UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

S ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2004,

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO .

Commission

File Number

| Registrants, State of Incorporation,

Address, and Telephone Number

| I.R.S. Employer

Identification No.

|

| | 001-09120 | | PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

(A New Jersey Corporation)

80 Park Plaza, P.O. Box 1171

Newark, New Jersey 07101-1171

973 430-7000

http://www.pseg.com | | 22-2625848 | |

| | 001-00973 | | PUBLIC SERVICE ELECTRIC AND GAS COMPANY

(A New Jersey Corporation)

80 Park Plaza, P.O. Box 570

Newark, New Jersey 07101-0570

973 430-7000

http://www.pseg.com | | 22-1212800 | |

| | 000-49614 | | PSEG POWER LLC

(A Delaware Limited Liability Company)

80 Park Plaza—T25

Newark, New Jersey 07102-4194

973 430-7000

http://www.pseg.com | | 22-3663480 | |

| | 000-32503 | | PSEG ENERGY HOLDINGS LLC

(A New Jersey Limited Liability Company)

80 Park Plaza—T20

Newark, New Jersey 07102-4194

973 456-3581

http://www.pseg.com | | 42-1544079 | |

Securities registered pursuant to Section 12(b) of the Act:

Registrant

| | Title of Each Class

| | Name of Each Exchange

On Which Registered

|

Public Service Enterprise

Group Incorporated | | Common Stock without

par value | | New York Stock Exchange |

Participating Equity Preference Securities (consisting of a Purchase Contract and a Preferred Trust Security), $50 par value at 10.25%, issued by PSEG Funding Trust I (Registrant) and registered on the New York Stock Exchange.

Trust Originated Preferred Securities (Guaranteed Preferred Beneficial Interest in PSEG's Debentures), $25 par value at 8.75%, issued by PSEG Funding Trust II (Registrant) and registered on the New York Stock Exchange.

Registrant

| | Title of Each Class

| | Title of Each Class

| | Name of Each Exchange

On Which Registered

|

Public Service Electric and

Gas Company | | Cumulative Preferred Stock

$100 par value Series: | | First and Refunding

Mortgage Bonds: | | |

| | | | | | | Series | | Due | | |

| | | 4.08% | | 91⁄8% | | BB | | 2005 | | |

| | | 4.18% | | 91⁄4% | | CC | | 2021 | | |

| | | 4.30% | | 63⁄4% | | UU | | 2006 | | New York Stock Exchange |

| | | 5.05% | | 63⁄4% | | VV | | 2016 | | |

| | | 5.28% | | 61⁄4% | | WW | | 2007 | | |

| | | | | 63⁄8% | | YY | | 2023 | | |

| | | | | 8% | | | | 2037 | | |

| | | | | 5% | | | | 2037 | | |

(Cover continued on next page)

(Cover continued from previous page)

Securities registered pursuant to Section 12(g) of the Act:

Registrant

| | Title of Class

|

| Public Service Enterprise Group Incorporated | | Floating Rate Capital Securities (Guaranteed Preferred Beneficial Interest in PSEG's Debentures), $1,000 par value issued by Enterprise Capital Trust II (Registrant), LIBOR plus 1.22%. |

| | | Trust Originated Preferred Securities (Guaranteed Preferred Beneficial Interest in PSEG's Debentures), $25 par value at 7.44%, issued by Enterprise Capital Trust I (Registrant). |

| | | Trust Originated Preferred Securities (Guaranteed Preferred Beneficial Interest in PSEG's Debentures), $25 par value at 7.25%, issued by Enterprise Capital Trust III (Registrant). |

| Public Service Electric and Gas Company | | 6.92% Cumulative Preferred Stock $100 par value

Medium-Term Notes, Series A

Medium-Term Notes, Series B

Medium-Term Notes, Series C |

| PSEG Power LLC | | Limited Liability Company Membership Interest |

| PSEG Energy Holdings LLC | | Limited Liability Company Membership Interest |

The aggregate market value of the Common Stock of Public Service Enterprise Group Incorporated held by non-affiliates as of June 30, 2004 was $9,313,972,867 based upon the New York Stock Exchange Composite Transaction closing price.

The number of shares outstanding of Public Service Enterprise Group Incorporated's sole class of Common Stock, as of the latest practicable date, was as follows:

Class

| | Outstanding at January 31, 2005

|

| Common Stock, without par value | | 238,350,363 |

PSEG Power LLC and PSEG Energy Holdings LLC are wholly-owned subsidiaries of Public Service Enterprise Group Incorporated and meet the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and are filing their respective Annual Reports on Form 10-K with the reduced disclosure format authorized by General Instruction I.

As of January 31, 2005, Public Service Electric and Gas Company had issued and outstanding 132,450,344 shares of Common Stock, without nominal or par value, all of which were privately held, beneficially and of record by Public Service Enterprise Group Incorporated.

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports) and (2) have been subject to such filing requirements for the past 90 days. Yes S No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. S

Indicate by check mark whether each registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act).

| | Public Service Enterprise Group Incorporated | | Yes S | | No £ |

| | Public Service Electric and Gas Company | | Yes £ | | No S |

| | PSEG Power LLC | | Yes £ | | No S |

| | PSEG Energy Holdings LLC | | Yes £ | | No S |

DOCUMENTS INCORPORATED BY REFERENCE

Part of Form 10-K of Public Service Enterprise Group Incorporated

| | Documents Incorporated by Reference

|

| III | | Portions of the definitive Proxy Statement for the 2005 Annual Meeting of Stockholders of Public Service Enterprise Group Incorporated, which definitive Proxy Statement is expected to be filed with the Securities and Exchange Commission on or about April 30, 2005, as specified herein. |

TABLE OF CONTENTS

i

Page

ii

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this report constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such statements are based on management's beliefs as well as assumptions made by and information currently available to management. When used herein, the words “will,” “anticipate,” “intend,” “estimate,” “believe,” “expect,” “plan,” “hypothetical,” “potential,” “forecast,” “project,” variations of such words and similar expressions are intended to identify forward-looking statements. Public Service Enterprise Group Incorporated (PSEG), Public Service Electric and Gas Company (PSE&G), PSEG Power LLC (Power) and PSEG Energy Holdings LLC (Energy Holdings) undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The following review should not be construed as a complete list of factors that could effect forward-looking statements.

In addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements discussed above, factors that could cause actual results to differ materially from those contemplated in any forward-looking statements include, among others, the following:

PSEG, PSE&G, Power and Energy Holdings

| • | credit, commodity, interest rate, counterparty and other financial market risks; |

| |

| • | liquidity and the ability to access capital and credit markets and maintain adequate credit ratings; |

| |

| • | adverse or unanticipated weather conditions that significantly impact costs and/or operations, including generation; |

| |

| • | changes in the electric industry, including changes to power pools; |

| |

| • | changes in the number of market participants and the risk profiles of such participants; |

| |

| • | changes in technology that may make power generation, transmission and/or distribution assets less competitive; |

| |

| • | availability of power transmission facilities that impact the ability to deliver output to customers; |

| |

| • | growth in costs and expenses; |

| |

| • | environmental regulations that significantly impact operations; |

| |

| • | changes in rates of return on overall debt and equity markets that could adversely impact the value of pension assets and liabilities and the Nuclear Decommissioning Trust Funds; |

| |

| • | ability to maintain satisfactory regulatory results; |

| |

| • | changes in political conditions, recession, acts of war or terrorism; |

| |

| • | continued availability of insurance coverage at commercially reasonable rates; |

| |

| • | involvement in lawsuits, including liability claims and commercial disputes; |

| |

| • | inability to attract and retain management and other key employees; |

| |

| • | acquisitions, divestitures, mergers, restructurings or strategic initiatives that change PSEG's, PSE&G's, Power's and Energy Holdings' structure; |

| |

| • | business combinations among competitors and major customers; |

| |

| • | general economic conditions, including inflation or deflation; |

| |

| • | regulatory issues that significantly impact operations; |

| |

| • | changes to accounting standards or accounting principles generally accepted in the U.S., which may require adjustments to financial statements; |

| |

| • | changes in tax laws and regulations; |

| |

| • | ability to service debt as a result of any of the aforementioned events; |

1

PSE&G and Energy Holdings

| • | ability to obtain adequate and timely rate relief; |

Power and Energy Holdings

| • | energy transmission constraints or lack thereof; |

| |

| • | adverse changes in the market for energy, capacity, natural gas, emissions credits, congestion credits and other commodity prices, especially during significant price movements for natural gas and power; |

| |

| • | surplus of energy capacity and excess supply; |

| |

| • | generation operating performance below projected levels; |

| |

| • | substantial competition in the worldwide energy markets; |

| |

| • | inability to effectively manage portfolios of electric generation assets, gas supply contracts and electric and gas supply obligations; |

| |

| • | margin posting requirements, especially during significant price movements for natural gas and power; |

| |

| • | availability of fuel and timely transportation at reasonable prices; |

| |

| • | effects on competitive position of actions involving competitors or major customers; |

| |

| • | changes in product or sourcing mix; |

| |

| • | delays, cost escalations or unsuccessful acquisitions, construction and development; |

