UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

|

| |

| (X) | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended June 30, 2012 |

| OR |

| | |

| ( ) | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from ______________ to ________________ |

Commission file number 0-14112

JACK HENRY & ASSOCIATES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 43-1128385 |

| (State or Other Jurisdiction of Incorporation) | | (I.R.S Employer Identification No.) |

663 Highway 60, P.O. Box 807, Monett, MO 65708

(Address of Principle Executive Offices)

(Zip Code)

417-235-6652

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ X ] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ X ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” ”accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | |

| Large accelerated filer [X] | | Accelerated filer [ ] |

| | | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [ ] |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes [ ] No [ X ]

As of August 22, 2012, the Registrant had 86,151,011 shares of Common Stock outstanding ($0.01 par value). On December 31, 2011, the aggregate market value of the Common Stock held by persons other than those who may be deemed affiliates of Registrant was $2,766,705,073 (based on the average of the reported high and low sales prices on NASDAQ on December 31, 2011).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company's Notice of Annual Meeting of Stockholders and Proxy Statement for its 2012 Annual Meeting of Stockholders (the "Proxy Statement"), to the Table of Contents below, are incorporated by reference into Part II, Item 5 and into Part III of this Report.

TABLE OF CONTENTS

|

| | |

| PART I | | Page Reference |

| | | |

| ITEM 1. | BUSINESS | |

| | | |

| ITEM 1A. | RISK FACTORS | |

| | | |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | |

| | | |

| ITEM 2. | PROPERTIES | |

| | | |

| ITEM 3. | LEGAL PROCEEDINGS | |

| | | |

| ITEM 4. | MINE SAFETY DISCLOSURES | |

| | | |

| PART II | | |

| | | |

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | |

| | | |

| ITEM 6. | SELECTED FINANCIAL DATA | |

| | | |

| ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| | | |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

| | | |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |

| | | |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

| | | |

| ITEM 9A. | CONTROLS AND PROCEDURES | |

| | | |

| ITEM 9B. | OTHER INFORMATION | |

| | | |

| PART III | | |

| | | |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

| | | |

| ITEM 11. | EXECUTIVE COMPENSATION | |

| | | |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

| | | |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |

| | | |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

| | | |

| PART IV | | |

| | | |

| ITEM 15 | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | |

In this report, all references to “JHA”, the “Company”, “we”, “us”, and “our”, refer to Jack Henry & Associates, Inc., and its consolidated subsidiaries.

FORWARD LOOKING STATEMENTS

Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this report, including without limitation, in Management's Discussion and Analysis of Financial Condition and Results of Operations. Forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” (Part I, Item 1A of this Form 10-K). We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

PART I

ITEM 1. BUSINESS

Jack Henry & Associates, Inc. was founded in 1976 as a provider of core information processing solutions for community banks. Today, the Company’s extensive array of products and services includes processing transactions, automating business processes, and managing information for more than 11,900 financial institutions and diverse corporate entities.

JHA provides its products and services through three marketed brands:

| |

| • | Jack Henry Banking is a leading provider of integrated data processing systems to more than 1,330 banks ranging from de novo or start-up institutions to mid-tier banks with assets of up to $30 billion. Our banking solutions support both in-house and outsourced operating environments with three functionally distinct core processing platforms and more than 100 integrated complementary solutions. |

| |

| • | Symitar is a leading provider of core data processing solutions for credit unions of all sizes, with over 750 credit union customers. Symitar markets two functionally distinct core processing platforms and more than 50 integrated complementary solutions that support both in-house and outsourced operating environments. |

| |

| • | ProfitStars is a leading provider of highly specialized products and services to financial institutions that are primarily not core customers of the Company. ProfitStars offers highly specialized financial performance, imaging and payments processing, information security and risk management, retail delivery, and online and mobile solutions. ProfitStars’ products and services enhance the performance of financial services organizations of all asset sizes and charters, and diverse corporate entities with approximately 11,000 domestic and international customers. |

Our products and services enable our customers to implement technology solutions that can be tailored to support their unique growth, service, operational, and performance goals. Our solutions also enable financial institutions to offer the high-demand products and services required to compete more successfully, and to capitalize on evolving trends shaping the financial services industry.

We are committed to exceeding our customers’ service-related expectations. We measure and monitor customer satisfaction using formal annual surveys and online surveys initiated each day by routine support requests. The results of this extensive survey process confirm that our service consistently exceeds our customers’ expectations and generates excellent customer retention rates.

We also focus on establishing long-term customer relationships, continually expanding and strengthening those relationships with cross sales of additional products and services, earning new traditional and nontraditional clients, and ensuring each product offering is highly competitive.

The majority of our revenue is derived from recurring outsourcing fees, transaction processing fees, and support and service fees that generally have contract terms of five years or greater. Less predictable software license fees, paid by customers implementing our software solutions in-house, and hardware sales, including all non-software products that we re-market in order to support our software systems, complement our primary revenue sources.

JHA’s gross revenue has grown from $742.9 million in fiscal 2008 to $1,027.1 million in fiscal 2012, representing a compound annual growth rate during this challenging five-year period of 7 percent. Net income from continuing operations has grown from $105.3 million to $155.0 million during this same five-year period, representing a compound

annual growth rate of 8 percent. Information regarding the classification of our business into separate segments serving the banking and credit union industries is set forth in Note 13 to the Consolidated Financial Statements (see Item 8).

JHA’s progress and performance have been guided by the focused work ethic and fundamental ideals fostered by the Company’s founders over three decades ago:

| |

| • | Do whatever it takes, and |

We recognize that our associates and their collective contribution are ultimately responsible for JHA’s past, present, and future success. Recruiting and retaining high-quality employees is essential to our ongoing growth and financial performance, and we have established a corporate culture that sustains high levels of employee satisfaction.

Industry Background

Jack Henry Banking primarily serves commercial banks and savings institutions with up to $30.0 billion in assets. According to the Federal Deposit Insurance Corporation (“FDIC”), there were more than 7,300 commercial banks and savings institutions in this asset range as of December 31, 2011. Jack Henry Banking currently supports over 1,330 of these banks with its core information processing platforms and complementary products and services.

Symitar serves credit unions of all asset sizes. According to the Credit Union National Association (“CUNA”), there were more than 7,300 domestic credit unions as of December 31, 2011. Symitar currently supports nearly 750 of these credit unions with core information processing platforms and complementary products and services.

ProfitStars serves financial services organizations of all asset sizes and charters and other diverse corporate entities. ProfitStars currently supports nearly 11,000 institutions with specialized solutions for generating additional revenue and growth, increasing security, mitigating operational risks, and controlling operating costs.

The FDIC reports the number of commercial banks and savings institutions declined 15 percent from the beginning of calendar year 2008 to the end of calendar year 2011. Although the number of banks declined at a 3 percent compound annual rate during this period, aggregate assets increased at a compound annual rate of 5 percent and totaled $12.6 trillion as of December 31, 2011. Comparing calendar years 2011 to 2010, new bank charters decreased 73 percent and mergers increased 1 percent.

CUNA reports the number of credit unions also declined 15 percent from the beginning of calendar year 2008 to the end of calendar year 2011. Although the number of credit unions declined at a 3 percent compound annual rate during this period, aggregate assets increased at a compound annual rate of 6 percent and totaled $982.1 billion as of December 31, 2011.

