UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2020

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-19311

BIOGEN INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 33-0112644 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

225 Binney Street, Cambridge, MA 02142

(617) 679-2000

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered | |

| Common Stock, $0.0005 par value | | BIIB | | The Nasdaq Global Select Market | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files): Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | |

| Large accelerated filer | x | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The number of shares of the issuer’s Common Stock, $0.0005 par value, outstanding as of October 20, 2020, was 153,881,597 shares.

BIOGEN INC.

FORM 10-Q — Quarterly Report

For the Quarterly Period Ended September 30, 2020

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| | |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| | |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 6. | | |

| | |

| | |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that are being made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995 (the Act) with the intention of obtaining the benefits of the “Safe Harbor” provisions of the Act. These forward-looking statements may be accompanied by such words as “aim,” “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “potential,” “possible,” “will,” “would” and other words and terms of similar meaning. Reference is made in particular to forward-looking statements regarding:

•the anticipated amount, timing and accounting of revenues; contingent, milestone, royalty and other payments under licensing, collaboration, acquisition or divestiture agreements; tax positions and contingencies; collectability of receivables; pre-approval inventory; cost of sales; research and development costs; compensation and other selling, general and administrative expenses; amortization of intangible assets; foreign currency exchange risk; estimated fair value of assets and liabilities; and impairment assessments;

•expectations, plans and prospects relating to sales, pricing, growth and launch of our marketed and pipeline products;

•the potential impact of increased product competition in the markets in which we compete, including increased competition from generics, biosimilars, prodrugs and products approved under abbreviated regulatory pathways, including generic or biosimilar versions of our products;

•the timing, outcome and impact of administrative, regulatory, legal and other proceedings related to our patents and other proprietary and intellectual property rights, tax audits, assessments and settlements, pricing matters, sales and promotional practices, product liability and other matters;

•patent terms, patent term extensions, patent office actions and expected availability and period of regulatory exclusivity;

•our plans and investments in our core and emerging growth areas as well as implementation of our corporate strategy;

•the drivers for growing our business, including our plans and intention to commit resources relating to research and development programs and business development opportunities as well as the potential benefits and results of certain business development transactions;

•our ability to finance our operations and business initiatives and obtain funding for such activities;

•the costs and timing of potential clinical trials, filings and approvals, and the potential therapeutic scope of the development and commercialization of our and our collaborators’ pipeline products;

•adverse safety events involving our marketed products, generic or biosimilar versions of our marketed products or any other products from the same class as one of our products;

•the direct and indirect impact of COVID-19 on our business and operations, including sales, expenses, supply chain, manufacturing, research and development costs, clinical trials and employees;

•the potential impact of healthcare reform in the United States (U.S.) and measures being taken worldwide designed to reduce healthcare costs and limit the overall level of government expenditures, including the impact of pricing actions and reduced reimbursement for our products;

•our manufacturing capacity, use of third-party contract manufacturing organizations, plans and timing relating to changes in our manufacturing capabilities, activities in new or existing manufacturing facilities and the expected timeline for the Solothurn manufacturing facility to be partially operational;

•the impact of the continued uncertainty of the credit and economic conditions in certain countries in Europe and our collection of accounts receivable in such countries;

•the potential impact on our results of operations and liquidity of the United Kingdom's (U.K.) departure from the European Union (E.U.);

•lease commitments, purchase obligations and the timing and satisfaction of other contractual obligations; and

•the impact of new laws, regulatory requirements, judicial decisions and accounting standards.

These forward-looking statements involve risks and uncertainties, including those that are described in Item 1A. Risk Factors included in this report and elsewhere in this report that could cause actual results to differ materially from those reflected in such statements. You should not place undue reliance on these statements. Forward-looking statements speak only as of the date of this report. Except as required by law, we do not undertake any obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise.

NOTE REGARDING COMPANY AND PRODUCT REFERENCES

References in this report to:

•“Biogen,” the “company,” “we,” “us” and “our” refer to Biogen Inc. and its consolidated subsidiaries; and

•“RITUXAN” refers to both RITUXAN (the trade name for rituximab in the U.S., Canada and Japan) and MabThera (the trade name for rituximab outside the U.S., Canada and Japan).

NOTE REGARDING TRADEMARKS

AVONEX®, PLEGRIDY®, RITUXAN®, RITUXAN HYCELA®, SPINRAZA®, TECFIDERA®, TYSABRI®, VUMERITY® and ZINBRYTA® are registered trademarks of Biogen.

BENEPALI™, FLIXABI™, FUMADERM™, IMRALDI™ and Healthy Climate, Healthy Lives™ are trademarks of Biogen.

ENBREL®, EYLEA®, FAMPYRATM, GAZYVA®, HUMIRA®, LUCENTIS®, OCREVUS®, REMICADE®, SkySTAR™ and other trademarks referenced in this report are the property of their respective owners.

PART I FINANCIAL INFORMATION

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(unaudited, in millions, except per share amounts)

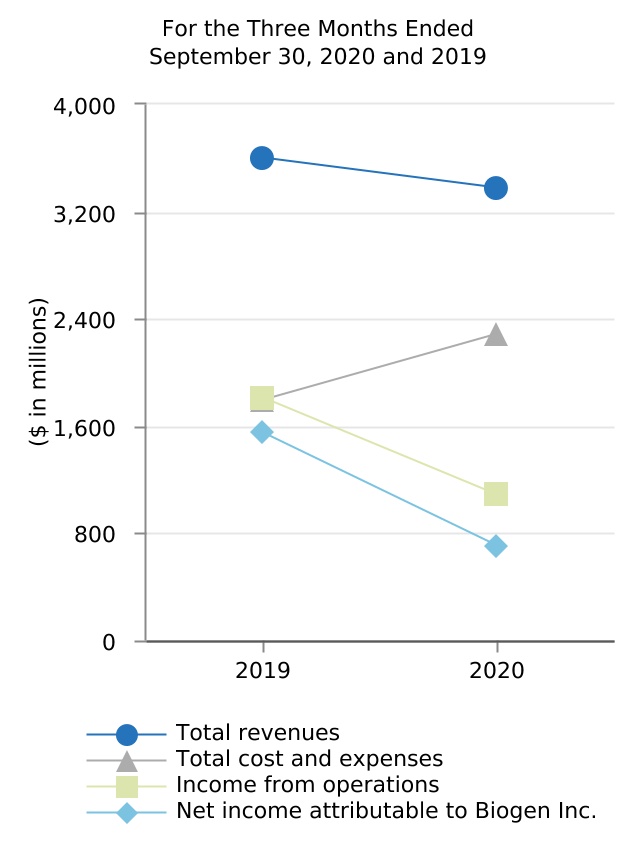

| | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended September 30, | | | | For the Nine Months Ended September 30, | | |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Revenues: | | | | | | | |