Power

| • | changes in regulation and safety and security measures at nuclear facilities; |

Energy Holdings

| • | changes in political regimes in foreign countries; |

| |

| • | international developments negatively impacting business; |

| |

| • | changes in foreign currency exchange rates; |

| |

| • | substandard operating performance or cash flow from investments falling below projected levels, adversely impacting the ability to service project debt; |

| |

| • | deterioration in the credit of lessees and their ability to adequately service lease rentals; and |

| |

| • | ability to realize tax benefits. |

Consequently, all of the forward-looking statements made in this report are qualified by these cautionary statements and PSEG, PSE&G, Power and Energy Holdings cannot assure you that the results or developments anticipated by management will be realized, or even if realized, will have the expected consequences to, or effects on, PSEG, PSE&G, Power and Energy Holdings or their respective business prospects, financial condition or results of operations. Undue reliance should not be placed on these forward-looking statements in making any investment decision. Each of PSEG, PSE&G, Power and Energy Holdings expressly disclaims any obligation or undertaking to release publicly any updates or revisions to these forward-looking statements to reflect events or circumstances that occur or arise or are anticipated to occur or arise after the date hereof. In making any investment decision regarding PSEG's, PSE&G's, Power's and Energy Holdings' securities, PSEG, PSE&G, Power and Energy Holdings are not making, and you should not infer, any representation about the likely existence of any particular future set of facts or circumstances. The forward-looking statements contained in this report are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

2

WHERE TO FIND MORE INFORMATION

Public Service Enterprise Group Incorporated (PSEG), Public Service Electric and Gas Company (PSE&G), PSEG Power LLC (Power) and PSEG Energy Holdings LLC (Energy Holdings) file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission (SEC). You may read and copy any document that PSEG, PSE&G, Power and Energy Holdings file at the Public Reference Room of the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. You may also obtain PSEG's, PSE&G's, Power's and Energy Holdings' filings on the Internet at the SEC's website at www.sec.gov or at PSEG's website, www.pseg.com. PSEG's Common Stock is listed on the New York Stock Exchange under the ticker symbol “PEG.” You can obtain information about PSEG, PSE&G, Power and Energy Holdings at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005.

PART I

This combined Annual Report on Form 10-K is separately filed by PSEG, PSE&G, Power and Energy Holdings. Information contained herein relating to any individual company is filed by such company on its own behalf. PSE&G, Power and Energy Holdings each makes representations only as to itself and its subsidiaries and makes no other representations whatsoever as to any other company.

ITEM 1. BUSINESS

GENERAL

PSEG, PSE&G, Power and Energy Holdings

PSEG was incorporated under the laws of the State of New Jersey in 1985 and has its principal executive offices located at 80 Park Plaza, Newark, New Jersey 07102. PSEG is an exempt public utility holding company under the Public Utility Holding Company Act of 1935 (PUHCA).

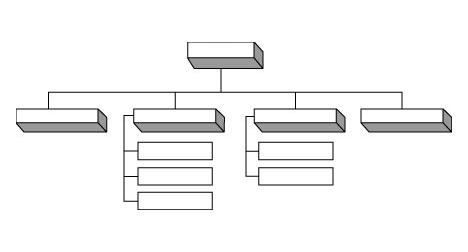

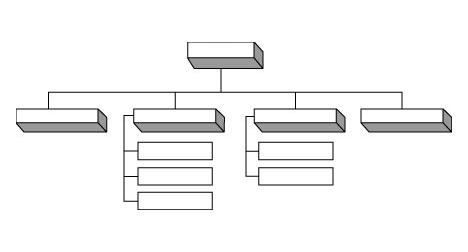

PSEG has four principal direct wholly-owned subsidiaries: PSE&G, Power, Energy Holdings and PSEG Services Corporation (Services). The following organization chart shows PSEG and its principal subsidiaries, as well as the principal operating subsidiaries of Power: PSEG Fossil LLC (Fossil), PSEG Nuclear LLC (Nuclear) and PSEG Energy Resources & Trade LLC (ER&T); and of Energy Holdings: PSEG Global LLC (Global) and PSEG Resources LLC (Resources):

PSEG

PSE&G

Power

Energy Holdings

Services

Global

Resources

Fossil

Nuclear

ER&T

The regulatory structure that has historically governed the electric and gas utility industries in the United States (U.S.) has changed dramatically in recent years. Deregulation is complete in New Jersey and is complete or underway in certain other states in the Northeast and across the U.S. Actions by state regulators and the Federal Energy Regulatory Commission (FERC) and the implementation of the National Energy Policy Act of 1992 (Energy Policy Act) have afforded power marketers, merchant generators, Exempt Wholesale Generators (EWGs) and utilities the opportunity to compete actively in wholesale energy markets and have allowed consumers the right to choose their energy suppliers. The deregulation and restructuring of the nation's energy markets, the unbundling of energy and related services, the diverse strategies within the industry related to holding, building, buying or selling generation capacity and consolidation within the

3

industry have had, and are likely to continue to have, a significant effect on PSEG and its subsidiaries, providing them with new opportunities and exposing them to new risks.

As energy markets have changed dramatically in recent years, PSEG and its subsidiaries have transitioned from a vertically integrated utility to an energy company with a diversified business mix. PSEG has realigned its organizational structure to address the competitive environment brought about by the deregulation of the electric generation industry and has evolved from primarily being a state regulated New Jersey utility to operating as a competitive energy company with operations primarily in the Northeastern U.S. and in other select markets. As the competitive portion of PSEG's business has grown, the resulting financial risks and rewards have become greater, causing financial requirements to change and increasing the volatility of earnings and cash flows.

PSEG seeks to reduce future volatility of earnings and cash flows principally by entering into longer-term contracts for material portions of its anticipated energy output. PSEG may also reduce exposure to its international businesses by seeking to opportunistically monetize investments of Energy Holdings that may no longer have a strategic fit. PSEG also expects a gradual decline in earnings from Resources' leveraged leasing business due to the maturation of its investment portfolio. The proceeds from Energy Holdings' asset sales will be used, over time, to reduce debt and equity and to maintain credit requirements. For additional information, see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A)—Overview of 2004 and Future Outlook.

Recent Developments—Merger Agreement

On December 20, 2004, PSEG entered into an agreement and plan of merger (Merger Agreement) with Exelon Corporation (Exelon), a public utility holding company registered under PUHCA which is headquartered in Chicago, Illinois, whereby PSEG will be merged with and into Exelon (Merger). Under the Merger Agreement, each share of PSEG Common Stock will be converted into 1.225 shares of Exelon Common Stock.

The Merger Agreement has been unanimously approved by both companies' boards of directors. Before the Merger may be completed, various approvals or consents must be obtained from shareholders, FERC, the SEC, the Nuclear Regulatory Commission (NRC) and various utility regulatory, antitrust and other authorities in the U.S. and in foreign jurisdictions. PSEG and Exelon have made some of the regulatory filings to obtain necessary regulatory approvals. It is anticipated that this approval process will be completed and the Merger will close within 12 months to 15 months after the announcement of the Merger Agreement in December 2004.

