Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from_____to_____

Commission | | Registrant; State of Incorporation; | | IRS Employer |

File Number | | Address; and Telephone Number | | Identification No. |

1-9513 | | CMS ENERGY CORPORATION | | 38-2726431 |

| | (A Michigan Corporation) | | |

| | One Energy Plaza, Jackson, Michigan 49201 | | |

| | (517) 788-0550 | | |

| | | | |

1-5611 | | CONSUMERS ENERGY COMPANY | | 38-0442310 |

| | (A Michigan Corporation) | | |

| | One Energy Plaza, Jackson, Michigan 49201 | | |

| | (517) 788-0550 | | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | Name of Each Exchange |

Registrant | | Title of Class | | on Which Registered |

CMS Energy Corporation | | Common Stock, $0.01 par value | | New York Stock Exchange |

Consumers Energy Company | | Cumulative Preferred Stock, $100 par value: $4.50 Series | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

CMS Energy Corporation: Yes x No o | Consumers Energy Company: Yes x No o |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

CMS Energy Corporation: Yes o No x | | Consumers Energy Company: Yes o No x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

CMS Energy Corporation: Yes x No o | Consumers Energy Company: Yes x No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

CMS Energy Corporation: Yes x No o | Consumers Energy Company: Yes x No o |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

CMS Energy Corporation: Large accelerated filer x Non-Accelerated filer o (Do not check if a smaller reporting company) | Accelerated filer o Smaller reporting company o |

| |

Consumers Energy Company: Large accelerated filer o Non-Accelerated filer x (Do not check if a smaller reporting company) | Accelerated filer o Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

CMS Energy Corporation: Yes o No x | Consumers Energy Company: Yes o No x |

The aggregate market value of CMS Energy voting and non-voting common equity held by non-affiliates was $8.736 billion for the 274,372,316 CMS Energy Common Stock shares outstanding on June 30, 2015 based on the closing sale price of $31.84 for CMS Energy Common Stock, as reported by the New York Stock Exchange on such date. There were no shares of Consumers common equity held by non-affiliates as of June 30, 2015.

There were 277,970,146 shares of CMS Energy Common Stock outstanding on January 13, 2016, including 803,551 shares owned by Consumers Energy Company. On January 13, 2016, CMS Energy held all 84,108,789 outstanding shares of common equity of Consumers.

Documents incorporated by reference in Part III: CMS Energy’s proxy statement and Consumers’ information statement relating to the 2016 Annual Meeting of Shareholders to be held May 6, 2016.

Table of Contents

CMS Energy Corporation

Consumers Energy Company

Annual Reports on Form 10-K to the Securities and Exchange Commission for the Year Ended December 31, 2015

TABLE OF CONTENTS

1

Table of Contents

GLOSSARY

Certain terms used in the text and financial statements are defined below.

2008 Energy Law

Comprehensive energy reform package enacted in Michigan in 2008

ABATE

Association of Businesses Advocating Tariff Equity

ABO

Accumulated benefit obligation; the liabilities of a pension plan based on service and pay to date, which differs from the PBO in that it does not reflect expected future salary increases

AFUDC

Allowance for borrowed and equity funds used during construction

AOCI

Accumulated other comprehensive income (loss)

ARO

Asset retirement obligation

ASU

Financial Accounting Standards Board Accounting Standards Update

Bay Harbor

A residential/commercial real estate area located near Petoskey, Michigan, in which CMS Energy sold its interest in 2002

bcf

Billion cubic feet

Btu

British thermal unit

Cantera Gas Company

Cantera Gas Company LLC, a non-affiliated company, formerly known as CMS Field Services

Cantera Natural Gas, Inc.

Cantera Natural Gas, Inc., a non-affiliated company that purchased CMS Field Services

CAO

Chief Accounting Officer

Cash Balance Pension Plan

Cash balance pension plan of CMS Energy and Consumers

CCR

Coal combustion residual

CEO

Chief Executive Officer

3

Table of Contents

CERCLA

Comprehensive Environmental Response, Compensation, and Liability Act of 1980

CFO

Chief Financial Officer

city-gate contract

An arrangement made for the point at which a local distribution company physically receives gas from a supplier or pipeline

Clean Air Act

Federal Clean Air Act of 1963, as amended

Clean Water Act

Federal Water Pollution Control Act of 1972, as amended

CMS Capital

CMS Capital, L.L.C., a wholly owned subsidiary of CMS Energy

CMS Energy

CMS Energy Corporation and its consolidated subsidiaries, unless otherwise noted; the parent of Consumers and CMS Enterprises

CMS Enterprises

CMS Enterprises Company, a wholly owned subsidiary of CMS Energy

CMS ERM

CMS Energy Resource Management Company, formerly known as CMS MST, a wholly owned subsidiary of CMS Enterprises

CMS Field Services

CMS Field Services, Inc., a former wholly owned subsidiary of CMS Gas Transmission

CMS Gas Transmission

CMS Gas Transmission Company, a wholly owned subsidiary of CMS Enterprises

CMS Land

CMS Land Company, a wholly owned subsidiary of CMS Capital

CMS MST

CMS Marketing, Services and Trading Company, a wholly owned subsidiary of CMS Enterprises, whose name was changed to CMS ERM in 2004

Consumers

Consumers Energy Company and its consolidated subsidiaries, unless otherwise noted; a wholly owned subsidiary of CMS Energy

Consumers 2014 Securitization Funding

Consumers 2014 Securitization Funding LLC, a wholly owned consolidated bankruptcy-remote subsidiary of Consumers and special-purpose entity organized for the sole purpose of purchasing and owning Securitization property, issuing Securitization bonds, and pledging its interest in Securitization property to a trustee to collateralize the Securitization bonds

4

Table of Contents

CSAPR

The Cross-State Air Pollution Rule

DB Pension Plan

Defined benefit pension plan of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries

DB SERP

Defined Benefit Supplemental Executive Retirement Plan

DCCP

Defined Company Contribution Plan

DC SERP

Defined Contribution Supplemental Executive Retirement Plan

DIG

Dearborn Industrial Generation, L.L.C., a wholly owned subsidiary of Dearborn Industrial Energy, L.L.C., a wholly owned subsidiary of CMS Energy

Dodd-Frank Act

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

DOE

U.S. Department of Energy

DTE Electric

DTE Electric Company, a non-affiliated company

DTE Gas

DTE Gas Company, a non-affiliated company

DTIA

Distribution-Transmission Interconnection Agreement dated April 1, 2001 between METC and Consumers, as amended

EBITDA

Earnings before interest, taxes, depreciation, and amortization

EnerBank

EnerBank USA, a wholly owned subsidiary of CMS Capital

Entergy

Entergy Corporation, a non-affiliated company

EPA

U.S. Environmental Protection Agency

EPS

Earnings per share

Exchange Act

Securities Exchange Act of 1934

5

Table of Contents

FDIC

Federal Deposit Insurance Corporation

FERC

The Federal Energy Regulatory Commission

First Mortgage Bond Indenture

The indenture dated as of September 1, 1945 between Consumers and The Bank of New York Mellon, as Trustee, as amended and supplemented

FLI Liquidating Trust

Trust formed in Missouri bankruptcy court to accomplish the liquidation of Farmland Industries, Inc., a non-affiliated entity

FMB

First mortgage bond

FTR

Financial transmission right

GAAP

U.S. Generally Accepted Accounting Principles

GCC

Gas Customer Choice, which allows gas customers to purchase gas from alternative suppliers

GCR

Gas cost recovery

Genesee

Genesee Power Station Limited Partnership, a variable interest entity in which HYDRA-CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises, has a 50 percent interest

Grayling

Grayling Generating Station Limited Partnership, a variable interest entity in which HYDRA-CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises, has a 50 percent interest

GWh

Gigawatt-hour, a unit of energy equal to one billion watt-hours

Health Care Acts

Comprehensive health care reform enacted in 2010, comprising the Patient Protection and Affordable Care Act and the related Health Care and Education Reconciliation Act

IRS

Internal Revenue Service

kilovolts

Thousand volts, a unit used to measure the difference in electrical pressure along a current

kVA

Thousand volt-amperes, a unit used to reflect the electrical power capacity rating of equipment or a system

6

Table of Contents

kWh

Kilowatt-hour, a unit of energy equal to one thousand watt-hours

LIBOR

The London Interbank Offered Rate

Ludington

Ludington pumped-storage plant, jointly owned by Consumers and DTE Electric

MATS

Mercury and Air Toxics Standards, which limit mercury, acid gases, and other toxic pollution from coal-fueled and oil-fueled power plants

MBT

Michigan Business Tax

mcf

Thousand cubic feet

MCIT

Michigan Corporate Income Tax

MCV Facility

A 1,647 MW natural gas-fueled, combined-cycle cogeneration facility operated by the MCV Partnership

MCV Partnership

Midland Cogeneration Venture Limited Partnership

MCV PPA

PPA between Consumers and the MCV Partnership

MD&A

Management’s Discussion and Analysis of Financial Condition and Results of Operations

MDEQ

Michigan Department of Environmental Quality

METC

Michigan Electric Transmission Company, LLC, a non-affiliated company

MGP

Manufactured gas plant

Michigan Mercury Rule

Michigan Air Pollution Control Rules, Part 15, Emission Limitations and Prohibitions – Mercury, addressing mercury emissions from coal-fueled electric generating units

MISO

Midcontinent Independent System Operator, Inc.

