UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 25, 2009

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-14543

TrueBlue, Inc.

(Exact name of Registrant as specified in its charter)

| | |

| Washington | | 91-1287341 |

| (State of Incorporation) | | (IRS Employer ID) |

| |

| 1015 A Street, Tacoma, Washington | | 98402 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (253) 383-9101

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock without par value | | The New York Stock Exchange |

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes¨ No¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Large accelerated filer¨ Accelerated filerx Non-accelerated filer¨ (Do not check if a smaller reporting company) Smaller reporting company¨

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Nox

The aggregate market value (based on the NYSE quoted closing price) of the common stock held by non-affiliates of the registrant as of the last business day of the second fiscal quarter, June 26, 2009, was approximately $0.356 billion.

As of February 5, 2010, there were 44,024,282 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report is incorporated by reference from the registrant’s definitive proxy statement, relating to the Annual Meeting of Shareholders scheduled to be held May 12, 2010, which definitive proxy statement will be filed not later than 120 days after the end of the fiscal year to which this report relates.

COMMENT ON FORWARD LOOKING STATEMENTS

This Form 10-K contains forward-looking statements. These statements relate to our expectations for future events and future financial performance. Generally, the words “anticipate,” “believe,” “expect,” “intend,” “plan” and similar expressions identify forward-looking statements. Forward-looking statements involve risks and uncertainties, and future events and circumstances could differ significantly from those anticipated in the forward-looking statements. These statements are only predictions. Actual events or results may differ materially. Factors which could affect our financial results are described in Item 1A of this Form 10-K. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy and completeness of the forward-looking statements. We undertake no duty to update any of the forward-looking statements after the date of this report to conform such statements to actual results or to changes in our expectations.

TrueBlue, Inc.

2009 Annual Report on Form 10-K

Table of Contents

TrueBlue, Inc.

Form 10-K

PART I

Description of the Business

TrueBlue, Inc. (“TrueBlue,” “we,” “us,” “our”) is a provider of temporary blue-collar staffing. In 2009, we connected approximately 300,000 people to work through the following brands: Labor Ready for general labor, Spartan Staffing for light industrial services, CLP Resources for skilled trades, PlaneTechs for aviation and diesel mechanics and technicians, and Centerline, formerly Transportation Logistics Company, for dedicated and temporary drivers. Headquartered in Tacoma, Washington, we serve approximately 175,000 businesses, which are primarily in the services, construction, transportation, manufacturing, retail, and wholesale industries.

We began operations in 1989 under the name Labor Ready, Inc. providing on-demand, general labor staffing services. Starting in 2004, we began acquiring additional brands to expand our service offerings to customers in the blue-collar staffing market. Effective December 18, 2007, Labor Ready, Inc. changed its name to TrueBlue, Inc. The name change reflects our vision to be the leading provider of blue-collar staffing with multiple brands serving the temporary staffing industry. Our former company name of Labor Ready remains as our primary brand name for on-demand, general labor staffing services.

Temporary Staffing Industry

The temporary staffing industry evolved out of the need to minimize the cost and effort of hiring and administering permanent employees in response to temporary changes in business conditions. The demand for temporary employees has been driven primarily by the need to satisfy peak production and service requirements and to temporarily replace full-time employees absent due to illness, vacation or abrupt termination. Competitive pressures have forced businesses to focus on reducing costs, including converting fixed or permanent labor costs to variable or flexible costs. Improving economic growth typically results in increasing demand for labor, resulting in greater demand for our services. Conversely, during an economic downturn, businesses generally reduce their use of temporary staffing as they experience lower levels of demand from consumers.

The temporary staffing industry includes a number of markets focusing on business needs that vary widely in duration of assignment and level of technical specialization. We operate within the blue-collar staffing market of the temporary staffing industry. This market is fragmented among a large number of providers and presents opportunities for larger, well capitalized companies to compete effectively. Our primary competitive advantages include:

| | • | | Specialized focus on blue-collar staffing; |

| | • | | Ability to fulfill short-term customer orders with short notice and meet quality expectations; |

| | • | | Multi-location servicing of regional and national customers; |

| | • | | Worker safety programs and risk management; |

| | • | | Proprietary systems and automation that efficiently process a high volume of customer orders and temporary worker pay transactions; |

| | • | | Legal and regulatory compliance programs; |

| | • | | Management and employee development programs; and |

| | • | | Leverage of infrastructure support of multi-brand and multi-location activities. |

The blue-collar staffing market has experienced significant decreases in demand as a result of the recession, which has negatively impacted our performance. We believe the markets we serve will continue to remain under pressure until the overall economy begins to have sustained growth.

Long-term Strategies

Our long-term business strategies for profitable growth remain unchanged. We plan to expand our market share in the blue-collar staffing markets we serve; be the customer service leader; and operate multiple blue-collar staffing brands. We believe we are the gateway to individual growth for our temporary workers and the gateway for our customers seeking to reduce their costs, convert their fixed or permanent labor costs to variable costs, and sustain or grow their businesses.

We plan to grow our market share in the blue-collar staffing market through the following strategies:

We plan to increase existing branch revenue, which has declined during the recession. We believe the key to increasing same branch revenue is largely tied to our strategy of becoming the service leader in the blue-collar staffing market, which is discussed further below.

We plan to open new branches that can reach or exceed performance standards and close branches that are under-performing. The primary factors in determining which branches to close are financial performance, the ability to consolidate with another branch, the tenure and quality of branch management, and the long-term potential of the location. In response to the economic downturn over the last several years, we have reduced the number of branch openings and increased the number of branch closings. During 2009 we opened nine new branches and closed 105 for a net reduction of 96 branches. In 2008, we opened four new branches, closed 73 branches and sold the remaining 29 branches in the United Kingdom for a net reduction of 98 branches. As the economy improves, we expect to close fewer branches and as the economy reaches stable levels of growth, we expect to increase our branch openings. We expect to have future branch openings in all of our brands; however, we expect larger rates of growth from new branches in the Centerline, CLP Resources, and/or Spartan Staffing brands as these brands do not yet have a national presence. We currently do not have any significant branch opening or closing plans.

We plan to make strategic acquisitions in the blue-collar staffing market that can produce strong returns on investment. Our focus is on acquisitions which can accelerate the building of a national presence for all brands or that provide new opportunities to serve the blue-collar staffing market.

We plan to be the service leader by building customer loyalty and retaining our top talent.

We are building a sales culture with a commitment to capturing and cultivating customer loyalty. We build a relationship of trust with our customers, gaining a firm understanding of their needs, finding solutions, and ensuring our service delivery meets or exceeds their expectations. Our ability to provide the right temporary employee, at the right time, and for the right duration is important to meeting our customers’ needs. We remain committed to maintaining a safe work environment through our safety and risk management programs to keep our temporary employees safe and better serve our customers.

Our customers value the relationship with our branch personnel. We focus on attracting, developing and retaining quality employees. We invest in extensive training in company values, leadership practices, sales techniques, customer service and account management, and management of branch operations. Over the past three years, we have developed a standardized sales methodology and focused extensively on developing the sales skills of our employees. We believe this helps better position us to take advantage of additional opportunities that should occur with an economic recovery.

We plan to operate with multiple blue-collar brands.

We plan to achieve a dominant market position in each of our blue-collar brands. We have achieved a dominant position with our general labor brand Labor Ready and that blueprint for success is being applied to Spartan Staffing, CLP Resources, PlaneTechs, and Centerline. We believe these brands can be expanded into a national presence with dominant market positions. We will also continue to invest in building effective and efficient support services that can be leveraged across brands to provide cost efficient support services to our operations.