Community and mid-tier banks and credit unions are important in the communities and to the consumers they serve. Bank customers and credit union members rely on these institutions to provide personalized, relationship-based service and competitive financial products and services available through the customer’s delivery channel of choice. Institutions are recognizing that attracting and retaining customers/members in today’s highly competitive financial industry and realizing near and long term performance goals are often technology-dependent. Financial institutions must implement technological solutions that enable them to:

| |

| • | Maximize performance with accessible, accurate, and timely business intelligence information; |

| |

| • | Offer the high-demand products and services needed to successfully compete with traditional competitors and non-traditional competitors created by convergence within the financial services industry; |

| |

| • | Enhance the customer/member experience at varied points of contact; |

| |

| • | Expand existing customer/member relationships and strengthen exit barriers by cross selling additional products and services; |

| |

| • | Capitalize on new revenue and deposit growth opportunities; |

| |

| • | Increase operating efficiencies and reduce operating costs; |

| |

| • | Implement e-commerce strategies that provide the convenience-driven services required in today’s financial services industry; |

| |

| • | Protect mission-critical information assets and operational infrastructure; |

| |

| • | Protect customers/members from fraud and related financial losses; |

| |

| • | Maximize the day-to-day use of technology and return on technology investments; and |

| |

| • | Ensure full regulatory compliance. |

JHA’s extensive product and service offering enables diverse financial institutions to capitalize on these business

opportunities and respond to these business challenges. We strive to establish a long-term, value-added technology partnership with each customer, and to continually expand our offering with the specific solutions our customers need to prosper in the evolving financial services industry.

Mission Statement

JHA’s mission is to protect and increase the value of its stockholders' investment by providing quality products and services to our customers by:

| |

| • | Concentrating our activities on what we know best - information systems and services for financial institutions; |

| |

| • | Providing outstanding commitment and service to our customers so that the perceived value of our products and services is consistent with the real value; and |

| |

| • | Maintaining a work environment that is personally, professionally, and financially rewarding to our employees. |

Business Strategy

Our fundamental business strategy is to generate organic revenue and earnings growth supplemented by strategic acquisitions. We execute this strategy by:

| |

| • | Providing commercial banks and credit unions with core software systems that provide excellent functionality, and support in-house and outsourced operating environments with identical functionality. |

| |

| • | Expanding each core customer relationship by cross-selling complementary products and services that enhance the functionality provided by our core information processing systems. |

| |

| • | Maintaining a company-wide commitment to customer service that consistently exceeds our customers’ expectations and generates high levels of customer retention. |

| |

| • | Capitalizing on our focused diversification acquisition strategy. |

Focused Diversification Acquisition Strategy

JHA’s acquisition strategy, which complements and accelerates our organic growth, focuses on successful companies that provide in-demand products and services, excellent customer relationships, and strong management teams and employee bases.

Historically, our acquisition strategy focused on companies that:

| |

| • | Expanded our base of core financial institution customers, |

| |

| • | Expanded our suite of complementary products and services that were cross sold to existing customers, |

| |

| • | Enabled our entry into adjacent markets within the financial services industry; and/or |

| |

| • | Provided additional outsourcing capabilities/opportunities. |

In 2004, we adopted our focused diversification acquisition strategy and began acquiring companies and highly specialized products that are:

| |

| • | Sold to existing core customers; |

| |

| • | Sold outside JHA’s base of core bank and credit union customers to financial services organizations of all charters and asset sizes; |

| |

| • | Selectively sold outside the financial services industry to diverse corporate entities; and |

| |

| • | Selectively sold internationally. |

Since our focused diversification strategy was adopted, JHA has completed 19 acquisitions that support it and assembled three distinct product brands that enable users to:

| |

| • | Generate additional revenue and growth opportunities, |

| |

| • | Increase security and mitigate operational risks, and /or |

| |

| • | Control operating costs. |

These products and services enable us to expand our reach well beyond our traditional markets with solutions that are appropriate for virtually any financial services organization, including thousands of institutions that we previously did not sell to.

Following are the acquisitions that have been made in the last five fiscal years to support JHA’s focused diversification:

|

| | |

| Fiscal Year | Company or Product Name | Products and Services |

| 2010 | iPay Technologies | Internet and telephone bill payment services |

| 2010 | PEMCO Technology Services | Payment processing solutions for credit unions |

| 2010 | Goldleaf Financial Solutions | Integrated technology and payment processing solutions |

| 2008 | AudioTel | Check and document imaging and electronic banking |

| 2008 | Gladiator Technology | Information Technology Security Services |

Solutions

Our proprietary solutions are marketed through three business brands:

| |

| • | Jack Henry Banking supports commercial banks with information and transaction processing platforms that provide enterprise-wide automation. Its solutions encompass three functionally distinct core processing systems and more than 100 complementary solutions, including business intelligence and bank management, retail and business banking, internet banking and electronic funds transfer (“EFT”), risk management and protection, and item and document imaging solutions. Our banking solutions have state-of-the-art functional capabilities, and we can provide the hardware required by each software system. Our banking solutions can be delivered in-house or through outsourced implementation, and are backed by a company-wide commitment to provide exceptional personal service. Jack Henry Banking is a recognized market leader, currently supporting nearly 1,330 banks with its technology platforms. |

| |

| • | Symitar supports credit unions of all sizes with information and transaction processing platforms that provide enterprise-wide automation. Its solutions include two functionally distinct core processing systems and more than 50 complementary solutions, including business intelligence and credit union management, member and member business services, Internet banking and EFT, risk management and protection, and item and document imaging solutions. Our credit union solutions also have state-of-the-art functional capabilities, and we can provide the hardware required by each software system. Our credit union solutions can be delivered in-house or through outsourced implementation, and are also backed by our company-wide commitment to provide exceptional personal service. |

| |

| • | ProfitStars is a leading provider of specialized products and services assembled through our focused diversification acquisition strategy. These solutions are compatible with a wide variety of information technology platforms and operating environments, and include proven solutions for generating additional revenue and growth, increasing security and mitigating operational risks, and/or controlling operating costs. ProfitStars’ products and services are enhancing the performance of financial services organizations of all asset sizes and charters, and diverse corporate entities with nearly 11,000 domestic and international customers. These distinct products and services can be implemented individually or as solution suites to address specific business problems and enable effective responses to dynamic industry trends. |

We will continue to develop and maintain functionally robust, integrated solutions that are supported with high service levels; regularly enhanced using an interactive customer enhancement process; compliant with relevant regulations; updated with proven advances in technology; and consistent with JHA’s reputation as a premium product and service provider.

Core Software Systems

Core software systems primarily consist of the integrated applications required to process deposit, loan, and general ledger transactions, and to maintain centralized customer/member information.

Jack Henry Banking markets three core software systems to banks and Symitar markets two core software systems to credit unions. These core systems are available for in-house installation at customer sites or financial institutions can outsource ongoing information processing to JHA based on the core processing solution most compatible with their specific operational requirements.

