| Exhibit 13 | ||||||||

| United States Cellular Corporation and Subsidiaries | ||||||||

| Index | Page No. | |||||||

United States Cellular Corporation

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Executive Overview

The following Management’s Discussion and Analysis (MD&A) should be read in conjunction with the audited consolidated financial statements and notes of United States Cellular Corporation (UScellular) for the year ended December 31, 2020, and with the description of UScellular’s business included herein. Certain numbers included herein are rounded to millions for ease of presentation; however, certain calculated amounts and percentages are determined using the unrounded numbers.

This report contains statements that are not based on historical facts, including the words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions. These statements constitute and represent “forward looking statements” as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward looking statements. See Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement for additional information.

UScellular uses certain “non-GAAP financial measures” and each such measure is identified in the MD&A. A discussion of the reason UScellular determines these metrics to be useful and reconciliations of these measures to their most directly comparable measures determined in accordance with accounting principles generally accepted in the United States of America (GAAP) are included in the Supplemental Information Relating to Non-GAAP Financial Measures section within the MD&A of this Form 10-K Report.

The following MD&A omits discussion of 2019 compared to 2018. Refer to Management's Discussion and Analysis of Financial Condition and Results of Operations in UScellular's Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 25, 2020, for that discussion.

1

General

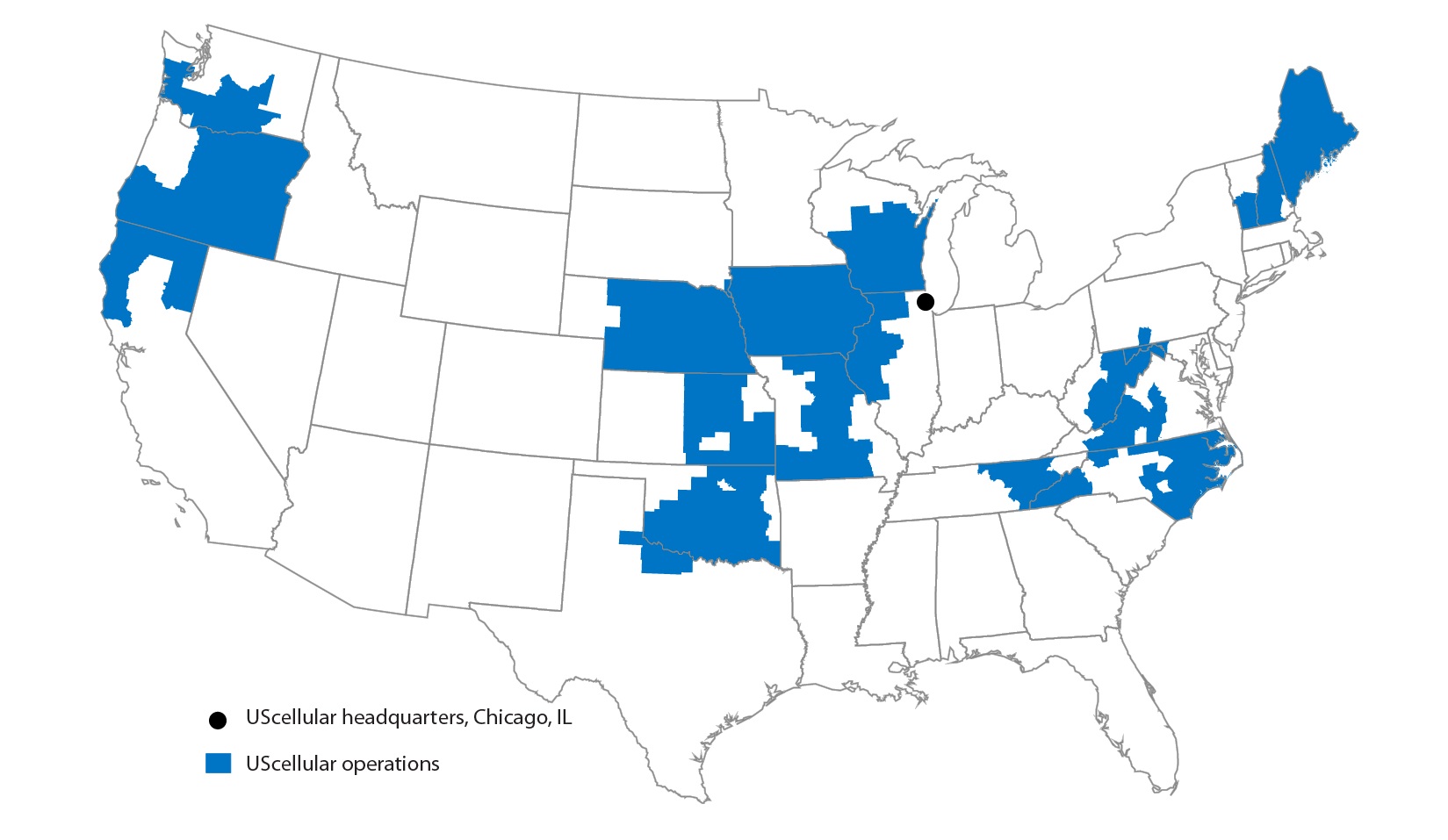

UScellular owns, operates, and invests in wireless markets throughout the United States. UScellular is an 82%-owned subsidiary of Telephone and Data Systems, Inc. (TDS).

| OPERATIONS | ||

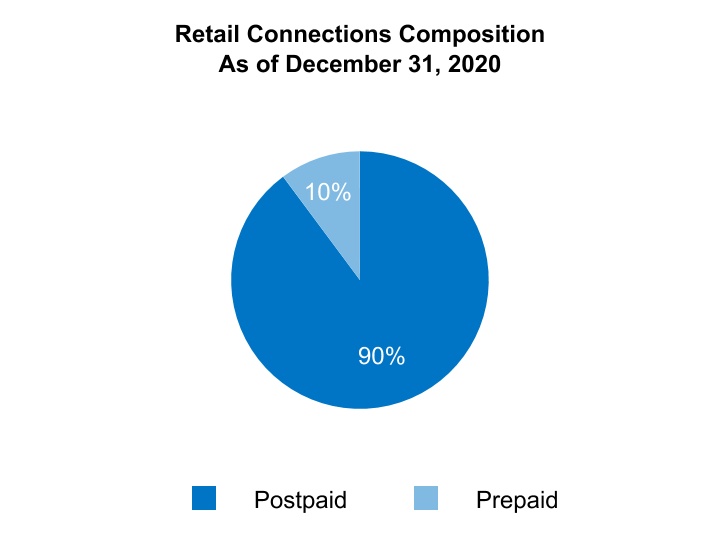

▪Serves customers with 5.0 million connections including 4.4 million postpaid, 0.5 million prepaid and 0.1 million reseller and other connections

▪Operates in 21 states

▪Employs approximately 5,300 associates

▪4,271 owned towers

▪6,797 cell sites in service

2

COVID-19 considerations

The impact of the global spread of the coronavirus disease (COVID-19) on UScellular's future operations is uncertain. There are many factors, including the severity and duration of the outbreak, as well as other direct and indirect impacts, that could negatively impact UScellular.

COVID-19 impacts on UScellular's business for 2020 include a reduction in certain components of service revenues and equipment sales, a reduction in advertising and sales promotion costs and a reduction in handset subscriber gross additions and defections. The impacts of COVID-19 could negatively affect UScellular’s results of operations, cash flows and financial position in future periods. The extent and duration of these impacts are uncertain due to many factors and could be material. Certain impacts on and actions by UScellular related to COVID-19 include, but are not limited to, the following:

•Taking action to keep associates safe, including implementing a work-from-home strategy for employees whose jobs can be performed remotely. In addition, to keep associates, customers, and communities safe, UScellular performs enhanced cleanings and provides associates with personal protective equipment to be worn during customer interactions. UScellular has also implemented a daily health check process for associates and requires social distancing and mask wearing in all company facilities, including stores. Throughout this period of change, UScellular has continued serving its customers and ensuring its wireless network remains fully operational.

•Participation in the FCC Keep Americans Connected Pledge, through June 30, 2020, to not turn-off service or charge late fees due to a customer’s inability to pay their bill due to circumstances related to COVID-19. This resulted in a reduction in non-pay defections, as well as reduced service revenues for the year ended December 31, 2020. During the third and fourth quarter of 2020, certain accounts that were part of the Pledge were terminated due to non-payment. Many of the remaining accounts that were on the Pledge are on payment arrangements of varying durations, and UScellular expects additional terminations due to non-payment in future periods.

•Waiving overage charges and certain other charges. This resulted in reduced service revenues for the year ended December 31, 2020.

•Supporting the communities in which UScellular operates. Through UScellular’s partnership with Boys & Girls Clubs, UScellular has contributed to the Boys & Girls Clubs’ COVID-19 Relief Fund to support children, families and communities. These funds are dispersed directly to more than 50 clubs in UScellular’s service regions to support the most immediate needs of youth in areas of importance such as providing food for children who rely on their Boys & Girls Clubs for their dinner, care for children of essential workers and first responders, and digital learning resources. UScellular also began exploring ways to leverage its assets, brand, partnerships, and resources to begin to close the digital divide and ensure all youth in its markets have reliable and fast internet access in school and at home.