Brand Operations

Labor Ready – On-Demand, General Labor Services. Labor Ready provides on-demand general labor. Positions tend to be project-based and are filled quickly through a nationwide network of local community branches. Workers are paid at the end of every day. Positions may lead to permanent employment. At the end of 2009, the Labor Ready brand had an aggregate 627 branches in all 50 states, Puerto Rico, and Canada.

Spartan Staffing – Light Industrial Temporary Services. Spartan Staffing places employees with specialized skills into manufacturing and logistics companies. Employees’ skills are carefully matched to jobs for a customized workforce solution. This enables our customers to obtain immediate value by placing a productive and skilled employee on the job site. Positions often have extended length and may lead to permanent employment. On-site management of personnel ensures full-service staffing on large accounts. Spartan Staffing was acquired in 2004 with 10 branches. In April 2008, we added 44 branches to our light industrial temporary services with the purchase of Personnel Management, Inc (“PMI”). PMI was integrated with Spartan Staffing effective in fiscal 2009. At the end of fiscal 2009, Spartan Staffing operated 52 branches.

CLP Resources (“CLP”) – Skilled Trades Services. CLP provides skilled trades people to commercial, industrial and residential building contractors and building and plant maintenance. CLP verifies employee skills and matches them to specific customer needs. This enables our customers to obtain immediate value by placing a highly productive and skilled employee on the job site. The staffing assignments are project-based but typically last several weeks since the tradesperson is often needed for a substantial amount of the construction process. CLP was acquired in 2005 with 50 branches. In April 2007, we acquired 17 branches through the purchase of Skilled Services Corporation (“SSC”). SSC was integrated with CLP effective in fiscal 2008. At the end of fiscal 2009, CLP operated 59 branches.

PlaneTechs – Skilled Aviation Services. PlaneTechs provides highly-skilled mechanics and technicians to the aviation maintenance, repair and overhaul, and aerospace manufacturing and assembly industries. We also provide mechanics to other transportation industries. In-depth screening verifies aviation certification and specialized skills. Centralized recruiting and dispatch provides efficient and cost-effective solutions for customers across the country. In December 2007, we purchased substantially all of the assets of PlaneTechs, LLC. PlaneTechs operates nationally out of one recruiting center in Oak Brook, IL.

Centerline Drivers (“Centerline”) – Professional Truck Drivers. Centerline specializes in providing temporary and dedicated drivers to the transportation and distribution industries. In February 2008, we purchased substantially all of the assets of TLC Services Group, Inc. Effective January 4, 2010, we changed the name to Centerline Drivers, LLC. Centerline operates across multiple states out of 15 locations.

The following table reconciles the number of TrueBlue branches open at the end of each of the last three fiscal years:

| | | | | | | | | | | | | | | | | |

| | | Labor

Ready | | | Spartan

Staffing | | | CLP

Resources | | | Plane Techs(1) | | Centerline | | | Total

Branches | |

2006 Ending Branches | | 816 | | | 28 | | | 68 | | | — | | — | | | 912 | |

Branches acquired (2) | | — | | | — | | | 17 | | | 1 | | — | | | 18 | |

Branches opened | | 5 | | | 7 | | | 10 | | | — | | — | | | 22 | |

Branches closed | | (47 | ) | | (3 | ) | | (8 | ) | | — | | — | | | (58 | ) |

| | | | | | | | | | | | | | | | | |

2007 Ending Branches | | 774 | | | 32 | | | 87 | | | 1 | | — | | | 894 | |

Branches acquired (2) | | — | | | 44 | | | — | | | — | | 10 | | | 54 | |

Branches opened | | — | | | — | | | 3 | | | — | | 1 | | | 4 | |

Branches closed | | (77 | ) | | (12 | ) | | (13 | ) | | — | | — | | | (102 | ) |

| | | | | | | | | | | | | | | | | |

2008 Ending Branches | | 697 | | | 64 | | | 77 | | | 1 | | 11 | | | 850 | |

Branches opened | | — | | | 3 | | | 1 | | | — | | 5 | | | 9 | |

Branches closed | | (70 | ) | | (15 | ) | | (19 | ) | | — | | (1 | ) | | (105 | ) |

| | | | | | | | | | | | | | | | | |

2009 Ending Branches | | 627 | | | 52 | | | 59 | | | 1 | | 15 | | | 754 | |

| | | | | | | | | | | | | | | | | |

| | (1) | PlaneTechs operates nationally out of one centralized recruiting center. |

| | (2) | Branches acquired in the table above includes branches added as a result of the following acquisitions: |

| | • | | In April 2007, we acquired all of the stock of SSC. SSC was integrated with CLP effective fiscal 2008. SSC operated 17 branches at the time of acquisition. |

| | • | | In December 2007, we purchased substantially all of the assets of PlaneTechs, LLC. PlaneTechs operates nationally out of one recruiting facility in Oak Brook, IL. |

| | • | | In February 2008, we purchased substantially all of the assets of TLC. TLC operated 10 branches at the time of acquisition. Effective January 4, 2010, we changed the name to Centerline Drivers, LLC. |

| | • | | In April 2008, we acquired all of the stock of PMI. PMI was integrated with Spartan Staffing effective fiscal 2009. PMI operated 44 branches at the time of acquisition. |

Information about Business Segments

TrueBlue operations are one reportable segment. Our operations are all in the blue-collar staffing market of the temporary staffing industry and focus on supplying customers with temporary employees. All our brands have the following similar characteristics:

| | • | | They provide blue-collar temporary labor services; |

| | • | | They serve customers who have a need for temporary staff to perform tasks which do not require a permanent employee; |

| | • | | They each build a temporary work force through recruiting, screening and hiring. Temporary workers are dispatched to customers where they work under the supervision of our customers; and |

| | • | | Profitability is driven largely by managing the bill rates to our customers and the pay rates to our workers. The difference between the bill rate and pay rate is a key metric used to drive the business in all our brands. Profitable growth requires increased volume or bill rates which grow faster than pay rates. Profitable growth is also driven by leveraging our cost structure across all brands. |

We expect similar operating margins for our brands based on historical experience. The long-term performance expectations of all our brands are similar as are the underlying financial and economic metrics used to manage those brands.

Our international operations are not significant to our total operations for segment reporting purposes.

Operations

Branch operations are organized into geographic areas. Each area is under the supervision of a manager who oversees branch performance. Within a region, multi-unit managers supervise branch operations and meet regularly with branch managers to discuss new customers, customer satisfaction, temporary workforce recruitment and retention, and operating performance. Similar meetings are conducted at the corporate level with regional management.

Branches are generally open five days a week, with extended hours as required to meet customer needs. Branch locations are generally staffed with a branch manager and two or more additional employees that focus on customer sales and service, temporary worker recruiting, screening and placement. Branches follow standardized and detailed operating procedures.

We believe that one of the most critical factors determining the success of a branch is selecting, hiring and retaining an effective branch manager. Each branch manager has the responsibility for recruiting and retaining a quality temporary workforce and capturing and cultivating customer loyalty. Each branch manager manages the operations of the branch, which include the recruiting, dispatch and payment of temporary employees, meeting the needs of our customers with a guarantee of customer satisfaction, selling our services to new customers, as well as cost control through accident prevention, and compliance with the laws and regulations. We commit substantial resources to the training, development, and operational support of our branch managers and developing information systems to facilitate their efficiency and effectiveness.

