Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 27, 2009 Commission file number 000-14742

|

CANDELA CORPORATION

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 04-2477008

(I.R.S. Employer

Identification No.) |

530 Boston Post Road, Wayland, Massachusetts |

|

01778 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code:(508) 358-7400 |

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of exchange on which registered |

|---|

| Common Stock, $.01 par value per share | | The NASDAQ Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period than the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule12b-2 of the Exchange Act)

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act) Yes o No ý

The aggregate market value of our voting stock held by non-affiliates was approximately $10,784,350 on December 29, 2008 based on the last reported sale price of our common stock on the NASDAQ Stock Market on that day. As of September 30, 2009, 22,913,036 shares of the registrant's common stock, $.01 par value, were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates by reference certain information from the registrant's definitive Proxy Statement relating to the 2009 meeting of stockholders, which the registrant expects to file prior to October 25, 2009.

Table of Contents

CANDELA CORPORATION

2009 Form 10-K Annual Report

Table of Contents

| | | | |

| |

| | Begins on

Page |

|---|

PART I |

Item 1. | | Business | | 3 |

Item 1A. | | Risk Factors | | 20 |

Item 1B. | | Unresolved Staff Comments | | 26 |

Item 2. | | Properties | | 26 |

Item 3. | | Legal Proceedings | | 27 |

Item 4. | | Submission of Matters to a Vote of Security Holders | | 29 |

PART II |

Item 5. | | Market for the Registrant's Common Equity; Related Stockholder Matters and Issuer Purchases of Equity Securities | | 29 |

Item 6. | | Selected Financial Data | | 31 |

Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 32 |

Item 8. | | Financial Statements and Supplementary Data | | 42 |

Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 77 |

Item 9A(T). | | Controls and Procedures | | 77 |

Item 9B. | | Other Information | | 77 |

PART III |

Item 10. | | Directors, Executive Officers, and Corporate Governance | | 78 |

Item 11. | | Executive Compensation | | 78 |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 78 |

Item 13. | | Certain Relationships and Related Transactions; and Director Independence | | 78 |

Item 14. | | Principal Accountant Fees and Services | | 79 |

PART IV |

Item 15. | | Exhibits and Financial Statement Schedules | | 81 |

2

Table of Contents

PART I

Item 1. Business.

Introduction

Candela Corporation ("Candela" or the "Company") is a pioneer in the development and commercialization of advanced aesthetic lasers that allow physicians and personal care practitioners to treat a wide variety of cosmetic and medical conditions including:

- •

- permanent hair reduction on all skin types;

- •

- skin rejuvenation, skin tightening and wrinkle reduction;

- •

- vascular lesions such as rosacea, facial spider veins, leg veins, port wine stains, angiomas and hemangiomas;

- •

- all-color tattoo removal;

- •

- skin resurfacing scars, stretch marks and warts;

- •

- removal of benign pigmented lesions such as sun spots, age spots, freckles, and Nevus of Ota/Ito;

- •

- acne and acne scars;

- •

- sebaceous hyperplasia;

- •

- pseudofolliculitis barbae (beard bumps or "PFB");

- •

- psoriasis; and

- •

- other cosmetic skin treatments.

Since our founding nearly 40 years ago, we have continuously developed and enhanced applications for laser technology. In the mid-1980's we began developing laser technology for medical applications, and since that time have shipped approximately 14,500 systems to over 85 countries. Since the early 1990's we have focused our organizational resources on developing laser and light-based technology for use solely in cosmetic, dermatological, and aesthetic applications. Below is a sampling of Candela's innovations in the laser and light-based technologies market:

- •

- first laser system based on selective photothermolysis to treat cutaneous vascular lesions with minimal skin injury;

- •

- first laser system to treat vascular lesions approved by the FDA for use on children;

- •

- first Q-switched alexandrite laser for pigmented lesions and tattoos;

- •

- first effective pulsed dye laser treatment of hemangiomas, scars and warts;

- •

- first multi-wavelength long-pulse dye laser for treatment of leg telangiectasia (spider veins);

- •

- first laser with a clearance for non-invasive treatment of acne and acne scars;

- •

- first hair removal laser with integrated Dynamic Cooling Device ("DCD");

- •

- first pulsed dye laser with DCD for wrinkles;

- •

- first DCD for epidermal protection in vascular lesion treatment;

- •

- first to introduce "laser-pumped-laser" hand-piece technology for more efficacious pigmented lesion and all color tattoo removal treatments (for which we have applied for a patent); and

- •

- first pain reduction device for aesthetic lasers and intense pulse light ("IPL") systems.

3

Table of Contents

Candela's current product line offers comprehensive and technologically sophisticated cosmetic and aesthetic lasers and light-based systems used by physicians and personal care practitioners to treat a wide variety of cosmetic and medical conditions. Candela's product line includes the following innovative products:

- •

- GentleMax™—Multi-wavelength technology integrated aesthetic treatment workstation.

- •

- AlexTriVantage™—The total pigmented lesion and tattoo solution using multi-wavelength technology in conjunction with our "laser-pumped-laser" hand piece technology.

- •

- GentleLASE® family of alexandrite lasers which provide the highest power, speed, efficacy and ease-of-use in permanent hair reduction, vascular lesions, wrinkle reduction and the treatment of pigmented lesions.

- •

- GentleYAG® family of Nd: YAG lasers which provide fast, effective permanent hair reduction for every skin type including tanned or dark skin, treatment of beard bumps, leg and facial veins, and skin tightening.

- •

- Vbeam®—The gold standard pulsed-dye technology which eliminates vascular lesions including port wine stain birthmarks, rosacea, leg and facial veins, post-operative bruising and provides skin rejuvenation by the reduction of diffuse redness and pigmentation, scars, warts, psoriasis and hemangiomas.

- •

- Smoothbeam® diode laser, for treatment of acne and acne scars, sebaceous hyperplasia and wrinkle reduction.

- •

- SmoothPeel™—Erbium: YAG laser, the simple choice for superior laser peels.

- •

- QuadraLASE™—A complete solution to Fractionated and traditional C02 skin resurfacing.

There were nearly 10.3 million surgical and non-surgical cosmetic procedures performed in the United States in 2008, as reported by the American Society for Aesthetic Plastic Surgery ("ASAPS"). While there was a 12% decrease in total number of cosmetic procedures from 2007 to 2008, there still has been an overall increase of over 160% in the number of cosmetic procedures performed since 1997. Women represented 92% of this total market or nearly 9.3 million procedures. The growth in the market for using aesthetic laser and light-based products is currently a worldwide phenomenon being driven by an increase in discretionary income of aging baby-boomers, which continues to create new opportunities for Candela. This market demographic places a premium on good health and personal appearance, and has demonstrated a willingness to pay for health and cosmetic products and services.

In addition, growth in the popularity of laser and light-based treatments among the general population is also spurring demand for Candela's products. In calendar 2008, according to The American Society for Aesthetic Plastic Surgery, Americans spent an estimated $11.8 billion on cosmetic procedures. In particular, laser and light-based systems are proving an attractive alternative for eliminating unwanted hair. Of the top five non-surgical cosmetic procedures performed in 2008, laser hair removal was the second most popular and is the most common procedures performed on patients aged 18 and under. According to a 2007 report published by the Millennium Research Group, it is estimated that by 2011 the U.S. market for laser hair removal will reach approximately $238.5 million, representing a CAGR of 10.8%.

