UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: September 30, 2006

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________________ to _________________________

Commission file number 0-17706

(Exact Name of Registrant as Specified in Its Charter)

| Pennsylvania | 23-2318082 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| | |

| 15 North Third Street, Quakertown, PA | 18951-9005 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's Telephone Number, Including Area Code (215)538-5600

Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No____

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ____ Accelerated filer ü Non-accelerated filer ____

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ____ No ü

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| Class | | Outstanding at November 6, 2006 |

| Common Stock, par value $.625 | | 3,126,985 |

QNB CORP. AND SUBSIDIARY

FORM 10-Q

QUARTER ENDED SEPTEMBER 30, 2006

| | | |

| | | |

ITEM 1. | | PAGE |

| | | |

| | | 1 |

| | | |

| | | 2 |

| | | |

| | | 3 |

| | | |

| | | 4 |

| | | |

ITEM 2. | | 12 |

| | | |

ITEM 3. | | 37 |

| | | |

ITEM 4. | | 37 |

| | | |

| | | |

| | | |

ITEM 1. | | 38 |

| | | |

ITEM 1A. | | 38 |

| | | |

ITEM 2. | | 38 |

| | | |

ITEM 3. | | 38 |

| | | |

ITEM 4. | | 38 |

| | | |

ITEM 5. | | 38 |

| | | |

ITEM 6. | | 38 |

| | | |

| |

| | | |

| |

QNB CORP. AND SUBSIDIARY

SEPTEMBER 30, 2006 AND 2005, AND DECEMBER 31, 2005

(Unaudited)

1. REPORTING AND ACCOUNTING POLICIES

The accompanying unaudited consolidated financial statements include the accounts of QNB Corp. (QNB) and its wholly-owned subsidiary, The Quakertown National Bank (the Bank). All significant intercompany accounts and transactions are eliminated in the consolidated financial statements.

These consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in QNB's 2005 Annual Report incorporated in the Form 10-K. Operating results for the three- and nine-month periods ended September 30, 2006 are not necessarily indicative of the results that may be expected for the year ending December 31, 2006.

The unaudited consolidated financial statements reflect all adjustments, which in the opinion of management are necessary for a fair presentation of the results of the interim periods and are of a normal and recurring nature. Tabular information, other than share and per share data, is presented in thousands of dollars.

In preparing the consolidated financial statements, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities at the dates of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from such estimates.

STOCK-BASED COMPENSATION

QNB sponsors stock-based compensation plans, administered by a committee, under which both qualified and non-qualified stock options may be granted periodically to certain employees. QNB accounted for all awards granted after January 1, 2002 under the “fair value” approach under Financial Accounting Standards Board (FASB) Statement No. 123, Accounting for Stock-Based Compensation. Effective January 1, 2006, QNB adopted FASB Statement No. 123 (revised 2004), Share-Based Payment (FASB No. 123r), using the modified prospective application method. The modified prospective application method applies to new awards, to any outstanding liability awards, and to awards modified, repurchased, or cancelled after January 1, 2006. For all awards granted prior to January 1, 2006, unrecognized compensation cost, on the date of adoption, will be recognized as an expense in future periods. The results for prior periods have not been restated.

The adoption of FASB No. 123r reduced net income by approximately $27,000 and $86,000 for the three- and nine-months ended September 30, 2006, respectively. The following table illustrates the effect on net income and earnings per share if QNB had applied the fair value recognition provisions to stock-based employee compensation during the period presented. For purposes of this pro forma disclosure, the value of the options is estimated using the Black-Scholes option-pricing model and amortized to expense over the options’ vesting period.

QNB CORP. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2006 AND 2005, AND DECEMBER 31, 2005

(Unaudited)

| | Three Months Ended September 30, 2005 | | Nine Months Ended September 30, 2005 | |

| Net income, as reported | | $ | 1,431 | | $ | 3,833 | |

| Deduct: Total stock-based employee compensation expense determined under fair value based method for all awards, net of related tax effects | | | 25 | | | 76 | |

| Pro forma net income | | $ | 1,406 | | $ | 3,757 | |

| | | | | | | | |

Earnings per share Basic - as reported | | $ | .46 | | $ | 1.24 | |

| | | | | | | | |

| Basic - pro forma | | $ | .45 | | $ | 1.21 | |

| | | | | | | | |

| Diluted - as reported | | $ | .45 | | $ | 1.21 | |

| | | | | | | | |

| Diluted - pro forma | | $ | .44 | | $ | 1.18 | |

As of September 30, 2006, there was approximately $119,000 of unrecognized compensation cost related to unvested share-based compensation awards granted. That cost is expected to be recognized over the next two and a quarter years.

Options are granted to certain employees at prices equal to the market value of the stock on the date the options are granted. The 1998 Plan authorizes the issuance of 220,500 options. The time period during which any option is exercisable under the Plan is determined by the committee but shall not commence before the expiration of six months after the date of grant or continue beyond the expiration of ten years after the date the option is awarded. The granted options vest ratably over a three-year period. As of September 30, 2006, there were 180,458 options outstanding under this Plan. The 2005 Plan authorizes the issuance of 200,000 options. The terms of the 2005 Plan are identical to the 1998 Plan, except options expire five years after the grant date. As of September 30, 2006, there were 8,900 options outstanding under this Plan.

The fair value of each option is amortized into compensation expense on a straight-line basis between the grant date for the option and each vesting date. QNB estimated the fair value of stock options on the date of the grant using the Black-Scholes option pricing model. The model requires the use of numerous assumptions, many of which are subjective in nature. The following assumptions were used in the option pricing model in determining the fair value of options granted during the three- and nine-months ended September 30:

| Options granted | | 2006 | | 2005 | | 2004 | |

| Risk-free interest rate | | | 4.27 | % | | 4.18 | % | | 4.39 | % |

| Dividend yield | | | 3.23 | | | 2.40 | | | 2.20 | |

| Volatility | | | 13.28 | | | 14.05 | | | 13.61 | |

| Expected life | | | 5 yrs. | | | 10 yrs. | | | 10 yrs. | |

The risk-free interest rate was selected based upon yields of U.S. Treasury issues with a term equal to the expected life of the option being valued. Historical information was the primary basis for the selection of the expected dividend yield, expected volatility and expected lives of the options.

QNB CORP. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2006 AND 2005, AND DECEMBER 31, 2005

(Unaudited)

The fair market value of options granted in the first nine months of 2006 and 2005 was $3.13 and $6.46, respectively.

Stock option activity during the nine-months ended September 30, 2006 is as follows:

| | | | | | | Weighted | | | |

| | | | | | | Average | | Aggregate | |

| | | | | Weighted | | Remaining | | Intrinsic | |

| | Number of | | Average | | Contractual | | Value | |

| | | Options | | Exercise Price | | Term (in yrs.) | | (in thousands) | |

| | | | | | | | | | |

| Outstanding at January 1, 2006 | | | 193,374 | | $ | 19.18 | | | 5.93 | | | | |

| Exercised | | | (21,416 | ) | | 16.27 | | | | | | | |

| Granted | | | 17,400 | | | 26.00 | | | | | | | |

| Outstanding at September 30, 2006 | | | 189,358 | | | 20.13 | | | 5.17 | | $ | 1,177 | |

| Exercisable at September 30, 2006 | | | 137,058 | | | 16.16 | | | 4.58 | | $ | 1,177 | |

2. PER SHARE DATA

The following sets forth the computation of basic and diluted earnings per share (share and per share data are not in thousands):

| | | For the Three Months Ended September 30, | | For the Nine Months Ended September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | |

| Numerator for basic and diluted earnings per share-net income | | $ | 1,517 | | $ | 1,431 | | $ | 4,497 | | $ | 3,833 | |

| | | | | | | | | | | | | | |

| Denominator for basic earnings per share-weighted average shares outstanding | | | 3,126,985 | | | 3,102,628 | | | 3,123,800 | | | 3,101,300 | |

| | | | | | | | | | | | | | |

| Effect of dilutive securities-employee stock options | | | 51,086 | | | 71,420 | | | 52,300 | | | 74,898 | |

| Denominator for diluted earnings per share- adjusted weighted average shares outstanding | | | 3,178,071 | | | 3,174,048 | | | 3,176,100 | | | 3,176,198 | |

| | | | | | | | | | | | | | |

| Earnings per share-basic | | $ | .48 | | $ | .46 | | $ | 1.44 | | $ | 1.24 | |

| Earnings per share-diluted | | $ | .48 | | $ | .45 | | $ | 1.42 | | $ | 1.21 | |

QNB CORP. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2006 AND 2005, AND DECEMBER 31, 2005

(Unaudited)

2. PER SHARE DATA (Continued):

There were 52,300 and 34,900 stock options that were anti-dilutive for the three- and nine-month periods ended September 30, 2006, respectively. There were 40,000 stock options that were anti-dilutive for the three- and nine-month periods ended September 30, 2005. These stock options were not included in the above calculation.

3. COMPREHENSIVE INCOME

Comprehensive income is defined as the change in equity of a business entity during a period from transactions and other events and circumstances, excluding those resulting from investments by and distributions to owners. For QNB, the sole component of other comprehensive income is the unrealized holding gains and losses on available-for-sale investment securities.

