UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-05986

| T. Rowe Price Index Trust, Inc. |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

|

| Total Equity Market Index Fund | December 31, 2021 |

| POMIX | Investor Class |

| T. ROWE PRICE EQUITY MARKET INDEX FUNDS |

HIGHLIGHTS

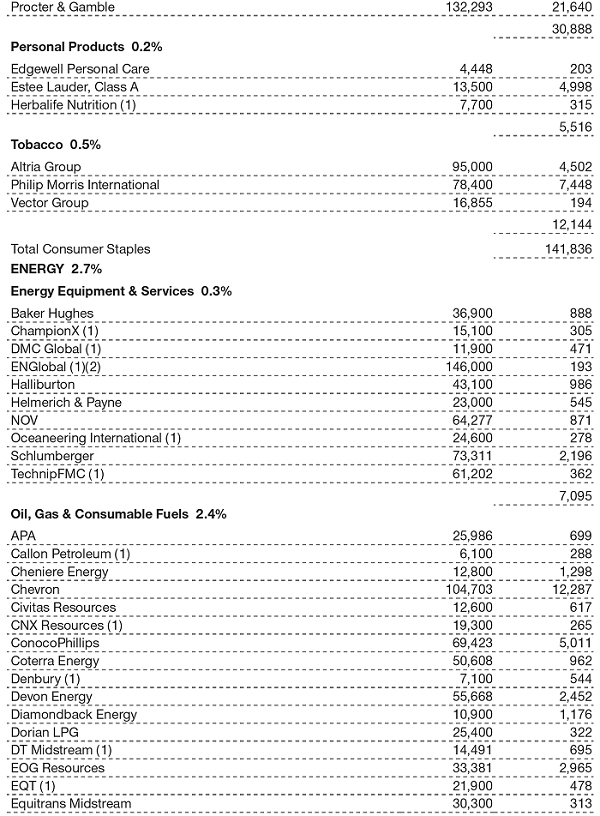

| ■ | Each of the three Equity Market Index Funds produced positive returns in 2021 and closely tracked its benchmark. Large-cap shares outperformed. |

| ■ | Stocks in the financials sector were among the largest contributors to performance in each of the funds. |

| ■ | Using full replication and sampling strategies, we kept the composition and other attributes of the index funds similar to those of their benchmarks. |

| ■ | The trajectories of the coronavirus pandemic, the economy, and interest rates are unpredictable, and investor sentiment toward the broad market and various market segments could change without warning. Our main task, however, is to use full replication or sampling strategies so that the Equity Market Index Funds are structured like major U.S. equity indexes and closely track their performance. |

Log in to your account at troweprice.com for more information.

* Certain mutual fund accounts that are assessed an annual account service fee can also save money by switching to e-delivery.

Market Commentary

Dear Shareholder

Major stock and bond indexes produced mixed results during 2021 as strong corporate earnings growth and a recovering economy contended with worries about inflation, new coronavirus variants, and less accommodative central banks. Most developed market stock benchmarks finished the year with positive returns, although gains slowed in the second half of the year, while fixed income returns faced headwinds from rising interest rates.

Large-cap U.S. growth stocks delivered the strongest returns, but solid results were common in many developed markets. However, emerging markets stock benchmarks struggled amid a significant equity market downturn in China.

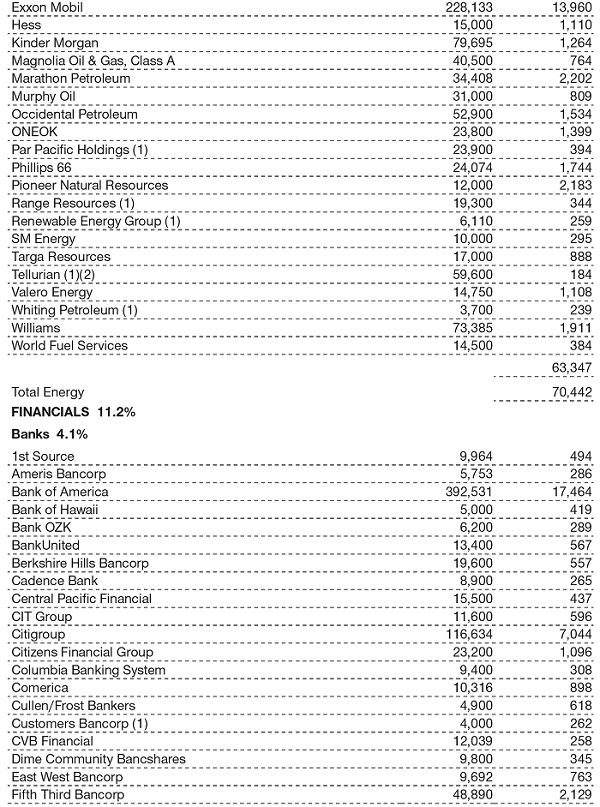

The large-cap S&P 500 Index returned almost 29%, marking its third straight year of positive returns. Robust results were widespread across the benchmark—according to Bloomberg data, 2021 marked the first year that all of the S&P 500 sectors recorded double-digit gains. The energy sector, which was the worst performer in 2020, was the leader in 2021 amid a sharp increase in oil prices, and real estate stocks also rebounded from a down year as strong demand led to rising rents. Financial and information technology stocks also produced excellent returns and outperformed the broad market.

In the fixed income market, rising Treasury yields weighed on performance, but below investment-grade corporate bonds delivered solid results as they benefited from improving fundamentals and investor demand for higher-yielding securities. (Bond prices and yields move in opposite directions.)

A robust increase in corporate earnings growth appeared to be a significant performance driver during the year. According to FactSet, overall earnings for the S&P 500 rose 89% in the second quarter of 2021 versus the year before, the fastest pace since 2009, and while third-quarter earnings slowed, they continued to beat expectations at an impressive pace. Despite the significant rally in the S&P 500 during 2021, the index’s price/earnings ratio actually fell over that period as earnings rose faster than stock prices. Although economic growth showed signs of slowing at times, data remained generally positive through the end of the period. The unemployment rate, which started the year at 6.7%, fell to 3.9% by December, and job openings reached a record high.

However, optimism surrounding strong earnings and employment gains was tempered by inflation concerns. Prices surged as the release of pent-up demand and supply chain disruptions contributed to higher inflation around the globe. In the U.S., the 6.8% increase in the consumer price index for the 12-month period ended in November was the highest level since 1982, a factor that may have contributed to a decline in consumer sentiment late in the year.

Meanwhile, central banks began to move away from the extremely accommodative policies they instituted in response to the initial wave of the coronavirus. The Federal Reserve began trimming its purchases of Treasuries and agency mortgage-backed securities in November, and policymakers indicated that they could soon start raising short-term interest rates.

How markets respond to the normalization of monetary policy is an open question. While fading stimulus might pose some challenges for investors, I believe it could contribute to a return of price sensitivity in global markets, which bodes well for selective investors focused on fundamentals.

Elevated valuations, higher inflation, and the continuing struggle to control the pandemic also pose potential challenges for financial markets in 2022. However, on the positive side, household wealth gains, pent-up consumer demand, and a potential boom in capital expenditures could sustain growth even as monetary policy turns less supportive. In this environment, our investment teams will remain focused on using fundamental research to identify companies that can add value to your portfolio over the long term.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

President and CEO

Management's Discussion of Fund Performance

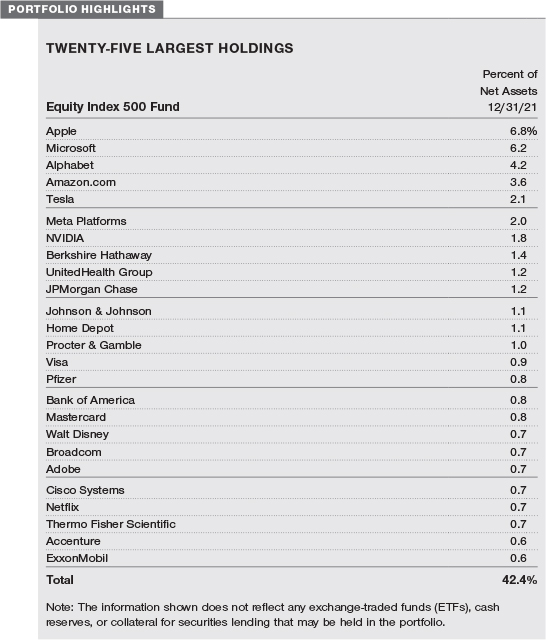

EQUITY INDEX 500 FUND

INVESTMENT OBJECTIVE

The fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization U.S. stocks.

FUND COMMENTARY

How did the fund perform in the past 12 months?

Large-cap U.S. stocks rose as the economy strengthened and corporate profits were robust in 2021. Equities extended 2020’s brisk gains and lifted the S&P 500 Index to all-time highs on a regular basis through the end of the year. The Equity Index 500 Fund returned 28.50% versus 28.71% for its benchmark, the S&P 500. The fund’s performance tends to slightly lag that of the index due to operating and management expenses. (Performance for the fund’s I Class and Z Class shares will vary due to their different fee structures. Past performance cannot guarantee future results.)

What factors influenced the fund's performance?

All sectors in the S&P 500 produced positive returns in 2021. Within our portfolio, information technology (IT) stocks contributed the most in absolute terms and by a wide margin. Microsoft was not only the top-performing software company, but it was also the top contributor in the entire portfolio. Despite ongoing supply constraints amid a global semiconductor chip shortage, semiconductor and semiconductor equipment companies performed very well; NVIDIA and Broadcom were leading contributors in the segment. On the other hand, IT services companies involved in the processing of electronic payments struggled, especially PayPal Holdings. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

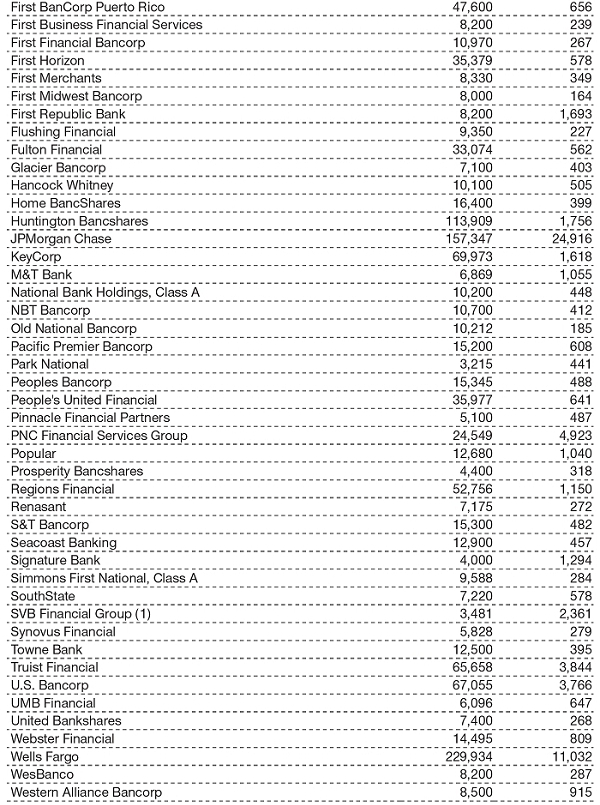

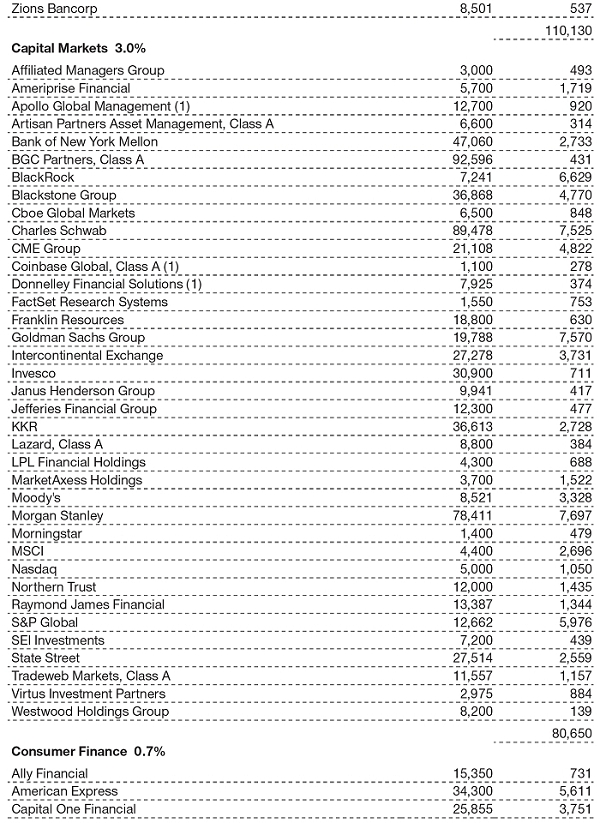

The financials sector offered strong positive returns, especially banks, which benefited from the economic recovery, consumer credit resilience on the back of fiscal stimulus measures, and expectations for rising interest rates and greater loan growth. Money center banks JPMorgan Chase, Bank of America, and Wells Fargo were some of the largest performance contributors in the portfolio. Capital markets companies, which benefited from rising equity markets and increased trading activity, also helped portfolio results. Discount broker Charles Schwab and Wall Street firms Morgan Stanley and Goldman Sachs, which are diversifying into other financial businesses, were strong contributors. Berkshire Hathaway, a holding company that owns stakes in a number of companies, including several financial entities, also fared well. Consumer finance companies that offer credit cards trailed.

