| | UNITED STATES | | |

| | SECURITIES AND EXCHANGE COMMISSION |

| | Washington, D.C. 20549 | | |

| | | | |

| | FORM N-CSR | | |

| | | | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| | INVESTMENT COMPANIES | | |

| | | | |

| Investment Company Act file number 811-4237 | | |

| | | | |

| DREYFUS INSURED MUNICIPAL BOND FUND, INC. |

| | (Exact name of Registrant as specified in charter) |

| | | | |

| | c/o The Dreyfus Corporation | | |

| | 200 Park Avenue | | |

| | New York, New York 10166 | | |

| | (Address of principal executive offices) | | (Zip code) |

| | | | |

| | Mark N. Jacobs, Esq. | | |

| | 200 Park Avenue | | |

| | New York, New York 10166 | | |

| | (Name and address of agent for service) |

| | | | |

| Registrant's telephone number, including area code: | | (212) 922-6000 |

| | | | |

| Date of fiscal year end: | 4/30 | | |

| | | | |

| Date of reporting period: | 4/30/04 | | |

SSL-DOCS2 70128344v10

| | | FORM N-CSR |

| | | |

| Item 1. | Reports to Stockholders. | |

| Dreyfus |

| Insured Municipal |

| Bond Fund, Inc. |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

Contents

T H E F U N D

2

| Letter from the Chairman

|

3

| Discussion of Fund Performance

|

6

| Fund Performance

|

7

| Statement of Investments

|

13

| Statement of Assets and Liabilities

|

14

| Statement of Operations

|

15

| Statement of Changes in Net Assets

|

16

| Financial Highlights

|

17

| Notes to Financial Statements

|

23

| Report of Independent Registered Public Accounting Firm

|

24

| Important Tax Information

|

25

| Board Members Information

|

27

| Officers of the Fund

|

F O R M O R E I N F O R M AT I O N

|

Back Cover

|

| Dreyfus Insured Municipal |

| Bond Fund, Inc. |

The Fund

LETTER FROM THE CHAIRMAN

Dear Shareholder:

This annual report for Dreyfus Insured Municipal Bond Fund, Inc. covers the 12-month period from May 1, 2003, through April 30, 2004. Inside, you'll find valuable information about how the fund was managed during the reporting period, including a discussion with the fund's portfolio manager, Scott Sprauer.

Positive economic data continued to accumulate during the reporting period, as consumers, flush with extra cash from federal tax refunds and mortgage refinancings, continued to spend. At the same time, recent evidence of stronger job growth supports the view that corporations have become more willing to spend and invest. As a result, fixed-income investors have apparently grown concerned that long-dormant inflationary pressures could resurface.

Although our analysts and portfolio managers work hard to identify trends that may move the markets, no one can know with complete certainty what lies ahead for the U.S. economy and the bond market. As always, we encourage you to review your investments regularly with your financial advisor, who may be in the best position to suggest ways to position your portfolio for the opportunities and challenges of today's financial markets.

Thank you for your continued confidence and support.

Sincerely,

Stephen E. Canter

Chairman and Chief Executive Officer The Dreyfus Corporation

May 17, 2004

2

DISCUSSION OF FUND PERFORMANCE

Scott Sprauer, Portfolio Manager

How did Dreyfus Insured Municipal Bond Fund, Inc. perform relative to its benchmark?

For the 12-month period ended April 30, 2004, the fund achieved a total return of 0.51%.1 The Lehman Brothers Municipal Bond Index, the fund's benchmark, achieved a total return of 2.68% for the same period.2 In addition, the average total return for all funds reported in the Lipper Insured Municipal Debt Funds category was 1.05%.3

After rising during the opening months of the reporting period, municipal bond prices became more volatile during the summer of 2003, when signs of stronger economic growth began to emerge. Heightened market volatility generally continued through the end of the reporting period, with bond prices rising and falling along with investors' concerns regarding potentially higher interest rates. The fund's performance lagged that of its benchmark and Lipper category average, primarily because of its relatively long average duration during the summer of 2003.

What is the fund's investment approach?

The fund seeks as high a level of current income exempt from federal income tax as is consistent with the preservation of capital.To pursue this goal, the fund normally invests substantially all of its assets in investment-grade municipal bonds that provide income exempt from federal personal income tax. These bonds will be insured as to the timely payment of principal and interest by recognized insurers of municipal bonds, such as Ambac Assurance Corporation, Financial Guaranty Insurance Company, Financial Security Assurance, Inc. and MBIA Insurance Corporation.4 The dollar-weighted average maturity of the fund's portfolio normally exceeds 10 years, but the fund is not subject to any maturity restrictions.

We may buy and sell bonds based on credit quality, market outlook and yield potential. In selecting municipal bonds for investment, we

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

may assess the current interest-rate environment and a municipal bond's potential volatility in different rate environments.We focus on bonds with the potential to offer attractive current income, typically looking for bonds that can provide consistently attractive current yields or that are trading at competitive market prices.A portion of the fund's assets may be allocated to “discount” bonds, which are bonds that sell at a price below their face value, or to “premium” bonds, which are bonds that sell at a price above their face value.The fund's allocation either to discount bonds or to premium bonds will change along with our changing views of the current interest-rate and market environment.We may also look to select bonds that are most likely to obtain attractive prices when sold.

What other factors influenced the fund's performance?

Early in the reporting period, municipal bonds continued to benefit from a rally that began several years earlier as the U.S. economy weakened and the Federal Reserve Board (the “Fed”) reduced short-term interest rates.The most recent rate-cut occurred in late June 2003, when the Fed reduced the federal funds rate to its lowest level since 1958.

During the summer of 2003, however, new signs of economic recovery suggested that the June rate-cut might have been the Fed's last of the current cycle, and municipal bond prices fell sharply. Although bonds gradually recovered during the fall of 2003 and winter of 2003-04, the market remained volatile as many investors reacted to new releases of economic data. Finally, during late March and April 2004, stronger evidence of job growth and renewed inflation-related concerns caused municipal bond prices to fall.

While stronger economic growth contributed to heightened market volatility during the reporting period, it also helped to improve the fiscal condition of many states and municipalities. Some states recently have reported higher than expected collections of state income and sales taxes, while others have increased sales and so-called “sin taxes” to bridge their budget deficits. In our view, these developments have helped to support the general credit quality of municipal bond issuers, including those that issue insured securities.

4

In this environment, we gradually adopted a defensive investment posture, balancing the fund's holdings more evenly among insured bonds of various maturities.We also have attempted to identify, more precisely, areas of the bond market in which the fund may be over- or underrepresented compared to its benchmark. These strategies are designed to help us manage the impact of heightened market volatility on the fund. In addition, when purchasing new securities, we have generally focused on what we believe are high-coupon bonds selling at premiums to their face values. Such bonds historically have held more of their value during market declines.

