UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04409

Eaton Vance Municipals Trust

(Exact Name of Registrant as Specified in Charter)

One Post Office Square, Boston, Massachusetts 02109

(Address of Principal Executive Offices)

Deidre E. Walsh

One Post Office Square, Boston, Massachusetts 02109

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2024

Date of Reporting Period

Item 1. Reports to Stockholders

(a)

Eaton Vance California Municipal Opportunities Fund

Class A EACAX

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about the Eaton Vance California Municipal Opportunities Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class A | $79 | 0.75% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ Out-of-Index positions in variable-rate demand notes and floating-rate notes — typically considered defensive investments with virtually zero duration — detracted from returns relative to the Index as interest rates generally declined during the period

↓ Security selections and an underweight position in the health care sector, which outperformed the Index, detracted from performance relative to the Index

↓ Security selections and an underweight position in A-rated bonds hampered performance as lower-rated bonds generally outperformed higher-rated bonds

↑ An overweight position in bonds with 17 years or more remaining to maturity contributed to Index-relative returns as longer-maturity bonds generally outperformed shorter-maturity bonds during the period

↑ Tactical short-term U.S. Treasury futures trades, which were not present at period-end, contributed to performance relative to the Index during the period

↑ Security selections in general obligation bonds contributed to returns relative to the Index during the period

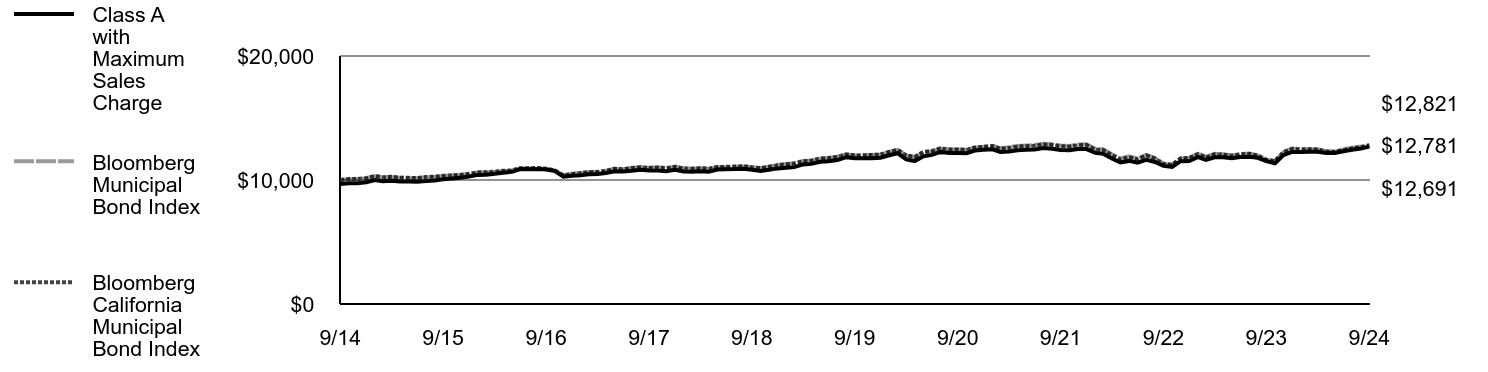

Fund Performance

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | Bloomberg Municipal Bond Index | Bloomberg California Municipal Bond Index | |

|---|---|---|---|

| 9/14 | $9,675 | $10,000 | $10,000 |

| 10/14 | $9,743 | $10,069 | $10,072 |

| 11/14 | $9,745 | $10,086 | $10,084 |

| 12/14 | $9,822 | $10,137 | $10,140 |

| 1/15 | $9,995 | $10,317 | $10,314 |

| 2/15 | $9,892 | $10,210 | $10,220 |

| 3/15 | $9,932 | $10,240 | $10,252 |

| 4/15 | $9,876 | $10,186 | $10,195 |

| 5/15 | $9,878 | $10,158 | $10,172 |

| 6/15 | $9,850 | $10,148 | $10,163 |

| 7/15 | $9,909 | $10,222 | $10,240 |

| 8/15 | $9,957 | $10,242 | $10,268 |

| 9/15 | $10,054 | $10,316 | $10,339 |

| 10/15 | $10,112 | $10,357 | $10,377 |

| 11/15 | $10,189 | $10,398 | $10,417 |

| 12/15 | $10,277 | $10,472 | $10,496 |

| 1/16 | $10,413 | $10,596 | $10,611 |

| 2/16 | $10,430 | $10,613 | $10,628 |

| 3/16 | $10,495 | $10,647 | $10,664 |

| 4/16 | $10,590 | $10,725 | $10,745 |

| 5/16 | $10,654 | $10,754 | $10,776 |

| 6/16 | $10,887 | $10,925 | $10,946 |

| 7/16 | $10,861 | $10,932 | $10,951 |

| 8/16 | $10,892 | $10,947 | $10,969 |

| 9/16 | $10,842 | $10,892 | $10,902 |

| 10/16 | $10,720 | $10,778 | $10,775 |

| 11/16 | $10,266 | $10,376 | $10,360 |

| 12/16 | $10,348 | $10,497 | $10,482 |

| 1/17 | $10,391 | $10,567 | $10,564 |

| 2/17 | $10,455 | $10,640 | $10,625 |

| 3/17 | $10,489 | $10,663 | $10,646 |

| 4/17 | $10,563 | $10,741 | $10,721 |

| 5/17 | $10,708 | $10,911 | $10,900 |

| 6/17 | $10,679 | $10,872 | $10,863 |

| 7/17 | $10,743 | $10,960 | $10,959 |

| 8/17 | $10,827 | $11,043 | $11,026 |

| 9/17 | $10,776 | $10,987 | $10,975 |

| 10/17 | $10,756 | $11,014 | $11,010 |

| 11/17 | $10,716 | $10,955 | $10,951 |

| 12/17 | $10,821 | $11,069 | $11,071 |

| 1/18 | $10,687 | $10,939 | $10,939 |

| 2/18 | $10,659 | $10,906 | $10,904 |

| 3/18 | $10,713 | $10,947 | $10,953 |

| 4/18 | $10,674 | $10,908 | $10,908 |

| 5/18 | $10,845 | $11,033 | $11,055 |

| 6/18 | $10,868 | $11,042 | $11,059 |

| 7/18 | $10,881 | $11,069 | $11,085 |

| 8/18 | $10,914 | $11,097 | $11,119 |

| 9/18 | $10,832 | $11,025 | $11,034 |

| 10/18 | $10,728 | $10,957 | $10,958 |

| 11/18 | $10,826 | $11,079 | $11,072 |

| 12/18 | $10,936 | $11,211 | $11,194 |

| 1/19 | $10,991 | $11,296 | $11,267 |

| 2/19 | $11,037 | $11,357 | $11,323 |

| 3/19 | $11,255 | $11,536 | $11,509 |

| 4/19 | $11,300 | $11,579 | $11,560 |

| 5/19 | $11,474 | $11,739 | $11,729 |

| 6/19 | $11,518 | $11,782 | $11,769 |

| 7/19 | $11,605 | $11,877 | $11,868 |

| 8/19 | $11,843 | $12,065 | $12,060 |

| 9/19 | $11,755 | $11,968 | $11,970 |

| 10/19 | $11,753 | $11,989 | $11,991 |

| 11/19 | $11,763 | $12,019 | $12,018 |

| 12/19 | $11,802 | $12,056 | $12,053 |

| 1/20 | $11,997 | $12,273 | $12,269 |

| 2/20 | $12,161 | $12,431 | $12,428 |

| 3/20 | $11,665 | $11,980 | $11,994 |

| 4/20 | $11,522 | $11,830 | $11,865 |

| 5/20 | $11,908 | $12,206 | $12,267 |

| 6/20 | $12,028 | $12,307 | $12,338 |

| 7/20 | $12,266 | $12,514 | $12,550 |

| 8/20 | $12,183 | $12,455 | $12,467 |

| 9/20 | $12,175 | $12,458 | $12,463 |

| 10/20 | $12,157 | $12,420 | $12,429 |

| 11/20 | $12,373 | $12,608 | $12,621 |

| 12/20 | $12,430 | $12,685 | $12,673 |

| 1/21 | $12,476 | $12,765 | $12,734 |

| 2/21 | $12,266 | $12,563 | $12,502 |

| 3/21 | $12,298 | $12,640 | $12,589 |

| 4/21 | $12,399 | $12,746 | $12,689 |

| 5/21 | $12,433 | $12,784 | $12,724 |

| 6/21 | $12,467 | $12,819 | $12,757 |

| 7/21 | $12,571 | $12,926 | $12,863 |

| 8/21 | $12,515 | $12,878 | $12,819 |

| 9/21 | $12,426 | $12,785 | $12,725 |

| 10/21 | $12,404 | $12,748 | $12,689 |

| 11/21 | $12,496 | $12,856 | $12,802 |

| 12/21 | $12,494 | $12,877 | $12,827 |

| 1/22 | $12,187 | $12,525 | $12,447 |

| 2/22 | $12,121 | $12,480 | $12,409 |

| 3/22 | $11,736 | $12,075 | $11,996 |

| 4/22 | $11,420 | $11,741 | $11,649 |

| 5/22 | $11,540 | $11,916 | $11,845 |

| 6/22 | $11,400 | $11,720 | $11,662 |

| 7/22 | $11,626 | $12,030 | $11,990 |

| 8/22 | $11,453 | $11,766 | $11,734 |

| 9/22 | $11,140 | $11,315 | $11,300 |

| 10/22 | $11,050 | $11,221 | $11,226 |

| 11/22 | $11,518 | $11,746 | $11,742 |

| 12/22 | $11,524 | $11,779 | $11,780 |

| 1/23 | $11,855 | $12,118 | $12,098 |

| 2/23 | $11,630 | $11,844 | $11,823 |

| 3/23 | $11,836 | $12,106 | $12,081 |

| 4/23 | $11,832 | $12,079 | $12,050 |

| 5/23 | $11,757 | $11,974 | $11,950 |

| 6/23 | $11,847 | $12,094 | $12,068 |

| 7/23 | $11,878 | $12,142 | $12,117 |

| 8/23 | $11,791 | $11,967 | $11,977 |

| 9/23 | $11,516 | $11,616 | $11,633 |

| 10/23 | $11,347 | $11,517 | $11,532 |

| 11/23 | $12,014 | $12,249 | $12,237 |

| 12/23 | $12,264 | $12,533 | $12,513 |

| 1/24 | $12,262 | $12,469 | $12,462 |

| 2/24 | $12,272 | $12,485 | $12,476 |

| 3/24 | $12,282 | $12,485 | $12,461 |

| 4/24 | $12,172 | $12,330 | $12,301 |

| 5/24 | $12,181 | $12,294 | $12,264 |

| 6/24 | $12,325 | $12,482 | $12,436 |

| 7/24 | $12,432 | $12,596 | $12,547 |

| 8/24 | $12,540 | $12,696 | $12,652 |

| 9/24 | $12,691 | $12,821 | $12,781 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

| Class A | 10.16% | 1.53% | 2.74% |

| Class A with 3.25% Maximum Sales Charge | 6.53% | 0.87% | 2.41% |

| Bloomberg Municipal Bond Index | 10.37% | 1.38% | 2.51% |

| Bloomberg California Municipal Bond Index | 9.87% | 1.32% | 2.48% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

Key Fund Statistics

| Total Net Assets | $942,281,175 |

| # of Portfolio Holdings | 284 |

| Portfolio Turnover Rate | 173% |

| Total Advisory Fees Paid | $3,457,213 |

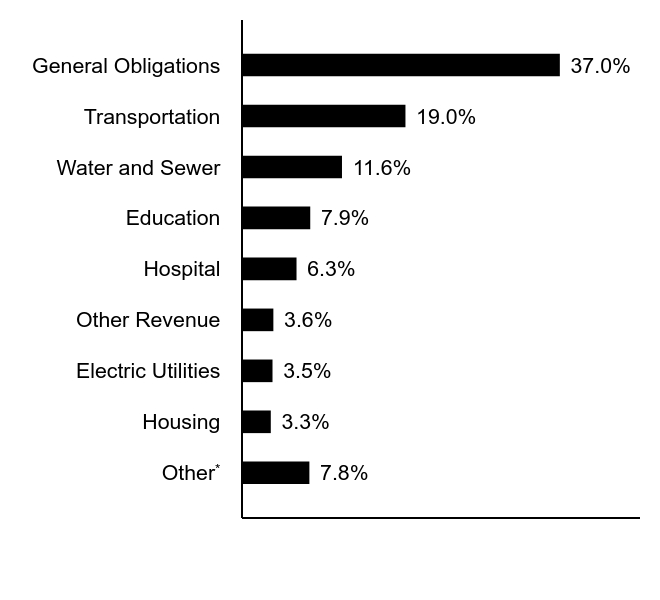

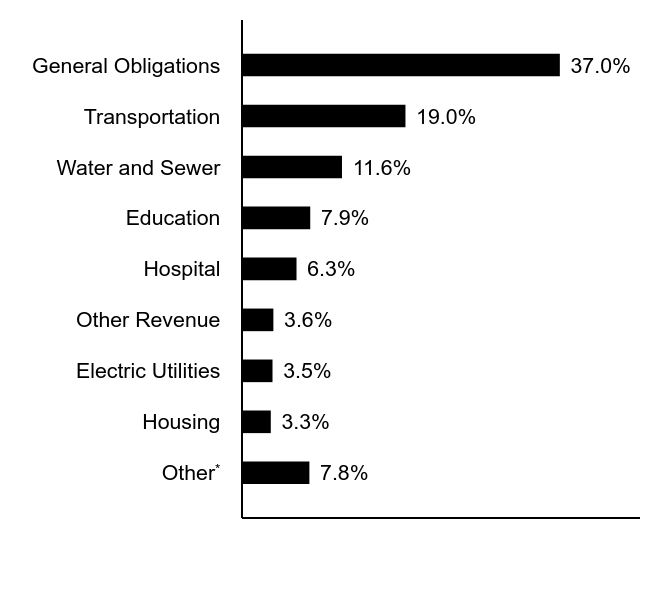

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|---|

OtherFootnote Reference* | 7.8% |

| Housing | 3.3% |

| Electric Utilities | 3.5% |

| Other Revenue | 3.6% |

| Hospital | 6.3% |

| Education | 7.9% |

| Water and Sewer | 11.6% |

| Transportation | 19.0% |

| General Obligations | 37.0% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

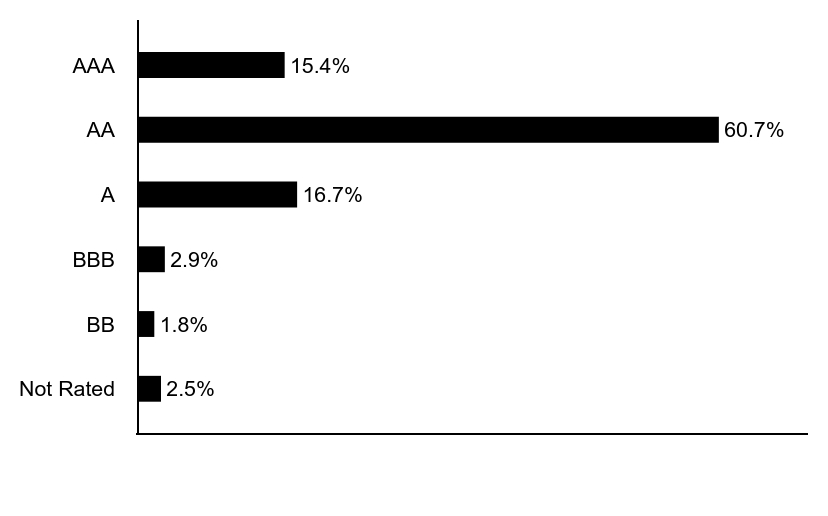

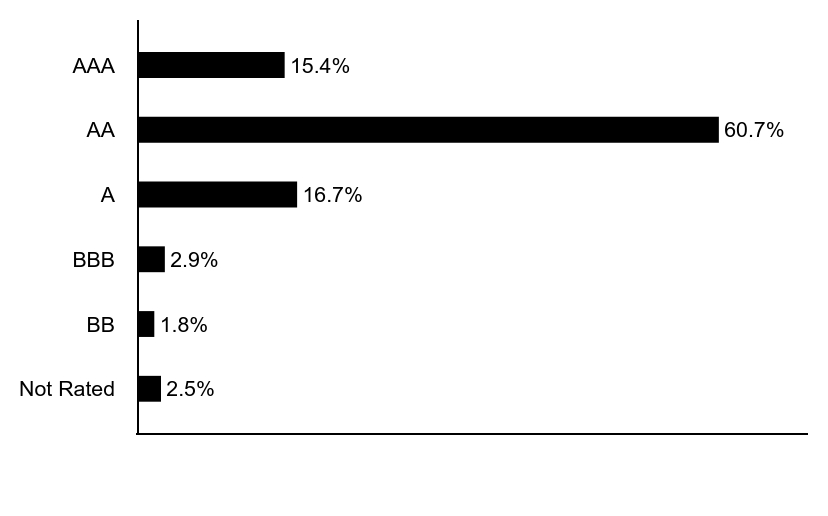

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|---|

| Not Rated | 2.5% |

| BB | 1.8% |

| BBB | 2.9% |

| A | 16.7% |

| AA | 60.7% |

| AAA | 15.4% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

Additional Information

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

Householding

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

EACAX-TSR-AR

Eaton Vance California Municipal Opportunities Fund

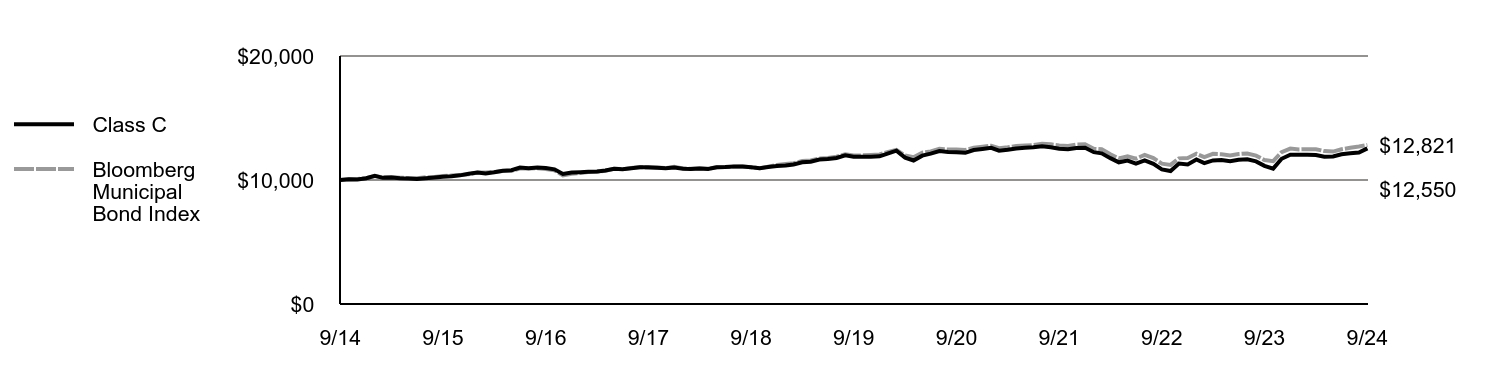

Class C ECCAX

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about the Eaton Vance California Municipal Opportunities Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class C | $157 | 1.50% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ Out-of-Index positions in variable-rate demand notes and floating-rate notes — typically considered defensive investments with virtually zero duration — detracted from returns relative to the Index as interest rates generally declined during the period

