UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2005

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-09818

ALLIANCEBERNSTEIN HOLDING L.P.

(Exact name of registrant as specified in its charter)

Delaware | | 13-3434400 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

1345 Avenue of the Americas, New York, N.Y. | | 10105 |

(Address of principal executive offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code: (212) 969-1000 |

Securities registered pursuant to Section 12(b) of the Act:

Title of Class | | Name of each exchange on which registered |

units representing assignments of beneficial ownership of limited partnership interests* | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the units representing assignments of beneficial ownership of limited partnership interests held by non-affiliates computed by reference to the price at which such units were last sold on the New York Stock Exchange as of June 30, 2005 was approximately $3,668,403,343.

The number of units representing assignments of beneficial ownership of limited partnership interests outstanding as of January 31, 2006 was 83,613,491.*

DOCUMENTS INCORPORATED BY REFERENCE

This Form 10-K does not incorporate any document by reference.

* includes 100,000 units of general partnership interest having economic interests equivalent to the economic interests of the units representing assignments of beneficial ownership of limited partnership interests

GLOSSARY OF CERTAIN DEFINED TERMS

“AllianceBernstein” — AllianceBernstein L.P. (Delaware limited partnership formerly known as Alliance Capital Management L.P.), the operating partnership, and its subsidiaries and, where appropriate, its predecessors, Holding and ACMC, Inc. and their respective subsidiaries.

“AllianceBernstein Investments”— AllianceBernstein Investments, Inc. (Delaware corporation formerly known as AllianceBernstein Investment Research and Management, Inc.), a wholly-owned subsidiary of AllianceBernstein, that services retail clients and distributes company-sponsored mutual funds.

“AllianceBernstein Partnership Agreement”— the Amended and Restated Agreement of Limited Partnership of AllianceBernstein.

“AllianceBernstein Units”— units of limited partnership interest in AllianceBernstein.

“AUM” — assets under management for clients.

“AXA”— AXA (société anonyme organized under the laws of France), the holding company for an international group of insurance and related financial services companies engaged in the financial protection and wealth management businesses.

“AXA Equitable”— AXA Equitable Life Insurance Company (New York stock life insurance company), an indirect wholly-owned subsidiary of AXA Financial, and its subsidiaries other than AllianceBernstein and its subsidiaries.

“AXA Financial”— AXA Financial, Inc. (Delaware corporation), a wholly-owned subsidiary of AXA.

“Bernstein GWM” — Bernstein Global Wealth Management (formerly known as Bernstein Investment Research and Management), a unit of AllianceBernstein that services private clients.

“Bernstein Transaction”— on October 2, 2000, AllianceBernstein acquired the business and assets of SCB Inc., formerly known as Sanford C. Bernstein Inc. (“Bernstein”), and assumed the liabilities of the Bernstein business.

“Exchange Act”—the Securities Exchange Act of 1934, as amended.

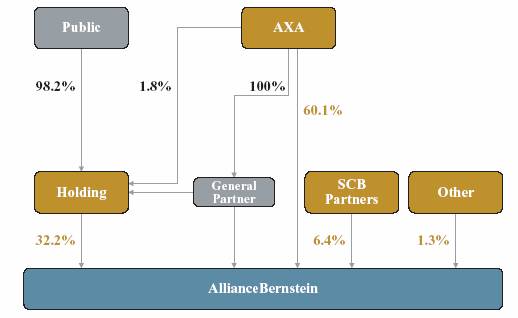

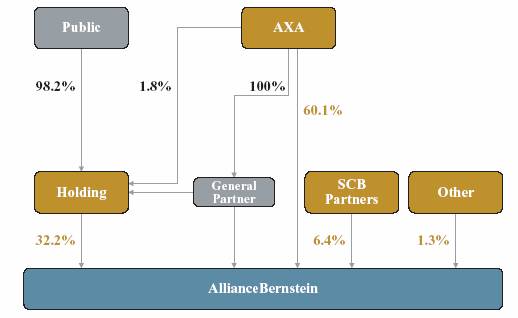

“General Partner”— AllianceBernstein Corporation (Delaware corporation formerly known as Alliance Capital Management Corporation), the general partner of AllianceBernstein and Holding and a wholly-owned subsidiary of AXA Equitable, and, where appropriate, ACMC, Inc., its predecessor.

“Holding” — AllianceBernstein Holding L.P. (Delaware limited partnership formerly known as Alliance Capital Management Holding L.P.).

“Holding Partnership Agreement”— the Amended and Restated Agreement of Limited Partnership of Holding.

“Holding Units”— units representing assignments of beneficial ownership of limited partnership interests in Holding.

“Investment Advisers Act”— the Investment Advisers Act of 1940, as amended.

“Investment Company Act”— the Investment Company Act of 1940, as amended.

“Partnerships”— AllianceBernstein and Holding together.

“SCB LLC”— Sanford C. Bernstein & Co., LLC (Delaware limited liability company), a wholly-owned subsidiary of AllianceBernstein that provides institutional research services in the United States.

“SCBL”— Sanford C. Bernstein Limited (UK company), a wholly-owned subsidiary of AllianceBernstein that provides institutional research services in Europe, Australia, and Asia.

“SEC”— the United States Securities and Exchange Commission.

“Securities Act”— the Securities Act of 1933, as amended.

ii

PART I

Item 1. Business

The words “we” and “our” in this Form 10-K refer collectively to Holding, AllianceBernstein and its subsidiaries, or to their officers and employees. Similarly, the word “company” refers to both Holding and AllianceBernstein. Where the context requires distinguishing between Holding and AllianceBernstein, we identify which of them is being discussed. Holding Unitholders own partnership interests in a holding company whose principal source of income and cash flow is attributable to its limited partnership interests in AllianceBernstein.

We use “global” in this Form 10-K to refer to all nations, including the United States, while we use “international” or “non-U.S.” to refer to all nations except for the United States.

General

Re-branding

Effective February 24, 2006, we changed the name of Alliance Capital Management L.P. to AllianceBernstein L.P., and also changed the names of Alliance Capital Management Holding L.P. and Alliance Capital Management Corporation to AllianceBernstein Holding L.P. and AllianceBernstein Corporation, respectively. Some of our subsidiaries underwent a similar change. We believe our new name better describes the character of our business and the shared mission, values, dedication to research and client focus of all of our employees, and is an affirmation of the success of the combination of Alliance Capital and Sanford Bernstein.

Clients

AllianceBernstein provides diversified investment management and related services globally to a broad range of clients, including:

• institutional clients, including unaffiliated corporate and public employee pension funds, endowment funds, domestic and foreign institutions and governments, and various affiliates;

• retail clients;

• private clients, including high-net-worth individuals, trusts and estates, charitable foundations, partnerships, private and family corporations, and other entities; and

• institutional investors seeking institutional research.

We also provide distribution, shareholder servicing, and administrative services to our sponsored mutual funds.

Recognizing that clients’ trust is imperative to the proper functioning of our company, we are dedicated to creating and sustaining a fiduciary culture. As a fiduciary, we place the interests of our clients first and foremost. We are committed to the fair and equitable treatment of all our clients, to protect them from potential conflicts of interest within our company, and to comply with all applicable rules and regulations and internal compliance policies that impact our business. On a company-wide basis, we pursue these goals through education of our employees to promote awareness, incentives that align employees’ interests with those of our clients, and a range of measures, including active monitoring, to ensure regulatory compliance.

Research

The foundation of our investment management process is our high-quality, in-depth research. We believe that having more knowledge, and using that knowledge better than other market participants, gives us a competitive advantage in achieving investment success for our clients.

Our research disciplines include bottom-up, fundamental research, quantitative research, economic research, and currency forecasting capabilities. In addition, we have created several specialist research units over the past two years, including one unit that examines global strategic changes that can impact multiple industries and geographies, and another dedicated to identifying potentially successful innovations within early-stage companies.

1

Products and Services

We offer a broad range of investment products and services in which our clients can invest:

• To our institutional clients, we offer separately managed accounts, sub-advisory relationships, structured products, group trusts, mutual funds, and other investment vehicles (“Institutional Investment Services”);

• To our retail clients, we offer retail mutual funds sponsored by AllianceBernstein, our subsidiaries, and our affiliated joint venture companies, sub-advisory relationships in respect of mutual funds sponsored by third parties, separately managed account programs that are sponsored by registered broker-dealers (“Separately Managed Account Programs”), and other investment vehicles (“Retail Services”);

• To our private clients, we offer separately managed accounts, hedge funds, mutual funds, and other investment vehicles (“Private Client Services”); and

• To our institutional investors seeking institutional research, we offer in-depth research, portfolio strategy, trading, and brokerage-related services (“Institutional Research Services”).

