UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | | | | | | | | | | | | | |

| ☑ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended | December 31, 2024 | | For the transition period from to |

Commission File Number 1-9210

Occidental Petroleum Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| State or other jurisdiction of incorporation or organization | | Delaware |

| I.R.S. Employer Identification No. | | 95-4035997 |

| Address of principal executive offices | | 5 Greenway Plaza, Suite 110 | Houston, | Texas |

| Zip Code | | 77046 |

| Registrant’s telephone number, including area code | | (713) | 215-7000 |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, $0.20 par value | OXY | New York Stock Exchange |

| Warrants to Purchase Common Stock, $0.20 par value | OXY WS | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☑ | Accelerated Filer | ☐ | Emerging Growth Company | ☐ |

| Non-Accelerated Filer | ☐ | Smaller Reporting Company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the registrant’s Common Stock held by nonaffiliates of the registrant was approximately $59.2 billion computed by reference to the closing price on the New York Stock Exchange of $63.03 per share of Common Stock on June 28, 2024.

As of January 31, 2025, there were 938,500,965 shares of Common Stock outstanding, par value $0.20 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement, relating to its 2025 Annual Meeting of Stockholders, are incorporated by reference into Part III of this Form 10-K.

| | | | | | | | |

| TABLE OF CONTENTS | PAGE |

| Part I | | |

| Items 1 and 2. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Part II | | |

| Item 5. | | |

| | |

| Item 7. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 7A. | | |

| Item 8. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 9. | | |

| Item 9A. | | |

| | |

| | |

| Item 9B. | | |

| Item 9C. | | |

| Part III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| Part IV | | |

| Item 15. | | |

| Item 16. | | |

| | | | | |

| ABBREVIATIONS USED WITHIN THIS DOCUMENT |

| AOC | Administrative Order on Consent |

| Anadarko | Anadarko Petroleum Corporation and its consolidated subsidiaries |

| Anadarko Acquisition | a transaction pursuant to the Agreement and Plan of Merger dated May 9, 2019, in which Occidental acquired all of the outstanding shares of Anadarko on August 8, 2019, and in which a wholly owned subsidiary of Occidental merged with and into Anadarko |

| Andes | Andes Petroleum Ecuador Ltd. |

| ARO | asset retirement obligations |

| Bcf | billions of cubic feet |

| Bcf/d | billions of cubic feet per day |

| Berkshire Hathaway | Berkshire Hathaway Inc. |

| BlackRock | BlackRock Inc., which has formed a joint venture with Occidental on the construction of STRATOS |

| BLM | U.S. Bureau of Land Management

|

| the Board | Occidental Board of Directors |

| Boe | barrels of oil equivalent |

| BOEM | U.S. Bureau of Ocean Energy Management |

| CAD | Canadian dollar |

| CCUS | carbon capture, utilization and storage |

| CERCLA | Comprehensive Environmental Response, Compensation, and Liability Act |

| CEO | chief executive officer |

CO2 | carbon dioxide |

| CODM | chief operating decision maker |

| Common Stock Warrants | a distribution of warrants to holders of Occidental common stock |

| CROCE | cash return on capital employed |

| CROCEI | cash return on capital employed incentive |

| CrownRock | CrownRock, L.P. |

| CrownRock Acquisition | acquisition of all of the outstanding partnership interests of CrownRock by Occidental |

| DAC | direct air capture |

| DASS | Diamond Alkali Superfund Site |

| DD&A | depreciation, depletion and amortization |

| DEL | Dolphin Energy Limited |

| DOE | U.S. Department of Energy |

| DOJ | U.S. Department of Justice |

| DSCC | Diamond Shamrock Chemicals Company |

| ECMC | Colorado Energy and Carbon Management Commission, formerly the Colorado Oil & Gas Conservation Commission |

| EDC | ethylene dichloride |

| EOR | enhanced oil recovery |

| EPA | U.S. Environmental Protection Agency |

| EPS | earnings per share |

| Exchange Act | Securities Exchange Act of 1934 |

| GAAP | Generally accepted accounting principles |

| GHG | greenhouse gas |

| GOA | Gulf of America |

| HSE | health, safety and environmental |

| IRA | Inflation Reduction Act |

| IRS | Internal Revenue Service |

| Kerr-McGee | Kerr-McGee Corporation and certain of its subsidiaries |

| LIFO | last-in, first-out |

| Maxus | Maxus Energy Corporation |

| Mbbl | thousands of barrels |

| Mbbl/d | thousands of barrels per day |

| Mboe | thousands of barrels equivalent |

| Mboe/d | thousands of barrels equivalent per day |

| Mcf | thousands of cubic feet |

| | | | | |

| ABBREVIATIONS USED WITHIN THIS DOCUMENT |

| MMbbl | millions of barrels |

| MMbtu | million British thermal units |

| MMcf | millions of cubic feet |

| MMcf/d | millions of cubic feet per day |

| NAV | net asset value |

| NCI | noncontrolling interest |

| NEPA | National Environmental Policy Act |

| NGL | natural gas liquids |

| NPL | National Priorities List |

| NYMEX | New York Mercantile Exchange |

| NYSE | New York Stock Exchange |

| Occidental | Occidental Petroleum Corporation, a Delaware corporation and one or more entities in which it owns a controlling interest (subsidiaries) |

| OCI | other comprehensive income |

| OECD | Organization for Economic Cooperation and Development |

| OLCV | Oxy Low Carbon Ventures, LLC and its consolidated subsidiaries |

| OPEC | Organization of the Petroleum Exporting Countries |

| Options | stock options |

| OTC | over-the-counter |

| OU | operable unit |

| OxyChem | Occidental Chemical Corporation and its consolidated subsidiaries |

| the Plans | the stockholder-approved 2015 Long-Term Incentive Plan, as amended and restated, for certain employees and directors and the Phantom Share Unit Award Plan |

| PP&E | property, plant & equipment |

| PSC | production sharing contracts |

| PUD | proved undeveloped |

| PVC | polyvinyl chloride |

| RCF | revolving credit facility |

| Reserves Committee | Corporate Reserves Review Committee |

| ROD | Record of Decision |

| RSUs | restricted stock units |

| Ryder Scott | Ryder Scott Company, L.P. |

| S&P 500 | Standard & Poor’s 500 Stock Index |

| SEC | U.S. Securities and Exchange Commission |

| SOFR | Secured Overnight Financing Rate |

| Sonatrach | the national oil and gas company of Algeria |

| SPEE | Society of Petroleum Evaluation Engineers |

| STEP | Strategic Technical Excellence Program |

| STRATOS | Occidental’s first large-scale DAC facility in Ector County, Texas |

| TSRI | total shareholder return incentive |

| UAE | United Arab Emirates |

| VCM | vinyl chloride monomer |

| Waha | natural gas trading hub in the Permian Basin |

| WES | Western Midstream Partners, LP |

| WTI | west Texas intermediate |

| Zero Coupons | Zero Coupon senior notes due 2036 |

| 2024 Form 10-K | Occidental’s Annual Report on Form 10-K for the year ended December 31, 2024 |

Part I

ITEMS 1 AND 2. BUSINESS AND PROPERTIES

In this Form 10-K, “Occidental”, “we”, “our” and “the Company” refers to Occidental Petroleum Corporation, a Delaware corporation incorporated in 1986, or Occidental and one or more entities in which it owns a controlling interest (subsidiaries). Occidental conducts its operations through its various subsidiaries and affiliates. Occidental’s executive offices are located at 5 Greenway Plaza, Suite 110, Houston, Texas 77046; telephone (713) 215-7000.

Occidental is an international energy company with premier diversified assets primarily located in the United States, the Middle East and North Africa and distinguished operational capabilities that create a runway for sustainable shareholder value accretion. Occidental is one of the largest oil and gas producers in the U.S., where it is a leading producer in the Permian and DJ basins, and offshore Gulf of America, and it is the largest independent oil producer in Oman. Occidental’s midstream and marketing segment provides flow assurance and enhances the value of the oil and gas segment. Oxy Low Carbon Ventures, a subsidiary within the midstream and marketing segment, is advancing leading-edge technologies and decarbonization solutions, including direct air capture, lithium development and near-zero emissions power, that seek to economically grow the business while reducing emissions. Occidental’s chemical subsidiary, OxyChem, is a leading North American manufacturer that produces the building blocks for life-enhancing products, including drinking water, medical supplies and construction materials.

Occidental’s culture is built upon the following core values:

■Lead with Passion

■Outperform Expectations

■Deliver Results Responsibly

■Unleash Opportunities

■Commit to Good

Occidental’s human capital resources and programs are managed by its Human Resources department, with support from business leaders across the Company. Occidental’s senior management team plays a key role in setting and monitoring Occidental’s culture, values and broader human capital management practices, with oversight by Occidental’s Board of Directors, the Sustainability and Shareholder Engagement Committee of the Board and the Environmental, Health and Safety Committee of the Board. To enhance senior leadership’s engagement with employees, Occidental hosts quarterly executive virtual conversations led by its President and CEO, Vicki Hollub, who along with other executives reviews financial and operational performance and responds to employee questions.