Our Labor Ready and CLP brands own proprietary front-end software systems, and our Spartan Staffing and PlaneTechs brands have highly customized front-end software systems. These systems process all required work order, billing, collection and temporary worker payroll; together with other information and reporting systems necessary for the management of hundreds of thousands of temporary employees and operations in multiple locations. These custom systems reduce the administrative workload of our branch personnel allowing them to focus on servicing our customers and selling to new customers. In addition, these systems are compliant with the various regulatory jurisdictions we operate in.

Our Customers

The majority of our customers require temporary employees for peak production and service requirements and to temporarily replace absent full-time employees. Additionally, a growing number of our customers have increased the percentage of temporary workers in their workforce. This trend may continue as companies position themselves to address potential future economic downturns and lower the cost of temporary reductions to their workforce.

We derive our revenue from a large number of customers. During 2009, we served approximately 175,000 customers. Our ten largest customers accounted for approximately 21.3% of total revenue in 2009, up from 10.7% for 2008 and 4.0% for 2007. Sales to The Boeing Company and affiliates (“Boeing”) accounted for 13.4% of total revenue for 2009, 5.1% for 2008, and 0.3% for 2007. For 2008 and 2007, no single company accounted for more than 10% of total revenue.

Our Temporary Employees

During 2009, we put approximately 300,000 people to work. We recruit temporary employees daily so that we can be responsive to the planned as well as unplanned needs of the customers we serve. We attract our pool of temporary employees through advertising and word of mouth. We believe our focus on locating branches in areas convenient for our temporary employees is particularly important in attracting temporary employees. We consider our relations with temporary employees to be good.

Seasonality

Our business experiences seasonal fluctuation. Construction and landscaping businesses and, to a lesser degree, other customer businesses typically increase activity in spring, summer and early fall months and decrease activity in late fall and winter months. As a result, we generally experience an increase in temporary labor demand in the spring, summer and early fall months, and lower demand in the late fall and winter months when inclement weather can slow construction and landscaping activities.

Competition

The blue-collar staffing market is highly competitive with limited barriers to entry. We compete with several multi-national full-service companies, specialized temporary staffing companies, as well as local companies. The majority of temporary staffing companies serving the blue-collar staffing market are local operations with fewer than five branches. In most geographic areas, no single company has a dominant share of the market. One or more of these competitors may decide at any time to enter or expand their existing activities in the blue-collar staffing market and provide new and increased competition to us. While entry to the market has limited barriers, there are several factors that frequently limit widespread expansion of smaller competitors:

| | • | | Lack of working capital to fund a cyclical business; |

| | • | | Lack of working capital to fund insurance programs for workers; |

| | • | | Lack of regional and/or national presence to service large customers; |

| | • | | Lack of information systems that can be leveraged by multiple branches; and |

| | • | | Lack of support services that can be leveraged by multiple brands. |

We believe that the primary competitive factors in obtaining and retaining customers and providing superior customer service are:

| | • | | The customer bill rates for temporary workers; |

| | • | | Attracting and retaining quality temporary workers; |

| | • | | Understanding and appropriately responding to customer service requirements and issues; |

| | • | | A commitment to compliance with applicable laws and regulations; |

| | • | | Deploying temporary employees on time and for the required duration; and |

| | • | | A national footprint, which allows servicing of regional and national customers. |

Competitive forces have historically limited our ability to raise our prices to immediately and fully offset increased costs of doing business, including increased labor costs, costs for workers’ compensation and state unemployment insurance. As a result of these forces, we have in the past faced pressure on our operating margins. See Item 1A “Risk Factors” below of this Annual Report on Form 10-K.

Government Regulations

We are in the business of employing people and placing them in the workplaces of other businesses. As a result, we are subject to a number of federal, state and local laws and regulations regulating our industry. Some of the most important areas of regulation include the following:

| | • | | Wage and hour regulation. We are required to comply with applicable state and federal wage and hour laws. These laws require us to pay our employees a minimum wage and overtime at applicable rates. When our temporary employees are employed on public works projects we are generally required to pay prevailing wages and to comply with additional reporting obligations. |

| | • | | Regulation concerning equal opportunity. We are required to comply with applicable state and federal laws prohibiting harassment and discrimination on the basis of race, gender and other legally-protected factors in the employment of our temporary and permanent employees. |

| | • | | Workplace safety. We are subject to a number of state and federal statutes and administrative regulations pertaining to the safety of our employees. These laws generally require us to provide general safety awareness and basic safety equipment to our temporary employees. |

Patents and Trademarks

Our business is not presently dependent on any patents, licenses, franchises or concessions. “TrueBlue,” “Labor Ready,” “Spartan Staffing,” “CLP Resources,” “PlaneTechs,” “Centerline Drivers,” and certain other service marks are registered with the U.S. Patent and Trademark Office.

Fiscal Year End

Our fiscal year is based on a 52/53-week year ending on the last Friday in December. In fiscal years consisting of 53 weeks the final quarter will consist of 14 weeks while in 52-week years all quarters will consist of 13 weeks. References to 2009, 2008 and 2007 relate to the 52-week fiscal years ending December 25, 2009, December 26, 2008 and December 28, 2007, respectively. Our 2010 fiscal year ending December 31, 2010, will include 53 weeks, with the 53rd week falling in our fourth fiscal quarter.

Financial Information about Geographic Areas

The following table depicts our revenue derived from within the United States and that derived from international operations for the past three fiscal years (in millions). International operations include Canada in 2009 and Canada and the United Kingdom for all prior years. We sold the remaining 29 branches in the United Kingdom in 2008.

| | | | | | | | | | | | | | | |

| | | 2009 | | 2008 | | 2007 |

United States (including Puerto Rico) | | $ | 984.5 | | 96.7% | | $ | 1,308.0 | | 94.5% | | $ | 1,288.5 | | 93.0% |

International operations | | $ | 33.9 | | 3.3% | | $ | 76.3 | | 5.5% | | $ | 97.2 | | 7.0% |

| | | | | | | | | | | | | | | |

Total revenue from services | | $ | 1,018.4 | | 100.0% | | $ | 1,384.3 | | 100.0% | | $ | 1,385.7 | | 100.0% |

| | | | | | | | | | | | | | | |

The following table depicts our net property and equipment located in the United States and the net property and equipment located in international operations for the past three years (in millions).

| | | | | | | | | | | | | | | |

| | | 2009 | | 2008 | | 2007 |

United States (including Puerto Rico) | | $ | 60.3 | | 99.8% | | $ | 61.2 | | 99.5% | | $ | 43.6 | | 97.2% |

International operations | | $ | 0.1 | | 0.2% | | $ | 0.3 | | 0.5% | | $ | 1.3 | | 2.8% |

| | | | | | | | | | | | | | | |

Total property and equipment, net | | $ | 60.4 | | 100.0% | | $ | 61.5 | | 100.0% | | $ | 44.9 | | 100.0% |

| | | | | | | | | | | | | | | |

The international operations are dependent on shared information and communications equipment housed and maintained in the United States.

Number of Employees

As of February 5, 2010, we employed approximately 2,500 full-time and part-time employees in addition to our temporary employees.

Available Information

Our Internet website address is www.trueblueinc.com. We make available at this address, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Information available on our website is not incorporated by reference in and is not deemed a part of this Form 10-K.

Investing in our securities involves a high degree of risk. The following risk factors, issues and uncertainties should be considered in evaluating our future prospects. In particular, keep these risk factors in mind when you read “forward-looking” statements elsewhere in this report. Forward-looking statements relate to our expectations for future events and time periods. Generally, the words “anticipate,” “believe,” “expect,” “intend,” “plan” and similar expressions identify forward-looking statements. Forward–looking statements involve risks and uncertainties, and future events and circumstances could differ significantly from those anticipated in the forward–looking statements. Any of the following risks could harm our business, operating results or financial condition and could result in a complete loss of your investment. Additional risks and uncertainties that are not yet identified or that we currently think are immaterial may also harm our business and financial condition in the future.

