TRUSTEES

Carol T. Crawford

Bruce C. Ellis

William M Lane

Robert P. Moltz

Wayne H. Shaner

INVESTMENT ADVISOR

Torray LLC

OFFICERS

Robert E. Torray

William M Lane

Fred M. Fialco

Nicholas C. Haffenreffer

Barbara C. Warder

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

BBD, LLP

1835 Market Street, 26th Floor

Philadelphia, PA 19103

TRANSFER AGENT

BNY Mellon Investment Servicing (US) Inc.

4400 Computer Drive

Westborough, MA 01581-1722

LEGAL COUNSEL

Dechert LLP

1900 K Street, N.W.

Washington, DC 20006

Distributed by Foreside Funds Distributors LLC

400 Berwyn Park, 899 Cassatt Road,

Berwyn, PA 19132

Date of first use, August 2013

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus. All indices are unmanaged groupings of stocks that are not available for investment.

(17) (f) The Torray Resolute Fund Semi-Annual Report

The

TORRAY

RESOLUTE

FUND

SEMI-ANNUAL REPORT

June 30, 2013

The Torray Resolute Fund

Suite 750 W

7501 Wisconsin Avenue

Bethesda, Maryland 20814-6519

(301) 493-4600

(800) 443-3036

The Torray Resolute Fund

Letter to Shareholders

July 8, 2013

Dear Fellow Shareholders,

The first half of 2013 frustrated the skeptics. As the post-crisis recovery continued at a measured but steady pace, U.S. equity markets reclaimed the historic highs of 2007. During this period, your Fund performed well, gaining 10.8% in the first half of the year and 20.9% over the trailing twelve months. The Fund’s returns modestly underperformed the Russell 1000 Growth Index’s gains of 11.8% in the first half, but outperformed the benchmark’s 17.1% gains over the trailing twelve months. The question on most investors’ minds is whether recent gains are justified and sustainable. Milestones such as the record highs inevitably bring out the naysayers, but the backdrop of steadily improving fundamentals provided adequate support for the market’s advances. Growth is slow but steady, valuations are reasonable, employment is weak but improving, and interest rates are rising, but remain low by historic standards. This balanced assessment leads us to the conclusion that current market levels are appropriate and we continue to find exceptional companies to invest in at attractive prices.

We recently bought shares of FMC Corp. (FMC), a diversified chemical company with $4 billion in revenues and operations in 21 countries. Approximately half of the company’s sales are generated by the Agricultural Products division, with the balance split between the Specialty and Industrial Chemicals divisions. What distinguishes FMC from other specialty chemical companies is a long-standing record of consistent growth and relatively low economic sensitivity. A disciplined strategy of diversifying the portfolio and minimizing fixed costs has produced industry-leading earnings and cash flow growth of 20% annually over the past 10 years. We expect the company’s focus on product innovation and operating efficiencies will continue to support attractive rates of growth.

Top contributors for the period included Gilead Sciences (GILD) and Vertex Pharmaceuticals (VRTX). The release of positive clinical data on drugs targeting hepatitis C (Gilead) and cystic fibrosis (Vertex) increase the probability of continued profitable growth in the future. Apple (AAPL) was the largest detractor for the period. While innovation and growth have stalled at Apple, we believe the valuation, profit potential and recent plan to return significant capital to shareholders make Apple a compelling investment. We are always amazed by the market’s tendency to overreact in the short and intermediate term. In this case, we believe investors have mispriced the risks associated with Apple.

1

The Torray Resolute Fund

Letter to Shareholders (continued)

July 8, 2013

Chairman Bernanke’s May 22nd comments contemplating a reduction of the Federal Reserve’s stimulus program took the market by surprise. Immediately following his remarks, rates on the 10-Year Treasury bond jumped approximately 50 basis points and stocks and bonds dropped 5% before recovering. Four-plus years into the recovery, it is easy to forget the Federal Reserve will eventually remove the economy’s training wheels. The market’s response to Bernanke’s testimony is curious. On the one hand, a withdrawal of stimulative policy introduces uncertainty. On the other, the Chairman’s comments come as a result of continued economic stability and improvement. This should be a source of confidence for the market. We believe a focus on innovation and value is a far more productive investment strategy than second guessing the Federal Reserve’s next move. However, the Chairman’s statements mark an important turning point as the Federal Reserve prepares to step back and allow market fundamentals to lead. In this case, the transition is likely to be volatile, but ultimately positive for the economy and your portfolio.