Occidental strives to create an environment where employees’ differences are appreciated, celebrated and encouraged. Occidental has attracted, and continues to recruit, a diverse workforce of exceptional talent. This diversity enriches Occidental’s culture and its employees' experiences on the job and contributes to an innovative and effective business model that encourages local communities to thrive.

The Human Resources department supports eleven voluntary Employee Resource Groups, which promote peer engagement and education to help advance inclusion and a sense of belonging of employees with common interests.

TALENT ATTRACTION, DEVELOPMENT AND RETENTION

Occidental recruits candidates in numerous ways, including through job fairs, professional societies and campus recruiting, including expanded recruiting at diverse colleges and universities.

To attract and retain talent, Occidental has implemented programs that afford employees more flexibility and promote increased work-life balance. Among them is the Balanced Workplace Program under which eligible office-based employees may opt to work three days in the office and two days at home each week.

In addition, Occidental’s global STEP was formed to recruit, develop and retain highly skilled and valued geoscientists, engineers, scientists and other petrotechnical professionals who collectively drive innovation, advance performance and inspire the future of energy development. STEP is a highly valued program for individual contributors to focus and advance on a technical, non-managerial career path, providing a competitive advantage for Occidental through the optimum application of technology. The Chief Petrotechnical Officer leads all aspects of STEP and reports directly to Occidental’s President and CEO.

Occidental employees have access to extensive development and training opportunities and programs to expand their personal and professional skills and knowledge. Occidental’s approach to education includes leadership/management training to develop leadership skills at all levels and expanded on-demand professional and development classes and mentoring to enhance critical business skills, broaden employee networks, and engage its employees.

EMPLOYEE COMPENSATION AND BENEFITS

Occidental’s compensation and benefits program is designed to attract and retain the talent necessary to achieve its business strategy. The compensation and benefits program recognizes and rewards strong Company and individual performance with competitive base salaries, as well as an annual bonus program, recognition awards, long-term performance incentives and advancement opportunities for eligible individuals. Occidental’s compensation and benefits program is routinely reviewed and benchmarked to ensure competitiveness and to provide the benefits that matter most to current and future employees.

Occidental strives to give employees the tools and resources they need to succeed both professionally and personally and to foster a safe and collaborative work environment. To that end, Occidental offers, and regularly evaluates, its comprehensive health, welfare and retirement and savings benefits plans, professional memberships and work-life balance benefits. It also provides programs to enhance and support employees’ overall well-being, including their physical, mental, social and financial health. Addressing well-being is imperative to ensure that Occidental’s employees stay resilient, healthy and productive. Occidental offers an enhanced mental health benefit through Lyra Health, which provides cost-free mental and emotional healthcare that is effective, convenient and personalized to all employees and their eligible dependents. Lyra Health professionals provide virtual or in-person support for a variety of mental health concerns including anxiety, depression, stress management, parenting challenges, relationship conflicts and sleep problems.

HEALTH AND SAFETY

The health and safety of Occidental’s workforce and communities is a top priority as reflected in the Company's HSE and Sustainability Principles. Occidental’s Operating Management System sets expectations, provides guidance, training and resources, and empowers employees and contractors to stop any job or activity if they observe conditions that may give rise to a safety or environmental incident. The Company is also focused on reducing incident severity, enhancing contractor safety programs and harmonizing safety systems, programs and tools. These efforts helped Occidental sustain its robust safety record and promote continued improvements and innovations in safety, efficiency, reliability and environmental stewardship.

WORKFORCE COMPOSITION

The following table approximates regional distribution of Occidental’s employees as of December 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | North America | | Middle East | | Latin America | | Other (a) | | Total |

| Union | | 426 | | 405 | | | 56 | | — | | | 887 |

| Non-Union | | 9,177 | | 3,007 | | 115 | | 137 | | 12,436 |

| Total | | 9,603 | | 3,412 | | 171 | | 137 | | 13,323 |

(a)Other headcount included North Africa, Europe and Asia.

Occidental’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports are available free of charge on its website, www.oxy.com, as soon as reasonably practicable after Occidental electronically files the material with, or furnishes it to, the SEC. In addition, copies of Occidental’s annual report will be made available, free of charge, upon written request.

From time to time, Occidental has made and expects in the future to use its website as a channel of distribution of material information regarding the Company. Financial and other material information regarding the Company is routinely posted on Occidental’s website and accessible at www.oxy.com/investors/.

Information contained on Occidental’s website is not part of or incorporated into this Form 10-K or any other filings with the SEC.

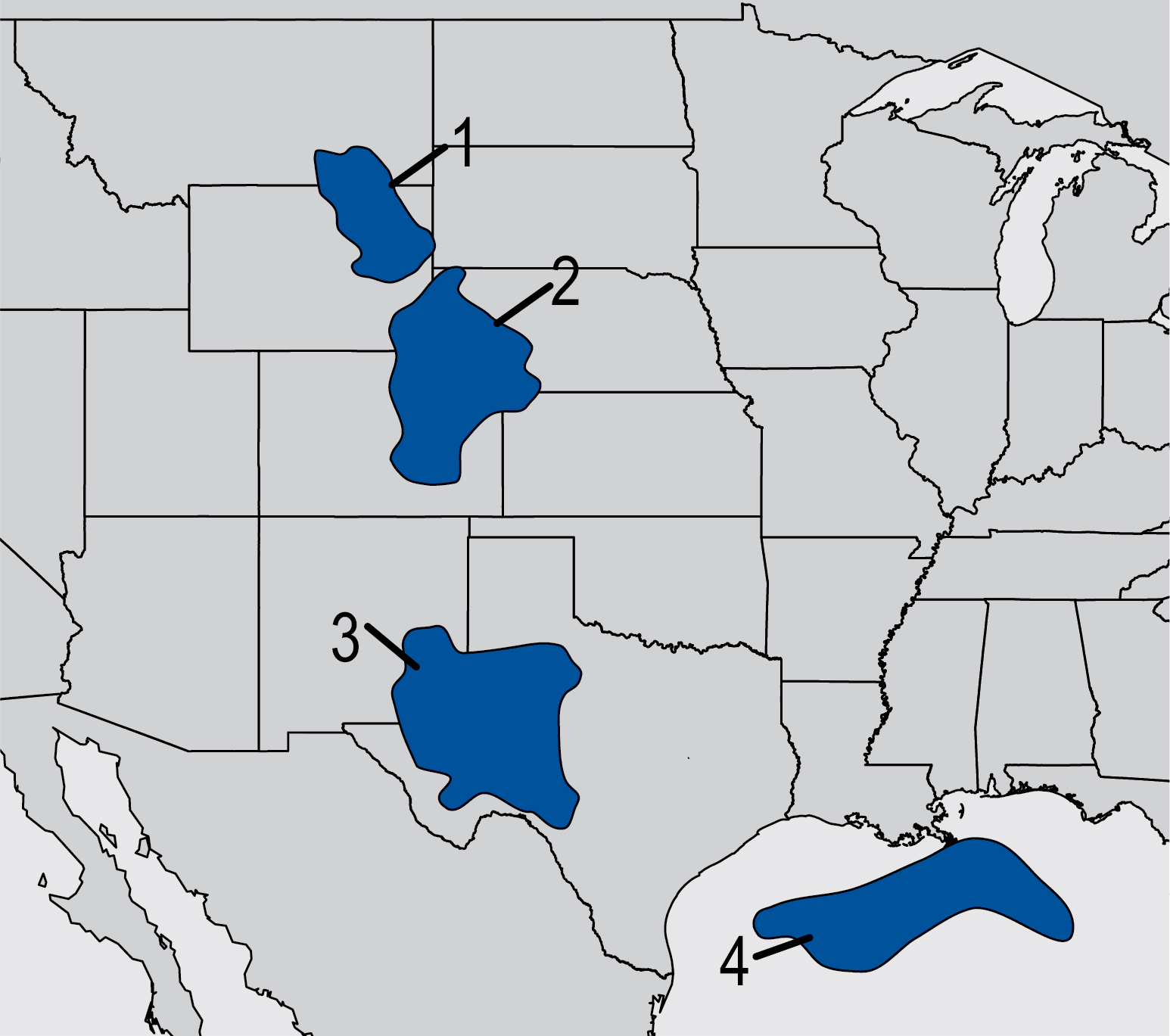

GENERAL

Occidental’s oil and gas business is primarily located in the United States, the Middle East and North Africa. Within the United States, Occidental has operations primarily in Texas, New Mexico and Colorado, as well as offshore in the Gulf of America. Through the CrownRock Acquisition on August 1, 2024, Occidental added high margin production and low-breakeven inventory to its oil and gas portfolio in the Permian Basin. Occidental’s international assets are primarily located in Algeria, Oman, Qatar and the UAE. Refer to the Oil and Gas Acreage section in Supplemental Oil and Gas Information under Item 8 of this Form 10-K for further disclosure of Occidental’s holdings of developed and undeveloped oil and gas acreage and Note 5 - Acquisitions, Divestitures and Other Transactions in the Notes to Consolidated Financial Statements in Part II Item 8 of this Form 10-K for further details on the CrownRock Acquisition.