↓ Security selections and an underweight position in the health care sector, which outperformed the Index, detracted from performance relative to the Index

↓ Security selections and an underweight position in A-rated bonds hampered performance as lower-rated bonds generally outperformed higher-rated bonds

↑ An overweight position in bonds with 17 years or more remaining to maturity contributed to Index-relative returns as longer-maturity bonds generally outperformed shorter-maturity bonds during the period

↑ Tactical short-term U.S. Treasury futures trades, which were not present at period-end, contributed to performance relative to the Index during the period

↑ Security selections in general obligation bonds contributed to returns relative to the Index during the period

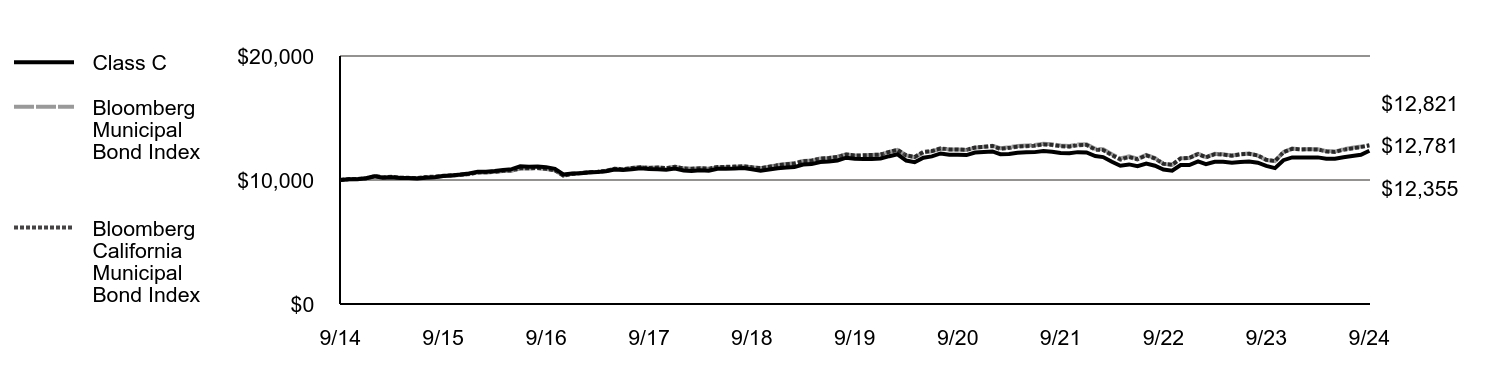

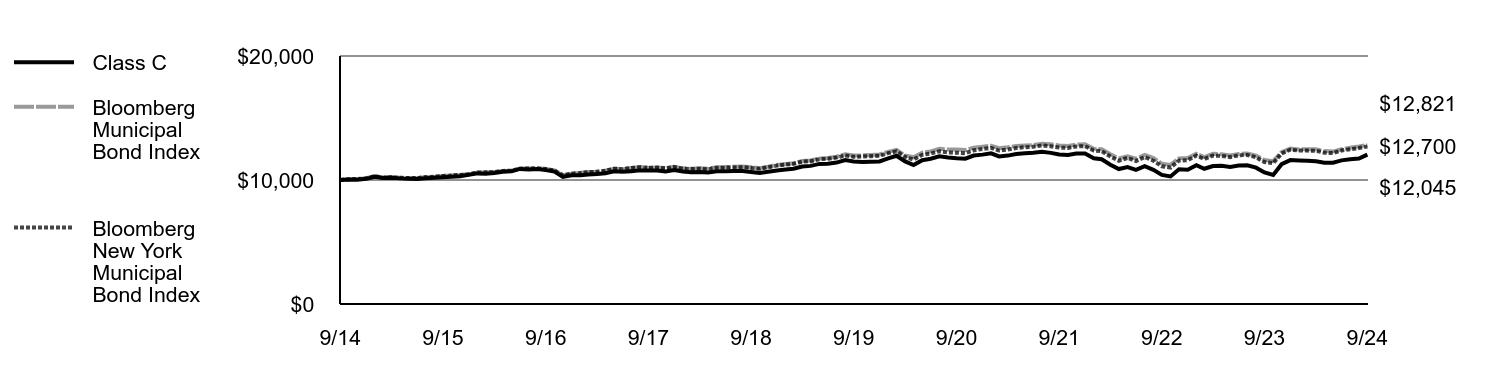

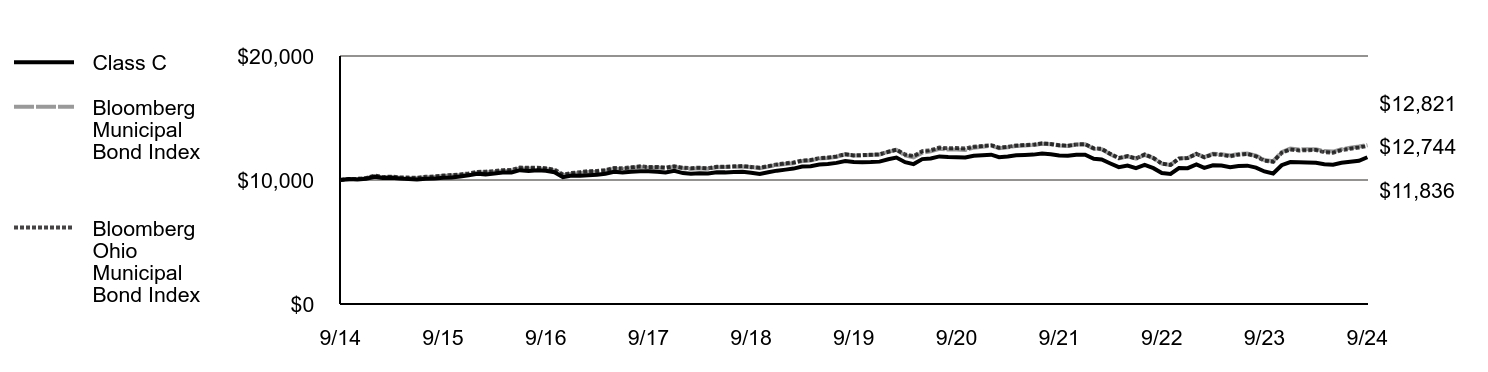

Fund Performance

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | Bloomberg Municipal Bond Index | Bloomberg California Municipal Bond Index | |

|---|---|---|---|

| 9/14 | $10,000 | $10,000 | $10,000 |

| 10/14 | $10,067 | $10,069 | $10,072 |

| 11/14 | $10,060 | $10,086 | $10,084 |

| 12/14 | $10,138 | $10,137 | $10,140 |

| 1/15 | $10,301 | $10,317 | $10,314 |

| 2/15 | $10,187 | $10,210 | $10,220 |

| 3/15 | $10,223 | $10,240 | $10,252 |

| 4/15 | $10,163 | $10,186 | $10,195 |

| 5/15 | $10,156 | $10,158 | $10,172 |

| 6/15 | $10,117 | $10,148 | $10,163 |

| 7/15 | $10,184 | $10,222 | $10,240 |

| 8/15 | $10,229 | $10,242 | $10,268 |

| 9/15 | $10,317 | $10,316 | $10,339 |

| 10/15 | $10,371 | $10,357 | $10,377 |

| 11/15 | $10,438 | $10,398 | $10,417 |

| 12/15 | $10,526 | $10,472 | $10,496 |

| 1/16 | $10,656 | $10,596 | $10,611 |

| 2/16 | $10,666 | $10,613 | $10,628 |

| 3/16 | $10,730 | $10,647 | $10,664 |

| 4/16 | $10,815 | $10,725 | $10,745 |

| 5/16 | $10,877 | $10,754 | $10,776 |

| 6/16 | $11,103 | $10,925 | $10,946 |

| 7/16 | $11,065 | $10,932 | $10,951 |

| 8/16 | $11,091 | $10,947 | $10,969 |

| 9/16 | $11,037 | $10,892 | $10,902 |

| 10/16 | $10,906 | $10,778 | $10,775 |

| 11/16 | $10,443 | $10,376 | $10,360 |

| 12/16 | $10,525 | $10,497 | $10,482 |

| 1/17 | $10,552 | $10,567 | $10,564 |

| 2/17 | $10,614 | $10,640 | $10,625 |

| 3/17 | $10,642 | $10,663 | $10,646 |

| 4/17 | $10,704 | $10,741 | $10,721 |

| 5/17 | $10,843 | $10,911 | $10,900 |

| 6/17 | $10,814 | $10,872 | $10,863 |

| 7/17 | $10,864 | $10,960 | $10,959 |

| 8/17 | $10,947 | $11,043 | $11,026 |

| 9/17 | $10,883 | $10,987 | $10,975 |

| 10/17 | $10,864 | $11,014 | $11,010 |

| 11/17 | $10,822 | $10,955 | $10,951 |

| 12/17 | $10,917 | $11,069 | $11,071 |

| 1/18 | $10,774 | $10,939 | $10,939 |

| 2/18 | $10,735 | $10,906 | $10,904 |

| 3/18 | $10,786 | $10,947 | $10,953 |

| 4/18 | $10,746 | $10,908 | $10,908 |

| 5/18 | $10,911 | $11,033 | $11,055 |

| 6/18 | $10,917 | $11,042 | $11,059 |

| 7/18 | $10,922 | $11,069 | $11,085 |

| 8/18 | $10,961 | $11,097 | $11,119 |

| 9/18 | $10,874 | $11,025 | $11,034 |

| 10/18 | $10,752 | $10,957 | $10,958 |

| 11/18 | $10,851 | $11,079 | $11,072 |

| 12/18 | $10,949 | $11,211 | $11,194 |

| 1/19 | $11,000 | $11,296 | $11,267 |

| 2/19 | $11,042 | $11,357 | $11,323 |

| 3/19 | $11,244 | $11,536 | $11,509 |

| 4/19 | $11,284 | $11,579 | $11,560 |

| 5/19 | $11,452 | $11,739 | $11,729 |

| 6/19 | $11,491 | $11,782 | $11,769 |

| 7/19 | $11,575 | $11,877 | $11,868 |

| 8/19 | $11,799 | $12,065 | $12,060 |

| 9/19 | $11,707 | $11,968 | $11,970 |

| 10/19 | $11,696 | $11,989 | $11,991 |

| 11/19 | $11,698 | $12,019 | $12,018 |

| 12/19 | $11,730 | $12,056 | $12,053 |

| 1/20 | $11,920 | $12,273 | $12,269 |

| 2/20 | $12,075 | $12,431 | $12,428 |

| 3/20 | $11,569 | $11,980 | $11,994 |

| 4/20 | $11,430 | $11,830 | $11,865 |

| 5/20 | $11,800 | $12,206 | $12,267 |

| 6/20 | $11,907 | $12,307 | $12,338 |

| 7/20 | $12,141 | $12,514 | $12,550 |

| 8/20 | $12,043 | $12,455 | $12,467 |

| 9/20 | $12,038 | $12,458 | $12,463 |

| 10/20 | $12,010 | $12,420 | $12,429 |

| 11/20 | $12,220 | $12,608 | $12,621 |

| 12/20 | $12,260 | $12,685 | $12,673 |

| 1/21 | $12,301 | $12,765 | $12,734 |

| 2/21 | $12,080 | $12,563 | $12,502 |

| 3/21 | $12,106 | $12,640 | $12,589 |

| 4/21 | $12,193 | $12,746 | $12,689 |

| 5/21 | $12,232 | $12,784 | $12,724 |

| 6/21 | $12,248 | $12,819 | $12,757 |

| 7/21 | $12,337 | $12,926 | $12,863 |

| 8/21 | $12,281 | $12,878 | $12,819 |

| 9/21 | $12,178 | $12,785 | $12,725 |

| 10/21 | $12,158 | $12,748 | $12,689 |

| 11/21 | $12,247 | $12,856 | $12,802 |

| 12/21 | $12,224 | $12,877 | $12,827 |

| 1/22 | $11,927 | $12,525 | $12,447 |

| 2/22 | $11,849 | $12,480 | $12,409 |

| 3/22 | $11,469 | $12,075 | $11,996 |

| 4/22 | $11,151 | $11,741 | $11,649 |

| 5/22 | $11,257 | $11,916 | $11,845 |

| 6/22 | $11,113 | $11,720 | $11,662 |

| 7/22 | $11,330 | $12,030 | $11,990 |

| 8/22 | $11,151 | $11,766 | $11,734 |

| 9/22 | $10,849 | $11,315 | $11,300 |

| 10/22 | $10,746 | $11,221 | $11,226 |

| 11/22 | $11,205 | $11,746 | $11,742 |

| 12/22 | $11,201 | $11,779 | $11,780 |

| 1/23 | $11,504 | $12,118 | $12,098 |

| 2/23 | $11,282 | $11,844 | $11,823 |

| 3/23 | $11,476 | $12,106 | $12,081 |

| 4/23 | $11,462 | $12,079 | $12,050 |

| 5/23 | $11,387 | $11,974 | $11,950 |

| 6/23 | $11,459 | $12,094 | $12,068 |

| 7/23 | $11,494 | $12,142 | $12,117 |

| 8/23 | $11,393 | $11,967 | $11,977 |

| 9/23 | $11,133 | $11,616 | $11,633 |

| 10/23 | $10,960 | $11,517 | $11,532 |

| 11/23 | $11,597 | $12,249 | $12,237 |

| 12/23 | $11,823 | $12,533 | $12,513 |

| 1/24 | $11,822 | $12,469 | $12,462 |

| 2/24 | $11,824 | $12,485 | $12,476 |

| 3/24 | $11,824 | $12,485 | $12,461 |

| 4/24 | $11,711 | $12,330 | $12,301 |

| 5/24 | $11,712 | $12,294 | $12,264 |

| 6/24 | $11,838 | $12,482 | $12,436 |

| 7/24 | $11,927 | $12,596 | $12,547 |

| 8/24 | $12,029 | $12,696 | $12,652 |

| 9/24 | $12,355 | $12,821 | $12,781 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

| Class C | 9.20% | 0.76% | 2.14% |

| Class C with 1% Maximum Deferred Sales Charge | 8.20% | 0.76% | 2.14% |

| Bloomberg Municipal Bond Index | 10.37% | 1.38% | 2.51% |

| Bloomberg California Municipal Bond Index | 9.87% | 1.32% | 2.48% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

Key Fund Statistics

| Total Net Assets | $942,281,175 |

| # of Portfolio Holdings | 284 |

| Portfolio Turnover Rate | 173% |

| Total Advisory Fees Paid | $3,457,213 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|---|