This broad range of investment services is managed by a group of investment professionals with significant expertise in their respective disciplines. As of December 31, 2005, our clients’ assets were managed by 169 portfolio managers with an average of 14 years of experience in the industry and seven years of experience with AllianceBernstein. These portfolio managers oversee a number of different types of investment products within various vehicles and strategies, including separately managed accounts, mutual funds, hedge funds, structured products, and other investment vehicles. Our investment strategies include:

• Growth and value equity, the two predominant equity strategies;

• Blend, combining growth and value equity components and systematic rebalancing between the two;

• Fixed income, including both taxable and tax-exempt securities;

• Balanced, combining equity and fixed income components; and

• Passive, including both index and enhanced index strategies.

We manage these strategies using various investment disciplines, including market capitalization (e.g., large-, mid-, and small-cap equities), term (e.g., long-, intermediate-, and short-duration debt securities), and geographic location (e.g., U.S., international, global, and emerging markets), as well as local and regional disciplines in major markets around the world.

Blend strategies have become an increasingly important component of our product line. As of December 31, 2005, blend AUM were $85 billion (representing 15% of our company-wide AUM), up 63% from $52 billion on December 31, 2004 and 143% from $35 billion on December 31, 2003.

Sub-advisory client mandates span our investment strategies, including growth, value, blend, and fixed income. We serve as sub-adviser for retail products, insurance products, retirement platforms, and institutional investors. Dedicated marketing and client servicing professionals are responsible for servicing these relationships.

Global Reach

We serve clients in major global markets through operations in 44 cities in 23 countries. Our client base includes investors throughout the Americas, Europe, Asia, Africa, and Australia. We are committed to an integrated global investment platform so that our clients everywhere have access to local (country-specific), international, and global research and investment strategies.

2

AUM by client domicile and investment strategy as of December 31, 2005, 2004, and 2003 were as follows:

By Client Domicile ($ in billions): | | |

| | |

|

|

|

December 31, 2005 | December 31, 2004 | December 31, 2003 |

| | |

By Investment Strategy ($ in billions): | | |

| | |

|

|

|

December 31, 2005 | December 31, 2004 | December 31, 2003 |

As the above charts indicate, we have significantly enhanced our international client base and product mix over the last three years. We increased our international client base by 30% during 2005 and 27% during 2004 and, likewise, we increased our global and international AUM by 38% during 2005 and 42% during 2004. In addition, approximately 69%, 51%, and 50% of our company-wide gross asset inflows during 2005, 2004, and 2003, respectively, were invested in global and international investment products.

Revenues

We earn revenues by charging fees for managing the investment assets of our clients. We generally calculate fees as a percentage of the value of AUM, with such fees varying by type of investment strategy and discipline, size of account, and total amount of assets we manage for a particular client. Accordingly, fee income generally increases or decreases as AUM increase or decrease. Increases in assets under management generally result from market appreciation, positive investment performance, or net asset inflows from new or existing clients. Similarly, decreases in assets under management generally result from market depreciation, negative investment performance, or net asset outflows due to client redemptions, account terminations, or asset withdrawals.

We sometimes charge a performance-based fee, in addition to or in lieu of a base fee. Performance-based fees are calculated as either a percentage of absolute investment results or a percentage of investment results in excess of a stated benchmark over a specified period of time. Performance-based fees are recorded as revenue at the end of the measurement period and will be higher in favorable markets and lower in unfavorable markets, which may increase the volatility of our revenues and earnings.

3

We sometimes experience periods when the number of new accounts or the amounts of AUM increase significantly, as well as periods when our accounts or AUM have decreased significantly. These shifts result from wide-ranging factors, including conditions of financial markets, our investment performance, and changes in the investment preferences of clients.

Employees

As of December 31, 2005, we had 4,312 full-time employees, including 619 investment professionals, of whom 169 were portfolio managers, 361 were research analysts, 60 were order placement specialists, and 29 were professionals with other investment-related responsibilities. We have employed these professionals for an average period of approximately seven years, and their average investment experience is approximately 14 years. We consider our employee relations to be good.

Institutional Investment Services

We serve our institutional clients through AllianceBernstein Institutional Investments, a unit of AllianceBernstein, and through other units in our international subsidiaries and affiliates. Institutional Investment Services include actively managed equity accounts (including growth, value, and blend accounts), fixed income accounts, and balanced accounts, as well as passive management of index and enhanced index accounts. These services are provided through separately managed accounts, sub-advisory relationships, structured products, group trusts, mutual funds, and other investment vehicles. As of December 31, 2005, institutional assets under management were $359 billion, or 62% of our company-wide assets under management. For more information concerning institutional assets under management, revenues, and fees, see “Assets Under Management, Revenues, and Fees” in this Item 1.

Our institutional client base includes unaffiliated corporate and public employee pension funds, endowment funds, domestic and foreign institutions and governments, and various affiliates, as well as certain sub-advisory relationships with unaffiliated sponsors of various other investment products. We manage approximately 3,450 separate accounts for these clients, which are located in more than 40 countries. As of December 31, 2005, we managed employee benefit plan assets for 37 of the Fortune 100 companies, and we managed public pension fund assets for 37 states.

Our efforts to create an integrated global investment platform are most evident in our institutional investment channel. As of December 31, 2005, our institutional assets under management invested in global and international investment services increased to $172 billion, or 48% of institutional AUM, from $123 billion, or 39% of institutional AUM, as of December 31, 2004, and from $78 billion, or 29% of institutional AUM, as of December 31, 2003. Similarly, as of December 31, 2005, the assets under management we invested for clients domiciled outside the United States increased to $137 billion, or 38% of institutional AUM, from $103 billion, or 33% of institutional AUM, as of December 31, 2004, and from $77 billion, or 29% of institutional AUM, as of December 31, 2003.

Relationship managers, based in 11 offices around the world, work with institutional clients and prospective clients to determine their financial goals and needs, while specialist marketers, located in New York, London, and Tokyo, offer clients specific investment products and services to meet their overall financial plans.

Retail Services

Through financial intermediaries, we provide investment management and related services to a wide variety of individual retail investors, both in the U.S. and internationally, through retail mutual funds sponsored by our company, our subsidiaries and affiliated joint venture companies; sub-advisory relationships with mutual funds sponsored by third parties; Separately Managed Account Programs; and other investment vehicles (“Retail Products”). As of December 31, 2005, retail AUM, which are determined by subtracting applicable liabilities from the value of AUM, were $145 billion, or 25% of our company-wide AUM. For more information concerning retail AUM, revenues, and fees, see “Assets Under Management, Revenues, and Fees” in this Item 1.

4

Our Retail Services are designed to provide disciplined, research-based investments that play a consistent and effective role in a well-diversified investment portfolio. We distribute our Retail Products through a number of financial intermediaries, including broker-dealers, insurance sales representatives, banks, registered investment advisers, and financial planners.

Among our Retail Products are open-end and closed-end funds that are either (i) registered as investment companies under the Investment Company Act (“U.S. Funds”), or (ii) not registered under the Investment Company Act and not publicly offered to United States persons (“Non-U.S. Funds” and collectively with the U.S. Funds, “AllianceBernstein Funds”). Our Retail Products provide a broad range of investment options, including local and global growth equities, value equities, blend, and fixed income securities. Also among these products are retail Separately Managed Account Programs, which are sponsored by various registered broker-dealers and generally charge an all-inclusive fee covering investment management, trade execution, asset allocation, and custodial and administrative services. We also provide distribution, shareholder servicing, and administrative services for our Retail Products.

AllianceBernstein Investments, Inc., a wholly-owned subsidiary of AllianceBernstein, serves as the principal underwriter and distributor of U.S. Funds and as a placing or distribution agent for most of the Non-U.S. Funds. AllianceBernstein Investments employs approximately 185 sales representatives who devote their time exclusively to promoting the sale of Retail Services by financial intermediaries. AllianceBernstein Investments services approximately 3.9 million shareholder accounts globally.

Our efforts to create an integrated global investment platform are applicable to our retail channel as well, although in 2005 the increased global and international share of our total retail assets under management is due more to the disposition of our cash management services (see Note 20 in AllianceBernstein’s consolidated financial statements in Item 8) than to expansion abroad. As of December 31, 2005, our retail AUM invested in global and international investment services increased to $65 billion, or 45% of retail AUM, from $48 billion, or 29% of retail AUM, as of December 31, 2004, and from $42 billion, or 27% of retail AUM, as of December 31, 2003. Similarly, as of December 31, 2005, the AUM we invested for retail clients domiciled outside the United States increased to $39 billion, or 27% of retail AUM, from $32 billion, or 19% of retail AUM, as of December 31, 2004, and $29 billion, or 18% of retail AUM, as of December 31, 2003.

