| | | | | | | | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| SCHEDULE 14A |

|

| Proxy Statement Pursuant to Section 14(a) of |

| the Securities Exchange Act of 1934 (Amendment No. ) |

| |

| | Filed by the Registrant ☒ |

| |

| | Filed by a Party other than the Registrant ☐ |

| |

| | Check the appropriate box: |

| | ☐ | Preliminary Proxy Statement |

| | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | ☒ | Definitive Proxy Statement |

| | ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| | | |

| United States Cellular Corporation |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, If other than the Registrant) |

| |

| | Payment of Filing Fee (Check all boxes that apply): |

| | ☒ | No fee required. |

| | ☐ | Fee paid previously with preliminary materials. |

| | ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | | | | |

| UNITED STATES CELLULAR CORPORATION | | |

8410 West Bryn Mawr Avenue

Chicago, Illinois 60631

Phone: (773) 399-8900

| |

April 9, 2024

Dear Fellow Shareholders:

You are cordially invited to attend the 2024 annual meeting of shareholders ("2024 Annual Meeting") of United States Cellular Corporation ("UScellular" or the "Company") on Tuesday, May 21, 2024, at 8:30 a.m., Central Time, at Sidley Austin LLP, One South Dearborn Street, Chicago, Illinois. At the meeting, we will report on the accomplishments and plans of UScellular.

The Notice of the 2024 Annual Meeting of Shareholders and 2024 Proxy Statement ("2024 Proxy Statement") of our Board of Directors is attached. Also enclosed is our 2023 Annual Report to shareholders ("2023 Annual Report"). At the 2024 Annual Meeting, shareholders are being asked to take the following actions:

1. elect the director nominees named in the attached 2024 Proxy Statement;

2. ratify the selection of independent registered public accounting firm for the current fiscal year; and

3. approve, on an advisory basis, the compensation of our named executive officers as disclosed in the attached 2024 Proxy Statement (commonly known as "Say-on-Pay").

Your Board of Directors unanimously recommends a vote "FOR" its nominees for election as directors, "FOR" the proposal to ratify accountants, and "FOR" the Say-on-Pay proposal.

We would like to have as many shareholders as possible represented at the 2024 Annual Meeting. Therefore, whether or not you plan to attend the meeting, please sign, date and return the enclosed proxy card(s), or vote on the Internet in accordance with the instructions set forth on the proxy card(s).

| | | | | | | | |

| Very truly yours, |

| | |

LeRoy T. Carlson, Jr.

Chair | | Laurent C. Therivel

President and Chief Executive Officer |

As UScellular celebrated its 40th anniversary in 2023, we are pleased to reflect on our accomplishments and share our strategic priorities for the future. As always, we remain committed to connecting people to what matters most.

We are proud of how our associates have continued to serve customers, communities, stakeholders and each other over the years, particularly during 2023, given the fierce competition for subscribers in the markets we serve. We kept our focus on our goal of effectively balancing subscriber objectives with financial goals, which led to increased profitability year over year.

Balancing Growth and Profitability

Looking ahead to 2024, UScellular’s operational priorities will continue to focus on balancing subscriber growth with financial discipline.

Financial Discipline

In 2024, we plan to keep working on our multi-year cost optimization program as part of our commitment to financial discipline. Building upon the successes achieved in recent years, we will remain laser-focused on identifying further opportunities for enhancing efficiencies in the coming year.

Exploration of Strategic Alternatives for UScellular

In August of 2023 the boards of directors of TDS and UScellular decided to initiate a process to explore strategic alternatives for UScellular. At the time of this proxy’s printing, the review remains active and on-going.

Thank You

Finally, we would like to thank our associates for their unwavering dedication and innovation in delivering outstanding services, products, and experiences to our customers. We also want to thank our shareholders for their continued support of our long-term strategies.

UNITED STATES CELLULAR CORPORATION

2024 PROXY STATEMENT

Proxy Statement Summary

| | | | | | | | | | | | | | |

| Annual Meeting Information | | | |

| Date and Time | May 21, 2024 at 8:30 a.m. Central Time | | |

| Place | Sidley Austin LLP, One South Dearborn Street, Chicago, Illinois 60603 | |

| Record Date | March 25, 2024 | | | |

| Webcast | investors.uscellular.com/events-and-presentations |

Governance Highlights

•Annual election of all directors

•Directors, officers and certain other employees prohibited from pledging or hedging shares

•The positions of Chair of the Board of Directors and President/Chief Executive Officer are separate

•Succession planning sessions held at least annually

•Annual self-assessment of board and its committees

•Although not required to do so as a controlled company, established a Long-Term Incentive Compensation Committee, comprised of independent directors

Board Effectiveness

•Active board refreshment in 2023

•Orientation program for new Directors

•Limits on other public board service

The following is a summary of the actions being taken at the 2024 Annual Meeting and does not include all the information that may be important to you. You should carefully read this entire Proxy Statement and not rely solely on the following summary.

Proposal 1—Election of Directors

Under the terms of UScellular's Restated Certificate of Incorporation ("Restated Charter"), the terms of all directors will expire at the 2024 Annual Meeting.

The holders of Common Shares are entitled to elect four directors. Your Board of Directors has nominated the following persons for election as directors by the holders of Common Shares: Harry J. Harczak, Jr., Gregory P. Josefowicz, Cecelia D. Stewart and Xavier D. Williams.

Telephone and Data Systems, Inc. ("TDS"), as the sole holder of Series A Common Shares, is entitled to elect nine directors. Your Board of Directors has nominated the following persons for election as directors by the holder of Series A Common Shares: James W. Butman, LeRoy T. Carlson, Jr., Walter C. D. Carlson, Douglas W. Chambers, Deirdre C. Drake, Esteban C. Iriarte, Michael S. Irizarry, Laurent C. Therivel, and Vicki L. Villacrez.

Our 2024 Director Nominees

| | | | | | | | | | | | | | | | | | | | |

| Name | Age | Gender | Race/ Ethnicity | Director Since | Independent | Principal Occupation |

| James W. Butman** | 66 | M | W | 2023 | | President and CEO, TDS Telecommunications LLC ("TDS Telecom"), a wholly-owned subsidiary of TDS |

| LeRoy T. Carlson, Jr.** | 77 | M | W | 1984 | | President and CEO, TDS |

| Walter C. D. Carlson** | 70 | M | W | 1989 | | Senior Counsel at Sidley Austin LLP |

| Douglas W. Chambers** | 54 | M | W | 2023 | | Executive Vice President, Chief Financial Officer and Treasurer, UScellular |

| Deirdre C. Drake** | 58 | F | B | 2021 | | Former Executive Vice President - Chief People Officer and Head of Communications, UScellular |

| Harry J. Harczak, Jr.* | 67 | M | W | 2003 | X | Managing Director of Sawdust Capital, LLC |

| Esteban C. Iriarte** | 51 | M | H | 2022 | X | Former Executive Vice President and Chief Operating Officer, Latin America, Millicom International Cellular S.A. |

| Michael S. Irizarry** | 62 | M | H | 2020 | | Executive Vice President, Chief Technology Officer and Head of Engineering and Information Technology, UScellular |

| Gregory P. Josefowicz* | 71 | M | W | 2009 | X | Former Chair, CEO and President of Borders Group, Inc. |

| Cecelia D. Stewart* | 65 | F | W | 2013 | X | Former President of U.S. Consumer and Commercial Banking of Citigroup Inc. |

| Laurent C. Therivel** | 49 | M | W | 2020 | | President and CEO, UScellular |

| Vicki L. Villacrez** | 62 | F | W | 2022 | | Executive Vice President and Chief Financial Officer of TDS |

| Xavier D. Williams* | 56 | M | B | 2023 | X | CEO of Network Wireless Solutions, LLC |

*To be elected by Common Shares **To be elected by Series A Common Shares

M - Male; F - Female; W - White; B - Black or African American; H - Hispanic or Latinx

Proposal 2—Ratification of Independent Registered Public Accounting Firm

As in prior years, shareholders are being asked to ratify PricewaterhouseCoopers LLP ("PwC") as the Company's independent registered public accounting firm for the year ending December 31, 2024.

Proposal 3—Advisory Vote to Approve Executive Compensation or "Say-on-Pay"

Shareholders are being asked to approve, on an advisory basis, the compensation of our named executive officers for 2023.