•Recognizing income tax benefits associated with the enactment of the CARES Act. This legislation resulted in a reduction to income tax expense for the year ended December 31, 2020 and a projected cash refund in 2021 of taxes paid in prior years.

•Monitoring its supply chain to assess impacts to availability and costs of device inventory and network equipment and services, including monitoring the dependency on third parties to continue network related projects. At this time, UScellular expects to be able to meet customer demand for devices and services and to be able to continue its 4G LTE network modernization and 5G deployment with no significant disruptions.

•UScellular is tracking customer usage and, at this time, believes network capacity is sufficient to accommodate expected usage.

•Monitoring roaming behaviors. Both inbound and outbound roaming traffic have been dampened by COVID-19 as wireless customers are reducing travel. The extent to which roaming traffic will be impacted by the pandemic in the future will depend upon governmental mandates and customer behavior in response to the outbreak.

See the following areas within this MD&A for additional discussion of the direct and indirect impacts of COVID-19:

•Operational Overview

•Financial Overview

Also see the "Risk Factors" in UScellular's Form 10-K for the year ended December 31, 2020 for risks related to COVID-19.

3

UScellular Mission and Strategy

UScellular’s mission is to provide exceptional wireless communication services which enhance consumers’ lives, increase the competitiveness of local businesses, and improve the efficiency of government operations in the markets UScellular serves.

UScellular’s strategy is to attract and retain customers through a value proposition comprising a high-quality network, outstanding customer service, and competitive devices, plans and pricing - all provided with a community focus. Strategic efforts include:

▪UScellular offers economical and competitively priced service plans and devices to its customers and is focused on increasing revenues from sales of related products such as accessories and device protection plans and from new services such as home internet. In addition, UScellular is focused on expanding its solutions available to business and government customers.

▪UScellular continues to devote efforts to enhance its network capabilities. UScellular has completed its deployment of VoLTE technology. VoLTE technology allows customers to utilize a 4G LTE network for both voice and data services and offers enhanced services such as high definition voice and simultaneous voice and data sessions.

▪5G technology helps address customers’ growing demand for data services and creates opportunities for new services requiring high speed and reliability as well as low latency. UScellular's 5G deployment is initially focused on mobility services using its low band spectrum. UScellular has acquired high band spectrum, which it will deploy in the future to further enable the delivery of 5G services. UScellular has launched commercial 5G services in portions of California, Illinois, Iowa, Kansas, Maine, Maryland, Missouri, Nebraska, New Hampshire, North Carolina, Oklahoma, Oregon, Tennessee, Texas, Virginia, Washington, West Virginia and Wisconsin and will continue to launch in additional areas in the coming years. In addition to the deployment of 5G technology, UScellular is also modernizing its 4G LTE network to further enhance 4G LTE speeds.

▪UScellular assesses its existing wireless interests on an ongoing basis with a goal of improving the competitiveness of its operations and maximizing its long-term return on capital. As part of this strategy, UScellular actively seeks attractive opportunities to acquire wireless spectrum, including pursuant to FCC auctions such as Auctions 103, 105 and 107.

4

Terms Used by UScellular

The following is a list of definitions of certain industry terms that are used throughout this document:

▪4G LTE – fourth generation Long-Term Evolution, which is a wireless technology that enables more network capacity for more data per user as well as faster access to data compared to third generation (3G) technology.

▪5G – fifth generation wireless technology that helps address customers’ growing demand for data services and creates opportunities for new services requiring high speed and reliability as well as low latency.

▪Account – represents an individual or business financially responsible for one or multiple associated connections. An account may include a variety of types of connections such as handsets and connected devices.

▪Auctions 101, 102, 103, 105 and 107 – Auction 101 was an FCC auction of 28 GHz wireless spectrum licenses that started in November 2018 and concluded in January 2019. Auction 102 was an FCC auction of 24 GHz wireless spectrum licenses that started in March 2019 and concluded in May 2019. Auction 103 was an FCC auction of 37, 39, and 47 GHz wireless spectrum licenses that started in December 2019 and concluded in March 2020. Auction 105 was an FCC auction of 3.5 GHz wireless spectrum licenses that started in July 2020 and concluded in September 2020. Auction 107 is an FCC auction of 3.7-3.98 GHz wireless spectrum licenses that started in December 2020 and is not complete as of the date of this report.

▪Churn Rate – represents the percentage of the connections that disconnect service each month. These rates represent the average monthly churn rate for each respective period.

▪Connections – individual lines of service associated with each device activated by a customer. Connections are associated with all types of devices that connect directly to the UScellular network.

▪Connected Devices – non-handset devices that connect directly to the UScellular network. Connected devices include products such as tablets, wearables, modems, and hotspots.

▪Coronavirus Aid, Relief, and Economic Security (CARES) Act – economic relief package signed into law on March 27, 2020 to address the public health and economic impacts of COVID-19, including a variety of tax provisions.

▪EBITDA – refers to earnings before interest, taxes, depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted EBITDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Eligible Telecommunications Carrier (ETC) – designation by states for providing specified services in “high cost” areas which enables participation in universal service support mechanisms.

▪Free Cash Flow – non-GAAP metric defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Gross Additions – represents the total number of new connections added during the period, without regard to connections that were terminated during that period.

▪Keep Americans Connected Pledge – voluntary FCC initiative, through June 30, 2020, in response to the COVID-19 pandemic to ensure that Americans do not lose their broadband or telephone connectivity as a result of the exceptional circumstance.

▪Net Additions (Losses) – represents the total number of new connections added during the period, net of connections that were terminated during that period.

▪OIBDA – refers to operating income before depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted OIBDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Postpaid Average Revenue per Account (Postpaid ARPA) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid accounts and by the number of months in the period.

▪Postpaid Average Revenue per User (Postpaid ARPU) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid connections and by the number of months in the period.

▪Retail Connections – the sum of postpaid connections and prepaid connections.

▪Tax Act – refers to comprehensive federal tax legislation enacted on December 22, 2017, which made broad changes to the U.S. tax code. Now titled H.R.1, the Tax Act was originally identified as the Tax Cuts and Jobs Act of 2017.

▪Universal Service Fund (USF) – a system of telecommunications collected fees and support payments managed by the FCC intended to promote universal access to telecommunications services in the United States.

▪VoLTE – Voice over Long-Term Evolution is a technology specification that defines the standards and procedures for delivering voice communications and related services over 4G LTE networks.

5

Operational Overview

| As of December 31, | 2020 | 2019 | |||||||||||||||

| Retail Connections – End of Period | |||||||||||||||||

| Postpaid | 4,412,000 | 4,383,000 | |||||||||||||||

| Prepaid | 499,000 | 506,000 | |||||||||||||||

| Total | 4,911,000 | 4,889,000 | |||||||||||||||

| Year Ended December 31, | 2020 | 2019 | 2020 vs. 2019 | ||||||||||||||||||||

| Postpaid Activity and Churn | |||||||||||||||||||||||

| Gross Additions | |||||||||||||||||||||||

| Handsets | 397,000 | 458,000 | (13) | % | |||||||||||||||||||

| Connected Devices | 203,000 | 148,000 | 37 | % | |||||||||||||||||||

| Total Gross Additions | 600,000 | 606,000 | (1) | % | |||||||||||||||||||

| Net Additions (Losses) | |||||||||||||||||||||||

| Handsets | (13,000) | (24,000) | 46 | % | |||||||||||||||||||

| Connected Devices | 39,000 | (65,000) | N/M | ||||||||||||||||||||

| Total Net Additions (Losses) | 26,000 | (89,000) | N/M | ||||||||||||||||||||

| Churn | |||||||||||||||||||||||

| Handsets | 0.89 | % | 1.04 | % | |||||||||||||||||||

| Connected Devices | 2.58 | % | 3.24 | % | |||||||||||||||||||

| Total Churn | 1.09 | % | 1.31 | % | |||||||||||||||||||

N/M - Percentage change not meaningful

Total postpaid handset net losses decreased in 2020 due primarily to lower handset defections as a result of lower consumer switching activity related to COVID-19, as well as a reduction in non-pay defections. Partially offsetting the decrease in defections were lower gross additions resulting from lower consumer switching activity.

Total postpaid connected device net additions increased in 2020 due primarily to (i) an increase in gross additions due to higher demand for internet related products given a need for remote connectivity related to COVID-19 and (ii) a decrease in tablet defections.

Postpaid Revenue

| Year Ended December 31, | 2020 | 2019 | 2020 vs. 2019 | ||||||||||||||||||||

| Average Revenue Per User (ARPU) | $ | 47.01 | $ | 46.01 | 2% | ||||||||||||||||||

| Average Revenue Per Account (ARPA) | $ | 122.93 | $ | 119.80 | 3% | ||||||||||||||||||

Postpaid ARPU and Postpaid ARPA increased in 2020, due primarily to (i) an increase in device protection plan revenues, (ii) an increase in regulatory recovery revenues, and (iii) having proportionately fewer tablet connections, which on a per-unit basis contribute less revenue than other connected devices and smartphones. These increases were partially offset by the impact of waiving overage charges and late payment and related fees, measures UScellular took to assist customers during 2020 related to the COVID-19 pandemic.