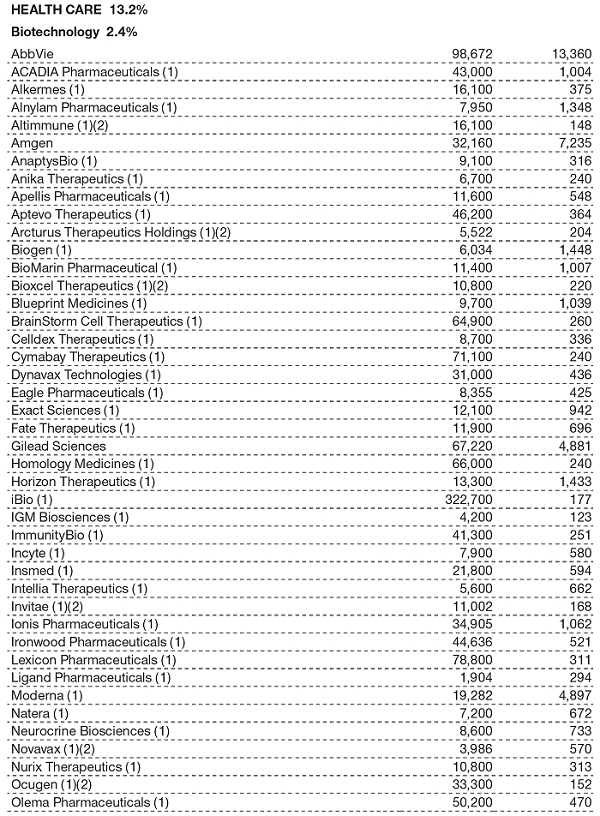

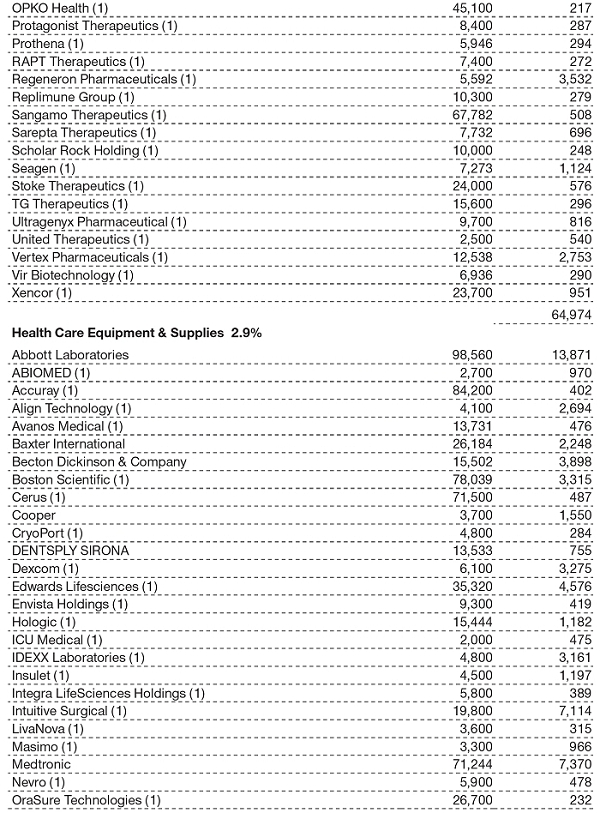

Health care stocks rose broadly. The providers and services industry was particularly strong, led by managed care giants UnitedHealth Group and CVS Health, which owns Aetna. Pharmaceutical companies also generated robust returns, such as Pfizer, which partnered with European company BioNTech to develop one of the first coronavirus vaccines. In the life sciences tools and services space, Thermo Fisher Scientific and Danaher performed well. Biotechnology stocks lagged other health care industries.

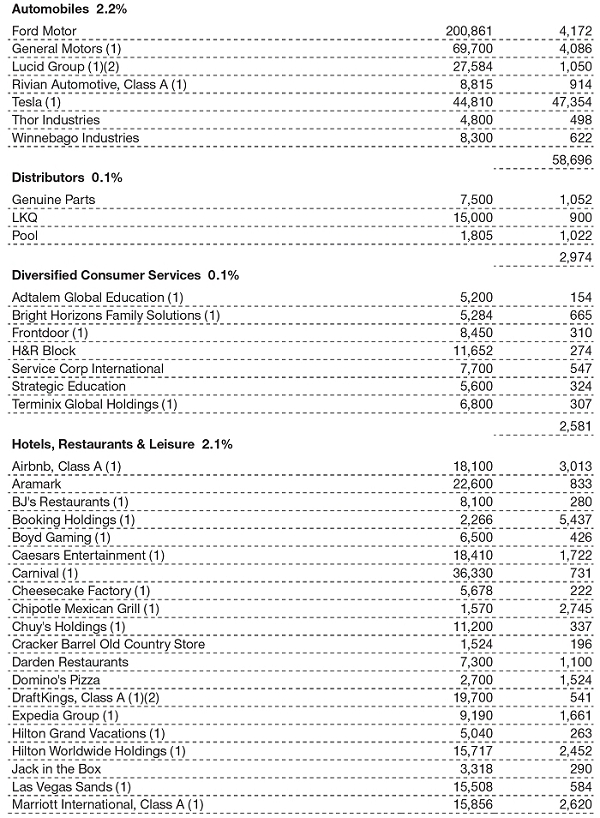

Consumer discretionary shares also enhanced the portfolio’s absolute returns. The automobiles segment was paced by Tesla, one of the top-performing companies in the portfolio. Specialty retailers Home Depot and Lowe’s were very strong, as both companies continued to benefit from a strong housing market and demand for home improvements. Stocks of hotel and restaurant operators generally appreciated, especially fast-food giant McDonald’s, but gaming companies and cruise operators underperformed.

The utilities sector, one of the smallest in the index and the portfolio, produced mild gains in percentage terms and contributed the least to performance in absolute terms. Utilities stocks, which tend to have above-average dividend yields, often behave like bonds, and their performance was hindered by generally rising longer-term Treasury yields and, more recently, expectations for the Federal Reserve to raise short-term rates in 2022.

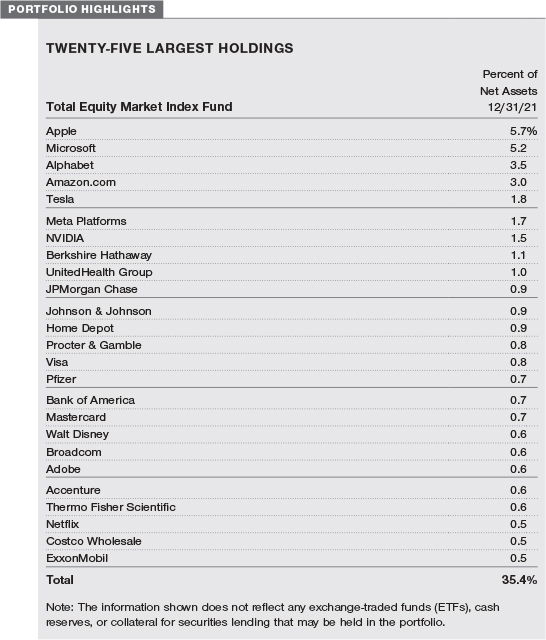

TOTAL EQUITY MARKET INDEX FUND

INVESTMENT OBJECTIVE

The fund seeks to match the performance of the entire U.S. stock market.

FUND COMMENTARY

How did the fund perform in the past 12 months?

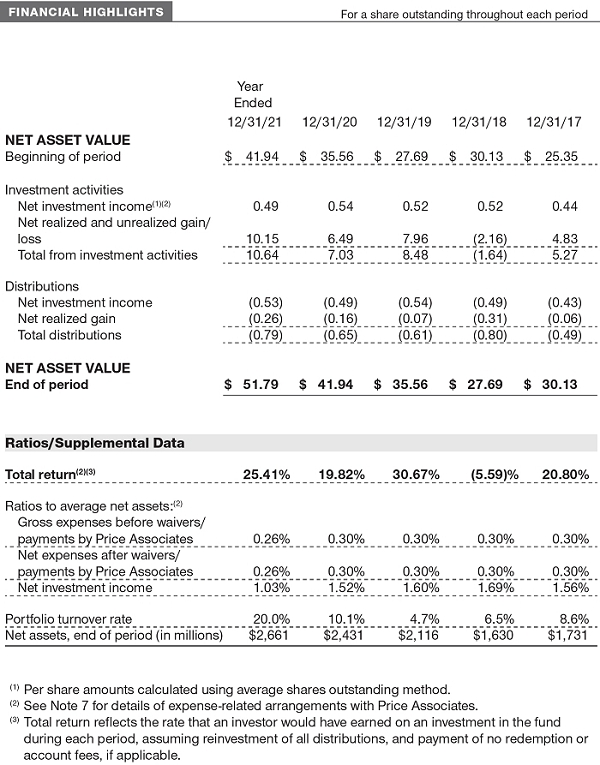

U.S. stocks rose in 2021, extending 2020’s brisk gains, as the economy strengthened and corporate profits were robust. The Total Equity Market Index Fund returned 25.41% versus 25.66% for its benchmark, the S&P Total Market Index. Fund performance tends to slightly lag that of the index due to operating and management expenses. (Past performance cannot guarantee future results.)

What factors influenced the fund's performance?

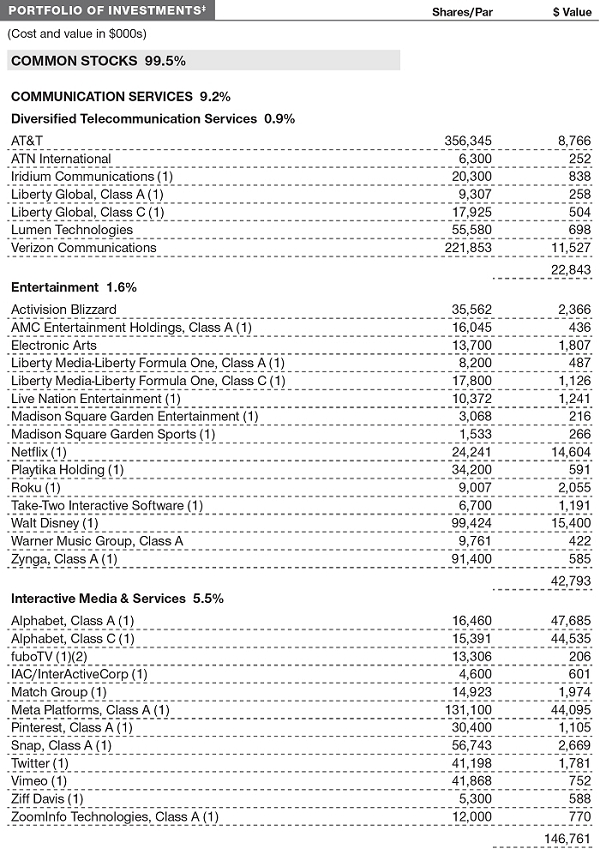

All sectors of the U.S. stock market produced positive returns in 2021. Within our portfolio, information technology (IT) stocks contributed the most in absolute terms. Microsoft was not only the top-performing software company, but it was also the top contributor in the entire portfolio. Despite ongoing supply constraints amid a global semiconductor chip shortage, semiconductor and semiconductor equipment companies performed very well, especially NVIDIA. Other technology bellwethers, such as iPhone maker Apple and communications equipment giant Cisco Systems, were also significant contributors. On the other hand, IT services companies involved in the processing of electronic payments were among our largest detractors, especially PayPal Holdings, Global Payments, and Fidelity National Information Services. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

The financials sector offered strong positive returns, especially banks, which benefited from the economic recovery, as well as expectations for rising interest rates and greater loan growth. Money center banks Bank of America, JPMorgan Chase, and Wells Fargo were among the largest contributors in the portfolio. Capital markets companies, which benefited from rising equity markets and increased trading activity, also helped results. Discount broker Charles Schwab and Wall Street firms Morgan Stanley and Goldman Sachs, which are diversifying into other financial businesses, were strong contributors. Asset management firms Blackstone, BlackRock, and KKR performed well, too. Among insurance companies, property and casualty insurers American International Group and Chubb were important absolute contributors to performance, driven by rising earnings. Thrifts and mortgage finance companies trailed with relatively mild gains.