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS AND 2024 PROXY STATEMENT

TO THE SHAREHOLDERS OF

UNITED STATES CELLULAR CORPORATION

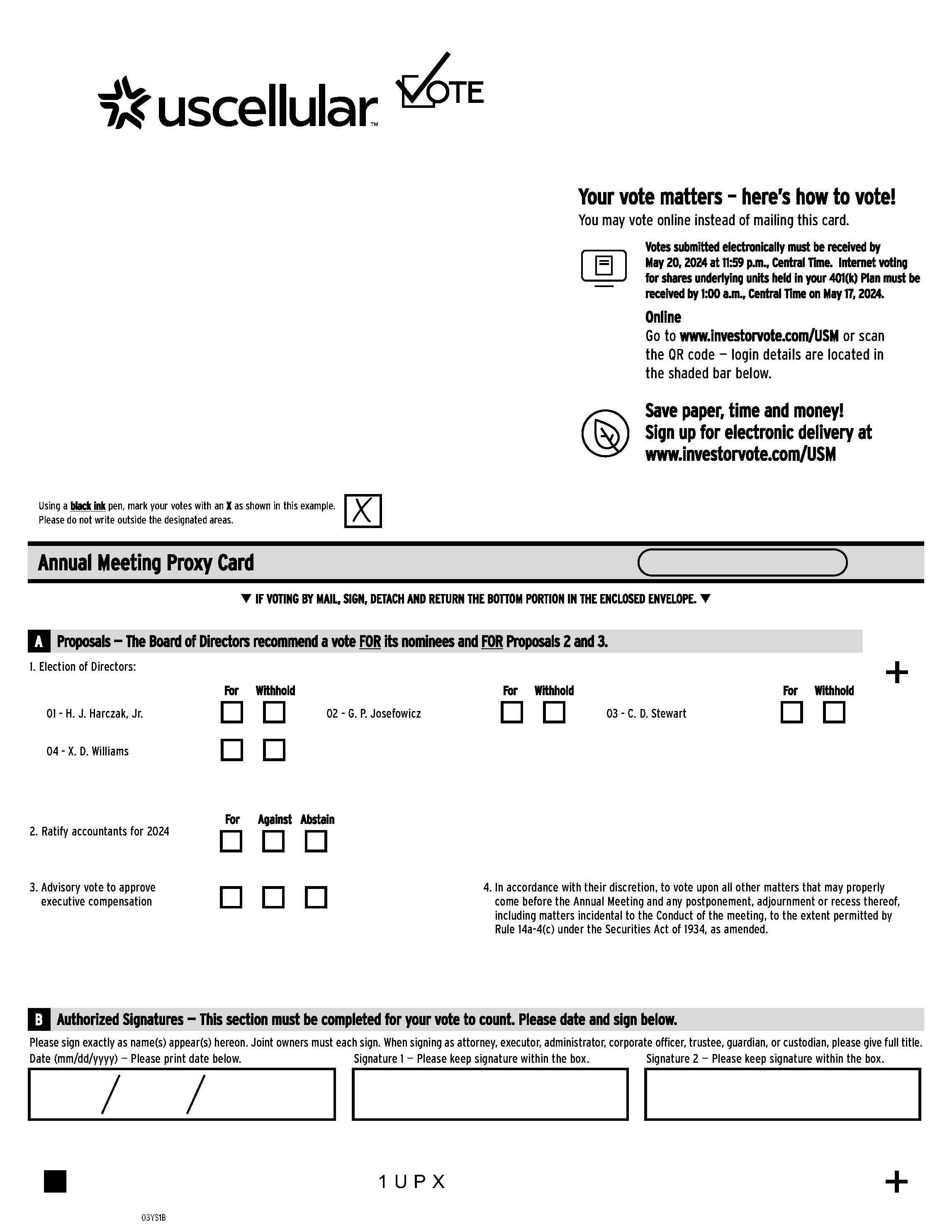

We will hold the 2024 annual meeting of the shareholders ("2024 Annual Meeting") of United States Cellular Corporation ("UScellular"), a Delaware corporation at Sidley Austin LLP, One South Dearborn Street, Chicago, Illinois, on Tuesday, May 21, 2024, at 8:30 a.m., Central Time. At the meeting, we are asking shareholders to take the following actions:

1. To elect the director nominees named in this proxy statement.

2. To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2024.

3. To approve, on an advisory basis, the compensation of our named executive officers as disclosed herein (commonly known as "Say-on-Pay").

4. To transact such other business as may properly come before the meeting or any postponement, adjournment or recess thereof.

Your Board of Directors recommends a vote "FOR" each of the nominees for election as directors, "FOR" the proposal to ratify accountants, and "FOR" approval of the Say-on-Pay proposal.

We have fixed the close of business on March 25, 2024, as the record date for the determination of shareholders entitled to notice of, and to vote at, the 2024 Annual Meeting or any postponement, adjournment or recess thereof.

We are first sending this Notice of the 2024 Annual Meeting of Shareholders and Proxy Statement and proxy card, together with our 2023 Annual Report, on or about April 9, 2024, to shareholders who are receiving a paper copy of the proxy materials. We have made arrangements to commence mailing a Notice of Internet Availability of Proxy Materials on or about April 9, 2024 to other shareholders as discussed below.

VOTING INFORMATION

What matters are being presented at the 2024 Annual Meeting?

A summary of the matters being presented and important voting information is provided below:

| | | | | | | | | | | | | | | | | | | | |

| Voting Matters | Board's Recommendations | Voting Options | Vote Required | Effect of Abstentions | Effect of Broker Non-Votes | Page Reference |

1. Election of Directors

• Four director nominees elected by holders of Common Shares

• Nine director nominees elected by holders of Series A Common Shares | FOR all nominees | For or Withhold authority to vote for such director nominee | * | N/A | No effect | 7 |

| 2. Ratify independent registered public accountants | FOR | For, Against, or Abstain | ** | Will have same effect as a vote against | N/A | 24 |

| 3. Approve, on an advisory basis, the compensation of named executive officers ("Say-on-Pay") | FOR | For, Against, or Abstain | ** | Will have same effect as a vote against | No effect | 27 |

* Directors will be elected by a plurality of the votes cast by the class or group of shareholders entitled to vote in the election of such directors which are present in person or represented by proxy at the meeting and withhold votes will have no legal effect in the election of directors.

** The approvals of Proposals 2 and 3 will require the affirmative vote of the holders of stock having a majority of the votes which could be cast by the holders of all stock entitled to vote on the applicable proposal which are present in person or represented by proxy at the meeting.

Voting Rights

Under the Restated Charter, each Series A Common Share is entitled to ten votes on all applicable matters, and each Common Share is entitled to one vote on all applicable matters. The holders of Common Shares, voting as a separate class, are entitled to elect 25% of the directors (rounded up to the nearest whole number), and the holders of Series A Common Shares are entitled to elect the remaining 75% of the directors (rounded down to the nearest whole number).

What is the record date for the meeting?

The close of business on March 25, 2024.

Shareholders must contact UScellular's Corporate Secretary to make arrangements to view the complete list of shareholders entitled to vote at the 2024 Annual Meeting. This examination by any shareholder, for any purpose germane to the 2024 Annual Meeting, will only be during normal business hours in the ten-day period prior to the 2024 Annual Meeting.

How can I contact UScellular's Corporate Secretary?

You can contact her at Jane W. McCahon, Corporate Secretary, UScellular, 8410 West Bryn Mawr Avenue, Chicago, Illinois 60631 or by email at jane.mccahon@tdsinc.com.

What shares of stock entitle holders to vote at the meeting?

We have the following classes or series of stock outstanding, each of which entitles holders to vote at the meeting:

•Common Shares; and

•Series A Common Shares.

The Common Shares are listed on the New York Stock Exchange ("NYSE") under the symbol "USM."

No public market exists for the Series A Common Shares, but the Series A Common Shares are convertible on a share-for-share basis into Common Shares.

On the record date, UScellular had outstanding 52,282,979 Common Shares, par value $1.00 per share (excluding 2,785,022 Common Shares held by UScellular and a subsidiary of UScellular), and 33,005,877 Series A Common Shares, par value $1.00 per share.

What is the voting power of the outstanding shares in the election of directors?

