UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the Fiscal Year Ended December 31, 2012 |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to |

Commission File Number 333-50239

_____________________________

ACCURIDE CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 61-1109077 (I.R.S. Employer Identification No.) |

7140 Office Circle, Evansville, Indiana (Address of Principal Executive Offices) | 47715 (Zip Code) |

Registrant’s telephone number, including area code: (812) 962-5000

Securities registered pursuant to Section 12(b) of the Act:

| | Name of exchange on which registered |

| Common Stock, $0.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

_____________________________

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o | Accelerated Filer x | Non-Accelerated Filer o | Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes o No x

The aggregate market value of the registrant’s common stock held by non-affiliates based on the New York Stock Exchange closing price as of June 30, 2012 (the last business day of registrant’s most recently completed second fiscal quarter) was approximately $283,251,114. This calculation does not reflect a determination that such persons are affiliates of registrant for any other purposes.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No o

The number of shares of Common Stock, $0.01 par value, of Accuride Corporation outstanding as of March 14, 2013 was 47,419,115.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Registrant’s 2013 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2012

| PART I | | |

| Item 1. | | 3 |

| Item 1A. | | 11 |

| Item 1B. | | 22 |

| Item 2. | | 23 |

| Item 3. | | 23 |

| Item 4. | | 23 |

| PART II | | |

| Item 5. | | 24 |

| Item 6. | | 27 |

| Item 7. | | 31 |

| Item 7A. | | 47 |

| Item 8. | | 48 |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| PART III | | |

| Item 10. | | 49 |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| PART IV | | |

| Item 15. | | 50 |

| | | 54 |

| | |

| FINANCIAL STATEMENTS | |

| Report of Independent Registered Public Accounting Firm | 56 |

| Consolidated Balance Sheets | 58 |

| Consolidated Statements of Comprehensive Income (Loss) | 59 |

| Consolidated Statements of Stockholders’ Equity (Deficiency) | 60 |

| Consolidated Statements of Cash Flows | 61 |

| Notes to Consolidated Financial Statements | 63 |

Explanatory Note:

Effective November 18, 2010, Accuride Corporation implemented a one-for-ten reverse stock split of its Common Stock. Unless otherwise indicated, all share amounts and per share data in this Annual Report on Form 10-K for the Successor Company (as defined herein) have been adjusted to reflect this reverse stock split. See Note 1 of the consolidated financial statements for further discussion.

PART I

The Company

We are one of the largest and most diversified manufacturers and suppliers of commercial vehicle components in North America. Our products include commercial vehicle wheels, wheel-end components and assemblies, truck body and chassis parts, and ductile and gray iron castings. We market our products under some of the most recognized brand names in the industry, including Accuride, Gunite, Imperial, and Brillion. We serve the leading original equipment manufacturers, or OEMs, and their related aftermarket channels in most major segments of the commercial vehicle market, including heavy- and medium-duty trucks, commercial trailers, light trucks, buses, as well as specialty and military vehicles.

Our primary product lines are standard equipment used by a majority of North American heavy- and medium-duty truck OEMs, creating a significant barrier to entry. We believe that substantially all heavy-duty truck models manufactured in North America contain one or more of our components.

Our diversified customer base includes substantially all of the leading commercial vehicle OEMs, such as Daimler Truck North America, LLC (“DTNA”), with its Freightliner and Western Star brand trucks, PACCAR, Inc. (“PACCAR”), with its Peterbilt and Kenworth brand trucks, Navistar International Corporation, . (“International Truck”), with its International brand trucks, and Volvo Group North America (“Volvo/Mack”), with its Volvo and Mack brand trucks. Our primary commercial trailer customers include leading commercial trailer OEMs, such as Great Dane Limited Partnership, Utility Trailer Manufacturing Company, and Wabash National Corporation. Our major light truck customer is General Motors Company. Our product portfolio is supported by strong sales, marketing and design engineering capabilities and is manufactured in 14 strategically located, technologically-advanced facilities across the United States, Mexico and Canada.

Our business consists of four operating segments that design, manufacture, and distribute components for the commercial vehicle market, including heavy- and medium-duty trucks, commercial trailers, light trucks, buses, as well as specialty and military vehicles and their related aftermarkets. We have identified each of our operating segments as reportable segments. The Wheels segment’s products primarily consist of steel and aluminum wheels. The Gunite segment’s products consist primarily of wheel-end components and assemblies. The Imperial Group segment’s products consist primarily of truck body and chassis parts. The Brillion Iron Works segment’s products primarily consist of ductile, austempered ductile and gray iron castings, including engine and transmission components and industrial components. We believe this segmentation is appropriate based upon operating decisions and performance assessments by our President and Chief Executive Officer, who is our chief operating decision maker. Our financial results for the previous three fiscal years are discussed in “Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operation” and “Item 8: Financial Statements and Supplementary Data” of this Annual Report.

Corporate History

Accuride Corporation, a Delaware corporation (“Accuride” or the “Company”, and Accuride Canada Inc., a corporation formed under the laws of the province of Ontario, Canada, and a wholly owned subsidiary of Accuride, were incorporated in November 1986 for the purpose of acquiring substantially all of the assets and assuming certain of the liabilities of Firestone Steel Products, a division of The Firestone Tire & Rubber Company. The respective acquisitions by the companies were consummated in December 1986.

On January 31, 2005, pursuant to the terms of an agreement and plan of merger, a wholly owned subsidiary of Accuride merged with and into Transportation Technologies Industries, Inc., or TTI, resulting in TTI becoming a wholly owned subsidiary of Accuride, which we refer to as the TTI merger. TTI was founded as Johnstown America Industries, Inc. in 1991 in connection with the purchase of Bethlehem Steel Corporation’s freight car manufacturing operations.

Discontinued Operations

On January 31, 2011, substantially all of the assets, liabilities and business of our Bostrom Seating subsidiary were sold to a subsidiary of Commercial Vehicle Group, Inc. for approximately $8.8 million and resulted in recognition of a $0.3 million loss on our consolidated statements of operations and comprehensive income (loss) for the year ended December 31, 2011, which have been reclassified to discontinued operations. See Note 2 “Discontinued Operations” for further discussion.

On September 26, 2011, the Company announced the sale of its wholly-owned subsidiary, Fabco Automotive Corporation (“Fabco”) to Fabco Holdings, Inc., a new company formed and capitalized by Wynnchurch Capital, Ltd. in partnership with Stone River Capital Partners, LLC. The sale concluded for a purchase price of $35.0 million, subject to a working capital adjustment, plus a contingent receipt of up to $2.0 million depending on Fabco’s 2012 financial performance, which may become payable during 2013. The Company recognized a loss of $6.3 million, including $2.1 million in transactional fees, related to the sale transaction for the year ended ended December 31, 2011, which is included as a component of discontinued operations. See Note 2 “Discontinued Operations” for further discussion.

Impairment

As of November 30, 2012, the Company experienced a decline in its stock price to an amount below current book value as well as the impact of recent business developments in its Gunite reporting unit including a loss of customer market share and evidence of declining aftermarket sales. The Gunite reporting unit recorded impairments of goodwill of $62.8 million, other intangible assets of $36.8 million, and property, plant and equipment of $34.1 million.

