Many of our products are subject to regulation by U.S. and foreign regulatory agencies. The following is a description of the principal regulations affecting our businesses.

Our veterinary diagnostic instrument systems are medical devices regulated by the U.S. Food and Drug Administration (“FDA”) under the Food, Drug and Cosmetics Act (the “FDC Act”). While the sale of these products does not require premarket approval by FDA and does not subject us to the FDA’s current Good Manufacturing Practices regulations (“cGMP”), these products must not be adulterated or misbranded under the FDC Act.

Any acquisitions of new products and technologies may subject us to additional areas of government regulation. These may involve food, drug, medical device and water-quality regulations of the FDA, the EPA and the USDA, as well as state, local and foreign governments. See “Part I, Item 1A. Risk Factors.”

At December 31, 2006, we had approximately 3,900 full-time and part-time employees. We are not a party to any collective bargaining agreement and we believe that relations with our employees are good.

Our future operating results involve a number of risks and uncertainties. Actual events or results may differ materially from those discussed in this report. Factors that could cause or contribute to such differences include, but are not limited to, the factors discussed below, as well as those discussed elsewhere in this report.

Our ability to maintain our growth rate depends on our successful implementation of various strategies, including:

However, we may not be able to successfully implement some or all of these strategies and increase or sustain our rate of growth or profitability.

One of our veterinary pharmaceutical products is sold under the FDA’s regulatory discretion and we believe that the FDA would require us to discontinue sales of this product within a short period if and when the FDA approves another product to treat the same condition, whether such new product was our product or that of another commercial supplier. In addition, we have a finite inventory of the raw materials used in the manufacture of the product, and these raw materials are no longer commercially available. We believe that our remaining inventory of raw materials will be adequate to satisfy existing market demand until late 2008 or early 2009. We have, in advanced development and clinical trials, a new product based on different raw materials and we intend to seek FDA approval of this product. FDA approval of this new product would fully mitigate the commercial risk that we would be required to stop selling our current product due either to FDA approval of another manufacturer’s product or to the full depletion of our inventory of raw materials. While we hope to smoothly transition to our new product, we cannot predict when or if the FDA will approve our new product or any product that treats the same condition from another manufacturer. Revenues from sales of this pharmaceutical product were $11.9 million in 2006.

Many of our rapid assay and production animal diagnostic products are biologics, which are products that are comprised of materials from living organisms, such as antibodies, cells and sera. Manufacturing biologic products is highly complex. Unlike products that rely on chemicals for efficacy (such as most pharmaceuticals), biologics are difficult to characterize due to the inherent variability of biological input materials. Difficulty in characterizing biological materials or their interactions creates greater risk in the manufacturing process. There can be no assurance that we will be able to maintain adequate sources of biological materials or that biological materials that we maintain in inventory will yield finished products that satisfy applicable product release criteria. Our inability to obtain necessary biological materials or to successfully manufacture biologic products that incorporate such materials could have a material adverse effect on our results of operations.

We rely on a combination of patent, trade secret, trademark and copyright laws to protect our proprietary rights. If we do not have adequate protection of our proprietary rights, our business may be affected by competitors who develop substantially equivalent technologies that compete with us.

We cannot ensure that we will obtain issued patents, that any patents issued or licensed to us will remain valid, or that any patents owned or licensed by us will provide protection against competitors with similar technologies. Even if our patents cover products sold by our competitors, the time and expense of litigating to enforce our patent rights could be substantial, and could have a material adverse effect on our results of operations. In addition, expiration of patent rights could result in substantial new competition in the markets for products previously covered by those patent rights.

In the past, we have received notices claiming that our products infringe third-party patents and we may receive such notices in the future. Patent litigation is complex and expensive, and the outcome of patent litigation can be difficult to predict. We cannot ensure that we will win a patent litigation case or negotiate an acceptable resolution of such a case. If we lose, we may be stopped from selling certain products and/or we may be required to pay damages and/or ongoing royalties as a result of the lawsuit. Any such adverse result could have a material adverse effect on our results of operations.

We sell many of our products, including substantially all of the rapid assays and instrument consumables sold in the U.S., through distributors. Distributor purchasing patterns can be unpredictable and may be influenced by factors unrelated to the end-user demand for our products. In addition, our agreements with distributors may generally be terminated by the distributors for any reason on 60 days notice. Because significant product sales are made to a limited number of distributors, the loss of a distributor or unanticipated changes in the frequency, timing or size of distributor purchases, could have a negative effect on our results of operations. Our financial performance, therefore, is subject to an unexpected downturn in product demand and may be unpredictable.

Distributors of veterinary products have entered into business combinations resulting in fewer distribution companies. Consolidation within distribution channels would increase our customer concentration level, which could increase the risks described in the preceding paragraph.

| | Increased Competition and Technological Advances by Our Competitors Could Negatively Affect Our Operating Results |

We face intense competition within the markets in which we sell our products and services. We expect that future competition will become even more intense, and that we will have to compete with changing and improving technologies. Some of our competitors and potential competitors, including large pharmaceutical and diagnostic companies, have substantially greater capital, manufacturing, marketing, and research and development resources than we do.

| | Changes in Testing Could Negatively Affect Our Operating Results |

The market for our companion and production animal diagnostic tests and our dairy and water testing products could be negatively impacted by a number of factors. The introduction or broad market acceptance of vaccines or preventatives for the diseases and conditions for which we sell diagnostic tests and services could result in a decline in testing. Eradication or substantial declines in the prevalence of certain diseases also could lead to a decline in diagnostic testing for such diseases. Our production animal products business in particular is subject to fluctuations resulting from changes in disease prevalence. In addition, changes in government regulations could negatively affect sales of our products that are driven by compliance testing, such as our dairy and water products. Declines in testing for any of the reasons described could have a material adverse effect on our results of operations.

On December 29, 2006, the Drinking Water Inspectorate in the U.K. published a proposal to discontinue the regulation that requires testing water supplies forCryptosporidia effective as of December 22, 2007 or, if approved by the regulator, at an earlier date. If this proposal is adopted, the Company believes that it will lose a substantial portion of its sales of Filta-Max® products in England and Wales, which were $2.9 million in the year ended December 31, 2006.

| | Consolidation of Veterinary Hospitals in the U.S. Could Negatively Affect Our Business |

An increasing percentage of veterinary hospitals in the U.S. are owned by corporations that are in the business of acquiring veterinary hospitals and/or opening new veterinary hospitals nationally or regionally. Major corporate hospital owners include VCA/Antech, Inc. and Banfield, The Pet Hospital, both of whom are currently customers of IDEXX. Corporate owners of veterinary hospitals could attempt to improve profitability by leveraging the buying power they derive from their scale to obtain favorable pricing from suppliers, which could have a negative impact on our results. In addition, VCA/Antech is our primary competitor in the U.S. market for reference laboratory services, and hospitals acquired by VCA/Antech will use its laboratory services almost exclusively. Therefore, hospitals acquired by VCA/Antech generally will cease to be customers or potential customers of our reference laboratories business.

| | Our Inexperience in the Human Point-of-Care Market Could Inhibit Our Success in this Market |

Upon acquiring the Critical Care Division of Osmetech plc, we entered the human point-of-care medical diagnostics market for the first time with the sale of the OPTI® line of electrolyte and blood gas analyzers. The human point-of-care medical diagnostics market differs in many respects from the veterinary medical market. Significant differences include the impact of third party reimbursement on diagnostic testing, more extensive regulation, greater product liability risks, larger competitors, and more rapid technological innovation. There can be no assurance that we will be successful in achieving growth and profitability in the human point-of-care medical diagnostics market comparable to the results we have achieved in the veterinary medical market.

| | Risks Associated with Doing Business Internationally Could Negatively Affect Our Operating Results |

For the year ended December 31, 2006, 35% of our revenue was attributable to sales of products and services to customers outside the U.S. Various risks associated with foreign operations may impact our international sales. Possible risks include fluctuations in the value of foreign currencies, disruptions in transportation of our products, the differing product and service needs of foreign customers, difficulties in building and managing foreign operations, import/export duties and quotas, and unexpected regulatory, economic or political changes in foreign markets. Prices that we charge to foreign customers may be different than the prices we charge for the same products in the U.S. due to competitive, market or other factors. As a result, the mix of domestic and international sales in a particular period could have a material impact on our results for that period. In addition, many of the products for which our selling price may be denominated in foreign currencies are manufactured, sourced, or both, in the U.S. and our costs are incurred in U.S. dollars. We utilize non-speculative forward currency exchange contracts to mitigate foreign currency exposure. However, an appreciation of the U.S. dollar relative to the foreign currencies in which we sell these products would reduce our operating margins.