PSEG is committed to this proposed business combination, however, pending receipt of the various required approvals, which cannot be assured, PSEG intends to remain positioned with a viable stand-alone strategy. For additional information related to the Merger, see Item 3. Legal Proceedings, Item 7. MD&A—Overview of 2004 and Future Outlook—Merger Agreement and Note 25. Merger Agreement of the Notes to the Consolidated Financial Statements (Notes).

PSE&G

PSE&G is a New Jersey corporation, incorporated in 1924, and has principal executive offices at 80 Park Plaza, Newark, New Jersey 07102. PSE&G is an operating public utility company engaged principally in the transmission and distribution of electric energy and gas service in New Jersey. PSE&G, pursuant to an order of the New Jersey Board of Public Utilities (BPU) issued under the provisions of the New Jersey Electric Discount and Energy Competition Act (EDECA), transferred all of its electric generation facilities, plant, equipment and wholesale power trading contracts to Power and its subsidiaries in August 2000 for approximately $2.8 billion. Also, pursuant to a BPU order, PSE&G transferred its gas supply business, including its inventories and supply contracts, to Power in May 2002 for $183 million. PSE&G continues to own and operate its electric and gas transmission and distribution business. In addition, PSE&G Transition Funding LLC (Transition Funding), a bankruptcy-remote subsidiary of PSE&G, was formed in 1999 for the sole purpose of issuing $2.525 billion principal amount of transition bonds in connection with the securitization of $2.4 billion of PSE&G's stranded costs approved for recovery by the BPU under EDECA.

PSE&G provides electric and gas service in areas of New Jersey in which approximately 5.5 million people, about 70% of the state's population, reside. PSE&G's electric and gas service area is a corridor of approximately 2,600 square miles running diagonally across New Jersey from Bergen County in the northeast to an area below the city of Camden in the southwest. The greater portion of this area is served with both

4

electricity and gas, but some parts are served with electricity only and other parts with gas only. This heavily populated, commercialized and industrialized territory encompasses most of New Jersey's largest municipalities, including its six largest cities—Newark, Jersey City, Paterson, Elizabeth, Trenton and Camden—in addition to approximately 300 suburban and rural communities. This service territory contains a diversified mix of commerce and industry, including major facilities of many nationally prominent corporations. PSE&G's load requirements are split among residential, commercial and industrial customers, detailed below under customers. PSE&G believes that it has all the franchise rights (including consents) necessary for its electric and gas distribution operations in the territory it serves. Such franchise rights are not exclusive.

PSE&G distributes electric energy and gas to end-use customers within its designated service territory. All electric and gas customers in New Jersey have the ability to choose an electric energy and/or gas supplier. Pursuant to BPU requirements, PSE&G serves as the supplier of last resort for electric and gas customers within its service territory. PSE&G earns no margin on the commodity portion of its electric and gas sales. PSE&G earns margins through the transmission and distribution of electricity and gas. PSE&G's revenues for these services are based upon tariffs approved by the BPU and FERC. The demand for electric energy and gas by PSE&G's customers is affected by customer conservation, economic conditions, weather and other factors not within PSE&G's control.

New Jersey's Electric Distribution Companies (EDCs), including PSE&G, provide two types of Basic Generation Service (BGS). BGS is the default electric supply service for customers who do not choose a third party to source their electric supply requirements. BGS-Fixed Price (FP) provides supply for smaller commercial and residential customers at seasonally-adjusted fixed prices. BGS-FP rates change annually on June 1 and are based on the average BGS price obtained at auction in the current year and two prior years. BGS-Commercial and Industrial Energy Price (CIEP) provides supply for larger customers at hourly PJM Interconnection, L.L.C. (PJM) real-time market prices for a term of 12 months. BGS-FP and BGS-CIEP represent approximately 84% and 16%, respectively, of PSE&G's load.

New Jersey's EDCs jointly procure the supply to meet their BGS obligations through two concurrent auctions authorized by the BPU for New Jersey's total BGS requirement each February. The results of this auction determine which energy suppliers are authorized to supply BGS to New Jersey's EDCs. As a condition of qualification to participate in this auction, energy suppliers are required to agree to execute the BGS Master Service Agreement and provide required security within three days of BPU certification of auction results, in addition to satisfying creditworthiness requirements.

PSE&G's total BGS-FP load is approximately 8,600 megawatts (MW). Approximately one-third of this total load is expected to be auctioned off each year for a three-year term. The current pricing is as follows:

| | | | Term Ending

|

| | | | May 2005(a)

| | May 2006(b)

| | May 2007(a)

| | May 2008(c)

|

| | Term

| | 12 months

| | 34 months

| | 36 months

| | 36 months

|

| | Load (MW) | | | 2,840 | | | | 2,900 | | | | 2,840 | | | | 2,840 | |

| | $ per Kilowatt-hour (kWh) | | $ | 0.05479 | | | $ | 0.05560 | | | $ | 0.05515 | | | $ | 0.06541 | |

| | | | | | | | | | | | | | | | | | |

| | | |

| (a) | | Prices set in the February 2004 BGS auction. |

| | | |

| (b) | | Prices set in the February 2003 BGS auction. |

| | | |

| (c) | | Prices set in the February 2005 BGS auction which become effective on June 1, 2005 when the agreements for the 12-month (May 2005) BGS-FP supply agreements expire. |

PSE&G has entered into a full requirements contract through 2007 with Power to meet the supply requirements of PSE&G's gas customers. Power charges PSE&G for gas commodity costs which PSE&G recovers from its customers. Any difference between rates charged by Power under the Basic Gas Supply Service (BGSS) contract and rates charged to its customers are deferred and collected or refunded through adjustments in future rates.

On October 5, 2004, the BPU approved a 3% increase in PSE&G's residential gas commodity charge to cover the higher cost of natural gas. The cost of energy supply, for both gas and electricity, is passed through from PSE&G to its customers.

5

Competitive Environment

The electric and gas transmission and distribution business has minimal risks from competitors. PSE&G's transmission and distribution business is minimally impacted when customers choose alternate electric or gas suppliers since PSE&G earns its return by providing transmission and distribution service, not by supplying the commodity.

Customers

As of December 31, 2004, PSE&G provided service to approximately 2.1 million electric customers and approximately 1.7 million gas customers, detailed below. In addition to its transmission and distribution business, PSE&G also offers appliance services and repairs to customers throughout its service territory.

| | | | % of Sales

|

| | Customer Type

| | Electric

| | Gas

|

| | Commercial | | | 30% | | | | 60% | |

| | Residential | | | 55% | | | | 36% | |

| | Industrial | | | 15% | | | | 4% | |

| | | | |

| | | |

| |

| | Total | | | 100% | | | | 100% | |

| | | | |

| | | |

| |

| | | | | | | | | | |

Employee Relations

As of December 31, 2004, PSE&G had 6,327 employees. PSE&G has three-year collective bargaining agreements in place with four unions, representing 4,996 employees, which expire on April 30, 2005. New six-year collective bargaining agreements with the four unions were ratified in February 2005. PSE&G believes that it maintains satisfactory relationships with its employees. For additional information related to the Merger, see Item 7. MD&A—Overview of 2004 and Future Outlook—Merger Agreement and Note 25. Merger Agreement of the Notes.

Power

Power is a Delaware limited liability company, formed in 1999, and has its principal executive offices at 80 Park Plaza, Newark, New Jersey 07102. Power is a multi-regional, independent wholesale energy supply company that integrates its generating asset operations with its wholesale energy, fuel supply, energy trading and marketing and risk management functions through three principal direct wholly-owned subsidiaries: Nuclear, Fossil and ER&T.

As of December 31, 2004, Power's generation portfolio consisted of approximately 14,607 MW of installed capacity which is diversified by fuel source and market segment. For additional information, see Item 2. Properties.

Through its operating subsidiaries, Power competes as an independent wholesale electric generating company, primarily in the Northeast U.S. Most of Power's generating assets are strategically located within PJM, one of the nation's largest and most developed energy markets.

