UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4085

Fidelity Income Fund

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | July 31 |

| |

Date of reporting period: | January 31, 2006 |

Item 1. Reports to Stockholders

| | Fidelity® Ginnie Mae Fund

Fidelity Government

Income Fund

Fidelity Intermediate

Government Income Fund

|

| | Semiannual Report

January 31, 2006

|

| Contents | | | | |

| |

| |

| Chairman’s Message | | 3 | | Ned Johnson’s message to shareholders. |

| Shareholder Expense | | 4 | | An example of shareholder expenses. |

| Example | | | | |

| Fidelity Ginnie Mae Fund | | | | |

| | | 6 | | Investment Changes |

| | | 7 | | Investments |

| | | 15 | | Financial Statements |

| Fidelity Government Income Fund |

| | | 19 | | Investment Changes |

| | | 20 | | Investments |

| | | 30 | | Financial Statements |

| Fidelity Intermediate Government Income Fund |

| | | 34 | | Investment Changes |

| | | 35 | | Investments |

| | | 45 | | Financial Statements |

| Notes | | 49 | | Notes to the financial statements |

| Proxy Voting Results | | 55 | | |

| Board Approval of | | 56 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended

June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s

(SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy

voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies, Inc.

and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of

FMR Corp. or an affiliated company.

|

| | This report and the financial statements contained herein are submitted for the general

information of the shareholders of the funds. This report is not authorized for distribution to

prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third

quarters of each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at

http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public

Reference Room in Washington, DC. Information regarding the operation of the SEC’s Public

Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s port

folio holdings, view the most recent quarterly holdings report, semiannual report, or annual

report on Fidelity’s web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

|

Semiannual Report 2

Chairman’s Message

(photograph of Edward C. Johnson 3d)

Dear Shareholder:

During the past year or so, much has been reported about the mutual fund industry, and much of it has been more critical than I believe is warranted. Allegations that some companies have been less than forthright with their shareholders have cast a shadow on the entire industry. I continue to find these reports disturbing, and assert that they do not create an accurate picture of the industry overall. Therefore, I would like to remind every one where Fidelity stands on these issues. I will say two things specifically regarding allegations that some mutual fund companies were in violation of the Securities and Exchange Commission’s forward pricing rules or were involved in so called “market timing” activities.

First, Fidelity has no agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not a new policy. This is not to say that some one could not deceive the company through fraudulent acts. However, we are extremely diligent in preventing fraud from occurring in this manner and in every other. But I underscore again that Fidelity has no so called “agreements” that sanction illegal practices.

Second, Fidelity continues to stand on record, as we have for years, in opposition to predatory short term trading that adversely affects shareholders in a mutual fund. Back in the 1980s, we initiated a fee which is returned to the fund and, therefore, to investors to discourage this activity. Further, we took the lead several years ago in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. I am confident we will find other ways to make it more difficult for predatory traders to operate. However, this will only be achieved through close cooperation among regulators, legislators and the industry.

Yes, there have been unfortunate instances of unethical and illegal activity within the mutual fund industry from time to time. That is true of any industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. But we are still concerned about the risk of over regulation and the quick application of simplistic solutions to intricate problems. Every system can be improved, and we support and applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors’ holdings.

For nearly 60 years, Fidelity has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

3 Semiannual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2005 to January 31, 2006).

The first line of the table below for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the table below for each fund provides information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | | | Ending | | | | During Period* |

| | | | | Account Value | | | | Account Value | | | | August 1, 2005 |

| | | | | August 1, 2005 | | | | January 31, 2006 | | | | to January 31, 2006 |

| Ginnie Mae Fund | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | $ | 1,012.80 | | | $ | 2.28 |

| HypotheticalA | | | $ | 1,000.00 | | | $ | 1,022.94 | | | $ | 2.29 |

| Government Income Fund | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | $ | 1,010.00 | | | $ | 2.28 |

| HypotheticalA | | | $ | 1,000.00 | | | $ | 1,022.94 | | | $ | 2.29 |

| Intermediate Government | | | | | | | | | | | | |

| Income Fund | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | $ | 1,009.90 | | | $ | 2.28 |

| HypotheticalA | | | $ | 1,000.00 | | | $ | 1,022.94 | | | $ | 2.29 |

A 5% return per year before expenses

* Expenses are equal to each Fund’s annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one half year period).

| | | Annualized |

| | | Expense Ratio |

| Ginnie Mae Fund | | 45% |

| Government Income Fund | | 45% |

| Intermediate Government Income Fund | | 45% |

5 Semiannual Report

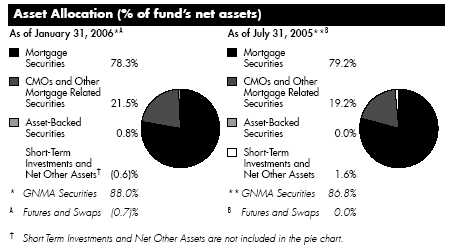

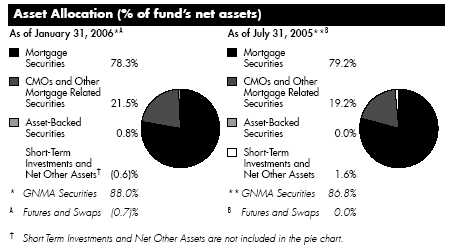

| Fidelity Ginnie Mae Fund | | | | |

| Investment Changes | | | | |

| |

| Coupon Distribution as of January 31, 2006 | | |

| | | % of fund’s | | % of fund’s investments |

| | | investments | | 6 months ago |

| Less than 4% | | 3.5 | | 3.2 |

| 4 – 4.99% | | 10.0 | | 5.7 |

| 5 – 5.99% | | 46.9 | | 43.5 |

| 6 – 6.99% | | 22.4 | | 26.8 |

| 7 – 7.99% | | 4.6 | | 5.2 |

| 8% and over | | 0.8 | | 1.0 |

Coupon distribution shows the range of stated interest rates on the fund’s investments, excluding short term investments.

| Average Years to Maturity as of January 31, 2006 | | |

| | | | | 6 months ago |

| Years | | 5.8 | | 4.9 |

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund’s bonds, weighted by dollar amount.

| Duration as of January 31, 2006 | | | | |

| | | | | | | 6 months ago |

| Years | | | | 3.3 | | 2.7 |

Duration shows how much a bond fund’s price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund’s performance and share price. Accordingly, a bond fund’s actual performance may differ from this example.

Semiannual Report 6

Fidelity Ginnie Mae Fund

Investments January 31, 2006 (Unaudited)

Showing Percentage of Net Assets

|

| U.S. Government Agency Mortgage Securities 78.3% | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| Fannie Mae – 8.7% | | | | | | | | |

| 3.752% 10/1/33 (c) | | | | $ 586 | | | | $ 572 |

| 3.765% 7/1/34 (c) | | | | 2,476 | | | | 2,465 |

| 3.826% 10/1/33 (c) | | | | 4,911 | | | | 4,822 |

| 3.828% 4/1/33 (c) | | | | 1,719 | | | | 1,685 |

| 4.177% 3/1/35 (c) | | | | 2,507 | | | | 2,518 |

| 4.255% 1/1/34 (c) | | | | 1,497 | | | | 1,480 |

| 4.297% 3/1/33 (c) | | | | 685 | | | | 681 |

| 4.301% 10/1/34 (c) | | | | 205 | | | | 205 |

| 4.306% 3/1/33 (c) | | | | 252 | | | | 248 |

| 4.324% 10/1/33 (c) | | | | 265 | | | | 261 |

| 4.339% 9/1/34 (c) | | | | 756 | | | | 750 |

| 4.364% 9/1/34 (c) | | | | 1,868 | | | | 1,854 |

| 4.368% 4/1/35 (c) | | | | 382 | | | | 377 |

| 4.378% 6/1/33 (c) | | | | 325 | | | | 323 |

| 4.403% 5/1/35 (c) | | | | 1,748 | | | | 1,724 |

| 4.409% 10/1/34 (c) | | | | 2,921 | | | | 2,882 |

| 4.517% 8/1/34 (c) | | | | 2,612 | | | | 2,634 |

| 4.544% 7/1/34 (c) | | | | 852 | | | | 847 |

| 4.545% 7/1/35 (c) | | | | 2,145 | | | | 2,124 |

| 4.561% 1/1/35 (c) | | | | 1,167 | | | | 1,167 |

| 4.577% 9/1/34 (c) | | | | 2,235 | | | | 2,217 |

| 4.584% 2/1/35 (c) | | | | 2,278 | | | | 2,253 |

| 4.605% 8/1/34 (c) | | | | 761 | | | | 757 |

| 4.627% 1/1/33 (c) | | | | 381 | | | | 381 |

| 4.629% 9/1/34 (c) | | | | 226 | | | | 225 |

| 4.637% 10/1/35 (c) | | | | 185 | | | | 183 |

| 4.653% 3/1/35 (c) | | | | 280 | | | | 281 |

| 4.712% 10/1/32 (c) | | | | 157 | | | | 157 |

| 4.728% 2/1/33 (c) | | | | 113 | | | | 113 |

| 4.732% 10/1/32 (c) | | | | 151 | | | | 151 |

| 4.789% 1/1/35 (c) | | | | 2,106 | | | | 2,099 |

| 4.814% 2/1/33 (c) | | | | 794 | | | | 792 |

| 4.815% 5/1/33 (c) | | | | 32 | | | | 32 |

| 4.825% 12/1/34 (c) | | | | 640 | | | | 637 |

| 4.83% 1/1/35 (c) | | | | 105 | | | | 105 |

| 4.835% 8/1/34 (c) | | | | 621 | | | | 616 |

| 4.862% 9/1/34 (c) | | | | 1,091 | | | | 1,085 |

| 4.898% 10/1/35 (c) | | | | 1,511 | | | | 1,503 |

| 4.904% 12/1/32 (c) | | | | 60 | | | | 60 |

| 4.98% 11/1/32 (c) | | | | 421 | | | | 426 |

| 5% 10/1/17 to 9/1/18 (b) | | | | 72,517 | | | | 71,778 |

| 5.02% 9/1/34 (c) | | | | 980 | | | | 979 |

See accompanying notes which are an integral part of the financial statements.