What is the fund's current strategy?

We have continued to maintain our strategy in an attempt to manage risks in the stronger economic environment. Although we do not expect the Fed to raise interest rates imminently, we believe that it has begun to lay the groundwork for an eventual increase.Accordingly, we have positioned the fund in an attempt to weather further volatility while investors adjust to a stronger economy and potentially greater inflationary pressures.

May 17, 2004

1

| Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guarantee of future results. Share price, yield and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Income may be subject to state and local taxes, and some income may be subject to the federal alternative minimum tax (AMT) for certain investors. Capital gains, if any, are fully taxable. Return figures provided reflect the absorption of fund expenses by The Dreyfus Corporation pursuant to an undertaking in effect that may be extended, terminated or modified at any time. Had these expenses not been absorbed, the fund's return would have been lower.

|

2

| SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital gain distributions.The Lehman Brothers Municipal Bond Index is a widely accepted, unmanaged total return performance benchmark for the long-term, investment-grade, tax-exempt bond market. However, the bonds in the index generally are not insured. Index returns do not reflect the fees and expenses associated with operating a mutual fund.

|

3

| SOURCE: LIPPER INC. — Category average returns reflect the fees and expenses of the funds composing the average.

|

4

| Portfolio insurance extends to the repayment of principal and payment of interest in the event of default. It does not extend to the market value of the portfolio securities or the value of the fund's shares.

|

The Fund 5

FUND PERFORMANCE

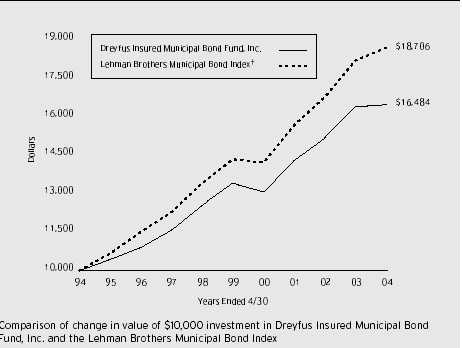

| Average Annual Total Returns as of 4/30/04 | | | | | | |

| | 1 Year | | 5 Years | | 10 Years | |

|

| |

| |

| |

| Fund | 0.51% | | 4.21% | | 5.13% | |

† Source: Lipper Inc.

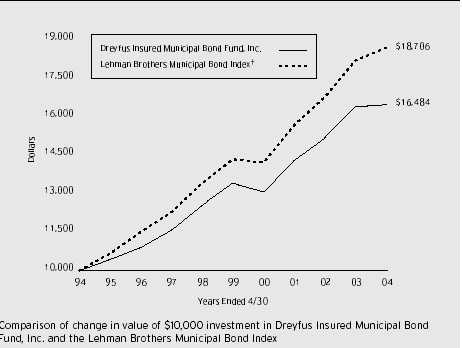

Past performance is not predictive of future performance.The fund's performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The above graph compares a $10,000 investment made in Dreyfus Insured Municipal Bond Fund, Inc. on 4/30/94 to a $10,000 investment made in the Lehman Brothers Municipal Bond Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested.

The fund invests primarily in municipal securities which are insured as to the timely payment of principal and interest by recognized issuers of municipal securities.The fund's performance shown in the line graph takes into account all applicable fees and expenses.The Index, unlike the fund, is an unmanaged total return performance benchmark for the long-term, investment-grade tax-exempt bond market, calculated by using municipal bonds selected to be representative of the municipal market overall; however, the bonds in the Index are generally not insured.The Index also does not take into account charges, fees and other expenses.All of these factors can contribute to the Index potentially outperforming or underperforming the fund. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report. Neither fund shares nor the market value of its portfolio securities are insured.

6

STATEMENT OF INVESTMENTS

April 30, 2004

| | Principal | | | |

| Long-Term Municipal Investments—96.7% | Amount ($) | | Value ($) | |

|

| |

| |

| Alabama—3.9% | | | | |

| Auburn University General Fee Revenue | | | | |

| 5.75%, 6/1/2017 (Insured; MBIA) | 1,000,000 | | 1,111,320 | |

| Jefferson County, Capital Improvement and Warrants | | | | |

| 5%, 4/1/2009 (Insured; MBIA) | 4,000,000 | | 4,356,600 | |

| Alaska—3.5% | | | | |

| Alaska International Airports System, Revenue | | | | |

| 5.75%, 10/1/2020 (Insured; AMBAC) | 4,500,000 | | 4,939,650 | |

| Arizona—1.6% | | | | |

| Phoenix Civic Improvement Corp., | | | | |

| Water System Revenue | | | | |

| 5.25%, 7/1/2015 (Insured; FGIC) | 2,000,000 | | 2,195,880 | |

| California—5.6% | | | | |

| California Department of Water Resources, | | | | |

| Power Supply Revenue | | | | |

| 5.50%, 5/1/2009 (Insured; MBIA) | 5,000,000 | | 5,568,800 | |

| San Diego Unified School District | | | | |

| Zero Coupon, 7/1/2015 (Insured; FGIC) | 3,690,000 | | 2,192,635 | |

| Connecticut—6.0% | | | | |

| Connecticut Special Tax Obligation, Revenue | | | | |

| (Transportation Infrastructure Purpose) | | | | |

| 5%, 1/1/2023 (Insured; FGIC) | 2,000,000 | | 2,048,400 | |

| South Central Connecticut Regional Water Authority, | | | | |

| Water System Revenue | | | | |

| 5%, 8/1/2033 (Insured; MBIA) | 2,500,000 | | 2,524,725 | |

| University of Connecticut | | | | |

| 5%, 1/15/2017 (Insured; MBIA) | 3,520,000 | | 3,735,178 | |

| Delaware—3.8% | | | | |

| Delaware Economic Development Authority, | | | | |

| Water Revenue (United Water Delaware | | | | |

| Inc. Project) 6.20%, 6/1/2025 | | | | |

| (Insured; AMBAC) | 5,000,000 | | 5,284,100 | |

| Florida—4.4% | | | | |

| Miami-Dade County, | | | | |

| Miami International Airport, | | | | |

| Aviation Revenue | | | | |

| (Hub of the Americas) | | | | |

| 5%, 10/1/2037 (Insured; FGIC) | 3,500,000 | | 3,455,060 | |

| Tampa Bay Water, Utility System | | | | |

| Improvement Revenue | | | | |

| 5.25%, 10/1/2019 (Insured; FGIC) | 2,575,000 | | 2,723,706 | |

The Fund 7

STATEMENT OF INVESTMENTS (continued)

