As filed with the U.S. Securities and Exchange Commission on April 24, 2024

Registration No. 333-269725

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

_________________

EALIXIR, INC.

(Exact name of registrant as specified in its charter)

_________________

Nevada | 7380 | 84-4905484 | ||

(State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

40 SW 13th St.

Penthouse 1

Miami, FL 33130

(786) 856-0358

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

_________________

Eleonora Ramondetti, Chief Executive Officer and Secretary

EALIXIR, INC.

40 SW 13th St.

Penthouse 1

Miami, FL 33130

(786) 856-0358

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_________________

Copies to:

Richard I. Anslow, Esq. | Mitchell S. Nussbaum, Esq. |

_________________

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If delivery of the Prospectus is expected to be made pursuant to Rule 434, check the following box. ☐

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer,” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large, accelerated filer | ☐ | Accelerated filer | ☐ | |||||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||||

Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such dates as the Commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities in this registration statement may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED APRIL 24, 2024 |

EALIXIR, INC.

[•] shares of Common Stock

This is a firm commitment public offering (“Public Offering”) of shares of common stock of EALIXIR, INC., par value, $0.001 per share (“Common Stock”), and which we refer to as the Public Offering. We currently estimate that the public offering price will be between $[•] and $[•] per share.

Our Common Stock is quoted on the OTC Pink Open Market operated by OTC Markets Group, Inc. (the “OTC Pink”), under the ticker symbol “EAXR.” As of [March 29, 2024], the last reported price of our Common Stock was $1.81 per share at market close. There is a limited public trading market for our Common Stock. You are urged to obtain current market quotations for the Common Stock. We intend to apply to list our Common Stock on a national securities exchange under the symbol “EAXR”. We believe that upon completion of the Public Offering contemplated by this prospectus, we will meet the standards for listing on the Nasdaq. No assurance can be given that our application will be approved or that the trading prices of our Common Stock on the OTC Pink will be indicative of the prices of our Common Stock if our Common Stock were traded on a national securities exchange.

The offering price of our shares of Common Stock in the Public Offering will be determined between the underwriters and us at the time of pricing, considering our historical performance and capital structure, prevailing market conditions, and overall assessment of our business, and may be at a discount to the current market price. Therefore, the recent market price of our Common Stock and the Public Offering price of the Common Stock used throughout this prospectus for the Public Offering (the “Public Offering Prospectus”) may not be indicative of the actual Public Offering price for the shares of Common Stock.

We are an “emerging growth company” and a “smaller reporting company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and have elected to comply with certain reduced public company reporting requirements. See “Public Offering Prospectus Summary — Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

We are, and, upon completion of this Public Offering, will continue to be a “controlled company,” as defined under the Nasdaq Listing Rules and under the listing rules of the New York Stock Exchange, as long as our majority stockholder, Eleonora Ramondetti, our director, CEO, and Secretary, and her affiliates own and hold more than 50% of the voting power of us. For as long as we remain a controlled company under that definition, we are permitted to elect to rely, and may rely, on certain exemptions from certain Nasdaq or NYSE corporate governance requirements. See “Public Offering Prospectus Summary — Implications of Being a Controlled Company.”

Our officers and directors will have significant influence over the Company following the completion of the Public Offering due to their significant shareholding in the Company, in particular, Ms. Eleonora Ramondetti, our director, CEO and Secretary, who currently holds approximately 93.7% of the voting power of our Company (based on 1,000,000 issued and outstanding shares of our Series Z Preferred Stock as of the date of this Public Offering Prospectus), and is expected to own approximately [•]% of the voting power of our Company upon the completion of this Public Offering thereby causing us to become a “controlled company” under the Nasdaq Listing Rules and under the listing rules of the New York Stock Exchange. For more information regarding Ms. Ramondetti’s beneficial ownership, see “Security Ownership of Principal Stockholders And Management” on page 69 and “Risk Factors — Risks Related to Our Securities — Our director, CEO and Secretary, Ms. Eleonora Ramondetti Ramondetti, has a substantial influence over our Company. Her interests may not be aligned with the interests of our other stockholders, and she could prevent or cause a change of control or other transactions” on page 25. For more information regarding implications of us being a “controlled company,” see “Risk Factors — Risks Related to Our Securities — We are a “controlled company” defined under the Nasdaq Listing Rule and the rules of the NYSEs. Although we do not intend to rely on the “controlled company” exemption under the Nasdaq Listing Rules or the rules of the NYSE, we could elect to rely on this exemption in the future and you will not have the same protection afforded to stockholders of companies that are subject to these corporate governance requirements” on page 25.

Investing in our Common Stock involves significant risks. You should read the section entitled “Risk Factors” beginning on page 15 of this Public Offering Prospectus for a discussion of information that should be considered before investing in our Common Stock.

We may amend or supplement this Public Offering Prospectus from time to time by filing amendments or supplements as required. You should read the entire Public Offering Prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this Public Offering Prospectus. Any representation to the contrary is a criminal offense.

Per Share | Total | |||||

Public offering price | $ | $ | ||||

Underwriting discounts and commissions(1) | $ | $ | ||||

Proceeds to us, before expenses | $ | $ | ||||

____________

(1) Does not include the reimbursement of certain expenses of the underwriters. See “Underwriting” beginning on page 84 of this Public Offering Prospectus for additional information regarding underwriting compensation.

We have granted the underwriters a 45-day option to purchase up to additional shares of Common Stock on the same terms as other shares being purchased by the underwriters from us, solely to cover over-allotments, if any (such shares not to exceed, in the aggregate, 15% of the shares offered hereby). If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ , and the total proceeds to us, before expenses, will be $ .

The underwriter expects to deliver the shares on or about , 2024.

Sole Book-Running Manager

Maxim Group LLC

The date of this prospectus is , 2024.

Page | ||

ii | ||

iv | ||

v | ||

vi | ||

1 | ||

11 | ||

13 | ||

15 | ||

30 | ||

31 | ||

32 | ||

33 | ||

35 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 37 | |

46 | ||

61 | ||

69 | ||

71 | ||

74 | ||

78 | ||

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS | 80 | |

84 | ||

93 | ||

93 | ||

93 | ||

F-1 |

Through and including , 2024 (the 25th day after the date of this Public Offering Prospectus), all dealers effecting transactions in these securities, whether or not participating in the listing, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

You should rely only on the information contained in this Public Offering Prospectus. Neither we nor the underwriters have not authorized anyone to provide you with different information. If anyone provides you with different information, you should not rely on it. Neither we nor the underwriters are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this Public Offering Prospectus is accurate only as of the date on the front cover of this Public Offering Prospectus. Neither the delivery of this Public Offering Prospectus nor any sale made in connection with this Public Offering Prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this Public Offering Prospectus or that the information contained in this Public Offering Prospectus is correct as of any time after its date. Information contained on our website, or any other website operated by us, is not part of this Public Offering Prospectus.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit possession or distribution of this Public Offering Prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this Public Offering Prospectus must inform themselves about, and observe any restrictions relating to, the Public Offering of the shares of Common Stock and the distribution of this Public Offering Prospectus outside the United States.

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this Public Offering Prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts contained in this Public Offering Prospectus are “forward-looking statements” for purposes of federal and state securities laws, including statements regarding our expectations and projections regarding future developments, operations and financial conditions, and the anticipated impact of our acquisitions, business strategy, and strategic priorities. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. The forward-looking statements in this Public Offering Prospectus are only predictions and are based largely on our current expectations and projections about future events and financial trends that we reasonably believe may affect our business, financial condition, and results of operations. These forward-looking statements speak only as of the date of this Public Offering Prospectus and are subject to several known and unknown risks, uncertainties, and assumptions. Although we believe the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties.

These forward-looking statements present our estimates and assumptions only as of the date of this Public Offering Prospectus. Accordingly, you are cautioned not to place undue reliance on forward-looking statements, which speak only as of the dates on which they are made. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether because of any new information, future events, changed circumstances or otherwise. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, those summarized below:

• Although we have generated positive cash flow from operating activities for the year ended December 31, 2023 and 2022, there can be no assurance that we can continue to generate positive cash flow in the near term.

• We may need to raise additional funds in the future that may not be available on acceptable terms or available at all.

• Our independent auditor has expressed a “going concern” opinion in the 2023 and 2022 audit report.

• We do not currently have an external line of credit facility with any financial institution.