| Fidelity Ginnie Mae Fund | | | | | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| U.S. Government Agency Mortgage Securities continued | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| Fannie Mae – continued | | | | | | | | |

| 5.031% 2/1/35 (c) | | | | $ 302 | | | | $ 303 |

| 5.035% 11/1/34 (c) | | | | 143 | | | | 143 |

| 5.046% 7/1/34 (c) | | | | 347 | | | | 348 |

| 5.101% 7/1/35 (c) | | | | 2,464 | | | | 2,474 |

| 5.105% 5/1/35 (c) | | | | 4,080 | | | | 4,093 |

| 5.106% 9/1/34 (c) | | | | 567 | | | | 566 |

| 5.197% 6/1/35 (c) | | | | 2,968 | | | | 2,972 |

| 5.208% 5/1/35 (c) | | | | 13,281 | | | | 13,327 |

| 5.216% 8/1/33 (c) | | | | 835 | | | | 831 |

| 5.276% 3/1/35 (c) | | | | 358 | | | | 359 |

| 5.333% 7/1/35 (c) | | | | 371 | | | | 371 |

| 5.349% 12/1/34 (c) | | | | 1,082 | | | | 1,082 |

| 5.5% 11/1/13 to 3/1/25 | | | | 85,049 | | | | 85,596 |

| 6.5% 10/1/17 to 3/1/34 | | | | 39,081 | | | | 40,133 |

| 6.5% 2/13/36 (a) | | | | 50,000 | | | | 51,266 |

| 7% 11/1/16 to 3/1/17 | | | | 2,255 | | | | 2,328 |

| 7.5% 1/1/07 to 4/1/17 | | | | 4,462 | | | | 4,639 |

| 8.5% 12/1/27 | | | | 434 | | | | 470 |

| 9.5% 9/1/30 | | | | 474 | | | | 522 |

| 10.25% 10/1/18 | | | | 15 | | | | 16 |

| 11.5% 5/1/14 to 9/1/15 | | | | 41 | | | | 45 |

| 12.5% 11/1/13 to 7/1/16 | | | | 88 | | | | 96 |

| 13.25% 9/1/11 | | | | 62 | | | | 70 |

| | | | | | | | | 328,499 |

| Freddie Mac – 1.0% | | | | | | | | |

| 4.49% 3/1/35 (c) | | | | 5,782 | | | | 5,687 |

| 4.782% 10/1/32 (c) | | | | 103 | | | | 104 |

| 4.996% 3/1/33 (c) | | | | 288 | | | | 286 |

| 5.5% 11/1/17 to 3/1/25 | | | | 27,949 | | | | 27,939 |

| 5.651% 4/1/32 (c) | | | | 174 | | | | 177 |

| 8.5% 2/1/09 to 6/1/25 | | | | 85 | | | | 90 |

| 9% 7/1/08 to 7/1/21 | | | | 296 | | | | 309 |

| 9.5% 7/1/30 to 8/1/30 | | | | 159 | | | | 174 |

| 9.75% 12/1/08 to 4/1/13 | | | | 32 | | | | 34 |

| 10% 1/1/09 to 11/1/20 | | | | 633 | | | | 689 |

| 10.25% 2/1/09 to 11/1/16 | | | | 261 | | | | 278 |

| 10.5% 5/1/10 | | | | 5 | | | | 5 |

| 11.25% 2/1/10 | | | | 20 | | | | 22 |

| 11.75% 11/1/11 | | | | 11 | | | | 12 |

| 12% 5/1/10 to 2/1/17 | | | | 90 | | | | 98 |

| 12.5% 11/1/12 to 5/1/15 | | | | 131 | | | | 144 |

See accompanying notes which are an integral part of the financial statements.

| U.S. Government Agency Mortgage Securities continued | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| Freddie Mac – continued | | | | | | | | |

| 13% 5/1/14 to 11/1/14 | | | | $ 15 | | | | $ 16 |

| 13.5% 1/1/13 to 12/1/14 | | | | 7 | | | | 8 |

| | | | | | | | | 36,072 |

| Government National Mortgage Association – 68.6% | | | | | | |

| 3% 4/20/35 (c) | | | | 4,138 | | | | 4,044 |

| 3.5% 3/20/34 | | | | 1,279 | | | | 1,138 |

| 3.5% 5/20/34 (c) | | | | 1,854 | | | | 1,778 |

| 3.5% 5/20/35 (c) | | | | 2,252 | | | | 2,148 |

| 3.5% 6/20/35 (c) | | | | 2,403 | | | | 2,292 |

| 3.5% 6/20/35 (c) | | | | 7,259 | | | | 7,117 |

| 3.75% 1/20/34 (c) | | | | 22,094 | | | | 21,803 |

| 3.75% 6/20/34 (c) | | | | 7,196 | | | | 7,019 |

| 3.75% 5/20/35 (c) | | | | 10,399 | | | | 10,012 |

| 3.75% 6/20/35 | | | | 5,475 | | | | 5,272 |

| 4% 11/20/33 | | | | 1,816 | | | | 1,659 |

| 4.25% 7/20/34 (c) | | | | 1,551 | | | | 1,524 |

| 4.5% 4/15/18 to 4/20/34 | | | | 299,919 | | | | 288,241 |

| 4.5% 9/20/34 (c) | | | | 7,744 | | | | 7,661 |

| 4.5% 3/20/35 (c) | | | | 1,363 | | | | 1,343 |

| 5% 4/15/24 to 9/20/34 | | | | 501,898 | | | | 493,643 |

| 5% 2/20/35 (c) | | | | 380 | | | | 377 |

| 5% 6/20/35 (c) | | | | 7,185 | | | | 7,070 |

| 5% 6/20/35 (c) | | | | 19,798 | | | | 19,643 |

| 5.5% 12/20/18 to 4/15/35 | | | | 287,555 | | | | 288,798 |

| 5.5% 2/1/36 (a) | | | | 49,750 | | | | 49,968 |

| 5.5% 2/1/36 (a) | | | | 31,988 | | | | 32,128 |

| 5.5% 2/1/36 (a) | | | | 66,000 | | | | 66,062 |

| 5.5% 2/1/36 (a) | | | | 145,000 | | | | 145,136 |

| 5.5% 2/1/36 (a) | | | | 87,181 | | | | 87,262 |

| 5.5% 2/1/36 (a)(b) | | | | 50,000 | | | | 50,047 |

| 5.75% 8/20/35 (c) | | | | 762 | | | | 758 |

| 6% 10/15/23 to 9/20/34 | | | | 477,124 | | | | 488,305 |

| 6% 2/1/36 (a)(b) | | | | 20,000 | | | | 20,425 |

| 6.5% 4/15/23 to 11/20/34 | | | | 250,728 | | | | 261,396 |

| 7% 3/15/22 to 9/20/34 | | | | 119,729 | | | | 125,719 |

| 7.25% 9/15/27 to 12/15/30 | | | | 451 | | | | 472 |

| 7.5% 4/15/06 to 9/20/32 | | | | 41,915 | | | | 44,218 |

| 8% 4/15/06 to 7/15/32 | | | | 15,998 | | | | 17,120 |

| 8.5% 7/15/06 to 2/15/31 | | | | 6,042 | | | | 6,526 |

| 9% 5/15/08 to 6/15/30 | | | | 2,448 | | | | 2,665 |

| 9.5% 12/20/15 to 4/20/17 | | | | 867 | | | | 942 |

See accompanying notes which are an integral part of the financial statements.

9 Semiannual Report

| Fidelity Ginnie Mae Fund | | | | | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| U.S. Government Agency Mortgage Securities continued | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| Government National Mortgage Association – continued | | | | | | |

| 10.5% 1/15/14 to 9/15/19 | | | | $ 836 | | | | $ 928 |

| 13% 2/15/11 to 1/15/15 | | | | 186 | | | | 207 |

| 13.5% 7/15/10 to 1/15/15 | | | | 30 | | | | 33 |

| | | | | | | | | 2,572,899 |

| |

| TOTAL U.S. GOVERNMENT AGENCY MORTGAGE SECURITIES | | | | |

| (Cost $2,943,630) | | | | | | 2,937,470 |

| |

| Asset Backed Securities 0.8% | | | | | | |

| |

| Fannie Mae Grantor Trust Series 2005-T4 Class A1C, 4.68% | | | | | | |

| 9/25/35 (c) | | | | | | | | |

| (Cost $28,756) | | | | 28,756 | | | | 28,780 |

| |

| Collateralized Mortgage Obligations 19.3% | | | | | | |

| |

| U.S. Government Agency 19.3% | | | | | | |

| Fannie Mae: | | | | | | | | |

| Series 2003-39 Class IA, 5.5% 10/25/22 (c)(d) | | 5,797 | | | | 956 |

| target amortization class Series G94-2 Class D, 6.45% | | | | | | |

| 1/25/24 | | | | 5,258 | | | | 5,341 |

| Fannie Mae guaranteed REMIC pass thru certificates Series | | | | | | |

| 2005-69 Class ZL, 4.5% 8/25/25 | | | | 5,434 | | | | 5,408 |

| Freddie Mac floater Series 2344 Class FP, 5.42% 8/15/31 (c) | | 2,926 | | | | 2,993 |

| Freddie Mac Multi-class participation certificates guaranteed: | | | | | | |

| floater: | | | | | | | | |

| Series 2406: | | | | | | | | |

| Class FP, 5.45% 1/15/32 (c) | | | | 5,807 | | | | 5,926 |

| Class PF, 5.45% 12/15/31 (c) | | | | 5,002 | | | | 5,125 |

| Series 2410 Class PF, 5.45% 2/15/32 (c) | | 11,475 | | | | 11,748 |

| Series 2412 Class GF, 5.42% 2/15/32 (c) | | 2,158 | | | | 2,207 |

| Series 2861 Class JF, 4.77% 4/15/17 (c) | | 3,941 | | | | 3,947 |

| Series 3094 Class UF, 0% 9/15/34 (c) | | 866 | | | | 841 |

| planned amortization class: | | | | | | | | |

| Series 2220 Class PD, 8% 3/15/30 | | 5,930 | | | | 6,297 |

| Series 2535 Class IP, 6% 6/15/29 (d) | | 2,032 | | | | 27 |

| Series 2787 Class OI, 5.5% 10/15/24 (d) | | 10,791 | | | | 658 |

| Series 40 Class K, 6.5% 8/17/24 | | | | 2,300 | | | | 2,369 |

| sequential pay: | | | | | | | | |

| Series 2601 Class TI, 5.5% 10/15/22 (d) | | 23,733 | | | | 3,859 |

| Series 2750 Class ZT, 5% 2/15/34 | | 5,634 | | | | 5,061 |

| Series 2866 Class CY, 4.5% 10/15/19 | | 4,491 | | | | 4,230 |

See accompanying notes which are an integral part of the financial statements.