The following table shows the components and activity of comprehensive income during the periods ended September 30, 2006 and 2005:

| | | For the Three Months Ended September 30, | | For the Nine Months Ended September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | |

| Unrealized holding gains (losses) arising during the period on securities held (net of taxes of $(1,222), $718, $(215) and $1,052, respectively) | | $ | 2,373 | | $ | (1,283 | ) | $ | 418 | | $ | (1,811 | ) |

| Reclassification adjustment for (gains) losses included in net income (net of taxes of $67, $(1), $208 and $(7), respectively) | | | (129 | ) | | 3 | | | (403 | ) | | 573 | |

| Net change in unrealized gains (losses) during the period | | | 2,244 | | | (1,280 | ) | | 15 | | | (1,238 | ) |

| | | | | | | | | | | | | | |

| Unrealized holding (losses) gains, beginning of period | | | (3,491 | ) | | 733 | | | (1,262 | ) | | 691 | |

| Unrealized holding losses, end of period | | $ | (1,247 | ) | $ | (547 | ) | $ | (1,247 | ) | $ | (547 | ) |

| | | | | | | | | | | | | |

| Net income | | $ | 1,517 | | $ | 1,431 | | $ | 4,497 | | $ | 3,833 | |

Other comprehensive income, net of tax: Unrealized holding gains (losses) arising during the period (net of taxes of $(1,155), $717, $(7) and $1,045, respectively) | | | 2,244 | | | (1,280 | ) | | 15 | | | (1,238 | ) |

| Comprehensive income | | $ | 3,761 | | $ | 151 | | $ | 4,512 | | $ | 2,595 | |

QNB CORP. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2006 AND 2005, AND DECEMBER 31, 2005

(Unaudited)

4. LOANS

The following table presents loans by category as of September 30, 2006 and December 31, 2005:

| | September 30, 2006 | | December 31, 2005 | |

| Commercial and industrial | | $ | 64,477 | | $ | 64,812 | |

| Construction | | | 11,084 | | | 7,229 | |

| Real estate-commercial | | | 114,386 | | | 104,793 | |

| Real estate-residential | | | 123,754 | | | 112,920 | |

| Consumer | | | 5,288 | | | 5,080 | |

| Indirect lease financing | | | 12,665 | | | 6,451 | |

| Total loans | | | 331,654 | | | 301,285 | |

| Unearned costs | | | 146 | | | 64 | |

| Total loans net of unearned costs | | $ | 331,800 | | $ | 301,349 | |

5. INTANGIBLE ASSETS

As a result of a purchase of deposits in 1997, QNB recorded a deposit premium of $511,000. This premium is being amortized, for book purposes, over ten years and is reviewed annually for impairment. The net deposit premium intangible was $56,000 and $94,000 at September 30, 2006 and December 31, 2005, respectively. Amortization expense for core deposit intangibles was $12,000 for both three-month periods ended September 30, 2006 and 2005 and $38,000 for both nine-month periods ended September 30, 2006 and 2005.

The following table reflects the components of mortgage servicing rights as of the periods indicated:

| | | September 30, | | December 31, | |

| | | 2006 | | 2005 | |

| | | | | | |

| Mortgage servicing rights beginning balance | | $ | 528 | | $ | 552 | |

| Mortgage servicing rights capitalized | | | 23 | | | 80 | |

| Mortgage servicing rights amortized | | | (65 | ) | | (109 | ) |

| Fair market value adjustments | | | — | | | 5 | |

| Mortgage servicing rights ending balance | | $ | 486 | | $ | 528 | |

| | | | | | | | |

| Mortgage loans serviced for others | | $ | 76,369 | | $ | 77,196 | |

| Amortization expense of intangibles | | | 103 | | | 160 | |

QNB CORP. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2006 AND 2005, AND DECEMBER 31, 2005

(Unaudited)

5. INTANGIBLE ASSETS (Continued):

The annual estimated amortization expense of intangible assets for each of the five succeeding fiscal years is as follows:

Estimated Amortization Expense

| For the Year Ended 12/31/06 | | $ | 138 | |

| For the Year Ended 12/31/07 | | | 130 | |

| For the Year Ended 12/31/08 | | | 75 | |

| For the Year Ended 12/31/09 | | | 62 | |

| For the Year Ended 12/31/10 | | | 51 | |

6. RELATED PARTY TRANSACTIONS

As of September 30, 2006, amounts due from directors, principal officers, and their related interests totaled $4,281,000. All of these transactions were made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons. The Bank believes that these loans did not involve a more than normal risk of collectibility or present any other unfavorable features.

On September 22, 2005, the Bank approved and entered into an agreement with Eugene T. Parzych, Inc. to act as the general contractor for the renovation of its property at 322 W. Broad Street, Quakertown, Pennsylvania to be used as additional office space. The bids for this project were submitted through a formal bidding process and reviewed by the Board of Directors. Mr. Gary S. Parzych is the president of Eugene T. Parzych, Inc. and is also a director of QNB Corp. Management and the Board of Directors of QNB Corp. and the Bank believe this is an arms-length transaction. The total paid to Eugene T. Parzych Inc. for this project was $1,243,000 with $1,029,000 being paid during 2006.

7. RECENT ACCOUNTING PRONOUNCEMENTS

In February 2006, the FASB issued FASB No. 155, Accounting for Certain Hybrid Instruments, as an amendment of FASB Statements No. 133 and 140. FASB No. 155 allows financial instruments that have embedded derivatives to be accounted for as a whole (eliminating the need to bifurcate the derivative from its host) if the holder elects to account for the whole instrument on a fair value basis. This statement is effective for all financial instruments acquired or issued after the beginning of an entity’s first fiscal year that begins after September 15, 2006. The adoption of this standard is not expected to have a material effect on the QNB’s results of operations or financial position.

In March 2006, the FASB issued FASB No. 156, Accounting for Servicing of Financial Assets. This Statement, which is an amendment to FASB No. 140, will simplify the accounting for servicing assets and liabilities, such as those common with mortgage securitization activities. Specifically, FASB No. 156 addresses the recognition and measurement of separately recognized servicing assets and liabilities and provides an approach to simplify efforts to obtain hedge-like (offset) accounting. FASB No. 156 also clarifies when an obligation to service financial assets should be separately recognized as a servicing asset or a servicing liability, requires that a separately recognized servicing asset or servicing liability be initially measured at fair value, if practicable, and permits an entity with a separately recognized

QNB CORP. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2006 AND 2005, AND DECEMBER 31, 2005

(Unaudited)

servicing asset or servicing liability to choose either of the amortization or fair value methods for subsequent measurement. The provisions of FASB No. 156 are effective as of the beginning of the first fiscal year that begins after September 15, 2006. The adoption of this standard is not expected to have a material effect on QNB’s results of operations or financial position.

In September 2006, the FASB issued FASB No. 157, Fair Value Measurements, which provides enhanced guidance for using fair value to measure assets and liabilities. The standard applies whenever other standards require or permit assets or liabilities to be measured at fair value. The Standard does not expand the use of fair value in any new circumstances. FASB No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. Early adoption is permitted. The adoption of this standard is not expected to have a material effect on QNB’s results of operations or financial position.

In June 2006, the FASB issued FASB Interpretation No. 48 (FIN 48), Accounting for Uncertainty in Income Taxes. FIN 48 is an interpretation of FASB No. 109, Accounting for Income Taxes, and it seeks to reduce the diversity in practice associated with certain aspects of measurement and recognition in accounting for income taxes. In addition, FIN 48 requires expanded disclosure with respect to the uncertainty in income taxes and is effective for fiscal years beginning after December 15, 2006. The adoption of this standard is not expected to have a material effect on QNB’s results of operations

In September 2006, the SEC issued Staff Accounting Bulletin No. 108 (SAB 108), Considering the Effects of Prior Year Misstatements When Quantifying Misstatements in Current Year Financial Statements, providing guidance on quantifying financial statement misstatement and implementation when first applying this guidance. Under SAB 108, companies should evaluate a misstatement based on its impact on the current year income statement, as well as the cumulative effect of correcting such misstatements that existed in prior years existing in the current year's ending balance sheet. SAB 108 is effective for fiscal years ending after November 15, 2006. The adoption of this standard is not expected to have a material effect on QNB’s results of operations.

In September 2006, the FASB reached consensus on the guidance provided by Emerging Issues Task Force Issue 06-4 (EITF 06-4), Accounting for Deferred Compensation and Postretirement Benefit Aspects of Endorsement Split-Dollar Life Insurance Arrangements. The guidance is applicable to endorsement split-dollar life insurance arrangements, whereby the employer owns and controls the insurance policy, that are associated with a postretirement benefit. EITF 06-4 requires that for a split-dollar life insurance arrangement within the scope of the Issue, an employer should recognize a liability for future benefits in accordance with FAS No. 106 (if, in substance, a postretirement benefit plan exists) or Accounting Principles Board Opinion No. 12 (if the arrangement is, in substance, an individual deferred compensation contract) based on the substantive agreement with the employee. EITF 06-4 is effective for fiscal years beginning after December 15, 2007. QNB is currently evaluating the impact the adoption of the standard will have on its results of operations and financial position.