Consumer discretionary shares generally contributed to fund performance. Specialty retailers Home Depot and Lowe’s were very strong, as both companies continued to benefit from a strong housing market and demand for home improvements. AutoZone and O’Reilly Automotive also did well. These companies, which sell automotive replacement parts and accessories to do-it-yourself and commercial customers, enjoyed strong demand for parts in supply-constrained new and used car markets. The automobiles segment was paced by Tesla, one of the top-performing companies in the portfolio. Stocks of hotel and restaurant operators generally did well, especially fast-food giant McDonald’s, but gaming companies, such as DraftKings, and cruise operators, such as Carnival, underperformed. Makers of leisure products also lagged, with exercise equipment maker Peloton Interactive—which produced stellar returns in 2020—falling sharply in 2021 as the economy reopened and consumers resumed more normal activities outside of the home.

Health care stocks rose broadly. The providers and services industry paced the sector, led by managed care giants UnitedHealth Group, CVS Health (which owns Aetna), and Anthem. Pharmaceutical companies were mixed, though several made a strong contribution to fund performance, including coronavirus vaccine makers Pfizer and Johnson & Johnson, as well as Zoetis and Eli Lilly. In the life sciences tools and services space, Thermo Fisher Scientific and Danaher performed well. Biotechnology stocks were widely mixed, with coronavirus vaccine maker Moderna among the better performers, while ACADIA Pharmaceuticals fared poorly, as the FDA notified the company early in the year that it would be unable to complete the review process for its prospective Nuplazid treatment due to deficiencies in the approval filing.

Stocks of industrials and business services companies, many of which are cyclical and thus closely tied to the economy’s health, generally contributed to performance. Machinery stocks Deere and Caterpillar produced solid gains, while freight railroad Union Pacific and trucking company Old Dominion Freight Line led the road and rail industry. In the commercial services and supply segment, waste collection and disposal companies Waste Management and Republic Services performed well. These companies operate in a recession-resistant industry with predictable volumes, and their pricing power was advantageous in the midst of labor constraints and wage pressures. On the other hand, shares of automobile auction company IAA struggled amid weaker-than-expected earnings and higher-than-expected costs. Airline stocks underperformed, especially Southwest Airlines, as the pandemic and rising jet fuel costs weighed on the industry.

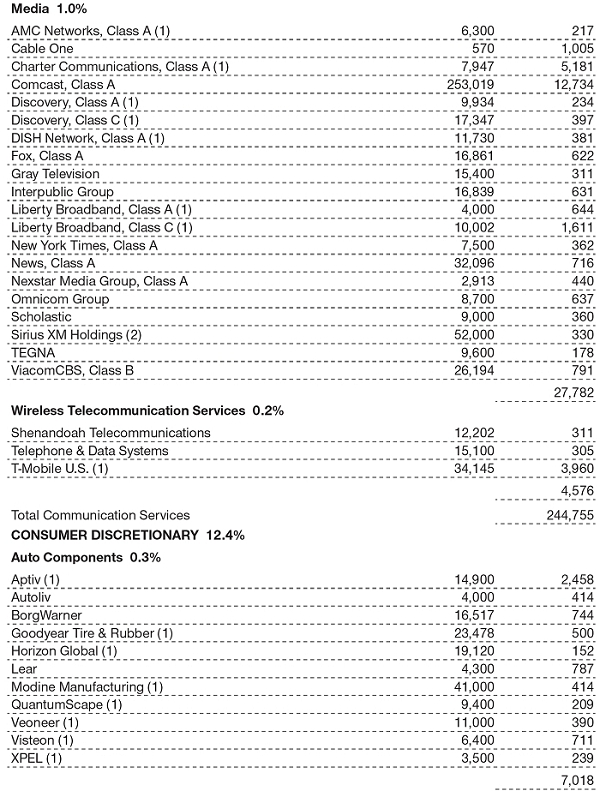

Communication services stocks were mixed. Top performers included Google’s parent company Alphabet, Facebook’s parent company Meta Platforms, and streaming entertainment provider Netflix. On the other hand, social media company Pinterest fared poorly. Shares of entertainment giant Walt Disney also struggled due in part to reduced Disney+ streaming service subscriber growth compared with 2020. Traditional telecom companies AT&T and Verizon Communications fared poorly, as did cable TV providers Comcast and Cable One.

The utilities sector, one of the smallest in the index and the portfolio, contributed the least to performance in absolute terms. Utilities stocks, which tend to have above-average dividend yields, often behave like bonds, and their performance was hindered by generally rising longer-term Treasury yields and, more recently, expectations for the Federal Reserve to raise short-term rates in 2022. Nevertheless, NextEra Energy was a significant contributor in the portfolio. The company has a regulated utilities business and seems to have competitive advantages as a provider of renewable energy, especially wind and solar power.

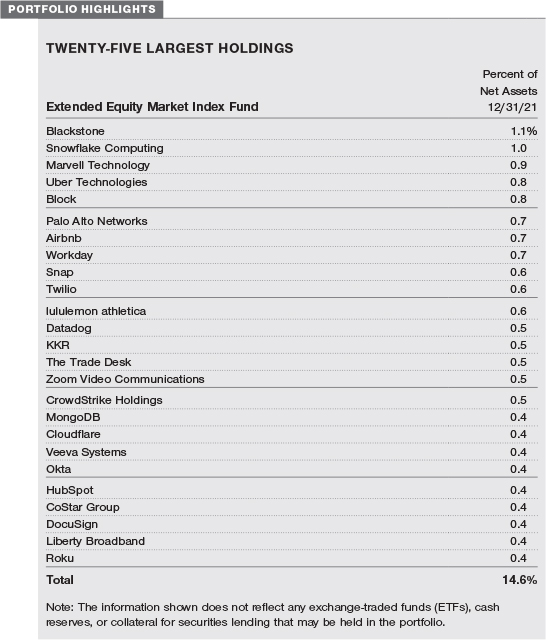

EXTENDED EQUITY MARKET INDEX FUND

INVESTMENT OBJECTIVE

The fund seeks to track the performance of a benchmark index that measures the investment return of small- and mid-capitalization U.S. stocks.

FUND COMMENTARY

How did the fund perform in the past 12 months?

Small- and mid-cap U.S. stocks rose but lagged large-cap shares in 2021, as the economy strengthened and corporate profits were robust. The Extended Equity Market Index Fund returned 12.31% versus 12.35% for its benchmark, the S&P Completion Index. Fund performance tends to slightly lag that of the index due to operating and management expenses. (Past performance cannot guarantee future results.)

What factors influenced the fund's performance?

In the small- and mid-cap universe, stocks of financial services companies contributed the most in absolute terms. Among capital markets companies, asset manager Blackstone and private equity manager KKR were two of the largest contributors in the entire portfolio. Regional banks were also very strong, rallying in anticipation of higher interest rates that would increase the profitability of the loans that they make. Signature Bank, which we sold when it joined the S&P 500 near the end of the year, was a major contributor to fund performance; Western Alliance Bancorp and East West Bancorp also did very well. Insurance stocks generally rose, while consumer finance companies and thrifts and mortgage finance businesses made relatively mild contributions to performance. Providers of diversified financial services were laggards. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

Industrials and business services companies rose broadly. Makers of building products were significant contributors, especially Builders FirstSource, a maker of assorted building products used in new home construction, as well as remodeling, repairs, and renovations. Shares climbed amid strong earnings stemming from housing market strength. Machinery stocks were mostly higher, including Watts Water Technologies, a supplier of valves and other plumbing products and solutions that manage and conserve the flow of fluids and energy into, through, and out of buildings. Another solid contributor was Herc Holdings, a large equipment rental company that was spun off by car rental company Hertz in 2016. The professional services industry was weighed down by CoStar Group, which focuses on the real estate market through its research-driven database and internet listings of properties. Shares underperformed due in part to a couple of failed acquisitions, as well as reduced guidance stemming from an expected increase in sales and marketing spending. Electrical equipment companies trailed. Generac Holdings, which makes power generation equipment, contributed to performance before we sold it when it was moved to the S&P 500 Index. However, various makers of equipment used to harness solar power declined significantly.

The real estate sector was a meaningful contributor to fund performance. Real estate investment trusts (REITs) tend to have above-average yields and are often regarded as bond market proxies in response to interest rate movements. Although longer-term interest rates rose in 2021, a number of our REITs performed well, as the reopening of the economy led to increased business and consumer activity at malls, shopping centers, hotels, apartments, and other facilities owned by REITs. Invitation Homes, Camden Property Trust, and Sun Communities (which owns manufactured housing communities and recreational vehicle parks and resorts) were major contributors not only in the sector but also in the entire portfolio. Real estate management and development companies were widely mixed. Shares of Jones Lang LaSalle climbed as earnings recovered with the commercial real estate market. In contrast, shares of Zillow Group, which generates revenue through the sale of advertising and marketing services to residential real estate professionals, plunged as the company decided to exit the business of buying and selling houses.

Information technology (IT) stocks in aggregate contributed to our results. The sector was driven by favorable performance of many semiconductor and semiconductor equipment companies despite continuing supply constraints and a global semiconductor chip shortage. Top contributors in the industry and the sector included Synaptics, a developer and supplier of custom-designed semiconductor solutions that make it easier for people to engage with connected devices and data; Entegris, a leading provider of semiconductor chemicals and materials, with dominant positions in attractive niches of the market; and ON Semiconductor, which focuses on industrial and automotive end markets. Electronic equipment, communications equipment, and IT services companies produced milder gains. Software stocks underperformed, with Zoom Video Communications among the largest detractors in the portfolio. Shares fell as the company faced challenging year-over-year earnings comparisons. Shares of DocuSign, which enables people to sign and send documents electronically, also fared poorly, as the company reported disappointing billings growth and issued weaker billings projections late in the year.

Health care stocks as a group detracted from fund performance. Biotechnology was one of the weakest industries in the entire portfolio, due in part to a lack of good product launches other than those related to the coronavirus. Many of our holdings declined in value, especially Exact Sciences, which makes a noninvasive test for colon cancer called Cologuard, and Sarepta Therapeutics. Moderna, however, which created one of the coronavirus vaccines and which joined the S&P 500 in July, was the largest contributor to fund performance for the whole year. Among health care technology companies, Teladoc Health, which provides telehealth services, fell sharply in 2021 following stellar gains in 2020. On the plus side, shares of Omnicell, which produces medication solutions for the inpatient hospital market, appreciated as earnings improved amid indications that hospitals are giving greater attention to their pharmacy operations and supply chains. Most of our pharmaceutical stocks declined in value. Life sciences tools and services companies, however, fared best. One of our larger contributors in the industry was Medpace Holdings, a contract research organization that focuses on helping small and mid-size biopharma clients pursue and receive regulatory approval for new drugs. Another was Repligen, a maker of biologic drugs through the use of bioprocessing technologies. Its main customers are biopharmaceutical drug developers and contract development and manufacturing organizations.

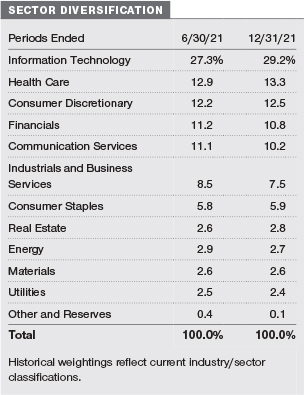

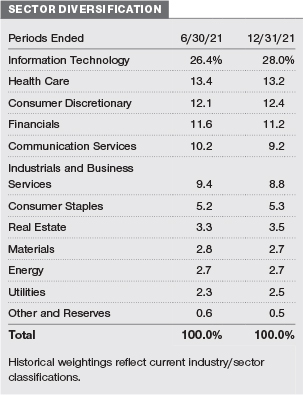

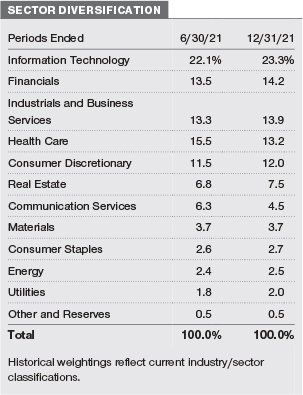

How are the Equity Market Index Funds positioned?