The recession has negatively affected our customers and our business, and could continue to negatively affect our customers and materially adversely affect our results of operations and liquidity.

The recession is having a significant negative impact on businesses around the world. The full impact of this recession on our customers, especially our customers engaged in construction, cannot be predicted and may be quite severe. These and other economic factors, such as consumer demand, unemployment, inflation levels and the availability of credit have had and could continue to have a material adverse effect on demand for our services and on our financial condition and operating results. We sell our services to a large number of small and medium sized businesses and these businesses have been and are more likely to be impacted by unfavorable general economic and market conditions than larger and better capitalized companies. If our customers cannot access credit to support increased demand for their product or if demand for their products declines, they will have less need for our services.

We may be negatively affected by the financial crisis in the U.S. and global capital and credit markets.

We must maintain liquidity to fund our working capital and to fund our premium and collateral obligations to our insurance providers. Without sufficient liquidity, we could be forced to limit our operations or we may not be able to pursue new business opportunities. The principal sources of our liquidity are cash generated from operating activities, available cash and cash equivalents, and borrowings under our credit facility. The capital and credit markets have been experiencing extreme volatility and disruption during the past year. These market conditions could affect our ability to borrow under our credit facility, or adversely affect our banking partners. We can make no assurances that our banking partners will not experience a significant adverse event that could impact their abilities to fulfill their obligations to us. Even if the credit markets improve, the availability of financing will depend on a variety of factors, such as economic and market conditions, the availability of credit and our credit ratings, as well as the possibility that lenders could develop a negative perception of us or the markets that we serve. We may not be able to successfully obtain any necessary additional financing on favorable terms, or at all.

Competition for customers in the staffing markets we serve is intense, and if we are not able to effectively compete our financial results could be harmed and the price of our securities could decline.

The temporary staffing industry is highly competitive, with limited barriers to entry. Several large and medium sized full-service and specialized temporary staffing companies, as well as small local operations, compete with us in the staffing industry. Competition in the markets we serve is intense and these competitive forces limit our ability to raise prices to our customers. For example, competitive forces have historically limited our ability to raise our prices to immediately and fully offset increased costs of doing business, including increased labor costs, costs for workers’ compensation and state unemployment insurance. As a result of these forces, we have in the past faced pressure on our operating margins. Pressure on our margins is intense, and most of our customer contracts can be terminated by the customer on short notice without penalty. If we are not able to effectively compete in the staffing markets we serve, our operating margins and other financial results will be harmed and the price of our securities could decline.

A significant portion of our insurance coverage, including workers’ compensation, is provided by Chartis. If Chartis, or its insurance subsidiaries, were to experience further financial problems, it could harm our business, financial condition or results of operations.

Our workers’ compensation insurance policies are with various insurance subsidiaries of Chartis, formerly known as AIU Holdings, Inc., a subsidiary of American International Group, Inc. Chartis holds the majority of the restricted cash collateralizing our self-insured workers’ compensation policies. We also rely on Chartis to provide state-mandated statutory workers’ compensation coverage, employers’ liability coverage, auto coverage, and general liability coverage. While we have not experienced a loss of collateral with any of the prior insurance companies that have entered liquidation, if Chartis were to experience financial problems, our restricted cash deposits, letters of credit, and/or our workers’ compensation or other coverage at Chartis could be at risk. The loss of the cash deposits and letters of credit would have a material negative impact on our balance sheet and could require us to seek additional sources of capital to pay our accrued workers’ compensation claims. These additional sources of financing may not be available on commercially reasonable terms, or at all. The loss of our workers’ compensation coverage would prevent us from doing business in the majority of our markets.

If we are not able to obtain or maintain insurance on commercially reasonable terms, our financial condition or results of operations could suffer.

We maintain various types of insurance coverage to help offset the costs associated with certain risks to which we are exposed. We have previously experienced, and could again experience, changes in the insurance markets that result in significantly increased insurance costs and higher deductibles. For example, we are required to pay workers’ compensation benefits for our temporary and permanent employees. Under our workers’ compensation insurance program, we maintain “per occurrence” insurance, which covers claims for a particular event above a $2.0 million deductible, and we do not maintain an aggregate stop-loss limit other than on a per occurrence basis. We have secured coverage with Chartis for occurrences during the period from July 2009 to July 2010.

Our insurance policies must be renewed annually, and we cannot guarantee that we will be able to successfully renew such policies for any future period. In the event we are not able to obtain workers’ compensation insurance, or any of our other insurance coverages, on commercially reasonable terms, our ability to operate our business would be significantly impacted and our financial condition and results of operations could suffer.

The terms under which we post the collateral necessary to support our workers’ compensation obligations may change, which could reduce the capital we have available to support our operations.

We are required to maintain commitments such as cash and cash-backed instruments, irrevocable letters of credit, and/or surety bonds to secure repayment to our insurance companies (or in some instances, the state) of the deductible portion of all open workers’ compensation claims. We pledge cash or other assets in order to secure these commitments and there are a number of factors that cause the size of our collateral commitments to grow over time. As our business grows we expect that our workers’ compensation reserve and the collateral needed to support it will also grow. We sometimes face difficulties in recovering our collateral from insurers or other entities, particularly when they are in financial distress, and we cannot guarantee that our collateral for past claims will be released in a timely manner as we pay down claims. As a result, we expect that the amount of collateral required to secure our commitments to our insurance carriers and issuers of surety bonds and letters of credit could continue to increase. Alternatively, if our financial results deteriorate, our insurance carriers, insurance regulators, surety carriers, or letter of credit issuers may require additional collateral or capital, or we may see a shortening of the amount of time that the insurance carriers allow us to deposit collateral. Such a change in our collateral payment terms could impact our available cash, and our financial condition or operations could suffer. Our currently available sources of capital for these commitments are limited, and have been further limited by the current global liquidity shortage, and we could be required to seek additional sources of capital in the future. These additional sources of financing may not be available on commercially reasonable terms, or at all. Even if such sources of financing are available, they could result in a dilution of value to our existing shareholders.

Some insurance companies with which we have previously done business are in financial distress, and one has been relieved of its insurance obligations to us. If our insurers do not fulfill their obligations, we could experience significant losses.

Prior to our current policies with Chartis, we purchased annual insurance policies in connection with our workers’ compensation obligations from three primary carriers. Prior to 2001, Legion Insurance Company (Legion) and Reliance Insurance Company (Reliance) provided coverage to us. Legion and Reliance are in liquidation and have failed to pay a number of covered claims that exceed our deductible limits. We have presented these excess claims to the guarantee funds of the states in which the claims originated. Certain of these excess claims have been rejected by the state guarantee funds due to statutory eligibility limitations. As a result, we have concluded it is likely that we will be unable to obtain reimbursement for at least a portion of these excess claims. To the extent we experience additional claims that exceed our deductible limits and our insurers do not satisfy their coverage obligations, we may be forced to satisfy some or all of those claims directly; this in turn could harm our financial condition or results of operations.