Our Non-U.S. Funds, which represented $36 billion, or 25% of our total Retail assets under management (excluding certain investment vehicles, as discussed below) as of December 31, 2005, include:

• Internationally-distributed funds that offer more than 27 different portfolios to non-U.S. investors distributed through local financial intermediaries by means of distribution agreements in most major international markets (AUM in these funds totaled $21 billion as of December 31, 2005); and

• Local-market funds that we distribute through financial intermediaries in specific countries, including Japan, Singapore, and Taiwan (our most successful local offerings to date have been in Japan where, as of December 31, 2005, AUM in our local Japanese funds totaled $5.4 billion).

Our Non-U.S. Funds also include hedge funds, which we market and distribute to high-net-worth and institutional investors globally, and various types of structured products (e.g., collateralized bond obligations), which we market and distribute to institutional investors globally. We report hedge fund AUM, which totaled $4.6 billion as of December 31, 2005, as either Institutional Investment AUM ($0.8 billion) or Private Client AUM ($3.8 billion). We report structured product AUM, which totaled $4.0 billion as of December 31, 2005, as Institutional Investment AUM.

Our U.S. Funds, which include retail funds, our variable products series fund (an insurance product), and the Sanford C. Bernstein Funds (Private Client Services products), offer approximately 120 different portfolios to U.S. investors. As of December 31, 2005, assets under management in the retail U.S. Funds were approximately $44 billion, or 30% of total Retail AUM. We report nearly all of the AUM in the Sanford C. Bernstein Funds, which totaled $22.2 billion as of December 31, 2005, as Private Client Services AUM.

In 2003, we began offering the AllianceBernstein Wealth Strategies portfolios, which offer investments in various combinations of U.S. and non-U.S. growth equity, value equity, and fixed income securities (with automatic re-balancing of securities), providing diversified solutions for meeting the risk and return appetites of retail

5

investors. As of December 31, 2005, assets under management in the Wealth Strategies portfolios were $3.1 billion.

Cash Management Services

During June 2005, AllianceBernstein and Federated Investors, Inc (“Federated”) completed a transaction pursuant to which Federated acquired our cash management services. For additional information, see Note 20 in AllianceBernstein’s consolidated financial statements in Item 8.

Private Client Services

Bernstein Global Wealth Management (“Bernstein GWM”), a unit of AllianceBernstein, combines the former private client services group of Bernstein, which has served private clients for over 35 years, and the former private client group of AllianceBernstein. As of December 31, 2005, private client assets under management were $75 billion, or 13% of our company-wide assets under management. For more information concerning private client assets under management, revenues, and fees, see “Assets Under Management, Revenues, and Fees” in this Item 1.

Through Bernstein GWM, we provide Private Client Services to high-net-worth individuals, trusts and estates, charitable foundations, partnerships, private and family corporations, and other entities by means of separately managed accounts, hedge funds, mutual funds, and other investment vehicles. We target households with financial assets of $1 million or more, and we have a minimum opening account size of $400,000.

Our private client activities are built on a direct sales effort that involves approximately 260 financial advisors. These advisors do not manage money, but work with private clients and their tax, legal, and other advisors to assist clients in determining a suitable mix of U.S. and non-U.S. equity securities and fixed income investments. The portfolio created for each client is intended to maximize after-tax investment returns, in light of the client’s individual investment goals, income requirements, risk tolerance, tax considerations, and any other factors relevant for that client. Our private clients have access to all of our resources, including research reports, investment planning services, an extensive nationwide referral network, including accountants, attorneys, and consultants, and our Wealth Management Group, which has in-depth knowledge of trust and estate and tax management issues.

Our financial advisors are based in 18 cities in the U.S., including New York City, Atlanta, Boston, Chicago, Cleveland, Dallas, Denver, Houston, Los Angeles, Miami, Minneapolis, Philadelphia, San Diego (newly-opened in January 2006), San Francisco, Seattle, Tampa, Washington, D.C., and West Palm Beach. We plan to open an office in London later this year. These offices service the targeted market within these cities and the surrounding areas. In addition, Bernstein GWM added 70 financial advisors in 2005, and plans to add an additional 27 advisors in 2006.

We have made significant strides with non-U.S. investment services in the private client channel as well. As of December 31, 2005, our private client assets under management invested in global and international investment services increased to $20 billion, or 26% of private client AUM, from $14 billion, or 22% of Private Client Services AUM, as of December 31, 2004, and from $10 billion, or 19% of private client AUM, as of December 31, 2003. When measured by client domicile, there has been little change thus far in Private Client Services AUM, but we believe our launch of a private client office in London later this year will enhance our ability to reach non-U.S. clients.

Institutional Research Services

Institutional Research Services consist of in-depth research, portfolio strategy, trading and brokerage-related services provided to institutional investors such as pension funds, mutual fund managers, asset managers, and other institutional investors. Trade execution and brokerage-related services are provided by Sanford C. Bernstein & Co., LLC (our wholly-owned subsidiary, “SCB LLC”) in the United States and Sanford C. Bernstein Limited (our wholly-owned subsidiary, “SCBL”) in Europe, Australia, and Asia. As of December 31, 2005, SCB LLC and SCBL (together, “SCB”) served approximately 1,200 clients in the U.S. and approximately 365 clients in Europe, Australia, and Asia. For more information concerning the revenues we derive from institutional research services, see “Assets Under Management, Revenues, and Fees” in this Item 1.

6

SCB provides in-depth company and industry reports, along with disciplined research into securities valuation and the factors affecting stock-price movements. Company and industry analysts in most cases have business experience in the industries they cover and are consistently among the highest ranked sell-side research analysts in industry surveys by third-party organizations. Along with quantitative analysts and portfolio strategists, our sell-side research team totals approximately 140 people, including 50 senior analysts.

In 2005, SCB further strengthened its research effort in London and now has 10 published analysts covering industries and companies in Europe, with nine additional analysts due to commence coverage in 2006. In addition, SCB’s trading and brokerage operations were further enhanced in 2005 with the launch of several proprietary algorithmic trading products. These product additions complemented other major changes already undertaken to transform our trading capability, including the launch of a dedicated sector block trading desk and the expansion of our product specialist team.

Assets Under Management, Revenues, and Fees

The following tables summarize our AUM by distribution channel, along with associated revenues:

Assets Under Management(1)(2)

| | December 31, | | % Change | |

| | 2005 | | 2004 | | 2003 | | 2005-04 | | 2004-03 | |

| | | | (in millions) | | | | | | | |

Institutional Investment Services | | $ | 358,545 | | $ | 309,883 | | $ | 267,241 | | 15.7 | % | 16.0 | % |

Retail Services | | 145,134 | | 134,882 | | 125,051 | | 7.6 | | 7.9 | |

Private Client Services | | 74,873 | | 63,600 | | 53,236 | | 17.7 | | 19.5 | |

| | 578,552 | | 508,365 | | 445,528 | | 13.8 | | 14.1 | |

Dispositions(3) | | — | | 30,399 | | 31,739 | | (100.0 | ) | (4.2 | ) |

Total | | $ | 578,552 | | $ | 538,764 | | $ | 477,267 | | 7.4 | % | 12.9 | % |

(1) | Excludes certain non-discretionary client relationships and assets managed by unconsolidated affiliates. |

(2) | Starting in 2005, we revised the way we classified our assets under management to better align publicly reported AUM with our internal reporting, and for consistency, our AUM as of December 31, 2004 and previous years have been reclassified by investment service and distribution channel, including the fixed income portions of balanced accounts previously reported in equity. |

(3) | Includes assets related to cash management services, South African joint venture interest, and Indian mutual funds. For information about these dispositions, see Note 20 in AllianceBernstein’s consolidated financial statements in Item 8. |

Revenues(1)

| | Years Ended December 31, | | % Change | |

| | 2005 | | 2004 | | 2003 | | 2005-04 | | 2004-03 | |

| | | | (in thousands) | | | | | | | |

Institutional Investment Services(2) | | $ | 904,758 | | $ | 755,279 | | $ | 644,441 | | 19.8 | % | 17.2 | % |

Retail Services | | 1,192,059 | | 1,294,267 | | 1,306,475 | | (7.9 | ) | (0.9 | ) |

Private Client Services(2) | | 691,208 | | 627,067 | | 493,903 | | 10.2 | | 27.0 | |

Institutional Research Services | | 321,281 | | 303,609 | | 267,868 | | 5.8 | | 13.3 | |

Other | | 141,374 | | 75,211 | | 52,241 | | 88.0 | | 44.0 | |

Total | | $ | 3,250,680 | | $ | 3,055,433 | | $ | 2,764,928 | | 6.4 | % | 10.5 | % |

(1) Certain prior-year amounts have been reclassified to conform to our 2005 presentation: we reclassified (i) certain sub-accounting payments and networking fees from other promotion and servicing expense to shareholder servicing fees, and (ii) transaction charges paid by our sponsored mutual funds from Institutional Investment Services and Private Client Services to Retail Services.

