Filed Pursuant to Rule 253(g)(1)

File No. 024-11576

Offering Circular

35 William Street, Lyons, New York 14489

(315) 781-5007

bankwithlnb.com

Best Efforts Offering of Common Stock

Offering Price: $39.50 per share

Offering: 252,121 shares for $9,958,780

We are distributing to our shareholders, free of charge, non-transferable subscription rights to purchase up to 252,121 shares of our common stock, par value $0.50 per share, at an offering price of $39.50 per share. You will receive one right for each thirteen shares of common stock, and for each thirteen shares of common stock underlying our Series A convertible preferred stock, that you hold of record as of 5:00 p.m., Lyons, New York time, on August 2, 2021. If you exercise your subscription rights for all of the shares that you hold of record, then you may also subscribe to purchase additional shares, subject to the conditions and limitations described later in this offering circular, at the same price of $39.50 per share. The shares in this rights offering will be sold on a best efforts basis.

We also plan to offer any unsold shares in the rights offering to beneficial owners and other investors in a supplemental offering. Neither the rights offering nor the supplemental offering is contingent upon the occurrence of any event or the sale of a minimum number of shares. We have not made arrangements to place funds we receive from subscribers in trust or similar account.

Your subscription rights may be exercised at any time during the period starting on August 9, 2021 and ending at 5:00 p.m., Lyons, New York time, on September 8, 2021, unless we extend the rights offering period, in our sole discretion. At the expiration of the rights offering, and after taking into consideration all over-subscription requests, we may sell shares to the public at $39.50 per share in the supplemental offering. Under no circumstances will we issue more than 252,121 shares in the combined rights and supplemental offerings. The supplemental offering will end on September 17, 2021, subject to extension in our sole discretion. We may cancel the rights offering or the supplemental offering, or both, at any time and for any reason.

Our stock is quoted on the OTCQX under the symbol “LYBC.” The two most recent sales occurred on July 6, 2021, at a price of $42.55 per share, and on June 28, 2021, at a price of $ 43.00 per share. See “Description of Securities”.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This Offering Circular is following the offering circular format described in Part II of Form 1-A.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other selling literature. These securities are offered pursuant to an exemption from registration with the Commission; however, the commission has not made an independent determination that the securities offered hereunder are exempt from registration.

| | | Price to the Public | | Underwriting

Discount and Commissions(1) | | | Proceeds to the

Company(2) | | Proceeds to Other

Persons | |

| Per share | | $39.50 | | $ | -0- | | | $39.50 | | $ | 0.00 | |

| Maximum Total | | $9,958,780 | | $ | -0- | | | $9,958,780 | | $ | 0.00 | |

(1) We will not pay any commission or other compensation to our officers based on their selling efforts in the offering.

(2) Before deducting $125,000 in estimated offering expenses payable by us, including, among others, printing, mailing and marketing expenses as well as legal and accounting fees.

This investment involves risk. See “Risk Factors” beginning on page 18.

The date of this Offering Circular is August 6, 2021.

NEITHER THE SUBSCRIPTION RIGHTS NOR THE SHARES OF COMMON STOCK ARE A DEPOSIT OR AN ACCOUNT OF OUR BANK SUBSIDIARY AND ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY.

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY US CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

TABLE OF CONTENTS

Page

Questions and Answers Relating to the Rights Offering

As used through this offering circular, the terms “we,” “us,” “our,” “the Company” and “Lyons Bancorp, Inc.” refers to Lyons Bancorp, Inc. and its subsidiaries. “Bank” refers to our wholly-owned subsidiary, The Lyons National Bank.

The following are examples of what we anticipate will be common questions about the rights offering. The answers are based on selected information included elsewhere in this offering circular. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the rights offering. This offering circular contains a more detailed description of the terms and conditions of the rights offering and provides additional information about us and our business, including potential risks related to the rights offering, the common stock of the Bank, and our business. See the section entitled “The Rights Offering” beginning on page 38 below.

What is being offered?

We are distributing, at no cost or charge to our shareholders subscription rights to purchase up to 252,121 shares of our common stock. The purchase price is $39.50 per share. These rights may be exercised only by the shareholders to whom they are distributed, and may not be sold, transferred or assigned to anyone else. The rights will be issued to holders of our common stock and holders of our Series A Non-Cumulative Convertible Preferred Stock, and which we refer to as our Series A preferred stock. Holders of our common stock and our Series A preferred stock will receive one subscription right for each thirteen shares of common stock, and for each thirteen shares of common stock underlying our Series A preferred stock, held of record as of 5:00 p.m., Lyons, New York time on August 2, 2021, the record date of the rights offering. The subscription rights will be evidenced by Subscription Election Forms. Each subscription right will entitle you to purchase one share of common stock, at a subscription price equal to $39.50 per share. Any unsold shares from the basic subscription privilege will be available for purchase under the over-subscription opportunity, described below, and in the supplemental offering. You may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights.

Fractional shares resulting from the exercise of the basic subscription privilege or the over-subscription opportunity, each as described below, will be eliminated by rounding down to the nearest whole share, with the total subscription payment being adjusted accordingly. As a result, we may not issue the full number of shares authorized for issuance in connection with the rights offering. Any excess subscription payments received by us will be returned, without interest or penalty, as soon as practicable.

Why are we conducting the rights offering?

We are conducting the rights offering as a way of raising equity capital in a cost-effective manner that gives all of our shareholders an opportunity to participate. We cannot predict the number of shares that will be sold. We intend to add the proceeds from the sales to our general funds to be used for general corporate purposes. See section entitled “Use of Proceeds” beginning on page 38 below.

How will the shares be offered?

The shares will be offered in the rights offering to our current shareholders. These shareholders have a right to buy shares pursuant to their basic subscription privilege, and the ability to subscribe for additional shares through an over-subscription opportunity in our discretion. The shares will also be offered for subscription in our discretion to our shareholders, including beneficial owners, and to others in the supplemental offering. Our marketing for this offering will be accomplished through a combination of telephone calls, mail and personal visits and meetings.

What is the basic subscription privilege?

For each right that you own, you will have a basic subscription privilege to buy from us one share of common stock at the subscription price. You may exercise your basic subscription privilege for some or all of your subscription rights, or you may choose not to exercise any subscription rights. Holders of our common stock and Series A preferred stock will receive one subscription right for each 13 shares of common stock, and for each 13 shares of common stock underlying our Series A preferred stock.

For example, if you owned 1,000 shares of our common stock, or Series A preferred stock convertible into 1,000 shares of our common stock as of 5:00 p.m., Lyons, New York time on the record date, you would receive 76 subscription rights and would have the right to purchase 76 shares of common stock for $39.50 per share with your basic subscription privilege.

What is the over-subscription opportunity?

If you exercise your basic subscription privilege in full, you, together with other shareholders that exercise their basic subscription privilege in full, will be entitled to subscribe to purchase additional shares subject to certain conditions and limitations. The subscription price per share that applies to the over-subscription opportunity is the same subscription price per share that applies to the basic subscription privilege.

What are the limitations on the over-subscription opportunity?