13

| | The Loss of Our President, Chief Executive Officer and Chairman Could Adversely Affect Our Business |

We rely on the management and leadership of Jonathan W. Ayers, our President, Chief Executive Officer and Chairman. We do not maintain key man life insurance coverage for Mr. Ayers. The loss of Mr. Ayers could have a material adverse impact on our business.

| | We Could Be Subject to Class Action Litigation Due to Stock Price Volatility, which, if it Occurs, Could Result in Substantial Costs or Large Judgments Against Us |

The market for our common stock may experience extreme price and volume fluctuations, which may be unrelated or disproportionate to our operating performance or prospects. In the past, securities class action litigation has often been brought against companies following periods of volatility in the market prices of their securities. We may be the target of similar litigation in the future. Securities litigation could result in substantial costs and divert our management’s attention and resources, which could have a negative effect on our business, operating results and financial condition.

| | If Our Quarterly Results of Operations Fluctuate, This Fluctuation May Cause Our Stock Price to Decline, Resulting in Losses to You |

Our prior operating results have fluctuated due to a number of factors, including seasonality of certain product lines; changes in our accounting estimates; the impact of acquisitions; timing of distributor purchases, product launches, research and development expenditures, litigation and claim-related expenditures; changes in competitors’ product offerings; and other matters. Similarly, our future operating results may vary significantly from quarter to quarter due to these and other factors, many of which are beyond our control. If our operating results or projections of future operating results do not meet the expectations of market analysts or investors in future periods, our stock price may fall.

| | Future Operating Results Could Be Negatively Affected By the Resolution of Various Uncertain Tax Positions and by Potential Changes to Tax Incentives |

In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Significant judgment is required in determining our worldwide provision for income taxes and our income tax filings are regularly under audit by tax authorities. The final determination of tax audits could be materially different than that which is reflected in historical income tax provisions and accruals. Additionally, we benefit from certain tax incentives offered by various jurisdictions. If we are unable to meet the requirements of such incentives, our inability to use these benefits could have a material negative effect on future earnings.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

In May 2006, we acquired the Westbrook, Maine facility in which we previously leased space. We currently occupy 350,000 square feet of this facility for manufacturing, research and development, and corporate headquarters functions. We plan to renovate and expand this facility during 2007 through 2009, which will provide an additional 200,000 square feet of space. We lease collectively approximately 110,000 square feet of additional office space in Scarborough and Westbrook, Maine under leases expiring in 2009 and 2013, respectively. We lease approximately 97,500 square feet of industrial space in Memphis, Tennessee for use as a distribution facility under a lease expiring in 2013; approximately 40,000 square feet of office and manufacturing space in Eau Claire, Wisconsin for our practice information management systems business under leases expiring in 2008 and 2009; approximately 60,000 square feet of office and manufacturing space in Roswell, Georgia for our OPTI Medical Systems business under a lease expiring in 2010; approximately 16,000 square feet of office and manufacturing space in Switzerland for our European production animal products manufacturing activities under a lease expiring in 2013; and approximately 48,000 square feet of warehouse and office space in the Netherlands for use as our headquarters for European operations under a lease expiring in 2008.

14

We also lease a total of approximately 35,000 square feet of smaller office, manufacturing and warehouse space in the U.S. and elsewhere in the world under leases having expiration dates up to the year 2021. In addition, we own or lease approximately 300,000 square feet of space in the U.S., Australia, Canada, France, Germany, Switzerland, South Africa, and the United Kingdom for use as veterinary reference laboratories and office space for our veterinary consulting services. Of this space, 73,000 square feet is owned by us and the remaining amount is leased, under leases having expiration dates up to the year 2019.

We consider that the properties are generally in good condition, are well-maintained, and are generally suitable and adequate to carry on our business.

ITEM 3. LEGAL PROCEEDINGS

From time to time, we are subject to litigation in the ordinary course of business. However, we do not believe that we are party to any material legal proceedings.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders during the fourth quarter of the fiscal year covered by this report.

EXECUTIVE OFFICERS OF THE COMPANY

Our executive officers as of February 23, 2007 were as follows:

Name

| Age

| | Title

|

|---|

| Jonathan W. Ayers | | 50 | | Chairman of the Board of Directors, President and Chief Executive Officer | |

| William C. Wallen, PhD | | 63 | | Senior Vice President and Chief Scientific Officer | |

| Conan R. Deady | | 45 | | Corporate Vice President, General Counsel and Secretary | |

| Thomas J. Dupree | | 38 | | Corporate Vice President, Companion Animal Group | |

| S. Sam Fratoni, PhD | | 59 | | Corporate Vice President and Chief Information Officer | |

| Robert S. Hulsy | | 62 | | Corporate Vice President, Reference Laboratories and Digital | |

| Irene C. Kerr | | 57 | | Corporate Vice President, Worldwide Operations | |

| Ali Naqui, PhD | | 53 | | Corporate Vice President Water, Dairy, Asia Pacific and Latin America Operations | |

| James F. Polewaczyk | | 43 | | Corporate Vice President, Rapid Assay | |

| Merilee Raines | | 51 | | Corporate Vice President, Chief Financial Officer and Treasurer | |

| Quentin J. Tonelli, PhD | | 58 | | Corporate Vice President, Production Animal Segment | |

| Michael J. Williams, PhD | | 39 | | Corporate Vice President, Instrument Diagnostics | |

Mr. Ayers has been Chairman of the Board, Chief Executive Officer and President of IDEXX since January 2002. Prior to joining IDEXX, from 1999 to 2001, Mr. Ayers was President of Carrier Corporation, the then-largest business unit of United Technologies Corporation, and from 1997 to 1999, he was President of Carrier’s Asia Pacific Operations. From 1995 to 1997, Mr. Ayers was Vice President, Strategic Planning at United Technologies. Before joining United Technologies, from 1986 to 1995, Mr. Ayers held various positions at Morgan Stanley & Co. in mergers and acquisitions and corporate finance. Prior to Morgan Stanley, Mr. Ayers was a strategy consultant for Bain & Company from 1983 to 1986 and was in the field sales organization of IBM’s Data Processing Division from 1978 to 1981. Mr. Ayers holds an undergraduate degree in molecular biophysics and biochemistry from Yale University and graduated from Harvard Business School in 1983.

15

Dr. Wallen has been Senior Vice President and Chief Scientific Officer of the Company and has been leading the Pharmaceutical Products business since September 2003. Prior to joining IDEXX, Dr. Wallen held various positions with Bayer Corporation, most recently as Senior Vice President, Research and Development, and Head, Office of Technology for the Diagnostics Division of Bayer Healthcare. From 2001 to 2003, Dr. Wallen served as Senior Vice President and Head of Research, Nucleic Acid Diagnostics Segment; from 1999 to 2001, as Senior Vice President of Research and Development Laboratory Testing Segment; and from 1993 to 1999, as Vice President of Research and Development, Immunodiagnostic and Clinical Chemistry Business Units. Before joining Bayer Corporation, from 1990 to 1993, Dr. Wallen was Vice President, Research and Development at Becton Dickinson Advanced Diagnostics.

