UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 29, 2006.

OR

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission File Number 0-18655

EXPONENT, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 77-0218904 |

(State or other jurisdiction of incorporation or organization) | | (IRS employer identification no.) |

149 Commonwealth Drive, Menlo Park, California 94025

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (650) 326-9400

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant based on the closing sales price of the Common Stock as reported on the NASDAQ National Market on June 30, 2006, the last business day of the registrant’s most recently completed second quarter, was $218,402,435. Shares of the registrant’s common stock held by each executive officer and director and by each entity or person that, to the registrant’s knowledge, owned 10% or more of registrant’s outstanding common stock as of June 30, 2006 have been excluded in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the issuer’s Common Stock outstanding as of February 23, 2007 was 14,786,424.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement for the Registrant’s 2007 Annual Meeting of Stockholders to be held on May 22, 2007, are incorporated by reference into Part III of this Form 10-K.

EXPONENT, INC.

FORM 10-K ANNUAL REPORT

FISCAL YEAR ENDED DECEMBER 29, 2006

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains, and incorporates by reference, certain “forward-looking” statements (as such term is defined in the Private Securities Litigation Reform Act of 1995, and the rules promulgated pursuant to the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended thereto under) that are based on the beliefs of the Company’s management, as well as assumptions made by, and information currently available to, the Company’s management. Such forward-looking statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. When used in this document and in the documents incorporated herein by reference, statements other than statements of current

or historical fact are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect” and similar expressions, as they relate to the Company or its management, identify certain of such forward-looking statements. Such statements reflect the current views of the Company or its management with respect to future events and are subject to certain risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, the Company’s actual results, performance, or achievements could differ materially from those expressed in, or implied by, any such forward-looking statements. Factors that could cause or contribute to such material differences include the possibility that the demand for our services may decline as a result of changes in general and industry

2

specific economic conditions, the timing of engagements for our services, the effects of competitive services and pricing, tort reform and liabilities resulting from claims made against us. Additional risks and uncertainties are discussed in this Report under the heading “Risk Factors” and elsewhere. The inclusion of such forward-looking information should not be regarded as a representation by the Company or any other person that the future events, plans, or expectations contemplated by the Company will be achieved. The Company undertakes no obligation to update or revise any such forward-looking statements.

PART I

Item 1. Business

GENERAL

The inception of Exponent, Inc. goes back to 1967, with the founding of the partnership Failure Analysis Associates, which was incorporated the following year in California and reincorporated in Delaware as Failure Analysis Associates, Inc. in 1988. The Failure Group, Inc. was organized in 1989 as a holding company for Failure Analysis Associates, Inc. and changed its name to Exponent, Inc. in 1998. Exponent, Inc. (together with its subsidiaries, “Exponent” or the “Company”), is a science and engineering consulting firm that provides solutions to complex problems. Our multidisciplinary team of scientists, physicians, engineers, business and regulatory consultants brings together more than 90 different technical disciplines to solve complicated issues facing industry and government today. Our professional staff can perform in-depth scientific research and analysis, or very rapid-response evaluations to provide our clients with the critical information they need.

CLIENTS

General

Exponent serves clients in automotive, aviation, chemical, construction, consumer products, energy, government, health, insurance, manufacturing, technology and other sectors of the economy. Many of our engagements are initiated directly with large corporations or by lawyers or insurance companies, whose clients anticipate, or are engaged in, litigation related to their products, equipment or service. Our services in failure prevention and technology evaluation have grown as the technological complexity of products has increased over the years.

Pricing and Terms of Engagements

We generally provide our services on either a fixed-price basis or on a “time and expenses” basis, charging hourly rates for each staff member involved in a project, based on his or her skills and experience. Our standard rates for professionals range from $90 to $800 per hour. Our engagement agreements typically provide for monthly billing, require payment of our invoices within 30 days of receipt and permit clients to terminate engagements at any time. Clients normally agree to indemnify us and our personnel against liabilities arising out of the use or application of the results of our work or recommendations.

SERVICES

In 2007, the firm celebrates 40 years of technical excellence. From its beginning in 1967, it has expanded its service offerings from mechanical engineering and materials science to over 90 technical disciplines. Exponent’s service offerings are provided on a project-by-project basis. Many projects require support from multiple practices. We currently operate 19 practices and centers, including:

| | • | | Construction Consulting |

| | • | | Electrical & Semiconductors |

| | • | | Center for Chemical Registration and Food Safety |

| | • | | Center for Epidemiology, Biostatistics and Computational Biology |

| | • | | Center for Toxicology and Mechanistic Biology |

| | • | | Center for Exposure Assessment and Dose Reconstruction |

| | • | | Center for Public Health and Industrial Hygiene |

| | • | | Mechanical Engineering & Materials Science |

| | • | | Statistical & Data Sciences |

3

Biomechanics

Exponent’s Biomechanics staff uses engineering and biomedical science to explore the cause, nature and severity of injuries, and evaluate the performance of medical devices. The type and distribution of injuries, combined with our extensive experience in human injury tolerance, allows us to determine the forces and motions that must have occurred to produce the injuries. Through close interaction with our Vehicle Analysis and Human Factors practices, our consultants analyze the human’s overall role in an accident, including assessments of the likelihood, causation and severity of the accident.

In 2006, our staff published a study on joint replacements with the American Academy of Orthopaedic Surgeons (AAOS). As presented at the 73rd Annual Meeting of the AAOS, the study projects the number of hip and knee replacement procedures that will be performed in the United States through the year 2030. It was projected that the number of procedures for primary (first-time) total knee replacement would jump by almost 700 percent in 2030. The number of primary total hip replacements will increase by nearly 200 percent in 2030. Partial joint replacements were projected to increase by only 54 percent. Also expected to become more prevalent is the repair or replacement of the artificial joint, called revision joint replacement. The number of revision surgeries likely will double by 2015 for total knee replacement and by 2026 for total hip replacement, Currently, hip revisions outnumber knee revisions, but knee revisions should surpass hip revisions after 2007. The research team based its projections on historical procedure rates from 1990 to 2003, combined with population projections from the U.S. Census Bureau.

Civil Engineering

Exponent has over 25 years experience investigating all types of structural, geotechnical, hydrological, construction and building problems, from major catastrophes to simple performance failures. Our rigorous technical analysis of these problems provides our clients with a thorough assessment of damage, as well as expert analysis of causation to be used for purposes of retrofit, repair, claims adjustment, or litigation. In addition, we use our expertise to help clients avoid failures with services such as vulnerability assessments of their facilities, development of appropriate mitigation measures, and development of solutions to challenging development and design problems.

During 2006 our consultants assisted commercial, industrial and insurance clients with failure investigations and damage assessments at more than five hundred land-based and offshore sites in Louisiana, Mississippi and Alabama. Following the October 15, 2006 earthquake off the Big Island of Hawaii, we performed structural and geotechnical evaluations for insurers and corporate clients. Our hydrologists are also addressing some of the key issues in floodplain management such as delineation of flood hazards, and the identification of possible measures to mitigate potential impacts.

Construction Consulting

Exponent’s Construction Consulting practice provides construction management services to clients through all phases of the project life cycle, and, if necessary, through dispute resolution. Exponent’s engineers, cost accountants, architects and scientists provide these services to both the public and private sectors, supporting our client’s project staff through all phases of the design and construction process. Our staff identifies and evaluates construction processes and issues related to scope changes, schedule delays, production disruptions and inefficiencies, as well as the costs associated with these types of issues. They also identify the risks associated with large-scale, complex construction projects and the proactive measures to take to avoid potential obstacles.