We reserve the right to reject in whole or in part any over-subscription request, regardless of the availability of shares to satisfy these requests. Subject to this right, we will honor over-subscription requests in full to the extent sufficient shares are available following the exercise of rights under the basic subscription privilege, taking into account our right to facilitate sales of shares in the supplemental offering that we are undertaking concurrently with the rights offering. If over-subscription requests exceed the shares that are available to satisfy the requests, then, subject to our right to reject in whole or in part any over-subscription request, we will allocate the available shares, first, by satisfying the first 250 shares requested in each over-subscription, and then second, pro rata based on the number of shares each over-subscribing shareholder purchased under the basic subscription privilege. Any excess subscription payments will be returned, without interest or penalty.

What will happen if less than all of the subscription rights are exercised?

In the event shares remain available for sale after taking into account the exercise of basic subscription rights and such over-subscription requests as we choose to satisfy, we will offer those remaining shares to others at the $39.50 per share subscription price in the supplemental offering.

Am I required to exercise the rights I receive in the rights offering?

No. You may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights. However, if you choose not to fully exercise your basic subscription privilege and other shareholders fully exercise their basic subscription privilege, the percentage of our common stock owned by these other shareholders will increase relative to your ownership percentage, and your voting rights, if any, and other rights will likewise be diluted. In addition, if you do not exercise your basic subscription privilege in full, you will not be entitled to subscribe to purchase additional shares pursuant to the over-subscription opportunity and your ownership percentage in our common stock and any related voting and other rights may be further diluted.

How soon must I act to exercise my subscription rights?

The subscription rights may be exercised at any time during the 30- day subscription period, which commences on August 9, 2021, through the expiration date for the rights offering, which is 5:00 p.m., Lyons, New York time, on September 8, 2021. If you elect to exercise any subscription rights, the Bank must actually receive all required documents and payments from you at or prior to the expiration date. Although we have the option of extending the subscription period at our sole discretion, we do not currently intend to do so.

May I transfer my subscription rights?

No. You may not sell, transfer or assign your subscription rights to anyone else.

Are we requiring a minimum subscription to complete the rights offering?

No.

Are there any limitations on the number of subscription rights I may exercise in the rights offering?

You may only purchase the number of shares purchasable upon exercise of the number of basic subscription rights distributed to you in the rights offering, plus up to the number of shares that may be made available pursuant to the over-subscription opportunity. Accordingly, the number of shares you may purchase in the rights offering is limited by the number of shares of our common stock or shares of our Series A preferred stock you held on the record date and by the extent to which other shareholders exercise their subscription rights, including any over-subscription requests, as well as by our determination as to the number of shares, if any, that we will offer to sell to beneficial owners in the supplemental offering.

However, no sale may be made to you in this offering if the aggregate purchase price you would pay exceeds 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

In addition, under applicable federal banking laws, any purchase of shares may also require the prior clearance or approval of, or prior notice to, federal bank regulatory authorities if the purchase will result in any person or entity or group of persons or entities acting in concert owning or controlling shares in excess of 10.0% of our outstanding shares of common stock following the completion of the rights offering.

Can the rights offering be cancelled?

Yes. We may cancel the rights offering at any time prior to the expiration date for any reason.

How do I exercise my subscription rights?

If you wish to participate in the rights offering, you must properly complete the enclosed Subscription Election Form and deliver it, along with the full subscription price (including any amounts in respect of your over-subscription request), to the Bank before 5:00 p.m., Lyons, New York time, on September 8, 2021. If you use the mail, we recommend that you use insured, registered mail, return receipt requested.

If you send a payment that is insufficient to purchase the number of shares you requested, or if the number of shares you requested is not specified in the forms, the payment received will be applied to exercise your basic subscription right and, if applicable, any over-subscription request that we have accepted to the fullest extent possible based on the amount of the payment received, subject to the elimination of fractional shares. If the payment exceeds the subscription price for the full exercise of your basic subscription right and any applicable over-subscription request that we have accepted, or if you subscribe for more shares than you are eligible to purchase pursuant to the over-subscription opportunity, then the excess will be returned to you as soon as practicable. You will not receive interest on any payments refunded to you under the rights offering.

If the rights offering or supplemental offering is not completed, will my subscription payment be refunded to me?

Yes. We will hold all funds received in a segregated account until completion of the rights offering. If the rights offering or supplemental offering is not completed, we will promptly return, without interest or penalty, all subscription payments.

What form of payment must I use to pay the subscription price?

You must timely pay the full subscription price for the full number of shares you wish to acquire under the basic subscription privilege and any over-subscription request by delivering to the Bank a certified or cashier’s check, a bank draft drawn on a U.S. bank, a U.S. postal or express money order, a personal check that clears before the expiration date of the rights offering, or an authorization to deduct payment from your checking or savings account with the Bank. If you wish to use any other form of payment, then you must make arrangements in advance with the Bank for the delivery of such payment.

What should I do if I want to participate in the rights offering, but my shares are held in the name of my broker, dealer, custodian bank or other nominee?

If you hold your shares in the name of a broker, dealer, bank or other nominee and you wish to participate in the Rights Offering or Supplemental Offering and purchase our Common Shares, you should complete and return to your Subscription Form along with payment in full for the number of shares you are subscribing. DO NOT SEND THE RIGHTS SUBSCRIPTION AGREEMENT AND PAYMENT TO YOUR BROKER, DEALER, BANK OR OTHER NOMINEE UNLESS YOU ARE SIMPLY INSTRUCTING THEM TO FORWARD THEM TO US. You should receive the form from your broker, dealer, bank or other nominee with the other offering materials. We assume no responsibility in respect of the timely administration of your broker, dealer, bank or other nominee to perform its obligations on your behalf.

After I exercise my subscription rights, can I change my mind?

No. All exercises of subscription rights are irrevocable by the shareholders, even if you later learn information about us that you consider unfavorable. You should not exercise your subscription rights unless you are certain that you wish to purchase. However, we may cancel, extend or otherwise amend the rights offering at any time prior to the expiration date.

Does exercising my subscription rights involve risk?

Yes. The exercise of your subscription rights involves risks. Exercising your subscription rights involves the purchase of additional shares of our common stock and should be considered as carefully as you would consider other equity investments. Among other things, you should carefully consider the risks described under the heading “Risk Factors” beginning on page 18 of this offering circular.

Has our Board of Directors made a recommendation to our shareholders regarding the rights offering?

No. Our Board of Directors is making no recommendations regarding your exercise of subscription rights. You could risk investment loss on new money invested. We cannot assure you that the trading price for our common stock will be above the subscription price at the time of exercise or at the expiration of the rights offering period or that anyone purchasing shares at the subscription price will be able to sell those shares in the future at the same price or a higher price. You are urged to decide whether or not to exercise your subscription rights based on your own assessment of our business and the rights offering. See the section entitled “Risk Factors” beginning on page 18 of this offering circular.

What fees or charges apply if I exercise my subscription rights?

We are not charging any fees or sales commissions to issue subscription rights to you or to issue shares to you if you exercise your subscription rights. If you exercise your subscription rights through a broker or other record holder of your shares, you are responsible for paying any fees that person may charge.

When will I receive my new shares of common stock?

As soon as practicable after the expiration of the rights offering period, we will direct our transfer agent, Broadridge Corporate Issuer Solutions, Inc., to issue the Common Stock in book-entry form. Shortly thereafter, shareholders whose subscriptions are accepted will receive a statement of ownership from our transfer agent reflecting the Common Stock purchased in the offering. Shares purchased pursuant to the over-subscription opportunity and in the supplemental offering will be issued in the same manner as soon as practicable after the expiration date of the rights offering and following the completion of any pro-rations as may be necessary in the event the over-subscription requests exceed the number of shares available to satisfy such requests. Thereafter, the shares should be available for delivery to you or your broker as soon as reasonably possible.