Jack Henry Banking’s three core banking platforms are:

| |

| • | SilverLake® is a robust IBM® System i™-based system primarily designed for commercial-focused banks with assets ranging from $500 million to $30 billion. However, an increasing number of progressive smaller banks, including de novo, or recently chartered start-up banks, are now selecting SilverLake. This system has been implemented by over 420 banks, and now automates approximately 6 percent of the domestic banks with assets less than $30 billion. |

| |

| • | CIF 20/20® is a parameter-driven, easy-to-use system that now supports nearly 690 banks ranging from de novo institutions to those with assets exceeding $2 billion. CIF 20/20 is the most widely used IBM System i-based core processing system in the community bank market. |

| |

| • | Core Director® is a Windows®-based, client/server system that now supports over 220 banks ranging from de novo institutions to those with assets exceeding $1 billion. Core Director is a cost-efficient operating platform and provides intuitive point-and-click operation. |

Symitar’s two functionally distinct core credit union platforms are:

| |

| • | Episys® is a robust IBM System p™-based system primarily designed for credit unions with more than $50 million in assets. It has been implemented by over 570 credit unions and is ranked as the system implemented by more credit unions with assets exceeding $25 million than any other alternative. |

| |

| • | Cruise® is a Windows-based, client/server system designed primarily for credit unions with less than $50 million in assets. It has been implemented by more than 180 credit unions, is cost-efficient, and provides intuitive point-and-click, drag-and-drop operation. |

Customers electing to install our solutions in-house license the proprietary software systems based on initial license fees. The large majority of these customers pay ongoing annual software maintenance fees. We also re-market the hardware and peripheral equipment that is required by our software solutions; and we contract to perform software implementation, data conversion, training, ongoing support, and other related services. In-house customers generally license our core software systems under a standard license agreement that provides a fully paid, nonexclusive, nontransferable right to use the software on a single computer at a single location.

Customers can eliminate the significant up-front capital expenditures required by in-house installations and the responsibility for operating information and transaction processing infrastructures by outsourcing these functions to JHA. Our outsourcing services are provided through a national network of data centers in five physical locations and four image-enabled item processing centers. Customers electing to outsource their core processing typically sign contracts for five or more years that include transaction-based processing fees and minimum guaranteed payments during the contract period.

We support the dynamic business requirements of our core bank and credit union clients with ongoing enhancements to each core system, the regular introduction of new integrated complementary products, the ongoing integration of practical new technologies, and regulatory compliance initiatives. JHA also serves each core customer as a single point of contact, support, and accountability.

Complementary Products and Services

We provide more than 100 complementary products and services that are sold to our core bank and credit union customers, and selectively sold by our ProfitStars division to financial services organizations that use other core processing systems.

These complementary solutions enable core bank and credit union clients to respond to evolving customer/member demands, expedite speed-to-market with competitive offerings, increase operating efficiency, address specific operational issues, and generate new revenue streams. The highly specialized solutions sold by ProfitStars enable diverse financial services organizations and corporate entities to generate additional revenue and growth opportunities, increase security and mitigate operational risks, and control operating costs. As part of ProfitStars, iPay Technologies, our most recent acquisition, provides a configurable electronic payments platform and turnkey online bill payment solutions that can integrate with any online banking platform.

JHA regularly introduces new products and services based on demand for integrated complementary solutions from our existing core clients, and based on the growing demand among financial services organizations and corporate entities for specialized solutions capable of increasing revenue and growth opportunities, mitigating and controlling operational risks, and containing costs. The Company’s Industry Research department solicits customer guidance on the business solutions they need, formally evaluates available solutions and competitive offerings, and manages the introduction of new product offerings. JHA’s new complementary products and services are developed internally, acquired, or provided through strategic alliances.

Hardware Systems

Hardware sales support our software systems and include non-JHA products that we re-market.

Our software systems operate on a variety of hardware platforms. We have established remarketing agreements with IBM Corporation, Avnet, Inc., and other hardware providers that allow JHA to purchase hardware at a discount and resell it directly to our customers. We currently sell the IBM Power Systems and System x servers; Lenovo workstations; Dell servers and workstations; Burroughs, RDM, Panini, Digital Check, Canon check scanners; and other devices that complement our software solutions.

Implementation and Training

While it is not essential, the majority of our core bank and credit union customers contract with us for implementation

and training services in connection with their in-house systems.

A complete core system implementation typically includes detailed planning, project management, data conversion, and testing. Our experienced implementation teams travel to customer facilities to help manage the process and ensure that all data is transferred from the legacy system to the JHA system being implemented. Our implementation fees are fixed or hourly based on the core system being installed.

Implementation and training services also are provided in connection with new customers outsourcing their information processing to JHA.

We also provide extensive initial and ongoing education to our customers. Know-It-All Education is a comprehensive training program that supports new customers with basic training and longtime customers with continuing education. The curricula provide the ongoing training financial institutions need to maximize the use of JHA’s core and complementary products, to optimize ongoing system enhancements, and to fully understand dynamic year-end legislative and regulatory requirements. Each basic, intermediate, and advanced course is delivered by system experts, supported by professional materials and training tools, and incorporates different educational media in a blended learning approach. Know-It-All Education supports distinct learning preferences with a variety of delivery channels, including classroom-based courses offered in JHA’s regional training centers, Internet-based live instruction, eLearning courses, on-site training, and train-the-trainer programs.

Support and Services

We serve our customers as a single point of contact and support for the complex solutions we provide. The Company’s comprehensive support infrastructure incorporates:

| |

| • | Exacting service standards; |

| |

| • | Trained support staffs available 24 hours-a-day, 365 days-a-year; |

| |

| • | Assigned account managers; |

| |

| • | Sophisticated support tools, resources, and technology; and |

| |

| • | A best practices methodology developed and refined through the company-wide, day-to-day experience supporting more than 11,900 diverse clients. |

JHA’s experience converting diverse banks and credit unions to our core platforms from every competitive platform also provides highly effective change management and control processes.

Most in-house customers contract for annual software support services, and this represents a significant source of recurring revenue for JHA. These support services are typically priced at approximately 18 to 20 percent of the respective product’s software license fee. These fees generally increase as customer assets increase and as additional complementary products are purchased. Annual software support fees are typically billed during June and are paid in advance for the entire fiscal year, with pro-ration for new product implementations that occur during the year. Hardware support fees also are usually paid in advance for entire contract periods which typically range from one to five years. Most support contracts automatically renew unless the customer or JHA gives notice of termination at least 60 days prior to contract expiration.

High levels of support are provided to our outsourced customers by the same support infrastructure utilized for in-house customers. However, these support fees are included as part of monthly outsourcing fees.

JHA regularly measures customer satisfaction using formal annual surveys and online surveys initiated each year by routine support requests. This process shows that we consistently exceed our customers’ service-related expectations.

Backlog

Backlog consists of contracted in-house products and services that have not been delivered. Backlog also includes the minimum monthly payments for the remaining portion of multi-year outsourcing contracts, and typically includes the minimum payments guaranteed for the remainder of the contract period.

Backlog as of June 30, 2012 totaled $435.3 million, consisting of $92.7 million for in-house products and services, and $342.6 million for outsourcing services. Approximately $268.3 million of the outsourcing services backlog as of June 30, 2012 is not expected to be realized during fiscal 2013 due to the long-term nature of many outsourcing contracts. Backlog as of June 30, 2011 totaled $358.8 million, consisting of $79.1 million for in-house products and services, and $279.7 million for outsourcing services.

Our in-house backlog is subject to seasonal variations and can fluctuate quarterly. Our outsourcing backlog continues to experience growth based on new contracting activities and renewals of multi-year contracts, and although the appropriate portion of this revenue will be recognized during fiscal 2013, the backlog is expected to trend up gradually for the foreseeable future due to renewals of existing relationships and new contracting activities.