Candela is dedicated to developing safe and effective products. Our aesthetic laser and light-based systems are further distinguished by being among the fastest, smallest and most affordable in their respective markets.

Candela was incorporated in Massachusetts on October 22, 1970 and subsequently reincorporated in Delaware on July 1, 1985.

4

Table of Contents

Proposed Merger

On September 9, 2009, Candela Corporation and Syneron Medical Ltd. ("Syneron") announced that they had entered into an Agreement and Plan of Merger (the "Merger Agreement"), pursuant to which Candela and Syneron will combine their businesses through a merger of Candela and a newly formed, wholly owned subsidiary of Syneron. Existing stockholders of Candela will exchange each of their shares of Candela common stock for 0.2911 ordinary shares of Syneron (the "Merger"). The Merger is discussed more fully below under the caption "Proposed Merger with Syneron." If the merger is not consummated on or before June 1, 2010, either party may terminate the Merger Agreement.

Industry Overview

Lasers and light-based devices use the unique characteristics of light to achieve precise and efficacious therapeutic effects, often in a non-invasive manner. The precise color, concentration and controllability of different types of light provide for the delivery of a wide range of specialized treatments. First introduced in the 1960's, the use of lasers for medical applications grew rapidly in the 1990's as technical advances made medical lasers more effective and reliable. Medical lasers and light-based devices are today used for numerous types of procedures falling into four broad categories: ophthalmic surgery, aesthetic and cosmetic procedures, general surgery, and dental procedures. Candela competes solely within the growing market for lasers and light-based devices for performing aesthetic, dermatological, and cosmetic procedures including:

- •

- removal of unwanted hair;

- •

- treatment of rosacea, facial veins and leg veins, red birthmarks, scars, stretch marks and warts;

- •

- facial rejuvenation and skin tightening to reduce the appearance of fine lines and wrinkles;

- •

- removal of pigmented lesions such as sun spots, age spots and freckles;

- •

- treatment of acne and acne scars;

- •

- treatment of psoriasis;

- •

- treatment of Nevus of Ota and melasma;

- •

- tattoo removal; and

- •

- skin resurfacing.

Lasers produce intense bursts of highly focused light to treat skin tissues. A laser's wavelength (color), energy level, spot size and pulse width (exposure time) are optimized for the specific treatment. Light-based devices commonly referred to as intense pulsed light ("IPL"), feature a broad range of wavelength of light designed to target vascular and pigmentary targets for facial rejuvenation procedures. Hair removal and the treatment of various leg vein malformations require the deepest laser penetration for successful treatment while scars and red birthmarks (port wine stains and hemangiomas) require less laser penetration. Pigmented lesions such as sun spots, age spots and tattoos are typically surface conditions that require the least amount of penetration. Different conditions may require the use of different types of lasers with specific power requirements and optimized operating parameters. An active aesthetic practice addressing a broad range of cosmetic procedures may need multiple lasers.

We believe the aesthetic and cosmetic laser industry, while in a temporary downturn, remains a sector poised for long-term growth. The major factors converging to drive this anticipated growth are:

- •

- medical practitioners desire to drive additional revenue into their practices due to the increasing reduction in insurance reimbursement;

5

Table of Contents

- •

- discretionary income of aging baby boomers;

- •

- increased general acceptance of aesthetic and cosmetic laser treatments.

Aesthetic and cosmetic device vendors, who are able to deliver lasers that are efficacious, cost effective, reliable, and easy to use, will be well positioned to take advantage of such broad-based industry growth.

Managed care and reimbursement restrictions in the United States, and similar constraints outside the United States, such as socialized medicine, are motivating practitioners to emphasize aesthetic and cosmetic procedures that are delivered on a private, fee-for-service basis. While cosmetic procedures were once the domain of plastic surgeons and dermatologists, reimbursement reductions coupled with the reliable revenue stream from private-pay procedures have piqued the interest of other specialties, including general practitioners, family care practitioners, obstetricians, gynecologists and general and vascular surgeons.

Key technical developments required for the broader cosmetic laser and light-based treatment markets relate to ease-of-use, versatility, speed, lower costs, safety and effective elimination of undesirable side effects. These factors are critical for broader segments of practitioners who wish to build aesthetic and cosmetic laser and light-based treatment practices. These factors are also important for minimizing the disruption of a patient's normal routine and for building demand for procedures addressing very large patient populations.

Business Strategy

Candela believes that a convergence of price, performance and technology is occurring in the aesthetic and cosmetic laser industry which is driving market expansion. We believe we have the necessary infrastructure in place to capitalize on this expansion. Candela's objective is to continue to be the leading provider of aesthetic and cosmetic lasers by using its proprietary technology and expertise in light and tissue interaction, as well as by developing market-oriented products that utilize related technologies. Our business strategy is focused on the following goals:

- •

- increase penetration of our traditional customer base;

- •

- expand beyond our traditional customer base;

- •

- reduce product costs;

- •

- expand and leverage our international distribution channels;

- •

- introduce new technologies or expand existing technologies that improve current treatment procedures and outcomes and provide our customers with unique differentiation;

- •

- develop home use products that enable consumers to leverage the advantages of light based technologies at home; and

- •

- continue investing in research and development to develop new applications that are efficacious, cost-effective, reliable and easy to use and have a high return on investment for our customers.

Increase Penetration of Our Traditional Customer Base. Our traditional customer base consists of dermatologists and plastic and cosmetic surgeons. We believe that the continued innovation that results in the introduction of devices and applications that enable our traditional customers to deliver new services to their patients is the key to growth in this segment. In addition, more versatile devices, differentiated features and increased efficacy and speed will enable Candela to continue to grow our share in this market.

Expand beyond our traditional customer base. As reimbursement rates have dropped over the past several years, many primary care physicians (family and general practice, and obstetrics and gynecology

6

Table of Contents

physicians) have begun to seek new services to offer to their patients. Cosmetic laser and light-based procedures represent an ideal new service that is appealing to their patients, and adds a new "cash-pay" revenue stream to their practices. As more primary care physicians realize that these procedures are safe and easy to perform and that the devices are versatile and affordable, awareness of cosmetic laser and light-based procedures will continue to grow.

Reduce Product Costs. We apply bottom-up engineering, focusing on each component to improve the performance of each device while reducing its size, complexity, and cost. We believe our approach leads to devices with fewer parts and greater manufacturing efficiency, resulting in lower production costs. This enables us to offer more reliable products at more affordable prices.

Expand and Leverage Our Distribution Channels. North America presently is the largest single geographic market for our products. We continue to upgrade our United States sales force to better address the needs of our traditional core markets. Outside of the Unites States, we continue to strengthen our long-standing positions in Europe and Japan and are seeking to expand our markets in Asia-Pacific and Latin America. We currently have direct sales offices in Madrid, Lisbon, Rome, Frankfurt, Paris, Cwmbran (U.K.), Osaka, Fukuoka, Nagoya, Tokyo, Prospect (Australia), and strong distribution partners covering 76 countries worldwide including China. Over the past year we increased the number and improved the quality of our international independent distributor channels.

Introduce New Technologies or Expand Existing Technologies that Improve Current Treatment Procedures. As the market for non-invasive cosmetic procedures continues to expand, Candela has a strong focus on how to improve existing treatments which enables our customers to improve results and the overall experience for their customers. For example, improving patient outcomes for post-surgical bruising is an expanded treatment capability for the Vbeam.