| Collateralized Mortgage Obligations continued | | | | |

| | | Principal | | Value (Note 1) |

| | | Amount (000s) | | (000s) |

| U.S. Government Agency continued | | | | | | | | |

| Ginnie Mae guaranteed Multi family pass thru securities | | | | | | | | |

| sequential pay Series 2002 71 Class Z, 5.5% 10/20/32 | | | | $ 42,030 | | | | $ 41,186 |

| Ginnie Mae guaranteed REMIC pass thru securities: | | | | | | | | |

| planned amortization class: | | | | | | | | |

| Series 1994-4 Class KQ, 7.9875% 7/16/24 | | | | 1,621 | | | | 1,694 |

| Series 2000-26 Class PK, 7.5% 9/20/30 | | | | 4,863 | | | | 4,966 |

| Series 2001-13 Class PC, 6.5% 12/20/28 | | | | 938 | | | | 936 |

| Series 2001-53: | | | | | | | | |

| Class PB, 6.5% 11/20/31 | | | | 10,000 | | | | 10,483 |

| Class TA, 6% 12/20/30 | | | | 22 | | | | 21 |

| Series 2001-60 Class PD, 6% 10/20/30 | | | | 6,167 | | | | 6,204 |

| Series 2001-65 Class PH, 6% 11/20/28 | | | | 6,323 | | | | 6,427 |

| Series 2002-5 Class PD, 6.5% 5/16/31 | | | | 4,750 | | | | 4,810 |

| Series 2003-103 Class PC, 5.5% 11/20/33 | | | | 18,843 | | | | 18,461 |

| Series 2003-12 Class IO, 5.5% 11/16/25 (d) | | | | 5,594 | | | | 111 |

| Series 2003-19 Class IL, 5.5% 12/16/25 (d) | | | | 917 | | | | 7 |

| Series 2003-20 Class BI, 5.5% 5/16/27 (d) | | | | 8,850 | | | | 344 |

| Series 2003-29 Class PD, 5.5% 4/16/33 | | | | 25,000 | | | | 24,411 |

| Series 2003-31 Class PI, 5.5% 4/16/30 (d) | | | | 18,496 | | | | 1,171 |

| Series 2003-34 Class IO, 5.5% 4/16/28 (d) | | | | 21,062 | | | | 1,198 |

| Series 2003-4 Class LI, 5.5% 7/16/27 (d) | | | | 8,802 | | | | 344 |

| Series 2003-7: | | | | | | | | |

| Class IN, 5.5% 1/16/28 (d) | | | | 19,119 | | | | 1,249 |

| Class IP, 5.5% 10/16/25 (d) | | | | 1,334 | | | | 24 |

| Series 2003-70 CLass LE, 5% 7/20/32 | | | | 44,000 | | | | 42,536 |

| Series 2003-79 Class PV, 5.5% 10/20/23 | | | | 27,869 | | | | 27,753 |

| Series 2003-8 Class QI, 5.5% 1/16/27 (d) | | | | 993 | | | | 22 |

| Series 2004-19 Class DP, 5.5% 3/20/34 | | | | 3,895 | | | | 3,921 |

| Series 2004-30 Class PC, 5% 11/20/30 | | | | 19,736 | | | | 19,351 |

| Series 2004-41 Class PC, 5.5% 10/20/33 | | | | 27,523 | | | | 27,255 |

| Series 2004-54 Class LE, 5.5% 8/20/33 | | | | 45,183 | | | | 44,689 |

| Series 2004-64 Class KE, 5.5% 12/20/33 | | | | 22,978 | | | | 22,752 |

| Series 2004-98 Class IG, 5.5% 2/20/30 (d) | | | | 2,581 | | | | 497 |

| Series 2005-17 Class IA, 5.5% 8/20/33 (d) | | | | 11,263 | | | | 1,732 |

| Series 2005-24 Class TC, 5.5% 3/20/35 | | | | 5,403 | | | | 5,337 |

| Series 2005-54 Class BM, 5% 7/20/35 | | | | 9,658 | | | | 9,409 |

| Series 2005-57 Class PB, 5.5% 7/20/35 | | | | 5,673 | | | | 5,532 |

| Series 2005-58 Class NJ, 4.5% 8/20/35 | | | | 40,000 | | | | 39,152 |

| Series 2008-28 Class PC, 5.5% 4/20/34 | | | | 18,652 | | | | 18,704 |

See accompanying notes which are an integral part of the financial statements.

11 Semiannual Report

| Fidelity Ginnie Mae Fund | | | | | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| Collateralized Mortgage Obligations continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| U.S. Government Agency continued | | | | | | | | |

| Ginnie Mae guaranteed REMIC pass thru securities: - | | | | | | | | |

| continued | | | | | | | | |

| sequential pay: | | | | | | | | |

| Series 1995-4 Class CQ, 8% 6/20/25 | | | | $ 1,217 | | | | $ 1,242 |

| Series 1998-23 Class ZB, 6.5% 6/20/28 | | | | 31,413 | | | | 32,172 |

| Series 2001-15 Class VB, 6.5% 4/20/19 | | | | 4,530 | | | | 4,539 |

| Series 2002-29 Class SK, 7.74% 5/20/32 (c) | | | | 625 | | | | 674 |

| Series 2002-41 Class VD, 6% 4/16/13 | | | | 7,471 | | | | 7,525 |

| Series 2002-54 Class GA, 6.5% 7/20/31 | | | | 69 | | | | 69 |

| Series 2002-88 Class GZ, 5.5% 12/20/32 | | | | 23,687 | | | | 22,603 |

| Series 2003-7 Class VP, 6% 11/20/13 | | | | 5,937 | | | | 6,077 |

| Series 2004-105 Class VD, 5.5% 6/17/16 | | | | 12,213 | | | | 12,308 |

| Series 2004-65 Class VE, 5.5% 7/20/15 | | | | 5,351 | | | | 5,405 |

| Series 2004-86 Class G, 6% 10/20/34 | | | | 6,273 | | | | 6,409 |

| Series 2005-28: | | | | | | | | |

| Class AJ, 5.5% 4/20/35 | | | | 96,450 | | | | 97,323 |

| Class AK, 5.5% 4/20/35 | | | | 49,587 | | | | 49,982 |

| Series 2005-47 Class ZY, 6% 6/20/35 | | | | 4,142 | | | | 4,185 |

| Series 2005-6 Class EX, 5.5% 11/20/34 | | | | 1,001 | | | | 977 |

| Series 1995-6 Class Z, 7% 9/20/25 | | | | 3,427 | | | | 3,527 |

| Series 2004-19 Class DJ, 4.5% 3/20/34 (a) | | | | 4,068 | | | | 4,005 |

| Series 2005-6 Class EY, 5.5% 11/20/33 | | | | 1,016 | | | | 977 |

| Series 2005-82 Class JV, 5% 6/20/35 | | | | 3,500 | | | | 3,240 |

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | | | | | | |

| (Cost $740,194) | | | | | | | | 722,921 |

| |

| Commercial Mortgage Securities 2.2% | | | | | | |

| |

| Fannie Mae: | | | | | | | | |

| sequential pay Series 2000-7 Class MB, 7.5314% | | | | | | | | |

| 2/17/24 (c) | | | | 7,106 | | | | 7,356 |

| Series 1997-M1 Class N, 0.445% 10/17/36 (c)(d) | | | | 60,577 | | | | 670 |

| Fannie Mae guaranteed REMIC pass thru certificates: | | | | | | | | |

| Series 1998-M3 Class IB, 0.9123% 1/17/38 (c)(d) | | | | 44,396 | | | | 1,216 |

| Series 1998-M4 Class N, 1.3098% 2/25/35 (c)(d) | | | | 23,217 | | | | 790 |

| Ginnie Mae guaranteed Multi-family pass thru securities: | | | | | | |

| sequential pay Series 2001-58 Class X, 1.4157% | | | | | | | | |

| 9/16/41 (c)(d) | | | | 198,156 | | | | 8,940 |

| Series 2001-12 Class X, 1.027% 7/16/40 (c)(d) | | | | 73,995 | | | | 3,267 |

See accompanying notes which are an integral part of the financial statements.

| Commercial Mortgage Securities continued | | | | | | | | |

| | | | | | | Principal | | Value (Note 1) |

| | | | | | | Amount (000s) | | (000s) |

| Ginnie Mae guaranteed REMIC pass thru securities: | | | | | | | | |

| sequential pay Series 2002-81 Class IO, 1.8989% | | | | | | | | |

| 9/16/42 (c)(d) | | | | | | $ 122,760 | | | | $ 9,862 |

| Series 2002-62 Class IO, 1.5723% 8/16/42 (c)(d) | | | | 93,609 | | | | 6,285 |

| Series 2002-85 Class X, 1.9671% 3/16/42 (c)(d) | | | | 87,758 | | | | 8,940 |

| Series 2003-22 Class XA, 0.3667% 2/16/43 (c)(d) | | | | 277,282 | | | | 18,207 |

| Series 2003-36 Class XA, 0.2815% 3/16/43 (d) | | | | 304,990 | | | | 16,715 |

| Series 2003-47 Class XA, 0.0203% 6/16/43 (c)(d) | | | | 37,468 | | | | 2,010 |

| TOTAL COMMERCIAL MORTGAGE SECURITIES | | | | | | | | |

| (Cost $111,891) | | | | | | | | | | 84,258 |

| |

| Cash Equivalents 13.3% | | | | | | | | | | |

| | | | | | | Maturity | | | | |

| | | | | | | Amount (000s) | | | | |

| Investments in repurchase agreements (Collateralized by U.S. | | | | | | | | |

| Government Obligations, in a joint trading account at | | | | | | | | |

| 4.46%, dated 1/31/06 due 2/1/06) (e) | | | | | | | | |

| (Cost $500,601) | | | | | | $ 500,663 | | | | 500,601 |

| |

| TOTAL INVESTMENT PORTFOLIO 113.9% | | | | | | | | |

| (Cost $4,325,072) | | | | | | | | 4,274,030 |

| |

| NET OTHER ASSETS (13.9)% | | | | | | | | | | (522,019) |

| NET ASSETS 100% | | | | | | | | $ 3,752,011 |

| |

| Swap Agreements | | | | | | | | | | |

| | | Expiration | | | | Notional | | | | Value |

| | | Date | | | | Amount | | | | (000s) |

| | | | | | | (000s) | | | | |

| |

| Interest Rate Swaps | | | | | | | | | | |

| Receive quarterly a floating rate based on | | | | | | | | | | |

| 3-month LIBOR and pay quarterly a fixed | | | | | | | | |

| rate equal to 4.5046% with Lehman | | | | | | | | | | |

| Brothers, Inc. | | Sept. 2015 | | | $ | 25,000 | | | $ | 953 |

| |

| |

| |

| |

| See accompanying notes which are an integral part of the financial statements. | | | | |

| |

| | | 13 | | | | Semiannual Report |

| | Fidelity Ginnie Mae Fund

Investments (Unaudited) continued

|

| | Legend

(a) Security or a portion of the security

purchased on a delayed delivery or

when-issued basis.

