12/10/18 | | 26,891,000 | | 24,739,720 |

TOTAL CAYMAN ISLANDS | | 101,711,010 |

Chile - 0.6% |

Corporacion Nacional del Cobre de Chile (Codelco) 4.5% 9/16/25 (f) | | 14,090,000 | | 13,268,356 |

Empresa Nacional de Petroleo: | | | | |

4.75% 12/6/21 (f) | | 2,600,000 | | 2,625,888 |

5.25% 8/10/20 (f) | | 3,750,000 | | 3,875,254 |

TOTAL CHILE | | 19,769,498 |

China - 0.2% |

Export-Import Bank of China 3.625% 7/31/24 (f) | | 4,930,000 | | 5,028,058 |

Colombia - 0.2% |

Ecopetrol SA 7.375% 9/18/43 | | 6,955,000 | | 5,842,200 |

Costa Rica - 0.3% |

Banco de Costa Rica 5.25% 8/12/18 (f) | | 1,645,000 | | 1,649,113 |

Banco Nacional de Costa Rica 6.25% 11/1/23 (f) | | 1,600,000 | | 1,536,000 |

Nonconvertible Bonds - continued |

| Principal

Amount (c) | | Value |

Costa Rica - continued |

Instituto Costarricense de Electricidad: | | | | |

6.375% 5/15/43 (f) | | $ 3,400,000 | | $ 2,550,000 |

6.95% 11/10/21 (f) | | 3,639,000 | | 3,625,354 |

TOTAL COSTA RICA | | 9,360,467 |

Croatia - 0.1% |

Hrvatska Elektroprivreda 5.875% 10/23/22 (f) | | 1,580,000 | | 1,595,926 |

Georgia - 0.6% |

Georgian Oil & Gas Corp. 6.875% 5/16/17 (f) | | 19,540,000 | | 19,684,596 |

Hungary - 0.1% |

Hungarian Development Bank Ltd. 6.25% 10/21/20 (f) | | 2,145,000 | | 2,361,323 |

India - 0.2% |

Export-Import Bank of India 4% 1/14/23 (Reg. S) | | 4,925,000 | | 4,986,760 |

ICICI Bank Ltd. 7.25% (f)(g)(h) | | 2,000,000 | | 2,025,538 |

TOTAL INDIA | | 7,012,298 |

Indonesia - 2.0% |

PT Pertamina Persero: | | | | |

4.3% 5/20/23 (f) | | 6,240,000 | | 5,672,341 |

4.875% 5/3/22 (f) | | 8,610,000 | | 8,255,500 |

5.25% 5/23/21 (f) | | 11,605,000 | | 11,581,419 |

5.625% 5/20/43 (f) | | 9,025,000 | | 7,063,353 |

6% 5/3/42 (f) | | 8,575,000 | | 7,021,184 |

6.45% 5/30/44 (f) | | 8,095,000 | | 7,032,288 |

6.5% 5/27/41 (f) | | 9,975,000 | | 8,716,384 |

PT Perusahaan Listrik Negara 5.5% 11/22/21 (Reg. S) | | 6,760,000 | | 6,886,750 |

TOTAL INDONESIA | | 62,229,219 |

Ireland - 1.8% |

RZD Capital Ltd. 5.7% 4/5/22 (Reg. S) | | 5,300,000 | | 5,180,750 |

SCF Capital Ltd. 5.375% 10/27/17 (f) | | 6,750,000 | | 6,679,125 |

Vnesheconombank Via VEB Finance PLC: | | | | |

4.224% 11/21/18 (f) | | 5,900,000 | | 5,683,706 |

5.375% 2/13/17 (f) | | 5,005,000 | | 5,024,419 |

5.45% 11/22/17 (f) | | 9,210,000 | | 9,183,752 |

5.942% 11/21/23 (f) | | 1,935,000 | | 1,806,826 |

6.025% 7/5/22 (f) | | 5,110,000 | | 4,839,119 |

6.902% 7/9/20 (f) | | 17,060,000 | | 17,239,471 |

TOTAL IRELAND | | 55,637,168 |

Nonconvertible Bonds - continued |

| Principal

Amount (c) | | Value |

Israel - 0.9% |

B Communications Ltd. 7.375% 2/15/21 (f) | | $ 9,765,000 | | $ 10,516,905 |

Israel Electric Corp. Ltd.: | | | | |

5.625% 6/21/18 (Reg. S) | | 6,180,000 | | 6,508,034 |

7.25% 1/15/19 (Reg. S) | | 7,810,000 | | 8,655,917 |

7.75% 12/15/27 (Reg. S) | | 2,776,000 | | 3,273,737 |

TOTAL ISRAEL | | 28,954,593 |

Kazakhstan - 2.2% |

Development Bank of Kazakhstan JSC 4.125% 12/10/22 (f) | | 6,670,000 | | 5,868,493 |

Kazagro National Management Holding JSC 4.625% 5/24/23 (f) | | 5,030,000 | | 4,323,456 |

KazMunaiGaz Finance Sub BV: | | | | |

6.375% 4/9/21 (f) | | 12,630,000 | | 12,991,850 |

7% 5/5/20 (f) | | 18,385,000 | | 19,465,964 |

9.125% 7/2/18 (f) | | 21,430,000 | | 23,551,570 |

Samruk-Energy JSC 3.75% 12/20/17 (Reg. S) | | 1,955,000 | | 1,896,350 |

TOTAL KAZAKHSTAN | | 68,097,683 |

Luxembourg - 2.7% |

Cosan Luxembourg SA 9.5% 3/14/18 (f) | BRL | 15,690,000 | | 3,123,128 |

OJSC Russian Agricultural Bank 7.75% 5/29/18 (Issued by RSHB Capital SA for OJSC Russian Agricultural Bank) (f) | | 14,050,000 | | 14,735,500 |