• We are an early-stage company with a business model and marketing strategy still being developed and largely untested.

• Our management and organizational structures are still developing and remain susceptible to error and inefficiencies.

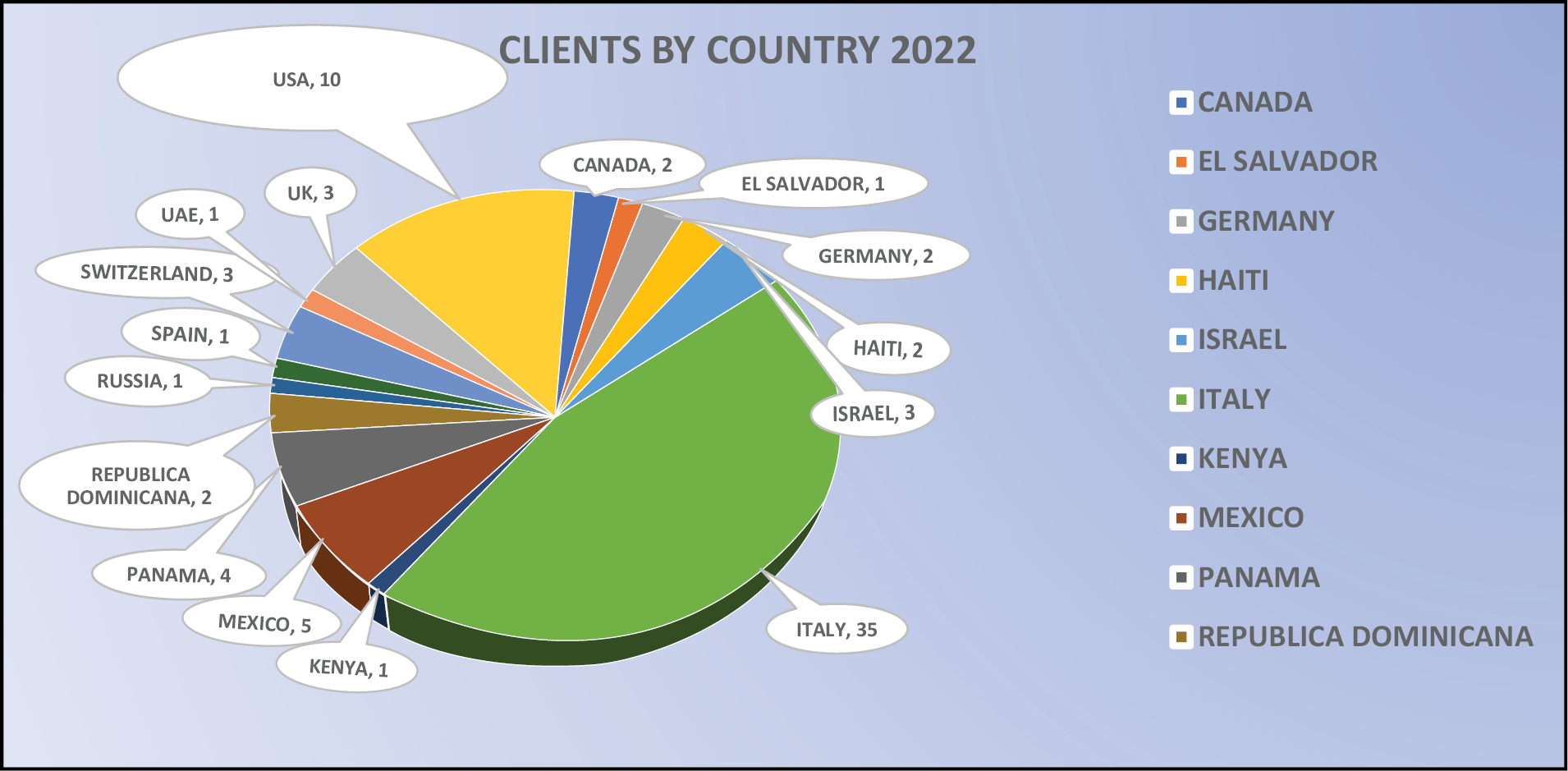

• We have significant customer concentration, with a limited number of customers accounting for a substantial portion of our revenues. Failure to attract, grow and retain a diverse and balanced customer base could harm our business and operating results.

• If we experience a significant disruption in our information technology systems, including security breaches, or if we fail to implement new systems and software successfully, our business operations and financial condition could be adversely affected.

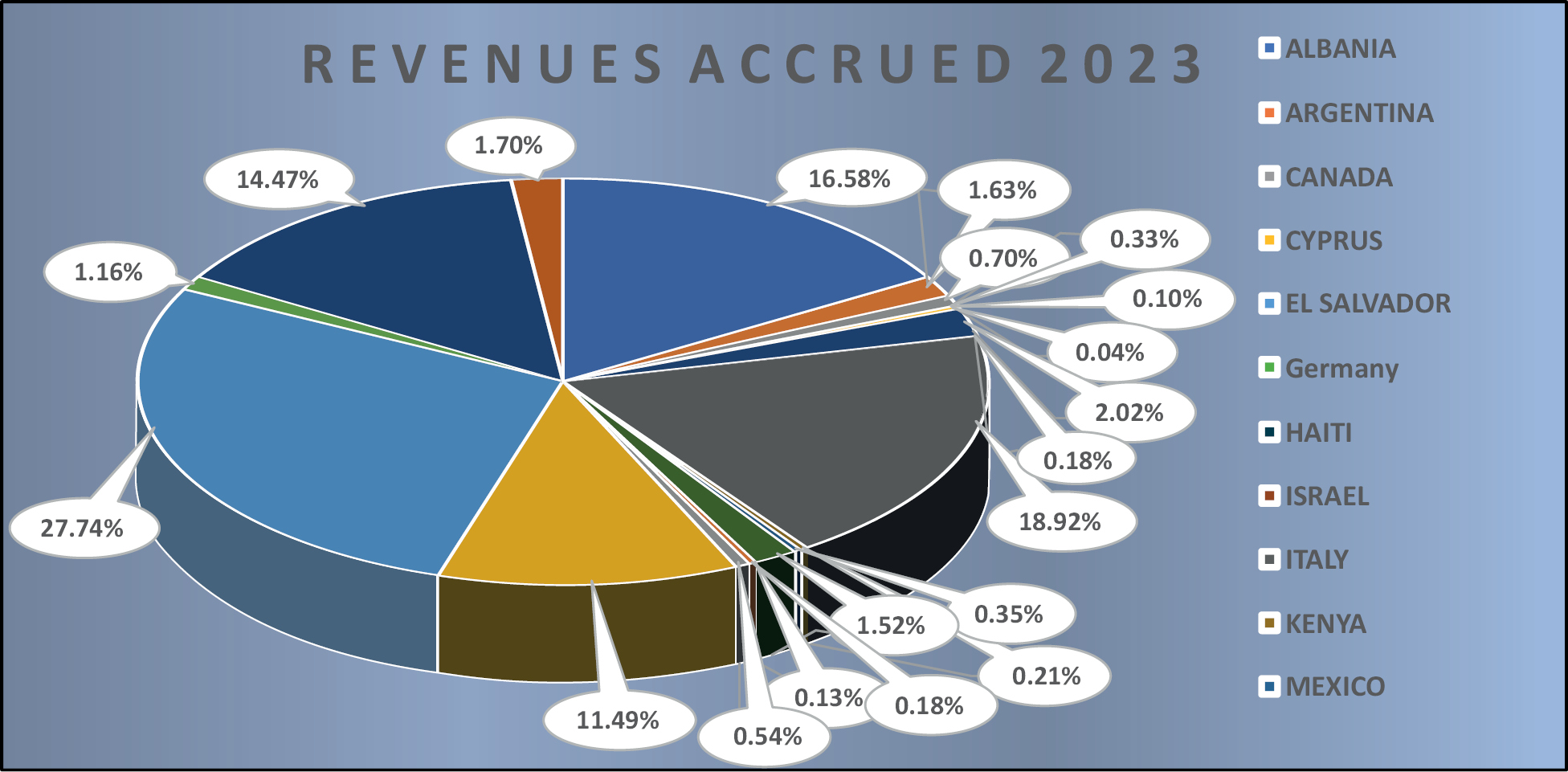

• Because we conduct operations in several different countries, we may be affected by currency fluctuations.

ii

• Our expansion into new markets may present increased risks due to our unfamiliarity with those areas and our target customers’ unfamiliarity with our brand.