In September 2006, the FASB reached consensus on the guidance provided by Emerging Issues Task Force Issue 06-5 (EITF 06-5), Accounting for Purchases of Life Insurance—Determining the Amount That Could Be Realized in Accordance with FASB Technical Bulletin No. 85-4, Accounting for Purchases of Life Insurance. EITF 06-5 states that a policyholder should consider any additional amounts included in the contractual terms of the insurance policy other than the cash surrender value in determining the amount that could be realized under the insurance contract. EITF 06-5 also states that a

QNB CORP. AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2006 AND 2005, AND DECEMBER 31, 2005

(Unaudited)

policyholder should determine the amount that could be realized under the life insurance contract assuming the surrender of an individual-life by individual-life policy (or certificate by certificate in a group policy). EITF 06-5 is effective for fiscal years beginning after December 15, 2006. QNB is currently evaluating the impact the adoption of the standard will have on its results of operations and financial position.

QNB Corp. (the Corporation) is a bank holding company headquartered in Quakertown, Pennsylvania. The Corporation, through its wholly-owned subsidiary, The Quakertown National Bank (the Bank), has been serving the residents and businesses of upper Bucks, northern Montgomery and southern Lehigh Counties in Pennsylvania since 1877. The Bank is a locally managed community bank that provides a full range of commercial and retail banking and retail brokerage services. The consolidated entity is referred to herein as “QNB”.

Forward-Looking Statements

In addition to historical information, this document contains forward-looking statements. Forward-looking statements are typically identified by words or phrases such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” or similar expressions. The U.S. Private Securities Litigation Reform Act of 1995 provides safe harbor in regard to the inclusion of forward-looking statements in this document and documents incorporated by reference.

Shareholders should note that many factors, some of which are discussed elsewhere in this document and in the documents that are incorporated by reference, could affect the future financial results of the Corporation and its subsidiary and could cause those results to differ materially from those expressed in the forward-looking statements contained or incorporated by reference in this document. These factors include, but are not limited, to the following:

| | · | Operating, legal and regulatory risks |

| | · | Economic, political and competitive forces affecting the Corporation’s line of business |

| | · | The risk that the analysis of these risks and forces could be incorrect, and/or that the strategies developed to address them could be unsuccessful |

| | · | Volatility in interest rates and shape of the yield curve |

QNB cautions that these forward-looking statements are subject to numerous assumptions, risks and uncertainties, all of which change over time, and QNB assumes no duty to update forward-looking statements. Management cautions readers not to place undue reliance on any forward-looking statements. These statements speak only as of the date made, and they advise readers that various factors, including those described above, could affect QNB’s financial performance and could cause actual results or circumstances for future periods to differ materially from those anticipated or projected. Except as required by law, QNB does not undertake, and specifically disclaims any obligation, to publicly release any revisions to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

Critical Accounting Policies and Estimates

Discussion and analysis of the financial condition and results of operations are based on the consolidated financial statements of QNB, which are prepared in accordance with U.S. generally accepted accounting principles (GAAP). The preparation of these consolidated financial statements requires QNB to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosures of contingent assets and liabilities. QNB evaluates estimates on an on-going basis, including those

QNB CORP. AND SUBSIDIARY

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

Critical Accounting Policies and Estimates (Continued):

related to the allowance for loan losses, non-accrual loans, other real estate owned, other-than-temporary investment impairments, intangible assets, stock option plans and income taxes. QNB bases its estimates on historical experience and various other factors and assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

QNB believes the following critical accounting policies affect its more significant judgments and estimates used in preparation of its consolidated financial statements: allowance for loan losses, income taxes and other-than-temporary investment security impairment. Each estimate is discussed below. The financial impact of each estimate is discussed in the applicable sections of Management’s Discussion and Analysis.

Allowance for Loan Losses

QNB considers that the determination of the allowance for loan losses involves a higher degree of judgment and complexity than its other significant accounting policies. The allowance for loan losses is calculated with the objective of maintaining a level believed by management to be sufficient to absorb probable known and inherent losses in the outstanding loan portfolio. The allowance is reduced by actual credit losses and is increased by the provision for loan losses and recoveries of previous losses. The provisions for loan losses are charged to earnings to bring the total allowance for loan losses to a level considered necessary by management.

The allowance for loan losses is based on management’s continuing review and evaluation of the loan portfolio. The level of the allowance is determined by assigning specific reserves to individually identified problem credits and general reserves to all other loans. The portion of the allowance that is allocated to internally criticized and non-accrual loans is determined by estimating the inherent loss on each credit after giving consideration to the value of underlying collateral. The general reserves are based on the composition and risk characteristics of the loan portfolio, including the nature of the loan portfolio, credit concentration trends, historic and anticipated delinquency and loss experience, as well as other qualitative factors such as current economic trends.

Management emphasizes loan quality and close monitoring of potential problem credits. Credit risk identification and review processes are utilized in order to assess and monitor the degree of risk in the loan portfolio. QNB’s lending and loan administration staff are charged with reviewing the loan portfolio and identifying changes in the economy or in a borrower’s circumstances which may affect the ability to repay debt or the value of pledged collateral. A loan classification and review system exists that identifies those loans with a higher than normal risk of uncollectibility. Each commercial loan is assigned a grade based upon an assessment of the borrower’s financial capacity to service the debt and the presence and value of collateral for the loan. An independent loan review group tests risk assessments and evaluates the adequacy of the allowance for loan losses. Management meets monthly to review the credit quality of the loan portfolio and quarterly to review the allowance for loan losses.

In addition, various regulatory agencies, as an integral part of their examination process, periodically review QNB’s allowance for loan losses. Such agencies may require QNB to recognize additions to the allowance based on their judgments about information available to them at the time of their examination.

Management believes that it uses the best information available to make determinations about the adequacy of the allowance and that it has established its existing allowance for loan losses in accordance with GAAP. If circumstances differ substantially from the assumptions used in making determinations, future adjustments to the

QNB CORP. AND SUBSIDIARY

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

Critical Accounting Policies and Estimates (Continued):

allowance for loan losses may be necessary and results of operations could be affected. Because future events affecting borrowers and collateral cannot be predicted with certainty, increases to the allowance may be necessary should the quality of any loans deteriorate as a result of the factors discussed above.

Income Taxes.

QNB accounts for income taxes under the asset/liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases, as well as operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is established against deferred tax assets, when in the judgment of management, it is more likely than not that such deferred tax assets will not become available. A valuation allowance of $46,000 existed as of September 30, 2006 to offset a portion of the tax benefits associated with certain impaired securities that management believes may not be realizable. Because the judgment about the level of future taxable income is dependent to a great extent on matters that may, at least in part, be beyond QNB’s control, it is at least reasonably possible that management’s judgment about the need for a valuation allowance for deferred taxes could change in the near term.

Other-than-Temporary Impairment of Investment Securities

Securities are evaluated periodically to determine whether a decline in their value is other-than-temporary. Management utilizes criteria such as the magnitude and duration of the decline, in addition to the reasons underlying the decline, to determine whether the loss in value is other-than-temporary. The term “other-than-temporary” is not intended to indicate that the decline is permanent, but indicates that the prospects for a near-term recovery of value are not necessarily favorable, or that there is a lack of evidence to support realizable value equal to or greater than carrying value of the investment. Once a decline in value is determined to be other-than-temporary, the value of the security is reduced, and a corresponding charge to earnings is recognized.

QNB CORP. AND SUBSIDIARY

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

RESULTS OF OPERATIONS - OVERVIEW

QNB Corp. earns its net income primarily through its subsidiary, The Quakertown National Bank. Net interest income, or the spread between the interest, dividends and fees earned on loans and investment securities and the expense incurred on deposits and other interest-bearing liabilities, is the primary source of operating income for QNB. QNB seeks to achieve sustainable and consistent earnings growth while maintaining adequate levels of capital and liquidity and limiting its exposure to credit and interest rate risk to Board of Directors approved levels. Due to its limited geographic area, comprised principally of upper Bucks, southern Lehigh and northern Montgomery counties, growth is pursued through expansion of existing customer relationships and building new relationships by stressing a consistently high level of service at all points of contact.