In the PJM market, the pricing of energy is based upon the locational marginal price (LMP) set through power providers' bids. Due to transmission constraints, the LMP may be higher in congested areas during peak demand periods reflecting the bid prices of the higher cost units that are dispatched to supply demand. This typically occurs in the eastern portion of the grid, where many of Power's plants are located. These bids are currently capped at $1,000 per megawatt-hour (MWh). In the event that available generation within PJM is insufficient to satisfy demand, PJM may institute emergency purchases from adjoining regions for which there is no price cap.

To reduce volatility in earnings and cash flow, Power's objective is to enter into load serving contracts, firm sales and trading positions sufficient to hedge at least 75% of its anticipated output over an 18-month to 24-month horizon. Power has achieved this objective through a combination of contracts related to the New Jersey BGS auctions, contracts in Pennsylvania and Connecticut and other firm sales and trading positions. Prospectively, Power intends to take advantage of the BGS auctions in New Jersey and other opportunities elsewhere in the market region to continue to meet this objective.

In February 2005, the BPU approved the results of the BGS-FP and CIEP auctions for New Jersey customers. Each bidder was limited to a third of each EDC's total load. Power will continue to be a direct supplier of New Jersey EDCs under both the BGS-FP and CIEP auctions, entering into additional contracts that will begin on June 1, 2005. Power believes that its obligations under these contracts are reasonably balanced by its available supply.

6

In addition to the electric generation business described above, Power's revenues include gas supply sales under the BGSS contract with PSE&G. Power also generates revenue from the sales of various commodity-based instruments, such as capacity, ancillary services, emission credits and congestion credits, such as firm transmission rights (FTRs).

Fossil

Fossil has an ownership interest in 12 generating stations in New Jersey, one in New York, two in Connecticut, two in Pennsylvania, one in Ohio and one in Indiana. Fossil also has an ownership interest in one hydroelectric-pumped storage facility in New Jersey. For additional information, see Item 2. Properties—Power.

Fossil began operating in New England Power Pool (NEPOOL) with the acquisition of two fossil fuel generating stations in Connecticut in late 2002: the Bridgeport Harbor facility, a 513 MW coal/oil fuel facility and the New Haven Harbor facility, a 448 MW oil/gas facility. Fossil completed construction of the Waterford, Ohio plant, an 821 MW natural gas-fired, combined cycle plant, which began commercial operation in August 2003. In addition, Fossil completed construction of a 1,096 MW natural gas-fired, combined cycle plant in Lawrenceburg, Indiana, which began commercial operation in June 2004. Additionally, the Albany, New York generating station is currently being replaced with a 763 MW combined cycle plant, the Bethlehem Energy Center, which is expected to be operational in the second quarter of 2005. The Linden, New Jersey generating station is currently being replaced with a 1,220 MW natural gas-fired, combined cycle plant, which is expected to be operational in 2006.

Fossil uses coal, natural gas and oil for electric generation. These fuels are purchased through various contracts and in the spot market and represent a significant portion of Power's working capital requirements. Changes in the prices of these fuel sources impact Power's costs and working capital requirements. The majority of Power's fossil generating stations obtain their fuel supply from within the U.S. In order to minimize emissions levels, the Connecticut generating facilities use a specific type of coal, which is obtained from Indonesia through a fixed-price supply contract through 2008 and transportation contracts covering 100% of supply through 2006, 66% in 2007 and 33% in 2008. Fossil believes it can obtain adequate coal, natural gas and oil supplies for its facilities over the next several years. However, issues could arise, such as transportation constraints, which could adversely affect the operation of Fossil's plants. In addition, if the supply of coal from Indonesia or equivalent coal from other sources was not available for the Connecticut facilities, additional material capital expenditures could be required to modify the existing plants to enable their continued operation. For additional information, see Item 2. Properties—Power.

Nuclear

Nuclear has an ownership interest in five nuclear generating units: the Salem Nuclear Generating Station, Units 1 and 2 (Salem 1 and 2), each owned 57.41% by Nuclear and 42.59% by Exelon Generation Company LLC (Exelon Generation); the Hope Creek Nuclear Generating Station (Hope Creek), which is owned 100% by Nuclear; and, the Peach Bottom Atomic Power Station Units 2 and 3 (Peach Bottom 2 and 3), each of which is operated by Exelon Generation and owned 50% by Nuclear. For additional information, see Item 2. Properties—Power.

For a discussion of recent operational issues, see Regulatory Issues—NRC.

Nuclear unit capacity and availability factors for 2004 were as follows:

| | Unit

| | Capacity

Factor*

| | Availability

Factor

|

| | Salem Unit 1 | | | 74.9 | % | | | 77.0 | % |

| | Salem Unit 2 | | | 89.8 | % | | | 90.5 | % |

| | Hope Creek | | | 65.6 | % | | | 69.7 | % |

| | Peach Bottom Unit 2 | | | 91.0 | % | | | 91.9 | % |

| | Peach Bottom Unit 3 | | | 102.3 | % | | | 100.0 | % |

| | | | |

| | | |

| |

| | Combined Nuclear's Share | | | 81.8 | % | | | 83.2 | % |

| | | | |

| | | |

| |

| | | | | | | | | | |

| | |

* Maximum Dependable Capacity (MDC) net. |

| | | The 2004 capacity factor was adversely affected by extended outages at Salem and Hope Creek during the year. For additional information, see Regulatory Issues—NRC and Item 7. MD&A—Overview of 2004 and Future Outlook—Power. The combined capacity factor for Nuclear in 2003 was approximately 87.7%. |

7

Nuclear has several long-term purchase contracts with uranium suppliers, converters, enrichers and fabricators to meet the currently projected fuel requirements for the Salem and Hope Creek nuclear power plants. Nuclear has been advised by Exelon Generation that it has similar purchase contracts to satisfy the annual fuel requirements for Peach Bottom. See Note 14. Commitments and Contingent Liabilities of the Notes.

Concurrent with the Merger Agreement, Nuclear entered into an Operating Services Contract (OSC) with Exelon Generation, which commenced on January 17, 2005, relating to the operation of the Salem and Hope Creek nuclear generating stations. The OSC provides that Exelon Generation will provide a chief nuclear officer and other key personnel to oversee daily plant operations at the Hope Creek and Salem nuclear generating stations and to implement the Exelon operating model, which defines practices that Exelon has used to manage its own nuclear performance improvement program. Nuclear will continue as the license holder with exclusive legal authority to operate and maintain the plants, will retain responsibility for management oversight and will have full authority with respect to the marketing of its share of the output from the facilities. Exelon Generation will be entitled to receive reimbursement of its costs in discharging its obligations, an annual operating services fee and incentive fees of up to $12 million annually based on attainment of goals relating to safety, capacity factors of the plants and operation and maintenance expenses. The OSC has a term of two years, subject to earlier termination in certain events upon prior notice, including any termination of the Merger Agreement. In the event of such termination, Exelon Generation will continue to provide services under the OSC for a transition period of at least 180 days and up to two years at the election of Nuclear. This period may be further extended by Nuclear for up to an additional 12 months if Nuclear determines that additional time is necessary to complete required activities during the transition period.

ER&T

ER&T purchases the capacity and energy produced by each of the generation subsidiaries of Power. In conjunction with these purchases, ER&T uses commodity and financial instruments designed to cover estimated commitments for BGS and other bilateral contract agreements. ER&T also markets electricity, capacity, ancillary services and natural gas products on a wholesale basis. ER&T is a fully integrated wholesale energy marketing and trading organization that is active in the long-term and spot wholesale energy markets.

Electric Supply

Power's generation capacity is sourced from a diverse mix of fuels comprised of approximately 45% gas, 24% nuclear, 16% coal, 14% oil and 1% pumped storage. Power's fuel diversity serves to mitigate risks associated with fuel price volatility and market demand cycles. The following table indicates the MWh output of Power's generating stations by fuel type in 2004 and its estimated MWh output by fuel type for 2005.