Mr. Deady has been Corporate Vice President and General Counsel of the Company since 1999 and has been leading the Company’s business development activities since April 2005. Mr. Deady was Deputy General Counsel of the Company from 1997 to 1999. Before joining the Company in 1997, Mr. Deady was Deputy General Counsel of Thermo Electron Corporation (now Thermo Fisher Scientific, Inc.), a manufacturer of technology-based instruments. Previously, Mr. Deady was a partner at Hale and Dorr LLP (now WilmerHale).

Mr. Dupree has been Corporate Vice President of the Company since September 2006 and has been leading the Companion Animal Group Customer Facing Organization in North America since January 2007. Mr. Dupree was General Manager of the Company’s Rapid Assay business from April 2005 to January 2007. Prior to that, Mr. Dupree was Vice President, Business Development. Before joining the Company in 2003, Mr. Dupree was employed at the Boston Consulting Group, a business strategy consulting firm, where he spent seven years leading project teams in the firm’s technology and health care practices. Prior to that, Mr. Dupree held various management positions at Bath Iron Works Corporation.

Dr. Fratoni has been Corporate Vice President of the Company since May 1997 and Chief Information Officer since November 2000 and has been leading the Practice Information Management Systems business since November 2000. He led the Company’s Food and Environmental Group from July 1999 to December 2000. From May 1997 to July 1999, Dr. Fratoni was Vice President of Human Resources of the Company, and from October 1996 to May 1997, he was Director of Business Development for the Food and Environmental Group. Before joining the Company in October 1996, Dr. Fratoni held various positions with Hewlett-Packard Company.

Mr. Hulsy has been Corporate Vice President of the Company since February 1999 and has been leading the Company’s Reference Laboratory and Consulting Services business since August 1998 and the Digital Radiography business since its launch in December 2000. Before joining the Company in August 1998, Mr. Hulsy was President of American Environmental Network, Inc., a network of environmental laboratories, from 1992 to 1998.

Ms. Kerr joined IDEXX as Corporate Vice President, Worldwide Operations in December 2006. Prior to joining IDEXX, Ms. Kerr led strategic initiatives and investments at MDS, Inc., Canada’s largest health and life sciences company. From 1993 to 1999, Ms. Kerr was employed at Bayer Diagnostics, most recently as Senior Vice President of Group Development, and, prior to that, as Senior Vice President of the Clinical Chemistry and Immunodiagnostics Business Units. Ms. Kerr was employed by Abbott Laboratories from 1983 to 1993, initially in Corporate Planning and subsequently as General Manager of Drugs and Drug Delivery Systems in the Hospital Products Division and then as Vice President and General Manager of several global business units and sectors in the Diagnostics Division. Prior to joining Abbott, Ms. Kerr was a general management consultant with Booz Allen & Hamilton.

Dr. Naqui became Corporate Vice President of the Company in January 2006 and oversees the Company’s Water and Dairy Testing businesses, as well as the Company’s Asia Pacific and Latin American operations. Dr. Naqui served as Vice President, Water and Dairy from January 2000 to December 2005, General Manager, Water from September 1997 to January 2000, and Director of Research and Development from February 1993 to September 1997. Dr. Naqui joined the Company in 1993 as a result of the acquisition of Environetics, where he was the Director of Research and Development. Prior to joining Environetics, he was a research and development manager with Becton, Dickinson and Company.

16

Mr. Polewaczyk joined IDEXX as Corporate Vice President and General Manager of the Company’s Rapid Assay business in February 2007. Prior to joining IDEXX, Mr. Polewaczyk was employed with Philips Medical Systems, a subsidiary of Royal Philips Electronics, The Netherlands for fifteen years in various senior marketing and general management positions, most recently as General Manager, Medical Consumables and Sensor Business.

Ms. Raines has been Chief Financial Officer of the Company since October 2003 and Corporate Vice President, Finance of the Company since May 1995. Ms. Raines served as Vice President, Finance from March 1995 to May 1995, Director of Finance from 1988 to March 1995 and Controller from 1985 to 1988.

Dr. Tonelli has been Corporate Vice President of the Company since June 2001 and oversees the Company’s Production Animal Segment and infectious disease research and development activities. Previously he held various positions with the Company, including Vice President for Research and Development and Vice President, Business Development. Before joining the Company in 1984, he was a Group Leader of Research and Development for the Hepatitis and AIDS Business Unit within the diagnostic division of Abbott Laboratories, Inc.

Dr. Williams has been Corporate Vice President of the Company since September 2006 and General Manager of the Companion Animal Instrument and Consumables business since 2004. Effective February 1, 2007, Dr. Williams also oversees the OPTI Medical Systems business. Dr. Williams was Vice President and General Manager of the Company’s chemistry instruments and consumables business from 2003 to 2004. Prior to joining the Company in 2003, Dr. Williams was a healthcare strategy consultant at McKinsey & Company from 1995 to 2002 and a senior research associate at the Scripps Research Institute from 1992 to 1995.

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is quoted on the NASDAQ Global Market under the symbol IDXX. The table below shows the high and low sale prices per share of our common stock as reported on the NASDAQ Global Market for the years 2006 and 2005.

Calendar Year

| High

| | Low

| |

|---|

| 2006 | | | | | | | | |

| First Quarter | | | $ | 86.36 | | $ | 71.00 | |

| Second Quarter | | | | 85.50 | | | 74.14 | |

| Third Quarter | | | | 94.36 | | | 72.69 | |

| Fourth Quarter | | | | 95.17 | | | 79.19 | |

| | | | | | | | | |

| 2005 | | | | | | | | |

| First Quarter | | | $ | 58.23 | | $ | 52.18 | |

| Second Quarter | | | | 63.00 | | | 52.94 | |

| Third Quarter | | | | 67.95 | | | 60.16 | |

| Fourth Quarter | | | | 75.14 | | | 61.11 | |

| | | | | | | | | |

As of February 27, 2007, there were 909 holders of record of our common stock.

We have never paid any cash dividends on our common stock. From time to time our Board of Directors may consider the declaration of a dividend. However, we have no present intention to pay a dividend.

17

During the three months ended December 31, 2006, we repurchased our shares as described below:

Period

| Total Number of

Shares Purchased

(a)

| | Average

Price Paid

per Share

(b)

| | Total Number of

Shares Purchased

as Part of

Publicly

Announced Plans

or Programs

(c)

| | Maximum Number of

Shares that May Yet

Be Purchased Under

the Plans or

Programs

(d)

| |

|---|

| October 1, 2006 to October 31, 2006 | | | | - | | $ | - | | | - | | | 857,430 | |

| November 1, 2006 to November 30, 2006 | | | | 69,300 | | | 83.86 | | | 69,300 | | | 788,130 | |

| December 1, 2006 to December 31, 2006 | | | | 73,500 | | | 82.54 | | | 73,500 | | | 714,630 | (1) |

|

| | |

| | |

| Total | | | | 142,800 | | $ | 83.18 | | | 142,800 | | | 714,630 | (1) |

|

| | |

| | |

| (1) | Represents the number of shares remaining at December 31, 2006 exclusive of the subsequent amendment on February 14, 2007 whereby our Board of Directors approved an increase to the repurchase authorization of 2,000,000 shares. |

Our Board of Directors has approved the repurchase of up to 18,000,000 shares of our common stock in the open market or in negotiated transactions. The plan was approved and announced on August 13, 1999, and subsequently amended on October 4, 1999, July 21, 2000, October 20, 2003, October 12, 2004, October 12, 2005, and February 14, 2007 and does not have a specified expiration date. There were no other repurchase plans outstanding during the year ended December 31, 2006, and no repurchase plans expired during the period. Repurchases of approximately 1,338,000 shares were made during the year ended December 31, 2006 in open market transactions.

