UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 26, 2012

Commission file number 0-18051

DENNY'S CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

| Delaware | 13-3487402 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) |

| 203 East Main Street, Spartanburg, South Carolina | 29319-9966 |

| (Address of principal executive offices) | (Zip Code) |

(864) 597-8000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Title of each class | Name of each exchange on which registered |

| $.01 Par Value, Common Stock | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer," "accelerated filer��� and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | |

| Large accelerated filer | o | Accelerated filer | þ | Non-accelerated filer | o | Smaller reporting company | o |

| | | | | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

The aggregate market value of the voting common stock held by non-affiliates of the registrant was approximately $340.2 million as of June 27, 2012, the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing sales price of registrant’s common stock on that date of $4.26 per share and, for purposes of this computation only, the assumption that all of the registrant’s directors, executive officers and beneficial owners of 10% or more of the registrant’s common stock are affiliates.

As of March 6, 2013, 92,425,265 shares of the registrant’s common stock, $.01 par value per share, were outstanding.

Documents incorporated by reference:

Portions of the registrant’s definitive Proxy Statement for the 2013 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

The forward-looking statements included in the “Business,” “Risk Factors,” “Legal Proceedings,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures About Market Risk” sections and elsewhere herein, which reflect our best judgment based on factors currently known, involve risks and uncertainties. Words such as “expects,” “anticipates,” “believes,” “intends,” “plans,” “hopes,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements speak only as to the date thereof. Except as may be required by law, we expressly disclaim any obligation to update these forward-looking statements to reflect events or circumstances after the date of this Form 10-K or to reflect the occurrence of unanticipated events. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a number of factors including, but not limited to, the factors discussed in such sections and, in particular, those set forth in the cautionary statements contained in “Risk Factors.” The forward-looking information we have provided in this Form 10-K pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995 should be evaluated in the context of these factors.

PART I

Item 1. Business

Description of Business

Denny’s Corporation (Denny’s) is one of America’s largest full-service restaurant chains, based on number of restaurants. Denny’s, through its wholly-owned subsidiary, Denny’s, Inc., owns and operates the Denny’s brand. At December 26, 2012, the Denny’s brand consisted of 1,688 franchised, licensed, and company operated restaurants around the world with combined sales of $2.5 billion, including 1,590 restaurants in the United States and 98 restaurants in Canada, Costa Rica, Mexico, Honduras, Guam, Curaçao, Puerto Rico, Dominican Republic and New Zealand. As of December 26, 2012, 1,524 of our restaurants were franchised/licensed, representing 90% of the total restaurants, and 164 were company operated.

Denny’s is known as America's Diner, or in the case of our international locations, “the local diner.” Open 24/7 in most locations, we provide our guests quality food that emphasizes everyday value and new products through our compelling limited time only offerings, delivered in a warm, friendly “come as you are” atmosphere. Denny's is best know for its breakfast fare, which is available around the clock, and the Original Grand Slam, introduced in 1977, remains one of our most popular menu items. In addition to our breakfast-all-day items, Denny's offers a wide selection of lunch and dinner items including burgers, sandwiches, salads and skillet entrees, along with an assortment of beverages, appetizers and desserts.

References to "Denny's," the "Company," "we," "us," and "our" in this Form 10-K are references to Denny's Corporation and its subsidiaries.

Restaurant Development

Franchising

Our criteria to become a Denny’s franchisee include minimum liquidity and net worth requirements and appropriate operational experience. We believe that Denny’s is an attractive financial proposition for current and potential franchisees and that our fee structure is competitive with other full-service brands. The initial fee for a single twenty-year Denny’s franchise agreement is $40,000 and the royalty payment is up to 4% of gross sales. Additionally, our franchisees are required to contribute up to 4% of gross sales for advertising and may make additional advertising contributions as part of a local marketing co-operative.

We work closely with our franchisees to plan and execute many aspects of the business. The Denny's Franchise Association ("DFA") was created to promote communication among our franchisees and between the Company and our franchise community. DFA board members and Company management work together through Brand Advisory Councils.

Site Selection

The success of any restaurant is influenced significantly by its location. Our development team works closely with franchisees and real estate brokers to identify sites which meet specific standards. Sites are evaluated on the basis of a variety of factors, including but not limited to:

| |

| • | environmental restrictions; and |

| |

| • | proximity to high-traffic consumer activities. |

Domestic Development

We completed our Franchise Growth Initiative ("FGI") during 2012. This initiative increased franchise restaurant development through the sale of certain geographic clusters of company restaurants to both current and new franchisees. As of December 26, 2012, the total number of company restaurants sold under our FGI program since it began in early 2007 is 380. Fulfilling the unit growth expectations of this program, certain franchisees that have purchased company restaurants also signed development agreements to open additional restaurants. We also negotiate development agreements outside of our FGI program.

To accelerate the growth of the brand in certain under-penetrated markets, we launched the New and Emerging Markets Incentive Program. This program provides significant incentives for franchisees to develop multiple locations in areas where Denny's does not have the top market share. The benefits to franchisees include reduced franchise fees, lower royalties for a limited time period and credits towards certain development services, such as architecture and training fees.

In recent years, we opened restaurant locations within travel centers, primarily with Pilot and Pilot Flying J Travel Centers. There were 133 restaurants located within domestic travel centers as of December 26, 2012. Additionally, we opened nontraditional locations on university campuses. As of December 26, 2012, there were 11 franchise restaurants on university campuses in the U.S., operating under either the Denny's Fresh Express® or Denny's AllNighter® names.

Through our various development efforts, we have negotiated development agreements for 257 new domestic franchise restaurants, 133 of which have opened. The majority of the remaining restaurants in the development agreement pipeline are expected to open over the next five years. While the majority of the restaurants to be opened under these agreements are on schedule, from time to time some of our franchisees' ability to grow and meet their development commitments is hampered by the economy and the difficult lending environment.

International Development

In addition to the development agreements signed for domestic restaurants, we have signed development agreements for 62 new international franchise restaurants, 16 of which have opened. Of the 16 opened units, during 2012, we opened two traditional franchise locations in Honduras and Puerto Rico, our first nontraditional airport location in the Dominican Republic, our first international nontraditional university location at the Southern Alberta Institute of Technology and two Pilot Flying J locations in Canada. This brings the total number of international Pilot Flying J locations to nine as of December 26, 2012.

During 2012, we announced a franchise development agreement for Chile and we expect the first restaurant there to open during 2013. We also announced a development agreement for parts of southern China. Subsequently, in March 2013, we announced that we and our development partner mutually decided to cancel the plans for this partner to develop franchise restaurants in southern China. We continue to believe Denny's has great potential in the Pacific Rim in general and China in particular, and are actively seeking development partners who share that vision.

During 2013, we expect to open a total of 40 to 45 franchise restaurants in domestic and international markets.

Ongoing Transition to a Franchise Focused Business Model

As a result of the development efforts described above, over the past six years we have transitioned from a restaurant portfolio mix of 66% franchised and 34% company-operated to a restaurant portfolio mix of 90% franchised and 10% company-operated. After achieving the 90% target in 2012, we expect that our percentage of company restaurants will gradually decrease, as the majority of our unit openings and the future growth of the brand will come primarily from the development of franchise restaurants. The following table summarizes the changes in the number of company restaurants and franchised and licensed restaurants during the past five years:

|

| | | | | | | | | | | | | | |

| | 2012 | | 2011 | | 2010 | | 2009 | | 2008 |

| Company restaurants, beginning of period | 206 |

| | 232 |

| | 233 |

| | 315 |

| | 394 |

|

| Units opened | 1 |

| | 8 |

| | 24 |

| | 1 |

| | 3 |

|

| Units relocated | — |

| | — |

| | 1 |

| | — |

| | — |

|

| Units acquired from franchisees | 1 |

| | — |

| | — |

| | — |

| | — |

|

| Units sold to franchisees | (36 | ) | | (30 | ) | | (24 | ) | | (81 | ) | | (79 | ) |

| Units closed (including units relocated) | (8 | ) | | (4 | ) | | (2 | ) | | (2 | ) | | (3 | ) |