In 2006, Exponent’s Construction Consulting practice continued to add staff and expand their construction dispute resolution services. In one particular matter Exponent was retained by a subcontractor who was being accused by the general contractor of delaying the completion of a project, which consisted of a 62 acre residential development with 324 living units in 28 three-story, wood framed buildings, and a community clubhouse and pool. Exponent analyzed the project’s schedule record to determine the project’s as-built critical path, and subsequently, quantify delays experienced along that path. In addition, Exponent analyzed and calculated the subcontractor’s extended performance costs incurred as a result of seven months of overall project delay.

EcoSciences

Exponent’s ecological scientists provide proven, cost-effective and scientifically defensible solutions to complex issues. State and federal trustees are pursuing natural resource damage claims more aggressively than in the past. Natural resource damages are a corporate environmental liability beyond cleanup or response actions. Damage claims

4

can be very large, and settlement or litigation costs correspondingly high. Exponent assists clients in optimizing costs associated with claims for damages to natural resources, while still protecting the environment.

At the end of 2006, the practice added a new practice director and six consultants from Charles Menzie and Associates, a Boston-based environmental consulting practice. Their addition adds greatly to the firm’s ability to assess environmental fate and effects of physical, biological, and chemical stressors on terrestrial and aquatic systems.

Electrical & Semiconductors

In the age of electronics, Exponent continues to be a highly sought-after resource for understanding current and potential risks involving electrical and electronic components. Our team of electrical engineers performs a wide array of investigations ranging from electric power systems to semiconductor devices. We operate laboratories for testing both heavy equipment and light electronic equipment, and use computers and specialized software to analyze electric power systems, circuits and other equipment configurations.

Over the past year, our office in China expanded its ability to provide independent manufacturing audit services for U.S. entities with manufacturing facilities in China. The safety evaluations of clients’ pre-production products continued in the U.S. as well. These are performed to minimize corporate risk as well as help to reduce warranty claims and product recalls. Products are evaluated based on the client’s safety specifications and also Exponent’s expertise in the field.We also operate a specialized laboratory in Phoenix for safety assessment of lithium ion and other battery storage systems.

Environmental Sciences

Exponent’s environmental scientists and engineers provide proven, cost-effective, scientifically defensible and realistic assessments and solutions to complex environmental issues. We offer technical, regulatory and litigation support to industries that include mining and minerals, petrochemicals, forest products, shipbuilding, railroads, aerospace, and defense and trade associations. Our consultants also address hydrological issues related to new housing and office complex developments around the country.

In 2006, the practice began looking into environmental and health impacts related to coal fire power plants. According to reports, 153 new coal-fired power plants are currently proposed. Given the

concurrent “boom” in general concern over mercury in the environment and, specifically, atmospheric emissions from coal-fired power plants, the transport, fate, and effects of mercury will be a significant issue for most proposed plants. Our consultants have been outlining some of the key technical issues related to mercury emissions as well as identifying some of the key issues related to evaluation of the effects of increased mercury deposition on human health and the environment.

Health Sciences

Exponent’s Health Sciences group is comprised of 5 centers as described on the previous page and specializes in solving complex health problems that require an experienced team of multidisciplined health professionals. Our epidemiologists, physicians, toxicologists, statisticians, industrial hygienists and other health care professionals apply innovative techniques to help clients address a variety of issues. These include environmental and occupational epidemiology, pharmacoepidemiology, industrial hygiene, emergency response and risk assessment. Exponent applies sophisticated approaches in study design, statistical analysis, exposure assessment and medical causation to examine a variety of health issues.

In June 2006, we added a new Group Vice President, Dr. Elizabeth Anderson, to lead our Health Sciences group. Dr. Anderson is an internationally recognized health scientist with over 30 years’ experience in health and environmental sciences. One area of research that the group has been working on over the past year is the effect of nanomaterials on human health. By the end of 2006, nearly 400 consumer products were identified as containing nanoengineered materials. Nanotechnology involves working with matter on a very small scale, loosely defined as <100 nm in at least one dimension. Amid the excitement generated by the promising application of these miraculous technologies, concern has mounted over the limited understanding of potential product failures, nanomaterial releases, their effect on human health and the environment, and the lack of regulatory guidance specific to nanoengineered particles. Creation of safe, beneficial products containing nanomaterials involves a blending of materials sciences and product engineering with health and environmental sciences to help ensure that the full potential of this technology is realized.

Our Center for Chemical Registration and Food Safety includes experienced staff of both technical and regulatory specialists who are experienced in dealing

5

with foods, and with pesticide and non-pesticide products including conventional chemicals, biochemicals, microbials and products of biotechnology. We provide practical, creative, scientific and regulatory support to meet global business objectives at every stage of the product cycle, from R&D to retail. During the past year we recruited significantly in the area of food safety and food borne illness and added several former members of the U.S. Food & Drug Administration to our staff.

During the past year, the Center for Chemical Registration and Food Safety continued to work with a number of European biocides manufacturers to evaluate data, produce data waiver argumentation, conduct human and environmental risk assessments, and produce summary dossiers of data that are required for ongoing regulatory review in Europe. In addition, we completed a study of the relationship between flavonoid intake and cardiovascular disease. Flavonoids are a class of antioxidant compound found in a number of plant foods, including vegetables, tea, wine, nuts, seeds, herbs and spices. The study found that dietary intake of flavones and anthocyanidins, and certain foods rich in flavonoids, appear to reduce the risk of death due to coronary heart disease and cardiovascular disease.

Human Factors

Our Human Factors practice analyzes human cognition and behavior to guide product design decisions to provide better product safety and usability.Working in conjunction with other Exponent practices, our scientists look at ways to improve product design, as well as review safety information and training to help change human behavior and reduce accidents. At the 2006 annual meeting of the Human Factors and Ergonomics Society, the group presented its finding on driver inattention related to backseat occupant behavior. The publication, “Who’s in the Back Seat? A Study of Driver Inattention.” discussed the difficulty of detecting objects in a scene to people who are already expecting to see them and are aware of the objects’ presence. Visual performance limitations, environmental expectations and “inattentional blindness” effects were some of the causes that contributed to driver’s inability to see things around them – sometimes leading to tragic consequences.

Industrial Structures

Our Industrial Structures practice, based in Düsseldorf, Germany, specializes in design and assessment of industrial concrete structures subject to extreme conditions. Exponent’s Düsseldorf office has provided design reviews and assessments on

more than 800 structures around the world, and our staff has participated in the creation of several engineering standards.

Mechanical Engineering & Materials Science

As the largest technical practice at Exponent, our mechanical engineers and materials scientists have both an academic and “real-world” understanding of their field, including reliability and hazard evaluation, design assessment and materials life prediction. We routinely work with manufacturers to assess risks to their products during their design and manufacturing phases of product development. In addition, we help manufacturers analyze allegations of defective design by the federal regulatory agencies such as the Consumer Product Safety Commission.

In 2006, our mechanical engineers and materials scientists worked on a number of international projects including projects in South America, the European Union and the Middle East. We also assisted a major electronic consumer product manufacturer analyze the design of products it planned to introduce into the market to assess potential failure and other risk mechanisms.

By using a multidisciplinary approach involving staff from a wide range of disciplines, we continue to provide independent third party consulting services to battery and component manufacturers and suppliers. These services cover the entire field of portable power: basic electrochemistry and cell design fundamentals, cell manufacturing and quality control, battery pack design evaluation and testing, regulatory compliance, failure analysis and disposal/recycling issues.

Statistical & Data Sciences

All living humans continually bear a certain degree of risk of injury or death. Exponent’s Statistical & Data Sciences (formerly Data/Risk Analysis) practice specializes in determining whether a particular activity or product poses an unreasonable risk. Risk estimation involves establishing a reference period and then collecting information about the number of injuries (or other adverse events) suffered and the amount of exposure during this period.