During the year ended December 31, 2006, we received 227 shares of our common stock that were surrendered by employees in payment for the minimum required withholding taxes due on the vesting of restricted stock units and settlement of deferred stock units. These shares do not reduce the number of shares that may yet be purchased under the repurchase plan.

18

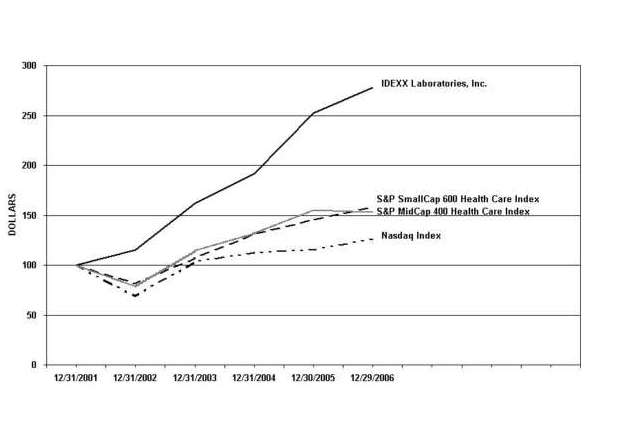

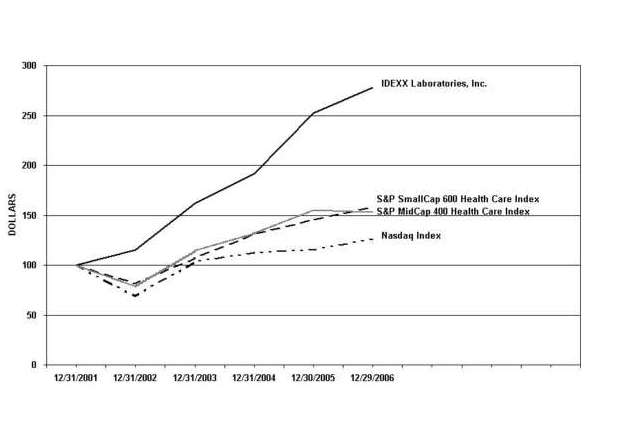

STOCK PERFORMANCE GRAPH

This graph compares our total stockholder returns, the Standard & Poor’s (“S&P”) MidCap 400 Health Care Index, the S&P SmallCap 600 Health Care Index and the Total Return Index for the NASDAQ Stock Market (U.S. Companies) prepared by the Center for Research in Security Prices (the “NASDAQ Index”). This graph assumes the investment of $100 on December 31, 2001 in IDEXX’s common stock, the S&P MidCap 400 Health Care Index, the S&P SmallCap 600 Health Care Index and the NASDAQ Index and assumes dividends, if any, are reinvested. Measurement points are the last trading days of the years ended December 2001, 2002, 2003, 2004, 2005 and 2006.

| 12/31/2001

| | 12/31/2002

| | 12/31/2003

| | 12/31/2004

| | 12/30/2005

| | 12/29/2006

| |

|---|

| IDEXX Laboratories, Inc. | | | $ | 100.00 | | $ | 115.22 | | $ | 162.33 | | $ | 191.48 | | $ | 252.47 | | $ | 278.15 | |

| S&P MidCap 400 Health Care Index | | | | 100.00 | | | 78.88 | | | 114.40 | | | 113.49 | | | 154.88 | | | 153.09 | |

| S&P SmallCap 600 Health Care Index | | | | 100.00 | | | 81.48 | | | 106.99 | | | 130.97 | | | 145.32 | | | 157.72 | |

| NASDAQ Index | | | | 100.00 | | | 69.13 | | | 103.36 | | | 112.49 | | | 114.88 | | | 126.22 | |

19

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth selected consolidated financial data of the Company for each of the five years ending with December 31, 2006. The selected consolidated financial data presented below have been derived from the Company’s consolidated financial statements. These financial data should be read in conjunction with the consolidated financial statements, related notes and other financial information appearing elsewhere in this Form 10-K.

| For the Years Ended December 31,

(in thousands, except per share data)

| |

|---|

| 2006

| | 2005

| | 2004

| | 2003

| | 2002

| |

|---|

| INCOME STATEMENT DATA: | | | | | | | | | | | | | | | | | |

| Revenue | | | $ | 739,117 | | $ | 638,095 | | $ | 549,181 | | $ | 475,992 | | $ | 412,670 | |

| Cost of revenue | | | | 359,588 | | | 315,195 | | | 270,164 | | | 245,688 | | | 219,945 | |

|

| |

| |

| |

| |

| |

| Gross profit | | | | 379,529 | | | 322,900 | | | 279,017 | | | 230,304 | | | 192,725 | |

| Expenses: | | | | | | | | | | | | | | | | | |

| Sales and marketing | | | | 115,882 | | | 101,990 | | | 85,710 | | | 71,846 | | | 56,794 | |

| General and administrative | | | | 82,097 | | | 64,631 | | | 49,870 | | | 45,752 | | | 40,787 | |

| Research and development | | | | 53,617 | | | 40,948 | | | 35,402 | | | 32,319 | | | 29,329 | |

|

| |

| |

| |

| |

| |

| Income from operations | | | | 127,933 | | | 115,331 | | | 108,035 | | | 80,387 | | | 65,815 | |

| Interest income, net | | | | 2,817 | | | 3,141 | | | 3,068 | | | 2,867 | | | 2,955 | |

|

| |

| |

| |

| |

| |

| Income before provision for income | | | | | | | | | | | | | | | | | |

| taxes and partner's interest | | | | 130,750 | | | 118,472 | | | 111,103 | | | 83,254 | | | 68,770 | |

| Provision for income taxes | | | | 37,224 | | | 40,670 | | | 33,165 | | | 26,278 | | | 23,381 | |

| Partner's interest in loss of subsidiary | | | | (152 | ) | | (452 | ) | | (394 | ) | | (114 | ) | | -- | |

|

| |

| |

| |

| |

| |

| Net income | | | $ | 93,678 | | $ | 78,254 | | $ | 78,332 | | $ | 57,090 | | $ | 45,389 | |

|

| |

| |

| |

| |

| |

| Earnings per share: | | | | | | | | | | | | | | | | | |

| Basic | | | $ | 2.98 | | $ | 2.41 | | | 2.29 | | | 1.67 | | | 1.35 | |

| Diluted | | | | 2.84 | | | 2.30 | | | 2.19 | | | 1.59 | | | 1.30 | |

| Weighted average shares outstanding: | | | | | | | | | | | | | | | | | |

| Basic | | | | 31,433 | | | 32,521 | | | 34,214 | | | 34,271 | | | 33,622 | |

| Diluted | | | | 32,954 | | | 34,055 | | | 35,800 | | | 35,931 | | | 35,043 | |

| Dividends paid | | | $ | -- | | $ | -- | | | -- | | | -- | | | -- | |

| | | | | | | | | | | | | | | | | | |

| BALANCE SHEET DATA: | | | | | | | | | | | | | | | | | |

| Cash and investments | | | $ | 96,666 | | $ | 132,731 | | | 156,959 | | | 255,787 | | | 162,763 | |

| Working capital | | | | 177,520 | | | 192,679 | | | 201,640 | | | 270,244 | | | 217,740 | |

| Total assets | | | | 559,560 | | | 490,676 | | | 514,237 | | | 521,875 | | | 417,426 | |

| Total debt | | | | 7,125 | | | 551 | | | 1,810 | | | 494 | | | 973 | |

| Stockholders' equity | | | | 409,861 | | | 369,010 | | | 397,660 | | | 413,292 | | | 340,973 | |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSES OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

During 2006, we operated primarily through three business segments: products and services for the veterinary market, which we refer to as our Companion Animal Group (“CAG”), water quality products (“Water”) and products for production animal health, which we refer to as the Production Animal Segment (“PAS”). We also operate a smaller segment that comprises products for dairy quality, which we refer to as Dairy. Financial information about the Dairy operating segment is presented in an “Other” category. As of January 2007, we have added an operating segment, OPTI Medical, in connection with our acquisition of the Critical Care Division of Osmetech plc, which is presented in an “Other” category. CAG develops, designs, manufactures, and distributes products and performs services for veterinarians. Water develops, designs, manufactures and distributes products to detect contaminants in water. PAS develops, designs, manufactures and distributes products to detect diseases in production animals. Dairy develops, designs, manufactures and distributes products to detect contaminants in dairy products. OPTI Medical develops, manufactures, and sells point-of-care electrolyte and blood gas analyzers and related consumable products for the human medical diagnostics market. Unallocated items that are not allocated to our operating segments are comprised primarily of share-based compensation costs (effective January 1, 2006), corporate research and development expenses, interest income and expense, and income taxes. The segment information for the years ended December 31, 2005 and 2004 has been restated to conform to our presentation of reportable segments for the year ended December 31, 2006. Previously, PAS and Dairy were aggregated into a single reportable segment, which we referred to as the Food Diagnostics Group. See Note 16 to the consolidated financial statements for the year ended December 31, 2006 included in this Form 10-K for financial information about our segments, including geographic information, and about our product and service categories.