RSHB Capital SA: | | | | |

5.1% 7/25/18 (f) | | 14,135,000 | | 13,993,650 |

5.298% 12/27/17 (f) | | 28,845,000 | | 28,882,499 |

6% 6/3/21 (Reg. S) (h) | | 3,405,000 | | 3,231,345 |

6.299% 5/15/17 (Reg. S) | | 18,710,000 | | 19,009,734 |

8.5% 10/16/23 (f) | | 2,460,000 | | 2,278,486 |

TOTAL LUXEMBOURG | | 85,254,342 |

Malaysia - 0.3% |

1MDB Global Investments Ltd. 4.4% 3/9/23 | | 12,400,000 | | 10,775,030 |

Mexico - 7.5% |

Comision Federal de Electricid: | | | | |

4.875% 5/26/21 (f) | | 4,745,000 | | 4,804,313 |

4.875% 1/15/24 (f) | | 10,990,000 | | 10,825,150 |

Grupo Televisa SA de CV 6.125% 1/31/46 | | 3,080,000 | | 3,061,828 |

Pemex Project Funding Master Trust: | | | | |

6.625% 6/15/35 | | 40,775,000 | | 36,442,656 |

8.625% 2/1/22 | | 8,763,000 | | 9,770,745 |

Nonconvertible Bonds - continued |

| Principal

Amount (c) | | Value |

Mexico - continued |

Petroleos Mexicanos: | | | | |

3.5% 1/30/23 | | $ 3,785,000 | | $ 3,302,413 |

4.5% 1/23/26 (f) | | 27,315,000 | | 23,996,228 |

4.875% 1/24/22 | | 23,340,000 | | 22,464,750 |

4.875% 1/18/24 | | 5,785,000 | | 5,394,513 |

5.5% 1/21/21 | | 13,345,000 | | 13,461,102 |

5.5% 6/27/44 | | 13,515,000 | | 10,167,875 |

5.625% 1/23/46 (f) | | 14,958,000 | | 11,445,862 |

6.375% 1/23/45 | | 16,845,000 | | 14,257,288 |

6.5% 6/2/41 | | 46,035,000 | | 39,797,258 |

6.625% (f)(g) | | 27,390,000 | | 25,335,750 |

TOTAL MEXICO | | 234,527,731 |

Morocco - 0.1% |

OCP SA 5.625% 4/25/24 (f) | | 3,250,000 | | 3,297,938 |

Netherlands - 2.3% |

Bulgaria Steel Finance BV 12% 5/4/13 unit (b) | EUR | 600,000 | | 0 |

Dilijan Finance BV 12% 7/29/20 (f) | | 1,980,000 | | 1,900,800 |

Kazakhstan Temir Zholy Finance BV: | | | | |

6.375% 10/6/20 (f) | | 3,505,000 | | 3,461,188 |

6.95% 7/10/42 (f) | | 12,065,000 | | 10,583,901 |

Majapahit Holding BV: | | | | |

7.75% 1/20/20 (f) | | 5,675,000 | | 6,348,906 |

7.875% 6/29/37 (Reg. S) | | 4,700,000 | | 5,076,000 |

8% 8/7/19 (f) | | 3,010,000 | | 3,371,200 |

Petrobras Global Finance BV: | | | | |

3.25% 3/17/17 | | 1,620,000 | | 1,498,500 |

6.25% 3/17/24 | | 21,600,000 | | 15,498,000 |

6.85% 6/5/2115 | | 26,420,000 | | 17,106,950 |

7.25% 3/17/44 | | 12,125,000 | | 8,184,375 |

TOTAL NETHERLANDS | | 73,029,820 |

Philippines - 0.2% |

Power Sector Assets and Liabilities Management Corp. 7.39% 12/2/24 (f) | | 5,855,000 | | 7,545,924 |

Qatar - 0.2% |

Ras Laffan Liquefied Natural Gas Co. Ltd. III 6.75% 9/30/19 (Reg. S) | | 5,455,000 | | 6,333,615 |