Will the subscription rights be listed on a stock exchange or trading market?

The subscription rights may not be sold, transferred or assigned to anyone else and will not be listed on any other stock exchange or trading market or on the OTC Markets. Our common stock is quoted on the OTC Markets OTCQX tier under the symbol “LYBC”.

What are the U.S. federal income tax consequences of exercising my subscription rights?

The receipt and exercise of your subscription rights will generally not be taxable under U.S. federal income tax laws. You should, however, seek specific tax advice from your personal tax advisor in light of your personal tax situation and as to the applicability of any other tax laws. See the section below entitled “United States Federal Income Taxation”.

Is the supplemental offering subject to any minimum or maximum subscription amount?

We are offering shares in the supplemental offering to beneficial owners of our shares as of the record date. There is no minimum or maximum amount of shares you can subscribe for as long as we have shares remaining available for sale after our rights offering is completed. You may not revoke or change your subscription after you have submitted your subscription agreement. We may choose to reject your subscription entirely or accept it for only a portion of the shares for which you subscribe.

In addition, under applicable federal and state banking laws, any purchase of shares may also require the prior clearance or approval of, or prior notice to, federal and state bank regulatory authorities if the purchase will result in any person or entity or group of persons or entities acting in concert owning or controlling shares in excess of 10.0% of our outstanding shares of common stock following the completion of the supplemental.

How can I get further information about the rights offering?

This offering circular describes the rights offering in detail. If you would like further information, please call Robert A. Schick, Chairman of the Board and President at (315) 946-8260, or Carol Snook, Corporate Secretary (315) 781-5007 to set up an appointment or pick up additional materials. Neither the subscription rights nor the shares being offered are a deposit or an account of the Bank, are not insured by the Federal Deposit Insurance Corporation or any other government agency, and are not offered through normal banking channels.

Summary

As used through this offering circular, the terms “we,” “us,” “our,” “the Company” and “Lyons Bancorp, Inc.” refers to Lyons Bancorp, Inc. and its subsidiaries. “Bank” refers to our wholly-owned subsidiary, The Lyons National Bank.

This summary highlights selected information from this offering circular and may not contain all the information that you should consider before investing in the securities we are offering. To understand the offered securities properly, you should read the entire document carefully, including the risk factors and our consolidated financial statements and the related notes.

Lyons Bancorp, Inc. and its Subsidiaries

Lyons Bancorp, Inc. is a bank holding company under the Federal Bank Holding Company Act of 1956. We were incorporated in 1987 under the laws of New York.

We own and operate The Lyons National Bank, which is our principal subsidiary. We also own all of the common beneficial interest of Lyons Capital Statutory Trust II, which is a Delaware statutory trust, which we formed in August 2004 in connection with the issuance of $5,000,000 of trust preferred capital securities.

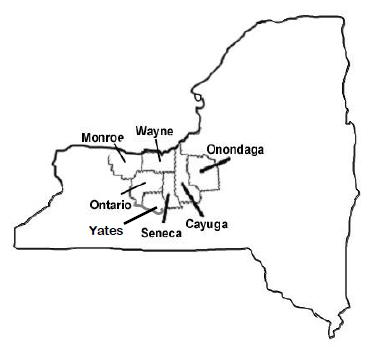

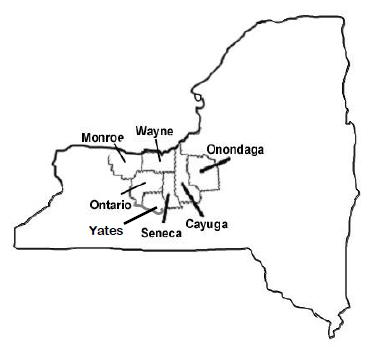

The Lyons National Bank is a full service, nationally chartered, commercial bank serving Wayne County and portions of Cayuga, Monroe, Onondaga, Ontario, Seneca and Yates Counties in New York through sixteen full-service banking offices located in Lyons (two offices), Wolcott, Newark, Macedon, Ontario, Jordan, Clyde, Geneva, Penn Yan, Waterloo, Canandaigua, Perinton, Auburn (two offices) and Farmington, New York, an ATM network and Internet and telephone banking services. The Bank owns all of the common stock of Lyons Realty Associates Corp., a real estate investment trust which holds a portfolio of real estate mortgages. The Bank also provides brokerage investment and insurance products and services to its customers through an arrangement with LPL Financial.

We are a community oriented bank, emphasizing personal service and customer convenience in serving the financial needs of the individuals, families and businesses residing in our markets. We attract deposits from the general public in the markets we serve and use those funds, together with funds generated from operations and borrowings, to originate commercial real estate loans, residential mortgage loans, commercial and agricultural loans and consumer loans. We also invest in mortgage-backed securities and other permissible investments.

Over the past several years, we have experienced significant growth in our assets, deposit base, loan portfolio and net worth. As of December 31, 2020, we had $1,423 million in total assets, $1,020 million in total loans, $1,286 million in total deposits and $95 million in stockholders’ equity.

Our main office is located at 35 William Street, Lyons, New York 14489. Our telephone number is (315) 946-4871, and our web site is www.bankwithlnb.com. Information on our web site is not a part of this offering circular.

The Offering

The following summary describes the principal terms of the rights offering, but is not intended to be complete. See the section of this offering circular below entitled “The Rights Offering” for a more detailed description of the terms and conditions of the rights offering.

Securities Offered

We are distributing, at no cost or charge to our shareholders of record subscription rights to purchase up to 252,121 shares of common stock. Holders of our common stock and our Series A preferred stock will receive one subscription right for each thirteen shares of common stock, and for each thirteen shares of common stock underlying our Series A preferred stock, held of record as of 5:00 p.m., Lyons, New York time on August 2, 2021, the record date of the rights offering. These rights may be exercised only by you, and cannot be sold, transferred or assigned to anyone else.

Basic Subscription Privilege

For each right that you own, you will have a basic subscription privilege to buy from us one share of common stock at the subscription price. You may exercise your basic subscription privilege for some or all of your subscription rights, or you may choose not to exercise your subscription rights.

Over-subscription opportunity

If you exercise your basic subscription privilege in full, you will also have an opportunity to subscribe to purchase any shares that our other subscription rights holders do not purchase under their basic subscription privilege. The subscription price for shares purchased pursuant to the over-subscription opportunity will be the same as the subscription price for the basic subscription privilege. We reserve the right to reject in whole or in part any or all over-subscription requests, and we may choose to issue some or all of the shares that we may issue beyond the number necessary to satisfy properly exercised basic subscription rights to beneficial owners in the supplemental offering.

Subscription Price

The subscription price per share shall be equal to $39.50 per share. To be effective, any payment related to the exercise of a subscription right, or over-subscription, must clear prior to the expiration of the rights offering period.

Record Date

The record date will be August 2, 2021.

Expiration Date

The subscription rights will expire at 5:00 p.m., Lyons, New York time, on September 8, 2021 unless the expiration date is extended. We reserve the right to extend the subscription rights period at our sole discretion.