20

The following is a discussion of the strategic and operating factors that we believe have the most significant effect on the performance of our business.

Companion Animal Group

In the CAG segment, we believe we have developed a strategic advantage over companies with more narrow product or service offerings. The breadth of our products and services gives us scale in sales and distribution, permits us to offer integrated disease-management solutions that leverage the advantages of both point-of-care and outside laboratory testing, and facilitates the flow of medical and business information in the veterinary practice by connecting practice information software systems, including connecting the electronic health record with laboratory test data, in-clinic test data from our IDEXX VetLab® suite of analyzers, and radiographic data in the IDEXX-PACS™ software taken by our digital radiography systems.

In the U.S., we sell instrument consumables, rapid assay products and pharmaceutical products primarily through distributors, and, therefore, our reported sales of these products are sales made to distributors, rather than sales to veterinarians, the end users. Because distributors’ inventory levels and purchasing patterns may fluctuate, sales of a particular product line in a particular period may not always be representative of the underlying end-user demand for the product. Therefore, we closely track sales of these products by our U.S. distributors to the veterinarians (“practice-level sales”), which we think provide a more accurate picture of the real growth rate for these products.

Instruments and Consumables. Our instrument strategy is to provide veterinarians with an integrated set of instruments that, individually and together, provide superior diagnostic information in the clinic, enabling veterinarians to practice better medicine and, in doing so, achieve their practice economic objectives, including growth and profitability. We derive substantial revenues and margins from the sale of consumables that are used in these instruments. During the early stage of an instrument’s life cycle, we derive relatively greater revenues from instrument placements, while consumable sales become relatively more significant in later stages as the installed base of instruments increases and instrument placement revenues begin to decline.

We have a large installed base of VetTest® Chemistry Analyzers, and substantially all of our revenues from that product line are now derived from consumables sales, although we continue to place instruments through sales, lease, rental and other programs. Our long-term success in this area of our business is dependent upon new customer acquisition, customer retention and increased customer utilization of existing and new assays introduced on these instruments. To increase utilization, we seek to educate veterinarians about best medical practices that emphasize the importance of blood and urine chemistry testing for a variety of diagnostic purposes.

We purchase the consumables used in VetTest® Chemistry Analyzers from Ortho under a supply agreement that continues through 2020. This supply agreement provides us with a long-term source of slides at costs that improve annually through 2010, and also improve over the term of the agreement as a result of increasing volume. Under this agreement, we are developing and expect to introduce a next-generation chemistry analyzer, named Catalyst Dx™, for the veterinary market based primarily on the Ortho dry-slide technology and secondarily on OPTI® electrolyte technology, and Ortho will supply us with slide consumables used in both the new instrument and the VetTest® Chemistry Analyzer. We plan to launch Catalyst Dx™ in January 2008.

In the fourth quarter of 2002, we introduced the LaserCyte® Hematology Analyzer, which provides more extensive hematological diagnostic information than our original platform, the VetAutoread™ Hematology Analyzer. A substantial portion of LaserCyte® placements have been made at veterinary clinics that already own our VetAutoread™ Hematology Analyzers. Although we have experienced growth in sales of hematology consumables, LaserCyte® consumable sales have been partially offset by declines in sales of VetAutoread™ consumables. Because the gross margin percentage of LaserCyte®consumables exceeds the gross margin percentage of the VetAutoread™ consumables, gross margin from hematology consumables is expected to increase with continued penetration of the LaserCyte® Hematology Analyzer.

21

With all of our instrument lines, we seek to differentiate our products based on breadth of diagnostic menu, flexibility of menu selection, accuracy, reliability, ease of use, ability to handle compromised samples, time to result, analytical capability of software, integration with the IDEXX VetLab® Station, education and training, and superior sales and customer service. Our instruments and consumables typically are sold at a premium price to competitive offerings. Our success depends, in part, on our ability to differentiate our products in a way that justifies premium pricing.

Rapid Assay Products. Our rapid assay business consists primarily of single-use kits for point-of-care testing and, to a limited degree, microwell-based kits for laboratory testing for canine and feline diseases and conditions. Our rapid assay strategy is to develop, manufacture, market and sell proprietary tests that address important medical needs for particular diseases prevalent in the companion animal population. We seek to differentiate our tests through superior performance, including by providing our customers with proprietary combination tests that test a single sample for multiple analytes. Where alternative point-of-care offerings exist, we seek to differentiate our tests with superior performance. As in our other lines of business, we also seek to differentiate our products through superior customer service. These products carry price premiums over competitive products that we believe do not offer equivalent performance and diagnostic capabilities, and which we believe do not include a similar level of support. We further augment our product development and customer service efforts with sales and marketing programs that enhance medical awareness and understanding regarding our target diseases and the importance of diagnostic testing. In 2008, we plan to introduce a new IDEXX VetLab® analyzer, SNAPshot Dx™, that, later that year, will include the capability to interpret the test results from all SNAP assays and log the tests and their results in the IDEXX VetLab® Station database and, therefore, in the medical and financial records of the practice.

Reference Laboratory and Consulting Services. We believe that more than half of all diagnostic testing by U.S. veterinarians is done at outside reference laboratories such as our IDEXX Reference Laboratories. In markets outside the U.S., in-clinic testing is less prevalent and an even greater percentage of diagnostic testing is done in reference laboratories. We attempt to differentiate our laboratory testing services from those of our competitors primarily on the basis of quality, customer service, technology employed and specialized test menu. Revenue growth in this business is achieved both through increased sales at existing laboratories and through the acquisition of new customers, including through laboratory acquisitions and opening new laboratories. In 2004, we acquired a laboratory in Columbus, Ohio, opened a laboratory in Seattle, Washington, and acquired Vet Med Lab, which is based in Germany and is the largest European veterinary reference laboratory. In 2005, we acquired laboratories in Switzerland, the United Kingdom, and France and acquired veterinary laboratory customer lists in the U.S. and Germany. In 2006, we acquired laboratories in Clearwater, Florida, South Africa, and Canada and acquired a veterinary laboratory customer list in the U.S. Profitability of this business is largely the result of our ability to achieve efficiencies from both volume and operational improvements. New laboratories that we open typically will operate at a loss until testing volumes reach a level that permits profitability. Acquired laboratories frequently operate less profitably than our existing laboratories and those laboratories may not achieve profitability comparable to our existing laboratories for several years while we implement operating improvements and efficiencies. Therefore, in the short term, new and acquired reference laboratories generally will have a negative effect on the operating margin of the laboratory and consulting services business.