The Equity Market Index Funds, which tend to closely track their benchmarks, offer broad exposure to different sectors of the U.S. stock market, and each fund’s sector allocations are consistent with those of its benchmark. As such, changes in each portfolio’s sector diversification and other overall characteristics reflect changes in the composition of the indexes rather than strategic shifts that are typical of an actively managed fund. Since the portfolios are designed to track their indexes, they do not have the flexibility to shift assets toward stocks or sectors that are rising or away from those that are declining. The funds’ expenses are generally low, which allows investors to retain more of their returns.

As a reminder, the Equity Market Index Funds are designed for investors who want to harness the potential for long-term capital appreciation from broad exposure to large-cap U.S. stocks, the entire U.S. stock market, or small- and mid-cap U.S. stocks. The portfolios could serve as core holdings in an investor’s portfolio, as they offer attributes that many investors will find appealing.

The Equity Index 500 Fund uses a full replication strategy, which involves investing substantially all of its assets in all of the stocks in the S&P 500. The fund seeks to maintain holdings of each stock in proportion to its weight in the index. The Total Equity Market Index Fund and the Extended Equity Market Index Fund use a sampling strategy, which involves investing substantially all of their assets in a group of stocks representative of the sector allocations, financial characteristics, and other attributes of the S&P Total Market Index and S&P Completion Index, respectively. These two funds do not attempt to fully replicate their indexes by owning each of the stocks in them. All three index funds may occasionally invest in securities such as futures and exchange-traded funds so that they can accommodate cash flows and remain fully invested.

What is portfolio management's outlook?

Although the coronavirus pandemic is not yet over, the U.S. economy has recovered substantially from the brief but deep economic downturn in the first half of 2020. Most sectors of the economy have reopened to varying degrees, and many measures of the labor market have reached their best levels since the beginning of the pandemic. Corporate earnings growth has been very strong, and equity valuations in many cases are above their longer-term averages. Inflation is also elevated, due in part to supply chain disruptions and shortages in some industries, and central bank officials no longer refer to rising prices as a “transitory” development.

Late in 2021, the Federal Reserve announced its first step in reducing its accommodative policies—a tapering of its monthly asset purchases in November and December. In mid-December, the central bank announced that it would accelerate its tapering pace starting in January. As a result, the Fed should complete its asset purchases by the end of March, and short-term interest rate increases could commence shortly thereafter. Higher interest rates do not necessarily mean that the bull market or the economic recovery are about to end, though some equity sectors and some parts of the economy will fare better than others as borrowing costs increase.

The trajectories of the pandemic, the economy, and interest rates are unpredictable, and investor sentiment toward the broad market and various market segments could change without warning. Our main task, however, is not to determine which stocks or sectors may perform best in the period ahead. As always, our intention is to use full replication or sampling strategies so that the Equity Market Index Funds are structured like major U.S. equity indexes and closely track their performance.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

RISKS OF INVESTING IN THE EQUITY MARKET INDEX FUNDS

Common stocks generally fluctuate in value more than bonds and may decline significantly over short time periods. There is a chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising and falling prices. The value of a stock in which the funds invest may decline due to general weakness in the U.S. stock market, such as when the U.S. financial markets decline, or because of factors that affect a particular company or industry.

Although stocks issued by larger companies tend to have less overall volatility than stocks issued by smaller companies, larger companies may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods. In addition, larger companies may be less capable of responding quickly to competitive challenges and industry changes and may suffer sharper price declines as a result of earnings disappointments.

Funds that invest in small and medium-sized companies could be more volatile than funds that are exposed to only large companies. Small and medium-sized companies often have less experienced management, narrower product lines, more limited financial resources, and less publicly available information than larger companies. Smaller companies may have limited trading markets and tend to be more sensitive to changes in overall economic conditions.

Because the funds are passively managed, holdings are generally not reallocated based on changes in market conditions or the outlook for a specific security, industry, or market sector. As a result, the funds’ performance may lag the performance of actively managed funds. Funds that use a sampling strategy (and thus do not attempt to fully replicate their benchmark indexes) have a greater potential for their performance to deviate from that of their benchmarks.

BENCHMARK INFORMATION

Note: ©2022, S&P Global Market Intelligence. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.

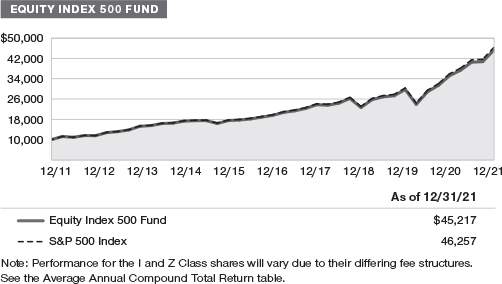

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

AVERAGE ANNUAL COMPOUND TOTAL RETURN

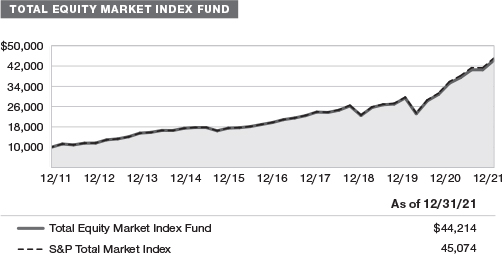

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

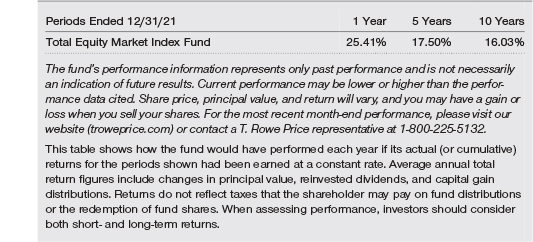

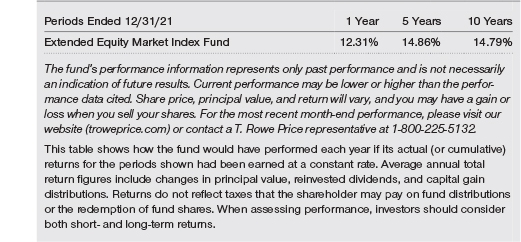

AVERAGE ANNUAL COMPOUND TOTAL RETURN

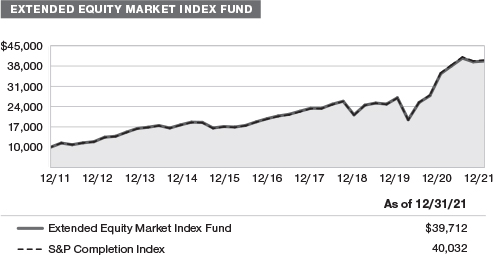

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

AVERAGE ANNUAL COMPOUND TOTAL RETURN

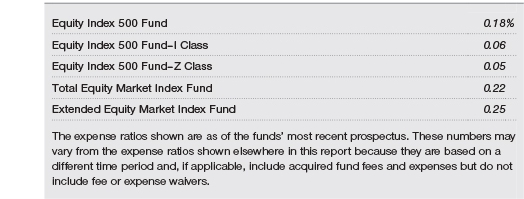

EXPENSE RATIO

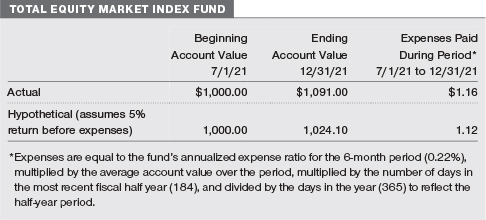

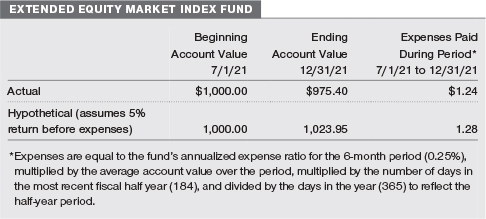

FUND EXPENSE EXAMPLE

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the Equity Index 500 Fund has three share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, I Class shares are also available to institutionally oriented clients and impose no 12b-1 or administrative fee payment, and Z Class shares are offered only to funds advised by T. Rowe Price and other advisory clients of T. Rowe Price or its affiliates that are subject to a contractual fee for investment management services and impose no 12b-1 fee or administrative fee payment. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an account service fee that is not included in the accompanying table. The account service fee is charged on a quarterly basis, usually during the last week of a calendar quarter, and applies to accounts with balances below $10,000 on the day of the assessment. The fee is charged to accounts that fall below $10,000 for any reason, including market fluctuations, redemptions, or exchanges. When an account with less than $10,000 is closed either through redemption or exchange, the fee is charged and deducted from the proceeds. The fee applies to IRAs but not to retirement plans directly registered with T. Rowe Price Services or accounts maintained by intermediaries through NSCC® Networking. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

The accompanying notes are an integral part of these financial statements.