| End of period | 164 |

| | 206 |

| | 232 |

| | 233 |

| | 315 |

|

| | | | | | | | | | |

| Franchised and licensed restaurants, beginning of period | 1,479 |

| | 1,426 |

| | 1,318 |

| | 1,226 |

| | 1,152 |

|

| Units opened | 39 |

| | 53 |

| | 112 |

| | 39 |

| | 31 |

|

| Units relocated | 2 |

| | 1 |

| | 4 |

| | 3 |

| | 1 |

|

| Units purchased from Company | 36 |

| | 30 |

| | 24 |

| | 81 |

| | 79 |

|

| Units acquired by Company | (1 | ) | | — |

| | — |

| | — |

| | — |

|

| Units closed (including units relocated) | (31 | ) | | (31 | ) | | (32 | ) | | (31 | ) | | (37 | ) |

| End of period | 1,524 |

| | 1,479 |

| | 1,426 |

| | 1,318 |

| | 1,226 |

|

| Total restaurants, end of period | 1,688 |

| | 1,685 |

| | 1,658 |

| | 1,551 |

| | 1,541 |

|

The table below sets forth information regarding the distribution of single-store and multi-store franchisees as of December 26, 2012:

|

| | | | | | | | | | | |

| | Franchisees | | Percentage of Franchisees | | Restaurants | | Percentage of Restaurants |

| One | 93 |

| | 34.2 | % | | 93 |

| | 6.1 | % |

| Two to five | 113 |

| | 41.5 | % | | 332 |

| | 21.8 | % |

| Six to ten | 30 |

| | 11.0 | % | | 228 |

| | 15.0 | % |

| Eleven to fifteen | 12 |

| | 4.4 | % | | 152 |

| | 10.0 | % |

| Sixteen to thirty | 16 |

| | 5.9 | % | | 335 |

| | 22.0 | % |

| Thirty-one and over | 8 |

| | 3.0 | % | | 384 |

| | 25.1 | % |

| Total | 272 |

| | 100.0 | % | | 1,524 |

| | 100.0 | % |

Restaurant Operations

We believe that the superior execution of basic restaurant operations in each Denny’s restaurant, whether it is company or franchised, is critical to our success. To meet and exceed our guests’ expectations, we require both our company and our franchised restaurants to maintain the same strict brand standards. These standards relate to the preparation and efficient serving of quality food and the maintenance, repair and cleanliness of restaurants.

We devote significant effort to ensuring all restaurants offer quality food served by friendly, knowledgeable and attentive employees in a clean and well-maintained restaurant. We seek to ensure that our company restaurants meet our high standards through a network of Directors of Company Operations, Company District Managers and restaurant level managers, all of whom spend the majority of their time in the restaurants. A network of Regional Directors of Franchise Operations and Franchise Business Leaders provide oversight of our franchised restaurants to ensure compliance with brand standards, promote operational excellence, and provide general support to our franchisees.

A principal feature of Denny’s restaurant operations is the consistent focus on improving operations at the restaurant level. Restaurant managers are hands-on and versatile in their supervisory activities. Many of our restaurant management personnel began as hourly associates in the restaurants and, therefore, know how to perform restaurant functions and are able to train by example.

Denny’s maintains training programs for hourly employees and restaurant management. Hourly employee training programs (including eLearning) are position-specific and focus on skills and tasks necessary to successfully fulfill the responsibilities assigned to them, while continually enhancing guest satisfaction. Denny's Manager In Training (“MIT”) program is conducted at Approved Training Restaurants by Approved Training Managers. The MIT program is required for all new management hires and those promoted internally. The program is available for use by Denny's franchisees to train their managers to Denny's brand standards. The mission of the MIT program is to provide managers with the knowledge and leadership skills needed to successfully operate a Denny's restaurant.

Product Development and Marketing

Menu Offerings

We are leveraging our heritage as a classic American diner with our “America’s Diner is Always Open" brand positioning, which provides the promise of Everyday Value with craveable, indulgent products served in a friendly and inviting atmosphere. This positioning provides the framework for our three primary marketing strategies: (1) delivering everyday affordability, primarily through our $2 $4 $6 $8 Value Menu®, (2) creating compelling limited-time-only products, and (3) driving sales beyond breakfast. The Denny’s menu offers a large selection of high-quality, moderately priced products designed to appeal to all types of guests. We offer a wide variety of items for breakfast, lunch, and dinner, in addition to appetizers, desserts and beverages. Our Fit Fare® menu helps our guests identify items best suited to their dietary needs. Most Denny’s restaurants offer special items for children and seniors at reduced prices. Some restaurants cater to local tastes by offering regional items that complement the core menu.

Product Development

Denny’s is a consumer-driven brand with particular focus on hospitality, menu choices and overall guest experience. Our Product Development team works closely with consumer insights obtained through primary and secondary qualitative and quantitative studies. Input and ideas from our franchisees, vendors and operators are also integrated into this process. These insights form the strategic foundation for menu architecture, pricing, promotion and advertising. Before a new menu item can be brought to fruition, it is rigorously tested against standards of culinary discipline, food science and technology, nutritional analysis and operational execution. This testing process ensures that new menu items are not only appealing and marketable, but can be prepared and delivered with excellence in our restaurants.

The added value of these insights and strategic understandings also assist our Restaurant Operations and Information Technology staffs in the evaluation and development of new restaurant processes and upgraded restaurant equipment that may enhance our speed of service, food quality and order accuracy.

We continually strive to improve existing menu items and to add new menu items to give our guests additional reasons to return to our restaurants.

Product Sources and Availability

Our purchasing department administers programs for the procurement of food and non-food products. Our franchisees also purchase food and non-food products directly from the vendors under these programs. Our centralized purchasing program is designed to ensure uniform product quality as well as to minimize food, beverage and supply costs. Our size provides significant purchasing power, which often enables us to obtain products at favorable prices from nationally recognized manufacturers.

While nearly all products are contracted for by our purchasing department, the majority are purchased and distributed through Meadowbrook Meat Company (MBM), under a long-term distribution contract. MBM distributes restaurant products and supplies to the Denny’s system from approximately 200 vendors, representing approximately 90% of our restaurant product and supply purchases. We believe that satisfactory alternative sources of supply are generally available for all the items regularly used by our restaurants. We have not experienced any material shortages of food, equipment, or other products which are necessary to our restaurant operations.

Marketing and Advertising

Denny’s marketing team employs integrated marketing and advertising strategies that promote the Denny’s brand. Communications strategy, media, advertising, menu management, product innovation and development, consumer insights, public relations, field marketing and national promotions all fall under the marketing umbrella.

Our marketing campaigns, including broadcast advertising, focus on amplifying Denny's brand strengths with what consumers want – it’s about choice with made-to-order variety and an emphasis on breakfast at an affordable value offered all day, every day. On a national level and through local co-operatives, the campaigns reach target customers through network, cable and local television, radio, online, digital, social, outdoor and print media.

Brand Protection & Quality

Denny’s will only serve our guests food that is safe and wholesome and that meets our quality standards. Our systems, from the supply chain through our restaurants, are based on Hazard Analysis and Critical Control Points (HACCP), whereby we prevent, eliminate or reduce hazards to a safe level to protect the health of the employees and guests. To ensure this basic expectation to our guests, Denny’s also has risk-based systems in place to validate only approved vendors and distributors which meet and follow our product specifications and food handling procedures. Vendors, distributors and restaurant employees follow regulatory requirements (federal, state and local), industry “best practices” and Denny’s Brand Standards.

We use multiple approaches including third-party unannounced restaurant inspections (utilizing Denny’s Brand Protection Reviews), health department reviews and employee/manager training in their respective roles. If operational brand standard expectations are not met, a remediation process is immediately initiated. Our HACCP system uses nationally recognized food safety training courses and American National Standards Institute accredited certification programs.

All Denny’s restaurants are required to have a person certified in food protection on duty for all hours of operation. Our Food Safety/HACCP program has been recognized nationally by regulatory departments, the restaurant industry, and our peers as one of the best. We work daily on improving our processes and procedures. We are advocates for the advancement of food safety within the industry’s organizations, such as the National Council of Chain Restaurants, the National Restaurant Association (NRA) and the NRA's Quality Assurance Executive Study Groups.