Product Overview

We believe we design, produce, and market one of the broadest portfolios of commercial vehicle components in the industry. We classify our products under several categories, including wheels, wheel-end components and assemblies, truck body and chassis parts, and ductile and gray iron castings. The following describes our major product lines and brands.

Wheels (Approximately 45% of our 2012 net sales, 43% of our 2011 net sales, and 43% of our 2010 net sales)

We are the largest North American manufacturer and supplier of wheels for heavy- and medium-duty trucks, commercial trailers and related aftermarkets. We offer the broadest product line in the North American heavy- and medium-duty wheel industry and are the only North American manufacturer and supplier of both steel and forged aluminum heavy- and medium-duty wheels. We also produce wheels for buses, commercial light trucks, heavy-duty pick-up trucks, and military vehicles. We market our wheels under the Accuride brand. A description of each of our major products is summarized below:

| | ● | Heavy- and medium-duty steel wheels. We offer the broadest product line of steel wheels for the heavy- and medium-duty truck, commercial trailer markets and related aftermarkets. The wheels range in diameter from 17.5” to 24.5” and are designed for load ratings ranging from 3,640 to 13,000 lbs. We also offer a number of coatings and finishes which we believe provide the customer with increased durability and exceptional appearance. We are the standard steel wheel supplier to most North American heavy- and medium-duty truck OEMs and to a number of North American trailer OEMs. |

| | ● | Heavy- and medium-duty aluminum wheels. We offer a full product line of aluminum wheels for the heavy- and medium-duty truck, commercial trailer markets and related aftermarkets. The wheels range in diameter from 19.5” to 24.5” and are designed for load ratings ranging from 5,000 to 13,000 lbs. Aluminum wheels are generally lighter in weight, more readily stylized, and approximately 2.0 to 3.0 times as expensive as steel wheels. |

| | ● | Light truck steel wheels. We manufacture light truck single and dual steel wheels that range in diameter from 16” to 19.5” for customers such as General Motors. We are focused on larger diameter wheels designed for select truck platforms used for carrying heavier loads. |

| | ● | Military Wheels. We produce steel and aluminum wheels for military applications under the Accuride brand name. |

Wheel-End Components and Assemblies (Approximately 24% of our 2012 net sales, 27% of our 2011 net sales, and 30% of our 2010 net sales)

We are a major North American supplier of wheel-end components and assemblies to the heavy- and medium-duty truck markets and related aftermarket. We market our wheel-end components and assemblies under the Gunite brand. We produce four basic wheel-end assemblies: (1) disc wheel hub/brake drum, (2) spoke wheel/brake drum, (3) spoke wheel/brake rotor and (4) disc wheel hub/brake rotor. We also manufacture an extensive line of wheel-end components for the heavy- and medium-duty truck markets, such as brake drums, disc wheel hubs, spoke wheels, rotors and automatic slack adjusters. The majority of these components are critical to the safe operation of vehicles. A description of each of our major wheel-end components is summarized below:

| | ● | Brake Drums. We offer a variety of heavy- and medium-duty brake drums for truck, commercial trailer, bus, and off-highway applications. A brake drum is a braking device utilized in a “drum brake” which is typically made of iron and has a machined surface on the inside. When the brake is applied, air or brake fluid is forced, under pressure, into a wheel cylinder which, in turn, pushes a brake shoe into contact with the machined surface on the inside of the drum and stops the vehicle. Our brake drums are custom-engineered to exact requirements for a broad range of applications, including logging, mining, and more traditional over-the-road vehicles. To ensure product quality, we continually work with brake and lining manufacturers to optimize brake drum and brake system performance. Brake drums are our primary aftermarket product. The aftermarket opportunities in this product line are substantial as brake drums continually wear with use and eventually need to be replaced, although the timing of such replacement depends on the severity of use. |

| | ● | Disc Wheel Hubs. We manufacture a complete line of traditional ferrous disc wheel hubs for heavy- and medium-duty trucks and commercial trailers. A disc wheel hub is the connecting piece between the brake system and the axle upon which the wheel and tire are mounted. In addition, we offer a line of lightweight cast iron hubs that provide users with improved operating efficiency. Our lightweight hubs utilize advanced metallurgy and unique structural designs to offer both significant weight savings and lower costs due to fewer maintenance requirements. Our product line also includes finely machined hubs for anti-lock braking systems, or ABS, which enhance vehicle safety. |

| | ● | Spoke Wheels. We manufacture a full line of spoke wheels for heavy-and medium-duty trucks and commercial trailers. While disc wheel hubs have largely displaced spoke wheels for on-highway applications, they are still popular for severe-duty applications such as off-highway vehicles, refuse vehicles, and school buses, due to their greater strength. Our product line also includes finely machined wheels for ABS systems, similar to our disc wheel hubs. |

| | ● | Disc Brake Rotors. We develop and manufacture durable, lightweight disc brake rotors for a variety of heavy-duty truck applications. A disc rotor is a braking device that is typically made of iron with highly machined surfaces. When the brake is applied in a disc brake system, brake fluid from the master cylinder is forced into a caliper where it presses against a piston, which squeezes two brake pads against the disc rotor and stops the vehicle. Disc brakes are generally viewed as more efficient, although more expensive, than drum brakes and are often found in the front of a vehicle with drum brakes often located in the rear. We manufacture ventilated disc brake rotors that significantly improve heat dissipation as required for applications on Class 7 and 8 vehicles. We offer one of the most complete lines of heavy-duty and medium-duty disc brake rotors in the industry. |

| | ● | Automatic Slack Adjusters. Automatic slack adjusters react to, and adjust for, variations in brake shoe-to-drum clearance and maintain the proper amount of space between the shoe and drum. Our automatic slack adjusters automatically adjust the brake shoe-to-brake drum clearance, ensuring that this clearance is always constant at the time of braking. The use of automatic slack adjusters reduces maintenance costs, improves braking performance and minimizes side-to-pull and stopping distance. |

Truck Body and Chassis Parts (Approximately 14% of our 2012 net sales, 14% of our 2011 net sales, and 12% of our 2010 net sales)

We are a leading supplier of truck body and chassis parts to heavy- and medium-duty truck and bus manufacturers. We fabricate a broad line of truck body and chassis parts under the Imperial brand name, including bumpers, battery and toolboxes, crown assemblies, fuel tanks, roofs, fenders, crossmembers, tubular assemblies and stamping/fabricating assemblies including complete bus chassis. We also provide a variety of value-added services, such as chrome plating and polishing, powder coating, assembly, kitting and line sequencing.

