Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer £ | Accelerated filer R |

Non-accelerated filer (do not check if a smaller reporting company) £ | Smaller reporting company £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The aggregate market value of 9,543,453 shares of the voting stock held by non-affiliates of the registrant as of June 30, 2010 was approximately $139,525,283. Directors, executive officers, and trusts controlled by said individuals are considered affiliates for the purpose of this calculation and should not necessarily be considered affiliates for any other purpose.

The number of shares of common stock, par value $.01 per share, outstanding as of March 11, 2011 was 12,065,543.

| DOCUMENTS INCORPORATED BY REFERENCE |

Parts of the registrant’s definitive proxy statement for the 2011 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A under the Securities Exchange Act of 1934 are incorporated by reference in Part III of this Annual Report.

LIFETIME BRANDS, INC.

FORM 10-K

TABLE OF CONTENTS

| PART I | | |

| 1. | | 3 |

| 1A. | | 6 |

| 1B. | | 9 |

| 2. | | 9 |

| 3. | | 9 |

| 4. | | 9 |

| | | |

| PART II | | |

| 5. | | 10 |

| 6. | | 12 |

| 7. | | 13 |

| 7A. | | 25 |

| 8. | | 26 |

| 9. | | 27 |

| 9A. | | 27 |

| 9B. | | 29 |

| | | |

| PART III | | |

| 10. | | 29 |

| 11. | | 29 |

| 12. | | 29 |

| 13. | | 29 |

| 14. | | 29 |

| | | |

| PART IV | | |

| 15. | | 30 |

| 34 |

This Annual Report on Form 10-K contains “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements include information concerning Lifetime Brands, Inc.’s (the “Company’s”) plans, objectives, goals, strategies, future events, future revenues, performance, capital expenditures, financing needs and other information that is not historical information. Many of these statements appear, in particular, under the headings Business and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in Item 1 of Part I and Item 7 of Part II, respectively. When used in this Annual Report on Form 10-K, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, the Company’s examination of historical operating trends, are based upon the Company’s current expectations and various assumptions. The Company believes there is a reasonable basis for its expectations and assumptions, but there can be no assurance that the Company will realize its expectations or that the Company’s assumptions will prove correct.

There are a number of risks and uncertainties that could cause the Company’s actual results to differ materially from the forward-looking statements contained in this Annual Report. Important factors that could cause the Company’s actual results to differ materially from those expressed as forward-looking statements are set forth in this Annual Report, including the risk factors discussed in Part I, Item 1A under the heading Risk Factors.

Except as may be required by law, the Company undertakes no obligation to publicly update or revise forward-looking statements which may be made to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events.

OTHER INFORMATION

The Company is required to file its annual reports on Forms 10-K and quarterly reports on Forms 10-Q, and other reports and documents as required from time to time with the United States Securities and Exchange Commission (the “SEC”). The public may read and copy any materials that the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information may be obtained with respect to the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding the Company’s electronic filings with the SEC at http://www.sec.gov. The Company also maintains a website at http://www.lifetimebrands.com where users can access the Company’s electronic filings free of charge.

PART I

OVERVIEW

The Company is one of North America’s leading resources for nationally branded kitchenware, tabletop and home décor products. The Company either owns or licenses its brands. The Company’s licenses generally only permit the Company to sell certain products using the licensed brand name. The Company sells its products to retailers and distributors, and directly to consumers through its Internet websites and mail-order catalog operations. The Company markets its products under well-respected and widely-recognized brand names in the U.S. housewares industry. According to the Home Furnishing News Brand Survey issued in 2009, three of the Company’s brands, KitchenAid®, Cuisinart®, and Farberware®, are among the four most recognized brands in the “Kitchen Tool, Cutlery and Gadgets” category. The Company primarily targets moderate to premium price points through every major level of trade and generally markets several lines within each of its product categories under more than one brand. At the heart of the Company is a strong culture of innovation and new product development. The Company brought over 4,000 new or redesigned products to market in 2010 and expects to introduce between 4,000 and 5,000 new or redesigned products in 2011.

The Company’s major product categories are Kitchenware, consisting primarily of kitchen tools and gadgets, cutlery, cutting boards, cookware/bakeware and pantryware, Tabletop, consisting primarily of dinnerware and flatware, and Home Décor, which consists primarily of wall décor, picture frames and decorative shelving products.

The Company sources almost all of its products from suppliers located outside the United States, primarily in the People’s Republic of China. The Company manufactures its sterling silver products at a leased facility in San Germán, Puerto Rico and fills spices and assembles spice racks at its owned Winchendon, Massachusetts distribution facility.

The Company seeks to expand its presence in international markets by making investments in various companies that operate outside of the United States. In 2007, the Company acquired a 30% interest in Grupo Vasconia, S.A.B. (“Vasconia”), a Mexican company. In January 2011, the Company, together with Vasconia and unaffiliated partners, formed Housewares Corporation of Asia Limited, a Hong Kong-based company that will supply direct import kitchenware programs to retailers in North, Central and South America.

In addition, the Company licenses certain of its brands to other companies, including Vasconia, that operates in various foreign markets.

The Company continues to evaluate opportunities to expand the reach of its brands and to invest in other companies that operate principally outside the United States. These opportunities involve risks as the industry and foreign markets may not evolve as anticipated and the Company’s strategic objectives may not be achieved.

The Company’s top brands and their respective product categories are:

| Brand | | Licensed/Owned | | Product Category |

| Farberware® | | Licensed* | | Kitchenware and Tabletop |

| Mikasa® | | Owned | | Tabletop and Home Décor |

| KitchenAid® | | Licensed | | Kitchenware |

| Pfaltzgraff® | | Owned | | Tabletop and Home Décor |

| Melannco® | | Owned | | Home Décor |

| Elements® | | Owned | | Home Décor |

| Cuisinart® | | Licensed | | Kitchenware and Tabletop |

| Kamenstein® | | Owned | | Kitchenware |

| Wallace Silversmiths® | | Owned | | Tabletop and Home Décor |

| Towle® | | Owned | | Tabletop and Home Décor |

* The Company has a 184 year royalty free license to utilize the Farberware® brand for kitchenware products.

The Company’s wholesale customers include mass merchants, specialty stores, national chains, department stores, warehouse clubs, supermarkets, off-price retailers and Internet retailers.

BUSINESS SEGMENTS

The Company operates in two business segments: the Wholesale segment, which is the Company’s primary business that designs, markets and distributes its products to retailers and distributors, and the Retail Direct segment in which the Company markets and sells its products through its Pfaltzgraff®, Mikasa®, Lifetime SterlingTM and Housewares DealsTM Internet websites and Pfaltzgraff® mail-order catalogs. The Company has segmented its operations to reflect the manner in which management reviews and evaluates the results of its operations. While both segments distribute similar products, the segments are distinct due to the different types of customers and the different methods the Company uses to sell, market and distribute the products.

Additional information regarding the Company’s reportable segments is included in Note J of the Notes to the Consolidated Financial Statements included in Item 15.

CUSTOMERS

The Company’s products are sold in North America to a diverse customer base including mass merchants (such as Wal-Mart and Target), specialty stores (such as Bed Bath & Beyond), national chains (such as Kohl’s, JC Penney and Sears), department stores (such as Macy’s), warehouse clubs (such as Costco, BJ’s Wholesale Club and Sam’s Club), supermarkets (such as Stop & Shop and Kroger), off-price retailers (such as TJX and Ross Stores), and Internet retailers (such as Amazon.com).

The Company also operates Internet and catalog operations that sell the Company’s products directly to consumers.

During the years ended December 31, 2010, 2009 and 2008, Wal-Mart Stores, Inc. (including Sam’s Club) accounted for 15%, 18%, and 20% of sales, respectively. No other customer accounted for 10% or more of the Company’s sales during these periods. For the years ended December 31, 2010, 2009 and 2008, the Company’s ten largest customers accounted for 67%, 64%, and 60% of sales, respectively.