Seasonality

Restaurant sales are generally higher in the second and third calendar quarters (April through September) than in the first and fourth calendar quarters (October through March). Additionally, severe weather, storms and similar conditions may impact sales volumes seasonally in some operating regions.

Trademarks and Service Marks

Through our wholly-owned subsidiaries, we have certain trademarks and service marks registered with the United States Patent and Trademark Office and in international jurisdictions, including "Denny's®", "Grand Slam®", "$2 $4 $6 $8 Value Menu®" and "Fit Fare®". We consider our trademarks and service marks important to the identification of our restaurants and believe they are of material importance to the conduct of our business. Domestic trademark and service mark registrations are renewable at various intervals from 10 to 20 years. International trademark and service mark registrations have various durations from 5 to 20 years. We generally intend to renew trademarks and service marks which come up for renewal. We own or have rights to all trademarks we believe are material to our restaurant operations in the United States and other jurisdictions where we do business. In addition, we have registered various domain names on the internet that incorporate certain of our trademarks and service marks, and believe these domain name registrations are an integral part of our identity. From time to time, we may resort to legal measures to defend and protect the use of our intellectual property.

Competition

The restaurant industry is highly competitive. Restaurants compete on the basis of name recognition and advertising; the price, quality, variety and perceived value of their food offerings; the quality and speed of their guest service; and the convenience and attractiveness of their facilities.

Denny’s direct competition in the full-service category includes a collection of national and regional chains, as well as thousands of independent operators. We also compete with quick service restaurants as they attempt to upgrade their menus with premium sandwiches, entree salads, new breakfast offerings and extended hours.

We believe that Denny’s has a number of competitive strengths, including strong brand name recognition, well-located restaurants and market penetration. We benefit from economies of scale in a variety of areas, including advertising, purchasing and distribution. Additionally, we believe that Denny’s has competitive strengths in the value, variety and quality of our food products, and in the quality and training of our employees. See “Risk Factors” for certain additional factors relating to our competition in the restaurant industry.

Economic, Market and Other Conditions

The restaurant industry is affected by many factors, including changes in national, regional and local economic conditions affecting consumer spending, the political environment (including acts of war and terrorism), changes in customer travel patterns, changes in socio-demographic characteristics of areas where restaurants are located, changes in consumer tastes and preferences, increases in the number of restaurants, unfavorable trends affecting restaurant operations, such as rising wage rates, healthcare costs, utilities expenses and unfavorable weather. See "Risk Factors" for additional information.

Government Regulations

We and our franchisees are subject to local, state, federal and international laws and regulations governing various aspects of the restaurant business.

We are subject to Federal Trade Commission regulation and a number of state laws which regulate the offer and sale of franchises. We also are subject to a number of state laws which regulate substantive aspects of the franchisor-franchisee relationship. We believe we are in material compliance with applicable laws and regulations, but we cannot predict the effect on operations of the enactment of additional regulations in the future.

We are also subject to federal and state laws, including the Fair Labor Standards Act, governing matters such as minimum wage, tip reporting, overtime, exempt status classification and other working conditions. A substantial number of our employees are paid the minimum wage. Accordingly, increases in the minimum wage or decreases in the allowable tip credit (which reduces wages deemed to be paid to tipped employees in certain states) increase our labor costs. This is especially true for our operations in California, where there is no tip credit. Employers must pay the higher of the federal or state minimum wage. We have attempted to offset increases in the minimum wage through pricing and various cost control efforts; however, there can be no assurance that we will be successful in these efforts in the future.

The Patient Protection and Affordable Care Act and the Health Care and Education Affordability Reconciliation Act require that most individuals obtain health insurance coverage beginning in 2014 and also require that certain large employers offer coverage to their employees or pay a financial penalty. We are evaluating the impact the new law will have on our business. Although we cannot predict with certainty the financial and operational impacts the new law will have on us, we expect that our expenses related to employee health benefits will increase over the long term as a result of this legislation. Any such increases could adversely affect our business, cash flows, financial condition and results of operations.

Environmental Matters

Federal, state and local environmental laws and regulations have not historically had a material impact on our operations; however, we cannot predict the effect of possible future environmental legislation or regulations on our operations.

Executive Officers of the Registrant

The following table sets forth information with respect to each executive officer of Denny’s:

|

| | | | |

Name | | Age | | Positions |

| Frances L. Allen | | 50 | | Executive Vice President, Global Brand Strategy and Chief Marketing Officer |

| | | | | |

| John C. Miller | | 57 | | Chief Executive Officer and President |

| | | | | |

| F. Mark Wolfinger | | 57 | | Executive Vice President, Chief Administrative Officer and Chief Financial Officer |

Ms. Allen has been Executive Vice President, Global Brand Strategy and Chief Marketing Officer since June 2011. She previously served as Executive Vice President and Chief Marketing Officer from July 2010 to June 2011. Prior to joining the Company, Ms. Allen served as Chief Marketing Officer of Dunkin' Donuts, U.S. from 2007 to 2009 and Vice President, Marketing of Sony Ericsson Mobile Communication from 2004 to 2007.

Mr. Miller has been Chief Executive Officer and President since February 2011. Prior to joining the Company, he served as Chief Executive Officer and President of Taco Bueno Restaurants, Inc. (an operator and franchisor of quick service Mexican eateries) from 2005 to February 2011 and President of Romano's Macaroni Grill from 1997 to 2004.

Mr. Wolfinger has been Executive Vice President and Chief Administrative Officer since April 2008 and Chief Financial Officer since September 2005. He previously served as Executive Vice President, Growth Initiatives from October 2006 to April 2008 and as Senior Vice President from September 2005 to October 2006. Prior to joining the Company, Mr. Wolfinger served as Executive Vice President and Chief Financial Officer of Danka Business Systems (a document imaging company) from 1998 to 2005.

Employees

At December 26, 2012, we had approximately 8,000 employees, of whom 7,600 were restaurant employees, 100 were field support employees and 300 were corporate personnel. None of our employees are subject to collective bargaining agreements. Many of our restaurant employees work part-time, and many are paid at or slightly above minimum wage levels. As is characteristic of the restaurant industry, we experience a high level of turnover among our restaurant employees. We have experienced no significant work stoppages, and we consider relations with our employees to be satisfactory.

The staff for a typical restaurant consists of one General Manager, two or three Restaurant Managers, and approximately 45 hourly employees. A Senior Vice President, Operations, along with a VP, Company Operations and a VP, Operations Support & Training, establish the strategic direction and key initiatives for the Operations Teams. In addition, we employ four Directors of Company Operations, six Regional Directors of Franchise Operations, and a team of Company District Managers and Franchise Business Leaders to guide and support the franchisees and in-restaurant teams. The duties of the Directors of Operations, District Managers, and Franchise Business Leaders include regular restaurant visits and inspections, as well as frequent interactions with our franchisees, employees and guests, which ensures the ongoing adherence to our standards of quality, service, cleanliness, value and hospitality.

Available Information

We make available free of charge through our website at investor.dennys.com (in the Investor Relations—SEC Filings section) copies of materials that we file with, or furnish to, the Securities and Exchange Commission ("SEC"), including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the SEC.

Item 1A. Risk Factors

We caution you that our business and operations are subject to a number of risks and uncertainties. The factors listed below could cause actual results to differ materially from our historical results and from projections in forward-looking statements contained in this Form 10-K, in our other filings with the SEC, in our news releases and in public statements made orally by our representatives.

Risks Related to Our Business

A decline in general economic conditions could adversely affect our financial results.

Consumer spending habits, including discretionary spending on dining at restaurants such as ours, are affected by many factors, including:

| |

| • | prevailing economic conditions; |

| |

| • | energy costs, especially gasoline prices; |

| |

| • | salaries and wage rates; |

| |

| • | consumer confidence; and |

| |

| • | consumer perception of economic conditions. |

Continued weakness or uncertainty regarding the United States economy, as a result of reactions to consumer credit availability, increasing energy prices, inflation, increasing interest rates, unemployment, war, terrorist activity or other unforeseen events could adversely affect consumer spending habits, which may result in lower restaurant sales.