Exponent recently developed and proposed the design of an experimental study to determine which concrete mixes will possess minimum permeability at cryogenic temperatures. Factors of interest included water/cement ratio, age at filling, and percent of silica. Observations at systematically chosen factor-level combinations can be used to estimate the response surface and the manufacturing settings that will produce optimum results. Planning for implementation of the study is underway.

6

Technology Development

Drawing on our multidisciplinary engineering, testing and failure analysis and prevention expertise, our Technology Development practice specializes in harnessing commercial technologies to develop effective military equipment and systems. In 2006, we continued to support the U.S. Army’s efforts in Afghanistan and Iraq. In the field, our engineers are assisting the Rapid Equipping Force develop technical solutions related to combat issues. We continue to supply the U.S. Army with MARCbot – our multifunction, agile remote controlled robot for use in reconnaissance missions. Finally, we have been working with the U.S. Navy on a Network-Enabled Anti-Submarine Warfare (NEASW) sensor system. The NEASW system establishes a submarine barrier with a high probability of detection. Various configurations of the system can serve different strategic objectives: a barrier across a chokepoint, a perimeter around a sea base, or even a means of confirming and prosecuting submarines detected but not localized by a different sensor system. The system is currently under evaluation by the U.S. Navy.

Thermal Sciences

Exponent has investigated and analyzed thousands of fires and explosions ranging from high loss disasters at manufacturing facilities to small insurance claims. Information gained from these analyses has helped us assist clients in assessing preventative measures related to the design of their products.

In 2006, Exponent worked on a number of facility upsets, residential and commercial fires and fire protection evaluations. One of the more significant investigations was of the Buncefield Oil Storage Depot in the United Kingdom. On December 11, 2005, an explosion and fire occurred at Buncefield Oil Storage Depot, outside of London. The explosion measured 2.4 on the Richter scale and caused severe damage to neighboring buildings, and damaged windows over a mile from the site. The incident has been called one of the largest fires in Europe since World War II and caused large smoke plumes over Southern England. Despite the significant damage caused by the event there were no fatalities or serious injuries.

Vehicle Analysis

Our Vehicle Analysis practice provides design analysis, vehicle crash testing, component testing and accident reconstruction services to clients developing new automotive products, facing unexpected performance issues, or seeking information on how an accident occurred. At our 147-acre Test and Engineering Center in Phoenix, Arizona, we develop unique test protocols using proprietary tests developed by our consulting staff.

In 2006, we continued to develop expertise in the analysis of the Event Data Recorder (EDR), which is a device installed in a motor vehicle to record technical vehicle and occupant information for a brief period of time (seconds, not minutes) before, during and after a crash. For instance, EDRs may record (1) pre-crash vehicle dynamics and system status, (2) driver inputs, (3) vehicle crash signature, (4) restraint usage/deployment status, and (5) post-crash data such as the activation of an automatic collision notification (ACN) system. In the October 2006 edition of the SAE Magazine,Automotive Engineering International, Exponent consultants published an article entitled “EDR’s (Event Data Recorders) take to the road”. In the article, we discussed the development of a new SAE Recommended Practice for heavy vehicle EDRs.

Visual Communications

The Visual Communications practice combines art and science to help clients create compelling, fact-based visual displays that communicate complex subject matter, conveying important information to audiences unfamiliar with the matters at hand. Specific components include animation, graphics, multimedia and photography.

COMPETITION

The marketplace for our services is fragmented and we face different sources of competition in providing various services. In addition, the services that we provide to some of our clients can be performed in-house by those clients. However, because of liability and independence concerns, clients that have the capability to perform such services themselves often retain Exponent or other independent consultants.

7

In each of the foregoing practices, we believe that the principal competitive factors are: technical capability and breadth of services, ability to deliver services on a timely basis, professional reputation and knowledge of the litigation process. Although we believe that we generally compete favorably in each of these areas, some of our competitors may be able to provide services acceptable to our clients at lower prices.

We believe that the barriers to entry in particular areas of engineering expertise are low and that for many of our technical disciplines, competition is increasing. In response to competitive forces in the marketplace, we continue to explore new markets for our various technical disciplines.

EMPLOYEES

As of December 29, 2006, we employed 835 full-time and part-time employees, including 548

engineering and scientific staff, 110 technical support staff and 177 administrative and support staff. Our staff includes 453 employees with advanced degrees, of which 268 employees have achieved the level of Ph.D. or M.D.

ADDITIONAL INFORMATION

The address of our internet website is www.exponent.com. We make available, free of charge through our website, access to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other periodic SEC reports, along with amendments to all of those reports, as soon as reasonably practicable after we file the reports with the SEC. The content of our internet website is not incorporated into and is not part of this Annual Report on Form 10-K.

8

EXECUTIVE OFFICERS

The executive officers of Exponent and their ages as of March 7, 2007 are as follows:

| | | | |

Name | | Age | | Position |

| Michael R. Gaulke | | 61 | | President, Chief Executive Officer and Director |

| | |

| Elizabeth L. Anderson, Ph.D. | | 67 | | Group Vice President |

| | |

| Paul D. Boehm, Ph.D. | | 58 | | Group Vice President |

| | |

| Robert D. Caligiuri, Ph.D. | | 55 | | Group Vice President |

| | |

| Paul R. Johnston, Ph.D. | | 53 | | Chief Operating Officer |

| | |

| Subbaiah V. Malladi, Ph.D. | | 60 | | Chief Technical Officer |

| | |

| John E. Moalli, Sc.D. | | 42 | | Group Vice President |

| | |

| John D. Osteraas, Ph.D. | | 53 | | Group Vice President |

| | |

| Richard L. Schlenker, Jr. | | 41 | | Chief Financial Officer and Corporate Secretary |

Executive officers of Exponent are appointed by the Board of Directors and serve at the discretion of the Board or until the appointment of their successors. There is no family relationship between any of the directors and officers of the Company.

Michael R. Gaulke joined the Company in September 1992, as Executive Vice President and Chief Financial Officer. He was named President in March 1993 and he was appointed as a member of the Board of Directors of the Company in January 1994. He assumed his current role of President and Chief Executive Officer in June 1996. From November 1988 to September 1992, Mr. Gaulke served as Executive Vice President and Chief Financial Officer at Raynet Corporation, a subsidiary of Raychem Corporation. Prior to joining Raynet, Mr. Gaulke was Executive Vice President and Chief Financial Officer of Spectra Physics, Inc., where he was employed from 1979 to 1988. From 1972 to 1979, Mr. Gaulke served as a consultant with McKinsey & Company. Mr. Gaulke is a member of the Board of Directors of Cymer, Inc. and LECG Corporation and serves on the Board of Trustees of the Palo Alto Medical Foundation. Mr. Gaulke received an M.B.A. (1972) in Marketing and Operations from the Stanford University Graduate School of Business and a B.S. (1968) in Electrical Engineering from Oregon State University.

Elizabeth L. Anderson, Ph.D., joined the Company in June 2006 as a Group Vice President. Prior to joining Exponent, Dr. Anderson was President and CEO of Sciences International, a health and environmental consulting firm. Dr. Anderson received her Ph.D. (1970) in Organic Chemistry from The American University, M.S. (1964) in Organic Chemistry from the University of Virginia and B.S. (1962) in Chemistry from the College of William and Mary. Dr. Anderson is a Fellow of the Academy of Toxicological Sciences, founder and past-President of the Society for Risk Analysis and Editor-in-Chief of the journal, Risk Analysis: An International Journal.