Research and Development

We invest significant resources in ongoing research and development to develop new software solutions and services, and enhance existing solutions with additional functionality and features required to ensure regulatory compliance. Our core and complementary systems are typically enhanced once each year. Product-specific enhancements are largely customer-driven with recommended enhancements formally gathered through focus groups, change control boards, strategic initiatives meetings, annual user group meetings, and ongoing customer contact. We also continually evaluate and implement process improvements that expedite the delivery of new products and enhancements to our customers, and reduce related costs.

Research and development expenses for fiscal years 2012, 2011, and 2010 were $60.9 million, $63.4 million, and $50.8 million, respectively. Capitalized software for fiscal years 2012, 2011, and 2010 was $37.9 million, $27.0 million, and $25.6 million, respectively.

Sales and Marketing

JHA serves established, well defined markets that provide ongoing sales and cross-sales opportunities.

Jack Henry Banking sells core processing systems and integrated complementary solutions to domestic commercial banks with assets up to $30.0 billion. Symitar sells core processing systems and integrated complementary solutions to domestic credit unions of all asset sizes. The marketing and sales initiatives within these business lines are primarily focused on identifying banks and credit unions evaluating alternative core information and transaction processing solutions. Jack Henry Banking also has been successfully selling its core and complementary solutions to a significant number of the de novo banks chartered in recent years. ProfitStars sells specialized niche solutions that complement existing technology platforms to domestic financial services organizations of all asset sizes and charters.

Dedicated sales forces support each of JHA’s three business brands. Sales executives are responsible for the activities required to earn new customers in assigned territories, and regional account executives are responsible for nurturing customer relationships and cross selling additional products and services. Our sales professionals receive base salaries and performance-based commission compensation. Brand-specific sales support staff provide a variety of services, including product and service demonstrations, responses to prospect-issued requests-for-proposals, and proposal and contract generation. A centralized marketing department supports all three business lines with lead generation and brand-building activities, including participation in state-specific, regional, and national trade shows; print and online advertising; telemarketing; customer newsletters; ongoing promotional campaigns; and media relations. JHA also hosts annual national user group meetings which provide opportunities to network with existing clients and demonstrate new products and services.

jhaDirect sells specific complementary solutions, and business forms and supplies that are compatible with JHA’s software solutions. jhaDirect’s offering consists of more than 4,000 items, including tax and custom forms, ATM and teller supplies, check imaging and reader/sorter supplies, magnetic media, laser printers and supplies, loan coupon books, and much more. New items are regularly added in response to dynamic regulatory requirements and to support JHA’s ever-expanding product and service suite.

JHA sells select products and services in the Caribbean and, as a result of recent acquisitions, Europe and South America. International sales account for less than one percent of JHA’s total revenue in each of the three years ended June 30, 2012, 2011, and 2010.

Competition

The market for companies providing technology solutions to financial services organizations is competitive, and we expect that competition from both existing competitors and companies entering our existing or future markets will remain strong. Some of JHA’s current competitors have longer operating histories, larger customer bases, and greater financial resources. The principal competitive factors affecting the market for technology solutions include product/service functionality, price, operating flexibility and ease-of-use, customer support, and existing customer references. For more than a decade there has been significant consolidation among providers of products and services designed for financial institutions, and this consolidation is expected to continue in the future.

Jack Henry Banking and Symitar compete with large vendors that provide information and transaction processing solutions to banks and credit unions, including Fidelity National Information Services, Inc.; Fiserv, Inc.; Open Solutions, Inc.; and Harland Financial Solutions – Ultradata. ProfitStars competes with an array of disparate vendors that provide niche solutions to financial services organizations and corporate entities.

Intellectual Property, Patents, and Trademarks

Although we believe our success depends upon our technical expertise more than our proprietary rights, our future success and ability to compete depend in part upon our proprietary technology. We have registered or filed applications

for our primary trademarks. Most of our technology is not patented. Instead, we rely on a combination of contractual rights, copyrights, trademarks, and trade secrets to establish and protect our proprietary technology. We generally enter into confidentiality agreements with our employees, consultants, resellers, customers, and potential customers. Access to and distribution of our Company’s source code is restricted, and the disclosure and use of other proprietary information is further limited. Despite our efforts to protect our proprietary rights, unauthorized parties can attempt to copy or otherwise obtain, or use our products or technology. We cannot be certain that the steps taken in this regard will be adequate to prevent misappropriation of our technology or that our competitors will not independently develop technologies that are substantially equivalent or superior to our technology.

Regulatory Compliance

JHA maintains a strict corporate commitment to address compliance issues and implement requirements imposed by the federal regulators prior to the effective date of such requirements when adequate prior notice is given. JHA’s comprehensive compliance program is provided by a team of compliance analysts and auditors that possess extensive regulatory agency and financial institution experience, and a thorough working knowledge of JHA and our solutions. These compliance professionals leverage multiple channels to remain informed about potential and recently enacted regulatory requirements, including regular discussions on emerging topics with the Federal Financial Institutions Examination Council (“FFIEC”) examination team and training sessions sponsored by various professional associations.

JHA has a proven process to inform internal contacts of new and revised regulatory requirements. Upcoming regulatory changes also are presented to the Company’s product-specific change control boards and the necessary product changes are included in the ongoing product development cycle. A representative of JHA’s compliance organization serves on every change control board to ensure that the regulatory perspective is addressed in proposed product/service changes. We publish newsletters to keep our customers informed of regulatory changes that could impact their operations. Periodically, customer advisory groups are assembled to discuss significant regulatory changes, such as recent changes to the FDIC’s overdraft fee guidance.

Internal audits of our systems, networks, operations, and applications are conducted and specialized outside firms are periodically engaged to perform testing and validation of our systems, processes, and security. Ensuring that confidential information remains private is a high priority, and JHA’s initiatives to protect confidential information include regular third-party application reviews intended to better secure information access. Additional third-party reviews are performed throughout the organization, such as vulnerability tests, intrusion tests, and SSAE 16 reviews. The FFIEC conducts annual reviews throughout the Company and issues reports that are reviewed by the JHA Audit Committee of the Board of Directors.

Government Regulation

The financial services industry is subject to extensive and complex federal and state regulation. All financial institutions are subject to substantial regulatory oversight and supervision, with increased attention to consumer regulations with the addition of the Consumer Financial Protection Bureau. Our products and services must comply with the extensive and evolving regulatory requirements applicable to our customers, including but not limited to those mandated by federal truth-in-lending and truth-in-savings rules, the Privacy of Consumer Financial Information regulations, usury laws, the Equal Credit Opportunity Act, the Fair Housing Act, the Electronic Funds Transfer Act, the Fair Credit Reporting Act, the Bank Secrecy Act, the USA Patriot Act, the Gramm-Leach-Bliley Act, and the Community Reinvestment Act. The compliance of JHA’s products and services with these requirements depends on a variety of factors, including the particular functionality, the interactive design, the classification of customers, and the manner in which the customer utilizes the products and services. Our customers are contractually responsible for assessing and determining what is required of them under these regulations and then we assist them in meeting their regulatory needs through our products and services. The impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act is still evolving as the regulations are written to implement the various provisions of the law. We cannot predict the impact these regulations, any future amendments to these regulations or any newly implemented regulations will have on our business in the future.