6

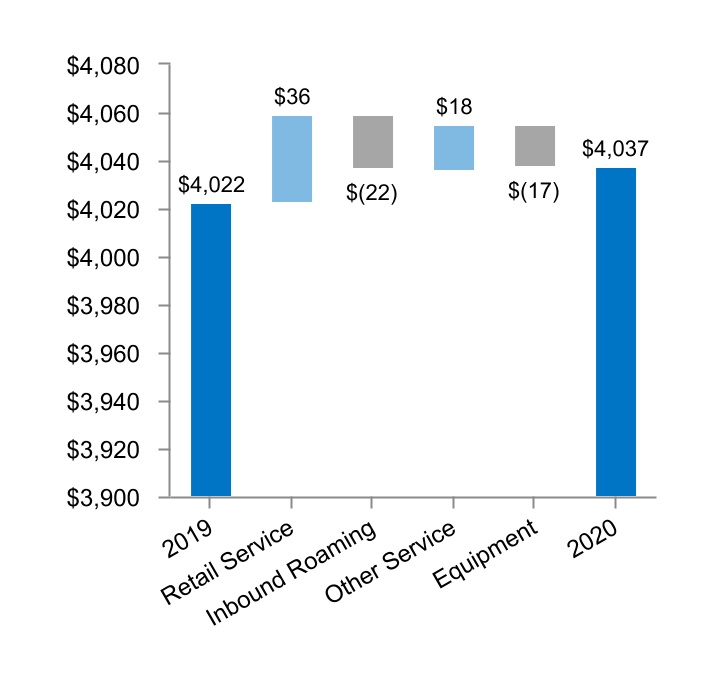

Financial Overview

| Year Ended December 31, | 2020 | 2019 | 2020 vs. 2019 | ||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| Retail service | $ | 2,686 | $ | 2,650 | 1 | % | |||||||||||||||||||||||

| Inbound roaming | 152 | 174 | (13) | % | |||||||||||||||||||||||||

| Other | 229 | 211 | 8 | % | |||||||||||||||||||||||||

| Service revenues | 3,067 | 3,035 | 1 | % | |||||||||||||||||||||||||

| Equipment sales | 970 | 987 | (2) | % | |||||||||||||||||||||||||

| Total operating revenues | 4,037 | 4,022 | – | ||||||||||||||||||||||||||

| System operations (excluding Depreciation, amortization and accretion reported below) | 782 | 756 | 3 | % | |||||||||||||||||||||||||

| Cost of equipment sold | 1,011 | 1,028 | (2) | % | |||||||||||||||||||||||||

| Selling, general and administrative | 1,368 | 1,406 | (3) | % | |||||||||||||||||||||||||

| Depreciation, amortization and accretion | 683 | 702 | (3) | % | |||||||||||||||||||||||||

| (Gain) loss on asset disposals, net | 25 | 19 | 36 | % | |||||||||||||||||||||||||

| (Gain) loss on sale of business and other exit costs, net | — | (1) | N/M | ||||||||||||||||||||||||||

| (Gain) loss on license sales and exchanges, net | (5) | — | N/M | ||||||||||||||||||||||||||

| Total operating expenses | 3,864 | 3,910 | (1) | % | |||||||||||||||||||||||||

| Operating income | $ | 173 | $ | 112 | 54 | % | |||||||||||||||||||||||

| Net income | $ | 233 | $ | 133 | 76 | % | |||||||||||||||||||||||

Adjusted OIBDA (Non-GAAP)1 | $ | 876 | $ | 832 | 5 | % | |||||||||||||||||||||||

Adjusted EBITDA (Non-GAAP)1 | $ | 1,063 | $ | 1,015 | 5 | % | |||||||||||||||||||||||

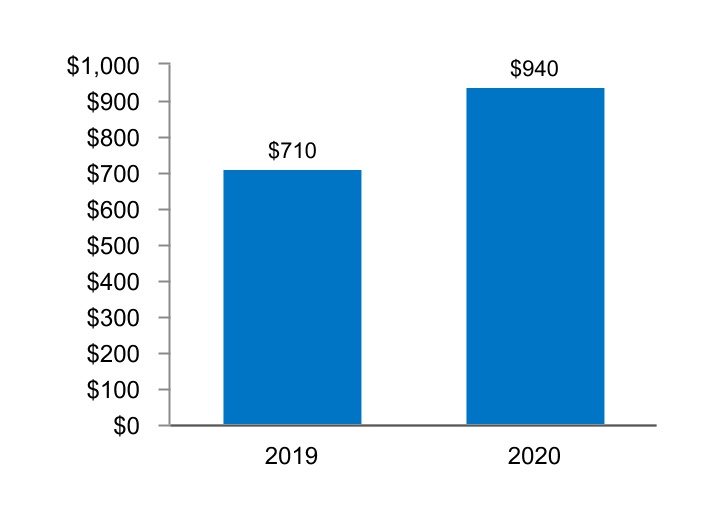

Capital expenditures2 | $ | 940 | $ | 710 | 32 | % | |||||||||||||||||||||||

N/M - Percentage change not meaningful

1Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

2Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

7

Operating Revenues

(Dollars in millions)

Service revenues consist of:

▪Retail Service – Charges for voice, data and value added services and recovery of regulatory costs

▪Inbound Roaming – Charges to other wireless carriers whose customers use UScellular’s wireless systems when roaming

▪Other Service – Amounts received from the Federal USF, tower rental revenues, and miscellaneous other service revenues

Equipment revenues consist of:

▪Sales of wireless devices and related accessories to new and existing customers, agents, and third-party distributors

Key components of changes in the statement of operations line items were as follows:

Total operating revenues

Retail service revenues increased in 2020, primarily as a result of an increase in Postpaid ARPU as previously discussed in the Operational Overview section, partially offset by a decline in the average number of postpaid subscribers.

Inbound roaming revenues decreased in 2020, primarily driven by lower data revenues, with lower rates partially offset by higher usage. UScellular expects inbound roaming revenues to continue to decline as a result of a decrease in rates, and the merger of Sprint and T-Mobile.

Other service revenues increased in 2020, resulting from increases in tower rental revenues and miscellaneous other service revenues.

Equipment sales revenues decreased in 2020, due primarily to a decrease in new smartphone and accessory sales, partially offset by an increase in used smartphone sales.

System operations expenses

System operations expenses increased in 2020, due to increased cell site rent expense, non-capitalizable costs to add network capacity and costs to decommission network assets.

Cost of equipment sold

Cost of equipment sold decreased in 2020, due primarily to a decrease in new smartphone and accessory sales, partially offset by an increase in used smartphone and connected device sales.

Selling, general and administrative expenses

Selling, general and administrative expenses decreased in 2020, due primarily to decreases in (i) bad debts expense driven by fewer non-pay customers as a result of better credit mix and improved customer payment behavior and (ii) advertising expense due to reduced sponsorship expense from cancelled events related to COVID-19.

Depreciation, amortization and accretion

Depreciation, amortization, and accretion decreased in 2020, due to certain billing system assets reaching their end of life, partially offset by higher depreciation due to increased capital expenditures and accelerated depreciation of certain assets due to changes in network technology.

8

(Gain) loss on asset disposals, net

Loss on asset disposals, net increased in 2020 due primarily to higher disposal of used equipment.

Components of Other Income (Expense)

| Year Ended December 31, | 2020 | 2019 | 2020 vs. 2019 | ||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| Operating income | $ | 173 | $ | 112 | 54 | % | |||||||||||||||||||||||

| Equity in earnings of unconsolidated entities | 179 | 166 | 8 | % | |||||||||||||||||||||||||

| Interest and dividend income | 8 | 17 | (54) | % | |||||||||||||||||||||||||

| Gain (loss) on investments | 2 | — | N/M | ||||||||||||||||||||||||||

| Interest expense | (112) | (110) | (2) | % | |||||||||||||||||||||||||

| Total investment and other income | 77 | 73 | 6 | % | |||||||||||||||||||||||||

| Income before income taxes | 250 | 185 | 35 | % | |||||||||||||||||||||||||

| Income tax expense | 17 | 52 | (68) | % | |||||||||||||||||||||||||

| Net income | 233 | 133 | 76 | % | |||||||||||||||||||||||||

| Less: Net income attributable to noncontrolling interests, net of tax | 4 | 6 | (30) | % | |||||||||||||||||||||||||

| Net income attributable to UScellular shareholders | $ | 229 | $ | 127 | 81 | % | |||||||||||||||||||||||

N/M - Percentage change not meaningful

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents UScellular’s share of net income from entities in which it has a noncontrolling interest and that are accounted for using the equity method. UScellular’s investment in the Los Angeles SMSA Limited Partnership (LA Partnership) contributed pre-tax income of $82 million and $78 million in earnings of unconsolidated entities in 2020 and 2019, respectively. See Note 8 — Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements for additional information.

Interest and dividend income

Interest and dividend income decreased in 2020, primarily driven by lower interest rates.

Interest Expense

Interest expense increased in 2020, primarily as a result of an increase in interest expense related to new borrowings, partially offset by a higher amount of capitalized interest.