7

Table of Contents

mothball

To place a generating unit into a state of extended reserve shutdown in which the unit is inactive and unavailable for service for a specified period, during which the unit can be brought back into service after receiving appropriate notification and completing any necessary maintenance or other work; generation owners in MISO must request approval to mothball a unit, and MISO then evaluates the request for reliability impacts

MPSC

Michigan Public Service Commission

MRV

Market-related value of plan assets

MW

Megawatt, a unit of power equal to one million watts

MWh

Megawatt-hour, a unit of energy equal to one million watt-hours

NAAQS

National Ambient Air Quality Standards

NAV

Net asset value

NERC

The North American Electric Reliability Corporation, a non-affiliated company responsible for developing and enforcing reliability standards, monitoring the bulk power system, and educating and certifying industry personnel

NPDES

National Pollutant Discharge Elimination System, a permit system for regulating point sources of pollution under the Clean Water Act

NREPA

Part 201 of the Michigan Natural Resources and Environmental Protection Act, a statute that covers environmental activities including remediation

NSR

New Source Review, a construction-permitting program under the Clean Air Act

OPEB

Other Post-Employment Benefits

OPEB Plan

Postretirement health care and life insurance plans of CMS Energy and Consumers, including certain present and former affiliates and subsidiaries

Palisades

Palisades nuclear power plant, sold by Consumers to Entergy in 2007

PBO

Projected benefit obligation

8

Table of Contents

PCB

Polychlorinated biphenyl

PISP

Performance Incentive Stock Plan

PPA

Power purchase agreement

PSCR

Power supply cost recovery

REC

Renewable energy credit established under the 2008 Energy Law

ReliabilityFirst Corporation

ReliabilityFirst Corporation, a non-affiliated company responsible for the preservation and enhancement of bulk power system reliability and security

Resource Conservation and Recovery Act

Federal Resource Conservation and Recovery Act of 1976

RMRR

Routine maintenance, repair, and replacement

ROA

Retail Open Access, which allows electric generation customers to choose alternative electric suppliers pursuant to a Michigan statute enacted in 2000

S&P

Standard & Poor’s Financial Services LLC

SEC

U.S. Securities and Exchange Commission

Securitization

A financing method authorized by statute and approved by the MPSC which allows a utility to sell its right to receive a portion of the rate payments received from its customers for the repayment of securitization bonds issued by a special-purpose entity affiliated with such utility

Sherman Act

Sherman Antitrust Act of 1890

Smart Energy

Consumers’ Smart Energy grid modernization project, which includes the installation of smart meters that transmit and receive data, a two-way communications network, and modifications to Consumers’ existing information technology system to manage the data and enable changes to key business processes

T.E.S. Filer City

T.E.S. Filer City Station Limited Partnership, a variable interest entity in which HYDRA-CO Enterprises, Inc., a wholly owned subsidiary of CMS Enterprises, has a 50 percent interest

9

Table of Contents

USW

United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, AFL-CIO-CLC

UWUA

Utility Workers Union of America, AFL-CIO

VEBA trust

Voluntary employees’ beneficiary association trusts accounts established specifically to set aside employer-contributed assets to pay for future expenses of the OPEB Plan

10

Table of Contents

FILING FORMAT

This combined Form 10-K is separately filed by CMS Energy and Consumers. Information in this combined Form 10-K relating to each individual registrant is filed by such registrant on its own behalf. Consumers makes no representation regarding information relating to any other companies affiliated with CMS Energy other than its own subsidiaries. None of CMS Energy, CMS Enterprises, nor any of CMS Energy’s other subsidiaries (other than Consumers) has any obligation in respect of Consumers’ debt securities and holders of such debt securities should not consider the financial resources or results of operations of CMS Energy, CMS Enterprises, nor any of CMS Energy’s other subsidiaries (other than Consumers and its own subsidiaries (in relevant circumstances)) in making a decision with respect to Consumers’ debt securities. Similarly, neither Consumers nor any other subsidiary of CMS Energy has any obligation in respect of debt securities of CMS Energy.

FORWARD-LOOKING STATEMENTS AND INFORMATION

This Form 10-K and other CMS Energy and Consumers disclosures may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. The use of “might,” “may,” “could,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “forecasts,” “predicts,” “assumes,” and other similar words is intended to identify forward-looking statements that involve risk and uncertainty. This discussion of potential risks and uncertainties is designed to highlight important factors that may impact CMS Energy’s and Consumers’ businesses and financial outlook. CMS Energy and Consumers have no obligation to update or revise forward-looking statements regardless of whether new information, future events, or any other factors affect the information contained in the statements. These forward-looking statements are subject to various factors that could cause CMS Energy’s and Consumers’ actual results to differ materially from the results anticipated in these statements. These factors include, but are not limited to, the following, all of which are potentially significant:

· the impact of new regulation by the MPSC, FERC, and other applicable governmental proceedings and regulations, including any associated impact on electric or gas rates or rate structures

· potentially adverse regulatory treatment or failure to receive timely regulatory orders affecting Consumers that are or could come before the MPSC, FERC, or other governmental authorities

· changes in the performance of or regulations applicable to MISO, METC, pipelines, railroads, vessels, or other service providers that CMS Energy, Consumers, or any of their affiliates rely on to serve their customers

· the adoption of federal or state laws or regulations or changes in applicable laws, rules, regulations, principles, or practices, or in their interpretation, such as those related to energy policy and ROA, gas pipeline safety, gas pipeline capacity, energy efficiency, the environment, regulation or deregulation, reliability, health care reforms (including the Health Care Acts), taxes, accounting matters, climate change, air emissions, renewable energy, potential effects of the Dodd-Frank Act, and other business issues that could have an impact on CMS Energy’s, Consumers’, or any of their affiliates’ businesses or financial results

· potentially adverse regulatory or legal interpretations or decisions regarding environmental matters, or delayed regulatory treatment or permitting decisions that are or could come before the MDEQ, EPA, and/or U.S. Army Corps of Engineers, and potential environmental remediation costs associated with these interpretations or decisions, including those that may affect Bay Harbor or Consumers’ RMRR classification under NSR regulations

11

Table of Contents

· changes in energy markets, including availability and price of electric capacity and the timing and extent of changes in commodity prices and availability and deliverability of coal, natural gas, natural gas liquids, electricity, oil, and certain related products

· the price of CMS Energy common stock, the credit ratings of CMS Energy and Consumers, capital and financial market conditions, and the effect of these market conditions on CMS Energy’s and Consumers’ interest costs and access to the capital markets, including availability of financing to CMS Energy, Consumers, or any of their affiliates

· the investment performance of the assets of CMS Energy’s and Consumers’ pension and benefit plans, the discount rates used in calculating the plans’ obligations, and the resulting impact on future funding requirements

· the impact of the economy, particularly in Michigan, and potential future volatility in the financial and credit markets on CMS Energy’s, Consumers’, or any of their affiliates’ revenues, ability to collect accounts receivable from customers, or cost and availability of capital

· changes in the economic and financial viability of CMS Energy’s and Consumers’ suppliers, customers, and other counterparties and the continued ability of these third parties, including those in bankruptcy, to meet their obligations to CMS Energy and Consumers

· population changes in the geographic areas where CMS Energy and Consumers conduct business

· national, regional, and local economic, competitive, and regulatory policies, conditions, and developments

· loss of customer demand for electric generation supply to alternative energy suppliers, increased use of distributed generation, or energy efficiency

· federal regulation of electric sales and transmission of electricity, including periodic re-examination by federal regulators of CMS Energy’s and Consumers’ market-based sales authorizations

· the impact of credit markets, economic conditions, and any new banking regulations on EnerBank

· the availability, cost, coverage, and terms of insurance, the stability of insurance providers, and the ability of Consumers to recover the costs of any insurance from customers

· the effectiveness of CMS Energy’s and Consumers’ risk management policies, procedures, and strategies, including strategies to hedge risk related to future prices of electricity, natural gas, and other energy-related commodities

· factors affecting development of electric generation projects and gas and electric transmission and distribution infrastructure replacement, conversion, and expansion projects, including factors related to project site identification, construction material pricing, schedule delays, availability of qualified construction personnel, permitting, and government approvals

· factors affecting operations, such as costs and availability of personnel, equipment, and materials, unusual weather conditions, natural disasters, catastrophic weather-related damage, scheduled or unscheduled equipment outages, maintenance or repairs, environmental incidents, equipment failures, and electric transmission and distribution or gas pipeline system constraints