(b) A portion of the security is subject to a

forward commitment to sell.

(c) The coupon rate shown on floating or

adjustable rate securities represents the

rate at period end.

(d) Security represents right to receive

monthly interest payments on an

underlying pool of mortgages. Principal

shown is the par amount of the

mortgage pool.

(e) Additional information on each

counterparty to the repurchase

agreement is as follows:

|

| Repurchase Agreement/ | | | | Value |

| Counterparty | | | | (000s) |

| $500,601,000 due 2/1/06 | | | | |

| at 4.46% | | | | |

| Banc of America Securities | | | | |

| LLC | | | $ | 182,543 |

| Bank of America, National | | | | |

| Association | | | | 46,508 |

| Barclays Capital Inc. | | | | 157,025 |

| BNP Paribas Securities Corp. | | | | 5,813 |

| Countrywide Securities | | | | |

| Corporation | | | | 23,254 |

| Goldman Sachs & Co. | | | | 69,762 |

| Morgan Stanley & Co. | | | | |

| Incorporated | | | | 15,696 |

| | | | $ | 500,601 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report 14

| Fidelity Ginnie Mae Fund | | | | | | |

| |

| Financial Statements | | | | | | |

| |

| Statement of Assets and Liabilities | | | | | | |

| Amounts in thousands (except per share amount) | | | | January 31, 2006 (Unaudited) |

| |

| Assets | | | | | | |

| Investment in securities, at value | | | | | | |

| (including repurchase agreements of $500,601) | | | | | | |

| See accompanying schedule: | | | | | | |

| Unaffiliated issuers (cost $4,325,072) | | | | | $ | 4,274,030 |

| Commitment to sell securities on a delayed delivery basis | | | $ | (75,047) | | |

| Receivable for securities sold on a delayed delivery basis | | | | 75,381 | | 334 |

| Receivable for investments sold, regular delivery | | | | | | 176 |

| Receivable for fund shares sold | | | | | | 1,608 |

| Interest receivable | | | | | | 16,964 |

| Swap agreements, at value | | | | | | 953 |

| Other affiliated receivables | | | | | | 14 |

| Total assets | | | | | | 4,294,079 |

| |

| Liabilities | | | | | | |

| Payable for investments purchased | | | | | | |

| Regular delivery | | | $ | 23,153 | | |

| Delayed delivery | | | | 510,835 | | |

| Payable for fund shares redeemed | | | | 4,980 | | |

| Distributions payable | | | | 1,572 | | |

| Accrued management fee | | | | 1,015 | | |

| Other affiliated payables | | | | 462 | | |

| Other payables and accrued expenses | | | | 51 | | |

| Total liabilities | | | | | | 542,068 |

| |

| Net Assets | | | | | $ | 3,752,011 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | | $ | 3,821,005 |

| Distributions in excess of net investment income | | | | | | (9,578) |

| Accumulated undistributed net realized gain (loss) on | | | | | | |

| investments | | | | | | (9,661) |

| Net unrealized appreciation (depreciation) on | | | | | | |

| investments | | | | | | (49,755) |

| Net Assets, for 346,373 shares outstanding | | | | | $ | 3,752,011 |

| Net Asset Value, offering price and redemption price per | | | | | | |

| share ($3,752,011 ÷ 346,373 shares) | | | | | $ | 10.83 |

See accompanying notes which are an integral part of the financial statements.

15 Semiannual Report

| Fidelity Ginnie Mae Fund | | | | | | |

| Financial Statements continued | | | | |

| |

| Statement of Operations | | | | | | |

| Amounts in thousands | | Six months ended January 31, 2006 (Unaudited) |

| |

| Investment Income | | | | | | |

| Interest | | | | | $ | 94,718 |

| |

| Expenses | | | | | | |

| Management fee | | | $ | 6,292 | | |

| Transfer agent fees | | | | 1,952 | | |

| Fund wide operations fee | | | | 531 | | |

| Independent trustees’ compensation | | | | 8 | | |

| Appreciation in deferred trustee compensation account | | | | 1 | | |

| Miscellaneous | | | | 3 | | |

| Total expenses before reductions | | | | 8,787 | | |

| Expense reductions | | | | (25) | | 8,762 |

| |

| Net investment income | | | | | | 85,956 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | (7,447) | | |

| Swap agreements | | | | (42) | | |

| Total net realized gain (loss) | | | | | | (7,489) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment securities | | | | (29,490) | | |

| Swap agreements | | | | 953 | | |

| Delayed delivery commitments | | | | 310 | | |

| Total change in net unrealized appreciation | | | | |

| (depreciation) | | | | | | (28,227) |

| Net gain (loss) | | | | | | (35,716) |

| Net increase (decrease) in net assets resulting from | | | | |

| operations | | | | | $ | 50,240 |

See accompanying notes which are an integral part of the financial statements.

| Statement of Changes in Net Assets | | | | | | | | |

| | | Six months ended | | | | Year ended |

| | | January 31, 2006 | | | | July 31, |

| Amounts in thousands | | (Unaudited) | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | | 85,956 | | | $ | 161,629 |

| Net realized gain (loss) | | | | (7,489) | | | | 25,145 |

| Change in net unrealized appreciation (depreciation) . | | | | (28,227) | | | | (25,474) |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from operations | | | | 50,240 | | | | 161,300 |

| Distributions to shareholders from net investment income . | | | | (102,909) | | | | (162,997) |

| Distributions to shareholders from net realized gain | | | | (7,297) | | | | — |

| Total distributions | | | | (110,206) | | | | (162,997) |

| Share transactions | | | | | | | | |

| Proceeds from sales of shares | | | | 244,379 | | | | 798,447 |

| Reinvestment of distributions | | | | 98,021 | | | | 144,222 |

| Cost of shares redeemed | | | | (563,900) | | | | (884,514) |

| Net increase (decrease) in net assets resulting from | | | | | | | | |

| share transactions | | | | (221,500) | | | | 58,155 |

| Total increase (decrease) in net assets | | | | (281,466) | | | | 56,458 |

| |

| Net Assets | | | | | | | | |

| Beginning of period | | | | 4,033,477 | | | | 3,977,019 |

| End of period (including distributions in excess of net | | | | | | | | |

| investment income of $9,578 and undistributed net | | | | | | | | |

| investment income of $7,375, respectively) | | $ | | 3,752,011 | | | $ | 4,033,477 |

| |

| Other Information | | | | | | | | |

| Shares | | | | | | | | |

| Sold | | | | 22,388 | | | | 72,083 |

| Issued in reinvestment of distributions | | | | 9,001 | | | | 13,026 |

| Redeemed | | | | (51,757) | | | | (79,918) |

| Net increase (decrease) | | | | (20,368) | | | | 5,191 |

See accompanying notes which are an integral part of the financial statements.

17 Semiannual Report

| Financial Highlights | | | | | | | | | | | | |

| | | Six months ended | | | | | | | | | | |

| | | January 31, | | | | | | | | | | |

| | | 2006 | | Years ended July 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | |

| beginning of period | | | | $11.00 | | $ 11.00 | | $ 11.05 | | $ 11.11 | | $ 10.91 | | $ 10.42 |

| Income from Investment | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | |

| Net investment | | | | | | | | | | | | | | |

| incomeD | | | | 240 | | .443 | | .404 | | .364 | | .563G | | .684 |

| Net realized and | | | | | | | | | | | | | | |

| unrealized gain | | | | | | | | | | | | | | |

| (loss) | | | | (.101) | | .004E | | .027 | | (.029) | | .225G | | .487 |

| Total from investment | | | | | | | | | | | | | | |

| operations | | | | 139 | | .447 | | .431 | | .335 | | .788 | | 1.171 |

| Distributions from net | | | | | | | | | | | | | | |

| investment income | | | | (.289) | | (.447) | | (.391) | | (.395) | | (.588) | | (.681) |

| Distributions from net | | | | | | | | | | | | | | |

| realized gain | | | | (.020) | | — | | (.090) | | — | | — | | — |

| Total distributions | | | | (.309) | | (.447) | | (.481) | | (.395) | | (.588) | | (.681) |

| Net asset value, | | | | | | | | | | | | | | |

| end of period | | | | $ 10.83 | | $ 11.00 | | $ 11.00 | | $ 11.05 | | $ 11.11 | | $ 10.91 |

| Total ReturnB,C | | | | 1.28% | | 4.11% | | 3.96% | | 3.02% | | 7.42% | | 11.55% |

| Ratios to Average Net AssetsF | | | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | | | |

| reductions | | | | 45%A | | .57% | | .60% | | .57% | | .60% | | .63% |

| Expenses net of fee | | | | | | | | | | | | | | |

| waivers, if any | | | | 45%A | | .57% | | .60% | | .57% | | .60% | | .62% |

| Expenses net of all | | | | | | | | | | | | | | |

| reductions | | | | 45%A | | .57% | | .60% | | .57% | | .60% | | .62% |

| Net investment | | | | | | | | | | | | | | |

| income | | | | 4.37%A | | 4.00% | | 3.64% | | 3.25% | | 5.15%G | | 6.40% |

| Supplemental Data | | | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | | | |

| period (in millions) | | | | $ 3,752 | | $ 4,033 | | $ 3,977 | | $ 5,606 | | $ 5,743 | | $ 2,836 |

| Portfolio turnover | | | | | | | | | | | | | | |

| rate | | | | 187%A | | 160% | | 155% | | 262% | | 327% | | 120% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E The amount shown for a share outstanding does not correspond with the aggregate net gain (loss) on investments for the period due to the timing of

sales and repurchases of shares in relation to fluctuating market values of the investments of the fund.

F Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense

offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of fee

waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all

reductions represent the net expenses paid by the fund.

G Effective August 1, 2001, the fund adopted the provisions of the AICPA Audit and Accounting Guide for Investment Companies and began amortizing

premium and discount on all debt securities. Per share data and ratios for periods prior to adoption have not been restated to reflect this change.

|

See accompanying notes which are an integral part of the financial statements.