DISTRIBUTION

The Company operates the following distribution centers:

| Location | | Size

(square feet) |

| Fontana, California | | 753,000 |

| Robbinsville, New Jersey | | 700,000 |

| Winchendon, Massachusetts | | 175,000 |

| Medford, Massachusetts | | 5,590 |

SALES AND MARKETING

The Company’s sales and marketing staff coordinate directly with its wholesale customers to devise marketing strategies and merchandising concepts and to furnish advice on advertising and product promotion. The Company has developed several promotional programs for use in the ordinary course of business to promote sales throughout the year.

The Company’s sales and marketing efforts are supported from its principal offices and showroom in Garden City, New York; as well as showrooms in New York, New York; Medford, Massachusetts; Atlanta, Georgia; Bentonville, Arkansas; and Menomonee Falls, Wisconsin.

The Company generally collaborates with its largest wholesale customers and in many instances produces specific versions of the Company’s product lines with exclusive designs and/or packaging for their stores.

DESIGN AND INNOVATION

At the heart of the Company is a strong culture of innovation and new product development. The Company’s in-house design and development teams currently consist of 77 professional designers, artists and engineers. Utilizing the latest available design tools, technology and materials, these teams create new products, redesign products, and create packaging and merchandising concepts.

SOURCES OF SUPPLY

The Company sources its products from over 400 suppliers. Most of the Company’s suppliers are located in the People’s Republic of China. The Company also sources products from suppliers in the United States, India, Japan, Indonesia, Korea, Italy, Thailand, Germany, Slovakia, Vietnam, American Samoa, Czech Republic, United Kingdom, Canada, Poland, Portugal, Switzerland, Malaysia, Slovenia, and Mexico. The Company orders products substantially in advance of the anticipated time of their sale. The Company does not have any formal long-term arrangements with any of its suppliers and its arrangements with most manufacturers allow for flexibility in modifying the quantity, composition and delivery dates of orders. All purchase orders issued by the Company are cancelable.

MANUFACTURING

The Company manufactures its sterling silver products at its leased manufacturing facility in San Germán, Puerto Rico and fills spices and assembles spice racks at its owned Winchendon, Massachusetts distribution facility.

COMPETITION

The markets for kitchenware, tabletop and home décor products are highly competitive and include numerous domestic and foreign competitors, some of which are larger than the Company. The primary competitive factors in selling such products to retailers are innovative products, brand, quality, aesthetic appeal to consumers, packaging, breadth of product line, distribution capability, prompt delivery and selling price.

PATENTS

The Company owns 133 design and utility patents on the overall design of some of its products. The Company believes that the expiration of any of its patents would not have a material adverse effect on the Company’s business.

BACKLOG

Backlog is not material to the Company’s business because actual confirmed orders from the Company’s customers are typically not received until close to the required shipment dates.

EMPLOYEES

At December 31, 2010, the Company had a total of 1,040 full-time employees, 154 of whom are located in China. In addition, the Company employed 60 people on a part-time basis, predominately in customer service. None of the Company’s employees are represented by a labor union. The Company considers its employee relations to be good.

REGULATORY MATTERS

The products the Company sells are subject to various Federal, state and local statutes and the jurisdiction of various regulatory agencies, as well as the scrutiny of consumer groups. The Company’s spice container filling operation in Winchendon, Massachusetts is regulated by the Food and Drug Administration. The Company’s sterling silver manufacturing operations are subject to the jurisdiction of the Environmental Protection Agency. The Company’s products are also subject to regulation under certain state laws pertaining to product safety and liability.

The Company’s businesses, operations, and financial condition are subject to various risks. The risks and uncertainties described below are those that the Company considers material.

General Economic Factors and Political Conditions

The Company’s performance is affected by general economic factors and political conditions that are beyond its control. These factors include, among other factors, recession, inflation, deflation, housing markets, consumer credit availability, consumer debt levels, fuel and energy costs, material input costs, foreign currency translation, labor cost inflation, interest rates, tax rates and policy, unemployment trends, the impact of natural disasters and terrorist activities, conditions affecting the retail environment for the home and other matters that influence consumer spending. Unfavorable economic conditions in the United States adversely affected the Company’s performance in 2008 and 2009 and could continue to adversely affect the Company’s performance in the future. Unstable economic and political conditions, civil unrest and political activism, particularly in Asia, could adversely impact the Company’s businesses.

Liquidity

The Company has substantial indebtedness and depends upon its bank lenders to finance its liquidity needs. In June 2010, the Company entered into a new $125.0 million secured credit agreement (the “Revolving Credit Facility”) and a $40.0 million second lien credit agreement (the “Term Loan”). Amounts loaned under these agreements bear interest at floating rates. Therefore, an increase in interest rates would adversely affect the Company’s performance. To the extent that the Company’s access to credit was to be restricted because of its own performance, its bank lenders’ performances, or conditions in the markets generally, the Company would not be able to operate normally.

Competition

The markets for the Company’s products are intensely competitive and the Company competes with numerous other suppliers, some of which are larger than the Company, have greater financial and other resources or employ brands that are more established, have greater consumer recognition or are more favorably perceived by consumers or retailers than the Company’s brands.

The Company believes it possesses certain competitive advantages; however, many factors could erode these competitive advantages or prevent their strengthening. Accordingly, future operating results will depend on the Company’s ability to protect or enhance its competitive advantages.

Customers

The Company’s wholesale customers include mass merchants, specialty stores, national chains, department stores, warehouse clubs, supermarkets, off-price retailers, and Internet retailers. Unanticipated changes in purchasing and other practices by its customers, including customers’ pricing and other requirements, could adversely affect the Company. In its e-commerce and catalog businesses, the Company sells to individual consumers nationwide.

Many of the Company’s wholesale customers are significantly larger than the Company, have greater financial and other resources and also purchase goods directly from vendors in Asia and elsewhere. Decisions by large customers to increase their purchases directly from overseas vendors could have a materially adverse affect on the Company.

Significant changes or financial difficulties, including consolidations of ownership, restructurings, bankruptcies, liquidations or other events that affect retailers could result in fewer stores selling the Company’s products, the Company having to rely on a smaller group of customers, an increase in the risk of extending credit to these customers or limitations on the Company’s ability to collect amounts due from these customers.

In 2010, Wal-Mart Stores, Inc. (including Sam’s Club) accounted for 15% of the Company’s sales. A material reduction in purchases by Wal-Mart Stores, Inc. could have a significant adverse effect on the Company’s business and operating results. In addition, pressures by Wal-Mart Stores, Inc. that would cause the Company to materially reduce the price of the Company’s products could result in reductions of the Company’s operating margin.

Supply Chain

The Company sources its products from suppliers located principally in Asia and, to a lesser extent, in Europe and in the United States. The Company’s Asia vendors are located primarily in the People’s Republic of China. Interruption of supply from any of the Company’s suppliers, or the loss of one or more key vendors, could have a negative effect on the Company’s business and operating results.

Changes in currency exchange rates might negatively affect the profitability and business prospects of the Company and its overseas vendors. The Company does not have access to its vendors’ financial information and is unable to assess its vendors’ financial conditions including their liquidity.

The Company is subject to risks and uncertainties associated with economic and political conditions in foreign countries, including but not limited to, foreign government regulations, taxes, import and export duties and quotas, anti-dumping regulations, incidents and fears involving security, terrorism and wars, political unrest and other restrictions on trade and travel.

The Company imports its products for delivery to its distribution centers as well as arranges for its customers to import goods to which title has passed overseas. For purchases that are to be delivered to its distribution centers, the Company arranges for transportation, primarily by sea, from ports in Asia and Europe to ports in the United States, principally New York/Newark/Elizabeth and Los Angeles/Long Beach. Accordingly, the Company is subject to risks incidental to such transportation. These risks include, but are not limited to, increases in fuel costs, the availability of ships, increased security restrictions, work stoppages and carriers’ ability to provide delivery services to meet the Company’s shipping needs. Transportation disruptions and increased transportation costs could adversely affect the Company’s business.