Develop Home Use Products. Candela continues to evaluate opportunities to leverage technologies and application knowledge from our professional business and apply it to the Home Use Market. Despite the current economic environment we have continued to fund proof of concept activities focused on the Home Use market.

Continue Investing in Research & Development. We believe that continued investment in research and development is necessary to maintain our position as a leader in the aesthetic laser and light-based device market. Our research and development approach is to develop high quality, reliable, and affordable products that address our existing markets and also allow us to expand into larger, growing markets. In support of this approach, our research and development staff works closely with our marketing and operations teams to identify new clinical applications that serve our markets. We have numerous research and development arrangements with leading physicians, hospitals and academic laboratories in the United States and throughout the world. In a parallel effort, our research and development and engineering teams continue to optimize our existing products by adding new technologies, increasing the speed of treatment and ease of use for our customers as well as reduce the overall size of our products.

The Market for Aesthetic and Cosmetic Laser and Light-Based Systems

Our traditional customer base for aesthetic and cosmetic devices consists of dermatologists and plastic and cosmetic surgeons. In addition, other practitioner groups are emerging as potential customers, including general and family practitioners, obstetricians, gynecologists, and general and vascular surgeons. In the United States, according to the American Medical Association and various professional societies, there are approximately 15,580 dermatologists, 10,000 plastic and cosmetic surgeons and 13,600 ear, nose and throat specialists. Practitioners in other specialties that are beginning to buy aesthetic and cosmetic laser and light-based systems include 101,000 general and family practitioners, 40,433 obstetricians and gynecologists, and 28,000 general and vascular surgeons. In

7

Table of Contents

addition, the aesthetic and cosmetic laser and light-based system market includes non-medical practitioners, notably electrologists, of which there are an estimated 6,000 in the United States and approximately 4,000 med spa owners in the United States.

The end markets for cosmetic procedures encompass broad and growing patient groups, including aging "baby boomers" as well as younger age groups. There are approximately 80 million baby boomers, representing approximately 29% of the total United States population. This large population group has exhibited a strong demand for aesthetic and cosmetic procedures. We believe that as the cost of treatments decreases and the popularity of cosmetic procedures such as hair removal increases, the target market for these procedures will expand beyond the baby boomers to include a broad range of women and men aged 17 to 65. We believe that similar demographics will help support the growth of the aesthetic and cosmetic market outside of the United States as well.

Hair Removal. We believe that the great majority of the 108 million women over the age of 16 in the United States employ one or more techniques for temporary hair removal from various parts of the body. Also, a growing number of men are removing hair by means other than their daily shaving routine. A number of techniques are used to pull hair from the follicle including waxing, depilatories, and tweezing. In the waxing process, a lotion, generally beeswax-based, is spread on the area to be treated and is then rapidly peeled off, pulling out the entrapped hairs. Depilatories employ rotating spring coils or slotted rubber rolls to trap and pull out the hairs. Tweezing involves removing individual hairs with a pair of tweezers. Pulling hair from the follicle produces temporary results, but is often painful and may cause skin irritation. Depilatory creams, which contain chemicals to dissolve hair, frequently leave a temporary unpleasant odor and may also cause skin irritation. Shaving is the most widely used method of hair removal, especially for legs and underarms but produces the shortest-term results. Hair bleaches do not remove hair, but instead lighten the color of hair so that it is less visible. A principal drawback of all of these methods is that they require frequent treatment.

We believe the market for laser and light-based hair removal is growing as the customer compares laser and light-based treatments to the other hair removal methods currently available. The benefits of a laser and light-based system treatment include:

- •

- significantly reduced procedure time and number of treatments;

- •

- significantly longer-term cosmetic improvement;

- •

- treatment of larger areas in each treatment session;

- •

- less discomfort during and immediately following procedures;

- •

- reduced risk of scarring and infection; and

- •

- non-invasive in nature.

Vascular Lesions. Benign vascular lesions are abnormal, generally enlarged and sometimes proliferating blood vessels that appear on the surface of the skin as splotches, dots, bulges, and spider shapes in a variety of colors ranging from red to purple. Different types of benign vascular lesions include the following:

- •

- stretch marks and scars;

- •

- varicose veins, which are large veins greater than 1mm in diameter and often bulge above the skin surface;

- •

- rosacea, which is the dilation of capillaries in the cheeks, nose, forehead and chin;

- •

- telangiectasias, more commonly referred to as spider veins, appearing on the face and other parts of the body;

8

Table of Contents

- •

- leg telangiectasias, which are smaller spider veins up to 1mm in diameter appearing as single strands;

- •

- port wine stains, which are vascular birthmarks characterized by a red or purple discoloration of the skin; and

- •

- hemangiomas, which are protuberances that consist of dilated vessels, which often appear on newborns within one month of birth.

Pigmented Lesions/Tattoos. Benign pigmented lesions can be both epidermal, on the outer layer of skin, and dermal, on the innermost layer of skin, natural or man-made (tattoos) and can constitute a significant cosmetic problem to those who have them. There has been a significant increase, in recent years, in the number of people getting tattoos and it is currently estimated that approximately 24% of the U.S. population has one or more of them. This figure is expected to grow to as much as 40% of the population in the next several years.

Skin Rejuvenation. Skin rejuvenation is one of the fastest growing segments of the aesthetic laser and light-based system market. A significant percentage of the population suffers from fine lines and wrinkles or older looking skin as a result of the normal aging process. This is the primary group of candidates for non-ablative laser and skin tightening treatments. While the market for skin rejuvenation is greatest in the United States, significant opportunities abound in international markets where there is an aging demographic, such as Japan, or a high prevalence of photo-damaged skin, such as Australia and Latin America.

Acne. Patients have expressed dissatisfaction with existing therapies for acne and acne scarring. These therapies include the following: drug therapy, dermabrasion, ablation, excision, chemical peeling and injections of filler materials. These therapies have minimal efficacy, a significant side-effect profile, require long recovery periods and, in most cases, do not meet patient expectations. For many of these patients, laser treatment can represent a better treatment alternative. Laser therapy can effectively target the sebaceous gland which is the root cause of acne.

Acne Scars. The majority of existing acne scar patients that initially seek traditional treatments decide not to undertake a procedure due to the side-effects and social down-time. A more acceptable alternative for acne scar treatment is laser therapy. In the treatment of acne scars, the laser initiates deposition of new collagen to raise depressions in the skin, reducing the appearance of acne scars. Over a series of treatments, new collagen can fill in and soften the appearance of acne scars.

Psoriasis. According to the National Institutes of Health (NIH), as many as 7.5 million Americans and 125 million people worldwide have psoriasis.

Skin Resurfacing. In calendar 2008, there were approximately 571,000 skin resurfacing procedures performed in the U.S., most using non-ablative skin resurfacing technologies. In addition to these procedures, there were also approximately 592,000 chemical peels and 557,000 microdermabrasion procedures conducted in the U.S, respectively.

Candela's Products

We research, develop, manufacture, market, sell, distribute, and service laser systems used to perform procedures addressing patients' aesthetic medical and cosmetic concerns. We offer a comprehensive range of products based on proprietary technologies focusing on the major aesthetic and cosmetic laser applications.