Supplemental Offering

If shares remain available for sale after the closing of the rights offering, we will offer and sell those remaining shares in a supplemental offering to beneficial owners of our shares as of the record date at the $39.50 per share subscription price. Initially, we anticipate that any shares offered in the supplemental offering will be offered with a preference given to beneficial owners of our common stock.

We have the right to accept or reject, in our sole discretion, any orders received in the supplemental offering.

Procedure for Exercising Subscription Rights

The subscription rights may be exercised at any time during the subscription period, which commences on August 9, 2021. To exercise your subscription rights, you must properly complete the enclosed Subscription Election Form and deliver it, along with the full subscription price (including any amounts in respect of an over-subscription request), to the Bank before 5:00 p.m., Lyons, New York time, on September 8, 2021, unless the expiration date is extended.

If you use the mail, we recommend that you use insured, registered mail, return receipt requested.

Net Proceeds of Offering

The net proceeds to us will depend on the number of subscription rights that are exercised, including over-subscription requests, and the number of shares, if any, that are sold in the supplemental offering. If we issue all shares available for the exercise of basic subscription rights in the rights offering, the net proceeds to us, after deducting estimated offering expenses, will be approximately $9.88 million. We estimate that the expenses of the combined rights and supplemental offerings will be approximately $125,000. We intend to use the net proceeds to fund future asset growth and for general corporate purposes. See the section below entitled “Use of Proceeds”.

Non-Transferability of Subscription Rights

The subscription rights may not be sold, transferred or assigned to anyone else and will not be listed for trading on any other stock exchange or trading market or on the OTCQX.

No Revocation of Exercise by Shareholders

All exercises of subscription rights are irrevocable, even if you later learn information about us that you consider unfavorable. You should not exercise your subscription rights unless you are certain that you wish to purchase the shares of common stock offered pursuant to the rights offering.

Conditions to the Rights Offering

The completion of the rights offering is subject to the conditions described in the section below entitled “The Rights Offering—Conditions and Cancellation”.

Amendment; Cancellation

We may amend the terms of the rights offering or extend the rights offering period. We also reserve the right to cancel the rights offering at any time prior to the expiration date for any reason.

No Board Recommendation

Our Board of Directors is making no recommendations regarding your exercise of the subscription rights. You are urged to make your own decision whether or not to exercise your subscription rights based on your own assessment of our business and the rights offering. See the section below entitled “Risk Factors”.

Issuance of Common Stock

If you purchase shares through the rights offering, we will issue those shares of common stock to you as soon as practicable after the completion of the rights offering.

Trading of Common Stock

Our common stock is quoted on the OTC Markets OTCQX tier under the symbol “LYBC.”

Certain Material U.S. Federal Income Tax Considerations

The receipt and exercise of your subscription rights will generally not be taxable under U.S. federal income tax laws. However, you should seek specific tax advice from your personal tax advisor in light of your personal tax situation and as to the applicability and effect of any other tax laws. See the section entitled “United States Federal Income Taxation” on page 102 below.

Subscription Agent

Our subscription agent is The Lyons National Bank.

Shares of Common Stock Outstanding Before the Rights Offering

As of December 31, 2020, there were 3,156,444 shares of our common stock outstanding. In addition, holders of our Series A preferred stock may elect to convert their holdings into 120,000 shares of common stock, which would increase the diluted total of shares outstanding to 3,276,444.

Shares of Common Stock Outstanding After Completion of the Rights Offering

We will issue up to 252,121 shares of common stock in the rights offering, depending on the number of subscription rights that are exercised. Assuming no Series A preferred stock are converted prior to the expiration of the rights offering period, and based on the number of shares of common stock outstanding as of June 30, 2021, if we issue all 252,121 shares of common stock available for the exercise of basic subscription rights in the rights offering and any supplemental offering, we would have 3,409,696 shares of common stock outstanding following the completion of the rights offering and any supplemental offering.

How We Determined the Subscription Price

Our Board of Directors determined the terms of the rights offering, including the subscription price, in its sole discretion. In determining the subscription price, our Board of Directors considered a number of factors, including:

| · | the size and timing of the rights offering and the price at which our stockholders might be willing to participate in a rights offering offered on a pro rata basis to all stockholders with an over-subscription opportunity; |

| · | historical and current trading prices for our common stock; and |

| · | analysis of information related to other recent rights offerings and the range of discounts that the subscription prices represented to the then prevailing and historical trading prices for those offerings. |

The subscription price is not necessarily related to our book value, results of operations, cash flows, financial condition or net worth or any other established criteria of value and may or may not be considered the fair value of our common stock at the time the rights offering was approved by our Board or during the rights offering period. We cannot assure you that the trading price of our common stock will not decline during or after the rights offering. We also cannot assure you that you will be able to sell shares purchased in this offering at a price equal to or greater than the subscription price. We do not intend to change the subscription price in response to changes in the trading price of our common stock prior to the closing of the rights offering.

Selected Financial and Other Data

The following table sets forth our selected consolidated historical financial and other data for the years and at the dates indicated. The information at December 31, 2020 and 2019, and for the years then ended is derived in part from and should be read together with our consolidated financial statements and notes thereto beginning at page F-1 of this offering circular. The information at December 31, 2018 and for the fiscal year then ended is derived in part from our audited consolidated financial statements not contained in this offering circular. The selected consolidated financial data below should be read in conjunction with our consolidated financial statements and the accompanying notes and “Management's Discussion and Analysis of Financial Condition and Results of Operations.” The historical results are not necessarily indicative of results that may be expected for any future period.

| Dollars in thousands | | For the year ended December 31, | |

| | | 2020 | | | 2019 | | | 2018 | |

| Interest income | | $ | 46,547 | | | $ | 44,985 | | | $ | 40,589 | |

| Interest expense | | | 7,033 | | | | 8,571 | | | | 5,962 | |

| Provision for loan losses | | | 6,258 | | | | 2,341 | | | | 2,133 | |

| Net interest income after provision for loan losses | | | 33,256 | | | | 34,073 | | | | 32,494 | |

| Noninterest income | | | 16,436 | | | | 13,431 | | | | 11,207 | |

| Noninterest expense | | | 37,207 | | | | 34,010 | | | | 30,926 | |

| Income tax expense | | | 2,212 | | | | 2,484 | | | | 2,778 | |

| Net income attributable to noncontrolling interests | | | 5 | | | | 5 | | | | 5 | |

| Net income | | $ | 10,268 | | | $ | 11,005 | | | $ | 9,992 | |

| Per share data: | | | | | | | | | | | | |

| Basic earnings per share | | $ | 3.16 | | | $ | 3.38 | | | $ | 3.06 | |

| Diluted income per share | | $ | 3.12 | | | $ | 3.33 | | | $ | 3.03 | |

| Book value per share | | $ | 28.99 | | | $ | 26.38 | | | $ | 23.61 | |

| Cash dividends declared | | $ | 1.24 | | | $ | 1.22 | | | $ | 1.14 | |

| Weighted average shares outstanding-basic | | | 3,171,206 | | | | 3,182,515 | | | | 3,180,057 | |

| Weighted average shares outstanding-diluted | | | 3,291,206 | | | | 3,302,515 | | | | 3,300,057 | |