The Company delivers its products to its customers or makes such products available for customer pickup from its distribution centers. Prolonged domestic transportation disruptions, as well as workforce or systems issues related to the Company’s distribution centers, could have a negative affect on the Company’s ability to deliver goods to its customers.

Intellectual Property

Significant portions of the Company’s business are dependent on trade names, trademarks and patents, some of which are licensed from third-parties. Several of these license agreements are subject to termination by the licensor. The loss of certain licenses or a material increase in the royalties the Company pays under such licenses upon renewal could result in a reduction of the Company’s operating margin.

Regulatory

The Company is subject in the ordinary course of its business, in the United States and elsewhere, to many statutes, ordinances, rules and regulations that if violated by the Company could have a material adverse effect on the Company’s business. The Company’s operations could be conducted by its employees, contractors, representatives, or agents in ways which violate the Foreign Corrupt Practices Act or other similar anti-bribery laws.

The marketing of certain of the Company’s consumer products involve an inherent risk of product liability claims or recalls or other regulatory or enforcement actions initiated by the U.S. Consumer Product Safety Commission, by state regulatory authorities or through private causes of action. Any defects in products the Company markets could harm the Company’s credibility, adversely affect its relationship with its customers and decrease market acceptance of the Company’s products and the strength of the brand names under which the Company markets such products. Potential product liability claims may exceed the amount of the Company’s insurance coverage and could materially damage the Company’s business and its financial condition.

The Company is subject to significant regulations, including the Sarbanes-Oxley Act of 2002. The Company cannot assure that it will not find material weaknesses in the future or that the Company’s independent registered public accounting firm will conclude that the Company’s internal control over financial reporting is operating effectively.

The Company is subject to general business regulations and laws, as well as regulations and laws specifically governing the Internet and e-commerce. Such existing and future laws and regulations may impede the growth of the Internet or other online services. These regulations and laws may cover taxation, user privacy, data protection,

pricing, content, copyrights, distribution, electronic contracts and other communications, consumer protection, the provision of online payment services, broadband residential Internet access, and the characteristics and quality of products and services. It is not clear how existing laws governing issues such as property ownership, sales and other taxes, and personal privacy apply to the Internet and e-commerce. Unfavorable resolutions of these issues would harm the Company’s business. This could, in turn, diminish the demand for the Company’s products on the Internet and increase the Company’s cost of doing business.

Technology

The Company relies on several different information technology systems for the operation of its principal business functions, including the Company’s enterprise, warehouse management, inventory forecast and re-ordering and call center systems. In the case of the Company’s inventory forecast and re-ordering system, most of the Company’s orders are received directly through electronic connections with the Company’s largest customers. The failure of any one of these systems could have a material adverse effect on the Company’s business and results of operations.

The Company has made significant efforts to secure its computer network. However, the Company’s computer network could be compromised and confidential information such as customer credit card information could be misappropriated. This could lead to adverse publicity, loss of sales and profits or cause the Company to incur significant costs to reimburse third-parties for damages which could adversely impact profits.

In addition, although the Company’s systems and procedures comply with Payment Card Industry (“PCI”) data security standards, failure by the Company to maintain compliance with the PCI requirements or rectify a security issue could result in fines and the imposition of restrictions on the Company’s ability to accept credit cards.

Personnel

The Company’s success depends on its ability to identify, hire and retain skilled personnel. The Company’s industry is characterized by a high level of employee mobility and aggressive recruiting among competitors for personnel with successful track records. The Company may not be able to attract and retain skilled personnel or may incur significant costs in order to do so. If Jeffrey Siegel, the Company’s Chairman, President and Chief Executive Officer, was no longer employed by the Company, it could have a material adverse effect on the Company.

None

The following table lists the principal properties at which the Company operates its business at December 31, 2010:

| Location | | Description | | Size

(square feet) | | Owned/

Leased |

| | | | | | | |

| Fontana, California | | Principal West Coast warehouse and distribution facility | | 753,000 | | Leased |

| Robbinsville, New Jersey | | Principal East Coast warehouse and distribution facility | | 700,000 | | Leased |

| Winchendon, Massachusetts | | Warehouse and distribution facility, and spice packing line | | 175,000 | | Owned |

| Garden City, New York | | Corporate headquarters/main showroom | | 146,000 | | Leased |

| Medford, Massachusetts | | Offices, showroom, warehouse and distribution facility | | 69,000 | | Leased |

| San Germán, Puerto Rico | | Sterling silver manufacturing facility | | 55,000 | | Leased |

| Guangzhou, China | | Offices | | 18,000 | | Leased |

| New York, New York | | Showrooms | | 17,000 | | Leased |

| York, Pennsylvania | | Offices | | 14,000 | | Leased |

| Atlanta, Georgia | | Showrooms | | 11,000 | | Leased |

| Shanghai, China | | Offices | | 11,000 | | Leased |

In March 2008, the Environmental Protection Agency (“EPA”) announced that the San Germán Ground Water Contamination site in Puerto Rico was added to the Superfund National Priorities List due to contamination present in the local drinking water supply. Wallace Silversmiths de Puerto Rico, Ltd. (“Wallace”), a wholly-owned subsidiary of the Company, received a Notice of Potential Liability and Request for Information Pursuant to 42 U.S.C. Sections 9607(a) and 9604(e) of the Comprehensive Environmental Response, Compensation, Liability Act regarding the San Germán Ground Water Contamination Superfund Site, San Germán, Puerto Rico dated May 29, 2008 from the EPA. The Company responded to the EPA’s Request for Information on behalf of Wallace. At this time, it is not possible for the Company to evaluate the outcome of this matter.

The Company is, from time to time, involved in other legal proceedings. The Company believes that other current litigation is routine in nature and incidental to the conduct of the Company’s business, and that none of this litigation, individually or collectively, would have a material adverse effect on the Company’s consolidated financial position, results of operations or cash flows.

| (a) | The Company’s common stock is traded under the symbol “LCUT” on The NASDAQ Global Select Market (“NASDAQ”). |

The following table sets forth the quarterly high and low sales prices for the common stock of the Company for the fiscal periods indicated as reported by NASDAQ.

| | | 2010 | | | 2009 | |

| | | High | | | Low | | | High | | | Low | |

| First quarter | | $ | 12.00 | | | $ | 6.61 | | | $ | 3.96 | | | $ | 0.97 | |

| Second quarter | | | 15.86 | | | | 11.87 | | | | 4.59 | | | | 1.38 | |

| Third quarter | | | 15.68 | | | | 13.53 | | | | 5.95 | | | | 3.33 | |

| Fourth quarter | | | 15.23 | | | | 12.70 | | | | 7.40 | | | | 5.34 | |

At December 31, 2010, the Company estimates that there were approximately 2,586 beneficial holders of the Company’s common stock.

The Company is authorized to issue 100 shares of Series A Preferred stock and 2,000,000 shares of Series B Preferred stock, none of which were issued or outstanding at December 31, 2010.

The Company paid quarterly cash dividends of $0.0625 per share, or a total annual cash dividend of $0.25 per share, on its common stock during 2008. In February 2009, the Company suspended paying cash dividends on its outstanding shares of common stock. In March 2011, the Company determined that it will resume paying cash dividends on its outstanding shares of common stock. On March 4, 2011, the Board of Directors declared a quarterly dividend of $0.025 per share payable on May 16, 2011, to shareholders of record on May 2, 2011.