9

Table of Contents

Our objective is to remain a leading provider of aesthetic and cosmetic lasers by continually striving to develop effective, versatile, smaller, faster, and less expensive devices. Candela has been, and continues to be, a pioneer in the laser industry. From the start, our mission has been to lead the way in the development of innovative laser products which include:

Dynamic Cooling Device ("DCD"). The DCD cools the top layer of the skin, while leaving the targeted underlying hair follicle, vein or other structure at normal temperature. As a result, higher levels of laser energy can be delivered during treatment, while minimizing thermal injury, pain, and the inconvenience associated with anesthetics. The design of the hand-held DCD enables the practitioner to clearly see the area being treated, and the combined efficiency of the lasers and DCD reduces the risks of over treatment. The DCD delivers just the right amount of cooling quickly and consistently. Currently, DCD is available as an option on several Candela laser systems.

GentleMax®

- •

- Integrated aesthetic treatment workstation with multiple wavelength capability;

- •

- The fastest and most powerful Nd:YAG 1064 laser and 755 nm laser in one;

- •

- Superior results in less time and in fewer treatments;

- •

- Touch-screen technology for user-friendly interface;

- •

- Unlimited potential with complete treatment versatility offering unmatched permanent hair reduction to skin tightening and skin rejuvenation to treating leg and facial veins- as many as 36 different applications;

- •

- Offers a choice of skin cooling options—from chilled air technology to Candela's integrated and patented DCD that utilizes bursts of cryogen before and after the laser pulse to offer unparalleled patient comfort.

SmoothPeel®

- •

- Erbium:YAG laser for precise and predictable peels without the chemicals;

- •

- Superior ablative characteristics for skin;

- •

- Offering patients multiple treatment options from simple freshening to a peel comparable to a glycolic acid peel with just a few days of downtime.

AlexTriVantage®™

- •

- The total all-color tattoo and pigmented lesion solution;

- •

- New laser-pumped laser hand pieces (patent pending) offer a unique and elegant design;

- •

- Effective removal of even the most difficult tattoo colors;

- •

- New long pulse mode offers advanced rejuvenation treatments for a wider variety of pigmented lesions;

- •

- Candela's fastest, gentlest, most powerful q-switched alexandrite laser;

- •

- Touch-screen technology for user friendly interface.

QuadraLASE™

- •

- The complete solution to fractional and traditional CO2 skin resurfacing;

- •

- Provides a unique QuadraSCAN™ scanning system for enhanced patient comfort;

10

Table of Contents

- •

- Dual fractionated (300 and 180m) hand pieces and surgical hand pieces provide variable depth therapy and full range of treatment options;

- •

- No disposables and value-pricing mean lower cost of ownership and therefore greater profitability for users.

GentleLASE®

- •

- One of the largest spot size on any hair removal laser (18mm) resulting in faster treatment times, more patients seen, more revenue generated , greater profit ability;

- •

- Treats most skin types;

- •

- Longer delivery system: treat head-to-toe without repositioning laser;

- •

- Lightweight, compact design;

- •

- Multiple spot sizes and applications;

- •

- DCD epidermal cooling—no messy gels required.

GentleYAG®

- •

- One of the fastest, most powerful Nd:YAG laser on the market today;

- •

- Provides treatment versatility, including skin tightening and leg vein removal;

- •

- One of the largest spot (18mm) on any Nd:YAG laser; multiple spot sizes for multiple applications;

- •

- Optimized for all skin types, including dark and tanned skin;

- •

- Multiple configurations, upgradeable;

- •

- Advanced yet affordable;

- •

- DCD epidermal cooling—no messy gels required.

Vbeam®

- •

- Gold standard pulsed dye laser offering vascular and skin rejuvenation treatments with no downtime;

- •

- Reduces bruising associated with injectables and other cosmetic procedures;

- •

- Micro-pulse technology for purpura-free results;

- •

- Smart user interface provides pre-set treatment parameters with a touch of the screen;

- •

- DCD epidermal cooling—no messy gels required.

Smoothbeam®

- •

- Clinically proven leader in acne therapy with clearance up to 24 months;

- •

- 1450 nm wavelength stimulates new collagen growth to treat fine lines and wrinkles;

- •

- Quick, effective, non-invasive treatment for patients;

- •

- DCD epidermal cooling—no messy gels required;

- •

- Convenient table top size and simple set-up.

11

Table of Contents

Sales and Distribution

We market and sell our products worldwide. Executives in North America, Latin America, Japan, Asia-Pacific, and Europe manage our marketing, selling, and service activities through a combination of direct personnel and a network of independent distributors.

The mix of direct sales and distributor sales varies by region. Generally, our distributors enter into 2-3 year exclusive agreements during which they typically agree not to sell our competitors' products. Our sales strategy is to choose the most productive and practicable distribution channel within each of our geographic markets.

We sell products in the United States primarily through our direct sales force to our traditional customer base of dermatologists and plastic and cosmetic surgeons. Candela's products are distributed to our non-traditional markets through an exclusive arrangement with McKesson's Medical Surgical Division. McKesson has approximately 450 dedicated sales representatives that showcase a wide range of products to family and general practice, and obstetrics and gynecology, physicians.

Outside the United States, we sell our products in Europe, Japan, Latin America, the Middle East, and Asia-Pacific through direct sales offices and distribution relationships. We have a total of 130 employees in our direct sales offices in Madrid, Lisbon, Rome, Frankfurt, Paris, Tokyo, Nagoya, Fukuoka, Osaka, Cwmbran, and Sydney. We also have established distribution relationships in China, Europe, Japan, Africa, Latin America, and the Middle East. Outside the United States, we are utilizing approximately 60 distributors. Refer to Note 13 of our Consolidated Financial Statements for additional financial information about segments and geographical areas.

The following chart shows data relating to Candela's international activities during each of the last three fiscal years by geographic region. Revenue generated from regions other than the United States includes sales from our German, Spanish, Italian, United Kingdom, French, Japanese, and Australian subsidiaries, as well as sales shipped directly to international locations from the United States.

| | | | | | | | | | |

Revenues: | | June 27,

2009 | | June 28,

2008 | | June 30,

2007 | |

|---|

(in thousands)

| |

| |

| |

| |

|---|

United States and Canada | | $ | 39,050 | | $ | 55,077 | | $ | 64,397 | |

Europe | | | 43,814 | | | 55,521 | | | 42,344 | |

Japan and Asia-Pacific | | | 29,717 | | | 31,330 | | | 29,935 | |

Latin America & all others | | | 3,999 | | | 4,689 | | | 11,101 | |

| | | | | | | | |

| | $ | 116,580 | | $ | 146,617 | | $ | 147,777 | |

| | | | | | | | |

Service and Support

Candela believes that quick and effective delivery of service is important to our customers. Our principal service center and parts depot is located at our Wayland, Massachusetts headquarters. Parts depots are also located at our sales offices in Japan, Australia, the U.K., Spain, Portugal, Italy, Germany, and France. Independent distributors also maintain parts depots.

We also believe a highly trained and qualified service staff is important to product reliability. Distributors and subsidiaries have the primary responsibility of servicing systems within their territories. Their service personnel are required to attend formal training to become authorized. We provide service training in Asia, Europe and the United States. In addition, we have service and technical support staff in each of our markets worldwide.

Post-warranty product maintenance and repair provides an additional recurring source of revenue. Customers may elect to purchase a service contract or purchase service on a time-and-materials basis.