The following shows information relating to the outstanding shares and voting power of such shares in the election of directors as of the record date: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class or Series of Common Stock | | Outstanding

Shares | | Votes

per Share | | Total

Voting Power | | Total Number

of Directors

Elected by

Class or Series |

| Series A Common Shares | | 33,005,877 | | | 10 | | | 330,058,770 | | | 9 | |

| Common Shares | | 52,282,979 | | | 1 | | | 52,282,979 | | | 4 | |

| Total Directors | | | | | | | | 13 | |

Based on the current Board size of 13 directors, TDS, as the sole holder of Series A Common Shares, is entitled to elect nine directors and the holders of Common Shares (including TDS) are entitled to elect four other directors.

Director Voting Sunset Provision.

As noted above, the holders of Series A Common Shares and holders of Common Shares vote separately in the election of directors. However, pursuant to UScellular's Restated Charter, if the number of Series A Common Shares issued and outstanding at any time falls below 12.5% of the number of outstanding shares of common stock, because of the conversion of Series A Common Shares into Common Shares or otherwise, the holder of Series A Common Shares would lose the right to vote as a separate class, and thereafter the holder of Series A Common Shares, with ten votes per share, and the holders of Common Shares, with one vote per share, would vote as a single class in the election of all directors.

What is the voting power of the outstanding shares in matters other than the election of directors?

The following shows information relating to the outstanding shares and voting power of such shares in matters other than the election of directors as of the record date.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class or Series of Common Stock | | Outstanding

Shares | | Votes

per Share | | Total

Voting Power | | Percent |

| Series A Common Shares | | 33,005,877 | | | 10 | | | 330,058,770 | | | 86.3 | % |

| Common Shares | | 52,282,979 | | | 1 | | | 52,282,979 | | | 13.7 | % |

| | | | | | 382,341,749 | | | 100.0 | % |

Voting Power Sunset Provision.

Each Series A Common Share has ten votes per share in all matters and, as a result, the Series A Common Shares have a substantial majority of votes in matters other than the election of directors that the holders of Common Shares are entitled to vote upon. However, this percentage could decrease. For instance, this could occur if TDS converts Series A Common Shares into Common Shares for any reason. Accordingly, the Restated Charter effectively has a sunset provision for voting in matters other than the election of directors because, if a sufficient number of Series A Common Shares are converted into Common Shares, the voting power of Series A Common Shares could decline below 50%.

How does TDS intend to vote?

TDS, the parent company of UScellular, is the sole holder of Series A Common Shares and on the record date held 33,005,877 Series A Common Shares. By reason of such holding, TDS has the voting power to elect all of the directors to be elected by the Series A Common Shares. TDS also held 37,782,826 Common Shares on the record date, representing approximately 72.3% of the voting power with respect to the election of the directors to be elected by the holders of Common Shares. TDS has approximately 96.2% of the voting power with respect to matters other than the election of directors that the holders of Common Shares are entitled to vote upon.

TDS has advised us that it intends to vote:

•FOR the Board of Directors' nominees for election by the Series A Common Shares and Common Shares,

•FOR the proposal to ratify the selection of PwC, and

•FOR the Say-on-Pay proposal.

How do I vote?

Proxies are being requested from the holders of Common Shares in connection with the election of four directors, the ratification of PwC and the Say-on-Pay proposal. Please sign, date and mail your proxy card(s) in the enclosed self-addressed envelope to Proxy Services, C/O Computershare Investor Services, PO Box 43101, Providence, RI 02940-3101 or vote on the Internet using the control/identification number on your proxy card in accordance with the instructions set forth on the proxy card. You have the power to revoke your proxy at any time before it is voted.

How will proxies be voted?

All properly voted and un-revoked proxies received in time for the 2024 Annual Meeting will be voted in the manner directed.

If no direction is made, a properly submitted proxy by a shareholder will be voted FOR the election of each of the named director nominees in Proposal 1, FOR Proposal 2, and FOR Proposal 3.

How will my shares be voted if I own shares through a broker?

If you are the beneficial owner of shares held in "street name" by a broker, bank, or other nominee ("broker"), such broker, as the record holder of the shares, is required to vote those shares in accordance with your instructions.

In the event that there are no contested matters at the meeting, the broker may be entitled to vote the shares on your behalf with respect to "discretionary" items but will not be permitted to vote the shares with respect to "non-discretionary" items (in which case such shares will be treated as "broker non-votes"). In general, the ratification of auditors is considered a discretionary item. Matters such as the election of directors and votes on Say-on-Pay are non-discretionary items. In such cases, if your broker does not have specific or standing instructions, your shares will be treated as broker non-votes and will not be voted on such matters.

Accordingly, we urge you to provide instructions to your broker so that your votes may be counted on all matters. If your shares are held in street name, your broker will include a voting instruction form with this 2024 Proxy Statement. We strongly encourage you to vote your shares by following the instructions provided on the voting instruction form. Please return your voting instruction form to your broker and/or contact your broker to ensure that your shares are voted on your behalf.

What constitutes a quorum for the meeting?

A quorum is the minimum number of shares that must be represented at the Annual Meeting to conduct business at the Annual Meeting. A majority of the voting power of shares of capital stock in matters other than the election of directors and entitled to vote, present in person or represented by proxy, will constitute a quorum to permit the 2024 Annual Meeting to proceed. Withheld votes, abstentions and any broker non-votes will be counted in establishing a quorum for the meeting. If the shares beneficially owned by TDS are present in person or represented by proxy at the 2024 Annual Meeting, such shares will constitute a quorum. In addition, where a separate vote by a class or group is required with respect to a proposal, a quorum is also required with respect to such proposal for the vote to proceed.

In the election of directors, where a separate vote by a class or voting group is required, the holders of a majority of the votes of the stock of such class or voting group, present in person or represented by proxy, will constitute a quorum entitled to take action with respect to that vote on that matter. If the shares beneficially owned by TDS are present in person or represented by proxy at the 2024 Annual Meeting, such shares will constitute a quorum with respect to the nine directors to be elected by the Series A Common Shares and the four directors to be elected by the Common Shares.

The holders of a majority of the votes of the stock issued and outstanding and entitled to vote with respect to the other proposals, present in person or represented by proxy, will constitute a quorum at the 2024 Annual Meeting in connection with such other proposals. If the shares beneficially owned by TDS are present in person or represented by proxy at the 2024 Annual Meeting, such shares will constitute a quorum in connection with such proposals.

What does it mean if I receive more than one proxy card?

If you hold multiple series of shares, or hold shares in multiple registrations, you will receive a proxy card for each such account. Please sign, date, and return all proxy cards you receive to ensure all of your shares are counted. If you choose to vote by Internet, please vote each proxy card you receive. Only your latest dated proxy for each account will be voted at the 2024 Annual Meeting.

Can I change my vote or revoke my proxy?

Yes. You can change your vote or revoke your proxy at any time before it is voted at the 2024 Annual Meeting by written notice to the Corporate Secretary of UScellular, by voting a later-dated proxy or by voting by ballot at the meeting. Only the latest dated proxy card you vote will be counted for voting purposes.

PROPOSAL 1

ELECTION OF DIRECTORS

The terms of all directors will expire at the 2024 Annual Meeting. The Board of Directors' nominees for election as directors are identified in the table below. The term of office of each director elected at the 2024 Annual Meeting shall expire at the next annual meeting of shareholders in 2025, and each director elected shall serve until his or her successor shall be elected and qualify, or until his or her earlier death, resignation, removal or disqualification. Each of the nominees has consented to be named in this 2024 Proxy Statement and serve if elected. The age of the following persons is as of the date of this 2024 Proxy Statement.