We specialize in the fabrication of complex components and assemblies requiring a significant amount of tooling or customization. Our truck body and chassis parts manufacturing operations are characterized by low-volume production runs. Additionally, because each truck is uniquely customized to end user specifications, we have developed flexible production systems that are capable of accommodating multiple variations for each product design. A description of each of our major truck body and chassis parts is summarized below:

| | ● | Bumpers. We manufacture a wide variety of steel bumpers. These bumpers are polished/chrome plated to meet specific OEM and private label aftermarket requirements. |

| | ● | Fuel Tanks. We manufacture and assemble polished/unpolished aluminum fuel tanks and fuel tank straps for OEM and aftermarket customers. |

| | ● | Battery Boxes and Toolboxes. We design and manufacture polished/unpolished steel and aluminum battery and toolboxes for heavy-duty truck OEM and aftermarket customers. |

| | ● | Front-End Crossmembers. We fabricate and assemble crossmembers for heavy-duty trucks. A crossmember is a structural component of a chassis. These products are manufactured from heavy gauge, high-strength steel and assembled to customer line-set schedules. |

| | ● | Muffler Assemblies. We assemble and line-set complete muffler assemblies consisting of fabricated/polished parts, heat shields, mufflers, and exhaust tubing. |

| | ● | Crown Assemblies and Components. We manufacture multiple styles of crown assemblies and components. A crown assembly is the highly visible front section (grill) of the truck. These products are fabricated from both steel and aluminum, which are chrome-plated. |

| | ● | Tubular Products. We manufacture different exhaust, air, water, and decorative tubular products/assemblies. These products include grab handles, exhaust stacks, elbows, cooling tubes, intake tubes, turbo, and intermediate tubular assemblies. We are capable of producing these products with different grades of materials including mild steel, stainless steel and aluminum. |

| | ● | Bus Chassis. We manufacture and assemble chassis/frames for bus OEMs. These frames consist of heavy gauge metal fabrications involving extensive welding. |

| | ● | Other Products. We fabricate a wide variety of structural components/assemblies for truck and bus OEMs and aftermarket customers. These products include fenders, exhaust components, sun visors, windshield masks, step assemblies, brackets, fuel tank supports, inner-hood panels, door assemblies, dash panel assemblies, and various other components. |

Ductile, Austempered Ductile and Gray Iron Castings (Approximately 17% of our 2012 net sales, 16% of our 2011 net sales, and 15% of our 2010 net sales)

We produce ductile, austempered ductile and gray iron castings under the Brillion brand name. Our Brillion Foundry facility is one of North America’s largest iron foundries focused on the supply of complex, highly cored cast products to market leading customers in the commercial vehicle, diesel engine, construction, agricultural, hydraulic, oil and gas and industrial markets. Brillion offers both vertical and horizontal green sand molding processes to produce cast products that include:

| | ● | Transmission and Engine-Related Components. We believe that our Brillion foundry is a leading source for the casting of transmission and engine-related components to the heavy- and medium-duty truck markets, including flywheels, transmission and engine-related housings and brackets. |

| | ● | Industrial Components. Our Brillion foundry produces components for a wide variety of applications to the industrial machinery and construction equipment markets, including flywheels, pump housings, small engine components, and other industrial components. Our industrial components are made to specific customer requirements and, as a result, our product designs are typically proprietary to our customers. |

Cyclical and Seasonal Industry

The commercial vehicle components industry is highly cyclical and, in large part, depends on the overall strength of the demand for heavy- and medium-duty trucks. The industry has historically experienced significant fluctuations in demand based on factors such as general economic conditions, including industrial production and consumer spending, as well as, gas prices, credit availability, and government regulations. Cyclical peaks of commercial vehicle production in 1999 and 2006 were followed by sharp production declines of 48% and 69% to trough production levels in 2001 and 2009, respectively. Since 2009, commercial vehicle production levels have increased, and demand for our products as predicted by analysts, including America’s Commercial Transportation (“ACT”) and FTR Associates (“FTR”) Publications, is expected to improve in the second half of 2013 as economic conditions continue to improve. OEM production of major markets that we serve in North America, from 2006 to 2012, are shown below:

| | | For the Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| North American Class 8 | | | 278,720 | | | | 255,261 | | | | 154,173 | | | | 118,396 | | | | 205,639 | | | | 212,391 | | | | 376,448 | |

| North American Classes 5-7 | | | 188,449 | | | | 166,798 | | | | 117,901 | | | | 97,733 | | | | 158,294 | | | | 206,954 | | | | 275,332 | |

| U.S. Trailers | | | 240,015 | | | | 209,005 | | | | 124,162 | | | | 79,027 | | | | 143,901 | | | | 214,615 | | | | 280,203 | |

Our operations are typically seasonal as a result of regular OEM customer maintenance and model changeover shutdowns, which typically occur in the third and fourth quarter of each calendar year. In addition, our Gunite product line typically experiences higher aftermarket purchases of wheel-end components in the first and second quarters of each calendar year. This seasonality may result in decreased net sales and profitability during the third and fourth fiscal quarters of each calendar year.

Customers

We market our components to more than 1,000 customers, including most of the major North American heavy- and medium-duty truck and commercial trailer OEMs, as well as to the major aftermarket suppliers, including OEM dealer networks, wholesale distributors, and aftermarket buying groups. Our largest customers are PACCAR, Navistar, DTNA, and Volvo/Mack, which combined accounted for approximately 51.8 percent of our net sales in 2012, and individually constituted approximately 18.7 percent, 13.3 percent, 11.9 percent, and 7.9 percent, respectively, of our 2012 net sales. We have long-term relationships with our larger customers, many of whom have purchased components from us or our predecessors for more than 45 years. We garner repeat business through our reputation for quality and position as a standard supplier for a variety of truck lines. We believe that we will continue to be able to effectively compete for our customers’ business due to the high quality of our products, the breadth of our product portfolio, and our continued product innovation.

Sales and Marketing

We have an integrated, corporate-wide sales and marketing group. We have dedicated salespeople and sales engineers who reside near the headquarters of each of the four major truck OEMs and who spend substantially all of their professional time coordinating new sales opportunities and developing our relationship with the OEMs. These sales professionals function as a single point of contact with the OEMs, providing “one-stop shopping” for all of our products. Each brand has marketing personnel who, together with applications engineers, have in-depth product knowledge and provide support to the designated OEM salespeople.

We also market our products directly to end users, particularly large truck fleet operators, with a focus on wheels and wheel-end products to create “pull-through” demand for our products. This effort is intended to help convince the truck and trailer OEMs to designate our products as standard equipment and to create sales by encouraging fleets to specify our products on the equipment that they purchase, even if our product is not standard equipment. The fleet sales group also provides aftermarket sales coverage for our various products, particularly wheels and wheel-end components. These salespeople promote and sell our products to the aftermarket, including OEM dealers, warehouse distributors and aftermarket buying groups.

We have a consolidated aftermarket distribution strategy for our wheels and wheel-end components. In support of this strategy, we have a centralized distribution center in the Indianapolis, Indiana, metropolitan area. As a result, customers can order steel and aluminum wheels, brake drums/rotors and automatic slack adjusters on one purchase order, improving freight efficiencies and inventory turns for our customers. The aftermarket infrastructure enables us to expand our manufacturing plant direct shipments to larger aftermarket customers utilizing a virtual distribution strategy that allows us to maintain and enhance our competitiveness by eliminating unnecessary freight and handling through the distribution center.