(2) Includes performance-based fees, incentive allocations or carried interests we earn for managing hedge funds and certain other investment vehicles.

AXA Financial, AXA Equitable, and our other affiliates, whose AUM consist primarily of fixed income investments, together constitute our largest client. Our affiliates represented approximately 19%, 20%, and 18% of our company-wide AUM as of December 31, 2005, 2004, and 2003,

7

respectively. They also represented approximately 5% of our company-wide revenues for each of 2005, 2004, and 2003. We manage our affiliates’ assets as part of our Institutional Investment Services and Retail Services.

Institutional Investment Services

The following tables summarize our Institutional Investment Services assets under management, along with associated revenues:

Institutional Investment Services Assets Under Management(1)

(by Investment Service)

| | December 31, | | % Change | |

| | 2005 | | 2004 | | 2003 | | 2005-04 | | 2004-03 | |

| | | | (in millions) | | | | | | | |

Growth Equity: | | | | | | | | | | | |

U.S. | | $ | 39,721 | | $ | 39,600 | | $ | 51,990 | | 0.3 | % | (23.8 | )% |

Global and International | | 39,327 | | 23,326 | | 15,716 | | 68.6 | | 48.4 | |

| | 79,048 | | 62,926 | | 67,706 | | 25.6 | | (7.1 | ) |

Value Equity: | | | | | | | | | | | |

U.S. | | 50,556 | | 51,006 | | 45,945 | | (0.9 | ) | 11.0 | |

Global and International | | 101,791 | | 68,595 | | 42,876 | | 48.4 | | 60.0 | |

| | 152,347 | | 119,601 | | 88,821 | | 27.4 | | 34.7 | |

Fixed Income: | | | | | | | | | | | |

U.S. | | 74,964 | | 77,314 | | 72,752 | | (3.0 | ) | 6.3 | |

Global and International | | 27,709 | | 25,859 | | 14,009 | | 7.2 | | 84.6 | |

| | 102,673 | | 103,173 | | 86,761 | | (0.5 | ) | 18.9 | |

Index / Structured: | | | | | | | | | | | |

U.S. | | 20,908 | | 19,297 | | 18,403 | | 8.3 | | 4.9 | |

Global and International | | 3,569 | | 4,886 | | 5,550 | | (27.0 | ) | (12.0 | ) |

| | 24,477 | | 24,183 | | 23,953 | | 1.2 | | 1.0 | |

Total: | | | | | | | | | | | |

U.S. | | 186,149 | | 187,217 | | 189,090 | | (0.6 | ) | (1.0 | ) |

Global and International | | 172,396 | | 122,666 | | 78,151 | | 40.5 | | 57.0 | |

| | 358,345 | | 309,883 | | 267,241 | | 15.7 | | 16.0 | |

Dispositions(2) | | — | | 1,375 | | 555 | | (100.0 | ) | 147.7 | |

Total | | $ | 358,545 | | $ | 311,258 | | $ | 267,796 | | 15.2 | % | 16.2 | % |

(1) Excludes certain non-discretionary client relationships and assets managed by unconsolidated affiliates.

(2) Includes assets related to South African joint venture interest. For information about this disposition, see Note 20 in AllianceBernstein’s consolidated financial statements in Item 8.

8

Revenues From Institutional Investment Services(1)

(by Investment Service)

| | Years Ended December 31, | | % Change | |

| | 2005 | | 2004 | | 2003 | | 2005-04 | | 2004-03 | |

| | | | (in thousands) | | | | | | | |

Investment Advisory and Services Fees: | | | | | | | | | | | |

Growth Equity: | | | | | | | | | | | |

U.S. | | $ | 126,083 | | $ | 141,891 | | $ | 164,638 | | (11.1 | )% | (13.8 | )% |

Global and International | | 115,982 | | 68,240 | | 42,061 | | 70.0 | | 62.2 | |

| | 242,065 | | 210,131 | | 206,699 | | 15.2 | | 1.7 | |

Value Equity: | | | | | | | | | | | |

U.S. | | 162,708 | | 178,058 | | 169,675 | | (8.6 | ) | 4.9 | |

Global and International | | 364,480 | | 219,532 | | 127,726 | | 66.0 | | 71.9 | |

| | 527,188 | | 397,590 | | 297,401 | | 32.6 | | 33.7 | |

Fixed Income: | | | | | | | | | | | |

U.S. | | 94,596 | | 110,184 | | 108,348 | | (14.1 | ) | 1.7 | |

Global and International | | 28,965 | | 25,668 | | 20,760 | | 12.8 | | 23.6 | |

| | 123,561 | | 135,852 | | 129,108 | | (9.0 | ) | 5.2 | |

Index / Structured: | | | | | | | | | | | |

U.S. | | 6,432 | | 6,942 | | 6,341 | | (7.3 | ) | 9.5 | |

Global and International | | 5,083 | | 4,764 | | 4,892 | | 6.7 | | (2.6 | ) |

| | 11,515 | | 11,706 | | 11,233 | | (1.6 | ) | 4.2 | |

Total Investment Advisory and Services Fees: | | | | | | | | | | | |

U.S. | | 389,819 | | 437,075 | | 449,002 | | (10.8 | ) | (2.7 | ) |

Global and International | | 514,510 | | 318,204 | | 195,439 | | 61.7 | | 62.8 | |

| | 904,329 | | 755,279 | | 644,441 | | 19.7 | | 17.2 | |

Distribution Revenues | | 429 | | — | | — | | n/m | | — | |

Total | | $ | 904,758 | | $ | 755,279 | | $ | 644,441 | | 19.8 | % | 17.2 | % |

(1) Certain prior-year amounts have been reclassified to conform to our 2005 presentation: we reclassified transaction charges paid by our sponsored mutual funds from Institutional Investment Services and Private Client Services to Retail Services.

As of December 31, 2005, 2004, and 2003, Institutional Investment Services represented approximately 62%, 58%, and 56%, respectively, of our company-wide assets under management. The fees we earned from these services represented approximately 28%, 25%, and 23% of our company-wide revenues for 2005, 2004, and 2003, respectively.

As part of our Institutional Investment Services, we manage assets for AXA and its subsidiaries, which together constitute our largest institutional client. These assets accounted for approximately 18%, 20%, and 19% of our total institutional assets under management as of December 31, 2005, 2004, and 2003, respectively, and approximately 8%, 9%, and 10% of our total institutional revenues for 2005, 2004, and 2003, respectively.

The institutional assets we manage for our affiliates, along with our nine other largest institutional accounts, made up approximately 20% of our total company-wide assets under management as of December 31, 2005 and approximately 4% of our total company-wide revenues for the year ended December 31, 2005. No single institutional client other than AXA and its subsidiaries accounted for more than approximately 1% of our company-wide revenues for the year ended December 31, 2005.

We manage each institutional account pursuant to a written investment management agreement. Each agreement is usually terminable at any time or upon relatively short notice by either party. In general, our contracts may not be assigned without client consent.

We are compensated principally on the basis of management fees calculated as a percentage of assets under management. The percentage we charge varies with the type of portfolio strategy, the size of the account, and the total amount of assets we manage for a particular client.

9

We charge performance-based fees on approximately 16% of institutional assets under management. Performance-based fees provide for a relatively low base fee plus an additional fee based on investment performance.