| | Principal | | | |

| Long-Term Municipal Investments (continued) | Amount ($) | Value ($) | |

|

|

| |

| Idaho—1.5% | | | | |

| Boise State University, Revenue | | | | |

| 5.375%, 4/1/2022 (Insured; FGIC) | 2,000,000 | | 2,122,540 | |

| Illinois—1.8% | | | | |

| Chicago O'Hare International Airport, Revenue | | | | |

| (General Airport Third Lien) | | | | |

| 5.25%, 1/1/2027 (Insured; MBIA) | 2,500,000 | | 2,519,625 | |

| Indiana—2.6% | | | | |

| Indiana Educational Facilities Authority, | | | | |

| Educational Facilities Revenue | | | | |

| (Butler University Project) | | | | |

| 5.50%, 2/1/2026 (Insured; MBIA) | 3,500,000 | | 3,644,305 | |

| Massachusetts—.7% | | | | |

| Massachusetts Housing Finance Agency, | | | | |

| Housing Revenue (Rental-Mortgage) | | | | |

| 6.50%, 7/1/2025 (Insured; AMBAC) | 905,000 | | 932,847 | |

| Michigan—.9% | | | | |

| Michigan Housing Development Authority, LOR | | | | |

| (Greenwood Villa Project) | | | | |

| 6.50%, 9/15/2007 (Insured; FSA) | 1,235,000 | | 1,261,441 | |

| Minnesota—2.3% | | | | |

| Southern Minnesota Municipal Power Agency, | | | | |

| Power Supply System Revenue | | | | |

| 5%, 1/1/2012 (Insured; MBIA) | 3,000,000 | | 3,248,820 | |

| Missouri—5.8% | | | | |

| The City of Saint Louis, Airport Revenue | | | | |

| (Airport Development Program): | | | | |

| 5%, 7/1/2011 (Insured; MBIA) | 5,000,000 | | 5,378,100 | |

| 5.625%, 7/1/2019 (Insured; MBIA) | 2,500,000 | | 2,717,775 | |

| New Jersey—6.4% | | | | |

| New Jersey Economic Development Authority, PCR | | | | |

| (Public Service Electric and Gas Co.) | | | | |

| 6.40%, 5/1/2032 (Insured; MBIA) | 7,600,000 | | 7,777,612 | |

| New Jersey Health Care Facilities Financing Authority, | | | | |

| Revenue (Jersey Shore Medical Center): | | | | |

| 6.25%, 7/1/2021 (Insured; AMBAC) | 70,000 | | 71,903 | |

| 6.25%, 7/1/2021 (Insured; AMBAC) | | | | |

| (Prerefunded 7/1/2004) | 30,000 | a | 30,855 | |

| New Jersey Housing and Mortgage Finance Agency, | | | | |

| Revenue Home Buyer | | | | |

| 6.20%, 10/1/2025 (Insured; MBIA) | 965,000 | | 983,740 | |

8

| | Principal | | | |

| Long-Term Municipal Investments (continued) | Amount ($) | Value ($) | |

|

|

| |

| New York—7.0% | | | | |

| Metropolitan Transportation Authority: | | | | |

| (State Service Contract) 5.50%, 1/1/2020 | | | | |

| (Insured; MBIA) | 2,000,000 | | 2,151,040 | |

| Transportation Revenue 5.50%, 11/15/2019 | | | | |

| (Insured; AMBAC) | 5,000,000 | | 5,422,050 | |

| New York City Municipal Water | | | | |

| Finance Authority, Water and | | | | |

| Sewer System Revenue | | | | |

| 5%, 6/15/2014 (Insured; FSA) | 2,000,000 | | 2,148,700 | |

| North Carolina—2.6% | | | | |

| Gaston County 4%, 5/1/2008 (Insured; FSA) | 1,500,000 | | 1,575,720 | |

| Lincoln County 4%, 6/1/2007 (Insured; MBIA) | 1,910,000 | b | 2,003,552 | |

| North Dakota—2.5% | | | | |

| Mercer County, PCR | | | | |

| (Montana-Dakota Utilities Co. Project) | | | | |

| 6.65%, 6/1/2022 (Insured; FGIC) | 3,500,000 | | 3,514,385 | |

| Ohio—1.6% | | | | |

| Ohio Turnpike Commission, Turnpike Revenue | | | | |

| 5.50%, 2/15/2017 (Insured; FGIC) | 1,995,000 | | 2,231,647 | |

| Rhode Island—3.1% | | | | |

| Rhode Island Housing and Mortgage Finance Corp., | | | | |

| SFMR 9.30%, 7/1/2004 (Insured; FGIC) | 5,000 | | 5,027 | |

| Rhode Island Port Authority and Economic | | | | |

| Development Corp., Airport Revenue | | | | |

| 6.625%, 7/1/2024 (Insured; FSA) | | | | |

| (Prerefunded 7/1/2004) | 4,250,000 | a | 4,370,487 | |

| South Carolina—5.5% | | | | |

| South Carolina Public Service | | | | |

| Authority, Revenue (Santee Cooper) | | | | |

| 5%, 1/1/2009 (Insured; FSA) | 3,215,000 | | 3,498,209 | |

| South Carolina Transportation | | | | |

| Infrastructure Bank, Revenue | | | | |

| 5%, 10/1/2024 (Insured; AMBAC) | 2,500,000 | | 2,527,050 | |

| University of South Carolina, Athletic Facilities | | | | |

| Revenue 5.50%, 5/1/2022 (Insured; AMBAC) | 1,575,000 | | 1,675,737 | |

| Texas—6.5% | | | | |

| Brownsville Housing Finance Corp., SFMR | | | | |

| (Mortgage-Multiple Originators and | | | | |

| Services) 9.625%, 12/1/2011 | | | | |

| (Insured; FGIC) | 140,000 | | 140,090 | |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| | Principal | | | |