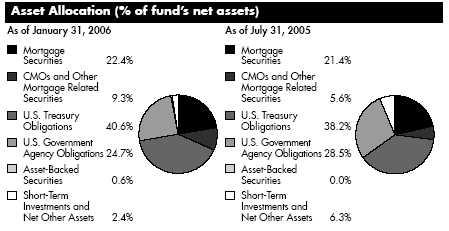

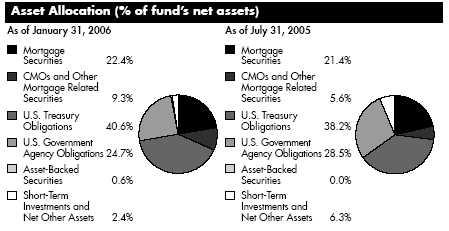

| Fidelity Government Income Fund | | | | |

| Investment Changes | | | | |

| |

| Coupon Distribution as of January 31, 2006 | | |

| | | % of fund’s | | % of fund’s investments |

| | | investments | | 6 months ago |

| Less than 2% | | 4.1 | | 4.3 |

| 2 – 2.99% | | 4.6 | | 15.1 |

| 3 – 3.99% | | 26.6 | | 16.2 |

| 4 – 4.99% | | 27.4 | | 12.8 |

| 5 – 5.99% | | 23.1 | | 20.4 |

| 6 – 6.99% | | 8.1 | | 12.0 |

| 7% and over | | 4.5 | | 6.3 |

Coupon distribution shows the range of stated interest rates on the fund’s investments, excluding short term investments.

| Average Years to Maturity as of January 31, 2006 | | |

| | | | | 6 months ago |

| Years | | 6.8 | | 6.1 |

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund’s bonds, weighted by dollar amount.

| Duration as of January 31, 2006 | | | | |

| | | | | | | 6 months ago |

| Years | | | | 4.2 | | 4.1 |

Duration shows how much a bond fund’s price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund’s performance and share price. Accordingly, a bond fund’s actual performance may differ from this example.

19 Semiannual Report

Fidelity Government Income Fund

Investments January 31, 2006 (Unaudited)

Showing Percentage of Net Assets

|

| U.S. Government and Government Agency Obligations 65.3% |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| U.S. Government Agency Obligations 24.7% | | | | | | | | |

| Fannie Mae: | | | | | | | | |

| 2.625% 11/15/06 | | | | $ 45,430 | | | | $ 44,669 |

| 3.125% 12/15/07 | | | | 160,000 | | | | 155,297 |

| 3.25% 1/15/08 | | | | 57,140 | | | | 55,531 |

| 3.25% 2/15/09 | | | | 116,465 | | | | 111,470 |

| 3.875% 5/15/07 | | | | 6,660 | | | | 6,580 |

| 4.5% 10/15/08 | | | | 5,738 | | | | 5,698 |

| 4.625% 1/15/08 | | | | 82,408 | | | | 82,179 |

| 4.625% 10/15/13 | | | | 2,800 | | | | 2,758 |

| 4.625% 10/15/14 | | | | 48,700 | | | | 47,936 |

| 4.75% 12/15/10 | | | | 200,000 | | | | 199,496 |

| 5.125% 1/2/14 | | | | 15,000 | | | | 14,975 |

| 5.5% 3/15/11 | | | | 36,525 | | | | 37,647 |

| 6.25% 2/1/11 | | | | 19,445 | | | | 20,473 |

| 6.375% 6/15/09 | | | | 39,220 | | | | 41,092 |

| Federal Home Loan Bank: | | | | | | | | |

| 3.75% 9/28/06 | | | | 34,660 | | | | 34,435 |

| 3.8% 12/22/06 | | | | 7,375 | | | | 7,310 |

| 5.8% 9/2/08 | | | | 7,750 | | | | 7,917 |

| Freddie Mac: | | | | | | | | |

| 2.75% 8/15/06 | | | | 6,630 | | | | 6,561 |

| 2.875% 12/15/06 | | | | 45,920 | | | | 45,165 |

| 3.55% 11/15/07 | | | | 77,765 | | | | 76,086 |

| 4% 8/17/07 | | | | 5,305 | | | | 5,240 |

| 4.125% 4/2/07 | | | | 20,542 | | | | 20,375 |

| 4.25% 7/15/09 | | | | 4,460 | | | | 4,381 |

| 4.875% 11/15/13 | | | | 18,800 | | | | 18,795 |

| 5.75% 1/15/12 | | | | 1,223 | | | | 1,279 |

| 5.875% 3/21/11 | | | | 34,550 | | | | 35,881 |

| 7% 3/15/10 | | | | 6,405 | | | | 6,921 |

| Government Loan Trusts (assets of Trust guaranteed by U.S. | | | | | | |

| Government through Agency for International Development) | | | | | | |

| Series 1-B, 8.5% 4/1/06 | | | | 893 | | | | 910 |

| Guaranteed Export Trust Certificates (assets of Trust | | | | | | |

| guaranteed by U.S. Government through Export-Import | | | | | | |

| Bank) Series 1994-A, 7.12% 4/15/06 | | | | 520 | | | | 523 |

| Israeli State (guaranteed by U.S. Government through Agency | | | | | | |

| for International Development): | | | | | | | | |

| 5.5% 9/18/23 | | | | 110,500 | | | | 117,102 |

| 6.6% 2/15/08 | | | | 23,039 | | | | 23,483 |

| 6.8% 2/15/12 | | | | 18,000 | | | | 19,398 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report 20

| U.S. Government and Government Agency Obligations continued |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| U.S. Government Agency Obligations continued | | | | | | |

| Overseas Private Investment Corp. U.S. Government | | | | | | | | |

| guaranteed participation certificates: | | | | | | | | |

| 6.77% 11/15/13 | | | | $ 5,108 | | | | $ 5,427 |

| 6.99% 5/21/16 | | | | 16,665 | | | | 18,201 |

| Private Export Funding Corp.: | | | | | | | | |

| secured: | | | | | | | | |

| 5.34% 3/15/06 | | | | 21,700 | | | | 21,716 |

| 5.66% 9/15/11 (a) | | | | 11,160 | | | | 11,574 |

| 5.685% 5/15/12 | | | | 16,815 | | | | 17,546 |

| 6.49% 7/15/07 | | | | 5,000 | | | | 5,109 |

| 6.67% 9/15/09 | | | | 2,120 | | | | 2,252 |

| 7.17% 5/15/07 | | | | 8,500 | | | | 8,745 |

| 3.375% 2/15/09 | | | | 3,565 | | | | 3,428 |

| 4.974% 8/15/13 | | | | 16,940 | | | | 17,012 |

| Small Business Administration guaranteed development | | | | | | |

| participation certificates: | | | | | | | | |

| Series 2002-20J Class 1, 4.75% 10/1/22 | | | | 7,897 | | | | 7,763 |

| Series 2002-20K Class 1, 5.08% 11/1/22 | | | | 4,125 | | | | 4,126 |

| Series 2003 P10B, 5.136% 8/10/13 | | | | 12,455 | | | | 12,477 |

| Series 2004-20H Class 1, 5.17% 8/1/24 | | | | 3,776 | | | | 3,788 |

| U.S. Department of Housing and Urban Development | | | | | | | | |

| Government guaranteed participation certificates | | | | | | | | |

| Series 1999 A: | | | | | | | | |

| 5.75% 8/1/06 | | | | 9,300 | | | | 9,355 |

| 5.96% 8/1/09 | | | | 9,930 | | | | 10,093 |

| U.S. Trade Trust Certificates (assets of Trust guaranteed by | | | | | | |

| U.S. Government through Export-Import Bank) 8.17% | | | | | | |

| 1/15/07 | | | | 623 | | | | 634 |

| |

| TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | | | | | | | | 1,416,809 |

| U.S. Treasury Inflation Protected Obligations 10.0% | | | | | | |

| U.S. Treasury Inflation-Indexed Bonds: | | | | | | | | |

| 2.375% 1/15/25 | | | | 115,343 | | | | 121,975 |

| 3.625% 4/15/28 | | | | 135,645 | | | | 175,787 |

| U.S. Treasury Inflation-Indexed Notes: | | | | | | | | |

| 0.875% 4/15/10 | | | | 158,585 | | | | 152,017 |

| 1.875% 7/15/13 | | | | 80,712 | | | | 80,245 |

| 2% 7/15/14 | | | | 41,943 | | | | 42,014 |

| |

| TOTAL U.S. TREASURY INFLATION PROTECTED OBLIGATIONS | | | | | | 572,038 |

See accompanying notes which are an integral part of the financial statements.

21 Semiannual Report

| Fidelity Government Income Fund | | | | |

| Investments (Unaudited) continued | | | | |

| |

| U.S. Government and Government Agency Obligations continued |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| U.S. Treasury Obligations – 30.6% | | | | |

| U.S. Treasury Bonds: | | | | | | |

| 6.125% 8/15/29 | | | | $ 112,000 | | $ 134,033 |

| 8% 11/15/21 | | | | 142,000 | | 193,131 |

| U.S. Treasury Notes: | | | | | | |

| 3.375% 9/15/09 | | | | 287,793 | | 277,091 |

| 3.75% 5/15/08 | | | | 480,000 | | 472,294 |

| 3.875% 7/31/07 | | | | 105,347 | | 104,326 |

| 4.25% 8/15/13 | | | | 59,275 | | 58,182 |

| 4.25% 11/15/13 | | | | 15,000 | | 14,711 |

| 4.25% 11/15/14 | | | | 430,000 | | 420,644 |

| 4.75% 5/15/14 | | | | 75,948 | | 76,998 |

| |

| TOTAL U.S. TREASURY OBLIGATIONS | | | | | | 1,751,410 |

| |

| TOTAL U.S. GOVERNMENT AND | | | | |

| GOVERNMENT AGENCY OBLIGATIONS | | | | |

| (Cost $3,742,958) | | | | | | 3,740,257 |

| |

| U.S. Government Agency Mortgage Securities 22.4% | | |

| |

| Fannie Mae – 20.2% | | | | | | |

| 3.476% 4/1/34 (c) | | | | 1,634 | | 1,627 |

| 3.723% 1/1/35 (c) | | | | 1,010 | | 993 |

| 3.75% 1/1/34 (c) | | | | 820 | | 800 |

| 3.752% 10/1/33 (c) | | | | 724 | | 707 |

| 3.753% 10/1/33 (c) | | | | 895 | | 872 |

| 3.756% 12/1/34 (c) | | | | 795 | | 784 |

| 3.788% 12/1/34 (c) | | | | 182 | | 179 |

| 3.791% 6/1/34 (c) | | | | 3,226 | | 3,106 |

| 3.82% 6/1/33 (c) | | | | 522 | | 511 |

| 3.825% 1/1/35 (c) | | | | 688 | | 675 |

| 3.828% 4/1/33 (c) | | | | 2,499 | | 2,450 |

| 3.847% 1/1/35 (c) | | | | 1,987 | | 1,950 |

| 3.869% 1/1/35 (c) | | | | 1,193 | | 1,188 |

| 3.877% 6/1/33 (c) | | | | 2,791 | | 2,745 |

| 3.889% 12/1/34 (c) | | | | 616 | | 614 |

| 3.902% 10/1/34 (c) | | | | 830 | | 820 |

| 3.945% 5/1/34 (c) | | | | 280 | | 284 |

| 3.948% 11/1/34 (c) | | | | 1,300 | | 1,288 |

| 3.958% 1/1/35 (c) | | | | 856 | | 848 |

| 3.971% 5/1/33 (c) | | | | 253 | | 250 |

| 3.981% 12/1/34 (c) | | | | 655 | | 650 |

See accompanying notes which are an integral part of the financial statements.