As ever, we appreciate your interest and trust.

| Respectfully, | ||||||

| ||||||

| Nicholas C. Haffenreffer | ||||||

2

The Torray Resolute Fund

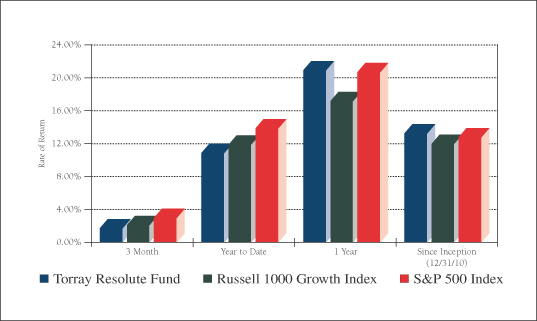

PERFORMANCE DATA

As of June 30, 2013 (unaudited)

Average Annual Returns on an Investment in

The Torray Resolute Fund vs. the Russell 1000 Growth Index and the S&P 500 Index

For the periods ended June 30, 2013:

| 3 Month* | Year to Date* | 1 Year | Since Inception 12/31/10 | |||||||||||||

The Torray Resolute Fund | 1.57% | 10.82% | 20.87% | 13.20% | ||||||||||||

Russell 1000 Growth Index | 2.06% | 11.80% | 17.07% | 11.86% | ||||||||||||

S&P 500 Index | 2.91% | 13.82% | 20.60% | 12.70% | ||||||||||||

Cumulative Returns for the 2 1/2 years ended June 30, 2013

| The Torray Resolute Fund | 36.27 | % | ||

| Russell 1000 Growth Index | 32.27 | % | ||

| S&P 500 Index | 34.83 | % |

* Not annualized

3

The Torray Resolute Fund

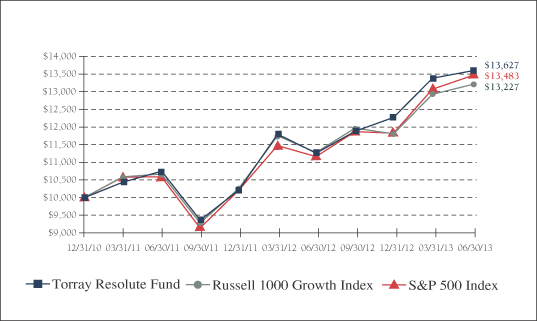

PERFORMANCE DATA (continued)

As of June 30, 2013 (unaudited)

Change in Value of $10,000 Invested

on December 31, 2010 (commencement of operations) to:

| 12/31/10 | 06/30/11 | 12/31/11 | 06/30/12 | 12/31/12 | 06/30/13 | |||||||||||||||||||

The Torray Resolute Fund | $ | 10,000 | $ | 10,760 | $ | 10,223 | $ | 11,274 | $ | 12,297 | $ | 13,627 | ||||||||||||

Russell 1000 Growth Index | $ | 10,000 | $ | 10,683 | $ | 10,264 | $ | 11,299 | $ | 11,826 | $ | 13,227 | ||||||||||||

S&P 500 Index | $ | 10,000 | $ | 10,603 | $ | 10,211 | $ | 11,180 | $ | 11,842 | $ | 13,483 | ||||||||||||

The returns quoted represent past performance and do not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher. For performance current to the most recent month end, please call (800) 626-9769. The returns shown do not reflect the deduction of taxes a shareholder would pay on the redemption of fund shares and distributions. The Fund’s gross annual operating expense ratio as stated in the Fund’s current prospectus was 3.68% before fee waivers and expense reimbursements by the Adviser. The Fund’s net annual operating expense ratio after such fee waivers and expense reimbursements was 1.25%. The Adviser has contractually agreed to waive fees and/or reimburse expenses of the Fund in order to limit the total annual operating expenses of the Fund to 1.25% of the Fund’s average daily net assets through May 1, 2014. Total returns shown above include fee waivers and expense reimbursements. These total returns would have been lower had there been no waivers and reimbursements by the Adviser during the periods shown. Returns on The Torray Resolute Fund, the Russell 1000 Growth Index, the Fund’s primary benchmark index, and the S&P 500 Index assume reinvestment of all dividends and distributions. The Russell 1000 Growth Index is an unmanaged index consisting of 575 U.S. large-cap growth stocks, and the S&P 500 Index is an unmanaged index consisting of 500 U.S. large-cap stocks. It is not possible to invest directly in an index. Current and future portfolio holdings are subject to change and risk.