Generation by Fuel Type

| | Actual

2004

| | Estimated

2004(A)

|

Nuclear: | | | | | | | | |

New Jersey facilities | | | 34 | % | | | 38 | % |

Pennsylvania facilities | | | 21 | % | | | 18 | % |

Fossil: | | | | | | | | |

Coal: | | | | | | | | |

New Jersey facilities | | | 12 | % | | | 14 | % |

Pennsylvania facilities | | | 13 | % | | | 13 | % |

Connecticut facilities | | | 6 | % | | | 5 | % |

Oil and Natural Gas: | | | | | | | | |

New Jersey facilities | | | 13 | % | | | 7 | % |

New York facilities | | | — | | | | 2 | % |

Connecticut facilities | | | 1 | % | | | 2 | % |

Midwest facilities | | | — | | | | 1 | % |

Pumped Storage: | | | — | | | | — | |

| | | |

| | | |

| |

Total | | | 100 | % | | | 100 | % |

| | | |

| | | |

| |

| | | | | | | | |

| | | |

| (A) | | No assurances can be given that actual 2005 output by source will match estimates. |

8

Approximately 86% of Power's generation was from nuclear and coal facilities in 2004, which are typically the most cost-effective fuel types on an operating cost basis. On a per-MWh basis, nuclear power is the most cost-effective and, as a result, Power's profitability is largely affected by the utilization and efficiency of its nuclear facilities. The nuclear facilities are considered “base load” and run continuously when not in shutdown. Older oil and gas-fired facilities are typically the least cost-effective of the fossil fuel burners. Accordingly, these plants are not usually run outside of peak periods of demand when the cost of operation can be justified by the market price. The costs of operating coal and oil burning facilities and new combined cycle gas facilities range between those of the two aforementioned facility types. These plants can be base load plants and/or load following plants.

Gas Supply

As described above, Power sells gas to PSE&G under the BGSS contract. Additionally, based upon availability, Power sells gas to others. About 42% of PSE&G's peak daily gas requirements are provided through firm transportation, which is available every day of the year. The remainder comes from field storage, liquefied natural gas, seasonal purchases, contract peaking supply, propane and refinery and landfill gas. Power purchases gas for its gas operations directly from natural gas producers and marketers. These supplies are transported to New Jersey by four interstate pipeline suppliers.

Power has approximately 1.17 billion cubic-feet-per-day of firm transportation capacity under contract to meet the primary needs of the gas consumers of PSE&G and the needs of its generation fleet. In addition, Power supplements that supply with a total storage capacity of 82 billion cubic feet that provides a maximum of 0.94 billion cubic feet-per-day of gas during the winter season.

Power expects to be able to meet the energy-related demands of its firm natural gas customers. However, the ability to maintain an adequate supply could be affected by several factors not within Power's control, including curtailments of natural gas by its suppliers, the severe weather and the availability of feedstocks for the production of supplements to its natural gas supply. In addition, supply of all types of gas is affected by the nationwide availability of all sources of fuel for energy production.

Competitive Environment

Power's competitors include merchant generators with or without trading capabilities, utilities that have generating capability or have formed generation and/or trading affiliates, aggregators, wholesale power marketers and combinations thereof. These participants compete with Power and one another buying and selling in wholesale power pools, entering into bilateral contracts and/or selling to aggregated retail customers. Power believes that its asset size and location, regional market knowledge and integrated functions allow it to compete effectively in its selected markets.

Actions by developers, including Power, to build new generating stations have led to an overbuild situation in certain markets, including PJM, causing downward pressure on energy and capacity prices. Capacity prices in PJM have recently averaged well below $10 per kW-year as compared to historical levels of more than $25 per kW-year. This overcapacity has decreased capacity revenues and has decreased margins from some of Power's units. Power believes that recent events in PJM, including preliminary discussions with regard to changes in the design of the capacity market, as well as advancement toward reliability-based payments to generators, may lead to changes that could enhance the value of Power's generation fleet in PJM. In addition, Power anticipates that capacity prices in PJM will return to historical levels in the next several years.

The New England market is also overbuilt and is also undergoing changes. The existence of reliability-based payments, coupled with the anticipated start of locational capacity markets in 2006, could also enhance the value of Power's generation assets in Connecticut.

The Midwest is also expected to have excess capacity over the next several years due to recent additions, which will continue to negatively impact the expected returns of Power's Lawrenceburg and Waterford facilities. The drivers to reduce the excess capacity will be load growth, the retirement of certain plants, particularly older plants of competitors due to the weakened wholesale energy and capacity market, and increased costs associated with higher levels of environmental compliance.

9

PJM continues to expand. On May 1, 2004, Commonwealth Edison Company joined PJM. On June 17, 2004, FERC issued two orders to allow the operating affiliates of American Electric Power (AEP) Service Corporation to transfer transmission facilities in Virginia to PJM's control and to allow AEP's Kentucky operating company to join PJM. AEP joined PJM effective October 1, 2004. On January 1, 2005, Duquesne Light Company joined PJM. In addition, FERC has conditionally approved Virginia Electric and Power Company's, a unit of Dominion Resources Inc., application to join PJM. These changes bring both opportunities and risks to Power.

Power's businesses are also under competitive pressure due to technological advances in the power industry and increased efficiency in certain energy markets. It is possible that advances in technology, such as distributed generation, will reduce the cost of alternative methods of producing electricity to a level that is competitive with that of most central station electric production.

Additional legislation in the states where Power operates or into which Power sells energy has been introduced within the last few years to further encourage competition at the retail level (often referred to as customer choice or retail access). However, there is a risk if states should decide to turn away from competition and allow regulated utilities to continue to own or reacquire and operate generating stations in a regulated and potentially uneconomical manner. This has already occurred in certain states in which Power does business. The lack of consistent rules in markets outside of PJM can negatively impact the competitiveness of Power's plants. Also, regional inconsistencies in environmental regulations, particularly those related to emissions, have put some of Power's plants which are located in the Northeast, where rules are more stringent, at an economic disadvantage compared to its competitors in certain Midwest states.

Customers

As EWGs, Power's subsidiaries do not directly serve retail customers. Power uses its generation facilities primarily for the production of electricity for sale at the wholesale level. Power's customers consist mainly of wholesale buyers, primarily within PJM, but also in New York, Connecticut and the Midwest. Power is a direct supplier of New Jersey's EDCs. In addition, Power extended into the New England Power Market by securing a three-year, full requirements contract with a Connecticut utility with an expected peak load of 1,150 MW expiring December 31, 2006. In addition, Power has entered into four-year contracts totaling 500 MW with two Pennsylvania utilities, expiring in 2008 and is considering pursuing similar opportunities in other states.

Employee Relations

As of December 31, 2004, Power had 2,935 employees. Power has collective bargaining agreements with three union groups, which expire on April 30, 2005, October 31, 2005 and May 15, 2006, respectively. New six-year collective bargaining agreements were ratified with the three union groups in February 2005. These agreements cover 1,449 employees (701 employees, or approximately 65% of the workforce for Fossil and 748 employees, or approximately 45% of the workforce for Nuclear). Power believes that it maintains satisfactory relationships with its employees. For additional information, see Item 7. MD&A—Overview of 2004 and Future Outlook—Merger Agreement and Note 25. Merger Agreement of the Notes.

Energy Holdings

Energy Holdings is a New Jersey limited liability company and is the successor to PSEG Energy Holdings Inc., which was originally incorporated in 1989. Energy Holdings' principal executive offices are located at 80 Park Plaza, Newark, New Jersey 07102. Energy Holdings has two principal direct wholly-owned subsidiaries, which are also its segments: Global and Resources.

Energy Holdings has pursued investment opportunities in the global energy markets, with Global focusing on the operating segments of the electric industries and Resources primarily making financial investments in these industries. Global and Resources have more than 70 financial and operating investments.