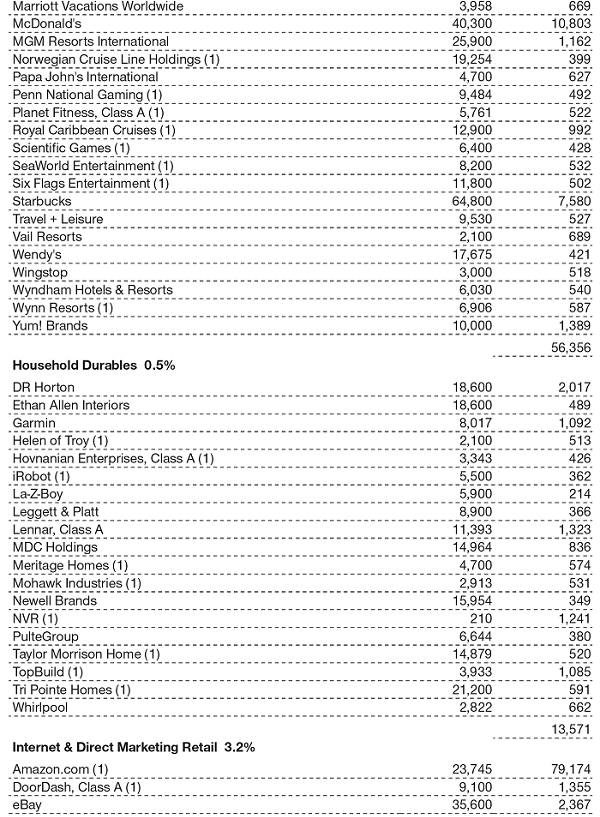

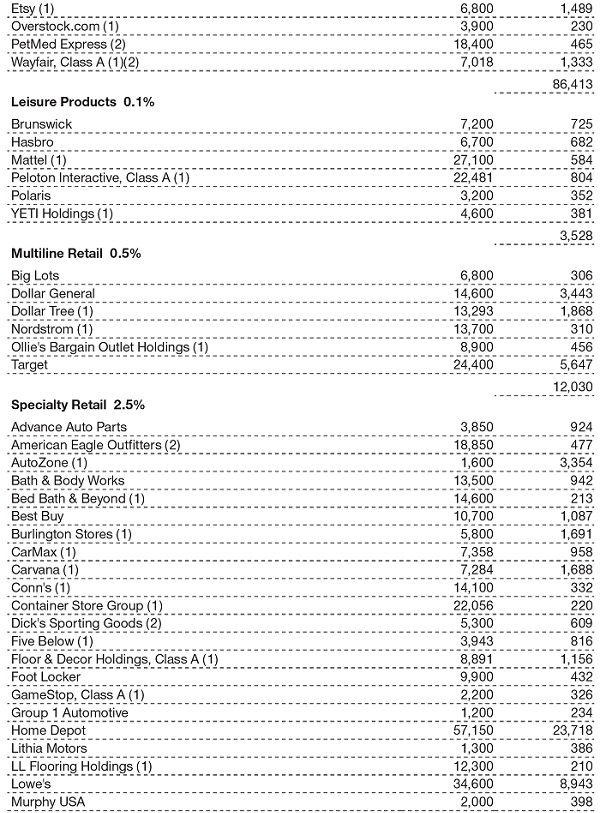

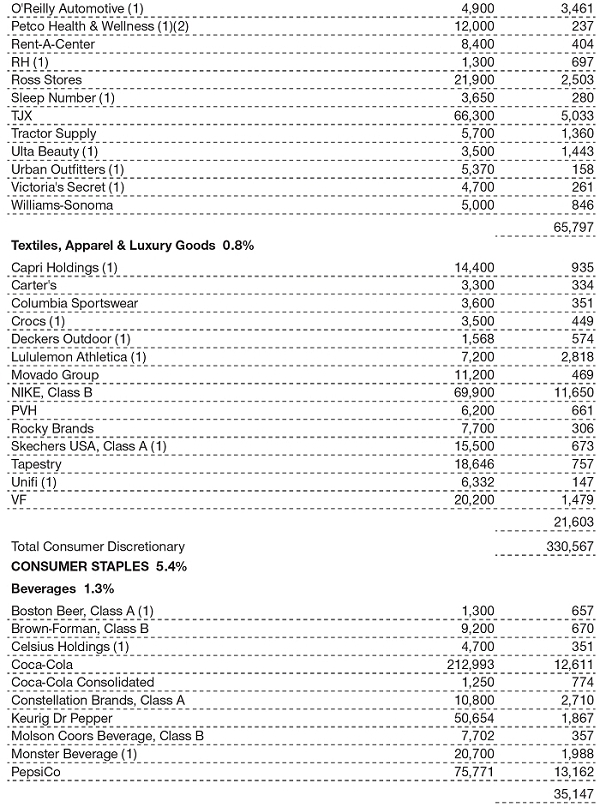

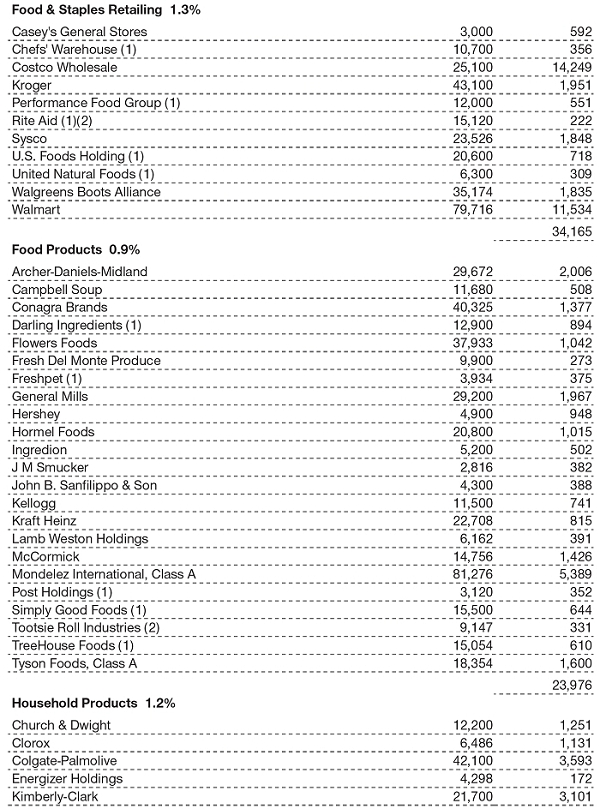

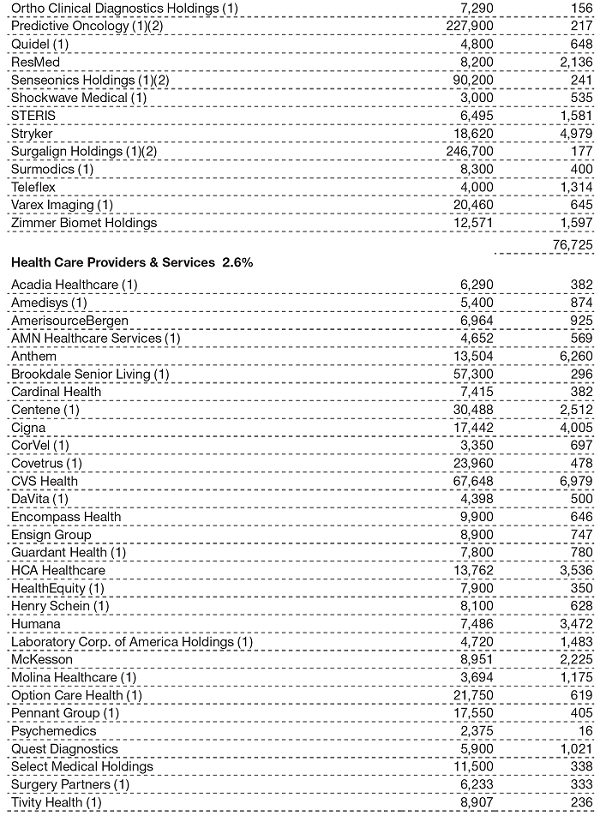

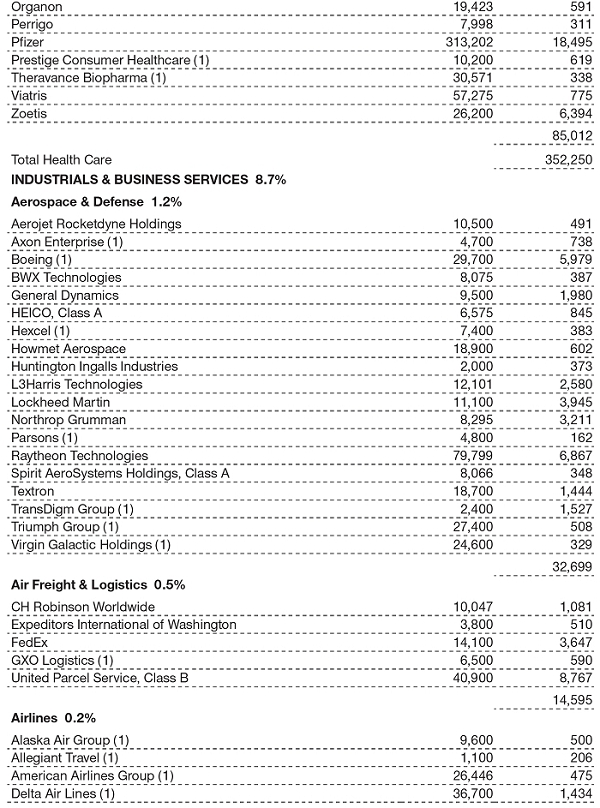

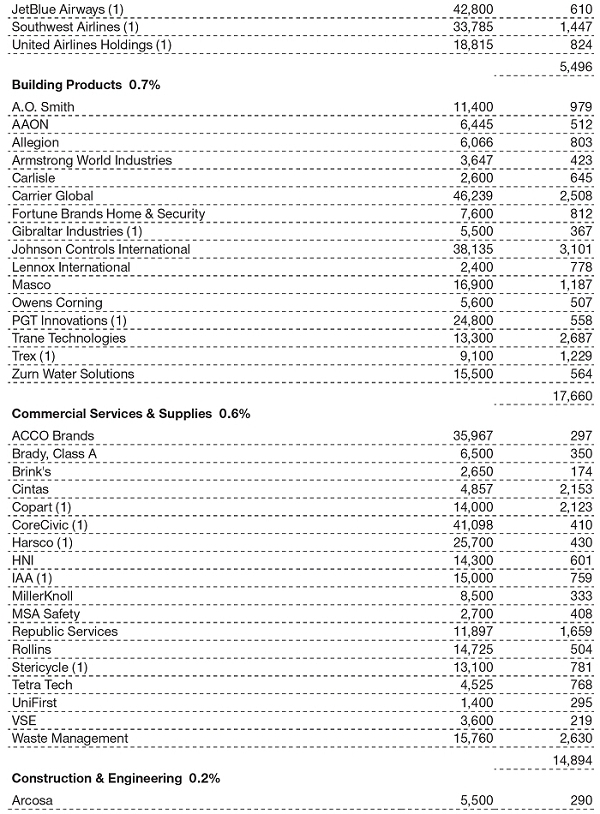

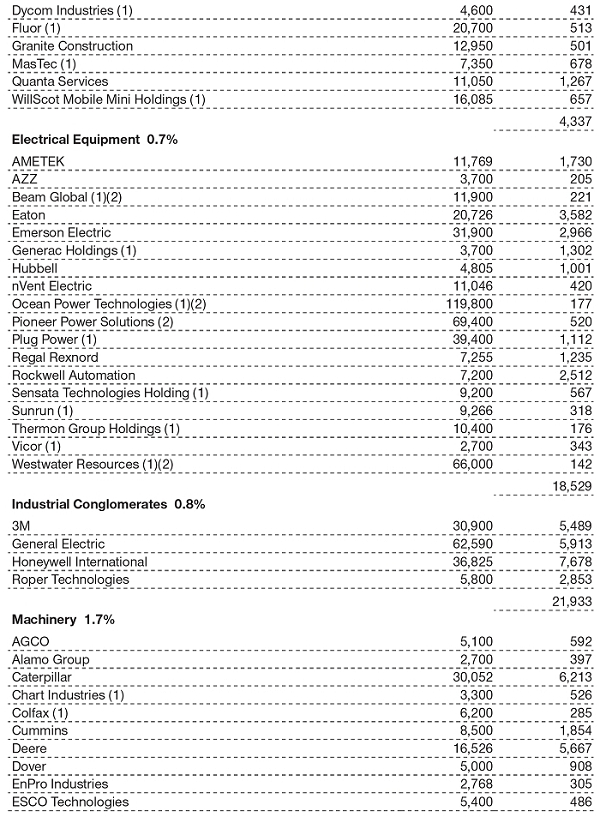

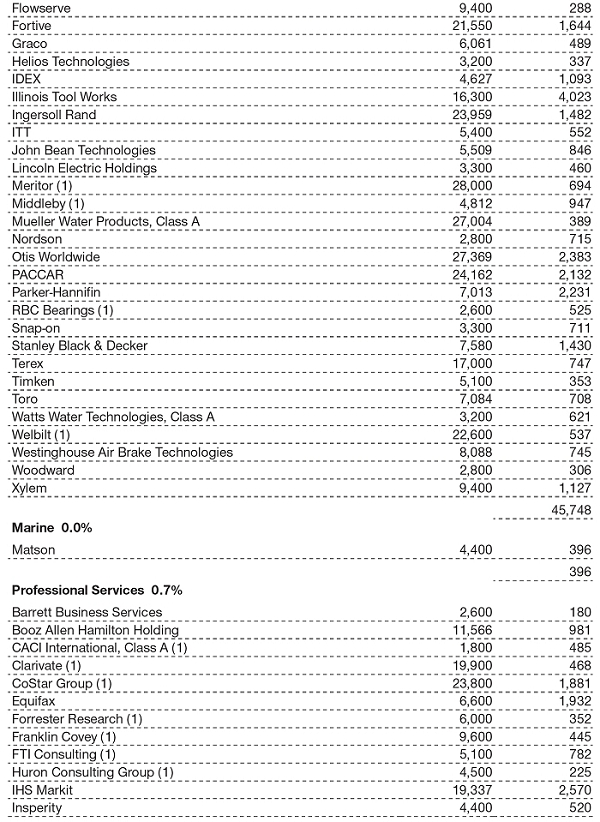

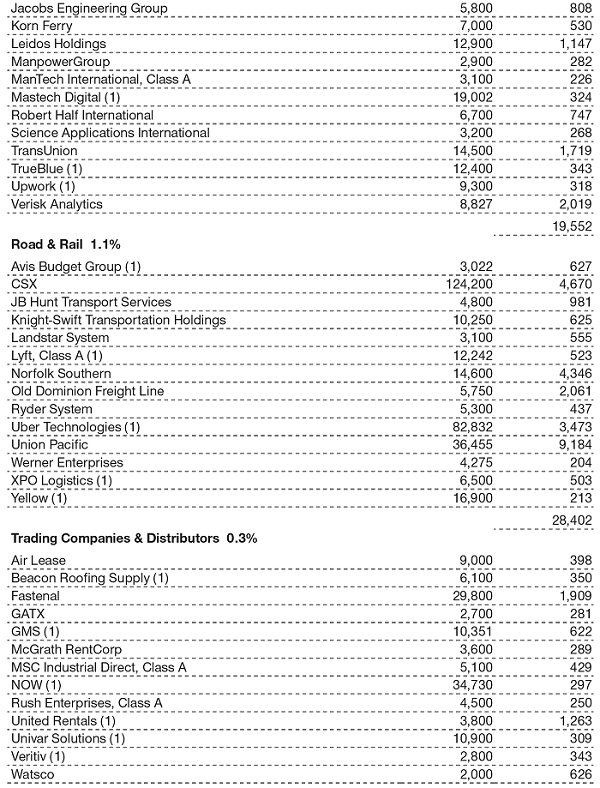

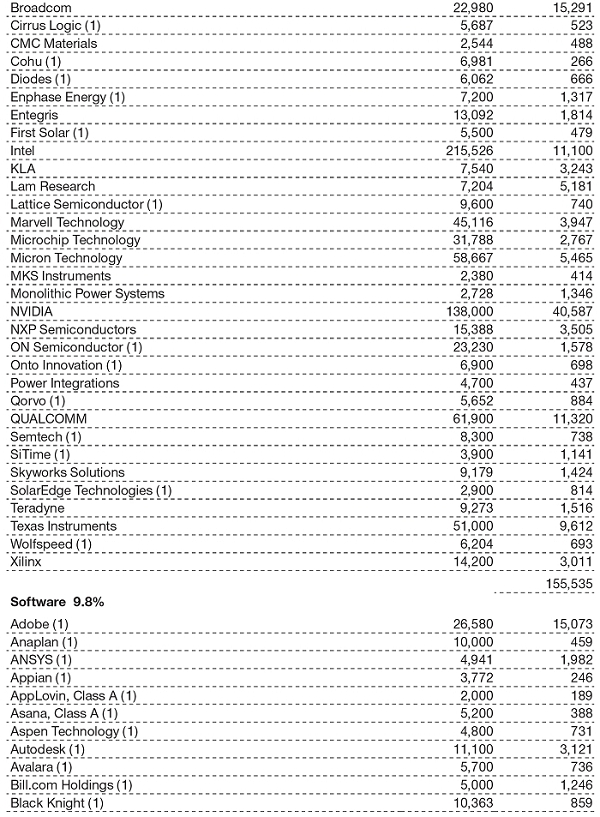

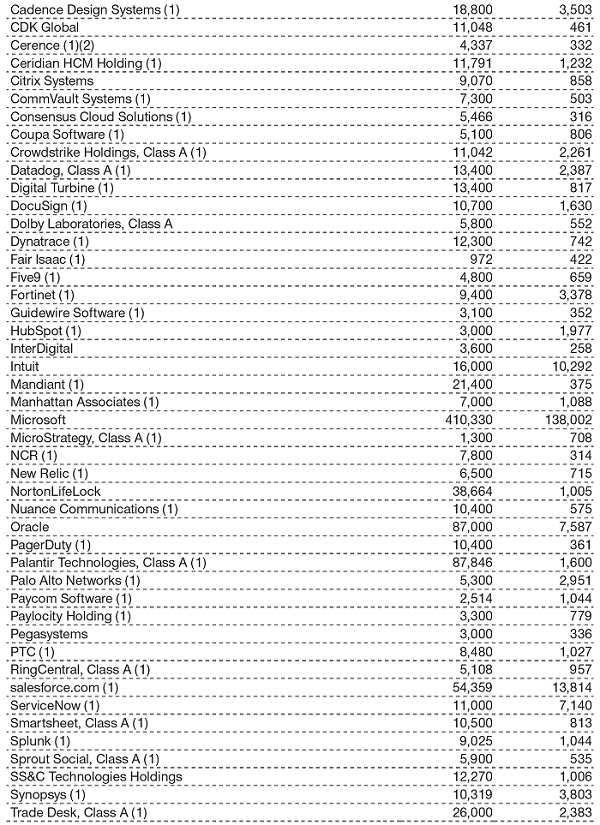

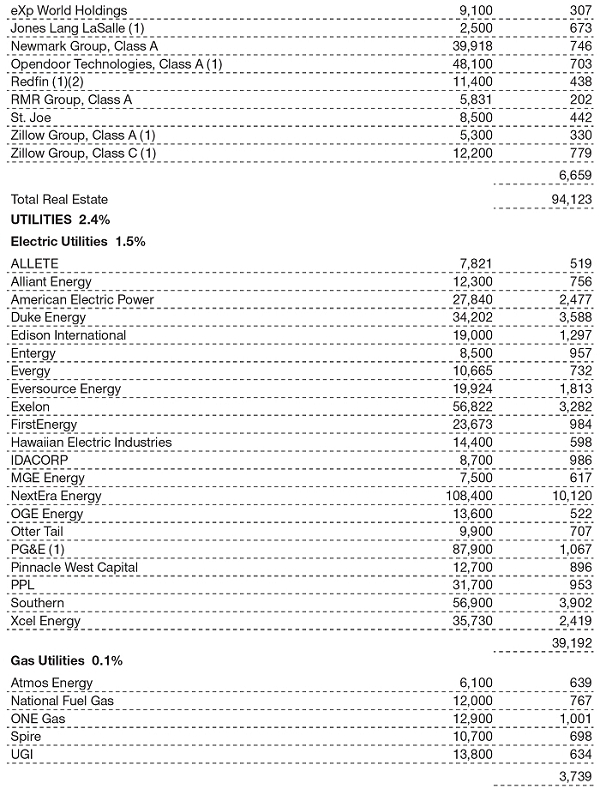

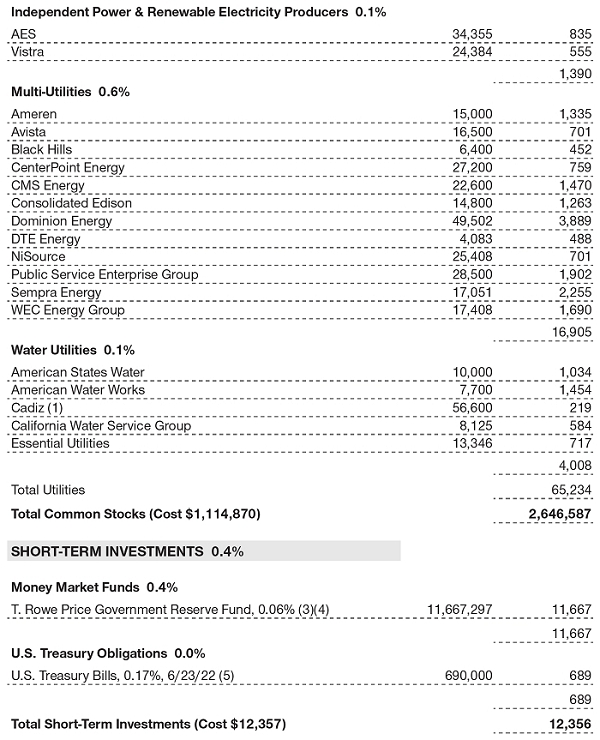

December 31, 2021

The accompanying notes are an integral part of these financial statements.

December 31, 2021

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| NOTES TO FINANCIAL STATEMENTS |

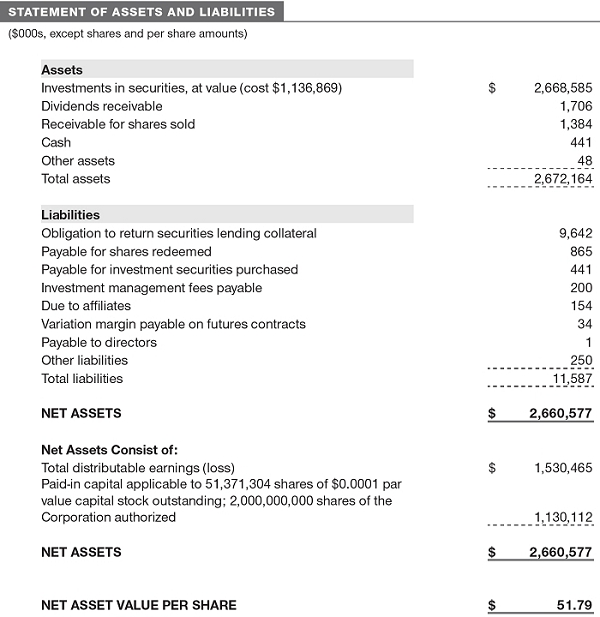

T. Rowe Price Index Trust, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Total Equity Market Index Fund (the fund) is an open-end management investment company established by the corporation and intends to be diversified in approximately the same proportion as the index it tracks is diversified. The fund may become nondiversified for periods of time solely as a result of changes in the composition of the index (for example, changes in the relative market capitalization or index weighting of one or more securities represented in the index). The fund seeks to match the performance of the entire U.S. stock market.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

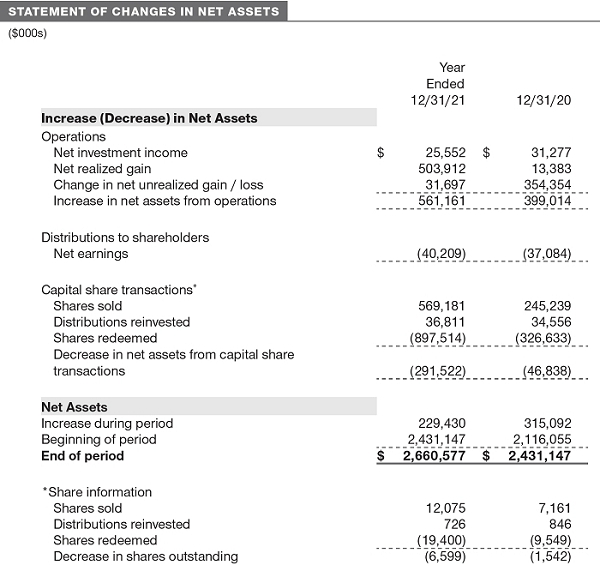

Investment Transactions, Investment Income, and Distributions Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Distributions from REITs are initially recorded as dividend income and, to the extent such represent a return of capital or capital gain for tax purposes, are reclassified when such information becomes available. Non-cash dividends, if any, are recorded at the fair market value of the asset received. Distributions to shareholders are recorded on the ex-dividend date. Income distributions, if any, are declared and paid annually. A capital gain distribution may also be declared and paid by the fund annually.

In-Kind Redemptions In accordance with guidelines described in the fund’s prospectus, the fund may distribute shares of the underlying Price Funds rather than cash as payment for a redemption of fund shares (in-kind redemption). For financial reporting purposes, the fund recognizes a gain on in-kind redemptions to the extent the value of the distributed shares of the underlying Price Funds on the date of redemption exceeds the cost of those shares. Gains and losses realized on in-kind redemptions are not recognized for tax purposes and are reclassified from undistributed realized gain (loss) to paid-in capital. During the year ended December 31, 2021, the fund realized $461,483,000 of net gain on $587,882,000 of in-kind redemptions.