Income tax expense

The effective tax rate on Income before income taxes for 2020 was 6.6%. The effective tax rate includes the impact of federal and state tax, and is reduced significantly in 2020 due to the tax benefits of the CARES Act enacted on March 27, 2020.

The CARES Act provides retroactive eligibility of bonus depreciation on qualified improvement property put into service after December 31, 2017 and a 5-year carryback of net operating losses generated in years 2018-2020. As the statutory federal tax rate applicable to certain years within the carryback period is 35%, carryback to those years provides a tax benefit in excess of the current federal statutory rate of 21%, resulting in a reduction of income tax expense for the year ended December 31, 2020, and a projected cash refund in 2021 of taxes paid in prior years.

The effective tax rate on Income before income taxes for 2019 was 28.1%. The effective tax rate includes the impact of federal and state tax, as well as other increases due primarily to nondeductible interest expense.

See Note 5 — Income Taxes in the Notes to Consolidated Financial Statements for additional information.

9

Liquidity and Capital Resources

Sources of Liquidity

UScellular operates a capital-intensive business. In the past, UScellular’s existing cash and investment balances, funds available under its revolving credit and receivables securitization agreements, funds from other financing sources, including a term loan and other long-term debt, and cash flows from operating and certain investing and financing activities, including sales of assets or businesses, provided sufficient liquidity and financial flexibility for UScellular to meet its normal day-to-day operating needs and debt service requirements, to finance the build-out and enhancement of markets and to fund acquisitions, primarily of wireless spectrum licenses. There is no assurance that this will be the case in the future. See Market Risk for additional information regarding maturities of long-term debt.

UScellular has incurred negative free cash flow at times in the past and this could occur in the future. However, UScellular believes that existing cash and investment balances, funds available under its revolving credit, term loan and receivables securitization agreements, expected future tax refunds and expected cash flows from operating and investing activities will provide sufficient liquidity for UScellular to meet its normal day-to-day operating needs and debt service requirements for the coming year. UScellular will continue to monitor the rapidly changing business and market conditions and plans to take appropriate actions, as necessary, to meet its liquidity needs.

UScellular may require substantial additional capital for, among other uses, funding day-to-day operating needs including working capital, acquisitions of providers of wireless telecommunications services, wireless spectrum license or system acquisitions, capital expenditures, agreements to purchase goods or services, leases, debt service requirements, the repurchase of shares, or making additional investments. It may be necessary from time to time to increase the size of the existing revolving credit agreement, to put in place new credit agreements, or to obtain other forms of financing in order to fund potential expenditures.

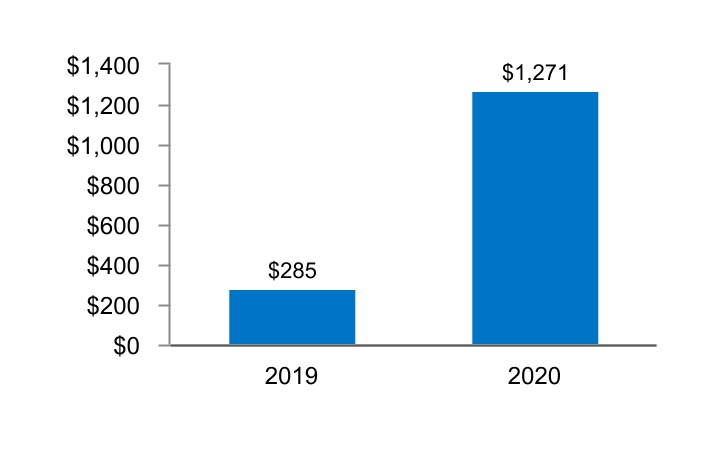

Cash and Cash Equivalents

Cash and cash equivalents include cash and money market investments.

Cash and Cash Equivalents

(Dollars in millions)

The majority of UScellular’s Cash and cash equivalents are held in bank deposit accounts and in money market funds that purchase only debt issued by the U.S. Treasury or U.S. government agencies.

Revolving Credit Agreement

In March 2020, UScellular entered into a new $300 million unsecured revolving credit agreement with certain lenders and other parties. Amounts under the new revolving credit agreement may be borrowed, repaid and reborrowed from time to time until maturity in March 2025. As a result of the new agreement, UScellular's previous revolving credit agreement due to expire in May 2023 was terminated. As of December 31, 2020, there were no outstanding borrowings under the revolving credit agreement, except for letters of credit, and UScellular’s unused borrowing capacity under its revolving credit agreement was $298 million.

10

Term Loan Agreement

In March 2020, UScellular amended its unsecured senior term loan credit agreement in order to conform the agreement with its revolving credit agreement. In June 2020, UScellular amended and restated the agreement and increased its borrowing capacity to $300 million. The term loan may be drawn in one or more advances by the one-year anniversary of the date of the agreement; amounts not drawn by that time will cease to be available. The maturity date of the term loan is in June 2027. As of December 31, 2020, the outstanding borrowings under the agreement were $83 million and the unused borrowing capacity was $217 million.

Receivables Securitization Agreement

In April 2020, UScellular borrowed $125 million under its receivables securitization agreement. In October 2020, UScellular amended and restated its agreement to increase its total borrowing capacity to $300 million. Amounts under the receivables securitization agreement may be borrowed, repaid and reborrowed from time to time until maturity in December 2022, which may be extended from time to time as specified therein. In December 2020, UScellular repaid $100 million of the outstanding borrowing. As of December 31, 2020, the outstanding borrowings under the agreement were $25 million and the unused capacity was $275 million, subject to sufficient collateral to satisfy the asset borrowing base provisions of the agreement.

Financial Covenants

The revolving credit agreement, senior term loan agreement and receivables securitization agreement require UScellular to comply with certain affirmative and negative covenants, which include certain financial covenants. In particular, under these agreements, UScellular is required to maintain the Consolidated Interest Coverage Ratio at a level not lower than 3.00 to 1.00 as of the end of any fiscal quarter. UScellular also was required to maintain the Consolidated Leverage Ratio at a level not to exceed 3.25 to 1.00 as of the end of any fiscal quarter. UScellular believes that it was in compliance as of December 31, 2020 with all such financial covenants.

Other Long-Term Financing

In August 2020, UScellular issued $500 million of 6.25% Senior Notes due in 2069 and in December 2020, UScellular issued $500 million of 5.5% Senior Notes due in 2070. The proceeds from both issuances will be used for general corporate purposes, which may include the repayment of other debt, the purchase of additional spectrum and the funding of capital expenditures, including in connection with 5G buildout projects.

UScellular has an effective shelf registration statement on Form S-3 to issue senior or subordinated debt securities. The proceeds from any such issuance may be used for general corporate purposes, including the possible reduction of other short-term or long-term debt; spectrum purchases; capital expenditures; acquisition, construction and development programs; working capital; additional investments in subsidiaries; or the repurchase of shares. The UScellular shelf registration statement permits UScellular to issue at any time and from time to time senior or subordinated debt securities in one or more offerings, up to the amount registered, which is currently $500 million. The ability of UScellular to complete an offering pursuant to such shelf registration statement is subject to market conditions and other factors at the time.

UScellular believes that it was in compliance as of December 31, 2020, with all covenants and other requirements set forth in the UScellular long-term debt indentures. UScellular has not failed to make nor does it expect to fail to make any scheduled payment of principal or interest under such indentures.

Refer to Market Risk — Long-Term Debt for additional information regarding required principal payments and the weighted average interest rates related to UScellular’s Long-term debt.

UScellular, at its discretion, may from time to time seek to retire or purchase its outstanding debt through cash purchases and/or exchanges for other securities, in open market purchases, privately negotiated transactions, tender offers, exchange offers or otherwise. Such repurchases or exchanges, if any, will depend on prevailing market conditions, liquidity requirements, contractual restrictions and other factors. The amounts involved may be material.

See Note 12 — Debt in the Notes to Consolidated Financial Statements for additional information regarding the revolving credit agreement, senior term loan agreement, receivables securitization agreement, Senior Notes and other long-term financing.

11

Credit Ratings

In certain circumstances, UScellular’s interest cost on its revolving credit and term loan agreements may be subject to increase if its current credit ratings from nationally recognized credit rating agencies are lowered, and may be subject to decrease if the ratings are raised. UScellular’s agreements do not cease to be available nor do the maturity dates accelerate solely as a result of a downgrade in credit rating. However, a downgrade in UScellular’s credit rating could adversely affect its ability to renew the agreements or obtain access to other credit agreements in the future.

UScellular is rated at sub-investment grade. UScellular’s credit ratings as of December 31, 2020, and the dates such ratings were re-affirmed were as follows:

| Rating Agency | Rating | Outlook | ||||||

| Moody's (re-affirmed October 2020) | Ba1 | stable outlook | ||||||

| Standard & Poor's (re-affirmed October 2020) | BB | stable outlook | ||||||

| Fitch Ratings (re-affirmed June 2020) | BB+ | stable outlook | ||||||

Capital Requirements

The discussion below is intended to highlight some of the significant cash outlays expected during 2021 and beyond and to highlight the spending incurred in prior years for these items. This discussion does not include cash required to fund normal operations, and is not a comprehensive list of capital requirements. Significant cash requirements that are not routine or in the normal course of business could arise from time to time.