| Period End Balance Sheet Summary: | | | | | | | | | | | | |

| Total assets | | $ | 1,423,147 | | | $ | 1,163,683 | | | $ | 1,081,697 | |

| Investment securities | | | 292,293 | | | | 214,341 | | | | 191,919 | |

| Loans | | | 1,019,696 | | | | 862,509 | | | | 810,136 | |

| Allowance for loan losses | | | 17,382 | | | | 11,555 | | | | 10,035 | |

| Deposits | | | 1,285,967 | | | | 1,029,485 | | | | 945,837 | |

| Total equity | | | 95,462 | | | | 86,792 | | | | 78,009 | |

| Selected Financial Ratios: | | | | | | | | | | | | |

| Return on average assets | | | 0.78 | % | | | 0.98 | % | | | 0.95 | % |

| Return on average stockholders' equity | | | 10.47 | % | | | 12.99 | % | | | 13.37 | % |

| Dividends declared to net income | | | 39.24 | % | | | 36.10 | % | | | 39.98 | % |

| Loans to deposits | | | 79.29 | % | | | 83.78 | % | | | 85.65 | % |

| Average equity to average total assets | | | 7.43 | % | | | 7.52 | % | | | 7.14 | % |

| Capital Ratios (Bank only): | | | | | | | | | | | | |

| Leverage ratio | | | 8.41 | % | | | 8.41 | % | | | 8.50 | % |

| Common equity tier 1 | | | 12.24 | % | | | 10.62 | % | | | 10.50 | % |

| Tier 1 risk-based capital | | | 12.37 | % | | | 11.03 | % | | | 11.09 | % |

| Total risk-based capital | | | 13.63 | % | | | 12.29 | % | | | 12.33 | % |

Risk Factors

An investment in the securities offered hereby involves certain risks. You should carefully read the following risk factors about our business and this offering, together with the other information in this offering circular, before making a decision to purchase any shares.

If any of the following risks actually occurs, our business, assets, liquidity, operating results, prospects and financial condition could be seriously harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment.

Risks Relating to the Company and the Offered Stock

You may have difficulty in selling your securities or selling them at a fair price because there is little trading activity.

Our common stock is quoted on the OTC Market's OTCQX tier under the symbol “LYBC.” We have no plans to list any of our securities on any exchange. As a result, you may not be able to sell your shares without delay, or be able to sell your shares at a fair price. We cannot predict when, if ever, a fully developed active and liquid public trading market for our securities will occur. If a developed public trading market for our securities does develop at a future time, such developed public trading market may not be sustained for any period of time.

The future trading price of our common stock may be less than the purchase price in this offering.

While the trading price for our common stock has been relatively stable, we cannot assure you that the market price will not decline if and after you acquire our common shares. The trading price of our stock could fluctuate substantially based on a variety of factors, including, but not limited to, the following:

| · | future announcements concerning us, our competitors or the businesses with whom we have relationships, including new competition from former officers and employees of Lyons Bancorp, Inc. in our market area; |

| · | changes in government regulations and the financial services industry, generally that affect our costs, and the types and mix of our products; |

| · | the overall volatility of the stock markets and the economy generally; |

| · | our growth and ability to implement our expansion strategy, especially given the competition in the banking industry in our market area; and |

| · | changes in our operating results from quarter to quarter. |

In addition, the trading volume of our stock has been limited, which may increase the volatility of the trading price of our stock. Further, the economic impact of the COVID-19 pandemic has caused and may continue to cause the price of our stock to fluctuate.

Fluctuating interest rates may reduce our profitability.

Fluctuations in interest rates will ultimately affect both the level of income and expense we record on a large portion of the Bank’s assets and liabilities, and the market value of all interest-earning assets, other than interest-earning assets that mature in the short term. The Bank’s interest rate management strategy is designed to stabilize net interest income and preserve capital over a broad range of interest rate movements by matching the interest rate sensitivity of assets and liabilities. Although we believe that our current mix of loans, securities and deposits is reasonable, significant fluctuations in interest rates may have a negative effect on our profitability.

Persistently low interest rates could erode our core profitability.

We derive a significant portion of our net revenues (net interest income plus noninterest income) from the difference between what we earn on our interest-bearing assets such as loans and investment securities and what we pay for our interest-bearing liabilities. Of the $56.0 million of net revenues for the fiscal year ended December 31, 2020, 70.6% was attributable to this difference.

Part of the core profitability of a community bank such as ours is the lower cost inherent in the deposits it gathers at its branch offices compared to those that could be obtained in the wholesale money markets. This benefit has been eroding as market lending rates remain at low levels. In such an environment, our ability to save on funding costs is reduced and few additional savings will accrue to us for a longer period of time. In addition, as many of our interest-bearing assets prepay or mature, we will be forced to replace them with assets at lower current market yields. This asymmetrical impact could reduce our net interest income and adversely affect our operating results.

We may experience difficulties in managing our organic growth.

The success of our organic growth strategy will depend primarily on our ability to generate an increasing level of loans and deposits at acceptable risk levels and terms without significant increases in noninterest expenses relative to revenues generated. Our growth strategy involves a variety of risks, including our ability to:

| · | attract the talent needed to maintain adequate depth of management throughout our organization as we continue to grow; |

| · | maintain adequate sources of funding at attractive pricing; |

| · | maintain adequate underwriting practices and monitoring systems to maintain credit quality and manage a growing loan portfolio in the future; and |

| · | implement appropriate policies, procedures and operating systems necessary to support a larger organization while keeping expenses under control. |

If we fail to effectively identify or mitigate our risks, we could suffer unexpected losses and could be materially adversely affected.

Our risk management framework seeks to mitigate risk and appropriately balance risk and return. We have established processes and procedures intended to identify, measure, monitor and report the types of risk to which we are subject, including credit, liquidity, interest rate sensitivity, compliance, reputation, and operations. We seek to monitor and control our risk exposure through a framework of policies, procedures and reporting requirements. Management of our risks in some cases depends upon the use of analytical and/or forecasting models. If the models that we use to mitigate these risks are inadequate, we may incur increased losses. In addition, there may be risks that exist, or that develop in the future, that we have not appropriately anticipated, identified or mitigated. If our risk management framework does not effectively identify or mitigate our risks, we could suffer unexpected losses and could be materially adversely affected.

We may experience difficulties in assimilating future acquisitions into our business model.

As part of our general growth strategy, we may acquire banks and businesses that we believe provide a strategic fit with our business. We do not have a history of growth by acquisitions. To the extent that we grow by acquisition, we cannot assure you that we will be able to manage our growth adequately and profitably. Acquiring other banks and businesses will involve risks commonly associated with acquisitions, including:

| · | potential exposure to liabilities of banks and businesses we acquire; |

| · | difficulty and expense of integrating the operations and personnel of banks and businesses we acquire; |

| · | potential disruption to our business; |

| · | potential diversion of our management’s time and attention; and |

| · | impairment of relationships with and the possible loss of key employees and customers of the banks and businesses we acquire. |

Failure to successfully address the issues of growth either internally or by acquisition could adversely affect our results of operations and financial condition.

Because we primarily serve Wayne County and several counties in a close proximity, a decline in the economy of this local region could lower our profitability and adversely affect our growth.