COMPETITION

As a producer of oil, NGL and natural gas, Occidental competes domestically and internationally with public, private and nationalized producers. Oil, NGL and natural gas are sensitive to current and anticipated market conditions, both global and local. Occidental’s competitive strategy relies on producing hydrocarbons in a capital efficient manner through developing conventional and unconventional fields and utilizing primary, secondary (waterflood) and tertiary (CO2 and steam flood) recovery techniques in areas where Occidental has a competitive advantage, resulting from its successful operations or investments in shared infrastructure. Occidental also competes to develop and produce its worldwide oil and gas reserves safely, sustainably and cost-effectively, maintain a skilled workforce and use high quality service providers. Occidental believes that its core competencies in CO2 separation, transportation, use, recycling and storage in EOR provide a competitive advantage over its peers as the world transitions to a less carbon-intensive economy and seeks to remove CO2 from the atmosphere.

PROVED RESERVES AND SALES VOLUMES

The table below shows Occidental’s year-end oil, NGL and natural gas proved reserves. See the information under Oil and Gas Segment in the Management's Discussion and Analysis section under Part II, Item 7, of this Form 10-K for details regarding Occidental’s proved reserves, the reserves estimation process, sales and production volumes, production costs and other reserves-related data.

COMPARATIVE OIL AND GAS PROVED RESERVES AND SALES VOLUMES

Oil and NGL is in MMbbl; natural gas is in Bcf.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | 2023 | | 2022 | |

| Oil | NGL | Gas | Boe | (a) | Oil | NGL | Gas | Boe | (a) | Oil | NGL | Gas | Boe | (a) |

| Proved Reserves | | | | | | | | | | | | | | | |

| United States | 1,832 | | 1,060 | | 5,394 | | 3,791 | | | 1,600 | | 802 | | 4,235 | | 3,108 | | | 1,639 | | 654 | | 4,073 | | 2,972 | | |

| International | 303 | | 176 | | 2,049 | | 821 | | | 340 | | 181 | | 2,117 | | 874 | | | 274 | | 192 | | 2,277 | | 845 | | |

| Total | 2,135 | | 1,236 | | 7,443 | | 4,612 | | | 1,940 | | 983 | | 6,352 | | 3,982 | | | 1,913 | | 846 | | 6,350 | | 3,817 | | |

| Sales Volumes | | | | | | | | | | | | | | | |

| United States | 209 | | 102 | | 548 | | 402 | | | 195 | | 90 | | 480 | | 365 | | | 185 | | 83 | | 445 | | 342 | | |

| International | 38 | | 14 | | 191 | | 84 | | | 39 | | 13 | | 176 | | 81 | | | 41 | | 12 | | 164 | | 81 | | |

| Total | 247 | | 116 | | 739 | | 486 | | | 234 | | 103 | | 656 | | 446 | | | 226 | | 95 | | 609 | | 423 | | |

(a)Natural gas volumes are converted to Boe at six Mcf of gas per one barrel of oil. Conversion to Boe does not necessarily result in price equivalency.

GENERAL

OxyChem owns and operates manufacturing plants at 21 domestic sites in Alabama, Georgia, Illinois, Kansas, Louisiana, Michigan, New Jersey, Ohio, Tennessee and Texas and at two international sites in Canada and Chile.

COMPETITION

OxyChem competes with numerous domestic and international chemical producers. OxyChem’s market position was either first or second in the United States in 2024 for each of the principal basic chemical products it manufactured and marketed as well as for VCM. OxyChem ranks in the top three producers of PVC in the United States. OxyChem’s competitive strategy is to be a low-cost producer of its products in order to compete on price.

OxyChem produced the following products:

| | | | | | | | |

| Principal Products | Major Uses | Annual Capacity |

| Basic Chemicals | | |

| Chlorine | Raw material for EDC, water treatment and pharmaceuticals | 3.2 million tons |

| Caustic soda | Pulp, paper and aluminum production | 3.3 million tons |

| Chlorinated organics | Refrigerants (a), silicones and pharmaceuticals | 1 billion pounds |

| Potassium chemicals | Fertilizers, batteries, soaps, detergents and specialty glass | 0.4 million tons |

| EDC | Raw material for VCM | 2.1 billion pounds |

| Chlorinated isocyanurates | Swimming pool sanitation and disinfecting products | 150 million pounds |

| Sodium silicates | Catalysts, soaps, detergents and paint pigments | 0.6 million tons |

| Calcium chloride | Ice melting, dust control, road stabilization and oil field services | 0.7 million tons |

| Vinyls | | |

| VCM | Precursor for PVC | 6.2 billion pounds |

| PVC | Piping, building materials and automotive and medical products | 3.7 billion pounds |

| Ethylene | Raw material for VCM | 1.3 billion pounds (b) |

(a)Includes 4CPe, a raw material used in making next generation refrigerants with low global warming and zero ozone depletion potential.

(b)Amount is gross production capacity for 50/50 joint venture with Orbia.

| | |

| MIDSTREAM AND MARKETING OPERATIONS |

GENERAL

Occidental’s midstream and marketing operations primarily support and enhance its oil and gas and chemical businesses. The midstream and marketing segment strives to optimize the use of its gathering, processing, transportation, storage and terminal commitments and to provide access to domestic and international markets. To generate returns, the segment evaluates opportunities across the value chain to provide services to Occidental subsidiaries, as well as third parties. The midstream and marketing segment operates or contracts for services on gathering systems, gas plants, co-generation facilities and storage facilities and invests in entities that conduct similar activities, such as WES in the United States and DEL in the Middle East, which are accounted for as equity method investments. WES owns gathering systems, plants and pipelines and earns revenue from fee-based and service-based contracts with Occidental and third parties. DEL owns and operates a pipeline that connects its gas processing and compression plant in Qatar and its receiving facilities in the UAE, and uses its network of DEL-owned and other existing leased pipelines to supply natural gas to the UAE and Oman. The midstream segment also includes Al Hosn Gas, a processing facility in the UAE that removes sulfur from natural gas and processes the natural gas and sulfur for sale, as well as the OLCV businesses.

Leveraging Occidental’s carbon management expertise, OLCV primarily focuses on advancing carbon removal and CCUS projects, including developing and commercializing DAC technology. STRATOS, the Company’s first large-scale DAC facility, is designed to capture up to 500,000 tonnes of CO2 per annum once complete. Commissioning and start-up of operations for the first phase of the project is expected in mid-2025, with an initial capacity of up to 250,000 tonnes of CO2 per annum. OLCV also invests in third-party entities developing technologies to advance other low-carbon initiatives, including NET Power, an energy technology company building its first utility-scale plant to provide near-zero emissions electricity by 2028.

COMPETITION

Occidental’s midstream and marketing businesses operate in competitive and highly regulated markets. Occidental competes for capacity and infrastructure for the gathering, processing, transportation, storage and delivery of its products, which are sold at market prices or on a forward basis to refiners, end users and other market participants. Occidental’s marketing business competes with other market participants on exchange platforms and through other bilateral transactions with direct counterparties. OLCV and its businesses and investees also face a broad range of competitors, with nascent markets for low-carbon products and CO2 removal credits that are subject to rapidly changing laws, regulations, policies and reporting and verification mechanisms that can significantly impact the financing, construction and operation of projects and the development of markets.

Occidental’s midstream and marketing operations are conducted in the locations described below as of December 31, 2024:

| | | | | | | | |

Location(a) | Description | Capacity (b) |

| Gas Plants | |

| Texas, New Mexico and Colorado | Occidental and third-party-operated natural gas/CO2 gathering, compression and processing systems | 2.1 Bcf/d |

| Texas, Rocky Mountains and Other | Equity investment in WES - gas processing facilities | 5.5 Bcf/d |

| UAE | Natural gas processing facilities for Al Hosn Gas | 1.45 Bcf/d |

| Pipelines and Gathering Systems | |

| Texas, New Mexico and Colorado | CO2 fields and pipeline systems transporting CO2 to oil and gas producing locations | 2.8 Bcf/d |

| Qatar, UAE and Oman | Equity investment in the DEL natural gas pipeline | 3.2 Bcf/d |

| United States | Equity investment in WES involved in gathering and transportation | 14,371 miles of pipeline |

| Power Generation | |

| Texas and Louisiana | Occidental-operated power and steam generation facilities | 1,218 megawatts of electricity and 1.6 million pounds of steam per hour |

| OLCV | |

| Texas | Occidental-owned solar generation facility | 16.8 megawatts of electricity |

| Texas | Equity investment in a near-zero emissions natural gas based power generation demonstration facility | up to 50 megawatts of electricity |

(a)Table does not include assets under construction.