To be Elected by Holders of Common Shares

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position with UScellular

and Current or Former Principal Occupation | | Served as

Director since |

| Harry J. Harczak, Jr. | | 67 | | Director of UScellular, Managing Director of Sawdust Capital, LLC and former Executive Vice President at CDW Corporation | | 2003 |

| Gregory P. Josefowicz | | 71 | | Director of UScellular, former Chair, Chief Executive Officer and President of Borders Group, Inc. and former Chief Executive Officer of the Jewel-Osco division of American Stores Company | | 2009 |

| Cecelia D. Stewart | | 65 | | Director of UScellular, former President of U.S. Consumer and Commercial Banking of Citigroup Inc. | | 2013 |

| Xavier D. Williams | | 56 | | Director of UScellular, CEO of Network Wireless Solutions, LLC | | January 2023 |

To be Elected by Holder of Series A Common Shares

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position with UScellular

and Current or Former Principal Occupation | | Served as

Director since |

| James W. Butman | | 66 | | Director of UScellular, President and CEO of TDS Telecom | | January 2023 |

| LeRoy T. Carlson, Jr. | | 77 | | Chair and Director of UScellular and Director and President and Chief Executive Officer of TDS | | 1984 |

| Walter C. D. Carlson | | 70 | | Director of UScellular, Senior Counsel, Sidley Austin LLP, and Director of TDS | | 1989 |

| Douglas W. Chambers | | 54 | | Director and Executive Vice President, Chief Financial Officer and Treasurer of UScellular | | January 2023 |

| Deirdre C. Drake | | 58 | | Director of UScellular, former Executive Vice President - Chief People Officer and Head of Communications of UScellular | | 2021 |

| Esteban C. Iriarte | | 51 | | Director of UScellular, former Executive Vice President and Chief Operating Officer, Millicom International Cellular S.A. | | 2022 |

| Michael S. Irizarry | | 62 | | Director and Executive Vice President, Chief Technology Officer and Head of Engineering and Information Technology of UScellular | | 2020 |

| Laurent C. Therivel | | 49 | | Director and President and Chief Executive Officer of UScellular | | 2020 |

| Vicki L. Villacrez | | 62 | | Director of UScellular, Executive Vice President and Chief Financial Officer of TDS | | 2022 |

Your Board of Directors unanimously recommends a vote "FOR" the above nominees.

The Board of Directors does not have any specific, minimum qualifications that must be met by a nominee, or any specific qualities or skills that are necessary for directors to possess. The Board of Directors believes that substantial judgment, diligence and care are required to identify and select qualified persons and it does not believe that it would be appropriate to place limitations on its own discretion.

The Board of Directors has consistently sought to nominate eminently qualified individuals that can provide substantial benefit and guidance. UScellular also believes that it is desirable to have diverse backgrounds, experience, skills and other characteristics. In addition, the conclusion of which persons should serve is based in part on the fact that UScellular is a controlled company with a capital structure in which different classes of stock vote for different directorships. In particular, because TDS owns 100% of the Series A Common Shares, nominations of directors for election by the holder of the Series A Common Shares are based on the recommendation of TDS. In addition, the Board of Directors may consider the recommendations of large shareholders, including TDS, in nominating persons for election as directors by the holders of Common Shares.

Board composition supports long-term strategy

UScellular's mission is to connect its customers to what matters most to them. This includes providing exceptional wireless communications services which enhance consumers' lives, increase the competitiveness of local businesses and improve the efficiency of government operations in mid-sized and rural markets we serve. UScellular's Board of Directors has broad experiences, qualifications, attributes and skills that support its long-term strategy.

Nominees for Election by Holders of Common Shares

| | | | | | | | | | | |

Harry J. Harczak Independent Director | | Age: 67 |

Current Role: Managing Director of Sawdust Capital, LLC, since 2008 | | Director since: 2003 |

Mr. Harczak has significant experience with UScellular and the wireless industry, in addition to his many years of Board and Audit Committee experience. Mr. Harczak is currently a Managing Director at Sawdust Capital, a private investment firm. He brings substantial experience in finance, sales, operations and management as a result of his executive leadership positions at CDW. He also has significant experience in accounting and auditing as a result of being a chief financial officer and a former partner at PricewaterhouseCoopers. Mr. Harczak is a Certified Public Accountant (inactive). Mr. Harczak has a bachelor of science degree in accounting from DePaul University and an MBA from the University of Chicago. | |

Board Committee: Audit Committee, Designated financial expert, Chair since 2023 Prior Business and other Experience: CDW Corporation (1994-2007), including several executive leadership positions most recently as Chief Financial Officer and Executive Vice President of Sales, Marketing and Business Development PricewaterhouseCoopers LLP |

Current Public Company Boards: None | Former Public Company Boards: Tech Data Corporation (2008-2020); Audit Committee, Chairperson; Cybertech Committee | |

| | | | | | | | | | | |

Gregory P. Josefowicz Independent Director | | Age: 71 |

Current Role: Private Investor | | Director since: 2009 |

Mr. Josefowicz has significant experience with UScellular and the wireless industry, in addition to his many years of Board, Long-Term Incentive Compensation, Audit and Technology Advisory Committee experience. He has substantial experience in retail marketing, merchandising and general management, along with service as a public company board member. He also has extensive executive leadership experience from leading large retail operations. In addition, he has substantial experience as a result of serving on multiple Audit, Compensation, and Nominating and Governance Committees. Mr. Josefowicz holds a BA in Marketing from Michigan State University and an MBA from Northwestern University’s Kellogg Graduate School of Management. | |

Board Committees: Audit Committee Long-Term Incentive Compensation Committee, Chairperson since 2017 Technology Advisory Group Committee Prior Business and other Experience: True Value Company (2010-2018); Vice Chair Borders Group, Inc. (1999-2006), President and Chief Executive Officer Tops Holding Corporation (2008-2013). Board member President, Albertson’s Inc.(1999) Jewel-Osco division of American Stores (1974-1999), including several executive leadership positions and ending as its President |

Current Public Company Boards Empire Company Limited, since 2016; Human Resources Committee | Former Public Company Boards Borders Group, Inc., Chairperson (2002-2006) PetSmart, Inc. (2004-2015); Chairperson; Lead Director; Compensation Committee; Nomination and Governance Committee Roundy’s, Inc. (2012-2015); Audit Committee; Compensation Committee; Nominating and Corporate Governance; Lead Director Ryerson, Inc. (1999-2006); Audit Committee, Chairperson Spartan Stores (2001-2005); Compensation Committee TDS (2007-2009) Winn-Dixie Stores, Inc. (2006-2012); Audit Committee, designated financial expert; Lead Director | |

| | | | | | | | | | | |

Cecelia D. Stewart Independent Director | | Age: 65 |

Current Role: Private Investor | | Director since: 2013 |

Ms. Stewart has significant experience with UScellular and the wireless industry, in addition to her many years of Board, Long-Term Incentive Compensation, Audit and Technology Advisory Group Committee experience. She has more than 30 years of experience in the consumer banking industry. She also has extensive executive leadership experience from leading large, global financial services firms. Further, her background and attributes bring diversity to the board. Ms. Stewart has an MBA from Winthrop University’s Executive MBA program and she was awarded an Honorary Doctorate Degree from Winthrop University in 2014. | |

Board Committees: Audit Committee Long-Term Incentive Compensation Committee Technology Advisory Group Committee Prior Business and other Experience: President, U.S. Consumer and Commercial Banking of Citigroup Inc. (2011-2014) Morgan Stanley, President of Retail Banking Group and Chief Executive Officer of the Private Bank Division (2009-2011) Wachovia Corporation (1978-2008), several leadership positions including Executive Vice President and head of retail and small business banking |

Current Public Company Boards First Horizon National Corporation, since 2014; Audit Committee; Information Technology Committee, Chairperson | Former Public Company Boards None | |

| | | | | | | | | | | | | | |

Xavier D. Williams Independent Director | | Age: 56 |

Current Role: CEO of Network Wireless Solutions, LLC | | Director since: January 2023 |

Mr. Williams has significant leadership experience in the telecommunications industry as CEO of Network Wireless Solutions, an infrastructure solution provider for wireless and wireline communications providers, since March 2022, and from his thirty years at AT&T, Inc., most recently as President, Public Sector & FirstNet, which included responsibility for a multi-billion dollar nationwide wireless broadband network for first responders. He has extensive B2B experience in addition to experience in sales, finance, strategy, product management, global operations and human resources. Mr. Williams has also worked in the technology industry and was CEO of American Virtual Cloud Technologies, Inc., a publicly traded special purpose acquisition company focused on providing secure managed cloud services, hardware, and software, from October 2020 to June 2021 and then he became its Vice Chairman from July 2021 to August 2021. Further, his background and attributes bring diversity to the Board. He has a bachelor's degree in business administration from Edinboro University of Pennsylvania and an MBA from the University of Pittsburgh-Joseph M. Katz Graduate School of Business. | |

Board Committee:

Audit Committee

Prior Business and other Experience: Significant leadership and operational experience with AT&T (1990-2020), most recently President- Public Sector & FirstNet |

Current Public Company Boards

None | | Former Public Company Boards

American Virtual Cloud Technologies, (2020-2021) | |

Your Board of Directors unanimously recommends a vote "FOR" each of the above nominees for election by the holders of Common Shares.