12

Table of Contents

Candela's service contracts offer a range of service levels and options, including additional clinical support. The contract terms generally run in 12 or 24-month intervals (See Item 8).

Candela emphasizes education and support of its customers. Periodic device calibration/verification, coupled with the continuous training of our service providers, helps to ensure product reliability. We extend prompt and courteous technical and clinical support to our customers when needed.

Manufacturing and Raw Materials

We design, assemble, and test our branded products at our Wayland, Massachusetts and South Plainfield, New Jersey facilities. Ensuring adequate and flexible production capacity, applying lean manufacturing techniques, continually reducing costs, and maintaining superior product quality are top priorities of our manufacturing organization. We achieve our goals by:

- •

- working closely with the research and development organization, including significant early involvement in product design;

- •

- continually improving our just-in-time manufacturing and inventory processes;

- •

- effectively managing and working closely with a limited number of the most qualified suppliers; and

- •

- applying the latest cell manufacturing techniques.

Our facility has ISO 13485 certification and has established and is maintaining a quality system that meets the requirements of ISO 13485:2003 from both the EC Directive 93/42/EEC and Canadian Medical Devices Regulation. The ISO 13485 certification provides evidence that Candela conforms to quality system requirements for the design, development, production, servicing and distribution of medical lasers and accessories.

Our products are manufactured with standard components and subassemblies supplied by third party manufacturers to our specifications. We purchase certain components and subassemblies from a limited number of suppliers.

If our suppliers are unable to meet our requirements on a timely basis, our production could be interrupted until we obtain an alternative source of supply. To date, we have not experienced significant delays in obtaining dyes, optical and electro-optical components, electronic components, Alexandrite rods and other raw materials for our products. We believe that over time alternative component and subassembly manufacturers and suppliers can be identified if our current third party manufacturers and suppliers fail to fulfill our requirements.

Research and Development

We believe that our advanced research and engineering activities are crucial to maintaining and enhancing our business, and we are currently conducting research on a number of applications. We believe that our in-house research and development (R&D) staff has demonstrated its ability to develop innovative new products that meet evolving market needs. Our core competencies include:

- •

- applied laser physics and technology;

- •

- tissue optics;

- •

- photochemistry;

- •

- light-tissue interaction;

- •

- clinical research;

- •

- aesthetic laser applications;

13

Table of Contents

- •

- engineering and design of medical laser devices; and

- •

- collaborative research with leading academic and medical institutions.

As we discover new technologies or applications with commercial potential, we assemble a team to develop the new product or application in cooperation with leading physicians and medical and research institutions. In the United States in particular, we must receive United States Food and Drug Administration ("FDA") clearance before marketing new products or applications.

Our research and development team works with our operations group to design our products for ease of manufacturing and assembly and with our marketing group to create and respond to market opportunities. We believe this interaction between functional groups facilitates the introduction of new products with the right balance of features, clinical benefits, performance, quality, and cost. Historically, our research and development effort has relied primarily on internal development building on our core technologies. In addition to our internal team, we regularly engage the services of independent engineering and development firms to assist in the acceleration of new product development.

Candela also conducts joint research with physicians affiliated with various medical and research institutions. One example of technology developed through joint research is our Dynamic Cooling Device which was developed in conjunction with the Beckman Laser Institute at the University of California, Irvine. We anticipate continuing joint research and licensing arrangements with reputable medical research institutions in future periods.

Our expenditures on research and development are set forth in Item 7.

Backlog

We typically have not had, and do not anticipate having, significant backlog in the future. Accordingly, we do not believe that our backlog at any particular date is necessarily an accurate predictor of revenue for any succeeding period.

Customers

Our sales are not dependent on any single customer or distributor, and we continue to expand our distribution channel worldwide through direct and indirect sales forces. We experience some seasonal reduction of our product sales in our first fiscal quarter due to the summer holiday schedule of physicians and their patients.

Competition

Competition in the aesthetic and cosmetic laser industry is intense and technological developments are expected to continue at a rapid pace. Although there are several manufacturers of aesthetic and cosmetic lasers, we believe Candela is one of only a few companies that offer a broad range of technologies and products able to address multiple clinical applications. Unlike Candela, few of our competitors focus exclusively on the cosmetic and aesthetic laser market and several rely on a single technology which can be limiting. We compete on the basis of proprietary technology, product features, performance, service, price, and reputation. Some of our competitors have greater financial, marketing, and technical resources than we do. Moreover, some competitors have developed, and others may attempt to develop, products with applications similar to ours. We believe that many factors will affect our competitive position in the future, including our ability to:

- •

- develop and manufacture new products that meet the needs of our markets;

- •

- respond to competitive developments and technological changes;

- •

- manufacture our products at lower cost;

14

Table of Contents

- •

- retain a highly qualified research and engineering staff;

- •

- provide sales and service to a worldwide customer base; and

- •

- maintain and improve product reliability.

Proprietary Rights

We have numerous patents and have a number of patent applications pending to protect our rights in certain technical aspects of our hair removal, wrinkle removal, acne treatment, benign vascular lesion, pigmented lesion, and other laser systems.

In addition to our portfolio of issued patents and patent applications, we license patented technology from third parties. We use our patented DCD under a license agreement to patent rights owned by the Regents of the University of California ("Regents").

In August 2000, we obtained exclusive license rights to the DCD, subject to certain limited license rights of Cool Touch, Inc. ("Cool Touch"), in the following fields of use:

- •

- procedures that involve skin resurfacing and rejuvenation,

- •

- vascular skin lesions, and

- •

- laser hair removal.

Cool Touch obtained a license to the DCD on a co-exclusive basis with Candela, in certain narrower fields of use. Cool Touch is restricted in its ability to assign its license rights to certain existing competitors of Candela. Candela is entitled to one-half of all royalty income payable to the Regents from Cool Touch. Under the agreement, Candela no longer is required by the Regents to negotiate sublicenses to third parties. However, Candela is entitled to one-half of all royalties due from any other entity that licenses the DCD technology from the Regents in other fields of use.

We rely primarily on a combination of patent, copyright, and trademark laws to establish and protect our proprietary rights. We also rely on trade secret laws, confidentiality procedures and licensing arrangements to establish and protect our technology rights. In addition, we seek to protect our proprietary rights by using confidentiality agreements with employees, consultants, advisors, and others. We cannot be certain that these agreements will adequately protect our proprietary rights in the event of any unauthorized use or disclosure, that our employees, consultants, advisors or others will maintain the confidentiality of such proprietary information, or that our competitors will not otherwise learn about or independently develop such proprietary information.

Despite our efforts to protect our intellectual property, unauthorized third parties may attempt to copy aspects of our products, to violate our patents, or to obtain and use our proprietary information. In addition, the laws of some foreign countries do not protect our intellectual property to the same extent as do the laws of the United States. The loss of any material patent, trademark, trade name, trade secret or copyright could hurt our business, results of operations and financial condition.

We believe that our products do not infringe the rights of third parties, although two parties are presently asserting that our products infringe their patents (see Item 3). We cannot be certain that third parties will not assert infringement claims against us in the future or that any such assertions will not result in costly litigation or require us to obtain a license to third party intellectual property. In addition, we cannot be certain that such licenses will be available on reasonable terms or at all, which could hurt our business, results of operations and financial condition.