4

The Torray Resolute Fund

FUND PROFILE

As of June 30, 2013 (unaudited)

DIVERSIFICATION (% of net assets) |

| |||

Information Technology | 28.84% | |||

Health Care | 15.82% | |||

Industrials | 13.80% | |||

Energy | 10.01% | |||

Consumer Discretionary | 9.32% | |||

Materials | 8.01% | |||

Financials | 7.49% | |||

Consumer Staples | 3.31% | |||

Short-Term Investments | 2.21% | |||

Other Assets Less Liabilities | 1.19% | |||

|

| |||

| 100.00% | ||||

|

| |||

TOP TEN EQUITY HOLDINGS (% of net assets) |

| |||||

| 1. | QUALCOMM Inc. | 4.04% | ||||

| 2. | American Tower Corp., REIT | 4.02% | ||||

| 3. | Roche Holding AG ADR | 4.01% | ||||

| 4. | Danaher Corp. | 3.95% | ||||

| 5. | EOG Resources, Inc. | 3.82% | ||||

| 6. | Precision Castparts Corp. | 3.71% | ||||

| 7. | Visa Inc., Class A | 3.69% | ||||

| 8. | Enbridge Inc. | 3.57% | ||||

| 9. | Fiserv, Inc. | 3.55% | ||||

| 10. | Apple Inc. | 3.53% | ||||

|

| |||||

| 37.89% | ||||||

|

| |||||

PORTFOLIO CHARACTERISTICS |

| |||||||

Net Assets (million) | $12 | |||||||

Number of Holdings | 30 | |||||||

Portfolio Turnover | 5.06% | * | ||||||

P/E Multiple (forward) | 17.0x | |||||||

Trailing Weighted Average Dividend Yield |

| 1.42% | ||||||

Market Capitalization (billion) | Average | $61.9 | ||||||

| Median | $34.5 | |||||||

| * | Not annualized |

5

The Torray Resolute Fund

SCHEDULE OF INVESTMENTS

As of June 30, 2013 (unaudited)

| Shares | Market Value | |||||||||

| COMMON STOCK 96.60% | ||||||||||

28.84% INFORMATION TECHNOLOGY | ||||||||||

| 7,680 | QUALCOMM Inc. | $ | 469,094 | |||||||

| 2,345 | Visa Inc., Class A | 428,549 | ||||||||

| 4,716 | Fiserv, Inc. * | 412,226 | ||||||||

| 1,035 | Apple Inc. | 409,943 | ||||||||

| 4,827 | Amphenol Corp., Class A | 376,216 | ||||||||

| 5,111 | Accenture PLC, Class A | 367,788 | ||||||||

| 8,270 | MICROS Systems, Inc. * | 356,851 | ||||||||

| 9,053 | Oracle Corp. | 278,108 | ||||||||

| 5,399 | Adobe Systems Inc. * | 245,978 | ||||||||

|

| |||||||||

| 3,344,753 | ||||||||||

15.82% HEALTH CARE | ||||||||||

| 7,515 | Roche Holding AG ADR | 464,916 | ||||||||

| 5,908 | Baxter International Inc. | 409,247 | ||||||||

| 7,460 | Gilead Sciences, Inc. * | 382,027 | ||||||||

| 4,300 | Vertex Pharmaceuticals Inc. * | 343,441 | ||||||||

| 3,485 | Varian Medical Systems, Inc. * | 235,063 | ||||||||

|

| |||||||||

| 1,834,694 | ||||||||||

13.80% INDUSTRIALS | ||||||||||

| 7,246 | Danaher Corp. | 458,672 | ||||||||

| 1,903 | Precision Castparts Corp. | 430,097 | ||||||||

| 4,315 | United Technologies Corp. | 401,036 | ||||||||

| 2,866 | Cummins Inc. | 310,846 | ||||||||

|

| |||||||||

| 1,600,651 | ||||||||||

10.01% ENERGY | ||||||||||

| 3,361 | EOG Resources, Inc. | 442,577 | ||||||||

| 9,845 | Enbridge Inc. | 414,179 | ||||||||

| 2,002 | Core Laboratories N.V. | 303,623 | ||||||||

|

| |||||||||

| 1,160,379 | ||||||||||

6

The Torray Resolute Fund

SCHEDULE OF INVESTMENTS (continued)