Our financial condition depends on our ability and the ability of our franchisees to operate restaurants profitably, to generate positive cash flows and to generate acceptable returns on invested capital. The returns and profitability of our restaurants may be negatively impacted by a number of factors, including those described below.

Food service businesses are often adversely affected by changes in:

| |

| • | consumer spending habits; |

| |

| • | global, national, regional and local economic conditions; and |

The performance of our individual restaurants may be adversely affected by factors such as:

| |

| • | demographic considerations; and |

| |

| • | the type, number and location of competing restaurants. |

Multi-unit food service chains such as ours can also be adversely affected by publicity resulting from:

| |

| • | other health concerns or operating issues. |

Dependence on frequent deliveries of fresh produce and groceries subjects food service businesses to the risk that shortages or interruptions in supply caused by adverse weather or other conditions could adversely affect the availability, quality and cost of ingredients. In addition, the food service industry in general, and our results of operations and financial condition in particular, may be adversely affected by unfavorable trends or developments such as:

| |

| • | labor and employee benefits costs (including increases in minimum hourly wage, employment tax rates and health care costs and workers’ compensation costs); |

| |

| • | regional weather conditions; and |

| |

| • | the availability of experienced management and hourly employees. |

The financial performance of our franchisees can negatively impact our business.

As we are heavily franchised, our financial results are contingent upon the operational and financial success of our franchisees. We receive royalties, contributions to advertising and, in some cases, lease payments from our franchisees. We have established operational standards, guidelines and strategic plans for our franchisees; however, we have limited control over how our franchisees’ businesses are run. While we are responsible for ensuring the success of our entire chain of restaurants and for taking a longer term view with respect to system improvements, our franchisees have individual business strategies and objectives, which might conflict with our interests. Our franchisees may not be able to secure adequate financing to open or continue operating their Denny’s restaurants. If they incur too much debt or if economic or sales trends deteriorate such that they are unable to repay existing debt, it could result in financial distress or even bankruptcy. We anticipate that our franchisees will be impacted by the implementation of the health care reform legislation. If a significant number of franchisees become financially distressed, it could harm our operating results through reduced royalties and lease income.

For 2012, our ten largest franchisees accounted for 32% of our franchise revenue. The balance of our franchise revenue is derived from the remaining 262 franchisees. Although the loss of revenues from the closure of any one franchise restaurant may not be material, such revenues generate margins that may exceed those generated by other restaurants or offset fixed costs which we continue to incur.

We have guaranteed certain franchisee lease payments and loan payments in relation to the Pilot Flying J locations. These guarantees include up to $2.0 million of lease payments and $0.9 million in loan payments. During 2011, we announced a new loan program to support domestic franchise growth. This program will provide up to $100 million in loans to new and existing franchisees that open new restaurants in under-penetrated markets. We will guarantee up to the lesser of $12 million or 12% of the total outstanding loans under the program. As of December 26, 2012, there were no loans outstanding under this program. Under either of the programs, if franchisees are not able to fund required payments when due, we could be required to make payments up to the amounts guaranteed.

Our growth strategy depends on our ability and that of our franchisees to open new restaurants. Delays or failures in opening new restaurants could adversely affect our planned growth.

The development of new restaurants may be adversely affected by risks such as:

| |

| • | costs and availability of capital for the company and/or franchisees; |

| |

| • | competition for restaurant sites; |

| |

| • | inability to identify suitable franchisees; |

| |

| • | negotiation of favorable purchase or lease terms for restaurant sites; |

| |

| • | inability to obtain all required governmental approvals and permits; |

| |

| • | developed restaurants not achieving the expected revenue or cash flow; and |

| |

| • | general economic conditions. |

The locations where we have restaurants may cease to be attractive as demographic patterns change.

The success of our owned and franchised restaurants is significantly influenced by location. Current locations may not continue to be attractive as demographic patterns change. It is possible that the neighborhood or economic conditions where our restaurants are located could decline in the future, potentially resulting in reduced sales at those locations.

The restaurant business is highly competitive, and if we are unable to compete effectively, our business will be adversely affected.

Each of our restaurants competes with a wide variety of restaurants ranging from national and regional restaurant chains to locally owned restaurants. We expect competition to continue to increase. The following are important aspects of competition:

| |

| • | advantageous commercial real estate suitable for restaurants; |

| |

| • | number and location of competing restaurants; |

| |

| • | training, courtesy and hospitality standards; |

| |

| • | availability of and quality of staff; |

| |

| • | dietary trends, including nutritional content; |

| |

| • | quality and speed of service; |

| |

| • | attractiveness and repair and maintenance of facilities; and |

| |

| • | the effectiveness of marketing and advertising programs. |

Our reputation and business could be materially harmed as a result of the failure to protect the integrity and security of guest information or our employees' personal data.

We receive and maintain certain personal information about our guests and our employees. Our use of this information is regulated at the federal and state levels, as well as by certain third-party contracts. If our security and information systems are compromised or our business associates fail to comply with these laws and regulations and this information is obtained by unauthorized persons or used inappropriately, it could adversely affect our reputation, operations, results of operations and financial condition, and could result in litigation against us or the imposition of penalties. As privacy and information security laws and regulations change, we may incur additional costs to ensure we remain in compliance.

Numerous government regulations impact our business, and our failure to comply with them could adversely affect our business.

We and our franchisees are subject to federal, state and local laws and regulations governing, among other things:

| |

| • | land use, sign restrictions and environmental matters; |

| |

| • | employee health care requirements, including the implementation and uncertain legal, regulatory and cost implications of the health care reform law; |

| |

| • | the sale of alcoholic beverages; and |

| |

| • | hiring and employment practices, including minimum wage laws and fair labor standards. |

Our restaurant operations are also subject to federal and state laws that prohibit discrimination and laws regulating the design and operation of facilities, such as the Americans with Disabilities Act of 1990. The operation of our franchisee system is also subject to regulations enacted by a number of states and rules promulgated by the Federal Trade Commission. If we or our franchisees fail to comply with these laws and regulations, we or our franchisees could be subjected to restaurant closure, fines, penalties and litigation, which may be costly and could adversely affect our results of operations and financial condition. In addition, the future enactment of additional legislation regulating the franchise relationship could adversely affect our operations.

We are continuing to review the health care reform legislation. Because of the breadth and complexity of this legislation, the current lack of interpretive guidance and the phased-in nature of implementation, we cannot predict with certainty the financial and operational impacts the law will have on us. However, we expect that our expenses related to employee health benefits will increase over the long term as a result of this legislation. Any such increases could adversely affect our business, cash flows, financial condition and results of operations. Additionally, the legislation requires restaurant companies such as ours to disclose calorie information on their menus. We do not expect to incur any material costs from compliance with this provision of the law, but cannot anticipate the changes in guest behavior that could result from the implementation of this provision, which could have an adverse effect on our sales or results of operations.

We are also subject to federal, state and international laws regulating the offer and sale of franchises. Such laws impose registration and disclosure requirements on franchisors in the offer and sale of franchises, and may contain provisions that supersede the terms of franchise agreements, including limitations on the ability of franchisors to terminate franchises and alter franchise arrangements.

Negative publicity generated by incidents at a few restaurants can adversely affect the operating results of our entire chain and the Denny’s brand.

Food safety concerns, criminal activity, alleged discrimination or other operating issues stemming from one restaurant or a limited number of restaurants do not just impact that particular restaurant or a limited number of restaurants. Rather, our entire chain of restaurants may be at risk from the negative publicity generated by an incident at a single restaurant. This negative publicity can adversely affect the operating results of our entire chain and the Denny’s brand.

If we lose the services of any of our key management personnel, our business could suffer.

Our future success significantly depends on the continued services and performance of our key management personnel. Our future performance will depend on our ability to attract, motivate and retain these and other key officers and key team members, particularly regional and area managers and restaurant general managers. Competition for these employees is intense.

If our internal controls are ineffective, we may not be able to accurately report our financial results or prevent fraud.