(b)Amounts are gross, including interests held by third parties.

ITEM 1A. RISK FACTORS

Volatile global and local commodity pricing strongly affects Occidental’s results of operations.

Occidental’s financial results correlate closely to the prices it obtains for its products, particularly oil and, to a lesser extent, NGL, natural gas and chemical products.

Prices for oil, NGL and natural gas fluctuate widely. Historically, the markets for oil, NGL and natural gas have been volatile and may continue to be volatile in the future. If the prices of oil, NGL or natural gas continue to be volatile or decline, Occidental’s operations, financial condition, cash flows, level of expenditures and the quantity of estimated proved reserves that may be attributed to its properties may be materially and adversely affected. Prices are determined by global and local market forces which are not in Occidental’s control. These factors include, among others:

■Worldwide and domestic supplies of, and demand for, oil, NGL, natural gas and refined products;

■The cost of exploring for, developing, producing, refining and marketing oil, NGL, natural gas and refined products;

■Operational impacts such as production disruptions, technological advances and regional market conditions, including available transportation capacity and infrastructure constraints in producing areas;

■Changes in weather patterns and climate;

■The impacts of the members of OPEC and non-OPEC member-producing nations that may agree to and maintain production levels;

■The ongoing global impact of the Russia-Ukraine war and conflicts in the Middle East;

■The worldwide military and political environment, including uncertainty or instability resulting from an escalation or outbreak of armed hostilities or acts of terrorism in the United States or elsewhere;

■The price and availability of and demand for alternative and competing fuels and emissions reducing technology;

■Technological advances affecting energy consumption and supply;

■Government policies and support and market demand for low-carbon technologies;

■Domestic and international government regulations, tariffs and taxes, including those that restrict the import or export of hydrocarbons and other products and goods;

■Shareholder activism or activities by non-governmental organizations (NGOs) to restrict the exploration, development and production of oil, NGL and natural gas;

■Additional or increased nationalization and expropriation activities by international governments;

■The impact and uncertainty of world health events, including pandemics and epidemics;

■The effect of releases from or replenishment of the U.S. Strategic Petroleum Reserve;

■Volatility in commodity markets;

■The effect of energy conservation efforts; and

■Global inventory levels and general economic conditions, including potential economic slowdowns or recessions, domestically or internationally.

The long-term effects of these and other conditions on the prices of oil, NGL, natural gas and chemical products are uncertain and there can be no assurance that the demand or pricing for Occidental’s products will follow historic patterns in the near term. Prolonged or substantial decline, or sustained market uncertainty, in these commodity prices may have the following effects on Occidental’s businesses:

■Adversely affect Occidental’s financial condition, results of operations, liquidity, ability to reduce debt, access to and cost of capital, and ability to finance planned capital expenditures or planned acquisitions, pay dividends and repurchase shares;

■Reduce the amount of oil, NGL and natural gas that Occidental can produce economically;

■Cause Occidental to delay or postpone some of its capital projects;

■Reduce Occidental’s revenues, operating income or cash flows;

■Reduce the amounts of Occidental’s estimated proved oil, NGL and natural gas reserves;

■Reduce the carrying value of Occidental’s oil and natural gas properties due to recognizing impairments of proved properties, unproved properties and exploration assets;

■Reduce the standardized measure of discounted future net cash flows relating to oil, NGL and natural gas reserves; and

■Adversely affect the ability of Occidental’s partners to fund their working interest capital requirements.

Generally, Occidental’s historical practice has been to remain exposed to the market prices of commodities. As of December 31, 2024, there were no active commodity hedges in place. Management may choose to put hedges in place in the future for oil, NGL and natural gas commodities. Commodity price risk management activities may prevent Occidental from fully benefiting from price increases and may expose it to regulatory, counterparty credit and other risks.

The prices obtained for OxyChem’s products correlate to the strength of the United States and global economies, as well as chemical industry expansion and contraction cycles. OxyChem also depends on feedstocks and energy to produce chemicals, which are commodities subject to significant price fluctuations.

Anadarko’s Tronox settlement may not be deductible for income tax purposes; Occidental may be required to repay the tax refund Anadarko received in 2016 related to the deduction of the Tronox settlement payment, which may have a material adverse effect on Occidental’s results of operations, liquidity and financial condition.

In April 2014, Anadarko and Kerr-McGee entered into a settlement agreement for $5.2 billion, resolving, among other things, all claims that were or could have been asserted in connection with the May 2009 lawsuit filed by Tronox against Anadarko and Kerr-McGee in the U.S. Bankruptcy Court for the Southern District of New York. After the settlement became effective in January 2015, Anadarko paid $5.2 billion and deducted this payment on its 2015 federal income tax return. Due to the deduction, Anadarko had a net operating loss carryback for 2015, which resulted in a tentative tax refund of $881 million in 2016.

The IRS audited Anadarko’s tax position regarding the deductibility of the payment and in September 2018 issued a statutory notice of deficiency rejecting Anadarko’s refund claim. Anadarko disagreed and, in November 2018, filed a petition with the U.S. Tax Court to dispute the disallowance. Trial was held in May 2023. The parties filed post-trial briefs throughout 2023 and 2024. Closing arguments were held in May 2024. The Tax Court may issue an opinion at any time. If the Tax Court opines that all or a portion of the original $5.2 billion deduction is not deductible, a computation phase will commence where the parties will compute the tax amount to be included in the Tax Court’s decision. Once the parties submit their computation, the Tax Court judge will formally enter the decision reflecting the computed tax amount. To pursue an appeal of the Tax Court’s decision, any tax due as a result of the Tax Court’s decision must be fully bonded or paid within 90 days of the decision’s entry. If Anadarko does not pursue an appeal, the IRS will assess any resulting tax deficiency, including interest, and issue a notice demanding payment thereof.

In accordance with Accounting Standards Codification (ASC) Topic 740’s guidance on the accounting for uncertain tax positions, as of December 31, 2024, Occidental had recorded no tax benefit on the tentative cash tax refund of $881 million. Additionally, Occidental has recorded no tax benefit on approximately $500 million of additional cash tax benefits realized from the utilization of tax attributes generated as a result of the deduction of the $5.2 billion Tronox Adversary Proceeding settlement payment in 2015. If the payment is ultimately determined not to be deductible, Occidental would be required to repay the tentative refund received, plus other cash benefits received related to the $5.2 billion deduction, plus interest, which as of December 31, 2024 totaled approximately $2.1 billion and could have a material adverse effect on its liquidity and consolidated balance sheets. Occidental’s Consolidated Financial Statements include an uncertain tax position for the approximate repayment of $1.4 billion in federal and state taxes plus accrued interest of approximately $760 million. This amount is not covered by insurance. For additional information on income taxes, see Note 10 - Income Taxes in the Notes to Consolidated Financial Statements in Part II Item 8 of this Form 10-K.

Occidental’s indebtedness may make it more vulnerable to economic downturns and adverse developments in its businesses. Downgrades in Occidental’s credit ratings or future increases in interest rates may negatively impact Occidental’s cost of capital and ability to access capital markets.

Occidental’s level of indebtedness, including indebtedness incurred in connection with the CrownRock Acquisition, could increase its vulnerability to adverse changes in general economic and industry conditions, economic downturns and adverse developments in its businesses or limit Occidental’s flexibility in planning for or reacting to changes in its businesses and the industries in which it operates. From time to time, Occidental has relied on access to capital markets for funding. Occidental’s ability to obtain additional financing or refinancing will be subject to a number of factors, including general economic and market conditions such as rising interest rates, inflation or unstable or illiquid market conditions, Occidental’s performance, investor sentiment, risks impacting financial institutions and the credit markets more broadly and Occidental’s ability to meet existing debt compliance requirements. Occidental’s ability to access credit and capital markets may be restricted at a time when it would like, or need, access to those markets, which could constrain its flexibility to react to changing economic and business conditions. If Occidental is unable to generate sufficient funds from its operations or complete planned divestitures on favorable terms or at all to satisfy its capital requirements, including its existing debt obligations, or to raise additional capital on acceptable terms, Occidental’s businesses, financial condition, results of operations, cash flows and/or stock price could be adversely affected. In addition, Occidental is regularly evaluated by the major rating agencies based on a number of factors, including its financial strength and conditions affecting the oil and gas industry generally. Occidental and other industry companies have had their ratings reduced in the past due to negative commodity price outlooks. These major rating agencies are now considering environmental, social and governance (ESG) attributes when assessing credit profiles. While these assessments have limited impact today, they have the potential to pressure credit ratings over time. Any downgrade in Occidental’s credit rating or announcement that its credit rating is under review for possible downgrade could increase the cost associated with any additional indebtedness Occidental incurs or limit or impair Occidental’s access to additional indebtedness, financial assurance, or other forms of liquidity. As of the date of this filing, Occidental’s long-term debt was rated BBB- by Fitch Ratings, Baa3 by Moody’s Investors Service and BB+ by Standard and Poor’s.