As of June 30, 2013 (unaudited)

| Shares | Market Value | |||||||||

9.32% CONSUMER DISCRETIONARY | ||||||||||

| 4,916 | Tupperware Brands Corp. | $ | 381,924 | |||||||

| 5,865 | Nike, Inc., Class B | 373,483 | ||||||||

| 5,703 | Coach, Inc. | 325,584 | ||||||||

|

| |||||||||

| 1,080,991 | ||||||||||

8.01% MATERIALS | ||||||||||

| 3,022 | Praxair, Inc. | 348,014 | ||||||||

| 4,900 | FMC Corp. | 299,194 | ||||||||

| 3,332 | Compass Minerals International, Inc. | 281,654 | ||||||||

|

| |||||||||

| 928,862 | ||||||||||

7.49% FINANCIALS | ||||||||||

| 6,367 | American Tower Corp. REIT | 465,873 | ||||||||

| 2,965 | Franklin Resources, Inc. | 403,299 | ||||||||

|

| |||||||||

| 869,172 | ||||||||||

3.31% CONSUMER STAPLES | ||||||||||

| 6,708 | Colgate-Palmolive Co. | 384,301 | ||||||||

|

| |||||||||

| TOTAL COMMON STOCK 96.60% | 11,203,803 | |||||||||

(cost $9,695,915) | ||||||||||

Principal Amount ($) | ||||||||||

| SHORT-TERM INVESTMENTS 2.21% | ||||||||||

| 256,857 | BNY Mellon Cash Reserve, 0.05%(1) | 256,857 | ||||||||

(cost $256,857) | ||||||||||

|

| |||||||||

| TOTAL INVESTMENTS 98.81% | 11,460,660 | |||||||||

(cost $9,952,772) | ||||||||||

| OTHER ASSETS LESS LIABILITIES 1.19% | 137,629 | |||||||||

|

| |||||||||

| NET ASSETS 100.00% | $ | 11,598,289 | ||||||||

|

| |||||||||

| * | Non-income producing securities. |

| (1) | Represents current yield at June 30, 2013. |

| ADR | - American Depositary Receipt |

| REIT | - Real Estate Investment Trust |

See notes to the financial statements.

7

The Torray Resolute Fund

STATEMENT OF ASSETS AND LIABILITIES

As of June 30, 2013 (unaudited)

ASSETS | ||||

Investments in securities at value | $ | 11,460,660 | ||

Receivable for investments sold | 75,195 | |||

Interest and dividends receivable | 12,940 | |||

Receivable from Advisor | 9,877 | |||

Prepaid expenses | 58,594 | |||

|

| |||

TOTAL ASSETS | 11,617,266 | |||

|

| |||

LIABILITIES | ||||

Payable to advisor | 9,631 | |||

Payable for audit fees | 7,744 | |||

Payable for transfer agent fees & expenses | 1,602 | |||

|

| |||

TOTAL LIABILITIES | 18,977 | |||

|

| |||

NET ASSETS | $ | 11,598,289 | ||

|

| |||

Paid-in-capital (858,197 shares outstanding, unlimited shares authorized) | $ | 9,884,882 | ||

Undistributed net investment income | 1,904 | |||

Accumulated net realized gain on investments | 203,615 | |||

Net unrealized appreciation of investments | 1,507,888 | |||

|

| |||

TOTAL NET ASSETS | $ | 11,598,289 | ||

|

| |||

Net Asset Value, Offering and Redemption Price per Share | $ | 13.51 | ||

|

| |||

See notes to the financial statements.

8

The Torray Resolute Fund

STATEMENT OF OPERATIONS

For the six months ended June 30, 2013 (unaudited)