| Long-Term Municipal Investments (continued) | Amount ($) | | Value ($) | |

|

| |

| |

| Texas (continued) | | | | |

| City of San Antonio, Water System Revenue: | | | | |

| 5.50%, 5/15/2019 (Insured; FSA) | 1,000,000 | | 1,080,200 | |

| 5.50%, 5/15/2020 (Insured; FSA) | 2,500,000 | | 2,686,100 | |

| Houston Area Water Corp., City of Houston | | | | |

| Contract Revenue (Northeast Water Purification | | | | |

| Plant Project) | | | | |

| 5.25%, 3/1/2023 (Insured; FGIC) | 2,470,000 | | 2,545,780 | |

| Texas Turnpike Authority (Central Texas | | | | |

| Turnpike System) Revenue | | | | |

| 5.50%, 8/15/2039 (Insured; AMBAC) | 2,500,000 | | 2,603,075 | |

| Virginia—7.1% | | | | |

| Chesapeake, Water and Sewer | | | | |

| 5%, 6/1/2028 (Insured; FGIC) | 4,290,000 | | 4,335,731 | |

| Upper Occoquan Sewer Authority, Regional | | | | |

| Sewer Revenue | | | | |

| 5.15%, 7/1/2020 (Insured; MBIA) | 5,210,000 | | 5,586,423 | |

| Washington—4.8% | | | | |

| Washington, MFMR: | | | | |

| (Gilman Meadows Project) | | | | |

| 7.40%, 1/1/2030 (Insured; FSA) | 3,000,000 | | 3,097,710 | |

| (Mallard Cove Project 1) | | | | |

| 7.40%, 1/1/2030 (Insured; FSA) | 770,000 | | 795,079 | |

| (Mallard Cove Project 2) | | | | |

| 7.40%, 1/1/2030 (Insured; FSA) | 2,670,000 | | 2,756,962 | |

| West Virginia—5.2% | | | | |

| West Virginia: | | | | |

| 6.50%, 11/1/2026 (Insured; FGIC) | 2,600,000 | | 2,993,978 | |

| Zero Coupon, 11/1/2026 (Insured; FGIC) | 5,450,000 | | 1,569,219 | |

| West Virginia Building Commission, LR | | | | |

| (West Virginia Regional Jail) | | | | |

| 5.375%, 7/1/2021 (Insured; AMBAC) | 2,505,000 | | 2,713,366 | |

| Total Long-Term Municipal Investments | | | | |

| (cost $132,273,326) | | | 134,852,934 | |

10

| | | | Principal | | | |

| Short-Term Municipal Investments—1.4% | Amount ($) | Value ($) | |

|

|

| |

| Massachusetts—.7% | | | | | |

| Massachusetts Health and Educational Facilities Authority, | | | | |

| Revenue, VRDN (Capital Asset Program) | | | | |

| 1.08% (Insured; MBIA) | | 1,000,000 | c | 1,000,000 | |

| Texas—.7% | | | | | |

| Tarrant County Health Facilities Development Corp., | | | | |

| Revenue, VRDN (Cumberland Restaurant Project) | | | | |

| 1.12% (Insured; AGIC) | | 1,000,000 | c | 1,000,000 | |

| Total Short-Term Municipal Investments | | | | |

| (cost $ | 2,000,000) | | | | 2,000,000 | |

|

|

|

|

|

| |

| | | | | | | |

| Total Investments (cost $ | 134,273,326) | 98.1% | | 136,852,934 | |

| Cash and Receivables (Net) | 1.9% | | 2,699,409 | |

| Net Assets | | 100.0% | | 139,552,343 | |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

| Summary of Abbreviations | | |

| AGIC | Asset Guaranty Insurance | LR | Lease Revenue |

| | Company | MBIA | Municipal Bond Investors |

| AMBAC | American Municipal Bond | | Assurance Insurance |

| | Assurance Corporation | | Corporation |

| FGIC | Financial Guaranty Insurance | MFMR | Multi-Family Mortgage Revenue |

| | Company | PCR | Pollution Control Revenue |

| FSA | Financial Security Assurance | SFMR | Single Family Mortgage Revenue |

| LOR | Limited Obligation Revenue | VRDN | Variable Rate Demand Notes |

| Summary of Combined Ratings (Unaudited) | | |

| | | | | | | |

| Fitch | or | Moody's | or | Standard & Poor's | Value (%) | |

|

|

|

|

|

| |

| AAA | | Aaa | | AAA | 98.5 | |

| F1 | | MIG1/P1 | | SP1/A1 | 1.5 | |

| | | | | | 100.0 | |

a Bonds which are prerefunded are collateralized by U.S. Government securities which are held in escrow and are used to pay principal and interest on the municipal issue and to retire the bonds in full at the earliest refunding date.

|

b

| Purchased on delayed delivery basis.

|

c

| Securities payable on demand.Variable interest rate—subject to periodic change.

|

d

| At April 30, 2004, 38.9% of the fund's net assets are insured by MBIA. See notes to financial statements.

|

12

| STATEMENT OF ASSETS AND LIABILITIES |

| April 30, 2004 |

| | | Cost | Value | |

|

|

|

| |

| Assets ($): | | | | |

| Investments in securities—See Statement of Investments | 134,273,326 | 136,852,934 | |

| Cash | | | 137,823 | |

| Receivable for investment securities sold | | 2,546,436 | |

| Interest receivable | | 2,186,718 | |

| Prepaid expenses | | 20,718 | |

| | | | 141,744,629 | |

|

|

|

| |

| Liabilities ($): | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(a) | | 86,485 | |

| Payable for investment securities purchased | | 2,021,871 | |

| Payable for shares of Common Stock redeemed | | 36,036 | |

| Accrued expenses | | 47,894 | |

| | | | 2,192,286 | |

|

|

|

| |

| Net Assets ( | $) | | 139,552,343 | |

|

|

|

| |

| Composition of Net Assets ($): | | | |

| Paid-in capital | | | 135,366,991 | |

| Accumulated net realized gain (loss) on investments | | 1,605,744 | |

| Accumulated net unrealized appreciation | | | |

| (depreciation) on investments | | 2,579,608 | |

|

|

| |

| Net Assets ( | $) | | 139,552,343 | |

|

|

|

| |

| Shares Outstanding | | | |

| (300 million shares of $.001 par value Common Stock authorized) | | 7,894,305 | |

| Net Asset Value, offering and redemption price per share—Note 3(d) ($) | 17.68 | |

See notes to financial statements.

The Fund 13

| STATEMENT OF OPERATIONS |

| Year Ended April 30, 2004 |

| Investment Income ($): | | |

| lnterest Income | 7,236,220 | |

| Expenses: | | |

| Management fee—Note 3(a) | 889,179 | |

| Service plan and prospectus fees—Note 3(b) | 299,505 | |

| Shareholder servicing costs—Note 3(b) | 88,991 | |

| Professional fees | 33,092 | |

| Registration fees | 31,156 | |

| Custodian fees | 19,584 | |

| Directors' fees and expenses—Note 3(c) | 13,785 | |

| Shareholders' reports | 9,860 | |

| Loan commitment fees—Note 2 | 1,470 | |

| Miscellaneous | 12,873 | |

| Total Expenses | 1,399,495 | |

| Less—reduction in management fee due to | | |

| undertaking—Note 3(a) | (140,481) | |

| Net Expenses | 1,259,014 | |

| Investment Income—Net | 5,977,206 | |

|

| |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

| Net realized gain (loss) on investments | 1,603,801 | |

| Net unrealized appreciation (depreciation) on investments | (6,755,144) | |

| Net Realized and Unrealized Gain (Loss) on Investments | (5,151,343) | |

| Net Increase in Net Assets Resulting from Operations | 825,863 | |

See notes to financial statements.