The following table summarizes the Company’s equity compensation plan as of December 31, 2010:

| Plan category | | Number of shares of common stock to be issued upon exercise of outstanding options | | | Weighted- average exercise price of outstanding options | | | Number of shares of common stock remaining available for future issuance | |

| Equity compensation plan approved by security holders | | | 2,219,200 | | | $ | 12.46 | | | | 733,926 | |

| Equity compensation plan not approved by security holders | | | ― | | | | ― | | | | ― | |

| Total | | | 2,219,200 | | | $ | 12.46 | | | | 733,926 | |

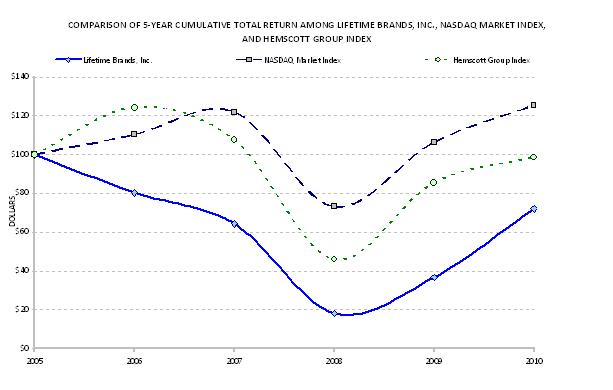

PERFORMANCE GRAPH

The following chart compares the cumulative total return on the Company’s common stock with the NASDAQ Market Index and the Hemscott Group Index for Housewares & Accessories. The comparisons in this chart are required by the SEC and are not intended to forecast or be indicative of the possible future performance of the Company’s common stock.

| Date | | Lifetime Brands, Inc. | | | Hemscott Group Index | | | NASDAQ Market Index | |

12/31/2005 | | $ | 100.00 | | | $ | 100.00 | | | $ | 100.00 | |

12/31/2006 | | | 80.37 | | | | 124.17 | | | | 110.26 | |

12/31/2007 | | | 64.33 | | | | 107.75 | | | | 121.89 | |

12/31/2008 | | | 18.16 | | | | 45.94 | | | | 73.10 | |

12/31/2009 | | | 36.69 | | | | 85.53 | | | | 106.23 | |

12/31/2010 | | | 72.04 | | | | 98.49 | | | | 125.37 | |

| | (1) | The chart assumes $100 was invested on December 31, 2005 and dividends were reinvested. Measurement points are at the last trading day of each of the fiscal years ended December 31, 2006, 2007, 2008, 2009 and 2010. The material in this chart is not soliciting material, is not deemed filed with the Securities and Exchange Commission and is not incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether or not made before or after the date of this Annual Report on Form 10-K and irrespective of any general incorporation language in such filing. A list of the companies included in the Hemscott Group Index will be furnished by the Company to any stockholder upon written request to the Chief Financial Officer of the Company. |

The selected consolidated statement of operations data for the years ended December 31, 2010, 2009 and 2008, and the selected consolidated balance sheet data as of December 31, 2010 and 2009, have been derived from the Company’s audited consolidated financial statements included elsewhere in this Annual Report on Form 10-K. The selected consolidated statement of operations data for the years ended December 31, 2007 and 2006, and the selected consolidated balance sheet data at December 31, 2008, 2007 and 2006, have been derived from the Company’s audited consolidated financial statements included in the Company’s Annual Reports on Form 10-K for those respective years, which are not included in this Annual Report on Form 10-K.

This information should be read together with the discussion in Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Company’s consolidated financial statements and notes to those statements included elsewhere in this Annual Report on Form 10-K.

| | | Year ended December 31, | |

| | | 2010(2) | | | 2009 | | | 2008(3) | | | 2007(3) | | | 2006(3) | |

STATEMENT OF OPERATIONS DATA (1) | | (in thousands, except per share data) | |

| | | | | | | | | | | | | | | | |

| Net sales | | $ | 443,171 | | | $ | 415,040 | | | $ | 487,935 | | | $ | 493,725 | | | $ | 457,400 | |

| | | | | | | | | | | | | | | | | | | | | |

| Cost of sales | | | 273,774 | | | | 257,839 | | | | 303,535 | | | | 288,997 | | | | 265,749 | |

| Distribution expenses | | | 44,570 | | | | 43,329 | | | | 57,695 | | | | 53,493 | | | | 49,729 | |

| Selling, general and administrative expenses | | | 95,044 | | | | 95,647 | | | | 131,226 | | | | 128,527 | | | | 112,122 | |

| Goodwill and intangible asset impairment | | | ― | | | | ― | | | | 29,400 | | | | ― | | | | ― | |

| Restructuring expenses | | | ― | | | | 2,616 | | | | 17,992 | | | | 1,924 | | | | ― | |

| Income (loss) from operations | | | 29,783 | | | | 15,609 | | | | (51,913 | ) | | | 20,784 | | | | 29,800 | |

| | | | | | | | | | | | | | | | | | | | | |

| Interest expense | | | (9,351 | ) | | | (13,185 | ) | | | (11,577 | ) | | | (10,623 | ) | | | (5,616 | ) |

| Loss on early retirement of debt | | | (764 | ) | | | ― | | | | ― | | | | ― | | | | ― | |

| Other income, net | | | ― | | | | ― | | | | ― | | | | 3,935 | | | | 31 | |

| Income (loss) before income taxes, equity in earnings of Grupo Vasconia, S.A.B. and extraordinary item | | | 19,668 | | | | 2,424 | | | | (63,490 | ) | | | 14,096 | | | | 24,215 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income tax benefit (provision) | | | (4,602 | ) | | | (1,880 | ) | | | 14,249 | | | | (6,567 | ) | | | (9,320 | ) |

| Equity in earnings of Grupo Vasconia, S.A.B., net of taxes | | | 2,718 | | | | 2,171 | | | | 1,486 | | | | ― | | | | ― | |

| Income (loss) before extraordinary item | | $ | 17,784 | | | $ | 2,715 | | | $ | (47,755 | ) | | $ | 7,529 | | | $ | 14,895 | |

| Extraordinary item, net of taxes | | | 2,477 | | | | ― | | | | ― | | | | ― | | | | ― | |

| Net income (loss) | | $ | 20,261 | | | $ | 2,715 | | | $ | (47,755 | ) | | $ | 7,529 | | | $ | 14,895 | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic income (loss) per common share before extraordinary item | | $ | 1.48 | | | $ | 0.23 | | | $ | (3.99 | ) | | $ | 0.58 | | | $ | 1.13 | |

| Basic income per common share of extraordinary item | | $ | 0.20 | | | $ | ― | | | $ | ― | | | $ | ― | | | $ | ― | |

| Basic income (loss) per common share | | $ | 1.68 | | | $ | 0.23 | | | $ | (3.99 | ) | | $ | 0.58 | | | $ | 1.13 | |

| Weighted-average shares outstanding – basic | | | 12,036 | | | | 12,009 | | | | 11,976 | | | | 12,969 | | | | 13,171 | |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted income (loss) per common share before extraordinary item | | $ | 1.44 | | | $ | 0.22 | | | $ | (3.99 | ) | | $ | 0.57 | | | $ | 1.10 | |

| Diluted income per common share of extraordinary item | | $ | 0.20 | | | $ | ― | | | $ | ― | | | $ | ― | | | $ | ― | |

| Diluted income (loss) per common share | | $ | 1.64 | | | $ | 0.22 | | | $ | (3.99 | ) | | $ | 0.57 | | | $ | 1.10 | |

| Weighted-average shares outstanding – diluted | | | 12,376 | | | | 12,075 | | | | 11,976 | | | | 13,099 | | | | 14,716 | |

| | | | | | | | | | | | | | | | | | | | | |

| Cash dividends per common share | | $ | ― | | | $ | ― | | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.25 | |

| | | December 31, | |

| | | 2010 | | | 2009 | | | 2008(3) | | | 2007(3) | | | 2006(3) | |

BALANCE SHEET DATA (1) | | (in thousands) | |

| Current assets | | $ | 182,253 | | | $ | 173,850 | | | $ | 232,678 | | | $ | 228,078 | | | $ | 231,633 | |

| Current liabilities | | | 60,512 | | | | 77,210 | | | | 149,981 | | | | 71,283 | | | | 89,727 | |

| Working capital | | | 121,741 | | | | 96,640 | | | | 82,697 | | | | 156,795 | | | | 141,906 | |

| Total assets | | | 277,586 | | | | 276,723 | | | | 341,781 | | | | 371,415 | | | | 343,064 | |

| Short-term borrowings | | | 4,100 | | | | 24,601 | | | | 89,300 | | | | 13,500 | | | | 21,500 | |

| Long-term debt | | | 50,000 | | | | ― | | | | ― | | | | 55,200 | | | | 5,000 | |

| Convertible senior notes | | | 23,557 | | | | 70,527 | | | | 67,864 | | | | 65,428 | | | | 63,203 | |

| Stockholders’ equity | | | 127,606 | | | | 104,012 | | | | 97,509 | | | | 153,102 | | | | 168,836 | |