Practice Information Management Systems and Digital Radiography. These businesses consist of veterinary practice information management systems (“PIMS”) including hardware and software and veterinary-specific digital radiography systems. Our strategy in the PIMS business is to provide superior total software and hardware integrated information solutions, backed by superior customer support and education, to allow the veterinarian to practice better medicine and achieve the practice’s business objectives. We differentiate our software systems through enhanced functionality and ease of use. Our veterinary-specific digital radiography systems allow veterinarians to capture digital radiographs with ease and without the use of hazardous chemicals. The digital radiography systems also incorporate IDEXX-PACS™ picture archiving and communication software developed by IDEXX that allows for image enhancement, manipulation, storage and retrieval, and integration with the practice information software. Our strategy in digital radiography is to offer a system that provides superior image quality and software capability at a competitive price, backed by the same customer support provided for our other products and services in the Companion Animal Group.

22

Pharmaceutical Products. We currently offer pharmaceutical products to regulate feline diabetes, eradicate internal parasites, and treat lameness in horses. Our pharmaceutical strategy is to develop, register and sell proprietary pharmaceutical products for the veterinary market. We seek to differentiate our pharmaceutical products through ease of use, which in turn enhances customers’ compliance with prescribed treatment programs. Our product development efforts are focused on applying superior and proprietary delivery technologies to existing pharmaceutical compounds.

Water

Our strategy in the water testing business is to develop, manufacture, market and sell proprietary products with superior performance, supported by exceptional customer service. Our customers are primarily water utilities to whom strong relationships and customer support are very important. Over the past several years, the rate of growth of this product line has slowed as a result of market penetration by competitors and increased competition. International sales of water testing products represented 42% of total water product sales in 2006, and we expect that future growth in this business will be significantly dependent on our ability to increase international sales. Growth also will be dependent on our ability to enhance and broaden our product line. Most water microbiological testing is driven by regulation, and, in many countries, a test may not be used for regulatory testing unless it has been approved by the applicable regulatory body. As a result, we maintain an active regulatory program under which we are seeking regulatory approvals in a number of countries, primarily in Europe.

Production Animal Segment

We develop, manufacture, market and sell a broad range of tests for various poultry, cattle and swine diseases and conditions, and have an active research and development and in-licensing program in this area. Our strategy is to offer proprietary tests with superior performance characteristics. Disease outbreaks are episodic and unpredictable, and certain diseases that are prevalent at one time may be substantially contained or eradicated at a later time. In response to outbreaks, testing initiatives may lead to exceptional demand for certain products in certain periods. Conversely, successful eradication programs may result in significantly decreased demand for certain products. The performance of this business, therefore, can be subject to fluctuation. In 2006, approximately 79% of our sales in this business were international. Because of the significant dependence of this business on international sales, the performance of the business is particularly subject to the various risks described below that are associated with doing business internationally.

In 2004, we received USDA approval of our postmortem test for BSE (mad cow disease) and, in February 2005, we were informed that this test was approved by the European Commission for sale in EU member countries. While BSE testing is very limited in the U.S., a larger market for BSE testing exists in Europe.

Other

Dairy. Our strategy in the dairy testing business is to develop, manufacture and sell antibiotic residue testing products that satisfy applicable regulatory requirements for testing of bulk milk by producers and provide reliable field performance. The manufacture of these testing products leverage, almost exclusively, the SNAP® platform as well as the production equipment and lines of our rapid assay business, incorporating customized reagents for antibiotic detection. Sales of dairy testing products have declined slightly over the last several years largely as a result of increased competition in the domestic market. To increase sales of dairy testing products, we look to increase penetration in geographies outside the U.S. and in the farm segment of the dairy market, and to develop product line enhancements and extensions.

OPTI Medical Systems. Our strategy in the OPTI Medical Systems business is to develop, manufacture, and sell electrolyte and blood gas analyzers and related consumable products for the medical point-of-care diagnostics market worldwide, with a focus on small- to mid-sized hospitals. We seek to differentiate our products based on ease of use, menu, convenience, international distribution and service, and instrument reliability. Similar to our veterinary instruments and consumables strategy, a substantial portion of the revenues from this product line are derived from the sale of consumables for use on the installed base of electrolyte and blood gas analyzers. During the early stage of an instrument’s life cycle, relatively greater revenues are derived from instrument placements, while consumable sales become relatively more significant in later stages as the installed base of instruments increases and instrument placement revenues begin to decline. Our long-term success in this area of our business is dependent upon new customer acquisition, customer retention and increased customer utilization of existing and new assays introduced on these instruments.

23

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The discussion and analysis of our financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the U.S. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to revenue recognition, inventory, goodwill and other intangible assets, share-based compensation, income taxes, and contingencies. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates. Note 2 to the consolidated financial statements for the year ended December 31, 2006 included in this Form 10-K describes the significant accounting policies used in preparation of these financial statements.

We believe the following critical accounting policies reflect our more significant judgments and estimates used in the preparation of our consolidated financial statements.

Revenue Recognition

We recognize revenue when four criteria are met: (i) persuasive evidence that an arrangement exists, (ii) delivery has occurred or services have been rendered, (iii) the sales price is fixed or determinable, and (iv) collectibility is reasonably assured.

| | • | We recognize revenue at the time of shipment to distributors for substantially all products sold through distributors, as title and risk of loss pass to these customers on delivery to the common carrier. Our distributors do not have the right to return products. We recognize revenue for the remainder of our customers when the product is delivered, except as noted below. |

| | • | We recognize revenue from the sales of instruments, noncancelable software licenses and hardware systems upon installation (and completion of training if applicable) and the customer’s acceptance of the instrument or system because at this time we have no significant further obligations. |

| | • | We recognize service revenue at the time the service is performed. |

| | • | We recognize revenue associated with extended maintenance agreements over the life of the contracts. Amounts collected in advance of revenue recognition are recorded as a current or long-term liability based on the time from the balance sheet date to the future date of revenue recognition. |

| | • | We recognize revenue on certain instrument systems under rental programs over the life of the rental agreement. Amounts collected in advance of revenue recognition are recorded as a current or long-term liability based on the time from the balance sheet date to the future date of revenue recognition. |

Certain diagnostic instruments and practice information management systems offered for sale may include software that is considered more than incidental to the utility and value of the product. Sales arrangements may provide for software update rights or postcontract customer support. Judgment is required to determine whether sales arrangements include multiple elements.

When multiple products and/or services are sold together, we generally allocate the total consideration received amongst the elements based on their relative fair values, which is determined by amounts charged separately for the delivered and undelivered elements to other customers. When there is objective and reliable evidence of the fair value of the undelivered elements but no such evidence for the delivered elements, the fair value of the undelivered elements is deferred and the residual revenue is allocated to the delivered elements. The delivered elements are recognized as revenue when appropriate under the policies described above. If there is not sufficient evidence of the fair value of the undelivered elements, no revenue is allocated to the delivered elements and the total consideration received is deferred until delivery of those elements for which objective and reliable evidence of the fair value is not available. Shipping costs reimbursed by the customer are included in revenue.

24

We record estimated reductions to revenue in connection with customer programs and incentive offerings, which may give customers credits, award points, or trade-in rights. Awards points may be applied to trade receivables owed to us and/or toward future purchase of our products and services. We estimate these reductions based on our experience with similar customer programs in prior years. Revenue reductions are recorded on a quarterly basis based on issuance of credits, points actually awarded, and estimates of points to be awarded in the future based on current revenue. For the SNAP Up the Savings™ program, estimates of future points are revised quarterly and finalized annually in the third quarter of each year upon the issuance of points to customers. For our Practice Developer™ volume discount program, we have reduced revenue assuming all points granted will result in future credits because the historical forfeitures have been de minimus. On November 30 of each year, unused points awarded before January 1 of the prior year expire.

We may offer customers the right to trade in instruments for credit against the purchase price of other instruments acquired in the future. For trade-in rights, we have reduced revenue using estimates regarding the percentage of qualifying instruments that will be traded in and the average trade-in value.