| U.S. Government Agency Mortgage Securities continued | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| Fannie Mae – continued | | | | | | | | |

| 3.983% 12/1/34 (c) | | | | $ 4,472 | | | | $ 4,450 |

| 3.984% 12/1/34 (c) | | | | 861 | | | | 854 |

| 3.988% 1/1/35 (c) | | | | 544 | | | | 540 |

| 3.991% 2/1/35 (c) | | | | 603 | | | | 598 |

| 4% 10/1/18 to 6/1/20 | | | | 9,895 | | | | 9,431 |

| 4.014% 12/1/34 (c) | | | | 413 | | | | 410 |

| 4.026% 1/1/35 (c) | | | | 1,167 | | | | 1,159 |

| 4.03% 2/1/35 (c) | | | | 585 | | | | 579 |

| 4.037% 1/1/35 (c) | | | | 308 | | | | 306 |

| 4.039% 10/1/18 (c) | | | | 692 | | | | 681 |

| 4.053% 4/1/33 (c) | | | | 240 | | | | 239 |

| 4.057% 1/1/35 (c) | | | | 573 | | | | 567 |

| 4.063% 12/1/34 (c) | | | | 1,206 | | | | 1,198 |

| 4.075% 1/1/35 (c) | | | | 1,143 | | | | 1,133 |

| 4.094% 2/1/35 (c) | | | | 412 | | | | 410 |

| 4.097% 2/1/35 (c) | | | | 1,114 | | | | 1,104 |

| 4.101% 2/1/35 (c) | | | | 445 | | | | 441 |

| 4.105% 2/1/35 (c) | | | | 2,214 | | | | 2,197 |

| 4.111% 1/1/35 (c) | | | | 1,239 | | | | 1,226 |

| 4.114% 11/1/34 (c) | | | | 963 | | | | 954 |

| 4.121% 1/1/35 (c) | | | | 2,244 | | | | 2,224 |

| 4.123% 1/1/35 (c) | | | | 1,186 | | | | 1,181 |

| 4.127% 2/1/35 (c) | | | | 1,351 | | | | 1,339 |

| 4.144% 1/1/35 (c) | | | | 1,825 | | | | 1,822 |

| 4.159% 2/1/35 (c) | | | | 1,182 | | | | 1,173 |

| 4.171% 1/1/35 (c) | | | | 1,029 | | | | 1,021 |

| 4.176% 11/1/34 (c) | | | | 312 | | | | 310 |

| 4.179% 1/1/35 (c) | | | | 2,277 | | | | 2,258 |

| 4.181% 1/1/35 (c) | | | | 1,474 | | | | 1,445 |

| 4.188% 10/1/34 (c) | | | | 1,760 | | | | 1,761 |

| 4.205% 3/1/34 (c) | | | | 634 | | | | 626 |

| 4.25% 2/1/35 (c) | | | | 755 | | | | 740 |

| 4.255% 1/1/34 (c) | | | | 2,180 | | | | 2,155 |

| 4.277% 1/1/35 (c) | | | | 674 | | | | 669 |

| 4.278% 2/1/35 (c) | | | | 432 | | | | 428 |

| 4.288% 8/1/33 (c) | | | | 1,460 | | | | 1,444 |

| 4.292% 7/1/34 (c) | | | | 547 | | | | 551 |

| 4.295% 3/1/35 (c) | | | | 683 | | | | 676 |

| 4.297% 3/1/33 (c) | | | | 968 | | | | 962 |

| 4.301% 10/1/34 (c) | | | | 205 | | | | 205 |

| 4.306% 3/1/33 (c) | | | | 351 | | | | 345 |

| 4.313% 3/1/33 (c) | | | | 357 | | | | 351 |

See accompanying notes which are an integral part of the financial statements.

23 Semiannual Report

| Fidelity Government Income Fund | | | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| U.S. Government Agency Mortgage Securities continued | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| Fannie Mae – continued | | | | | | | | |

| 4.316% 5/1/35 (c) | | | | $ 1,016 | | | | $ 1,005 |

| 4.324% 10/1/33 (c) | | | | 372 | | | | 367 |

| 4.327% 12/1/34 (c) | | | | 422 | | | | 422 |

| 4.339% 9/1/34 (c) | | | | 1,119 | | | | 1,110 |

| 4.348% 1/1/35 (c) | | | | 752 | | | | 741 |

| 4.354% 1/1/35 (c) | | | | 846 | | | | 834 |

| 4.364% 9/1/34 (c) | | | | 2,711 | | | | 2,691 |

| 4.367% 2/1/34 (c) | | | | 1,687 | | | | 1,669 |

| 4.368% 4/1/35 (c) | | | | 482 | | | | 476 |

| 4.378% 6/1/33 (c) | | | | 461 | | | | 458 |

| 4.394% 2/1/35 (c) | | | | 1,107 | | | | 1,090 |

| 4.403% 5/1/35 (c) | | | | 2,180 | | | | 2,150 |

| 4.409% 10/1/34 (c) | | | | 4,236 | | | | 4,179 |

| 4.411% 11/1/34 (c) | | | | 9,304 | | | | 9,252 |

| 4.439% 10/1/34 (c) | | | | 3,626 | | | | 3,607 |

| 4.44% 3/1/35 (c) | | | | 997 | | | | 982 |

| 4.445% 4/1/34 (c) | | | | 1,150 | | | | 1,142 |

| 4.467% 8/1/34 (c) | | | | 2,271 | | | | 2,245 |

| 4.477% 1/1/35 (c) | | | | 1,124 | | | | 1,119 |

| 4.481% 5/1/35 (c) | | | | 736 | | | | 726 |

| 4.5% 7/1/18 to 12/1/20 | | | | 83,429 | | | | 81,053 |

| 4.517% 8/1/34 (c) | | | | 1,477 | | | | 1,489 |

| 4.541% 2/1/35 (c) | | | | 782 | | | | 775 |

| 4.542% 2/1/35 (c) | | | | 4,700 | | | | 4,694 |

| 4.544% 7/1/34 (c) | | | | 1,221 | | | | 1,214 |

| 4.545% 7/1/35 (c) | | | | 2,721 | | | | 2,693 |

| 4.56% 2/1/35 (c) | | | | 474 | | | | 474 |

| 4.561% 1/1/35 (c) | | | | 1,620 | | | | 1,620 |

| 4.577% 9/1/34 (c) | | | | 3,154 | | | | 3,129 |

| 4.581% 9/1/34 (c) | | | | 21,808 | | | | 21,600 |

| 4.584% 2/1/35 (c) | | | | 3,372 | | | | 3,335 |

| 4.605% 8/1/34 (c) | | | | 1,087 | | | | 1,081 |

| 4.627% 1/1/33 (c) | | | | 533 | | | | 533 |

| 4.629% 9/1/34 (c) | | | | 319 | | | | 318 |

| 4.637% 10/1/35 (c) | | | | 370 | | | | 366 |

| 4.653% 3/1/35 (c) | | | | 400 | | | | 400 |

| 4.712% 10/1/32 (c) | | | | 217 | | | | 218 |

| 4.725% 3/1/35 (c) | | | | 1,178 | | | | 1,168 |

| 4.728% 2/1/33 (c) | | | | 159 | | | | 159 |

| 4.73% 7/1/34 (c) | | | | 2,088 | | | | 2,070 |

| 4.732% 10/1/32 (c) | | | | 211 | | | | 212 |

| 4.808% 12/1/32 (c) | | | | 1,014 | | | | 1,018 |

See accompanying notes which are an integral part of the financial statements.

| U.S. Government Agency Mortgage Securities continued | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| Fannie Mae – continued | | | | | | | | |

| 4.814% 2/1/33 (c) | | | | $ 1,191 | | | | $ 1,188 |

| 4.815% 5/1/33 (c) | | | | 43 | | | | 43 |

| 4.825% 12/1/34 (c) | | | | 810 | | | | 806 |

| 4.83% 1/1/35 (c) | | | | 135 | | | | 135 |

| 4.835% 8/1/34 (c) | | | | 873 | | | | 867 |

| 4.898% 10/1/35 (c) | | | | 2,266 | | | | 2,255 |

| 4.904% 12/1/32 (c) | | | | 82 | | | | 82 |

| 4.98% 11/1/32 (c) | | | | 593 | | | | 599 |

| 5% 12/1/15 to 12/1/35 | | | | 296,213 | | | | 287,539 |

| 5.031% 2/1/35 (c) | | | | 424 | | | | 425 |

| 5.035% 11/1/34 (c) | | | | 200 | | | | 200 |

| 5.046% 7/1/34 (c) | | | | 495 | | | | 496 |

| 5.105% 5/1/35 (c) | | | | 5,173 | | | | 5,190 |

| 5.106% 9/1/34 (c) | | | | 850 | | | | 849 |

| 5.197% 6/1/35 (c) | | | | 3,748 | | | | 3,753 |

| 5.216% 8/1/33 (c) | | | | 1,176 | | | | 1,170 |

| 5.276% 3/1/35 (c) | | | | 537 | | | | 538 |

| 5.333% 7/1/35 (c) | | | | 520 | | | | 521 |

| 5.349% 12/1/34 (c) | | | | 1,601 | | | | 1,601 |

| 5.5% 4/1/09 to 12/1/35 (b) | | | | 532,736 | | | | 529,209 |

| 6% 9/1/17 to 10/1/32 | | | | 38,197 | | | | 38,798 |

| 6.5% 3/1/13 to 3/1/35 | | | | 30,561 | | | | 31,391 |

| 7% 7/1/13 to 5/1/30 | | | | 3,734 | | | | 3,891 |

| 7.5% 8/1/10 to 10/1/15 | | | | 233 | | | | 244 |

| 8% 1/1/22 | | | | 68 | | | | 70 |

| 8.5% 1/1/15 to 4/1/16 | | | | 707 | | | | 747 |

| 9% 5/1/14 | | | | 711 | | | | 768 |

| 9.5% 11/15/09 to 10/1/20 | | | | 1,204 | | | | 1,304 |

| 10% 8/1/10 | | | | 19 | | | | 19 |

| 11.5% 6/15/19 to 1/15/21 | | | | 2,001 | | | | 2,190 |

| | | | | | | | | 1,158,276 |

| Freddie Mac – 2.0% | | | | | | | | |

| 4.055% 12/1/34 (c) | | | | 791 | | | | 783 |

| 4.113% 12/1/34 (c) | | | | 1,152 | | | | 1,133 |

| 4.176% 1/1/35 (c) | | | | 1,066 | | | | 1,048 |

| 4.288% 3/1/35 (c) | | | | 1,008 | | | | 998 |

| 4.296% 5/1/35 (c) | | | | 1,796 | | | | 1,775 |

| 4.305% 12/1/34 (c) | | | | 1,089 | | | | 1,069 |

| 4.33% 1/1/35 (c) | | | | 2,347 | | | | 2,333 |

| 4.366% 2/1/35 (c) | | | | 2,163 | | | | 2,143 |

| 4.445% 3/1/35 (c) | | | | 1,016 | | | | 994 |

See accompanying notes which are an integral part of the financial statements.