12

Table of Contents

· potential disruption to, interruption of, or other impacts on facilities, utility infrastructure, or operations due to accidents, explosions, physical disasters, cyber incidents, vandalism, war, or terrorism, and the ability to obtain or maintain insurance coverage for these events

· changes or disruption in fuel supply, including but not limited to supplier bankruptcy and delivery disruptions

· potential costs, lost revenues, or other consequences resulting from misappropriation of assets or sensitive information, corruption of data, or operational disruption in connection with a cyber attack or other cyber incident

· technological developments in energy production, storage, delivery, usage, and metering

· the ability to implement technology, including Smart Energy, successfully

· the impact of CMS Energy’s and Consumers’ integrated business software system and its effects on their operations, including utility customer billing and collections

· adverse consequences resulting from any past, present, or future assertion of indemnity or warranty claims associated with assets and businesses previously owned by CMS Energy or Consumers, including claims resulting from attempts by foreign or domestic governments to assess taxes on or to impose environmental liability associated with past operations or transactions

· the outcome, cost, and other effects of any legal or administrative claims, proceedings, investigations, or settlements

· the reputational impact on CMS Energy and Consumers of operational incidents, violations of corporate policies, regulatory violations, inappropriate use of social media, and other events

· restrictions imposed by various financing arrangements and regulatory requirements on the ability of Consumers and other subsidiaries of CMS Energy to transfer funds to CMS Energy in the form of cash dividends, loans, or advances

· earnings volatility resulting from the application of fair value accounting to certain energy commodity contracts or interest rate contracts

· changes in financial or regulatory accounting principles or policies

· other matters that may be disclosed from time to time in CMS Energy’s and Consumers’ SEC filings, or in other public documents

All forward-looking statements should be considered in the context of the risk and other factors described above and as detailed from time to time in CMS Energy’s and Consumers’ SEC filings. For additional details regarding these and other uncertainties, see Item 1A. Risk Factors; Item 8. Financial Statements and Supplementary Data—MD&A—Outlook; and Item 8. Financial Statements and Supplementary Data—Notes to the Consolidated Financial Statements—Note 3, Regulatory Matters and Note 4, Contingencies and Commitments.

13

Table of Contents

Part I

Item 1. Business

GENERAL

CMS Energy

CMS Energy was formed as a corporation in Michigan in 1987 and is an energy company operating primarily in Michigan. It is the parent holding company of several subsidiaries, including Consumers, an electric and gas utility, and CMS Enterprises, primarily a domestic independent power producer. Consumers serves individuals and businesses operating in the alternative energy, automotive, chemical, metal, and food products industries, as well as a diversified group of other industries. CMS Enterprises, through its subsidiaries and equity investments, is engaged primarily in independent power production and owns power generation facilities fueled mostly by natural gas and biomass.

CMS Energy manages its businesses by the nature of services each provides, and operates principally in three business segments: electric utility, gas utility, and enterprises, its non-utility operations and investments. Consumers’ consolidated operations account for the substantial majority of CMS Energy’s total assets, income, and operating revenue. CMS Energy’s consolidated operating revenue was $6.5 billion in 2015, $7.2 billion in 2014, and $6.6 billion in 2013.

For further information about operating revenue, income, and assets and liabilities attributable to all of CMS Energy’s business segments and operations, see Item 8. Financial Statements and Supplementary Data—CMS Energy’s Selected Financial Information, Consolidated Financial Statements, and Notes to the Consolidated Financial Statements.

Consumers

Consumers has served Michigan customers since 1886. Consumers was incorporated in Maine in 1910 and became a Michigan corporation in 1968. Consumers owns and operates electric generation, transmission, and distribution facilities and gas transmission, storage, and distribution facilities. It provides electricity and/or natural gas to 6.7 million of Michigan’s 10 million residents. Consumers’ rates and certain other aspects of its business are subject to the jurisdiction of the MPSC and FERC, as well as to NERC reliability standards, as described in “CMS Energy and Consumers Regulation” in this Item 1.

Consumers’ consolidated operating revenue was $6.2 billion in 2015, $6.8 billion in 2014, and $6.3 billion in 2013. For further information about operating revenue, income, and assets and liabilities attributable to Consumers’ electric and gas utility operations, see Item 8. Financial Statements and Supplementary Data—Consumers’ Selected Financial Information, Consolidated Financial Statements, and Notes to the Consolidated Financial Statements.

Consumers owns its principal properties in fee, except that most electric lines and gas mains are located below or adjacent to public roads or on land owned by others and are accessed by Consumers through easements and other rights. Almost all of Consumers’ properties are subject to the lien of its First Mortgage Bond Indenture. For additional information on Consumers’ properties, see Item 1. Business—Business Segments—Consumers Electric Utility—Electric Utility Properties and Consumers Gas Utility—Gas Utility Properties.

14

Table of Contents

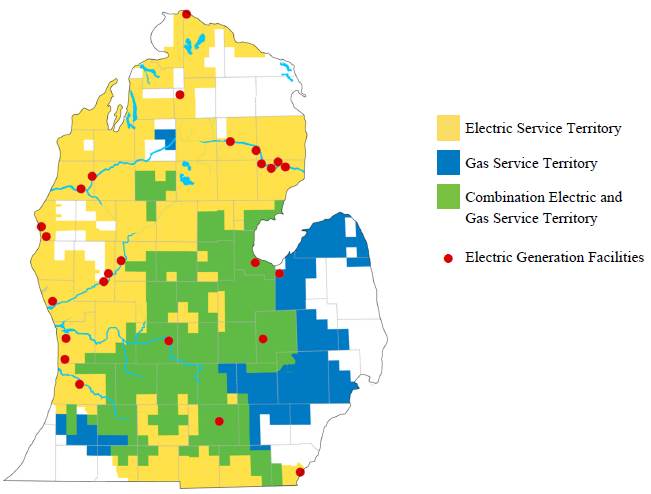

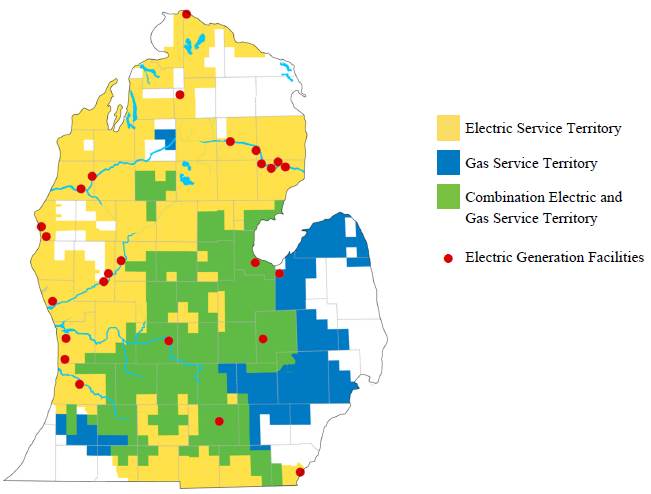

In 2015, Consumers served 1.8 million electric customers and 1.7 million gas customers in Michigan’s Lower Peninsula. Presented in the following map are Consumers’ service territories:

BUSINESS SEGMENTS

Consumers Electric Utility

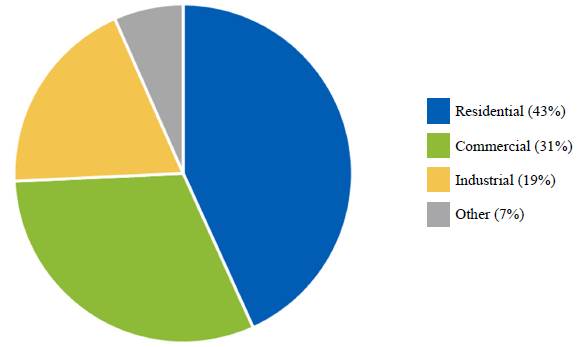

Electric Utility Operations: Consumers’ electric utility operations, which include the generation, purchase, transmission, distribution, and sale of electricity, generated operating revenue of $4.2 billion in 2015, $4.4 billion in 2014, and $4.2 billion in 2013. Consumers’ electric utility customer base consists of a mix of primarily residential, commercial, and diversified industrial customers in Michigan’s Lower Peninsula.