We serve Wayne County and portions of Cayuga, Monroe, Onondaga, Ontario, Seneca and Yates counties with 16 banking offices, 27 ATMs and our Internet and telephone banking services. Our profits depend on providing products and services to customers in this local region. An increase in unemployment, a decrease in real estate values, inclement weather, natural disasters and adverse trends or events affecting various industry groups such as agriculture are among the factors that could weaken the local economy. With a weaker local economy:

| · | customers may not want or need our products and services; |

| · | borrowers may be unable to repay their loans; |

| · | the value of the collateral securing our loans to borrowers may decline; and |

| · | the overall quality of our loan portfolio may decline. |

Making mortgage loans, consumer loans, commercial loans and agricultural loans is a significant source of our profits. If customers in the local area do not want these loans, our profits may decrease. Although we could make other investments, we may earn less revenue on these investments than on loans. Also, our losses on loans may increase if borrowers are unable to make payments on their loans. Increases in delinquent and non-accrual loans may result in an additional provision for loan losses which will negatively affect earnings. All of these factors could lower our profitability and adversely affect our growth.

We operate in a highly competitive industry and market area.

Competition for commercial banking and other financial services is strong in our market area. In one or more aspects of business, the Company’s subsidiaries compete with other commercial banks, savings and loan associations, credit unions, finance companies, Internet-based financial services companies, mutual funds, insurance companies, brokerage and investment banking companies, and other financial intermediaries. Some of these competitors have substantially greater resources and lending capabilities and may offer services we do not currently provide. In addition, many of our non-banking competitors are not subject to the same extensive Federal regulations that govern bank holding company and federally insured banks. We focus on providing unparalleled customer service, which includes offering a strong suite of products and services. Based upon our ability to grow our customer base in recent years, management believes this business model allows us to compete effectively in the markets we serve, but there can be no assurance that this business model will be successful.

We may suffer more severely than other lenders if the local agricultural economy experiences a downturn in its economic performance as a business segment.

Our agricultural lending activities are an important part of the growth and profitability of the Company, with approximately 11.43% of our loan portfolio as of December 31, 2020, in either agriculture-related real estate or business loans. Based on Federal Reserve data for bank holding companies as of December 31, 2020, our peers held approximately 1.1% of their loan portfolios in agriculture-related loans. To the extent that the fortunes of the farm economy are adversely affected by general economic conditions, we may suffer more than our peers.

The COVID-19 outbreak has adversely affected, and is likely to continue to adversely affect, our business and results of operations.

The ongoing COVID-19 pandemic and measures intended to prevent its spread have had, and likely will continue to have, a material adverse effect on our business, financial condition, liquidity, and results of operations. The nature and extent of these effects will depend on future developments, which are highly uncertain and are difficult to predict.

In December 2019, a novel coronavirus was reported in China, and, in March 2020, the World Health Organization declared COVID-19 a pandemic. In March 2020, the United States declared the COVID-19 outbreak a national emergency. The COVID-19 pandemic has caused significant economic dislocation in the United States as many state and local governments, including New York, ordered non-essential businesses to close and residents to restrict their activities. This resulted in an unprecedented slow-down in economic activity and a related increase in unemployment. In response to the COVID-19 outbreak, the Federal Reserve has reduced the benchmark federal funds rate to a target range of 0% to 0.25% and the yields on 10 and 30-year treasury notes have declined to historic lows. Various state governments and federal agencies are requiring lenders to provide forbearance and other relief to borrowers (e.g., waiving late payment and other fees). Federal banking agencies have encouraged financial institutions to prudently work with affected borrowers and recently passed legislation has provided relief from reporting loan classifications due to modifications related to the COVID-19 outbreak. Certain industries have been particularly impacted, including the travel and hospitality industry, the restaurant industry, and the retail industry. In response to COVID-19, we have modified our business practices, including employee travel, employee work locations, and cancellation of physical participation in meetings, events and conferences. We also have had employees working remotely and may be required to take further actions required by government authorities or that we determine are in the best interests of our employees, customers and business partners.

Given the ongoing and dynamic nature of the circumstances, it is difficult to predict the full impact of the COVID-19 outbreak on our business. The extent of this impact will depend on future developments, which are highly uncertain, including the extent to which the outbreak can be controlled or abated, and the recovery of the economy generally. As the result of the COVID-19 pandemic and the related adverse local and national economic consequences, we may be subject to the following risks, any of which could have a material, adverse effect on our business, financial condition, liquidity, and results of operations:

| · | demand for our products and services may decline, making it difficult to grow assets and income; |

| · | if the economy is unable to substantially reopen, and high levels of unemployment continue for an extended period of time, loan delinquencies, problem assets, and foreclosures may increase, resulting in increased charges and reduced income; |

| · | collateral for loans, especially real estate, may decline in value, which could cause loan losses to increase; |

| · | our allowance for loan losses may have to be increased if borrowers experience financial difficulties beyond forbearance periods, which will adversely affect net income; |

| · | the net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments; |

| · | as the result of the decline in the Federal Reserve Board’s target federal funds rate to near 0%, the yield on our assets may decline to a greater extent than the decline in our cost of interest-bearing liabilities, reducing our net interest margin and spread and reducing net income; |

| · | a material decrease in net income or a net loss over several quarters could result in a decrease in the rate of Company dividends; |

| · | cyber security risks are increased as the result of an increase in the number of employees working remotely; and |

| · | our reliance on third party vendors for certain services and the unavailability of a critical service due to the COVID-19 outbreak could have an adverse effect on our operations. |

Moreover, our future success and profitability substantially depends on our executive officers and key employees, many of whom have held positions with us for many years. The unanticipated loss or unavailability of executive officers or key employees due to the outbreak could harm our ability to execute our business strategy, and we might not be successful in finding and integrating suitable successors in the event of executive officer or key employee loss or unavailability. Any of the factors identified above could negatively impact our business, financial condition and results of operations and prospects.

We are subject to regulatory, litigation, reputation and other risks related to our participation in the Paycheck Protection Program.

In response to the COVID-19 outbreak and related economic hardships, the CARES Act provided for the Paycheck Protection Program (“PPP”) as a loan program administered through the Small Business Administration (“SBA”). Under the PPP, small businesses and other entities and individuals can apply for loans from existing SBA lenders and other lenders, subject to detailed qualifications and eligibility criteria. Beginning in 2020, we have participated in the PPP, adding new commercial customers and $166 million in PPP loans.

Because of the short timeframe between the passing of the CARES Act and implementation of the PPP, some of the rules and guidance relating to PPP were issued after lenders began processing PPP applications. There continues to be uncertainty in the laws, rules and guidance relating to the PPP. Since the opening of the PPP, several banks have been subject to litigation regarding the procedures used in processing PPP applications and the payment of fees to agents that assisted borrowers in obtaining PPP loans. In addition, some banks and borrowers have received negative media attention associated with PPP loans. Although we believe that we have administered the PPP in accordance with all applicable laws, regulations and guidance, we may be exposed to litigation risk and negative media attention related to our participation in the PPP. Any such litigation may result in significant financial liability to us or adversely affect our reputation.

Federal and state regulators can also impose or request that we consent to substantial sanctions, restrictions and requirements if they determine there are violations of laws, rules or regulations or weaknesses or failures with respect to general standards of safety and soundness, including with respect to our PPP lending, which could adversely affect our business, reputation, results of operation and financial condition.