OtherFootnote Reference* | 7.8% |

| Housing | 3.3% |

| Electric Utilities | 3.5% |

| Other Revenue | 3.6% |

| Hospital | 6.3% |

| Education | 7.9% |

| Water and Sewer | 11.6% |

| Transportation | 19.0% |

| General Obligations | 37.0% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

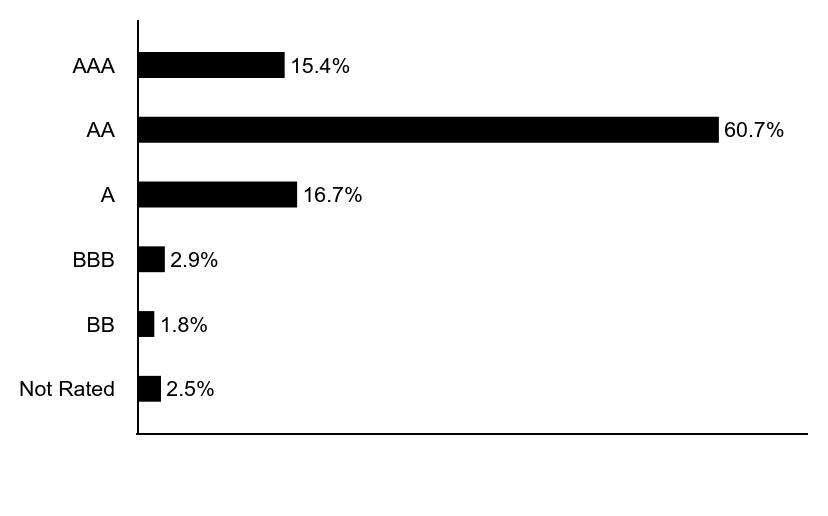

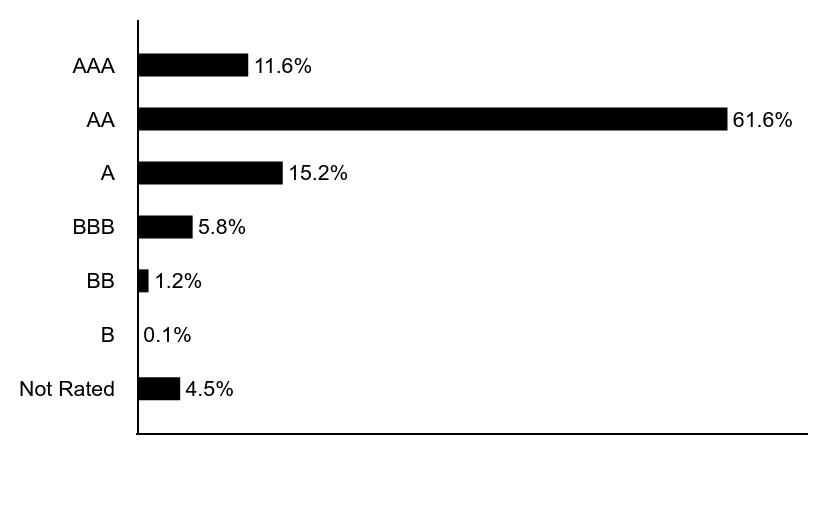

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|---|

| Not Rated | 2.5% |

| BB | 1.8% |

| BBB | 2.9% |

| A | 16.7% |

| AA | 60.7% |

| AAA | 15.4% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

Additional Information

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

Householding

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

ECCAX-TSR-AR

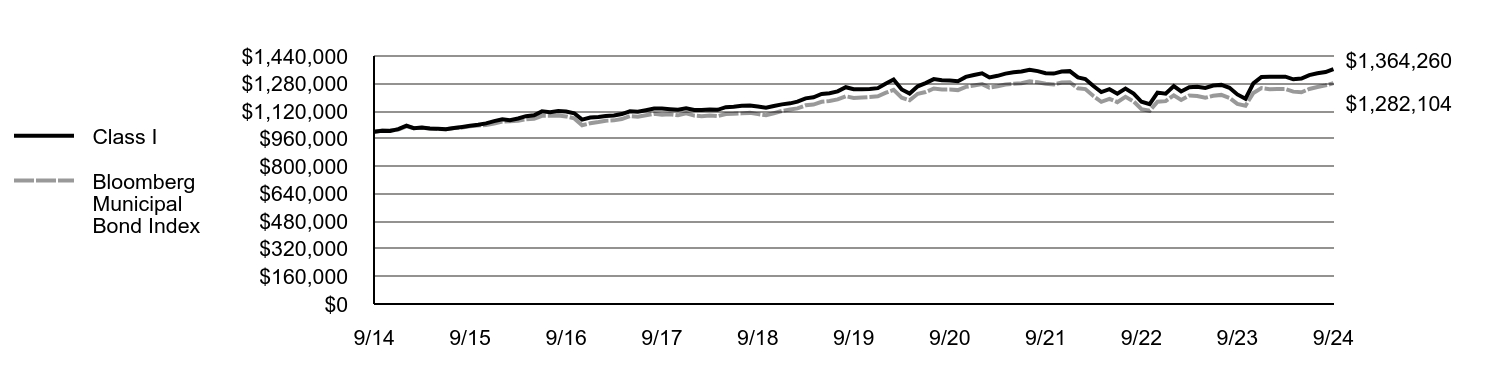

Eaton Vance California Municipal Opportunities Fund

Class I EICAX

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about the Eaton Vance California Municipal Opportunities Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class I | $53 | 0.50% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ Out-of-Index positions in variable-rate demand notes and floating-rate notes — typically considered defensive investments with virtually zero duration — detracted from returns relative to the Index as interest rates generally declined during the period

↓ Security selections and an underweight position in the health care sector, which outperformed the Index, detracted from performance relative to the Index

↓ Security selections and an underweight position in A-rated bonds hampered performance as lower-rated bonds generally outperformed higher-rated bonds

↑ An overweight position in bonds with 17 years or more remaining to maturity contributed to Index-relative returns as longer-maturity bonds generally outperformed shorter-maturity bonds during the period

↑ Tactical short-term U.S. Treasury futures trades, which were not present at period-end, contributed to performance relative to the Index during the period

↑ Security selections in general obligation bonds contributed to returns relative to the Index during the period

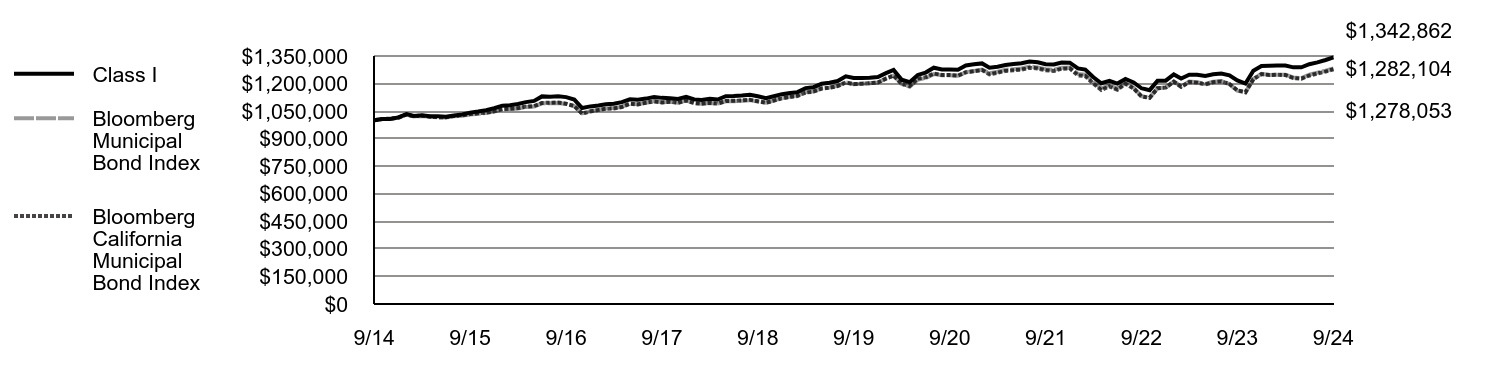

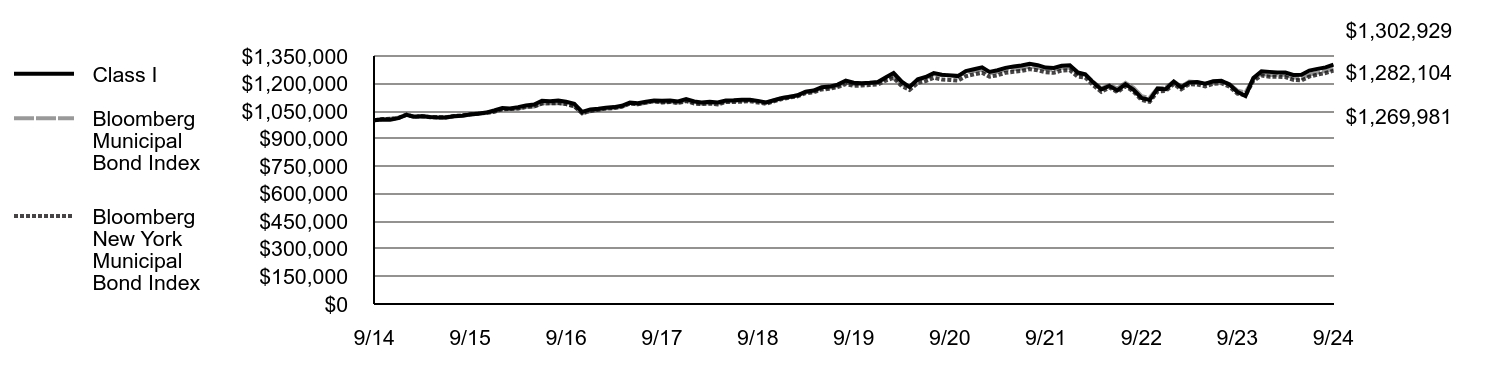

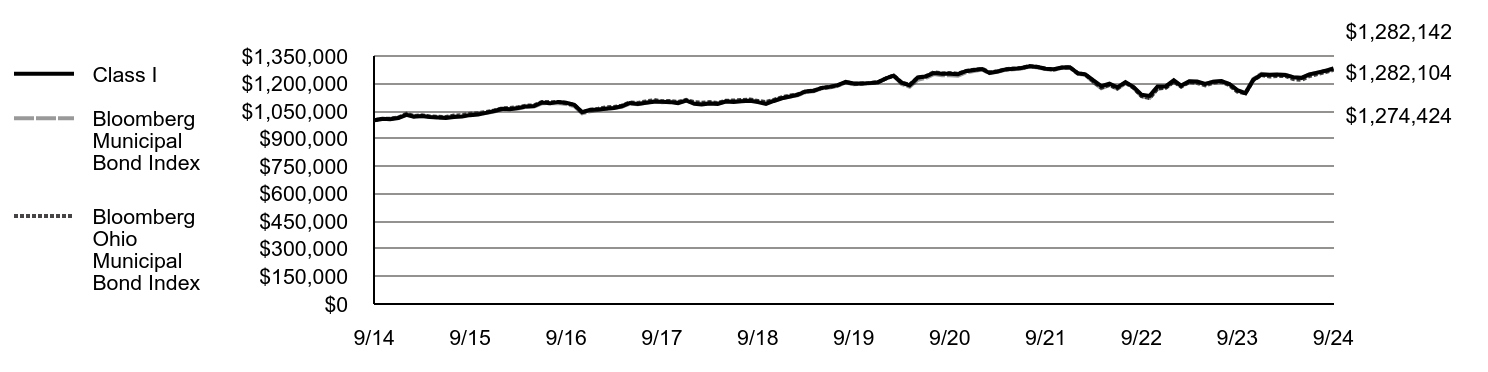

Fund Performance

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | Bloomberg Municipal Bond Index | Bloomberg California Municipal Bond Index | |

|---|---|---|---|

| 9/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 10/14 | $1,007,255 | $1,006,857 | $1,007,201 |