| Product, net | $ | 2,690.3 | | | $ | 2,894.7 | | | $ | 8,390.6 | | | $ | 8,455.0 | |

| Revenues from anti-CD20 therapeutic programs | 560.1 | | | 595.8 | | | 1,558.8 | | | 1,689.6 | |

| Other | 125.7 | | | 109.6 | | | 642.6 | | | 562.0 | |

| Total revenues | 3,376.1 | | | 3,600.1 | | | 10,592.0 | | | 10,706.6 | |

| Cost and expenses: | | | | | | | |

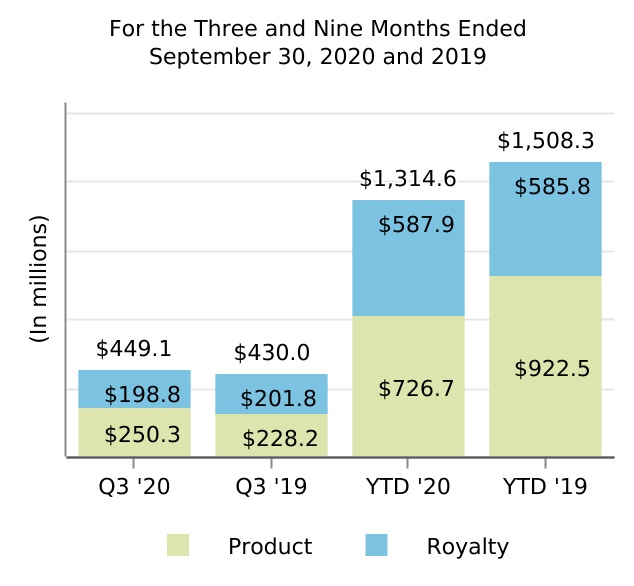

| Cost of sales, excluding amortization and impairment of acquired intangible assets | 449.1 | | | 430.0 | | | 1,314.6 | | | 1,508.3 | |