• Privacy and data protection regulations are complex and rapidly evolving areas. Adverse interpretations of these laws could harm our business, reputation, financial condition, and operating results.

• Our business depends on continued and unimpeded access to the Internet by us and our users. Internet access providers may be able to restrict, block, degrade, or charge for access to certain of our products and services, which could lead to additional expenses and the loss of users and advertisers.

• Our director, CEO, and Secretary, Ms. Eleonora Ramondetti, has a substantial influence over our Company. Her interests may not be aligned with the interests of our other stockholders, and she could prevent or cause a change of control or other transactions of the Company.

• The other risks identified in this Public Offering Prospectus including, without limitation, those under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as such factors may updated from time to time in our other filings with the SEC.

Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements represent our estimates and assumptions only as of the date of this Public Offering Prospectus and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this Public Offering Prospectus. We qualify all our forward-looking statements by these cautionary statements.

iii

You should rely only on the information contained in or incorporated by reference in this Public Offering Prospectus. Neither we nor the underwriters have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

You should not assume that the information contained in this Public Offering Prospectus, or any document incorporated by reference in this Public Offering Prospectus, is accurate as of any date other than the date on the front cover of the applicable document. The information contained in this Public Offering Prospectus is accurate only as of the date of this Public Offering Prospectus, regardless of the time of delivery of this Public Offering Prospectus or of any sale of our Common Stock. Neither the delivery of this Public Offering Prospectus nor any distribution of securities in accordance with this Public Offering Prospectus shall, under any circumstances, imply that there has been no change in the information set forth or incorporated by reference into this Public Offering Prospectus or in our affairs since the date of this Public Offering Prospectus. Our business, financial condition, operating results and prospects may have changed since that date. Information contained on our website, or any other website operated by us, is not part of this Public Offering Prospectus.

Before purchasing any securities, you should carefully read both this Public Offering Prospectus, together with the additional information described under the heading “Where You Can Find More Information” in this Public Offering Prospectus.

iv

This Public Offering Prospectus, and the documents incorporated by reference in this Public Offering Prospectus include industry data and forecasts that we obtained from industry publications and surveys, public filings, and internal company sources. Statements as to our ranking, market position and market estimates are based on independent industry publications, government publications, third-party forecasts and management’s good faith estimates and assumptions about our markets and our internal research. Although we believe our internal company research and estimates are reliable, such research and estimates have not been verified by any independent source. This data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings “Risk Factors” and “Cautionary Note Regarding Forward Looking Statements” in this Public Offering Prospectus and the documents incorporated by reference herein and therein.

v

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos, and website names. This Public Offering Prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this Public Offering Prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this Public Offering Prospectus are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

vi

EXCHANGE RATE INFORMATION

Unless stated otherwise, all dollar amounts are in United States Dollars. Certain amounts are expressed in Euros (“€”).

The annual average exchange rates for Euros in terms of the United States Dollar for each of the two-year periods ended December 31, 2023 and 2022, as quoted by the European Central Bank, were as follows:

Year ended December 31, | ||

2023 | 2022 | |

€ 1.0815 | € 1.0528 | |

On April 23, 2024, the daily rate for United States Dollars in terms of the Euros, as quoted by the European Central Bank, was USD $1.00 = € 0.9368.

PRESENTATION OF FINANCIAL INFORMATION

The financial information contained in this Public Offering Prospectus derives from our audited consolidated financial statements as of December 31, 2023 and 2022. These financial statements and related notes included elsewhere in this Public Offering Prospectus are presented in the reporting currency of United States Dollars ($) and are collectively referred to as our audited consolidated financial statements herein and throughout this Public Offering Prospectus. Our audited consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and with reference to the Accounting Standards Codification (“ASC”). Our fiscal year ends on December 31 of each year, so all references to a particular fiscal year are to the applicable year ended December 31.

vii

PUBLIC OFFERING PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this Public Offering Prospectus, but it does not contain all of the information that you may consider important in making your investment decision. You should read the entire Public Offering Prospectus carefully, including the section entitled “Risk Factors” in this Public Offering Prospectus, the financial statements and the notes to the financial statements included elsewhere in this Public Offering Prospectus. Unless the context otherwise requires, references contained in this Public Offering Prospectus to the “Company,” “Ealixir,” “we,” “us,” or “our” or similar terminology refers to Ealixir, Inc., a Nevada corporation, and its consolidated subsidiaries.

THE COMPANY

Ealixir is an internet technology company specializing in online reputation management services, which we refer to as ORM. The heart of our operational philosophy is to ensure that our clients have the “right to be forgotten”. We support a more professional and accurate Internet whereby content publishers or providers regulate the use of people’s information by third parties, especially in the context of preventing or limiting third parties’ abilities from doxing (referring to the unauthorized release of personal identifying information) or engaging in libelous, slandering or any other similar malicious dissemination of (mis)communication.

Ealixir uses its advanced technological platform to provide ORM services and digital privacy solutions to individuals, professional organizations, and small, medium businesses, or “SMBs”. By providing our clients with an ability to control, remove and edit information posted and available on the Internet, individuals, professional organizations, and SMBs can choose what verified content about them will appear on websites and search engines. Our extensive removal experience and proprietary removal technology allows us, we believe, to offer one of the best services available in the content removal industry. Our objective is to provide protection for the reputation of our clients on websites and search engines by drafting and correcting inaccurate information, filtering harmful or negative information and misinformation from social engines, and by managing the online status of individuals, brands and companies. Furthermore, we aim to enhance the image, legacy and the web-reputation of our customers by creating positive links and original tailor-made content, which is then disseminated online through a vast network of newspapers, agencies and websites with whom we work.

Our objective as a company is to advocate the “right to be forgotten” in order to help individuals, SMBs and others fight back against outdated negative information and harmful spurious content online, and we strive at being subject matter professionals at what we do.

The Internet and its various platforms have become in our opinion the new media battlefield which can be used to destroy brand and reputation. Our purpose as a company is to provide protection against these unwanted and often spurious attacks, while offering a possible risk-free, technical approach to permanent content removal. We have witnessed the repercussions that negative online content can bring to both businesses and individuals and strive to give our clients back control over their online presence.

Our employees include computer science specialists, web analysists, and digital media or communication strategists, supported by a legal specialist specialized in privacy laws. We also maintain relationships with a data analysis search engine and data banks with whom we work on the deindexation of harmful and unwanted content and links.

By our choice and not by legal obligation, as a policy, we do not work with those who have been found guilty in the past of committing crimes related to drugs, criminal organizations or violence against women or minors. Moreover, before working with any client, as a policy, we run background checks from a combination of compliance and know-your-client databases and ask for supporting legal documentation such as criminal records or certificate of pending charges from applicable jurisdictions. We have instituted certain controls and procedures to enforce this policy, including using internal technologies aimed at proper customer due diligence and compliance databases. These controls and procedures are activated at the moment of preliminary discussions with potential clients and, therefore, prior to signing any contract or the start of any collaboration. Moreover, all of our clients have to accept a clause pursuant to our standard form agreement with clients that states the client has read and accepted the terms of our Code of Ethics and that in the event of a violation of the Code of Ethics, we have the right to renegotiate or terminate the agreements with the client.

1

Ealixir offers its individual and corporate clients a full suite of ORM solutions. Our primary service offering is Ealixir Removal, the removal of negative content and online spurious content, To complement the removal service we offer ancillary services to both remove such content and also promote our clients’ positive online reputation and improve search results. Our ancillary services include: WEBiD, Ealixir Story, NewsDelete, Ealixir Analytics, Ealixir Event Launch, Monitoring and ReputScore:

• Ealixir Removal — Our primary service, which aims to protect the online reputation of clients (individuals or corporations) utilizing the Company’s innovative technological platform to achieve the removal, de-indexation or the anonymization of negative or unwanted information

• WEBiD — a detailed report covering the past ten years of online content, including media presence, mentions, news, images, social media posts, blogs and forums relating to individuals, brands and companies. Based on such report, the client receives an immediate and accurate portrait of the dominant “sentiment” which is associated with the specific content — whether positive, neutral or negative. We uncover harmful information; we geo-localize online conversations related to the subject and analyze their demographic composition. At the end of this, we then prepare a report which summarizes the strengths and weaknesses, which is delivered to the customer’s home or headquarters.