We recognize revenue only in those situations where collection from the customer is reasonably assured. We maintain allowances for doubtful accounts for estimated losses resulting from the inability of our customers to make required payments. We base our estimates on detailed analysis of specific customer situations and a percentage of our accounts receivable by aging category. If the financial condition of our customers were to deteriorate, resulting in an impairment of their ability to make payments, additional allowances might be required.

Inventory Valuation

We write down inventory for estimated obsolescence when warranted by estimates of future demand and market conditions. If actual market conditions are less favorable than those we estimated, additional inventory write-downs may be required, which would have a negative effect on results of operations. Certain major components of inventory for which we have made critical valuation judgments are discussed in more detail below.

LaserCyte® Hematology Analyzer. At December 31, 2006, our net inventories included $11.5 million of component parts and finished goods associated with our LaserCyte® hematology instrument. In addition, we had firm purchase commitments for an additional $4.2 million of component parts as of December 31, 2006. At December 31, 2006, $1.7 million of the net LaserCyte® inventory required rework before it could be used to manufacture finished goods, which was net of $0.9 million write-downs for inventory estimated to be obsolete. We expect to fully realize our net investment in inventory and purchase commitments. However, if we alter the design of this product, we may be required to write off some or all of the remaining associated inventory.

Nitazoxanide. Our nitazoxanide product, Navigator®, for the treatment of equine protozoal myeloencephalitis (“EPM”) was approved by the FDA in November 2003. At December 31, 2006, our inventories included $9.3 million of inventory associated with Navigator®, consisting of $0.2 million of finished goods and $9.1 million of active ingredient and other raw materials. We have an agreement with our supplier of nitazoxanide under which the supplier agreed until 2017 to replace any expiring inventory of nitazoxanide with longer-dated material. We paid $0.9 million in January 2005 for consideration for this agreement and capitalized this payment as inventory cost. We believe that this agreement has substantially mitigated the risk that we would be required to write down nitazoxanide inventory due to its anticipated expiration prior to sale. However, if actual market conditions or our market share through 2022 are less than we estimate, we may be required to write off some of the associated inventory. For example, if we sell approximately 50% fewer units through 2025 than we estimate, we would have approximately $5 million of excess inventory.

Valuation of Goodwill and Other Intangible Assets

A significant portion of the purchase prices of our business acquisitions is assigned to intangible assets. Intangible assets other than goodwill are initially valued at the lesser of fair value or, if applicable, fair value proportionately reduced by the excess of the fair value of acquired net assets over cost, (collectively, “fair value”) when acquired. If a market value is not readily available, the fair value of the intangible asset is estimated based on discounted cash flows using market participant assumptions. The estimation of discounted cash flows requires significant assumptions about the timing and amounts of future cash flows, risks, the cost of capital, and the useful lives of intangible assets. When the fair values of acquired intangible assets are significant, we utilize independent valuation experts to advise and assist us in allocating the purchase prices of acquisitions to the fair values of the identified intangible assets and in determining appropriate amortization methods and periods for those intangible assets. Goodwill is initially valued based on the excess of the purchase price of a business combination over the fair values of acquired net assets.

25

We assess the impairment of identifiable intangible assets and other long-lived assets whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Factors we consider important that could trigger an impairment review include, but are not limited to, the following:

| | • | Significant under-performance relative to historical or projected future operating results; |

| | • | Failure to obtain regulatory approval of certain products; |

| | • | Significant changes in regulations; |

| | • | Significant changes in the manner of our use of the acquired assets or the strategy for our overall business; |

| | • | Significant increase in the discount rate assumed to calculate the present value of future cash flow; |

| | • | Significant negative industry or economic trends; |

| | • | Significant advancements or changes in technology; and |

| | • | Cancellation or significant changes in contractual relationships. |

We continually assess the realizability of intangible assets other than goodwill in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” (“SFAS No. 144”). If an impairment review is triggered, we evaluate the carrying value of long-lived assets by determining if impairment exists based on estimated undiscounted future cash flows over the remaining useful life of the assets and comparing that value to the carrying value of the assets. If the carrying value of the asset is greater than the estimated future cash flows, the asset is written down to its estimated fair value. In determining expected future cash flows, assets are grouped at the lowest level for which cash flows are identifiable and independent of cash flows from other asset groups. The cash flow estimates that are used contain our best estimates, using appropriate and customary assumptions and projections at the time.

We assess goodwill for impairment annually and whenever events or circumstances indicate an impairment may exist, in accordance with SFAS No. 142, “Goodwill and Other Intangible Assets” (“SFAS No. 142”). For impairment testing, we identify our reporting units, allocate assets and liabilities (including goodwill) to the reporting units and compare the reporting units’ net book value to their estimated fair value. The fair value of the reporting units is estimated using a discounted cash flow approach. The cash flow estimates used contain our best estimates, using appropriate and customary assumptions and projections at the time. If a reporting unit’s net book value exceeds its fair value, then the implied fair value of goodwill is determined. If the net book value of goodwill exceeds the implied fair value of goodwill, a goodwill impairment loss is recognized in an amount equal to that excess. No impairments have been identified as a result of the annual or event-driven reviews during the years ended December 31, 2006, 2005 or 2004.

The determination of the fair value of our pharmaceutical products business unit requires significant assumptions about the timing and amounts of the unit’s future cash flows, including assumptions about the markets for our products and proprietary technologies, the future success of research and development activities, the attainment and timing of regulatory approvals to manufacture and sell new products, the introduction and success of competitive products by other market participants, and other business risks. We believe that the goodwill attributable to our pharmaceutical business of $13.7 million is not impaired at December 31, 2006. However, changes in our assumptions and estimates due to new information, or actual results that are below expectations, could result in an impairment in the future of some or all of the goodwill attributable to our pharmaceutical products business.

26

Share-based Compensation

We adopted the provisions of SFAS No. 123(R), “Share-Based Payment” (“SFAS No. 123(R)”) on January 1, 2006. SFAS No. 123(R) requires all share-based compensation to employees, including grants of stock options, to be valued at fair value on the date of grant, and to be expensed over the requisite service period (generally the vesting period). Prior to January 1, 2006, we measured costs related to employee share-based compensation plans in accordance with Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB No. 25”). Accordingly, no employee compensation cost was recognized for these plans prior to January 1, 2006.

Effective January 1, 2006, under the modified prospective method of transition, share-based compensation expense includes expense for unvested awards at December 31, 2005 and all awards granted subsequent to December 31, 2005. Share-based compensation expense for the unvested awards outstanding at December 31, 2005 is based on the grant-date fair value previously calculated in developing the pro forma disclosures in accordance with the provisions of SFAS No. 123.

Beginning in 2006, we modified our share-based employee compensation programs to shift from the grant of stock options and employee stock purchase rights only to the grant of a mix of restricted stock units and stock options, along with employee stock purchase rights. There were no modifications to the terms of outstanding options during 2006 or 2005.

In connection with the adoption of SFAS No. 123(R), we adopted the straight-line method to prospectively expense share-based awards granted subsequent to December 31, 2005. The graded-vesting, or accelerated, method has been used to calculate the expense for stock options granted prior to January 1, 2006. If the total fair value of share-based compensation awards, as well as other features that impact expense, including forfeitures and capitalization of costs, was consistent from year-to-year in each of the last five years and through 2010, this change in expense method from graded-vesting to straight-line expensing would yield decreasing annual expense through 2010 until awards granted prior to January 1, 2006 were fully expensed. However, the total fair value of future awards may vary significantly from past awards based on a number of factors, including our share-based award practices. Therefore, share-based compensation expense is likely to fluctuate, possibly significantly, from year to year.