Disruptions in the political, regulatory, economic, and social environments of the countries in which Occidental operates could adversely affect its reputation, financial condition, results of operations and cash flows.

Occidental’s non-U.S. operations accounted for approximately 16% of its consolidated revenue in 2024, 16% in 2023 and 15% in 2022. Operations in non-U.S. countries with varying degrees of political, legal and economic stability expose

Occidental to a wide range of developments that could result in contractual, legal or regulatory changes. Instability and unforeseen changes in any of the markets in which Occidental operates could result in business disruptions or operational challenges that may adversely affect the demand for Occidental’s products and services, or its reputation, financial condition, results of operations or cash flows. These factors include, but are not limited to, the following:

■ Uncertain or volatile political, social, and economic conditions;

■ Social unrest, acts of terrorism, war, or other armed conflict;

■ Public health crises and other catastrophic events, such as pandemics;

■ Confiscatory taxation or other adverse tax policies;

■ Trade regulation and tariffs;

■ Theft of, or lack of sufficient legal protection for, proprietary technology and other intellectual property;

■ Unexpected changes in legal and regulatory requirements, including changes in interpretation or enforcement of existing laws;

■ Restrictions on the repatriation of income or capital;

■ Currency exchange controls;

■ Inflation;

■ Currency exchange rate fluctuations and devaluations; and

■ Changes in usage of the U.S. dollar in global trade.

In addition, the U.S. government has the authority to prevent or restrict Occidental from doing business in foreign jurisdictions or with certain parties or to restrict the kind of business that may be conducted, including acquiring or divesting certain assets. These restrictions and similar restrictions imposed by foreign governments have in the past limited Occidental’s ability to operate in, or gain access to, opportunities in various jurisdictions. Changes in domestic and international policies and regulations may also restrict the Company’s ability to obtain or maintain licenses or permits necessary to operate in foreign jurisdictions, including those necessary for drilling and development of wells. Any of these actions could adversely affect its businesses or results of operations.

Government actions and political instability may adversely affect Occidental’s businesses and results of operations.

Occidental’s businesses are subject to, and may be adversely affected by, the actions and decisions of many federal, state, local and international governments and political interests. As a result, Occidental faces risks of:

■New or amended laws and regulations, or new or different applications or interpretations of, or reversal of, existing laws and regulations, including those related to drilling, manufacturing or production processes (including flaring and well stimulation techniques such as hydraulic fracturing and acidization), pipelines, labor and employment, taxes, royalty rates, permitted production rates, entitlements, import, export and use of raw materials, equipment or products, use or increased use of land, water and other natural resources, air emissions (including restrictions, taxes or fees on emissions of methane, CO2, or other substances), water recycling and disposal, waste minimization and disposal, public and occupational health and safety, the manufacturing of chemicals, asset integrity management, the marketing or export of commodities, security, environmental protection, and climate change-related and sustainability initiatives, all of which may restrict or prohibit activities of Occidental or its contractors or customers, increase Occidental’s costs or reduce demand for Occidental’s products;

■Violation of certain laws and regulations, and associated claims, litigation, investigations and other proceedings, which may result in strict or joint and several liability and the imposition of significant administrative, civil or criminal fines and penalties, monetary damages, and remedial actions or assessments, potentially requiring significant changes to, or even closure of, facilities or operations;

■Refusal of, or delay in, the extension or grant of exploration, development or production contracts or leases; and

■Development delays and cost overruns due to approval delays for, or denial of, drilling, construction, environmental and other regulatory approvals, permits and authorizations.

Examples of provisions of recent U.S. federal statutes and regulations that affect key aspects of taxation, land use and production or manufacturing operations and present the foregoing types of risks are described in this risk factor, and examples of those regarding climate change and GHG and other air emissions are described in a later risk factor. Regulatory efforts, both in the U.S. and internationally, are evolving, including the international alignment of such efforts, and Occidental cannot determine what final regulations will be enacted, modified, or reversed or what their ultimate impact on Occidental’s businesses will be.

In 2022, the IRA imposed new or reinstated corporate taxes and fees that could have an adverse effect on Occidental’s tax liability. The IRA enacted a new corporate alternative minimum tax (CAMT) that started in tax year 2023 and imposed a 15% minimum tax on the adjusted financial statement income (AFSI), net of the CAMT foreign tax credit, of corporations with average AFSI exceeding $1 billion for three preceding consecutive tax years. In 2024, the IRS issued proposed CAMT regulations with a public hearing held in January 2025. The IRA also imposed a 1% excise tax on the aggregate fair market

value of corporate share repurchases, net of certain corporate share issuances and other adjustments, by certain corporations. In addition, the IRA provided significant policy support and incentives, including enhanced tax credits, for DAC, CCUS, hydrogen and other low-carbon projects, which may be subject to further administrative or congressional action. In January 2025, the Trump Administration issued an executive order that pauses the disbursement of funds appropriated under the IRA. Finally, the IRA expanded GHG emissions reporting requirements and imposed a new methane emissions charge on owners or operators of various U.S. oil and gas facilities, as described in a subsequent risk factor. For additional discussion of such matters, see Note 10 - Income Taxes in the Notes to Consolidated Financial Statements in Part II Item 8 of this Form 10-K. In 2021, the Infrastructure Investment and Jobs Act (IIJA) reinstated federal Superfund chemical excise taxes on various listed taxable chemicals that OxyChem manufactures, produces or imports, such as chlorine, sodium hydroxide and ethylene, subject to certain exceptions such as methane used for fuel and exported chemical products. These excise taxes could lead to higher costs and impact margins. The IIJA also authorized federal support, including grants, loans and loan guarantees, for low-carbon ventures and infrastructure, including grants for DAC and CCUS research, development and demonstration, carbon transport and storage infrastructure and permitting, carbon utilization and market development, and carbon removal. 1PointFive, LLC, a wholly owned subsidiary of Occidental (1PointFive), secured a grant from the DOE for the development of its South Texas DAC Hub, which may be subject to change as federal spending and programs are reviewed pursuant to executive orders issued by the Trump Administration and could adversely affect the project. The awarding of grants or other federal support under various statutes also could affect the selection and deployment of competing low-carbon technologies and the financing and market acceptance of proposed projects of Occidental and its competitors.

During the Biden Administration, federal resource agencies sought to significantly restrict or delay leasing and access to federal lands for oil and gas exploration, production and infrastructure, to increase royalty rates, fees and bonding requirements, to impose significant preconditions, restrictions or delays on permitting, and in certain locations, to prohibit or significantly restrict oil and gas activities under various federal laws. For example, offshore leasing is important for Occidental to sustain GOA production and reserves over the long term. GOA Lease Sale 261 proceeded in 2023 due to the IRA and federal court decisions that overruled the BOEM’s efforts to cancel the sale outright and then impose acreage and other restrictions regarding the Rice’s whale based on a proposed critical habitat designation by the National Marine Fisheries Service (NMFS) which has not been finalized.

In August 2024, the U.S. District Court for the District of Maryland vacated the NMFS’ 2020 programmatic Biological Opinion under the ESA on GOA oil and gas activities (BiOp) in response to a lawsuit from advocacy groups. The BiOp underpins lease sales and permitting that are needed for sustained GOA oil and gas exploration and production. The BiOp assessed risks to marine species, including the Rice’s whale, implemented mitigation measures for their protection and authorized the incidental take of species that may occur during permitted offshore oil and gas operations. The Court found the BiOp insufficient in safeguarding the whale species and, in October 2024, set a deadline of May 2025 when the 2020 BiOp will be vacated and by which the NMFS must issue a new opinion. The NMFS may seek to impose additional conditions on offshore oil and gas and vessel activity, which could affect Occidental’s GOA exploration, development and operations, and a new opinion may be the subject of further litigation. The absence of an opinion and its associated incidental take coverage could adversely impact the ability of federal agencies to conduct lease sales and issue or modify permits and approvals and increase the risk of ESA liability for offshore oil and gas operators and contractors.

Regarding onshore federal oil and gas leasing, in April 2024, the BLM adopted final regulations to revise its oil and gas leasing process to implement the IRA’s increases in royalty rates, rental rates and minimum bids, restrict leasing to areas with known resource potential and near existing infrastructure and avoid areas with competing uses such as recreation and conservation, increase bonding requirements, impose new requirements for temporarily abandoned wells and change the term of an approved application for permit to drill. Occidental’s subsidiaries may incur increased federal royalties and face restrictions on future potential drilling sites or infrastructure on federal lands due to these regulations.