JHA is not chartered by the Office of the Comptroller of Currency, the Board of Governors of the Federal Reserve System, the National Credit Union Administration or other federal or state agencies that regulate or supervise depository institutions.

Operating as a service provider to financial institutions, JHA’s operations are governed by the same regulatory requirements as those imposed on financial institutions, and subject to periodic reviews by FFIEC regulators who have broad supervisory authority to remedy any shortcomings identified in such reviews.

JHA provides outsourced data and item processing through geographically dispersed OutLink™ Data Centers, electronic transaction processing through our PassPort and Enterprise Payments Solutions™, Internet banking through

NetTeller, ProfitStar’s Teleweb, and MemberConnect™ online solutions, and business recovery services through Centurion Disaster Recovery.

The services provided by our OutLink Data Centers are subject to examination by the Federal Financial Institution Examination Council regulators under the Bank Service Company Act. These outsourcing services also are subject to examination by state banking authorities on occasion.

Employees

As of June 30, 2012 and 2011, JHA had 4,872 and 4,667 full-time employees, respectively. Of our full-time employees, approximately 862 are employed in the credit union segment of our business, with the remainder employed in the bank segment or in general and administrative functions that serve both segments. Our employees are not covered by a collective bargaining agreement and there have been no labor-related work stoppages.

Available Information

JHA’s Website is easily accessible to the public at www.jackhenry.com. The “For Investors" portion of the Website provides key corporate governance documents, the code of conduct, an archive of press releases, and other relevant Company information. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and other filings and amendments thereto that are made with the U.S. Securities and Exchange Commission (SEC) also are available free of charge on our Website as soon as reasonably practical after these reports have been filed with or furnished to the SEC.

ITEM 1A. RISK FACTORS

The Company’s business and the results of its operations are affected by numerous factors and uncertainties, some of which are beyond our control. The following is a description of some of the important risks and uncertainties that may cause the actual results of the Company’s operations in future periods to differ from those expected or desired.

Our business may be adversely impacted by U.S. and global market and economic conditions. We derive most of our revenue from products and services we provide to the financial services industry. Given this concentration, we may be particularly exposed to the current difficult and unsettled economic climate. If the economic environment remains poor, it may result in significant decreases in demand by current and potential clients for our products and services, which could have a material adverse effect on our business, results of operations and financial condition.

Changes in the banking and credit union industry could reduce demand for our products. Cyclical fluctuations in economic conditions affect profitability and revenue growth at commercial banks and credit unions. Unfavorable economic conditions negatively affect the spending of banks and credit unions, including spending on computer software and hardware. Such conditions could reduce both our sales to new customers and upgrade/complementary product sales to existing customers. The Company could also experience the loss of customers due to their financial failure.

Competition or general economic conditions may result in decreased demand or require price reductions or other concessions to customers which could result in lower margins and reduce income. We vigorously compete with a variety of software vendors in all of our major product lines. We compete on the basis of product quality, reliability, performance, ease of use, quality of support and services, integration with other products and pricing. Some of our competitors may have advantages over us due to their size, product lines, greater marketing resources, or exclusive intellectual property rights. If competitors offer more favorable pricing, payment or other contractual terms, warranties, or functionality, or if general economic conditions decline such that customers are less willing or able to pay the cost of our products and services, we may need to lower prices or offer favorable terms in order to successfully compete.

Security problems could damage our reputation and business. We rely on industry-standard encryption, network and Internet security systems, most of which we license from third parties, to provide the security and authentication necessary to effect secure transmission of data. Our services and infrastructure are increasingly reliant on the Internet. Computer networks and the Internet are vulnerable to unauthorized access, computer viruses and other disruptive problems such as denial of service attacks and other forms of cyber-terrorism. Individual personal computers can be stolen, and customer data media can be lost in shipment. Under state and proposed federal laws requiring consumer notification of security breaches, the costs to remediate security breaches can be substantial. Advances in computer capabilities, new discoveries in the field of cryptography or other events or developments may render our security measures inadequate. Security risks may result in liability to us and also may deter financial institutions from purchasing our products. We will continue to expend significant capital and other resources protecting against the threat of security breaches, and we may need to expend resources alleviating problems caused by breaches. Eliminating computer viruses and addressing other security problems may result in interruptions, delays or cessation of service to users, any of which could harm our business.

Failures associated with payment transactions could result in a financial loss. The volume and dollar amount

of payment transactions that we process is very large and continues to grow. We settle funds on behalf of financial institutions, other businesses and consumers and receive funds from clients, card issuers, payment networks and consumers on a daily basis for a variety of transaction types. Transactions facilitated by us include debit card, credit card, electronic bill payment transactions, Automated Clearing House (“ACH”) payments and check clearing that supports consumers, financial institutions and other businesses. If the continuity of operations, integrity of processing, or ability to detect or prevent fraudulent payments were compromised in connection with payments transactions, this could result in a financial as well as reputational loss to us. In addition, we rely on various financial institutions to provide ACH services in support of funds settlement for certain of our products. If we are unable to obtain such ACH services in the future, that could have a material adverse effect on our business, financial position and results of operations. In addition, we may issue credit to consumers, financial institutions or other businesses as part of the funds settlement. A default on this credit by a counterparty could result in a financial loss to us.

If we fail to adapt our products and services to changes in technology, we could lose existing customers and be unable to attract new business. The markets for our software and hardware products and services are characterized by changing customer requirements and rapid technological changes. These factors and new product introductions by our existing competitors or by new market entrants could reduce the demand for our existing products and services and we may be required to develop or acquire new products and services. Our future success is dependent on our ability to enhance our existing products and services in a timely manner and to develop or acquire new products and services. If we are unable to develop or acquire new products and services as planned, or if we fail to sell our new or enhanced products and services, we may incur unanticipated expenses or fail to achieve anticipated revenues.

Consolidation and failures of financial institutions will continue to reduce the number of our customers and potential customers. Our primary market consists of approximately 7,300 commercial and savings banks and 7,300 credit unions. The number of commercial banks and credit unions has decreased because of failures over the last few years and mergers and acquisitions over the last several decades and is expected to continue to decrease as more consolidation occurs.

The services we provide to our customers are subject to government regulation that could hinder the development of portions of our business or impose constraints on the way we conduct our operations. The financial services industry is subject to extensive and complex federal and state regulation. As a supplier of services to financial institutions, portions of our operations are examined by the Office of the Comptroller of the Currency, the Federal Reserve Board, the Federal Deposit Insurance Corporation, and the National Credit Union Association, among other regulatory agencies. These agencies regulate services we provide and the manner in which we operate, and we are required to comply with a broad range of applicable laws and regulations. In addition, existing laws, regulations, and policies could be amended or interpreted differently by regulators in a manner that has a negative impact on our existing operations or that limits our future growth or expansion. Our customers are also regulated entities, and actions by regulatory authorities could determine both the decisions they make concerning the purchase of data processing and other services and the timing and implementation of these decisions. Concerns are growing with respect to the use, confidentiality, and security of private customer information. Regulatory agencies, Congress and state legislatures are considering numerous regulatory and statutory proposals to protect the interests of consumers and to require compliance with standards and policies that have not been defined.

The software we provide to our customers is also affected by government regulation. We are generally obligated to our customers to provide software solutions that comply with applicable federal and state regulations. In particular, numerous new regulations have been proposed and are still being written to implement the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Substantial software research and development and other corporate resources have been and will continue to be applied to adapt our software products to this evolving, complex and often unpredictable regulatory environment. Our failure to provide compliant solutions could result in significant fines or consumer liability on our customers, for which we may bear ultimate liability.