Retail Services

The following tables summarize our Retail Services assets under management, along with associated revenues:

Retail Services Assets Under Management(1)

(by Investment Service)

| | December 31, | | % Change | |

| | 2005 | | 2004 | | 2003 | | 2005-04 | | 2004-03 | |

| | | | (in millions) | | | | | | | |

Growth Equity: | | | | | | | | | | | |

U.S. | | $ | 31,193 | | $ | 33,436 | | $ | 32,988 | | (6.7 | )% | 1.4 | % |

Global and International | | 19,523 | | 14,670 | | 14,579 | | 33.1 | | 0.6 | |

| | 50,716 | | 48,106 | | 47,567 | | 5.4 | | 1.1 | |

Value Equity: | | | | | | | | | | | |

U.S. | | 32,625 | | 32,113 | | 28,384 | | 1.6 | | 13.1 | |

Global and International | | 16,575 | | 8,600 | | 3,961 | | 92.7 | | 117.1 | |

| | 49,200 | | 40,713 | | 32,345 | | 20.8 | | 25.9 | |

Fixed Income: | | | | | | | | | | | |

U.S. | | 12,053 | | 17,076 | | 18,232 | | (29.4 | ) | (6.3 | ) |

Global and International | | 27,648 | | 23,742 | | 22,446 | | 16.5 | | 5.8 | |

| | 39,701 | | 40,818 | | 40,678 | | (2.7 | ) | 0.3 | |

Index / Structured: | | | | | | | | | | | |

U.S. | | 4,230 | | 4,203 | | 3,584 | | 0.6 | | 17.3 | |

Global and International | | 1,287 | | 1,042 | | 877 | | 23.5 | | 18.8 | |

| | 5,517 | | 5,245 | | 4,461 | | 5.2 | | 17.6 | |

Total: | | | | | | | | | | | |

U.S. | | 80,101 | | 86,828 | | 83,188 | | (7.7 | ) | 4.4 | |

Global and International | | 65,033 | | 48,054 | | 41,863 | | 35.3 | | 14.8 | |

| | 145,134 | | 134,882 | | 125,051 | | 7.6 | | 7.9 | |

Dispositions(2) | | — | | 28,670 | | 30,827 | | (100.0 | ) | (7.0 | ) |

Total | | $ | 145,134 | | $ | 163,552 | | $ | 155,878 | | (11.3 | )% | 4.9 | % |

(1) Excludes assets managed by unconsolidated affiliates.

(2) Includes assets related to cash management services and Indian mutual funds. For information about these dispositions, see Note 20 in AllianceBernstein’s consolidated financial statements in Item 8.

10

Revenues From Retail Services(1)

(by Investment Service)

| | Years Ended December 31, | | % Change | |

| | 2005(2) | | 2004(2) | | 2003 | | 2005-04 | | 2004-03 | |

| | | | (in thousands) | | | | | | | |

Investment Advisory and Services Fees: | | | | | | | | | | | |

Growth Equity: | | | | | | | | | | | |

U.S. | | $ | 142,899 | | $ | 155,518 | | $ | 173,268 | | (8.1 | )% | (10.2 | )% |

Global and International | | 118,574 | | 102,076 | | 104,324 | | 16.2 | | (2.2 | ) |

| | 261,473 | | 257,594 | | 277,592 | | 1.5 | | (7.2 | ) |

Value Equity: | | | | | | | | | | | |

U.S. | | 120,744 | | 118,619 | | 109,074 | | 1.8 | | 8.8 | |

Global and International | | 64,881 | | 28,774 | | 13,519 | | 125.5 | | 112.8 | |

| | 185,625 | | 147,393 | | 122,593 | | 25.9 | | 20.2 | |

Fixed Income: | | | | | | | | | | | |

U.S. | | 112,335 | | 182,865 | | 209,785 | | (38.6 | ) | (12.8 | ) |

Global and International | | 132,480 | | 141,211 | | 132,952 | | (6.2 | ) | 6.2 | |

| | 244,815 | | 324,076 | | 342,737 | | (24.5 | ) | (5.4 | ) |

Index / Structured: | | | | | | | | | | | |

U.S. | | 1,746 | | 1,663 | | 1,253 | | 5.0 | | 32.7 | |

Global and International | | 3,640 | | 1,651 | | 1,212 | | 120.5 | | 36.2 | |

| | 5,386 | | 3,314 | | 2,465 | | 62.5 | | 34.4 | |

Total Investment Advisory and Services Fees: | | | | | | | | | | | |

U.S. | | 377,724 | | 458,665 | | 493,380 | | (17.6 | ) | (7.0 | ) |

Global and International | | 319,575 | | 273,712 | | 252,007 | | 16.8 | | 8.6 | |

| | 697,299 | | 732,377 | | 745,387 | | (4.8 | ) | (1.7 | ) |

Distribution Revenues(3) | | 395,402 | | 445,911 | | 434,705 | | (11.3 | ) | 2.6 | |

Shareholder Servicing Fees(3) | | 99,358 | | 115,979 | | 126,383 | | (14.3 | ) | (8.2 | ) |

Total | | $ | 1,192,059 | | $ | 1,294,267 | | $ | 1,306,475 | | (7.9 | )% | (0.9 | )% |

(1) Certain prior-year amounts have been reclassified to conform to our 2005 presentation: we reclassified (i) certain sub-accounting payments and networking fees from other promotion and servicing expense to shareholder servicing fees, and (ii) transaction charges paid by our sponsored mutual funds from Institutional Investment Services and Private Client Services to Retail Services.

(2) Includes a reduction in advisory fees charged to certain U.S. Funds in connection with the resolution of market timing matters. For additional information, see “Regulation” in this Item 1.

(3) For a description of distribution revenues and shareholder servicing fees, see below.

We generally base our fees for our Retail Products on a percentage of average assets under management. We may also charge performance-based fees. As certain of the U.S. Funds have grown, we have revised our fee schedules to provide lower incremental fees above certain asset levels. In addition, as part of our resolution of the market timing investigation by the New York State Attorney General (“NYAG”), effective January 1, 2004 we reduced by 20% (on a weighted average basis) the advisory fees on U.S. long-term open-end retail mutual funds (for additional information, see “Regulation” in this Item 1). Fees paid by the U.S. Funds, EQAT (as defined below), AXA Enterprise Trust, and AXA Premier VIP Trust are reflected in the applicable investment management agreement and reviewed annually by the boards of directors or trustees of those funds, including by a majority of the independent directors or trustees. Increases in these fees must be approved by fund shareholders. Fees paid by Non-U.S. Funds are reflected in investment management agreements that continue until they are terminated. Increases in these fees must generally be approved by the Non-U.S. Fund shareholders and/or the relevant regulatory authority depending on the domicile and structure of the fund. In general, each investment management agreement with the AllianceBernstein Funds, EQAT, AXA Enterprise Trust, and AXA Premier VIP Trust provides for termination by either party at any time upon 60 days’ notice.

Our Retail Products include variable products, which are open-end mutual funds designed to fund variable annuity contracts and variable life insurance policies offered by the separate accounts of life insurance companies (“Variable Products”). We manage the AllianceBernstein Variable Products Series Fund, Inc. (“ABVPS”), which serves as the investment vehicle for insurance products offered by unaffiliated insurance companies, and we sub-advise EQ Advisors Trust (“EQAT”), AXA Enterprise Multimanager Funds Trust (formerly known as AXA

11

Premier Trust, “AXA Enterprise Trust”), AXA Premier VIP Trust, and mutual funds sponsored by AXA Asia Pacific Holdings Limited and its subsidiaries (“AXA Asia Pacific”). Each of these sub-advised vehicles serves as an investment vehicle for insurance products offered by AXA Equitable and its insurance company affiliates. As of December 31, 2005, the AUM of the portfolios of the Variable Products totaled approximately $51 billion.

EQAT, AXA Enterprise Trust, AXA Premier VIP Trust, and the mutual funds sponsored by AXA Asia Pacific, together with other AXA affiliates, constitute our largest retail client. They accounted for approximately 29%, 26%, and 24% of our total retail AUM as of December 31, 2005, 2004, and 2003, respectively, and approximately 9%, 7%, and 6% of our total retail revenues for 2005, 2004 and 2003, respectively.

Our mutual fund distribution system (the “System”) includes a multi-class share structure that permits open-end AllianceBernstein Funds to offer investors various options for the purchase of mutual fund shares, including both front-end load shares and back-end load shares. For front-end load shares of the open-end U.S. Funds, AllianceBernstein Investments pays sales commissions to financial intermediaries distributing the funds from the front-end sales charge it receives from investors at the time of the sale. For back-end load shares, AllianceBernstein Investments pays sales commissions to financial intermediaries at the time of sale and also receives higher ongoing distribution services fees from the mutual funds. In addition, investors who redeem back-end load shares before the expiration of the minimum holding period (which ranges from one year to four years) pay a contingent deferred sales charge (“CDSC”) to AllianceBernstein Investments. We expect to recover deferred sales commissions over periods not exceeding five and one-half years through receipt of a CDSC and/or the higher ongoing distribution services fees we receive from holders of back-end load shares. Payments of sales commissions made to financial intermediaries in connection with the sale of back-end load shares under the System, net of CDSC received of $21.4 million and $32.9 million, totaled approximately $74.2 million and $44.6 million during 2005 and 2004, respectively.