Notes:

| | (1) | The Company acquired the business and certain assets of the following in the respective years noted which affects the comparability of the periods: Syratech in April 2006, Pomerantz® and Design for Living® in April 2007, Gorham® in July 2007, a 30% interest in Grupo Vasconia, S.A.B. in December 2007 and Mikasa® in June 2008. |

| | (2) | In 2010, the Company recorded an extraordinary gain of $2.5 million in conjunction with the elimination of negative goodwill related to the 2008 acquisition of Mikasa, Inc. |

| | (3) | Certain amounts have been adjusted in these years to reflect the provisions of ASC Topic No. 470-20, Debt with Conversion and Other Options, on a retrospective basis. See Note E of the Notes to the Consolidated Financial Statements included in Item 15 for further information regarding the provisions of ASC Topic No. 470-20. |

The following discussion should be read in conjunction with the consolidated financial statements for the Company and notes thereto set forth in Item 15. This discussion contains forward-looking statements relating to future events and the future performance of the Company based on the Company’s current expectations, assumptions, estimates and projections about it and the Company’s industry. These forward-looking statements involve risks and uncertainties. The Company’s actual results and timing of various events could differ materially from those anticipated in such forward-looking statements as a result of a variety of factors, as more fully described in this section and elsewhere in this Annual Report. The Company undertakes no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

ABOUT THE COMPANY

The Company is one of North America’s leading resources for nationally branded kitchenware, tabletop and home décor products. The Company’s major product categories are Kitchenware, Tabletop and Home Décor. The Company markets several product lines within each of these product categories and under most of the Company’s brands, primarily targeting moderate to premium price points, through every major level of trade. The Company believes it possesses certain competitive advantages based on its brands, its emphasis on innovation and new product development and its sourcing capabilities. The Company owns or licenses a number of the leading brands in its industry including Farberware®, KitchenAid®, Cuisinart®, Pfaltzgraff®, Mikasa® and Pedrini®. Historically, the Company’s sales growth has come from expanding product offerings within its product categories, by developing existing brands, acquiring new brands and establishing new product categories. Key factors in the Company’s growth strategy have been the selective use and management of the Company’s brands, and the Company’s ability to provide a stream of new products and designs. A significant element of this strategy is the Company’s in-house design and development teams that create new products, packaging and merchandising concepts.

BUSINESS SEGMENTS

The Company operates in two reportable business segments; the Wholesale segment, which is the Company’s primary business that designs, markets and distributes its products to retailers and distributors, and the Retail Direct segment in which the Company markets and sells to consumers through its Pfaltzgraff®, Mikasa®, Lifetime Sterling™, and Housewares Deals™ Internet websites and Pfaltzgraff® mail-order catalogs. In 2007 and 2008, the Company discontinued operating retail outlet stores utilizing the Pfaltzgraff® and Farberware® names that were included in the Retail Direct segment’s results for those years.

INVESTMENT IN GRUPO VASCONIA, S.A.B.

The Company owns approximately 30% of the outstanding capital stock of Grupo Vasconia, S.A.B. (“Vasconia”), a leading Mexican housewares company. The Company accounts for its investment in Vasconia using the equity method of accounting and has recorded its proportionate share of Vasconia’s net income, net of taxes, as equity in earnings of Grupo Vasconia, S.A.B. in the Company’s consolidated statements of operations.

Vasconia is an integrated cookware manufacturer. Through its subsidiary, Industria Mexicana del Aluminio, S.A. de C.V., Vasconia manufactures and sells aluminum disks, sheets, strips, plates and coils. Vasconia sells cookware and other housewares product items in Mexico and in Central and South America under its Ekco®, Vasconia®, Regal®, Presto® and Thermos® brands and sells housewares products under several of the Company’s owned and licensed brands, including CasaMōda®, Farberware®, KitchenAid®, Mikasa® and Pedrini®. Vasconia purchases certain housewares products directly from third-party vendors in Asia. In connection with such purchases, Vasconia reimburses the Company for the use of the Company’s sourcing offices and personnel services.

The Company sells certain cookware products in the United States under the Vasconia® brand. The Company and Vasconia have entered into a cookware supply agreement, pursuant to which the Company is able to purchase cookware from Vasconia at Vasconia’s manufactured cost.

Pursuant to a Shares Subscription Agreement (the “Agreement”), the Company may designate four persons to be nominated as members of Vasconia’s Board of Directors. The Agreement also provides mechanisms whereby, through December 2012, the Company is able to acquire a controlling interest in Vasconia or to require Vasconia to repurchase the Company’s ownership interest. Jeffrey Siegel, Ronald Shiftan, Daniel Siegel and C.P. Eduardo Manuel Arturo Argil y Aguilar have been designated as the Company’s nominees and currently serve as directors of Vasconia. Mr. Argil, a Certified Public Accountant, also serves as a member of Vasconia’s Audit Committee. Shares of Vasconia’s capital stock are traded on the Bolsa Mexicana de Valores, the Mexican Stock Exchange (www.bmv.com.mx). The Quotation Key is VASCONI.

On January 29, 2010, Vasconia filed a Schedule 13D with the Securities and Exchange Commission, in which it disclosed that it had acquired 639,000 shares of the Company’s common stock.

INVENTORY REDUCTION PLAN

In 2007, the Company initiated a plan to reduce the number of individual items offered for sale and to shorten the period between procurement and sale. Consistent with this plan, the Company sold some slower moving inventory at lower than regular gross margin levels. The Company’s inventory was $144 million at December 31, 2007, $142 million at December 31, 2008, $104 million at December 31, 2009, and $100 million at December 31, 2010.

RESTRUCTURING EXPENSES

During the year ended December 31, 2009, the Company recognized restructuring and non-cash impairment charges of $2.6 million. The restructuring charges consisted of lease obligations, employee related expenses and other related costs.

The restructuring costs recognized in 2009 and 2008 were incurred in connection with: (i) the Company’s closure of its unprofitable retail outlet store operations, (ii) the closure of the Company’s York, Pennsylvania distribution center, the operations of which were consolidated with those of the Company’s main East Coast and West Coast distribution centers, (iii) the vacating of certain excess showroom space, (iv) the realignment of the management structure of certain of the Company’s divisions and (v) the elimination of a portion of the workforce at its Puerto Rico sterling silver manufacturing facility. These restructuring activities were completed by the end of 2009.

The Company has not accounted for the retail outlet store operations as discontinued operations pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic No. 205-20, Presentation of Financial Statements- Discontinued Operations, since the Company determined that the operations and cash flows of the retail outlet store operations would not be eliminated from the on-going operations of the Company. Specifically, the Company also determined that the migration of customers from the Company’s retail outlet stores to the Company’s retail direct and wholesale businesses would not be insignificant. For this purpose, the Company concluded that the migration of greater than 5% of sales from the retail outlet stores to the retail direct and wholesale businesses would be significant.

SEASONALITY

The Company’s business and working capital needs are highly seasonal, with a majority of sales occurring in the third and fourth quarters. In 2010, 2009 and 2008, net sales for the third and fourth quarters accounted for 60%, 58%, and 61% of total annual net sales, respectively. In anticipation of the pre-holiday shipping season, inventory levels increase primarily in the June through October time period.

EFFECT OF ADOPTION OF ACCOUNTING PRINCIPLE

Effective January 1, 2010, the Company adopted the provisions of ASC Topic No. 860, Transfers and Servicing. ASC Topic No. 860 revised the guidance required to determine controlling interests in a variable interest entity (“VIE”) and also added additional disclosure requirements regarding a company’s involvement with such entities. The new guidance requires a qualitative approach to identifying a controlling financial interest in a VIE, requires an on-going assessment of whether an entity is a VIE and whether the holder of the interest in a VIE is the primary beneficiary of the VIE. This guidance became effective for the Company beginning in 2010. The adoption of this guidance did not have an impact on the Company’s consolidated financial position or results of operations.