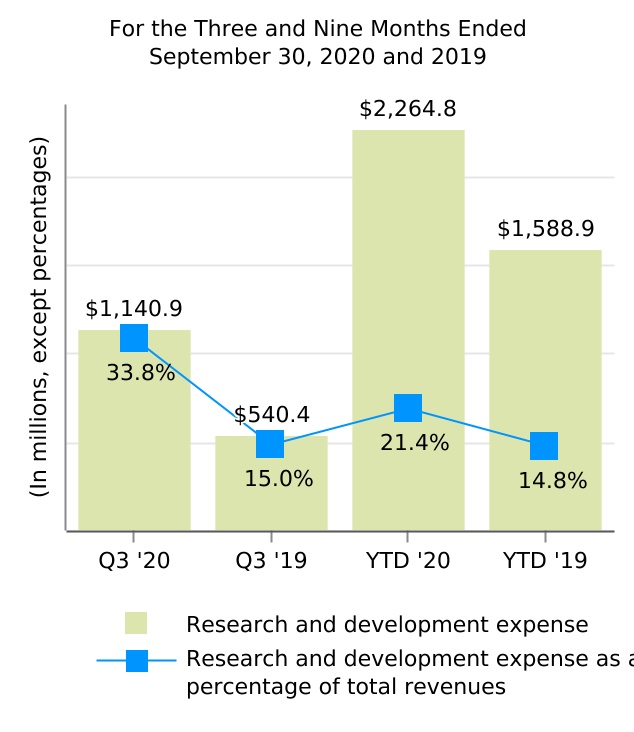

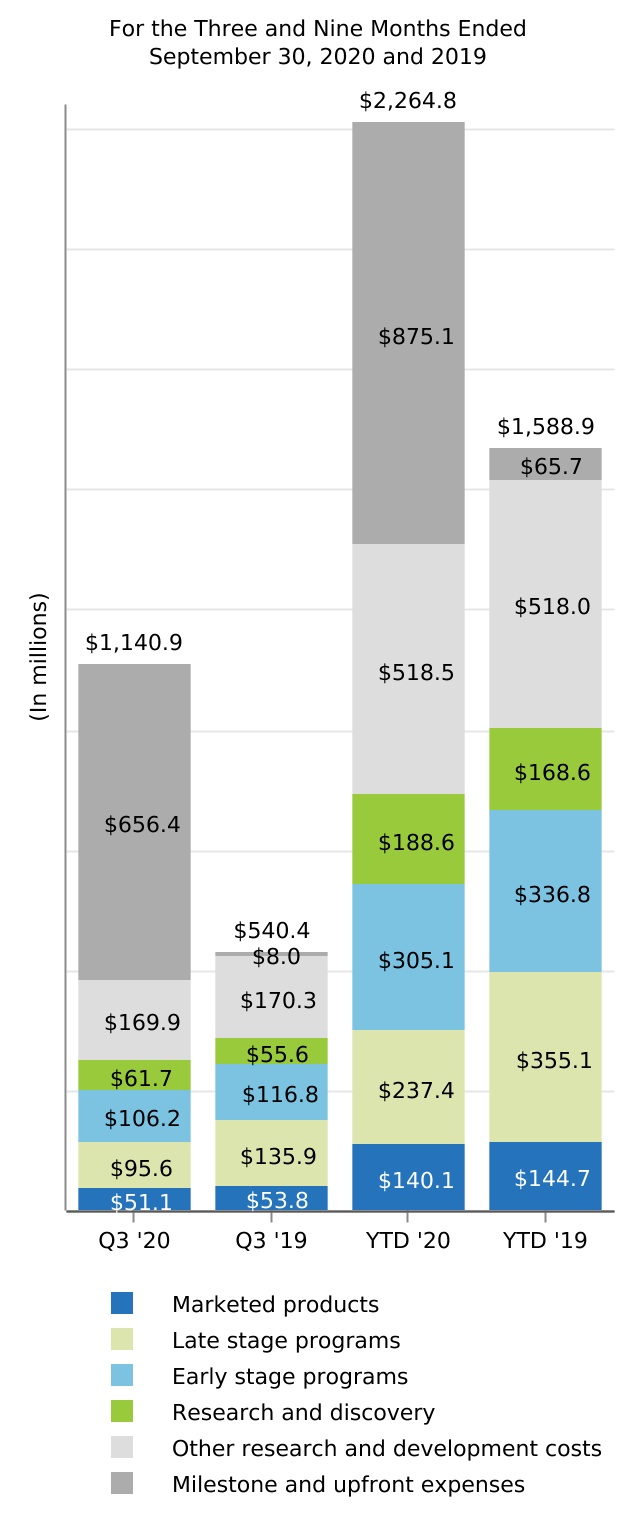

| Research and development | 1,140.9 | | | 540.4 | | | 2,264.8 | | | 1,588.9 | |

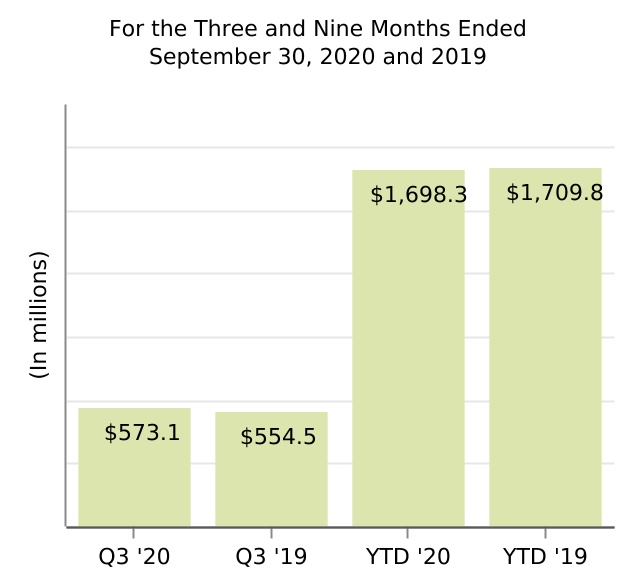

| Selling, general and administrative | 573.1 | | | 554.5 | | | 1,698.3 | | | 1,709.8 | |

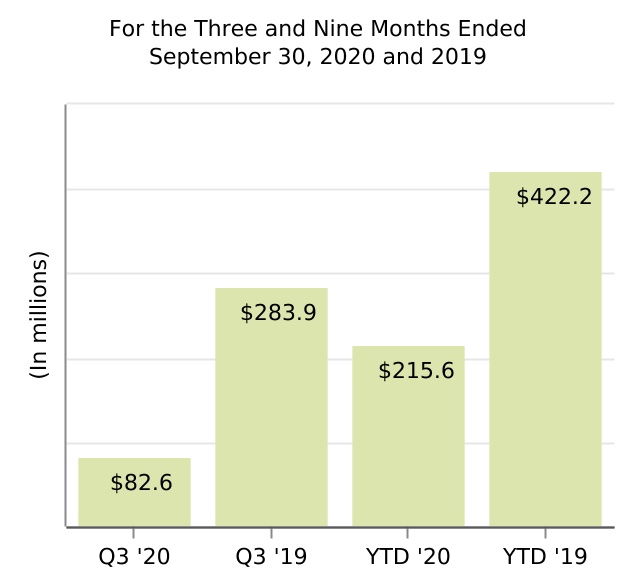

| Amortization and impairment of acquired intangible assets | 82.6 | | | 283.9 | | | 215.6 | | | 422.2 | |

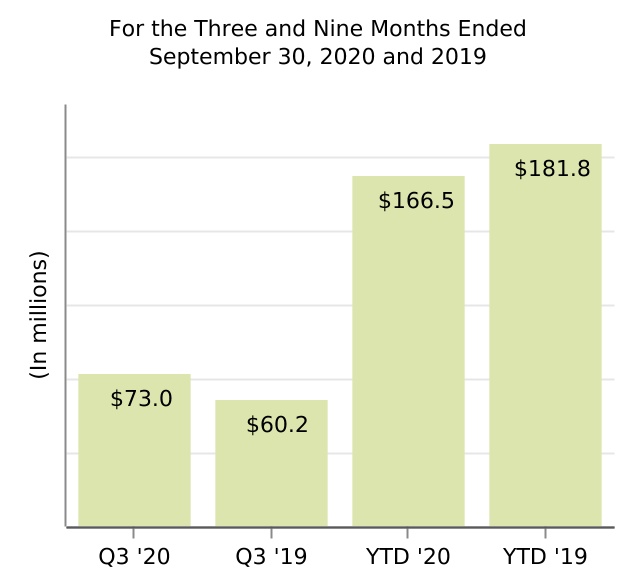

| Collaboration profit (loss) sharing | 73.0 | | | 60.2 | | | 166.5 | | | 181.8 | |

| Loss on divestiture of Hillerød, Denmark manufacturing operations | 0 | | | (17.7) | | | 0 | | | 95.5 | |

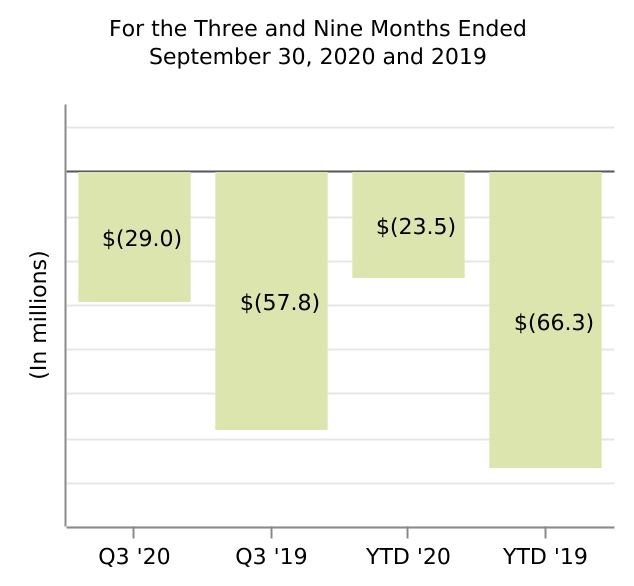

| (Gain) loss on fair value remeasurement of contingent consideration | (29.0) | | | (57.8) | | | (23.5) | | | (66.3) | |