International Sales

We consider sales to customers outside of the United States as international sales. International sales for the years, ended December 31, 2012, 2011, and 2010 are as follows:

| (In millions) | | International Sales | | | Percent of Net Sales | |

| 2012 | | $ | 139.6 | | | | 15.0 | % |

| 2011 | | $ | 158.3 | | | | 16.9 | % |

| 2010 | | $ | 104.1 | | | | 15.4 | % |

For additional information, see Note 11 to the “Notes to Consolidated Financial Statements” included herein.

Manufacturing

We operate 14 facilities, which are characterized by advanced manufacturing capabilities, in North America. Our U.S. manufacturing operations are located in Illinois, Kentucky, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin. In addition, we have manufacturing facilities in Canada and Mexico. These facilities are strategically located to meet our manufacturing needs and the demands of our customers.

All of our significant operations are QS-9000/TS 16949 certified, which means that they comply with certain quality assurance standards for truck components suppliers. We believe our manufacturing operations are highly regarded by our customers, and we have received numerous quality awards from our customers including PACCAR’s Preferred Supplier award and Daimler Truck North America’s Masters of Quality award. We were also awarded the 2011 Quality Leader of the Year award by the Automotive Division of the American Society for Quality.

All of our facilities incorporate extensive Lean Visual Operating Systems in the management of their day to day operations. This helps improve our product and process flow and on-time-delivery to our customers while minimizing required inventory levels across the business.

Competition

We operate in highly competitive markets. However, no single manufacturer competes with all of the products manufactured and sold by us in the heavy-duty truck market, and the degree of competition varies among the different products that we sell. In each of our markets, we compete on the basis of price, manufacturing and distribution capabilities, product quality, product design, product line breadth, delivery, and service.

The competitive landscape for each of our brands is unique. Our primary competitors in the wheel markets include Alcoa Inc., and Maxion Wheels. Our primary competitors in the wheel-ends and assemblies markets for heavy-duty trucks and commercial trailers are KIC Holdings, Inc., Meritor, Inc., Consolidated Metco Inc., and Webb Wheel Products Inc. The truck body and chassis parts markets are fragmented and characterized by many small private companies. Our major competitors in the industrial components market include ten to twelve foundries operating in the Midwest and Southern regions of the United States and in Mexico.

Raw Materials and Suppliers

We typically purchase steel for our wheel products from a number of different suppliers by negotiating high-volume one year contracts directly with steel mills or steel service centers. While we believe that our supply contracts can be renewed on acceptable terms, we may not be able to renew these contracts on such terms or at all. However, we do not believe that we are overly dependent on long-term supply contracts for our steel requirements as we have alternative sources available if need requires. Depending on market dynamics and raw material availability, the market is occasionally in tight supply, which may result in occasional industry allocations and surcharges.

We obtain aluminum for our wheel products from aluminum billet casting manufacturers. We believe that aluminum is readily available from a variety of sources. Aluminum prices have been volatile from time-to-time. We attempt to minimize the impact of such volatility through selected customer supported hedge agreements, supplier agreements and contractual price adjustments with customers.

Major raw materials for our wheel-end and industrial component products are steel scrap and pig iron. We do not have any long-term pricing agreements with any steel scrap or pig iron suppliers, but we do not anticipate having any difficulty in obtaining steel scrap or pig iron due to the large number of potential suppliers and our position as a major purchaser in the industry. A portion of the increases in steel scrap prices for our wheel-ends and industrial components are passed-through to most of our customers by way of a fluctuating surcharge, which is calculated and adjusted on a periodic basis. Other major raw materials include silicon sand, binders, sand additives and coated sand, which are generally available from multiple sources. Coke and natural gas, the primary energy sources for our melting operations, have historically been generally available from multiple sources, and electricity, another of these energy sources, has historically been generally available.

The main raw materials for our truck body and chassis parts are sheet and formed steel and aluminum. Price adjustments for these raw materials are passed-through to our largest customers for those parts on a contractual basis. We purchase major fabricating materials, such as fasteners, steel, and tube steel, from multiple sources, and these materials have historically been generally available.

Employees and Labor Unions

As of December 31, 2012, we had approximately 2,752 employees, of which 597 were salaried employees with the remainder paid hourly. Unions represent approximately 1,492 of our employees, which is approximately 54 percent of our total employees. We have collective bargaining agreements with several unions, including (1) the United Auto Workers, (2) the International Brotherhood of Teamsters, (3) the United Steelworkers, (4) the International Association of Machinists and Aerospace Workers, (5) the National Automobile, Aerospace, Transportation, and General Workers Union of Canada and (6) El Sindicato Industrial de Trabajadores de Nuevo Leon.

Each of our unionized facilities has a separate contract with the union that represents the workers employed at such facility. The union contracts expire at various times over the next few years with the exception of our union contract that covers the hourly employees at our Monterrey, Mexico, facility, which expires on an annual basis in January unless otherwise renewed. The 2013 negotiations in Monterrey were successfully completed prior to the expiration of our union contract. In 2012, we extended the labor contract at our London, Ontario facility through March 2018.

In 2013, we have collective bargaining agreements expiring at our Brillion, Wisconsin facility. We do not anticipate that our 2013 negotiations will have a material adverse effect on our operating performance or cost.

Intellectual Property

We believe the protection of our intellectual property is important to our business. Our principal intellectual property consists of product and process technology, a number of patents, trade secrets, trademarks and copyrights. Although our patents, trade secrets, and copyrights are important to our business operations and in the aggregate constitute a valuable asset, we do not believe that any single patent, trade secret, or copyright is critical to the success of our business as a whole. We also own common law rights and U.S. federal and foreign trademark registrations for several of our brands, which we believe are valuable, including Accuride®, Brillion TM, Gunite®, and Imperial TM. Our policy is to seek statutory protection for all significant intellectual property embodied in patents and trademarks. From time to time, we grant licenses under our intellectual property and receive licenses under intellectual property of others.

Backlog

Our production is based on firm customer orders and estimated future demand. Since firm orders generally do not extend beyond 15-45 days and we generally meet all requirements, backlog volume is generally not significant.

Environmental Matters

Our operations, facilities, and properties are subject to extensive and evolving laws and regulations pertaining to air emissions, wastewater and stormwater discharges, the handling and disposal of solid and hazardous materials and wastes, the investigation and remediation of contamination, and otherwise relating to health, safety, and the protection of the environment and natural resources. The violation of such laws can result in significant fines, penalties, liabilities or restrictions on operations. From time to time, we are involved in administrative or legal proceedings relating to environmental, health and safety matters, and have in the past incurred and will continue to incur capital costs and other expenditures relating to such matters. For example, we are currently involved in a proceeding regarding alleged violations of stormwater regulations at our Brillion facility, which could subject us to fines, penalties or other liabilities. In connection with that matter, we are negotiating with state authorities regarding certain capital improvements related to the underlying allegations. Based on current information, we do not expect that this matter will have a material adverse effect on our business, results of operations or financial conditions; however, we cannot assure you that this or any other future environmental compliance matters will not have such an effect.

In addition to environmental laws that regulate our ongoing operations, we are also subject to environmental remediation liability. Under the federal Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) and analogous state laws, we may be liable as a result of the release or threatened release of hazardous materials into the environment regardless of when the release occurred. We are currently involved in several matters relating to the investigation and/or remediation of locations where we have arranged for the disposal of foundry wastes. Such matters include situations in which we have been named or are believed to be potentially responsible parties in connection with the contamination of these sites. Additionally, environmental remediation may be required to address soil and groundwater contamination identified at certain of our facilities.