| 11/14 | $1,007,637 | $1,008,598 | $1,008,428 |

| 12/14 | $1,015,843 | $1,013,687 | $1,014,004 |

| 1/15 | $1,033,945 | $1,031,654 | $1,031,413 |

| 2/15 | $1,023,432 | $1,021,012 | $1,022,047 |

| 3/15 | $1,027,812 | $1,023,960 | $1,025,161 |

| 4/15 | $1,022,274 | $1,018,588 | $1,019,499 |

| 5/15 | $1,021,687 | $1,015,774 | $1,017,165 |

| 6/15 | $1,019,030 | $1,014,848 | $1,016,347 |

| 7/15 | $1,026,384 | $1,022,199 | $1,023,967 |

| 8/15 | $1,031,567 | $1,024,207 | $1,026,821 |

| 9/15 | $1,041,803 | $1,031,626 | $1,033,922 |

| 10/15 | $1,047,970 | $1,035,727 | $1,037,703 |

| 11/15 | $1,055,218 | $1,039,845 | $1,041,738 |

| 12/15 | $1,065,492 | $1,047,151 | $1,049,604 |

| 1/16 | $1,079,832 | $1,059,645 | $1,061,123 |

| 2/16 | $1,081,781 | $1,061,312 | $1,062,846 |

| 3/16 | $1,088,808 | $1,064,674 | $1,066,410 |

| 4/16 | $1,098,885 | $1,072,502 | $1,074,461 |

| 5/16 | $1,105,723 | $1,075,403 | $1,077,559 |

| 6/16 | $1,130,147 | $1,092,511 | $1,094,634 |

| 7/16 | $1,127,607 | $1,093,178 | $1,095,109 |

| 8/16 | $1,131,127 | $1,094,653 | $1,096,942 |

| 9/16 | $1,126,090 | $1,089,190 | $1,090,244 |

| 10/16 | $1,112,678 | $1,077,763 | $1,077,539 |

| 11/16 | $1,066,822 | $1,037,568 | $1,035,996 |

| 12/16 | $1,075,590 | $1,049,749 | $1,048,182 |

| 1/17 | $1,080,214 | $1,056,669 | $1,056,392 |

| 2/17 | $1,087,131 | $1,064,007 | $1,062,544 |

| 3/17 | $1,089,765 | $1,066,317 | $1,064,616 |

| 4/17 | $1,098,759 | $1,074,054 | $1,072,081 |

| 5/17 | $1,114,080 | $1,091,100 | $1,089,959 |

| 6/17 | $1,111,297 | $1,087,187 | $1,086,326 |

| 7/17 | $1,118,167 | $1,095,983 | $1,095,887 |

| 8/17 | $1,127,118 | $1,104,323 | $1,102,634 |

| 9/17 | $1,122,088 | $1,098,708 | $1,097,483 |

| 10/17 | $1,120,235 | $1,101,390 | $1,101,048 |

| 11/17 | $1,116,267 | $1,095,493 | $1,095,147 |

| 12/17 | $1,127,472 | $1,106,943 | $1,107,144 |

| 1/18 | $1,113,824 | $1,093,911 | $1,093,900 |

| 2/18 | $1,111,072 | $1,090,642 | $1,090,366 |

| 3/18 | $1,116,974 | $1,094,668 | $1,095,266 |

| 4/18 | $1,113,118 | $1,090,761 | $1,090,835 |

| 5/18 | $1,131,145 | $1,103,252 | $1,105,531 |

| 6/18 | $1,132,725 | $1,104,193 | $1,105,882 |

| 7/18 | $1,135,381 | $1,106,873 | $1,108,498 |

| 8/18 | $1,139,089 | $1,109,715 | $1,111,947 |

| 9/18 | $1,130,725 | $1,102,531 | $1,103,429 |

| 10/18 | $1,120,092 | $1,095,742 | $1,095,840 |

| 11/18 | $1,130,616 | $1,107,870 | $1,107,244 |

| 12/18 | $1,142,260 | $1,121,135 | $1,119,440 |

| 1/19 | $1,148,313 | $1,129,609 | $1,126,745 |

| 2/19 | $1,153,362 | $1,135,658 | $1,132,328 |

| 3/19 | $1,175,195 | $1,153,610 | $1,150,940 |

| 4/19 | $1,180,148 | $1,157,945 | $1,155,960 |

| 5/19 | $1,198,572 | $1,173,909 | $1,172,919 |

| 6/19 | $1,204,626 | $1,178,244 | $1,176,925 |

| 7/19 | $1,213,958 | $1,187,739 | $1,186,758 |

| 8/19 | $1,239,055 | $1,206,474 | $1,205,991 |

| 9/19 | $1,230,122 | $1,196,803 | $1,197,022 |

| 10/19 | $1,230,210 | $1,198,948 | $1,199,129 |

| 11/19 | $1,231,491 | $1,201,946 | $1,201,850 |

| 12/19 | $1,235,774 | $1,205,616 | $1,205,306 |

| 1/20 | $1,256,500 | $1,227,277 | $1,226,897 |

| 2/20 | $1,273,859 | $1,243,103 | $1,242,783 |

| 3/20 | $1,221,059 | $1,198,012 | $1,199,387 |

| 4/20 | $1,207,454 | $1,182,977 | $1,186,549 |

| 5/20 | $1,246,975 | $1,220,609 | $1,226,740 |

| 6/20 | $1,259,696 | $1,230,655 | $1,233,791 |

| 7/20 | $1,286,077 | $1,251,382 | $1,254,988 |

| 8/20 | $1,276,428 | $1,245,511 | $1,246,658 |

| 9/20 | $1,277,103 | $1,245,775 | $1,246,307 |

| 10/20 | $1,275,430 | $1,242,033 | $1,242,879 |

| 11/20 | $1,298,354 | $1,260,776 | $1,262,057 |

| 12/20 | $1,304,636 | $1,268,456 | $1,267,330 |

| 1/21 | $1,309,744 | $1,276,540 | $1,273,370 |

| 2/21 | $1,286,744 | $1,256,257 | $1,250,246 |

| 3/21 | $1,291,574 | $1,264,005 | $1,258,852 |

| 4/21 | $1,301,294 | $1,274,607 | $1,268,876 |

| 5/21 | $1,306,273 | $1,278,410 | $1,272,352 |

| 6/21 | $1,310,159 | $1,281,920 | $1,275,669 |

| 7/21 | $1,320,075 | $1,292,552 | $1,286,286 |

| 8/21 | $1,315,702 | $1,287,808 | $1,281,941 |

| 9/21 | $1,305,481 | $1,278,514 | $1,272,481 |

| 10/21 | $1,303,434 | $1,274,776 | $1,268,884 |

| 11/21 | $1,314,541 | $1,285,628 | $1,280,235 |

| 12/21 | $1,313,401 | $1,287,702 | $1,282,742 |

| 1/22 | $1,282,637 | $1,252,454 | $1,244,707 |

| 2/22 | $1,275,960 | $1,247,967 | $1,240,944 |

| 3/22 | $1,234,484 | $1,207,512 | $1,199,646 |

| 4/22 | $1,201,506 | $1,174,113 | $1,164,863 |

| 5/22 | $1,214,361 | $1,191,554 | $1,184,523 |

| 6/22 | $1,199,885 | $1,172,038 | $1,166,153 |

| 7/22 | $1,225,132 | $1,203,006 | $1,199,040 |

| 8/22 | $1,205,975 | $1,176,640 | $1,173,373 |

| 9/22 | $1,174,510 | $1,131,480 | $1,130,002 |

| 10/22 | $1,164,095 | $1,122,070 | $1,122,638 |

| 11/22 | $1,214,809 | $1,174,553 | $1,174,228 |

| 12/22 | $1,215,699 | $1,177,916 | $1,178,004 |

| 1/23 | $1,249,679 | $1,211,751 | $1,209,811 |

| 2/23 | $1,227,383 | $1,184,351 | $1,182,308 |

| 3/23 | $1,248,122 | $1,210,629 | $1,208,077 |

| 4/23 | $1,247,925 | $1,207,864 | $1,205,032 |

| 5/23 | $1,241,574 | $1,197,397 | $1,194,956 |

| 6/23 | $1,250,090 | $1,209,391 | $1,206,797 |

| 7/23 | $1,254,841 | $1,214,176 | $1,211,677 |

| 8/23 | $1,244,690 | $1,196,696 | $1,197,679 |

| 9/23 | $1,217,135 | $1,161,622 | $1,163,285 |

| 10/23 | $1,199,630 | $1,151,737 | $1,153,209 |

| 11/23 | $1,270,308 | $1,224,851 | $1,223,701 |

| 12/23 | $1,295,700 | $1,253,319 | $1,251,318 |

| 1/24 | $1,296,988 | $1,246,918 | $1,246,229 |

| 2/24 | $1,298,393 | $1,248,519 | $1,247,625 |

| 3/24 | $1,298,437 | $1,248,480 | $1,246,073 |

| 4/24 | $1,288,281 | $1,233,018 | $1,230,144 |

| 5/24 | $1,288,320 | $1,229,401 | $1,226,387 |

| 6/24 | $1,305,066 | $1,248,245 | $1,243,601 |

| 7/24 | $1,315,376 | $1,259,622 | $1,254,672 |

| 8/24 | $1,328,400 | $1,269,557 | $1,265,163 |

| 9/24 | $1,342,862 | $1,282,104 | $1,278,053 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

| Class I | 10.32% | 1.77% | 2.99% |

| Bloomberg Municipal Bond Index | 10.37% | 1.38% | 2.51% |

| Bloomberg California Municipal Bond Index | 9.87% | 1.32% | 2.48% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

Key Fund Statistics

| Total Net Assets | $942,281,175 |

| # of Portfolio Holdings | 284 |

| Portfolio Turnover Rate | 173% |

| Total Advisory Fees Paid | $3,457,213 |

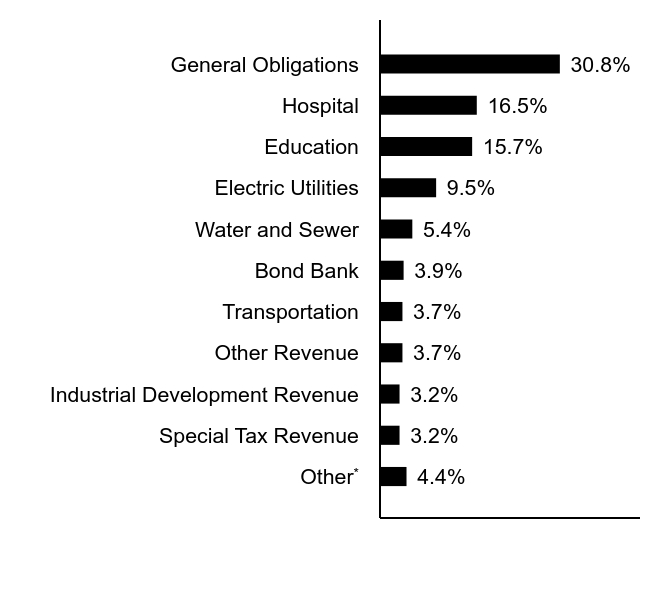

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|---|

OtherFootnote Reference* | 7.8% |

| Housing | 3.3% |

| Electric Utilities | 3.5% |

| Other Revenue | 3.6% |

| Hospital | 6.3% |

| Education | 7.9% |

| Water and Sewer | 11.6% |

| Transportation | 19.0% |

| General Obligations | 37.0% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

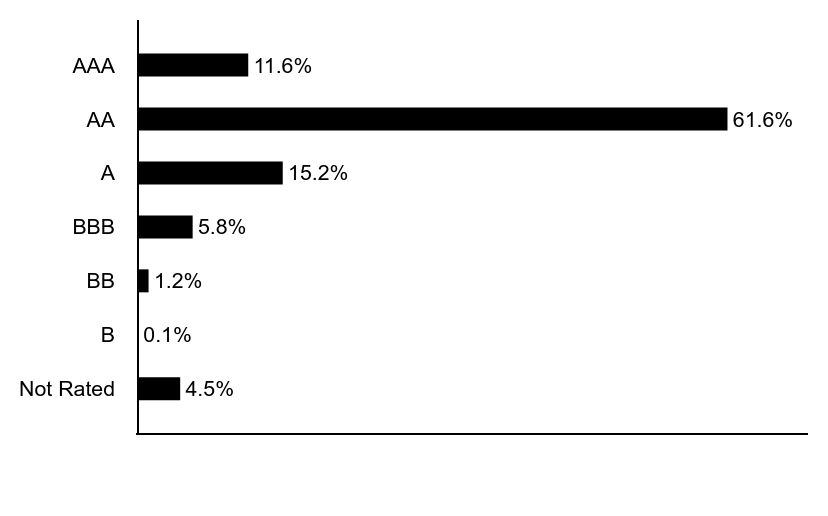

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|---|

| Not Rated | 2.5% |

| BB | 1.8% |

| BBB | 2.9% |

| A | 16.7% |

| AA | 60.7% |

| AAA | 15.4% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

Additional Information

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

Householding

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

EICAX-TSR-AR

Eaton Vance Massachusetts Municipal Income Fund

Class A ETMAX

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about the Eaton Vance Massachusetts Municipal Income Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class A | $85 | 0.81% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ Out-of-Index positions in variable-rate demand notes and floating-rate notes — typically considered defensive investments with virtually zero duration — detracted from returns relative to the Index as interest rates generally declined during the period

↓ Security selections in the health care sector detracted from performance relative to the Index during the period

↓ Security selections in the housing sector detracted from performance relative to the Index during the period

↑ An overweight position in bonds rated BBB and below helped returns as lower-credit-quality bonds generally outperformed higher-credit-quality bonds

↑ An overweight position in bonds with 17 years or more remaining to maturity contributed to Index-relative returns as longer-maturity bonds generally outperformed shorter-maturity bonds during the period

↑ An overweight position in 4% coupon bonds contributed to Index-relative returns as interest rates generally declined during the period

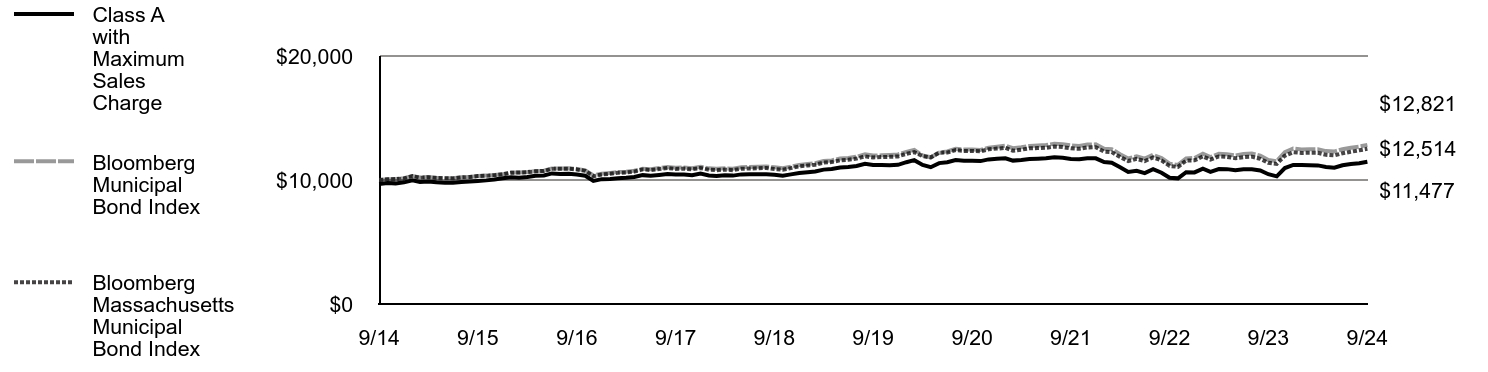

Fund Performance

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | Bloomberg Municipal Bond Index | Bloomberg Massachusetts Municipal Bond Index | |

|---|---|---|---|

| 9/14 | $9,675 | $10,000 | $10,000 |

| 10/14 | $9,757 | $10,069 | $10,060 |

| 11/14 | $9,728 | $10,086 | $10,073 |

| 12/14 | $9,811 | $10,137 | $10,130 |

| 1/15 | $9,967 | $10,317 | $10,314 |

| 2/15 | $9,845 | $10,210 | $10,186 |

| 3/15 | $9,884 | $10,240 | $10,223 |

| 4/15 | $9,816 | $10,186 | $10,160 |

| 5/15 | $9,779 | $10,158 | $10,143 |

| 6/15 | $9,775 | $10,148 | $10,130 |

| 7/15 | $9,836 | $10,222 | $10,211 |

| 8/15 | $9,875 | $10,242 | $10,241 |

| 9/15 | $9,926 | $10,316 | $10,320 |

| 10/15 | $9,970 | $10,357 | $10,349 |

| 11/15 | $10,043 | $10,398 | $10,390 |

| 12/15 | $10,140 | $10,472 | $10,462 |

| 1/16 | $10,230 | $10,596 | $10,586 |

| 2/16 | $10,180 | $10,613 | $10,601 |

| 3/16 | $10,243 | $10,647 | $10,629 |

| 4/16 | $10,339 | $10,725 | $10,705 |

| 5/16 | $10,366 | $10,754 | $10,727 |

| 6/16 | $10,530 | $10,925 | $10,906 |

| 7/16 | $10,479 | $10,932 | $10,913 |

| 8/16 | $10,506 | $10,947 | $10,913 |

| 9/16 | $10,442 | $10,892 | $10,851 |

| 10/16 | $10,344 | $10,778 | $10,741 |

| 11/16 | $9,927 | $10,376 | $10,304 |

| 12/16 | $10,070 | $10,497 | $10,441 |

| 1/17 | $10,086 | $10,567 | $10,506 |

| 2/17 | $10,138 | $10,640 | $10,580 |

| 3/17 | $10,178 | $10,663 | $10,603 |

| 4/17 | $10,239 | $10,741 | $10,678 |

| 5/17 | $10,392 | $10,911 | $10,854 |

| 6/17 | $10,350 | $10,872 | $10,806 |

| 7/17 | $10,411 | $10,960 | $10,888 |

| 8/17 | $10,484 | $11,043 | $10,973 |

| 9/17 | $10,441 | $10,987 | $10,894 |

| 10/17 | $10,445 | $11,014 | $10,919 |

| 11/17 | $10,393 | $10,955 | $10,862 |

| 12/17 | $10,529 | $11,069 | $10,974 |

| 1/18 | $10,368 | $10,939 | $10,829 |

| 2/18 | $10,325 | $10,906 | $10,793 |

| 3/18 | $10,388 | $10,947 | $10,843 |

| 4/18 | $10,354 | $10,908 | $10,794 |

| 5/18 | $10,452 | $11,033 | $10,914 |

| 6/18 | $10,454 | $11,042 | $10,921 |

| 7/18 | $10,467 | $11,069 | $10,943 |

| 8/18 | $10,470 | $11,097 | $10,974 |

| 9/18 | $10,423 | $11,025 | $10,892 |

| 10/18 | $10,352 | $10,957 | $10,825 |

| 11/18 | $10,452 | $11,079 | $10,960 |

| 12/18 | $10,563 | $11,211 | $11,096 |

| 1/19 | $10,626 | $11,296 | $11,172 |

| 2/19 | $10,689 | $11,357 | $11,233 |

| 3/19 | $10,838 | $11,536 | $11,403 |

| 4/19 | $10,889 | $11,579 | $11,448 |

| 5/19 | $11,013 | $11,739 | $11,593 |

| 6/19 | $11,051 | $11,782 | $11,635 |

| 7/19 | $11,125 | $11,877 | $11,727 |

| 8/19 | $11,310 | $12,065 | $11,910 |

| 9/19 | $11,202 | $11,968 | $11,819 |

| 10/19 | $11,200 | $11,989 | $11,847 |

| 11/19 | $11,199 | $12,019 | $11,870 |

| 12/19 | $11,223 | $12,056 | $11,902 |

| 1/20 | $11,436 | $12,273 | $12,114 |

| 2/20 | $11,601 | $12,431 | $12,251 |

| 3/20 | $11,210 | $11,980 | $11,930 |

| 4/20 | $11,033 | $11,830 | $11,818 |

| 5/20 | $11,361 | $12,206 | $12,207 |

| 6/20 | $11,436 | $12,307 | $12,210 |

| 7/20 | $11,611 | $12,514 | $12,410 |

| 8/20 | $11,557 | $12,455 | $12,340 |

| 9/20 | $11,553 | $12,458 | $12,348 |

| 10/20 | $11,523 | $12,420 | $12,312 |

| 11/20 | $11,661 | $12,608 | $12,479 |

| 12/20 | $11,721 | $12,685 | $12,531 |

| 1/21 | $11,751 | $12,765 | $12,588 |

| 2/21 | $11,563 | $12,563 | $12,367 |

| 3/21 | $11,605 | $12,640 | $12,450 |

| 4/21 | $11,687 | $12,746 | $12,551 |

| 5/21 | $11,718 | $12,784 | $12,571 |

| 6/21 | $11,749 | $12,819 | $12,595 |

| 7/21 | $11,830 | $12,926 | $12,697 |

| 8/21 | $11,795 | $12,878 | $12,654 |

| 9/21 | $11,695 | $12,785 | $12,551 |

| 10/21 | $11,673 | $12,748 | $12,517 |

| 11/21 | $11,757 | $12,856 | $12,627 |

| 12/21 | $11,750 | $12,877 | $12,649 |

| 1/22 | $11,451 | $12,525 | $12,289 |

| 2/22 | $11,391 | $12,480 | $12,250 |

| 3/22 | $11,027 | $12,075 | $11,862 |

| 4/22 | $10,651 | $11,741 | $11,528 |

| 5/22 | $10,736 | $11,916 | $11,706 |

| 6/22 | $10,559 | $11,720 | $11,528 |

| 7/22 | $10,872 | $12,030 | $11,817 |

| 8/22 | $10,590 | $11,766 | $11,578 |

| 9/22 | $10,187 | $11,315 | $11,137 |

| 10/22 | $10,132 | $11,221 | $11,056 |

| 11/22 | $10,625 | $11,746 | $11,564 |

| 12/22 | $10,610 | $11,779 | $11,586 |

| 1/23 | $10,918 | $12,118 | $11,902 |

| 2/23 | $10,662 | $11,844 | $11,637 |

| 3/23 | $10,877 | $12,106 | $11,901 |

| 4/23 | $10,876 | $12,079 | $11,862 |

| 5/23 | $10,781 | $11,974 | $11,755 |

| 6/23 | $10,863 | $12,094 | $11,841 |

| 7/23 | $10,863 | $12,142 | $11,881 |

| 8/23 | $10,768 | $11,967 | $11,712 |

| 9/23 | $10,468 | $11,616 | $11,383 |

| 10/23 | $10,291 | $11,517 | $11,299 |

| 11/23 | $10,966 | $12,249 | $11,961 |

| 12/23 | $11,216 | $12,533 | $12,236 |

| 1/24 | $11,203 | $12,469 | $12,182 |

| 2/24 | $11,191 | $12,485 | $12,193 |

| 3/24 | $11,179 | $12,485 | $12,190 |

| 4/24 | $11,057 | $12,330 | $12,030 |

| 5/24 | $10,990 | $12,294 | $11,981 |

| 6/24 | $11,189 | $12,482 | $12,154 |

| 7/24 | $11,291 | $12,596 | $12,280 |

| 8/24 | $11,351 | $12,696 | $12,392 |

| 9/24 | $11,477 | $12,821 | $12,514 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

| Class A | 9.68% | 0.49% | 1.73% |

| Class A with 3.25% Maximum Sales Charge | 6.07% | (0.16)% | 1.39% |

| Bloomberg Municipal Bond Index | 10.37% | 1.38% | 2.51% |

| Bloomberg Massachusetts Municipal Bond Index | 9.94% | 1.15% | 2.27% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