An operational failure in our outsourcing facilities could cause us to lose customers. Damage or destruction that interrupts our outsourcing operations could damage our relationship with customers and may cause us to incur substantial additional expense to repair or replace damaged equipment. Our back-up systems and procedures may not prevent disruption, such as a prolonged interruption of our transaction processing services. In the event that an interruption of our network extends for more than several hours, we may experience data loss or a reduction in revenues by reason of such interruption. In addition, a significant interruption of service could have a negative impact on our reputation and could lead our present and potential customers to choose other service providers.

Our growth may be affected if we are unable to find or complete suitable acquisitions. We have augmented the growth of our business with a number of acquisitions and we plan to continue to acquire appropriate businesses, products and services. This strategy depends on our ability to identify, negotiate and finance suitable acquisitions. Substantial recent merger and acquisition activity in our industry has affected the availability and pricing of such

acquisitions. If we are unable to acquire suitable acquisition candidates, we may experience slower growth.

Acquisitions may be costly and difficult to integrate. We have acquired a number of businesses in the last several years and will continue to explore acquisitions in the future. We may not be able to successfully integrate acquired companies. We may encounter problems with the integration of new businesses including: financial control and computer system compatibility; unanticipated costs; unanticipated quality or customer problems with acquired products or services; differing regulatory and industry standards; diversion of management's attention; adverse effects on existing business relationships with suppliers and customers; loss of key employees; and significant amortization expenses related to acquired assets. To finance future acquisitions, we may have to increase our borrowing or sell equity or debt securities to the public. If we fail to integrate our acquisitions, our business, financial condition and results of operations could be materially and adversely affected. Failed acquisitions could also produce material and unpredictable impairment charges as we periodically review our acquired assets.

The loss of key employees could adversely affect our business. We depend on the contributions and abilities of our senior management. Our Company has grown significantly in recent years and our management remains concentrated in a small number of key employees. If we lose one or more of our key employees, we could suffer a loss of sales and delays in new product development, and management resources would have to be diverted from other activities to compensate for this loss. We do not have employment agreements with any of our executive officers.

If others claim that we have infringed their intellectual property rights, we could be liable for significant damages. We have agreed to indemnify many of our customers against claims that our products and services infringe on the proprietary rights of others. We anticipate that the number of infringement claims will increase as the number of our software solutions and services increases and the functionality of our products and services expands. Any such claims, whether with or without merit, could be time-consuming, result in costly litigation and may not be resolved on terms favorable to us.

We may not be able to manage growth. We have grown both internally and through acquisitions. Our expansion has and will continue to place significant demands on our administrative, operational, financial and management personnel and systems. We may not be able to enhance and expand our product lines, manage costs, adapt our infrastructure and modify our systems to accommodate future growth.

Expansion of services to non-traditional customers could expose us to new risks. Some of our recent acquisitions include business lines that are marketed outside our traditional, regulated, and litigation-averse base of financial institution customers. These non-regulated customers may entail greater operational, credit and litigation risks than we have faced before and could result in increases in bad debts and litigation costs.

Failure to achieve favorable renewals of service contracts could negatively affect our outsourcing business. Our contracts with our customers for outsourced data processing services generally run for a period of five or more years. Because of the rapid growth of our outsourcing business over the last five years, we will experience greater numbers of these contracts coming up for renewal over the next few years. Renewal time presents our customers with the opportunity to consider other providers or to renegotiate their contracts with us. If we are not successful in achieving high renewal rates upon favorable terms, our outsourcing revenues and profit margins will suffer.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We own 154 acres located in Monett, Missouri on which we maintain nine office buildings, plus shipping & receiving and maintenance buildings. We also own buildings in Houston, Texas; Allen, Texas; Albuquerque, New Mexico; Birmingham, Alabama; Lenexa, Kansas; Angola, Indiana; Shawnee Mission, Kansas; Rogers, Arkansas; Oklahoma City, Oklahoma; Elizabethtown, Kentucky; Springfield, Missouri and San Diego, California. Our owned facilities represent approximately 1,000,000 square feet of office space in ten states. We have 39 leased office facilities in 21 states, which total approximately 374,000 square feet. All of our owned and leased office facilities are for normal business purposes.

Of our facilities, the credit union segment uses office space totaling approximately 151,000 square feet in ten facilities. The majority of our San Diego, California offices are used in the credit union segment, as are portions of nine other office facilities. The remainder of our leased and owned facilities, approximately 1,223,000 square feet of office space, is primarily devoted to serving our bank segment or supports our whole business.

We own four aircraft. Many of our customers are located in communities that do not have an easily accessible commercial airline service. We primarily use our airplanes in connection with implementation, sales of systems and internal

requirements for day-to-day operations. Transportation costs for implementation and other customer services are billed to our customers. We lease property, including real estate and related facilities, at the Monett, Missouri municipal airport.

ITEM 3. LEGAL PROCEEDINGS

We are subject to various routine legal proceedings and claims arising in the ordinary course of business. We do not expect that the results in any of these legal proceedings will have a material adverse effect on our business, financial condition, results of operations or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

None.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company's common stock is quoted on the NASDAQ Global Select Market (“NASDAQ”), formerly known as the NASDAQ National Market, under the symbol “JKHY”. The following table sets forth, for the periods indicated, the high and low sales price per share of the common stock as reported by NASDAQ.

|

| | | | | | | | | | | | | | | | |

| | | Fiscal 2012 | | Fiscal 2011 |

| | | High | | Low | | High | | Low |

| Fourth Quarter | | $ | 34.76 |

| | $ | 32.17 |

| | $ | 34.17 |

| | $ | 28.45 |

|

| Third Quarter | | 35.37 |

| | 32.11 |

| | 33.94 |

| | 28.96 |

|

| Second Quarter | | 34.50 |

| | 27.33 |

| | 29.97 |

| | 25.35 |

|

| First Quarter | | 31.15 |

| | 24.41 |

| | 26.30 |

| | 23.19 |

|

The Company established a practice of paying quarterly dividends at the end of fiscal 1990 and has paid dividends with respect to every quarter since that time. Quarterly dividends per share paid on the common stock for the two most recent fiscal years ended June 30, 2012 and 2011 are as follows:

|

| | | | | | | | |

| | | Fiscal 2012 | | Fiscal 2011 |

| Fourth Quarter | | $ | 0.115 |

| | $ | 0.105 |

|

| Third Quarter | | 0.115 |

| | 0.105 |

|

| Second Quarter | | 0.105 |

| | 0.095 |

|

| First Quarter | | 0.105 |

| | 0.095 |

|

The declaration and payment of any future dividends will continue to be at the discretion of our Board of Directors and will depend upon, among other factors, our earnings, capital requirements, contractual restrictions, and operating and financial condition. The Company does not currently foresee any changes in its dividend practices.

Information regarding the Company's equity compensation plans is set forth under the caption "Equity Compensation Plan Information" in the Company's definitive Proxy Statement and is incorporated herein by reference.

On August 22, 2012, there were approximately 43,000 holders of the Company’s common stock. On that same date the last sale price of the common shares as reported on NASDAQ was $37.13 per share.