INVESTMENT INCOME | ||||

Dividend income | $ | 78,236 | ||

Interest income | 121 | |||

Foreign tax withheld | (2,828 | ) | ||

|

| |||

Total investment income | 75,529 | |||

|

| |||

EXPENSES | ||||

Management fees | 56,083 | |||

Trustees’ fees | 23,340 | |||

Insurance expense | 9,127 | |||

Transfer agent fees & expenses | 8,996 | |||

Registration & filing fees | 8,637 | |||

Audit fees | 5,743 | |||

Custodian fees | 2,817 | |||

Legal fees | 451 | |||

Printing, postage & mailing | 129 | |||

|

| |||

Total expenses | 115,323 | |||

Fees waived and expenses reimbursed by Advisor | (45,081 | ) | ||

|

| |||

Net expenses | 70,242 | |||

|

| |||

NET INVESTMENT INCOME | 5,287 | |||

|

| |||

REALIZED AND UNREALIZED GAIN ON INVESTMENTS | ||||

Net realized gain on investments | 206,335 | |||

Net change in unrealized appreciation (depreciation) on investments | 908,532 | |||

|

| |||

Net realized and unrealized gain on investments | 1,114,867 | |||

|

| |||

NET INCREASE IN NET ASSETS FROM OPERATIONS | $ | 1,120,154 | ||

|

| |||

See notes to the financial statements.

9

The Torray Resolute Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the periods indicated:

| Six months ended 06/30/13 (unaudited) | Year ended 12/31/12 | |||||||

Increase in Net Assets from Operations: | ||||||||

Net investment income | $ | 5,287 | $ | 2,628 | ||||

Net realized gain on investments | 206,335 | 61,007 | ||||||

Net change in unrealized appreciation | 908,532 | 607,782 | ||||||

|

|

|

| |||||

Net increase in net assets from operations | 1,120,154 | 671,417 | ||||||

|

|

|

| |||||

Distributions to Shareholders from: | ||||||||

Net investment income ($0.004 and | (3,383 | ) | (2,880 | ) | ||||

Net realized gains ($0.040 and $0.047 per | (34,330 | ) | (23,593 | ) | ||||

|

|

|

| |||||

Total distributions | (37,713 | ) | (26,473 | ) | ||||

|

|

|

| |||||

Shares of Beneficial Interest | ||||||||

Net increase from share transactions | $ | 195,516 | $ | 6,874,773 | ||||

|

|

|

| |||||

Total increase | 1,277,957 | 7,519,717 | ||||||

Net Assets — Beginning of Period | 10,320,332 | 2,800,615 | ||||||

|

|

|

| |||||

Net Assets — End of Period | $ | 11,598,289 | $ | 10,320,332 | ||||

|

|

|

| |||||

Undistributed Net Investment Income | $ | 1,904 | $ | — | ||||

|

|

|

| |||||

See notes to the financial statements.

10

The Torray Resolute Fund

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each period presented:

PER SHARE DATA

| Six months ended 06/30/13 (unaudited) | Years ended December 31: | Period ended December 31: | ||||||||||||||

| 2012 | 2011 | 2010(3) | ||||||||||||||

Net Asset Value, Beginning of Period | $ | 12.240 | $ | 10.220 | $ | 10.000 | $ | 10.000 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Income from investment operations | ||||||||||||||||

Net investment income | 0.006 | (1) | 0.009 | (1)(5) | 0.003 | (1) | 0.000 | |||||||||

Net gains on securities (both realized and unrealized) | 1.308 | 2.064 | 0.221 | (4) | 0.000 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Total from investment operations | 1.314 | 2.073 | 0.224 | 0.000 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Less: distributions | ||||||||||||||||

Dividends (from net investment income) | (0.004 | ) | (0.006 | ) | (0.002 | ) | 0.000 | |||||||||

Distributions (from capital gains) | (0.040 | ) | (0.047 | ) | (0.002 | ) | — | |||||||||

|

|

|

|

|

|

|

| |||||||||

Total distributions | (0.044 | ) | (0.053 | ) | (0.004 | ) | 0.000 | |||||||||

|

|

|

|

|

|

|

| |||||||||

Net Asset Value, End of Period | $ | 13.510 | $ | 12.240 | $ | 10.220 | $ | 10.000 | ||||||||

|

|

|

|

|

|

|

| |||||||||

TOTAL RETURN(2) | 10.82 | %** | 20.28 | % | 2.23 | % | 0.00 | % | ||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||

Net assets, end of period (000’s omitted) | $ | 11,598 | $ | 10,320 | $ | 2,801 | $ | 100 | ||||||||

Ratios of expenses to average net assets before expense reimbursement | 2.06 | %* | 3.68 | % | 5.90 | % | 0.00 | % | ||||||||

Ratios of expenses to average net assets after expense reimbursement | 1.25 | %* | 1.25 | % | 1.25 | % | 0.00 | % | ||||||||

