UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT ON REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-4946

THOMPSON PLUMB FUNDS, INC.

(Exact name of registrant as specified in charter)

1200 John Q. Hammons Drive

Madison, Wisconsin 53717

(Address of principal executive offices)—(Zip code)

Thomas G. Plumb, President

Thompson Plumb Funds, Inc.

1200 John Q. Hammons Drive

Madison, Wisconsin 53717

(Name and address of agent for service)

With a copy to:

Charles M. Weber, Esq.

Quarles & Brady LLP

411 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Registrant’s telephone number, including area code: (608) 831-1300

Date of fiscal year end: November 30, 2003

Date of reporting period: November 30, 2003

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, N.W., Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| | | |

| |

Item 1. Reports to Stockholders

Annual Report

November 30, 2003

Thompson Plumb Growth Fund

Thompson Plumb Select Fund

Thompson Plumb Blue Chip Fund

Thompson Plumb Balanced Fund

Thompson Plumb Bond Fund

Telephone: 1-800-999-0887

www.thompsonplumb.com

|

THOMPSON PLUMB FUNDS, INC.

ANNUAL REPORT TO SHAREHOLDERS

NOTE ON FORWARD-LOOKING STATEMENTS

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each Fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any Fund to differ materially as compared to its benchmarks.

2

TABLE OF CONTENTS

THOMPSON PLUMB FUNDS, INC.

ANNUAL REPORT TO SHAREHOLDERS

November 30, 2003

CONTENTS

| | | | | | |

| | | | Page(s) |

INVESTMENT REVIEWS | | | | |

| | Growth Fund | | | 4-5 | |

| | Select Fund | | | 6-7 | |

| | Blue Chip Fund | | | 8-9 | |

| | Balanced Fund | | | 10-11 | |

| | Bond Fund | | | 12-13 | |

FINANCIAL STATEMENTS | | | | |

| | Statements of assets and liabilities | | | 14 | |

| | Schedules of investments | | | 15-21 | |

| | Statements of operations | | | 22 | |

| | Statements of changes in net assets | | | 23 | |

| | Notes to financial statements | | | 24-28 | |

| | Financial highlights | | | 29-33 | |

REPORT OF INDEPENDENT AUDITORS | | | 34 | |

DIRECTORS AND OFFICERS | | | 35-38 | |

This annual report is authorized for distribution to prospective investors only when

preceded or accompanied by a Fund prospectus which contains facts concerning the

Funds’ objectives and policies, management, expenses, and other information.

3

GROWTH FUND INVESTMENT REVIEW

November 30, 2003

| | | | | | | |

| |

- -s- John W. Thompson

John W. Thompson, CFA

Co-Portfolio Manager | |  | |

-s- John C. Thompson

John W. Thompson, CFA

Co-Portfolio Manager |

Performance

The stock markets were kind to investors over the last half of the fiscal year ended November 30, 2003, which was the significant factor behind the 10.17% gain in the value of the Growth Fund shares. The market as measured by the S&P 500 Index was up 10.80% in the identical period. For the entire fiscal year, the Growth Fund gained 13.28% while the S&P 500 Index grew by 15.09%. The markets rose as signs of economic improvement became more widespread and corporate earnings boomed. Productivity, which is the long-term driver of our standard of living, has risen dramatically in the past few years, further adding to the market’s optimism.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| | | | | | | | | | | | | | | | | |

|

Average Annual Total Returns

As of 11-30-03 |

|

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

Thompson Plumb Growth Fund | | | 13.28 | % | | | 6.91 | % | | | 10.25 | % | | | 15.77 | % |

Standard & Poor’s 500 Index | | | 15.09 | % | | | -5.52 | % | | | -0.47 | % | | | 10.63 | % |

|

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects voluntary fee waivers in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the Average Annual Total Returns table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Standard & Poor’s 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot directly invest in an index.

4

Factors Affecting Performance

The gain of the Fund was primarily concentrated in two areas: smaller companies and lesser quality companies. For example, CIT Group, Tyco, Time Warner, Circuit City, Henry Schein, Sybron Dental and Wendy’s rose significantly faster than the market. Offsetting these were somewhat stagnant share prices of some of our larger holdings, including Fannie Mae, Pfizer, Microsoft, Cincinnati Financial, and Freddie Mac. In general, the higher the quality of the company, the worse it performed in 2003.

Current Strategy and Outlook

Our strategy over the last few months has been to sell many of our strong performers, which were the companies that we purchased in anticipation of an improving economy, and invest in the high-quality companies that did not appreciate significantly this year. For example, we purchased shares in AIG, Johnson & Johnson, Fannie Mae, Microsoft, Colgate Palmolive, Berkshire Hathaway, Freddie Mac, and Viacom. Many of the smaller companies and technology related companies have risen substantially over the last few years, and this has reduced their appeal to us. In general, by moving into high-quality companies at reasonable multiples of their earnings, we believe that we will accomplish the dual goals of providing attractive investment returns while preserving your principal.

Please refer to the schedule of investments on page 15 of this report for holdings information. Fund holdings are subject to change and are not recommendations to buy or sell any securities.

Small-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies.

5

SELECT FUND INVESTMENT REVIEW

November 30, 2003

| | | |

| |

-s- Clint A. Oppermann

Clint A. Oppermann, CFA

Portfolio Manager |

Performance

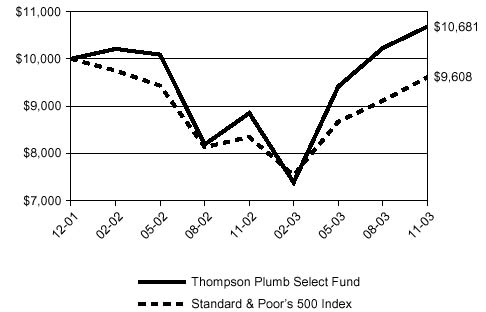

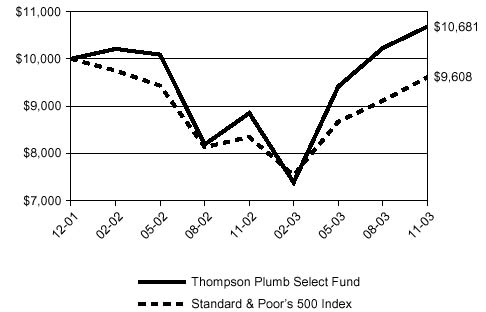

The Select Fund returned 20.69% for the fiscal year ended November 30, 2003. In comparison, the S&P 500 Index returned 15.09% for the same time period. Since inception (December 3, 2001), the Select Fund and S&P 500 have cumulative returns of 6.81% and -3.92%, respectively.

The Fund has now existed for two tumultuous years and we have good and bad news to report. We’ll start with the bad – our annualized return since inception is up only 3.36% per year. This is well short of any reasonable absolute return objective. The only good news is that the S&P 500 Index’s annualized return is actually down 1.99% over the same period. Obviously, we’re not too happy with our absolute performance but our relative performance is pretty much in line with our expectations.

Our goal is to outperform the S&P 500 Index by 4% or 5% per year. This, of course, is no lay up since all funds have 2 drags that the Index does not – an expense ratio and transaction costs. These twin drags are the main reasons that about 70% of actively-managed funds lag the Index over long periods of time (and why those that do outperform do so by seemingly modest amounts). We hope to continue to overcome these drags and add significant value above the Index through thorough research and unparalleled investment discipline.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| | | | | | | | | |

|

Average Annual Total Returns

As of 11-30-03 |

|

| | | 1 Year | | Since Inception |

Thompson Plumb Select Fund | | | 20.69 | % | | | 3.36 | % |

Standard & Poor’s 500 Index | | | 15.09 | % | | | -1.99 | % |

Fund Inception: December 3, 2001

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects voluntary fee waivers in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the Average Annual Total Returns table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Standard & Poor’s 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot directly invest in an index.

6

Factors Affecting Performance

You’ll notice a couple of big changes in today’s portfolio when compared to the end of last year. First, we have a large cash balance. Currently it stands at 21.16% of assets. The stock market has appreciated quite a lot over the last 8 to 12 months and we’re currently not able to find many truly compelling investment opportunities. Until we’re able to do so, we’ll contently wait in cash.

Obviously we’re not too happy with the 1% return we’re currently getting on a sizable part of the portfolio that is in cash. However, we’d rather suffer with a lower return today than what could potentially happen if we relaxed our investment discipline – a repeat of 2002. If you’ll recall, after a horrible first three quarters of 2002 we took the level of discipline we use in managing this portfolio up a notch. We started demanding higher quality businesses and bigger discounts to value before investing. In our opinion a fair amount of the pain that we felt in 2002 could have been avoided had we imposed the added discipline at the Fund’s inception rather than after 3 quarters of history. We’re not about to re-learn this lesson even though it’s costing us relative performance at this moment in time.

Second, the Select Fund is less focused today than it was last year at this time as a result of a conscious decision to trim some of our largest positions.Some of our most under priced stocks have rapidly appreciated this year. As they appreciated we sold down some of those holdings and added to other preexisting holdings with the proceeds. The stocks bought and sold have similar discounts to value and should theoretically have similar returns over time. Our objective with these transactions was not to enhance return but rather to reduce volatility by reducing the sizes of our larger positions.

This is not a permanent shift in philosophy. When we see businesses that are obviously much more compellingly priced than the others in the portfolio you can expect much bigger position sizes in the cheaper stocks. We will gladly take increased volatility when we think returns will be materially higher. However, today we’re faced with very similar discounts to value throughout much of the portfolio and don’t think there is much to gain from an extremely concentrated approach.