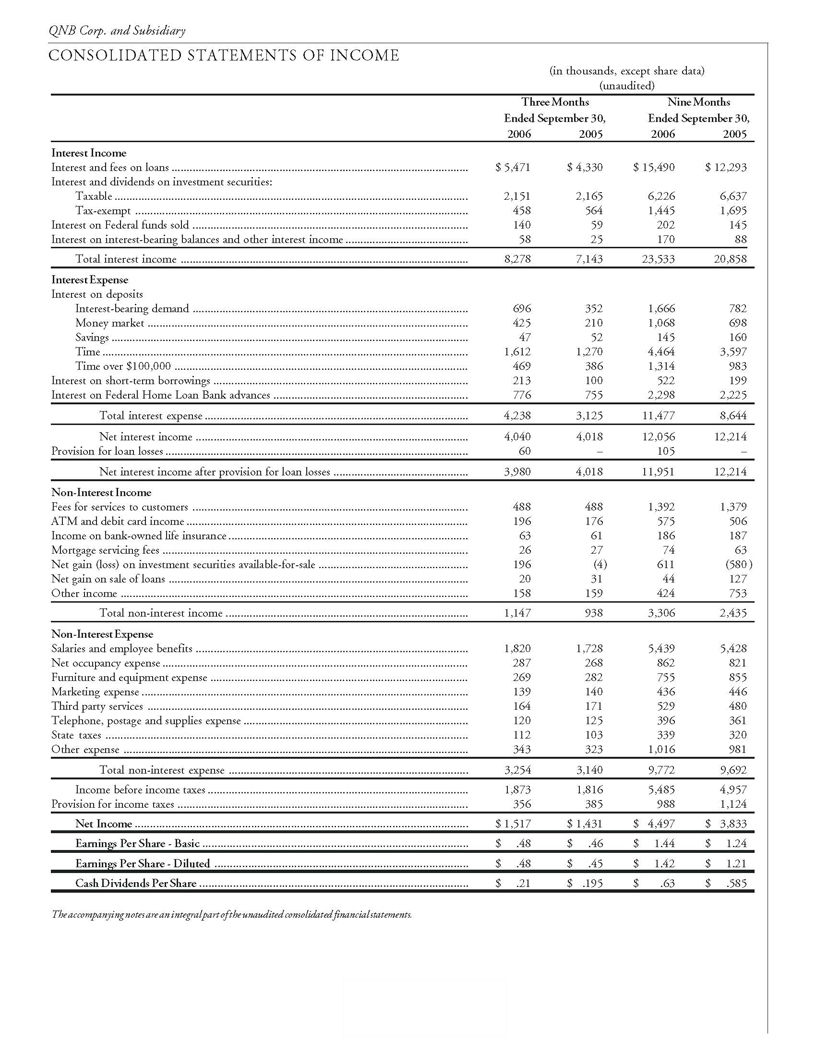

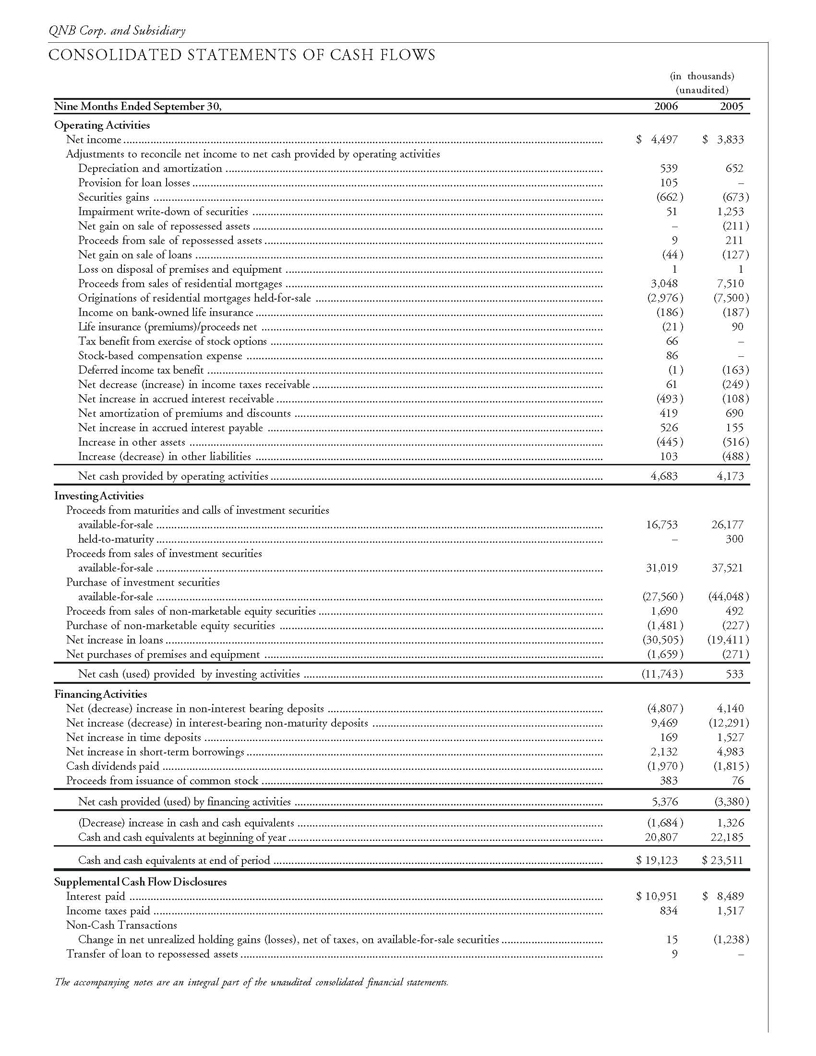

QNB reported net income for the third quarter of 2006 of $1,517,000, or $.48 per common share on a diluted basis. The results for the 2006 period compare to net income of $1,431,000, or $.45 per share on a diluted basis, for the same period in 2005. Net income for the first nine months of 2006 was $4,497,000, or $1.42 per diluted share, an increase from the $3,833,000, or $1.21 per diluted share, for the comparable period in 2005.

The results for the nine-month period ended September 30, 2005 were significantly impacted by a $1,253,000 unrealized loss as an other-than-temporary impairment related to certain Fannie Mae (FNMA) and Freddie Mac (FHLMC) preferred stock issues recorded in accordance with U.S. generally accepted accounting principles (GAAP). On an after-tax basis, the charge was approximately $1,017,000, or $.32 per share diluted. QNB established a $190,000 valuation allowance to offset a portion of the tax benefits associated with the write-down of these securities because such tax benefits may not be realizable. During the first quarter of 2006, QNB sold its preferred stock holdings and recorded a gain of $451,000 on the carrying value of those issues that had previously been impaired and a $300,000 loss on one issue that was not impaired in 2005. In addition, during the first nine months of 2006, QNB realized capital gains which allowed a reversal of $164,000 of the tax valuation allowance provided in 2005.

Two important measures of profitability in the banking industry are an institution's return on average assets and return on average shareholders' equity. Return on average assets was 1.00 percent and .97 percent, while the return on average equity was 11.99 percent and 12.19 percent, for the three-months ended September 30, 2006 and 2005, respectively. For the nine-month periods ended September 30, 2006 and 2005, return on average assets was 1.02 percent and .88 percent, and the return on average equity was 12.18 percent and 11.07 percent, respectively. Excluding the impact of the impairment charge, the return on average assets for the nine-month period ended September 30, 2005 would have been 1.11 percent and the return on average equity would have been 14.00 percent.

QNB’s net interest income increased in the third quarter of 2006, to $4,040,000, as compared to $4,018,000 for the same quarter of 2005. Growth in average earning assets and the continued shift of the balance sheet from investment securities to loans helped offset the decline in the net interest margin. For the nine-month periods, net interest income declined by 1.3 percent, to $12,056,000, as the decrease in the net interest margin was only partially offset by growth in average earning assets and the change in the balance sheet composition. Like most financial institutions, QNB’s funding costs of deposits and borrowed money continued to increase at a faster pace than the rates earned on loans and investment securities. This trends is primarily the result of three factors: a highly competitive deposit and loan pricing environment, a sustained flat to inverted Treasury yield curve and the current structure of QNB’s balance sheet. The net interest margin declined 12 basis points, to 3.06 percent, from the third quarter of 2005 to the third quarter of 2006 and declined 9 basis points for the nine-month period, to 3.16 percent. Included in net interest income for the nine-month period of 2005 was $40,000 of interest income recovered on non-accrual and previously charged-off loans.

QNB CORP. AND SUBSIDIARY

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

RESULTS OF OPERATIONS - OVERVIEW (Continued)

Total non-interest income was $1,147,000 for the third quarter of 2006, compared to $938,000 for the same period in 2005. Excluding gains and losses on securities and loans, non-interest income was $931,000 for the quarter-ended September 30, 2006 compared to $911,000 for the same period in 2005. An increase in ATM and debit card income accounted for the $20,000 difference in non-interest income.

For the nine-month period, total non-interest income increased $871,000, to $3,306,000. Excluding gains and losses on securities and loans, non-interest income for the nine-month period decreased $237,000. Included in

non-interest income, under the category other income, during 2005 were several non-operating items; life insurance proceeds of $61,000, a sales tax refund of $45,000 and a $209,000 gain on the liquidation of assets relinquished by a borrower.

QNB has been successful in operating efficiently and controlling the growth in non-interest expense. Total non-interest expense increased $114,000, or 3.6 percent, for the three-month period with salary and benefit expense contributing $92,000 to the increase. Of the $92,000 increase in salaries and benefits expense, $27,000 related to the adoption of FASB No. 123r in 2006 and $40,000 was a result of a reversal during the third quarter of 2005 of an accrual for incentive compensation that was recorded during the first quarter of 2005.

For the nine-month period, total non-interest expense increased $80,000, or .8 percent, to $9,772,000. Salary and benefit expense accounted for $11,000 of this increase when comparing the nine-month periods. Salary expense, excluding the impact of the stock option expense, actually decreased when comparing the nine-month periods, as the adoption of FASB No. 123r in 2006 had the impact of increasing salary expense $86,000 for the nine-month period. The remaining increase in non-interest expense was spread across various categories.