Our workers’ compensation reserves include not only estimated expenses for claims within our self-insured limit but also estimated expenses related to claims in excess of the deductible limits (“excess claims”). We record a receivable for the insurance coverage on excess claims. We have also recorded a valuation allowance against the insurance receivables from Legion and Reliance to reflect our best estimates of amounts we may not realize as a result of the liquidations of those insurers. The outcome of those liquidations is inherently uncertain and we may realize significantly less than currently estimated, in which case an adjustment would be charged to expense in the period in which the outcome occurs or the period in which our estimate changes.

Kemper Insurance Company (Kemper) provided coverage for occurrences commencing in 2001 through June 30, 2003. In December 2004, we executed a novation agreement pursuant to which we relinquished insurance coverage and assumed all further liability for all claims originating in the Kemper policy years. These claims are reserved for in the consolidated financial statements. Although we believe our judgments and estimates are adequate, we cannot assure you that claims originating in the Kemper policy years will not experience unexpected adverse developments.

Our reserves for workers’ compensation claims, other liabilities, and our allowance for doubtful accounts may be inadequate, and we may incur additional charges if the actual amounts exceed the estimated amounts.

We maintain reserves for workers’ compensation claims, including the excess claims portion above our deductible, using actuarial estimates of the future cost of claims and related expenses. These estimates are impacted by items that have been reported but not settled and items that have been incurred but not reported. This reserve, which reflects potential liabilities to be paid in future periods based on estimated payment patterns, is discounted to its estimated net present value using discount rates based on average returns of “risk-free” U.S. Treasury instruments with maturities comparable to the weighted average lives of our workers’ compensation claims. We evaluate the reserve regularly throughout the year and make adjustments accordingly. If the actual costs of such claims and related expenses exceed the amounts estimated, or if the discount rates represent an inflated estimate of our

return on capital over time, actual losses for these claims may exceed reserves and/or additional reserves may be required. There are two main factors that impact workers’ compensation expense: the number of claims and the cost per claim. The number of claims is driven by the volume of hours worked, the business mix which reflects the type of work performed, and the safety of the environment where the work is performed. The cost per claim is driven primarily by the severity of the injury, the state in which the injury occurs, related medical costs and lost-time wage costs. Our accident prevention programs have reduced the number of claims. This has had a positive impact on the cost of workers’ compensation for the current year as well as our prior year reserves which assumed less improvement to accident rates. In the event that we are not able to make further improvements, the positive impacts to our workers’ compensation expense will diminish. Furthermore, our accident rates and cost per claim trends could worsen and cause increasing cost of workers’ compensation. We have also established reserves for contingent legal and regulatory liabilities, based on management’s estimates and judgments of the scope and likelihood of these liabilities. While we believe our judgments and estimates are adequate, if the actual outcome of these matters is less favorable than expected, an adjustment would be charged to expense in the period in which the outcome occurs or the period in which our estimate changes. We also establish an allowance for doubtful accounts for estimated losses resulting from the inability of our customers to make required payments. If the financial condition of our customers were to deteriorate, resulting in an impairment of their ability to make payments, we may be required to incur additional charges.

Our credit facility limits our ability to borrow based upon collateral availability. We are also required to maintain certain levels of liquidity that if not met, require us to satisfy a fixed charge coverage ratio. In the event our collateral is insufficient for our borrowing needs, or we fail to meet the liquidity/fixed charge coverage ratio requirements or have them waived, we may be subject to penalties and we could be forced to seek additional financing.

We have a credit agreement with certain unaffiliated financial institutions (the “Revolving Credit Facility”) that expires in June 2012. The Revolving Credit Facility limits our ability to borrow (including issuances of letters-of-credit on our behalf) up to a certain percentage of certain assets. The Revolving Credit Facility also requires that we maintain certain levels of liquidity that if not met, require us to satisfy a fixed charge coverage ratio. Depletion of our cash position or reduction in our accounts receivable could limit our ability to borrow under the Revolving Credit Facility. Inability to borrow under the Revolving Credit Facility would adversely affect our operations. Additionally, the deterioration of our financial results would make it harder for us to comply with the fixed charge coverage ratio. In the past, we have negotiated amendments to similar covenants under our prior credit facility to ensure our continued compliance with their restrictions. We cannot be assured that our lenders would consent to such amendments on commercially reasonable terms in the future if we once again require such relief. Moreover, the Revolving Credit Facility differs from our prior facility in that it is asset based, and therefore if we trigger the implementation of the fixed charge coverage ratio and fail to meet it, the current group of lenders may be less likely to waive or amend the requirements. In the event that we do not comply with the fixed charge coverage ratio and the lenders do not waive such non-compliance, then we will be in default of the Revolving Credit Facility, which could subject us to default rates of interest and accelerate the maturity of the outstanding balances. Accordingly, if we default under the Revolving Credit Facility or if our ability to borrow is limited, we could be required to seek additional sources of capital to satisfy our liquidity needs. These additional sources of financing may not be available on commercially reasonable terms, or at all.

A significant portion of our liquidity relies on a limited number of banking partners. If these banks fail we could face a shortage of liquidity, which could harm our business operations.

In the current economic climate, we cannot assure you that the lenders under the Revolving Credit Facility will remain able to support their commitments to us in the future. If these lenders fail we may not be able to secure alternative financing on commercially reasonable terms, or at all.

We have significant working capital requirements.

We require significant working capital in order to operate our business. We may experience periods of negative cash flow from operations and investment activities, especially during seasonal peaks in revenue experienced in the second and third quarter of the year. We invest significant cash into the opening and operations of new branches until they begin to generate revenue sufficient to cover their operating costs. We also pay our temporary employees before customers pay us for the services provided. As a result, we must maintain cash reserves to pay our temporary employees prior to receiving payment from our customers. Our collateral requirements for workers’ compensation may increase in future periods, which would decrease amounts available for working capital purposes. If our available cash balances and available credit line under our existing credit facility do not grow commensurate with the growth in our working capital requirements, or if our banking partners experience cash shortages or are unwilling to provide us with necessary cash, we could be required to explore alternative sources of financing to satisfy our liquidity needs.

We may have additional tax liabilities that exceed our estimates.

We are subject to taxes in the United States and foreign jurisdictions. In the ordinary course of our business, there are transactions and calculations where the ultimate tax determination is uncertain. We are regularly subject to audit by tax authorities. Although

we believe our tax estimates are reasonable, the final determination of tax audits and any related litigation could be materially different from our historical tax provisions and accruals. The results of an audit or litigation could have a material effect on our financial position, results of operations, or cash flows in the period or periods for which that determination is made.

Our operations expose us to the risk of litigation, which could lead to significant potential liability and costs that could harm our business, financial condition or results of operations.

We are in the business of employing people and placing them in the workplaces of other businesses. As a result, we are subject to a large number of federal and state laws and regulations relating to employment. This creates a risk of potential claims that we have violated laws related to discrimination and harassment, health and safety, wage and hour laws, criminal activity, personal injury and other claims. We are also subject to other types of claims in the ordinary course of our business. Some or all of these claims may give rise to litigation, which could be time-consuming for our management team, costly and harmful to our business.

In addition, we are exposed to the risk of class action litigation. The costs of defense and the risk of loss in connection with class action suits are greater than in single-party litigation claims. Due to the costs of defending against such litigation, the size of judgments that may be awarded against us, and the loss of significant management time devoted to such litigation, we cannot assure you that such litigation will not disrupt our business or impact our financial results.

We are continually subject to the risk of new regulation, which could harm our business.

Each year a number of bills are introduced to federal, state, and local governments, any one of which, if enacted, could impose conditions which could harm our business. This proposed legislation has included provisions such as a requirement that temporary employees receive equal pay and benefits as permanent employees, requirements regarding employee health care, and a requirement that our customers provide workers’ compensation insurance for our temporary employees. We actively oppose proposed legislation adverse to our business and inform policy makers of the social and economic benefits of our business. However, we cannot guarantee that any of this legislation will not be enacted, in which event demand for our service may suffer.