Further, there is a risk that PPP borrowers may not qualify for the loan forgiveness feature of the program due to the conduct of the borrower after the loan is originated. We also have credit risk with respect to PPP loans given that the SBA may determine that there is a deficiency in the manner in which we originated, funded or serviced loans, including any issue with the eligibility of a borrower to receive a PPP loan. These factors may result in us having to hold a significant amount of these low-yield loans on our books for a significant period of time. Moreover, in the event of a loss resulting from a default on a PPP loan and a determination by the SBA that there was a deficiency in the manner in which we originated, funded or serviced a PPP loan, the SBA may deny its liability under the guaranty, reduce the amount of the guaranty or, if the SBA has already paid under the guaranty, seek recovery of any loss related to the deficiency from us.

A significant portion of our loans are commercial real estate and commercial loans, which carry greater credit risk than loans secured by owner-occupied one-to-four family real estate.

At December 31, 2020, commercial real estate loans totaled $252.3 million or approximately 24% of our loan portfolio, and commercial loans, including term loans and revolving lines of credit, totaled $180.4 million, or approximately 18% of our total loan portfolio. Given their larger balances and the complexity of the underlying collateral, commercial real estate and commercial loans generally expose a lender to greater credit risk than loans secured by owner-occupied one- to four-family real estate. Commercial real estate and commercial loans also have greater credit risk than residential real estate loans because repayment is dependent on income being generated in amounts sufficient to cover operating expenses, property maintenance and debt service, and because repayment is generally dependent upon the successful operation of the borrower’s business.

If loans that are collateralized by real estate of other business assets become troubled and the value of the collateral has been significantly impaired, then we may not be able to recover the full contractual amount of principal and interest that we anticipated at the time we originated the loan. This could cause us to increase our provision for loan losses and adversely affect our operation results and financial condition.

Our business may be adversely affected by credit risk associated with residential property.

At December 31, 2020, $440.9 million, or approximately 42% of our total loan portfolio, was secured by one-to-four family residential real estate mortgage and home equity loans that may be generally sensitive to regional and local economic conditions that significantly impact the ability of borrowers to meet their loan repayment obligations, making loss levels difficult to predict. The national residential market experienced such conditions during the recession of 2008.

Although the Upstate New York State markets we serve have not historically experienced the "boom/bust" market conditions that other parts of the country have experienced, we cannot assure that will continue to be the case. A decline in residential real estate values as a result of the weakness of the housing market in the areas we serve would reduce the value of the real estate collateral securing residential real estate mortgage and increase the risk that we would incur losses if borrowers default on their loans. A decline in home values in our market areas would result in our residential loans being secured by first mortgages on properties in which the borrowers have little or no equity. Residential loans with combined higher loan-to-value ratios would be more sensitive to declining property values than those with lower combined loan-to-value ratios and therefore may experience a higher incidence of default and severity of losses. In addition, if the borrowers sell their homes, they may be unable to repay their loans in full from the sale proceeds. Further, a significant amount of our home equity loans, and lines of credit consist of second mortgage loans. For home equity loans and lines of credit secured by a second mortgage, it is unlikely that we would be successful in recovering all or a portion of our loan proceeds in the event of default. For these reasons, declining property values in our market areas would adversely affect our results of operations and financial condition.

Our profitability and ability to grow would be adversely affected if a change in the law occurs that precludes our municipal customers from maintaining deposits with us or if those customers withdraw their deposits from us for other reasons.

Public deposits historically have been very important to us. As of December 31, 2020, 15.9% of our deposits were provided by municipal customers, which we believe to be significantly greater than our peers. If legislation to liberalize the options for municipal deposits were passed, or if our relationships with local municipalities were to deteriorate, this important source of funding could erode and/or become more expensive. This could affect our profitability and our ability to fund our growth strategies.

If our allowance for loan losses is not sufficient to cover actual loan losses, our earnings would decrease.

Lending money is an essential part of the banking business. However, borrowers do not always repay their loans. The risk of non-payment is affected by:

| · | credit risks of a particular borrower; |

| · | changes in economic and industry conditions; |

| · | the duration and other terms of the loan; and |

| · | in the case of a collateralized loan, uncertainties as to the future value of the collateral. |

If our borrowers do not repay their loans, we may suffer loan losses. Loan losses are inherent in the lending business and could have a materially adverse effect on our operating results. We make various assumptions and judgments about the collectability of our loan portfolio and provide an allowance for loan losses for loan defaults and non-performance. The amount of future losses is susceptible to changes in economic, operating and other conditions, including changes in interest rates, beyond our control. Such losses may exceed current estimates. If our assumptions are wrong, our allowance for loan losses may not be sufficient to cover our future losses, thereby having an adverse effect on our earnings. In addition, this may cause us to increase the allowance for loan losses in the future, thereby decreasing our future earnings. In addition, bank regulators periodically review our allowance for loan losses and may require us to increase our provision for loan losses or recognize further loan charge-offs. Any increase in our allowance for loan losses or loan charge-offs required by these regulatory authorities would decrease our earnings.

We may lose customers or be unable to grow our customer base if our competitors develop and invest in technological improvements that consumer’s desire, but which are beyond our financial ability to adopt and implement.

The financial services industry continues to undergo rapid technological change with frequent introductions of new technology-driven products and services. In addition, the effective uses of technology to better serve customers increases efficiency and enables financial institutions to reduce costs. Our future success and ability to implement our growth strategy will depend in part upon our ability to use technology to provide products and services that will satisfy customer demands for convenience as well as to create additional efficiencies in our operations. Many of our competitors have substantially greater resources to invest in technological improvements.

Our ability to compete successfully in the future will depend on whether we can anticipate and respond to technological changes. To develop these and other new technologies we will likely have to make additional capital investments. Although we continually invest in new technology, we cannot assure you that we will have sufficient resources or access to the necessary proprietary technology to remain competitive in the future. We may not be able to effectively implement new technology-driven products and services or be successful in marketing such products and services to our customers. This could result in a loss of customers or an inability to grow our customer base, either of which would adversely affect our profitability and ability to grow.

We are a community bank and our ability to maintain our reputation is critical to the success of our business and the failure to do so may materially adversely affect our performance.

Our subsidiary bank is a community bank, and its reputation is one of the most valuable aspects of our business. A key component of our business strategy is to rely on our reputation for customer service and knowledge of local markets to expand our presence by taking advantage of new business opportunities with existing and prospective customers in our current market areas. As a result, we strive to conduct our business in a manner that enhances our reputation. This is done, in part, by recruiting, hiring and retaining employees who share our core values of being an integral part of the communities we serve, delivering superior service to our customers and addressing the needs of our customers and employees. If our reputation is negatively affected, by the actions of our employees, by our inability to conduct our operations in a manner that is appealing to current or prospective customers, or otherwise, our business and operating results may be adversely affected.

Our Business requires the Collection and Retention of Large Volumes of Sensitive Data, which is subject to Extensive Regulation and Oversight and Exposes our Business to Additional Risks.

In our ordinary course of business, we collect and retain large volumes of customer data, including personally identifiable information in various information systems that we maintain and in systems maintained by third parties with whom we contract to provide data services. We also maintain important internal Company data such as personally identifiable information about our employees and information relating to our operations. Our customers and employees have been, and will continue to be, targeted by cybersecurity threats attempting to misappropriate passwords, bank account information or other personal information. Our attempts to mitigate these threats may not be successful as cybercrimes are complex and continue to evolve. Publicized information concerning security and cyber-related problems could cause us to incur reputational harm and discourage our customers from using our electronic or web-based applications or solutions, which could harm their utility as a means of conducting commercial transactions.