Key Fund Statistics

| Total Net Assets | $166,484,049 |

| # of Portfolio Holdings | 85 |

| Portfolio Turnover Rate | 57% |

| Total Advisory Fees Paid | $571,899 |

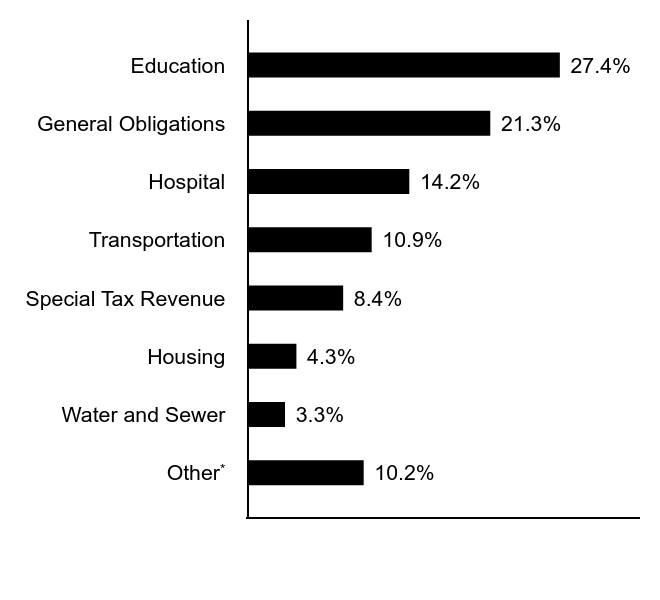

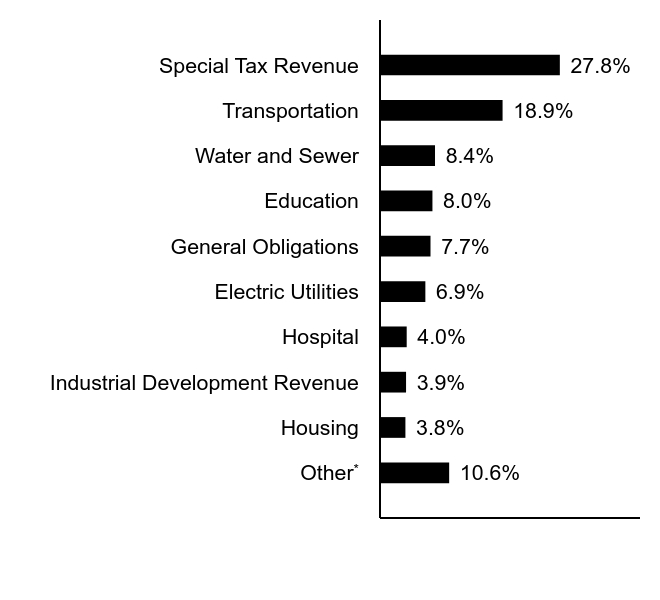

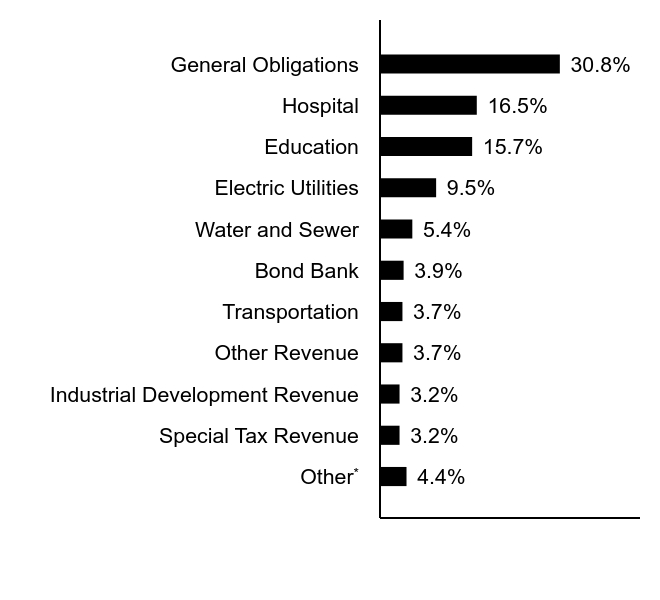

What did the Fund invest in?

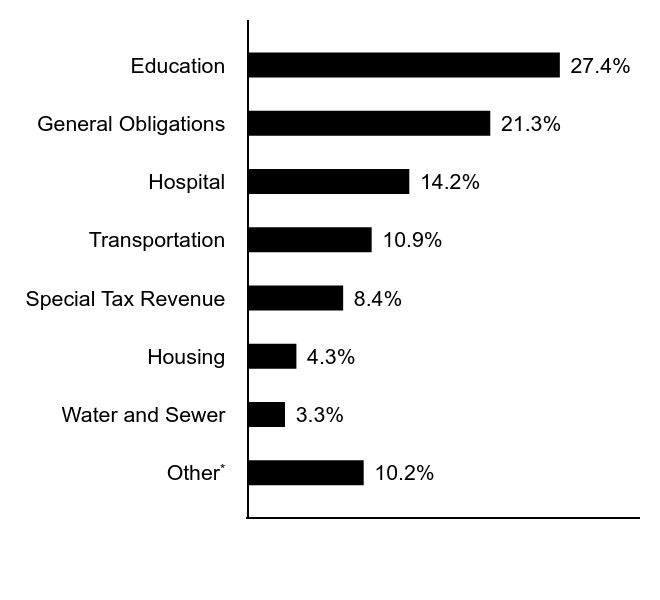

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|---|

OtherFootnote Reference* | 10.2% |

| Water and Sewer | 3.3% |

| Housing | 4.3% |

| Special Tax Revenue | 8.4% |

| Transportation | 10.9% |

| Hospital | 14.2% |

| General Obligations | 21.3% |

| Education | 27.4% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

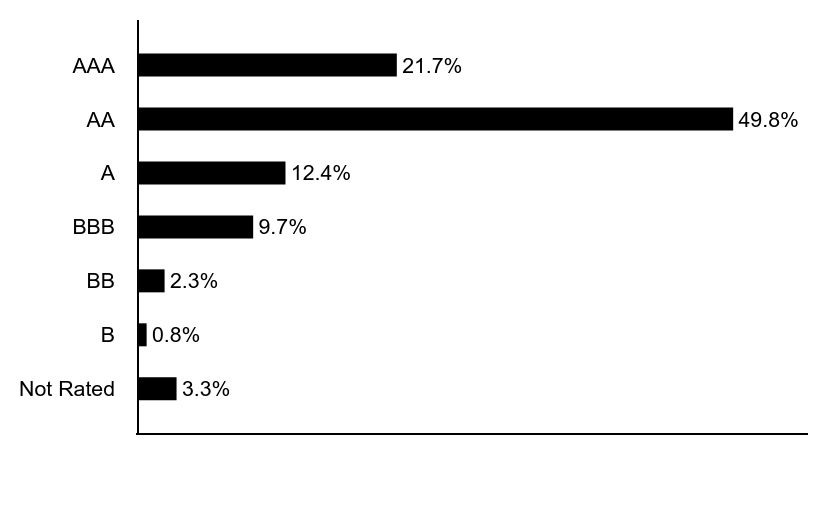

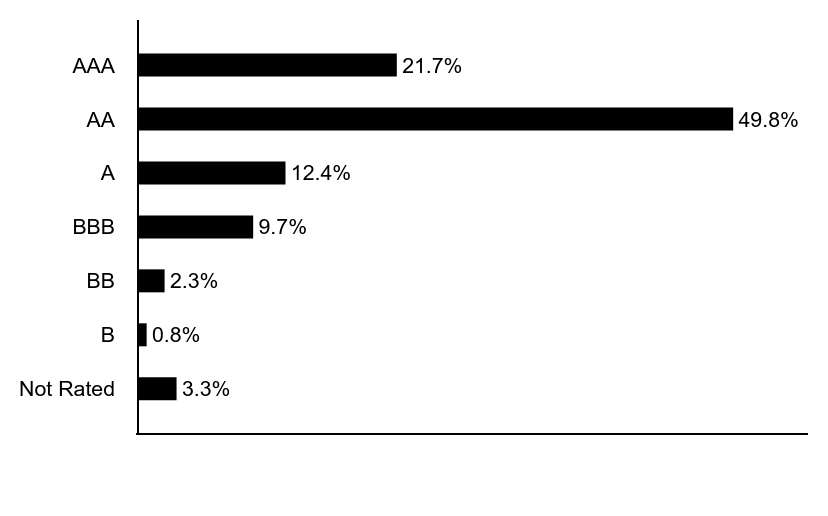

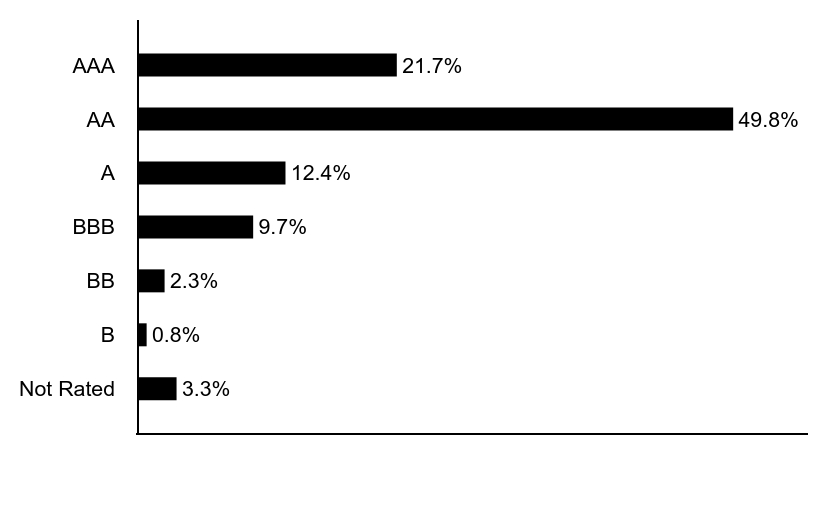

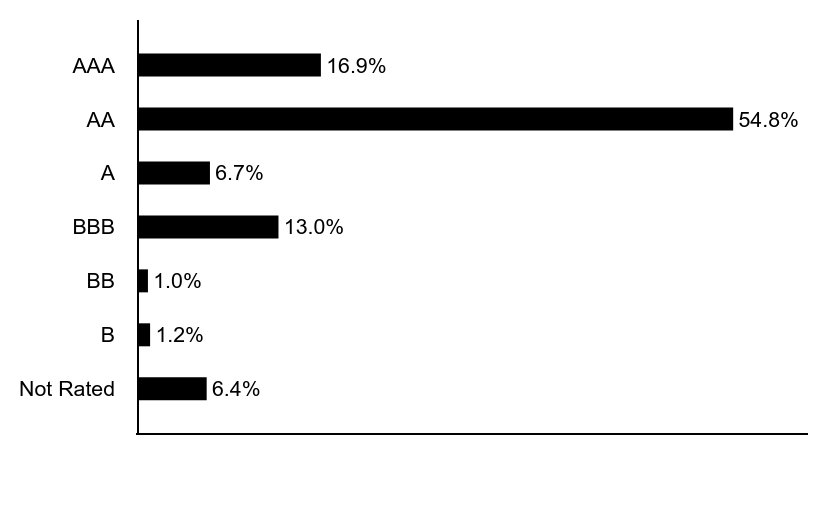

Credit Quality (% of total investments)Footnote Referencea ,Footnote Referenceb

| Value | Value |

|---|---|

| Not Rated | 3.3% |

| B | 0.8% |

| BB | 2.3% |

| BBB | 9.7% |

| A | 12.4% |

| AA | 49.8% |

| AAA | 21.7% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

Footnoteb | The chart includes the municipal bonds held by a trust that issues residual interest bonds. |

Additional Information

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

Householding

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

ETMAX-TSR-AR

Eaton Vance Massachusetts Municipal Income Fund

Class C ECMMX

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about the Eaton Vance Massachusetts Municipal Income Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class C | $163 | 1.56% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ Out-of-Index positions in variable-rate demand notes and floating-rate notes — typically considered defensive investments with virtually zero duration — detracted from returns relative to the Index as interest rates generally declined during the period

↓ Security selections in the health care sector detracted from performance relative to the Index during the period

↓ Security selections in the housing sector detracted from performance relative to the Index during the period

↑ An overweight position in bonds rated BBB and below helped returns as lower-credit-quality bonds generally outperformed higher-credit-quality bonds

↑ An overweight position in bonds with 17 years or more remaining to maturity contributed to Index-relative returns as longer-maturity bonds generally outperformed shorter-maturity bonds during the period

↑ An overweight position in 4% coupon bonds contributed to Index-relative returns as interest rates generally declined during the period

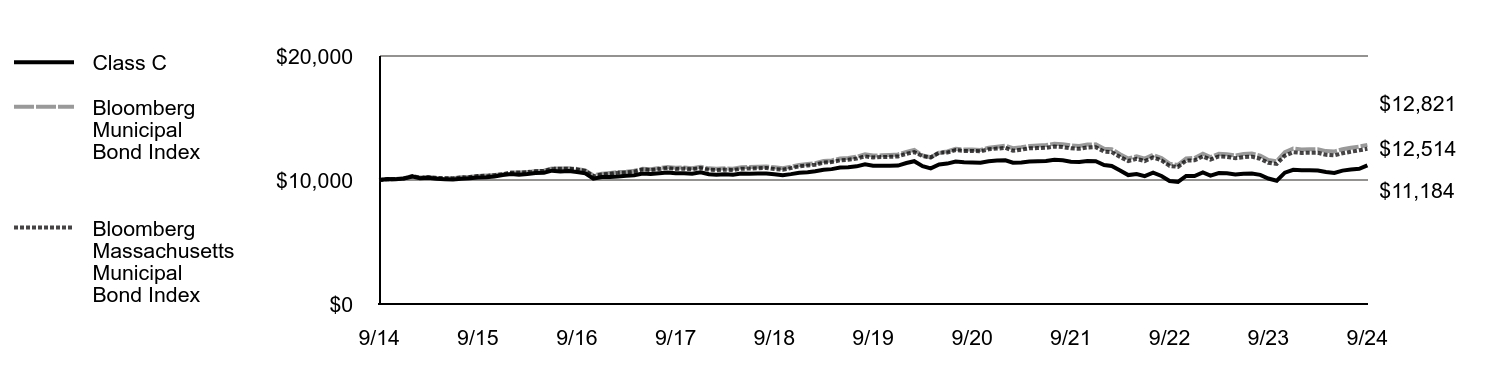

Fund Performance

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | Bloomberg Municipal Bond Index | Bloomberg Massachusetts Municipal Bond Index | |