Nominees for Election by Holders of Series A Common Shares

| | | | | | | | |

James W. Butman Non-Independent Director | Age: 66 |

Current Role: President and Chief Executive Officer of TDS Telecom | Director since January 2023 |

Mr. Butman brings substantial experience, expertise and qualifications with respect to TDS and UScellular and the industries in which they operate as a result of his leadership roles at TDS Telecom. He has extensive sales, marketing and customer operations experience. He was appointed President and Chief Executive Officer of TDS Telecom on January 1, 2018. Prior to that, he held several executive leadership roles at TDS Telecom and served as President of TDS Metrocom, a competitive local exchange operation. Mr. Butman has a Bachelor of Business Administration in Finance from the University of Wisconsin—Eau Claire and an MBA in Finance from the University of Wisconsin—Madison. |

Prior Business and other Experience

Significant leadership and operational experience since joining TDS Telecom in 1985 including several executive leadership roles in management, sales and marketing, and regulatory affairs.

Director of TDS Telecom |

Current Public Company Boards

TDS, since 2018 | Former Public Company Boards

None |

| | | | | | | | | | | |

LeRoy T. Carlson, Jr. Chair of the Board and Non-Independent Director | | Age: 77 |

Current Role: TDS President, since 1981, and TDS Chief Executive Officer, since 1986 | | Director since: 1984 |

Mr. Carlson brings substantial experience with respect to the wireless industry as a result of his many years as an investor in TDS, a trustee of the TDS Voting Trust, a director and President and Chief Executive Officer of TDS, and a director and Chair of UScellular. As the senior executive officer of UScellular and of its parent, the board of directors considers it essential that Mr. Carlson serve on the UScellular board. Also, because he is a director and officer of TDS, the largest shareholder of UScellular, his participation on the board permits him to represent the long-term interests of UScellular shareholders. He also has experience as chairperson of the Technology Advisory Group Committee since 2015 and as a member of the TDS Corporate Governance and Nominating Committee since 2004. Mr. Carlson has a bachelor's degree from Harvard College and an MBA from Harvard Graduate School of Business. LeRoy T. Carlson, Jr. is the brother of Walter C. D. Carlson. | |

Board Committee: Technology Advisory Group Committee, Chairperson Prior Business and other Experience: Trustee of the TDS Voting Trust |

Current Public Company Boards: TDS, since 1968 | Former Public Company Boards:

Aerial Communications

American Paging | |

| | | | | | | | | | | |

Walter C. D. Carlson Non-Independent Director | | Age: 70 |

Current Role: Senior Counsel of the law firm Sidley Austin LLP and partner there for more than five years | | Director since: 1989 |

Mr. Carlson brings substantial experience with respect to UScellular and the wireless industry as a result of his many years as an investor in TDS, as a trustee of the TDS Voting Trust, as a director of TDS and Chair of the TDS Board. Also, because he is a director of TDS, the largest shareholder of UScellular, his Board participation permits him to represent the long-term interests of UScellular shareholders. Mr. Carlson is an experienced litigator and has represented many public and private corporate clients. He also has experience as a member and the chairperson of the TDS Corporate Governance and Nominating Committee since 2004. Mr. Carlson has a bachelor’s degree from Yale University and a J.D. from Harvard University. Walter C. D. Carlson is the brother of LeRoy T. Carlson, Jr. | |

Prior Business and other Experience: Trustee of the TDS Voting Trust |

Current Public Company Boards: TDS, since 1981 | Former Public Company Boards: Aerial Communications, Inc. | |

| | | | | | | | | | | |

Douglas W. Chambers Non-Independent Director | | Age: 54 |

Current Role: Executive Vice President, Chief Financial Officer and Treasurer | | Director since January 2023 |

Mr. Chambers has more than 25 years of financial experience. He joined UScellular from TDS in 2018. Mr. Chambers is responsible for UScellular’s accounting and financial reporting, revenue assurance, financial planning and analysis, credit and collections, treasury, real estate, and supply chain activities. Mr. Chambers is a certified public accountant and a board member of the Southwest Wisconsin Chapter of the American Red Cross. He earned a bachelor’s degree in accounting from the University of Wisconsin-Madison and an MBA from the Kellogg School of Management at Northwestern University. | |

Prior Business and other Experience:

TDS (2007 - 2018)

Midway Games, Inc. (2004-2007)

PricewaterhouseCoopers LLP (1991-2004) |

Current Public Company Boards: None | Former Public Company Boards:

None | |

| | | | | | | | | | | |

Deirdre C. Drake Non-Independent Director | | Age: 58 |

Current Role: Private Investor | | Director since: 2021 |

Ms. Drake has significant experience with the wireless industry having served as the Executive Vice President - Chief People Officer and Head of Communications of UScellular until January 2023. She was appointed Executive Vice President - Chief People Officer in September 2020. Prior to that, she was Executive Vice President and Chief Human Resources Officer since May 2018. She joined UScellular as Senior Vice President - Chief Human Resources Officer in 2014. Ms. Drake was responsible for all aspects of the human resources organization and for communications at UScellular. Further, her background and attributes bring diversity to the board. Ms. Drake has a bachelor of science degree in business administration from Central Michigan University and an MBA from St. Joseph's University. | |

Prior Business and other Experience: Bank of Montreal Financial Group, Managing Director and Chief Human Resources Officer, BMO Capital Markets, (2012-2014); Senior Vice President, Human Resources, U.S. (2006-2012) Aramark Corporation (1995-2006), several executive leadership roles including Senior Vice President, Human Resources, Healthcare and Education Division |

Current Public Company Boards: Top Build Corp., since 2022; Audit Committee; Compensation Committee; Governance Committee | Former Public Company Boards: None | |

| | | | | | | | | | | |

Esteban C. Iriarte Independent Director | | Age: 51 |

Current Role: Private Investor | | Director since: 2022 |

Mr. Iriarte has significant leadership experience in the wireless and cable industries having served in several executive leadership positions with Millicom International Cellular S.A. (Millicom) from 2009 to 2023. Millicom provides cable and mobile services dedicated to emerging markets in Latin America. From 2016-2023, Mr. Iriarte was Executive Vice President and Chief Operating Officer of Millicom, where he led operations in nine different Latin American markets each with its own competitive context, product and management teams. Previously, Mr. Iriarte was Chief Executive Officer of Millicom’s Colombian businesses and prior to this was head of Millicom’s regional Home and B2B divisions. From 2009 to 2011, he was CEO of Amnet Inc., a leading service provider in Central America for broadband, cable TV, fixed line and data services that was bought by Millicom in 2008. He also brings significant experience successfully competing against large incumbent competitors in Latin America. Further, his background and attributes bring diversity to the board, in addition to his work in emerging markets in Latin America. Mr. Iriarte has a bachelor's degree from Universidad Católica Argentina, Ciudad de Buenos Aires, Argentina and an MBA from Universidad Austral, Ciudad de Buenos Aires, Argentina.

| |

Board Committees: Long-Term Incentive Compensation Committee

Technology Advisory Group Committee

Prior Business and other Experience:

Executive Vice President and Chief Operating Officer of Millicom International Cellular S.A. (2016-2023)

Board Member, SURA Asset Management S.A. de C.V, a privately owned investment manager and subsidiary of Grupo de Inversiones Suramericana S.A. (2016-present)

Manager, Operations, Cablevision Inc. (2006-2009) |

Current Public Company Boards: None | Former Public Company Boards: None | |

| | | | | | | | | | | |

Michael S. Irizarry, Ph.D. Non-Independent Director | | Age: 62 |

Current Role: Executive Vice President, Chief Technology Officer and Head of Engineering and Information Technology of UScellular | | Director since: 2020 |

Mr. Irizarry has significant experience with UScellular and the wireless industry having served as an executive officer of UScellular since 2002. He was appointed Executive Vice President, Chief Technology Officer and Head of Engineering and Information Technology in 2021. Prior to that he was Executive Vice President and Chief Technology Officer-Engineering and Information Services since 2011. Prior to that, he was Executive Vice President-Engineering and Chief Technology Officer since 2003. He joined UScellular as Executive Vice President and Chief Technology Officer in 2002. He is responsible for the Company’s information systems, technology and cybersecurity, as well as all of the wireless technological advancements. He is also on the board of the Next Generation Mobile Networks Alliance. Further, his background and attributes bring diversity to the board. He has a bachelor's degree in engineering from World College, a master of science in information management and an MBA from the International School of Information Management, a Ph.D. in Communications Technology from Capella University's School of Business and Technology and a Ph.D. in Computer Science and Enterprise Information Management from Colorado Technical University. | |

Prior Business and other Experience:

Verizon Wireless (2000-2002) Vice President Network Engineering

Bell Atlantic Mobile (1996-2000) Executive Director Network

PageNet (1988-1995) |

Current Public Company Boards: None | Former Public Company Boards: None | | |

| | | | | | | | | | | | | | |

Laurent C. Therivel Non-Independent Director | | Age: 49 |

Current Role: President and CEO of UScellular | | Director since: 2020 |

Mr. Therivel brings substantial experience, expertise and qualifications to UScellular and its subsidiaries as a result of his leadership role at UScellular. Mr. Therivel brings over 15 years of experience in the telecommunications industry, including more than 10 years at AT&T. Mr. Therivel has experience in wireless and wireline operations, strategy and finance. He served as the Chief Operating Officer at IPcelerate, a VoIP applications provider, and as a strategy consultant at Bain & Co. He also served as a Communications Officer in the U.S. Marine Corps. Therivel holds bachelor's degrees in business administration and marketing from Texas A&M University and an MBA from Harvard Business School. | |

Prior Business and other Experience

Significant leadership and operational experience with AT&T including CFO of AT&T Business Solutions; senior vice president of AT&T Small Business Solutions and most recently CEO of AT&T Mexico (2008-June 2020)

Chief Operating Officer for IPcelerate, Inc. (2006-2008)

Bain & Company (2003-2006)

United States Marine Corps (1997-2001) |

Current Public Company Boards

None | | Former Public Company Boards

TDS (2020-August 2023) | |

| | | | | | | | | | | | | | |

Vicki L. Villacrez Non-Independent Director | | Age: 62 |

Current Role: Executive Vice President and Chief Financial Officer of TDS | | Director since: 2022 |

Ms. Villacrez has significant experience with the telecommunications industry as a result of over thirty years at the TDS enterprise. She has substantial experience in finance, accounting, financial planning and strategic analysis. Ms. Villacrez is currently TDS’ Executive Vice President and CFO since 2022. She was previously Senior Financial Advisor of TDS from February 2022 to May 2022 and prior to that TDS Telecom’s Senior Vice President Finance and CFO since 2017 and TDS Telecom’s Vice President Finance and CFO between 2012 and 2017. Prior to that Ms. Villacrez held several financial leadership positions with growing responsibility at TDS, including leading Financial Analysis and Strategic Planning. Further, her background and attributes bring diversity to the board. Ms. Villacrez has a bachelor's degree in accounting from Upper Iowa University and an MBA from Edgewood College. She is also a CPA. | |

Prior Business and other Experience

Significant leadership and operational experience with TDS and its subsidiary TDS Telecom, most recently TDS Telecom's Senior Vice President and CFO, (1989-present) |

Current Public Company Boards

TDS, since August 2023 | | Former Public Company Boards

None | |

Your Board of Directors unanimously recommends a vote "FOR" each of the above nominees for election by the holders of Series A Common Shares.

CORPORATE GOVERNANCE

Board of Directors

The business and affairs of UScellular are managed by or under the direction of the Board of Directors. The Board of Directors consists of thirteen members. Holders of Common Shares elect 25% of the directors rounded up to the nearest whole number, or four directors based on a board size of thirteen directors. TDS, as the sole holder of Series A Common Shares, elects the remaining nine directors.

Board Leadership Structure

Under our leadership structure, the same person does not serve as both the chair of the board and chief executive officer. LeRoy T. Carlson, Jr. serves as Chair and, in that capacity, sets the agenda and presides over Board of Directors meetings, and assesses the performance of UScellular. Laurent C. Therivel serves as President and Chief Executive Officer and is responsible for day-to-day leadership and performance and, in that capacity, regularly confers and consults with the Chair with respect to important strategic, operating and financial activities and decisions.

This leadership structure is set forth in our Bylaws. UScellular has determined that this leadership structure is appropriate given that it is controlled by TDS. Additionally, UScellular believes that its leadership structure facilitates risk oversight because the role of the President and Chief Executive Officer, who has primary operating responsibility to assess and manage UScellular's exposure to risk, is separated from the role of the Chair of the Board, who sets the agenda for and presides over Board of Directors meetings at which the UScellular board exercises its oversight responsibility with respect to risk.

Board Role in Risk Oversight

The Board of Directors is primarily responsible for oversight of the risk assessment and risk management process. Although the Board of Directors can delegate this responsibility to board committees, the Board of Directors has not done so. Instead the actual risk assessment and risk management is carried out by the President and Chief Executive Officer and other officers and then reported to the Board of Directors.

As part of its oversight responsibilities, the Board of Directors reviews the Enterprise Risk Management (ERM) program which applies to TDS and all of its business units, including UScellular. This program was designed with the assistance of an outside consultant and is integrated into TDS' existing management and strategic planning processes, including such processes of UScellular. The ERM program provides a common enterprise-wide language and discipline around risk identification, quantification and mitigation.

Although the Board of Directors has ultimate oversight authority over risk, certain committees have responsibilities relating to risk. Under NYSE listing standards, and as set forth in its charter, the Audit Committee is required to discuss policies with respect to risk assessment and risk management. Accordingly, the Audit Committee discusses UScellular's major financial and operational risk exposures and the steps management has taken to monitor and control such exposures in connection with its review of financial statements and related matters on a quarterly basis.

In addition, as part of the ERM program, the Audit Committee, while not solely responsible for ERM, discusses guidelines and policies to govern the process by which risk assessment and risk management are handled. The Audit Committee receives updates and discusses policies with respect to risk assessment and risk management on a regular basis. In 2022, the committee expanded its charter to include the review of procedures and processes to ensure the accuracy of its material disclosures and reporting related to environment, social and governance matters.

In addition, the Long-Term Incentive Compensation Committee (LTICC), which has responsibilities relating to the equity compensation of the executive officers, and the Chair of UScellular, who in effect functions as the compensation committee for non-equity compensation for the executive officers other than himself, consider risks relating to compensation of executive officers, as discussed in the Compensation Discussion and Analysis and Risks from Compensation Policies and Practices.

Furthermore, TDS has established a Technology Advisory Group (TAG) for TDS and its business units, including UScellular. The TAG enhances the Board’s risk oversight through its review of technologies the Company is investing in and through discussion of potential technology disruptions. Related to this, the UScellular Board of Directors established a TAG Committee of the Board of Directors that consists of directors who participate in the TAG.

ESG Oversight

UScellular is in the business of making connections and has a responsibility to the people it serves with its network. As a part of that responsibility, the Company is committed to providing sustainable solutions within its operations and fostering a culture of inclusivity. UScellular uses the same guiding principles as TDS to guide their program and engagement in creating sustainability.

The Board of Directors believes that oversight of ESG is the responsibility of the full Board of Directors. However in 2022, the Audit Committee expanded its charter to include the review of procedures and processes to ensure the accuracy of its material disclosures and reporting related to environment, social and governance matters. Additional information related to ESG is available on UScellular's website, www.uscellular.com, Newsroom—Social Impact and on TDS’ Enterprise ESG website, tdsinc.com/esg. The information contained on the websites does not constitute a part of this proxy statement and is not incorporated by reference herein.

Board Oversight of Cybersecurity

UScellular continues to manage its evolving cybersecurity risks through ongoing investments in its security program and active monitoring of security risks. The Board continues to believe that the full Board should be responsible for cybersecurity. The UScellular Audit Committee and Board of Directors receive enhanced Board reporting on cybersecurity issues, in addition to the annual updates regarding UScellular's assessment of threats and mitigation plans. The Audit Committee also exercises oversight over control-related cybersecurity risks and mitigation plans, and receives updates at least bi-annually. Cybersecurity is also discussed at the Technology Advisory Group Committee as warranted.

UScellular conducts regular cyber incident simulations to ensure preparedness and it leverages external third parties to perform assessments and tests of security controls. In 2023, the full Board of Directors was included in multiple real-time briefings while UScellular conducted a live incident simulation.

Data Privacy

UScellular’s security safeguards are based on the Center for Internet Security's Critical Security Controls to protect against such risks as loss, unauthorized access, destruction, use, modification, or disclosure of information. UScellular uses a variety of commercially reasonable and appropriate safeguards to protect information residing on its systems including, without limitation, server firewalls and physical facility security. These security controls and safeguards consider the scope of the processing activities, the sensitivity of the information, the size of the entity doing the processing, and the technical feasibility of the security measures.