Capital Expenditures

UScellular makes substantial investments to acquire, construct and upgrade wireless telecommunications networks and facilities to remain competitive and as a basis for creating long-term value for shareholders. In recent years, rapid changes in technology and new opportunities (such as 5G and VoLTE technology) have required substantial investments in potentially revenue‑enhancing and cost-saving upgrades of UScellular’s networks to remain competitive; this is expected to continue in 2021 and future years with the continued deployment of 5G technology.

Capital expenditures (i.e., additions to property, plant and equipment and system development expenditures; excludes wireless spectrum license additions), which include the effects of accruals and capitalized interest, in 2020 and 2019 were as follows:

Capital Expenditures

(Dollars in millions)

In 2020, UScellular's capital expenditures were used for the following purposes:

▪Enhance and maintain UScellular's network coverage, including continuing deployment of VoLTE technology and providing additional speed and capacity to accommodate increased data usage by current customers;

▪Continue network modernization and 5G deployment; and

▪Invest in information technology to support existing and new services and products.

UScellular’s capital expenditures for 2021 are expected to be between $775 million and $875 million. UScellular will continue to incur spend in 2021 related to its multi-year 5G deployment and network modernization initiatives.

UScellular intends to finance its capital expenditures for 2021 using primarily Cash flows from operating activities, existing cash balances and, if required, additional debt financing from its receivables securitization agreement, senior term loan credit agreement, revolving credit agreement and/or other forms of financing.

12

Acquisitions, Divestitures and Exchanges

UScellular may be engaged from time to time in negotiations (subject to all applicable regulations) relating to the acquisition, divestiture or exchange of companies, properties or wireless spectrum licenses (including pursuant to FCC auctions). In general, UScellular may not disclose such transactions until there is a definitive agreement.

Subsequent to December 31, 2020, UScellular committed to purchase wireless spectrum licenses for approximately $1,460 million inclusive of associated costs, subject to regulatory approval. UScellular believes its cash balances, existing debt facilities, and other financing sources as described above are sufficient to meet this commitment.

Other Obligations

UScellular will require capital for future spending on existing contractual obligations, including long-term debt obligations; operating lease and finance lease commitments; commitments for device purchases, network facilities and transport services; agreements for software licensing; long-term marketing programs; and other agreements to purchase goods or services.

Variable Interest Entities

UScellular consolidates certain “variable interest entities” as defined under GAAP. See Note 14 — Variable Interest Entities in the Notes to Consolidated Financial Statements for additional information related to these variable interest entities. UScellular may elect to make additional capital contributions and/or advances to these variable interest entities in future periods in order to fund their operations.

Common Share Repurchase Program

During 2020, UScellular repurchased 803,836 Common Shares for $23 million at an average cost per share of $29.00. At December 31, 2020, the total cumulative amount of UScellular Common Shares authorized to be purchased is 4,507,000.

Depending on its future financial performance, construction, development and acquisition programs, and available sources of financing, UScellular may not have sufficient liquidity or capital resources to make share repurchases. Therefore, there is no assurance that UScellular will make any share repurchases in the future.

For additional information related to the current repurchase authorization, see Note 16 — Common Shareholders’ Equity in the Notes to Consolidated Financial Statements.

Off-Balance Sheet Arrangements

UScellular had no transactions, agreements or other contractual arrangements with unconsolidated entities involving “off-balance sheet arrangements,” as defined by SEC rules, that had or are reasonably likely to have a material current or future effect on its financial condition, results of operations, liquidity, capital expenditures or capital resources.

13

Consolidated Cash Flow Analysis

UScellular operates a capital‑intensive business. UScellular makes substantial investments to acquire wireless spectrum licenses and properties and to construct and upgrade wireless telecommunications networks and facilities as a basis for creating long-term value for shareholders. In recent years, rapid changes in technology and new opportunities have required substantial investments in potentially revenue‑enhancing and cost-saving upgrades to UScellular’s networks. Cash flows may fluctuate from quarter to quarter and year to year due to seasonality, the timing of acquisitions and divestitures, capital expenditures and other factors. The following discussion summarizes UScellular’s cash flow activities in 2020 and 2019.

2020 Commentary

UScellular’s Cash, cash equivalents and restricted cash increased $1,000 million. Net cash provided by operating activities was $1,237 million due to net income of $233 million adjusted for non-cash items of $758 million, distributions received from unconsolidated entities of $189 million including $89 million in distributions from the LA Partnership, and changes in working capital items which increased net cash by $57 million. The working capital changes were primarily influenced by the timing of vendor payments partially offset by tax impacts from the CARES Act and the timing of collections of customer and agent receivables.

Cash flows used for investing activities were $1,163 million. Cash paid for additions to property, plant and equipment totaled $989 million. Cash payments for wireless spectrum license acquisitions, including advance payments, were $201 million.

Cash flows provided by financing activities were $926 million, reflecting the issuance of $500 million of 5.50% Senior Notes, $500 million of 6.25% Senior Notes, and $125 million borrowed under the receivables securitization agreement. These were partially offset by a $100 million repayment on the receivables securitization agreement, payment of debt issuance costs of $38 million and the repurchase of $23 million of Common Shares.

2019 Commentary

UScellular’s Cash, cash equivalents and restricted cash decreased $292 million. Net cash provided by operating activities was $724 million due to net income of $133 million plus non-cash items of $702 million and distributions received from unconsolidated entities of $161 million, including $75 million in distributions from the LA Partnership. This was offset by changes in working capital items which decreased net cash by $272 million. The more significant working capital changes were increases in accounts receivables and equipment installment plan receivables and decreases in accounts payable and accrued taxes.

Cash flows used for investing activities were $864 million. Cash paid for additions to property, plant and equipment totaled $650 million and Cash paid for licenses totaled $266 million. This was partially offset by cash received from the redemption of short-term Treasury bills of $29 million and Cash received from divestitures and exchanges of $41 million.

Cash flows used for financing activities were $152 million, reflecting a $100 million principal prepayment on the senior term loan, the repurchase of $21 million of Common Shares and ordinary activity such as the scheduled repayments of debt.

14

Consolidated Balance Sheet Analysis

The following discussion addresses certain captions in the consolidated balance sheet and changes therein. This discussion is intended to highlight the significant changes and is not intended to fully reconcile the changes. Changes in financial condition during 2020 were as follows:

Income taxes receivable

Income taxes receivable increased $79 million primarily reflecting future tax refunds attributable to the carryback of 2020 net operating losses, as allowed under the CARES Act which was enacted in March 2020. See Note 5 — Income Taxes in the Notes to Consolidated Financial Statements for additional information.

Accounts payable - Trade

Accounts payable - Trade increased $81 million due primarily to software license and network equipment spending.

Deferred income tax liability, net

Deferred income tax liability, net increased $126 million due primarily to full deductibility for tax purposes of qualified property placed in service during 2020. See Note 5 — Income Taxes in the Notes to Consolidated Financial Statements for additional information.

Other deferred liabilities and credits

Other deferred liabilities and credits increased $57 million due primarily to increases in the asset retirement obligation liability and long-term contract liabilities from contracts with customers.

Long-term debt, net

Long-term debt, net increased $987 million due primarily to the issuance of $500 million of 5.50% Senior Notes and $500 million of 6.25% Senior Notes. See Note 12 — Debt in the Notes to Consolidated Financial Statements for additional information.

15

Application of Critical Accounting Policies and Estimates

UScellular prepares its consolidated financial statements in accordance with GAAP. UScellular’s significant accounting policies are discussed in detail in Note 1 — Summary of Significant Accounting Policies and Recent Accounting Pronouncements, Note 2 — Revenue Recognition and Note 10 — Leases in the Notes to Consolidated Financial Statements.

Management believes the application of the following critical accounting policies and the estimates required by such application reflect its most significant judgments and estimates used in the preparation of UScellular’s consolidated financial statements.

Wireless Spectrum Licenses

Wireless spectrum licenses represent a significant component of UScellular’s consolidated assets. Wireless spectrum licenses are considered to be indefinite-lived assets and, therefore, are not amortized but rather are tested at least annually for impairment. Significant negative events, such as changes in any of the assumptions described below as well as decreases in forecasted cash flows, could result in an impairment in future periods. Wireless spectrum licenses are tested for impairment at the level of reporting referred to as a unit of accounting.

For purposes of its impairment testing, UScellular separates its FCC wireless spectrum licenses into eight units of accounting, which consist of one unit of accounting for developed operating market wireless spectrum licenses (built wireless spectrum licenses) and seven geographic non-operating market wireless spectrum licenses (unbuilt wireless spectrum licenses). UScellular performed a qualitative impairment assessment in 2020 and a quantitative impairment assessment in 2019 to determine whether an impairment existed.

In 2020, UScellular considered several qualitative factors, including analyst estimates of wireless spectrum license values which contemplated recent spectrum auction results, recent UScellular and other market participant transactions and other industry and market factors. Based on this assessment, UScellular concluded that it was more likely than not that the fair value of the wireless spectrum licenses in each unit of accounting exceeded their respective carrying values. Therefore, no quantitative impairment evaluation was completed.