Paul D. Boehm, Ph.D., joined the Company in April 2004 as a Group Vice President. Prior to joining the Company, Dr. Boehm was Vice President and Market Manager, Oil and Gas Sector, at Battelle Memorial Institute from 2001 to 2004. From 1999 to 2001, Dr. Boehm was Vice President and Managing Director, Environmental Health and Safety Consulting at Arthur D. Little, Inc. Dr. Boehm received his Ph.D. (1977) and M.S. (1973) in Oceanography from the University of Rhode Island and B.S. (1970) in Chemical Engineering from the University of Rochester. Dr. Boehm has published more than 100 articles in peer-reviewed journals and authored numerous reports on environmental forensics and impact assessments. Dr. Boehm has been chosen to serve on several National Research Council panels.

9

Robert D. Caligiuri, Ph.D., joined the Company in 1987. He was promoted to Principal Engineer in 1990 and Group Vice President in 1999. Dr. Caligiuri received his Ph.D. (1977) and M.S. (1974) in Materials Science and Engineering from Stanford University and B.S. (1973) in Mechanical Engineering from the University of California, Davis. Prior to joining the Company he was a Program Manager and Materials Scientist for SRI International. He is a Registered Professional Metallurgical Engineer in the State of California, a Licensed Professional Engineer in the State of Utah and is a Fellow of the American Society for Materials.

Paul R. Johnston, Ph.D.,joined the Company in 1981, was promoted to Principal Engineer in 1987, and to Vice President in 1996. In 1997, he assumed responsibility for the firm’s network of offices. In July 2003, he was appointed Chief Operating Officer and added responsibility for the Health and Environmental Groups. In 2006, he assumed line responsibility for all of the firm’s consulting groups. He received his Ph.D. (1981) in Civil Engineering and M.S. (1977) in Structural Engineering from Stanford University. He received his B.A.I. (1976) in Civil Engineering with First Class Honors from Trinity College, University of Dublin, Ireland where he was elected a Foundation Scholar in 1975. Dr. Johnston is a Registered Professional Civil Engineer in the State of California and a Chartered Engineer in Ireland.

Subbaiah V. Malladi, Ph.D., joined the Company in 1982 as a Senior Engineer, becoming a Senior Vice President in January 1988 and a Corporate Vice President in September 1993. In October 1998, Dr. Malladi was appointed Chief Technical Officer of the Company. Dr. Malladi also served as a Director of the Company from March 1991 through September 1993. He was re-appointed as a Director in April 1996 and served on the Board until May 2005. He received a Ph.D. (1980) in Mechanical Engineering from the California Institute of Technology, M.Tech (1972) in Mechanical Engineering from the Indian Institute of Technology, B.E. (1970) in Mechanical Engineering from SRI Venkateswara University, India and B.S. (1966) in Physics, Chemistry and Mathematics from Osmania University, India. Dr. Malladi is a Registered Professional Mechanical Engineer in the State of California.

John E. Moalli, Sc.D., joined the Company in 1992. He was promoted to Principal Engineer in 1997 and Group Vice President in 2002. Dr. Moalli received his Sc.D. (1992) in Polymers from the Massachusetts Institute of Technology and B.S. (1987) in Civil Engineering from Northeastern University. He is a member of the Society for the Plastics Industry, Society for Plastics Engineers and a member of the Editorial Advisory Board of Medical Plastics and Biomaterials.

John D. Osteraas, Ph.D. joined the Company in 1990. He was promoted to Principal Engineer in 1992 and Group Vice President in 2006. Dr. Osteraas received his Ph.D. (1990) in Civil Engineering and M.S. (1977) in Civil Engineering: Structural Engineering from Stanford University and B.S. (1976) in Civil and Environmental Engineering from the University of Wisconsin. Dr. Osteraas is a Registered Professional Engineer in nine states and is a Fellow of the American Society of Civil Engineers.

Richard L. Schlenker, Jr. joined the Company in 1990. Mr. Schlenker is the Chief Financial Officer and Corporate Secretary of the Company. He was appointed Chief Financial Officer in July 1999 and was appointed Secretary of the Company in November 1997. Mr. Schlenker was the Director of Human Resources from 1998 until his appointment as CFO. He was the Manager of Corporate Development from 1996 until 1998. From 1993 to 1996, Mr. Schlenker was a Business Manager, where he managed the business activities for multiple consulting practices within the Company. Prior to 1993, he held several different positions in finance and accounting within the Company. Mr. Schlenker holds a B.S. in Finance from the University of Southern California.

10

Item 1A. Risk Factors

Exponent operates in a rapidly changing environment that involves a number of uncertainties, some of which are beyond our control. These uncertainties include, but are not limited to, those mentioned elsewhere in this report and the following:

Absence of Backlog

Revenues are primarily derived from services provided in response to client requests or events that occur without notice, and engagements, generally billed as services are performed, are terminable or subject to postponement or delay at any time by clients. As a result, backlog at any particular time is small in relation to our quarterly or annual revenues and is not a reliable indicator of revenues for any future periods. Revenues and operating margins for any particular quarter are generally affected by staffing mix, resource requirements and timing and size of engagements.

Attraction and Retention of Key Employees

Exponent’s business involves the delivery of professional services and is labor-intensive. Our success depends in large part upon our ability to attract, retain and motivate highly qualified technical and managerial personnel. Qualified personnel are in great demand and are likely to remain a limited resource for the foreseeable future. We cannot provide any assurance that we can continue to attract sufficient numbers of highly qualified technical and managerial personnel and to retain existing employees. The loss of key managerial employees or any significant number of employees could have a material adverse impact on our business, including our ability to secure and complete engagements.

Competition

The markets for our services are highly competitive. In addition, there are relatively low barriers to entry into our markets and we have faced, and expect to continue to face, additional competition from new entrants into our markets. Competitive pressure could reduce the market acceptance of our services and result in price reductions that could have a material adverse effect on our business, financial condition or results of operations.

Customer Concentration

We currently derive and believe that we will continue to derive a significant portion of our revenues from clients, organizations and insurers related to the transportation industry. Transportation industry related engagements accounted for approximately 17% of our revenues for the fiscal year ended

December 29, 2006. In addition, we performed engagements for the government sector, which accounted for approximately 10% of our revenues for the fiscal year ended December 29, 2006. The loss of any large client, organization or insurer related to either the transportation industry or government sector could have a material adverse effect on our business, financial condition or results of operations.

Economic Uncertainty

The markets that we serve are cyclical and subject to general economic conditions, particularly in light of the labor-intensive nature of our business and our relatively high compensation expenses. If the economy in which we operate, which is predominately in the U.S., were to experience a prolonged slowdown, demand for our services could be reduced considerably.

Professional Reputation

The professional reputation of Exponent and its consultants is critical to our ability to successfully compete for new client engagements and attract or retain professionals. Any factors that damage our professional reputation could have a material adverse effect on our business.

Regulation

Public concern over health, safety and preservation of the environment has resulted in the enactment of a broad range of environmental and/or other laws and regulations by local, state and federal lawmakers and agencies. These laws and the implementing regulations affect nearly every industry, as well as the agencies of federal, state and local governments charged with their enforcement. To the extent changes in such laws, regulations and enforcement or other factors significantly reduce the exposures of manufacturers, owners, service providers and others to liability, the demand for our services may be significantly reduced.

Tort Reform

Several of our practices have a significant concentration in litigation support consulting services. To the extent tort reform reduces the exposure of manufacturers, owners, service providers and others to liability, the demand for our litigation support consulting services may be significantly reduced.

Variability of Quarterly Financial Results

Variations in our revenues and operating results occur from time to time, as a result of a number of factors, such as the significance of client engagements commenced and completed during a

11

quarter, the timing of engagements, the number of working days in a quarter, employee hiring and utilization rates, and integration of companies acquired. Because a high percentage of our expenses, particularly personnel and facilities related expenses, are relatively fixed in advance of any particular quarter, a variation in the timing of the initiation or the completion of our client assignments can cause significant variations in operating results from quarter to quarter.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our Silicon Valley office facilities consist of a 153,738 square foot building, with office and laboratory space located on a 6.3-acre tract of land we own in Menlo Park, California and an adjacent 27,000 square feet of leased warehouse storage space.