25 Semiannual Report

| Fidelity Government Income Fund | | | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| U.S. Government Agency Mortgage Securities continued | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| Freddie Mac – continued | | | | | | | | |

| 4.446% 2/1/34 (c) | | | | $ 1,067 | | | | $ 1,051 |

| 4.465% 6/1/35 (c) | | | | 1,477 | | | | 1,455 |

| 4.49% 3/1/35 (c) | | | | 1,115 | | | | 1,091 |

| 4.49% 3/1/35 (c) | | | | 7,191 | | | | 7,073 |

| 4.554% 2/1/35 (c) | | | | 1,610 | | | | 1,590 |

| 4.704% 9/1/35 (c) | | | | 36,005 | | | | 35,741 |

| 4.782% 10/1/32 (c) | | | | 142 | | | | 142 |

| 4.996% 3/1/33 (c) | | | | 410 | | | | 407 |

| 5% 1/1/09 to 9/1/35 | | | | 9,230 | | | | 8,931 |

| 5.013% 4/1/35 (c) | | | | 5,659 | | | | 5,649 |

| 5.326% 8/1/33 (c) | | | | 434 | | | | 439 |

| 5.5% 11/1/20 | | | | 27,521 | | | | 27,678 |

| 5.651% 4/1/32 (c) | | | | 244 | | | | 248 |

| 6% 5/1/33 | | | | 9,063 | | | | 9,182 |

| 7% 4/1/11 | | | | 5 | | | | 5 |

| 7.5% 7/1/10 to 5/1/16 | | | | 2,304 | | | | 2,424 |

| 8% 1/1/10 to 6/1/11 | | | | 37 | | | | 37 |

| 8.5% 8/1/08 to 12/1/25 | | | | 154 | | | | 162 |

| 9% 8/1/09 to 12/1/10 | | | | 89 | | | | 92 |

| 9.75% 8/1/14 | | | | 173 | | | | 188 |

| | | | | | | | | 115,861 |

| Government National Mortgage Association – 0.2% | | | | | | |

| 4.25% 7/20/34 (c) | | | | 1,551 | | | | 1,524 |

| 6% 7/15/08 to 12/15/10 | | | | 4,240 | | | | 4,318 |

| 6.5% 5/15/28 to 11/15/32 | | | | 1,196 | | | | 1,248 |

| 7% 10/15/26 to 8/15/32 | | | | 53 | | | | 56 |

| 7.5% 3/15/28 to 8/15/28 | | | | 149 | | | | 157 |

| 8% 11/15/06 to 12/15/23 | | | | 1,198 | | | | 1,282 |

| 8.5% 10/15/08 to 2/15/31 | | | | 81 | | | | 85 |

| 9.5% 2/15/25 | | | | 1 | | | | 1 |

| | | | | | | | | 8,671 |

| |

| TOTAL U.S. GOVERNMENT AGENCY MORTGAGE SECURITIES | | | | |

| (Cost $1,298,300) | | | | | | 1,282,808 |

| |

| Asset Backed Securities 0.6% | | | | | | |

| |

| Fannie Mae Grantor Trust Series 2005-T4 | | | | | | |

| Class A1C, 4.68% 9/25/35 (c) | | | | | | | | |

| (Cost $37,030) | | | | 37,030 | | | | 37,061 |

See accompanying notes which are an integral part of the financial statements.

| Collateralized Mortgage Obligations 9.3% | | | | | | | | |

| | | Principal | | Value (Note 1) |

| | | Amount (000s) | | (000s) |

| U.S. Government Agency 9.3% | | | | | | | | |

| Fannie Mae: | | | | | | | | |

| planned amortization class: | | | | | | | | |

| Series 1993-109 Class NZ, 6% 7/25/08 | | | | $ 3,795 | | | | $ 3,809 |

| Series 1993-160 Class PK, 6.5% 11/25/22 | | | | 667 | | | | 665 |

| Series 1993-207 Class H, 6.5% 11/25/23 | | | | 18,360 | | | | 19,127 |

| Series 1994-23 Class PG, 6% 4/25/23 | | | | 9,565 | | | | 9,637 |

| Series 1994-27 Class PJ, 6.5% 6/25/23 | | | | 2,093 | | | | 2,100 |

| Series 1994-50 Class PJ, 6.5% 8/25/23 | | | | 15,748 | | | | 15,888 |

| Series 1996-28 Class PK, 6.5% 7/25/25 | | | | 3,430 | | | | 3,566 |

| Series 2003-28 Class KG, 5.5% 4/25/23 | | | | 4,225 | | | | 4,143 |

| sequential pay Series 1997-41 Class J, 7.5% 6/18/27 | | | | 4,187 | | | | 4,414 |

| Fannie Mae Grantor Trust floater Series 2005-93: | | | | | | | | |

| Class MF, 4.78% 8/25/34 (c) | | | | 31,407 | | | | 31,212 |

| Class NF, 4.78% 8/25/34 (c) | | | | 19,748 | | | | 19,587 |

| Fannie Mae guaranteed REMIC pass thru certificates: | | | | | | | | |

| floater: | | | | | | | | |

| Series 2003-122 Class FL, 4.88% 7/25/29 (c) | | | | 3,279 | | | | 3,296 |

| Series 2003-131 Class FM, 4.93% 12/25/29 (c) | | | | 2,423 | | | | 2,430 |

| Series 2004-33 Class FW, 4.93% 8/25/25 (c) | | | | 5,620 | | | | 5,636 |

| planned amortization class: | | | | | | | | |

| Series 2002-25 Class PD, 6.5% 3/25/31 | | | | 17,091 | | | | 17,267 |

| Series 2002-8 Class PD, 6.5% 7/25/30 | | | | 589 | | | | 588 |

| Series 2003-91 Class HA, 4.5% 11/25/16 | | | | 8,590 | | | | 8,466 |

| sequential pay: | | | | | | | | |

| Series 2002-79 Class Z, 5.5% 11/25/22 | | | | 20,620 | | | | 20,171 |

| Series 2005-41 Class WY, 5.5% 5/25/25 | | | | 15,330 | | | | 15,189 |

| Series 2002-50 Class LE, 7% 12/25/29 | | | | 577 | | | | 581 |

| Freddie Mac: | | | | | | | | |

| floater: | | | | | | | | |

| Series 2344 Class FP, 5.42% 8/15/31 (c) | | | | 4,221 | | | | 4,316 |

| Series 3028 Class FM, 4.72% 9/15/35 (c) | | | | 19,216 | | | | 19,114 |

| planned amortization class Series 1413 Class J, 4% | | | | | | | | |

| 11/15/07 | | | | 1,502 | | | | 1,492 |

| sequential pay: | | | | | | | | |

| Series 2114 Class ZM, 6% 1/15/29 | | | | 2,563 | | | | 2,593 |

| Series 2516 Class AH, 5% 1/15/16 | | | | 1,257 | | | | 1,252 |

| Freddie Mac Manufactured Housing participation certificates | | | | | | | | |

| guaranteed: | | | | | | | | |

| planned amortization class Series 1681 Class PJ, 7% | | | | | | | | |

| 12/15/23 | | | | 9,200 | | | | 9,426 |

| Series 1560 Class PN, 7% 12/15/12 | | | | 12,868 | | | | 13,071 |

See accompanying notes which are an integral part of the financial statements.

27 Semiannual Report

| Fidelity Government Income Fund | | | | | | | | |

| Investments (Unaudited) continued | | | | | | |

| |

| Collateralized Mortgage Obligations continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount (000s) | | (000s) |

| U.S. Government Agency continued | | | | | | | | |

| Freddie Mac Multi-class participation certificates guaranteed: | | | | | | | | |