15

Table of Contents

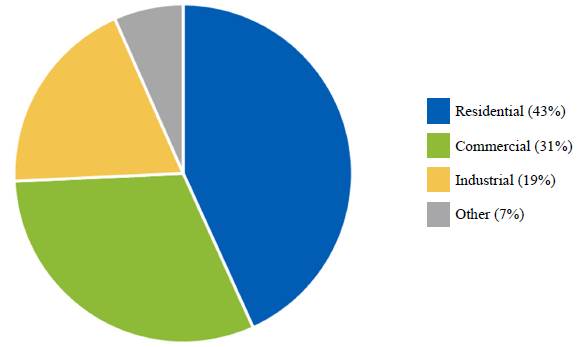

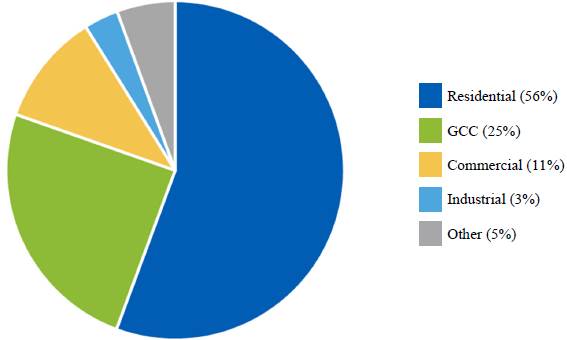

Presented in the following illustration is Consumers’ 2015 electric utility operating revenue of $4.2 billion by customer class:

Consumers’ electric utility operations are not dependent on a single customer, or even a few customers, and the loss of any one or even a few of Consumers’ largest customers is not reasonably likely to have a material adverse effect on Consumers’ financial condition.

In 2015, Consumers’ electric deliveries were 37 billion kWh, which included ROA deliveries of four billion kWh, resulting in net bundled sales of 33 billion kWh. In 2014, Consumers’ electric deliveries were 38 billion kWh, which included ROA deliveries of four billion kWh, resulting in net bundled sales of 34 billion kWh.

Consumers’ electric utility operations are seasonal. The consumption of electric energy typically increases in the summer months, due primarily to the use of air conditioners and other cooling equipment.

16

Table of Contents

Presented in the following illustration are Consumers’ monthly weather-adjusted electric deliveries (deliveries adjusted to reflect normal weather conditions) to its customers, including ROA deliveries, during 2015 and 2014:

Consumers’ 2015 summer peak demand was 7,812 MW, which included ROA demand of 581 MW. For the 2014-2015 winter period, Consumers’ peak demand was 6,067 MW, which included ROA demand of 492 MW. As required by MISO reserve margin requirements, Consumers owns or controls, through long-term PPAs and short-term capacity purchases, essentially all of the capacity required to supply its projected firm peak load and necessary reserve margin for summer 2016.

Electric Utility Properties: Consumers’ distribution system consists of:

· 434 miles of high-voltage distribution radial lines operating at 120 kilovolts or above

· 4,251 miles of high-voltage distribution overhead lines operating at 46 kilovolts and 69 kilovolts

· 18 miles of high-voltage distribution underground lines operating at 46 kilovolts

· 56,023 miles of electric distribution overhead lines

· 10,383 miles of underground distribution lines

· substations with an aggregate transformer capacity of 24 million kVA

Consumers is interconnected to the interstate high-voltage electric transmission system owned by METC and operated by MISO. Consumers is also interconnected to neighboring utilities and to other transmission systems.

17

Table of Contents

Presented in the following table are details about Consumers’ electric generating system at December 31, 2015:

| | Number of Units and | | 2015

Generation Capacity | 1 | 2015 Net Generation | |

Name and Location (Michigan) | | Year Entered Service | | (MW) | | (GWh) | |

Coal generation | | | | | | | |

J.H. Campbell 1 & 2 – West Olive | | 2 Units, 1962-1967 | | 603 | | 3,182 | |

J.H. Campbell 3 – West Olive2 | | 1 Unit, 1980 | | 751 | | 5,132 | |

B.C. Cobb 4 & 5 – Muskegon3 | | 2 Units, 1956-1957 | | 280 | | 1,825 | |

D.E. Karn 1 & 2 – Essexville | | 2 Units, 1959-1961 | | 515 | | 1,990 | |

J.C. Weadock 7 & 8 – Essexville3 | | 2 Units, 1955-1958 | | 303 | | 1,934 | |

J.R. Whiting 1-3 – Erie3 | | 3 Units, 1952-1953 | | 319 | | 1,770 | |

Total coal generation | | | | 2,771 | | 15,833 | |

Oil/Gas steam generation | | | | | | | |

Jackson – Jackson4 | | 1 Unit, 2002 | | - | | 130 | |

D.E. Karn 3 & 4 – Essexville5 | | 2 Units, 1975-1977 | | 1,155 | | 1 | |

Zeeland (combined cycle) – Zeeland | | 3 Units, 2002 | | 527 | | 3,258 | |

Total oil/gas steam generation | | | | 1,682 | | 3,389 | |

Hydroelectric | | | | | | | |

Ludington – Ludington | | 6 Units, 1973 | | 992 | 6 | (186 | )7 |

Conventional hydro generation – various locations | | 35 Units, 1906-1949 | | 77 | | 427 | |

Total hydroelectric | | | | 1,069 | | 241 | |

Gas/Oil combustion turbine | | | | | | | |

Zeeland (simple cycle) – Zeeland | | 2 Units, 2001 | | 316 | | 212 | |

Various plants – various locations8 | | 8 Units, 1966-1971 | | 13 | | - | |

Total gas/oil combustion turbine | | | | 329 | | 212 | |

Wind generation | | | | | | | |

Cross Winds® Energy Park – Tuscola County | | 62 Turbines, 2014 | | 16 | | 365 | |

Lake Winds® Energy Park – Mason County | | 56 Turbines, 2012 | | 18 | | 264 | |

Total wind generation | | | | 34 | | 629 | |

Total owned generation | | | | 5,885 | | 20,304 | |

Purchased and interchange power9 | | | | 2,877 | 10 | 15,210 | 11 |

Total supply | | | | 8,762 | | 35,514 | |

Generation and transmission use/loss | | | | | | 2,171 | |

Total net bundled sales | | | | | | 33,343 | |

1 Represents each plant’s electric generation capacity during the summer months.

2 Represents Consumers’ share of the capacity of the J.H. Campbell 3 unit, net of the 6.69-percent ownership interest of the Michigan Public Power Agency and Wolverine Power Supply Cooperative, Inc.

3 Consumers plans to retire these seven smaller coal-fueled generating units by April 2016.

4 Consumers completed the purchase of this plant in December 2015.

5 These units were mothballed in October 2014 and returned to service in June 2015.

6 Represents Consumers’ 51-percent share of the capacity of Ludington. DTE Electric holds the remaining 49-percent ownership interest.

7 Represents Consumers’ share of net pumped-storage generation. The pumped-storage facility consumes electricity to pump water during off-peak hours for storage in order to generate electricity later during peak-demand hours.

18

Table of Contents

8 Includes units that were mothballed beginning on various dates between October 2010 and October 2014.

9 Includes purchases from the MISO capacity and energy markets, and long-term PPAs.

10 Includes 1,240 MW of purchased contract capacity from the MCV Facility and 778 MW of purchased contract capacity from Palisades.

11 Includes 3,096 GWh of purchased energy from the MCV Facility and 6,910 GWh of purchased energy from Palisades.

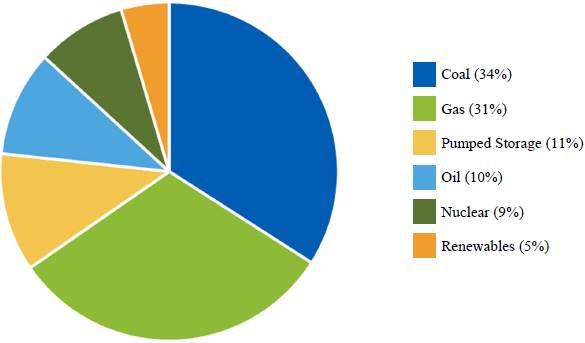

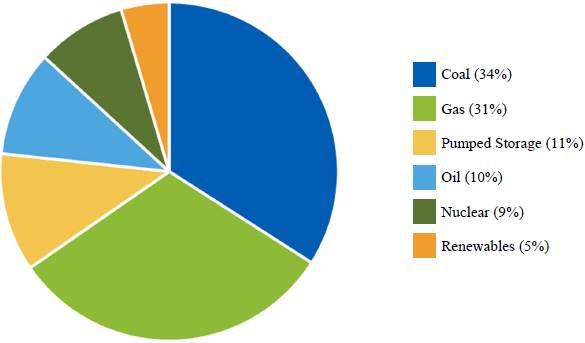

Consumers’ generation capacity is a measure of the maximum electric output that Consumers has available to meet peak load requirements. As shown in the following illustration, Consumers’ 2015 generation capacity of 8,762 MW, including purchased capacity of 2,877 MW, relied on a variety of fuel sources:

19

Table of Contents

Electric Utility Supply: Presented in the following table are the sources of Consumers’ electric supply over the last five years:

| | | | | | | | | | GWh | |

Years Ended December 31 | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Owned generation | | | | | | | | | | | |

Coal | | 15,833 | | 15,684 | | 15,951 | | 14,027 | | 15,468 | |

Gas | | 3,601 | | 2,012 | | 1,415 | | 3,003 | | 1,912 | |

Renewable energy | | 1,056 | | 748 | | 704 | | 433 | | 425 | |

Oil | | - | | - | | 4 | | 6 | | 7 | |

Net pumped storage1 | | (186 | ) | (300 | ) | (371 | ) | (295 | ) | (365 | ) |

Total owned generation | | 20,304 | | 18,144 | | 17,703 | | 17,174 | | 17,447 | |

Purchased and interchange power | | | | | | | | | | | |

Purchased renewable energy2 | | 2,163 | | 2,366 | | 2,250 | | 1,435 | | 1,587 | |

Purchased generation – other2 | | 11,720 | | 10,073 | | 10,871 | | 13,104 | | 11,087 | |

Net interchange power3 | | 1,327 | | 4,793 | | 3,656 | | 4,151 | | 6,825 | |

Total purchased and interchange power | | 15,210 | | 17,232 | | 16,777 | | 18,690 | | 19,499 | |

Total supply | | 35,514 | | 35,376 | | 34,480 | | 35,864 | | 36,946 | |

1 Represents Consumers’ share of net pumped-storage generation. The pumped-storage facility consumes electricity to pump water during off-peak hours for storage in order to generate electricity later during peak-demand hours.