Our Test and Engineering Center (“TEC”) occupies 147 acres in Phoenix, Arizona. We lease this land from the state of Arizona under a 30-year lease agreement that expires in January 2028 and have options to renew for two fifteen-year periods.We constructed an indoor test facility as well as an engineering and test preparation building at the TEC.

In addition, we lease office, warehouse and laboratory space in 21 other locations in 13 states and the District of Columbia, as well as in Germany, China and the United Kingdom. Leases for these offices, warehouse and laboratory facilities have terms generally ranging between one and ten years. Aggregate lease expense in fiscal 2006 for all leased properties was $4,804,000.

Item 3. Legal Proceedings

Exponent is not engaged in any material legal proceedings.

Item 4. Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of security holders during the fourth quarter of fiscal 2006.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Exponent’s common stock is traded on the NASDAQ Global Select Market, which up until July 1, 2006 was the NASDAQ National Market, under the symbol “EXPO”. The following table sets forth for the fiscal periods indicated the high and low closing sales prices for our common stock.

| | | | | | |

Stock prices by quarter | | High | | Low |

Fiscal Year Ended December 30, 2005: | | | | | | |

First Quarter | | $ | 14.75 | | $ | 11.44 |

Second Quarter | | $ | 14.56 | | $ | 11.74 |

Third Quarter | | $ | 15.70 | | $ | 13.77 |

Fourth Quarter | | $ | 15.33 | | $ | 13.68 |

| | |

Fiscal Year Ended December 29, 2006: | | | | | | |

First Quarter | | $ | 16.63 | | $ | 14.27 |

Second Quarter | | $ | 17.00 | | $ | 14.94 |

Third Quarter | | $ | 17.55 | | $ | 14.70 |

Fourth Quarter | | $ | 19.05 | | $ | 16.60 |

As of February 23, 2007, there were 348 holders of record of our common stock. Because many of the shares of our common stock are held by brokers and other institutions on behalf of stockholders, we believe that there are considerably more beneficial holders of our common stock than record holders.

We have never paid cash dividends on our common stock. See Item 7 of Part II “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.”

12

The following table provides information on the Company’s share repurchases for the quarter ended December 29, 2006:

| | | | | | | | | | |

(In thousands, except price per share) | | Total Number

of Shares

Purchased | | Average Price

Paid Per Share | | Total Number of

Shares Purchased as

Part of Publicly

Announced Programs | | Approximate Dollar

Value of Shares That

May Yet Be Purchased

Under the Program(1) |

September 30 to October 27 | | 84 | | $ | 17.23 | | 84 | | $ | 8,832 |

October 28 to November 24 | | 70 | | $ | 18.03 | | 70 | | $ | 7,577 |

November 25 to December 29 | | 125 | | $ | 18.01 | | 125 | | $ | 5,323 |

| | | | | | | | | | |

Total | | 279 | | $ | 17.86 | | 279 | | | |

(1) | In April 2006, the Company’s Board of Directors approved a plan to repurchase up to $35 million of the Company’s common stock. The plan has no expiration date. |

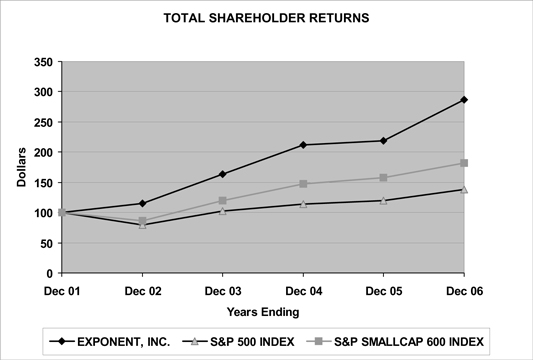

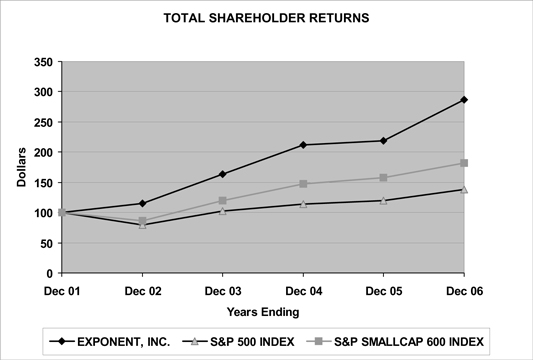

COMPANY STOCK PRICE PERFORMANCE GRAPH

The graph compares the Company’s cumulative total stockholder return calculated on a dividend-reinvested basis from 2001 through 2006 with those of the Standard & Poor’s (“S&P”) 500 Index and the S&P SmallCap 600 Index. The Company does not have a comparable peer group and thus has selected the S&P Small Cap 600 Index. The graph assumes that $100 was invested on the last day of 2001. Note that the historic stock price performance is not necessarily indicative of future stock price performance.

13

Item 6. Selected Consolidated Financial Data

The following selected consolidated financial data are derived from our consolidated financial statements. This data should be read in conjunction with the consolidated financial statements and notes thereto, and with Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

| | | | | | | | | | | | | | | |

| | | Fiscal Year |

(In thousands, except per share data) | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

Consolidated Statements of Income Data: | | | | | | | | | | | | | | | |

| | | | | |

Revenues before reimbursements | | $ | 156,742 | | $ | 142,861 | | $ | 138,718 | | $ | 125,943 | | $ | 115,298 |

Revenues | | $ | 168,496 | | $ | 155,196 | | $ | 151,509 | | $ | 139,676 | | $ | 126,055 |

Operating income | | $ | 20,189 | | $ | 20,380 | | $ | 19,324 | | $ | 16,902 | | $ | 14,036 |

Net income | | $ | 14,194 | | $ | 14,186 | | $ | 12,040 | | $ | 10,166 | | $ | 7,924 |

| | | | | |

Net income per share: | | | | | | | | | | | | | | | |

Basic | | $ | 0.89 | | $ | 0.88 | | $ | 0.78 | | $ | 0.71 | | $ | 0.58 |

Diluted | | $ | 0.83 | | $ | 0.81 | | $ | 0.71 | | $ | 0.64 | | $ | 0.53 |

| | | | | |

| Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | |

| | | | | |

Cash and cash equivalents | | $ | 5,238 | | $ | 13,216 | | $ | 4,680 | | $ | 5,666 | | $ | 22,480 |

Short-term investments | | $ | 52,844 | | $ | 55,682 | | $ | 55,366 | | $ | 35,932 | | $ | — |

Working capital | | $ | 81,280 | | $ | 93,755 | | $ | 78,972 | | $ | 57,519 | | $ | 44,696 |

Total assets | | $ | 161,216 | | $ | 164,241 | | $ | 144,132 | | $ | 121,842 | | $ | 107,216 |

Long-term liabilities | | $ | 6,185 | | $ | 4,631 | | $ | 2,571 | | $ | 2,494 | | $ | 1,864 |

Total stockholders’ equity | | $ | 124,305 | | $ | 133,200 | | $ | 117,022 | | $ | 95,118 | | $ | 83,786 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

Exponent, Inc. is a science and engineering consulting firm that provides solutions to complex problems. Our multidisciplinary team of scientists, physicians, engineers, business and regulatory consultants brings together more than 90 different technical disciplines to solve complicated issues facing industry and government today. Our services include analysis of products, people, property, processes and finances related to litigation, product recall, regulatory compliance, research, development and design.