Ratios of net investment income to average net assets | 0.09 | %* | 0.08 | %(5) | 0.03 | % | 0.00 | % | ||||||||

Portfolio turnover rate | 5.06 | %** | 21.76 | % | 22.35 | % | 0.00 | % | ||||||||

| * | Annualized |

| ** | Not annualized |

| (1) | Calculated based on the average amount of shares outstanding during the period. |

| (2) | Past performance is not predictive of future performance. |

| (3) | Commencement of operations on 12/31/10. |

| (4) | The amount of net gains on securities (both realized and unrealized) per share does not accord with the amounts reported in the Statement of Changes due to the timing of purchases and redemptions of Fund shares and fluctuating market values during the period. |

| (5) | For the year ended December 31, 2012, investment income per share reflects a special dividend which amounted to $0.01 per share. Excluding the special dividend, the ratio of net investment income to average net assets would have been (0.01)%. |

See notes to the financial statements.

11

The Torray Resolute Fund

NOTES TO FINANCIAL STATEMENTS

As of June 30, 2013 (unaudited)

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Torray Resolute Fund (“Fund”) is a separate series of The Torray Fund (“Trust”). The Trust is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The Trust is organized as a business trust under Massachusetts law. The Fund’s investment objective is to seek to achieve long-term growth of capital. The Fund seeks to meet its objective by investing its assets in a concentrated portfolio of predominantly large capitalization companies with proven records of increasing earnings on a consistent and sustainable basis. There can be no assurance that the Fund’s investment objective will be achieved.

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

Securities Valuation Portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price, or, if no sales are reported, the last reported bid price. For NASDAQ traded securities, market value is determined on the basis of the NASDAQ Official Closing Price instead of the last reported sales price. Other assets and securities for which no quotations are readily available or for which Torray LLC (the “Advisor”) believes do not reflect market value are valued at fair value as determined in good faith by the Advisor under the supervision of the Board of Trustees (the “Board” or “Trustees”) in accordance with the Fund’s Valuation Procedures. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Fair Value Measurements Various inputs are used in determining the fair value of investments which are as follows:

| • | Level 1 — quoted prices in active markets for identical securities |

| • | Level 2 — significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

12

The Torray Resolute Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of June 30, 2013 (unaudited)

The summary of inputs used to value the Fund’s investments as of June 30, 2013 is as follows:

Valuation Inputs | ||||

Level 1 — Quoted Prices * | $ | 11,460,660 | ||

Level 2 — Other Significant Observable Inputs | — | |||

Level 3 — Significant Unobservable Inputs | — | |||

|

| |||

Total Market Value of Investments | $ | 11,460,660 | ||

|

| |||

| * | Security types and industry classifications as defined in the Schedule of Investments. |

The Fund had no Level 3 investments during the period and had no transfers between Level 1, Level 2 and Level 3 investments during the reporting period.

Securities Transactions and Investment Income Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the specific identification basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income, including amortization of discount on short-term investments, and expenses are recorded on the accrual basis. Premium and discount are amortized using the effective yield to maturity method.

Federal Income Taxes The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income, including any net realized gain on investments to its shareholders. Therefore, no federal income tax provision is required.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (current and prior two tax years), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Net Asset Value The net asset value per share of the Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of the Fund’s net assets by the number of shares outstanding.

Use of Estimates In preparing financial statements in accordance with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

13

The Torray Resolute Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of June 30, 2013 (unaudited)

NOTE 2 — SHARES OF BENEFICIAL INTEREST TRANSACTIONS

Transactions in shares of beneficial interest were as follows:

| Six months ended 06/30/13 | Year ended 12/31/12 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

Shares issued | 30,392 | $ | 398,389 | 611,391 | $ | 7,365,038 | ||||||||||

Reinvestments of dividends and distributions | 2,726 | 36,983 | 1,979 | 24,168 | ||||||||||||

Shares redeemed | (18,035 | ) | (239,856 | ) | (44,281 | ) | (514,433 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||

| 15,083 | $ | 195,516 | 569,089 | $ | 6,874,773 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

As of June 30, 2013, the Trust’s officers, Trustees and affiliated persons and their families directly or indirectly controlled 665,724 shares or 77.57% of the Fund.

NOTE 3 — INVESTMENT TRANSACTIONS

Purchases and sales of investment securities, other than short-term investments, for the six months ended June 30, 2013, aggregated $1,024,269 and $539,351, respectively.