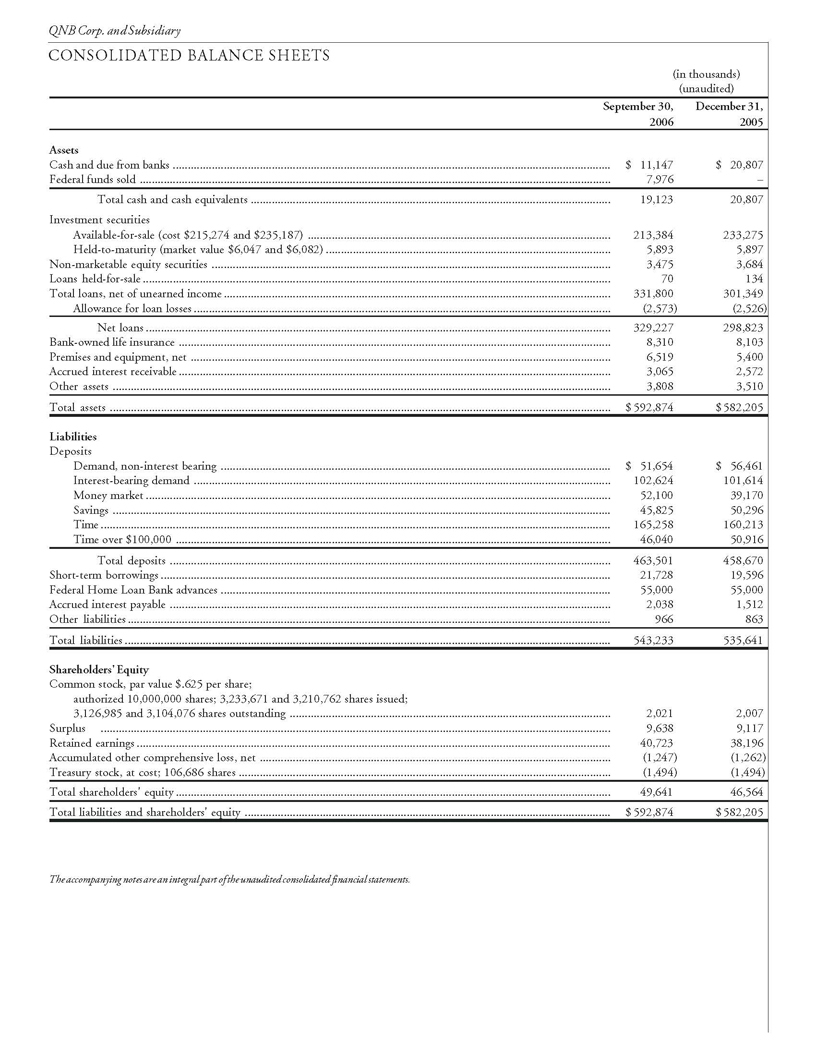

Loan growth, which has been extremely strong since the second quarter of 2005, slowed during the third quarter of 2006. Total loans decreased from $332,650,000 at June 30, 2006 to $331,800,000 at September 30, 2006. Some of this decline related to seasonal usage of commercial credit lines. However, when comparing total loans at September 30, 2005 and 2006, loans increased $44,312,000, or 15.4 percent. QNB’s successful loan growth is attributable to developing new relationships, as well as further developing existing relationships with small businesses in the communities served. Also contributing to loan growth was QNB’s entrance into indirect lease financing during the second quarter of 2005. This loan growth was achieved while maintaining excellent asset quality. Non-performing assets increased from .00 percent of total average assets at September 30, 2005 to .03 percent at September 30, 2006. While asset quality remained high, the strong growth in loans prompted the need for a provision for loan losses of $60,000 during the third quarter of 2006 and $105,000 for the first nine months of 2006. These provisions represented the first charges to loan loss expense since 1999. On the funding side of the balance sheet, total deposits increased $3,637,000, or .8 percent, from September 30, 2005 to September 30, 2006. The competition for deposits remains aggressive.

QNB operates in an attractive market for financial services, but also in a market with intense competition from other local community banks and regional and national financial institutions. QNB has been able to compete effectively with other financial institutions by emphasizing technology, including internet-banking and electronic bill pay, and customer service, including local decision-making on loans, an emphasis on long-term customer relationships and customer loyalty, and products and services designed to address the specific needs of our customers.

These items, as well as others, will be explained more thoroughly in the next sections.

QNB CORP. AND SUBSIDIARY

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

Average Balances, Rate, and Interest Income and Expense Summary (Tax-Equivalent Basis)

| | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | September 30, 2006 | | September 30, 2005 | |

| | | Average | | Average | | | | Average | | Average | | | |

| | | Balance | | Rate | | Interest | | Balance | | Rate | | Interest | |

Assets | | | | | | | | | | | | | |

| Federal funds sold | | $ | 10,570 | | | 5.27 | % | $ | 140 | | $ | 6,779 | | | 3.45 | % | $ | 59 | |

| Investment securities: | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury | | | 6,071 | | | 4.35 | % | | 67 | | | 6,107 | | | 2.22 | % | | 34 | |

| U.S. Government agencies | | | 36,587 | | | 5.03 | % | | 460 | | | 26,580 | | | 3.98 | % | | 265 | |

| State and municipal | | | 41,937 | | | 6.62 | % | | 694 | | | 52,595 | | | 6.50 | % | | 855 | |

| Mortgage-backed and CMOs | | | 119,239 | | | 4.30 | % | | 1,282 | | | 140,905 | | | 4.17 | % | | 1,468 | |

| Other | | | 21,278 | | | 6.54 | % | | 348 | | | 28,291 | | | 5.87 | % | | 415 | |

| Total investment securities | | | 225,112 | | | 5.07 | % | | 2,851 | | | 254,478 | | | 4.77 | % | | 3,037 | |

| Loans: | | | | | | | | | | | | | | | | | | | |

| Commercial real estate | | | 148,679 | | | 6.66 | % | | 2,497 | | | 125,132 | | | 6.23 | % | | 1,965 | |

| Residential real estate | | | 26,125 | | | 5.92 | % | | 387 | | | 25,669 | | | 5.85 | % | | 375 | |

| Home equity loans | | | 68,377 | | | 6.40 | % | | 1,103 | | | 61,055 | | | 6.00 | % | | 923 | |

| Commercial and industrial | | | 49,016 | | | 7.26 | % | | 897 | | | 47,761 | | | 6.33 | % | | 763 | |

| Indirect lease financing | | | 10,642 | | | 9.15 | % | | 246 | | | 3,674 | | | 8.85 | % | | 82 | |

| Consumer loans | | | 5,545 | | | 9.31 | % | | 130 | | | 5,434 | | | 8.68 | % | | 119 | |

| Tax-exempt loans | | | 21,347 | | | 5.95 | % | | 320 | | | 11,939 | | | 5.21 | % | | 157 | |

| Total loans, net of unearned* | | | 329,731 | | | 6.71 | % | | 5,580 | | | 280,664 | | | 6.20 | % | | 4,384 | |

| Other earning assets | | | 4,706 | | | 4.90 | % | | 58 | | | 4,716 | | | 2.12 | % | | 25 | |

| Total earning assets | | | 570,119 | | | 6.00 | % | $ | 8,629 | | | 546,637 | | | 5.45 | % | $ | 7,505 | |

| Cash and due from banks | | | 14,087 | | | | | | | | | 20,101 | | | | | | | |

| Allowance for loan losses | | | (2,555 | ) | | | | | | | | (2,582 | ) | | | | | | |

| Other assets | | | 20,539 | | | | | | | | | 19,112 | | | | | | | |

| Total assets | | $ | 602,190 | | | | | | | | $ | 583,268 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Liabilities and Shareholders' Equity | | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | | | | | | | | |

| Interest-bearing demand | | $ | 105,227 | | | 2.62 | % | $ | 696 | | $ | 97,314 | | | 1.43 | % | $ | 352 | |

| Money market | | | 54,154 | | | 3.11 | % | | 425 | | | 45,183 | | | 1.84 | % | | 210 | |

| Savings | | | 47,722 | | | 0.39 | % | | 47 | | | 52,571 | | | 0.39 | % | | 52 | |

| Time | | | 163,987 | | | 3.90 | % | | 1,612 | | | 161,786 | | | 3.11 | % | | 1,270 | |

| Time over $100,000 | | | 44,775 | | | 4.16 | % | | 469 | | | 47,676 | | | 3.21 | % | | 386 | |

| Total interest-bearing deposits | | | 415,865 | | | 3.10 | % | | 3,249 | | | 404,530 | | | 2.23 | % | | 2,270 | |

| Short-term borrowings | | | 23,337 | | | 3.62 | % | | 213 | | | 17,693 | | | 2.25 | % | | 100 | |

| Federal Home Loan Bank advances | | | 55,000 | | | 5.60 | % | | 776 | | | 55,000 | | | 5.45 | % | | 755 | |

| Total interest-bearing liabilities | | | 494,202 | | | 3.40 | % | | 4,238 | | | 477,223 | | | 2.60 | % | | 3,125 | |

| Non-interest-bearing deposits | | | 54,383 | | | | | | | | | 56,833 | | | | | | | |

| Other liabilities | | | 3,420 | | | | | | | | | 2,643 | | | | | | | |

| Shareholders' equity | | | 50,185 | | | | | | | | | 46,569 | | | | | | | |

| Total liabilities and shareholders' equity | | $ | 602,190 | | | | | | | | $ | 583,268 | | | | | | | |

| Net interest rate spread | | | | | | 2.60 | % | | | | | | | | 2.85 | % | | | |

| Margin/net interest income | | | | | | 3.06 | % | $ | 4,391 | | | | | | 3.18 | % | $ | 4,380 | |

| Tax-exempt securities and loans were adjusted to a tax-equivalent basis and are based on the marginal Federal corporate tax rate |