2 Includes purchases from long-term PPAs.

3 Includes purchases from the MISO energy market.

During 2015, 45 percent of the energy Consumers provided to customers was generated by its coal-fueled generating units, which burned nine million tons of coal and produced a combined total of 15,833 GWh of electricity.

In order to obtain the coal it needs, Consumers enters into physical coal supply contracts. At December 31, 2015, Consumers had contracts to purchase coal through 2018; payment obligations under these contracts totaled $118 million. Most of Consumers’ rail-supplied coal contracts have fixed prices, although some contain market-based pricing. Consumers’ vessel-supplied coal contracts have fixed base prices that are adjusted monthly to reflect changes to the fuel cost of vessel transportation. At December 31, 2015, Consumers had 79 percent of its 2016 expected coal requirements under contract, as well as a 34-day supply of coal on hand.

In conjunction with its coal supply contracts, Consumers leases a fleet of rail cars and has transportation contracts with various companies to provide rail and vessel services for delivery of purchased coal to Consumers’ generating facilities. Consumers’ coal transportation contracts expire through 2019; payment obligations under these contracts totaled $321 million at December 31, 2015.

During 2015, Consumers acquired 43 percent of the electricity it provided to customers through long-term PPAs and the MISO energy market. Consumers offers its generation into the MISO energy market on a day-ahead and real-time basis and bids for power in the market to serve the demand of its customers. Consumers is a net purchaser of power and supplements its generation capability with purchases from the MISO energy market to meet its customers’ needs during peak demand periods.

At December 31, 2015, Consumers had unrecognized future commitments (amounts for which, in accordance with GAAP, liabilities have not been recorded on its balance sheet) to purchase capacity and energy under long-term PPAs with various generating plants. These contracts require monthly capacity payments based on the plants’ availability or deliverability. The payments for 2016 through 2036 are

20

Table of Contents

estimated to total $10 billion and, for each of the next five years, $1.0 billion annually. These amounts may vary depending on plant availability and fuel costs. For further information about Consumers’ future capacity and energy purchase obligations, see Item 8. Financial Statements and Supplementary Data—MD&A—Capital Resources and Liquidity and Note 4, Contingencies and Commitments—Contractual Commitments.

During 2015, ten percent of the energy Consumers provided to customers was generated by natural gas-fueled generating units, which burned 25 bcf of natural gas and produced a combined total of 3,601 GWh of electricity.

In order to obtain the gas it needs for electric generation fuel, Consumers’ electric utility purchases gas from the market near the time of consumption, at prices that allow it to compete in the electric wholesale market. For units 3 and 4 of D.E. Karn and for the Jackson and Zeeland plants, Consumers utilizes an agent that owns firm transportation rights to each plant to purchase gas from the market and transport the gas to the facilities. For its smaller combustion turbines, Consumers’ electric utility purchases and transports gas to its facilities as a bundled-rate tariff customer of either the gas utility or DTE Gas.

Presented in the following table is the cost per million Btu of all fuels consumed, which fluctuates with the mix of fuel used.

| | | | | | | | Cost Per Million Btu | |

Years Ended December 31 | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Coal | | $ | 2.49 | | $ | 2.72 | | $ | 2.90 | | $ | 2.98 | | $ | 2.94 | |

Gas | | 3.06 | | 7.19 | | 4.68 | | 3.16 | | 4.95 | |

Oil | | 12.28 | | 20.16 | | 19.47 | | 19.08 | | 18.55 | |

Weighted-average fuel cost | | $ | 2.59 | | $ | 3.17 | | $ | 3.07 | | $ | 3.05 | | $ | 3.18 | |

Electric Utility Competition: Consumers’ electric utility business is subject to actual and potential competition from many sources, in both the wholesale and retail markets, as well as in electric generation, electric delivery, and retail services.

The 2008 Energy Law allows electric customers in Consumers’ service territory to buy electric generation service from alternative electric suppliers in an aggregate amount up to ten percent of Consumers’ weather-adjusted retail sales for the preceding calendar year. At December 31, 2015, electric deliveries under the ROA program were at the ten-percent limit and alternative electric suppliers were providing 751 MW of generation service to ROA customers. Of Consumers’ 1.8 million electric customers, 304 customers, or 0.02 percent, purchased generation service under the ROA program.

In early 2015, members of the Michigan Senate and House of Representatives introduced various bills related to energy policy. Among other things, the bills propose a range of changes to ROA, including eliminating ROA, maintaining the existing ROA program but imposing conditions on a customer’s return to utility service, and raising the ROA limit. If the ROA limit were increased or if electric generation service in Michigan were deregulated, it could have a material adverse effect on Consumers’ financial results and operations. Presently, the Michigan Senate and House of Representatives are considering two separate but similar pieces of legislation to address energy policy, including ROA. Consumers is unable to predict the form and timing of any final legislation.

Consumers also faces competition or potential competition associated with:

· industrial customers relocating all or a portion of their production capacity outside of Consumers’ service territory for economic reasons

· municipalities owning or operating competing electric delivery systems

· customer self-generation

21

Table of Contents

Consumers addresses this competition by monitoring activity in adjacent geographical areas, by providing non-energy services and value to customers through Consumers’ rates and service, and by offering tariff-based incentives that support economic development.

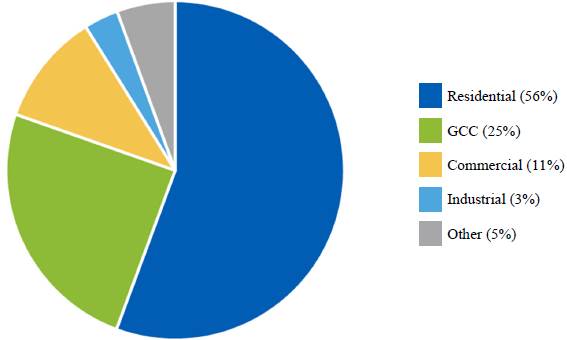

Consumers Gas Utility

Gas Utility Operations: Consumers’ gas utility operations, which include the purchase, transmission, storage, distribution, and sale of natural gas, generated operating revenue of $1.9 billion in 2015, $2.4 billion in 2014, and $2.1 billion in 2013. Consumers’ gas utility customer base consists of a mix of primarily residential, commercial, and diversified industrial customers in Michigan’s Lower Peninsula.

Presented in the following illustration is Consumers’ 2015 gas utility operating revenue of $1.9 billion by customer class:

Consumers’ gas utility operations are not dependent on a single customer, or even a few customers, and the loss of any one or even a few of Consumers’ largest customers is not reasonably likely to have a material adverse effect on Consumers’ financial condition.

In 2015, deliveries of natural gas, including off-system transportation deliveries, through Consumers’ pipeline and distribution network, totaled 356 bcf, which included GCC deliveries of 57 bcf. In 2014, deliveries of natural gas, including off-system transportation deliveries, through Consumers’ pipeline and distribution network, totaled 373 bcf, which included GCC deliveries of 65 bcf. Consumers’ gas utility operations are seasonal. Consumers injects natural gas into storage during the summer months for use during the winter months when the demand for natural gas is higher. Peak demand occurs in the winter due to colder temperatures and the resulting use of natural gas as a heating fuel. During 2015, 42 percent of the natural gas supplied to all customers during the winter months was supplied from storage.