• Ealixir Story — Through this service, we aim to assist our clients in developing and spreading on the Internet a new or revived story about themselves. Frequently following the completion of our Ealixir Removal work, the need to replace the content which was removed with new and positive content becomes apparent. We thus offer our customers a customized editorial plan, with the aim of developing a new “story” through a number of articles and features to be published by several online news outlets.

• NewsDelete — This service caters to customers concerned about their reputation in financial affairs, as it is portrayed by privately-managed databases. If certain conditions are met, we are able to obtain the removal of a client’s name from the database or the update of information that is incorrect or obsolete.

• Ealixir Analytics collects real-time big data about states, institutions, political parties, candidates and personalities. Through the web listening platform, we are able to monitor millions of online sources and, with the use of algorithms in-house developed. We are able to cross-reference words and sentences in order to identify trends in public audience reading in order to propose contents and information of interest. Through a detailed analysis of sentiment related to specific targets, we identify strategic and business opportunities in target countries and propose communication plans of effectiveness.

• Ealixir Event Launch gives companies the unique opportunity to promote their event on an international scale, providing visibility in online periodicals in multiple countries around the world. It works with accredited journalists and PR experts who will develop the most effective editorial plan to promote an event (e.g., the launch of a new product, an important anniversary or the grand opening of a new office) and draft articles and press releases for distribution in the target countries in authoritative periodicals.

• Monitoring is offered as a subscription service, where we provide continuous monitoring of the client’s online presence for a duration of one year. The primary objective is to identify and address potential threats to personal and professional reputation. This service is available in bundles, which also include the removal of certain negative links detected during the subscription period, with the extent of removal based on the package size chosen by the client.

• ReputScore is our latest offering, a mobile application or “app”, currently under development and we expect to offer new and existing client the services starting in June 2024. This service is designed to offer an individual or business an immediate and broad overview of such person’s or company’s web reputation. The app scans the Internet to analyze the sentiment which is mostly associated with the client, and we then assign a score from 1 to 100 (where a higher number denotes a more positive sentiment).

Competition

The ORM industry is a young and growing sector, because its growth is related to the growth of online content, as well as other factors, and thus in our view difficult to quantity. At the same time, the ORM industry is highly competitive and fragmented. The number, size and strength of our competitors vary by continent and country. Our

2

competitors also compete based on a number of factors, including speed of service, value, name recognition, and customer service. We believe our most direct competition comes from Reputation.com, Terakeet, and Repair Bad Reputation, among others.

We also compete with traditional public relations and communication agencies.

However, we believe that none of these competitors offers the breadth of services we provide. While some of them focus on the removal of unwanted Internet links, and others manage promotional campaigns, we believe that few, if any, of them can match the scope, depth and reach of our services, commencing from a thorough assessment of the nature of the web content relating to our client, to targeted link and content removal; the creation of new and tailor-made web content; and the removal of information from databases and so called “blacklists”.

“Blacklists” are databases that are used as compliance tools, containing information obtained from open sources, on individuals and business entities. These databases are risk intelligence tools used by banks and financial systems to finalize a customer’s “Know Your Customer” information, to mitigate financial risks and to make business transactions more transparent. The process is intended to address crimes that are mainly related to money laundering resulting from corruption and illegal activities generally.

Banks, credit, insurance and financial institutions, as well as government and intelligence services, use these databases to draw information on individuals, not only to screen their financial solvency or the feasibility of granting mortgages or financing, but also process the information to understand whether such individuals are linked to dynamics related to terrorism, drug trafficking, money laundering, arms and human trafficking. The information contained in these databases constitutes the basis for calculating risk in business and entrepreneurial relationships, a calculation that starts from merely financial data and then crosses over into a truly comprehensive report on the requesting subject.

These databases use open-source information, i.e., information that can be found on the Internet by performing a Google or similar search, from government websites or the media to create these profiles. Sometimes this information is outdated or no longer relevant (for example in cases of acquittal). In these cases, the failure to update information may cause serious damage to the person or business entity involved and it is part of Ealixir’s job to request an update of information and when possible, the cancellation of the profile.

Pricing; Sales and Marketing

The Company provides its “Removal” service, aimed at the cancellation or the deindexation of the harmful or undesired links. The service is provided for the benefit of the client’s online reputation. The Company currently offers monitoring services, as further described above, where the Company provides continuous monitoring of the client’s online presence.

Since each client needs and appreciates a tailored service, the Company agrees on rates on customized basis. In doing so, reference is made to the following pricing schedule:

Primary Service:

• Ealixir Removal — $1,500 per link

Ancillary Services:

• WEBiD — $5,000 per name of a person or company, hashtag or other identifier on average

• Ealixir Story — Three packages at $50,000; $100,000; and $150,000, respectively. The packages differ from each other in the number of items and geographic area of reference.

• News Delete — $25,000 each black list.

• Analytics — $500,000 starting price. Additional pricing is based on the scope of the project.

• Event Launch — $150,000 starting price. Additional pricing depends on the scope of the project.

• Monitoring — Five packages at a monthly rate of $500, $750, $1,000, $2,000, $2,500 or customized to the client’s needs.

The Ealixir Story pricing depends on the length, depth and complexity of the client’s story and the news media outlets to which it is distributed.

3

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this Public Offering, (b) in which we have total annual gross revenue of at least $1.235 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our shares of Common Stock that are held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 in this Public Offering Prospectus as the “JOBS Act,” and references in this Public Offering Prospectus to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

• only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure;

• reduced disclosure about our executive compensation arrangements;

• no requirement that we hold non-binding advisory votes on executive compensation or golden parachute arrangements; and

• exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

We have elected to adopt certain reduced disclosure requirements for purposes of the registration statement of which this Public Offering Prospectus is a part. In addition, for so long as we qualify as an emerging growth company, we expect to take advantage of certain of the reduced reporting and other requirements of the JOBS Act with respect to the periodic reports we will file with the SEC and proxy statements that we use to solicit proxies from our stockholders. As a result, the information contained in this Public Offering Prospectus and in our periodic reports and proxy statements may be different than the information provided by other public companies.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates for new or revised accounting standards.

For certain risks related to our status as an emerging growth company, see the section titled “Risk Factors — Risks Related to Our Securities — We are an “emerging growth company” and a “smaller reporting company” under the JOBS Act, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies will make our Common Stock less attractive to investors.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies. We will remain a smaller reporting company until the end of the fiscal year in which (1) we have a public common equity float of more than $250 million, or (2) we have annual revenues for the most recently completed fiscal year of more than $100 million and a public common equity float or public float of more than $700 million. We also would not be eligible for status as a smaller reporting company if we become an investment company, an asset-backed issuer or a majority-owned subsidiary of a parent company that is not a smaller reporting company.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this Public Offering Prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different from what you might receive from other public reporting companies in which you hold equity interests.

4

Implications of Being a Controlled Company

We expect that our director, CEO and Secretary, Ms. Eleonora Ramondetti, will hold a majority of our voting power following this Public Offering and we will continue to be a controlled company pursuant to “controlled company” defined under the Nasdaq Listing Rules and under the rules of the NYSE. Accordingly, we will be a controlled company under the applicable Nasdaq and NYSE listing standards. For so long as we are a controlled company under that definition, we are permitted to elect to rely, and may rely, on certain exemptions from corporate governance rules, including:

• an exemption from the rule that a majority of our board of directors must be independent directors;

• an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and

• an exemption from the rule that our director nominees must be selected or recommended solely by independent directors.

As a result, you will not have the same protection afforded to stockholders of companies that are subject to these corporate governance requirements.

Although we do not intend to rely on the “controlled company” exemption under the Nasdaq Listing Rules or under the rules of the NYSE, we could elect to rely on this exemption in the future. If we elected to rely on the “controlled company” exemption, a majority of the members of our board of directors might not be independent directors and our nominating and corporate governance and compensation committees might not consist entirely of independent directors upon closing of this Public Offering. Our status as a controlled company could cause our Common Stock to look less attractive to certain investors or otherwise harm our trading price. As a result, the investors will not have the same protection afforded to stockholders of companies that are subject to these corporate governance requirements. Please see “Risk Factors — We are a “controlled company” defined under the Nasdaq Listing Rules and under the rules of the NYSE. Although we do not intend to rely on the “controlled company” exemption under the Nasdaq Listing Rules or the rules of the NYSE, we could elect to rely on this exemption in the future and you will not have the same protection afforded to stockholders of companies that are subject to these corporate governance requirements.”