|---|---|---|---|

| 9/14 | $10,000 | $10,000 | $10,000 |

| 10/14 | $10,089 | $10,069 | $10,060 |

| 11/14 | $10,054 | $10,086 | $10,073 |

| 12/14 | $10,121 | $10,137 | $10,130 |

| 1/15 | $10,287 | $10,317 | $10,314 |

| 2/15 | $10,145 | $10,210 | $10,186 |

| 3/15 | $10,178 | $10,240 | $10,223 |

| 4/15 | $10,101 | $10,186 | $10,160 |

| 5/15 | $10,068 | $10,158 | $10,143 |

| 6/15 | $10,047 | $10,148 | $10,130 |

| 7/15 | $10,103 | $10,222 | $10,211 |

| 8/15 | $10,149 | $10,242 | $10,241 |

| 9/15 | $10,195 | $10,316 | $10,320 |

| 10/15 | $10,221 | $10,357 | $10,349 |

| 11/15 | $10,290 | $10,398 | $10,390 |

| 12/15 | $10,395 | $10,472 | $10,462 |

| 1/16 | $10,480 | $10,596 | $10,586 |

| 2/16 | $10,423 | $10,613 | $10,601 |

| 3/16 | $10,481 | $10,647 | $10,629 |

| 4/16 | $10,572 | $10,725 | $10,705 |

| 5/16 | $10,593 | $10,754 | $10,727 |

| 6/16 | $10,754 | $10,925 | $10,906 |

| 7/16 | $10,695 | $10,932 | $10,913 |

| 8/16 | $10,716 | $10,947 | $10,913 |

| 9/16 | $10,644 | $10,892 | $10,851 |

| 10/16 | $10,537 | $10,778 | $10,741 |

| 11/16 | $10,107 | $10,376 | $10,304 |

| 12/16 | $10,246 | $10,497 | $10,441 |

| 1/17 | $10,245 | $10,567 | $10,506 |

| 2/17 | $10,291 | $10,640 | $10,580 |

| 3/17 | $10,336 | $10,663 | $10,603 |

| 4/17 | $10,380 | $10,741 | $10,678 |

| 5/17 | $10,529 | $10,911 | $10,854 |

| 6/17 | $10,480 | $10,872 | $10,806 |

| 7/17 | $10,546 | $10,960 | $10,888 |

| 8/17 | $10,602 | $11,043 | $10,973 |

| 9/17 | $10,552 | $10,987 | $10,894 |

| 10/17 | $10,550 | $11,014 | $10,919 |

| 11/17 | $10,502 | $10,955 | $10,862 |

| 12/17 | $10,621 | $11,069 | $10,974 |

| 1/18 | $10,464 | $10,939 | $10,829 |

| 2/18 | $10,415 | $10,906 | $10,793 |

| 3/18 | $10,472 | $10,947 | $10,843 |

| 4/18 | $10,431 | $10,908 | $10,794 |

| 5/18 | $10,522 | $11,033 | $10,914 |

| 6/18 | $10,506 | $11,042 | $10,921 |

| 7/18 | $10,525 | $11,069 | $10,943 |

| 8/18 | $10,521 | $11,097 | $10,974 |

| 9/18 | $10,468 | $11,025 | $10,892 |

| 10/18 | $10,378 | $10,957 | $10,825 |

| 11/18 | $10,472 | $11,079 | $10,960 |

| 12/18 | $10,589 | $11,211 | $11,096 |

| 1/19 | $10,632 | $11,296 | $11,172 |

| 2/19 | $10,702 | $11,357 | $11,233 |

| 3/19 | $10,831 | $11,536 | $11,403 |

| 4/19 | $10,876 | $11,579 | $11,448 |

| 5/19 | $11,005 | $11,739 | $11,593 |

| 6/19 | $11,024 | $11,782 | $11,635 |

| 7/19 | $11,103 | $11,877 | $11,727 |

| 8/19 | $11,268 | $12,065 | $11,910 |

| 9/19 | $11,153 | $11,968 | $11,819 |

| 10/19 | $11,144 | $11,989 | $11,847 |

| 11/19 | $11,149 | $12,019 | $11,870 |

| 12/19 | $11,166 | $12,056 | $11,902 |

| 1/20 | $11,371 | $12,273 | $12,114 |

| 2/20 | $11,515 | $12,431 | $12,251 |

| 3/20 | $11,120 | $11,980 | $11,930 |

| 4/20 | $10,938 | $11,830 | $11,818 |

| 5/20 | $11,257 | $12,206 | $12,207 |

| 6/20 | $11,325 | $12,307 | $12,210 |

| 7/20 | $11,492 | $12,514 | $12,410 |

| 8/20 | $11,431 | $12,455 | $12,340 |

| 9/20 | $11,421 | $12,458 | $12,348 |

| 10/20 | $11,386 | $12,420 | $12,312 |

| 11/20 | $11,516 | $12,608 | $12,479 |

| 12/20 | $11,569 | $12,685 | $12,531 |

| 1/21 | $11,592 | $12,765 | $12,588 |

| 2/21 | $11,399 | $12,563 | $12,367 |

| 3/21 | $11,421 | $12,640 | $12,450 |

| 4/21 | $11,494 | $12,746 | $12,551 |

| 5/21 | $11,517 | $12,784 | $12,571 |

| 6/21 | $11,541 | $12,819 | $12,595 |

| 7/21 | $11,626 | $12,926 | $12,697 |

| 8/21 | $11,584 | $12,878 | $12,654 |

| 9/21 | $11,466 | $12,785 | $12,551 |

| 10/21 | $11,450 | $12,748 | $12,517 |

| 11/21 | $11,525 | $12,856 | $12,627 |

| 12/21 | $11,511 | $12,877 | $12,649 |

| 1/22 | $11,211 | $12,525 | $12,289 |

| 2/22 | $11,132 | $12,480 | $12,250 |

| 3/22 | $10,769 | $12,075 | $11,862 |

| 4/22 | $10,395 | $11,741 | $11,528 |

| 5/22 | $10,485 | $11,916 | $11,706 |

| 6/22 | $10,306 | $11,720 | $11,528 |

| 7/22 | $10,592 | $12,030 | $11,817 |

| 8/22 | $10,323 | $11,766 | $11,578 |

| 9/22 | $9,924 | $11,315 | $11,137 |

| 10/22 | $9,850 | $11,221 | $11,056 |

| 11/22 | $10,324 | $11,746 | $11,564 |

| 12/22 | $10,316 | $11,779 | $11,586 |

| 1/23 | $10,609 | $12,118 | $11,902 |

| 2/23 | $10,354 | $11,844 | $11,637 |

| 3/23 | $10,556 | $12,106 | $11,901 |

| 4/23 | $10,549 | $12,079 | $11,862 |

| 5/23 | $10,450 | $11,974 | $11,755 |

| 6/23 | $10,510 | $12,094 | $11,841 |

| 7/23 | $10,517 | $12,142 | $11,881 |

| 8/23 | $10,418 | $11,967 | $11,712 |

| 9/23 | $10,121 | $11,616 | $11,383 |

| 10/23 | $9,943 | $11,517 | $11,299 |

| 11/23 | $10,590 | $12,249 | $11,961 |

| 12/23 | $10,824 | $12,533 | $12,236 |

| 1/24 | $10,791 | $12,469 | $12,182 |

| 2/24 | $10,787 | $12,485 | $12,193 |

| 3/24 | $10,769 | $12,485 | $12,190 |

| 4/24 | $10,644 | $12,330 | $12,030 |

| 5/24 | $10,572 | $12,294 | $11,981 |

| 6/24 | $10,758 | $12,482 | $12,154 |

| 7/24 | $10,849 | $12,596 | $12,280 |

| 8/24 | $10,899 | $12,696 | $12,392 |

| 9/24 | $11,184 | $12,821 | $12,514 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

| Class C | 8.86% | (0.24)% | 1.12% |

| Class C with 1% Maximum Deferred Sales Charge | 7.86% | (0.24)% | 1.12% |

| Bloomberg Municipal Bond Index | 10.37% | 1.38% | 2.51% |

| Bloomberg Massachusetts Municipal Bond Index | 9.94% | 1.15% | 2.27% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

Key Fund Statistics

| Total Net Assets | $166,484,049 |

| # of Portfolio Holdings | 85 |

| Portfolio Turnover Rate | 57% |

| Total Advisory Fees Paid | $571,899 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|---|

OtherFootnote Reference* | 10.2% |

| Water and Sewer | 3.3% |

| Housing | 4.3% |

| Special Tax Revenue | 8.4% |

| Transportation | 10.9% |

| Hospital | 14.2% |

| General Obligations | 21.3% |

| Education | 27.4% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

Credit Quality (% of total investments)Footnote Referencea ,Footnote Referenceb

| Value | Value |

|---|---|

| Not Rated | 3.3% |

| B | 0.8% |

| BB | 2.3% |

| BBB | 9.7% |

| A | 12.4% |

| AA | 49.8% |

| AAA | 21.7% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

Footnoteb | The chart includes the municipal bonds held by a trust that issues residual interest bonds. |

Additional Information

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

Householding

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

ECMMX-TSR-AR

Eaton Vance Massachusetts Municipal Income Fund

Class I EIMAX

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about the Eaton Vance Massachusetts Municipal Income Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class I | $64 | 0.61% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↓ Out-of-Index positions in variable-rate demand notes and floating-rate notes — typically considered defensive investments with virtually zero duration — detracted from returns relative to the Index as interest rates generally declined during the period

↓ Security selections in the health care sector detracted from performance relative to the Index during the period

↓ Security selections in the housing sector detracted from performance relative to the Index during the period

↑ An overweight position in bonds rated BBB and below helped returns as lower-credit-quality bonds generally outperformed higher-credit-quality bonds

↑ An overweight position in bonds with 17 years or more remaining to maturity contributed to Index-relative returns as longer-maturity bonds generally outperformed shorter-maturity bonds during the period

↑ An overweight position in 4% coupon bonds contributed to Index-relative returns as interest rates generally declined during the period

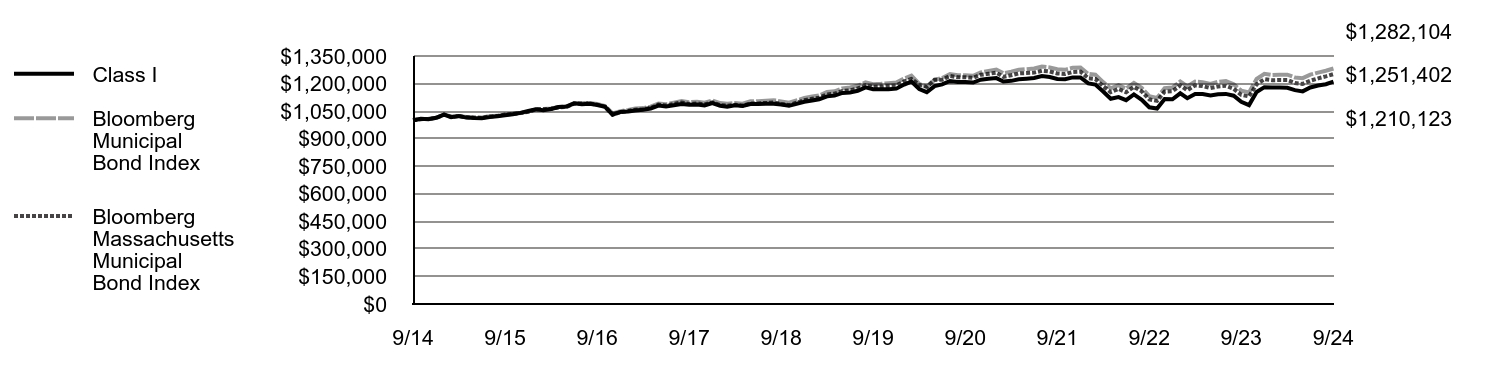

Fund Performance

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | Bloomberg Municipal Bond Index | Bloomberg Massachusetts Municipal Bond Index | |

|---|---|---|---|

| 9/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 10/14 | $1,008,636 | $1,006,857 | $1,006,017 |