22

Table of Contents

Presented in the following illustration are Consumers’ monthly weather-adjusted gas deliveries (deliveries adjusted to reflect normal weather conditions) to its customers, including GCC deliveries, during 2015 and 2014:

Gas Utility Properties: Consumers’ gas transmission, storage, and distribution system consists of:

· 1,686 miles of transmission lines

· 15 gas storage fields with a total storage capacity of 309 bcf and a working gas volume of 151 bcf

· 27,537 miles of distribution mains

· seven compressor stations with a total of 157,939 installed and available horsepower

23

Table of Contents

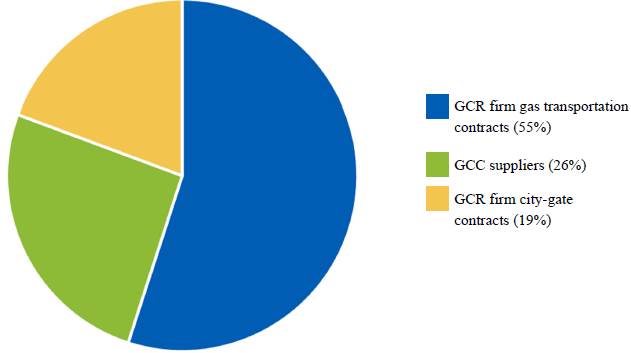

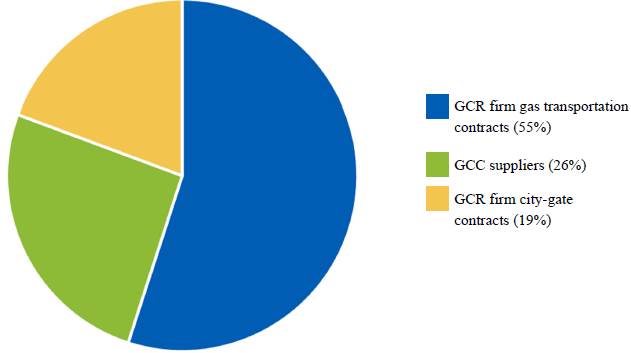

Gas Utility Supply: In 2015, Consumers purchased 69 percent of the gas it delivered from U.S. producers and five percent from Canadian producers. The remaining 26 percent was purchased from authorized GCC suppliers and delivered by Consumers to customers in the GCC program. Presented in the following illustration are the supply arrangements for the gas Consumers delivered to GCC and GCR customers during 2015:

Firm gas transportation or firm city-gate contracts are those that define a fixed amount, price, and delivery time frame. Consumers’ firm gas transportation contracts are with ANR Pipeline Company, Great Lakes Gas Transmission Limited Partnership, Panhandle Eastern Pipe Line Company, and Trunkline Gas Company, LLC, each a non-affiliated company. Under these contracts, Consumers purchases and transports gas to Michigan for ultimate delivery to its customers. Consumers’ firm gas transportation contracts expire through 2023 and provide for the delivery of 47 percent of Consumers’ total gas supply requirements in 2016. Consumers purchases the balance of its required gas supply under firm city-gate contracts and through authorized suppliers under the GCC program.

Gas Utility Competition: Competition exists in various aspects of Consumers’ gas utility business. Competition comes from GCC and from alternative fuels and energy sources, such as propane, oil, and electricity.

Enterprises Segment—Non-Utility Operations and Investments

CMS Energy’s enterprises segment, through various subsidiaries and certain equity investments, is engaged primarily in domestic independent power production and the marketing of independent power production. The enterprises segment’s operating revenue was $190 million in 2015, $299 million in 2014, and $181 million in 2013.

24

Table of Contents

Independent Power Production: At December 31, 2015, CMS Energy had ownership interests in independent power plants totaling 1,177 MW or 1,077 net MW. (Net MW reflects that portion of the capacity relating to CMS Energy’s ownership interests.) Presented in the following table are CMS Energy’s interests in independent power plants at December 31, 2015:

| | Ownership | | Primary | | Gross

Capacity | 1 | 2015 Net Generation | |

Location | | Interest (%) | | Fuel Type | | (MW) | | (GWh) | |

Dearborn, Michigan | | 100 | | Natural gas | | 752 | 2 | 3,399 | |

Gaylord, Michigan | | 100 | | Natural gas | | 156 | | 4 | |

Comstock, Michigan | | 100 | | Natural gas | | 68 | | — | |

Filer City, Michigan | | 50 | | Coal and biomass | | 73 | | 505 | |

New Bern, North Carolina | | 50 | | Biomass | | 50 | | 369 | |

Flint, Michigan | | 50 | | Biomass | | 40 | | 71 | |

Grayling, Michigan | | 50 | | Biomass | | 38 | | 122 | |

Total | | | | | | 1,177 | | 4,470 | |

1 Represents the intended full-load sustained output of each plant.

2 In December 2015, capital upgrades and modifications to the plant’s turbines increased gross capacity from 710 MW to 752 MW.

The operating revenue from independent power production was $17 million in 2015, $18 million in 2014, and $17 million in 2013. CMS Energy’s independent power production business faces competition from generators, marketers and brokers, and utilities marketing power in the wholesale market.

Energy Resource Management: CMS ERM purchases and sells energy commodities in support of CMS Energy’s generating facilities with a focus on optimizing CMS Energy’s independent power production portfolio. In 2015, CMS ERM marketed eight bcf of natural gas and 4,579 GWh of electricity. Electricity marketed by CMS ERM was generated by independent power production of the enterprises segment and by unrelated third parties. CMS ERM’s operating revenue was $173 million in 2015, $281 million in 2014, and $164 million in 2013.

Other Businesses

EnerBank: EnerBank is a Utah state-chartered, FDIC-insured industrial bank providing unsecured consumer installment loans for financing home improvements. EnerBank’s operating revenue was $101 million in 2015, $80 million in 2014, and $64 million in 2013.

CMS ENERGY AND CONSUMERS REGULATION

CMS Energy, Consumers, and their subsidiaries are subject to regulation by various federal, state, and local governmental agencies, including those described in the following sections.

FERC and NERC

FERC has exercised limited jurisdiction over several independent power plants and exempt wholesale generators in which CMS Enterprises has ownership interests, as well as over CMS ERM, CMS Gas Transmission, and DIG. FERC’s jurisdiction includes, among other things, acquisitions, operations, disposals of certain assets and facilities, services provided and rates charged, and conduct among affiliates. FERC also has limited jurisdiction over holding company matters with respect to CMS Energy. FERC, in connection with NERC and with regional reliability organizations, also regulates generation and

25

Table of Contents

transmission owners and operators, load serving entities, purchase and sale entities, and others with regard to reliability of the bulk power system.

FERC regulates limited aspects of Consumers’ gas business, principally compliance with FERC capacity release rules, shipping rules, the prohibition against certain buy/sell transactions, and the price-reporting rule.

FERC also regulates certain aspects of Consumers’ electric operations, including compliance with FERC accounting rules, wholesale and transmission rates, operation of licensed hydroelectric generating plants, transfers of certain facilities, corporate mergers, and issuances of securities.

MPSC

Consumers is subject to the jurisdiction of the MPSC, which regulates public utilities in Michigan with respect to retail utility rates, accounting, utility services, certain facilities, certain asset transfers, corporate mergers, and other matters.

The Michigan Attorney General, ABATE, the MPSC Staff, and certain other parties typically participate in MPSC proceedings concerning Consumers. These parties often challenge various aspects of those proceedings, including the prudence of Consumers’ policies and practices, and seek cost disallowances and other relief. The parties also have appealed significant MPSC orders.

Rate Proceedings: For information regarding open rate proceedings, see Item 8. Financial Statements and Supplementary Data—MD&A—Outlook and Notes to the Consolidated Financial Statements—Note 3, Regulatory Matters.

Other Regulation

The U.S. Secretary of Energy regulates imports and exports of natural gas and has delegated various aspects of this jurisdiction to FERC and the DOE’s Office of Fossil Fuels.

The U.S. Department of Transportation Office of Pipeline Safety regulates the safety and security of gas pipelines through the Natural Gas Pipeline Safety Act of 1968 and subsequent laws.

EnerBank is regulated by the Utah Department of Financial Institutions and the FDIC.

Energy Legislation

CMS Energy, Consumers, and their subsidiaries are subject to various legislative-driven matters, including Michigan’s 2008 Energy Law. This law requires that at least ten percent of Consumers’ electric sales volume come from renewable energy sources. It also allows electric customers in Consumers’ service territory to buy electric generation service from alternative electric suppliers in an aggregate amount up to ten percent of Consumers’ weather-adjusted retail sales of the preceding calendar year. For additional information regarding Consumers’ renewable energy plan and electric ROA, see Item 8. Financial Statements and Supplementary Data—MD&A—Outlook.

CMS ENERGY AND CONSUMERS ENVIRONMENTAL COMPLIANCE

CMS Energy, Consumers, and their subsidiaries are subject to various federal, state, and local regulations for environmental quality, including air and water quality, solid waste management, and other matters. Consumers expects to recover costs to comply with environmental regulations in customer rates, but cannot guarantee this result. For additional information concerning environmental matters, see Item 1A. Risk Factors and Item 8. Financial Statements and Supplementary Data—Notes to the Consolidated

26

Table of Contents

Financial Statements—Note 4, Contingencies and Commitments and Note 11, Asset Retirement Obligations.

CMS Energy has recorded a $58 million liability for its subsidiaries’ obligations associated with Bay Harbor and Consumers has recorded a $114 million liability for its obligations at a number of MGP sites. For additional information, see Item 1A. Risk Factors and Item 8. Financial Statements and Supplementary Data—Notes to the Consolidated Financial Statements—Note 4, Contingencies and Commitments.