| Restructuring charges | 0 | | | 0.3 | | | 0 | | | 1.5 | |

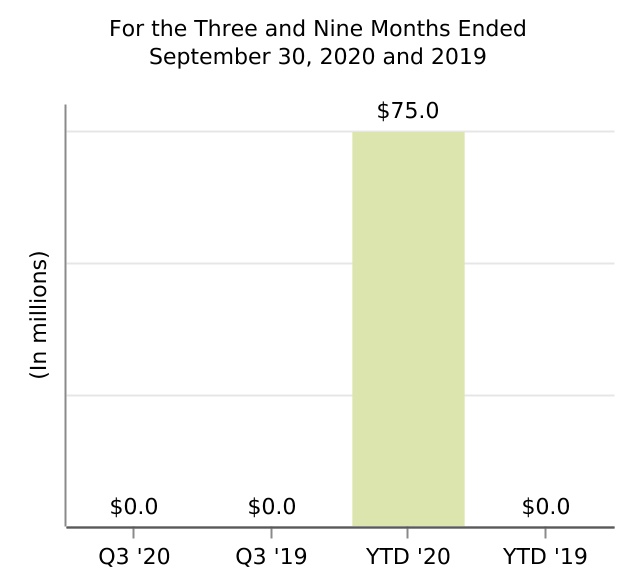

| Acquired in-process research and development | 0 | | | 0 | | | 75.0 | | | 0 | |

| Total cost and expenses | 2,289.7 | | | 1,793.8 | | | 5,711.3 | | | 5,441.7 | |

| Income from operations | 1,086.4 | | | 1,806.3 | | | 4,880.7 | | | 5,264.9 | |

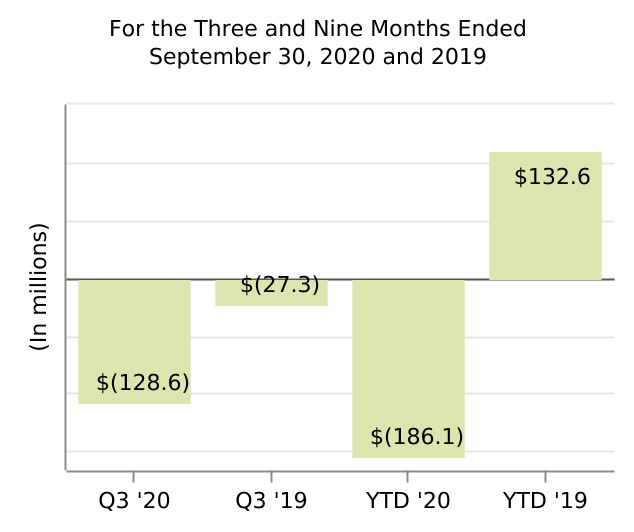

| Other income (expense), net | (128.6) | | | (27.3) | | | (186.1) | | | 132.6 | |

| Income before income tax expense and equity in loss of investee, net of tax | 957.8 | | | 1,779.0 | | | 4,694.6 | | | 5,397.5 | |

| Income tax expense | 240.8 | | | 211.3 | | | 979.0 | | | 881.9 | |

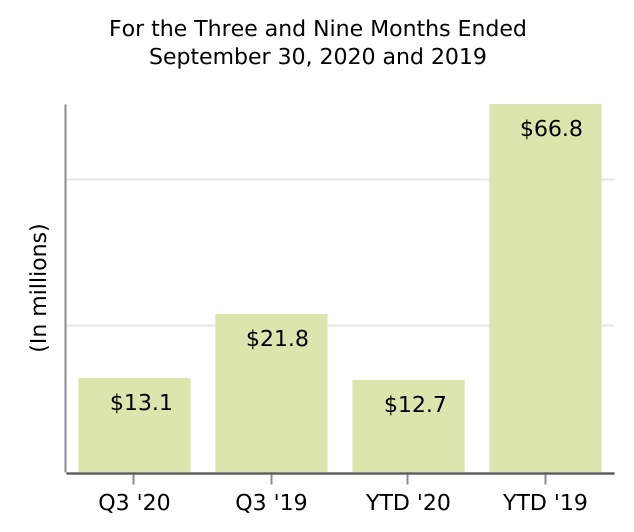

| Equity in (income) loss of investee, net of tax | 13.1 | | | 21.8 | | | 12.7 | | | 66.8 | |

| Net income | 703.9 | | | 1,545.9 | | | 3,702.9 | | | 4,448.8 | |

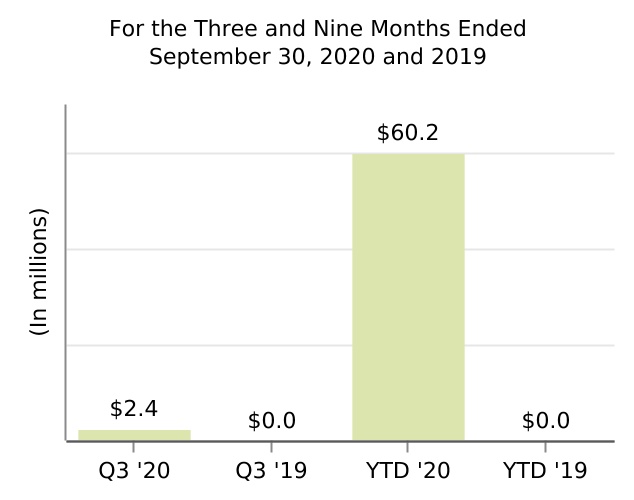

| Net income (loss) attributable to noncontrolling interests, net of tax | 2.4 | | | 0 | | | 60.2 | | | 0 | |

| Net income attributable to Biogen Inc. | $ | 701.5 | | | $ | 1,545.9 | | | $ | 3,642.7 | | | $ | 4,448.8 | |

| | | | | | | |

| Net income per share: | | | | | | | |

| Basic earnings per share attributable to Biogen Inc. | $ | 4.47 | | | $ | 8.40 | | | $ | 22.29 | | | $ | 23.38 | |

| Diluted earnings per share attributable to Biogen Inc. | $ | 4.46 | | | $ | 8.39 | | | $ | 22.25 | | | $ | 23.35 | |

| | | | | | | |

| Weighted-average shares used in calculating: | | | | | | | |

| Basic earnings per share attributable to Biogen Inc. | 156.9 | | | 184.0 | | | 163.4 | | | 190.3 | |

| Diluted earnings per share attributable to Biogen Inc. | 157.2 | | | 184.2 | | | 163.7 | | | 190.5 | |