South Africa - 0.9% |

Eskom Holdings SOC Ltd.: | | | | |

5.75% 1/26/21 (Reg. S) | | 12,100,000 | | 10,526,855 |

Nonconvertible Bonds - continued |

| Principal

Amount (c) | | Value |

South Africa - continued |

Eskom Holdings SOC Ltd.: - continued | | | | |

6.75% 8/6/23 (f) | | $ 6,550,000 | | $ 5,682,125 |

7.125% 2/11/25 (f) | | 6,015,000 | | 5,202,975 |

TransCanada PipeLines Ltd. 4% 7/26/22 (f) | | 6,075,000 | | 5,357,421 |

TOTAL SOUTH AFRICA | | 26,769,376 |

Sri Lanka - 0.2% |

Bank of Ceylon 6.875% 5/3/17 (f) | | 4,255,000 | | 4,265,638 |

National Savings Bank 8.875% 9/18/18 (f) | | 2,625,000 | | 2,700,600 |

TOTAL SRI LANKA | | 6,966,238 |

Trinidad & Tobago - 0.4% |

Petroleum Co. of Trinidad & Tobago Ltd.: | | | | |

6% 5/8/22 (f) | | 306,042 | | 283,089 |

9.75% 8/14/19 (f) | | 13,120,000 | | 13,644,800 |

TOTAL TRINIDAD & TOBAGO | | 13,927,889 |

Turkey - 0.4% |

Arcelik A/S 5% 4/3/23 (f) | | 9,180,000 | | 8,368,708 |

Export Credit Bank of Turkey 5% 9/23/21 (f) | | 3,420,000 | | 3,356,354 |

Turk Sise ve Cam Fabrikalari A/S 4.25% 5/9/20

(Reg. S) | | 300,000 | | 287,808 |

TOTAL TURKEY | | 12,012,870 |

United Arab Emirates - 0.1% |

DP World Ltd. 6.85% 7/2/37 (Reg. S) | | 4,530,000 | | 4,450,725 |

United Kingdom - 0.5% |

Biz Finance PLC 9.625% 4/27/22 (f) | | 15,140,000 | | 13,535,160 |

SSB #1 PLC 9.375% 3/10/23 (f) | | 2,955,000 | | 2,570,850 |

TOTAL UNITED KINGDOM | | 16,106,010 |

United States of America - 0.1% |

Brazil Loan Trust 1 5.477% 7/24/23 (f) | | 2,943,093 | | 2,479,556 |

Venezuela - 4.1% |

Petroleos de Venezuela SA: | | | | |

5.25% 4/12/17 | | 19,155,000 | | 9,623,472 |

5.375% 4/12/27 | | 47,810,000 | | 17,331,125 |

5.5% 4/12/37 | | 63,595,000 | | 23,053,188 |

6% 5/16/24 (f) | | 59,830,000 | | 22,137,100 |

6% 11/15/26 (Reg. S) | | 63,810,000 | | 23,450,175 |

8.5% 11/2/17 (f) | | 21,626,666 | | 11,516,200 |

8.5% 11/2/17 (Reg. S) | | 5,233,333 | | 2,786,750 |

Nonconvertible Bonds - continued |

| Principal

Amount (c) | | Value |

Venezuela - continued |

Petroleos de Venezuela SA: - continued | | | | |

9% 11/17/21 (Reg. S) | | $ 14,725,000 | | $ 5,897,363 |

9.75% 5/17/35 (f) | | 16,975,000 | | 7,044,625 |

9.75% 5/17/35 | | 4,955,000 | | 2,056,325 |

12.75% 2/17/22 (f) | | 11,435,000 | | 5,145,750 |

TOTAL VENEZUELA | | 130,042,073 |

TOTAL NONCONVERTIBLE BONDS (Cost $1,312,526,023) |

1,165,078,338

|

Government Obligations - 56.2% |

|

Angola - 0.2% |

Angola Republic 9.5% 11/12/25 (f) | | 7,005,000 | | 6,514,650 |

Armenia - 1.2% |

Republic of Armenia: | | | | |

6% 9/30/20 (f) | | 32,770,000 | | 31,774,775 |

7.15% 3/26/25 (f) | | 5,555,000 | | 5,366,741 |

TOTAL ARMENIA | | 37,141,516 |

Azerbaijan - 0.2% |

Azerbaijan Republic 4.75% 3/18/24 (f) | | 7,380,000 | | 6,883,916 |

Barbados - 0.6% |

Barbados Government: | | | | |

7% 8/4/22 (f) | | 11,709,000 | | 11,474,820 |

7.25% 12/15/21 (f) | | 7,679,000 | | 7,736,593 |

TOTAL BARBADOS | | 19,211,413 |

Belarus - 0.1% |

Belarus Republic 8.95% 1/26/18 | | 3,570,000 | | 3,649,540 |

Belize - 0.1% |

Belize Government 5% 2/20/38 (d)(f) | | 2,946,600 | | 2,121,552 |

Bolivia - 0.1% |

Plurinational State of Bolivia 5.95% 8/22/23 (f) | | 4,325,000 | | 4,616,938 |

Brazil - 3.9% |

Brazilian Federative Republic: | | | | |

2.625% 1/5/23 | | 11,500,000 | | 8,740,000 |

4.25% 1/7/25 | | 23,460,000 | | 18,885,300 |

4.875% 1/22/21 | | 13,130,000 | | 12,145,250 |

5% 1/27/45 | | 18,980,000 | | 12,669,150 |

Government Obligations - continued |

| Principal

Amount (c) | | Value |

Brazil - continued |

Brazilian Federative Republic: - continued | | | | |

5.625% 1/7/41 | | $ 12,260,000 | | $ 8,888,500 |

7.125% 1/20/37 | | 9,905,000 | | 8,543,063 |

8.25% 1/20/34 | | 32,000,000 | | 30,800,000 |

10.125% 5/15/27 | | 6,670,000 | | 7,870,600 |

12.25% 3/6/30 | | 6,915,000 | | 9,611,850 |

Caixa Economica Federal 4.5% 10/3/18 (f) | | 6,530,000 | | 6,015,763 |

TOTAL BRAZIL | | 124,169,476 |

Cameroon - 0.2% |

Cameroon Republic 9.5% 11/19/25 (f) | | 7,625,000 | | 7,091,250 |

Colombia - 2.3% |

Colombian Republic: | | | | |

4% 2/26/24 | | 19,135,000 | | 18,226,088 |

4.5% 1/28/26 | | 4,040,000 | | 3,858,200 |

6.125% 1/18/41 | | 14,320,000 | | 13,818,800 |

7.375% 9/18/37 | | 29,915,000 | | 32,981,288 |

11.75% 2/25/20 | | 3,518,000 | | 4,555,810 |

TOTAL COLOMBIA | | 73,440,186 |

Congo - 0.6% |

Congo Republic 4% 6/30/29 (d) | | 24,002,415 | | 18,841,896 |

Costa Rica - 1.2% |

Costa Rican Republic: | | | | |

4.25% 1/26/23 (f) | | 10,485,000 | | 9,174,375 |

4.375% 4/30/25 (f) | | 8,360,000 | | 7,022,400 |

5.625% 4/30/43 (f) | | 2,120,000 | | 1,510,500 |

7% 4/4/44 (f) | | 10,070,000 | | 8,395,863 |

7.158% 3/12/45 (f) | | 14,970,000 | | 12,537,375 |

TOTAL COSTA RICA | | 38,640,513 |

Croatia - 1.0% |

Croatia Republic: | | | | |

5.5% 4/4/23 (f) | | 5,890,000 | | 5,979,528 |

6% 1/26/24 (f) | | 8,750,000 | | 9,115,138 |

6.375% 3/24/21 (f) | | 5,635,000 | | 5,984,370 |

6.625% 7/14/20 (f) | | 4,665,000 | | 4,998,781 |

6.75% 11/5/19 | | 5,455,000 | | 5,843,669 |

TOTAL CROATIA | | 31,921,486 |

Government Obligations - continued |

| Principal

Amount (c) | | Value |

Dominican Republic - 1.2% |

Dominican Republic: | | | | |

5.5% 1/27/25 (f) | | $ 8,000,000 | | $ 7,700,000 |

5.875% 4/18/24 (f) | | 5,170,000 | | 5,157,075 |

6.6% 1/28/24 (f) | | 3,375,000 | | 3,510,000 |

6.85% 1/27/45 (f) | | 8,305,000 | | 7,827,463 |

7.45% 4/30/44 (f) | | 6,495,000 | | 6,543,713 |

7.5% 5/6/21 (f) | | 6,245,000 | | 6,697,763 |

TOTAL DOMINICAN REPUBLIC | | 37,436,014 |

Ecuador - 0.2% |

Ecuador Republic 7.95% 6/20/24 (f) | | 10,540,000 | | 7,773,250 |

Egypt - 0.4% |

Arab Republic 5.875% 6/11/25 (f) | | 4,925,000 | | 4,268,498 |

Arab Republic of Egypt: | | | | |

5.75% 4/29/20 (f) | | 4,700,000 | | 4,554,300 |

6.875% 4/30/40 (f) | | 3,170,000 | | 2,567,700 |

TOTAL EGYPT | | 11,390,498 |

El Salvador - 0.7% |

El Salvador Republic: | | | | |

5.875% 1/30/25 (Reg.S) | | 5,722,000 | | 4,777,870 |

6.375% 1/18/27 (f) | | 4,065,000 | | 3,434,925 |

7.375% 12/1/19 | | 3,695,000 | | 3,682,068 |

7.625% 2/1/41 (f) | | 2,940,000 | | 2,462,250 |

7.65% 6/15/35 (Reg. S) | | 2,715,000 | | 2,314,538 |

7.75% 1/24/23 (Reg. S) | | 2,995,000 | | 2,920,125 |

8.25% 4/10/32 (Reg. S) | | 1,930,000 | | 1,799,725 |

TOTAL EL SALVADOR | | 21,391,501 |

Ethiopia - 0.1% |

Federal Democratic Republic of Ethiopia 6.625% 12/11/24 (f) | | 4,030,000 | | 3,586,700 |