CRITICAL ACCOUNTING ESTIMATES

In preparing our consolidated financial statements, we make assumptions, judgments and estimates that can have a significant impact on our revenue, operating income and net income, as well as on the value of certain assets and liabilities on our consolidated balance sheet. We base our

assumptions, judgments and estimates on historical experience and various other factors that we believe to be reasonable under the circumstances. Actual results could differ materially from these estimates under different assumptions or conditions. On a regular basis we evaluate our assumptions, judgments and estimates and make changes accordingly. We believe that the assumptions, judgments and estimates involved in the accounting for revenue recognition, estimating the allowance for doubtful accounts, accounting for income taxes, valuing goodwill and accounting for stock-based compensation have the greatest potential impact on our consolidated financial statements, so we consider these to be our critical accounting policies. We discuss below the critical accounting estimates associated with these policies. Historically, our assumptions, judgments and estimates relative to our critical accounting policies have not differed materially from actual results. For further information on our critical accounting policies, see Note 1 of our Notes to Consolidated Financial Statements.

14

Revenue recognition.We derive our revenues primarily from professional fees earned on consulting engagements and fees earned for the use of our equipment and facilities, as well as reimbursements for outside direct expenses associated with the services that are billed to our clients.

Substantially all of our engagements are performed under time and material or fixed-price billing arrangements. On time and material and fixed-price projects, revenue is generally recognized as the services are performed. For substantially all of our fixed-price engagements we recognize revenue based on the relationship of incurred labor hours at standard rates to our estimate of the total labor hours at standard rates we expect to incur over the term of the contract. Our estimate of total labor hours we expect to incur over the term of the contract is based on the nature of the project and our past experience on similar projects. We believe this methodology achieves a reliable measure of the revenue from the consulting services we provide to our customers under fixed-price contracts.

Significant management judgments and estimates must be made and used in connection with the revenues recognized in any accounting period. These judgments and estimates include an assessment of collectibility and, for fixed-price engagements, an estimate as to the total effort required to complete the project. If we made different judgments or utilized different estimates, the amount and timing of our revenue for any period could be materially different.

All consulting contracts are subject to review by management, which requires a positive assessment of the collectibility of contract amounts. If, during the course of the contract, we determine that collection of revenue is not reasonably assured, we do not recognize the revenue until its collection becomes reasonably assured, which is generally upon receipt of cash. We assess collectibility based on a number of factors, including past transaction history with the client, as well as the credit-worthiness of the client. Losses on fixed-price contracts are recognized during the period in which the loss first becomes evident. Contract losses are determined to be the amount by which the estimated total costs of the contract exceeds the total fixed price of the contract.

Estimating the allowance for doubtful accounts.We must make estimates of our ability to collect accounts receivable and our unbilled work-in-process. In circumstances where we are aware of a specific customer’s inability to meet its financial obligations to us, we record a specific allowance to

reduce the net recognized receivable to the amount we reasonably believe will be collected. For all other customers we recognize allowances for doubtful accounts based upon historical bad debts, customer concentration, customer credit-worthiness, current economic conditions and changes in customer payment terms. As of December 29, 2006, our accounts receivable balance was $48.2 million, net of an allowance for doubtful accounts of $1.8 million.

Accounting for income taxes.In preparing our consolidated financial statements, we are required to estimate our income taxes in each of the jurisdictions where we operate. This process involves estimating actual current tax exposure together with assessing temporary differences resulting from differing treatment of items for tax and accounting purposes. These differences result in deferred tax assets and liabilities, which are included in our consolidated balance sheet. We must then assess the likelihood that our deferred tax assets will be recovered from future taxable income and, to the extent that we believe that recovery is not likely, we must establish a valuation allowance.

Significant judgment is required in determining the provision for income taxes, deferred tax assets and liabilities and any valuation allowance against our deferred tax assets, such as current tax laws, our interpretation of current tax laws and possible outcomes of current and future audits conducted by foreign and domestic tax authorities. In the event that actual results differ from these estimates or the estimates are adjusted in future periods, then we may need to establish a valuation allowance, which could materially impact our financial position and results of operations. Based on our current financial projections and operating plan for fiscal 2007, we currently believe that we will be able to utilize our deferred tax assets.

Valuing goodwill. We assess the impairment of goodwill annually or more frequently if certain triggering events occur indicating that the carrying value of goodwill may be impaired. Factors that we consider when evaluating for possible impairment include the following:

| | • | | significant under-performance relative to expected historical or projected future operating results; |

| | • | | significant changes in the manner of our use of the acquired assets or the strategy for our overall business; and |

| | • | | significant negative economic trends. |

15

When evaluating our goodwill for impairment, based upon the existence of one or more of the above factors, we determine the existence of an impairment by assessing the fair value of the applicable reporting unit, including goodwill, using expected future cash flows to be generated by the reporting unit. If the carrying amount of a reporting unit exceeds its fair value, then an impairment loss is recognized for any excess of the carrying amount of the reporting unit’s goodwill over the implied fair value of that goodwill.

We completed our annual impairment review as of the end of the 47th week of fiscal 2006 and determined that we had no impairment of our goodwill and therefore did not record an impairment charge. As of December 29, 2006, goodwill totaled $8.6 million.

Stock-based compensation.We adopted the provisions of, and accounted for stock-based compensation in accordance with, Statement of Financial Accounting Standards No. 123 (revised 2004), “Share-Based Payment” (“SFAS 123(R)”) during fiscal 2006. We elected the modified-prospective method of adoption, under which prior periods are not revised for comparative purposes. Under the fair value recognition provisions of this statement, stock-based compensation cost is measured at the grant date based on the fair value of the award and is recognized as expense on a straight-line basis over the requisite service period.

We currently use the Black-Scholes option-pricing model to determine the fair value of stock options. The determination of the fair value of stock options on the date of grant using an

option-pricing model is affected by our stock price as well as assumptions regarding a number of complex and subjective variables. These variables include the expected term of the options, our expected stock price volatility over the term of the options, risk-free interest rate and expected dividends.

We use historical exercise and post-vesting forfeiture and expiration data to estimate the expected term of options granted. The historical volatility of our common stock over a period of time equal to the expected term of the options granted is used to estimate expected volatility. We base the risk-free interest rate that we use in the option-pricing model on U.S. Treasury zero-coupon issues with remaining terms similar to the expected term on the options. We do not anticipate paying any cash dividends in the foreseeable future and therefore use an expected dividend yield of zero in the option-pricing model. We are required to estimate forfeitures at the time of grant and revise those estimates in subsequent periods if actual forfeitures differ from those estimates. We use historical data to estimate pre-vesting option forfeitures and record stock-based compensation expense only for those awards that are expected to vest. All share based payment awards are amortized on a straight-line basis over the requisite service periods of the awards.

If factors change and we employ different assumptions for estimating stock-based compensation expense in future periods or if we decide to use a different valuation model, the future periods may differ significantly from what we have recorded in the current period and could materially affect our operating income, net income and net income per share.