RESULTS OF OPERATIONS

The following table sets forth statement of operations data of the Company as a percentage of net sales for the periods indicated below.

| | Year Ended December 31, |

| | 2010 | | 2009 | | 2008 | |

| Net sales | 100.0 | % | 100.0 | % | 100.0 | % |

| Cost of sales | 61.8 | | 62.1 | | 62.2 | |

| Distribution expenses | 10.1 | | 10.4 | | 11.8 | |

| Selling, general and administrative expenses | 21.4 | | 23.0 | | 26.9 | |

| Goodwill and intangible asset impairment | ― | | ― | | 6.0 | |

| Restructuring expenses | ― | | 0.6 | | 3.7 | |

| Income (loss) from operations | 6.7 | | 3.9 | | (10.6 | ) |

| | | | | | | |

| Interest expense | (2.1 | ) | (3.2 | ) | (2.4) | ) |

| Loss on early retirement of debt | (0.2 | ) | ― | | ― | |

| Income (loss) before income taxes, equity in earnings of Grupo Vasconia, S.A.B. and extraordinary item | 4.4 | | 0.7 | | (13.0 | ) |

| Income tax benefit (provision) | (1.0 | ) | (0.5 | ) | 2.9 | |

| Equity in earnings of Grupo Vasconia, S.A.B., net of taxes | 0.6 | | 0.5 | | 0.3 | |

| Income (loss) before extraordinary item | 4.0 | % | 0.7 | % | (9.8 | )% |

| Extraordinary item, net of taxes | 0.6 | | ― | | ― | |

| Net income (loss) | 4.6 | % | 0.7 | % | (9.8 | )% |

MANAGEMENT’S DISCUSSION AND ANALYSIS

2010 COMPARED TO 2009

Net Sales

Net sales for the year were $443.2 million, an increase of 6.8% compared to net sales of $415.0 million in 2009.

Net sales for the Wholesale segment in 2010 were $413.8 million, an increase of $24.8 million or 6.4% compared to net sales of $389.0 million in 2009. Net sales in 2009 included approximately $4.7 million of net sales in the going-out-of-business sales of a customer that was liquidated. Excluding the impact of the customer’s 2009 going-out-of business sales, net sales for the Wholesale segment in 2010 increased approximately $29.5 million or 7.7% compared to 2009. More specifically, excluding the impact of the customer’s 2009 going-out-of business sales, net sales in the Company’s Kitchenware product category increased approximately $19.6 million, or 8.9%, in 2010 as compared to 2009, net sales for the Company’s Tabletop product category increased approximately $12.7 million, or 11.5%, in 2010 as compared to 2009, and net sales for the Company’s Home Décor product category decreased approximately $2.8 million, or 5.3%, in 2010 as compared to 2009. Net sales to Wal-Mart Stores Inc. decreased $8.5 million in 2010 as compared to 2009, principally due to changes in Wal-Mart’s inventory management strategy, which have resulted in the maintenance of fewer product offerings in its stores during the first half of 2010. The decrease in net sales to Wal-Mart Stores Inc., within the Kitchenware, Tabletop and Home Décor product categories, was substantially offset by an increase in sales to other retailers attributable to higher volume and the introduction of new products.

Net sales for the Retail Direct segment in 2010 were $29.4 million, an increase of $3.4 million, as compared to $26.0 million for 2009. The increase in net sales was primarily attributable to targeted sales promotions on the Company’s Pfaltzgraff® and Mikasa® websites and additional net sales from the Company’s new Lifetime Sterling™ and Housewares Deals™ websites. The increase was partially offset by lower shipping income from free shipping promotions.

Cost of sales

Cost of sales for 2010 was $273.8 million compared to $257.8 million for 2009. Cost of sales as a percentage of net sales was 61.8% for 2010 compared to 62.1% for 2009.

Cost of sales as a percentage of net sales for the Wholesale segment was 63.7% for 2010 compared to 64.3% for 2009. Gross margin in 2010 increased as a result of favorable product mix. Gross margin in 2009 was negatively affected by lower margin sales in the going-out-of-business sales of the customer that was liquidated.

Cost of sales as a percentage of net sales for the Retail Direct segment increased to 34.9% in 2010 from 29.4% in 2009. The decrease in gross margin was principally due to an increase in free shipping promotions.

Distribution expenses

Distribution expenses for 2010 were $44.6 million compared to $43.3 million for 2009. Distribution expenses as a percentage of net sales were 10.1% in 2010 and 10.4% for 2009.

Distribution expenses as a percentage of net sales for the Wholesale segment was unchanged at 8.7% in both 2010 and 2009.

Distribution expenses as a percentage of net sales for the Retail Direct segment were 29.2% for 2010 compared to 35.3% for 2009. The decrease is primarily attributable to improved labor efficiencies due to the Company’s exit from its York, Pennsylvania distribution center in July 2009.

Selling, general and administrative expenses

Selling, general and administrative expenses for 2010 were $95.0 million, a decrease of 0.6% compared to $95.6 million for 2009.

Selling, general and administrative expenses for 2010 for the Wholesale segment were $71.3 million, a decrease of $2.2 million or 3.0% compared to $73.5 million in 2009. As a percentage of net sales, selling, general and administrative expenses were 17.2% for 2010 compared to 18.9% for 2009. The decrease of 3.0% was attributable to the benefit of the 2009 restructuring activities and lower depreciation and amortization resulting from the write-off of fixed assets at exited facilities and a reduction of occupancy expenses primarily from consolidating showrooms and the Company’s continued expense reduction efforts. The decrease was offset by higher incentive compensation.

Selling, general and administrative expenses for 2010 for the Retail Direct segment were $11.5 million compared to $10.8 million for 2009. The increase was in support of sales growth and was attributable to higher employee expenses and an increase in web related search expenses. This increase was partially offset by lower catalog related expenses.

Unallocated corporate expenses for 2010 and 2009 were $12.2 million and $11.3 million, respectively. The increase was primarily attributable to higher compensation expense, including incentive compensation and stock options.

Interest expense

Interest expense for 2010 was $9.4 million compared to $13.2 million for 2009. The decrease in interest expense was primarily attributable to lower average borrowings and lower interest rates resulting from the Company’s debt refinancing in 2010.

Loss on early retirement of debt

During 2010, the Company entered into a new revolving credit facility and term loan and repurchased $50.9 million principal amount of its convertible senior notes. In connection with these activities, the Company incurred a non-cash pre-tax charge of approximately $764,000 consisting primarily of the write-off of deferred financing costs and unamortized debt discount related to the Company’s prior revolving credit facility and the 4.75% convertible senior notes that were repurchased.

Income tax provision

The income tax provision for 2010 was $4.6 million compared to $1.9 million for 2009. The effective tax rates in 2010 and 2009 reflect a reduction in the valuation allowance related to certain deferred tax assets. The increase in the income tax provision resulted from higher income before income taxes offset by the effect of the valuation allowance reduction.

Equity in earnings of Grupo Vasconia, S.A.B.

Equity in earnings of Grupo Vasconia, net of taxes, was $2.7 million for 2010 compared to $2.2 million for 2009. Grupo Vasconia reported income from operations for the year ended 2010 of $15.1 million compared to $11.8 million for 2009; and net income of $9.9 million in 2010 compared to $8.3 million in 2009. The increase in income from operations in 2010 as compared to 2009 is primarily attributable to the growth in aluminum sales during 2010. Increased margins from kitchenware sales during 2010 were offset by increases in selling and distribution expenses.

Extraordinary item

In 2010, the Company recorded an extraordinary gain of $2.5 million in conjunction with the elimination of negative goodwill related to the 2008 acquisition of Mikasa, Inc.

2009 COMPARED TO 2008

Net Sales

Net sales for the year were $415.0 million, a decrease of 14.9% compared to net sales of $487.9 million in 2008.