Issuer Purchases of Equity Securities

The following shares of the Company were repurchased during the quarter ended June 30, 2012:

|

| | | | | | | | | | | | |

| | Total Number of Shares Purchased | | Average Price of Share | | Total Number of Shares Purchased as Part of Publicly Announced Plans | | Maximum Number of Shares that May Yet Be Purchased Under the Plans (1) |

| April 1 - April 30, 2012 | — |

| | $ | — |

| | — |

| | 5,583,981 |

|

| May 1 - May 31, 2012 | 717,099 |

| | 32.92 |

| | 717,099 |

| | 4,866,882 |

|

| June 1 - June 30, 2012 | 328,330 |

| | 32.78 |

| | 328,330 |

| | 4,538,552 |

|

| Total | 1,045,429 |

| | 32.88 |

| | 1,045,429 |

| | 4,538,552 |

|

(1) Purchases made under the stock repurchase authorization approved by the Company's Board of Directors on October 4, 2002 with respect to 3.0 million shares, increased by 2.0 million shares on April 29, 2005, by 5.0 million shares on August 28, 2006, by 5.0 million shares on February 4, 2008, and by 5.0 million shares on August 25, 2008. These authorizations have no specific dollar or share price targets and no expiration dates.

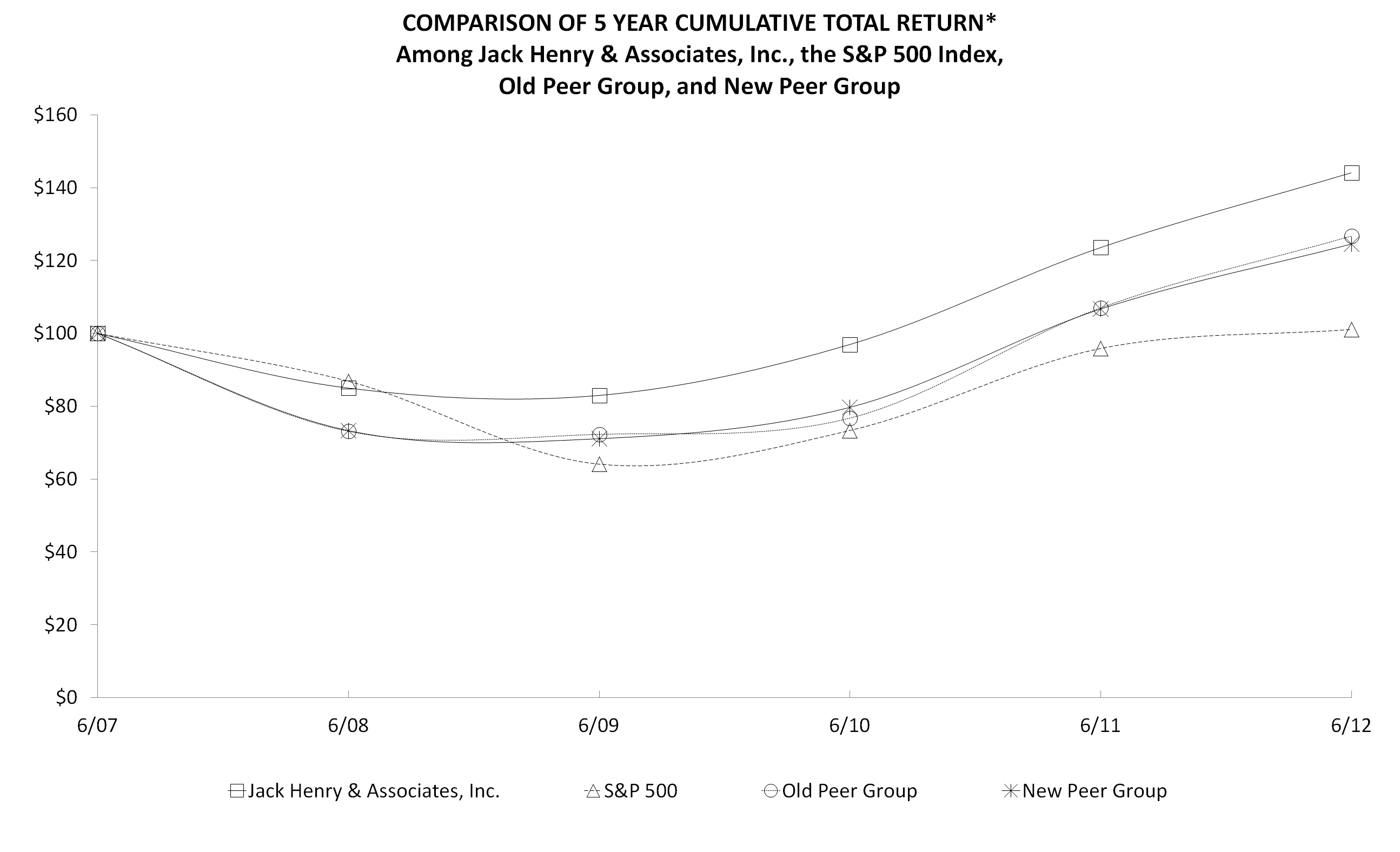

Performance Graph

The following chart presents a comparison for the five-year period ended June 30, 2012, of the market performance of the Company’s common stock with the S & P 500 Index and an index of peer companies selected by the Company:

The following information depicts a line graph with the following values:

|

| | | | | | | | | | | | |

| | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

| JKHY | 100.00 |

| 84.98 |

| 82.97 |

| 96.96 |

| 123.57 |

| 144.10 |

|

| Old Peer Group | 100.00 |

| 73.12 |

| 72.29 |

| 76.75 |

| 107.02 |

| 126.72 |

|

| New Peer Group | 100.00 |

| 73.30 |

| 71.10 |

| 79.71 |

| 106.69 |

| 124.52 |

|

| S & P 500 | 100.00 |

| 86.88 |

| 64.10 |

| 73.35 |

| 95.87 |

| 101.09 |

|

This comparison assumes $100 was invested on June 30, 2007, and assumes reinvestments of dividends. Total returns are calculated according to market capitalization of peer group members at the beginning of each period. Peer companies selected are in the business of providing specialized computer software, hardware and related services to financial institutions and other businesses. In fiscal year 2012, we changed our peer group of companies used for this analysis to maintain alignment with peer companies selected by our Compensation Committee for use in determining compensation for executive management. Companies in the New Peer Group are Bottomline Technology, Inc., Cerner

Corp., DST Systems, Inc., Euronet Worldwide, Inc., Fair Isaac Corp., Fidelity National Information Services, Inc., Fiserv, Inc., Online Resources Corp., SEI Investments Company, Telecommunications Systems, Inc., and Tyler Technologies Corp.

Companies in the Old Peer Group are Bottomline Technology, Inc., Cerner Corp., DST Systems, Inc., Euronet Worldwide, Inc., Fair Isaac Corp., Fidelity National Financial, Inc., Fiserv, Inc., Online Resources Corp., S1 Corp., SEI Investments Company, Telecommunications Systems, Inc., and Tyler Technologies Corp.