| of 34 percent. |

| Non-accrual loans are included in earning assets. |

| * Includes loans held-for-sale |

QNB CORP. AND SUBSIDIARY

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

Average Balances, Rate, and Interest Income and Expense Summary (Tax-Equivalent Basis)

| | | | | | | | | | | | | | |

| | | Nine Months Ended | |

| | | September 30, 2006 | | September 30, 2005 | |

| | | Average | | Average | | | | Average | | Average | | | |

| | | Balance | | Rate | | Interest | | Balance | | Rate | | Interest | |

Assets | | | | | | | | | | | | | |

| Federal funds sold | | $ | 5,309 | | | 5.09 | % | $ | 202 | | $ | 6,312 | | | 3.07 | % | $ | 145 | |

| Investment securities: | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury | | | 6,075 | | | 3.77 | % | | 171 | | | 6,124 | | | 2.10 | % | | 96 | |

| U.S. Government agencies | | | 29,129 | | | 4.72 | % | | 1,032 | | | 37,498 | | | 3.74 | % | | 1,052 | |

| State and municipal | | | 44,165 | | | 6.61 | % | | 2,190 | | | 52,660 | | | 6.50 | % | | 2,569 | |

| Mortgage-backed and CMOs | | | 123,623 | | | 4.29 | % | | 3,975 | | | 136,983 | | | 4.18 | % | | 4,299 | |

| Other | | | 22,829 | | | 6.30 | % | | 1,080 | | | 29,431 | | | 5.66 | % | | 1,249 | |

| Total investment securities | | | 225,821 | | | 4.99 | % | | 8,448 | | | 262,696 | | | 4.70 | % | | 9,265 | |

| Loans: | | | | | | | | | | | | | | | | | | | |

| Commercial real estate | | | 142,179 | | | 6.56 | % | | 6,971 | | | 123,388 | | | 6.15 | % | | 5,674 | |

| Residential real estate | | | 26,017 | | | 5.87 | % | | 1,146 | | | 24,957 | | | 5.87 | % | | 1,098 | |

| Home equity loans | | | 66,294 | | | 6.31 | % | | 3,131 | | | 60,100 | | | 5.88 | % | | 2,642 | |

| Commercial and industrial | | | 50,342 | | | 7.09 | % | | 2,671 | | | 45,628 | | | 6.15 | % | | 2,099 | |

| Indirect lease financing | | | 8,874 | | | 9.25 | % | | 614 | | | 1,488 | | | 9.11 | % | | 101 | |

| Consumer loans | | | 5,197 | | | 9.19 | % | | 357 | | | 5,298 | | | 8.83 | % | | 350 | |

| Tax-exempt loans | | | 20,875 | | | 5.82 | % | | 909 | | | 12,683 | | | 5.25 | % | | 499 | |

| Total loans, net of unearned* | | | 319,778 | | | 6.61 | % | | 15,799 | | | 273,542 | | | 6.09 | % | | 12,463 | |

| Other earning assets | | | 4,614 | | | 4.92 | % | | 170 | | | 4,689 | | | 2.50 | % | | 88 | |

| Total earning assets | | | 555,522 | | | 5.93 | % | $ | 24,619 | | | 547,239 | | | 5.37 | % | $ | 21,961 | |

| Cash and due from banks | | | 17,225 | | | | | | | | | 19,252 | | | | | | | |

| Allowance for loan losses | | | (2,531 | ) | | | | | | | | (2,595 | ) | | | | | | |

| Other assets | | | 19,979 | | | | | | | | | 19,006 | | | | | | | |

| Total assets | | $ | 590,195 | | | 5.58 | % | | | | $ | 582,902 | | | 5.04 | % | | | |

| | | | | | | | | | | | | | | | | | | | |

Liabilities and Shareholders' Equity | | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | | | | | | | | |

| Interest-bearing demand | | $ | 100,204 | | | 2.22 | % | $ | 1,666 | | $ | 93,440 | | | 1.12 | % | $ | 782 | |

| Money market | | | 50,050 | | | 2.85 | % | | 1,068 | | | 55,073 | | | 1.69 | % | | 698 | |

| Savings | | | 49,478 | | | 0.39 | % | | 145 | | | 54,507 | | | 0.39 | % | | 160 | |

| Time | | | 162,404 | | | 3.68 | % | | 4,464 | | | 162,986 | | | 2.95 | % | | 3,597 | |

| Time over $100,000 | | | 45,756 | | | 3.84 | % | | 1,314 | | | 44,307 | | | 2.96 | % | | 983 | |

| Total interest-bearing deposits | | | 407,892 | | | 2.84 | % | | 8,657 | | | 410,313 | | | 2.03 | % | | 6,220 | |

| Short-term borrowings | | | 20,532 | | | 3.40 | % | | 522 | | | 13,330 | | | 2.00 | % | | 199 | |

| Federal Home Loan Bank advances | | | 55,000 | | | 5.59 | % | | 2,298 | | | 55,000 | | | 5.41 | % | | 2,225 | |

| Total interest-bearing liabilities | | | 483,424 | | | 3.17 | % | | 11,477 | | | 478,643 | | | 2.41 | % | | 8,644 | |

| Non-interest-bearing deposits | | | 54,279 | | | | | | | | | 55,192 | | | | | | | |

| Other liabilities | | | 3,144 | | | | | | | | | 2,766 | | | | | | | |

| Shareholders' equity | | | 49,348 | | | | | | | | | 46,301 | | | | | | | |

| Total liabilities and shareholders' equity | | $ | 590,195 | | | 2.60 | % | | | | $ | 582,902 | | | 1.98 | % | | | |

| Net interest rate spread | | | | | | 2.76 | % | | | | | | | | 2.96 | % | | | |

| Margin/net interest income | | | | | | 3.16 | % | $ | 13,142 | | | | | | 3.25 | % | $ | 13,317 | |

| Tax-exempt securities and loans were adjusted to a tax-equivalent basis and are based on the marginal Federal corporate tax rate |

| of 34 percent. |

| Non-accrual loans are included in earning assets. |

| * Includes loans held-for-sale |

QNB CORP. AND SUBSIDIARY

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

| | | Three Months Ended | | Nine Months Ended | |

| | | September 30, 2006 compared | | September 30, 2006 compared | |

| | | to September 30, 2005 | | to September 30, 2005 | |

| | | Total | | Due to change in: | | Total | | Due to change in: | |

| | | Change | | Volume | | Rate | | Change | | Volume | | Rate | |

Interest income: | | | | | | | | | | | | | |

| Federal funds sold | | $ | 81 | | $ | 33 | | $ | 48 | | $ | 57 | | $ | (23 | ) | $ | 80 | |

| Investment securities: | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury | | | 33 | | | (0 | ) | | 33 | | | 75 | | | (1 | ) | | 76 | |

| U.S. Government agencies | | | 195 | | | 99 | | | 96 | | | (20 | ) | | (235 | ) | | 215 | |

| State and municipal | | | (161 | ) | | (173 | ) | | 12 | | | (379 | ) | | (415 | ) | | 36 | |

| Mortgage-backed and CMOs | | | (186 | ) | | (226 | ) | | 40 | | | (324 | ) | | (419 | ) | | 95 | |

| Other | | | (67 | ) | | (103 | ) | | 36 | | | (169 | ) | | (280 | ) | | 111 | |

| Loans: | | | | | | | | | | | | | | | | | | | |

| Commercial real estate | | | 532 | | | 370 | | | 162 | | | 1,297 | | | 864 | | | 433 | |

| Residential real estate | | | 12 | | | 7 | | | 5 | | | 48 | | | 47 | | | 1 | |

| Home equity loans | | | 180 | | | 111 | | | 69 | | | 489 | | | 272 | | | 217 | |

| Commercial and industrial | | | 134 | | | 20 | | | 114 | | | 572 | | | 217 | | | 355 | |

| Indirect lease financing | | | 164 | | | 156 | | | 8 | | | 513 | | | 503 | | | 10 | |

| Consumer loans | | | 11 | | | 2 | | | 9 | | | 7 | | | (7 | ) | | 14 | |

| Tax-exempt loans | | | 163 | | | 124 | | | 39 | | | 410 | | | 322 | | | 88 | |

| Other earning assets | | | 33 | | | (0 | ) | | 33 | | | 82 | | | (2 | ) | | 84 | |

| Total interest income | | $ | 1,124 | | $ | 420 | | $ | 704 | | $ | 2,658 | | $ | 843 | | $ | 1,815 | |

Interest expense: | | | | | | | | | | | | | | | | | | | |

| Interest-bearing demand | | $ | 344 | | $ | 28 | | $ | 316 | | $ | 884 | | $ | 56 | | $ | 828 | |

| Money market | | | 215 | | | 42 | | | 173 | | | 370 | | | (63 | ) | | 433 | |

| Savings | | | (5 | ) | | (5 | ) | | 0 | | | (15 | ) | | (15 | ) | | (0 | ) |

| Time | | | 342 | | | 17 | | | 325 | | | 867 | | | (13 | ) | | 880 | |

| Time over $100,000 | | | 83 | | | (23 | ) | | 106 | | | 331 | | | 32 | | | 299 | |

| Short-term borrowings | | | 113 | | | 32 | | | 81 | | | 323 | | | 108 | | | 215 | |

| Federal Home Loan Bank advances | | | 21 | | | — | | | 21 | | | 73 | | | — | | | 73 | |

| Total interest expense | | | 1,113 | | | 91 | | | 1,022 | | | 2,833 | | | 105 | | | 2,728 | |