Current Strategy and Outlook

Our strategy remains unchanged from the last time we wrote. We will continue to invest the Select Fund in a limited number of average or higher quality understandable businesses when their stock prices are at substantial discounts to our estimates of intrinsic value. The discounts we typically demand are 40% for what we deem are superior businesses and 50% for what we deem are more average businesses.

Our investment discipline is strict and very few businesses currently have the combination of sufficiently high quality and cheapness relative to value to make it into the Select Fund. When we can’t find businesses to invest in our default is cash. We remain confident that the stock market will eventually give us attractive reinvestment opportunities but realize that we might lag our competitors until this happens.

We estimate that the businesses in your portfolio are currently trading at about 70% to 75% of intrinsic value (on a position-size weighted basis) whereas the S&P 500 Index is trading at about 110% to 115% of intrinsic value. Because of the absolute discount to value of the Select Fund and the stark relative valuation between the Fund and the Index, we continue to be excited about return prospects.

Please refer to the schedule of investments on page 16 of this report for holdings information. Fund holdings are subject to change and are not recommendations to buy or sell any securities.

The Thompson Plumb Select Fund is a non-diversified Fund. As a result, the value of the Fund’s shares may fluctuate more widely and may be subject to greater market risk than a Fund that invests more broadly.

7

BLUE CHIP FUND INVESTMENT REVIEW

November 30, 2003

| | | | | | | |

| |

- -s- David B. Duchow

David B. Duchow, CFA

Co-Portfolio Manager | |  | |

-s- Timothy R. O’Brien

Timothy R. O’Brien, CFA

Co-Portfolio Manager |

Performance

The Blue Chip Fund produced a return of 13.74% for the fiscal year ended November 30, 2003 compared to the 15.09% return for the S&P 500 Index. The Lipper Large Cap Core average return was 11.61% for the same period. Since the Fund’s inception on August 1, 2002 through November 30, 2003, the Blue Chip Fund returned 13.45% compared to the S&P 500 Index return of 13.93% annually. The Lipper Large Cap Core average return was 10.38% for the same period.

Lipper Large Cap Core Fund Average is the load-adjusted, equal weighted average performance of all large cap core funds measured by Lipper, Inc.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| | | | | | | | | |

|

Average Annual Total Returns

As of 11-30-03 |

|

| | | 1 Year | | Since Inception |

Thompson Plumb Blue Chip Fund | | | 13.74 | % | | | 13.45 | % |

Standard & Poor’s 500 Index | | | 15.09 | % | | | 13.93 | % |

| |

| Fund Inception: August 1, 2002 |

|

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects voluntary fee waivers in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the Average Annual Total Returns table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Standard & Poor’s 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot directly invest in an index.

8

Factors Affecting Performance

The performance of the Blue Chip Fund over the past year has been a tale of two markets. The first four months of the year were a tale of a declining stock market with the Blue Chip Fund underperforming in this stormy environment. However, the rest of the year was a different tale with the Blue Chip Fund outperforming in a strong up stock market.

Early in the year, investors struggled with uncertainties including the war in Iraq, weak domestic employment growth and international terrorism issues. The Standard & Poor’s 500 Index closed below 800 in the middle of March of 2003. Record amounts of stimulus in the form of federal budget deficits and record low interest rates propelled the economy during the third and fourth quarters of 2003. Investors gained confidence in the economic recovery and improving corporate profitability. They pushed the stock market to rally over the remainder of the year.

Current Strategy and Outlook

With the stock market trading at near 20 times 2003 earnings, a good question is: where are we finding businesses priced significantly below their intrinsic value, or more simply put, where are we finding value in today’s stock market? Currently, we feel the major drug companies offer an attractive risk/reward scenario.

Major pharmaceuticals such as Abbott Labs, Merck and Pfizer have many strengths including robust internal R&D, high return on equity, strong balance sheets with growing new product lines, as well as proven management teams. In addition, our country’s demographics of an aging population give these companies solid end markets.

These stocks are not without their risks. Several multi-billion dollar drugs such as Merck’s Zocor for high cholesterol and Pfizer’s Zoloft for depression come off patent over the next several years. Also, the political environment remains unsettled. Drugs like Pfizer’s Lipitor and Viagra face new competition. While at the same time, every company is working hard to keep their costs in-line.

We feel these risks are reflected in the drug companies’ stock price. Over the last ten years, major pharmaceutical companies have traded on average at a 30% premium to the S&P 500 Index. Today, these companies are below a market multiple with Pfizer, Merck, Wyeth and Bristol-Myers Squibb all trading between 15 and 18 times 2003 earnings and 14 to 16 times projected 2004 earnings. In addition, these companies have an attractive dividend yield of between 2.0 and 4.3%.

Over the last 9 months, major pharmaceutical stocks have fallen out of favor, especially when compared to technology stocks. In this time period, the top 20 technology companies have climbed to an average P/E of 40 times 2003 earnings while the major pharmaceutical index has fallen to a P/E of 18 times 2003 earnings. In this environment, expectations for some technology stocks have become too high, while at the same time we believe projections for major drug stocks are too low.

So, how are we positioning the Blue Chip Fund? We have bought a basket of drug stocks including Abbott Labs, Pfizer, Merck, Bristol-Myers Squibb and, lately, Schering-Plough. These stocks help make healthcare our largest sector allocation. We believe a portfolio of these drug stocks will outperform a basket of tech stocks and the market over the next several years.

The stock market has rallied strongly from the lows in March of this year. The valuation of the broad stock market has moved from undervalued to slightly overvalued, in our opinion. That said, we are still finding high-quality companies such as the large pharmaceutical companies trading at discounts to our estimate of intrinsic value. We think our approach of buying high-quality companies at 30-50% discounts to our estimate of intrinsic value has the opportunity to provide attractive risk-adjusted returns over the long term. In addition, we have over 10% of the Blue Chip Fund in cash. We are not excited making 1% return on our cash, but we are excited about having some cash available for more compelling investment opportunities.

Please refer to the schedule of investments on page 17 of this report for holdings information. Fund holdings are subject to change and are not recommendations to buy or sell any securities.

9

BALANCED FUND INVESTMENT REVIEW

November 30, 2003

| | | | | | | | | | | |

| |

- -s- Thomas G. Plumb

Thomas G. Plumb,

CFA

Portfolio

Manager | |  | |

-s- David B. Duchow

David B. Duchow,

CFA

Associate Portfolio

Manager | |  | |

-s- Timothy R. O’Brien

Timothy R. O’Brien,

CFA

Associate Portfolio

Manager |

Performance

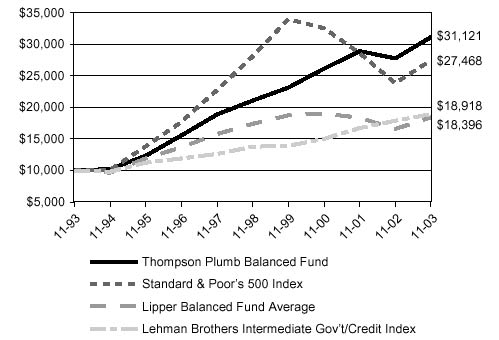

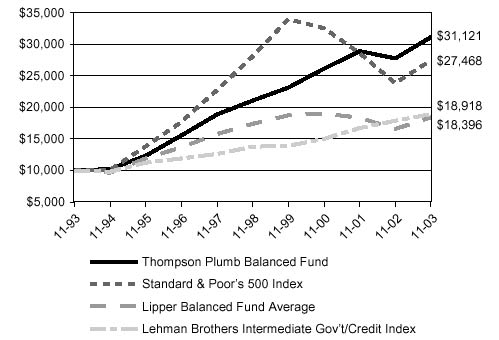

The Balanced Fund produced a 12.05% return for the fiscal year ended November 30, 2003 which exceeded the Lipper Balanced Fund average return of 10.87%. During the same period the Standard & Poor’s 500 Index returned 15.09% and the Lehman Intermediate Government/Credit Index returned 5.66%.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| | | | | | | | | | | | | | | | | |

|

Average Annual Total Returns

As of 11-30-03 |

|

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

Thompson Plumb Balanced Fund | | | 12.05 | % | | | 5.98 | % | | | 8.11 | % | | | 12.02 | % |

Standard & Poor’s 500 Index | | | 15.09 | % | | | -5.52 | % | | | -0.47 | % | | | 10.63 | % |

Lipper Balanced Fund Average | | | 10.87 | % | | | -0.37 | % | | | 2.10 | % | | | 7.72 | % |

Lehman Brothers Intermediate Gov’t/Credit Index | | | 5.66 | % | | | 8.02 | % | | | 6.55 | % | | | 6.58 | % |

|

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects voluntary fee waivers in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the Average Annual Total Returns table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Standard & Poor’s 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot directly invest in an index. Lipper Balanced Fund Average is the load-adjusted, equal weighted average performance of all balanced funds measured by Lipper, Inc. For purposes of the line graph above, the year-by-year change in the value of the Lipper Balanced Fund Average is based on the total return of the balanced funds that were included in the Lipper Balanced Fund Average for that year; however, for purposes of calculating the average annual total returns for the Lipper Balanced Fund Average during the periods presented in the table above, Lipper only considers the performance of the balanced funds that were in existence during all such periods. The Lehman Brothers Intermediate Government/Credit Index is a market value weighted performance benchmark which includes virtually every major U.S. Government and investment-grade rated corporate bond with 1-10 years remaining until maturity.

10

Factors Affecting Performance

The performance of the Balanced Fund over the past year has been a tale of two markets. The first four months of the year were a tale of a declining stock market with the Balanced Fund underperforming in this stormy environment. However, the rest of the year was a different tale with the Balanced Fund outperforming in a strong up stock market.