Gabon - 0.4% |

Gabonese Republic: | | | | |

6.375% 12/12/24 (f) | | 9,200,000 | | 7,300,936 |

6.95% 6/16/25 (f) | | 7,370,000 | | 5,860,624 |

TOTAL GABON | | 13,161,560 |

Ghana - 1.2% |

Ghana Republic: | | | | |

7.875% 8/7/23 (Reg.S) | | 9,735,000 | | 7,672,154 |

Government Obligations - continued |

| Principal

Amount (c) | | Value |

Ghana - continued |

Ghana Republic: - continued | | | | |

8.125% 1/18/26 (f) | | $ 9,855,000 | | $ 7,688,871 |

10.75% 10/14/30 (f) | | 22,375,000 | | 22,699,438 |

TOTAL GHANA | | 38,060,463 |

Hungary - 1.8% |

Hungarian Republic: | | | | |

5.375% 2/21/23 | | 6,538,000 | | 7,126,420 |

5.375% 3/25/24 | | 8,657,000 | | 9,479,415 |

5.75% 11/22/23 | | 10,330,000 | | 11,558,237 |

6.25% 1/29/20 | | 9,369,000 | | 10,477,165 |

6.375% 3/29/21 | | 15,263,000 | | 17,399,820 |

TOTAL HUNGARY | | 56,041,057 |

Indonesia - 2.9% |

Indonesian Republic: | | | | |

3.375% 4/15/23 (f) | | 3,400,000 | | 3,159,423 |

3.75% 4/25/22 (f) | | 5,600,000 | | 5,364,251 |

4.875% 5/5/21 (f) | | 18,975,000 | | 19,654,647 |

5.875% 3/13/20 (f) | | 12,005,000 | | 13,012,724 |

5.875% 1/15/24 (f) | | 7,205,000 | | 7,718,817 |

5.95% 1/8/46 (f) | | 11,670,000 | | 11,490,014 |

6.625% 2/17/37 | | 11,475,000 | | 12,023,344 |

8.5% 10/12/35 (f) | | 14,490,000 | | 18,021,880 |

TOTAL INDONESIA | | 90,445,100 |

Iraq - 0.3% |

Republic of Iraq 5.8% 1/15/28 (Reg. S) | | 11,910,000 | | 8,015,906 |

Ivory Coast - 0.6% |

Ivory Coast: | | | | |

5.375% 7/23/24 (f) | | 3,045,000 | | 2,702,438 |

5.75% 12/31/32 | | 11,950,000 | | 10,622,833 |

6.375% 3/3/28 (f) | | 6,070,000 | | 5,540,089 |

TOTAL IVORY COAST | | 18,865,360 |

Jamaica - 0.5% |

Jamaican Government: | | | | |

6.75% 4/28/28 | | 4,710,000 | | 4,674,675 |

7.625% 7/9/25 | | 2,440,000 | | 2,589,450 |

7.875% 7/28/45 | | 1,980,000 | | 1,925,550 |

Government Obligations - continued |

| Principal

Amount (c) | | Value |

Jamaica - continued |

Jamaican Government: - continued | | | | |

8% 6/24/19 | | $ 3,875,000 | | $ 4,155,938 |

8% 3/15/39 | | 2,245,000 | | 2,339,290 |

TOTAL JAMAICA | | 15,684,903 |

Jordan - 0.3% |

Jordanian Kingdom 6.125% 1/29/26 (f) | | 9,030,000 | | 9,201,570 |

Kazakhstan - 0.5% |

Kazakhstan Republic: | | | | |

5.125% 7/21/25 (f) | | 7,400,000 | | 7,292,848 |

6.5% 7/21/45 (f) | | 7,285,000 | | 7,161,446 |

TOTAL KAZAKHSTAN | | 14,454,294 |

Kenya - 0.4% |

Republic of Kenya: | | | | |

5.875% 6/24/19 (f) | | 2,750,000 | | 2,591,875 |

6.875% 6/24/24 (f) | | 10,855,000 | | 9,498,125 |

TOTAL KENYA | | 12,090,000 |

Lebanon - 2.2% |

Lebanese Republic: | | | | |

5% 10/12/17 | | 5,090,000 | | 5,049,321 |

5.15% 11/12/18 | | 6,525,000 | | 6,471,756 |

5.45% 11/28/19 | | 8,145,000 | | 7,999,042 |

6.1% 10/4/22 | | 7,905,000 | | 7,735,043 |

6.6% 11/27/26 | | 8,060,000 | | 7,898,800 |

6.65% 2/26/30(Reg. S) | | 8,250,000 | | 8,003,160 |

6.75% 11/29/27 (Reg. S) | | 6,300,000 | | 6,221,250 |

7.05% 11/2/35(Reg. S) | | 3,040,000 | | 3,032,400 |

8.25% 4/12/21 (Reg.S) | | 9,540,000 | | 10,391,827 |

9% 3/20/17 | | 5,355,000 | | 5,586,336 |

TOTAL LEBANON | | 68,388,935 |

Mexico - 3.5% |

United Mexican States: | | | | |

5.75% 10/12/2110 | | 15,380,000 | | 14,341,850 |

6.05% 1/11/40 | | 16,633,000 | | 18,213,135 |

7.5% 4/8/33 | | 2,500,000 | | 3,243,750 |

7.75% 11/13/42 | MXN | 164,405,000 | | 10,423,675 |

8.3% 8/15/31 | | 9,880,000 | | 14,573,000 |

8.5% 12/13/18 | MXN | 173,500,000 | | 11,074,222 |

Government Obligations - continued |

| Principal

Amount (c) | | Value |

Mexico - continued |

United Mexican States: - continued | | | | |

10% 12/5/24 | MXN | $ 440,365,000 | | $ 32,165,208 |

11.5% 5/15/26 | | 3,595,000 | | 5,689,088 |

TOTAL MEXICO | | 109,723,928 |

Mongolia - 0.2% |

Mongolian People's Republic: | | | | |

4.125% 1/5/18 (Reg. S) | | 3,355,000 | | 3,065,799 |

5.125% 12/5/22 (Reg. S) | | 3,360,000 | | 2,664,033 |

TOTAL MONGOLIA | | 5,729,832 |

Namibia - 0.1% |

Republic of Namibia 5.5% 11/3/21 (f) | | 1,822,000 | | 1,831,474 |

Netherlands - 0.1% |

Republic of Angola 7% 8/16/19 (Issued by Northern Lights III BV for Republic of Angola) (Reg. S) | | 3,773,438 | | 3,632,688 |