15

Table of Contents

Government Regulation

FDA's Pre-market Clearance and Approval ("PMA") Requirements. Unless an exemption applies, each medical device that we wish to market in the U.S. must receive either "510(k) clearance" or PMA in advance from the FDA pursuant to the Federal Food, Drug, and Cosmetic Act. The FDA's 510(k) clearance process usually takes from three to twelve months, but it can last longer. The process of obtaining PMA approval is much more costly, lengthy, and uncertain and generally takes from one to three years or even longer. We cannot be sure that 510(k) clearance or PMA approval will ever be obtained for any product we propose to market.

The FDA decides whether a device must undergo either the 510(k) clearance or PMA approval process based upon statutory criteria. These criteria include the level of risk that the agency perceives is associated with the device and a determination whether the product is a type of device that is similar to devices that are already legally marketed. Devices deemed to pose relatively less risk are placed in either class I or II, which requires the manufacturer to submit a pre-market notification requesting 510(k) clearance, unless an exemption applies. The pre-market notification must demonstrate that the proposed device is "substantially equivalent" in intended use and in safety and effectiveness to a legally marketed "predicate device" that is either in class I, class II, or is a "pre-amendment" class III device (i.e., one that was in commercial distribution before May 28, 1976) for which the FDA has not yet decided to require PMA approval.

After a device receives 510(k) clearance, any modification that could significantly affect its safety or effectiveness, or that would constitute a major change in its intended use, requires a new 510(k) clearance. The FDA requires each manufacturer to make this determination in the first instance, but the FDA can review any such decision. If the FDA disagrees with a manufacturer's decision not to seek a new 510(k) clearance, the agency may retroactively require the manufacturer to submit a pre-market notification requiring 510(k) clearance. The FDA also can require the manufacturer to cease marketing and/or recall the modified device until 510(k) clearance is obtained. We have modified some of our 510(k) cleared devices but have determined that, in our view, new 510(k) clearances are not required. We cannot be certain that the FDA would agree with any of our decisions not to seek 510(k) clearance. If the FDA requires us to seek 510(k) clearance for any modification, we also may be required to cease marketing and/or recall the modified device until we obtain a new 510(k) clearance.

Devices deemed by the FDA to pose the greatest risk such as life-sustaining, life-supporting or implantable devices, or deemed not substantially equivalent to a legally marketed predicate device, are placed in class III. Such devices are required to undergo the PMA approval process in which the manufacturer must prove the safety and effectiveness of the device to the FDA's satisfaction. A PMA application must provide extensive pre-clinical and clinical trial data and also information about the device and its components regarding, among other things, manufacturing, labeling, and promotion. After approval of a PMA, a new PMA or PMA supplement is required in the event of a modification to the device, it's labeling, or its manufacturing process.

A clinical trial may be required in support of a 510(k) submission or PMA application. Such trials generally require an Investigational Device Exemption ("IDE") application approved in advance by the FDA for a limited number of patients, unless the product is deemed a non-significant risk device eligible for more abbreviated IDE requirements. The IDE application must be supported by appropriate data, such as animal and laboratory testing results. Clinical trials may begin once the IDE application is approved by the FDA and the appropriate institutional review boards are at the clinical trial sites.

To date, the FDA has deemed our products to be class II devices eligible for the 510(k) clearance process. We believe that most of our products in development will receive similar treatment. However, we cannot be certain that the FDA will not deem one or more of our future products to be a class III device and impose the more burdensome PMA approval process.

16

Table of Contents

Pervasive and Continuing FDA Regulation. A host of regulatory requirements apply to marketed devices such as our laser and light-based products, including labeling regulations, the Quality System Regulation (which requires manufacturers to follow design, testing, control, documentation, and other quality assurance procedures), the Medical Device Reporting regulation (which requires that manufacturers report to the FDA certain types of adverse events involving their products), and the FDA's general prohibition against promoting products for unapproved or "off label" uses. Our Class II devices can have special controls such as performance standards, post-market surveillance, patient registries, and FDA guidelines that do not apply to class I devices. Unanticipated changes in existing regulatory requirements or adoption of new requirements could hurt our business, financial condition, and results of operations.

We are subject to inspection and market surveillance by the FDA for compliance with regulatory requirements. If the FDA finds that we have failed to comply with applicable requirements, the agency can institute a wide variety of enforcement actions. The FDA sometimes issues a public warning letter but also may pursue more drastic remedies, such as refusing our requests for 510(k) clearance or PMA approval of new products, withdrawing product approvals already granted to us, requiring us to recall products, or asking a court to require us to pay civil penalties or criminal fines, adhere to operating restrictions, or close down our operations. Ultimately, criminal prosecution is available to the FDA as punishment for egregious offenses. Any FDA enforcement action against us could hurt our business, financial condition, and results of operation.

Other United States Regulation. We also must comply with numerous federal, state, and local laws relating to such matters as safe working conditions, manufacturing practices, environmental protection, fire hazard control, and hazardous substance disposal. We cannot be sure that we will not be required to incur significant costs to comply with such laws and regulations in the future or that such laws or regulations will not hurt our business, financial condition, and results of operations.

Foreign Regulation. International sales are subject to foreign government regulation, the requirements of which vary substantially from country to country. The time required to obtain approval by a foreign country may be longer or shorter than that required for FDA approval, and the requirements may differ. Companies are now required to obtain the CE Mark on a product prior to sale of those products within the European Union. During this process, the sponsor must demonstrate conformance to quality system requirements; i.e., ISO13485:2003.

Candela and its products may also be subject to other federal, state, local, or foreign regulations relating to health and safety, environmental matters, quality assurance, and the like. To date, Candela's compliance with laws that regulate the discharge of materials into the environment or otherwise relate to the protection of the environment has not had a material effect on its ongoing operations. Candela has not made any material expenditure for environmental control facilities. However, we cannot be certain that we will not be required to incur significant costs to comply with such laws and regulations in the future.

Product Liability and Warranties

Our products are generally covered by a standard warranty, with an option to purchase extended warranty contracts at the time of product sale or service contracts after the time of sale. We maintain a reserve based on anticipated standard warranty claims. We believe such reserves to be adequate, but in the event of a major product problem or recall, such reserves may be inadequate to cover all costs, and such an event could have a material adverse effect on our business, financial condition, and results of operations.

Our business involves the inherent risk of product liability claims. We believe that we maintain appropriate product liability insurance with respect to our products. We cannot be certain that with respect to our current or future products, such insurance coverage will continue to be available on

17

Table of Contents

terms acceptable to us or that such coverage will be adequate for liabilities that may actually be incurred.

Applied Optronics

In 2003, Candela acquired substantially all of the assets of Applied Optronics, the diode division of Schwartz Electro-Optics, Inc. Applied Optronics was a leading manufacturer of high-powered, pulsed and CW diode lasers, and was a component supplier to the OEM market that serves a variety of industries including the military, medical, industrial, research and robotics fields. Applied Optronics was the lead supplier of the diodes for our Smoothbeam® diode laser system. The Applied Optronics division of Candela, located in South Plainfield, New Jersey, generates revenue from diode sales to third-party customers.

Inolase

�� On March 6, 2007, we acquired Inolase (2002) Ltd. ("Inolase") a non-public company engaged in the development and manufacture of proprietary pneumatic skin flattening PSF devices for the aesthetic light-based treatment industry as well as the development of intellectual property related to medical devices and light sources.