The cost of compliance with government laws and regulations is significant and could harm our operating results.

We incur significant costs to comply with complex federal, state, and local laws and regulations relating to employment, including occupational safety and health provisions, wage and hour requirements (including minimum wages), workers’ compensation benefits, unemployment insurance, and immigration. In addition, from time to time, we are subject to audit by various governmental authorities to determine our compliance with a variety of these laws and regulations. We have in the past been found, and may in the future be found, to have violated such laws or regulations. We may, from time to time, incur fines and other losses or negative publicity with respect to any such violation. If we incur additional costs to comply with these laws and regulations or as a result of fines or other losses and we are not able to increase the rates we charge our customers to fully cover any such increase, our margins and operating results may be harmed.

The loss of any of our key personnel could harm our business.

Our future financial performance will depend to a significant extent on our ability to motivate and retain key management personnel. Competition for qualified management personnel is intense and in the event we experience turnover in our key management positions, we cannot assure you that we will be able to recruit suitable replacements or assimilate new key management personnel into our organization to achieve our operating objectives. Even if we are successful, turnover in key management positions could temporarily harm our financial performance and results of operations until new management becomes familiar with our business. Furthermore, we do not maintain key person life insurance on any of our executive officers.

Our business depends extensively on recruiting and retaining qualified branch managers. If we are not able to attract a sufficient number of qualified branch managers, our future growth and financial performance may suffer.

We rely heavily on our branch managers for the success of a branch. Each branch manager has the responsibility for recruiting and retaining a quality temporary workforce and capturing and cultivating customer loyalty. Each branch manager manages the operations of the branch, which include the recruiting, dispatch and payment of temporary employees, meeting the needs of our customers with a guarantee of customer satisfaction, selling our services to new customers, as well as cost control through accident prevention, and compliance with applicable laws and regulations. We have historically experienced a high degree of turnover among our branch managers. As a result, we must continue to recruit a sufficient number of managers to staff new branches and to replace managers lost through attrition or termination. Our future growth and financial performance depend on our ability to hire, train and retain qualified managers from a limited pool of qualified candidates.

Our business would suffer if we could not attract enough temporary employees.

We compete with other temporary personnel companies to meet our customer needs and we must continually attract reliable temporary employees to fill positions. We have in the past experienced short-term worker shortages and we may continue to

experience such shortages in the future. If we are unable to find temporary employees to fulfill the needs of our customers over a long period of time, we could lose customers and our business could suffer.

Our management information and computer processing systems are critical to the operations of our business and any failure, interruption in service, or security failure could harm our ability to effectively operate our business.

The efficient operation of our business is dependent on our management information systems. We rely heavily on our management information systems to manage our order entry, order fulfillment, pricing, and point-of-sale processes. The failure of our management information systems to perform as we anticipate could disrupt our business and could result in decreased revenue, increased overhead costs and could require that we commit significant additional capital and management resources to resolve the issue, causing our business and results of operations to suffer materially. In addition, failure to protect the integrity and security of our customers’ and employees’ information could expose us to litigation and materially damage our standing with our customers.

A significant portion of our revenue is derived from operations in a limited number of markets. Unfavorable economic conditions in these markets have harmed and could continue to harm our operations.

A significant portion of our revenue is derived from our operations in a limited number of states. Total revenue generated from operations in California, South Carolina, Washington, Texas and Florida, accounted for 48.6% of our overall revenue in 2009, 43.0% of our overall revenue in 2008 and 42.3% of our overall revenue in 2007. As a result, our business may be more susceptible to regional factors than the operations of more geographically diversified competitors.

Our results of operations can be dependent on revenue with major customers, and the loss of or substantial decline in revenue to a top customer could have a material adverse effect on our revenues, profitability and liquidity.

We have experienced increased customer concentration resulting from the decline in our total revenues coupled with an increase in revenue associated with The Boeing Company and parties affiliated with certain Boeing directed projects. The revenues associated with The Boeing Company and affiliates accounted for 13.4% of our total revenue for fiscal year 2009. A substantial amount of this revenue could lapse in 2010, which could have a significant negative impact on our profitability if not replaced with equally profitable revenue. The loss of, or reduced demand for our services related to this or other top customers could have a material adverse effect on our business, financial condition and results of operations. In addition, customer concentration exposes us to concentrated credit risk, as a large portion of our accounts receivable may be from a small number of customers.

International operations will burden our resources and may fail to generate a substantial increase in revenue.

As of December 25, 2009, we had 37 branches outside the United States. Our international branch operations expose us to certain risks. These risks include those already discussed in connection with our domestic branch operations and also include risks related to fluctuations in the value of foreign currencies, the additional expense and risks inherent in operations in geographically and culturally diverse locations, being subject to complex foreign tax laws and regulations. If we are not able to effectively manage those risks, our financial results could be harmed.

Failure in our pursuit or execution of new business ventures, strategic alliances and acquisitions could have a material adverse impact on our business.

Our long-term growth strategy includes expansion via new business ventures and acquisitions. While we employ several different valuation methodologies to assess a potential growth opportunity, we can give no assurance that new business ventures and strategic acquisitions will positively affect our financial performance. Acquisitions may result in the diversion of our capital and our management’s attention from other business issues and opportunities. Unsuccessful acquisition efforts may result in significant additional expenses that would not otherwise be incurred. We may not be able to assimilate or integrate successfully companies that we acquire, including their personnel, financial systems, distribution, operations and general operating procedures. If we fail to assimilate or integrate acquired companies successfully, our business could suffer materially. In addition, we may not realize the revenues and cost savings that we expect to achieve or that would justify the acquisition investment, and we may incur costs in excess of what we anticipate. We may also encounter challenges in achieving appropriate internal control over financial reporting in connection with the integration of an acquired company. In addition, the integration of any acquired company, and its financial results, into ours may have a material adverse effect on our operating results.

Labor unions have attempted to harm our business.

Various labor unions and activist groups have attempted to disrupt our business. For example, these groups have backed legislation designed to adversely impact our business, coordinated legal actions directed at our activities and engaged in a public relations campaign to discredit members of our management team and influence our customers. We cannot assure you that these activities will not harm our business or the price of our securities.

We are highly dependent on the cash flows from net earnings we generate during our second and third fiscal quarters.

A majority of our cash flow from operating activities is generated during the second and third quarters, which include the summer months. Unexpected events or developments such as natural disasters, manmade disasters and adverse economic conditions in our second and third quarter could have a material adverse effect on our operating cash flows.

The foregoing should not be construed as an exhaustive list of all factors that could cause actual results to differ materially from those expressed in forward-looking statements made by us or on our behalf.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

We lease the building space at all of our branches except two branches in Florida which we own. Under the majority of these leases, both parties to the agreement have the right to terminate the lease on 90 days notice. A small percentage of leases provide for a minimum lease term in excess of one year. We own an office building in Tacoma, Washington, which serves as our headquarters. Management believes all of our facilities are currently suitable for their intended use.

See discussion of Legal contingencies and developments in Note 13 to the consolidated financial statements included in Item 8 of this Annual Report on Form 10-K.

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the fourth quarter ended December 25, 2009.