ITEM 6. SELECTED FINANCIAL DATA

|

| | | | | | | | | | | | | | | | | | | | |

| Selected Financial Data |

| (In Thousands, Except Per Share Data) |

| | | YEAR ENDED JUNE 30, |

| Income Statement Data | | 2012 |

| | 2011 |

| | 2010 |

| | 2009 |

| | 2008 |

|

Revenue (1) | | $ | 1,027,109 |

| | $ | 966,897 |

| | $ | 836,586 |

| | $ | 745,593 |

| | $ | 742,926 |

|

| Income from continuing operations | | $ | 154,984 |

| | $ | 137,471 |

| | $ | 117,870 |

| | $ | 103,102 |

| | $ | 105,287 |

|

| Basic net income per share, continuing operations | | $ | 1.79 |

| | $ | 1.60 |

| | $ | 1.39 |

| | $ | 1.23 |

| | $ | 1.19 |

|

| Diluted net income per share, continuing operations | | $ | 1.78 |

| | $ | 1.59 |

| | $ | 1.38 |

| | $ | 1.22 |

| | $ | 1.17 |

|

| Dividends declared per share | | $ | 0.44 |

| | $ | 0.40 |

| | $ | 0.36 |

| | $ | 0.32 |

| | $ | 0.28 |

|

| Balance Sheet Data | | | | | | | | | | |

| Working capital | | $ | 66,406 |

| | $ | (26,561 | ) | | $ | (51,283 | ) | | $ | 15,239 |

| | $ | (11,418 | ) |

| Total assets | | $ | 1,619,492 |

| | $ | 1,505,797 |

| | $ | 1,560,560 |

| | $ | 1,050,700 |

| | $ | 1,021,044 |

|

| Long-term debt | | $ | 106,166 |

| | $ | 127,939 |

| | $ | 272,732 |

| | $ | — |

| | $ | 24 |

|

| Stockholders’ equity | | $ | 983,056 |

| | $ | 879,776 |

| | $ | 750,372 |

| | $ | 626,506 |

| | $ | 601,451 |

|

(1) Revenue includes license sales, support and service revenues, and hardware sales, less returns and allowances.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following section provides management's view of the financial condition and results of operations and should be read in conjunction with the Selected Financial Data, the audited Consolidated Financial Statements, and related notes included elsewhere in this report.

OVERVIEW

Jack Henry & Associates, Inc. (JHA) is headquartered in Monett, Missouri, employs approximately 4,900 associates nationwide, and is a leading provider of technology solutions and payment processing services primarily for financial services organizations. Its solutions serve more than 11,900 customers and are marketed and supported through three primary brands. Jack Henry Banking® supports banks ranging from community to mid-tier, multi-billion dollar institutions with information and transaction processing solutions. Symitar® is a leading provider of information and transaction processing solutions for credit unions of all sizes. ProfitStars® provides specialized products and services that enable financial institutions of every asset size and charter, and diverse corporate entities outside the financial services industry to mitigate and control risks, optimize revenue and growth opportunities, and contain costs. JHA's integrated solutions are available for in-house installation and outsourced and hosted delivery.

Each of our brands share the fundamental commitment to provide high quality business solutions, service levels that consistently exceed customer expectations, integration of solutions and practical new technologies. The quality of our solutions, our high service standards, and the fundamental way we do business typically foster long-term customer relationships, attract prospective customers, and have enabled us to capture substantial market share.

Through internal product development, disciplined acquisitions, and alliances with companies offering niche solutions that complement our proprietary solutions, we regularly introduce new products and services and generate new cross-sales opportunities across our three marketed brands. We provide compatible computer hardware for our in-house installations and secure processing environments for our outsourced and hosted solutions. We perform data conversions, software implementations, initial and ongoing customer training, and ongoing customer support services.

Our primary competitive advantage is customer service. Our support infrastructure and strict standards provide service levels we believe to be the highest in the markets we serve and generate high levels of customer satisfaction and

retention. We consistently measure customer satisfaction using comprehensive annual surveys and random surveys we receive in our everyday business. Dedicated surveys are also used to grade specific aspects of our customer experience, including product implementation, education, and consulting services.

The majority of our revenue is derived from recurring outsourcing fees, transaction processing fees, and support and service fees that generally have contract terms of five years or greater. Less predictable software license fees and hardware sales complement our primary revenue sources. We continually seek opportunities to increase revenue while at the same time containing costs to expand margins.

During the last five fiscal years, our revenues have grown from $742,926 in fiscal 2008 to $1,027,109 in fiscal 2012. Income from continuing operations has grown from $105,287 in fiscal 2008 to $154,984 in fiscal 2012. This growth has resulted primarily from internal expansion supplemented by strategic acquisitions.

Our three most recent acquisitions were completed in fiscal 2010. All of these acquisitions were accounted for using the purchase method of accounting and our consolidated financial statements include the results of operations of the acquired companies from their respective acquisition dates.

We have two reportable segments: bank systems and services and credit union systems and services. The respective segments include all related license, support and service, and hardware sales along with the related cost of sales.

We are cautiously optimistic regarding ongoing economic improvement and expect to continue investing in the products and services our clients need to improve their operating efficiencies and performance. We anticipate consolidation within the financial services industry to continue, including bank failures and increased merger and acquisition activity. Regulatory conditions and legislation such as the Dodd-Frank Wall Street Reform Act and Consumer Protection Act will continue to impact the financial services industry and potentially motivate some financial institutions to postpone discretionary spending.

A detailed discussion of the major components of the results of operations follows. All dollar amounts are in thousands and discussions compare fiscal 2012 to fiscal 2011 and compare fiscal 2011 to fiscal 2010.

RESULTS OF OPERATIONS

FISCAL 2012 COMPARED TO FISCAL 2011

In fiscal 2012, revenues increased 6% or $60,212 compared to the prior year due primarily to strong growth in our electronic payment services and our outsourcing services, as well as continued revenue growth in all three of our components of revenue (license, support and service, and hardware). During fiscal 2012, the Company continued to focus on cost management and also reduced interest cost through our sustained repayment of long-term debt. These changes have resulted in a 13% increase in net income.

The current condition of the U.S. financial markets continues to impact the overall demand and spending for new products and services by some of our customers. The profitability of many financial institutions continues to improve, but in many cases remains low and this appears to have resulted in some reduction of demand for new products and services. During the past four years, a number of financial institutions have closed or merged due to regulatory action. We believe that regulatory closings will continue to decline through fiscal 2013, absent a significant downturn in the economy. Furthermore, the increase in bank failures and forced consolidations has been, to some extent, offset by a general decline in the level of acquisition activity among financial institutions.

We move into fiscal 2013 with cautious optimism following strong fourth quarter fiscal 2012 results. Significant portions of our business continue to come from recurring revenue, and increases in backlog coupled with a healthy sales pipeline are also encouraging. Our customers continue to face regulatory and operational challenges which our products and services address, and in these times they have an even greater need for our solutions that directly address institutional profitability and efficiency. Our strong balance sheet, access to extensive lines of credit, the strength of our existing product line and an unwavering commitment to superior customer service position us well to address current and future opportunities to extend our customer base and produce returns for our stockholders.

REVENUE

|

| | | | | | | | | | |

| License Revenue | Year Ended | | % |

| | June 30, | | Change |

| | 2012 | | 2011 | | |

| License | $ | 54,811 |

| | $ | 53,067 |

| | 3 | % |

| Percentage of total revenue | 5 | % | | 6 | % | | |

License revenue represents the sale and delivery of application software systems contracted with us by the customer. We license our proprietary software products under standard license agreements that typically provide the customer with a non-exclusive, non-transferable right to use the software on a single computer and for a single financial institution.