In 2019, a market approach was used to value the wireless spectrum license portfolio. Within each unit of accounting, the wireless spectrum licenses were pooled by type and by geographic area. The market approach calculates estimated market values using observable pricing multiples from wireless spectrum license purchase and auction transactions to estimate fair value for each pool of wireless spectrum licenses. The sum of the fair values of each of the pools represents the estimated fair value of UScellular's wireless spectrum licenses. The most significant assumption made in this process was the pricing multiples which are units of value expressed in relation to the bandwidth and population covered by a wireless spectrum license. Based on the assessment, the fair values of the wireless spectrum license units of accounting exceeded their respective carrying values by amounts ranging from 39% to greater than 100%. It was determined that the carrying value of wireless spectrum licenses acquired through Auction 101 and 102 approximated fair value based on the recency of the auctions. Therefore, no impairment of wireless spectrum licenses existed.

See Note 7 — Intangible Assets in the Notes to Consolidated Financial Statements for information related to wireless spectrum licenses activity in 2020 and 2019.

Income Taxes

UScellular is included in a consolidated federal income tax return with other members of the TDS consolidated group. TDS and UScellular are parties to a Tax Allocation Agreement which provides that UScellular and its subsidiaries be included with the TDS affiliated group in a consolidated federal income tax return and in state income or franchise tax returns in certain situations. For financial statement purposes, UScellular and its subsidiaries calculate their income, income tax and credits as if they comprised a separate affiliated group. Under the Tax Allocation Agreement between TDS and UScellular, UScellular remits its applicable income tax payments to TDS, and receives applicable tax refunds from TDS, consistent with when such payments would be paid or received if UScellular and its subsidiaries were a separate affiliated group.

The amounts of income tax assets and liabilities, the related income tax provision and the amount of unrecognized tax benefits are critical accounting estimates because such amounts are significant to UScellular’s financial condition and results of operations.

The preparation of the consolidated financial statements requires UScellular to calculate a provision for income taxes. This process involves estimating the actual current income tax liability together with assessing temporary differences resulting from the different treatment of items for tax purposes. These temporary differences result in deferred income tax assets and liabilities which are included on a net basis in UScellular’s Consolidated Balance Sheet. UScellular must then assess the likelihood that deferred income tax assets will be realized based on future taxable income and, to the extent management believes that realization is not likely, establish a valuation allowance. Management’s judgment is required in determining the provision for income taxes, deferred income tax assets and liabilities and any valuation allowance that is established for deferred income tax assets.

UScellular recognizes the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on management’s judgment as to the possible outcome that has a greater than 50% cumulative likelihood of being realized upon ultimate resolution.

See Note 5 — Income Taxes in the Notes to Consolidated Financial Statements for additional information.

16

Regulatory Matters

5G Fund

On October 27, 2020, the FCC adopted rules creating the 5G Fund for Rural America, which will distribute up to $9 billion over ten years to bring 5G wireless broadband connectivity to rural America. The 5G Fund will be implemented through a two-phase competitive process, using multi-round auctions to award support. The winning bidders will be required to meet certain minimum speed requirements and interim and final deployment milestones. The order provides that the 5G Fund be in lieu of the previously proposed fund (the Phase II Connect America Mobility Fund) for the development of 4G LTE. The order also provides that over time a growing percentage of the legacy support a carrier receives must be used for 5G deployment.

UScellular cannot predict at this time when the 5G fund auction will occur, when the phase down period for its existing legacy support from the Federal USF will commence, or whether the 5G fund auction will provide opportunities to UScellular to offset any loss in existing support.

FCC Rulemaking – Restoring Internet Freedom

In December 2017, the FCC approved rules reversing or revising decisions made in the FCC’s 2015 Open Internet and Title II Order (Restoring Internet Freedom). The 2017 action reversed the FCC’s 2015 decision to reclassify Broadband Internet Access Services as telecommunications services subject to regulation under Title II of the Telecommunications Act. The 2017 action also reversed the FCC’s 2015 restrictions on blocking, throttling and paid prioritization, and modified transparency rules relating to such practices. Several parties filed suit in federal court challenging the 2017 actions. On October 1, 2019, the Court of Appeals for the D.C. Circuit issued an order reaffirming the FCC in most respects, but limiting the FCC's ability to preempt state and local net neutrality laws. On February 19, 2020, the FCC issued a Public Notice seeking comment on three issues under further consideration by the FCC based on a recent D.C. Circuit decision. On October 27, 2020, the FCC adopted an Order on Remand in response to the U.S. Court of Appeals for the D.C. Circuit’s remand on the three issues under further consideration by the FCC and found no basis to alter the FCC’s conclusions in the Restoring Internet Freedom Order.

A number of states, including certain states in which UScellular operates, have adopted or considered laws intended to reinstate aspects of the foregoing net neutrality regulations that were reversed or revised by the FCC in 2017. To the extent such laws are enacted, it is expected that legal proceedings will be pursued challenging such laws, subject now to the DC Circuit ruling limiting the FCC's preemptive authority in this matter. The new administration may also conduct rulemaking proceedings that may reinstate in some form net neutrality rules. UScellular cannot predict the outcome of any of these proceedings or the impact on its business.

Spectrum Auctions

On July 11, 2019, the FCC released a Public Notice establishing procedures for an auction offering wireless spectrum licenses in the 37, 39 and 47 GHz bands (Auction 103). On March 12, 2020, the FCC announced by public notice that UScellular was the provisional winning bidder for 237 wireless spectrum licenses for a purchase price of $146 million. In June 2020, the wireless spectrum licenses from Auction 103 were granted by the FCC.

On March 2, 2020, the FCC released a Public Notice establishing procedures for an auction offering wireless spectrum licenses in the 3.5 GHz band (Auction 105). On September 2, 2020, the FCC announced by public notice that UScellular was the provisional winning bidder for 243 wireless spectrum licenses for a purchase price of $14 million. The wireless spectrum licenses are expected to be granted by the FCC in 2021.

On August 7, 2020, the FCC released a Public Notice establishing procedures for an auction offering wireless spectrum licenses in the 3.7-3.98 GHz bands (Auction 107). UScellular filed an application to participate in Auction 107 on September 21, 2020. Bidding in Auction 107 commenced on December 8, 2020. The initial phase of this auction closed on January 15, 2021 and the assignment phase commenced on February 8, 2021.

Rural Digital Opportunity Fund

On January 30, 2020, the FCC adopted the Rural Digital Opportunity Fund Report and Order, which establishes the framework for the Rural Digital Opportunity Fund (Auction 904). Auction 904 was a reverse auction to provide funding for high speed fixed broadband service in underserved rural areas. On July 15, 2020, UScellular filed an application to participate in Auction 904. Auction 904 began on October 29, 2020 and concluded on November 25, 2020. UScellular was not a winning bidder in Auction 904.

17

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

SAFE HARBOR CAUTIONARY STATEMENT

This Management’s Discussion and Analysis of Financial Condition and Results of Operations and other sections of this Annual Report contain statements that are not based on historical facts and represent forward-looking statements, as this term is defined in the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, that address activities, events or developments that UScellular intends, expects, projects, believes, estimates, plans or anticipates will or may occur in the future are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions are intended to identify these forward‑looking statements, but are not the exclusive means of identifying them. Such forward‑looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward‑looking statements. Such risks, uncertainties and other factors include, but are not limited to, those set forth below. See “Risk Factors” in UScellular’s Annual Report on Form 10-K for the year ended December 31, 2020, for a further discussion of these risks. Each of the following risks could have a material adverse effect on UScellular’s business, financial condition or results of operations. However, such factors are not necessarily all of the important factors that could cause actual results, performance or achievements to differ materially from those expressed in, or implied by, the forward-looking statements contained in this document. Other unknown or unpredictable factors also could have material adverse effects on future results, performance or achievements. UScellular undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise. Readers should evaluate any statements in light of these important factors.

Operational Risk Factors

▪Intense competition involving products, services, pricing and network speed and technologies could adversely affect UScellular’s revenues or increase its costs to compete.

▪Changes in roaming practices or other factors could cause UScellular's roaming revenues to decline from current levels, roaming expenses to increase from current levels and/or impact UScellular's ability to service its customers in geographic areas where UScellular does not have its own network, which could have an adverse effect on UScellular's business, financial condition or results of operations.

▪A failure by UScellular to obtain access to adequate radio spectrum to meet current or anticipated future needs and/or to accurately predict future needs for radio spectrum could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪An inability to attract people of outstanding talent throughout all levels of the organization, to develop their potential through education and assignments, and to retain them by keeping them engaged, challenged and properly rewarded could have an adverse effect on UScellular's business, financial condition or results of operations.

▪UScellular’s smaller scale relative to larger competitors that may have greater financial and other resources than UScellular could cause UScellular to be unable to compete successfully, which could adversely affect its business, financial condition or results of operations.

▪Changes in various business factors, including changes in demand, consumer preferences and perceptions, price competition, churn from customer switching activity and other factors, could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪Advances or changes in technology could render certain technologies used by UScellular obsolete, could put UScellular at a competitive disadvantage, could reduce UScellular’s revenues or could increase its costs of doing business.

▪Complexities associated with deploying new technologies present substantial risk and UScellular investments in unproven technologies may not produce the benefits that UScellular expects.