Net interest income | | $ | 11 | | $ | 329 | | $ | (318 | ) | $ | (175 | ) | $ | 738 | | $ | (913 | ) |

QNB CORP. AND SUBSIDIARY

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

NET INTEREST INCOME

The following table presents the adjustment to convert net interest income to net interest income on a fully taxable equivalent basis for the three- and nine-month periods ended September 30, 2006 and 2005.

| | | For the Three Months | | For the Nine Months | |

| | | Ended September 30, | | Ended September 30, | |

| | | 2006 | | 2005 | | 2006 | | 2005 | |

| | | | | | | | | | |

| Total interest income | | $ | 8,278 | | $ | 7,143 | | $ | 23,533 | | $ | 20,858 | |

| Total interest expense | | | 4,238 | | | 3,125 | | | 11,477 | | | 8,644 | |

| | | | | | | | | | | | | | |

| Net interest income | | | 4,040 | | | 4,018 | | | 12,056 | | | 12,214 | |

| Tax equivalent adjustment | | | 351 | | | 362 | | | 1,086 | | | 1,103 | |

| | | | | | | | | | | | | | |

| Net interest income (fully taxable equivalent) | | $ | 4,391 | | $ | 4,380 | | $ | 13,142 | | $ | 13,317 | |

Net interest income is the primary source of operating income for QNB. Net interest income is interest income, dividends, and fees on earning assets, less interest expense incurred on funding sources. Earning assets primarily include loans, investment securities and Federal funds sold. Sources used to fund these assets include deposits, borrowed funds and shareholders’ equity. Net interest income is affected by changes in interest rates, the volume and mix of earning assets and interest-bearing liabilities, and the amount of earning assets funded by non-interest bearing deposits.

For purposes of this discussion, interest income and the average yield earned on loans and investment securities are adjusted to a tax-equivalent basis as detailed in the tables that appear on pages 17 and 18. This adjustment to interest income is made for analysis purposes only. Interest income is increased by the amount of savings of Federal income taxes, which QNB realizes by investing in certain tax-exempt state and municipal securities and by making loans to certain tax-exempt organizations. In this way, the ultimate economic impact of earnings from various assets can be more easily compared.

The net interest rate spread is the difference between average rates received on earning assets and average rates paid on interest-bearing liabilities, while the net interest rate margin includes interest-free sources of funds.

Net interest income increased .5 percent, to $4,040,000, for the quarter ended September 30, 2006, as compared to $4,018,000 for the quarter ended September 30, 2005. On a tax-equivalent basis, net interest income increased by .3 percent, from $4,380,000, for the three-months ended September 30, 2005 to $4,391,000 for the same period ended September 30, 2006. As mentioned previously, the growth in average earning assets and the continued shift of the balance sheet from investment securities to loans helped offset the continued decline in the net interest margin. When comparing the third quarters of 2006 and 2005, the net interest margin declined by 12 basis points. The net interest margin decreased to 3.06 percent for the third quarter of 2006 from 3.18 percent for the third quarter of 2005. The third quarter net interest margin also represents a 12 basis point decline from the 3.18 percent recorded in the second quarter of 2006. Funding costs for deposits and borrowed money continue to increase at a faster pace than the rate on earning assets. Contributing to this difference was the interest rate environment over the past year as short-term interest rates

QNB CORP. AND SUBSIDIARY

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

NET INTEREST INCOME (Continued)

have increased at a much faster pace than mid- and long-term interest rates, resulting in a flat to inverted yield curve. The structure of QNB’s balance sheet, which is comprised primarily of fixed-rate investments and loans and funding sources with relatively short-term repricing characteristics, as well as the strong competition for loans and deposits, has also contributed to the decline in the net interest margin.

Also contributing to the decline in the net interest margin, when comparing both the decline from the third quarter of 2005 and the second quarter of 2006, were the seasonal tax deposits of municipalities and school districts with whom QNB has built strong relationships. These deposits tend to be short-term and are priced at thin margins. The average balance of municipal interest-bearing accounts was $51,827,000 for the third quarter of 2006, compared to $40,079,000 for the third quarter of 2005 and $43,426,000 for the second quarter of 2006.

While average earning assets increased 4.3 percent, from $546,637,000 for the third quarter of 2005 to $570,119,000 for the third quarter of 2006, total interest income increased $1,124,000, or 15.0 percent, during the same period. The increase in interest income was a result of the increase in market interest rates and particularly the prime lending rate, in conjunction with the shift in the composition of the assets from investment securities to loans, as loans, in general, earn more than investment securities. When comparing the two quarters, average loans increased $49,067,000, or 17.5 percent, while average investment securities decreased $29,366,000, or 11.5 percent. Contributing to the increase in average earning assets and interest income was QNB’s ability, at the end of the second quarter of 2006, to reclassify some of its deposits for reserve calculation purposes. This reclassification enabled QNB to reduce its reserve requirements at the Federal Reserve Bank by approximately $8,500,000. These funds went from a non-earning asset into Federal funds sold and investment securities, thereby increasing interest income.

The Federal Reserve Board ended its increase of short-term interest rates during the third quarter by leaving the Federal funds rate unchanged at 5.25 percent. While short-term interest rates have increased significantly since June 2004, when the Federal funds rate was 1.00 percent to its current rate of 5.25 percent, the yield on earning assets on a tax-equivalent basis has only increased from 5.45 percent for the third quarter of 2005 to 6.00 percent for the third quarter of 2006. This differential was due to a number of factors including the long period of historically low interest rates since 2001 which enabled borrowers to lock into low-rate longer-term fixed-rate loans, the flat to inverted shape of the yield curve since the Federal Reserve began raising interest rates, the fixed-rate nature of the investment and loan portfolio and the price competition for loans.

Interest income on investment securities decreased $186,000 when comparing the two quarters, as the decline in balances offset the increase in the yield on the portfolio. The average yield increased from 4.77 percent for the third quarter of 2005 to 5.07 percent for the third quarter of 2006. Most of the increase in the yield was a result of the sale, maturity or payments of lower yielding securities. QNB has purchased very few securities over the past year, a period of increased interest rates, because of the growth in loans. Management has performed purchase and sale transactions in an attempt to increase the yield on the portfolio and to reposition the cash flow from the portfolio. Management will continue to look at trades that will enhance the structure and yield of the investment portfolio.

The yield on loans increased 51 basis points, to 6.71 percent, when comparing the third quarter of 2006 to the third quarter of 2005. The average prime rate when comparing these same periods increased 183 basis points, from 6.42 percent to 8.25 percent. While QNB was positively impacted by the increases in the prime rate, the overall yield on the loan portfolio did not increase proportionately, since only a small portion of the loan portfolio reprices immediately with changes in the prime rate. As short-term interest rates were increasing, mid- and longer-term interest rates were increasing but at a slower rate, creating a yield curve that is flat and

QNB CORP. AND SUBSIDIARY

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

NET INTEREST INCOME (Continued)

even inverted at points. This rate phenomenon, along with the competition for loans, has created an environment where borrowers are refinancing variable-rate and adjustable-rate loans tied to prime into lower fixed-rate borrowings, and new originations, while at higher rates than two years ago, are still at relatively low rates.

While total interest income on a tax-equivalent basis increased $1,124,000, or 15.0 percent, when comparing the third quarter of 2006 to the third quarter of 2005, total interest expense increased $1,113,000, or 35.6 percent. Average deposits increased $8,885,000, or 1.9 percent, when comparing the third quarters of 2006 and 2005. The increase in interest expense was a result of the increase in interest rates paid on both deposits and short-term borrowings. The rate paid on interest-bearing liabilities increased from 2.60 percent for the third quarter of 2005 to 3.40 percent for the third quarter of 2006, while the rate paid on interest-bearing deposits increased from 2.23 percent to 3.10 percent during this same period. Interest expense on interest-bearing demand accounts increased $344,000, and the rate paid increased from 1.43 percent to 2.62 percent when comparing the two quarters. Approximately 49.3 percent of the average balances of interest-bearing demand accounts for the third quarter of 2006 are the municipal deposits discussed previously. This compares to 41.2 percent of the average balance for the third quarter of 2005. The rates on these accounts are generally indexed to the Federal funds rate so the rate paid on these accounts has increased as the Federal funds rate has increased over the past two years. Interest expense on money market accounts increased by $215,000, and the rate paid increased from 1.84 percent to 3.11 percent when comparing the two quarters. The increase in the rate paid was primarily the result of the majority of the balances being in the Treasury Select product which is indexed to a percentage of the 91-day Treasury bill rate. This rate has also increased as short-term interest rates have increased. The average balance of money market accounts increased $8,971,000, or 19.9 percent, when comparing the two quarters with balances of the Treasury Select product increasing $16,171,000, or 64.2 percent.

Interest expense on time deposits increased $425,000, while the average rate paid on time deposits increased from 3.14 percent to 3.96 percent when comparing the two periods. Like fixed-rate loans and investment securities, time deposits reprice over time and, therefore, have less of an immediate impact on costs in either a rising or falling rate environment. Unlike loans and investment securities, the maturity and repricing characteristics tend to be shorter. With interest rates increasing over the past two years, customers have opted for shorter maturity time deposits. This result, combined with the strong rate competition for these deposits, has led to the increase in the yield on time deposits in 2006. Average time deposits decreased $700,000, or .3 percent, when comparing the third quarter of 2006 to the third quarter of 2005.