In 2022, advocacy groups filed a lawsuit in the U.S. District Court for the District of Columbia to invalidate numerous BLM drilling permits for oil and gas wells on federal lands in New Mexico and Wyoming, including certain permits obtained by Occidental subsidiaries. The plaintiffs alleged that the BLM failed to comply with NEPA and other federal statutes by not adequately addressing GHG emissions and climate change in its environmental reviews. In November 2023, the Court dismissed the case, and plaintiffs’ appeal is pending.

Litigation over NEPA environmental reviews by advocacy groups has significantly delayed federal permitting of proposed domestic energy, manufacturing and infrastructure projects, leading to increased costs, delays in financing and construction, or cancellation by project proponents, and such litigation and delays could adversely affect such projects in the future, including those involving Occidental or its subsidiaries, joint ventures or customers. In May 2024, the White House Council on Environmental Quality (CEQ) issued final NEPA regulations directing federal agencies to consider GHG emissions and climate change in NEPA environmental reviews, which regulations are subject to pending litigation.

Significant areas of the Permian Basin in West Texas and Southeast New Mexico are subject to current or proposed land use restrictions under the federal Endangered Species Act (ESA). In 2022 and May 2024, the U.S. Fish and Wildlife Service (FWS) published final rules listing the lesser prairie chicken and the dunes sagebrush lizard, respectively, as endangered species under the ESA, which decisions are subject to pending litigation. While Occidental has entered into voluntary conservation agreements with respect to these and other species and their associated habitat in the Permian

Basin, listing of such species may impose significant operational requirements and costs and increase the potential for litigation and enforcement actions.

Although the foregoing revisions to federal onshore and offshore leasing, royalties and permitting, the CEQ’s NEPA regulations, recent listing decisions under the ESA, and related lawsuits have not affected Occidental’s existing production or planned 2025 drilling and completions activity to date, restrictions, uncertainty, or litigation could impact the future ability to develop resources efficiently on federal lands or in projects that require federal actions on private or state lands.

Certain states where Occidental's subsidiaries conduct oil and gas operations have adopted or proposed significant land use and permitting laws and regulations that would impose siting requirements or “setbacks” on certain oil and gas drilling locations based on the distance of a proposed well pad to occupied structures, require additional permitting, notification and monitoring for various oil and gas drilling, completions, hydraulic fracturing and production operations or various types of wells and facilities, limit leasing or use of state lands or increase royalty rates, rental rates and fees for such use, increase bonding, plugging and abandonment, and reclamation requirements, and impose other operational restrictions. While, as of December 31, 2024, Occidental's subsidiaries maintained a significant inventory of permits and permit applications with applicable regulatory agencies for a substantial portion of their planned 2025 drilling and completions activity, any significant regulatory delays could result in changes to their development programs and ability to establish new proved undeveloped locations.

In recent years, the EPA has significantly expanded its regulation of chemicals under the Toxic Substances Control Act (TSCA). In 2024, the EPA issued final regulations with respect to one chemical used in OxyChem’s manufacturing operations and three other chemicals that OxyChem produces and sells. These regulations phase out various uses over differing time periods and require certain workplace controls for ongoing uses, typically authorized in industrial settings. In December 2024, the EPA designated vinyl chloride and four other chemicals as high-priority substances for which it plans to begin risk evaluations, and certain petroleum derivatives that it will assess as potential high-priority substances for a subsequent round of risk evaluations. The EPA also issued regulations to simplify its process for risk evaluation and enable it to regulate more chemicals. Litigation is pending or anticipated regarding these regulations. Given the scope of the EPA’s final regulations and its planned risk evaluations, the ability of OxyChem and its customers to use certain chemicals or manufacture or sell certain of its products could be restricted or phased out, which could impact OxyChem’s costs, sales and margins.

Claims, litigation, government investigations and other proceedings may adversely affect Occidental’s businesses, consolidated financial position, results of operations and cash flows.

Occidental is subject to actual and threatened claims, litigation, assessments, investigations, and other proceedings, including proceedings by governments and regulatory authorities, involving a wide range of issues, including regarding its drilling, manufacturing or production processes, commercial disputes, environmental compliance, public health and safety and taxes. The outcomes of these matters are inherently unpredictable and subject to significant uncertainties. Determining legal reserves or reasonably possible losses from such matters involves judgment and may not reflect the full range of uncertainties and unpredictable outcomes. Until the final resolution of such matters, Occidental may be exposed to losses in excess of the amount recorded, and such amounts could be material. Should any of its estimates and assumptions change or prove to have been incorrect, it could have a material adverse effect on Occidental’s businesses, consolidated financial position, results of operations and cash flows.

Compliance costs and liabilities associated with health, safety and environmental laws and regulations could have a material adverse effect on Occidental’s or its subsidiaries’ businesses, financial condition and results of operations.

Occidental and its subsidiaries and their respective operations are subject to numerous laws and regulations relating to public and occupational health, safety and environmental protection, including those governing GHG and other air emissions, water use and discharges, waste management, environmental remediation and protection of wildlife and ecosystems. The requirements of these laws and regulations have become increasingly complex, stringent and expensive to implement. Costs of compliance with these laws and regulations are significant and can be unpredictable. These laws sometimes provide for strict liability for events that pose an impact or threat to public health and safety or to the environment, including for funding or performance of remediation and, in some cases, compensation for alleged personal injury, property damage, natural resource damages, punitive damages, civil penalties, injunctive relief and government oversight costs. Strict liability can render Occidental or its subsidiaries liable for damages without regard to their degree of care or fault. Some environmental laws provide for joint and several strict liability for remediation of spills and releases of hazardous substances or materials, and, as a result, Occidental or its subsidiaries could be liable for the actions of others.

Occidental and its subsidiaries use and generate hazardous substances or materials in their respective operations. In addition, many of their current and former properties are, or have been, used for industrial purposes. Accordingly, Occidental or its subsidiaries have been, and could become, subject to significant liabilities relating to the investigation, assessment and remediation of potentially contaminated properties and to claims alleging personal injury or property damage as a result

of exposures to, or releases of, hazardous substances or materials. For example, as of the date of this filing, Occidental believes its range of reasonably possible additional losses of its subsidiaries for environmental remediation, beyond those amounts currently recorded, at the 158 sites they are currently monitoring with respect to existing conditions from alleged past practices could be up to $1.9 billion on a consolidated basis. For additional discussion of such matters, see Note 12 – Environmental Liabilities and Expenditures and Note 13 - Lawsuits, Claims, Commitments and Contingencies in the Notes to Consolidated Financial Statements in Part II Item 8 of this Form 10-K.

In addition, stricter enforcement, changing interpretations or reversal of existing laws and regulations, the enactment of new laws and regulations, the discovery of previously unknown contamination or the imposition of new or increased requirements could require Occidental or its subsidiaries to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on their respective businesses, financial condition and results of operations.

Occidental may experience delays, cost overruns, losses or other unrealized expectations in development efforts and exploration activities.

Oil, NGL and natural gas exploration and production activities are subject to numerous risks beyond Occidental’s control, including the risk that drilling will not result in commercially viable oil, NGL and natural gas production. In its development and exploration activities, Occidental bears the risks of:

■Equipment failures;

■Construction delays;

■Escalating costs for, competition for, shortages of or delays in services, materials, supplies, equipment or labor;

■Increasing prices as a result of broad inflation;

■Property or border disputes;

■Disappointing drilling results or reservoir performance;

■Title problems and other associated risks that may affect its ability to profitably grow production, replace reserves and achieve its targeted returns;

■Actions by third-party operators of its properties;

■Delays imposed by or resulting from compliance with permits, laws, regulations or litigation and costs of drilling wells on lands subject to complex development terms and circumstances; and

■Oil, NGL and natural gas gathering, transportation and processing availability, restrictions or limitations.

Exploration is inherently risky and is subject to delays, misinterpretation of geologic or engineering data, unexpected geologic conditions or finding reserves of disappointing quality or quantity, which may result in significant losses.

Occidental’s oil and gas business operates in highly competitive environments, which affect, among other things, its ability to source production and replace reserves.