Early in the year, investors struggled with uncertainties including the war in Iraq, weak domestic employment growth and international terrorism issues. The Standard & Poor’s 500 Index closed below 800 in the middle of March of 2003. Record amounts of stimulus in the form of federal budget deficits and record low interest rates propelled the economy during the third and fourth quarters of 2003. Investors gained confidence in the economic recovery and improving corporate profitability. They pushed the stock market to rally over the remainder of the year. In addition, the improved corporate environment has caused the spread between corporate bonds and U.S. Treasuries to narrow, helping the bond portion of the Balanced Fund to outperform.

Current Strategy and Outlook

The economy is responding to massive amounts of stimulus provided by both monetary and fiscal policy. The Federal Reserve has lowered short-term interest rates to the lowest levels in over 40 years and has signaled an intention to leave them there until an economic recovery is well under way. The Federal government has slashed tax rates and is spending at a rapid pace which is creating a $500-billion-a-year budget deficit. It appears that a sustained economic recovery is taking hold, but we believe the recovery will moderate to a 3-4% growth rate in 2004.

The stock market advanced sharply in 2003 in anticipation of improving corporate earnings next year. We believe that the stock market has reached a level where it is more fairly valued and some selected technology companies may be somewhat over-valued. We are still finding selected high-quality companies trading at discounts to our estimates of their value. The major pharmaceutical companies represent good value and should come back into vogue in 2004 as investors rotate from expensive technology and industrial companies back into higher-quality companies with reasonable valuations.

The tax cuts implemented in 2003 have made dividend-paying companies especially attractive to taxable investors. Our emphasis on high-quality companies with solid balance sheets and free cash flow are the most likely companies, in our opinion, to be in a position to raise their dividends.

Overall level of consumer, corporate and government debt outstanding concerns us. We believe this will act as a drag to future economic growth. Previous economic recessions were generally a time for businesses and consumers to cut back on capital investment and consumption in order to pay down debt accumulated during expansions. We feel this would create pent-up demand and buying power to fuel the next recovery. Consumers, in general, have used the record low interest rates to continue buying cars and homes rather than pay down debt during the last recession. Debt levels, when compared to income, are much closer to their historical highs than end-of-recession lows. We believe this will impede the consumer from leading a recovery.

Interest rates reached 40 year record lows this last summer. We believe that the 20-year bull market in bonds ended then and we expect interest rates to rise gradually with moderate economic growth. We have kept the bond maturities in the Fund’s portfolio relatively short to preserve principal in a rising rate environment and in anticipation of being able to take advantage of higher interest rates in 2004. We have emphasized corporate debt and preferred stocks to generate income.

We generally invest in high-quality companies that are industry leaders with high returns on invested capital, solid balance sheets and strong management when they trade at 30-50% discounts to our estimate of their intrinsic value. We utilize the same discount-to-value approach in fixed-income investments where we strive to generate total return, while preserving principal and generating current income. We believe that our investment approach of combining common stocks and bonds will continue to serve investors well.

Please refer to the schedule of investments on page 18 of this report for holdings information. Fund holdings are subject to change and are not recommendations to buy or sell any securities.

11

BOND FUND INVESTMENT REVIEW

November 30, 2003

| | | |

| |

- -s- John W. Thompson

John W. Thompson, CFA

Portfolio Manager |

Performance

The Thompson Plumb Bond Fund produced a total return of 13.75% for the fiscal year ended November 30, 2003. In comparison, the Lehman Brothers Intermediate Government/Credit Index (LGCI) returned 5.66% over the same period.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| | | | | | | | | | | | | | | | | |

|

Average Annual Total Returns

As of 11-30-03 |

|

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

Thompson Plumb Bond Fund | | | 13.75 | % | | | 8.74 | % | | | 5.85 | % | | | 5.82 | % |

Lehman Brothers Intermediate Gov’t/Credit Index | | | 5.66 | % | | | 8.02 | % | | | 6.55 | % | | | 6.58 | % |

|

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects voluntary fee waivers in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the Average Annual Total Returns table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Lehman Brothers Intermediate Government/Credit Index is a market value weighted performance benchmark which includes virtually every major U.S. Government and investment-grade rated corporate bond with 1-10 years remaining until maturity. You cannot directly invest in an index.

12

Factors Affecting Performance

The Bond Fund performed very well over the past six months despite an increase in interest rates and a surge in the amount of government and corporate debt issued during the period. This performance was the result of a continuing and significant recovery in the market value of a few of the below investment grade cable television corporate bond holdings which had been depressed last year. Also, timely sales of a preferred stock and several corporate bonds helped preserve gains in the portfolio. Bonds purchased during the period have also added to total return through capital appreciation, including GTE Southwest Inc., Textron Financial Corp., Freddie Mac, Fannie Mae and a United States Treasury Bond. As a result of our deliberate focus on shorter term quality bonds, it is unlikely that total return will approach that of 2003.

Current Strategy & Outlook

We believe the U.S. economic recovery, which has slowly gained momentum during the last two quarters, will continue to strengthen in 2004. Also, we expect the global economic picture to steadily improve as well. This economic growth should translate into higher interest rates at some point in the future, causing long-term bonds to potentially experience significant capital depreciation. For this reason we continue to keep the duration of the portfolio at approximately three to four years to avoid large declines in the value of long-term bonds, yet produce considerably more income than money market instruments. Corporate and consumer debt outstanding are both near record levels and remain a major concern as we select new securities for the portfolio with a higher quality focus. Recent purchases have been in U.S. Government and Federal Agency sectors.

Please refer to the schedule of investments on page 20 of this report for holdings information. Fund holdings are subject to change and are not recommendations to buy or sell any securities.

13

STATEMENTS OF ASSETS AND LIABILITIES

November 30, 2003 (In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | GROWTH | | SELECT | | BLUE CHIP | | BALANCED | | BOND |

| | | | | | FUND | | FUND | | FUND | | FUND | | FUND |

| | | | | |

| |

| |

| |

| |

|

ASSETS | | | | | | | | | | | | | | | | | | | | |

| | Investments, at market value (Cost $853,551, $19,568, $14,494, $195,201 and $39,255, respectively) | | | | | | | | | | | | | | | | | | | | |

| | | Common stocks | | $ | 872,088 | | | $ | 17,791 | | | $ | 13,919 | | | $ | 134,433 | | | | — | |

| | | Preferred stocks | | | — | | | | — | | | | — | | | | 11,036 | | | | — | |

| | | Bonds | | | — | | | | — | | | | — | | | | 56,082 | | | $ | 40,512 | |

| | | Short-term investments | | | 1,014 | | | | 4,768 | | | | 2,446 | | | | 14,571 | | | | 783 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | Total Investments | | | 873,102 | | | | 22,559 | | | | 16,365 | | | | 216,122 | | | | 41,295 | |

| | Due from sale of securities | | | — | | | | 145 | | | | 94 | | | | — | | | | — | |

| | Receivable from fund shares sold | | | 2,962 | | | | 29 | | | | 50 | | | | 189 | | | | 1 | |

| | Dividends and interest receivable | | | 1,033 | | | | 35 | | | | 26 | | | | 968 | | | | 596 | |

| | Prepaid expenses | | | 39 | | | | 3 | | | | 3 | | | | 12 | | | | 5 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | Total Assets | | | 877,136 | | | | 22,771 | | | | 16,538 | | | | 217,291 | | | | 41,897 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| |

LIABILITIES | | | | | | | | | | | | | | | | | | | | |

| | Due on purchase of securities | | | — | | | | 209 | | | | 419 | | | | — | | | | — | |

| | Payable for fund shares redeemed | | | 733 | | | | 3 | | | | — | | | | 104 | | | | — | |

| | Accrued expenses payable | | | 100 | | | | 17 | | | | 17 | | | | 37 | | | | 15 | |

| | Due to investment advisor | | | 674 | | | | 12 | | | | 2 | | | | 159 | | | | 27 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | Total Liabilities | | | 1,507 | | | | 241 | | | | 438 | | | | 300 | | | | 42 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| |

NET ASSETS | | $ | 875,629 | | | $ | 22,530 | | | $ | 16,100 | | | $ | 216,991 | | | $ | 41,855 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| |

| Net Assets consist of: | | | | | | | | | | | | | | | | | | | | |

| | Capital stock ($.001 par value) | | $ | 863,366 | | | $ | 22,906 | | | $ | 14,227 | | | $ | 197,063 | | | $ | 40,043 | |

| | Undistributed net investment income | | | 2,310 | | | | 141 | | | | 70 | | | | 3,027 | | | | 523 | |

| | Accumulated net realized loss on investments | | | (9,598 | ) | | | (3,508 | ) | | | (68 | ) | | | (4,020 | ) | | | (751 | ) |

| | Net unrealized appreciation on investments | | | 19,551 | | | | 2,991 | | | | 1,871 | | | | 20,921 | | | | 2,040 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | Net Assets | | $ | 875,629 | | | $ | 22,530 | | | $ | 16,100 | | | $ | 216,991 | | | $ | 41,855 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| |

| | Shares of capital stock outstanding (Unlimited shares authorized) | | | 20,625 | | | | 2,123 | | | | 1,365 | | | | 12,019 | | | | 3,853 | |

| | Offering and redemption price/Net asset value per share | | $ | 42.45 | | | $ | 10.61 | | | $ | 11.79 | | | $ | 18.05 | | | $ | 10.86 | |

| | | | | |

| | | |

| | | |

| | | |

| | | |

| |

See Notes to Financial Statements.