Capital Transactions Each investor’s interest in the net assets of the fund is represented by fund shares. The fund’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. Purchases and redemptions of fund shares are transacted at the next-computed NAV per share, after receipt of the transaction order by T. Rowe Price Associates, Inc., or its agents.

Indemnification In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

NOTE 2 - VALUATION

Fair Value The fund’s financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes policies and procedures used in valuing financial instruments, including those which cannot be valued in accordance with normal procedures or using pricing vendors; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; evaluates the services and performance of the pricing vendors; oversees the pricing process to ensure policies and procedures are being followed; and provides guidance on internal controls and valuation-related matters. The Valuation Committee provides periodic reporting to the Board on valuation matters.

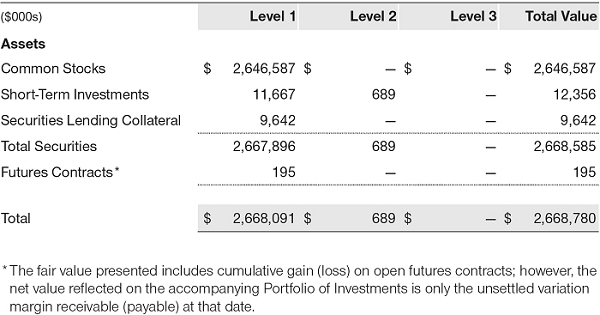

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs (including the fund’s own assumptions in determining fair value)

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Equity securities, including exchange-traded funds, listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices for domestic securities.

Debt securities generally are traded in the over-the-counter (OTC) market and are valued at prices furnished by independent pricing services or by broker dealers who make markets in such securities. When valuing securities, the independent pricing services consider the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation. Futures contracts are valued at closing settlement prices. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Investments for which market quotations or market-based valuations are not readily available or deemed unreliable are valued at fair value as determined in good faith by the Valuation Committee, in accordance with fair valuation policies and procedures. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded. Factors used in determining fair value vary by type of investment and may include market or investment specific considerations. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; discounted cash flows; yield to maturity; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the investment. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants.