10

Energy Holdings' portfolio is diversified by number, type and geographic location of investments. As of December 31, 2004, its assets were comprised of the following types:

| | | | As of

December 31, 2004

|

| | Leveraged Leases (mainly energy-related) | | | 40 | % |

| | International Electric Distribution Facilities | | | 22 | % |

| | International Electric Generation Plants | | | 15 | % |

| | Domestic Electric Generation Plants | | | 12 | % |

| | Other(1) | | | 8 | % |

| | Other Passive Financial Investments | | | 3 | % |

| | | | |

| |

| | Total | | | 100 | % |

| | | | |

| |

| | | | | | |

| | | |

| (1) | | Assets not allocated to a special project, including corporate receivables. |

The characteristics of each of these investment types are described in more detail below.

�� Global

Global is a power producer and distributor that owns and operates electric generation and distribution facilities in selected domestic and international markets.

As of December 31, 2004, Global's assets, which include consolidated projects and those accounted for under the equity method, share of project MW and number of customers by region are as follows:

| | | As of

December 31, 2004

|

| | | Assets

| | MW

| | Number of

Customers

|

| | | (Millions) | | | | | | | | |

Generation: | | | | | | | | | | | | |

North America | | $ | 841 | | | | 2,411 | | | | N/A | |

South America | | | 335 | | | | 397 | | | | N/A | |

Europe | | | 446 | | | | 662 | | | | N/A | |

India and the Middle East | | | 309 | | | | 260 | | | | 40,000 | |

Distribution: | | | | | | | | | | | | |

South America | | | 1,616 | | | | N/A | | | | 2,900,000 | |

Other: | | | | | | | | | | | | |

Other(1) | | | 597 | | | | N/A | | | | N/A | |

| | | |

| | | |

| | | |

| |

Total | | $ | 4,144 | | | | 3,730 | | | | 2,940,000 | |

| | | |

| | | |

| | | |

| |

| | | | | | | | | | | | |

| | | |

| (1) | | Assets not allocated to a specific project, including corporate receivables and deferred tax assets. |

Global realized substantial growth prior to 2002, but has been faced with significant challenges as the international electricity privatization model has become stressed. These challenges include the losses incurred on the abandonment of Global's Argentine investments in 2002, the devaluation of the Brazilian Real and the corresponding decrease in earnings and cash flow from Global's investment in Rio Grande Energia S.A. (RGE), the impact of other foreign currency fluctuations and the failure of certain counterparties to honor contracts with certain of Global's investments. In 2003, Global began to review its portfolio and to seek to opportunistically monetize investments that no longer had a strategic fit. As part of this strategy, in May 2004, Global completed the sale of its majority interest in Carthage Power Company (CPC) in Rades, Tunisia. In December 2004, Global completed the sale of its 50% equity interest in Meiya Power Company Limited (MPC) to BTU Power Company. For additional information relating to these dispositions, see Note 4. Discontinued Operations, Dispositions and Acquisitions of the Notes.

Global has placed its near-term emphasis on maintaining adequate liquidity and improving profitability of currently held investments. While Global still expects certain of its investments in South America to

11

contribute significantly to its earnings in the future, adverse political and economic risks associated with this region could have a material adverse impact on such investments.

Global has sought to minimize risk in the development and operation of its generation projects by selecting partners with complementary skills, structuring long-term power purchase contracts, arranging financing prior to the commencement of construction and contracting for adequate fuel supply. Historically, Global's operating affiliates have entered into long-term power purchase contracts, thereby selling the electricity produced for the majority of the project life. However, two plants in Texas, Guadalupe (1,000 MW) and Odessa (1,000 MW), and one plant in Poland, Skawina CHP Plant (Skawina) (439 MW), operate as merchant plants without long-term power purchase agreements (PPAs).

Global, to the extent practical, attempts to limit its financial exposure associated with each project and to mitigate development risk, foreign currency exposure, interest rate risk and operating risk, including exposure to fuel costs, through contracts. For additional information related to these risks, see Item 7A. Qualitative and Quantitative Disclosures About Market Risk. In addition, project loan agreements are generally structured on a non-recourse basis. Further, Global generally structures project financings so that a default under one project's loan agreement will have no effect on the loan agreements of other projects or Energy Holdings' debt.

Fuel supply arrangements are designed to balance long-term supply needs with price considerations. Global's project affiliates generally utilize a combination of long-term contracts and spot-market purchases. Global believes that there are adequate fuel supplies for the anticipated needs of its generating projects. Global also believes that transmission access and capacity are sufficient at this time for its generation projects.

See Item 2. Properties—Energy Holdings for discussion of individual investments.

Resources

Resources invests in energy-related financial transactions and manages a diversified portfolio of assets, including leveraged leases, operating leases, leveraged buyout funds, limited partnerships and marketable securities. Established in 1985, Resources has a portfolio of more than 50 separate investments. Based on current market conditions and Energy Holdings' intent to limit capital expenditures, it is unlikely that Resources will make significant additional investments in the near term.

Also, the Demand Side Management (DSM) business, previously managed by PSEG Energy Technologies Inc. (Energy Technologies) was transferred to Resources as of December 31, 2002. DSM revenues are earned principally from monthly payments received from utilities, which represent shared electricity savings from the installation of the energy efficient equipment.

12

The major components of Resources' investment portfolio as a percent of its total assets as of December 31, 2004 were:

| | | As of December 31, 2004

|

| | | Amount

| | % of

Resources'

Total Assets

|

| | | (Millions) | | | | |

Leveraged Leases | | | | | | | | |

Energy-Related | | | | | | | | |

Foreign | | $ | 1,341 | | | | 45 | % |

Domestic | | | 1,177 | | | | 39 | % |

Real Estate—Domestic | | | 188 | | | | 6 | % |

Commuter Railcars—Foreign | | | 88 | | | | 3 | % |

Aircraft—Domestic | | | 57 | | | | 2 | % |

| | | |

| | | |

| |

Total Leveraged Leases | | | 2,851 | | | | 95 | % |

| | | |

| | | |

| |

Limited Partnerships | | | | | | | | |

Leveraged Buyout Funds | | | 27 | | | | 1 | % |

Other | | | 14 | | | | — | |

| | | |

| | | |

| |

Total Limited Partnerships | | | 41 | | | | 1 | % |

| | | |

| | | |

| |

Marketable Securities | | | 3 | | | | — | |

Other Investments | | | 15 | | | | 1 | % |

Owned Property | | | 72 | | | | 2 | % |

Current and Other Assets | | | 17 | | | | 1 | % |

| | | |

| | | |

| |

Total Resources' Assets | | $ | 2,999 | | | | 100 | % |

| | | |

| | | |

| |

| | | | | | | | |

As of December 31, 2004, no single investment represented more than 9% of Resources' total assets.

Leveraged Lease Investments

Resources maintains a portfolio that is designed to provide a fixed rate of return. Income on leveraged leases is recognized by a method which produces a constant rate of return on the outstanding net investment in the lease, net of the related deferred tax liability, in the years in which the net investment is positive. Any gains or losses incurred as a result of a lease termination are recorded as Operating Revenues as these events occur in the ordinary course of business of managing the investment portfolio.

In a leveraged lease, the lessor acquires an asset by obtaining equity representing approximately 15% to 20% of the cost and incurring non-recourse lease debt for the balance. The lessor acquires economic and tax ownership of the asset and then leases it to the lessee for a period of time no greater than 80% of its remaining useful life. As the owner, the lessor is entitled to depreciate the asset under applicable federal and state tax guidelines. In addition, the lessor receives income from lease payments made by the lessee during the term of the lease and from tax receipts associated with interest and depreciation deductions with respect to the leased property. The ability of Resources to realize these tax benefits is dependent on operating gains generated by its affiliates and allocated pursuant to PSEG's consolidated tax sharing agreement. Lease rental payments are unconditional obligations of the lessee and are set at levels at least sufficient to service the non-recourse lease debt. The lessor is also entitled to any residual value associated with the leased asset at the end of the lease term. An evaluation of the after-tax cash flows to the lessor determines the return on the investment. Under accounting principles generally accepted in the U.S. (GAAP), the lease investment is recorded on a net basis and income is recognized as a constant return on the net unrecovered investment.