Selected financial impacts of share-based compensation, excluding the impact of deferred stock units issued under our Director Deferred Compensation Plan or our Executive Deferred Compensation Plan that do not have vesting conditions (which are described below), are presented in the table below (in thousands, except per share amounts):

| For the

Year Ended

December 31,

2006

| |

|---|

| Share-based compensation expense included in cost of revenue | | | $ | 1,671 | |

| Share-based compensation expense included in operating expense | | | | 8,986 | |

|

| |

| Total share-based compensation expense | | | | 10,657 | |

|

| |

| Income tax benefit in net income for share-based compensation expense | | | | (1,845 | ) |

| Income tax benefit in net income for employees' disqualifying dispositions of shares | | | | | |

| acquired through the exercise of stock options and employee stock purchase rights | | | | (57 | ) |

|

| |

| Total income tax benefit | | | | (1,902 | ) |

|

| |

| Net impact of share-based compensation on net income | | | $ | 8,755 | |

|

| |

| Net impact of share-based compensation on: | | | | | |

| Earnings per share, basic | | | $ | 0.28 | |

| Earnings per share, diluted | | | | 0.27 | |

Share-based compensation costs are classified in costs of sales and operating expenses consistently with the classification of cash compensation paid to the employees receiving such share-based compensation. Capitalized share-based employee compensation cost at December 31, 2006 was $0.2 million, which was included in inventory on the consolidated balance sheet.

27

The fair value of options, restricted stock units, deferred stock units with vesting conditions, and employee stock purchase rights awarded during the years ended December 31, 2006, 2005 and 2004 totaled $11.9 million, $15.7 million and $13.4 million, respectively. The total unrecognized compensation cost for unvested share-based compensation awards outstanding at December 31, 2006, net of estimated forfeitures, was $14.6 million. Approximately $6.3 million is expected to be recognized in the year ending December 31, 2007 for outstanding awards and decreasing amounts of the total expense are expected to be recognized over the subsequent five years, resulting in a weighted average remaining expense recognition period of approximately 1.5 years.

We use the Black-Scholes-Merton option-pricing model to determine the fair value of options granted. Option-pricing models require the input of highly subjective assumptions, particularly for the expected stock price volatility and the expected term of options. Changes in the subjective input assumptions can materially affect the fair value estimate. Our expected stock price volatility assumptions are based on the historical volatility of our stock over periods that are similar to the expected terms of grants, and other relevant factors. Lower estimated volatility reduces the fair value of an option. To develop the expected term assumption for 2006 option awards, we elected to use the simplified method described in the Securities and Exchange Commission Staff Accounting Bulletin No. 107, which is based on vesting and contractual terms. The application of the simplified method is allowable for options granted through December 31, 2007. We will transition to developing expected term assumptions for future awards based on historical experience and other relevant factors concerning expected employee behavior with regards to option exercise. Longer expected term assumptions increase the fair value of option awards, and therefore increase the expense recognized per award.

The weighted average valuation assumptions used to determine the fair value of each option grant on the date of grant and the weighted average estimated fair values were as follows:

| For the Years Ended December 31,

| |

|---|

| 2006

| | 2005

| | 2004

| |

|---|

| Expected stock price volatility | | | | 30 | % | | 40 | % | | 40 | % |

| Expected term, in years | | | | 5.0 | | | 5.8 | | | 5.8 | |

| Risk-free interest rate | | | | 4.6 | % | | 4.2 | % | | 3.1 | % |

Share-based compensation expense is based on the number of awards ultimately expected to vest and is, therefore, reduced for an estimate of the number of awards that are expected to be forfeited. The forfeiture estimate is based on historical data and other factors, and compensation expense is adjusted for actual results. Changes in estimated forfeiture rates and differences between estimated forfeiture rates and actual experience may result in significant, unanticipated increases or decreases in share-based compensation expense from period to period. The termination of employment by certain employees who hold large numbers of share-based compensation instruments may also have a significant, unanticipated impact on forfeiture experience and, therefore, on share-based compensation expense.

The tax benefit related to the option fair value is recognized when disqualifying dispositions of incentive stock options occur as either a reduction of the current period tax provision or an increase in additional paid-in capital, as required by SFAS No. 123(R) transitional accounting rules, depending on the vesting status of awards at the SFAS No. 123(R) adoption date, and the amounts previously expensed under SFAS No. 123(R). Employees’ exercise of vested options and disposition of shares acquired is influenced by the market price of the common stock and other factors outside of our control. The timing and volume of disqualifying dispositions; the vesting status of such exercised options at the date of our adoption of SFAS No. 123(R); and the relationship between the sale price of the common stock, the option exercise price and the option fair value may have a significant, unpredictable impact on our effective tax rate. As the aggregate fair value of outstanding options that has been expensed under SFAS No. 123(R) grows, we expect to recognize increasing tax benefits in net income related to disqualifying dispositions. However, the growth of the aggregate fair value of outstanding options that has been expensed under SFAS No. 123(R) will be limited in future years as a result of changes implemented in 2006 in our share-based compensation programs, under which we have shifted from the grant of stock options only to the grant of a mix of stock options and restricted stock unit awards that have a lower aggregate fair value than was awarded in prior years. Reductions in the fair value of options outstanding are expected to reduce the variability in our effective tax rate.

28

Income Taxes

We account for income taxes under SFAS No. 109, “Accounting for Income Taxes.” This statement requires that we recognize a current tax liability or asset for current taxes payable or refundable, respectively; and a deferred tax liability or asset, as the case may be, for the estimated future tax effects of temporary differences between book and tax treatment of assets and liabilities and carryforwards to the extent they are realizable. We record a valuation allowance to reduce our deferred tax assets to the amount that is more likely than not to be realized. While we consider future taxable income and ongoing prudent and feasible tax planning strategies in assessing the need for a valuation allowance, in the event we were to determine that we would be able to realize our deferred tax assets in the future in excess of the net recorded amount, an adjustment to the deferred tax asset would increase income in the period such determination was made. Likewise, should we determine that we would not be able to realize all or part of our net deferred tax asset in the future, an adjustment to the deferred tax asset would be charged to income in the period such determination was made. Significant judgment is required in determining our worldwide provision for income taxes and our income tax filings are regularly under audit by tax authorities. We periodically assess our exposures related to our worldwide provision for income taxes and believe that we have appropriately accrued taxes for contingencies. Any reduction of these contingent liabilities or additional assessment would increase or decrease income, respectively, in the period such determination was made.

We consider the operating earnings of non-United States subsidiaries to be indefinitely invested outside the United States, the cumulative amount of which was $111.4 million at December 31, 2006. No provision has been made for United States federal and state, or international taxes that may result from future remittances of undistributed earnings of non-United States subsidiaries. Should we repatriate non-United States earnings in the future, we would have to adjust the income tax provision in the period in which the decision to repatriate earnings is made.

Estimates for Certain Contingencies

Under our workers’ compensation insurance policies for U.S. employees for the years ended December 31, 2006, 2005, 2004 and 2003, we retain the first $250,000 in claim liability per incident and $3.1 million, $2.8 million, $3.0 million and $1.4 million, respectively, in aggregate claim liability. We entered into a similar workers’ compensation insurance policy effective January 1, 2007. The insurance company provides insurance for claims above the individual occurrence and aggregate limits. We estimate claim liability based on claims incurred and the estimated ultimate cost to settle the claims. Based on this analysis, we have recognized cumulative expenses of $1.3 million, $0.6 million, $0.7 million and $0.8 million for claims incurred during the years ended December 31, 2006, 2005, 2004 and 2003, respectively.

Under our employee health care insurance policy, we retain claims liability risk up to $125,000 per incident and an aggregate claim limit based on the number of employees enrolled in the plan per month. We estimate our liability for the uninsured portion of employee health care obligations based on individual and aggregate coverage, our claims experience, the number of employees enrolled in the program, and the average time from when a claim is incurred to the time it is reported. Should actual employee health care claims liability exceed estimates, we are liable for up to an additional $1.5 million for potential uninsured obligations at December 31, 2006. We have insurance coverage of $1.0 million for claims above the aggregate limit. Should employee health insurance claims exceed this coverage, we would have further obligations for the amount in excess of such coverage.