As of December 31, 2012, we had an environmental reserve of approximately $1.5 million, related primarily to our foundry operations. This reserve is based on management’s review of potential liabilities as well as cost estimates related thereto. Any expenditures required for us to comply with applicable environmental laws and/or pay for any remediation efforts will not be reduced or otherwise affected by the existence of the environmental reserve. Our environmental reserve may not be adequate to cover our future costs related to the sites associated with the environmental reserve, and any additional costs may have a material adverse effect on our business, results of operations or financial condition. The discovery of additional environmental issues, the modification of existing laws or regulations or the promulgation of new ones, more vigorous enforcement by regulators, the imposition of joint and several liability under CERCLA or analogous state laws, or other unanticipated events could also result in a material adverse effect.

The Iron and Steel Foundry National Emission Standard for Hazardous Air Pollutants (“NESHAP”) was developed pursuant to Section 112(d) of the Clean Air Act and requires major sources of hazardous air pollutants to install controls representative of maximum achievable control technology. Based on currently available information, we do not anticipate material costs regarding ongoing compliance with the NESHAP; however if we are found to be out of compliance with the NESHAP, we could incur liability that could have a material adverse effect on our business, results of operations or financial condition.

At our Erie, Pennsylvania, facility, we have obtained an environmental insurance policy to provide coverage with respect to certain environmental liabilities.

Management does not believe that the outcome of any environmental proceedings will have a material adverse effect on our consolidated financial condition or results of operations.

Research and Development Expense

Expenditures relating to the development of new products and processes, including significant improvements and refinements to existing products, are expensed as incurred. The amount expensed in the years ended December 31, 2012 and 2011 totaled $6.6 million and $4.8 million, respectively. For the period January 1, 2010 to February 26, 2010 and for the period February 26, 2010 to December 31, 2010 we expensed $0.7 million and $3.4 million, respectively.

Website Access to Reports

We make our periodic and current reports available, free of charge, on our website as soon as practicable after such material is electronically filed with the Securities and Exchange Commission (the “SEC”). Our website address is www.accuridecorp.com and the reports are filed under “SEC Filings” in the Investor Information section of our website. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s website is www.sec.gov.

Factors That May Affect Future Results

In this report, we have made various statements regarding current expectations or forecasts of future events. These statements are “forward-looking statements” within the meaning of that term in Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are also made from time-to-time in press releases and in oral statements made by our officers. Forward-looking statements are identified by the words “estimate,” “project,” “anticipate,” “will continue,” “will likely result,” “expect,” “intend,” “believe,” “plan,” “predict” and similar expressions.

Such forward-looking statements are based on assumptions and estimates, which although believed to be reasonable, may turn out to be incorrect. Therefore, undue reliance should not be placed upon these statements and estimates. These statements or estimates may not be realized and actual results may differ from those contemplated in these “forward-looking statements.” Some of the factors that may cause these statements and estimates to differ materially include, among others, market demand in the commercial vehicle industry, general economic, business and financing conditions, labor relations, government action, competitor pricing activity, expense volatility, and each of the risks highlighted below.

We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise. You are advised to consult further disclosures we may make on related subjects in our filings with the SEC. Our expectations, beliefs, or projections may not be achieved or accomplished. In addition to other factors discussed in the report, some of the important factors that could cause actual results to differ from those discussed in the forward-looking statements include the following risk factors.

Risks Related to Our Business and Industry

We rely on, and make significant operational decisions based, in part, upon industry data and forecasts that may prove to be inaccurate.

We continue to operate in a challenging economic environment and our ability to maintain liquidity may be affected by economic or other conditions that are beyond our control and which are difficult to predict. The 2013 OEM production forecasts by ACT Publications for the significant commercial vehicle markets that we serve, as of March 11, 2013, are as follows:

| North American Class 8 | | | 263,123 | |

| North American Classes 5-7 | | | 198,081 | |

| U.S. Trailers | | | 252,000 | |

We are dependent on sales to a small number of our major customers and on our status as standard supplier on certain truck platforms of each of our major customers.

Sales, including aftermarket sales, to PACCAR, Navistar, DTNA, and Volvo/Mack constituted approximately 18.7 percent, 13.3 percent, 11.9 percent, and 7.9 percent, respectively, of our 2012 net sales. No other customer accounted for more than 5 percent of our net sales for this period. The loss of any significant portion of sales to any of our major customers would likely have a material adverse effect on our business, results of operations or financial condition.

We are a standard supplier of various components at a majority of our major customers, which results in recurring revenue as our standard components are installed on most trucks ordered from that platform, unless the end user specifically requests a different product, generally at an additional charge. The selection of one of our products as a standard component may also create a steady demand for that product in the aftermarket. We may not maintain our current standard supplier positions in the future, and may not become the standard supplier for additional truck platforms. The loss of a significant standard supplier position or a significant number of standard supplier positions with a major customer could have a material adverse effect on our business, results of operations or financial condition. For example, during 2012 Gunite lost standard position at two OEMs for certain products, which led to impairment charges as described in Note 4 “Goodwill and Other Intangible Assets” and Note 5 “Property, Plant and Equipment”.

We are continuing to engage in efforts intended to improve and expand our relations with each of the customers named above. We have supported our position with these customers through direct and active contact with end users, trucking fleets, and dealers, and have located certain of our marketing personnel in offices near these customers and most of our other major customers. We may not be able to successfully maintain or improve our customer relationships so that these customers will continue to do business with us as they have in the past or be able to supply these customers or any of our other customers at current levels. The loss of a significant portion of our sales to any of these named customers could have a material adverse effect on our business, results of operations or financial condition. In addition, the delay or cancellation of

material orders from, or problems at, any of our other major customers could have a material adverse effect on our business, results of operations, or financial condition.

Increased cost or reduced supply of raw materials and purchased components may adversely affect our business, results of operations or financial condition.

Our business is subject to the risk of price increases and fluctuations and periodic delays in the delivery of raw materials and purchased components that are beyond our control. Our operations require substantial amounts of raw steel, aluminum, steel scrap, pig iron, electricity, coke, natural gas, sheet and formed steel, bearings, purchased components, fasteners, silicon sand, binders, sand additives, coated sand and tube steel. Fluctuations in the delivery of these materials may be driven by the supply/demand relationship for material, factors particular to that material or governmental regulation for raw materials such as electricity and natural gas. In addition, if any of our suppliers seek bankruptcy relief or otherwise cannot continue their business as anticipated or we cannot renew our supply contracts on favorable terms, the availability or price of raw materials could be adversely affected. Fluctuations in prices and/or availability of the raw materials or purchased components used by us, which at times may be more pronounced during periods of higher truck builds, may affect our profitability and, as a result, have a material adverse effect on our business, results of operations, or financial condition. In addition, as described above, a shortening or elimination of our trade credit by our suppliers may affect our liquidity and cash flow and, as a result, have a material adverse effect on our business, results of operations, or financial condition

We use substantial amounts of raw steel and aluminum in our production processes. Although raw steel is generally available from a number of sources, we have obtained favorable sourcing by negotiating and entering into high-volume contracts with terms ranging from one to two years. We obtain raw steel and aluminum from various suppliers. We may not be successful in renewing our supply contracts on favorable terms or at all. A substantial interruption in the supply of raw steel or aluminum or inability to obtain a supply of raw steel or aluminum on commercially desirable terms could have a material adverse effect on our business, results of operations or financial condition. We are not always able, and may not be able in the future, to pass on increases in the price of raw steel or aluminum to our customers on a timely basis or at all. In particular, when raw material prices increase rapidly or to significantly higher than normal levels, we may not be able to pass price increases through to our customers on a timely basis, if at all, which could adversely affect our operating margins and cash flow. Any fluctuations in the price or availability of raw steel or aluminum may have a material adverse effect on our business, results of operations or financial condition.