Pakistan - 0.4% |

Islamic Republic of Pakistan: | | | | |

6.875% 6/1/17 (f) | | 2,825,000 | | 2,881,525 |

7.125% 3/31/16 (f) | | 1,411,000 | | 1,412,851 |

7.25% 4/15/19 (f) | | 6,195,000 | | 6,309,521 |

8.25% 4/15/24 (f) | | 3,465,000 | | 3,553,018 |

TOTAL PAKISTAN | | 14,156,915 |

Panama - 0.7% |

Panamanian Republic: | | | | |

7.125% 1/29/26 | | 4,620,000 | | 5,751,900 |

8.875% 9/30/27 | | 5,299,000 | | 7,325,868 |

9.375% 4/1/29 | | 7,320,000 | | 10,540,800 |

TOTAL PANAMA | | 23,618,568 |

Peru - 0.3% |

Peruvian Republic 8.75% 11/21/33 | | 5,770,000 | | 8,135,700 |

Philippines - 1.6% |

Philippine Republic: | | | | |

6.375% 10/23/34 | | 5,005,000 | | 6,525,379 |

7.75% 1/14/31 | | 5,440,000 | | 7,643,037 |

9.5% 2/2/30 | | 9,745,000 | | 15,347,936 |

10.625% 3/16/25 | | 12,505,000 | | 19,653,846 |

TOTAL PHILIPPINES | | 49,170,198 |

Government Obligations - continued |

| Principal

Amount (c) | | Value |

Qatar - 0.2% |

State of Qatar 4.5% 1/20/22 (f) | | $ 4,900,000 | | $ 5,365,500 |

Romania - 0.8% |

Romanian Republic: | | | | |

4.375% 8/22/23 (f) | | 6,839,000 | | 7,119,057 |

4.875% 1/22/24 (f) | | 3,714,000 | | 3,973,980 |

6.125% 1/22/44 (f) | | 3,262,000 | | 3,816,540 |

6.75% 2/7/22 (f) | | 9,213,000 | | 10,820,024 |

TOTAL ROMANIA | | 25,729,601 |

Russia - 4.8% |

Russian Federation: | | | | |

4.5% 4/4/22 (f) | | 6,535,000 | | 6,573,909 |

4.875% 9/16/23 (f) | | 9,590,000 | | 9,743,440 |

5.625% 4/4/42 (f) | | 14,305,000 | | 13,532,530 |

5.875% 9/16/43 (f) | | 7,635,000 | | 7,426,565 |

7.5% 3/31/30 (Reg. S) | | 41,528,025 | | 49,754,145 |

12.75% 6/24/28 (Reg. S) | | 41,644,000 | | 65,825,005 |

TOTAL RUSSIA | | 152,855,594 |

Senegal - 0.2% |

Republic of Senegal: | | | | |

6.25% 7/30/24 (f) | | 2,415,000 | | 2,149,350 |

8.75% 5/13/21 (f) | | 4,565,000 | | 4,770,425 |

TOTAL SENEGAL | | 6,919,775 |

Serbia - 0.6% |

Republic of Serbia: | | | | |

4.875% 2/25/20 (f) | | 3,820,000 | | 3,909,923 |

5.875% 12/3/18 (f) | | 3,995,000 | | 4,202,740 |

7.25% 9/28/21 (f) | | 9,415,000 | | 10,643,206 |

TOTAL SERBIA | | 18,755,869 |

South Africa - 0.7% |

South African Republic: | | | | |

5.5% 3/9/20 | | 9,690,000 | | 9,945,312 |

5.875% 9/16/25 | | 10,890,000 | | 11,131,867 |

TOTAL SOUTH AFRICA | | 21,077,179 |

Sri Lanka - 0.5% |

Democratic Socialist Republic of Sri Lanka: | | | | |

5.125% 4/11/19 (f) | | 2,960,000 | | 2,811,115 |

5.875% 7/25/22 (f) | | 3,225,000 | | 2,942,951 |

Government Obligations - continued |

| Principal

Amount (c) | | Value |

Sri Lanka - continued |

Democratic Socialist Republic of Sri Lanka: - continued | | | | |

6% 1/14/19 (f) | | $ 3,180,000 | | $ 3,115,789 |

6.25% 10/4/20 (f) | | 4,345,000 | | 4,188,563 |

6.25% 7/27/21 (f) | | 4,475,000 | | 4,254,611 |

TOTAL SRI LANKA | | 17,313,029 |

Tanzania - 0.1% |

United Republic of Tanzania 6.5375% 3/9/20 (h) | | 2,460,000 | | 2,318,550 |

Turkey - 5.1% |

Turkish Republic: | | | | |

4.875% 4/16/43 | | 5,955,000 | | 5,240,400 |

5.125% 3/25/22 | | 5,305,000 | | 5,444,256 |

5.625% 3/30/21 | | 10,525,000 | | 11,129,177 |

5.75% 3/22/24 | | 13,855,000 | | 14,638,085 |

6% 1/14/41 | | 6,560,000 | | 6,702,680 |

6.25% 9/26/22 | | 14,140,000 | | 15,350,384 |

6.75% 5/30/40 | | 3,755,000 | | 4,173,592 |

6.875% 3/17/36 | | 12,520,000 | | 14,020,898 |

7% 6/5/20 | | 11,315,000 | | 12,589,680 |

7.375% 2/5/25 | | 13,805,000 | | 16,118,718 |

7.5% 11/7/19 | | 9,960,000 | | 11,167,849 |

8% 3/12/25 | TRY | 33,020,000 | | 9,703,107 |

8% 2/14/34 | | 2,740,000 | | 3,424,726 |

9.4% 7/8/20 | TRY | 58,760,000 | | 19,266,647 |

11.875% 1/15/30 | | 7,575,000 | | 12,413,759 |

TOTAL TURKEY | | 161,383,958 |

Ukraine - 3.2% |

Ukraine Government: | | | | |

0% 5/31/40 (f)(h) | | 33,770,000 | | 13,339,150 |

7.75% 9/1/19 (f) | | 19,023,000 | | 17,607,308 |

7.75% 9/1/20 (f) | | 9,792,000 | | 9,008,640 |

7.75% 9/1/21 (f) | | 9,792,000 | | 8,896,620 |

7.75% 9/1/22 (f) | | 9,792,000 | | 8,869,398 |

7.75% 9/1/23 (f) | | 9,542,000 | | 8,494,288 |

7.75% 9/1/24 (f) | | 10,292,000 | | 9,107,494 |

7.75% 9/1/25 (f) | | 8,792,000 | | 7,733,267 |

7.75% 9/1/26 (f) | | 9,792,000 | | 8,520,215 |

7.75% 9/1/27 (f) | | 9,792,000 | | 8,519,040 |

TOTAL UKRAINE | | 100,095,420 |

Government Obligations - continued |

| Principal

Amount (c) | | Value |

United States of America - 4.0% |

U.S. Treasury Bonds 3% 11/15/45 | | $ 126,525,000 | | $ 125,906,519 |

Venezuela - 3.0% |

Venezuelan Republic: | | | | |

oil recovery rights 4/15/20 (i) | | 211,320 | | 1,373,580 |

6% 12/9/20 | | 11,095,000 | | 4,132,888 |

7% 12/1/18 (Reg. S) | | 6,075,000 | | 2,718,563 |

7% 3/31/38 | | 5,645,000 | | 2,102,763 |

7.65% 4/21/25 | | 28,995,000 | | 10,728,150 |

7.75% 10/13/19 (Reg. S) | | 13,260,000 | | 5,270,850 |

8.25% 10/13/24 | | 16,655,000 | | 6,328,900 |

9% 5/7/23 (Reg. S) | | 22,080,000 | | 8,776,800 |

9.25% 9/15/27 | | 20,550,000 | | 8,425,500 |

9.25% 5/7/28 (Reg. S) | | 40,490,000 | | 15,791,100 |

9.375% 1/13/34 | | 19,015,000 | | 7,463,388 |

11.75% 10/21/26 (Reg. S) | | 14,165,000 | | 6,303,425 |

11.95% 8/5/31 (Reg. S) | | 18,410,000 | | 8,146,425 |

12.75% 8/23/22 | | 12,445,000 | | 5,569,138 |

TOTAL VENEZUELA | | 93,131,470 |

Vietnam - 0.3% |

Vietnamese Socialist Republic: | | | | |

4.8% 11/19/24 (f) | | 5,440,000 | | 5,224,467 |

6.75% 1/29/20 (f) | | 3,632,000 | | 3,980,454 |

TOTAL VIETNAM | | 9,204,921 |

Zambia - 0.4% |