16

CONSOLIDATED RESULTS OF OPERATIONS

The following table sets forth for the periods indicated, the percentage of revenues of certain items in our consolidated statements of income and the percentage increase (decrease) in the dollar amount of such items year to year:

| | | | | | | | | | | | | | | |

| | | PERCENTAGE OF REVENUES

FOR FISCAL YEARS | | | PERIOD TO PERIOD CHANGE | |

| | | 2006 | | | 2005 | | | 2004 | | | 2006 vs. 2005 | | | 2005 vs. 2004 | |

Revenues | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 8.6 | % | | 2.4 | % |

| | | | | |

Operating expenses: | | | | | | | | | | | | | | | |

Compensation and related expenses | | 62.8 | | | 60.5 | | | 59.9 | | | 12.7 | | | 3.5 | |

Other operating expenses | | 11.8 | | | 12.0 | | | 12.4 | | | 6.8 | | | (1.0 | ) |

Reimbursable expenses | | 7.0 | | | 8.0 | | | 8.4 | | | (4.7 | ) | | (3.6 | ) |

General and administrative expenses | | 6.4 | | | 6.4 | | | 6.5 | | | 9.2 | | | 0.7 | |

| | | | | | | | | | | | | | | |

| | 88.0 | | | 86.9 | | | 87.2 | | | 10.0 | | | 2.0 | |

| | | | | | | | | | | | | | | |

Operating income | | 12.0 | | | 13.1 | | | 12.8 | | | (0.9 | ) | | 5.5 | |

| | | | | |

Other income, net | | 2.0 | | | 1.5 | | | 0.7 | | | 51.4 | | | 107.4 | |

| | | | | | | | | | | | | | | |

Income before income taxes | | 14.0 | | | 14.6 | | | 13.5 | | | 4.2 | | | 10.9 | |

| | | | | |

Provision for income taxes | | 5.6 | | | 5.5 | | | 5.6 | | | 11.3 | | | 0.8 | |

| | | | | | | | | | | | | | | |

Net income | | 8.4 | % | | 9.1 | % | | 7.9 | % | | 0.1 | % | | 17.8 | % |

| | | | | | | | | | | | | | | |

OVERVIEW OF THE YEAR ENDED DECEMBER 29, 2006

During fiscal 2006, we had an 8.6% increase in revenues as compared to fiscal 2005. This growth was driven primarily by our civil engineering, construction consulting, mechanics and materials and biomechanics practices. Our civil engineering practice had a strong year as we assisted our clients in evaluating the impact of natural disasters. Construction consulting is a strategic growth area that we continued to expand during 2006. In our mechanics and materials practice we expanded our portfolio of projects in the energy sector and product design consulting work for consumer electronics companies. In our biomechanics practice, we continued to grow our business, working with clients in their medical device development as well as in accident injury analysis. This growth was offset by lower revenues in our technology development practice due to a decrease in the number of large projects with the United States Department of Defense.

Our revenue growth was driven primarily by an increase in billable hours and higher billing rates. Total billable hours increased 6.2% to 757,000 during fiscal 2006 as compared to 713,000 during fiscal 2005. The increase in billable hours was supported by a 9.4% increase in technical full-time equivalent employees to 568 during fiscal 2006 as compared to 519 during fiscal 2005. This increase in technical full time equivalent employees was due to our continuing recruiting and retention efforts. Utilization decreased to 64% for fiscal 2006 as compared to 66% for fiscal 2005. This decrease in utilization was due to the integration of our recently hired technical consultants. The decrease in utilization and the adoption of SFAS 123(R) negatively affected our operating income. As a result of the adoption of SFAS 123(R) our operating income and net income were $1.2 million and $850,000 lower, respectively.

17

FISCAL YEARS ENDED DECEMBER 29, 2006, AND DECEMBER 30, 2005

Revenues

Our revenues consist of professional fees earned on consulting engagements, fees for use of our equipment and facilities, as well as reimbursements for outside direct expenses associated with the services performed that are billed to our clients. We operate on a 52-53 week fiscal year with each year ending on the Friday closest to December 31st. The fiscal years ended December 29, 2006, December 30, 2005 and December 31, 2004 included 52 weeks of activity.

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2006 | | | 2005 | | |

Engineering and other scientific | | $ | 130,960 | | | $ | 119,037 | | | 10.0 | % |

Percentage of total revenues | | | 77.7 | % | | | 76.7 | % | | | |

Environmental and health | | | 37,536 | | | | 36,159 | | | 3.8 | % |

Percentage of total revenues | | | 22.3 | % | | | 23.3 | % | | | |

| | | | | | | | | | | |

Total revenues | | $ | 168,496 | | | $ | 155,196 | | | 8.6 | % |

| | | | | | | | | | | |

The increase in revenues for our engineering and other scientific segment during fiscal 2006 was the result of higher billing rates and an increase in billable hours. During fiscal 2006, billable hours for this segment increased by 8.8% to 582,000 as compared to 535,000 during fiscal 2005. Technical full-time equivalents for this segment increased by 10.3% to 419 during fiscal 2006 as compared to 380 during fiscal 2005. Utilization for this segment decreased to 67% for fiscal 2006 as compared to 68% for fiscal 2005.

The increase in revenues for our environmental and health segment during fiscal 2006 was the result of higher billing rates, partially offset by a decrease in billable hours. During fiscal 2006 billable hours for this segment decreased by 1.7% to 175,000 as compared to 178,000 during fiscal 2005. This decrease in billable hours was primarily due to a decrease in the volume and size of new and recurring engagements in our ecosciences practice. This practice operates in one of our more competitive markets. Technical full-time equivalents for this segment increased by 7.2% to 149 during fiscal 2006 as compared to 139 during fiscal 2005. Utilization for this segment decreased to 57% for fiscal 2006 as compared to 61% for fiscal 2005.

Revenues are primarily derived from services provided in response to client requests or events that occur without notice and engagements are generally

terminable or subject to postponement or delay at any time by our clients. As a result, backlog at any particular time is small in relation to our quarterly or annual revenues and is not a reliable indicator of revenues for any future periods.

Compensation and Related Expenses

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2006 | | | 2005 | | |

Compensation and related expenses | | $ | 105,860 | | | $ | 93,963 | | | 12.7 | % |

Percentage of total revenues | | | 62.8 | % | | | 60.5 | % | | | |

The increase in compensation and related expenses during fiscal 2006 was due to an increase in payroll expense, stock-based compensation, and fringe benefits. Payroll expense increased by $8.0 million due to a corresponding increase in technical full-time equivalent employees and the impact of our annual salary increase. Fringe benefits increased by $1.3 million due to the increase in technical full-time equivalent employees. Stock-based compensation expense related to matching restricted stock units and stock options increased by $1.6 million due primarily to the adoption of SFAS 123(R) during 2006. We expect compensation and related expenses to increase due to the anticipated hiring of additional staff and the impact of future annual salary increases.

Other Operating Expenses

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2006 | | | 2005 | | |

Other operating expenses | | $ | 19,886 | | | $ | 18,618 | | | 6.8 | % |

Percentage of total revenues | | | 11.8 | % | | | 12.0 | % | | | |

Other operating expenses primarily include facilities related costs, technical materials, computer-related expenses and depreciation and amortization of property, equipment and leasehold improvements. The increase in other operating expenses was primarily due to an increase of $650,000 in occupancy expense, an increase of $285,000 in computer-related expenses, and a $223,000 increase in depreciation and amortization. The increase in occupancy expense, computer-related expenses, and depreciation and amortization were due to expansion in certain offices to support our increase in technical-full time equivalent employees. We anticipate other operating expenses to increase due to the support associated with the anticipated hiring of additional staff and the anticipated expansion of our offices.

18

Reimbursable Expenses

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2006 | | | 2005 | | |

Reimbursable expenses | | $ | 11,754 | | | $ | 12,335 | | | (4.7 | )% |

Percentage of total revenues | | | 7.0 | % | | | 8.0 | % | | | |

The decrease in reimbursable expenses during fiscal 2006 was primarily due to a decrease in purchases of technical materials related to projects in our technology development practice.

General and Administrative Expenses

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2006 | | | 2005 | | |

General and administrative expenses | | $ | 10,807 | | | $ | 9,900 | | | 9.2 | % |

Percentage of total revenues | | | 6.4 | % | | | 6.4 | % | | | |

The increase in general and administrative expenses during fiscal 2006 was primarily due to an increase in travel and meals of $388,000 and an increase in other professional services of $295,000. The increase in travel and meals was primarily due to our increase in technical full-time equivalent employees and an increase in business development activities. The increase in outside consulting services was primarily due to $216,000 in sub-contractor fees related to a potential project with the United States government that was not executed by the end of fiscal 2004. This project was executed during the first quarter of fiscal 2005 and the sub-contractor fees previously expensed were recovered. The recovery of these expenses during fiscal 2005 contributed to the period-to-period increase in outside consulting services.