| floater: | | | | | | | | |

| Series 2406: | | | | | | | | |

| Class FP, 5.45% 1/15/32 (c) | | | | $ 7,360 | | | | $ 7,511 |

| Class PF, 5.45% 12/15/31 (c) | | | | 6,340 | | | | 6,497 |

| Series 2410 Class PF, 5.45% 2/15/32 (c) | | | | 14,540 | | | | 14,885 |

| Series 2412 Class GF, 5.42% 2/15/32 (c) | | | | 3,117 | | | | 3,188 |

| Series 2553 Class FB, 4.97% 3/15/29 (c) | | | | 17,107 | | | | 17,199 |

| Series 2577 Class FW, 4.97% 1/15/30 (c) | | | | 12,673 | | | | 12,745 |

| Series 2861 Class GF, 4.77% 1/15/21 (c) | | | | 3,341 | | | | 3,343 |

| Series 2994 Class FB, 4.62% 6/15/20 (c) | | | | 4,707 | | | | 4,695 |

| planned amortization class: | | | | | | | | |

| Class 2325 Class PL, 7% 1/15/31 | | | | 1,069 | | | | 1,071 |

| Series 1614 Class L, 6.5% 7/15/23 | | | | 8,138 | | | | 8,312 |

| Series 1727 Class H, 6.5% 8/15/23 | | | | 4,216 | | | | 4,228 |

| Series 2461 Class PG, 6.5% 1/15/31 | | | | 562 | | | | 563 |

| Series 2628 Class OE, 4.5% 6/15/18 | | | | 9,400 | | | | 9,067 |

| Series 2690: | | | | | | | | |

| Class PD, 5% 2/15/27 | | | | 12,900 | | | | 12,798 |

| Class TB, 4.5% 12/15/17 | | | | 5,555 | | | | 5,529 |

| Series 2755 Class LC, 4% 6/15/27 | | | | 9,685 | | | | 9,269 |

| Series 2760 Class EC, 4.5% 4/15/17 | | | | 8,098 | | | | 7,788 |

| Series 2763 Class PD, 4.5% 12/15/17 | | | | 10,150 | | | | 9,784 |

| Series 2770 Class UD, 4.5% 5/15/17 | | | | 15,620 | | | | 15,084 |

| Series 2780 Class OC, 4.5% 3/15/17 | | | | 4,980 | | | | 4,865 |

| Series 2802 Class OB, 6% 5/15/34 | | | | 7,795 | | | | 8,027 |

| Series 2828 Class JA, 4.5% 1/15/10 | | | | 7,111 | | | | 7,079 |

| Series 2831 Class PB, 5% 7/15/19 | | | | 4,945 | | | | 4,846 |

| Series 2885 Class PC, 4.5% 3/15/18 | | | | 6,710 | | | | 6,538 |

| Series 2966 Class XC, 5.5% 1/15/31 | | | | 25,111 | | | | 24,996 |

| sequential pay: | | | | | | | | |

| Series 2608 Class FJ, 4.87% 3/15/17 (c) | | | | 11,100 | | | | 11,158 |

| Series 2638 Class FA, 4.87% 11/15/16 (c) | | | | 10,221 | | | | 10,265 |

| Series 2644 Class EF, 4.82% 2/15/18 (c) | | | | 11,411 | | | | 11,465 |

| Series 2866 Class N, 4.5% 12/15/18 | | | | 5,873 | | | | 5,761 |

| Series 2998 Class LY, 5.5% 7/15/25 | | | | 1,720 | | | | 1,705 |

| Series 3007 Class EW, 5.5% 7/15/25 | | | | 6,620 | | | | 6,639 |

| Series 2769 Class BU, 5% 3/15/34 | | | | 5,134 | | | | 4,851 |

| target amortization class Series 2156 Class TC, 6.25% | | | | | | |

| 5/15/29 | | | | 7,970 | | | | 8,109 |

See accompanying notes which are an integral part of the financial statements.

| Collateralized Mortgage Obligations continued | | | | | | |

| | | | | Principal | | | | Value (Note 1) |

| | | | | Amount (000s) | | | | (000s) |

| U.S. Government Agency continued | | | | | | | | | | |

| Ginnie Mae guaranteed REMIC pass thru securities planned | | | | | | | | |

| amortization class: | | | | | | | | | | |

| Series 1997-8 Class PE, 7.5% 5/16/27 | | | | $ 6,750 | | | | | | $ 6,985 |

| Series 2001-53 Class TA, 6% 12/20/30 | | | | 11 | | | | | | 11 |

| Series 2005-58 Class NJ, 4.5% 8/20/35 | | | | 16,000 | | | | | | 15,661 |

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | | | | | | | | |

| (Cost $537,459) | | | | | | | | | | 531,553 |

| |

| Cash Equivalents 1.6% | | | | | | | | | | |

| | | | | Maturity | | | | | | |

| | | | | Amount (000s) | | | | | | |

| Investments in repurchase agreements (Collateralized by U.S. | | | | | | | | |

| Government Obligations, in a joint trading account at | | | | | | | | |

| 4.46%, dated 1/31/06 due 2/1/06) | | | | | | | | | | |

| (Cost $91,336) | | | | $ 91,347 | | | | | | 91,336 |

| |

| TOTAL INVESTMENT PORTFOLIO 99.2% | | | | | | | | | | |

| (Cost $5,707,083) | | | | | | | | 5,683,015 |

| |

| NET OTHER ASSETS – 0.8% | | | | | | | | | | 47,352 |

| NET ASSETS 100% | | | | | | | | $ 5,730,367 |

Legend

(a) Security exempt from registration under

Rule 144A of the Securities Act of 1933.

These securities may be resold in

transactions exempt from registration,

normally to qualified institutional buyers.

At the period end, the value of these

securities amounted to $11,574,000 or

0.2% of net assets.

(b) A portion of the security is subject to a

forward commitment to sell.

(c) The coupon rate shown on floating or

adjustable rate securities represents the

rate at period end.

|

See accompanying notes which are an integral part of the financial statements.

29 Semiannual Report

| Fidelity Government Income Fund | | | | | | |

| |

| Financial Statements | | | | | | |

| |

| Statement of Assets and Liabilities | | | | | | |

| Amounts in thousands (except per share amount) | | | | January 31, 2006 (Unaudited) |

| |

| Assets | | | | | | |

| Investment in securities, at value | | | | | | |

| (including repurchase agreements of $91,336) | | | | | | |

| See accompanying schedule: | | | | | | |

| Unaffiliated issuers (cost $5,707,083) | | | | | $ | 5,683,015 |

| Commitment to sell securities on a delayed delivery basis | | | $ | (37,584) | | |

| Receivable for securities sold on a delayed delivery basis | | | | 37,691 | | 107 |

| Receivable for investments sold, regular delivery | | | | | | 755 |

| Receivable for fund shares sold | | | | | | 6,733 |

| Interest receivable | | | | | | 44,664 |

| Total assets | | | | | | 5,735,274 |

| |

| Liabilities | | | | | | |

| Payable for fund shares redeemed | | | $ | 2,495 | | |

| Distributions payable | | | | 274 | | |

| Accrued management fee | | | | 1,524 | | |

| Transfer agent fee payable | | | | 474 | | |

| Other affiliated payables | | | | 139 | | |

| Other payables and accrued expenses | | | | 1 | | |

| Total liabilities | | | | | | 4,907 |

| |

| Net Assets | | | | | $ | 5,730,367 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | | $ | 5,777,145 |

| Undistributed net investment income | | | | | | 1,336 |

| Accumulated undistributed net realized gain (loss) on | | | | | | |

| investments | | | | | | (24,153) |

| Net unrealized appreciation (depreciation) on | | | | | | |

| investments | | | | | | (23,961) |

| Net Assets, for 568,108 shares outstanding | | | | | $ | 5,730,367 |

| Net Asset Value, offering price and redemption price per | | | | | | |

| share ($5,730,367 ÷ 568,108 shares) | | | | | $ | 10.09 |

See accompanying notes which are an integral part of the financial statements.

| Statement of Operations | | | | | | |

| Amounts in thousands | | Six months ended January 31, 2006 (Unaudited) |

| |

| Investment Income | | | | | | |

| Interest | | | | | $ | 117,736 |

| |

| Expenses | | | | | | |

| Management fee | | | $ | 8,712 | | |

| Transfer agent fees | | | | 2,703 | | |

| Fund wide operations fee | | | | 736 | | |

| Independent trustees’ compensation | | | | 11 | | |

| Miscellaneous | | | | 5 | | |

| Total expenses before reductions | | | | 12,167 | | |

| Expense reductions | | | | (157) | | 12,010 |

| |

| Net investment income | | | | | | 105,726 |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | | | (15,295) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment securities | | | | (39,294) | | |

| Delayed delivery commitments | | | | 107 | | |

| Total change in net unrealized appreciation | | | | | | |

| (depreciation) | | | | | | (39,187) |

| Net gain (loss) | | | | | | (54,482) |

| Net increase (decrease) in net assets resulting from | | | | |

| operations | | | | | $ | 51,244 |

See accompanying notes which are an integral part of the financial statements.

31 Semiannual Report

| Fidelity Government Income Fund | | | | | | | | |

| Financial Statements continued | | | | | | | | |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| | | Six months ended | | | | Year ended |

| | | January 31, 2006 | | | | July 31, |

| Amounts in thousands | | (Unaudited) | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | | 105,726 | | | $ | 148,489 |

| Net realized gain (loss) | | | | (15,295) | | | | 6,387 |

| Change in net unrealized appreciation (depreciation) . | | | | (39,187) | | | | 31,902 |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from operations | | | | 51,244 | | | | 186,778 |

| Distributions to shareholders from net investment income . | | | | (113,131) | | | | (144,880) |

| Distributions to shareholders from net realized gain | | | | — | | | | (15,082) |

| Total distributions | | | | (113,131) | | | | (159,962) |

| Share transactions | | | | | | | | |

| Proceeds from sales of shares | | | | 820,472 | | | | 1,285,690 |

| Reinvestment of distributions | | | | 111,259 | | | | 156,778 |

| Cost of shares redeemed | | | | (266,852) | | | | (510,049) |

| Net increase (decrease) in net assets resulting from | | | | | | | | |

| share transactions | | | | 664,879 | | | | 932,419 |

| Total increase (decrease) in net assets | | | | 602,992 | | | | 959,235 |

| |

| Net Assets | | | | | | | | |

| Beginning of period | | | | 5,127,375 | | | | 4,168,140 |

| End of period (including undistributed net investment | | | | | | | | |

| income of $1,336 and undistributed net investment | | | | | | | | |

| income of $8,741, respectively) | | $ | | 5,730,367 | | | $ | 5,127,375 |

| |

| Other Information | | | | | | | | |

| Shares | | | | | | | | |

| Sold | | | | 80,850 | | | | 125,500 |

| Issued in reinvestment of distributions | | | | 10,974 | | | | 15,297 |

| Redeemed | | | | (26,301) | | | | (49,765) |

| Net increase (decrease) | | | | 65,523 | | | | 91,032 |

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights | | | | | | | | | | | | | | |

| | | Six months ended | | | | | | | | | | | | |

| | | January 31, | | | | | | | | | | | | |

| | | 2006 | | Years ended July 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | | |

| beginning of period | | | | $ 10.20 | | $ 10.13 | | $ 10.16 | | $ 10.30 | | $ 9.98 | | | | $ 9.49 |

| Income from Investment | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | |

| Net investment | | | | | | | | | | | | | | | | |

| incomeD | | | | 198 | | .329 | | .307 | | .374 | | .452F | | | | .577 |

| Net realized and | | | | | | | | | | | | | | | | |

| unrealized gain | | | | | | | | | | | | | | | | |

| (loss) | | | | (.097) | | .097 | | .124 | | (.014) | | .335F | | | | .525 |

| Total from investment | | | | | | | | | | | | | | | | |

| operations | | | | 101 | | .426 | | .431 | | .360 | | .787 | | | | 1.102 |

| Distributions from net | | | | | | | | | | | | | | | | |

| investment income | | | | (.211) | | (.321) | | (.301) | | (.370) | | (.467) | | | | (.612) |

| Distributions from net | | | | | | | | | | | | | | | | |

| realized gain | | | | | | (.035) | | (.160) | | (.130) | | — | | | | — |

| Total distributions | | | | (.211) | | (.356) | | (.461) | | (.500) | | (.467) | | | | (.612) |

| Net asset value, | | | | | | | | | | | | | | | | |

| end of period | | | | $ 10.09 | | $ 10.20 | | $ 10.13 | | $ 10.16 | | $ 10.30 | | | | $ 9.98 |

| Total ReturnB,C | | | | 1.00% | | 4.24% | | 4.30% | | 3.45% | | 8.08% | | | | 11.92% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | | | | | |

| reductions | | | | 45%A | | .58% | | .63% | | .65% | | .69% | | | | .61% |