We maintain a documented system of internal controls which is reviewed and tested by the company’s full time Internal Audit Department. The Internal Audit Department reports directly to the Audit Committee of the Board of Directors. We believe we have a well-designed system to maintain adequate internal controls on the business; however, we cannot be certain that our controls will be adequate in the future or that adequate controls will be effective in preventing errors or fraud. Any failures in the effectiveness of our internal controls could have an adverse effect on our operating results or cause us to fail to meet reporting obligations.

As a holding company, Denny’s Corporation depends on upstream payments from its operating subsidiaries.

Almost all our assets are owned, and all of our operating revenues are earned, by our subsidiaries, which are also the primary obligors for substantially all of the indebtedness, obligations and liabilities related to our business. Accordingly, our ability to repurchase shares of our Common Stock and to make any distributions to our shareholders depends on the performance of those subsidiaries and their ability to make distributions to Denny’s Corporation. Their ability to make such distributions may be subject to contractual and other restrictions.

Many factors, including those over which we have no control, affect the trading price of our stock.

Factors such as reports on the economy or the price of commodities, as well as negative or positive announcements by competitors, regardless of whether the report directly relates to our business, could have an impact of the trading price of our stock. In addition to investor expectations about our prospects, trading activity in our stock can reflect the portfolio strategies and investment allocation changes of institutional holders, as well as non-operating initiatives such as our share repurchase program. Any failure to meet market expectations whether for same-store sales, restaurant unit growth, earnings per share or other metrics could cause our share price to decline.

Risks Related to our Indebtedness

Our indebtedness could have an adverse effect on our financial condition and operations.

As of December 26, 2012, we had total indebtedness of $190.1 million, including capital leases.

We continually monitor our cash flow and liquidity needs. Although we believe that our existing cash balances, funds from operations and amounts available under our credit facility will be adequate to cover those needs, we could seek additional sources of funds, including incurring additional debt and selling selected assets, to maintain sufficient cash flow to fund our ongoing operating needs, pay interest and scheduled debt amortization and fund anticipated capital expenditures over the next twelve months. We have no material debt maturities scheduled until April 2017. If we are unable to satisfy or refinance our current debt as it comes due, we may default on our debt obligations.

For additional information concerning our indebtedness see "Management's Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources."

Our debt instruments include restrictive covenants. These covenants may restrict or prohibit our ability to engage in or enter a variety of transactions. A breach of these covenants could cause acceleration of a significant portion of our outstanding indebtedness.

The credit agreement governing our indebtedness contains various covenants that limit, among other things, our ability to:

| |

| • | incur additional indebtedness; |

| |

| • | pay dividends, purchase shares of Common Stock or make distributions or certain other restricted payments; |

| |

| • | make certain investments; |

| |

| • | create dividend or other payment restrictions affecting restricted subsidiaries; |

| |

| • | issue or sell capital stock of restricted subsidiaries; |

| |

| • | enter into transactions with stockholders or affiliates; |

| |

| • | sell assets and use the proceeds thereof; |

| |

| • | engage in sale-leaseback transactions; and |

| |

| • | enter into certain mergers and consolidations. |

These covenants could have an adverse effect on our business by limiting our ability to take advantage of financing, merger, acquisition or other corporate opportunities and to fund our operations. If we incur additional debt in the future, covenant limitations on our activities (and risks associated with such increased debt levels generally) could increase.

Our credit agreement contains additional restrictive covenants, including financial maintenance requirements. Our ability to comply with these covenants may be affected by events beyond our control, such as uncertainties related to the current economy, and we cannot be sure that we will be able to comply with these covenants.

Upon the occurrence of an event of default under any of our debt instruments, the lenders could elect to declare all amounts outstanding to be immediately due and payable and terminate all commitments to extend further credit. If we were unable to repay those amounts, the lenders could proceed against the collateral granted to them, if any, to secure the indebtedness. If the lenders under our current or future indebtedness accelerate the payment of the indebtedness, we cannot be sure that our assets would be sufficient to repay in full our outstanding indebtedness.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Most Denny’s restaurants are free-standing facilities with property sizes averaging approximately one acre. The restaurant buildings average between 3,800 - 4,800 square feet, allowing them to accommodate an average of 130-150 guests. The number and location of our restaurants as of December 26, 2012 and December 28, 2011 are presented below:

|

| | | | | | | | | | | | | | | | | | |

| | | 2012 | | 2011 |

| State/Country | | Company | | Franchised / Licensed | | Total | | Company | | Franchised / Licensed | | Total |