▪Costs, integration problems or other factors associated with acquisitions, divestitures or exchanges of properties or wireless spectrum licenses and/or expansion of UScellular’s business could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪A failure by UScellular to complete significant network construction and systems implementation activities as part of its plans to improve the quality, coverage, capabilities and capacity of its network, support and other systems and infrastructure could have an adverse effect on its operations.

▪Difficulties involving third parties with which UScellular does business, including changes in UScellular's relationships with or financial or operational difficulties of key suppliers or independent agents and third-party national retailers who market UScellular’s services, could adversely affect UScellular's business, financial condition or results of operations.

▪A failure by UScellular to maintain flexible and capable telecommunication networks or information technology, or a material disruption thereof, could have an adverse effect on UScellular’s business, financial condition or results of operations.

18

Financial Risk Factors

▪Uncertainty in UScellular’s future cash flow and liquidity or the inability to access capital, deterioration in the capital markets, other changes in UScellular’s performance or market conditions, changes in UScellular’s credit ratings or other factors could limit or restrict the availability of financing on terms and prices acceptable to UScellular, which could require UScellular to reduce its construction, development or acquisition programs, reduce the amount of wireless spectrum licenses acquired, and/or reduce or cease share repurchases.

▪UScellular has a significant amount of indebtedness which could adversely affect its financial performance and in turn adversely affect its ability to make payments on its indebtedness, comply with terms of debt covenants and incur additional debt.

▪UScellular’s assets and revenue are concentrated in the U.S. wireless telecommunications industry. Consequently, its operating results may fluctuate based on factors related primarily to conditions in this industry.

▪UScellular has significant investments in entities that it does not control. Losses in the value of such investments could have an adverse effect on UScellular’s financial condition or results of operations.

Regulatory, Legal and Governance Risk Factors

▪Failure by UScellular to timely or fully comply with any existing applicable legislative and/or regulatory requirements or changes thereto could adversely affect UScellular’s business, financial condition or results of operations.

▪UScellular receives significant regulatory support, and is also subject to numerous surcharges and fees from federal, state and local governments – the applicability and the amount of the support and fees are subject to great uncertainty, including the ability to pass through certain fees to customers, and this uncertainty could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪Settlements, judgments, restraints on its current or future manner of doing business and/or legal costs resulting from pending and future litigation could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪The possible development of adverse precedent in litigation or conclusions in professional studies to the effect that radio frequency emissions from wireless devices and/or cell sites cause harmful health consequences, including cancer or tumors, or may interfere with various electronic medical devices such as pacemakers, could have an adverse effect on UScellular's business, financial condition or results of operations.

▪Claims of infringement of intellectual property and proprietary rights of others, primarily involving patent infringement claims, could prevent UScellular from using necessary technology to provide products or services or subject UScellular to expensive intellectual property litigation or monetary penalties, which could have an adverse effect on UScellular’s business, financial condition or results of operations.

▪There are potential conflicts of interests between TDS and UScellular.

▪Certain matters, such as control by TDS and provisions in the UScellular Restated Certificate of Incorporation, may serve to discourage or make more difficult a change in control of UScellular or have other consequences.

General Risk Factors

▪UScellular has experienced, and in the future expects to experience, cyber-attacks or other breaches of network or information technology security of varying degrees on a regular basis, which could have an adverse effect on UScellular's business, financial condition or results of operations.

▪Disruption in credit or other financial markets, a deterioration of U.S. or global economic conditions or other events could, among other things, impede UScellular’s access to or increase the cost of financing its operating and investment activities and/or result in reduced revenues and lower operating income and cash flows, which would have an adverse effect on UScellular’s business, financial condition or results of operations.

▪The impact of public health emergencies, such as the COVID-19 pandemic, on UScellular's business is uncertain, but depending on duration and severity could have a material adverse effect on UScellular's business, financial condition or results of operations.

19

Market Risk

Long-Term Debt

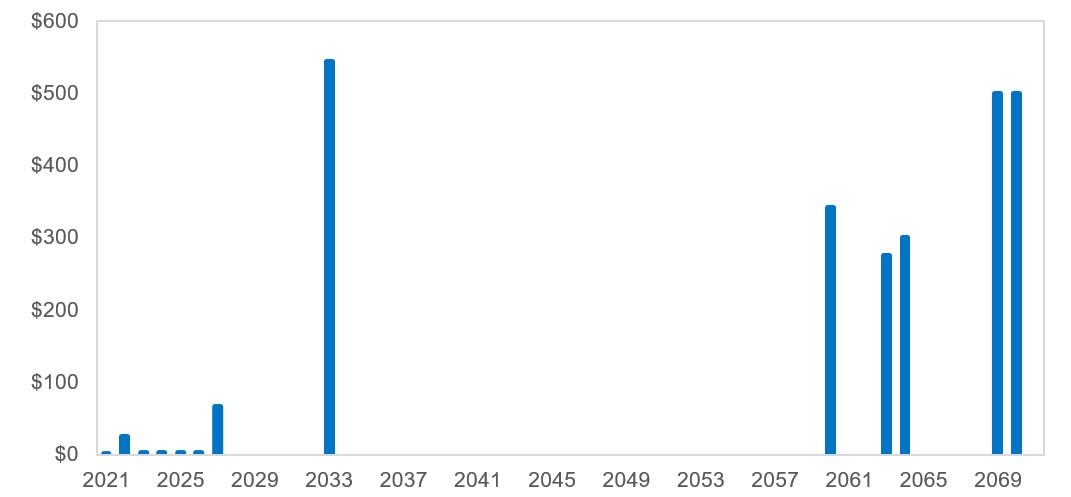

As of December 31, 2020, the majority of UScellular’s long-term debt was in the form of fixed-rate notes with remaining maturities ranging up to 50 years. Fluctuations in market interest rates can lead to significant fluctuations in the fair value of these fixed-rate notes.

The following chart presents the scheduled principal payments on long-term debt by maturity dates at December 31, 2020:

The following table presents the scheduled principal payments on long-term debt, finance lease obligations and other installment arrangements, and the related weighted average interest rates by maturity dates at December 31, 2020:

| Principal Payments Due by Period | |||||||||||

Long-Term Debt Obligations1 | Weighted-Avg. Interest Rates on Long-Term Debt Obligations2 | ||||||||||

| (Dollars in millions) | |||||||||||

| 2021 | $ | 2 | 2.8 | % | |||||||

| 2022 | 28 | 1.5 | % | ||||||||

| 2023 | 3 | 2.7 | % | ||||||||

| 2024 | 3 | 2.7 | % | ||||||||

| 2025 | 3 | 2.6 | % | ||||||||

| Thereafter | 2,533 | 6.4 | % | ||||||||

| Total | $ | 2,572 | 6.3 | % | |||||||

1The total long-term debt obligation differs from Long-term debt in the Consolidated Balance Sheet due to unamortized debt issuance costs on all non-revolving debt instruments and unamortized discounts related to the 6.7% Senior Notes. See Note 12 — Debt in the Notes to Consolidated Financial Statements for additional information.

2Represents the weighted average stated interest rates at December 31, 2020, for debt maturing in the respective periods.

Fair Value of Long-Term Debt

At December 31, 2020 and 2019, the estimated fair value of long-term debt obligations, excluding finance lease obligations, other installment arrangements, the current portion of such long-term debt and debt financing costs, was $2,775 million and $1,620 million, respectively. See Note 3 — Fair Value Measurements in the Notes to Consolidated Financial Statements for additional information.

Other Market Risk Sensitive Instruments

The substantial majority of UScellular’s other market risk sensitive instruments (as defined in Item 305 of SEC Regulation S-K) are short-term, including Cash and cash equivalents. Accordingly, UScellular believes that a significant change in interest rates would not have a material effect on such other market risk sensitive instruments.

20

Supplemental Information Relating to Non-GAAP Financial Measures

UScellular sometimes uses information derived from consolidated financial information but not presented in its financial statements prepared in accordance with GAAP to evaluate the performance of its business. Certain of these measures are considered “non-GAAP financial measures” under U.S. Securities and Exchange Commission Rules. Specifically, UScellular has referred to the following measures in this Form 10-K Report:

▪EBITDA

▪Adjusted EBITDA

▪Adjusted OIBDA

▪Free cash flow

Following are explanations of each of these measures:

EBITDA, Adjusted EBITDA and Adjusted OIBDA

EBITDA, Adjusted EBITDA and Adjusted OIBDA are defined as net income adjusted for the items set forth in the reconciliation below. EBITDA, Adjusted EBITDA and Adjusted OIBDA are not measures of financial performance under GAAP and should not be considered as alternatives to Net income or Cash flows from operating activities, as indicators of cash flows or as measures of liquidity. UScellular does not intend to imply that any such items set forth in the reconciliation below are non-recurring, infrequent or unusual; such items may occur in the future.