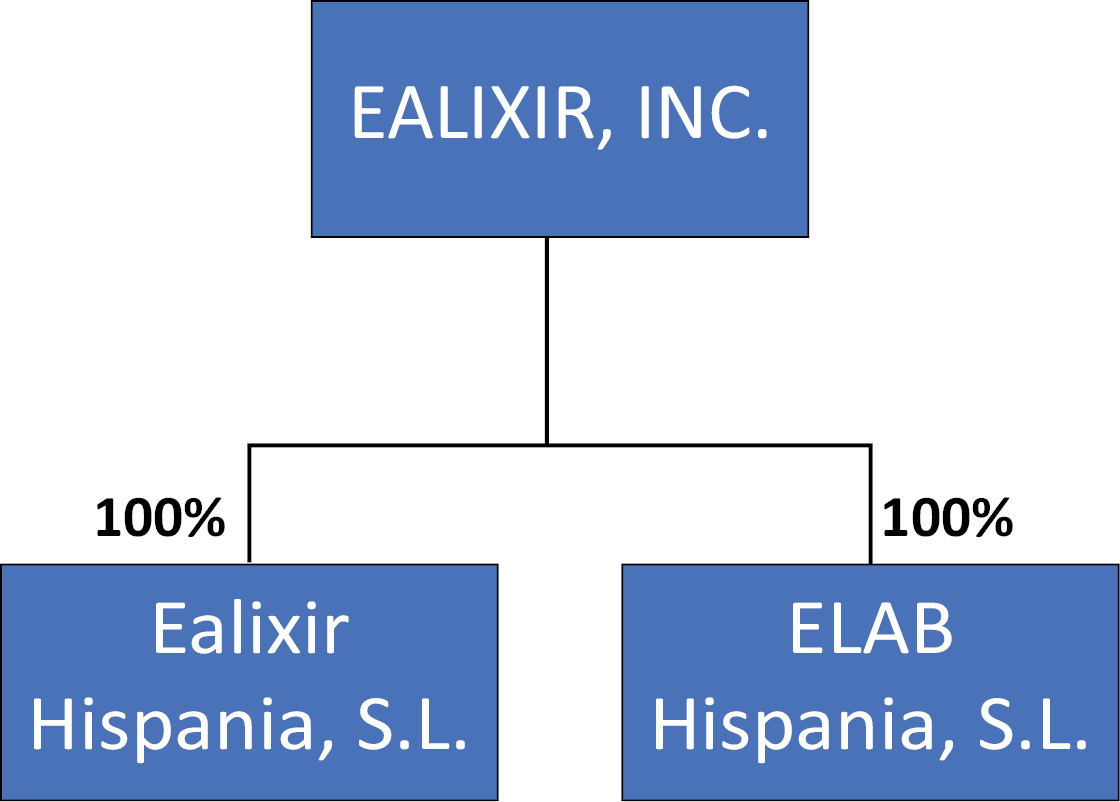

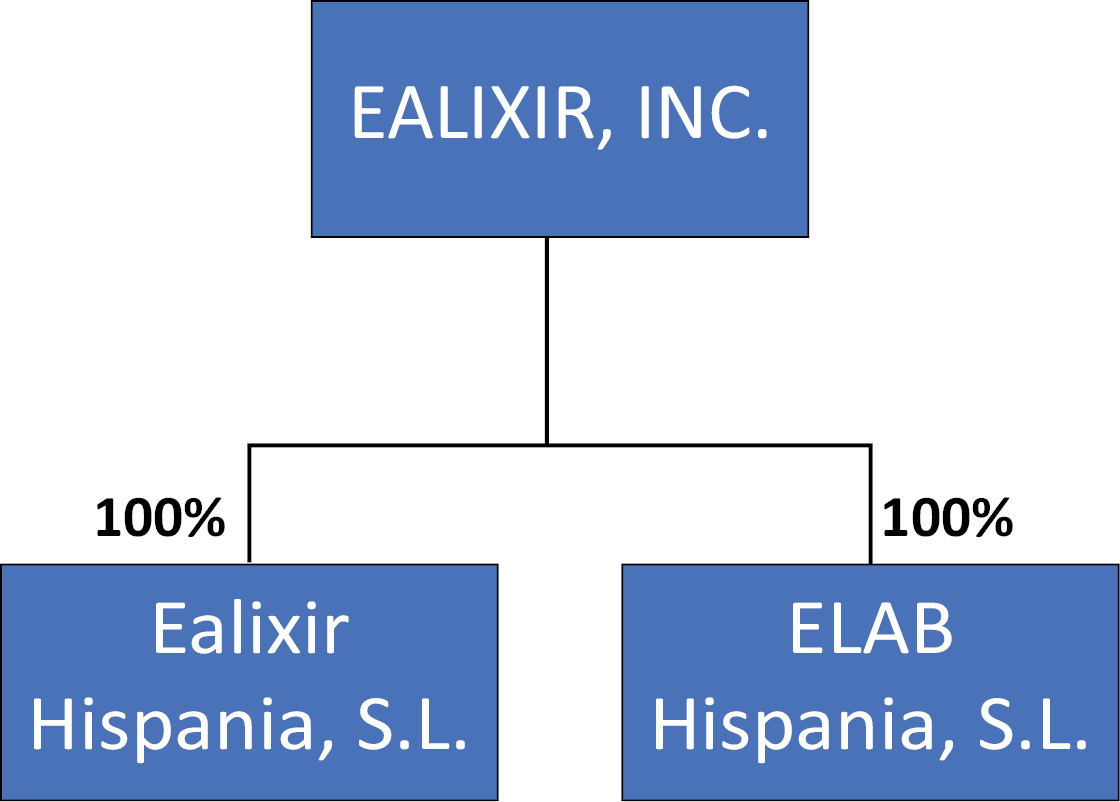

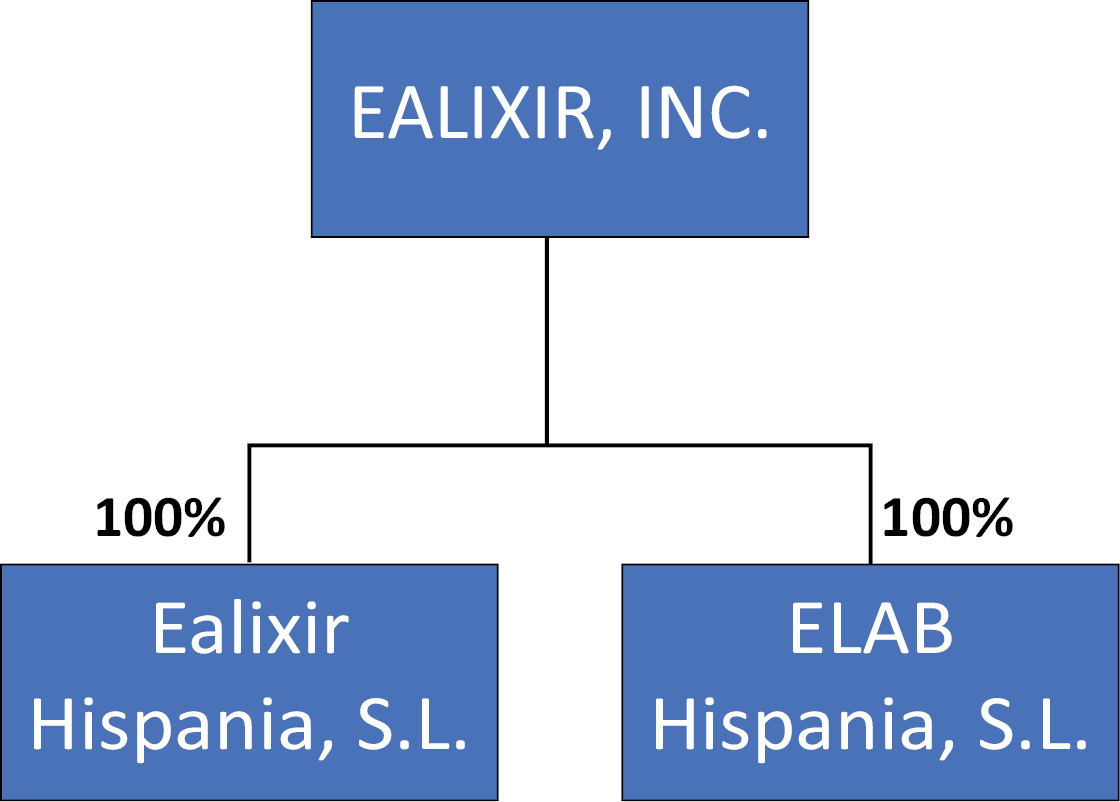

Corporate History and Structure

We were incorporated in the State of Nevada on June 7, 2019 under the name Bull Run Capital Holdings, Inc. in order to participate in a holding company reorganization pursuant to the laws of the State of Nevada, which was completed on July 19, 2019. In this reorganization Flint Telecom Group, Inc., our predecessor company (the “Predecessor”) merged with and into its indirect wholly owned subsidiary, Flint Merger Group Sub Inc., with the Predecessor as the surviving corporation and becoming our wholly owned subsidiary. At that time we engaged in a reverse stock split whereby one share of Common Stock was issued in exchange for every 50 shares then outstanding. Concurrently with this, we cancelled all of the stock held in Flint Telecom Group, Inc. resulting in our becoming a stand-alone entity with no subsidiaries. Our Common Stock was traded on the OTC Pink Market under the symbol “BRCH”. On January 8, 2020, our stockholders adopted an amendment to our Articles of Incorporation, changing our name from “Bull Run Capital Holdings, Inc.” to “Budding Times, Inc.” As a result, our trading symbol was changed to “BRCH.”

On May 21, 2020, we engaged in a merger (the “2020 Merger”) with Ealixir Privacy Services, Ltd, Dublin, Ireland, whereby we issued an aggregate of 35,376,126 shares of our Common Stock (post reverse 1:50 stock split) to the stockholders of Ealixir, pro rata to their respective ownership prior to the 2020 Merger. As part of this transaction our stockholders approved a reverse stock split whereby one share of Common Stock was issued for every 25 shares outstanding and adopted an amendment to our Articles of Incorporation, changing our name to “Ealixir, Inc.”. The effective date of the reverse split was July 8, 2020. All references in this Prospectus to our issued and outstanding Common Stock is presented on a post reverse stock split basis unless otherwise indicated.

5

Listing on a National Securities Exchange

Our Common Stock is currently quoted on the OTC Pink Market under the symbol “EAXR.” In connection with this Public Offering, we intend to apply to list our Common Stock on a national securities exchange under the symbol “EAXR.” If our listing application is approved, we expect to list our Common Stock on a national securities exchange upon consummation of the Public Offering, at which point our Common Stock will cease to be traded on the OTC Pink Market. No assurance can be given that our listing application will be approved. The listing requirements of a national securities exchange include, among other things, a stock price threshold. As a result, prior to effectiveness, we will need to take the necessary steps to meet the listing requirements of such national securities exchange. There can be no assurance that our Common Stock will be listed on a national securities exchange.

Corporate Information

Our principal place of business is located at 40 SW 13th Street, Penthouse 1, Miami FL 33130. Our telephone number is (786) 856-0358. Since April 25, 2018, our principal office in Europe is located at Avenida Josep Tarradellas, 38, 08029, Barcelona, Spain.

Recent Developments

The hallmark of Ealixir has always been to maintain leadership in the market of online identity management, through continuous research in the IT field, in order to be able to provide trusted services to companies and individuals. Ealixir recently undertook investments in artificial intelligence technologies that will enable self-diagnostic mechanisms and simple applications to be downloaded onto client smartphones. We anticipate that by next year these applications will enable our clients to analyze their reputational content on the Internet in a quick and effective manner, at a competitive price. This process will enable Ealixir to evaluate and analyze large amounts of data points to ensure our marketing efforts are reaching intended audiences.

Artificial Intelligence

In pursuing the process of strengthening the IT architecture and to broaden its offer of services, the Company recently engaged in a strategic collaboration with an institute for development of artificial intelligence. The cooperation, driven by Ealixir in its inner features, will support several innovative applications and the deployment of new services; in this regard, it is worthy to mention the service ‘ReputScore’, our latest offering, which is designed to offer an immediate and broad overview of a person’s or company’s web reputation; the application scans the Internet to analyze the sentiment which is mostly associated with the client and, then, assigns a score from 1 to 100 (where a higher number denotes a more positive sentiment).

We believe mobile applications has significant growth potential. We expect to offer ReputScore to new and existing clients starting in June 2024. To date, we do not believe that there is an existing app that allows users to measure their online reputation. Once our app launches, we are planning to do an international communication plan