The rules of the National Association of Securities Dealers, Inc. (“NASD”) effectively cap the aggregate sales charges received by AllianceBernstein Investments. The cap is 6.25% of cumulative gross sales (plus interest at the prime rate plus 1% per annum) in each share class of the open-end U.S. Funds.

Most open-end U.S. Funds have adopted a plan under Rule 12b-1 of the Investment Company Act that allows the fund to pay, out of assets of the fund, asset-based sales charges or distribution and service fees for the distribution and sale of its shares (“Rule 12b-1 Fees”). The open-end AllianceBernstein Funds have entered into agreements with AllianceBernstein Investments under which they pay a distribution services fee. AllianceBernstein Investments and the financial intermediaries have entered into selling and distribution agreements for the distribution of AllianceBernstein Funds pursuant to which AllianceBernstein Investments pays sales commissions. These agreements are terminable by either party upon notice (generally not more than 60 days) and do not obligate the financial intermediary to sell any specific amount of fund shares. A small amount of mutual fund sales is made directly by AllianceBernstein Investments, in which case AllianceBernstein Investments retains the entire sales charge.

In addition to Rule 12b-1 Fees, AllianceBernstein Investments, at its own expense, currently provides additional payments under Distribution Services and Educational Support agreements to firms that sell shares of our funds, a practice sometimes referred to as revenue sharing. Although the individual components may be higher and the total amount of payments made to each qualifying firm in any given year may vary, the total amount paid to a financial intermediary in connection with the sale of shares of U.S. Funds will generally not exceed the sum of (i) 0.25% of the current year’s fund sales by that firm, and (ii) 0.10% of average daily net assets attributable to that firm over the course of the year. These sums may be associated with our funds’ status on a financial intermediary’s preferred list of funds or may be otherwise associated with the financial intermediary’s marketing and other support activities, such as client education meetings and training efforts relating to our funds.

During 2005, the 10 financial intermediaries responsible for the largest volume of sales of open-end AllianceBernstein Funds were responsible for 30% of such sales. AXA Advisors, LLC (“AXA Advisors”), a wholly-owned subsidiary of AXA Financial that utilizes members of AXA Equitable’s insurance sales force as its registered representatives, was responsible for approximately 3%, 4%, and 3% of total sales of shares of open-end AllianceBernstein Funds in 2005, 2004, and 2003, respectively. AXA Advisors is under no obligation to sell

12

a specific amount of AllianceBernstein Fund shares and also sells shares of mutual funds sponsored by other affiliates and unaffiliated organizations.

Subsidiaries of Merrill Lynch & Co., Inc. (collectively “Merrill Lynch”) were responsible for approximately 5%, 6%, and 7% of open-end AllianceBernstein Fund sales in 2005, 2004, and 2003, respectively. Citigroup Inc. (and its subsidiaries, “Citigroup”) was responsible for approximately 5% of open-end AllianceBernstein Fund sales in 2005, 7% in 2004, and 9% in 2003. Neither Merrill Lynch nor Citigroup is under any obligation to sell a specific amount of AllianceBernstein Fund shares and each also sells shares of mutual funds that it sponsors and that are sponsored by unaffiliated organizations.

No dealer or agent has in any year since 2003 accounted for more than 10% of our sales of shares of open-end AllianceBernstein Funds.

Based on industry sales data reported by the Investment Company Institute (December 2005), our market share in the U.S. mutual fund industry is 1.11% of total industry assets and we accounted for 0.65% of total open-end industry sales in the U.S. during 2005. The investment performance of the U.S. Funds is an important factor in the sale of their shares, but there are other factors contributing to sales of our mutual fund shares. These factors include the level and quality of shareholder services (see below) and the amounts and types of distribution assistance and administrative services payments made to financial intermediaries. We believe that our compensation programs with financial intermediaries are competitive with others in the industry.

Under current interpretations of U.S. laws and regulations governing depository institutions, banks and certain of their affiliates generally are permitted to act as agent for their customers in connection with the purchase of mutual fund shares and to receive as compensation a portion of the sales charges paid with respect to such purchases. During 2005, banks and their affiliates accounted for approximately 17% of the sales of shares of open-end U.S. Funds and Variable Products.

During 2004, each of the U.S. Funds appointed an independent compliance officer reporting to the independent directors of each U.S. Fund. The expense of this officer and his staff is borne by AllianceBernstein.

AllianceBernstein Investor Services, Inc. (“Investor Services”), one of our wholly-owned subsidiaries, provides transfer agency and related services for each open-end U.S. Fund and provides shareholder servicing for each open-end U.S. Fund’s shareholder accounts. As of December 31, 2005, Investor Services employed 247 people. Investor Services operates in Secaucus, New Jersey, and San Antonio, Texas. It receives a monthly fee under each of its servicing agreements with the open-end U.S. Funds based on the number and type of shareholder accounts. Each servicing agreement must be approved annually by the relevant open-end U.S. Fund’s board of directors or trustees, including a majority of the independent directors or trustees, and may be terminated by either party without penalty upon 60 days’ notice.

Most AllianceBernstein Funds utilize AllianceBernstein and Investor Services personnel to perform legal, clerical, and accounting services not required to be provided by AllianceBernstein. Payments by the U.S. Funds and certain Non-U.S. Funds for these services must be specifically approved in advance by the fund’s board of directors or trustees. Currently, AllianceBernstein and Investor Services are recording revenues for providing these services to the AllianceBernstein Funds at the rate of approximately $8.0 million per year.

ACM Global Investor Services (“ACMGIS”), a division of Alliance Capital (Luxembourg) S.A. (another of our wholly-owned subsidiaries), is the transfer agent of substantially all of the Non-U.S. Funds. As of December 31, 2005, ACMGIS employed 41 people. ACMGIS operates in Luxembourg and Singapore and receives a monthly fee for its transfer agency services under services agreements, which may be terminated by either party upon 60 days’ notice.

13

Private Client Services

The following tables summarize Private Client Services assets under management, along with associated revenues:

Private Client Services Assets Under Management

(by Investment Service)

| | December 31, | | % Change | |

| | 2005 | | 2004 | | 2003 | | 2005-04 | | 2004-03 | |

| | | | (in millions) | | | | | | | |

Growth Equity: | | | | | | | | | | | |

U.S. | | $ | 9,986 | | $ | 7,022 | | $ | 5,479 | | 42.2 | % | 28.2 | % |

Global and International | | 6,390 | | 4,001 | | 3,065 | | 59.7 | | 30.5 | |

| | 16,376 | | 11,023 | | 8,544 | | 48.6 | | 29.0 | |

Value Equity: | | | | | | | | | | | |

U.S. | | 23,725 | | 22,411 | | 19,681 | | 5.9 | | 13.9 | |

Global and International | | 12,959 | | 9,874 | | 6,921 | | 31.2 | | 42.7 | |

| | 36,684 | | 32,285 | | 26,602 | | 13.6 | | 21.4 | |

Fixed Income: | | | | | | | | | | | |

U.S. | | 21,471 | | 20,111 | | 17,955 | | 6.8 | | 12.0 | |

Global and International | | 241 | | 75 | | 55 | | 221.3 | | 36.4 | |

| | 21,712 | | 20,186 | | 18,010 | | 7.6 | | 12.1 | |

Index / Structured: | | | | | | | | | | | |

U.S. | | 101 | | 106 | | 80 | | (4.7 | ) | 32.5 | |

Global and International | | — | | — | | — | | — | | — | |

| | 101 | | 106 | | 80 | | (4.7 | ) | 32.5 | |

Total: | | | | | | | | | | | |

U.S. | | 55,283 | | 49,650 | | 43,195 | | 11.3 | | 14.9 | |

Global and International | | 19,590 | | 13,950 | | 10,041 | | 40.4 | | 38.9 | |

| | 74,873 | | 63,600 | | 53,236 | | 17.7 | | 19.5 | |

Dispositions(1) | | — | | 354 | | 357 | | (100.0 | ) | (0.8 | ) |

Total | | $ | 74,873 | | $ | 63,954 | | $ | 53,593 | | 17.1 | % | 19.3 | % |

(1) Includes assets related to cash management services. For information about this disposition, see Note 20 in AllianceBernstein’s consolidated financial statements in Item 8.