Republic of Zambia: | | | | |

5.375% 9/20/22 (f) | | 2,880,000 | | 2,078,208 |

8.5% 4/14/24 (f) | | 4,790,000 | | 3,797,991 |

8.97% 7/30/27 (f) | | 6,865,000 | | 5,414,426 |

20% 3/8/16 | ZMW | 23,615,000 | | 2,095,157 |

TOTAL ZAMBIA | | 13,385,782 |

TOTAL GOVERNMENT OBLIGATIONS (Cost $1,862,081,534) |

1,769,673,913

|

Common Stocks - 0.2% |

| Shares | | Value |

Canada - 0.0% |

First Quantum Minerals Ltd. | 150,000 | | $ 561,538 |

China - 0.2% |

China Petroleum & Chemical Corp. (H Shares) | 8,242,000 | | 4,949,528 |

India - 0.0% |

Bharti Infratel Ltd. | 144,013 | | 928,453 |

TOTAL COMMON STOCKS (Cost $7,852,384) |

6,439,519

|

Investment Companies - 1.0% |

| | | |

United States of America - 1.0% |

iShares MSCI Emerging Markets Index ETF (e)

(Cost $34,516,545) | 1,028,500 | |

33,107,415

|

Preferred Securities - 0.6% |

| Principal

Amount | | |

China - 0.1% |

Sinochem Group 5% (f)(g)(h) | | $ 3,040,000 | | 3,125,855 |

Colombia - 0.2% |

Colombia Telecomunicacines SA 8.5% (f)(g)(h) | | 6,840,000 | | 6,013,845 |

India - 0.3% |

State Bank of India: | | | | |

6.439% (g)(h) | | 7,825,000 | | 8,057,020 |

7.14% (g)(h) | | 1,200,000 | | 1,237,185 |

TOTAL INDIA | | 9,294,205 |

TOTAL PREFERRED SECURITIES (Cost $18,991,553) |

18,433,905

|

Money Market Funds - 5.3% |

| Shares | | Value |

Fidelity Cash Central Fund, 0.33% (a) | 134,403,040 | | $ 134,403,040 |

Fidelity Securities Lending Cash Central Fund, 0.35% (a)(j) | 33,148,500 | | 33,148,500 |

TOTAL MONEY MARKET FUNDS (Cost $167,551,540) |

167,551,540

|

TOTAL INVESTMENT PORTFOLIO - 100.3% (Cost $3,403,519,579) | 3,160,284,630 |

NET OTHER ASSETS (LIABILITIES) - (0.3)% | (8,958,087) |

NET ASSETS - 100% | $ 3,151,326,543 |

Currency Abbreviations |

BRL | - | Brazilian real |

EUR | - | European Monetary Unit |

MXN | - | Mexican peso |

TRY | - | Turkish Lira |

ZMW | - | Zambian Kwacha |

Security Type Abbreviations |

ETF - Exchange-Traded Fund |

Legend |

(a) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(b) Non-income producing - Security is in default. |

(c) Amount is stated in United States dollars unless otherwise noted. |

(d) Security initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

(e) Security or a portion of the security is on loan at period end. |

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $1,286,914,155 or 40.8% of net assets. |

(g) Security is perpetual in nature with no stated maturity date. |

(h) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

(i) Quantity represents share amount. |

(j) Investment made with cash collateral received from securities on loan. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 324,347 |

Fidelity Securities Lending Cash Central Fund | 103,569 |

Total | $ 427,916 |

Other Information |

Categorizations in the Schedule of Investments are based on country or territory of incorporation. |

The following is a summary of the inputs used, as of December 31, 2015, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Energy | $ 4,949,528 | $ - | $ 4,949,528 | $ - |

Materials | 561,538 | 561,538 | - | - |

Telecommunication Services | 928,453 | - | 928,453 | - |

Corporate Bonds | 1,165,078,338 | - | 1,165,078,338 | - |

Government Obligations | 1,769,673,913 | - | 1,768,300,333 | 1,373,580 |

Investment Companies | 33,107,415 | 33,107,415 | - | - |

Preferred Securities | 18,433,905 | - | 18,433,905 | - |

Money Market Funds | 167,551,540 | 167,551,540 | - | - |

Total Investments in Securities: | $ 3,160,284,630 | $ 201,220,493 | $ 2,957,690,557 | $ 1,373,580 |

Other Information |

The composition of credit quality ratings as a percentage of net assets is as follows (Unaudited): |

U.S. Government and U.S. Government Agency Obligations | 4.0% |

AAA,AA,A | 7.6% |

BBB | 33.3% |

BB | 24.1% |

B | 10.5% |

CCC,CC,C | 11.0% |

Not Rated | 3.3% |

Equities | 1.2% |

Short-Term Investments and Net Other Assets | 5.0% |

| 100.0% |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

| | December 31, 2015 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $32,435,305) - See accompanying schedule: Unaffiliated issuers (cost $3,235,968,039) | $ 2,992,733,090 | |

Fidelity Central Funds (cost $167,551,540) | 167,551,540 | |

Total Investments (cost $3,403,519,579) | | $ 3,160,284,630 |

Receivable for investments sold | | 251,563 |

Receivable for fund shares sold | | 10,653,344 |

Interest receivable | | 53,947,095 |

Distributions receivable from Fidelity Central Funds | | 53,785 |

Prepaid expenses | | 5,753 |

Other receivables | | 13,023 |

Total assets | | 3,225,209,193 |

| | |

Liabilities | | |

Payable to custodian bank | $ 532,753 | |

Payable for investments purchased | 20,984,351 | |

Payable for fund shares redeemed | 9,606,704 | |

Distributions payable | 7,111,172 | |

Accrued management fee | 1,712,322 | |

Distribution and service plan fees payable | 154,615 | |

Other affiliated payables | 473,459 | |

Other payables and accrued expenses | 158,774 | |

Collateral on securities loaned, at value | 33,148,500 | |

Total liabilities | | 73,882,650 |

| | |

Net Assets | | $ 3,151,326,543 |

Net Assets consist of: | | |

Paid in capital | | $ 3,404,601,204 |

Undistributed net investment income | | 23,232,217 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (33,237,498) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | (243,269,380) |