14

STATEMENT OF CHANGES IN NET ASSETS

| | | | Year Ended April 30, | |

| | | |

| |

| | 2004 | | 2003 | |

|

| |

| |

| Operations ($): | | | | |

| Investment income—net | 5,977,206 | | 6,837,815 | |

| Net realized gain (loss) on investments | 1,603,801 | | 749,867 | |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | (6,755,144) | | 4,577,298 | |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | 825,863 | | 12,164,980 | |

|

| |

| |

| Dividends to Shareholders from ($): | | | | |

| Investment income—net | (5,936,744) | | (6,804,530) | |

| Net realized gain on investments | (310,028) | | (784,314) | |

| Total Dividends | (6,246,772) | | (7,588,844) | |

|

| |

| |

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold | 51,300,966 | | 50,140,657 | |

| Dividends reinvested | 4,300,749 | | 5,342,922 | |

| Cost of shares redeemed | (67,878,910) | | (54,624,843) | |

| Increase (Decrease) in Net Assets | | | | |

| from Capital Stock Transactions | (12,277,195) | | 858,736 | |

| Total Increase (Decrease) in Net Assets | (17,698,104) | | 5,434,872 | |

|

| |

| |

| Net Assets ($): | | | | |

| Beginning of Period | 157,250,447 | | 151,815,575 | |

| End of Period | 139,552,343 | | 157,250,447 | |

|

| |

| |

| Capital Share Transactions (Shares): | | | | |

| Shares sold | 2,826,877 | | 2,761,014 | |

| Shares issued for dividends reinvested | 237,422 | | 293,891 | |

| Shares redeemed | (3,738,008) | | (2,997,216) | |

| Net Increase (Decrease) in Shares Outstanding | (673,709) | | 57,689 | |

See notes to financial statements.

The Fund 15

FINANCIAL HIGHLIGHTS

The following table describes the performance for the fiscal periods indicated.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and dis-tributions.These figures have been derived from the fund's financial statements.

| | | | Year Ended April 30, | | | |

| | | |

| | | |

| | 2004 | | 2003 | | 2002a | | 2001 | | 2000 | |

|

| |

| |

| |

| |

| |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 18.35 | | 17.84 | | 17.64 | | 16.93 | | 18.24 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—net | .73b | | .80b | | .81b | | .86 | | .86 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | (.63) | | .59 | | .25 | | .71 | | (1.32) | |

| Total from Investment Operations | .10 | | 1.39 | | 1.06 | | 1.57 | | (.46) | |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.73) | | (.79) | | (.80) | | (.86) | | (.85) | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | (.04) | | (.09) | | (.06) | | — | | — | |

| Total Distributions | (.77) | | (.88) | | (.86) | | (.86) | | (.85) | |

| Net asset value, end of period | 17.68 | | 18.35 | | 17.84 | | 17.64 | | 16.93 | |

|

| |

| |

| |

| |

| |

| Total Return (%) | .51 | | 7.98 | | 6.08 | | 9.45 | | (2.45) | |

|

| |

| |

| |

| |

| |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of expenses to average net assets | .85 | | .85 | | .85 | | .85 | | .85 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 4.03 | | 4.39 | | 4.50 | | 4.91 | | 4.99 | |

| Decrease reflected in above expense | | | | | | | | | | |

| ratios due to undertakings by | | | | | | | | | | |

| The Dreyfus Corporation | .09 | | .10 | | .10 | | .10 | | .11 | |

| Portfolio Turnover Rate | 74.22 | | 45.87 | | 58.16 | | 6.97 | | 12.36 | |

|

| |

| |

| |

| |

| |

| Net Assets, end of period ($ x 1,000) | 139,552 | | 157,250 | | 151,816 | | 154,332 | | 156,432 | |

a As required, effective May 1, 2001, the fund has adopted the provisions of the AICPA Audit and Accounting Guide for Investment Companies and began amortizing discount or permium on a scientific basis for debt securities on a daily basis.The effect of this change for the period ended April 30, 2002 was to increase net investment income per share by $.01, decrease net realized and unrealized gain (loss) on investments per share by $.01 and increase the ratio of net investment income to average net assets from 4.46% to 4.50%. Per share data and ratios/supplemental data for periods prior to May 1, 2001, have not been restated to reflect this change in presentation. b Based on average shares outstanding at each month end.

See notes to financial statements.

16

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Insured Municipal Bond Fund, Inc. (the “fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as a diversified open-end management investment company.The fund's investment objective is to provide investors with as high a level of current income exempt from federal income tax as is consistent with the preservation of capital. The Dreyfus Corporation (the “Manager” or “Dreyfus”) serves as the fund's investment adviser. The Manager is a wholly-owned subsidiary of Mellon Financial Corporation (“Mellon Financial”). Dreyfus Service Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund's shares, which are sold to the public without a sales charge.

The fund's financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund's maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued each business day by an independent pricing service (the “Service”) approved by the Board of Directors. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are carried at fair value as determined by the Service, based on methods which include consideration of: yields or prices of municipal securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions.

The Fund 17

NOTES TO FINANCIAL STATEMENTS (continued)

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the identified cost basis. Interest income, adjusted for amortization of discount and premium on investments, is earned from settlement date and recognized on the accrual basis. Securities purchased or sold on a when-issued or delayed-delivery basis may be settled a month or more after the trade date. Under the terms of the custody agreement, the fund receives net earnings credits, based on available cash balances left on deposit and includes such credits in interest income.

(c) Dividends to shareholders: It is the policy of the fund to declare dividends daily from investment income-net. Such dividends are paid monthly. Dividends from net realized capital gain, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gain can be offset by capital loss carryovers, if any, it is the policy of the fund not to distribute such gain. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(d) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, which can distribute tax exempt dividends, by complying with the applicable provisions of the Code, and to make distributions of income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

At April 30,2004,the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $ 383,455, undistributed capital gains $1,222,288 and unrealized appreciation $2,684,129.

18

The tax character of distributions paid to shareholders during the fiscal periods ended April 30, 2004 and April 30, 2003, were as follows: tax exempt income $5,936,744 and $6,804,530, ordinary income $265,849 and $238,902 and long-term capital gains $44,179 and $545,412, respectively.

During the period ended April 30, 2004, as a result of permanent book to tax differences primarily due to amortization adjustments, the fund decreased accumulated undistributed investment income-net by $40,462, increased accumulated net realized gain (loss) on investments by $15,095 and increased paid-in capital by $25,367. Net assets were not affected by this reclassification.