6

to bring awareness of our app in over 20 countries. Since we believe that most of the users who download the app will probably be aware they might have online reputation issues, we forecast for the first year 400,000 downloads for the application and 6,000-7,000 actual new clients onboard (an estimated 0.2 % of new clients over downloads).

The assumption for the 400,000 app downloads is derived from the fact there are close to 100 million profiles on compliance databases and politically-exposed persons (“PEP”) lists that may be interested in our services. A PEP is a person who has been entrusted with a prominent public function. Based upon existing conversion rate for a mobile application user which downloads an application and uses the app, and that a typical conversion rate for visitors to websites is between 2% to 5%, we apply a conservative conversion of 0.4% for downloads of our app. As such, we expect that there will be 400,000 downloads of our app from 100 million interested profiles from compliance databases and PEP lists.

Corporate events (‘Ealixir Event Launch’).

The development of the application is also driven in-house, with limited support by external IT professionals. It gives the client companies the unique opportunity to promote their event on an international scale, providing visibility in more than 1200 online periodicals in 30 countries around the world. In delivering the services, Ealixir works with accredited journalists and PR experts who will develop the most effective editorial plan to promote an event (e.g., the launch of a new product, an important anniversary, or the grand opening of a new office) and draft articles and press releases for distribution in the target countries in authoritative newspapers.

Contracts management

Ealixir considers the operational contract management software (the “Platform”) to be of strategic importance; the Platform was initially developed exclusively in-house. It is regularly updated, and new functions are continuously being developed in order to support the increasing complexity of customer relations, enabling the Company operations to keep not only effective, but ever more distinctive compared to its competitors.

These improvements, which take the form of operational adjustments and the implementation of new functions, although entrusted in the operational component to an external company, are always driven by the Company’s top managers, in order to ensure the committed confidentiality to our clients and the advisable protection of the Company’s know-how.

Sale of Wholly-Owned Subsidiary Ealixir USA Inc.

Pursuant to a Share Purchase Agreement, dated December 31, 2023, by and among Roya Bosch Junia (“Bosch”) and the Company, the Company had sold the entirety of the shares it held in Ealixir USA Inc. (“Ealixir USA”) to Bosch. In consideration of the entirety of the shares of Ealixir USA, Bosch paid the Company a sum of three thousand dollars. Bosch have also agreed to indemnify the Company against any third party claims, suits, actions, demands or judgement brought against Ealixir USA, including those brought by certain Ealixir USA debtors or creditors. The sale of Ealixir USA is the result of the continuous effort of the Company to streamline its processes which allows our management the best use of the available resources and reduce operating costs.

7

SUMMARY OF RISK FACTORS

Our business is subject to multiple risks and uncertainties, as more fully described in “Risk Factors” and elsewhere in this Public Offering Prospectus. We urge you to read “Risk Factors” and this prospectus in full. Our principal risks may be summarized as follows:

We are subject to risks and uncertainties related to our business and Company, including, but are not limited to, the following:

• Although we have generated positive cash flow for the year ended December 31, 2023 and 2022, there can be no assurance that we can continue to generate positive cash flow in the near term.

• We may need to raise additional funds in the future that may not be available on acceptable terms or available at all.

• Our independent auditor has expressed a “going concern” opinion in the 2021 and 2022 audit report.

• We do not currently have an external line of credit facility with any financial institution.

• We are an early-stage company with a business model and marketing strategy still being developed and largely untested.

• Our management and organizational structures are still developing and remain susceptible to error and inefficiencies.

• We have adopted a corporate policy to prohibit our services from being rendered to clients who have been found guilty of committing certain crimes. Any deviation from this policy would result in negative publicity.

• We have significant customer concentration, with a limited number of customers accounting for a substantial portion of our revenues. Failure to attract, grow and retain a diverse and balanced customer base could harm our business and operating results.