Supplier Diversity

UScellular is committed to enhancing the use of diverse businesses by proactively developing relationships with minorities, women, veterans, service-disabled veterans, disabled individuals, members of the LGBT (lesbian, gay, bisexual, transgender) community, disadvantaged persons and local businesses within our supply chain. Supplier diversity is a core value and a strategic business decision that is expected to help drive the economic growth and expansion of our business. UScellular also encourages subcontracting opportunities for diverse businesses.

Environment and Sustainability

UScellular has a focus on reducing its impact on the environment and finding sustainable solutions in how we run our operations. We have engaged in practices like installing solar panels, installing an electric vehicle charging station, and providing bicycle racks at most locations. Additionally, we’ve implemented BPA-free paper recyclable receipt papers at all our retail stores and have put a concentrated effort on reducing our carbon footprint through a series of recycling programs. We have also partnered with organizations to collect and recycle electronic waste such as computers and monitors, responsibly disposing and removing hazardous materials to prevent it from entering a landfill.

A Culture of Giving Back

UScellular’s commitment to giving back is deeply ingrained in the corporate culture. UScellular’s corporate social responsibility efforts provide critical resources in local communities in three distinct areas:

1.K-12 STEM (Science, Technology, Engineering and Mathematics): STEM education and access to technology go hand in hand. That’s why UScellular helps provide youth in grades K-12 with equitable opportunities to pursue careers in STEM. Our partnerships with organizations like Boys & Girls Clubs of America, Girls Who Code and YWCA provide students with resources, access, mentorship, and hands-on education to reach their full potential.

Our commitment to empowering the next generation has led us to support Boys & Girls Club of America’s K-12 STEM education and academic enrichment programs. By providing things like new laptops, 3-D printers, expanding programming to include LEGO robotics, we’re helping enrich learning experiences along with hosting field trips to the Summerfest music festival in Milwaukee, Wisconsin and sports arenas like Lambeau Field in Green Bay, Wisconsin.

Since 2022, UScellular has partnered with Girls Who Code to help close the STEM gender gap by providing equal opportunities for girls, women and nonbinary students in STEM fields. Last year, UScellular supported their growing clubs and the Summer Immersion Program – a 2-week intensive where high-school-aged girls learn to code and build their own game.

2.After School Access Project: UScellular is working to close the “homework gap” – a divide that exists for children who do not have access to reliable internet outside the classroom. These students miss out on essential tools and opportunities for continued learning after school. In 2021, we launched After School Access Project with a pledge to provide hotspots and service to connect up to 50,000 youth. We extended our commitment in 2023. By partnering with youth-serving nonprofits in UScellular markets, we bring connectivity to help youth continue to learn and thrive.

3.Associate Passions: UScellular offers a variety of programs in which associates can engage like personal donation matching, cause cards rewards and dollars for doers to support causes they care about in local communities. UScellular matches associates’ donations dollar-for-dollar to 501c3 registered nonprofits up to $2,500 per associate until the company reaches its annual cap of $250,000 for matching donations. In 2023, the company matched nearly $240,000 in associate donations to support the causes and communities our associates care about most.

Awards

In 2023, UScellular was recognized with several awards ranging from brand purpose to inclusion:

Company Awards

•2023 Brands That Matter; Fast Company

•2023 Chicagoland Admin Awards – Founder’s Award; Admin Awards

Workplace Awards

•Top Score of 100 on Disability Equality Index; Disability IN

•Top Score on Corporate Equality Index; Human Rights Campaign

•2023 Inclusion Index; Seramount

•2023 Veteran-Friendly Companies; U.S. Veteran’s Magazine

•2023 Southeast Wisconsin Top Workplace; Milwaukee Journal Sentinel

•100 Best Companies to Work For in Oregon, Oregon Business Magazine

•America's Best Places to Work for Hispanics/Latinos; Hispanic/Latino Professionals Association

•2023 Best Employers for Diversity; Forbes

•2023 Best Midsize Employers; Forbes

Diversity, Equity and Inclusion

The culture at UScellular starts with taking care of its people. UScellular provides a competitive wage and benefits package, a safe workplace, and an environment where associates feel engaged and included. UScellular periodically surveys its associates and those surveys have consistently shown that associates have strong engagement and high overall job satisfaction. UScellular adheres to equal opportunity, which leads to greater diversity of thoughts, ideas and the innovation needed to move the business forward.

UScellular strives to support an inclusive and diverse workforce and wants its associates to feel supported without regard to race, color, religion, national origin, age, genetic information, sex, gender identity or expression, sexual orientation, marital status, disability, protected veteran status, or any other characteristics protected by applicable federal, state or local law.

UScellular is committed to demonstrating equity and fairness through the inclusion of diverse associates, customers, and suppliers. Additionally, UScellular supports various associate resource groups to promote diverse and inclusive experiences that align with UScellular’s vision and values, increase associate engagement and empowerment, and support professional development. Since its founding, UScellular has been committed to associate development, which is critical to its success.

UScellular provides job specific, diversity and inclusion, safety, and fraud and IT security awareness training for all associates – and also offers programs to further develop its associates including educational assistance, developmental assignments, and mentoring programs. UScellular is committed to supporting and enhancing the communities it serves through local and philanthropic initiatives that enrich the lives of those living where it operates and where its associates live, work and play.

UScellular encourages associates to volunteer and support local organizations and community groups. Local communities are at the center of UScellular’s business, and it takes great pride in giving back to the people and places that contribute to its sustainability and long-term success.

In 2023, UScellular held its fourth annual Inclusion Summit featuring UScellular leaders, associates, and guest speakers from across the country. The theme, The Inclusion Experience, provided an opportunity for associates, company wide, to come together and learn new perspectives and take actions to build an environment of inclusion, understanding and belonging for all. Laurent Therivel kicked off the summit and spoke about UScellular's commitment to Diversity, Equity, and Inclusion.

Director Independence and New York Stock Exchange Listing Standards

UScellular Common Shares are listed on the NYSE. Under NYSE listing standards, UScellular is a "controlled company" because over 50% of the voting power for the election of directors is held by TDS. Accordingly, UScellular is exempt from certain listing standards under the rules of the NYSE that require listed companies that are not controlled companies to (i) have a board composed of a majority of directors who qualify as independent, (ii) have a compensation committee composed entirely of directors who qualify as independent, and (iii) have a nominating/corporate governance committee composed entirely of directors who qualify as independent.

As discussed below under "Audit Committee," the following members of the Audit Committee qualify as independent under the NYSE listing standards: Harry J. Harczak, Jr. (chairperson), Gregory P. Josefowicz, Cecelia D. Stewart and Xavier D. Williams. In addition to the four independent directors on the Audit Committee, Esteban C. Iriarte qualifies as an independent director under the listing standards of the NYSE. As a result, five of thirteen directors, or 38% of the directors, have been determined to qualify as independent under the NYSE listing standards.

Meetings of Board of Directors

The strategic alternatives review for UScellular increased the number of board meetings. Our Board of Directors held nine meetings during 2023, of which five were regularly scheduled and four were special board meetings related to the aforementioned strategic alternatives review. Each director attended at least 75% of the total number of meetings and at least 75% of the total number of committee meetings on which such person was a member of the committee (during the period such person was a director or member of such committee).

Corporate Governance Best Practices

The following identifies a number of the good corporate governance best practices adopted and followed by UScellular:

•Annual election of directors.

•UScellular has adopted Corporate Governance Guidelines that are intended to reflect good corporate governance and other best practices.

•The positions of (i) Chair of the Board and (ii) President and Chief Executive Officer are separated.

•The Audit Committee, which is comprised entirely of independent directors as required, operates under a charter and in a manner that is intended to reflect good corporate governance and other best practices.

•The UScellular Chair, who is the CEO of the controlling shareholder (TDS), approves executive compensation, other than long-term equity-based compensation, ensuring the interests of shareholders are represented in compensation matters.

•Although not required to do so as a controlled company, UScellular has established an LTICC, comprised solely of independent directors, with responsibility for long-term equity-based compensation.

•The LTICC operates under a charter and in a manner that is intended to reflect good corporate governance and other best practices.

•The LTICC uses market compensation information supplied by our compensation consultant, Willis Towers Watson, as one factor in making executive officer long-term equity-based compensation decisions.

•Annual self-assessment of board.

•UScellular holds an annual "Say-on-Pay" vote.

•At least once per year, independent directors will meet without non-independent directors and management.

•Non-management directors meet at regularly scheduled executive sessions without management.

•No super-majority vote is required to amend the UScellular Charter or Bylaws.