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended September 30, | | | | For the Nine Months Ended September 30, | | |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Net income attributable to Biogen Inc. | $ | 701.5 | | | $ | 1,545.9 | | | $ | 3,642.7 | | | $ | 4,448.8 | |

| Other comprehensive income: | | | | | | | |

| Unrealized gains (losses) on securities available for sale, net of tax | 0.1 | | | 0.1 | | | 1.0 | | | 10.3 | |

| Unrealized gains (losses) on cash flow hedges, net of tax | (83.7) | | | 59.1 | | | (101.1) | | | 38.1 | |

| Gains (losses) on net investment hedges | (11.3) | | | 21.2 | | | 5.5 | | | 46.9 | |

| Unrealized gains (losses) on pension benefit obligation, net of tax | (0.5) | | | 0.8 | | | 0.4 | | | 1.5 | |

| Currency translation adjustment | 50.9 | | | 79.4 | | | 3.9 | | | 51.3 | |

| Total other comprehensive income (loss), net of tax | (44.5) | | | 160.6 | | | (90.3) | | | 148.1 | |

| Comprehensive income attributable to Biogen Inc. | 657.0 | | | 1,706.5 | | | 3,552.4 | | | 4,596.9 | |

| Comprehensive income (loss) attributable to noncontrolling interests, net of tax | 1.5 | | | 0 | | | 61.1 | | | (0.4) | |

| Comprehensive income | $ | 658.5 | | | $ | 1,706.5 | | | $ | 3,613.5 | | | $ | 4,596.5 | |

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in millions, except per share amounts)

| | | | | | | | | | | |

| As of September 30, 2020 | | As of December 31, 2019 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,224.8 | | | $ | 2,913.7 | |

| Marketable securities | 1,355.0 | | | 1,562.2 | |

| Accounts receivable, net | 2,024.9 | | | 1,880.5 | |

| Due from anti-CD20 therapeutic programs | 527.2 | | | 590.2 | |

| Inventory | 1,027.7 | | | 804.2 | |

| Other current assets | 683.5 | | | 631.0 | |

| Total current assets | 7,843.1 | | | 8,381.8 | |

| Marketable securities | 1,009.8 | | | 1,408.1 | |

| Property, plant and equipment, net | 3,359.9 | | | 3,247.3 | |

| Operating lease assets | 434.2 | | | 427.0 | |

| Intangible assets, net | 3,323.6 | | | 3,527.4 | |

| Goodwill | 5,755.7 | | | 5,757.8 | |

| Deferred tax asset | 1,372.9 | | | 3,232.1 | |

| Investments and other assets | 1,834.9 | | | 1,252.8 | |

| Total assets | $ | 24,934.1 | | | $ | 27,234.3 | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Current portion of notes payable | $ | 0 | | | $ | 1,495.8 | |

| Taxes payable | 119.4 | | | 71.4 | |

| Accounts payable | 398.4 | | | 530.8 | |

| Accrued expenses and other | 3,286.2 | | | 2,765.8 | |

| Total current liabilities | 3,804.0 | | | 4,863.8 | |

| Notes payable | 7,425.0 | | | 4,459.0 | |

| Deferred tax liability | 1,123.4 | | | 2,810.8 | |

| Long-term operating lease liabilities | 409.1 | | | 412.7 | |

| Other long-term liabilities | 1,428.1 | | | 1,348.9 | |

| Total liabilities | 14,189.6 | | | 13,895.2 | |

| Commitments and contingencies | | | |

| Equity: | | | |

| Biogen Inc. shareholders’ equity: | | | |

| Preferred stock, par value $0.001 per share | 0 | | | 0 | |

| Common stock, par value $0.0005 per share | 0.1 | | | 0.1 | |

| Additional paid-in capital | 0 | | | 0 | |

| Accumulated other comprehensive loss | (225.5) | | | (135.2) | |

| Retained earnings | 13,961.0 | | | 16,455.4 | |

| Treasury stock, at cost | (2,977.1) | | | (2,977.1) | |

| Total Biogen Inc. shareholders’ equity | 10,758.5 | | | 13,343.2 | |

| Noncontrolling interests | (14.0) | | | (4.1) | |

| Total equity | 10,744.5 | | | 13,339.1 | |

| Total liabilities and equity | $ | 24,934.1 | | | $ | 27,234.3 | |

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in millions)

| | | | | | | | | | | |

| | For the Nine Months Ended September 30, | | |

| | 2020 | | 2019 |

| Cash flows from operating activities: | | | |

| Net income | $ | 3,702.9 | | | $ | 4,448.8 | |

| Adjustments to reconcile net income to net cash flows from operating activities: | | | |

| Depreciation, amortization and impairments | 366.8 | | | 567.6 | |

| Acquired in-process research and development | 75.0 | | | 0 | |

| Share-based compensation | 149.3 | | | 143.9 | |

| | | |

| Contingent consideration | (23.5) | | | (66.3) | |

| Loss on divestiture of Hillerød, Denmark manufacturing operations | 0 | | | 95.5 | |

| Deferred income taxes | 211.9 | | | 28.4 | |

| Unrealized (gain) loss on strategic investments | 41.8 | | | (189.8) | |

| Loss on equity method investment | 14.7 | | | 63.5 | |

| Other | 110.1 | | | 87.4 | |

| Changes in operating assets and liabilities, net: | | | |

| Accounts receivable | (135.7) | | | (2.4) | |

| Due from anti-CD20 therapeutic programs | 63.0 | | | (55.4) | |

| Inventory | (270.6) | | | 47.3 | |

| Accrued expenses and other current liabilities | 372.9 | | | (109.1) | |

| Income tax assets and liabilities | 15.3 | | | 64.6 | |

| Other changes in operating assets and liabilities, net | (97.0) | | | (5.6) | |

| Net cash flows provided by operating activities | 4,596.9 | | | 5,118.4 | |

| Cash flows from investing activities: | | | |

| Proceeds from sales and maturities of marketable securities | 5,240.7 | | | 3,867.6 | |

| Purchases of marketable securities | (4,649.1) | | | (4,052.1) | |

| Contingent consideration paid related to Fumapharm AG acquisition | 0 | | | (300.0) | |