Net sales for the Wholesale segment in 2009 were $389.0 million, a decrease of $14.6 million or 3.6% compared to net sales of $403.6 million in 2008. On a comparable basis, adjusting 2009 net sales of Mikasa®, which was acquired on June 6, 2008, to reflect net sales only for the period after June 6, 2009, the same post acquisition period as 2008, net sales for the Company’s Wholesale segment were $374.4 million for 2009, a decrease of $29.2 million or 7.2% compared to net sales for 2008. Net sales for the Company’s Kitchenware product category decreased approximately $14.8 million. The decrease was primarily attributable to changes in the Company’s key customers’ sourcing patterns and product mix, and the liquidation of a significant customer in 2008. Net sales for the Company’s Tabletop product category, excluding Mikasa® sales, decreased approximately $12.9 million primarily as the result of lower sales of flatware and giftware which management attributes to the weak economy and its negative impact on consumer spending habits, particularly for luxury items. Net sales for the Company’s Home Décor product category decreased approximately $4.3 million due primarily to the elimination of certain low margin business in 2009. Net sales of other Wholesale products increased by $2.8 million due to the addition of a product line in 2009.

Net sales for the Retail Direct segment in 2009 were $26.0 million compared to $84.3 million for 2008. On a comparable basis, excluding (a) 2009 net sales related to Mikasa® of $1.4 million to reflect net sales for the same post acquisition period as 2008, and (b) 2008 net sales of $55.8 million attributable to the retail outlet stores that the Company closed by the end of 2008, net sales for the Retail Direct segment were $24.6 million for 2009 compared to $28.5 million in 2008, a decrease of $3.9 million. During 2009, the Company de-emphasized its catalog business due to low profitability which, together with the weak retail sales environment, contributed to the decline.

Cost of sales

Cost of sales for 2009 was $257.8 million compared to $303.5 million for 2008. Cost of sales as a percentage of net sales was 62.1% for 2009 compared to 62.2% for 2008.

Cost of sales as a percentage of net sales for the Wholesale segment was 64.3% for 2009 compared to 64.0% for 2008. The decrease in gross margin, primarily attributable to a shift in customer mix, was substantially offset by lower in-bound freight costs and lower minimum royalties during 2009.

Cost of sales as a percentage of net sales for the Retail Direct segment decreased to 29.4% in 2009 from 53.4% in 2008. On a comparable basis, excluding 2008 cost of sales attributable to the retail outlet stores that the Company closed by the end of 2008, cost of sales as a percentage of net sales for the Retail Direct segment were 31.8% for 2008. The increase in gross margin was primarily attributable to selective price increases and less promotional free shipping in 2009.

Distribution expenses

Distribution expenses for 2009 were $43.3 million compared to $57.7 million for 2008. Distribution expenses as a percentage of net sales were 10.4% in 2009 and 11.8% for 2008.

Distribution expenses as a percentage of net sales for the Wholesale segment decreased to 8.7% in 2009 from 11.0% in 2008. The decrease was primarily attributable to the elimination of duplicative costs incurred while the Company consolidated its West Coast distribution centers in 2008 and distribution services for Mikasa® provided by the seller and offset in part by additional costs to integrate the Mikasa® inventory into the Company’s existing distribution centers in 2008, collectively which accounted for approximately 1.3% of the decrease in distribution expenses as a percentage of net sales. The balance of the decrease was primarily attributable to improved labor efficiencies realized in 2009.

Distribution expenses as a percentage of net sales for the Retail Direct segment were 35.3% for 2009 compared to 15.9% for 2008. On a comparable basis, excluding 2008 distribution expenses for the retail outlet stores that the Company closed by the end of 2008, distribution expenses as a percentage of net sales for the Retail Direct segment were 39.6% for 2008. The decrease was due primarily to the benefit of the Company’s closure of its York, Pennsylvania distribution center.

Selling, general and administrative expenses

Selling, general and administrative expenses for 2009 were $95.6 million, a decrease of 27.1% compared to $131.2 million for 2008.

Selling, general and administrative expenses for 2009 for the Wholesale segment were $73.5 million, a decrease of $9.5 million or 11.4% compared to $83.0 million in 2008. As a percentage of net sales, selling, general and administrative expenses were 18.9% for 2009 compared to 20.6% for 2008. The decrease in selling, general and administrative expenses was primarily attributable to the Company’s expense reduction efforts and the non-recurrence of the costs incurred in 2008 for transitional services related to Mikasa®. The decrease as a percentage of net sales was offset in part due to the lower sales volume in 2009.

Selling, general and administrative expenses for 2009 for the Retail Direct segment were $10.8 million compared to $37.3 million for 2008. On a comparable basis, excluding 2008 selling, general and administrative expenses for the retail outlet stores that the Company closed by the end of 2008, selling, general and administrative expenses for the Retail Direct segment were $12.7 million for 2008. The decrease was primarily attributable to reductions in postage and catalog production costs as a result of the Company’s de-emphasis of its catalog channel.

Unallocated corporate expenses for 2009 and 2008 were $11.3 million and $10.9 million, respectively. The increase was primarily attributable to an increase in short-term incentive compensation expense offset by a decrease in professional fees and stock option expense.

Restructuring expenses

During 2009, the Company recorded restructuring expenses and non-cash impairment charges of $2.6 million related to the Company’s 2008 restructuring initiative, the realignment of the management structure of certain divisions and the elimination of a portion of the workforce at its Puerto Rico sterling silver manufacturing facility. The restructuring expenses consisted principally of charges for lease obligations, employee related expenses and other related costs. The restructuring charges in 2009 also reflect adjustments reducing the restructuring charges recognized in 2008 by $1.9 million as the result of decisions by the Company not to vacate certain leased space that the Company had expected to vacate and a decision not to terminate the employment of certain employees, whose employment the Company had expected to terminate.

Interest expense

Interest expense for 2009 was $13.2 million compared to $11.6 million for 2008. The increase in interest expense was primarily attributable to higher interest rates in 2009 primarily as the result of an increase in the applicable margin rates under the Company’s Credit Facility and a reclassification from other comprehensive loss to interest expense as a result of the de-designation of a cash flow hedge. The increase was offset in part by lower average borrowings during 2009.

Income tax benefit (provision)

The income tax provision for 2009 was $1.9 million compared to a benefit of $14.2 million for 2008. The Company’s effective tax rate for 2009 primarily reflects state taxes and deferred taxes related to basis differences in certain assets.

Equity in earnings of Grupo Vasconia, S.A.B.

Equity in earnings of Grupo Vasconia, net of taxes, was $2.2 million for 2009 compared to $1.5 million for 2008. Grupo Vasconia reported income from operations for the year ended 2009 of $11.8 million compared to $11.7 million for 2008; and net income of $8.3 million in 2009 compared to $6.3 million in 2008. The increase in net income for the year ended 2009 was primarily attributable to the growth in sales of kitchenware during 2009.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Management’s Discussion and Analysis of Financial Condition and Results of Operations discusses the Company’s consolidated financial statements which have been prepared in accordance with U.S. generally accepted accounting principles and with the instructions to Form 10-K and Article 10 of Regulation S-X. The preparation of these financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments based on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. The Company evaluates these estimates including those related to revenue recognition, allowances for doubtful accounts, reserves for sales returns and allowances and customer chargebacks, inventory mark-down provisions, impairment of tangible and intangible assets, stock option expense, derivative valuation, accruals related to the Company’s tax positions and tax valuation allowances. Actual results may differ from these estimates using different assumptions and under different conditions. The Company’s significant accounting policies are more fully described in Note A of the Notes to the Consolidated Financial Statements included in Item 15. The Company believes that the following discussion addresses its most critical accounting policies, which are those that are most important to the portrayal of the Company’s consolidated financial condition and results of operations and require management’s most difficult, subjective and complex judgments.