Steel scrap and pig iron are also major raw materials used in our business to produce our wheel-end and industrial components. Steel scrap is derived from, among other sources, junked automobiles, industrial scrap, railroad cars, agricultural and heavy machinery, and demolition steel scrap from obsolete structures, containers and machines. Pig iron is a low-grade cast iron that is a product of smelting iron ore with coke and limestone in a blast furnace. The availability and price of steel scrap and pig iron are subject to market forces largely beyond our control, including North American and international demand for steel scrap and pig iron, freight costs, speculation and foreign exchange rates. Steel scrap and pig iron availability and price may also be subject to governmental regulation. We are not always able, and may not be able in the future, to pass on increases in the price of steel scrap and pig iron to our customers. In particular, when raw material prices increase rapidly or to significantly higher than normal levels, we may not be able to pass price increases through to our customers on a timely basis, if at all, which could have a material adverse effect on our operating margins and cash flow. Any fluctuations in the price or availability of steel scrap or pig iron may have a material adverse effect on our business, results of operations or financial condition. See “Item 1—Business—Raw Materials and Suppliers”.

Our business is affected by the seasonality and regulatory nature of the industries and markets that we serve.

Our operations are typically seasonal as a result of regular customer maintenance and model changeover shutdowns, which typically occur in the third and fourth quarter of each calendar year. This seasonality may result in decreased net sales and profitability during the third and fourth fiscal quarters and have a material adverse effect on our business, results of operations, or financial condition. In addition, federal and state regulations (including engine emissions regulations, tariffs, import regulations and other taxes) may have a material adverse effect on our business and are beyond our control.

Cost reduction and quality improvement initiatives by OEMs could have a material adverse effect on our business, results of operations or financial condition.

We are primarily a components supplier to the heavy- and medium-duty truck industries, which are characterized by a small number of OEMs that are able to exert considerable pressure on components suppliers to reduce costs, improve quality and provide additional design and engineering capabilities. Given the fragmented nature of the industry, OEMs continue to demand and receive price reductions and measurable increases in quality through their use of competitive selection processes, rating programs, and various other arrangements. We may be unable to generate sufficient production cost savings in the future to offset such price reductions. OEMs may also seek to save costs by relocating production to countries with lower cost structures, which could in turn lead them to purchase components from local suppliers with lower production costs. Additionally, OEMs have generally required component suppliers to provide more design engineering input at earlier stages of the product development process, the costs of which have, in some cases, been absorbed by the suppliers. Future price reductions, increased quality standards and additional engineering capabilities required by OEMs may reduce our profitability and have a material adverse effect on our business, results of operations, or financial condition.

We operate in highly competitive markets and we may not be able to compete successfully.

The markets in which we operate are highly competitive. We compete with a number of other manufacturers and distributors that produce and sell similar products. Our products primarily compete on the basis of price, manufacturing and distribution capability, product design, product quality, product delivery and product service. Some of our competitors are companies, or divisions, units or subsidiaries of companies that are larger and have greater financial and other resources than we do. For these reasons, our products may not be able to compete successfully with the products of our competitors. In addition, our competitors may foresee the course of market development more accurately than we do, develop products that are superior to our products, have the ability to produce similar products at a lower cost than we can, or adapt more quickly than we do to new technologies or evolving regulatory, industry, or customer requirements. As a result, our products may not be able to compete successfully with their products. In addition, OEMs may expand their internal production of components, shift sourcing to other suppliers, or take other actions that could reduce the market for our products and have a negative impact on our business. We may encounter increased competition in the future from existing competitors or new competitors. We expect these competitive pressures in our markets to remain strong. See “Item 1—Business—Competition”.

In addition, competition from foreign truck components suppliers, especially in the aftermarket, may lead to an increase in truck components imports into North America, adversely affecting our market share and negatively affecting our ability to compete. Foreign truck components suppliers, including those in China, may in the future increase their current share of the markets for truck components in which we compete. Some of these foreign suppliers may be owned, controlled or subsidized by their governments, and their decisions with respect to production, sales and exports may be influenced more by political and economic policy considerations than by prevailing market conditions. In addition, foreign truck components suppliers may be subject to less restrictive regulatory and environmental regimes that could provide them with a cost advantage relative to North American suppliers. Therefore, there is a risk that some foreign suppliers, including those in China, may increase their sales of truck components in North American markets despite decreasing profit margins or losses.

On March 30, 2011, we, along with one other United States domestic commercial vehicle steel wheel supplier, filed antidumping and countervailing duty petitions with the United States International Trade Commission and the United States Department of Commerce alleging that manufacturers of certain steel wheels in China are dumping their products in the United States and that these manufacturers have been subsidized by their government in violation of United States trade laws. In May 2011, the International Trade Commission issued a preliminary determination that there was a reasonable indication that the U.S. steel wheel industry is materially injured or threatened with material injury by reason of imports from China of certain steel wheels, and began the final phase of its investigation. In August 2011, the U.S. Department of Commerce issued a preliminary determination of countervailing duties on steel wheels imported from China ranging from 26.2 percent to 46.6 percent ad valorem, and in October 2011, the U.S. Department of Commerce issued a preliminary determination of antidumping duty margins ranging from 110.6 percent to 243.9 percent ad valorem. On March 19, 2012, the Department of Commerce made final determinations of dumping and subsidy margins which cumulatively were approximately 70 percent to 228 percent ad valorem. However, on April 17, 2012, the International Trade Commission determined that the domestic industry has not been injured and was not presently threatened with injury from subject imports, and consequently withdrew all import duties on the subject imports. If future trade cases do not provide relief from unfair trade practices, U.S. protective trade laws are weakened or international demand for trucks and/or truck components decreases, an increase of truck component imports into the United States may occur, which could have a material adverse effect on our business, results of operation or financial condition.

Economic and other conditions may adversely impact the valuation of our assets resulting in impairment charges that could have a material adverse effect on our business, results of operations, or financial condition.