Net Assets | | $ 3,151,326,543 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities - continued

| December 31, 2015 |

Calculation of Maximum Offering Price | | |

Class A: | | |

Net Asset Value and redemption price per share ($238,065,037 ÷ 18,657,776 shares) | | $ 12.76 |

| | |

Maximum offering price per share (100/96.00 of $12.76) | | $ 13.29 |

Class T: | | |

Net Asset Value and redemption price per share ($78,114,485 ÷ 6,148,532 shares) | | $ 12.70 |

| | |

Maximum offering price per share (100/96.00 of $12.70) | | $ 13.23 |

Class B: | | |

Net Asset Value and offering price per share ($3,709,936 ÷ 287,183 shares)A | | $ 12.92 |

| | |

Class C: | | |

Net Asset Value and offering price per share ($98,757,412 ÷ 7,681,070 shares)A | | $ 12.86 |

| | |

Class I: | | |

Net Asset Value, offering price and redemption price per share ($2,732,679,673 ÷ 218,353,975 shares) | | $ 12.51 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

| Year ended December 31, 2015 |

| | |

Investment Income | | |

Dividends | | $ 4,342,394 |

Interest | | 187,337,944 |

Income from Fidelity Central Funds | | 427,916 |

Income before foreign taxes withheld | | 192,108,254 |

Less foreign taxes withheld | | (96,448) |

Total income | | 192,011,806 |

| | |

Expenses | | |

Management fee | $ 18,754,101 | |

Transfer agent fees | 4,293,815 | |

Distribution and service plan fees | 2,088,200 | |

Accounting and security lending fees | 1,235,523 | |

Custodian fees and expenses | 86,992 | |

Independent trustees' compensation | 11,964 | |

Registration fees | 371,318 | |

Audit | 90,372 | |

Legal | 6,703 | |

Miscellaneous | 18,608 | |

Total expenses before reductions | 26,957,596 | |

Expense reductions | (78,991) | 26,878,605 |

Net investment income (loss) | | 165,133,201 |

Realized and Unrealized Gain (Loss) | | |

Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | (20,633,779) | |

Foreign currency transactions | (967,352) | |

Total net realized gain (loss) | | (21,601,131) |

Change in net unrealized appreciation (depreciation) on: Investment securities (net of increase in deferred foreign taxes of $10,959) | (158,411,967) | |

Assets and liabilities in foreign currencies | 22,756 | |

Total change in net unrealized appreciation (depreciation) | | (158,389,211) |

Net gain (loss) | | (179,990,342) |

Net increase (decrease) in net assets resulting from operations | | $ (14,857,141) |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| Year ended

December 31, 2015 | Year ended

December 31, 2014 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 165,133,201 | $ 122,276,321 |

Net realized gain (loss) | (21,601,131) | 5,625,210 |

Change in net unrealized appreciation (depreciation) | (158,389,211) | (57,165,591) |

Net increase (decrease) in net assets resulting from operations | (14,857,141) | 70,735,940 |

Distributions to shareholders from net investment income | (141,885,884) | (108,098,355) |

Distributions to shareholders from net realized gain | - | (24,974,778) |

Total distributions | (141,885,884) | (133,073,133) |

Share transactions - net increase (decrease) | 658,778,469 | 616,181,307 |

Redemption fees | 393,390 | 289,479 |

Total increase (decrease) in net assets | 502,428,834 | 554,133,593 |

| | |

Net Assets | | |

Beginning of period | 2,648,897,709 | 2,094,764,116 |

End of period (including undistributed net investment income of $23,232,217 and undistributed net investment income of $10,381,028, respectively) | $ 3,151,326,543 | $ 2,648,897,709 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Fidelity Advisor Emerging Markets Income Fund Class A

Years ended December 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 13.43 | $ 13.60 | $ 15.30 | $ 13.55 | $ 13.32 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .746 | .690 | .639 | .668 | .726 |

Net realized and unrealized gain (loss) | (.783) | (.133) | (1.670) | 1.920 | .256 |

Total from investment operations | (.037) | .557 | (1.031) | 2.588 | .982 |

Distributions from net investment income | (.635) | (.602) | (.577) | (.603) | (.698) |

Distributions from net realized gain | - | (.127) | (.095) | (.237) | (.057) |

Total distributions | (.635) | (.729) | (.672) | (.840) | (.755) |

Redemption fees added to paid in capitalC | .002 | .002 | .003 | .002 | .003 |

Net asset value, end of period | $ 12.76 | $ 13.43 | $ 13.60 | $ 15.30 | $ 13.55 |

Total ReturnA, B | (.34)% | 4.01% | (6.83)% | 19.54% | 7.59% |

Ratios to Average Net AssetsD, F | | | | | |

Expenses before reductions | 1.16% | 1.16% | 1.17% | 1.18% | 1.19% |

Expenses net of fee waivers, if any | 1.16% | 1.16% | 1.17% | 1.18% | 1.18% |

Expenses net of all reductions | 1.15% | 1.16% | 1.17% | 1.18% | 1.18% |

Net investment income (loss) | 5.60% | 4.88% | 4.45% | 4.59% | 5.40% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 238,065 | $ 289,083 | $ 348,952 | $ 480,718 | $ 309,900 |

Portfolio turnover rateE | 105% | 143% | 138% | 87% | 133% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Fidelity Advisor Emerging Markets Income Fund Class T

Years ended December 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 13.37 | $ 13.54 | $ 15.24 | $ 13.50 | $ 13.28 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .736 | .681 | .635 | .662 | .721 |

Net realized and unrealized gain (loss) | (.781) | (.130) | (1.668) | 1.914 | .249 |

Total from investment operations | (.045) | .551 | (1.033) | 2.576 | .970 |

Distributions from net investment income | (.627) | (.596) | (.575) | (.601) | (.696) |

Distributions from net realized gain | - | (.127) | (.095) | (.237) | (.057) |

Total distributions | (.627) | (.723) | (.670) | (.838) | (.753) |

Redemption fees added to paid in capitalC | .002 | .002 | .003 | .002 | .003 |

Net asset value, end of period | $ 12.70 | $ 13.37 | $ 13.54 | $ 15.24 | $ 13.50 |