In the fiscal quarter ended December 27, 2008, in connection with our plan to focus on our core products, we initiated a plan to close the Inolase subsidiary. Accordingly, we classified the operating results of this business as discontinued operations in the statements of operations.

The Company determined that there was no future cash value inherent to its Inolase subsidiary and, accordingly, shut down this reporting unit as its fair value was zero. As part of that process the Company recognized a 100% impairment loss associated with the goodwill, other intangible assets, inventory, and fixed assets. The Company also recorded restructuring charges of approximately $0.4 million at December 27, 2008 associated with future occupancy costs, minimum termination benefits, and professional service fees. See Note 15 of our Consolidated Financial Statements for additional information about discontinued operations.

Employees

As of June 27, 2009, we employed 363 employees, 233 in the United States and 130 internationally. None of our employees are subject to collective bargaining agreements.

Available Information

Access to our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed with or furnished to the Securities and Exchange Commission may be obtained through the Investor Relations section of our website at www.candelalaser.com/ir_corp.asp as soon as reasonably practical after we electronically file or furnish these reports. We do not charge for access to and viewing of these reports. Information on our Investor Relations page and on our website is not part of this Annual Report on Form 10-K or any of our other securities filings unless specifically incorporated herein by reference. In addition, our filings with the Securities and Exchange Commission may be accessed through the Securities and Exchange Commission's Electronic Data Gathering, Analysis and Retrieval system at www.sec.gov. All statements made in any of our securities filings, including all forward-looking statements or information, are made as of the date of the document in which the statement is included, and we do not assume or undertake any obligation to update any of those statements or documents unless we are required to do so by law.

18

Table of Contents

Proposed Merger with Syneron

On September 8, 2009 we entered into an Agreement and Plan of Merger with Syneron Medical under which our business would be combined with that of Syneron through a merger of Candela and a newly formed, wholly owned subsidiary of Syneron.

The completion of the merger is subject to various closing conditions, including adoption and approval of the merger agreement by Candela's stockholders and receipt of certain regulatory and antitrust approvals. The merger is intended to qualify as a reorganization for federal income tax purposes.

At the effective time of the Merger, by virtue of the merger and without any action on the part of any stockholder, each share of our common stock then issued and outstanding will be converted into the right to receive 0.2911 shares of common stock of Syneron.

Mr. Louis P. Scafuri, currently chief executive officer of Syneron, will remain chief executive officer of the combined company and Mr. Gerard E. Puorro, currently chief executive officer of Candela, will join Syneron's Board of Directors.

The merger agreement contains certain termination rights both for us and for Syneron. If the merger agreement is terminated under circumstances specified in the merger agreement due to action by us, we will be required to pay Syneron a termination fee of $2.6 million.

Our board of directors and the board of directors of Syneron have each approved the merger.

The merger agreement contains representations and warranties which the parties thereto made to, and solely for, the benefit of each other. The assertions embodied in those representations and warranties are qualified by information in confidential disclosure schedules that the parties have exchanged in connection with signing the merger agreement and that modify, qualify and create exceptions to the representations and warranties contained in the merger agreement. We and Syneron each have made covenants in the merger agreement about continuing our respective businesses in the ordinary course.

Satisfaction of the closing conditions could take several months or longer. There can be no assurance that the conditions to completion of the merger will be met, or that the merger will be completed. If the merger is not consummated on or before June 1, 2010, either party may terminate the merger agreement.

Forward-looking and Cautionary Statements

Certain statements contained in this Form 10-K may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 ("Reform Act"). We may also make forward-looking statements in other reports filed with the Securities and Exchange Commission, in materials delivered to stockholders and in press releases. In addition, our representatives may from time to time make oral forward-looking statements. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Words such as "anticipates," "believes," "expects," "estimates," "intends," "plans," "projects," and similar expressions, may identify such forward-looking statements. Such forward looking statements include but are not limited to: that we have the necessary infrastructure in place to capitalize on expansion; the affordability of our products will allow for expansion; that we can lower production costs; or that the market will expand beyond baby boomers. Candela assumes no obligation to update or revise any forward-looking statements. In accordance with the Reform Act, set forth under Item 1A "Risk Factors", are cautionary statements that accompany those forward-looking statements. Readers should carefully review such cautionary statements as they identify certain important factors that could cause actual results to differ materially from those in the forward-looking statements and from historical trends. Those cautionary

19

Table of Contents

statements are not exclusive and are in addition to other factors discussed elsewhere in this Annual Report, in our filings with the Securities and Exchange Commission, or in materials incorporated therein by reference.

Candela GentleLASE, Vbeam, GentleYAG and Smoothbeam are registered trademarks and GentleMax, AlexTriVantage, SmoothPeel, Dynamic Cooling Device, DCD and the Candela flame are trademarks of Candela Corporation. Serenity, Pneumatic Skin Flattening, and, PSF are also trademarks of Candela Corporation.

Item 1A. Risk Factors.

The following important factors, among others, could cause our actual operating results to differ materially from those indicated or suggested by forward-looking statements made in this Form 10-K or presented elsewhere by management from time to time.

The ability to complete the merger is subject to the receipt of consents and approvals from government entities, which may impose conditions that could have an adverse effect on us or could cause either party to abandon the merger.

In deciding whether to grant regulatory or antitrust approvals, the relevant governmental entities will consider the effect of the merger on competition within their relevant jurisdictions. The terms and conditions of the approvals that are granted may impose requirements, limitations or costs or place restrictions on the conduct of the combined company's business.

The merger agreement may require us to accept significant conditions from regulatory bodies before either of us may refuse to close the merger on the basis of those regulatory conditions. We cannot provide any assurance that either party will obtain the necessary approvals or that any other conditions, terms, obligations or restrictions imposed by these regulatory bodies will not have a material adverse effect on the combined company following the merger. In addition, we can provide no assurance that these conditions, terms, obligations or restrictions will not result in the delay or abandonment of the merger.

Any delay in completion of the merger may significantly reduce the benefits expected to be obtained from the merger.

In addition to the required regulatory clearances and approvals, the merger is subject to a number of other conditions beyond our control that may prevent, delay or otherwise materially adversely affect its completion. We cannot predict whether and when these other conditions will be satisfied. Further, the requirements for obtaining the required clearances and approvals could delay the completion of the merger for a significant period of time or prevent it from occurring. Any delay in completing the merger may significantly reduce the synergies and other benefits that we expect to achieve if we successfully complete the merger within the expected timeframe and integrate our and Syneron's businesses.

The anticipated benefits of the merger may not be realized fully or at all or may take longer to realize than expected.

The merger involves the integration of two companies that have previously operated independently with principal offices in two distinct locations. Due to legal restrictions, we and Syneron have conducted only limited planning regarding the integration of the two companies. The combined company will be required to devote significant management attention and resources to integrating the two companies. Delays in this process could adversely affect the combined company's business, financial results, financial condition and stock price. Even if we were able to integrate our business operations successfully, there can be no assurance that this integration will result in the realization of the full

20

Table of Contents

benefits of synergies, cost savings, innovation and operational efficiencies that may be possible from this integration or that these benefits will be achieved within a reasonable period of time.

Additionally, as a condition to their approval of the merger, regulatory agencies may impose requirements, limitations or costs or require divestitures or place restrictions on the conduct of the combined company's business. If we and Syneron agree to these requirements, limitations, costs, divestitures or restrictions, the ability to realize the anticipated benefits of the merger may be impaired.