PART II

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is listed on the New York Stock Exchange under the ticker symbol TBI. The table below sets forth the high and low sales prices for our common stock as reported by the New York Stock Exchange during the last two fiscal years:

| | | | | | |

| | | High | | Low |

December 25, 2009: | | | | | | |

Fourth Quarter | | $ | 15.49 | | $ | 11.69 |

Third Quarter | | | 15.29 | | | 7.55 |

Second Quarter | | | 10.29 | | | 7.60 |

First Quarter | | | 10.47 | | | 5.95 |

December 26, 2008: | | | | | | |

Fourth Quarter | | $ | 16.23 | | $ | 5.57 |

Third Quarter | | | 17.50 | | | 12.39 |

Second Quarter | | | 14.65 | | | 12.00 |

First Quarter | | | 15.00 | | | 11.01 |

Holders of the Corporation’s Capital Stock

We had approximately 1,030 shareholders of record as of February 5, 2010.

Dividends

No cash dividends have been declared on our common stock to date nor have any decisions been made to pay a dividend in the future. Payment of dividends is evaluated on a periodic basis and if a dividend were paid, it would be subject to the covenants of our lending facility, which may have the effect of restricting our ability to pay dividends.

Issuer Purchases of Equity Securities

We did not purchase any shares of our common stock under our authorized share purchase program during 2009. Pursuant to our share purchase program, we purchased and retired 1.2 million shares of our common stock for a total of $16.0 million during 2008 and 7.6 million shares of our common stock for a total of $150.3 million during 2007. Any future common stock repurchases are subject to the covenants of our lending facility, which may have the effect of restricting our ability to repurchase common stock.

The table below includes purchases of our common stock pursuant to publicly announced plans or programs and those not made pursuant to publicly announced plans or programs during the thirteen weeks ended December 25, 2009.

| | | | | | | | | | | | |

| Period | | Total number of shares

purchased (1) | | | | Weighted average price

paid per share (2) | | Total number of shares

purchased as part of

publicly announced plans

or programs | | | | Maximum number of

shares (or approximate

dollar value) that may yet

be purchased under plans

or programs at period end

(3) |

9/26/09 through 10/23/09 | | 841 | | | | $14.59 | | — | | | | $21.5 million |

10/24/09 through 11/20/09 | | 973 | | | | $12.86 | | — | | | | $21.5 million |

11/21/09 through 12/25/09 | | 2,620 | | | | $13.42 | | — | | | | $21.5 million |

| | | | | | | | | | | | | |

Total | | 4,434 | | | | $13.52 | | 0 | | | | |

| | (1) | During the thirteen weeks ended December 25, 2009, we purchased 4,434 shares in order to satisfy employee tax withholding obligations upon the vesting of restricted stock. These shares were not acquired pursuant to any publicly announced purchase plan or program. |

| | (2) | Weighted average price paid per share does not include any adjustments for commissions. |

| | (3) | Our Board of Directors authorized a $100 million share purchase program in April 2007 that does not have an expiration date. An additional $21.5 million may be purchased by us pursuant to this program. We did not purchase any shares of our common stock pursuant to this program during the fifty-two weeks ended December 25, 2009. |

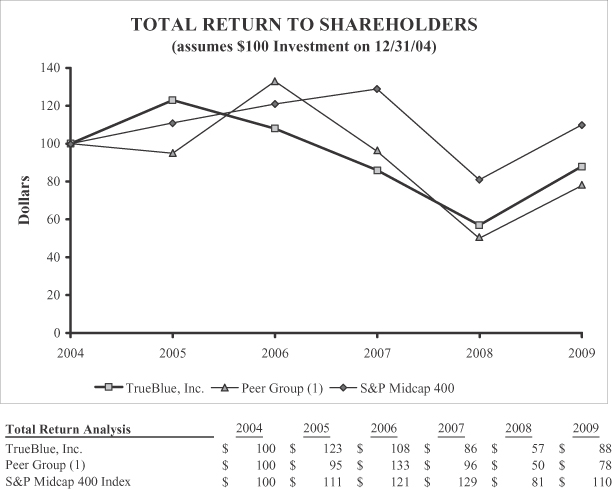

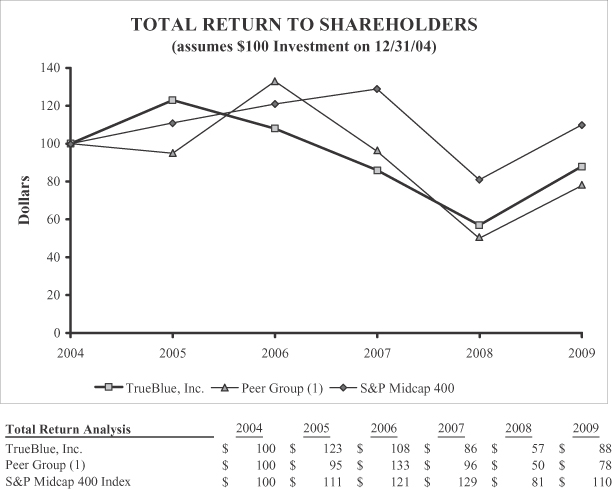

TrueBlue Stock Comparative Performance Graph

The following graph depicts our stock price performance from December 31, 2004 through December 25, 2009, relative to the performance of the S&P Midcap 400 Index, and a peer group of companies in the temporary staffing industry. All indices shown in the graph have been reset to a base of 100 as of December 31, 2004, and assume an investment of $100 on that date and the reinvestment of dividends, if any, paid since that date.

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN

Among TrueBlue, Inc., the S&P Midcap 400 Index

and Selected Peer Group

| | (1) | The peer group includes Kelly Services, Inc., Manpower, Inc., Volt Information Sciences, Inc., Spherion Corp. and Adecco SA. |

| Item 6. | SELECTED FINANCIAL DATA |

The following selected consolidated financial information has been derived from our audited Consolidated Financial Statements. The data should be read in conjunction with item 1A “Risk Factors”, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and the notes included in Item 8 of this Annual Report on Form 10-K.

Summary Consolidated Financial and Operating Data

(in millions, except per share data and number of branches)

| | | | | | | | | | | | | | | | |

| | | 2009 | | 2008 | | | 2007 | | 2006 | | 2005 |

Statements of Operations Data: | | | | | | | | | | | | | | | | |

Revenue from services | | $ | 1,018.4 | | $ | 1,384.3 | | | $ | 1,385.7 | | $ | 1,349.1 | | $ | 1,236.1 |

Cost of services | | | 727.4 | | | 971.8 | | | | 943.6 | | | 915.8 | | | 844.4 |

| | | | | | | | | | | | | | | | |

Gross profit | | | 291.0 | | | 412.5 | | | | 442.1 | | | 433.3 | | | 391.7 |

Selling, general and administrative expenses | | | 262.2 | | | 332.1 | | | | 336.2 | | | 318.7 | | | 286.5 |

Goodwill and intangible asset impairment | | | — | | | 61.0 | | | | — | | | — | | | — |

Depreciation and amortization | | | 17.0 | | | 16.8 | | | | 12.2 | | | 10.3 | | | 9.6 |

Interest and other income, net | | | 2.3 | | | 5.5 | | | | 10.9 | | | 11.9 | | | 4.6 |

| | | | | | | | | | | | | | | | |

Income before tax expenses | | | 14.1 | | | 8.1 | | | | 104.6 | | | 116.2 | | | 100.2 |

Income tax expense | | | 5.3 | | | 12.3 | | | | 38.4 | | | 39.7 | | | 38.2 |

| | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 8.8 | | $ | (4.2 | ) | | $ | 66.2 | | $ | 76.5 | | $ | 62.0 |

| | | | | | | | | | | | | | | | |

| | | | | |

Net income (loss) per diluted share | | $ | 0.20 | | $ | (0.10 | ) | | $ | 1.44 | | $ | 1.45 | | $ | 1.18 |