• We operate in a highly competitive industry and competitors may compete more effectively.

• If we are unable to keep up with technological developments, our business could be negatively affected.

• If we experience a significant disruption in our information technology systems, including security breaches, or if we fail to implement new systems and software successfully, our business operations and financial condition could be adversely affected.

• We are subject to cyber security risks and may incur delays in platform development in an effort to minimize those risks and to respond to cyber incidents.

• Disruptions to our information technology systems due to cyber-attacks or our failure to upgrade and adjust our information technology systems, may materially impair our operations, hinder our growth and materially and adversely affect our business and results of operations.

• We may be forced to litigate to enforce or defend our intellectual property rights or to protect trade secrets.

• Our officers and directors may be engaged in a range of business activities resulting in conflicts of interest.

• Because we conduct operations in several different countries, we may be affected by currency fluctuations.

• We rely on outside consultants and agents.

• Our expansion into new markets may present increased risks due to our unfamiliarity with those areas and our target customers’ unfamiliarity with our brand.

• If we fail to retain our key personnel or if we fail to attract additional qualified personnel, we may not be able to achieve our anticipated level of growth and our business could suffer.

8

• Changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters could significantly affect our financial results.

• If we are unable to manage any future growth effectively, our profitability and liquidity could be adversely affected.

• Privacy and data protection regulations are complex and rapidly evolving areas. Adverse interpretations of these laws could harm our business, reputation, financial condition, and operating results.

• We operate in numerous countries and are subject to various different laws and regulations which can change significantly which could adversely affect our future business, financial condition and results of operations.

• We may be subject to a various new and existing federal and state law. Adverse interpretations of these laws could harm our business, reputation, financial condition, and operating results.

• A patchwork of laws may negatively impact our ability to render our services.

• Extrajudicial laws may render our services moot.

• Our business depends on continued and unimpeded access to the Internet by us and our users. Internet access providers may be able to restrict, block, degrade, or charge for access to certain of our products and services, which could lead to additional expenses and the loss of users and advertisers.

• If our listing application for our Common Stock is not approved by a national securities exchange, we will not be able to consummate the offering and will terminate this Public Offering.

• Failure to adequately manage our growth could impair our ability to deliver high-quality solutions to our customers, hurt our reputation and compromise our ability to become profitable.

• The loss of key personnel could have a material adverse effect on our business, financial condition or results of operations.

• Our reported financial results may be adversely affected by changes in U.S. GAAP.

• We are subject to risks relating to our information technology systems, and any failure to adequately protect our critical information technology systems could materially affect our operations.

• The success of our Company will depend on relationships with third parties and pre-existing customers of Ealixir which relationships may be affected by customer preferences or public attitudes. Any adverse changes in these relationships could adversely affect our business, financial condition or results of operations.

• We face intense competition, and we may not be able to compete effectively, which could reduce demand for our products and adversely affect our business, growth, revenues and market share.

• Our director, CEO and Secretary, Eleonora Ramondetti, has a substantial influence over our Company. Her interests may not be aligned with the interests of our other stockholders, and she could prevent or cause a change of control or other transactions.

• We are a “controlled company” defined under the Nasdaq Listing Rules and under the rules of the NYSE. Although we do not intend to rely on the “controlled company” exemption under the Nasdaq Listing Rules or the rules of the NYSE, we could elect to rely on this exemption in the future and you will not have the same protection afforded to stockholders of companies that are subject to these corporate governance requirements.

• We have considerable discretion as to the use of the net proceeds from this Public Offering and we may use these proceeds in ways with which you may not agree.

• Because the market for our Common Stock is limited, persons who purchase our Common Stock may not be able to resell their shares at or above the purchase price paid for them.

9

• We may be unable to list our Common Stock on a national securities exchange.

• There is a limited market for our securities, which may make it more difficult to dispose of our securities and we may fail to sustain trading on a national securities exchange, which could make it more difficult for investors to sell their shares.

• An active market for our Common Stock may never develop, and we are under no obligation to seek out a more active market for our Common Stock.

• To date, we have not paid any cash dividends, and no cash dividends will be paid in the foreseeable future.

• Our articles of incorporation allow our Board to create new series of preferred stock without approval by our stockholders, which could adversely affect the rights of the holders of our Common Stock.

• Any adverse effect on the market price of our Common Stock could make it difficult for us to raise additional capital through sales of equity securities at a time and at a price that we deem appropriate.

• Provisions of our Bylaws and Nevada law may delay or prevent a take-over that may not be in the best interests of our stockholders.

• Our future results may vary significantly which may adversely affect the price of our Common Stock.

• We will incur increased costs as a result of operating as a public company, and our management will be required to devote substantial time to compliance requirements of the SEC and a national securities exchange.

• We are an “emerging growth company” and a “smaller reporting company” under the JOBS Act, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies will make our Common Stock less attractive to investors.

• If securities or industry analysts do not publish research or reports about our business, or if they publish a negative report regarding our Common Stock, the price of our Common Stock and trading volume could decline.

• Our existing stockholders will be able to sell their shares after the completion of this Public Offering subject to restrictions under Rule 144 under the Securities Act, which could impact the trading price of our Common Stock.

10

Common Stock offered by us: | [•] shares of Common Stock. | |

Shares of Common Stock Outstanding |

| |

Shares of Common Stock to be Outstanding after this Public Offering |

| |

Use of Proceeds | We estimate that the net proceeds from our issuance and sale of [•] shares of our Common Stock in this Public Offering will be approximately $[•], assuming an initial Offering price of $[•] per share, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. If the underwriters exercise their over-allotment option to purchase additional shares in full to cover over-allotments, if any, we estimate that our net proceeds will be approximately $[•]. We currently anticipate using the net proceeds from this Public Offering, together with our existing resources, for mergers and acquisitions, research and development, acquisition of complementary technologies, hiring of additional personnel and marketing, working capital and general corporate purposes. See the section titled “Use of Proceeds” for additional information. | |

Underwriter Warrants | We have agreed to issue warrants to the representative warrants (“Representative Warrants”) to purchase 8% of total number of the shares of Common Stock sold in this Public Offering. The Underwriter Warrants will have an exercise price equal to 100% of the offering price of the Common Stock sold in this Public Offering. The Representative Warrants are exercisable commencing six (6) months from the effective date of the registration statement of which this Public Offering Prospectus forms a part and will terminate five (5) years after such date. | |

Underwriter Over-Allotment Option | We have also granted to the underwriters an option, exercisable for 45 days from the date of this Public Offering Prospectus, to purchase up to an aggregate of [•] additional Common Stock at the Public Offering price. | |

Lock-up agreements | We, our directors, officers and any other holders of five percent (5%) or more of the outstanding shares of Common Stock of the Company as of the effective date of this registration statement (and all holders of securities exercisable for or convertible into shares of Common Stock) have agreed with the underwriters not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any securities of the Company for a period of six months from the date of this Public Offering Prospectus. See “Underwriting” for more information. | |

Dividend policy | The Company has never paid dividends on its Common Stock and does not anticipate that it will pay dividends in the foreseeable future. It intends to use any future earnings for the expansion of its business. Any future determination of applicable dividends will be made at the discretion of the Board and will depend on the results of operations, financial condition, capital requirements and other factors deemed relevant. See “Dividend Policy.” |

11

Risk Factors | Investing in our Common Stock involves a high degree of risk. For a discussion of factors, you should consider in making an investment, see “Risk Factors” beginning on page 15. | |

Proposed Listing | Our Common Stock is currently quoted on the OTC Pink Open Market operated by OTC Markets Group, Inc. under the ticker symbol “EAXR.” We intend to apply to have our Common Stock listed on a national securities exchange under the same symbol “EAXR”. There is no assurance that such application will be approved. |

Unless we indicate otherwise, the number of shares of our Common Stock that will be outstanding immediately after the Public Offering is based on 60,282,036 shares of our Common Stock outstanding as of April 22, 2024. Except as otherwise indicated herein, all information in this Public Offering Prospectus assumes no exercise by the underwriters of their over-allotment option to purchase additional shares.