Resources has evaluated the lease investments it has made against specific risk factors. The assumed residual-value risk, if any, was analyzed and verified by third parties at the time the investment was made. Credit risk was assessed and, if necessary, mitigated or eliminated through various structuring techniques, such as defeasance mechanisms and letters of credit. Resources has not taken currency risk in its cross-border lease investments. Transactions have been structured with rental payments denominated and payable in U.S. Dollars. Resources, as a passive lessor or investor, has not taken operating risk with respect to the assets it owns, so leveraged leases have been structured with the lessee having an absolute obligation to make rental payments whether or not the related assets operate. The assets subject to lease are an integral element in Resources' overall security and collateral position. If such assets were to be impaired, the rate of return on a

13

particular transaction could be affected. The operating characteristics and the business environment in which the assets operate are, therefore, important and must be understood and periodically evaluated. For this reason, Resources retains experts to conduct appraisals on the assets it owns and leases, as necessary.

Resources' ten largest lease investments as of December 31, 2004 were as follows:

Investment

| | Description

| | Recorded

Investment Balances

as of

December 31, 2004

| | % of

Resources'

Total Assets

|

| | | | | (Millions) | | | | |

Reliant Energy MidAtlantic

Power LLC | | Three generating stations (Keystone, Conemaugh and Shawville) | | $ | 255 | | | | 9 | % |

Dynegy Holdings Inc | | Two electric generating stations (Danskammer and Roseton) | | | 207 | | | | 7 | % |

Seminole Electric Cooperative | | Seminole Generation Station Unit #2 | | | 197 | | | | 7 | % |

Midwest Generation (Guaranteed by Edison Mission Energy) | | Two electric generating stations (Powerton and Joliet) | | | 191 | | | | 6 | % |

ENECO | | Gas distribution network (Netherlands) | | | 155 | | | | 5 | % |

Merrill Creek | | Merrill Creek Reservoir Project | | | 136 | | | | 5 | % |

Grand Gulf | | Nuclear generating station (U.S.) | | | 130 | | | | 4 | % |

ESG | | Electric distribution system (Austria) | | | 126 | | | | 4 | % |

EZH | | Electric generating station (Netherlands) | | | 122 | | | | 4 | % |

NUON | | Gas distribution network (Netherlands) | | | 98 | | | | 3 | % |

| | | | | |

| | | |

| |

| | | | $ | 1,617 | | | | 54 | % |

| | | | | |

| | | |

| |

For additional information on leases, including credit, tax and accounting risk related to certain lessees, see Item 7. MD&A—Results of Operations—Energy Holdings and Item 7A. Qualitative and Quantitative Disclosures About Market Risk—Credit Risk—Energy Holdings.

Other Subsidiaries

Enterprise Group Development Corporation (EGDC), a commercial real estate property management business, is conducting a controlled exit from the real estate business. Total assets of EGDC as of December 31, 2004 and 2003 were $72 million and $86 million, respectively, and include development land in New Jersey, Maryland and Virginia and an 80% partnership interest in buildings and land in New Jersey.

Competitive Environment

Energy Holdings and its subsidiaries continue to experience substantial competition, both in the U.S. and in international markets. In the U.S., an overbuild in generation facilities has led to a large capacity surplus in several regions, including Texas. This has resulted in reduced operating margins for both independent power producers and utility generators where the marketplace has been evolving from a rate-regulated structure to a competitive environment. Global anticipates that these matters in Texas may improve in the long term, leading to higher capacity prices and increased utilization of its facilities.

In addition, the Polish government is seeking to renegotiate existing PPAs that it believes to be uncompetitive in the local energy market. With respect to Global's distribution businesses in Chile, Peru and Brazil, these investments are rate-regulated and are exposed to minimal risks from competitors. See Regulatory Issues—International Regulation for additional information.

14

Customers

Global has ownership interests in four distribution companies in South America which serve approximately 2.9 million customers and has developed or acquired interests in electric generation facilities which sell energy, capacity and ancillary services to numerous customers through PPAs, as well as into the wholesale market. For additional information, see Item 2. Properties—Energy Holdings.

Employee Relations

As of December 31, 2004, Energy Holdings had 68 employees. Energy Holdings believes that it maintains satisfactory relationships with its employees. For additional information, see Item 7. MD&A—Overview of 2004 and Future Outlook—Merger Agreement and Note 25. Merger Agreement of the Notes.

Services

Services is a New Jersey corporation with its principal executive offices at 80 Park Plaza, Newark, New Jersey 07102. Services provides management and administrative services to PSEG and its subsidiaries. These include accounting, legal, communications, human resources, information technology, treasury and financial, investor relations, stockholder services, real estate, insurance, risk management, tax, library and information services, security, corporate secretarial and certain planning, budgeting and forecasting services. Services charges PSEG and its subsidiaries for the cost of work performed and services provided pursuant to the terms and conditions of intercompany service agreements. As of December 31, 2004, Services had 1,183 employees, including 114 unionized employees. A new six-year collective bargaining agreement with the union group was ratified in February 2005. Services believes that it maintains satisfactory relationships with its employees. For additional information, see Item 7. MD&A—Overview of 2004 and Future Outlook—Merger Agreement and Note 25. Merger Agreement of the Notes.

REGULATORY ISSUES

Federal Regulation

PSEG, PSE&G, Power and Energy Holdings

PUHCA

PSEG has claimed an exemption from regulation by the SEC as a registered holding company under PUHCA, except for Section 9(a)(2) thereof, which relates to the acquisition of 5% or more of the voting securities of an electric or gas utility company. Fossil, Nuclear, certain subsidiaries of Fossil and certain subsidiaries of Energy Holdings with domestic operations are EWGs. In addition, several of Energy Holdings' investments include foreign utility companies (FUCOs) under PUHCA and Qualifying Facilities (QFs) under the Public Utility Regulatory Policies Act of 1978 (PURPA). If PSEG were no longer exempt under PUHCA, or if the subsidiaries' investments failed to maintain their status as EWGs, FUCOs or QFs, PSEG and its subsidiaries may be subject to additional regulation by the SEC with respect to their financing and investing activities, including the amount and type of non-utility investments they would be permitted to make. PSEG does not believe, however, that this would have a material adverse effect on it and its subsidiaries.

Environmental

PSEG and its subsidiaries are also subject to the rules and regulations relating to environmental issues promulgated by the U.S. Environmental Protection Agency (EPA), the U.S. Department of Energy (DOE) and other regulators. For information on environmental regulation, see Environmental Matters.

FERC

FERC is an independent federal agency that regulates the transmission of electric energy and sale of electric energy at wholesale prices in interstate commerce pursuant to the Federal Power Act. FERC also regulates the interstate transportation of, as well as certain wholesale sales of, natural gas pursuant to the Natural Gas Act. Several PSEG subsidiaries including PSE&G, Fossil, Nuclear, ER&T and certain subsidiaries of Fossil and certain subsidiaries of Energy Holdings with domestic operations are public utilities subject to regulation by FERC. FERC's regulation of public utilities is comprehensive and governs such

15

matters as rates, services, mergers, financings, affiliate transactions, market behaviors and reporting. FERC is also responsible under PURPA for administering PURPA's requirements for QFs.

Power

Reliability Must-Run (RMR) Status in PJM and New England

In September 2004, Power filed notice with PJM that it was considering the retirement of seven generating units in New Jersey, effective December 7, 2004, due to concerns about whether the units were economically viable under the current market structure. The units being considered for retirement are Sewaren 1, 2, 3 and 4, Kearny 7 and 8 and Hudson 1. The sites where the units are located have other electric generating units that would remain in operation. The units that were the subject of the notice have a combined installed capacity of 1,132 MW and a combined book value of $22 million. In response to Power's filed notice, PJM identified certain system reliability concerns associated with the retirements and said it would initiate meetings with Power on these and other issues designed to address these concerns including the compensation necessary to retain the generating units, discussed below.