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on December 31, 2021 (for further detail by category, please refer to the accompanying Portfolio of Investments):

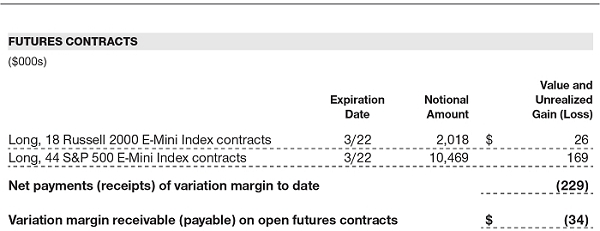

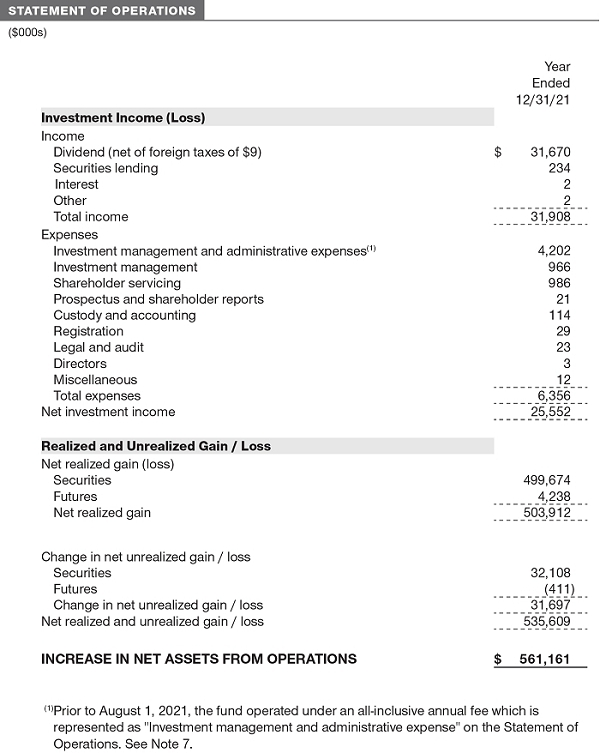

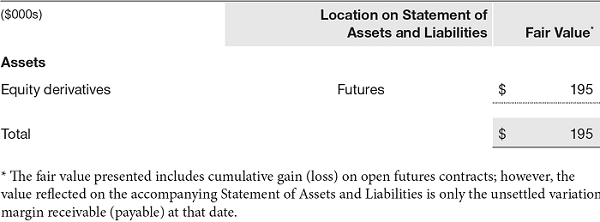

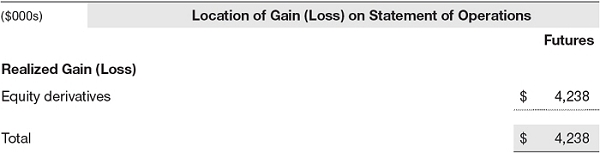

NOTE 3 - DERIVATIVE INSTRUMENTS

During the year ended December 31, 2021, the fund invested in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes and may use them to establish both long and short positions within the fund’s portfolio. Potential uses include to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, to enhance return, or to adjust credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based. The fund at all times maintains sufficient cash reserves, liquid assets, or other SEC-permitted asset types to cover its settlement obligations under open derivative contracts.

The fund values its derivatives at fair value and recognizes changes in fair value currently in its results of operations. Accordingly, the fund does not follow hedge accounting, even for derivatives employed as economic hedges. Generally, the fund accounts for its derivatives on a gross basis. It does not offset the fair value of derivative liabilities against the fair value of derivative assets on its financial statements, nor does it offset the fair value of derivative instruments against the right to reclaim or obligation to return collateral. The following table summarizes the fair value of the fund’s derivative instruments held as of December 31, 2021, and the related location on the accompanying Statement of Assets and Liabilities, presented by primary underlying risk exposure:

Additionally, the amount of gains and losses on derivative instruments recognized in fund earnings during the year ended December 31, 2021, and the related location on the accompanying Statement of Operations is summarized in the following table by primary underlying risk exposure:

Counterparty Risk and Collateral The fund invests in exchange-traded and/or centrally cleared derivative contracts, such as futures, exchange-traded options, and centrally cleared swaps. Counterparty risk on such derivatives is minimal because the clearinghouse provides protection against counterparty defaults. For futures and centrally cleared swaps, the fund is required to deposit collateral in an amount specified by the clearinghouse and the clearing firm (margin requirement), and the margin requirement must be maintained over the life of the contract. Each clearinghouse and clearing firm, in its sole discretion, may adjust the margin requirements applicable to the fund.

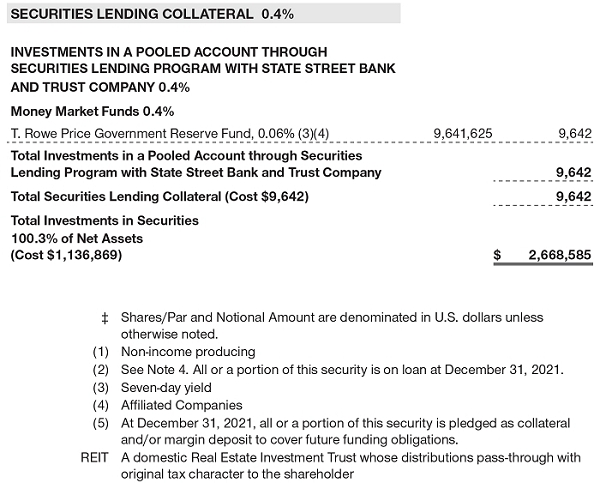

Collateral may be in the form of cash or debt securities issued by the U.S. government or related agencies. Cash posted by the fund is reflected as cash deposits in the accompanying financial statements and generally is restricted from withdrawal by the fund; securities posted by the fund are so noted in the accompanying Portfolio of Investments; both remain in the fund’s assets. While typically not sold in the same manner as equity or fixed income securities, exchange-traded or centrally cleared derivatives may be closed out only on the exchange or clearinghouse where the contracts were cleared. This ability is subject to the liquidity of underlying positions. As of December 31, 2021, securities valued at $626,000 had been posted by the fund for exchange-traded and/or centrally cleared derivatives.

Futures Contracts The fund is subject to equity price risk in the normal course of pursuing its investment objectives and uses futures contracts to help manage such risk. The fund may enter into futures contracts as an efficient means of maintaining liquidity while being invested in the market, to facilitate trading, or to reduce transaction costs. A futures contract provides for the future sale by one party and purchase by another of a specified amount of a specific underlying financial instrument at an agreed-upon price, date, time, and place. The fund currently invests only in exchange-traded futures, which generally are standardized as to maturity date, underlying financial instrument, and other contract terms. Payments are made or received by the fund each day to settle daily fluctuations in the value of the contract (variation margin), which reflect changes in the value of the underlying financial instrument. Variation margin is recorded as unrealized gain or loss until the contract is closed. The value of a futures contract included in net assets is the amount of unsettled variation margin; net variation margin receivable is reflected as an asset and net variation margin payable is reflected as a liability on the accompanying Statement of Assets and Liabilities. Risks related to the use of futures contracts include possible illiquidity of the futures markets, contract prices that can be highly volatile and imperfectly correlated to movements in hedged security values, and potential losses in excess of the fund’s initial investment. During the year ended December 31, 2021, the volume of the fund’s activity in futures, based on underlying notional amounts, was generally between 0% and 2% of net assets.

NOTE 4 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Securities Lending The fund may lend its securities to approved borrowers to earn additional income. Its securities lending activities are administered by a lending agent in accordance with a securities lending agreement. Security loans generally do not have stated maturity dates, and the fund may recall a security at any time. The fund receives collateral in the form of cash or U.S. government securities. Collateral is maintained over the life of the loan in an amount not less than the value of loaned securities; any additional collateral required due to changes in security values is delivered to the fund the next business day. Cash collateral is invested in accordance with investment guidelines approved by fund management. Additionally, the lending agent indemnifies the fund against losses resulting from borrower default. Although risk is mitigated by the collateral and indemnification, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities, collateral investments decline in value, and the lending agent fails to perform. Securities lending revenue consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower, compensation to the lending agent, and other administrative costs. In accordance with GAAP, investments made with cash collateral are reflected in the accompanying financial statements, but collateral received in the form of securities is not. At December 31, 2021, the value of loaned securities was $9,119,000; the value of cash collateral and related investments was $9,642,000.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $490,968,000 and $779,038,000, respectively, for the year ended December 31, 2021.

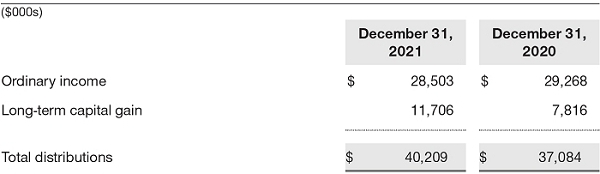

NOTE 5 - FEDERAL INCOME TAXES

Generally, no provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The permanent book/ tax adjustments have no impact on results of operations or net assets and relate primarily to redemptions in kind and a tax practice that treats a portion of the proceeds from each redemption of capital shares as a distribution of taxable net investment income or realized capital gain. For the year ended December 31, 2021, the following reclassification was recorded:

Distributions during the years ended December 31, 2021 and December 31, 2020, were characterized for tax purposes as follows:

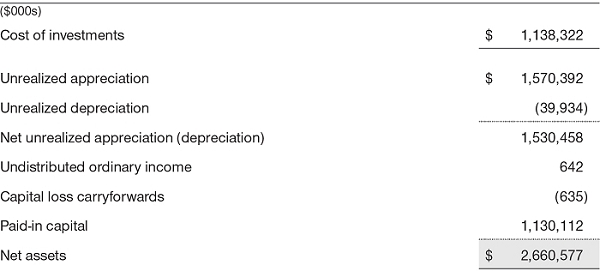

At December 31, 2021, the tax-basis cost of investments, including derivatives, and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales for tax purposes. The fund intends to retain realized gains to the extent of available capital loss carryforwards. Net realized capital losses may be carried forward indefinitely to offset future realized capital gains. All or a portion of the capital loss carryforwards may be from losses realized between November 1 and the fund’s fiscal year-end, which are deferred for tax purposes until the subsequent year but recognized for financial reporting purposes in the year realized.

NOTE 6 - FOREIGN TAXES

The fund is subject to foreign income taxes imposed by certain countries in which it invests. Additionally, capital gains realized upon disposition of securities issued in or by certain foreign countries are subject to capital gains tax imposed by those countries. All taxes are computed in accordance with the applicable foreign tax law, and, to the extent permitted, capital losses are used to offset capital gains. Taxes attributable to income are accrued by the fund as a reduction of income. Current and deferred tax expense attributable to capital gains is reflected as a component of realized or change in unrealized gain/loss on securities in the accompanying financial statements. To the extent that the fund has country specific capital loss carryforwards, such carryforwards are applied against net unrealized gains when determining the deferred tax liability. Any deferred tax liability incurred by the fund is included in either Other liabilities or Deferred tax liability on the accompanying Statement of Assets and Liabilities.

NOTE 7 - RELATED PARTY TRANSACTIONS

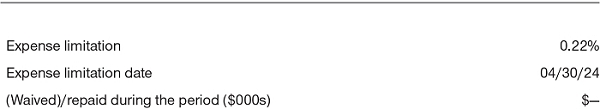

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee equal to 0.09% of the fund’s average daily net assets. The fee is computed daily and paid monthly. Prior to August 1, 2021, the fund paid an all-inclusive annual fee equal to 0.30% of the fund’s average daily net assets, which was computed daily and paid monthly. The all-inclusive fee covered investment management services and ordinary, recurring operating expenses, but did not cover interest expense; expenses related to borrowing, taxes, and brokerage; and nonrecurring expenses.

Effective August 1, 2021, the fund is subject to a contractual expense limitation through the expense limitation date indicated in the table below. During the limitation period, Price Associates is required to waive its management fee and pay the fund for any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; and other non-recurring expenses permitted by the investment management agreement) that would otherwise cause the fund’s ratio of annualized total expenses to average net assets (net expense ratio) to exceed its expense limitation. The fund is required to repay Price Associates for expenses previously waived/paid to the extent its net assets grow or expenses decline sufficiently to allow repayment without causing the fund’s net expense ratio (after the repayment is taken into account) to exceed the lesser of: (1) the expense limitation in place at the time such amounts were waived; or (2) the fund’s current expense limitation. However, no repayment will be made more than three years after the date of a payment or waiver.