14

SCHEDULES OF INVESTMENTS

November 30, 2003

| | | | | | | | | | | |

| | | | | | | | | Market |

| | | | | Shares | | Value |

| | | | |

| |

|

| | GROWTH FUND | | | | | | | | |

| COMMON STOCKS - 99.6% | | | | | | | | |

| | Consumer Discretionary - 19.4% | | | | | | | | |

| | | Blyth | | | 260,000 | | | $ | 7,813,000 | |

| | | Clear Channel | | | 390,000 | | | | 16,305,900 | |

| | | Gap | | | 450,000 | | | | 9,675,000 | |

| | | InterActiveCorp (a) | | | 30,000 | | | | 979,800 | |

| | | Liberty Media - Class A (a) | | | 700,000 | | | | 7,735,000 | |

| | | McGraw-Hill | | | 160,000 | | | | 10,960,000 | |

| | | Office Depot (a) | | | 1,500,000 | | | | 23,775,000 | |

| | | Reuters Group PLC | | | 420,000 | | | | 10,827,600 | |

| | | Time Warner (a) | | | 2,080,000 | | | | 33,862,400 | |

| | | Toys “R” Us (a) | | | 248,400 | | | | 2,916,216 | |

| | | Viacom - Class B | | | 1,140,000 | | | | 44,824,800 | |

| | | | | | | |

| |

| | | | | | | | 169,674,716 | |

| | | | | | | |

| |

| | Consumer Staples - 7.1% | | | | | | | | |

| | | Coca-Cola | | | 800,000 | | | | 37,200,000 | |

| | | Kraft Foods - Class A | | | 700,000 | | | | 22,169,000 | |

| | | PepsiCo | | | 60,000 | | | | 2,887,200 | |

| | | | | | | |

| |

| | | | | | | | 62,256,200 | |

| | | | | | | |

| |

| | Energy - 2.6% | | | | | | | | |

| | | ChevronTexaco | | | 300,000 | | | | 22,530,000 | |

| | | | | | | |

| |

| | Financials - 21.8% | | | | | | | | |

| | | American International Group | | | 350,000 | | | | 20,282,500 | |

| | | Berkshire Hathaway - Class B (a) | | | 5,437 | | | | 15,229,037 | |

| | | Cincinnati Financial | | | 780,000 | | | | 31,746,000 | |

| | | CIT Group | | | 80,000 | | | | 2,789,600 | |

| | | Fannie Mae | | | 740,000 | | | | 51,800,000 | |

| | | Freddie Mac | | | 980,000 | | | | 53,331,600 | |

| | | Hartford Financial | | | 139,300 | | | | 7,661,500 | |

| | | Instinet Group (a) | | | 360,000 | | | | 1,929,600 | |

| | | Prudential Financial | | | 150,000 | | | | 5,866,500 | |

| | | | | | | |

| |

| | | | | | | | 190,636,337 | |

| | | | | | | |

| |

| | Health Care - 25.9% | | | | | | | | |

| | | Apogent Technologies (a) | | | 460,000 | | | | 10,639,800 | |

| | | Bristol-Myers Squibb | | | 1,050,000 | | | | 27,667,500 | |

| | | Cardinal Health | | | 600,000 | | | | 36,684,000 | |

| | | ChromaVision Medical (a) | | | 1,500,000 | | | | 1,635,000 | |

| | | IMS Health | | | 120,000 | | | | 2,763,600 | |

| | | Johnson & Johnson | | | 760,000 | | | | 37,460,400 | |

| | | McKesson | | | 700,000 | | | | 20,440,000 | |

| | | Merck & Co. | | | 400,000 | | | | 16,240,000 | |

| | | Pfizer | | | 1,650,000 | | | | 55,357,500 | |

| | | Schein, Henry (a) | | | 70,000 | | | | 4,720,800 | |

| | | Schering-Plough | | | 280,000 | | | | 4,494,000 | |

| | | Sybron Dental Specialties (a) | | | 320,000 | | | | 9,219,200 | |

| | | | | | | |

| |

| | | | | | | | 227,321,800 | |

| | | | | | | |

| |

| | Industrials - 8.6% | | | | | | | | |

| | | Cendant (a) | | | 800,000 | | | | 17,728,000 | |

| | | GATX | | | 85,600 | | | | 2,080,080 | |

| | | General Electric | | | 780,000 | | | | 22,362,600 | |

| | | Tyco | | | 1,450,000 | | | | 33,277,500 | |

| | | | | | | |

| |

| | | | | | | | 75,448,180 | |

| | | | | | | |

| |

| | | | | | | | | | | |

| | | | | Shares or | | | | |

| | | | | Principal | | Market |

| | | | | Amount | | Value |

| | | | |

| |

|

| | Information Technology - 14.2% | | | | | | | | |

| | | Concord EFS (a) | | | 3,000,000 | | | $ | 34,470,000 | |

| | | First Data | | | 560,000 | | | | 21,196,000 | |

| | | Hewlett-Packard | | | 680,000 | | | | 14,749,200 | |

| | | Microsoft | | | 2,000,000 | | | | 51,420,000 | |

| | | Sabre Holdings | | | 114,400 | | | | 2,385,240 | |

| | | | | | | |

| |

| | | | | | | | 124,220,440 | |

| | | | | | | |

| |

| | | TOTAL COMMON STOCKS (COST $852,536,419) | | | | | | | 872,087,673 | |

| | | | | | | |

| |

| SHORT-TERM INVESTMENTS - 0.1% | | | | | | | | |

| | Variable Rate Demand Notes - 0.1% | | | | | | | | |

| | | American Family Financial 0.73% | | $ | 624,303 | | | | 624,303 | |

| | | Wisc. Central Credit Union 0.79% | | | 389,999 | | | | 389,999 | |

| | | | | | | |

| |

| | | Total Variable Rate Demand Notes | | | | | | | 1,014,302 | |

| | | | | | | |

| |

| | | TOTAL SHORT-TERM INVESTMENTS (COST $1,014,302) | | | | | | | 1,014,302 | |

| | | | | | | |

| |

| | | TOTAL INVESTMENTS - 99.7% (COST $853,550,721) | | | | | | | 873,101,975 | |

| | | | | | | |

| |

| | | NET OTHER ASSETS AND LIABILITIES - 0.3% | | | | | | | 2,527,320 | |

| | | | | | | |

| |

| | | NET ASSETS - 100.0% | | | | | | $ | 875,629,295 | |

| | | | | | | |

| |

(a) Non-income producing

See Notes to Financial Statements.

15

SCHEDULES OF INVESTMENTS (Continued)