Failure to complete the merger for regulatory or other reasons could adversely affect our stock price and our future business and financial results.

Completion of the merger is conditioned upon, among other things, the receipt of certain regulatory and antitrust approvals and the approval of our stockholders. There is no assurance that we will receive the necessary approvals or satisfy the other conditions to the completion of the merger. Failure to complete the proposed merger would prevent us from realizing the anticipated benefits of the merger. We also will remain liable for significant transaction costs, including legal, accounting and financial advisory fees, regardless of whether the merger is completed. In addition, the market price of our common stock may reflect various market assumptions as to whether the merger will occur. Consequently, the failure to complete the merger could result in a significant change in the market price of our common stock.

Unfavorable results in our intellectual property litigation with Palomar Medical Technologies may result in significant decline to our stock price or have a material affect on results of operations or on cash flows.

On August 9, 2006, one of our competitors, Palomar Medical Technologies ("Palomar"), alleged that the manufacture, use and sale of our products for laser hair removal infringe a certain United States patent. Public announcements concerning this litigation that are unfavorable to us may result in significant declines in our stock price. An adverse ruling or judgment in this matter, including the possible assessment of material historical infringement damages, could cause our stock price to decline significantly.

Litigation with Palomar will be expensive and protracted, and our intellectual property position may be weakened as a result of an adverse ruling or judgment. Whether or not we are successful in the pending lawsuits, litigation consumes substantial amounts of our financial resources and diverts management's attention away from our core business. See Item 3—"Legal Proceedings."

We depend on sales from outside the United States that could be adversely affected by changes in international markets.

We sell more than half of our products and services outside the United States. International sales accounted for approximately 67% of our revenue for fiscal year 2009 and we expect that they will continue to be significant. Accordingly, a major part of our revenues and operating results could be adversely affected by risks associated with international commerce. Significant fluctuations in the exchange rates between the United States dollar and foreign currencies could cause us to lower our prices and thus reduce our profitability, or could cause prospective customers to push out orders to later dates because of the increased relative cost of our products in the aftermath of a currency devaluation or currency fluctuation. Other risks associated with international business include:

- •

- longer payment cycles common in foreign markets;

- •

- changes in tax and other laws;

- •

- regulatory practices and tariffs; and

- •

- difficulties in staffing and managing our foreign operations.

21

Table of Contents

The failure to obtain Alexandrite rods for the GentleLASE® and the AlexTriVantage™ systems from our sole supplier would impair our ability to manufacture and sell these systems.

We use Alexandrite rods to manufacture the GentleLASE® and the AlexTriVantage™ systems, which accounts for a significant portion of our total revenues. We depend exclusively on our contract manufacturer to supply these rods, for which no alternative supplier meeting our quality standards exists. We cannot be certain that our contract manufacturer will be able to meet our future requirements at current prices or at all. To date, we have been able to obtain adequate supplies of Alexandrite rods in a timely manner, but any extended interruption in our supplies could hurt our results.

Disappointing quarterly revenue or operating results could cause the price of our common stock to fall.

Our quarterly revenue and operating results are difficult to predict and may swing sharply from quarter to quarter. Historically, our first fiscal quarter has typically had the least amount of revenue in any quarter of our fiscal year. The results of the first quarter are directly impacted by the seasonality of the purchasing cycle.

If our quarterly revenue or operating results fall below the expectations of investors or public market analysts, the price of our common stock could fall substantially. Our quarterly revenue is difficult to forecast for many reasons, some of which are outside of our control, including the following:

Market supply and demand

- •

- potential increases in the level and intensity of price competition between our competitors and us;

- •

- potential decrease in demand for our products; and

- •

- possible delays in market acceptance of our new products.

Customer behavior

- •

- changes in or extensions of our customers' budgeting and purchasing cycles; and

- •

- changes in the timing of product sales in anticipation of new product introductions or enhancements by us or our competitors.

Company operations

- •

- absence of significant product backlogs;

- •

- our effectiveness in our manufacturing process;

- •

- unsatisfactory performance of our distribution channels, service providers, or customer support organizations; and

- •

- timing of any acquisitions and related costs.

Our failure to respond to rapid changes in technology and intense competition in the laser industry could make our lasers obsolete.

The aesthetic and cosmetic laser equipment industry is subject to rapid and substantial technological development and product innovations. To be successful, we must be responsive to new developments in laser technology and new applications of existing technology. Our financial condition and operating results could be hurt if our products fail to compete favorably in response to such technological developments, or we are not agile in responding to competitors' new product introductions or product price reductions. In addition, we compete against numerous companies

22

Table of Contents

offering products similar to ours, some of which have greater financial, marketing, and technical resources than we do. We cannot be sure that we will be able to compete successfully with these companies and our failure to do so could hurt our business, financial condition, and results of operations.

Like other companies in our industry, we are subject to a regulatory review process and our failure to receive necessary government clearances or approvals could affect our ability to sell our products and remain competitive.

The types of medical devices that we seek to market in the United States generally must receive either "510(k) clearance" or "PMA approval" in advance from the United States Food and Drug Administration ("FDA") pursuant to the Federal Food, Drug, and Cosmetic Act. The FDA's 510(k) clearance process usually takes from three to twelve months, but it can last longer. The process of obtaining PMA approval is much more costly and uncertain and generally takes from one to three years or even longer. To date, the FDA has deemed our products eligible for the 510(k) clearance process. We believe that most of our products in development will receive similar treatment. However, we cannot be sure that the FDA will not impose the more burdensome PMA approval process upon one or more of our future products, nor can we be sure that 510(k) clearance or PMA approval will ever be obtained for any product we propose to market.

Many foreign countries in which we market or may market our products have regulatory bodies and restrictions similar to those of the FDA. We cannot be certain that we will be able to obtain (or continue to obtain) any such government approvals or successfully comply with any such foreign regulations in a timely and cost-effective manner, if at all, and our failure to do so could adversely affect our ability to sell our products.

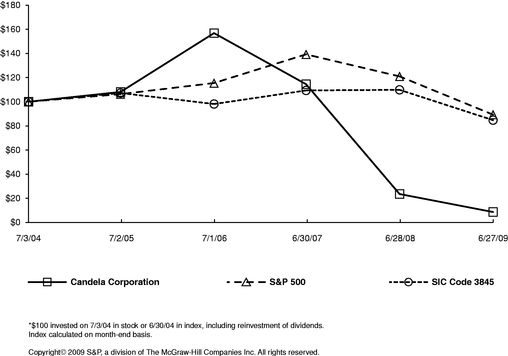

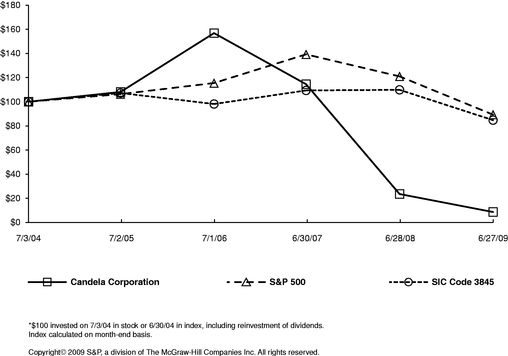

We have modified some of our products without FDA clearance. The FDA could retroactively decide the modifications were improper and require us to cease marketing and/or recall the modified products.