We review goodwill and our indefinite lived intangible assets (trade names) for impairment annually or more frequently if impairment indicators exist. A significant amount of judgment is involved in determining if an indicator of impairment has occurred. Such indicators may include, among others: a significant decline in our expected future cash flows, a sustained, significant decline in our stock price and market capitalization, a significant adverse change in industry or economic trends, unanticipated competition, slower growth rates, and significant changes in the manner of the use of our assets or the strategy for our overall business. Any adverse change in these factors could have a significant impact on the recoverability of these assets and could have a material impact on our consolidated financial statements. For example, due to recent business developments, including the loss of standard position for some of its products at two OEM customers, our Gunite reporting unit recorded goodwill, intangibles, and property, plant and equipment impairments of $62.8 million, $36.8 million and $34.1 million, respectively based upon our 2012 annual impairment testing. If we determine in the future that there are other potential impairments in any of our reporting units, we may be required to record additional charges to earnings that could have a material adverse effect on our business, results of operations, or financial condition.

We are subject to risks associated with our international operations.

We sell products in international locations and operate plants in Canada and Mexico. In addition, it is part our strategy to continue to expand internationally. Our current and future international sales and operations are subject to risks and uncertainties, including:

| | ● | possible government legislation; |

| | ● | difficulties and costs associated with complying with a wide variety of complex and changing laws, treaties and regulations; |

| | ● | unexpected changes in regulatory environments; |

| | ● | limitations on our ability to enforce legal rights and remedies; |

| | ● | economic and political conditions, war and civil disturbance; |

| | ● | tax inefficiencies and currency exchange controls that may adversely impact our ability to repatriate cash from non-United States subsidiaries; |

| | ● | the imposition of tariffs or other import or export restrictions; |

| | ● | costs and availability of shipping and transportation; and |

| | ● | nationalization of properties by foreign governments. |

We may have difficulty anticipating and effectively managing these and other risks that our international operations may face, which may adversely impact our business outside the United States and our business, financial condition and results of operations. In addition, international expansion will also require significant attention from our management and could require us to add additional management and other resources in these markets.

In addition, we operate in parts of the world that have experienced governmental corruption, and we could be adversely affected by violations of the Foreign Corrupt Practices Act (“FCPA”) and similar worldwide anti-bribery laws. The FCPA and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. If we were found to be liable for FCPA violations, we could be liable for criminal or civil penalties or other sanctions, which could have a material adverse impact on our business, financial condition and results of operations.

We face exposure to foreign business and operational risks including foreign exchange rate fluctuations and if we were to experience a substantial fluctuation, our profitability may change.

In the normal course of doing business, we are exposed to risks associated with changes in foreign exchange rates, particularly with respect to the Canadian Dollar and Mexican Peso. From time to time, we use forward foreign exchange contracts, and other derivative instruments, to help offset the impact of the variability in exchange rates on our operations, cash flows, assets and liabilities. At December 31, 2012, the notional amount of open foreign exchange forward contracts was $1.3 million. Factors that could further impact the risks associated with changes in foreign exchange rates include the accuracy of our sales estimates, volatility of currency markets and the cost and availability of derivative instruments. See “Item 7A— Quantitative and Qualitative Disclosure about Market Risk —Foreign Currency Risk”. In addition, changes in the laws or governmental policies in the countries in which we operate could have a material adverse effect on our business, results of operations, or financial condition.

We may not be able to continue to meet our customers’ demands for our products and services.

In order to remain competitive, we must continue to meet our customers’ demand for our products and services. However, we may not be successful in doing so. If our customers’ demand for our products and/or services exceeds our ability to meet that demand, we may be unable to continue to provide our customers with the products and/or services they require to meet their business needs. Factors that could result in our inability to meet customer demands include an unforeseen spike in demand for our products and/or services, a failure by one or more of our suppliers to supply us with the raw materials and other resources that we need to operate our business effectively or poor management of our Company or one or more divisions or units of our Company, among other factors. Our ability to provide our customers with products and services in a reliable and timely manner, in the quantity and quality desired and with a high level of customer service, may be severely diminished as a result. If this happens, we may lose some or all of our customers to one or more of our competitors, which could have a material adverse effect on our business, results of operations, or financial condition.

In addition, it is important that we continue to meet our customers’ demands in the truck components industry for product innovation, improvement and enhancement, including the continued development of new-generation products, design improvements and innovations that improve the quality and efficiency of our products. Developing product innovations for the truck components industry has been and will continue to be a significant part of our strategy. However, such development will require us to continue to invest in research and development and sales and marketing. Our recent financial condition has constrained our ability to make such investments. In the future, we may not have sufficient resources to make such necessary investments, or we may be unable to make the technological advances necessary to carry out product innovations sufficient to meet our customers’ demands. We are also subject to the risks generally associated with product development, including lack of market acceptance, delays in product development and failure of products to operate properly. We may, as a result of these factors, be unable to meaningfully focus on product innovation as a strategy and may therefore be unable to meet our customers’ demand for product innovation.

Equipment failures, delays in deliveries or catastrophic loss at any of our facilities could lead to production or service curtailments or shutdowns.

We manufacture our products at 14 facilities and provide logistical services at our just-in-time sequencing facilities in the United States. An interruption in production or service capabilities at any of these facilities as a result of equipment failure or other reasons could result in our inability to produce our products, which would reduce our net sales and earnings for the affected period. In the event of a stoppage in production at any of our facilities, even if only temporary, or if we experience delays as a result of events that are beyond our control, delivery times to our customers could be severely affected. Any significant delay in deliveries to our customers could lead to increased returns or cancellations and cause us to lose future sales. Our facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, explosions or violent weather conditions. We may experience plant shutdowns or periods of reduced production as a result of equipment failure, delays in deliveries or catastrophic loss, which could have a material adverse effect on our business, results of operations or financial condition.

We are subject to risks relating to our information technology systems, and any failure to adequately protect our critical information technology systems could materially affect our operations.

We rely on information technology systems across our operations, including for management, supply chain and financial information and various other processes and transactions. In addition, we are in the process of a corporate-wide migration to a new enterprise resource planning, or ERP, software system. Our ability to effectively manage our business depends on the security, reliability and capacity of these systems. Information technology system failures, network disruptions or breaches of security could disrupt our operations, causing delays or cancellation of customer orders or impeding the manufacture or shipment of products, processing of transactions or reporting of financial results. An attack or other problem with our systems could also result in the disclosure of proprietary information about our business or confidential information concerning our customers or employees, which could result in significant damage to our business and our reputation.

In addition, we could be required to expend significant additional amounts to respond to information technology issues or to protect against threatened or actual security breaches. We may not be able to implement measures that will protect against all of the significant risks to our information technology systems.

We may incur potential product liability, warranty and product recall costs.

We are subject to the risk of exposure to product liability, warranty and product recall claims in the event any of our products results in property damage, personal injury or death, or does not conform to specifications. We may not be able to continue to maintain suitable and adequate insurance in excess of our self-insured amounts on acceptable terms that will provide adequate protection against potential liabilities. In addition, if any of our products proves to be defective, we may be required to participate in a recall involving such products. A successful claim brought against us in excess of available insurance coverage, if any, or a requirement to participate in any product recall, could have a material adverse effect on our business, results of operations or financial condition.

Work stoppages or other labor issues at our facilities or at our customers’ facilities could have a material adverse effect on our operations.