November 30, 2003

| | | | | | | | | | | | |

| | | | | | | | | | Market |

| | | | | | Shares | | Value |

| | | | | |

| |

|

SELECT FUND | | | | | | | | |

| COMMON STOCKS - 79.0% | | | | | | | | |

| | Consumer Discretionary - 22.0% | | | | | | | | |

| | | Catalina Marketing (a) | | | 50,000 | | | $ | 926,500 | |

| | | Interpublic Group (a) | | | 60,000 | | | | 855,000 | |

| | | Liberty Media - Class A (a) | | | 76,000 | | | | 839,800 | |

| | | McDonald’s | | | 30,000 | | | | 768,900 | |

| | | Reuters Group PLC | | | 32,000 | | | | 824,960 | |

| | | Time Warner (a) | | | 45,000 | | | | 732,600 | |

| | | | | | | |

| |

| | | | | | | | 4,947,760 | |

| | | | | | | |

| |

| | Consumer Staples - 3.7% | | | | | | | | |

| | | Altria Group | | | 10,000 | | | | 520,000 | |

| | | Kroger (a) | | | 17,000 | | | | 320,620 | |

| | | | | | | |

| |

| | | | | | | | 840,620 | |

| | | | | | | |

| |

| | Financials - 9.7% | | | | | | | | |

| | | Fannie Mae | | | 7,500 | | | | 525,000 | |

| | | Freddie Mac | | | 13,000 | | | | 707,460 | |

| | | Trizec Properties | | | 68,000 | | | | 947,240 | |

| | | | | | | |

| |

| | | | | | | | 2,179,700 | |

| | | | | | | |

| |

| | Health Care - 16.2% | | | | | | | | |

| | | Abbott Laboratories | | | 5,000 | | | | 221,000 | |

| | | Bristol-Myers Squibb | | | 24,000 | | | | 632,400 | |

| | | IMS Health | | | 9,000 | | | | 207,270 | |

| | | Merck & Co. | | | 27,000 | | | | 1,096,200 | |

| | | Pfizer | | | 20,000 | | | | 671,000 | |

| | | Schering-Plough | | | 39,000 | | | | 625,950 | |

| | | Wyeth | | | 5,000 | | | | 197,000 | |

| | | | | | | |

| |

| | | | | | | | 3,650,820 | |

| | | | | | | |

| |

| | Industrials - 6.0% | | | | | | | | |

| | | Honeywell | | | 15,000 | | | | 445,350 | |

| | | Tyco | | | 40,000 | | | | 918,000 | |

| | | | | | | |

| |

| | | | | | | | 1,363,350 | |

| | | | | | | |

| |

| | Information Technology - 17.0% | | | | | | | | |

| | | BISYS Group (a) | | | 62,000 | | | | 925,040 | |

| | | Concord EFS (a) | | | 87,000 | | | | 999,630 | |

| | | Electronic Data Systems | | | 88,000 | | | | 1,902,560 | |

| | | | | | | |

| |

| | | | | | | | 3,827,230 | |

| | | | | | | |

| |

| | Telecommunication Services - 4.4% | | | | | | | | |

| | | Qwest Communications (a) | | | 160,000 | | | | 585,600 | |

| | | SBC Communications | | | 17,000 | | | | 395,760 | |

| | | | | | | |

| |

| | | | | | | | 981,360 | |

| | | | | | | |

| |

| | | TOTAL COMMONS TOCKS

(COST $14,799,932) | | | | | | | 17,790,840 | |

| | | | | | | |

| |

| | | | | | | | | | | |

| | | | | Principal | | Market |

| | | | | Amount | | Value |

| | | | |

| |

|

| SHORT-TERM INVESTMENTS - 21.1% | | | | | | | | |

| | United States Government Bills - 15.5% | | | | | | | | |

| | | United States Treasury Bills

1.010% Due 12/04/03 | | $ | 1,000,000 | | | $ | 999,923 | |

| | | United States Treasury Bills

0.860% Due 01/02/04 | | | 1,000,000 | | | | 999,195 | |

| | | United States Treasury Bills

1.030% Due 02/05/04 | | | 1,500,000 | | | | 1,497,518 | |

| | | | | | | |

| |

| | | Total United States

Government Bills | | | | | | | 3,496,636 | |

| | | | | | | |

| |

| | Variable Rate Demand Notes - 5.6% | | | | | | | | |

| | | American Family

Financial 0.73% | | | 244,814 | | | | 244,814 | |

| | | Wisc. Central Credit

Union 0.79% | | | 1,026,969 | | | | 1,026,969 | |

| | | | | | | |

| |

| | | Total Variable Rate Demand Notes | | | | | | | 1,271,783 | |

| | | | | | | |

| |

| | | TOTAL SHORT-TERM INVESTMENTS

(COST $4,768,419) | | | | | | | 4,768,419 | |

| | | | | | | |

| |

| | | TOTAL INVESTMENTS - 100.1%

(COST $19,568,351) | | | | | | | 22,559,259 | |

| | | | | | | |

| |

| | | NET OTHER ASSETS AND

LIABILITIES - ( 0.1%) | | | | | | | (28,917 | ) |

| | | | | | | |

| |

| | | NET ASSETS - 100.0% | | | | | | $ | 22,530,342 | |

| | | | | | | |

| |

(a) Non-income producing

See Notes to Financial Statements.

16

SCHEDULES OF INVESTMENTS (Continued)

November 30, 2003

| | | | | | | | | | | | |

| | | | | | | | | | Market |

| | | | | | Shares | | Value |

| | | | | |

| |

|

BLUE CHIP FUND | | | | | | | | |

| COMMON STOCKS - 86.4% | | | | | | | | |

| | Consumer Discretionary - 15.9% | | | | | | | | |

| | | Gap | | | 9,000 | | | $ | 193,500 | |

| | | Interpublic Group (a) | | | 35,000 | | | | 498,750 | |

| | | Liberty Media - Class A (a) | | | 45,000 | | | | 497,250 | |

| | | McDonald’s | | | 18,000 | | | | 461,340 | |

| | | Reuters Group PLC | | | 16,000 | | | | 412,480 | |

| | | Time Warner (a) | | | 25,000 | | | | 407,000 | |

| | | Viacom - - Class B | | | 2,200 | | | | 86,504 | |

| | | | | | | |

| |

| | | | | | | | 2,556,824 | |

| | | | | | | |

| |

| | Consumer Staples - 7.2% | | | | | | | | |

| | | Altria Group | | | 6,000 | | | | 312,000 | |

| | | Coca-Cola | | | 7,000 | | | | 325,500 | |

| | | CVS | | | 6,000 | | | | 224,760 | |

| | | Kroger (a) | | | 10,000 | | | | 188,600 | |

| | | Lauder, Estee - Class A | | | 3,000 | | | | 114,000 | |

| | | | | | | |

| |

| | | | | | | | 1,164,860 | |

| | | | | | | |

| |

| | Energy - 3.9% | | | | | | | | |

| | | ChevronTexaco | | | 6,000 | | | | 450,600 | |

| | | Exxon Mobil | | | 5,000 | | | | 180,850 | |

| | | | | | | |

| |

| | | | | | | | 631,450 | |

| | | | | | | |

| |

| | Financials - 15.1% | | | | | | | | |

| | | Alliance Capital Management | | | 3,000 | | | | 96,600 | |

| | | Cincinnati Financial | | | 5,000 | | | | 203,500 | |

| | | CIT Group | | | 11,000 | | | | 383,570 | |

| | | Citigroup | | | 6,500 | | | | 305,760 | |

| | | Fannie Mae | | | 4,500 | | | | 315,000 | |

| | | FleetBoston Financial | | | 10,000 | | | | 406,000 | |

| | | Freddie Mac | | | 7,000 | | | | 380,940 | |

| | | J.P. Morgan Chase | | | 6,000 | | | | 212,160 | |

| | | Prudential Financial | | | 3,500 | | | | 136,885 | |

| | | | | | | |

| |

| | | | | | | | 2,440,415 | |

| | | | | | | |

| |

| | Health Care - 20.0% | | | | | | | | |

| | | Abbott Laboratories | | | 7,000 | | | | 309,400 | |

| | | Baxter | | | 5,000 | | | | 139,100 | |

| | | Bristol-Myers Squibb | | | 15,000 | | | | 395,250 | |

| | | Cardinal Health | | | 7,000 | | | | 427,980 | |

| | | IMS Health | | | 12,000 | | | | 276,360 | |

| | | Merck & Co. | | | 12,000 | | | | 487,200 | |

| | | Pfizer | | | 15,000 | | | | 503,250 | |

| | | Schering-Plough | | | 30,000 | | | | 481,500 | |

| | | Wyeth | | | 5,000 | | | | 197,000 | |

| | | | | | | |

| |

| | | | | | | | 3,217,040 | |

| | | | | | | |

| |

| | Industrials - 4.6% | | | | | | | | |

| | | Cendant (a) | | | 13,000 | | | | 288,080 | |

| | | General Electric | | | 10,500 | | | | 301,035 | |

| | | Honeywell | | | 5,000 | | | | 148,450 | |

| | | | | | | |

| |

| | | | | | | | 737,565 | |

| | | | | | | |

| |

| | | | | | | | | | | |

| | | | | Shares or | | | | |

| | | | | Principal | | Market |

| | | | | Amount | | Value |

| | | | |

| |

|

| | Information Technology - 16.3% | | | | | | | | |

| | | BISYS Group (a) | | | 30,000 | | | $ | 447,600 | |

| | | Computer Sciences (a) | | | 4,000 | | | | 165,600 | |

| | | Concord EFS (a) | | | 60,000 | | | | 689,400 | |

| | | Electronic Data Systems | | | 33,000 | | | | 713,460 | |

| | | Microsoft | | | 18,000 | | | | 462,780 | |

| | | Sabre Holdings | | | 7,000 | | | | 145,950 | |

| | | | | | | |

| |

| | | | | | | | 2,624,790 | |

| | | | | | | |

| |

| | Telecommunication Services - 3.4% | | | | | | | | |

| | | SBC Communications | | | 15,000 | | | | 349,200 | |

| | | Verizon Communications | | | 6,000 | | | | 196,620 | |

| | | | | | | |

| |

| | | | | | | | 545,820 | |

| | | | | | | |

| |

| | | TOTAL COMMON STOCKS (COST $12,047,102) | | | | | | | 13,918,764 | |

| | | | | | | |

| |

| SHORT-TERM INVESTMENTS - 15.2% | | | | | | | | |

| | United States Government Bills - 6.2% | | | | | | | | |

| | | United States Treasury Bills

1.010% Due 12/04/03 | | $ | 500,000 | | | | 499,962 | |

| | | United States Treasury Bills

0.860% Due 01/02/04 | | | 500,000 | | | | 499,619 | |

| | | | | | | |

| |

| | | Total United States

Government Bills | | | | | | | 999,581 | |

| | | | | | | |

| |

| | Variable Rate Demand Notes - 9.0% | | | | | | | | |

| | | American Family

Financial 0.73% | | | 673,926 | | | | 673,926 | |

| | | Wisc. Central Credit Union 0.79% | | | 773,066 | | | | 773,066 | |

| | | | | | | |

| |

| | | Total Variable Rate Demand Notes | | | | | | | 1,446,992 | |

| | | | | | | |

| |

| | | TOTAL SHORT-TERM INVESTMENTS

(COST $2,446,573) | | | | | | | 2,446,573 | |

| | | | | | | |

| |

| | | TOTAL INVESTMENTS - 101.6%

(COST $14,493,675) | | | | | | | 16,365,337 | |

| | | | | | | |

| |

| | | NET OTHER ASSETS AND

LIABILITIES - (1.6%) | | | | | | | (264,880 | ) |

| | | | | | | |

| |

| | | NET ASSETS - 100.0% | | | | | | $ | 16,100,457 | |

| | | | | | | |

| |

(a) Non-income producing

See Notes to Financial Statements.