14

Revenues From Private Client Services(1)

(by Investment Service)

| | Years Ended December 31, | | % Change | |

| | 2005 | | 2004 | | 2003 | | 2005-04 | | 2004-03 | |

| | | | (in thousands) | | | | | | | |

Investment Advisory and Services Fees: | | | | | | | | | | | |

Growth Equity: | | | | | | | | | | | |

U.S. | | $ | 98,601 | | $ | 83,185 | | $ | 56,249 | | 18.5 | % | 47.9 | % |

Global and International | | 58,459 | | 39,273 | | 179 | | 48.9 | | n/m | |

| | 157,060 | | 122,458 | | 56,428 | | 28.3 | | 117.0 | |

Value Equity: | | | | | | | | | | | |

U.S. | | 267,730 | | 297,413 | | 258,928 | | (10.0 | ) | 14.9 | |

Global and International | | 163,568 | | 100,484 | | 85,903 | | 62.8 | | 17.0 | |

| | 431,298 | | 397,897 | | 344,831 | | 8.4 | | 15.4 | |

Fixed Income: | | | | | | | | | | | |

U.S. | | 99,899 | | 104,330 | | 90,960 | | (4.2 | ) | 14.7 | |

Global and International | | 879 | | 248 | | 163 | | 254.4 | | 52.1 | |

| | 100,778 | | 104,578 | | 91,123 | | (3.6 | ) | 14.8 | |

Index / Structured: | | | | | | | | | | | |

U.S. | | 103 | | 762 | | 189 | | (86.5 | ) | 303.2 | |

Global and International | | — | | — | | — | | — | | — | |

| | 103 | | 762 | | 189 | | (86.5 | ) | 303.2 | |

Total Investment Advisory and Services Fees: | | | | | | | | | | | |

U.S. | | 466,333 | | 485,690 | | 406,326 | | (4.0 | ) | 19.5 | |

Global and International | | 222,906 | | 140,005 | | 86,245 | | 59.2 | | 62.3 | |

| | 689,239 | | 625,695 | | 492,571 | | 10.2 | | 27.0 | |

Distribution Revenues | | 1,969 | | 1,372 | | 1,332 | | 43.5 | | 3.0 | |

Total | | $ | 691,208 | | $ | 627,067 | | $ | 493,903 | | 10.2 | % | 27.0 | % |

(1) Certain prior-year amounts have been reclassified to conform to our 2005 presentation: we reclassified transaction charges paid by our sponsored mutual funds from Institutional Investment Services and Private Client Services to Retail Services.

Private client accounts are managed pursuant to a written investment advisory agreement among the client, AllianceBernstein and SCB LLC, which usually is terminable at any time or upon relatively short notice by any party. In general, these contracts may not be assigned without the consent of the client. In providing services to private clients, we are compensated by fees calculated based on the type of portfolio and the size of the account. The aggregate fees we charge for managing hedge funds may be higher than the fees we charge for managing other assets in private client accounts because hedge fund fees provide for performance-based fees, incentive allocations, or carried interests. We charge performance-based fees on approximately 5% of private client assets under management, primarily assets held in hedge funds.

We eliminated transaction charges during 2005 on U.S. equity services for many private clients due to a number of factors, including a management initiative implemented during the first half of 2005 that changed the structure of investment advisory and services fees charged to private clients for our services. The restructuring eliminated transaction charges for most private clients while raising base fees. This restructuring increases the transparency and predictability of asset management costs for our private clients. The elimination of transaction charges was not the result of the Assurance of Discontinuance with the NYAG or an agreement with any other regulator.

Revenues from Private Client Services, which represented approximately 21%, 21%, and 18% of our company-wide revenues for the years ended December 31, 2005, 2004, and 2003, respectively, consist primarily of investment management fees earned from managing client assets, generally measured as a percentage of assets under management and, in the case of certain clients, include transaction charges earned by SCB LLC, a registered broker-dealer, for executing trades relating to equity securities under management.

15

Institutional Research Services

The following table summarizes Institutional Research Services revenues:

Revenues From Institutional Research Services

| | Years Ended December 31, | | % Change | |

| | 2005 | | 2004 | | 2003 | | 2005-04 | | 2004-03 | |

| | | | (in thousands) | | | | | | | |

Transaction Charges: | | | | | | | | | | | |

U.S. Clients | | $ | 226,615 | | $ | 225,820 | | $ | 192,597 | | 0.4 | % | 17.3 | % |

Non-U.S. Clients | | 90,291 | | 74,373 | | 72,800 | | 21.4 | | 2.2 | |

| | 316,906 | | 300,193 | | 265,397 | | 5.6 | | 13.1 | |

Other | | 4,375 | | 3,416 | | 2,471 | | 28.1 | | 38.2 | |

Total | | $ | 321,281 | | $ | 303,609 | | $ | 267,868 | | 5.8 | % | 13.3 | % |

SCB earns revenues by providing investment research to, and executing brokerage transactions for, research clients. Research clients provide compensation principally by directing brokerage transactions to SCB in return for its research products. These services accounted for approximately 10% of our revenues in each of 2005, 2004, and 2003.

AllianceBernstein (acting on behalf of its discretionary clients that have authorized it to transact business with SCB) is one of SCB’s largest client relationships. SCB earned revenues of approximately $36.5 million in 2005 from brokerage transactions executed for clients of AllianceBernstein, of which approximately $5.0 million is reported as Institutional Research Services revenues and approximately $31.5 million is reported as investment advisory and services fees (see Item 7). Beginning January 1, 2006, however, we intend to report all revenues earned by SCB from brokerage transactions executed for clients of AllianceBernstein as Institutional Research Services revenues.

Fee rates charged for brokerage transactions have declined significantly in recent years, but increases in transaction volume have more than offset decreases in fee rates. For additional information, see “Risk Factors” in Item 1A and “Executive Overview” in Item 7.

Custody and Brokerage

Custody

We do not generally maintain custody of client funds and securities. However, SCB LLC does maintain custody for the vast majority of our private clients. Other custodial arrangements are maintained by client-designated banks, trust companies, brokerage firms or other custodians.

Brokerage

We generally have the discretion to select the broker-dealers to execute transactions for client accounts. When selecting brokers, we are required to obtain “best execution”. Although there is no single statutory definition, SEC releases and other legal guidelines make clear that the duty to obtain best execution requires us to seek “the most advantageous terms reasonably available under the circumstances for a customer’s account”. In addition to paying the lowest possible commission rate, we take into account such factors as current market conditions, financial accountability, and the ability and willingness of the broker to commit capital by taking positions in order to execute transactions.

While we select brokers primarily on the basis of their execution capabilities, we may also take into consideration the quality and amount of research services (“Soft Dollar Services”) a broker provides to us for the benefit of our clients. Soft Dollar Services, which we purchase to augment our own research capabilities, are governed by Section 28(e) of the Exchange Act. We use broker-dealers that provide Soft Dollar Services in consideration for the execution of client trades, subject at all times to our duty to seek best execution, and with respect to which we reasonably conclude, in good faith, that the value of the execution and other services we receive from the broker-dealer is reasonable in relation to the amount of commissions paid. The commissions

16

charged by these full-service brokers are higher than those charged by electronic trading networks and other “low-touch” venues.

We sometimes execute client transactions through SCB LLC or SCBL, our affiliated broker-dealers. We do so only when our clients have consented to our use of affiliated broker-dealers or we are otherwise permitted to do so, and only when we can execute these transactions in accordance with applicable law (e.g., our obligation to obtain best execution).

We may use brokers to effect client transactions that sell shares of AllianceBernstein Funds or third party funds we sub-advise; however, we prohibit our investment professionals who place trades from considering these other relationships as a factor when selecting brokers to effect transactions. Similarly, we prohibit our investment professionals from considering the sale of fund shares as a factor when determining which brokers to use.

We have formed two Commission Allocation Committees, one covering growth equities and the other covering value equities. These committees have principal oversight responsibility for evaluating brokerage matters, including how to use the Soft Dollar Services we receive in a manner that is in the best interests of our clients and consistent with current regulatory requirements.

Service Marks

In connection with our recent name changes to AllianceBernstein L.P. and AllianceBernstein Holding L.P., we have applied to register a number of service marks with the U.S. Patent and Trademark Office, including an “AB” design logo and the combination of such logo with the words “AllianceBernstein”.

As a result of the Bernstein Transaction, we acquired all of the rights and title in, and to, the Bernstein service marks, including the name Bernstein. These marks were registered in 1981 and 1982. The marks “AllianceBernstein” and “Bernstein Investment Research and Management” were registered in 2003.