NOTE 4 — MANAGEMENT FEES

Pursuant to the Management Contract, the Advisor provides investment advisory and administrative services to the Fund. The Fund pays the Advisor a management fee, computed daily and payable monthly at the annual rate of 1.00% of the Fund’s average daily net assets. For the six months ended June 30, 2013, the Fund incurred management fees of $56,083.

Excluding the management fee, other expenses incurred by the Fund during the six months ended June 30, 2013, totaled $59,240. During the six months ended June 30, 2013, the Advisor waived fees and reimbursed expenses in the amount of $45,081 to maintain the Fund’s expense ratio at 1.25%. These expenses include all costs associated with the Fund’s operations including transfer agent fees, independent trustees’ fees ($14,000 per annum and $2,000 for each Board meeting attended per Trustee), dues, fees and expenses of registering and qualifying the Fund and its shares for distribution, charges of the custodian, auditing and legal expenses, insurance premiums, supplies, postage, expenses of issue or redemption of shares, reports to shareholders and Trustees, expenses of printing and mailing prospectuses, proxy statements and proxies to existing shareholders, and other miscellaneous expenses.

Certain officers and Trustees of the Fund are also officers and/or shareholders of the Advisor, and are not paid by the Fund for serving in such capacities.

14

The Torray Resolute Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of June 30, 2013 (unaudited)

NOTE 5 — TAX MATTERS

Distributions to shareholders are determined in accordance with United States federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

The tax character of distributions paid during the year ended December 31, 2012 was as follows:

Distributions paid from: | ||||

Ordinary income | $ | 2,628 | ||

Long-term capital gain | 23,845 | |||

|

| |||

| $ | 26,473 | |||

|

|

The primary difference between book basis and tax basis distributions is differing book and tax treatment of short-term capital gains.

At December 31, 2012, the Fund had no capital loss carry forward for federal income tax purposes.

The following information is based upon the federal tax basis of investment securities as of June 30, 2013:

Gross unrealized appreciation | $ | 1,613,124 | ||||

Gross unrealized depreciation | (105,236 | ) | ||||

|

| |||||

Net unrealized appreciation | $ | 1,507,888 | ||||

|

| |||||

Cost | $ | 9,952,772 | ||||

|

|

NOTE 6 — COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

15

The Torray Resolute Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of June 30, 2013 (unaudited)

NOTE 7 — SUBSEQUENT EVENTS

Management has evaluated the impact of all subsequent events on the Fund through the date these financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

NOTE 8 — NEW ACCOUNTING PRONOUNCEMENTS

In June 2013, the Financial Accounting Standards Board (the “FASB”) issued guidance that creates a two-tiered approach to assess whether an entity is an investment company. The guidance will also require an investment company to measure noncontrolling ownership interests in other investment companies at fair value and will require additional disclosures relating to investment company status, any changes thereto and information about financial support provided or contractually required to be provided to any of the investment company’s investees. The guidance is effective for financial statements with fiscal years beginning on or after December 15, 2013 and interim periods within those fiscal years. Management is evaluating the impact of this guidance on the Fund’s financial statement disclosures.

16

The Torray Resolute Fund

PORTFOLIO HOLDINGS, PROXY VOTING AND PROCEDURES

As of June 30, 2013 (unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-443-3036; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-443-3036; and on the Commission’s website at http://www.sec.gov.

17

The Torray Resolute Fund

ABOUT YOUR FUND’S EXPENSES

As of June 30, 2013 (unaudited)

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, including management fees, and other fund expenses. Operating expenses, which are deducted directly from the Fund’s gross income, directly reduce the investment return of the Fund.

A mutual fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table on the next page illustrates the Fund’s cost in two ways:

Actual Fund Return This section helps you estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period” on the next page.

Hypothetical 5% Return This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses, and that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transactions fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculation assumes no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

18

The Torray Resolute Fund

ABOUT YOUR FUND’S EXPENSES (continued)

As of June 30, 2013 (unaudited)

More information about the Fund’s expenses, including recent annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| Beginning Account Value January 1, 2013 | Ending Account Value June 30, 2013 | Expenses Paid During Period* | ||||||||||

Based on Actual Fund Return | $ | 1,000.00 | $ | 1,108.20 | $ | 6.53 | ||||||

Based on Hypothetical 5% Return | $ | 1,000.00 | $ | 1,018.60 | $ | 6.26 | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.25% for the period, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

19