NOTE 2—Bank Line of Credit:

The fund participates with other Dreyfus-managed funds in a $350 million redemption credit facility (the “Facility”) to be utilized for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay commitment fees on its pro rata portion of the Facility. Interest is charged to the fund based on prevailing market rates in effect at the time of borrowings. During the period ended April 30, 2004, the fund did not borrow under the Facility.

NOTE 3—Management Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement (“Agreement”) with the Manager, the management fee is computed at the annual rate of .60 of 1% of the value of the fund's average daily net assets and is payable monthly.The Agreement provides that if in any full year the aggregate expenses of the fund, exclusive of taxes, brokerage fees, commitment fees, interest on borrowings and extraordinary expenses, exceed 1 1 / 2% of the value of the fund's average net assets, the fund may deduct from

The Fund 19

NOTES TO FINANCIAL STATEMENTS (continued)

the payments to be made to the Manager, or the Manager will bear such excess. The Manager had undertaken from May 1, 2003 through April 19, 2004 to reduce the management fee paid by the fund, to the extent that if the fund's aggregate annual expenses (exclusive of certain expenses as described above) exceed an annual rate of .85 of 1% of the value of the fund's average daily net assets.The Manager has currently undertaken from May 1, 2004 through November 30, 2004 to reduce the management fee paid by the fund, to the extent that if the fund's aggregate annual expenses (exclusive of certain expenses as described above) exceed an annual rate of .80 of 1% of the value of the fund's average daily net assets.The reduction in management fee, pursuant to the undertaking, amounted to $140,481 during the period ended April 30, 2004.

The components of Due to The Dreyfus Corporation and affiliates in the Statement of Assets and Liabilities consists of: management fees $69,586, Rule 12b-1 distribution plan fees $23,195 and transfer agency per account fees $9,400, which are offset against an expense reimbursement currently in effect in the amount of $15,696.

(b) Under the Service Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, the fund pays the Distributor in respect of payments made to certain Service Agents (a securities dealer, financial institution or other industry professional) for distributing the fund's shares, servicing shareholder and for advertising and marketing relating to the fund.The Plan provides for payments to be made at an aggregate annual rate of .20 of 1% of the value of the fund's average daily net assets.The Distributor may pay one or more Service Agents a fee in respect of fund shares owned by shareholders with whom the Service Agent is the dealer or holder of record.The Distributor determines the amounts, if any, to be paid to Service Agents under the Plan and the basis on which such payments are made. The fees payable under the Plan are payable without regard to actual expenses incurred.

20

The Plan also separately provides for the fund to bear the costs of preparing, printing and distributing certain of the fund's prospectuses and statements of additional information and costs associated with implementing and operating the Plan, not to exceed the greater of $100,000 or .005 of 1% of the value of the fund's average daily net assets for any full fiscal year. During the period ended April 30, 2004, the fund was charged $299,505 pursuant to the Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended April 30, 2004, the fund was charged $58,138 pursuant to the transfer agency agreement.

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

(d) A .10% redemption fee is charged and retained by the fund on shares redeemed within thirty days following the date of issuance, including redemptions made through the use of fund's exchange privilege. During the period ended April 30, 2004, redemption fees charged and retained by the fund amounted to $1,964.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities,during the period ended April 30,2004, amounted to $108,584,714 and $117,805,605, respectively.

At April 30, 2004, the cost of investments for federal income tax purposes was $134,168,805; accordingly, accumulated net unrealized appreciation on investments was $2,684,129, consisting of $3,677,531 gross unrealized appreciation and $993,402 gross unrealized depreciation.

The Fund 21

NOTES TO FINANCIAL STATEMENTS (continued)

NOTE 5—Legal Matters:

Two class actions have been filed against Mellon Financial and Mellon Bank, N.A., and Dreyfus and Founders Asset Management LLC (the “Investment Advisers”), and the directors of all or substantially all of the Dreyfus funds, alleging that the Investment Advisers improperly used assets of the Dreyfus funds, in the form of directed brokerage commissions and 12b-1 fees, to pay brokers to promote sales of Dreyfus funds, and that the use of fund assets to make these payments was not properly disclosed to investors.The complaints further allege that the directors breached their fiduciary duties to fund shareholders under the Investment Company Act of 1940 and at common law.The complaints seek unspecified compensatory and punitive damages, rescission of the funds' contracts with the Investment Advisers, an accounting of all fees paid, and an award of attorneys' fees and litigation expenses. Dreyfus and the Dreyfus funds believe the allegations to be totally without merit and will defend the actions vigorously.

Additional lawsuits arising out of these circumstances and presenting similar allegations and requests for relief may be filed against the defendants in the future. Neither Dreyfus nor the Dreyfus funds believe that any of the pending actions will have a material adverse effect on the Dreyfus funds or Dreyfus' ability to perform its contracts with the Dreyfus funds.

22

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

Shareholders and Board of Directors Dreyfus Insured Municipal Bond Fund, Inc.

We have audited the accompanying statement of assets and liabilities of Dreyfus Insured Municipal Bond Fund, Inc., including the statement of investments, as of April 30, 2004, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the years indicated therein. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights. Our procedures included confirmation of securities owned as of April 30, 2004 by correspondence with the custodian and others. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Insured Municipal Bond Fund, Inc. at April 30, 2004, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated years, in conformity with U.S. generally accepted accounting principles.

| New York, New York |

| June 7, 2004 |

The Fund 23

IMPORTANT TAX INFORMATION (Unaudited)

In accordance with federal tax law, the fund hereby makes the following designations regarding its fiscal year ended April 30, 2004:

- all the dividends paid from investment income-net are “exempt-interest dividends” (not generally subject to regular federal income tax), and

- the fund hereby designates $.0055 per share as a long-term capital gain distribution of the $.0386 per share paid on December 5, 2003.

As required by federal tax law rules, shareholders will receive notification of their portion of the fund's taxable ordinary dividends (if any) and capital gain distributions (if any) paid for the 2004 calendar year on Form 1099-DIV which will be mailed by January 31, 2005.