17

SCHEDULES OF INVESTMENTS (Continued)

November 30, 2003

| | | | | | | | | | | | |

| | | | | | | | | | Market |

| | | | | | Shares | | Value |

| | | | | |

| |

|

BALANCED FUND | | | | | | | | |

| COMMON STOCKS - 62.0% | | | | | | | | |

| | Consumer Discretionary - 8.2% | | | | | | | | |

| | | Barnes & Noble (a) | | | 63,000 | | | $ | 2,090,340 | |

| | | Blyth | | | 35,000 | | | | 1,051,750 | |

| | | Catalina Marketing (a) | | | 145,000 | | | | 2,686,850 | |

| | | Interpublic Group (a) | | | 175,000 | | | | 2,493,750 | |

| | | Liberty Media - Class A (a) | | | 325,000 | | | | 3,591,250 | |

| | | Reuters Group PLC | | | 60,000 | | | | 1,546,800 | |

| | | Sherwin-Williams | | | 45,000 | | | | 1,459,350 | |

| | | Time Warner (a) | | | 170,000 | | | | 2,767,600 | |

| | | | | | | |

| |

| | | | | | | | 17,687,690 | |

| | | | | | | |

| |

| | Consumer Staples - 5.9% | | | | | | | | |

| | | Altria Group | | | 40,000 | | | | 2,080,000 | |

| | | Coca-Cola | | | 69,000 | | | | 3,208,500 | |

| | | CVS | | | 115,000 | | | | 4,307,900 | |

| | | Kimberly-Clark | | | 59,000 | | | | 3,198,980 | |

| | | | | | | |

| |

| | | | | | | | 12,795,380 | |

| | | | | | | |

| |

| | Energy - 2.5% | | | | | | | | |

| | | ChevronTexaco | | | 40,000 | | | | 3,004,000 | |

| | | Exxon Mobil | | | 65,000 | | | | 2,351,050 | |

| | | | | | | |

| |

| | | | | | | | 5,355,050 | |

| | | | | | | |

| |

| | Financials - 13.4% | | | | | | | | |

| | | Bank of America | | | 35,000 | | | | 2,640,050 | |

| | | Berkshire Hathaway - Class A (a) | | | 35 | | | | 2,931,250 | |

| | | Cincinnati Financial | | | 83,000 | | | | 3,378,100 | |

| | | CIT Group | | | 75,000 | | | | 2,615,250 | |

| | | Citigroup | | | 55,000 | | | | 2,587,200 | |

| | | Fannie Mae | | | 53,000 | | | | 3,710,000 | |

| | | FleetBoston Financial | | | 95,000 | | | | 3,857,000 | |

| | | Freddie Mac | | | 59,000 | | | | 3,210,780 | |

| | | J.P. Morgan Chase | | | 117,000 | | | | 4,137,120 | |

| | | | | | | |

| |

| | | | | | | | 29,066,750 | |

| | | | | | | |

| |

| | Health Care - 13.6% | | | | | | | | |

| | | AmerisourceBergen | | | 48,000 | | | | 3,037,920 | |

| | | Bristol-Myers Squibb | | | 140,000 | | | | 3,689,000 | |

| | | Cardinal Health | | | 50,000 | | | | 3,057,000 | |

| | | IMS Health | | | 137,000 | | | | 3,155,110 | |

| | | Johnson & Johnson | | | 25,000 | | | | 1,232,250 | |

| | | McKesson | | | 130,000 | | | | 3,796,000 | |

| | | Merck & Co. | | | 45,000 | | | | 1,827,000 | |

| | | Pfizer | | | 100,000 | | | | 3,355,000 | |

| | | Schering-Plough | | | 125,000 | | | | 2,006,250 | |

| | | Sybron Dental Specialties (a) | | | 63,000 | | | | 1,815,030 | |

| | | Wyeth | | | 63,000 | | | | 2,482,200 | |

| | | | | | | |

| |

| | | | | | | | 29,452,760 | |

| | | | | | | |

| |

| | Industrials - 5.8% | | | | | | | | |

| | | Cendant (a) | | | 130,000 | | | | 2,880,800 | |

| | | General Electric | | | 152,000 | | | | 4,357,840 | |

| | | Honeywell | | | 60,000 | | | | 1,781,400 | |

| | | Tyco | | | 158,000 | | | | 3,626,100 | |

| | | | | | | |

| |

| | | | | | | | 12,646,140 | |

| | | | | | | |

| |

| | | | | | | | | | | |

| | | | | Shares or | | | | |

| | | | | Principal | | Market |

| | | | | Amount | | Value |

| | | | |

| |

|

| | Information Technology - 10.6% | | | | | | | | |

| | | Acxiom (a) | | | 60,000 | | | $ | 996,600 | |

| | | BISYS Group (a) | | | 200,000 | | | | 2,984,000 | |

| | | Concord EFS (a) | | | 360,000 | | | | 4,136,400 | |

| | | Electronic Data Systems | | | 170,000 | | | | 3,675,400 | |

| | | Fiserv (a) | | | 55,000 | | | | 2,062,500 | |

| | | Lattice Semiconductor (a) | | | 100,000 | | | | 947,000 | |

| | | Microsoft | | | 188,000 | | | | 4,833,480 | |

| | | Unisys (a) | | | 211,000 | | | | 3,443,520 | |

| | | | | | | |

| |

| | | | | | | | 23,078,900 | |

| | | | | | | |

| |

| | Materials - 0.1% | | | | | | | | |

| | | FiberMark (a) | | | 90,000 | | | | 160,200 | |

| | | | | | | |

| |

| | Telecommunication Services - 1.9% | | | | | | | | |

| | | SBC Communications | | | 180,000 | | | | 4,190,400 | |

| | | | | | | |

| |

| | | TOTAL COMMON STOCKS (COST $115,875,979) | | | | | | | 134,433,270 | |

| | | | | | | |

| |

| PREFERRED STOCKS - 5.1% | | | | | | | | |

| | Consumer Discretionary - 1.6% | | | | | | | | |

| | | CorTS Trust II for Ford

8.000% Due 07/16/31 | | | 10,000 | | | | 256,600 | |

| | | General Motors

7.375% Due 10/01/51 | | | 124,000 | | | | 3,180,600 | |

| | | | | | | |

| |

| | | | | | | | 3,437,200 | |

| | | | | | | |

| |

| | Financials - 2.5% | | | | | | | | |

| | | BNY Capital V Series F

5.950% Due 05/01/33 | | | 10,000 | | | | 249,400 | |

| | | Citigroup Capital VII TruPS

7.125% Due 07/31/31 | | | 128,000 | | | | 3,415,040 | |

| | | Citigroup Capital IX TruPS

6.000% Due 02/14/33 | | | 10,000 | | | | 250,300 | |

| | | Lehman Brothers Capital Trust IV

6.375% Due 10/31/52 | | | 5,000 | | | | 125,000 | |

| | | Morgan Stanley Capital Trust V

5.750% Due 07/15/33 | | | 60,000 | | | | 1,450,800 | |

| | | | | | | |

| |

| | | | | | | | 5,490,540 | |

| | | | | | | |

| |

| | Telecommunication Services - 1.0% | | | | | | | | |

| | | Verizon South Series F

7.000% Due 04/30/41 | | | 80,000 | | | | 2,108,000 | |

| | | | | | | |

| |

| | | TOTAL PREFERRED STOCKS

(COST $10,884,191) | | | | | | | 11,035,740 | |

| | | | | | | |

| |

| BONDS - 25.8% | | | | | | | | |

| | Corporate Bonds - 21.2% | | | | | | | | |

| | | Alliant Energy

7.375% Due 11/09/09 | | $ | 1,500,000 | | | | 1,709,730 | |

| | | American Home Products

7.900% Due 02/15/05 | | | 3,000,000 | | | | 3,203,778 | |

| | | BankAmerica

7.125% Due 03/01/09 | | | 2,000,000 | | | | 2,282,580 | |

See Notes to Financial Statements.

18

SCHEDULES OF INVESTMENTS (Continued)

November 30, 2003

| | | | | | | | | | | |

| | | | | Principal | | Market |

| | | | | Amount | | Value |

| | | | |

| |

|

| BONDS - 25.8% (Continued) | | | | | | | | |

| | | Boeing

5.650% Due 05/15/06 | | $ | 1,500,000 | | | $ | 1,594,633 | |

| | | CIT Group

7.125% Due 10/15/04 | | | 3,010,000 | | | | 3,150,128 | |

| | | Citicorp

6.375% Due 11/15/08 | | | 1,000,000 | | | | 1,100,242 | |

| | | Disney, Walt

7.300% Due 02/08/05 | | | 2,000,000 | | | | 2,122,314 | |

| | | du Pont E. I. de Nemours

6.750% Due 10/15/04 | | | 1,500,000 | | | | 1,567,534 | |

| | | Electronic Data Systems

6.850% Due 10/15/04 | | | 3,000,000 | | | | 3,105,000 | |

| | | First Union

6.400% Due 04/01/08 | | | 500,000 | | | | 549,078 | |

| | | Ford Motor

6.875% Due 02/01/06 | | | 1,000,000 | | | | 1,052,503 | |

| | | Ford Motor

8.875% Due 04/01/06 | | | 1,015,000 | | | | 1,112,293 | |

| | | Ford Motor

7.250% Due 10/01/08 | | | 500,000 | | | | 530,955 | |

| | | GATX Financial

6.860% Due 10/13/05 | | | 1,000,000 | | | | 1,037,459 | |

| | | General American Transportation

8.625% Due 12/01/04 | | | 1,500,000 | | | | 1,567,567 | |

| | | General Electric

8.750% Due 05/21/07 | | | 1,540,000 | | | | 1,816,008 | |

| | | Goldman Sachs

7.350% Due 10/01/09 | | | 1,000,000 | | | | 1,155,654 | |

| | | Johnson Controls

6.300% Due 02/01/08 | | | 2,000,000 | | | | 2,190,642 | |

| | | Loews

6.750% Due 12/15/06 | | | 2,000,000 | | | | 2,140,754 | |

| | | NationsBank

6.375% Due 05/15/05 | | | 1,074,000 | | | | 1,139,654 | |

| | | Qwest

13.000% Due 12/15/07 | | | 2,000,000 | | | | 2,320,000 | |

| | | SBC Communications

5.750% Due 05/02/06 | | | 750,000 | | | | 801,946 | |

| | | Tenet Healthcare

5.375% Due 11/15/06 | | | 2,500,000 | | | | 2,406,250 | |

| | | Textron Financial

2.420% Due 04/24/06 | | | 2,000,000 | | | | 2,042,904 | |

| | | Wells Fargo

7.550% Due 06/21/10 | | | 1,000,000 | | | | 1,177,537 | |

| | | Wisconsin Energy

5.875% Due 04/01/06 | | | 1,950,000 | | | | 2,079,583 | |

| | | Wisconsin Power & Light

7.000% Due 06/15/07 | | | 1,000,000 | | | | 1,109,581 | |

| | | | | | | |

| |

| | | Total Corporate Bonds | | | | | | | 46,066,307 | |

| | | | | | | |

| |

| | United States Government and Agency Issues - 4.6% | | | | | | | | |

| | | United States Treasury Notes

3.000% Due 11/30/03 | | | 5,000,000 | | | | 5,000,000 | |

| | | United States Treasury Notes

3.000% Due 01/31/04 | | | 5,000,000 | | | | 5,016,405 | |

| | | | | | | |

| |

| | | Total United States Government and Agency Issues | | | | | | | 10,016,405 | |