| Alabama | | 2 |

| | 5 |

| | 7 |

| | 2 |

| | 5 |

| | 7 |

|

| Alaska | | — |

| | 3 |

| | 3 |

| | — |

| | 3 |

| | 3 |

|

| Arizona | | 8 |

| | 71 |

| | 79 |

| | 10 |

| | 72 |

| | 82 |

|

| Arkansas | | — |

| | 10 |

| | 10 |

| | — |

| | 11 |

| | 11 |

|

| California | | 59 |

| | 349 |

| | 408 |

| | 73 |

| | 344 |

| | 417 |

|

| Colorado | | — |

| | 30 |

| | 30 |

| | — |

| | 28 |

| | 28 |

|

| Connecticut | | — |

| | 8 |

| | 8 |

| | — |

| | 8 |

| | 8 |

|

| Delaware | | — |

| | 2 |

| | 2 |

| | 1 |

| | — |

| | 1 |

|

| District of Columbia | | — |

| | 1 |

| | 1 |

| | — |

| | 2 |

| | 2 |

|

| Florida | | 17 |

| | 134 |

| | 151 |

| | 17 |

| | 138 |

| | 155 |

|

| Georgia | | 1 |

| | 15 |

| | 16 |

| | 1 |

| | 14 |

| | 15 |

|

| Hawaii | | 5 |

| | 3 |

| | 8 |

| | 6 |

| | 3 |

| | 9 |

|

| Idaho | | — |

| | 9 |

| | 9 |

| | — |

| | 9 |

| | 9 |

|

| Illinois | | 7 |

| | 49 |

| | 56 |

| | 9 |

| | 47 |

| | 56 |

|

| Indiana | | — |

| | 38 |

| | 38 |

| | 1 |

| | 37 |

| | 38 |

|

| Iowa | | — |

| | 3 |

| | 3 |

| | — |

| | 3 |

| | 3 |

|

| Kansas | | — |

| | 10 |

| | 10 |

| | — |

| | 10 |

| | 10 |

|

| Kentucky | | 2 |

| | 15 |

| | 17 |

| | 10 |

| | 7 |

| | 17 |

|

| Louisiana | | 1 |

| | 2 |

| | 3 |

| | 1 |

| | 2 |

| | 3 |

|

| Maine | | — |

| | 7 |

| | 7 |

| | — |

| | 7 |

| | 7 |

|

| Maryland | | 3 |

| | 21 |

| | 24 |

| | 3 |

| | 20 |

| | 23 |

|

| Massachusetts | | — |

| | 6 |

| | 6 |

| | — |

| | 6 |

| | 6 |

|

| Michigan | | 4 |

| | 18 |

| | 22 |

| | 4 |

| | 18 |

| | 22 |

|

| Minnesota | | — |

| | 13 |

| | 13 |

| | — |

| | 13 |

| | 13 |

|

| Mississippi | | 1 |

| | 2 |

| | 3 |

| | 1 |

| | 2 |

| | 3 |

|

| Missouri | | 4 |

| | 34 |

| | 38 |

| | 4 |

| | 34 |

| | 38 |

|

| Montana | | — |

| | 5 |

| | 5 |

| | — |

| | 5 |

| | 5 |

|

| Nebraska | | — |

| | 5 |

| | 5 |

| | — |

| | 4 |

| | 4 |

|

| Nevada | | 6 |

| | 27 |

| | 33 |

| | 7 |

| | 25 |

| | 32 |

|

| New Hampshire | | — |

| | 3 |

| | 3 |

| | — |

| | 3 |

| | 3 |

|

| New Jersey | | — |

| | 9 |

| | 9 |

| | 2 |

| | 5 |

| | 7 |

|

| New Mexico | | — |

| | 27 |

| | 27 |

| | — |

| | 26 |

| | 26 |

|

| New York | | 1 |

| | 48 |

| | 49 |

| | 1 |

| | 48 |

| | 49 |

|

| North Carolina | | — |

| | 21 |

| | 21 |

| | — |

| | 20 |

| | 20 |

|

| North Dakota | | — |

| | 4 |

| | 4 |

| | — |

| | 4 |

| | 4 |

|

| Ohio | | 3 |

| | 36 |

| | 39 |

| | 3 |

| | 36 |

| | 39 |

|

| Oklahoma | | — |

| | 16 |

| | 16 |

| | — |

| | 17 |

| | 17 |

|

| Oregon | | — |

| | 24 |

| | 24 |

| | — |

| | 24 |

| | 24 |

|

| Pennsylvania | | 11 |

| | 28 |

| | 39 |

| | 16 |

| | 23 |

| | 39 |

|

| Rhode Island | | — |

| | 2 |

| | 2 |

| | — |

| | 2 |

| | 2 |

|

| South Carolina | | — |

| | 16 |

| | 16 |

| | — |

| | 15 |

| | 15 |

|

| South Dakota | | — |

| | 3 |

| | 3 |

| | — |

| | 3 |

| | 3 |

|

| Tennessee | | 2 |

| | 4 |

| | 6 |

| | 2 |

| | 4 |

| | 6 |

|

| Texas | | 17 |

| | 168 |

| | 185 |

| | 19 |

| | 167 |

| | 186 |

|

| Utah | | — |

| | 25 |

| | 25 |

| | — |

| | 25 |

| | 25 |

|

| Vermont | | — |

| | 2 |

| | 2 |

| | — |

| | 2 |

| | 2 |

|

| Virginia | | 10 |

| | 20 |

| | 30 |

| | 10 |

| | 19 |

| | 29 |

|

| Washington | | — |

| | 47 |

| | 47 |

| | — |

| | 46 |

| | 46 |

|

| West Virginia | | — |

| | 2 |

| | 2 |

| | — |

| | 2 |

| | 2 |

|

| Wisconsin | | — |

| | 23 |

| | 23 |

| | — |

| | 19 |

| | 19 |

|

| Wyoming | | — |

| | 3 |

| | 3 |

| | 3 |

| | — |

| | 3 |

|

| Canada | | — |

| | 63 |

| | 63 |

| | — |

| | 60 |

| | 60 |

|

| Costa Rica | | — |

| | 3 |

| | 3 |

| | — |

| | 3 |

| | 3 |

|

| Curacao N.V. | | — |

| | 1 |

| | 1 |

| | — |

| | 1 |

| | 1 |

|

| Dominican Republic | | — |

| | 1 |

| | 1 |

| | — |

| | — |

| | — |

|

| Guam | | — |

| | 2 |

| | 2 |

| | — |

| | 2 |

| | 2 |

|

| Honduras | | — |

| | 3 |

| | 3 |

| | — |

| | 2 |

| | 2 |

|

| Mexico | | — |

| | 5 |

| | 5 |

| | — |

| | 5 |

| | 5 |

|

| New Zealand | | — |

| | 8 |

| | 8 |

| | — |

| | 8 |

| | 8 |

|

| Puerto Rico | | — |

| | 12 |

| | 12 |

| | — |

| | 11 |

| | 11 |

|

| Total | | 164 |

| | 1,524 |

| | 1,688 |

| | 206 |

| | 1,479 |

| | 1,685 |

|

Of the total 1,688 restaurants in the Denny's brand, our interest in restaurant properties consists of the following:

|

| | | | | | | | |

| | Company Restaurants | | Franchised Restaurants | | Total |

| Owned properties | 35 |

| | 53 |

| | 88 |

|

| Leased properties | 129 |

| | 354 |

| | 483 |

|

| | 164 |

| | 407 |

| | 571 |

|

We have generally been able to renew our restaurant leases as they expire at then-current market rates. The remaining terms of leases range from less than one to approximately 35 years, including optional renewal periods. In addition to the restaurant properties, we own an 18-story, 187,000 square foot office building in Spartanburg, South Carolina, which serves as our corporate headquarters. Our corporate offices currently occupy 17 floors of the building, with a portion of the building leased to others.

See Note 11 to our Consolidated Financial Statements for information concerning encumbrances on substantially all of our properties.

Item 3. Legal Proceedings

There are various claims and pending legal actions against or indirectly involving us, incidental to and arising out of the ordinary course of the business. In the opinion of management, based upon information currently available, the ultimate liability with respect to these proceedings and claims will not materially affect the Company's consolidated results of operations or financial position. We record legal settlement costs as other operating expenses in our Consolidated Statements of Income as those costs are incurred.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our Common Stock is listed under the symbol “DENN” and trades on the NASDAQ Capital Market ("NASDAQ"). The following table lists the high and low sales prices of the Common Stock for each quarter of fiscal years 2012 and 2011, according to NASDAQ.

|

| | | | | | | | |

| | | High | | Low |

| 2012 | | | | |

| First quarter | | $ | 4.55 |

| | $ | 3.71 |

|

| Second quarter | | 4.45 |

| | 3.79 |

|

| Third quarter | | 5.24 |

| | 4.21 |

|

| Fourth quarter | | 5.13 |

| | 4.52 |

|

| 2011 | | | | |

| First quarter | | $ | 4.30 |

| | $ | 3.49 |

|

| Second quarter | | 4.24 |

| | 3.81 |

|

| Third quarter | | 4.37 |

| | 3.11 |

|

| Fourth quarter | | 4.07 |

| | 3.10 |

|

Stockholders

As of March 6, 2013, there were 92,425,265 shares of Common Stock outstanding and approximately 9,600 record and beneficial holders of Common Stock.

Dividends and Share Repurchases

Our credit facility allows for the payment of cash dividends and/or the purchase of Common Stock, subject to certain limitations and continued maintenance of all relevant covenants before and after any such payment of any dividend or stock purchase. The aggregate amount available for such dividends or stock purchases is as follows:

| |

| • | not to exceed $30.0 million if the Consolidated Leverage Ratio (as defined in the Credit Agreement) is 2.0x or greater and unlimited if the Consolidated Leverage Ratio is below 2.0x, provided that, in each case, at least $20.0 million of availability is maintained under the revolving credit facility after such payment; and |

| |

| • | an additional annual aggregate amount equal to $0.05 times the number of outstanding shares of Common Stock, that may not be carried forward to a future year if unused. |

The table below provides information concerning repurchases of shares of our Common Stock during the quarter ended December 26, 2012.

|

| | | | | | | | | | | | | |

| Period | | Total Number of Shares Purchased | | Average Price Paid Per Share (1) | | Total Number of Shares Purchased as Part of Publicly Announced Programs (2) | | Maximum Number of Shares that May Yet be Purchased Under the Program (2) |

| | | (In thousands, except per share amounts) | | |

| September 27, 2012 – October 24, 2012 | | 764 |

| | $ | 4.90 |

| | 764 |

| | 5,100 |

|

| October 25, 2012 – November 21, 2012 | | 720 |

| | 4.67 |

| | 720 |

| | 4,380 |

|

| November 22, 2012 – December 26, 2012 | | 915 |

| | 4.76 |

| | 915 |

| | 3,465 |

|

| Total | | 2,399 |

| | $ | 4.78 |

| | 2,399 |

| | |

| |

| (1) | Average price paid per share excludes commissions. |

| |

| (2) | On May 18, 2012 we announced that our Board of Directors had approved the repurchase of up to 6 million shares of Common Stock (in addition to a previous 6 million share authorization completed in the third quarter of 2012). Such repurchases may take place from time to time on the open market (including in pre-arranged stock trading plans in accordance with the guidelines specified in Rule 10b5-1 under the Securities Exchange Act of 1934) or in privately negotiated transactions, subject to market and business conditions. During the quarter ended December 26, 2012, we purchased 2,399,355 shares of Common Stock for an aggregate consideration of approximately $11.5 million, pursuant to the share repurchase program. |

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth information as of December 26, 2012 with respect to our compensation plans under which equity securities of Denny’s Corporation are authorized for issuance.