As of December 31, 2012, unions represented approximately 54 percent of our workforce. As a result, we are subject to the risk of work stoppages and other labor relations matters. Any prolonged strike or other work stoppage at any one of our principal unionized facilities could have a material adverse effect on our business, results of operations or financial condition. We have collective bargaining agreements with different unions at various facilities. These collective bargaining agreements expire at various times over the next few years, with the exception of our union contract at our Monterrey, Mexico facility, which expires on an annual basis. The 2013 negotiations in Monterrey were successfully completed prior to

the expiration of our union contract. In 2012, we extended the labor contract at our London, Ontario facility through March 2018. In 2013, we have collective bargaining agreements expiring at our Brillion, Wisconsin facility. We do not anticipate that our 2013 negotiations will have a material adverse effect on our operating performance or cost.

In addition, if any of our customers experience a material work stoppage, that customer may halt or limit the purchase of our products. This could cause us to shut down production facilities relating to these products, which could have a material adverse effect on our business, results of operations or financial condition.

We are subject to a number of environmental laws and regulations that may require us to make substantial expenditures or cause us to incur substantial liabilities.

Our operations, facilities, and properties are subject to extensive and evolving laws and regulations pertaining to air emissions, wastewater and stormwater discharges, the handling and disposal of solid and hazardous materials and wastes, the investigation and remediation of contamination, and otherwise relating to health, safety, and the protection of the environment and natural resources. The violation of such laws can result in significant fines, penalties, liabilities or restrictions on operations. From time to time, we are involved in administrative or legal proceedings relating to environmental, health and safety matters, and have in the past incurred and will continue to incur capital costs and other expenditures relating to such matters. For example, we are involved in a proceeding regarding alleged violations of stormwater regulations at our Brillion facility, which could subject us to fines, penalties or other liabilities. In connection with that matter, we are negotiating with state authorities regarding certain capital improvements related to the underlying allegations. Based on current information, we do not expect that this matter will have a material adverse effect on our business, results of operations or financial conditions; however, we cannot assure you that these or any other future environmental compliance matters will not have such an effect.

In addition to environmental laws that regulate our ongoing operations, we are also subject to environmental remediation liability. Under the federal Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) and analogous state laws, we may be liable as a result of the release or threatened release of hazardous materials into the environment regardless of when the release occurred. We are currently involved in several matters relating to the investigation and/or remediation of locations where we have arranged for the disposal of foundry wastes. Such matters include situations in which we have been named or are believed to be potentially responsible parties in connection with the contamination of these sites. Additionally, environmental remediation may be required to address soil and groundwater contamination identified at certain of our facilities.

As of December 31, 2012, we had an environmental reserve of approximately $1.5 million, related primarily to our foundry operations. This reserve is based on management’s review of potential liabilities as well as cost estimates related thereto. Any expenditures required for us to comply with applicable environmental laws and/or pay for any remediation efforts will not be reduced or otherwise affected by the existence of the environmental reserve. Our environmental reserve may not be adequate to cover our future costs related to the sites associated with the environmental reserve, and any additional costs may have a material adverse effect on our business, results of operations or financial condition. The discovery of additional environmental issues, the modification of existing laws or regulations or the promulgation of new ones, more vigorous enforcement by regulators, the imposition of joint and several liability under CERCLA or analogous state laws, or other unanticipated events could also result in a material adverse effect.

The Iron and Steel Foundry National Emission Standard for Hazardous Air Pollutants (“NESHAP”) was developed pursuant to Section 112(d) of the Clean Air Act and requires major sources of hazardous air pollutants to install controls representative of maximum achievable control technology. Based on currently available information, we do not anticipate material costs regarding ongoing compliance with the NESHAP; however if we are found to be out of compliance with the NESHAP, we could incur liability that could have a material adverse effect on our business, results of operations or financial condition.

At the Erie, Pennsylvania, facility, we have obtained an environmental insurance policy to provide coverage with respect to certain environmental liabilities.

Management does not believe that the outcome of any environmental proceedings will have a material adverse effect on our consolidated financial condition or results of operations. See “Item 1—Business—Environmental Matters.”

Future climate change regulation may require us to make substantial expenditures or cause us to incur substantial liabilities.

Many scientists, legislators and others attribute climate change to increased emissions of greenhouse gases (“GHGs”), which has led to significant legislative and regulatory efforts to limit GHGs. In the recent past, Congress has considered legislation that would have reduced GHG emissions through a cap-and-trade system of allowances and credits, under which emitters would be required to buy allowances to offset emissions. In addition, in late 2009, the EPA promulgated a rule requiring certain emitters of GHGs to monitor and report data with respect to their GHG emissions and, in May 2010, finalized its “tailoring” rule for determining which stationary sources are required to obtain permits, or implement best available control technology, on account of their GHG emission levels. The EPA is also expected to adopt additional rules in the future that will require permitting for ever-broader classes of GHG emission sources. Moreover, several states, including states in which we have facilities, are considering or have begun to implement various GHG registration and reduction programs. Certain of our facilities use significant amounts of energy and may emit amounts of GHGs above certain existing and/or proposed regulatory thresholds. GHG laws and regulations could increase the price of the energy we purchase, require us to purchase allowances to offset our own emissions, require us to monitor and report our GHG emissions or require us to install new emission controls at our facilities, any one of which could significantly increase our costs or otherwise negatively affect our business, results of operations or financial condition. In addition, future efforts to curb transportation-related GHGs could result in a lower demand for our products, which could negatively affect our business, results of operation or financial condition. While future GHG regulation appears likely, it is difficult to predict how these regulations will affect our business, results of operations or financial condition.

We might fail to adequately protect our intellectual property, or third parties might assert that our technologies infringe on their intellectual property.

The protection of our intellectual property is important to our business. We rely on a combination of trademarks, copyrights, patents, and trade secrets to provide protection in this regard, but this protection might be inadequate. For example, our pending or future trademark, copyright, and patent applications might not be approved or, if allowed, they might not be of sufficient strength or scope. Conversely, third parties might assert that our technologies or other intellectual property infringe on their proprietary rights. Any intellectual property-related litigation could result in substantial costs and diversion of our efforts and, whether or not we are ultimately successful, the litigation could have a material adverse effect on our business, results of operations or financial condition. See “Item 1—Business—Intellectual Property.”

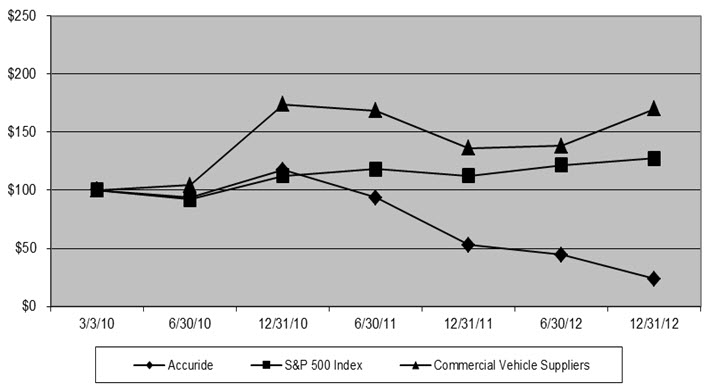

Litigation against us could be costly and time consuming to defend.