| | | | | | | |

| |

| | | TOTAL BONDS (COST $53,870,245) | | | | | | | 56,082,712 | |

| | | | | | | |

| |

| SHORT-TERM INVESTMENTS - 6.7% | | | | | | | | |

| | Commercial Paper - 1.0% | | | | | | | | |

| | | Prudential Funding

0.940% Due 12/01/03 | | | 2,116,000 | | | | 2,116,000 | |

| | | | | | | |

| |

| | | Total Commercial Paper | | | | | | | 2,116,000 | |

| | | | | | | |

| |

| | United States Government Bills - 2.3% | | | | | | | | |

| | | United States Treasury Bills

0.840% Due 12/26/03 | | | 5,000,000 | | | | 4,996,933 | |

| | | | | | | |

| |

| | | Total United States

Government Bills | | | | | | | 4,996,933 | |

| | | | | | | |

| |

| | Variable Rate Demand Notes - 3.4% | | | | | | | | |

| | | American Family

Financial 0.73% | | | 647,508 | | | | 647,508 | |

| | | Wisc. Central Credit

Union 0.79% | | | 6,810,319 | | | | 6,810,319 | |

| | | | | | | |

| |

| | | Total Variable Rate Demand Notes | | | | | | | 7,457,827 | |

| | | | | | | |

| |

| | | TOTAL SHORT-TERM INVESTMENTS

(COST $14,570,760) | | | | | | | 14,570,760 | |

| | | | | | | |

| |

| | | TOTAL INVESTMENTS - 99.6%

(COST $195,201,175) | | | | | | | 216,122,482 | |

| | | | | | | |

| |

| | | NET OTHER ASSETS AND LIABILITIES - 0.4% | | | | | | | 868,568 | |

| | | | | | | |

| |

| | | NET ASSETS - 100.0% | | | | | | $ | 216,991,050 | |

| | | | | | | |

| |

(a) Non-income producing

See Notes to Financial Statements.

19

SCHEDULES OF INVESTMENTS (Continued)

November 30, 2003

| | | | | | | | | | | |

| | | | | Principal | | Market |

| | | | | Amount | | Value |

| | | | |

| |

|

| BOND FUND | | | | | | | | |

| BONDS - 96.8% | | | | | | | | |

| | Corporate Bonds - 77.5% | | | | | | | | |

| | | Adelphia Communications (a)

9.875% Due 03/01/05 | | $ | 1,398,000 | | | $ | 1,160,340 | |

| | | AOL Time Warner

5.625% Due 05/01/05 | | | 1,500,000 | | | | 1,568,655 | |

| | | Associates Corp.

7.240% Due 08/15/06 | | | 1,000,000 | | | | 1,112,949 | |

| | | Beneficial Corp.

6.850% Due 10/03/07 | | | 1,000,000 | | | | 1,074,773 | |

| | | Boeing

7.100% Due 09/27/05 | | | 1,000,000 | | | | 1,080,613 | |

| | | Charter Communications Cvt.

4.750% Due 06/01/06 | | | 2,000,000 | | | | 1,690,000 | |

| | | CIT Group

6.625% Due 06/15/05 | | | 780,000 | | | | 832,769 | |

| | | Computer Associates

6.375% Due 04/15/05 | | | 500,000 | | | | 522,500 | |

| | | Deere & Co.

7.850% Due 05/15/10 | | | 500,000 | | | | 600,147 | |

| | | Dover

6.450% Due 11/15/05 | | | 1,000,000 | | | | 1,077,920 | |

| | | Electronic Data Systems

6.850% Due 10/15/04 | | | 500,000 | | | | 517,500 | |

| | | Ford Motor

7.500% Due 06/15/04 | | | 1,000,000 | | | | 1,025,664 | |

| | | General American Transportation

8.625% Due 12/01/04 | | | 1,000,000 | | | | 1,045,045 | |

| | | GTE Southwest

6.000% Due 01/15/06 | | | 300,000 | | | | 320,512 | |

| | | Hartford Life

7.100% Due 06/15/07 | | | 500,000 | | | | 557,408 | |

| | | International Lease Finance

5.625% Due 06/01/07 | | | 850,000 | | | | 908,793 | |

| | | Interpublic Group Cvt.

1.870% Due 06/01/06 | | | 1,000,000 | | | | 917,500 | |

| | | Marshall & Ilsley

5.750% Due 09/01/06 | | | 1,000,000 | | | | 1,081,208 | |

| | | Maytag

6.875% Due 03/31/06 | | | 1,000,000 | | | | 1,076,012 | |

| | | Morgan, J. P.

6.700% Due 11/01/07 | | | 500,000 | | | | 552,668 | |

| | | New York Times

6.950% Due 11/18/09 | | | 1,000,000 | | | | 1,134,942 | |

| | | Northern Trust

7.300% Due 09/15/06 | | | 1,000,000 | | | | 1,108,176 | |

| | | Penney, J. C.

7.600% Due 04/01/07 | | | 1,000,000 | | | | 1,107,500 | |

| | | Qwest

13.000% Due 12/15/07 | | | 1,031,000 | | | | 1,195,960 | |

| | | Sears, Roebuck

6.700% Due 11/15/06 | | | 1,000,000 | | | | 1,099,563 | |

| | | Tenet Healthcare

5.375% Due 11/15/06 | | | 350,000 | | | | 336,875 | |

| | | Textron Financial

2.750% Due 06/01/06 | | | 300,000 | | | | 297,132 | |

| | | Thermo Electron Cvt.

3.250% Due 11/01/07 | | | 1,500,000 | | | | 1,462,500 | |

| | | Toys “R” Us

7.625% Due 08/01/11 | | | 500,000 | | | | 529,633 | |

| | | Tribune

6.875% Due 11/01/06 | | | 1,000,000 | | | | 1,107,245 | |

| | | Tyco

5.875% Due 11/01/04 | | | 500,000 | | | | 515,000 | |

| | | Tyco

6.375% Due 06/15/05 | | | 1,040,000 | | | | 1,094,600 | |

| | | US West

7.200% Due 11/01/04 | | | 110,000 | | | | 113,025 | |

| | | US West

6.625% Due 09/15/05 | | | 265,000 | | | | 272,950 | |

| | | Verizon

6.750% Due 12/01/05 | | | 125,000 | | | | 135,329 | |

| | | Wells Fargo

7.125% Due 08/15/06 | | | 1,000,000 | | | | 1,111,798 | |

| | | Wisconsin Power & Light

7.000% Due 06/15/07 | | | 1,000,000 | | | | 1,109,581 | |

| | | | | | | |

| |

| | | Total Corporate Bonds | | | | | | | 32,454,785 | |

| | | | | | | |

| |

| | United States Government and Agency Issues - 19.3% | | | | | | | | |

| | | Fannie Mae

4.000% Due 10/30/08 | | | 1,250,000 | | | | 1,257,305 | |

| | | Fannie Mae

4.625% Due 05/01/13 | | | 1,500,000 | | | | 1,449,138 | |

| | | Federal Home Loan Banks

2.000% Due 12/30/08 | | | 1,000,000 | | | | 964,999 | |

| | | Federal Home Loan Banks

3.000% Due 05/22/09 | | | 1,100,000 | | | | 1,096,436 | |

| | | Federal Home Loan Banks

2.000% Due 06/30/09 | | | 750,000 | | | | 719,555 | |

| | | Freddie Mac

3.290% Due 06/16/09 | | | 600,000 | | | | 576,100 | |

| | | Freddie Mac

5.125% Due 08/20/12 | | | 1,000,000 | | | | 996,676 | |

| | | Unites States Treasury

Inflation-Indexed Securities

1.875% Due 07/15/13 | | | 1,008,250 | | | | 997,262 | |

| | | | | | | |

| |

| | | Total United States Government

and Agency Issues | | | | | | | 8,057,471 | |

| | | | | | | |

| |

| | | TOTAL BONDS

(COST $38,472,700) | | | | | | | 40,512,256 | |

| | | | | | | |

| |

See Notes to Financial Statements.