Total ReturnA, B | (.40)% | 3.99% | (6.87)% | 19.51% | 7.52% |

Ratios to Average Net AssetsD, F | | | | | |

Expenses before reductions | 1.20% | 1.20% | 1.19% | 1.20% | 1.21% |

Expenses net of fee waivers, if any | 1.20% | 1.20% | 1.19% | 1.20% | 1.20% |

Expenses net of all reductions | 1.20% | 1.19% | 1.19% | 1.20% | 1.20% |

Net investment income (loss) | 5.56% | 4.85% | 4.44% | 4.57% | 5.39% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 78,114 | $ 87,301 | $ 89,378 | $ 138,448 | $ 104,920 |

Portfolio turnover rateE | 105% | 143% | 138% | 87% | 133% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Fidelity Advisor Emerging Markets Income Fund Class B

Years ended December 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 13.59 | $ 13.76 | $ 15.47 | $ 13.69 | $ 13.46 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .661 | .596 | .546 | .569 | .639 |

Net realized and unrealized gain (loss) | (.787) | (.139) | (1.691) | 1.944 | .248 |

Total from investment operations | (.126) | .457 | (1.145) | 2.513 | .887 |

Distributions from net investment income | (.546) | (.502) | (.473) | (.498) | (.603) |

Distributions from net realized gain | - | (.127) | (.095) | (.237) | (.057) |

Total distributions | (.546) | (.629) | (.568) | (.735) | (.660) |

Redemption fees added to paid in capitalC | .002 | .002 | .003 | .002 | .003 |

Net asset value, end of period | $ 12.92 | $ 13.59 | $ 13.76 | $ 15.47 | $ 13.69 |

Total ReturnA, B | (.99)% | 3.24% | (7.49)% | 18.71% | 6.77% |

Ratios to Average Net AssetsD, F | | | | | |

Expenses before reductions | 1.87% | 1.88% | 1.89% | 1.89% | 1.90% |

Expenses net of fee waivers, if any | 1.87% | 1.88% | 1.89% | 1.89% | 1.87% |

Expenses net of all reductions | 1.87% | 1.87% | 1.89% | 1.89% | 1.87% |

Net investment income (loss) | 4.88% | 4.17% | 3.73% | 3.87% | 4.71% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 3,710 | $ 6,410 | $ 8,975 | $ 18,474 | $ 18,427 |

Portfolio turnover rateE | 105% | 143% | 138% | 87% | 133% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Fidelity Advisor Emerging Markets Income Fund Class C

Years ended December 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 13.52 | $ 13.70 | $ 15.40 | $ 13.64 | $ 13.40 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .651 | .588 | .536 | .564 | .630 |

Net realized and unrealized gain (loss) | (.774) | (.147) | (1.675) | 1.925 | .262 |

Total from investment operations | (.123) | .441 | (1.139) | 2.489 | .892 |

Distributions from net investment income | (.539) | (.496) | (.469) | (.494) | (.598) |

Distributions from net realized gain | - | (.127) | (.095) | (.237) | (.057) |

Total distributions | (.539) | (.623) | (.564) | (.731) | (.655) |

Redemption fees added to paid in capitalC | .002 | .002 | .003 | .002 | .003 |

Net asset value, end of period | $ 12.86 | $ 13.52 | $ 13.70 | $ 15.40 | $ 13.64 |

Total ReturnA, B | (.97)% | 3.14% | (7.48)% | 18.59% | 6.83% |

Ratios to Average Net AssetsD, F | | | | | |

Expenses before reductions | 1.91% | 1.91% | 1.92% | 1.92% | 1.93% |

Expenses net of fee waivers, if any | 1.91% | 1.91% | 1.92% | 1.92% | 1.92% |

Expenses net of all reductions | 1.90% | 1.91% | 1.92% | 1.92% | 1.92% |

Net investment income (loss) | 4.85% | 4.13% | 3.71% | 3.84% | 4.66% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 98,757 | $ 130,015 | $ 151,747 | $ 213,626 | $ 126,005 |

Portfolio turnover rateE | 105% | 143% | 138% | 87% | 133% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Fidelity Advisor Emerging Markets Income Fund Class I

Years ended December 31, | 2015 | 2014 | 2013 | 2012 | 2011 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 13.17 | $ 13.35 | $ 15.03 | $ 13.33 | $ 13.12 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .766 | .713 | .663 | .701 | .753 |

Net realized and unrealized gain (loss) | (.768) | (.132) | (1.633) | 1.881 | .249 |

Total from investment operations | (.002) | .581 | (.970) | 2.582 | 1.002 |

Distributions from net investment income | (.660) | (.636) | (.618) | (.647) | (.738) |

Distributions from net realized gain | - | (.127) | (.095) | (.237) | (.057) |

Total distributions | (.660) | (.763) | (.713) | (.884) | (.795) |

Redemption fees added to paid in capitalB | .002 | .002 | .003 | .002 | .003 |

Net asset value, end of period | $ 12.51 | $ 13.17 | $ 13.35 | $ 15.03 | $ 13.33 |

Total ReturnA | (.07)% | 4.27% | (6.54)% | 19.84% | 7.88% |

Ratios to Average Net AssetsC, E | | | | | |

Expenses before reductions | .87% | .89% | .89% | .89% | .89% |

Expenses net of fee waivers, if any | .87% | .89% | .89% | .89% | .89% |

Expenses net of all reductions | .86% | .88% | .89% | .89% | .89% |

Net investment income (loss) | 5.89% | 5.16% | 4.74% | 4.88% | 5.70% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 2,732,680 | $ 2,136,089 | $ 1,495,712 | $ 1,376,278 | $ 585,546 |

Portfolio turnover rateD | 105% | 143% | 138% | 87% | 133% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Annual Report

For the period ended December 31, 2015

1. Organization.

Fidelity Advisor Emerging Markets Income Fund (the Fund) is a non-diversified fund of Fidelity Advisor Series VIII (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class C and Class I (formerly Institutional Class) shares, each of which along with Class B shares, has equal shares as to assets and voting privileges. Class B shares are closed to new accounts and additional purchases, except for exchanges and reinvestments. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Annual Report

3. Significant Accounting Policies - continued

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fidelity Management & Research Company (FMR) Fair Value Committee (the Committee). In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Corporate bonds, foreign government and government agency obligations, preferred securities and U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances. The Fund invests a significant portion

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Investment Valuation - continued

of its assets in below investment grade securities. The value of these securities can be more volatile due to changes in the credit quality of the issuer and is sensitive to changes in economic, market and regulatory conditions.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

ETFs are valued at their last sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day but the exchange reports a closing bid level, ETFs are valued at the closing bid and would be categorized as Level 1 in the hierarchy. In the event there was no closing bid, ETFs may be valued by another method that the Board believes reflects fair value in accordance with the Board's fair value pricing policies and may be categorized as Level 2 in the hierarchy.

Investments in open-end mutual funds , including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of December 31, 2015 is included at the end of the Fund's Schedule of Investments.

Annual Report

3. Significant Accounting Policies - continued