|

| | | | | | | | | | | | | | |

| Plan category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans | | |

| Equity compensation plans approved by security holders | | 4,585,945 |

| | (1) | | $ | 3.24 |

| | 4,391,495 |

| | (2) |

| Equity compensation plans not approved by security holders | | 600,000 |

| | (3) | | 3.66 |

| | 900,000 |

| | (4) |

| Total | | 5,185,945 |

| | | | $ | 3.28 |

| | 5,291,495 |

| | |

| |

| (1) | Includes shares of Common Stock issuable pursuant to the grant or exercise of awards under the Denny’s Corporation 2012 Omnibus Incentive Plan (the “2012 Omnibus Plan”), Denny’s Corporation 2008 Omnibus Incentive Plan (the “2008 Omnibus Plan”), the Denny’s Corporation Amended and Restated 2004 Omnibus Incentive Plan (the “2004 Omnibus Plan”) and the Denny’s Inc. Omnibus Incentive Compensation Plan for Executives (collectively, the "Denny's Incentive Plans"). |

| |

| (2) | Includes shares of Common Stock available for issuance as awards of stock options, restricted stock, restricted stock units, deferred stock units and performance awards, under the 2012 Omnibus Plan. |

| |

| (3) | Includes shares of Common Stock issuable pursuant to the grant or exercise of employment inducement awards of stock options and restricted stock units granted outside of the Denny's Incentive Plans in accordance with NASDAQ Listing Rule 5635(c)(4). |

| |

| (4) | Includes shares of Common Stock available for issuance as awards of stock options and restricted stock units outside of the Denny's Incentive Plans in accordance with NASDAQ Listing Rule 5635(c)(4). |

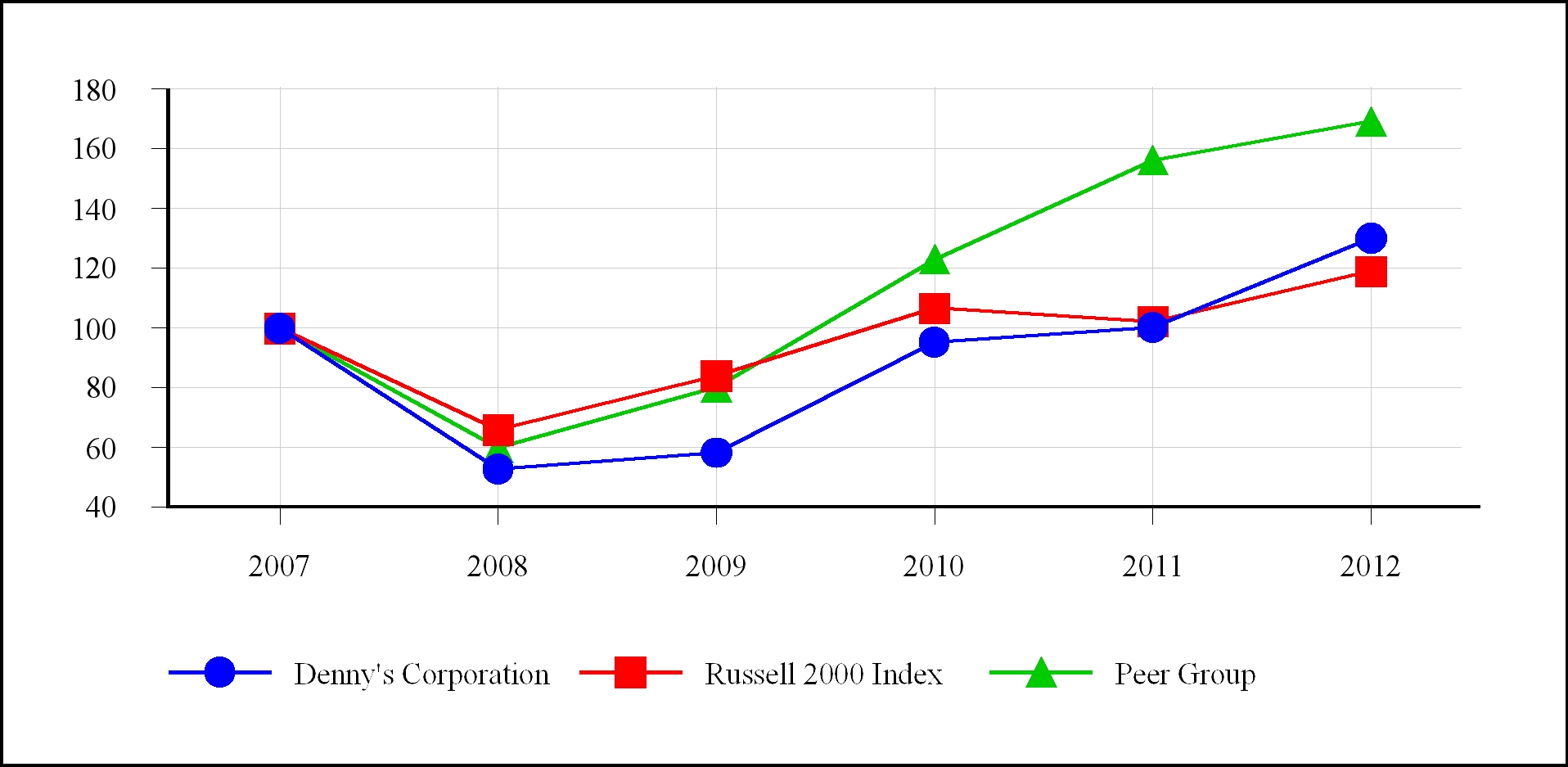

Performance Graph

The following graph compares the cumulative total stockholders’ return on our Common Stock for the five fiscal years ended December 26, 2012 (December 26, 2007 to December 26, 2012) against the cumulative total return of the Russell 2000® Index and a peer group. The graph and table assume that $100 was invested on December 26, 2007 (the last day of fiscal year 2007) in each of the Company’s Common Stock, the Russell 2000® Index and the peer group and that all dividends were reinvested.

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURN

ASSUMES $100 INVESTED ON DECEMBER 26, 2007

ASSUMES DIVIDENDS REINVESTED

FISCAL YEAR ENDED DECEMBER 26, 2012

|

| | | | | | | | | | | |

| | Russell 2000® Index (1) | | Peer Group (2) | | Denny's Corporation |

| December 26, 2007 | $ | 100.00 |

| | $ | 100.00 |

| | $ | 100.00 |

|

| December 31, 2008 | $ | 66.20 |

| | $ | 60.08 |

| | $ | 53.07 |

|

| December 30, 2009 | $ | 84.20 |

| | $ | 80.44 |

| | $ | 58.40 |

|

| December 29, 2010 | $ | 106.81 |

| | $ | 123.07 |

| | $ | 95.46 |

|

| December 28, 2011 | $ | 102.33 |

| | $ | 156.16 |

| | $ | 100.27 |

|

| December 26, 2012 | $ | 119.05 |

| | $ | 169.08 |

| | $ | 130.16 |

|

| |

| (1) | The Russell 2000 Index is a broad equity market index of 2,000 companies that measures the performance of the small-cap segment of the U.S. equity universe. As of December 31, 2012, the weighted average market capitalization of companies within the index was approximately $1.3 billion with the median market capitalization being approximately $0.5 billion. |

| |

| (2) | The peer group consists of 19 public companies that operate in the restaurant industry. The peer group includes the following companies: Einstein Noah Restaurant Group (BAGL), BJ's Restaurants (BJRI), Bob Evans Farms, Inc. (BOBE), Buffalo Wild Wings, Inc. (BWLD), The Cheesecake Factory Incorporated, (CAKE), Cracker Barrel Old Country Store, Inc. (CBRL), Chipotle Mexican Grill, Inc. (CMG), DineEquity, Inc. (DIN), Domino’s Pizza, Inc. (DPZ), Brinker International, Inc. (EAT), Jack In The Box Inc. (JACK), Krispy Kreme Doughnuts (KKD), Panera Bread Company (PNRA), Papa John’s International, Inc. (PZZA), Red Robin Gourmet Burgers, Inc. (RRGB), Ruby Tuesday, Inc. (RT), Sonic Corp. (SONC), Texas Roadhouse, Inc. (TXRH) and The Wendy’s Company (WEN). |