| 11/14 | $1,005,856 | $1,008,598 | $1,007,316 |

| 12/14 | $1,013,416 | $1,013,687 | $1,012,952 |

| 1/15 | $1,030,893 | $1,031,654 | $1,031,362 |

| 2/15 | $1,017,340 | $1,021,012 | $1,018,557 |

| 3/15 | $1,022,668 | $1,023,960 | $1,022,252 |

| 4/15 | $1,014,604 | $1,018,588 | $1,015,972 |

| 5/15 | $1,012,074 | $1,015,774 | $1,014,267 |

| 6/15 | $1,010,694 | $1,014,848 | $1,012,981 |

| 7/15 | $1,017,230 | $1,022,199 | $1,021,102 |

| 8/15 | $1,022,612 | $1,024,207 | $1,024,066 |

| 9/15 | $1,028,051 | $1,031,626 | $1,032,040 |

| 10/15 | $1,032,712 | $1,035,727 | $1,034,924 |

| 11/15 | $1,040,475 | $1,039,845 | $1,038,956 |

| 12/15 | $1,050,744 | $1,047,151 | $1,046,151 |

| 1/16 | $1,060,111 | $1,059,645 | $1,058,642 |

| 2/16 | $1,055,198 | $1,061,312 | $1,060,105 |

| 3/16 | $1,061,864 | $1,064,674 | $1,062,950 |

| 4/16 | $1,071,941 | $1,072,502 | $1,070,538 |

| 5/16 | $1,074,955 | $1,075,403 | $1,072,719 |

| 6/16 | $1,092,154 | $1,092,511 | $1,090,559 |

| 7/16 | $1,087,064 | $1,093,178 | $1,091,307 |

| 8/16 | $1,090,040 | $1,094,653 | $1,091,254 |

| 9/16 | $1,083,601 | $1,089,190 | $1,085,064 |

| 10/16 | $1,073,560 | $1,077,763 | $1,074,086 |

| 11/16 | $1,030,524 | $1,037,568 | $1,030,438 |

| 12/16 | $1,045,460 | $1,049,749 | $1,044,109 |

| 1/17 | $1,047,385 | $1,056,669 | $1,050,603 |

| 2/17 | $1,052,857 | $1,064,007 | $1,057,957 |

| 3/17 | $1,057,190 | $1,066,317 | $1,060,336 |

| 4/17 | $1,063,703 | $1,074,054 | $1,067,774 |

| 5/17 | $1,079,852 | $1,091,100 | $1,085,405 |

| 6/17 | $1,075,588 | $1,087,187 | $1,080,631 |

| 7/17 | $1,082,120 | $1,095,983 | $1,088,812 |

| 8/17 | $1,088,690 | $1,104,323 | $1,097,273 |

| 9/17 | $1,084,363 | $1,098,708 | $1,089,432 |

| 10/17 | $1,086,262 | $1,101,390 | $1,091,867 |

| 11/17 | $1,080,963 | $1,095,493 | $1,086,203 |

| 12/17 | $1,094,136 | $1,106,943 | $1,097,359 |

| 1/18 | $1,078,753 | $1,093,911 | $1,082,880 |

| 2/18 | $1,074,467 | $1,090,642 | $1,079,327 |

| 3/18 | $1,081,267 | $1,094,668 | $1,084,276 |

| 4/18 | $1,077,891 | $1,090,761 | $1,079,389 |

| 5/18 | $1,088,213 | $1,103,252 | $1,091,415 |

| 6/18 | $1,088,603 | $1,104,193 | $1,092,090 |

| 7/18 | $1,090,243 | $1,106,873 | $1,094,310 |

| 8/18 | $1,090,636 | $1,109,715 | $1,097,357 |

| 9/18 | $1,085,955 | $1,102,531 | $1,089,193 |

| 10/18 | $1,078,776 | $1,095,742 | $1,082,476 |

| 11/18 | $1,089,354 | $1,107,870 | $1,095,966 |

| 12/18 | $1,101,134 | $1,121,135 | $1,109,622 |

| 1/19 | $1,107,840 | $1,129,609 | $1,117,186 |

| 2/19 | $1,114,627 | $1,135,658 | $1,123,261 |

| 3/19 | $1,130,326 | $1,153,610 | $1,140,342 |

| 4/19 | $1,134,566 | $1,157,945 | $1,144,760 |

| 5/19 | $1,148,977 | $1,173,909 | $1,159,275 |

| 6/19 | $1,151,818 | $1,178,244 | $1,163,544 |

| 7/19 | $1,161,002 | $1,187,739 | $1,172,730 |

| 8/19 | $1,179,238 | $1,206,474 | $1,191,023 |

| 9/19 | $1,169,447 | $1,196,803 | $1,181,863 |

| 10/19 | $1,169,435 | $1,198,948 | $1,184,746 |

| 11/19 | $1,169,499 | $1,201,946 | $1,187,025 |

| 12/19 | $1,172,251 | $1,205,616 | $1,190,186 |

| 1/20 | $1,194,692 | $1,227,277 | $1,211,391 |

| 2/20 | $1,210,744 | $1,243,103 | $1,225,069 |

| 3/20 | $1,170,069 | $1,198,012 | $1,193,037 |

| 4/20 | $1,153,074 | $1,182,977 | $1,181,777 |

| 5/20 | $1,186,228 | $1,220,609 | $1,220,708 |

| 6/20 | $1,195,541 | $1,230,655 | $1,220,973 |

| 7/20 | $1,213,997 | $1,251,382 | $1,241,037 |

| 8/20 | $1,208,457 | $1,245,511 | $1,233,983 |

| 9/20 | $1,208,173 | $1,245,775 | $1,234,785 |

| 10/20 | $1,205,211 | $1,242,033 | $1,231,177 |

| 11/20 | $1,221,042 | $1,260,776 | $1,247,879 |

| 12/20 | $1,226,087 | $1,268,456 | $1,253,108 |

| 1/21 | $1,229,529 | $1,276,540 | $1,258,816 |

| 2/21 | $1,211,368 | $1,256,257 | $1,236,696 |

| 3/21 | $1,214,636 | $1,264,005 | $1,244,987 |

| 4/21 | $1,223,389 | $1,274,607 | $1,255,090 |

| 5/21 | $1,226,790 | $1,278,410 | $1,257,056 |

| 6/21 | $1,230,273 | $1,281,920 | $1,259,510 |

| 7/21 | $1,240,389 | $1,292,552 | $1,269,718 |

| 8/21 | $1,235,494 | $1,287,808 | $1,265,448 |

| 9/21 | $1,225,267 | $1,278,514 | $1,255,092 |

| 10/21 | $1,223,207 | $1,274,776 | $1,251,702 |

| 11/21 | $1,233,536 | $1,285,628 | $1,262,728 |

| 12/21 | $1,232,975 | $1,287,702 | $1,264,856 |

| 1/22 | $1,200,523 | $1,252,454 | $1,228,906 |

| 2/22 | $1,194,355 | $1,247,967 | $1,225,035 |

| 3/22 | $1,156,390 | $1,207,512 | $1,186,209 |

| 4/22 | $1,117,131 | $1,174,113 | $1,152,772 |

| 5/22 | $1,126,329 | $1,191,554 | $1,170,645 |

| 6/22 | $1,109,288 | $1,172,038 | $1,152,825 |

| 7/22 | $1,140,967 | $1,203,006 | $1,181,705 |

| 8/22 | $1,111,549 | $1,176,640 | $1,157,815 |

| 9/22 | $1,070,827 | $1,131,480 | $1,113,742 |

| 10/22 | $1,063,768 | $1,122,070 | $1,105,590 |

| 11/22 | $1,115,739 | $1,174,553 | $1,156,368 |

| 12/22 | $1,114,356 | $1,177,916 | $1,158,599 |

| 1/23 | $1,146,869 | $1,211,751 | $1,190,157 |

| 2/23 | $1,120,184 | $1,184,351 | $1,163,667 |

| 3/23 | $1,142,961 | $1,210,629 | $1,190,137 |

| 4/23 | $1,143,081 | $1,207,864 | $1,186,183 |

| 5/23 | $1,134,724 | $1,197,397 | $1,175,501 |

| 6/23 | $1,142,098 | $1,209,391 | $1,184,083 |

| 7/23 | $1,143,748 | $1,214,176 | $1,188,093 |

| 8/23 | $1,133,920 | $1,196,696 | $1,171,218 |

| 9/23 | $1,101,074 | $1,161,622 | $1,138,256 |

| 10/23 | $1,082,615 | $1,151,737 | $1,129,871 |

| 11/23 | $1,153,874 | $1,224,851 | $1,196,102 |

| 12/23 | $1,180,335 | $1,253,319 | $1,223,607 |

| 1/24 | $1,179,202 | $1,246,918 | $1,218,192 |

| 2/24 | $1,178,164 | $1,248,519 | $1,219,266 |

| 3/24 | $1,177,099 | $1,248,480 | $1,219,014 |

| 4/24 | $1,164,371 | $1,233,018 | $1,202,978 |

| 5/24 | $1,157,495 | $1,229,401 | $1,198,090 |

| 6/24 | $1,178,719 | $1,248,245 | $1,215,403 |

| 7/24 | $1,189,657 | $1,259,622 | $1,228,031 |

| 8/24 | $1,196,146 | $1,269,557 | $1,239,172 |

| 9/24 | $1,210,123 | $1,282,104 | $1,251,402 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

| Class I | 9.90% | 0.69% | 1.92% |

| Bloomberg Municipal Bond Index | 10.37% | 1.38% | 2.51% |

| Bloomberg Massachusetts Municipal Bond Index | 9.94% | 1.15% | 2.27% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

Key Fund Statistics

| Total Net Assets | $166,484,049 |

| # of Portfolio Holdings | 85 |

| Portfolio Turnover Rate | 57% |

| Total Advisory Fees Paid | $571,899 |

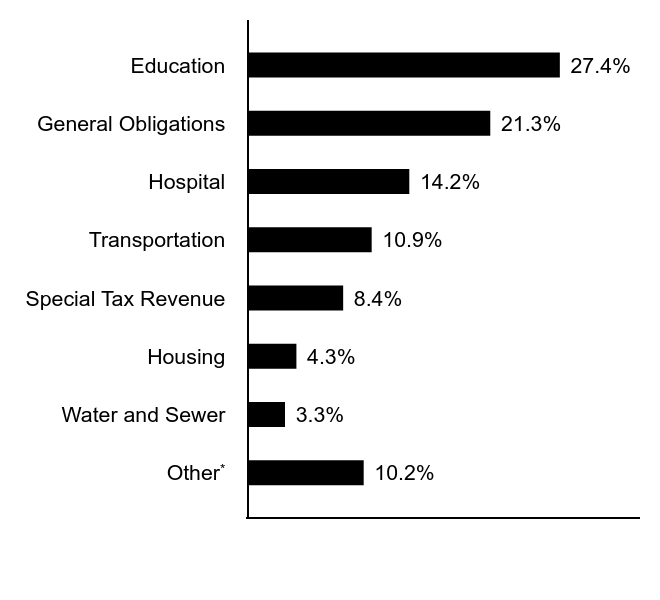

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Sector Allocation (% of total investments)

| Value | Value |

|---|---|

OtherFootnote Reference* | 10.2% |

| Water and Sewer | 3.3% |

| Housing | 4.3% |

| Special Tax Revenue | 8.4% |

| Transportation | 10.9% |

| Hospital | 14.2% |

| General Obligations | 21.3% |

| Education | 27.4% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

Credit Quality (% of total investments)Footnote Referencea ,Footnote Referenceb

| Value | Value |

|---|---|

| Not Rated | 3.3% |

| B | 0.8% |

| BB | 2.3% |

| BBB | 9.7% |

| A | 12.4% |

| AA | 49.8% |

| AAA | 21.7% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

Footnoteb | The chart includes the municipal bonds held by a trust that issues residual interest bonds. |

Additional Information

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

Householding

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

EIMAX-TSR-AR

Eaton Vance National Municipal Income Fund

Class A EANAX

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about the Eaton Vance National Municipal Income Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class A | $75 | 0.71% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Municipal Bond Index (the Index):

↑ An overweight position in bonds with 17 years or more remaining to maturity helped returns as longer-maturity bonds outperformed shorter-maturity bonds

↑ Security selections and an overweight position in 4% coupon bonds contributed to Index-relative returns as interest rates generally declined during the period

↑ Security selections and an overweight position in the health care sector — the best-performing sector within the Index during the period — contributed to Fund returns relative to the Index

↓ An out-of-Index position in variable-rate demand notes — typically considered defensive investments with virtually zero duration — detracted from returns relative to the Index as interest rates generally declined during the period

↓ An underweight position in bonds with coupon rates below 4% ― excluding zero-coupon bonds ― detracted from Index-relative returns during the period

↓ Security selections in bonds with 22 years or more remaining to maturity detracted from Fund performance relative to the Index during the period

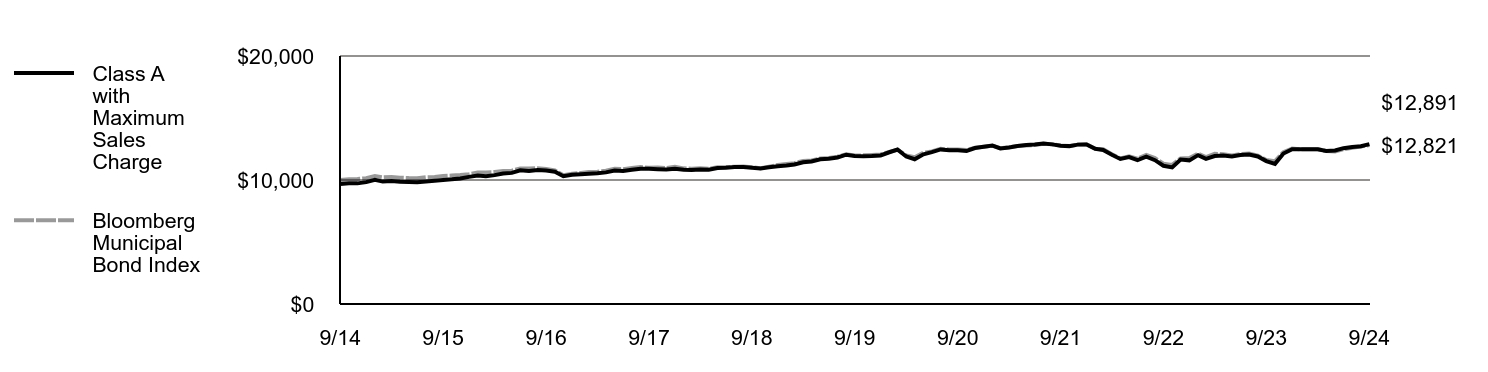

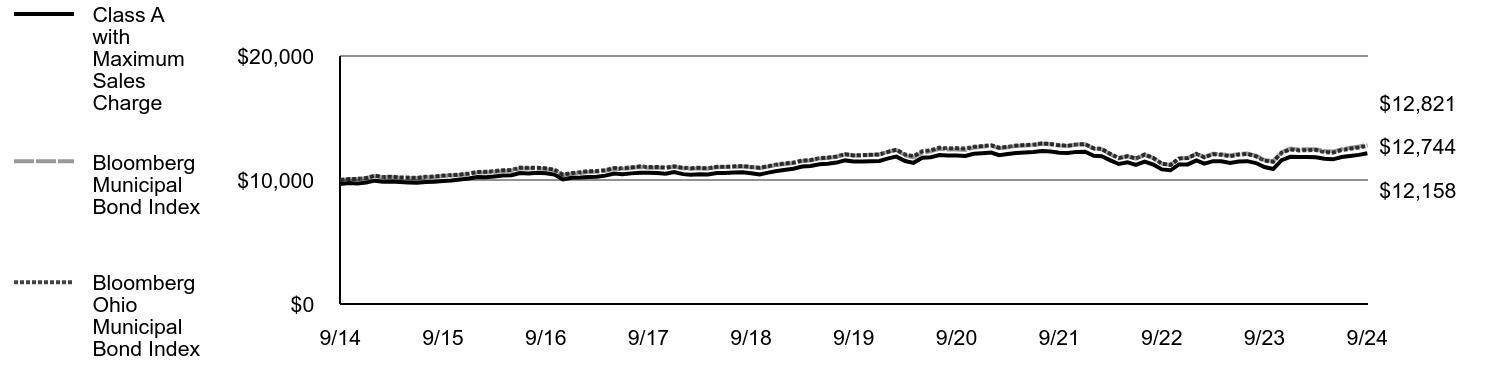

Fund Performance

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | Bloomberg Municipal Bond Index | |

|---|---|---|

| 9/14 | $9,675 | $10,000 |

| 10/14 | $9,736 | $10,069 |

| 11/14 | $9,728 | $10,086 |

| 12/14 | $9,829 | $10,137 |

| 1/15 | $10,020 | $10,317 |

| 2/15 | $9,873 | $10,210 |

| 3/15 | $9,915 | $10,240 |

| 4/15 | $9,857 | $10,186 |

| 5/15 | $9,839 | $10,158 |

| 6/15 | $9,811 | $10,148 |

| 7/15 | $9,873 | $10,222 |

| 8/15 | $9,936 | $10,242 |

| 9/15 | $9,999 | $10,316 |

| 10/15 | $10,052 | $10,357 |

| 11/15 | $10,126 | $10,398 |

| 12/15 | $10,252 | $10,472 |

| 1/16 | $10,356 | $10,596 |

| 2/16 | $10,297 | $10,613 |

| 3/16 | $10,393 | $10,647 |

| 4/16 | $10,520 | $10,725 |

| 5/16 | $10,573 | $10,754 |

| 6/16 | $10,785 | $10,925 |

| 7/16 | $10,734 | $10,932 |

| 8/16 | $10,798 | $10,947 |

| 9/16 | $10,767 | $10,892 |

| 10/16 | $10,672 | $10,778 |

| 11/16 | $10,310 | $10,376 |

| 12/16 | $10,427 | $10,497 |

| 1/17 | $10,461 | $10,567 |

| 2/17 | $10,505 | $10,640 |

| 3/17 | $10,538 | $10,663 |

| 4/17 | $10,614 | $10,741 |

| 5/17 | $10,766 | $10,911 |

| 6/17 | $10,733 | $10,872 |

| 7/17 | $10,820 | $10,960 |

| 8/17 | $10,907 | $11,043 |

| 9/17 | $10,908 | $10,987 |

| 10/17 | $10,873 | $11,014 |

| 11/17 | $10,839 | $10,955 |

| 12/17 | $10,915 | $11,069 |

| 1/18 | $10,825 | $10,939 |

| 2/18 | $10,813 | $10,906 |

| 3/18 | $10,846 | $10,947 |

| 4/18 | $10,822 | $10,908 |

| 5/18 | $10,968 | $11,033 |

| 6/18 | $10,993 | $11,042 |

| 7/18 | $11,039 | $11,069 |

| 8/18 | $11,049 | $11,097 |

| 9/18 | $10,991 | $11,025 |

| 10/18 | $10,931 | $10,957 |

| 11/18 | $11,020 | $11,079 |

| 12/18 | $11,108 | $11,211 |

| 1/19 | $11,163 | $11,296 |

| 2/19 | $11,254 | $11,357 |

| 3/19 | $11,436 | $11,536 |

| 4/19 | $11,491 | $11,579 |

| 5/19 | $11,672 | $11,739 |

| 6/19 | $11,714 | $11,782 |

| 7/19 | $11,813 | $11,877 |

| 8/19 | $12,042 | $12,065 |

| 9/19 | $11,932 | $11,968 |

| 10/19 | $11,925 | $11,989 |

| 11/19 | $11,943 | $12,019 |

| 12/19 | $11,984 | $12,056 |

| 1/20 | $12,237 | $12,273 |

| 2/20 | $12,456 | $12,431 |

| 3/20 | $11,899 | $11,980 |

| 4/20 | $11,676 | $11,830 |

| 5/20 | $12,074 | $12,206 |

| 6/20 | $12,246 | $12,307 |

| 7/20 | $12,467 | $12,514 |

| 8/20 | $12,399 | $12,455 |

| 9/20 | $12,390 | $12,458 |

| 10/20 | $12,345 | $12,420 |

| 11/20 | $12,578 | $12,608 |

| 12/20 | $12,677 | $12,685 |

| 1/21 | $12,775 | $12,765 |

| 2/21 | $12,544 | $12,563 |

| 3/21 | $12,628 | $12,640 |

| 4/21 | $12,749 | $12,746 |

| 5/21 | $12,819 | $12,784 |

| 6/21 | $12,855 | $12,819 |

| 7/21 | $12,951 | $12,926 |

| 8/21 | $12,874 | $12,878 |

| 9/21 | $12,760 | $12,785 |

| 10/21 | $12,732 | $12,748 |

| 11/21 | $12,853 | $12,856 |

| 12/21 | $12,863 | $12,877 |

| 1/22 | $12,512 | $12,525 |

| 2/22 | $12,424 | $12,480 |

| 3/22 | $12,035 | $12,075 |

| 4/22 | $11,698 | $11,741 |

| 5/22 | $11,851 | $11,916 |

| 6/22 | $11,604 | $11,720 |

| 7/22 | $11,885 | $12,030 |

| 8/22 | $11,599 | $11,766 |

| 9/22 | $11,149 | $11,315 |

| 10/22 | $11,018 | $11,221 |

| 11/22 | $11,652 | $11,746 |

| 12/22 | $11,585 | $11,779 |

| 1/23 | $12,005 | $12,118 |

| 2/23 | $11,707 | $11,844 |

| 3/23 | $11,937 | $12,106 |

| 4/23 | $11,973 | $12,079 |

| 5/23 | $11,892 | $11,974 |

| 6/23 | $12,019 | $12,094 |

| 7/23 | $12,055 | $12,142 |

| 8/23 | $11,895 | $11,967 |

| 9/23 | $11,526 | $11,616 |

| 10/23 | $11,301 | $11,517 |

| 11/23 | $12,133 | $12,249 |

| 12/23 | $12,477 | $12,533 |

| 1/24 | $12,489 | $12,469 |

| 2/24 | $12,488 | $12,485 |

| 3/24 | $12,486 | $12,485 |

| 4/24 | $12,338 | $12,330 |

| 5/24 | $12,377 | $12,294 |

| 6/24 | $12,566 | $12,482 |

| 7/24 | $12,660 | $12,596 |

| 8/24 | $12,726 | $12,696 |

| 9/24 | $12,891 | $12,821 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

| Class A | 11.82% | 1.55% | 2.91% |

| Class A with 3.25% Maximum Sales Charge | 8.24% | 0.89% | 2.57% |

| Bloomberg Municipal Bond Index | 10.37% | 1.38% | 2.51% |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