12

Summary of Consolidated Financial Information

The following tables summarizes our selected financial data for the periods and as of the dates indicated. The summary statements of operations data for the years ended December 31, 2023 and 2022 are derived from our audited financial statements and related notes included elsewhere in this Public Offering Prospectus. Our historical results are not necessarily indicative of results that may be expected in the future, and the results for the year ended December 31, 2023 are not necessarily indicative of results that may be expected in future periods. You should read the summary financial data together with our financial statements and related notes included elsewhere in this Public Offering Prospectus and the information in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

For the Year Ended | ||||||||

2023 | 2022 | |||||||

Revenue | $ | 5,051,624 |

| $ | 4,140,031 |

| ||

Cost of sales |

| 1,307,492 |

|

| 877,279 |

| ||

Gross profit |

| 3,744,132 |

|

| 3,262,752 |

| ||

|

|

|

| |||||

General and administrative expenses |

| 4,699,986 |

|

| 2,938,708 |

| ||

Advertising and marketing expenses |

| 20,323 |

|

| 53,665 |

| ||

Total operating expenses |

| 4,720,309 |

|

| 2,992,373 |

| ||

Operating loss |

| (976,177 | ) |

| 270,379 |

| ||

|

|

|

| |||||

Other income (expense) |

|

|

|

| ||||

Loss on disposition – subsidiaries |

| (359,851 | ) |

| — |

| ||

Loss on foreign exchange |

| — |

|

| (83,419 | ) | ||

Gain on forgiveness of debt |

| 4,882 |

|

| — |

| ||

Interest expense |

| (35,222 | ) |

| (26,836 | ) | ||

Total other income (expense) |

| (390,191 | ) |

| (110,255 | ) | ||

|

|

|

| |||||

Loss before income tax |

| (1,366,368 | ) |

| 160,124 |

| ||

Provision for income taxes |

| 515,664 |

|

| 20,358 |

| ||

Net income (loss) | $ | (850,704 | ) | $ | 139,766 |

| ||

|

|

|

| |||||

Other comprehensive income (loss), net of tax |

|

|

|

| ||||

Foreign exchange (income) expense | $ | 89,943 |

| $ | 97,910 |

| ||

Comprehensive income/(loss) |

| (940,647 | ) |

| 41,856 |

| ||

Comprehensive income/(loss) attributable to Ealixir, Inc. stockholders | $ | (940,647 | ) | $ | 41,856 |

| ||

13

Selected Balance Sheet Data

For the Year Ended | |||||||

2023 | 2022 | ||||||

Assets |

|

|

| ||||

Current assets |

|

|

| ||||

Cash | $ | 53,114 | $ | 113,155 |

| ||

Accounts receivable, net |

| 1,349,160 |

| 1,408,760 |

| ||

Total current assets |

| 1,754,353 |

| 1,621,558 |

| ||

Total assets | $ | 2,737,892 | $ | 2,045,979 |

| ||

|

|

| |||||

Liabilities and stockholders’ deficit |

|

|

| ||||

Current liabilities |

|

|

| ||||

Deferred revenue |

| 687,952 |

| 867,360 |

| ||

Other current liabilities |

| 20,378 |

| — |

| ||

Total current liabilities |

| 2,685,358 |

| 2,257,475 |

| ||

|

|

| |||||

Loan from stockholder |

| — |

| 299,673 |

| ||

Total liabilities |

| 2,735,394 |

| 2,674,065 |

| ||

|

|

| |||||

Stockholders’ deficit: |

|

|

| ||||

Total stockholders’ deficit |

| 2,498 |

| (628,086 | ) | ||

Total liabilities and stockholders’ deficit | $ | 2,737,892 | $ | 2,045,979 |

| ||

14

An investment in our Common Stock involves a high degree of risk. Before making an investment decision, you should carefully consider the following risk factors, which address the material risks concerning our business and an investment in our Common Stock, together with the other information contained in this Public Offering Prospectus. If any of the risks discussed in this Public Offering Prospectus occur, our business, prospects, liquidity, financial condition and results of operations could be materially and adversely affected, in which case the trading price of our Common Stock could decline significantly, and you could lose all or part of your investment. Some statements in this Public Offering Prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Company

Although we have generated positive cash flow for the year ended December 31, 2023 and 2022, there can be no assurance that we can continue to generate positive cash flow in the near term.

We provided net cash for operating activities of $405,858 and used $97,521 for the years ended December 31, 2023 and 2022, respectively. However, there can be no assurance that we can continue to generate positive cash flow in the near term from operations. As such, the Company may need additional financing to execute its business plan. If additional financing is required, the Company cannot predict whether this additional financing will be in the form of equity, debt, or another form, and the Company may not be able to obtain the necessary additional capital on a timely basis, on acceptable terms, or at all.

We may need to raise additional funds in the future that may not be available on acceptable terms or available at all.

We may consider issuing additional debt or equity securities in the future to fund our business plan, for potential investment acquisitions, or general corporate purposes. If we issue equity or convertible debt securities to raise additional funds, our existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences, and privileges senior to those of our existing stockholders. If we incur additional debt, it may increase our leverage relative to our earnings or to our equity capitalization, requiring us to pay additional interest expenses. We may not be able to obtain financing on favorable terms, or at all, in which case, we may not be able to develop or enhance our products, execute our business plan, take advantage of future opportunities, or respond to competitive pressures.

Our independent auditor has expressed a “going concern” opinion.

The report of our independent auditor that accompanies our 2023 consolidated financial statements includes an explanatory paragraph indicating a substantial doubt about our ability to continue as a going concern, citing our need for additional capital for the future planned expansion of our activities and to service our ordinary course activities (which may include servicing of indebtedness). Our financial statements have been prepared assuming that we will continue as a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The financial statements do not include any adjustment that might result from the outcome of this uncertainty. We have a minimal operating history and minimal revenues or earnings from operations. We have no significant assets or financial resources. We will, in all likelihood, sustain operating expenses without corresponding revenues for the immediate future.

For the year ended December 31, 2023, we had a net loss of $940,647. Based upon our current business plan, our ability to continue generating profits from operations is dependent upon increasing sales. However, there can be no assurance that we will continue to establish profitable operations. As we pursue our business plan, we are incurring significant expenses without corresponding revenues. In the event that we remain unable to generate significant revenues to pay our operating expenses, we will not be able to achieve profitability or continue operations.

Further, the inclusion of a going concern explanatory paragraph in the report of our independent auditor will make it more difficult for us to secure additional financing or enter into strategic relationships on terms acceptable to us, if at all, and likely will materially and adversely affect the terms of any financing that we might obtain. If we are not successful in generating sufficient revenues or raising additional capital, we may not have enough financial resources to support our business and operations and, as a result, may not be able to continue as a going concern and could be forced to liquidate.

15

We do not currently have an external line of credit facility with any financial institution.

As indicated above, we have estimated that we may need additional capital to generate profits from operations. To finance these capital requirements we may need, among other sources, credit facilities from financial institutions. If we attempted to establish an external line of credit in the future, there can be no assurances we will be able to do so. We also have limited assets available to secure such a line of credit. The failure to obtain an external line of credit could have a negative impact on our ability to generate profits.

We are an early-stage company with a business model and marketing strategy still being developed and largely untested.

We were incorporated in June 2019, and we are pursuing a business model which is innovative and largely untested. There is no assurance that a sustainable market for our products and services exists, or that we will be able to develop effective business and market strategies to seize these market opportunities. In turn, this would have a negative impact on our financial condition and share price.

Our management and organizational structures are still developing and remain susceptible to error and inefficiencies.

Because of the fact that we are an early-stage company, we are still in the process of hiring senior management and lower-level employees, adopting organizational structures and code of conducts, and expanding into new geographical markets and industry segments. These processes are susceptible to error which could result in delays and inefficiencies in the pursuit of our commercial strategy or in the implementation of our business model, and/or in cost overruns and loss of potential customers. Management, technical, scientific, research and marketing personnel with appropriate training may also be scarce resources and thus not easy to hire. Any of these events would have in turn an adverse effect on our business and financial condition.

We have adopted a corporate policy to prohibit our services from being rendered to clients who have been found guilty of committing certain crimes. Any deviation from this policy would result in negative publicity.

We have voluntarily adopted a corporate policy pursuant to which we will not render services to clients who have been found guilty in the past of committing crimes related to drugs, criminal organizations or violence against women or minors. We have instituted certain controls and procedures to enforce this policy, including using internal technologies aimed at customer due diligence and compliance databases. If we fail to observe this policy we could suffer negative publicity which would have an adverse effect on our business and financial condition.