Interest expense on short-term borrowings increased $113,000, both as a result of an increase in balances and rates. The average rate paid increased from 2.25 percent for the third quarter of 2005 to 3.62 percent for the third quarter of 2006, while average balances increased $5,644,000, to $23,337,000. Most of this increase was centered in repurchase agreements, a sweep product for commercial customers.

For the nine-month period ended September 30, 2006, net interest income decreased $158,000, or 1.3 percent, to $12,056,000. On a tax-equivalent basis, net interest income decreased $175,000, or 1.3 percent. Included in net interest income for the first nine months of 2005 was $40,000 in interest recognized on the pay-off of loans that had not been accruing interest or had previously been charged off. Average earning assets increased $8,283,000, or 1.5 percent, while the net interest margin declined 9 basis points. The net interest margin on a tax-equivalent basis was 3.16 percent for the nine-month period ended September 30, 2006 compared with 3.25 percent for the same period in 2005.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

NET INTEREST INCOME (Continued)

Total interest income on a tax-equivalent basis increased $2,658,000, from $21,961,000 to $24,619,000, when comparing the nine-month periods ended September 30, 2005 to September 30, 2006. With the small growth in earning assets, the increase in interest income was mostly a result of rate increases and the movement of balances from investment securities to loans. Approximately $843,000 of the increase in interest income was related to volume, while $1,815,000 was due to higher interest rates. The higher volume of loans resulted in an additional $2,218,000 in interest income, with growth in commercial loans including tax-exempt loans contributing $1,403,000. Growth in the indirect leasing portfolio contributed $503,000 while growth in home equity loans contributed $272,000. The impact on interest income from the growth in loans was partially offset by a reduction in interest income of $1,350,000 resulting from a lower volume of investment securities. The yield on earning assets increased from 5.37 percent to 5.93 percent for the nine-month periods. The yield on loans increased from 6.09 percent to 6.61 percent during this time, while the yield on investments increased from 4.70 percent to 4.99 percent when comparing the nine-month periods. The yield on commercial and industrial loans benefited the most from the increase in interest rates as most of these loans are indexed to the prime lending rate.

Total interest expense increased $2,833,000, from $8,644,000 to $11,477,000, for the nine-month periods with interest on demand accounts, money market accounts, and time deposits accounting for $884,000, $370,000 and $1,198,000, respectively, of the increase. Approximately $2,728,000 of the increase in interest expense was a result of higher interest rates. The yield on interest-bearing demand accounts, money market accounts and time deposits increased 110 basis points, 116 basis points and 76 basis points, respectively, when comparing the average rate paid for the nine-month periods ended September 30, 2006 and 2005. As was the case for the quarter, the municipal deposits had the largest impact on interest expense on interest-bearing demand accounts and the Treasury Select money market account had the greatest impact on money market expense. The average balance of municipal interest bearing demand accounts increased $10,571,000, or 30.7 percent, when comparing the nine-month periods and the average balance in the Treasury Select product increased $11,858,000, or 49.0 percent, during the same time period. Interest expense on short-term borrowings increased by $323,000 as the average rate paid on these accounts increased from 2.00 percent to 3.40 percent. The average balance of short-term borrowings, mostly commercial sweep accounts, increased $7,202,000, or 54.0 percent, to $20,532,000 for the nine-months ended September 30, 2006.

Management expects the remainder of 2006 and most of 2007 to be challenging with respect to net interest income and the net interest margin. The extremely competitive environment for loans and deposits, as well as the flat yield curve, is expected to continue. These factors combined with QNB’s current interest rate sensitivity position, which has funding sources repricing sooner than earning assets, will likely put more pressure on the net interest margin. However, the ability to continue to successfully increase loan balances should have a positive impact on the net interest margin and interest income, as loans tend to earn a higher yield than investment securities. Mixed signals resulting from recent data on the United States economy make it uncertain whether the Federal Reserve’s next move will be to lower or raise short-term interest rates.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

PROVISION FOR LOAN LOSSES

The provision for loan losses represents management's determination of the amount necessary to be charged to operations to bring the allowance for loan losses to a level that represents management’s best estimate of the known and inherent losses in the existing loan portfolio. Actual loan losses, net of recoveries, serve to reduce the allowance.

The determination of an appropriate level of the allowance for loan losses is based upon an analysis of the risk inherent in QNB's loan portfolio. Management uses various tools to assess the adequacy of the allowance for loan losses. One tool is a model recommended by the Office of the Comptroller of the Currency. This model considers a number of relevant factors including: historical loan loss experience, the assigned risk rating of the credit, current and projected credit worthiness of the borrower, current value of the underlying collateral, levels of and trends in delinquencies and non-accrual loans, trends in volume and terms of loans, concentrations of credit, and national and local economic trends and conditions. This model is supplemented with another analysis that also incorporates QNB’s portfolio exposure to borrowers with large dollar concentration. Other tools include ratio analysis and peer group analysis.

QNB’s management determined that $60,000 and $105,000 provisions for loan losses were necessary for the three- and nine-month periods ended September 30, 2006. There was no provision for loan losses necessary for the same periods in 2005. The need for a provision was determined by the analysis described above and resulted in an allowance for loan losses that management believes is adequate in relation to the estimate of known and inherent losses in the portfolio.

Loan charge-offs and non-performing assets remain at low levels. QNB had net charge-offs of $36,000 and $17,000 during the third quarters of 2006 and 2005, respectively. For the nine-month periods ended September 30, 2006 and 2005, QNB had net charge-offs of $58,000 and $44,000, respectively. The net charge-offs during both periods related primarily to loans in the consumer loan portfolio. The asset quality of the commercial portfolio remains excellent.

Non-performing assets (non-accruing loans, loans past due 90 days or more, other real estate owned and other repossessed assets) amounted to .03 percent and .00 percent of total assets, respectively, at September 30, 2006 and 2005. These levels compare to .002 percent at December 31, 2005. Non-accrual loans were $117,000 at September 30, 2006. There were no non-accrual loans at December 31, 2005 or September 30, 2005. QNB did not have any other real estate owned as of September 30, 2006, December 31, 2005 or September 30, 2005. There were no repossessed assets at September 30, 2006, December 31, 2005 or September 30, 2005.

There were no restructured loans as of September 30, 2006, December 31, 2005 or September 30, 2005 as defined in FASB Statement No. 15, Accounting by Debtors and Creditors for Troubled Debt Restructurings, that have not already been included in loans past due 90 days or more or non-accrual loans.

The allowance for loan losses was $2,573,000 and $2,526,000 at September 30, 2006 and December 31, 2005, respectively. The ratio of the allowance to total loans was .78 percent and .84 percent at the respective period end dates. The decrease in the ratio is a result of the strong growth in the loan portfolio. While QNB believes that its allowance is adequate to cover losses in the loan portfolio, there remain inherent uncertainties regarding future economic events and their potential impact on asset quality.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

PROVISION FOR LOAN LOSSES (Continued)

A loan is considered impaired, based on current information and events, if it is probable that QNB will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. The measurement of impaired loans is generally based on the present value of expected future cash flows discounted at the historical effective interest rate, except that all collateral-dependent loans are measured for impairment based on the fair value of the collateral. At September 30, 2006, the recorded investment in loans for which impairment had been recognized in accordance with FASB Statement No. 114, Accounting by Creditors for Impairment of a Loan—an amendment of FASB Statements No. 5 and 15, totaled $117,000. The loans identified as impaired were collateral-dependent, with no valuation allowance necessary. There were no loans considered impaired at September 30, 2005.

Management in determining the allowance for loan losses makes significant estimates and assumptions. Consideration is given to a variety of factors in establishing these estimates including current economic conditions, diversification of the loan portfolio, delinquency statistics, results of loan reviews, borrowers’ perceived financial and managerial strengths, the adequacy of underlying collateral if collateral dependent, or the present value of future cash flows.

Since the allowance for loan losses is dependent, to a great extent, on conditions that may be beyond QNB’s control, it is at least reasonably possible that management’s estimates of the allowance for loan losses and actual results could differ in the near term. In addition, various regulatory agencies, as an integral part of their examination process, periodically review QNB’s allowance for losses on loans. Such agencies may require QNB to recognize additions to the allowance based on their judgments about information available to them at the time of their examination.

NON-INTEREST INCOME

QNB, through its core banking business, generates various fees and service charges. Total non-interest income is composed of service charges on deposit accounts, ATM and debit card income, income on bank-owned life insurance, mortgage servicing fees, gains or losses on the sale of investment securities, gains on the sale of residential mortgage loans, and other miscellaneous fee income.

Total non-interest income increased $209,000, to $1,147,000, for the quarter ended September 30, 2006, when compared to September 30, 2005. For the nine-month period, total non-interest income increased $871,000, to $3,306,000. Excluding gains and losses on the sale of securities and loans, non-interest income for the three-month period increased $20,000, or 2.2 percent, and for the nine-month period decreased $237,000, or 8.2 percent. The first nine months of 2005 had several non-operating items: gain on the liquidation of assets relinquished by a borrower of $209,000, life insurance proceeds of $61,000 and a sales tax refund of $45,000. These items were included in the category other income.