Although applicable tariff provisions differ from region to region, RMR tariff provisions provide compensation to a generation owner when a unit proposed for retirement must continue operating for reliability purposes. On November 2, 2004, PJM filed with FERC to amend its Tariff and Operating Agreement. This filing sets forth a RMR compensation mechanism for those generation units in PJM that are scheduled to be retired or mothballed but would remain necessary for reliability. Under the proposal, RMR compensation would be in the form of cost-of-service recovery or recovery of going-forward costs plus a fixed cost adder. By order dated January 25, 2005, FERC approved the RMR compensation mechanism set forth in the November 2, 2004 filing. It is anticipated that the Sewaren 1, 2, 3 and 4 and Hudson 1 units will qualify for RMR treatment under these procedures at least through the summer of 2006. In February 2005, Power requested that FERC approve cost-of-service recovery rates for the Sewaren and Hudson units. If approved the rates would provide approximately $23 million and $17 million of annual revenue for the Sewaren and Hudson units, respectively. The Kearny 7 and 8 units, however, require significant repairs before they can be returned to operational status and it is not anticipated that this work can be performed in time for the units to be available for the summer of 2005, which is the only period for which PJM has identified a reliability need for them. As a result, it does not appear that these units will be eligible for RMR treatment under the PJM procedures.

In the New England electricity market, many owners of generation facilities have filed with FERC for RMR treatment under the NEPOOL Open Access Transmission Tariff. If FERC grants RMR status for a generation facility, the owner is entitled to receive cost-of-service treatment for its facility for the duration of an RMR contract that it enters into with ISO New England Inc. On November 17, 2004, PSEG Power Connecticut LLC (Power Connecticut), a Power subsidiary, filed a request for RMR treatment for the New Haven Harbor generation station and Unit 2 at the Bridgeport Harbor generation station. Numerous parties, including the Connecticut Department of Public Utility Control, the Connecticut Attorney General and various consumer groups, opposed this filing. On January 14, 2005, FERC issued an order that accepted the filing, suspended its effectiveness for a nominal period of 60 days, and set certain issues for hearing and settlement procedures. Beginning on January 14, 2005, subject to refund and hearing, Power Connecticut began collecting a monthly fixed payment amount of approximately $1.6 million for reliability services provided by the Bridgeport Harbor Station, Unit 2 and approximately $3.9 million for reliability services performed by the New Haven Harbor Station. By their terms, the RMR contracts expire when a locational installed capacity mechanism becomes effective in New England, which, according to FERC's directives, is expected to occur on January 1, 2006. The first RMR settlement conference was held on February 8, 2005. It is anticipated that settlement discussions will continue for a 60-day period, at a minimum. Power Connecticut believes that it has meritorious positions with respect to the issues set for hearing and settlement; however, a final outcome of this process cannot be determined at this time. In addition, it is anticipated that certain parties opposing the filing will seek rehearing of the January 14, 2005 order and, following the exhaustion of remedies at FERC, could seek judicial review. Settlement of challenges to the order would result in dismissal by the settling parties. While Power Connecticut does not believe such challenges are likely to be successful, Power Connecticut cannot predict a final outcome at this time.

16

PSEG, PSE&G and Power

Regional through and out rates (RTOR)

RTOR are separate transmission rates for transactions where electricity originated in one transmission control area was transmitted to a point outside that control area. Both the Midwest Independent Transmission System Operator, Inc. (MISO) and PJM charged RTORs through December 1, 2004. Under an order dated November 18, 2004, FERC approved a new regional rate design which became effective December 1, 2004 for the entire PJM/MISO region. FERC's order also approved the continuation of license plate or concentrated rates with a transitional Seams Elimination Charge/Cost Adjustment/Assignment (SECA) methodology effective from December 1, 2004 through March 2006.

PSEG and its subsidiaries, along with other stakeholders, jointly (1) filed for rehearing of the November 18, 2004 order as it relates to the imposition of a SECA charge, (2) protested the SECA compliance filings and (3) protested and moved to reject the filing of AEP, Commonwealth Edison Company and Dayton Power & Light Company (New PJM Companies) to collect certain lost revenues resulting from the elimination of RTORs between PJM transmission owners. This request for rehearing is currently pending. On November 30, 2004, FERC issued an order that allowed the New PJM Companies to make a filing with FERC to collect their lost revenues. On December 1, 2004, PSE&G began charging its BGS-FP customers for the increase in transmission charges. Consistent with the terms of the BGS-FP contracts, ER&T (and other BGS-FP suppliers) will not receive any revenue associated with a BGS-FP pass-through of the SECA charge until the FERC's November 18, 2004 order is final and non-appealable. In the case of BGS-CIEP, it is anticipated that pass-through of the SECA charge will commence at the time when PJM begins billing of the SECA. Pursuant to a reciprocity provision in its tariff, PJM will not bill for the SECA until MISO commences billing of the SECA, which is estimated to be during March or April 2005. This delay in billing may allow sufficient time for FERC to rule on the protests before the Regional Transmission Organizations (RTOs) begin SECA billing, subject to refund. On February 10, 2005, FERC issued an order that accepted various SECA filings, established December 2004 as the effective date for the SECA rates, made them subject to refund and surcharge, and established hearing procedures to resolve the outstanding factual issues raised in the filings and the responsive pleadings. Depending on the outcome of this proceeding, which cannot be predicted at this time, PSEG, PSE&G and/or Power's results of operations could be negatively affected.

PJM Expansion

For information on PJM expansion, see Item 1. Business—Power—Competitive Environment.

PSEG, PSE&G, Power and Energy Holdings

Market Power

Under FERC regulations, public utilities may sell power at cost-based rates or apply to FERC for authority to sell at market-based rates (MBR). PSE&G, Fossil, Nuclear, ER&T and certain subsidiaries of Fossil, have applied for and received MBR authority from FERC.

On April 14, 2004, FERC issued a final order revising its generation market power screen, which it uses to determine whether power sellers may have the ability to exercise market power. Upon application by a power seller, if FERC determines that a seller is not able to exercise market power under the screen, and the seller passes other tests, FERC's rules permit the seller to sell power at MBR. Failing FERC's revised screen will not conclusively determine whether an entity has market power, and applicants failing the test will have the ability to demonstrate that they do not possess market power despite the screen failure. The screen includes two separate analyses: (1) an uncommitted pivotal supplier analysis and (2) a market share analysis that is to be prepared on a seasonal basis. FERC eliminated an exemption that previously existed for generators in RTOs and Independent System Operators (ISOs), such as PJM and New York ISO (NYISO), and will require all entities that wish to sell at MBR to comply with the revised market power screen.

Also on April 14, 2004, FERC issued a notice that it will commence a pre-rulemaking to analyze the adequacy of its overall process used to consider whether an applicant is entitled to MBR authority. On July 8, 2004, FERC clarified that MBR applicants may net their supply against load-following or provider of last resort contracts, such as obligations to supply BGS in New Jersey, within the screen.

PSEG Lawrenceburg Energy Company LLC (Lawrenceburg) and PSEG Waterford Energy LLC (Waterford), indirect wholly-owned subsidiaries of Power, filed their respective triennial market power

17

reviews in August 2004, and received a notice from FERC on November 16, 2004 requesting further information as to whether Lawrenceburg and Waterford comply with FERC's revised market power screen in combination with other generation assets that their affiliates own in PJM. FERC required this new information by February 7, 2005, and Lawrenceburg and Waterford provided the required information by that date. Power is scheduled for its next triennial market power review in 2006. Despite the request for further information, Power continues to believe that the new market power rules as adopted by FERC will not have a material adverse effect on Power's ability to sell at MBR, although no assurances can be given.

On October 6, 2004, FERC issued a Notice of Proposed Rulemaking (NOPR) regarding reporting requirements for changes in status for entities with MBR authority. On February 10, 2005, FERC issued a final rule in this proceeding that requires entities with MBR to report to FERC within 90 days any changes in circumstances that FERC relied upon in granting MBR authority, and requires FERC to reevaluate MBR status following such an update. The final rule may require updates to FERC upon an acquisition, merger, generation retirement, contract execution or any other event that could affect the facts upon which FERC ruled in granting MBR to an entity. PSEG, PSE&G, Power and Energy Holdings cannot predict the impact, if any, that this rule will have on their operations.

Standards of Conduct