Regulation

AllianceBernstein, Holding, the General Partner, SCB LLC, AllianceBernstein Global Derivatives Corporation (a wholly-owned subsidiary of AllianceBernstein, “Global Derivatives”), and Alliance Corporate Finance Group Incorporated (a wholly-owned subsidiary of AllianceBernstein) are investment advisers registered under the Investment Advisers Act. Global Derivatives is also registered with the Commodity Futures Trading Commission as a commodity pool operator.

Each U.S. Fund is registered with the SEC under the Investment Company Act and the shares of most U.S. Funds are qualified for sale in all states in the United States and the District of Columbia, except for U.S. Funds offered only to residents of a particular state. Investor Services is registered with the SEC as a transfer agent.

SCB LLC and AllianceBernstein Investments are registered with the SEC as broker-dealers. SCB LLC is a member of the New York Stock Exchange, Inc. (“NYSE”). SCBL is a broker regulated by the Financial Services Authority of the United Kingdom (“FSA”) and is a member of the London Stock Exchange. SCB LLC and AllianceBernstein Investments are subject to minimum net capital requirements imposed by the SEC, and SCBL is subject to the financial resources requirements of the FSA, as follows:

| | Minimum Net Capital/

Financial Resources as of

December 31, 2005 | |

| | Required | | Actual | |

| | (in millions) | |

| | | |

AllianceBernstein Investments | | $ | 9.7 | | $ | 47.9 | |

SCB | | 26.3 | | 146.4 | |

SCBL | | 11.2 | | 33.6 | |

Total | | $ | 47.2 | | $ | 227.9 | |

17

Holding Units trade publicly on the NYSE. Holding Units currently trade under the ticker symbol “AC” but, beginning February 27, 2006, will trade under the ticker symbol “AB”. Holding is an NYSE listed company and, therefore, subject to the regulations set forth in the NYSE Listed Company Manual.

Our relationships with AXA and its subsidiaries are subject to applicable provisions of the insurance laws and regulations of New York and other states. Under such laws and regulations, the terms of certain investment advisory and other agreements we enter into with AXA or its subsidiaries are required to be fair and equitable, charges or fees for services performed must be reasonable, and, in some cases, are subject to regulatory approval.

All aspects of our business are subject to various federal and state laws and regulations, rules of various securities regulators and exchanges, and laws in the foreign countries in which our subsidiaries conduct business. These laws and regulations are primarily intended to benefit clients and fund shareholders and generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the carrying on of business for failure to comply with such laws and regulations. In such event, the possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in business for specific periods, the revocation of the registration as an investment adviser or broker-dealer, censures, and fines.

Market Timing Investigations

On December 18, 2003, we settled with the SEC and the NYAG regarding their investigations into trading practices in the shares of certain of our sponsored mutual funds. Our agreement with the SEC was reflected in an Order of the Commission (“SEC Order”) dated December 18, 2003 (amended and restated January 15, 2004), while our final agreement with the NYAG was reflected in an Assurance of Discontinuance (“AoD”) dated September 1, 2004. We have taken a number of important initiatives to resolve these matters. Specifically, we:

• established a $250 million restitution fund to compensate fund shareholders for the adverse effects of market timing (“Restitution Fund”);

• reduced by 20% (on a weighted average basis) the advisory fees on U.S. long-term open-end retail mutual funds by reducing our advisory fee rates (resulting in an approximate $63 million reduction in 2005 advisory fees and a $70 million reduction in 2004 advisory fees), and we will maintain these reduced fee rates for at least the five-year period that commenced January 1, 2004;

• appointed a new management team and specifically charged it with responsibility for ensuring that we maintain a fiduciary culture in our Retail Services;

• revised our code of ethics to better align the interests of our employees with those of our clients;

• formed two new committees composed of executive management to oversee and resolve code of ethics and compliance-related issues;

• instituted a substantially strengthened policy designed to detect and block market timing and material short duration trading;

• created an ombudsman office, where employees can voice concerns about work-related issues on a confidential basis; and

• initiated firm-wide compliance and ethics training programs.

We retained an Independent Compliance Consultant (“ICC”) to conduct a comprehensive review of supervisory, compliance, and other policies designed to detect and prevent conflicts of interest, breaches of fiduciary duty, and violations of law. The ICC completed its review, and submitted its report to the SEC in December 2004. By December 31, 2005, we had implemented substantially all of the ICC’s recommendations. Also, beginning in 2005 we had, and biannually thereafter will continue to have, an independent third party perform a comprehensive compliance review.

We believe that these remedial actions provide reasonable assurance that the deficiencies in our internal controls related to market timing will not recur.

18

With the approval of the independent directors of the U.S. Fund Boards and the staff of the SEC, we retained an Independent Distribution Consultant (“IDC”) to develop a plan for the distribution of the Restitution Fund. To the extent it is determined that the harm to mutual fund shareholders caused by market timing exceeds $200 million, we will be required to contribute additional monies to the Restitution Fund. On September 30, 2005, the IDC submitted to the SEC Staff the portion of his report concerning his methodology for determining damages. The IDC will, in the coming months, formally submit to the Staff the remainder of his proposed distribution plan, which addresses the mechanics of distribution. Once the Staff has approved both portions of the plan, it will be submitted to the SEC for final approval. The Restitution Fund proceeds will not be distributed until after the SEC has approved the distribution plan and issued an order doing so. Until then, it is not possible to predict the exact timing, method, or amount of the distribution.

On February 10, 2004, we received (i) a subpoena duces tecum from the Office of the Attorney General of the State of West Virginia and (ii) a request for information from the Office of the State Auditor, Securities Commission, for the State of West Virginia (“WV Securities Commissioner”) (subpoena and request together, the “Information Requests”). The Information Requests required us to produce documents concerning, among other things, any market timing or late trading in our sponsored mutual funds. We responded to the Information Requests and have been cooperating fully with the investigation.

On April 11, 2005, a complaint entitled The Attorney General of the State of West Virginia v. AIM Advisors, Inc., et al. (“WVAG Complaint”) was filed against AllianceBernstein, Holding, and various unaffiliated defendants. On May 31, 2005, defendants removed the WVAG Complaint to the United States District Court for the Northern District of West Virginia. On July 12, 2005, plaintiff moved to remand. On October 19, 2005, the WVAG Complaint was transferred to the Mutual Fund MDL (see Market Timing-related Matters in Item 3).

On August 30, 2005, the WV Securities Commissioner signed a “Summary Order to Cease and Desist, and Notice of Right to Hearing” addressed to us. The Summary Order claims that we violated the West Virginia Uniform Securities Act and makes factual allegations generally similar to those in the SEC Order and NYAG AoD. On January 26, 2006, AllianceBernstein, Holding, and various unaffiliated defendants filed a Petition for Writ of Prohibition and Order Suspending Proceedings in West Virginia state court seeking to vacate the Summary Order and for other relief.

As previously disclosed, AllianceBernstein recorded charges totaling $330 million during the second half of 2003, of which (i) $250 million was paid to the Restitution Fund (the $250 million was funded out of operating cash flow and paid to the SEC in January 2004), (ii) $30 million was used to settle a private civil mutual fund litigation unrelated to any regulatory agreements, and (iii) $50 million was reserved for estimated expenses related to our market-timing settlements with the SEC and the NYAG and our market timing-related liabilities (excluding WVAG Complaint-related expenses). AllianceBernstein paid $8 million during 2005 related to market timing and has cumulatively paid $310 million (excluding WVAG Complaint-related expenses). Including $10 million in charges taken in prior periods, we have reserves of approximately $30 million available for market timing-related liabilities in future periods.

Taxes

AllianceBernstein is a private partnership for federal income tax purposes and, accordingly, is not subject to federal and state corporate income taxes. However, AllianceBernstein is subject to the 4.0% New York City unincorporated business tax (“UBT”). Domestic corporate subsidiaries of AllianceBernstein, which are subject to federal, state and local income taxes, are generally included in the filing of a consolidated federal income tax return. Separate state and local income tax returns are filed. Foreign corporate subsidiaries are generally subject to taxes in the jurisdictions where they are located. Holding is a publicly traded partnership for federal income tax purposes and is subject to the 4.0% UBT, net of credits for UBT paid by AllianceBernstein, and a 3.5% federal tax on partnership gross income from the active conduct of a trade or business.

In order to preserve Holding’s status as a “grandfathered” publicly traded partnership for federal income tax purposes, management ensures that Holding does not directly or indirectly (through AllianceBernstein) enter into a substantial new line of business. If Holding were to lose its status as a grandfathered publicly traded partnership, it would be subject to corporate income tax, which would reduce materially Holding’s net income and its quarterly distributions to Holding Unitholders.