| Acquisition of Nightstar Therapeutics plc, net of cash acquired | 0 | | | (744.4) | |

| Purchase of Sangamo Therapeutics, Inc. stock | (141.8) | | | 0 | |

| Purchase of Denali Therapeutics Inc. stock | (423.7) | | | 0 | |

| Proceeds from divestiture of Hillerød, Denmark manufacturing operations | 0 | | | 923.7 | |

| Purchases of property, plant and equipment | (338.8) | | | (404.1) | |

| Acquired in-process research and development | (75.0) | | | 0 | |

| Acquisitions of intangible assets | (37.0) | | | 0 | |

| | | |

| | | |

| Proceeds from sales of strategic investments | 0.5 | | | 476.0 | |

| Other | (18.0) | | | (4.6) | |

| Net cash flows provided by (used in) investing activities | (442.2) | | | (237.9) | |

| Cash flows from financing activities: | | | |

| Purchases of treasury stock | (6,279.1) | | | (3,775.2) | |

| Payments related to issuance of stock for share-based compensation arrangements, net | (11.8) | | | (16.9) | |

| Proceeds from borrowings | 2,967.3 | | | 0 | |

| Repayment of borrowings | (1,500.0) | | | 0 | |

| | | |

| Net distribution to noncontrolling interest | (70.9) | | | 4.3 | |

| Other | 22.9 | | | 43.8 | |

| Net cash flows used in financing activities | (4,871.6) | | | (3,744.0) | |

| Net increase (decrease) in cash and cash equivalents | (716.9) | | | 1,136.5 | |

| Effect of exchange rate changes on cash and cash equivalents | 28.0 | | | (17.2) | |

| Cash and cash equivalents, beginning of the period | 2,913.7 | | | 1,224.6 | |

| Cash and cash equivalents, end of the period | $ | 2,224.8 | | | $ | 2,343.9 | |

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred stock | | | | Common stock | | | | Additional

paid-in

capital | | Accumulated

other

comprehensive

loss | | Retained

earnings | | Treasury stock | | | | Total

Biogen Inc.

shareholders’

equity | | Noncontrolling

interests | | Total

equity |

| | Shares | | Amount | | Shares | | Amount | | | | | | | | Shares | | Amount | | | | | | |

| Balance, June 30, 2020 | 0 | | | $ | 0 | | | 182.1 | | | $ | 0.1 | | | $ | 0 | | | $ | (181.0) | | | $ | 14,466.7 | | | (23.8) | | | $ | (2,977.1) | | | $ | 11,308.7 | | | $ | (19.5) | | | $ | 11,289.2 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | 701.5 | | | — | | | — | | | 701.5 | | | 2.4 | | | 703.9 | |

| Other comprehensive income (loss), net of tax | — | | | — | | | — | | | — | | | — | | | (44.5) | | | — | | | — | | | — | | | (44.5) | | | (0.9) | | | (45.4) | |

| Capital contribution by noncontrolling interest | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 0 | | | 4.0 | | | 4.0 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Repurchase of common stock pursuant to the December 2019 Share Repurchase Program, at cost | — | | | — | | | (4.5) | | | — | | | — | | | — | | | — | | | (4.5) | | | (1,250.0) | | | (1,250.0) | | | — | | | (1,250.0) | |

| Retirement of common stock pursuant to the December 2019 Share Repurchase Program, at cost | — | | | — | | | 0 | | | 0 | | | (45.1) | | | — | | | (1,204.9) | | | 4.5 | | | 1,250.0 | | | 0 | | | — | | | 0 | |

| Issuance of common stock under stock option and stock purchase plans | — | | | — | | | 0.1 | | | 0 | | | 9.7 | | | — | | | — | | | — | | | — | | | 9.7 | | | — | | | 9.7 | |

| Issuance of common stock under stock award plan | — | | | — | | | 0 | | | 0 | | | 0 | | | — | | | (2.3) | | | — | | | — | | | (2.3) | | | — | | | (2.3) | |

| Compensation related to share-based payments | — | | | — | | | — | | | — | | | 35.4 | | | — | | | — | | | — | | | — | | | 35.4 | | | — | | | 35.4 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Balance, September 30, 2020 | 0 | | | $ | 0 | | | 177.7 | | | $ | 0.1 | | | $ | 0 | | | $ | (225.5) | | | $ | 13,961.0 | | | (23.8) | | | $ | (2,977.1) | | | $ | 10,758.5 | | | $ | (14.0) | | | $ | 10,744.5 | |

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY - (Continued)

(unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred stock | | | | Common stock | | | | Additional

paid-in

capital | | Accumulated

other

comprehensive

loss | | Retained

earnings | | Treasury stock | | | | Total

Biogen Inc.

shareholders’

equity | | Noncontrolling

interests | | Total

equity |

| | Shares | | Amount | | Shares | | Amount | | | | | | | | Shares | | Amount | | | | | | |

| Balance, December 31, 2019 | 0 | | | $ | 0 | | | 198.0 | | | $ | 0.1 | | | $ | 0 | | | $ | (135.2) | | | $ | 16,455.4 | | | (23.8) | | | $ | (2,977.1) | | | $ | 13,343.2 | | | $ | (4.1) | | | $ | 13,339.1 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | 3,642.7 | | | — | | | — | | | 3,642.7 | | | 60.2 | | | 3,702.9 | |

| Other comprehensive income (loss), net of tax | — | | | — | | | — | | | — | | | — | | | (90.3) | | | — | | | — | | | — | | | (90.3) | | | 0.9 | | | (89.4) | |

| Distribution to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (75.0) | | | (75.0) | |

| Capital contribution by noncontrolling interest | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 4.0 | | | 4.0 | |

| Repurchase of common stock pursuant to the March 2019 Share Repurchase Program, at cost | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (4.1) | | | (1,279.1) | | | (1,279.1) | | | — | | | (1,279.1) | |

| Retirement of common stock pursuant to the March 2019 Share Repurchase Program, at cost | — | | | — | | | (4.1) | | | — | | | (71.0) | | | — | | | (1,208.1) | | | 4.1 | | | 1,279.1 | | | — | | | — | | | 0 | |

| Repurchase of common stock pursuant to the December 2019 Share Repurchase Program, at cost | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (16.7) | | | (5,000.0) | | | (5,000.0) | | | — | | | (5,000.0) | |