24

BOARD MEMBERS INFORMATION (Unaudited)

| Joseph S. DiMartino (60) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • The Muscular Dystrophy Association, Director |

| • Levcor International, Inc., an apparel fabric processor, Director |

| • Century Business Services, Inc., a provider of outsourcing functions for small and medium size |

| companies, Director |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director |

| No. of Portfolios for which Board Member Serves: 186 |

| ——————— |

| David W. Burke (68) |

| Board Member (1985) |

| Principal Occupation During Past 5 Years: |

| • Corporate Director and Trustee. |

| Other Board Memberships and Affiliations: |

| • John F. Kennedy Library Foundation, Director |

| • U.S.S. Constitution Museum, Director |

| No. of Portfolios for which Board Member Serves: 83 |

| ——————— |

| William Hodding Carter III (69) |

| Board Member (1988) |

| Principal Occupation During Past 5 Years: |

| • President and Chief Executive Officer of the John S. and James L. Knight Foundation |

| (1998-present) |

| Other Board Memberships and Affiliations: |

| • Independent Sector, Director |

| • The Century Foundation, Director |

| • The Enterprise Corporation of the Delta, Director |

| • Foundation of the Mid-South, Director |

| No. of Portfolios for which Board Member Serves: 11 |

| ——————— |

| Ehud Houminer (63) |

| Board Member (1994) |

| Principal Occupation During Past 5 Years: |

| • Executive-in-Residence at the Columbia Business School, Columbia University |

| • Principal of Lear,Yavitz and Associates, a management consulting firm (1996 to 2001) |

| Other Board Memberships and Affiliations: |

| • Avnet Inc., an electronics distributor, Director |

| • International Advisory Board to the MBA Program School of Management, Ben Gurion |

| University, Chairman |

| • Explore Charter School, Brooklyn, NY, Chairman |

No. of Portfolios for which Board Member Serves: 30

The Fund 25

BOARD MEMBERS INFORMATION (continued)

| Richard C. Leone (64) | |

| Board Member (1985) | |

| Principal Occupation During Past 5 Years: | |

| • President of The Century Foundation (formerly,The Twentieth Century Fund, Inc.), |

| a tax exempt research foundation engaged in the study of economic, foreign policy and |

| domestic issues | |

| No. of Portfolios for which Board Member Serves: 11 | |

| ——————— | |

| Hans C. Mautner (66) | |

| Board Member (1985) | |

| Principal Occupation During Past 5 Years: | |

| • President—International Division and an Advisory Director of Simon Property Group, |

| a real estate investment company (1998-present) | |

| • Director and Vice Chairman of Simon Property Group (1998-2003) |

| • Chairman and Chief Executive Officer of Simon Global Limited (1999-present) |

| Other Board Memberships and Affiliations: | |

| • Capital and Regional PLC, a British co-investing real estate asset manager, Director |

| No. of Portfolios for which Board Member Serves: 11 | |

| ——————— | |

| Robin A. Pringle (40) | |

| Board Member (1995) | |

| Principal Occupation During Past 5 Years: | |

| • Senior Vice President of Mentor/National Mentoring Partnership, a national non-profit |

| organization that is leading the movement to connect | America's young people with caring adult mentors |

| No. of Portfolios for which Board Member Serves: 11 | |

| ——————— | |

| John E. Zuccotti (66) | |

| Board Member (1985) | |

| Principal Occupation During Past 5 Years: | |

| • Chairman of Brookfield Financial Properties, Inc. | |

| No. of Portfolios for which Board Member Serves: 11 | |

| ——————— | |

Once elected all Board Members serve for an indefinite term.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166.Additional information about the Board Members is available in the fund's Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611.

26

OFFICERS OF THE FUND (Unaudited)

STEPHEN E. CANTER, President since March 2000.

Chairman of the Board, Chief Executive Officer and Chief Operating Officer of the Manager, and an officer of 97 investment companies (comprised of 190 portfolios) managed by the Manager. Mr. Canter also is a Board member and, where applicable, an Executive Committee Member of the other investment management subsidiaries of Mellon Financial Corporation, each of which is an affiliate of the Manager. He is 58 years old and has been an employee of the Manager since May 1995.

STEPHEN R. BYERS, Executive Vice President since November 2002.

Chief Investment Officer,Vice Chairman and a Director of the Manager, and an officer of 97 investment companies (comprised of 190 portfolios) managed by the Manager. Mr. Byers also is an officer, director or an Executive Committee Member of certain other investment management subsidiaries of Mellon Financial Corporation, each of which is an affiliate of the Manager. He is 50 years old and has been an employee of the Manager since January 2000. Prior to joining the Manager, he served as an Executive Vice President-Capital Markets, Chief Financial Officer and Treasurer at Gruntal & Co., L.L.C.

MARK N. JACOBS, Vice President since March 2000.

Executive Vice President, Secretary and General Counsel of the Manager, and an officer of 98 investment companies (comprised of 206 portfolios) managed by the Manager. He is 58 years old and has been an employee of the Manager since June 1977.

JOHN B. HAMMALIAN, Secretary since March 2000.

Associate General Counsel of the Manager, and an officer of 37 investment companies (comprised of 46 portfolios) managed by the Manager. He is 40 years old and has been an employee of the Manager since February 1991.

STEVEN F. NEWMAN, Assistant Secretary since March 2000.

Associate General Counsel and Assistant Secretary of the Manager, and an officer of 98 investment companies (comprised of 206 portfolios) managed by the Manager. He is 54 years old and has been an employee of the Manager since July 1980.

MICHAEL A. ROSENBERG, Assistant Secretary since March 2000.

Associate General Counsel of the Manager, and an officer of 95 investment companies (comprised of 199 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since October 1991.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 98 investment companies (comprised of 206 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since April 1985.

The Fund 27

OFFICERS OF THE FUND (continued)

GREGORY S. GRUBER, Assistant Treasurer since March 2000.

Senior Accounting Manager – Municipal Bond Funds of the Manager, and an officer of 30 investment companies (comprised of 59 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since August 1981.

KENNETH J. SANDGREN, Assistant Treasurer since November 2001.

Mutual Funds Tax Director of the Manager, and an officer of 98 investment companies (comprised of 206 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since June 1993.

28

WILLIAM GERMENIS, Anti-Money Laundering Compliance Officer since September 2002.

Vice President and Anti-Money Laundering Compliance Officer of the Distributor, and the Anti-Money Laundering Compliance Officer of 93 investment companies (comprised of 201 portfolios) managed by the Manager. He is 33 years old and has been an employee of the Distributor since October 1998.

For More Information

| Dreyfus |

| Insured Municipal |

| Bond Fund, Inc. |

| 200 Park Avenue |

| New York, NY 10166 |

| |

| Manager |

| The Dreyfus Corporation |

| 200 Park Avenue |

| New York, NY 10166 |

| |

| Custodian |

|

| The Bank of New York |

| One Wall Street |

| New York, NY 10286 |

| |

| Transfer Agent & |

| Dividend Disbursing Agent |

| Dreyfus Transfer, Inc. |

| 200 Park Avenue |

| New York, NY 10166 |

| |

| Distributor |

| Dreyfus Service Corporation |

| 200 Park Avenue |

| New York, NY 10166 |

To obtain information:

By telephone

Call 1-800-645-6561

By mail Write to:

The Dreyfus Family of Funds 144 Glenn Curtiss Boulevard Uniondale, NY 11556-0144

By E-mail Send your request to info@dreyfus.com

On the Internet Information can be viewed online or downloaded from: http://www.dreyfus.com

© 2004 Dreyfus Service Corporation 0306AR0404

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

Item 3. Audit Committee Financial Expert.