Item 6. Selected Financial Data

The following table provides selected financial data that was extracted or derived from our audited financial statements. The data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and related notes included elsewhere in this report.

|

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended |

| | | December 26, 2012 | | December 28, 2011 (a) | | December 29, 2010 | | December 30, 2009 | | December 31, 2008 (b) |

| | | (In millions, except ratios and per share amounts) |

| Statement of Income Data: | | | | | | | | | | |

| Operating revenue | | $ | 488.4 |

| | $ | 538.5 |

| | $ | 548.5 |

| | $ | 608.1 |

| | $ | 760.3 |

|

| Operating income | | 56.4 |

| | 51.0 |

| | 55.2 |

| | 72.4 |

| | 60.9 |

|

| Income from continuing operations | | $ | 22.3 |

| | $ | 112.3 |

| | $ | 22.7 |

| | $ | 41.6 |

| | $ | 12.7 |

|

| Basic net income per share: | | $ | 0.23 |

| | $ | 1.15 |

| | $ | 0.23 |

| | $ | 0.43 |

| | $ | 0.13 |

|

| Diluted net income per share: | | $ | 0.23 |

| | $ | 1.13 |

| | $ | 0.22 |

| | $ | 0.42 |

| | $ | 0.13 |

|

| | | | | | | | | | | |

| Cash dividends per common share (c) | | — |

| | — |

| | — |

| | — |

| | — |

|

| | | | | | | | | | | |

| Balance Sheet Data (at end of period): | | | | | | | | | | |

| Current assets | | $ | 64.6 |

| | $ | 61.3 |

| | $ | 62.5 |

| | $ | 58.3 |

| | $ | 53.5 |

|

| Working capital deficit (d) | | (27.2 | ) | | (25.9 | ) | | (27.8 | ) | | (33.8 | ) | | (53.7 | ) |

| Net property and equipment | | 107.0 |

| | 112.8 |

| | 129.5 |

| | 131.5 |

| | 160.0 |

|

| Total assets | | 324.9 |

| | 350.5 |

| | 311.2 |

| | 312.6 |

| | 341.8 |

|

| Long-term debt, excluding current portion | | 177.5 |

| | 211.3 |

| | 253.1 |

| | 274.0 |

| | 322.7 |

|

| |

| (a) | During 2011, we concluded that it is more likely than not that certain of our deferred tax assets will be utilized. As a result, we released the majority of our valuation allowance, recognizing a tax benefit of $89.1 million. |

| |

| (b) | The fiscal year ended December 31, 2008 includes 53 weeks of operations as compared with 52 weeks for all other years presented. We estimate that the additional, or 53rd, week added approximately $14.3 million of operating revenue in 2008. |

| |

| (c) | Prior to the 2010 refinancing of our credit facility and repurchase and redemption of our public debt securities, distributions and dividends on Denny’s Corporation’s common equity securities were prohibited. Our current credit facility allows for the payment of cash dividends and/or the purchase of Common Stock subject to certain limitations. See Part II Item 5. |

| |

| (d) | A negative working capital position is not unusual for a restaurant operating company. The decrease in working capital deficit from December 31, 2008 to December 26, 2012 is primarily due to the sale of company restaurants to franchisees from 2007 through 2011. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with “Selected Financial Data,” and our Consolidated Financial Statements and the notes thereto.

Overview

Denny’s Corporation is one of America’s largest family-style restaurant chains. Our fiscal year ends on the Wednesday in December closest to December 31 of each year. As a result, a fifty-third week is added to a fiscal year every five or six years. 2012, 2011 and 2010 each included 52 weeks of operations. Our revenues are derived primarily from two sources: the sale of food and beverages at our company restaurants and the collection of royalties and fees from restaurants operated by our franchisees under the Denny’s name. Sales and customer traffic at both company-operated and franchised restaurants are affected by the success of our marketing campaigns, new product introductions and customer service, menu pricing, as well as external factors including competition, economic conditions affecting consumer spending and changes in guest tastes and preferences. Sales at company restaurants and royalty income from franchise restaurants are also impacted by the opening of new restaurants, the closing of existing restaurants and the sale of company restaurants to franchisees.

Our operating costs are exposed to volatility in two main areas: product costs and payroll and benefit costs. Many of the products sold in our restaurants are affected by commodity pricing and are, therefore, subject to price volatility. This volatility is caused by factors that are fundamentally outside of our control and are often unpredictable. In general, we purchase food products based on market prices or we set firm prices in purchase agreements with our vendors. Our ability to lock in prices on certain key commodities is imperative to control food costs in an environment in which many commodity prices are on the rise. In addition, our continued success with menu management helps us to offer menu items that provide a compelling value to our customers while maintaining consistent product costs and appropriate profitability. The volatility of payroll and benefit costs results primarily from changes in wage rates and increases in labor related expenses, such as medical benefit costs and workers' compensation costs. A number of our employees are paid the minimum wage. Accordingly, substantial increases in the minimum wage increase our labor costs. Additionally, changes in guest counts and investments in store-level labor impact payroll and benefit costs as a percentage of sales.

During 2012, we completed FGI, a strategic initiative to increase franchise restaurant development through the sale of certain geographic clusters of company restaurants to both current and new franchisees. In 2012, as a result of our FGI, we sold 36 restaurant operations to franchisees. As of December 26, 2012, we have sold 380 company restaurants since our FGI program began in early 2007. While we now consider the FGI program to be complete, we may, from time to time, continue to sell restaurants to franchisees where geographically and economically beneficial to the company.

Additionally, we have negotiated development agreements for 257 new domestic restaurants, 133 of which have opened. The majority of the remaining restaurants in the development agreement pipeline are expected to open over the next five years. While the majority of the restaurants to be opened under these agreements are on schedule, from time to time some of our franchisees' ability to grow and meet their development commitments is hampered by the economy and the difficult lending environment.

As a result of the development efforts described above, over the past five years we have transitioned from a restaurant portfolio mix of 66% franchised and 34% company-operated to a restaurant portfolio mix of 90% franchised and 10% company-operated at December 26, 2012. Now that we have achieved our mix target, we expect that our percentage of company-operated restaurants will gradually decrease, as the majority of our future unit growth will be through franchised restaurants.

Specifically, our focus on FGI has impacted our financial performance as follows:

| |

| • | Company restaurant sales have decreased from $423.9 million in 2010 to $353.7 million in 2012, primarily as a result of the sale of restaurants to franchisees. |

| |

| • | The decline in company restaurant revenues is partially offset by increased royalty income derived from the growth in the franchise restaurant base resulting from both traditional development and the conversion of restaurants. As a result, royalty income, which is included as a component of franchise and license revenue, has increased from $73.0 million in 2010 to $83.8 million in 2012. |

| |

| • | The resulting net reduction in total revenue related to our FGI is generally recovered by the benefits of a lower cost structure related to franchise and license revenues, a decrease in depreciation and amortization due to the sale of restaurant related assets to franchisees (from $29.6 million in 2010 to $22.3 million in 2012) and a reduction in interest expense resulting from the use of proceeds to reduce debt (from $25.8 million in 2010 to $13.4 million in 2012). See also "Debt and Refinancing and Reductions" below. |

| |

| • | Initial franchise fees, included as a component of franchise and license revenue, are generally recognized in the period in which a restaurant is sold to a franchisee or when a new unit is opened. These initial fees are completely dependent on the number of restaurants sold to or opened by franchisees during a particular period and, as a result, can cause fluctuations in our total franchise and license revenue from year to year. |

| |

| • | Occupancy revenues, also included as a component of franchise and license revenue, result from leasing or subleasing restaurants to franchisees. As a result of our FGI, occupancy revenues have increased from $44.8 million in 2010 to $47.8 million in 2012. Additionally, when restaurants are sold and leased or subleased to franchisees, the occupancy costs related to these restaurants moves from costs of company restaurant sales to costs of franchise and license revenue to match the related occupancy revenue. As subleases with franchisees end over time, franchise occupancy revenue and costs could decrease if franchisees enter into direct leases with landlords. |

| |