The exploration and production of oil, NGL and natural gas is a highly competitive business. Occidental has many competitors (including national oil companies), some of which: (i) are larger and better funded; (ii) may be willing to accept greater risks; (iii) have greater access to capital; (iv) have substantially larger staffs; or (v) have special competencies. Results of operations, reserves replacement and the level of oil and gas production depend, in part, on Occidental’s ability to profitably acquire additional reserves. Competition for access to reserves may make it more difficult to find attractive investment opportunities or require delay of reserve replacement efforts. Further, during periods of low product prices, any cash conservation efforts may delay production growth and reserve replacement efforts. Also, there is substantial competition for capital available for investment in the oil and natural gas industry. Occidental’s failure to acquire properties, potentially grow production, replace reserves and attract and retain qualified personnel could have a material adverse effect on its cash flows and results of operations. Further, as its competitors use or develop new technologies (including with respect to their generative artificial intelligence capabilities), Occidental may be placed at a competitive disadvantage, and competitive pressures may force it to implement new technologies at a substantial cost.

In addition, Occidental’s acquisition activities carry risks that it may: (i) not fully realize anticipated benefits due to less-than-expected reserves or production or changed circumstances, such as declines in oil, NGL and natural gas prices; (ii) bear unexpected integration costs or experience other integration difficulties; (iii) experience share price declines based on the market’s evaluation of the activity; or (iv) be subject to liabilities that are greater than anticipated.

Occidental’s oil and gas reserve additions may not continue at the same rate and a failure to replace reserves may negatively affect Occidental’s businesses.

Producing oil and natural gas reservoirs generally are characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Unless Occidental conducts successful exploration or development activities, acquires properties containing proved reserves, or both, proved reserves will generally decline and negatively impact Occidental’s businesses. Occidental may not be successful in finding, developing or acquiring additional reserves, and its efforts may not be economic. Its ability to make the necessary capital investment to maintain or expand its asset base of oil and gas reserves would be limited to the extent cash flow from operations is reduced and external sources of capital become limited or unavailable. The value of Occidental’s securities and its ability to raise capital will be adversely

impacted if it is not able to replace reserves that are depleted by production or replace its declining production with new production by successfully allocating annual capital to maintain its reserves and production base. Occidental expects infill development projects, extensions, discoveries and improved recovery to continue as main sources for reserve additions but factors such as geology, government regulations and permits, the effectiveness of development plans and the ability to make the necessary capital investments or acquire capital are partially or fully outside management’s control and could cause results to differ materially from expectations.

Occidental’s oil and gas reserves are estimates based on professional judgments and may be subject to revision.

Reported oil and gas reserves are an estimate based on periodic review of reservoir characteristics and recoverability, including production decline rates, operating performance and economic feasibility at the prescribed weighted average commodity prices, future operating costs and capital expenditures, workover and remedial costs, assumed effects of regulation by government agencies, the quantity, quality and interpretation of relevant data, taxes and availability of funds. The procedures and methods for estimating the reserves by Occidental’s internal engineers were reviewed by independent petroleum consultants. The process of estimating oil and natural gas reserves, however, is complex and requires significant decisions and assumptions in the evaluation of available geological, geophysical, engineering and economic data for each reservoir and is therefore inherently uncertain. Actual production, revenues, expenditures, oil, NGL and natural gas prices and taxes with respect to Occidental’s reserves may vary from estimates and the variance may be material. If Occidental were required to make significant negative reserve revisions, its results of operations and stock price could be adversely affected.

In addition, the discounted cash flows included in this Form 10-K should not be construed as the fair value of the reserves attributable to Occidental’s properties. The estimated discounted future net cash flows from proved reserves are based on an unweighted arithmetic average of the first-day-of-the-month price for each month within the year in accordance with SEC regulations. Actual future prices and costs may differ materially from SEC regulation-compliant prices and costs used for purposes of estimating future discounted net cash flows from proved reserves. Also, actual future net cash flows may differ from these discounted net cash flows due to the amount and timing of actual production, availability of financing for capital expenditures necessary to develop Occidental’s undeveloped reserves, supply and demand for oil, NGL and natural gas, increases or decreases in consumption of oil, NGL and natural gas and changes in government regulations or taxation.

Occidental has previously recorded impairments of its assets and will continue to assess further impairments across its asset portfolio in the future.

Occidental has recorded impairments of its proved and unproved oil and gas properties resulting from prolonged declines in oil and gas prices, changes in development plans or operating costs and negative well results and may record such impairments in the future. Past impairments included pre-tax impairment and related charges to both proved and unproved oil and gas properties and a lower of cost or net realizable value adjustment for crude inventory. If there is an adverse downturn of the macroeconomic conditions and if such downturn is expected to or does persist for a prolonged period of time, Occidental’s assets, including, but not limited to, property, investments, and inventory, may be subject to further testing for impairment, which could result in additional non-cash asset impairments. Such impairments could be material to the financial statements.

Occidental may subject its low-carbon initiatives, including related acquisitions, investments in unconsolidated subsidiaries, property, intangibles, and goodwill, to impairment testing. If Occidental’s subsidiaries are not successful in these development-stage initiatives, including DAC, CCUS and other low-carbon projects, investments and ventures, such impairments could be material to the financial statements.

Future costs associated with reducing emissions and carbon intensity, as well as impacts resulting from other risk factors described herein, could lead to impairments in the future, if such costs significantly increase Occidental’s breakeven economics.

Acquisitions, divestitures and other transactions may cause Occidental’s financial results to differ from the Company’s expectations or the expectations of the investment community, Occidental may not achieve the anticipated benefits of such transactions, and such transactions may disrupt the Company’s current plans or operations.

The success of acquisitions, divestitures and other transactions will depend, in part, on Occidental’s ability to successfully complete and realize the anticipated benefits of such transactions. In the case of acquisitions, including the CrownRock Acquisition, difficulties in integrating businesses and/or employees may result in the failure to realize anticipated results, benefits, and synergies in the expected timeframes, in operational challenges, and in the diversion of management’s attention from ongoing business concerns, as well as in unforeseen expenses associated with the acquisitions, which may have an adverse impact on Occidental’s financial results.

One of Occidental’s subsidiaries acts as the general partner of WES, a publicly traded master limited partnership, which may involve potential legal liability.

One of Occidental’s subsidiaries acts as the general partner of WES, a publicly traded master limited partnership. Its

general partner interest in WES may increase the possibility that it could be subject to claims of breach of duties owed to WES, including claims of conflict of interest. Any such claims could increase Occidental’s costs and any liability resulting from such claims could have a material adverse effect on Occidental’s financial condition, operating results or cash flows.

Occidental is exposed to cyber-related risks.

The oil and gas industry is increasingly dependent on information technology (IT) and industrial control systems (ICS) to conduct certain exploration, development and production activities. Occidental relies on digital and industrial control systems, related infrastructure, technologies and networks to run its businesses and to control and manage its oil and gas, chemical, marketing and pipeline operations. Use of the internet, cloud services, mobile communication systems and other public networks exposes Occidental’s businesses to the risk of cyber attacks, which have escalated in recent years and which include, but are not limited to:

■Unauthorized access to, or control or disclosure of, sensitive information about Occidental’s businesses and its employees;

■Compromise of Occidental’s data or systems, including corruption, sabotage, encryption or acts that otherwise render its data or systems unusable (or those of third parties with whom Occidental does business, including third-party cloud and IT service providers);

■Theft or manipulation of Occidental’s proprietary information;

■Ransom;

■Extortion;

■Threats to the security of Occidental’s facilities and infrastructure; and

■Cyber terrorism.

In addition, Occidental has exposure to cybersecurity risks where its data and proprietary information are collected, hosted, and/or processed by third-party cloud and service providers. Occidental’s risks may be exacerbated by a delay or failure to detect a cybersecurity incident or understand the full extent of such incident notwithstanding its risk management processes and controls. Occidental faces risks associated with new and ever-increasing phishing technologies and hidden malware as well as risks associated with electronic data proliferation and technology digitization. Occidental also faces increased risk with the growing sophistication of generative artificial intelligence capabilities, which may improve or expand the existing capabilities of cybercriminals described above in a manner Occidental cannot predict at this time.

Information and industrial control technology system failures, network disruptions and breaches of data security could disrupt Occidental’s operations by causing delays, impeding processing of transactions and reporting financial results, or leading to the unintentional disclosure of Company, partner, customer or employee information that could damage its reputation. A cyber attack on Occidental’s information or industrial control systems and related infrastructure, or those of its business associates, suppliers, contractors, joint venture partners or third-party service providers, could negatively impact Occidental’s operations in a variety of ways, including, but not limited to:

■Adversely impacting Occidental’s ability to compete for oil and natural gas resources;

■Resulting in delays and failure to reach the intended target or cause a drilling incident;

■Resulting in a loss of production or accidental discharge;

■Resulting in a disruption of the manufacturing and marketing of its products or a potential HSE hazard;

■Resulting in supply chain disruptions, which could delay or halt Occidental’s construction and development projects;

■Delaying or preventing Occidental from producing, transporting, processing and marketing its production;

■Slowing or halting commodities trading, thus preventing Occidental from marketing its production or engaging in hedging activities;

■Adversely impacting the natural gas market;

■Causing operational disruption;

■Resulting in events of non-compliance which could then lead to regulatory fines or other penalties and legal liability; and

■Damaging Occidental’s reputation, subjecting it to potential financial or legal liability, regulatory fines and penalties and requiring it to incur significant costs, including compliance costs and costs to repair or restore its systems and data or to take other remedial steps.