20

SCHEDULES OF INVESTMENTS (Continued)

November 30, 2003

| | | | | | | | | | | |

| | | | | Principal | | Market |

| | | | | Amount | | Value |

| | | | |

| |

|

| SHORT-TERM INVESTMENTS - 1.9% | | | | | | | | |

| | Variable Rate Demand Notes - 1.9% | | | | | | | | |

| | | American Family

Financial 0.73% | | $ | 230,126 | | | $ | 230,126 | |

| | | Wisc. Central Credit

Union 0.79% | | | 552,653 | | | | 552,653 | |

| | | | | | | |

| |

| | | Total Variable Rate Demand Notes | | | | | | | 782,779 | |

| | | | | | | |

| |

| | | TOTAL SHORT-TERM INVESTMENTS

(COST $782,779) | | | | | | | 782,779 | |

| | | | | | | |

| |

| | | TOTAL INVESTMENTS - 98.7%

(COST $39,255,479) | | | | | | | 41,295,035 | |

| | | | | | | |

| |

| | | NET OTHER ASSETS AND

LIABILITIES - 1.3% | | | | | | | 560,103 | |

| | | | | | | |

| |

| | | NET ASSETS - 100.0% | | | | | | $ | 41,855,138 | |

| | | | | | | |

| |

(a) Security in default.

See Notes to Financial Statements.

21

STATEMENTS OF OPERATIONS

Year Ended November 30, 2003 (In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | GROWTH | | SELECT | | BLUE CHIP | | BALANCED | | BOND |

| | | | | FUND | | FUND | | FUND | | FUND | | FUND |

| | | | |

| |

| |

| |

| |

|

Investment income | | | | | | | | | | | | | | | | | | | | |

| | Dividends | | $ | 9,385 | | | $ | 349 | | | $ | 184 | | | $ | 2,254 | | | $ | 11 | |

| | Interest | | | 16 | | | | 18 | | | | 9 | | | | 2,485 | | | | 2,378 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | 9,401 | | | | 367 | | | | 193 | | | | 4,739 | | | | 2,389 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| |

Expenses | | | | | | | | | | | | | | | | | | | | |

| | Investment advisory fees | | | 5,543 | | | | 168 | | | | 99 | | | | 1,301 | | | | 247 | |

| | Shareholder servicing costs | | | 502 | | | | 23 | | | | 25 | | | | 119 | | | | 20 | |

| | Accounting services fees | | | 245 | | | | 30 | | | | 30 | | | | 130 | | | | 53 | |

| | Custody fees | | | 127 | | | | 6 | | | | 4 | | | | 36 | | | | 8 | |

| | Federal & state registration | | | 90 | | | | 25 | | | | 25 | | | | 40 | | | | 27 | |

| | Professional fees | | | 76 | | | | 26 | | | | 26 | | | | 39 | | | | 25 | |

| | Directors fees | | | 33 | | | | 4 | | | | 4 | | | | 9 | | | | 4 | |

| | Other expenses | | | 182 | | | | 5 | | | | 3 | | | | 38 | | | | 15 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | Total expenses | | | 6,798 | | | | 287 | | | | 216 | | | | 1,712 | | | | 399 | |

| | | Less expenses reimbursable by advisor | | | — | | | | (70 | ) | | | (98 | ) | | | — | | | | (95 | ) |

| | | Directed brokerage | | | (259 | ) | | | — | | | | — | | | | (6 | ) | | | — | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| |

| Net expenses | | | 6,539 | | | | 217 | | | | 118 | | | | 1,706 | | | | 304 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| |

Net investment income | | | 2,862 | | | | 150 | | | | 75 | | | | 3,033 | | | | 2,085 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| |

| Net realized gain (loss) on investments | | | 4,545 | | | | (1,247 | ) | | | (37 | ) | | | (2,167 | ) | | | 373 | |

| Net unrealized appreciation on investments | | | 72,392 | | | | 3,834 | | | | 1,537 | | | | 19,431 | | | | 2,390 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| |

Net gain on investments | | | 76,937 | | | | 2,587 | | | | 1,500 | | | | 17,264 | | | | 2,763 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| |

| Net increase in net assets resulting from operations | | $ | 79,799 | | | $ | 2,737 | | | $ | 1,575 | | | $ | 20,297 | | | $ | 4,848 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| |

See Notes to Financial Statements.

22

STATEMENTS OF CHANGES IN NET ASSETS

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | GROWTH | | SELECT | | BLUE CHIP |

| | | | FUND | | FUND | | FUND |

| | | |

| |

| |

|

| | | | Year Ended | | Year Ended | | Year Ended | | Year Ended | | Year Ended | | Period Ended |

| | | | Nov. 30, | | Nov. 30, | | Nov. 30, | | Nov. 30, | | Nov. 30, | | Nov. 30, |

| | | | 2003 | | 2002 | | 2003 | | 2002 | | 2003 | | 2002* |

| | | |

| |

| |

| |

| |

| |

|

Operations | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net investment income | | $ | 2,862 | | | $ | 3,107 | | | $ | 150 | | | $ | 101 | | | $ | 75 | | | $ | 15 | |

| | Net realized gain (loss) on investments | | | 4,545 | | | | (12,241 | ) | | | (1,247 | ) | | | (2,261 | ) | | | (37 | ) | | | (31 | ) |

| | Net unrealized appreciation (depreciation) on investments | | | 72,392 | | | | (69,028 | ) | | | 3,834 | | | | (843 | ) | | | 1,537 | | | | 334 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | Net increase (decrease) in net assets resulting from operations | | | 79,799 | | | | (78,162 | ) | | | 2,737 | | | | (3,003 | ) | | | 1,575 | | | | 318 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Distributions to Shareholders | | | | | | | | | | | | | | | | | | | | | | | | |

| | Distributions from net investment income | | | (3,646 | ) | | | (152 | ) | | | (112 | ) | | | — | | | | (20 | ) | | | — | |

| | Distributions from net realized gains on securities transactions | | | (1,634 | ) | | | (25,031 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | Total distributions to shareholders | | | (5,280 | ) | | | (25,183 | ) | | | (112 | ) | | | — | | | | (20 | ) | | | — | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Fund Share Transactions (See Note 4) | | | 280,465 | | | | 357,241 | | | | 2,090 | | | | 20,818 | | | | 8,420 | | | | 5,807 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Total Increase in Net Assets | | | 354,984 | | | | 253,896 | | | | 4,715 | | | | 17,815 | | | | 9,975 | | | | 6,125 | |

Net Assets | | | | | | | | | | | | | | | | | | | | | | | | |

| | Beginning of period | | | 520,645 | | | | 266,749 | | | | 17,815 | | | | — | | | | 6,125 | | | | — | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | End of period | | $ | 875,629 | | | $ | 520,645 | | | $ | 22,530 | | | $ | 17,815 | | | $ | 16,100 | | | $ | 6,125 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | Accumulated undistributed net investment income included in net assets at end of period | | $ | 2,310 | | | $ | 3,107 | | | $ | 141 | | | $ | 101 | | | $ | 70 | | | $ | 15 | |

[Additional columns below]

[Continued from above table, first column(s) repeated]

| | | | | | | | | | | | | | | | | | |

| | | | BALANCED | | BOND |

| | | | FUND | | FUND |

| | | |

| |

|

| | | | Year Ended | | Year Ended | | Year Ended | | Year Ended |

| | | | Nov. 30, | | Nov. 30, | | Nov. 30, | | Nov. 30, |

| | | | 2003 | | 2002 | | 2003 | | 2002 |

| | | |

| |

| |

| |

|

Operations | | | | | | | | | | | | | | | | |

| | Net investment income | | $ | 3,033 | | | $ | 2,159 | | | $ | 2,085 | | | $ | 1,945 | |

| | Net realized gain (loss) on investments | | | (2,167 | ) | | | (1,790 | ) | | | 373 | | | | (866 | ) |

| | Net unrealized appreciation (depreciation) on investments | | | 19,431 | | | | (6,464 | ) | | | 2,390 | | | | (1,224 | ) |

| | | | |

| | | |

| | | |

| | | |

| |

| | Net increase (decrease) in net assets resulting from operations | | | 20,297 | | | | (6,095 | ) | | | 4,848 | | | | (145 | ) |

| | | | |

| | | |

| | | |

| | | |

| |

Distributions to Shareholders | | | | | | | | | | | | | | | | |

| | Distributions from net investment income | | | (2,165 | ) | | | (1,176 | ) | | | (2,056 | ) | | | (1,789 | ) |

| | Distributions from net realized gains on securities transactions | | | — | | | | (5,971 | ) | | | — | | | | — | |

| | | | |

| | | |

| | | |

| | | |

| |

| | Total distributions to shareholders | | | (2,165 | ) | | | (7,147 | ) | | | (2,056 | ) | | | (1,789 | ) |

| | | | |

| | | |

| | | |

| | | |

| |

Fund Share Transactions (See Note 4) | | | 60,832 | | | | 67,472 | | | | 4,326 | | | | 8,621 | |

| | | | |

| | | |

| | | |

| | | |

| |

Total Increase in Net Assets | | | 78,964 | | | | 54,230 | | | | 7,118 | | | | 6,687 | |

Net Assets | | | | | | | | | | | | | | | | |

| | Beginning of period | | | 138,027 | | | | 83,797 | | | | 34,737 | | | | 28,050 | |

| | | | |

| | | |

| | | |

| | | |

| |

| | End of period | | $ | 216,991 | | | $ | 138,027 | | | $ | 41,855 | | | $ | 34,737 | |

| | | | |

| | | |

| | | |

| | | |

| |

| | Accumulated undistributed net investment income included in net assets at end of period | | $ | 3,027 | | | $ | 2,159 | | | $ | 523 | | | $ | 494 | |

* For the period August 1, 2002 (inception) through November 30, 2002.

See Notes to Financial Statements.

23

NOTES TO FINANCIAL STATEMENTS

November 30, 2003

NOTE 1 - ORGANIZATION