Inventory

Inventory consists principally of finished goods sourced from third-party suppliers. Inventory also includes finished goods, work in process and raw materials related to the Company’s manufacture of sterling silver products. Inventory is priced by the lower of cost (first-in, first-out basis) or market method. The Company estimates the selling price of its inventory on a product by product basis based on the current selling environment and considering the various available channels of distribution (e.g. wholesale: specialty store, off-price retailers, etc. or the Internet and catalog). If the estimated selling price is lower than the inventory’s cost, the Company reduces the value of inventory to its net realizable value. If a variance exists between the Company’s estimated selling prices and actual selling prices, material fluctuations in gross margin could occur. Historically, the Company’s adjustments to inventory have been appropriate and have not resulted in material unexpected charges.

Receivables

The Company periodically reviews the collectibility of its accounts receivable and establishes allowances for estimated losses that could result from the inability of its customers to make required payments. A considerable amount of judgment is required to assess the ultimate realization of these receivables including assessing the initial and on-going creditworthiness of the Company’s customers. The Company also maintains an allowance for anticipated customer deductions. The allowances for deductions are primarily based on contracts with customers. However, in certain cases the Company does not have a formal contract and therefore, customer deductions are non-contractual. To evaluate the reasonableness of non-contractual customer deductions, the Company analyzes currently available information and historical trends of deductions. If the financial conditions of the Company’s customers or general economic conditions were to deteriorate, resulting in an impairment of their ability to make payments or sell the Company’s products at reasonable sales prices, or the Company’s estimate of non-contractual deductions varied from actual deductions, revisions to allowances would be required, which could adversely affect the Company’s financial condition. Historically, the Company’s allowances have been appropriate and have not resulted in material unexpected charges.

Intangible assets and long-lived assets

Intangible assets deemed to have indefinite lives are not amortized but instead are subject to an annual impairment assessment.

Long-lived assets, including intangible assets deemed to have finite lives, are reviewed for impairment whenever events or changes in circumstances indicate that such assets may have been impaired. Impairment indicators include, among other conditions, cash flow deficits, historic or anticipated declines in revenue or operating profit or material adverse changes in the business climate that indicate that the carrying amount of an asset may be impaired. When impairment indicators are present, the Company compares the carrying value of the assets to the estimated undiscounted future cash flows expected to be generated by the assets. If the assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. The Company considered indicators of impairment of its long-lived assets and determined that no such indicators were present at December 31, 2010.

Revenue recognition

The Company sells products wholesale, to retailers and distributors, and retail, directly to the consumer through the Company’s Retail Direct operations. Wholesale sales and Retail Direct sales are recognized when title passes to the customer. Wholesale sales are recognized at shipping point and Retail Direct sales are recognized upon delivery to the customer. Shipping and handling fees that are billed to customers in sales transactions are recorded in net sales. Net sales exclude taxes that are collected from customers and remitted to the taxing authorities.

Employee stock options

The Company accounts for its stock options in accordance with ASC Topic No. 718-20, Awards Classified as Equity, which requires the measurement of compensation expense for all share-based compensation granted to employees and non-employee directors at fair value on the date of grant and recognition of compensation expense over the related service period for awards expected to vest. The Company uses the Black-Scholes option valuation model to estimate the fair value of its stock options. The Black-Scholes option valuation model requires the input of highly subjective assumptions including the expected stock price volatility of the Company’s common stock and the risk-free interest rate. Changes in these subjective input assumptions can materially affect the fair value estimate of the Company’s stock options on the date of the option grant. The Company historically has not issued options which would be variable awards under ASC 718-20.

Income taxes

The Company applies the provisions of ASC Topic No. 740, Income Taxes, for the financial statement recognition, measurement and disclosure of uncertain tax positions recognized in the Company’s financial statements. Tax positions must meet a more-likely-than-not recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken. The valuation allowance is also calculated in accordance with the provisions of ASC Topic No. 740, which requires a valuation allowance be established or maintained when it is “more likely than not” that all or a portion of deferred tax assets will not be realized.

Derivatives

The Company accounts for derivative instruments in accordance with ASC Topic No. 815, Derivatives and Hedging, which requires that all derivative instruments be recognized on the balance sheet at fair value as either an asset or a liability. Changes in the fair value of derivatives that qualify as hedges and have been designated as part of a hedging relationship for accounting purposes have no net impact on earnings to the extent the derivative is considered perfectly effective in achieving offsetting changes in fair value or cash flows attributable to the risk being hedged, until the hedged item is recognized in earnings. For derivatives that do not qualify or are not designated as hedging instruments for accounting purposes, changes in fair value are recorded in operations.

LIQUIDITY AND CAPITAL RESOURCES

The Company’s principal sources of cash to fund liquidity needs are: (i) cash provided by operating activities and (ii) amounts available under the Company’s revolving credit facility. The Company’s primary uses of funds consist of cash used in operating activities, capital expenditures and payment of principal and interest on its debt.

At December 31, 2010, the Company had cash and cash equivalents of $3.4 million compared to $682,000 at December 31, 2009, working capital was $121.7 million at December 31, 2010 compared to $96.6 million at December 31, 2009 and the current ratio was 3.01 to 1 at December 31, 2010 compared to 2.25 to 1 at December 31, 2009.

Borrowings under the Company’s revolving credit facility decreased to $14.1 million at December 31, 2010 compared to $24.6 million at December 31, 2009. The decrease in borrowings was primarily attributable to the use of cash from operations to pay down the amounts outstanding under the revolving credit facility.

The Company believes that availability under the Revolving Credit Facility and cash flows from operations is sufficient to fund the Company’s operations. However, if circumstances were to adversely change, the Company may seek alternative sources of liquidity including debt and equity financing. However, there can be no assurance that any such alternative sources would be available or sufficient. The Company closely monitors the creditworthiness of its customers. Based upon the evaluation of changes in customers’ creditworthiness, the Company may modify credit limits and/or terms of sale. The Company has not been materially affected by the bankruptcy or liquidation of any of its customers to date. However, notwithstanding the Company’s efforts to monitor its customers’ financial condition, the Company may be materially affected in the future.

In 2010, Wal-Mart Stores, Inc. (including Sam’s Club) accounted for 15% of the Company’s sales. A material reduction of product orders by Wal-Mart Stores, Inc. could have significant adverse effects on the Company’s business and operating results and ultimately the Company’s liquidity, including the loss of predictability and volume production efficiencies associated with such a large customer.

Revolving Credit Facility

On June 9, 2010, the Company entered into a $125.0 million secured credit agreement (the “Revolving Credit Facility”), which matures on June 9, 2015, with a bank group led by JPMorgan Chase Bank, N.A. The Revolving Credit Facility contains an expansion option permitting the Company, subject to certain conditions, to increase the amount available up to $150.0 million. Borrowings under the Revolving Credit Facility are secured by a first lien priority security interest in all of the assets of the Company and its domestic subsidiaries, including a pledge of the Company’s outstanding shares of stock in its subsidiaries (limited, in the case of its foreign subsidiaries, to 65.0% of the Company’s equity interests), except as set forth below regarding the Company’s shares in its wholly-owned subsidiary LTB de Mexico, S.A. de C.V. (“LTB de Mexico”).

Availability under the Revolving Credit Facility is subject to a borrowing base calculation equal to the sum of (i) 85.0% of eligible accounts receivable, (ii) 85.0% of the net orderly liquidation value of eligible inventory and (iii) the lesser of 50.0% of the orderly liquidation value of eligible trademarks and $10.0 million. Availability is subject to a $24.1 million reserve which represents the outstanding principal amount of the Company’s 4.75% convertible senior notes. The borrowing base is also subject to reserves that may be established by the administrative agent in its permitted discretion.

Borrowings under the Revolving Credit Facility bear interest, at the Company’s option, at one of the following rates: (i) the Alternate Base Rate, defined as the greater of the Prime Rate, Federal Funds Rate plus 0.5% or the Adjusted LIBOR rate plus 1.0%, plus a margin of 1.25% to 1.75%, or (ii) the Eurodollar Rate, defined as the Adjusted LIBOR Rate plus a margin of 2.25% to 2.75%. The respective margin is based upon availability. In addition, the Company pays a commitment fee of 0.50% on the unused portion of the Revolving Credit Facility.