While Occidental has experienced cyber attacks in the past, it has not suffered any material losses. However, the cyber risk landscape changes over time due to a variety of internal and external factors, including during political tensions, war or other military conflict or civil unrest. There can be no assurance that Occidental’s cybersecurity measures, or the efforts of its partners, will be sufficient to prevent or identify cybersecurity incidents. Although Occidental has implemented controls and multiple layers of security that it believes are reasonable to mitigate the risks of a cybersecurity incident, there can be no assurance that Occidental’s response will be successful or effectively address an incident on a timely basis.

Moreover, laws and regulations governing cybersecurity and data privacy and the unauthorized disclosure of confidential or protected information pose increasingly complex compliance challenges and potential costs, and any failure

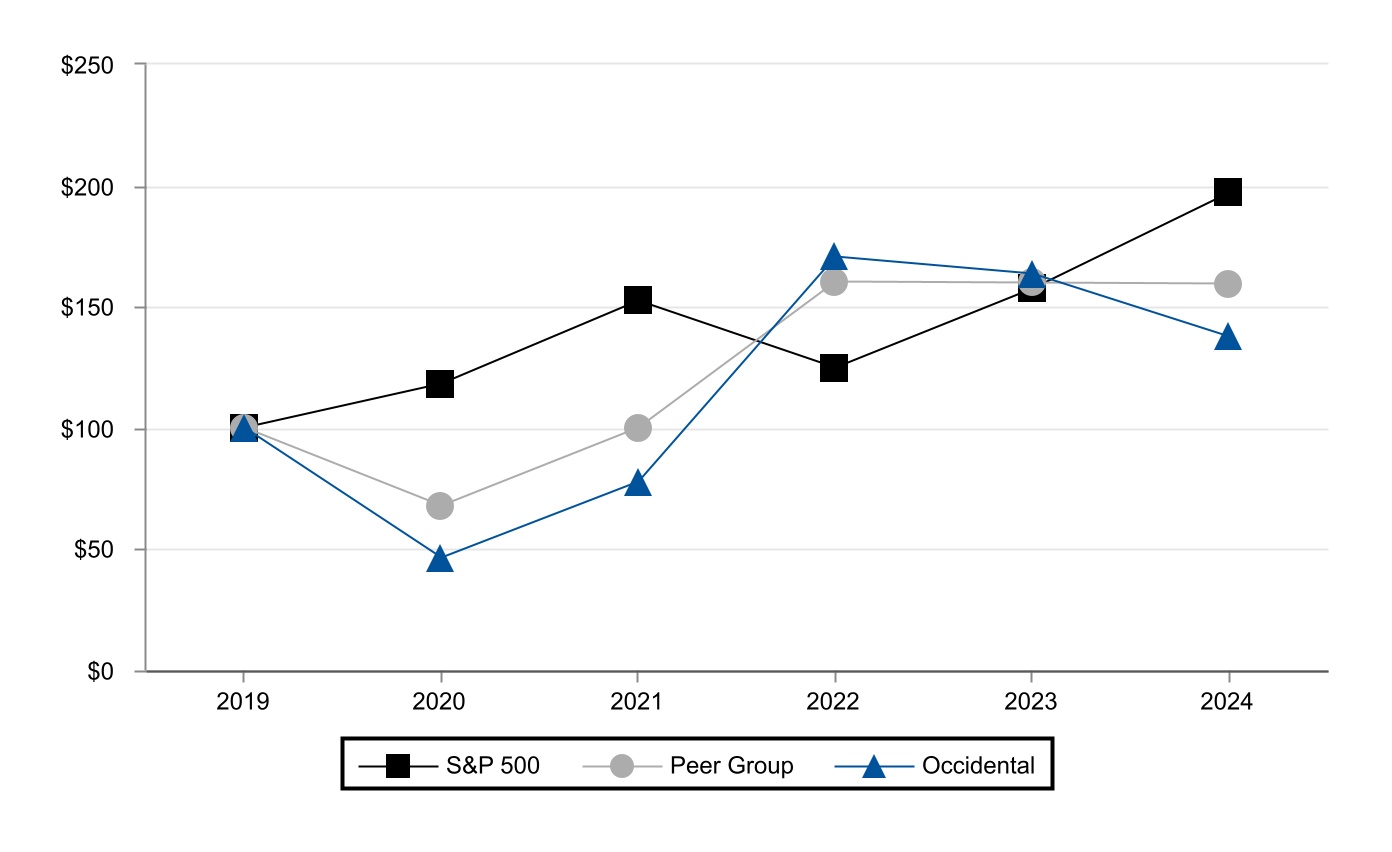

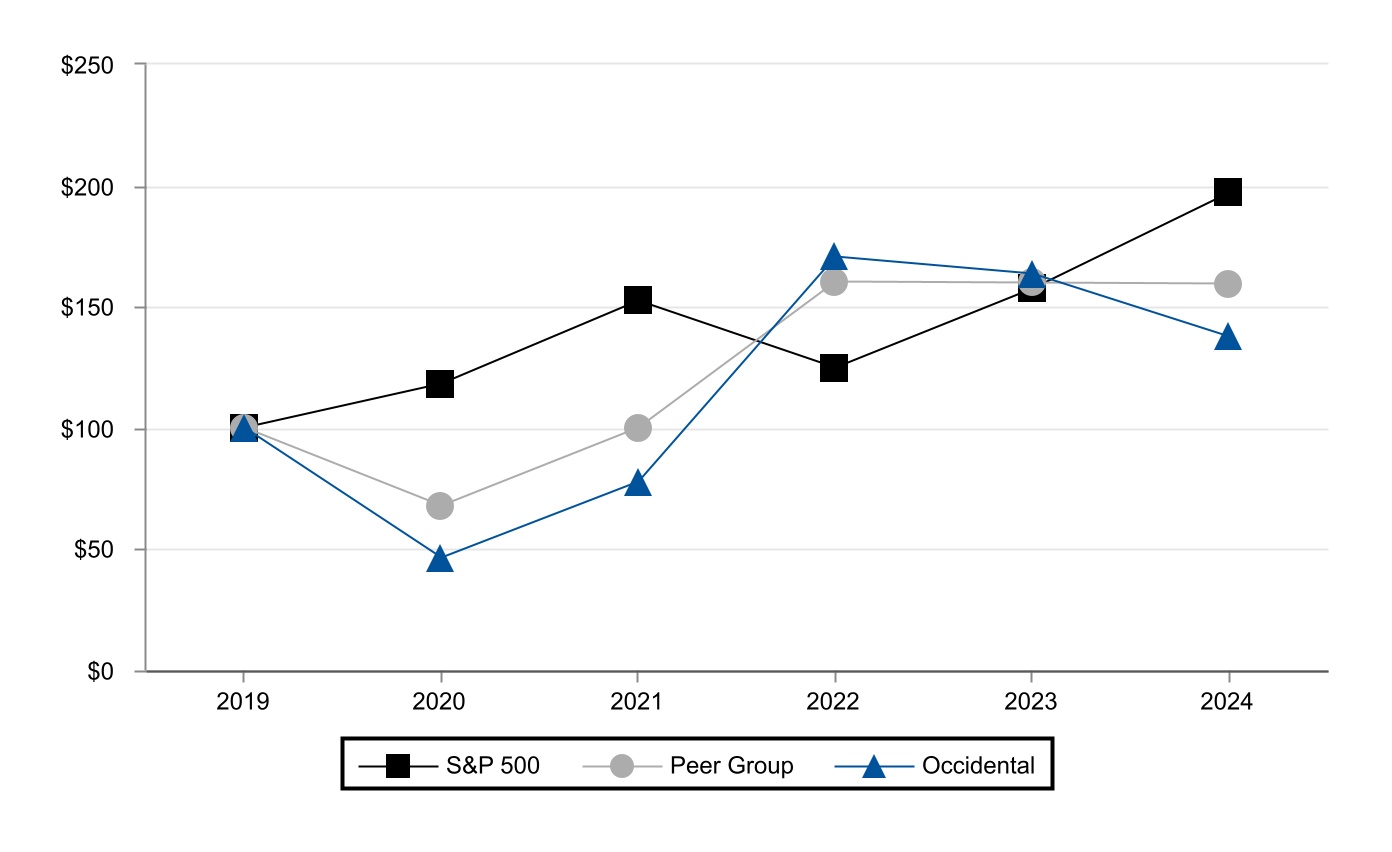

to comply with these data privacy requirements or other applicable laws and regulations in this area could lead to a loss of sensitive information and result in significant regulatory or other penalties and legal liability.