The Registrant's Board has determined that Richard C. Leone, a member of the Audit Committee of the Board, is an audit committee financial expert as defined by the Securities and Exchange Commission (the "SEC"). Mr. Leone is "independent" as defined by the SEC for purposes of audit committee financial expert determinations.

Item 4. Principal Accountant Fees and Services

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years (the "Reporting Periods") for professional services rendered by the Registrant's principal accountant (the "Auditor") for the audit of the Registrant's annual financial statements, or services that are normally provided by the Auditor in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $25,900 in 2003 and $27,195 in 2004.

(b) Audit-Related Fees. The aggregate fees billed in the Reporting Periods for assurance and related services by the Auditor that are reasonably related to the performance of the audit of the Registrant's financial statements and are not reported under paragraph (a) of this Item 4 were $-0- in 2003 and $-0- in 2004.

The aggregate fees billed in the Reporting Periods for non-audit assurance and related services by the Auditor to the Registrant's investment adviser (not including any sub-investment adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the Registrant ("Service Affiliates"), that were reasonably related to the performance of the annual audit of the Service Affiliate, which required pre-approval by the Audit Committee were $30,000 in 2003 and $273,500 in 2004.

Note: For the second paragraph in each of (b) through (d) of this Item 4, certain of such services were not pre-approved prior to May 6, 2003, when such services were required to be pre-approved. On and after May 6, 2003, 100% of all services provided by the Auditor were pre-approved as required. For comparative purposes, the fees shown assume that all such services were pre-approved, including services that were not pre-approved prior to the compliance date of the pre-approval requirement.

(c) Tax Fees. The aggregate fees billed in the Reporting Periods for professional services rendered by the Auditor for tax compliance, tax advice and tax planning ("Tax Services") were $1,998 in 2003 and $2,781 in 2004. These services consisted of (i) review or preparation of U.S. federal, state, local and excise tax returns; (ii) U.S. federal, state and local tax planning, advice and assistance regarding statutory, regulatory or administrative developments, (iii) tax advice regarding tax qualification matters and/or treatment of various

-2-

SSL-DOCS2 70128344v10

financial instruments held or proposed to be acquired or held, and (iv) determination of Passive Foreign Investment Companies.

The aggregate fees billed in the Reporting Periods for Tax Services by the Auditor to Service Affiliates which required pre-approval by the Audit Committee were $-0- in 2003 and $-0- in 2004.

(d) All Other Fees. The aggregate fees billed in the Reporting Periods for products and services provided by the Auditor, other than the services reported in paragraphs (a) through (c) of this Item, were $-0- in 2003 and $135 in 2004. These services consisted of a review of the Registrant's anti-money laundering program.

The aggregate fees billed in the Reporting Periods for Non-Audit Services by the Auditor to Service

Affiliates, other than the services reported in paragraphs (b) and (c) of this Item, which required pre-approval by the Audit Committee were $-0- in 2003 and $-0- in 2004.

Audit Committee Pre-Approval Policies and Procedures. The Registrant's Audit Committee has established policies and procedures (the "Policy") for pre-approval (within specified fee limits) of the Auditor's engagements for non-audit services to the Registrant and Service Affiliates without specific case-by-case consideration. Pre-approval considerations include whether the proposed services are compatible with maintaining the Auditor's independence. Pre-approvals pursuant to the Policy are considered annually.

Non-Audit Fees. The aggregate non-audit fees billed by the Auditor for services rendered to the Registrant, and rendered to Service Affiliates, for the Reporting Periods were $511,587 in 2003 and $611,435 in 2004.

Auditor Independence. The Registrant's Audit Committee has considered whether the provision of non-audit services that were rendered to Service Affiliates which were not pre-approved (not requiring pre-approval) is compatible with maintaining the Auditor's independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. [Reserved]

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management

Investment Companies.

Not applicable.

Item 8. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers.

Not applicable.

Item 9. Submission of Matters to a Vote of Security Holders.

The Fund has a Nominating Committee, which is responsible for selecting and nominating persons for election or appointment by the Fund’s Board as Board members. The Committee has adopted a Nominating Committee Charter (“Charter”). Pursuant to the Charter, the Committee will consider recommendations for nominees from shareholders submitted to the Secretary of the Fund, c/o The Dreyfus Corporation Legal Department, 200 Park Avenue, 8th Floor West, New York, New York 10166. A nomination submission must include information regarding the recommended nominee as specified in the Charter. This information includes all information relating to a

-3-

SSL-DOCS2 70128344v10

recommended nominee that is required to be disclosed in solicitations or proxy statements for the election of Board members, as well as information sufficient to evaluate the factors to be considered by the Committee, including character and integrity, business and professional experience, and whether the person has the ability to apply sound and independent business judgment and would act in the interests of the Fund and its shareholders. Nomination submissions are required to be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the shareholders, and such additional information must be provided regarding the recommended nominee as reasonably requested by the Committee.

Item 10. Controls and Procedures.

(a) The Registrant's principal executive and principal financial officers have concluded, based on their evaluation of the Registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the Registrant's disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed by the Registrant on Form N-CSR is recorded, processed, summarized and reported within the required time periods and that information required to be disclosed by the Registrant in the reports that it files or submits on Form N-CSR is accumulated and communicated to the Registrant's management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no changes to the Registrant's internal control over financial reporting that occurred during the Registrant's most recently ended fiscal half-year that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

Item 11. Exhibits.

(a)(1) Code of ethics referred to in Item 2.

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(a)(3) Not applicable.

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940.

-4-

SSL-DOCS2 70128344v10

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

DREYFUS INSURED MUNICIPAL BOND FUND, INC.

| By: | /s/ Stephen E. Canter |

| |

|

| | Stephen E. Canter |

| | President |

| | |

| Date: | June 25, 2004 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | /s/ Stephen E. Canter |

| |

|

| | Stephen E. Canter |

| | Chief Executive Officer |

| | |

| Date: | June 25, 2004 |

| | |

| By: | /s/ James Windels |

| |

|

| | James Windels |

| | Chief Financial Officer |

| | |

| Date: | June 25, 2004 |

EXHIBIT INDEX

(a)(1) Code of ethics referred to in Item 2.

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940. (EX-99.CERT)

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940. (EX-99.906CERT)

-5-

SSL-DOCS2 70128344v10