| Retirement of common stock pursuant to the December 2019 Share Repurchase Program, at cost | — | | | — | | | (16.7) | | | — | | | (121.3) | | | — | | | (4,878.7) | | | 16.7 | | | 5,000.0 | | | — | | | — | | | 0 | |

| Issuance of common stock under stock option and stock purchase plans | — | | | — | | | 0.2 | | | 0 | | | 38.8 | | | — | | | — | | | — | | | — | | | 38.8 | | | — | | | 38.8 | |

| Issuance of common stock under stock award plan | — | | | — | | | 0.3 | | | 0 | | | 0 | | | — | | | (50.3) | | | — | | | — | | | (50.3) | | | — | | | (50.3) | |

| Compensation related to share-based payments | — | | | — | | | — | | | — | | | 154.2 | | | — | | | — | | | — | | | — | | | 154.2 | | | — | | | 154.2 | |

| Other | — | | | — | | | — | | | — | | | (0.7) | | | — | | | 0 | | | — | | | — | | | (0.7) | | | — | | | (0.7) | |

| Balance, September 30, 2020 | 0 | | | $ | 0 | | | 177.7 | | | $ | 0.1 | | | $ | 0 | | | $ | (225.5) | | | $ | 13,961.0 | | | (23.8) | | | $ | (2,977.1) | | | $ | 10,758.5 | | | $ | (14.0) | | | $ | 10,744.5 | |

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY - (Continued)

(unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred stock | | | | Common stock | | | | Additional

paid-in

capital | | Accumulated

other

comprehensive

loss | | Retained

earnings | | Treasury stock | | | | Total

Biogen Inc.

shareholders’

equity | | Noncontrolling

interests | | Total

equity |

| Shares | | Amount | | Shares | | Amount | | | | | | | | Shares | | Amount | | | | | | |

| Balance, June 30, 2019 | 0 | | | $ | 0 | | | 208.6 | | | $ | 0.1 | | | $ | 0 | | | $ | (252.9) | | | $ | 16,182.8 | | | (23.8) | | | $ | (2,977.1) | | | $ | 12,952.9 | | | $ | (4.1) | | | $ | 12,948.8 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | 1,545.9 | | | — | | | — | | | 1,545.9 | | | — | | | 1,545.9 | |

| Other comprehensive income (loss), net of tax | — | | | — | | | — | | | — | | | — | | | 160.6 | | | — | | | — | | | — | | | 160.6 | | | 0 | | | 160.6 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Repurchase of common stock pursuant to the March 2019 Share Repurchase Program, at cost | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (3.1) | | | (717.9) | | | (717.9) | | | — | | | (717.9) | |

| Retirement of common stock pursuant to the March 2019 Share Repurchase Program, at cost | — | | | — | | | (3.1) | | | — | | | (55.1) | | | — | | | (662.8) | | | 3.1 | | | 717.9 | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock under stock option and stock purchase plans | — | | | — | | | 0.1 | | | 0 | | | 7.3 | | | — | | | — | | | — | | | — | | | 7.3 | | | — | | | 7.3 | |

| Issuance of common stock under stock award plan | — | | | — | | | 0.1 | | | 0 | | | 0 | | | — | | | (0.7) | | | — | | | — | | | (0.7) | | | — | | | (0.7) | |

| Compensation related to share-based payments | — | | | — | | | — | | | — | | | 47.8 | | | — | | | 0 | | | — | | | — | | | 47.8 | | | — | | | 47.8 | |

| Balance, September 30, 2019 | 0 | | | $ | 0 | | | 205.7 | | | $ | 0.1 | | | $ | 0 | | | $ | (92.3) | | | $ | 17,065.2 | | | (23.8) | | | $ | (2,977.1) | | | $ | 13,995.9 | | | $ | (4.1) | | | $ | 13,991.8 | |

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY - (Continued)

(unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred stock | | | | Common stock | | | | Additional

paid-in

capital | | Accumulated

other

comprehensive

loss | | Retained

earnings | | Treasury stock | | | | Total

Biogen Inc.

shareholders’

equity | | Noncontrolling

interests | | Total

equity |

| Shares | | Amount | | Shares | | Amount | | | | | | | | Shares | | Amount | | | | | | |

| Balance, December 31, 2018 | 0 | | | $ | 0 | | | 221.0 | | | $ | 0.1 | | | $ | 0 | | | $ | (240.4) | | | $ | 16,257.0 | | | (23.8) | | | $ | (2,977.1) | | | $ | 13,039.6 | | | $ | (8.0) | | | $ | 13,031.6 | |

| Net income | — | | | — | | | — | | | — | | | — | | | — | | | 4,448.8 | | | — | | | — | | | 4,448.8 | | | — | | | 4,448.8 | |

| Other comprehensive income (loss), net of tax | — | | | — | | | — | | | — | | | — | | | 148.1 | | | — | | | — | | | — | | | 148.1 | | | (0.4) | | | 147.7 | |

| Capital contribution by noncontrolling interest | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 0 | | | 4.3 | | | 4.3 | |

| Repurchase of common stock pursuant to the March 2019 Share Repurchase Program, at cost | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (7.0) | | | (1,627.8) | | | (1,627.8) | | | — | | | (1,627.8) | |

| Retirement of common stock pursuant to the March 2019 Share Repurchase Program, at cost | — | | | — | | | (7.0) | | | — | | | (74.8) | | | — | | | (1,553.0) | | | 7.0 | | | 1,627.8 | | | — | | | — | | | — | |

| Repurchase of common stock pursuant to the 2018 Share Repurchase Program, at cost | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (8.9) | | | (2,147.4) | | | (2,147.4) | | | — | | | (2,147.4) | |

| Retirement of common stock pursuant to the 2018 Share Repurchase Program, at cost | — | | | — | | | (8.9) | | | 0 | | | (110.5) | | | — | | | (2,036.9) | | | 8.9 | | | 2,147.4 | | | 0 | | | — | | | 0 | |

| Issuance of common stock under stock option and stock purchase plans | — | | | — | | | 0.2 | | | 0 | | | 33.5 | | | — | | | — | | | — | | | — | | | 33.5 | | | — | | | 33.5 | |

| Issuance of common stock under stock award plan | — | | | — | | | 0.4 | | | 0 | | | 0 | | | — | | | (50.7) | | | — | | | — | | | (50.7) | | | — | | | (50.7) | |

| Compensation related to share-based payments | — | | | — | | | — | | | — | | | 151.8 | | | — | | | 0 | | | — | | | — | | | 151.8 | | | — | | | 151.8 | |

| Balance, September 30, 2019 | 0 | | | $ | 0 | | | 205.7 | | | $ | 0.1 | | | $ | 0 | | | $ | (92.3) | | | $ | 17,065.2 | | | (23.8) | | | $ | (2,977.1) | | | $ | 13,995.9 | | | $ | (4.1) | | | $ | 13,991.8 | |

See accompanying notes to these unaudited condensed consolidated financial statements.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Summary of Significant Accounting Policies

References in these notes to "Biogen," the "company," "we," "us" and "our" refer to Biogen Inc. and its consolidated subsidiaries.