In addition, effective August 1, 2021, the fund is subject to a permanent contractual expense limitation, pursuant to which Price Associates is required to waive its management fee or pay any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; and other non-recurring expenses permitted by the investment management agreement) that would otherwise cause the class’s ratio of annualized total expenses to average net assets (net expense ratio) to exceed 0.30%. The agreement may only be terminated with approval by the fund’s shareholders. The fund is required to repay Price Associates for expenses previously waived/paid to the extent the fund’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s net expense ratio (after the repayment is taken into account) to exceed the lesser of: (1) the expense limitation in place at the time such amounts were waived; or (2) the fund’s current expense limitation. However, no repayment will be made more than three years after the date of a payment or waiver. No management fees were waived or any expenses paid under this arrangement during the year ended December 31, 2021.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates, each an affiliate of the fund (collectively, Price). Price Associates provides certain accounting and administrative services to the fund. T. Rowe Price Services, Inc. provides shareholder and administrative services in its capacity as the fund’s transfer and dividend-disbursing agent. T. Rowe Price Retirement Plan Services, Inc. provides subaccounting and recordkeeping services for certain retirement accounts invested in the fund. Prior to August 1, 2021, expenses incurred pursuant to these service agreements were borne by Price Associates pursuant to the fund’s all-inclusive fee arrangement. For the period August 1, 2021 through December 31, 2021, expenses incurred pursuant to these service agreements were $41,000 for Price Associates; $304,000 for T. Rowe Price Services, Inc.; and $89,000 for T. Rowe Price Retirement Plan Services, Inc. All amounts due to and due from Price, exclusive of investment management fees payable, are presented net on the accompanying Statement of Assets and Liabilities.

Additionally, prior to April 6, 2021, the fund was one of several mutual funds in which certain college savings plans managed by Price Associates had invested. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan were allocated to the fund in proportion to the average daily value of its shares owned by the college savings plan. Shareholder servicing costs allocated to the fund were borne by Price Associates, pursuant to the fund’s all-inclusive fee agreement. At December 31, 2021, no shares of the fund were held by college savings plans.

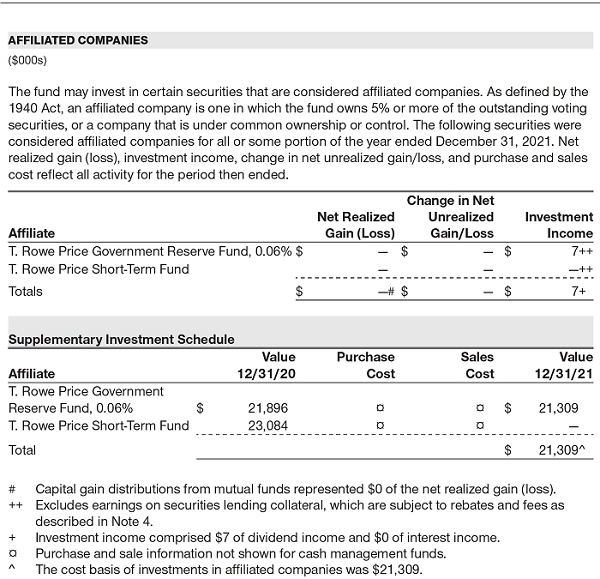

The fund may invest its cash reserves in certain open-end management investment companies managed by Price Associates and considered affiliates of the fund: the T. Rowe Price Government Reserve Fund or the T. Rowe Price Treasury Reserve Fund, organized as money market funds, or the T. Rowe Price Short-Term Fund, a short-term bond fund (collectively, the Price Reserve Funds). The Price Reserve Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. Cash collateral from securities lending, if any, is invested in the T. Rowe Price Government Reserve Fund; prior to December 13, 2021, the cash collateral from securities lending was invested in the T. Rowe Price Short-Term Fund. The Price Reserve Funds pay no investment management fees.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the year ended December 31, 2021, the fund had no purchases or sales cross trades with other funds or accounts advised by Price Associates.

Price Associates has voluntarily agreed to reimburse the fund from its own resources on a monthly basis for the cost of investment research embedded in the cost of the fund’s securities trades. This agreement may be rescinded at any time. For the year ended December 31, 2021, this reimbursement amounted to $14,000, which is included in Net realized gain (loss) on Securities in the Statement of Operations.

NOTE 8 - OTHER MATTERS

Unpredictable events such as environmental or natural disasters, war, terrorism, pandemics, outbreaks of infectious diseases, and similar public health threats may significantly affect the economy and the markets and issuers in which a fund invests. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others, and exacerbate other pre-existing political, social, and economic risks. The fund’s performance could be negatively impacted if the value of a portfolio holding were harmed by such events. Since 2020, a novel strain of coronavirus (COVID-19) has resulted in disruptions to global business activity and caused significant volatility and declines in global financial markets. The duration of this outbreak or others and their effects cannot be determined with certainty.

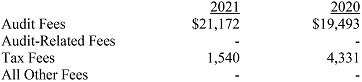

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of T. Rowe Price Index Trust, Inc. and Shareholders of

T. Rowe Price Total Equity Market Index Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of T. Rowe Price Total Equity Market Index Fund (one of the funds constituting T. Rowe Price Index Trust, Inc., referred to hereafter as the “Fund”) as of December 31, 2021, the related statement of operations for the year ended December 31, 2021, the statement of changes in net assets for each of the two years in the period ended December 31, 2021, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2021 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2021, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2021 and the financial highlights for each of the five years in the period ended December 31, 2021 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2021 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 15, 2022

We have served as the auditor of one or more investment companies in the T. Rowe Price group of investment companies since 1973.

TAX INFORMATION (UNAUDITED) FOR THE TAX YEAR ENDED 12/31/21

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

| ■ | $3,914,000 from short-term capital gains |

| ■ | $48,838,000 from long-term capital gains, of which $48,597,000 was subject to a long-term capital gains tax rate of not greater than 20% and $241,000 to a long-term capital gains tax rate of not greater than 25% |

For taxable non-corporate shareholders, $30,039,000 of the fund’s income represents qualified dividend income subject to a long-term capital gains tax rate of not greater than 20%.

For corporate shareholders, $28,856,000 of the fund’s income qualifies for the dividends-received deduction.

For individuals and certain trusts and estates which are entitled to claim a deduction of up to 20% of their combined qualified real estate investment trust (REIT) dividends, $1,536,000 of the fund’s income qualifies as qualified real estate investment trust (REIT) dividends.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS

A description of the policies and procedures used by T. Rowe Price funds to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www.troweprice.com/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s reports on Form N-PORT are available electronically on the SEC’s website (sec.gov). In addition, most T. Rowe Price funds disclose their first and third fiscal quarter-end holdings on troweprice.com.

LIQUIDITY RISK MANAGEMENT PROGRAM

In accordance with Rule 22e-4 (Liquidity Rule) under the Investment Company Act of 1940, as amended, the fund has established a liquidity risk management program (Liquidity Program) reasonably designed to assess and manage the fund’s liquidity risk, which generally represents the risk that the fund would not be able to meet redemption requests without significant dilution of remaining investors’ interests in the fund. The fund’s Board of Directors (Board) has appointed the fund’s investment advisor, T. Rowe Price Associates, Inc. (Price Associates), as the administrator of the Liquidity Program. As administrator, Price Associates is responsible for overseeing the day-to-day operations of the Liquidity Program and, among other things, is responsible for assessing, managing, and reviewing with the Board at least annually the liquidity risk of each T. Rowe Price fund. Price Associates has delegated oversight of the Liquidity Program to a Liquidity Risk Committee (LRC), which is a cross-functional committee composed of personnel from multiple departments within Price Associates.

The Liquidity Program’s principal objectives include supporting the T. Rowe Price funds’ compliance with limits on investments in illiquid assets and mitigating the risk that the fund will be unable to timely meet its redemption obligations. The Liquidity Program also includes a number of elements that support the management and assessment of liquidity risk, including an annual assessment of factors that influence the fund’s liquidity and the periodic classification and reclassification of a fund’s investments into categories that reflect the LRC’s assessment of their relative liquidity under current market conditions. Under the Liquidity Program, every investment held by the fund is classified at least monthly into one of four liquidity categories based on estimations of the investment’s ability to be sold during designated time frames in current market conditions without significantly changing the investment’s market value.

As required by the Liquidity Rule, at a meeting held on July 27, 2021, the Board was presented with an annual assessment prepared by the LRC, on behalf of Price Associates, that addressed the operation of the Liquidity Program and assessed its adequacy and effectiveness of implementation, including any material changes to the Liquidity Program and the determination of each fund’s Highly Liquid Investment Minimum (HLIM). The annual assessment included consideration of the following factors, as applicable: the fund’s investment strategy and liquidity of portfolio investments during normal and reasonably foreseeable stressed conditions, including whether the investment strategy is appropriate for an open-end fund, the extent to which the strategy involves a relatively concentrated portfolio or large positions in particular issuers, and the use of borrowings for investment purposes and derivatives; short-term and long-term cash flow projections covering both normal and reasonably foreseeable stressed conditions; and holdings of cash and cash equivalents, as well as available borrowing arrangements.

For the fund and other T. Rowe Price funds, the annual assessment incorporated a report related to a fund’s holdings, shareholder and portfolio concentration, any borrowings during the period, cash flow projections, and other relevant data for the period of April 1, 2020, through March 31, 2021. The report described the methodology for classifying a fund’s investments (including derivative transactions) into one of four liquidity categories, as well as the percentage of a fund’s investments assigned to each category. It also explained the methodology for establishing a fund’s HLIM and noted that the LRC reviews the HLIM assigned to each fund no less frequently than annually.

During the period covered by the annual assessment, the LRC has concluded, and reported to the Board, that the Liquidity Program continues to operate adequately and effectively and is reasonably designed to assess and manage the fund’s liquidity risk.

ABOUT THE FUND’S DIRECTORS AND OFFICERS

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting or potentially affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are considered to be independent, i.e., not “interested persons” as defined in Section 2(a)(19) of the 1940 Act, of the Boards of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “interested” directors and officers are employees of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| INDEPENDENT DIRECTORS(a) | ||

| Name (Year of Birth) Year Elected [Number of T. Rowe Price Portfolios Overseen] | Principal Occupation(s) and Directorships of Public Companies and Other Investment Companies During the Past Five Years | |

| Teresa Bryce Bazemore (1959) 2018 [204] | President and Chief Executive Officer, Federal Home Loan Bank of San Francisco (2021 to present); President, Radian Guaranty (2008 to 2017); Chief Executive Officer, Bazemore Consulting LLC (2018 to 2021); Director, Chimera Investment Corporation (2017 to 2021); Director, First Industrial Realty Trust (2020 to present); Director, Federal Home Loan Bank of Pittsburgh (2017 to 2019) | |

| Ronald J. Daniels (1959) 2018 [204] | President, The Johns Hopkins University(b) and Professor, Political Science Department, The Johns Hopkins University (2009 to present); Director, Lyndhurst Holdings (2015 to present); Director, BridgeBio Pharma, Inc. (2020 to present) | |

| Bruce W. Duncan (1951) 2013 [204] | President, Chief Executive Officer, and Director, CyrusOne, Inc. (2020 to 2021); Chief Executive Officer and Director (2009 to 2016), Chair of the Board (2016 to 2020), and President (2009 to 2016), First Industrial Realty Trust, owner and operator of industrial properties; Chair of the Board (2005 to 2016) and Director (1999 to 2016), Starwood Hotels & Resorts, a hotel and leisure company; Member, Investment Company Institute Board of Governors (2017 to 2019); Member, Independent Directors Council Governing Board (2017 to 2019); Senior Advisor, KKR (2018 to present); Director, Boston Properties (2016 to present); Director, Marriott International, Inc. (2016 to 2020) | |

| Robert J. Gerrard, Jr. (1952) 2012 [204] | Advisory Board Member, Pipeline Crisis/Winning Strategies, a collaborative working to improve opportunities for young African Americans (1997 to 2016); Chair of the Board, all funds (July 2018 to present) | |

| Paul F. McBride (1956) 2013 [204] | Advisory Board Member, Vizzia Technologies (2015 to present); Board Member, Dunbar Armored (2012 to 2018) | |