Even well-protected information, networks, systems and facilities remain potentially vulnerable because the techniques used in breach attempts or other disruptions are constantly evolving and generally are not recognized until launched against a target, and in some cases are designed not to be detected and, in fact, may not be detected. Accordingly, we may be unable to anticipate these techniques or to implement adequate security barriers or other preventative measures. A security breach or other significant disruption of our information systems or those related to our customers and our third party vendors, including as a result of cyberattacks, could:

| · | disrupt the proper functioning of our internal, or our third-party vendors’, networks and systems and therefore our operations and those of our customers, |

| · | result in the unauthorized access to, and destruction, loss, theft, misappropriation or release of our confidential, sensitive or otherwise valuable information or our customers’ information, |

| · | result in a violation of applicable privacy, data breach and other laws, subjecting us to additional regulatory scrutiny and expose the us to civil litigation, governmental fines and possible financial liability |

| · | require significant management attention and resources to remedy the damages that result, or |

| · | harm our reputation or cause a decrease in the number of customers that choose to do business with us. |

The occurrence of any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

A Breach of Information or Other Technological Security, including as a result of Cyberattacks, could have a Material Adverse Effect on our Business, Financial Condition and Results of Operations.

We cannot be certain that all of our systems, or third-party systems upon which we rely, are free from vulnerability to cyberattack or other technological difficulties or failures. Information security breaches and cybersecurity-related incidents may include attempts to access information, including customer and company information, malicious code, computer viruses, phishing, denial of service attacks and other means of intrusion that could result in unauthorized access, misuse, loss or destruction of data (including confidential customer or employee information), account takeovers, unavailability of service or other events. These types of threats may derive from human error, fraud or malice on the part of external or internal parties, or may result from accidental technological failure. Further, to access our products and services our customers may use computers and mobile devices that are beyond our security control systems. If information security is breached or difficulties or failures occur, despite the controls we and our third party vendors have instituted, information may be lost or misappropriated, resulting in financial loss or costs, reputational harm or damages and litigation, regulatory investigation costs or remediation costs to us or others. While we maintain specific “cyber” insurance coverage, which would apply in the event of many breach scenarios, the amount of coverage may not be adequate in any particular case. Furthermore, because cyber threat scenarios are inherently difficult to predict and can take many forms, some breaches may not be covered under our cyber insurance coverage. Any of these consequences could have a material adverse effect on our financial condition and results of operations.

The risk of a security breach or disruption, particularly through cyber-attack or cyber intrusion, has significantly increased, in part due to the expansion of new technologies, the increased use of the Internet and mobile services and the increased intensity and sophistication of attempted attacks and intrusions from around the world. The threat from cyber-attacks is severe, attacks are sophisticated and increasing in volume, and attackers respond rapidly to changes in defensive measures. Our systems and those of our customers and third-party service providers are under constant threat and it is possible that we could experience a significant event in the future. Our technologies, systems, networks and software, and those of other financial institutions have been, and are likely to continue to be, the target of cybersecurity threats and attacks, which may range from uncoordinated individual attempts to sophisticated and targeted measures directed at us. Risks and exposures related to cybersecurity attacks are expected to remain high for the foreseeable future due to the rapidly evolving nature and sophistication of these threats as well as the expanding use of Internet banking, mobile banking and other technology-based products and services by us and our customers.

We are also subject to data security standards and privacy and data breach notice requirements established by federal and state regulators. Banking agencies have adopted guidelines to encourage financial institutions to address cybersecurity risks and identify, assess and mitigate these risks, both internally and at critical third party service providers. For example, federal banking regulators have highlighted that financial institutions should establish several lines of defense and design their risk management processes to address the risk posed by compromised customer credentials. In addition, financial institutions are expected to maintain sufficient business continuity planning processes designed to facilitate a recovery, resumption and maintenance of the institution’s operations after a cyberattack.

As cyber threats continue to evolve, we may be required to expend significant additional resources to modify our protective measures or to investigate and remediate any information security vulnerabilities.

We cannot guarantee the future payment of dividends on our Common Stock.

Holders of our common stock are only entitled to receive such dividends as our Board of Directors may declare out of funds legally available for such payments. The payment of future dividends will depend upon our financial resources, the earnings and the financial condition of the Bank and its subsidiaries, restrictions under applicable law and regulations and other factors relevant at the time the Board of Directors considers any declaration of dividends. In addition, if a default occurs in the payment due on the trust preferred securities issued by Lyons Capital Statutory Trust II in which we own all of the common beneficial interest or in the payment of dividends on our Series A preferred stock, we would be prohibited from paying dividends on our common stock. Accordingly, dividends, if any, may not be paid at historical levels or may be increased, or such an increase may not occur.

Monetary policies and economic factors could adversely affect our financial performance.

The success of the Company will depend in significant part upon its ability to attract deposits and extend loans and to maintain a sufficient interest margin between the rates of interest it receives on loans and other investments and the rates it pays out on deposits and other liabilities. This is affected by the monetary policies of federal regulatory authorities, particularly the Federal Reserve, and by economic conditions in our service area and the United States generally, including the following:

| · | changes in governmental economic and monetary policies; |

| · | the Internal Revenue Code and banking and credit regulations; |

| · | national, state, and local economic growth rates; |

We cannot predict the nature and timing of any changes in such policies and conditions or their impact on us or our bank subsidiary. Any such changes may have a material adverse impact on our financial performance.

We may be Adversely Impacted by the Transition from LIBOR as a Reference Rate.

In 2017, the United Kingdom’s Financial Conduct Authority announced that after 2021, it would no longer compel banks to submit the rates required to calculate the London Interbank Offered Rate (“LIBOR”). In November 2020, the administrator of LIBOR announced it will consult on its intention to extend the retirement date of certain offered rates whereby the publication of the one week and two month LIBOR offered rates will cease after December 31, 2021, but the publication of the remaining LIBOR offered rates will continue until June 30, 2023. In light of consumer protection, litigation, and reputation risks, the bank regulatory agencies have indicated that entering into new contracts that use LIBOR as a reference rate after December 31, 2021, would create safety and soundness risks and that they will examine bank practices accordingly. Therefore, those agencies encouraged banks to cease entering into new contracts that use LIBOR as a reference rate as soon as practicable and in any event by December 31, 2021.

It is not possible to predict what rate or rates may become accepted alternatives to LIBOR, or what the effect of any such changes in views or alternatives may be on the markets for LIBOR-indexed financial instruments. In particular, regulators, industry groups and certain committees (e.g., the Alternative Reference Rates Committee) have, among other things, published recommended fallback language for LIBOR-linked financial instruments, identified recommended alternatives for certain LIBOR rates (e.g., AMERIBOR or the Secured Overnight Financing Rate as the recommended alternative to U.S. Dollar LIBOR), and proposed implementations of the recommended alternatives in floating rate instruments. At this time, it is not possible to predict whether these specific recommendations and proposals will be broadly accepted, whether they will continue to evolve, and what the effect of their implementation may be on the markets for floating-rate financial instruments.