Management uses Adjusted EBITDA and Adjusted OIBDA as measurements of profitability, and therefore, reconciliations to Net income and Operating income are deemed appropriate. Management believes Adjusted EBITDA and Adjusted OIBDA are useful measures of UScellular’s operating results before significant recurring non-cash charges, gains and losses, and other items as presented below as they provide additional relevant and useful information to investors and other users of UScellular’s financial data in evaluating the effectiveness of its operations and underlying business trends in a manner that is consistent with management’s evaluation of business performance. Adjusted EBITDA shows adjusted earnings before interest, taxes, depreciation, amortization and accretion, and gains and losses, while Adjusted OIBDA reduces this measure further to exclude Equity in earnings of unconsolidated entities and Interest and dividend income in order to more effectively show the performance of operating activities excluding investment activities. The following table reconciles EBITDA, Adjusted EBITDA and Adjusted OIBDA to the corresponding GAAP measures, Net income and Operating income.

21

| 2020 | 2019 | ||||||||||||||||

| (Dollars in millions) | |||||||||||||||||

| Net income (GAAP) | $ | 233 | $ | 133 | |||||||||||||

| Add back or deduct: | |||||||||||||||||

| Income tax expense | 17 | 52 | |||||||||||||||

| Interest expense | 112 | 110 | |||||||||||||||

| Depreciation, amortization and accretion | 683 | 702 | |||||||||||||||

| EBITDA (Non-GAAP) | 1,045 | 997 | |||||||||||||||

| Add back or deduct: | |||||||||||||||||

| (Gain) loss on asset disposals, net | 25 | 19 | |||||||||||||||

| (Gain) loss on sale of business and other exit costs, net | — | (1) | |||||||||||||||

| (Gain) loss on license sales and exchanges, net | (5) | — | |||||||||||||||

| (Gain) loss on investments | (2) | — | |||||||||||||||

| Adjusted EBITDA (Non-GAAP) | 1,063 | 1,015 | |||||||||||||||

| Deduct: | |||||||||||||||||

| Equity in earnings of unconsolidated entities | 179 | 166 | |||||||||||||||

| Interest and dividend income | 8 | 17 | |||||||||||||||

| Adjusted OIBDA (Non-GAAP) | 876 | 832 | |||||||||||||||

| Deduct: | |||||||||||||||||

| Depreciation, amortization and accretion | 683 | 702 | |||||||||||||||

| (Gain) loss on asset disposals, net | 25 | 19 | |||||||||||||||

| (Gain) loss on sale of business and other exit costs, net | — | (1) | |||||||||||||||

| (Gain) loss on license sales and exchanges, net | (5) | — | |||||||||||||||

| Operating income (GAAP) | $ | 173 | $ | 112 | |||||||||||||

Free Cash Flow

The following table presents Free cash flow, which is defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment. Free cash flow is a non-GAAP financial measure which UScellular believes may be useful to investors and other users of its financial information in evaluating liquidity, specifically, the amount of net cash generated by business operations after deducting Cash paid for additions to property, plant and equipment.

| 2020 | 2019 | ||||||||||||||||

| (Dollars in millions) | |||||||||||||||||

| Cash flows from operating activities (GAAP) | $ | 1,237 | $ | 724 | |||||||||||||

| Less: Cash paid for additions to property, plant and equipment | 989 | 650 | |||||||||||||||

| Free cash flow (Non-GAAP) | $ | 248 | $ | 74 | |||||||||||||

22

Financial Statements

United States Cellular Corporation

Consolidated Statement of Operations

| Year Ended December 31, | 2020 | 2019 | 2018 | ||||||||||||||

| (Dollars and shares in millions, except per share amounts) | |||||||||||||||||

| Operating revenues | |||||||||||||||||

| Service | $ | 3,067 | $ | 3,035 | $ | 2,978 | |||||||||||

| Equipment sales | 970 | 987 | 989 | ||||||||||||||

| Total operating revenues | 4,037 | 4,022 | 3,967 | ||||||||||||||

| Operating expenses | |||||||||||||||||

| System operations (excluding Depreciation, amortization and accretion reported below) | 782 | 756 | 758 | ||||||||||||||

| Cost of equipment sold | 1,011 | 1,028 | 1,031 | ||||||||||||||

| Selling, general and administrative | 1,368 | 1,406 | 1,388 | ||||||||||||||

| Depreciation, amortization and accretion | 683 | 702 | 640 | ||||||||||||||

| (Gain) loss on asset disposals, net | 25 | 19 | 10 | ||||||||||||||

| (Gain) loss on sale of business and other exit costs, net | 0 | (1) | 0 | ||||||||||||||

| (Gain) loss on license sales and exchanges, net | (5) | 0 | (18) | ||||||||||||||

| Total operating expenses | 3,864 | 3,910 | 3,809 | ||||||||||||||

| Operating income | 173 | 112 | 158 | ||||||||||||||

| Investment and other income (expense) | |||||||||||||||||

| Equity in earnings of unconsolidated entities | 179 | 166 | 159 | ||||||||||||||

| Interest and dividend income | 8 | 17 | 15 | ||||||||||||||

| Gain (loss) on investments | 2 | 0 | 0 | ||||||||||||||

| Interest expense | (112) | (110) | (116) | ||||||||||||||

| Other, net | 0 | 0 | (1) | ||||||||||||||

| Total investment and other income | 77 | 73 | 57 | ||||||||||||||

| Income before income taxes | 250 | 185 | 215 | ||||||||||||||

| Income tax expense | 17 | 52 | 51 | ||||||||||||||

| Net income | 233 | 133 | 164 | ||||||||||||||

| Less: Net income attributable to noncontrolling interests, net of tax | 4 | 6 | 14 | ||||||||||||||

| Net income attributable to UScellular shareholders | $ | 229 | $ | 127 | $ | 150 | |||||||||||

| Basic weighted average shares outstanding | 86 | 86 | 86 | ||||||||||||||

| Basic earnings per share attributable to UScellular shareholders | $ | 2.66 | $ | 1.47 | $ | 1.75 | |||||||||||

| Diluted weighted average shares outstanding | 87 | 88 | 87 | ||||||||||||||

| Diluted earnings per share attributable to UScellular shareholders | $ | 2.62 | $ | 1.44 | $ | 1.72 | |||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

23

United States Cellular Corporation

Consolidated Statement of Cash Flows

| Year Ended December 31, | 2020 | 2019 | 2018 | ||||||||||||||

| (Dollars in millions) | |||||||||||||||||

| Cash flows from operating activities | |||||||||||||||||

| Net income | $ | 233 | $ | 133 | $ | 164 | |||||||||||

| Add (deduct) adjustments to reconcile net income to net cash flows from operating activities | |||||||||||||||||

| Depreciation, amortization and accretion | 683 | 702 | 640 | ||||||||||||||

| Bad debts expense | 72 | 107 | 95 | ||||||||||||||

| Stock-based compensation expense | 32 | 41 | 37 | ||||||||||||||

| Deferred income taxes, net | 130 | (4) | (3) | ||||||||||||||

| Equity in earnings of unconsolidated entities | (179) | (166) | (159) | ||||||||||||||

| Distributions from unconsolidated entities | 189 | 161 | 152 | ||||||||||||||

| (Gain) loss on asset disposals, net | 25 | 19 | 10 | ||||||||||||||

| (Gain) loss on sale of business and other exit costs, net | 0 | (1) | 0 | ||||||||||||||

| (Gain) loss on license sales and exchanges, net | (5) | 0 | (18) | ||||||||||||||

| (Gain) loss on investments | (2) | 0 | 0 | ||||||||||||||

| Other operating activities | 2 | 4 | 3 | ||||||||||||||

| Changes in assets and liabilities from operations | |||||||||||||||||

| Accounts receivable | (8) | (46) | (39) | ||||||||||||||

| Equipment installment plans receivable | (54) | (97) | (149) | ||||||||||||||

| Inventory | 16 | (20) | (4) | ||||||||||||||

| Accounts payable | 145 | (69) | 3 | ||||||||||||||

| Customer deposits and deferred revenues | 2 | (8) | 7 | ||||||||||||||

| Accrued taxes | (57) | (23) | (39) | ||||||||||||||

| Other assets and liabilities | 13 | (9) | 9 | ||||||||||||||

| Net cash provided by operating activities | 1,237 | 724 | 709 | ||||||||||||||

| Cash flows from investing activities | |||||||||||||||||

| Cash paid for additions to property, plant and equipment | (989) | (650) | (512) | ||||||||||||||

| Cash paid for licenses | (171) | (266) | (8) | ||||||||||||||

| Cash received from investments | 1 | 29 | 50 | ||||||||||||||

| Cash paid for investments | (3) | (11) | (17) | ||||||||||||||

| Cash received from divestitures and exchanges | 26 | 41 | 24 | ||||||||||||||

| Advance payments for license acquisitions | (30) | (5) | (2) | ||||||||||||||

| Other investing activities | 3 | (2) | 1 | ||||||||||||||

| Net cash used in investing activities | (1,163) | (864) | (464) | ||||||||||||||

| Cash flows from financing activities | |||||||||||||||||

| Issuance of long-term debt | 1,125 | 0 | 0 | ||||||||||||||

| Repayment of long-term debt | (108) | (116) | (19) | ||||||||||||||

| Common Shares reissued for benefit plans, net of tax payments | (11) | (9) | 18 | ||||||||||||||

| Repurchase of Common Shares | (23) | (21) | 0 | ||||||||||||||