Air: Consumers continues to install state-of-the-art emissions control equipment at its electric generating plants. Consumers estimates that it will incur capital expenditures of $84 million from 2016 through 2020 to comply with present and future federal and state environmental regulations that will require extensive reductions in nitrogen oxides, sulfur dioxides, particulate matter, and mercury emissions. Consumers’ estimate may increase if additional or more stringent laws or regulations are adopted, including regulations regarding greenhouse gases.

Solid Waste Disposal: Costs related to the construction, operation, and closure of solid waste disposal facilities for coal ash are significant. Consumers’ solid waste disposal areas are regulated under Michigan’s solid waste rules. In April 2015, the EPA published a final rule regulating CCRs, such as coal ash, under the Resource Conservation and Recovery Act. The final rule adopts minimum standards for beneficially reusing and disposing of non-hazardous CCRs. The rule establishes new minimum requirements for site location, groundwater monitoring, flood protection, storm water design, fugitive dust control, and public disclosure of information. The rule also sets out conditions under which CCR units would be forced to cease receiving CCR and non-CCR waste and initiate closure based on the inability to achieve minimum safety standards, meet a location standard, or meet minimum groundwater standards. Consumers has converted all of its fly ash handling systems to dry systems to minimize applicable requirements. In addition, all of Consumers’ ash facilities have programs designed to protect the environment and are subject to quarterly MDEQ inspections. Consumers’ preliminary estimate of capital and cost of removal expenditures to comply with regulations relating to ash disposal is $243 million from 2016 through 2020.

Water: Consumers uses substantial amounts of water to operate and cool its electric generating plants. Water discharge quality is regulated and administered by the MDEQ under the federal NPDES program. To comply with such regulation, Consumers’ facilities have discharge monitoring programs. The EPA issued final regulations for wastewater discharges from electric generating plants in 2015. Consumers’ preliminary estimate of capital expenditures to comply with these regulations is $69 million from 2016 through 2020.

In 2014, the EPA finalized its cooling water intake rule, which requires Consumers to evaluate the biological impact of its cooling water intake systems and ensure that it is using the best technology available to minimize adverse environmental impacts. Consumers’ preliminary estimate of capital expenditures to comply with these regulations is $58 million from 2016 through 2020.

For further information concerning estimated capital expenditures related to air, solid waste disposal, and water see Item 8. Financial Statements and Supplementary Data—MD&A—Outlook—Consumers Electric Utility Outlook and Uncertainties—Electric Environmental Outlook.

INSURANCE

CMS Energy and its subsidiaries, including Consumers, maintain insurance coverage generally similar to comparable companies in the same lines of business. The insurance policies are subject to terms, conditions, limitations, and exclusions that might not fully compensate CMS Energy or Consumers for all losses. A portion of each loss is generally assumed by CMS Energy or Consumers in the form of deductibles and self-insured retentions that, in some cases, are substantial. As CMS Energy or Consumers

27

Table of Contents

renews its policies, it is possible that some of the present insurance coverage may not be renewed or obtainable on commercially reasonable terms due to restrictive insurance markets.

CMS Energy’s and Consumers’ present insurance program does not cover the risks of certain environmental costs, such as the cleanup of sites owned by CMS Energy or Consumers, or claims for the long-term storage or disposal of pollutants or for air pollution.

EMPLOYEES

Presented in the following table are the number of employees of CMS Energy and Consumers:

| | | | | | | |

December 31 | | 2015 | | 2014 | | 2013 | |

CMS Energy, including Consumers | | | | | | | |

Full-time employees | | 7,711 | | 7,671 | | 7,415 | |

Seasonal employees1 | | 39 | | 33 | | 321 | |

Part-time employees | | 54 | | 43 | | 45 | |

Total employees | | 7,804 | | 7,747 | | 7,781 | |

Consumers | | | | | | | |

Full-time employees | | 7,339 | | 7,336 | | 7,089 | |

Seasonal employees1 | | 39 | | 33 | | 321 | |

Part-time employees | | 16 | | 19 | | 25 | |

Total employees | | 7,394 | | 7,388 | | 7,435 | |

1 Consumers’ seasonal workforce peaked at 477 employees during 2015, 394 employees during 2014, and 321 employees during 2013. Seasonal employees work primarily during the construction season and are subject to yearly layoffs.

28

Table of Contents

CMS ENERGY AND CONSUMERS EXECUTIVE OFFICERS

(AS OF FEBRUARY 1, 2016)

| | | | | | |

Name | | Age | | Position | | Period |

John G. Russell | | 58 | | President, CEO, and Director of CMS Energy | | 5/2010 – Present |

| | | | President, CEO, and Director of Consumers | | 5/2010 – Present |

| | | | Chairman of the Board, President, CEO, and Director | | |

| | | | of CMS Enterprises | | 5/2010 – Present |

Thomas J. Webb | | 63 | | Executive Vice President and CFO of CMS Energy | | 8/2002 – Present |

| | | | Executive Vice President and CFO of Consumers | | 8/2002 – Present |

| | | | Executive Vice President, CFO, and Director of CMS Enterprises | | 8/2002 – Present |

John M. Butler | | 51 | | Senior Vice President of CMS Enterprises | | 9/2006 – Present |

| | | | Senior Vice President of CMS Energy | | 7/2006 – Present |

| | | | Senior Vice President of Consumers | | 7/2006 – Present |

Daniel J. Malone | | 55 | | Senior Vice President of CMS Energy | | 3/2015 – Present |

| | | | Senior Vice President of Consumers | | 5/2010 – Present |

David G. Mengebier | | 58 | | Senior Vice President of CMS Energy | | 11/2006 – Present |

| | | | Senior Vice President of Consumers | | 11/2006 – Present |

| | | | Senior Vice President of CMS Enterprises | | 3/2003 – Present |

| | | | Chief Compliance Officer of CMS Energy | | 11/2006 – 1/2016 |

| | | | Chief Compliance Officer of Consumers | | 11/2006 – 1/2016 |

Patricia K. Poppe | | 47 | | Senior Vice President of CMS Energy | | 3/2015 – Present |

| | | | Senior Vice President of Consumers | | 3/2015 – Present |

| | | | Vice President of Consumers | | 1/2011 – 3/2015 |

Catherine M. Reynolds | | 58 | | Senior Vice President, General Counsel, and Director | | |

| | | | of CMS Enterprises | | 1/2014 – Present |

| | | | Senior Vice President and General Counsel of CMS Energy | | 10/2013 – Present |

| | | | Senior Vice President and General Counsel of Consumers | | 10/2013 – Present |

| | | | Vice President, Deputy General Counsel, and Corporate | | |

| | | | Secretary of CMS Energy | | 1/2012 – 10/2013 |

| | | | Vice President, Deputy General Counsel, and Corporate | | |

| | | | Secretary of Consumers | | 1/2012 – 10/2013 |

| | | | Vice President and Corporate Secretary of CMS Energy | | 9/2006 – 1/2012 |

| | | | Vice President and Corporate Secretary of Consumers | | 9/2006 – 1/2012 |

| | | | Vice President and Secretary of CMS Enterprises | | 9/2006 – 1/2014 |

Glenn P. Barba | | 50 | | Vice President, Controller, and CAO of CMS Enterprises | | 11/2007 – Present |

| | | | Vice President, Controller, and CAO of CMS Energy | | 2/2003 – Present |

| | | | Vice President, Controller, and CAO of Consumers | | 1/2003 – Present |

Garrick J. Rochow | | 41 | | Vice President of CMS Energy | | 3/2015 – Present |

| | | | Vice President of Consumers | | 10/2010 – Present |

There are no family relationships among executive officers and directors of CMS Energy or Consumers. The term of office of each of the executive officers extends to the first meeting of the Board of Directors of CMS Energy and Consumers after the next annual election of Directors of CMS Energy and Consumers (to be held on May 6, 2016). Ms. Poppe will succeed Mr. Russell as Chief Executive Officer of CMS Energy and Consumers effective July 1, 2016, when Mr. Russell retires.

AVAILABLE INFORMATION

CMS Energy’s internet address is www.cmsenergy.com. CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution. Information contained on CMS Energy’s website is not incorporated

29

Table of Contents

herein. CMS Energy’s and Consumers’ annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act are accessible free of charge on CMS Energy’s website. These reports are available soon after they are electronically filed with the SEC. Also on CMS Energy’s website are:

· Corporate Governance Principles

· Articles of Incorporation

· Bylaws

· Charters and Codes of Conduct (including the Audit, Compensation and Human Resources, Finance, and Governance and Public Responsibility Committee Charters, as well as the Employee, Boards of Directors, EnerBank, and Third Party Codes of Conduct)

CMS Energy will provide this information in print to any stockholder who requests it.

Any materials CMS Energy files with the SEC may also be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address is www.sec.gov.