Other Income and Expense

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2006 | | | 2005 | | |

Other income and expense | | $ | 3,389 | | | $ | 2,238 | | | 51.4 | % |

Percentage of total revenues | | | 2.0 | % | | | 1.5 | % | | | |

Other income and expense, net, consists primarily of investment income earned on available cash, cash equivalents and short-term investments, rental income from leasing excess space in our Silicon Valley facility, and changes in the value of assets associated with our deferred compensation plan. The increase in other income and expense during fiscal

2006 was primarily due to an increase in interest income of $723,000, an increase in the fair value of deferred compensation plan assets of $251,000 and an increase in rental income of $94,000. The increase in interest income was due to higher balances of cash, cash equivalents and short-term investments and an increase in short term interest rates. Rental income increased due to the addition of a new tenant in our Silicon Valley facility.

Income Taxes

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2006 | | | 2005 | | |

Income taxes | | $ | 9,384 | | | $ | 8,432 | | | 11.3 | % |

Percentage of total revenues | | | 5.6 | % | | | 5.5 | % | | | |

Effective tax rate | | | 39.8 | % | | | 37.3 | % | | | |

The increase in our effective tax rate during fiscal 2006 was primarily due to $150,000 in additional income tax expense related to a change in estimated federal and state income taxes for 2005. During fiscal 2005 we recorded a credit of $272,000 to income tax expense related to a change in estimated federal and state income taxes for 2004.

FISCAL YEARS ENDED DECEMBER 30, 2005, AND DECEMBER 31, 2004

Revenues

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2005 | | | 2004 | | |

Engineering and other scientific | | $ | 119,037 | | | $ | 115,558 | | | 3.0 | % |

Percentage of total revenues | | | 76.7 | % | | | 76.3 | % | | | |

Environmental and health | | | 36,159 | | | | 35,951 | | | 0.6 | % |

Percentage of total revenues | | | 23.3 | % | | | 23.7 | % | | | |

| | | | | | | | | | | |

Total revenues | | $ | 155,196 | | | $ | 151,509 | | | 2.4 | % |

| | | | | | | | | | | |

The increase in revenues for our engineering and other scientific segment during fiscal 2005 was the result of higher billing rates and an increase in billable hours. During fiscal 2005, billable hours for this segment increased by 1.1% to 535,000 as compared to 529,000 during fiscal 2004. Technical full-time equivalents for this segment increased by 1.9% to 380 during fiscal 2005 as compared to 373 during fiscal 2004. Utilization for this segment was 68% during fiscal 2005 and 2004.

19

The increase in revenues for our environmental and health segment during fiscal 2005 was the result of higher billing rates, partially offset by a decrease in billable hours. During fiscal 2005 billable hours for this segment decreased by 1.7% to 178,000 as compared to 181,000 during fiscal 2004. This decrease in billable hours was primarily due to a decrease in the volume and size of new and recurring engagements in our environmental practice. This practice operates in one of our more competitive markets. The decrease in billable hours for this practice was partially offset by an increase in billable hours for our food & chemicals practice. Technical full-time equivalents for this segment decreased by 6.1% to 139 during fiscal 2005 as compared to 148 during fiscal 2004. Utilization for this segment increased to 61% for fiscal 2005 as compared to 59% for fiscal 2004.

Compensation and Related Expenses

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent | |

(In thousands) | | 2005 | | | 2004 | | | Change | |

Compensation and related expenses | | $ | 93,963 | | | $ | 90,760 | | | 3.5 | % |

Percentage of total revenues | | | 60.5 | % | | | 59.9 | % | | | |

The increase in compensation and related expenses during fiscal 2005 was due to the effects of our annual salary increase and an increase in bonuses. Our annual salary increase, which was approximately 5%, took effect at the beginning of April 2005. Bonuses are based on profitability and increased by $700,000 during fiscal 2005 as compared to fiscal 2004.

Other Operating Expenses

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent | |

(In thousands) | | 2005 | | | 2004 | | | Change | |

Other operating expenses | | $ | 18,618 | | | $ | 18,801 | | | (1.0 | )% |

Percentage of total revenues | | | 12.0 | % | | | 12.4 | % | | | |

The decrease in other operating expenses during fiscal 2005 was primarily due to the write-off of a foreign real estate investment for $230,000 during fiscal 2004. There was no such write-off during fiscal 2005. This decrease was partially offset by an increase in occupancy expense of $110,000.

Reimbursable Expenses

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2005 | | | 2004 | | |

Reimbursable expenses | | $ | 12,335 | | | $ | 12,791 | | | (3.6 | )% |

Percentage of total revenues | | | 8.0 | % | | | 8.4 | % | | | |

The decrease in reimbursable expenses during fiscal 2005 was primarily due to a decrease in purchases of technical materials related to projects in our technology development practice.

General and Administrative Expenses

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2005 | | | 2004 | | |

General and administrative expenses | | $ | 9,900 | | | $ | 9,833 | | | 0.7 | % |

Percentage of total revenues | | | 6.4 | % | | | 6.5 | % | | | |

The increase in general and administrative expenses during fiscal 2005 was primarily due to an increase in recruiting expense of $185,000 and an increase in professional development expense of $72,000, partially offset by a decrease in bad debt expense of $182,000. The increase in recruiting and professional development expense was due to our efforts to attract and develop technical consultants. The decrease in bad debt expense was due to a decrease in write-offs during fiscal 2005 as compared to fiscal 2004 and a decrease in the allowance for doubtful accounts at year-end.

Other Income and Expense

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2005 | | | 2004 | | |

Other income and expense | | $ | 2,238 | | | $ | 1,079 | | | 107.4 | % |

Percentage of total revenues | | | 1.5 | % | | | 0.7 | % | | | |

The increase in other income and expense during fiscal 2005 was primarily due to an increase in interest income of $734,000, an increase in the fair value of deferred compensation plan assets of $220,000 and an increase in rental income of $148,000. The increase in interest income was due to higher balances of cash, cash equivalents and short-term investments and an increase in short term interest rates. Rental income increased due to the addition of a new tenant in our Silicon Valley facility.

20

Income Taxes

| | | | | | | | | | | |

| | | Fiscal Years | | | Percent Change | |

(In thousands) | | 2005 | | | 2004 | | |

Income taxes | | $ | 8,432 | | | $ | 8,363 | | | 0.8 | % |

Percentage of total revenues | | | 5.5 | % | | | 5.6 | % | | | |

Effective tax rate | | | 37.3 | % | | | 41.0 | % | | | |

The decrease in our effective tax rate during fiscal 2005 was primarily due to a $272,000 true-up related to differences in estimated versus actual federal and state income taxes for fiscal 2004. An increase in tax-exempt interest income also contributed to a decrease in our effective tax rate during fiscal 2005.

RECENT ACCOUNTING PRONOUNCEMENTS

In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards No. 157 (“SFAS 157”), “Fair Value Measurements,” which defines fair value, establishes guidelines for measuring fair value and expands disclosures regarding fair value measurements. SFAS 157 does not require any new fair value measurements but rather eliminates inconsistencies in guidance found in various prior accounting pronouncements. SFAS 157 is effective for fiscal years beginning after November 15, 2007. Earlier adoption is permitted, provided the company has not yet issued financial statements, including for interim periods, for that fiscal year. We are currently evaluating the impact of SFAS 157, but do not expect the adoption of SFAS 157 to have a material impact on our consolidated financial position, results of operations or cash flows.