Weighted average diluted shares outstanding | | | 43.0 | | | 43.1 | | | | 46.0 | | | 52.9 | | | 53.8 |

| | | | | | | | | | | | | | | |

| | | At Fiscal Year End, |

| | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 |

Balance Sheet Data: | | | | | | | | | | | | | | | |

Working capital | | $ | 163.2 | | $ | 147.5 | | $ | 115.0 | | $ | 238.4 | | $ | 218.6 |

Total assets | | | 518.1 | | | 519.7 | | | 545.2 | | | 592.3 | | | 572.1 |

Long-term liabilities | | | 147.9 | | | 154.2 | | | 146.9 | | | 138.4 | | | 123.5 |

Total liabilities | | $ | 232.7 | | $ | 249.5 | | $ | 261.4 | | $ | 239.8 | | $ | 223.5 |

| | | | | |

Branches open at period end | | | 754 | | | 850 | | | 894 | | | 912 | | | 887 |

The operating results reported above include the results of acquisitions subsequent to their respective purchase dates:

| | • | | In May 2005, we acquired 100% of the common stock of CLP Holdings Corp; |

| | • | | In April 2007, we acquired 100% of the common stock of Skilled Services Corporation and in December 2007, we acquired substantially all of the assets of PlaneTechs, LLC; |

| | • | | In February 2008, we acquired substantially all of the assets of TLC Services Group, Inc. and in April 2008, we acquired 100% of the common stock of Personnel Management, Inc. |

No cash dividends have been declared on our common stock to date nor have any decisions been made to pay a dividend in the future.

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with, and is qualified in its entirety by, the Consolidated Financial Statements and Notes thereto included elsewhere in this Annual Report on Form 10-K. This item contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those indicated in such forward-looking statements. Factors that may cause such a difference include, but are not limited to, those discussed in “Item 1A, Risk Factors.”

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is designed to provide the reader of our financial statements with a narrative from the perspective of management on our financial condition, results of operations, liquidity and certain other factors that may affect future results. Our MD&A is presented in six sections:

| | • | | Liquidity and Capital Resources |

| | • | | Contractual Obligations and Commitments |

| | • | | Summary of Critical Accounting Policies and Estimates |

| | • | | New Accounting Standards |

OVERVIEW

TrueBlue, Inc. (“TrueBlue,” “we,” “us,” “our”) is a provider of temporary blue-collar staffing. The temporary staffing industry includes a number of markets focusing on business needs that vary widely in duration of assignment and level of technical specialization. We operate within the blue-collar staffing market of the temporary staffing industry. In 2009, we connected approximately 300,000 people to work through the following blue-collar staffing brands:

| | • | | Labor Ready for general labor; |

| | • | | Spartan Staffing for light industrial services; |

| | • | | CLP Resources for skilled trades; |

| | • | | PlaneTechs for aviation and diesel mechanics and technicians; and |

| | • | | Centerline, formerly Transportation Logistics Company, for dedicated and temporary drivers. |

Headquartered in Tacoma, Washington, we serve approximately 175,000 businesses primarily in the services, construction, transportation, manufacturing, retail, and wholesale industries.

We continue to face a challenging economic climate with customer spending being negatively impacted by the global recession as well as an increasingly competitive landscape. We experienced a significant decrease in demand for blue-collar staffing during 2009. The recession began in 2008 and continued throughout 2009. Excluding the impact of acquisitions, we experienced revenue declines of 26.4% in 2009 and 15.7% in 2008. We began in 2008 to scale our cost structure to meet the declining demand for our services. Those efforts continued throughout 2009 and helped to ensure our continued profitability. We believe the following actions have put us in a strong position to face the on-going challenges of the current economic climate and increase profitability when the economic conditions improve.

| | • | | During 2009, we closed 105 branches. During 2008, we closed 73 branches and sold the remaining 29 branches in the United Kingdom for a total reduction of 102 branches. Primary factors influencing which branches we closed included financial performance, ability to consolidate with another branch, tenure and quality of branch management, and long-term potential of the location. |

| | • | | We reduced selling, general and administrative expenses in 2009 by $70 million in comparison with 2008. This resulted from a reduction in branch locations, field management personnel, corporate support services and various program expenses. |

| | • | | On June 22, 2009, we entered into a credit agreement with Wells Fargo Foothill, LLC and Bank of America, N.A. for a secured revolving credit facility of up to a maximum of $80 million. The revolving credit facility, which expires June 2012, replaces our previous $80 million revolving credit facility with Wells Fargo Bank, N.A. and Bank of America, N.A., which was set to expire in April of 2011. Borrowing availability is principally based on accounts receivable and the value of the company’s corporate building whereas borrowing availability under the previous facility was based on EBITDA. We believe the new credit facility provides more borrowing availability during challenging economic conditions in comparison with the previous credit facility. |

| | • | | On July 22, 2009, we filed a $100 million Shelf Registration Statement with the Securities and Exchange Commission that allows us to sell various securities in amounts and prices determined at the time of sale. The filing enables us to access capital efficiently and quickly if needed; however, we have no current plans to make an offering. |

| | • | | On July 1, 2009, we negotiated the return of $39.2 million of collateral from our primary workers’ compensation insurance carrier. The collateral return came in the form of a $30.6 million reduction in letters of credit issued to the carrier that was completed in September 2009, and an $8.6 million credit to be applied against future restricted cash deposits for the new 2009/2010 policy year. As of December 25, 2009, $5.3 million of credits had been applied against restricted cash deposits. |

The actions above enabled us to generate positive cash flows, maintain a strong balance sheet, improve our liquidity, and overall financial flexibility. We also made significant investments in technology, which we believe will improve our branch operations.

The U.S. economy remains weak and as a result we continue to experience pressure on the demand for blue-collar staffing, which continues to negatively impact our performance. We experienced some improvements towards the end of 2009. However, we believe the markets we serve will continue to experience pressure and that customers will continue to be sensitive to bill rate increases until the overall economy has returned to sustained growth. We have no current plans to open any new branches and will continue to analyze branch performance and scale operations as needed in response to the recovering economy. We will continue to focus on providing exceptional service to our customers while balancing the need for aggressive cost management and maintaining a strong balance sheet.

RESULTS OF OPERATIONS

The following table presents the Consolidated Statements of Operations as a percent of revenue (except effective income tax rate and per share amounts):

| | | | | | | | | | | | |

| | | 2009 | | | 2008 | | | 2007 | |

Revenue from services | | | 100.0% | | | | 100.0% | | | | 100.0% | |

Cost of services | | | 71.4% | | | | 70.2% | | | | 68.1% | |

| | | | | | | | | | | | |

Gross profit | | | 28.6% | | | | 29.8% | | | | 31.9% | |

Selling, general and administrative expenses | | | 25.7% | | | | 24.0% | | | | 24.3% | |

Goodwill and intangible asset impairment | | | — | | | | 4.4% | | | | — | |

Depreciation and amortization | | | 1.7% | | | | 1.2% | | | | 0.8% | |

| | | | | | | | | | | | |

Income from operations | | | 1.2% | | | | 0.2% | | | | 6.8% | |

Interest expense | | | (0.1% | ) | | | (0.1% | ) | | | (0.1% | ) |

Interest and other income | | | 0.3% | | | | 0.5% | | | | 0.9% | |

| | | | | | | | | | | | |

Interest and other income, net | | | 0.2% | | | | 0.4% | | | | 0.8% | |