Corporate Governance Guidelines

UScellular's corporate governance guidelines address (i) Board of Directors structure, (ii) director qualification standards, (iii) director responsibilities, orientation and continuing education, (iv) director compensation, (v) board resources and access to management and independent advisors, (vi) annual performance evaluation of the board and committees, (vii) board committees, (viii) management succession and (ix) periodic review of the guidelines.

These Guidelines provide that, once each year, the Board of Directors will discuss corporate governance, including the allocation of seats between independent and non-independent directors.

A copy of such guidelines is available on UScellular's website, www.uscellular.com, Investor Relations—Corporate Governance—Governance Documents—Governance Guidelines.

Management Succession Planning

Our Board recognizes that one of its most important duties is to oversee the development of executive talent and ensure continuity at UScellular. The Executive Vice President – Chief People Officer and Head of Communications takes the lead in overseeing succession planning and assignments to key leadership positions, and regularly reports to the full Board during executive sessions.

Board Self-Assessment

Pursuant to these Guidelines, under the leadership of the Chair, the Board of Directors performed a self-assessment and evaluated its performance and effectiveness as a board in 2023. This self-assessment covered matters relating to board meetings, board composition, committees, board oversight, and other matters.

| | | | | | | | | | | | | | |

| Audit Committee |

| Meetings in Fiscal 2023: 8 |

Members: Harry J. Harczak(Chair)[FE], Gregory P. Josefowicz, Cecelia D. Stewart, Xavier D. Williams |

| Responsible for: |

● Assisting the Board of Directors of UScellular in its oversight of the: |

| • integrity of financial statements |

| • compliance with legal and regulatory requirements |

| • qualifications and independence of our registered public accounting firm |

| • performance of the internal audit function and registered public accounting firm |

| • cybersecurity |

| • ESG matters |

● Preparing an audit committee report |

● Reviewing related party transactions |

● Performing functions outlined in the UScellular Audit Committee Charter |

| [FE] — Audit Committee Financial Expert as defined by the SEC |

Each member qualifies as independent under the NYSE standards and Section 10A-3 that is applicable only to Audit Committee members.

A copy of the committee charter is available on UScellular’s website, www.uscellular.com, Investor Relations—Corporate Governance—Governance Documents—Audit Committee.

Pre-Approval Procedures

The Audit Committee has adopted a policy pursuant to which all audit and non-audit services provided by UScellular's principal independent registered public accounting firm must be pre-approved by the Audit Committee, consistent with the requirements of the Sarbanes Oxley Act of 2002 and rules issued thereunder.

Compensation Committee

Under NYSE listing standards, UScellular is a controlled company and not required to have an independent compensation committee. As a result, UScellular does not have a formal compensation committee and instead LeRoy T. Carlson, Jr. functions as the compensation committee for all matters not within the authority of the LTICC. LeRoy T. Carlson, Jr. does not operate with a charter. Laurent C. Therivel, in consultation with LeRoy T. Carlson, Jr., reviews and sets the cash compensation for Named Executive Officers (NEOs) other than himself. See "Compensation Discussion and Analysis" and "Compensation Committee Interlocks and Insider Participation" for further information.

Long-term equity compensation for executive officers is approved by the LTICC.

| | | | | | | | | | | | | | |

| Long-Term Incentive Compensation Committee (LTICC) |

Meetings in Fiscal 2023: 2 |

Members: Gregory P. Josefowicz (Chair), Esteban C. Iriarte, Cecelia D. Stewart |

| Responsible for: |

● Assisting the Board of Directors of UScellular in its oversight of the: |

| • review and recommendation of Long-Term Incentive Plans and programs for the employees of the Company |

| • review and recommended changes to the Company's Long-Term Incentive Plans and programs |

| • interpretation and administration of the Company's Long-Term Incentive Plans and programs |

| • reviewing disclosures regarding long-term equity-based compensation made in the Company's annual proxy statement |

A copy of the committee charter is available on UScellular’s website, www.uscellular.com, under Investor Relations— Corporate Governance—Governance Documents—Long-Term Incentive Compensation Committee.

UScellular has an LTICC comprised solely of directors who qualify as independent. None of such members receive any compensation from UScellular, TDS or any other member of the TDS consolidated group ("TDS Consolidated Group"), except permitted compensation for services as a UScellular director and committee member. Additionally, none of such members are affiliated with the TDS Consolidated Group by reason of being an executive officer, or the beneficial owner of more than 10% of any class of voting equity security, of any member of the TDS Consolidated Group. See Compensation Committee Interlocks and Insider Participation for further information.

UScellular's Human Resources Department supports the UScellular Chair and the LTICC in their functions. UScellular also utilizes the services of a compensation consultant. See Compensation Discussion and Analysis below for information about UScellular's compensation consultant.

It is the view of the UScellular Board of Directors that director compensation should be the responsibility of the full Board of Directors. Therefore, director compensation is approved by the full Board of Directors rather than by a committee of the Board of Directors. UScellular does not have any stock ownership guidelines for directors.

| | | | | | | | | | | | | | |

| Technology Advisory Group (TAG) Committee |

| Meetings is Fiscal 2023: 4 |

Members: LeRoy T. Carlson Jr. (Chair), Esteban C. Iriarte, Gregory P. Josefowicz and Cecelia D. Stewart |

● Responsible for reviewing, monitoring and informing the Board on technology and related matters affecting UScellular and its customers |

● The TAG Committee does not have authority to take action with respect to any technology matter, but serves solely in an informational and advisory role |

● TAG Committee members are also members of the Technology Advisory Group which also includes representatives of UScellular and TDS management, as well as TAG Committee members from TDS' Board |

The TAG Committee does not have a charter. The responsibilities of the TAG Committee, as generally described above, are set forth in full in the resolutions of the Board establishing such committee.

Director Nomination Process

As a controlled company, UScellular is exempt from the requirement to have a corporate governance and nominating committee comprised solely of independent directors. Accordingly, UScellular does not have a corporate governance and nominating committee or charter. Instead, the TDS Corporate Governance and Nominating Committee develops selection objectives and makes recommendations for qualified individuals to serve on the board. The entire Board of Directors participates in the consideration of director nominees.

In its annual board self-assessment, the full Board of Directors considers its composition, and the composition of each of its committees, and discusses expertise that may be needed in the future. In connection with the nominations of directors for election, the Board of Directors considers the tenure, qualifications and expertise of all of the directors. The Board of Directors does not have any specific, minimum qualifications that it believes must be met by a nominee.

The Board of Directors does not have a formal policy with regard to the consideration of director candidates recommended by shareholders. Because TDS has sole voting power in the election of directors elected by the holder of Series A Common Shares and a majority of the voting power in the election of directors elected by holders of Common Shares, nominations of directors for election by the holders of Series A Common Shares and Common Shares are generally based on the recommendation of TDS. With respect to candidates to be elected by the holders of Common Shares, the Board of Directors may from time to time informally consider candidates recommended by shareholders who hold a significant number of Common Shares, in addition to the recommendation of TDS. Shareholders who desire to nominate directors must follow the procedures set forth in UScellular's Bylaws.

Considering the importance of Federal Communications Commission ("FCC") licenses to UScellular, the UScellular Bylaws provide that a candidate will not be eligible for election or continued service as a director unless he or she is eligible to serve as a director of a company that controls licenses granted by the FCC, as determined by the Board of Directors with the advice of counsel. Another qualification requirement provides that a candidate will not be eligible for election or continued service as a director if he or she is or becomes affiliated with, employed by or a representative of, or has or acquires a material personal involvement with, or material financial interest in, a Business Competitor (as defined in the UScellular Bylaws), as determined by the Board of Directors. Another qualification requirement provides that a candidate will not be eligible for election or continued service as a director if, as determined by the Board of Directors with the advice of counsel, (i) such candidate's election as a director would violate federal, state or foreign law or applicable stock exchange requirements (other than those related to independence) or (ii) such candidate has been convicted, including a plea of guilty or nolo contendere, of any felony, or of any misdemeanor involving moral turpitude.

The Bylaws provide that a person properly nominated by a shareholder for election as a director shall not be eligible for election as a director unless he or she signs and returns to the Secretary of UScellular, within fifteen days of a request therefor, written responses to any questions posed by the Secretary, that are intended to (i) determine whether such person may qualify as independent and would qualify to serve as a director under rules of the FCC, and (ii) obtain information that would be disclosed in a proxy statement with respect to such person as a nominee for election as a director and other material information about such person.