Key Fund Statistics

| Total Net Assets | $4,618,197,661 |

| # of Portfolio Holdings | 548 |

| Portfolio Turnover Rate | 82% |

| Total Advisory Fees Paid | $13,359,012 |

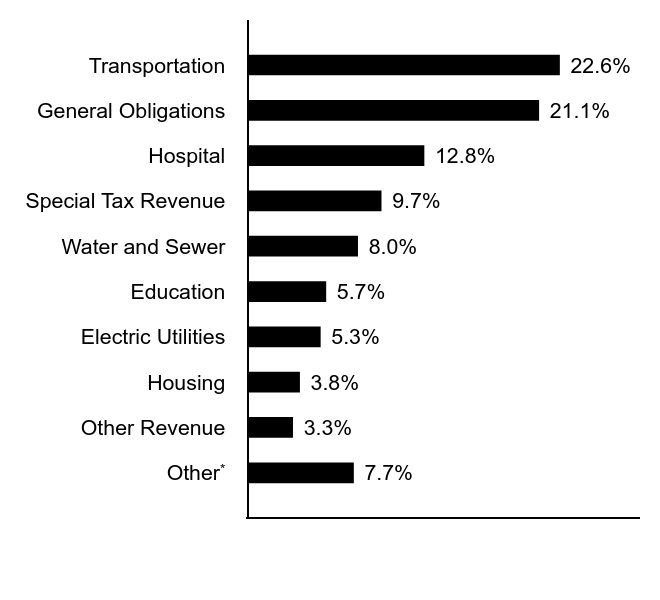

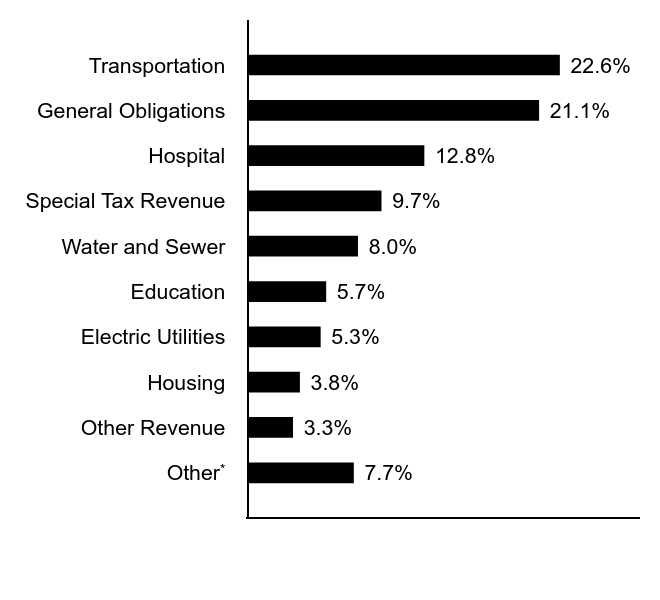

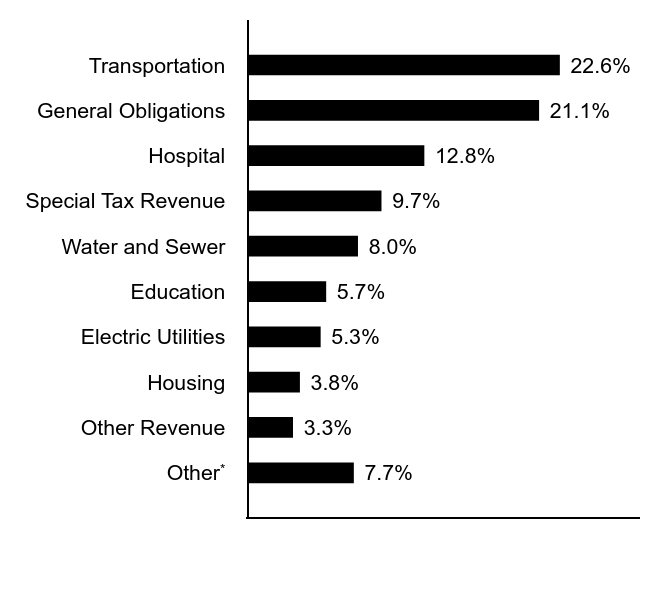

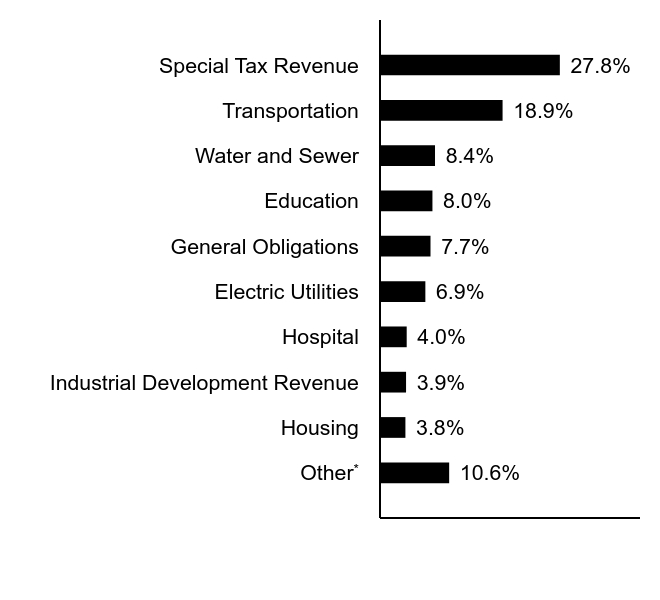

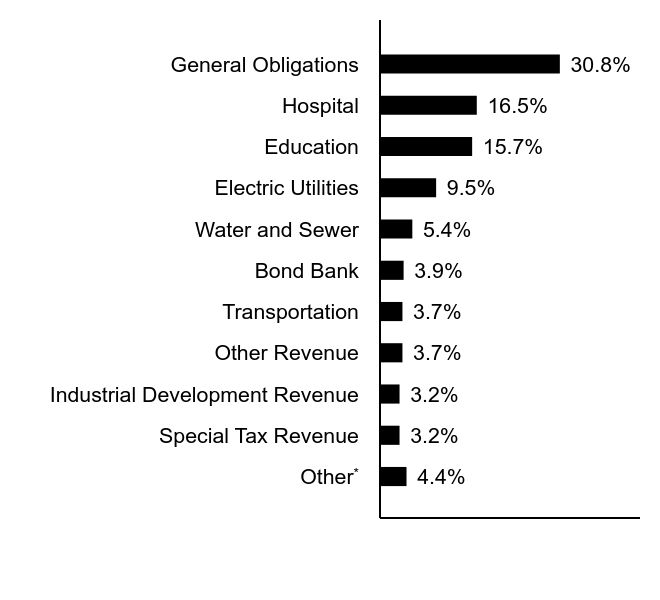

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

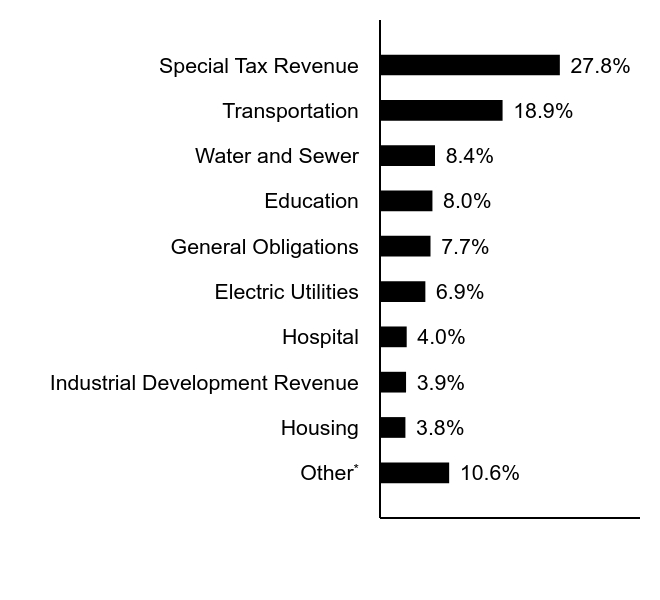

Sector Allocation (% of total investments)

| Value | Value |

|---|---|

OtherFootnote Reference* | 7.7% |

| Other Revenue | 3.3% |

| Housing | 3.8% |

| Electric Utilities | 5.3% |

| Education | 5.7% |

| Water and Sewer | 8.0% |

| Special Tax Revenue | 9.7% |

| Hospital | 12.8% |

| General Obligations | 21.1% |

| Transportation | 22.6% |

| Footnote | Description |

Footnote* | Sectors less than 3% each |

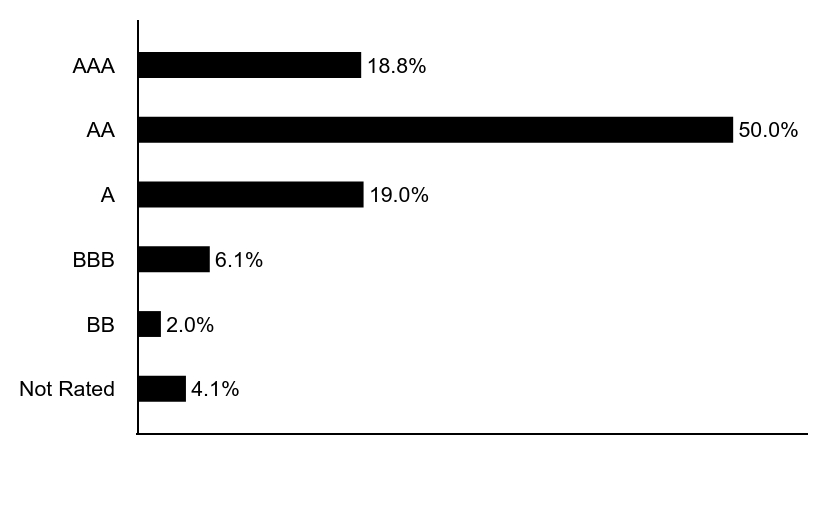

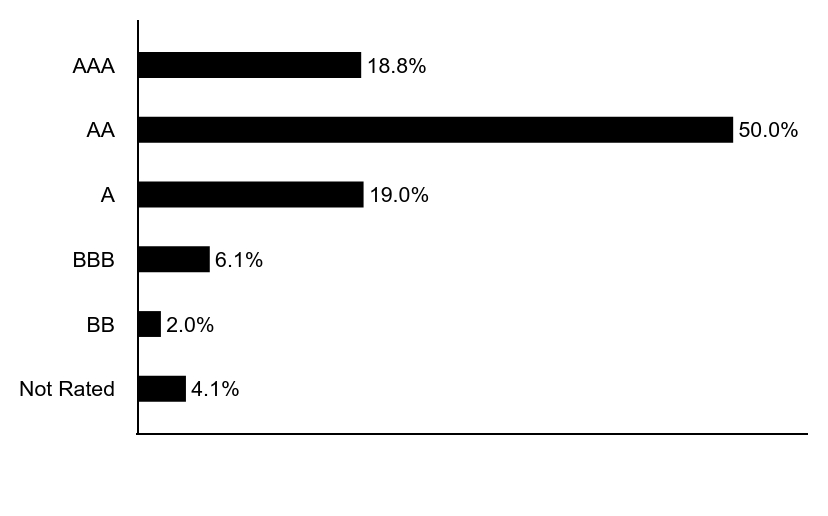

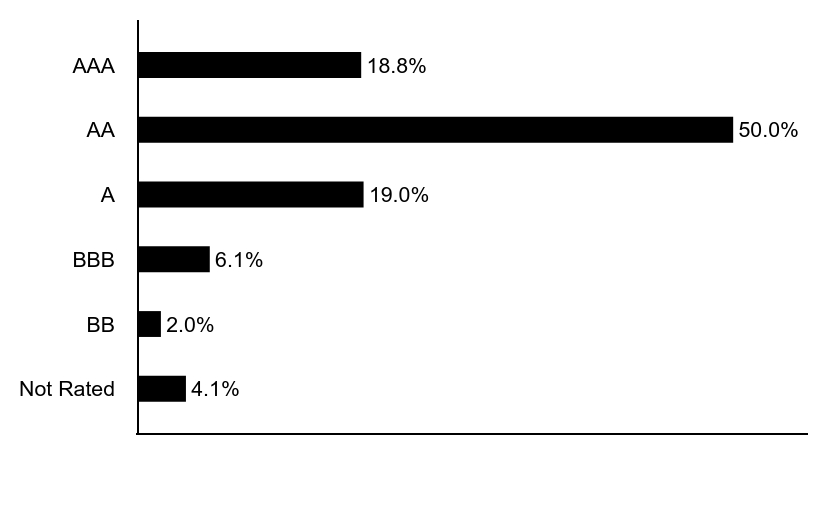

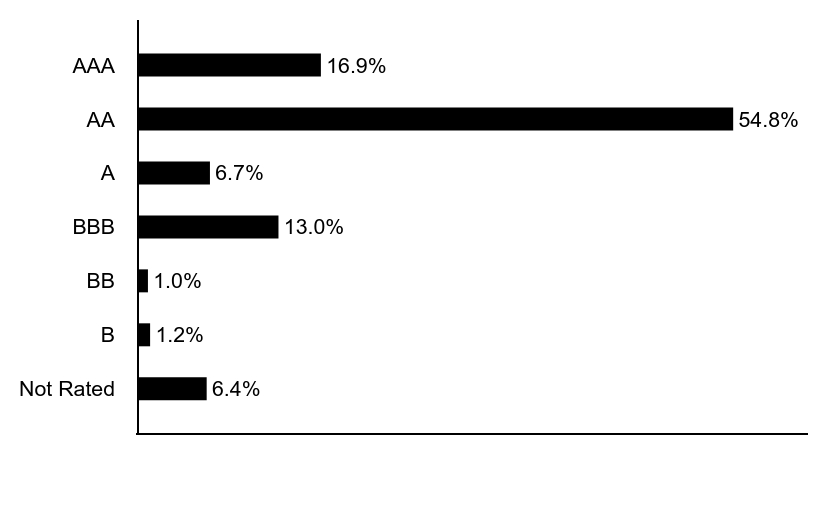

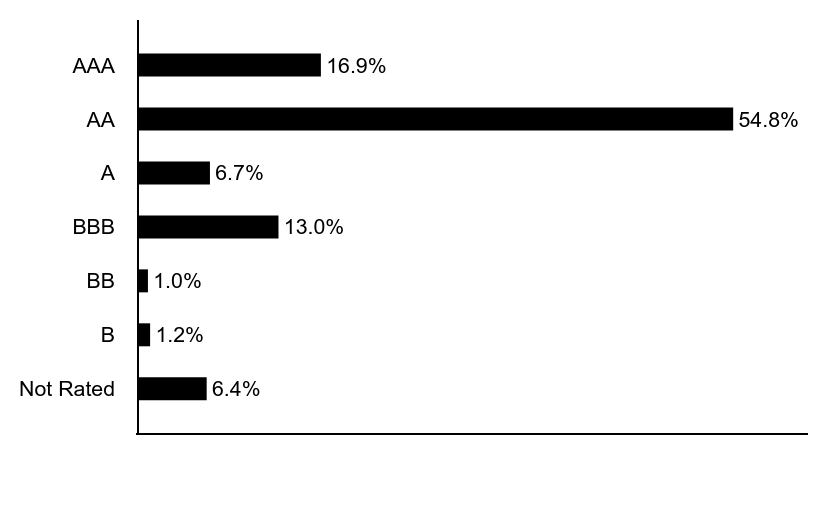

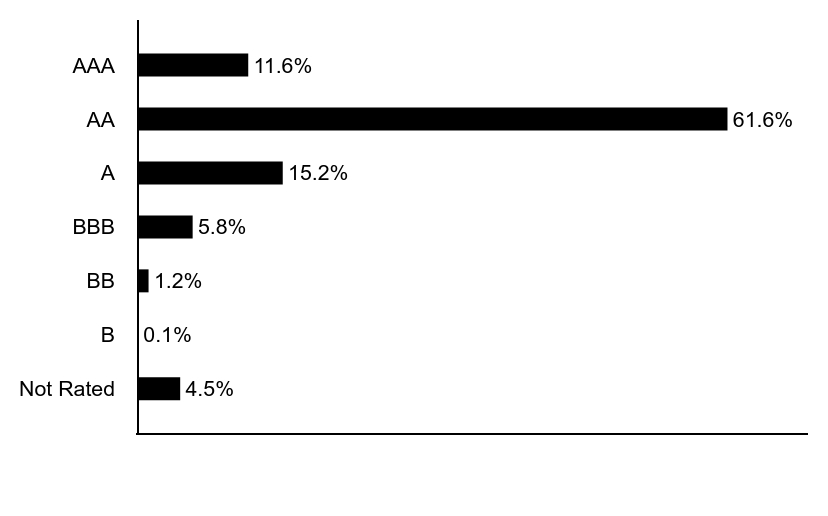

Credit Quality (% of total investments)Footnote Referencea ,Footnote Referenceb

| Value | Value |

|---|---|

| Not Rated | 4.1% |

| BB | 2.0% |

| BBB | 6.1% |

| A | 19.0% |

| AA | 50.0% |

| AAA | 18.8% |

| Footnote | Description |

Footnotea | Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). If securities are rated differently by the ratings agencies, the highest rating is applied. Moody's ratings are converted to the S&P and Fitch scale with ratings ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

Footnoteb | The chart includes the municipal bonds held by a trust that issues residual interest bonds. |

Additional Information

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

Householding

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report September 30, 2024

EANAX-TSR-AR

Eaton Vance National Municipal Income Fund

Class C ECHMX

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about the Eaton Vance National Municipal Income Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class C | $154 | 1.46% |

How did the Fund perform last year and what affected its performance?