Item 1A. Risk Factors

Actual results in future periods for CMS Energy and Consumers could differ materially from historical results and the forward-looking statements contained in this report. Factors that might cause or contribute to these differences include, but are not limited to, those discussed in the following sections. CMS Energy’s and Consumers’ businesses are influenced by many factors that are difficult to predict, that involve uncertainties that may materially affect results, and that are often beyond their control. Additional risks and uncertainties not presently known or that management believes to be immaterial may also adversely affect CMS Energy or Consumers. The risk factors described in the following sections, as well as the other information included in this report and in other documents filed with the SEC, should be considered carefully before making an investment in securities of CMS Energy or Consumers. Risk factors of Consumers are also risk factors of CMS Energy. All of these risk factors are potentially significant.

CMS Energy depends on dividends from its subsidiaries to meet its debt service obligations.

Due to its holding company structure, CMS Energy depends on dividends from its subsidiaries to meet its debt service and other payment obligations. If sufficient dividends were not paid to CMS Energy by its subsidiaries, CMS Energy might not be able to generate the funds necessary to fulfill its payment obligations, which could have a material adverse effect on CMS Energy’s liquidity and financial condition.

Consumers’ ability to pay dividends or acquire its own stock from CMS Energy is limited by restrictions contained in Consumers’ preferred stock provisions and potentially by other legal restrictions, such as certain terms in its articles of incorporation and FERC requirements.

30

Table of Contents

CMS Energy has indebtedness that could limit its financial flexibility and its ability to meet its debt service obligations.

The level of CMS Energy’s present and future indebtedness could have several important effects on its future operations, including, among others, that:

· a significant portion of CMS Energy’s cash flow from operations could be dedicated to the payment of principal and interest on its indebtedness and would not be available for other purposes

· covenants contained in CMS Energy’s existing debt arrangements, which require it to meet certain financial tests, could affect its flexibility in planning for, and reacting to, changes in its business

· CMS Energy’s ability to obtain additional financing for working capital, capital expenditures, acquisitions, and general corporate and other purposes could become limited

· CMS Energy could be placed at a competitive disadvantage to its competitors that are less leveraged

· CMS Energy’s vulnerability to adverse economic and industry conditions could increase

· CMS Energy’s future credit ratings could fluctuate

CMS Energy’s ability to meet its debt service obligations and to reduce its total indebtedness will depend on its future performance, which will be subject to general economic conditions, industry cycles, changes in laws or regulatory decisions, and financial, business, and other factors affecting its operations, many of which are beyond its control. CMS Energy cannot make assurances that its businesses will continue to generate sufficient cash flow from operations to service its indebtedness. If CMS Energy were unable to generate sufficient cash flows from operations, it could be required to sell assets or obtain additional financing.

CMS Energy and Consumers have financing needs and could be unable to obtain bank financing or access the capital markets.

CMS Energy and Consumers may be subject to liquidity demands under commercial commitments, guarantees, indemnities, letters of credit, and other contingent liabilities. Consumers’ capital requirements are expected to be substantial over the next several years as it invests in the Smart Energy program, construction or acquisition of power generation, environmental controls, decommissioning of older facilities, conversions and expansions, and other electric and gas infrastructure to upgrade delivery systems. Those requirements may increase if additional laws or regulations are adopted or implemented.

CMS Energy and Consumers rely on the capital markets, particularly for publicly offered debt, as well as on bank syndications, to meet their financial commitments and short-term liquidity needs if sufficient internal funds are not available from Consumers’ operations and, in the case of CMS Energy, from dividends paid by Consumers and its other subsidiaries. CMS Energy and Consumers also use letters of credit issued under certain of their revolving credit facilities to support certain operations and investments.

Disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives, or failures of significant financial institutions could adversely affect CMS Energy’s and Consumers’ access to liquidity needed for their businesses. Consumers’ inability to obtain prior FERC authorization for any securities issuances, including publicly offered debt, as is required under the Federal Power Act, could adversely affect Consumers’ access to liquidity. Any liquidity disruption could require CMS Energy and Consumers to take measures to conserve cash. These measures could include, but are not limited to, deferring capital expenditures, changing CMS Energy’s and Consumers’ commodity purchasing strategy to avoid collateral-posting requirements, and reducing or eliminating future share repurchases, dividend payments, or other discretionary uses of cash.

31

Table of Contents

CMS Energy continues to explore financing opportunities to supplement its financial strategy. These potential opportunities include refinancing and/or issuing new debt, preferred stock and/or common equity, commercial paper, and bank financing. Similarly, Consumers may seek funds through the capital markets, commercial lenders, and leasing arrangements. Entering into new financings is subject in part to capital market receptivity to utility industry securities in general and to CMS Energy’s and Consumers’ securities in particular. CMS Energy and Consumers cannot guarantee the capital markets’ acceptance of their securities or predict the impact of factors beyond their control, such as actions of rating agencies.

Certain of CMS Energy’s and Consumers’ securities and those of their affiliates are rated by various credit rating agencies. Any reduction or withdrawal of one or more of its credit ratings could have a material adverse impact on CMS Energy’s or Consumers’ ability to access capital on acceptable terms and maintain commodity lines of credit, could increase its cost of borrowing, and could cause CMS Energy or Consumers to reduce capital expenditures. If it were unable to maintain commodity lines of credit, CMS Energy or Consumers might have to post collateral or make prepayments to certain suppliers under existing contracts. Further, since Consumers provides dividends to CMS Energy, any adverse developments affecting Consumers that result in a lowering of its credit ratings could have an adverse effect on CMS Energy’s credit ratings. CMS Energy and Consumers cannot guarantee that any of their present ratings will remain in effect for any given period of time or that a rating will not be lowered or withdrawn entirely by a rating agency.

If CMS Energy or Consumers were unable to obtain bank financing or access the capital markets to incur or refinance indebtedness, or were unable to obtain commercially reasonable terms for any financing, this could have a material adverse effect on its liquidity, financial condition, and results of operations.

There are risks associated with Consumers’ substantial capital investment program planned for the next five years.

Consumers’ planned investments include the Smart Energy program, construction or acquisition of power generation, gas infrastructure, conversions and expansions, environmental controls, decommissioning of older facilities, and other electric and gas investments to upgrade delivery systems. The success of these capital investments depends on or could be affected by a variety of factors that include, but are not limited to:

· effective pre-acquisition evaluation of asset values, future operating costs, potential environmental and other liabilities, and other factors beyond Consumers’ control

· effective cost and schedule management of new capital projects

· availability of qualified construction personnel

· changes in commodity and other prices

· governmental approvals and permitting

· operational performance

· changes in environmental, legislative, and regulatory requirements

· regulatory cost recovery

It is possible that adverse events associated with these factors could have a material adverse effect on Consumers’ liquidity, financial condition, and results of operations.

Changes to ROA could have a material adverse effect on CMS Energy’s and Consumers’ businesses.

The 2008 Energy Law allows electric customers in Consumers’ service territory to buy electric generation service from alternative electric suppliers in an aggregate amount up to ten percent of Consumers’ weather-adjusted retail sales of the preceding calendar year. Lower natural gas prices due to a large supply of natural gas on the market, coupled with low capacity prices in the electric supply market, are

32

Table of Contents

placing increasing competitive pressure on the cost of Consumers’ electric supply. Presently, Consumers’ electric rates are above the Midwest average, while the ROA level on Consumers’ system is at the ten-percent limit and the proportion of Consumers’ electric deliveries under the ROA program and on the ROA waiting list is 25 percent. If the ROA limit were increased or if electric generation service in Michigan were deregulated, it could have a material adverse effect on Consumers’ financial results and operations.

CMS Energy and Consumers are subject to rate regulation, which could have an adverse effect on financial results.

CMS Energy and Consumers are subject to rate regulation. Consumers’ electric and gas retail rates are set by the MPSC and cannot be increased without regulatory authorization. Consumers is permitted by the 2008 Energy Law to self-implement rate changes six months after a rate filing with the MPSC, subject to certain limitations. If Consumers self-implements rates that result in higher revenues than would have resulted from rates that the MPSC authorizes in its final order, Consumers must refund the difference, with interest. Also, the MPSC may delay or deny implementation of a rate increase upon showing of good cause.

In addition, if rate regulators fail to provide timely rate relief, it could have a material adverse effect on Consumers or Consumers’ plans for making significant capital investments could be materially adversely affected. Regulators seeking to avoid or minimize rate increases could resist raising customer rates sufficiently to permit Consumers to recover the full cost of these investments. In addition, because there are statutory requirements mandating that regulators must allow Consumers to recover from customers certain costs, such as resource additions to meet Michigan’s renewable resource standard, energy optimization, and environmental compliance, regulators could be more inclined to oppose rate increases for other requested items and investments. Rate regulators could also face pressure to avoid or limit rate increases for a number of reasons, including an economic downturn in the state or diminishment of Consumers’ customer base. In addition to its potential effects on Consumers’ investment program, any limitation of cost recovery through rates could have a material adverse effect on Consumers’ liquidity, financial condition, and results of operations.