Business Overview

Biogen is a global biopharmaceutical company focused on discovering, developing and delivering worldwide innovative therapies for people living with serious neurological and neurodegenerative diseases as well as related therapeutic adjacencies. Our core growth areas include multiple sclerosis (MS) and neuroimmunology; Alzheimer's disease and dementia; neuromuscular disorders, including spinal muscular atrophy (SMA) and amyotrophic lateral sclerosis (ALS); movement disorders, including Parkinson's disease; and ophthalmology. We are also focused on discovering, developing and delivering worldwide innovative therapies in our emerging growth areas of immunology; neurocognitive disorders; acute neurology; and pain. In addition, we commercialize biosimilars of advanced biologics. We support our drug discovery and development efforts through the commitment of significant resources to discovery, research and development programs and business development opportunities.

Our marketed products include TECFIDERA, VUMERITY, AVONEX, PLEGRIDY, TYSABRI and FAMPYRA for the treatment of MS; SPINRAZA for the treatment of SMA; and FUMADERM for the treatment of severe plaque psoriasis. We also have certain business and financial rights with respect to RITUXAN for the treatment of non-Hodgkin's lymphoma, chronic lymphocytic leukemia (CLL) and other conditions; RITUXAN HYCELA for the treatment of non-Hodgkin's lymphoma and CLL; GAZYVA for the treatment of CLL and follicular lymphoma; OCREVUS for the treatment of primary progressive MS and relapsing MS; and other potential anti-CD20 therapies pursuant to our collaboration arrangements with Genentech, Inc. (Genentech), a wholly-owned member of the Roche Group. For additional information on our collaboration arrangements with Genentech, please read Note 18, Collaborative and Other Relationships, to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019 (2019 Form 10-K).

Our innovative drug development and commercialization activities are complemented by our biosimilar business that expands access to medicines and reduces the cost burden for healthcare systems. Through Samsung Bioepis Co., Ltd. (Samsung Bioepis), our joint venture with Samsung BioLogics Co., Ltd. (Samsung BioLogics), we market and sell BENEPALI, an etanercept biosimilar referencing ENBREL, IMRALDI, an adalimumab biosimilar referencing HUMIRA, and FLIXABI, an infliximab biosimilar referencing REMICADE, in certain countries in Europe and have exclusive rights to commercialize these products in China. Additionally, we have exclusive rights to commercialize 2 potential ophthalmology biosimilar products, SB11 referencing LUCENTIS and SB15 referencing EYLEA, in major markets worldwide, including the United States (U.S.), Canada, Europe, Japan and Australia. For additional information on our collaboration arrangements with Samsung Bioepis, please read Note 17, Collaborative and Other Relationships, to these unaudited condensed consolidated financial statements (condensed consolidated financial statements).

Basis of Presentation

In the opinion of management, our condensed consolidated financial statements include all adjustments, consisting of normal recurring accruals, necessary for a fair statement of our financial statements for interim periods in accordance with accounting principles generally accepted in the United States (U.S. GAAP). The information included in this quarterly report on Form 10-Q should be read in conjunction with our audited consolidated financial statements and the accompanying notes included in our 2019 Form 10-K. Our accounting policies are described in the Notes to Consolidated Financial Statements in our 2019 Form 10-K and updated, as necessary, in this report. The year-end condensed consolidated balance sheet data presented for comparative purposes was derived from our audited financial statements but does not include all disclosures required by U.S. GAAP. The results of operations for the three and nine months ended September 30, 2020, are not necessarily indicative of the operating results for the full year or for any other subsequent interim period.

We operate as 1 operating segment, focused on discovering, developing and delivering worldwide innovative therapies for people living with serious neurological and neurodegenerative diseases as well as related therapeutic adjacencies.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

Consolidation

Our condensed consolidated financial statements reflect our financial statements, those of our wholly-owned subsidiaries and those of certain variable interest entities where we are the primary beneficiary. For consolidated entities where we own or are exposed to less than 100% of the economics, we record net income (loss) attributable to noncontrolling interests in our condensed consolidated statements of income equal to the percentage of the economic or ownership interest retained in such entities by the respective noncontrolling parties. Intercompany balances and transactions are eliminated in consolidation.

In determining whether we are the primary beneficiary of a variable interest entity, we apply a qualitative approach that determines whether we have both (1) the power to direct the economically significant activities of the entity and (2) the obligation to absorb losses of, or the right to receive benefits from, the entity that could potentially be significant to that entity. These considerations impact the way we account for our existing collaborative relationships and other arrangements. We continuously assess whether we are the primary beneficiary of a variable interest entity as changes to existing relationships or future transactions may result in us consolidating or deconsolidating one or more of our collaborators or partners.

Use of Estimates

The preparation of our condensed consolidated financial statements requires us to make estimates, judgments and assumptions that may affect the reported amounts of assets, liabilities, equity, revenues and expenses and related disclosure of contingent assets and liabilities. On an ongoing basis we evaluate our estimates, judgments and methodologies. We base our estimates on historical experience and on various other assumptions that we believe are reasonable, the results of which form the basis for making judgments about the carrying values of assets, liabilities and equity and the amount of revenues and expenses. Actual results may differ from these estimates.

The length of time and full extent to which the COVID-19 pandemic directly or indirectly impacts our business, results of operations and financial condition, including sales, expenses, reserves and allowances, manufacturing, clinical trials, research and development costs and employee-related amounts, depends on future developments that are highly uncertain, subject to change and are difficult to predict, including as a result of new information that may emerge concerning COVID-19 and the actions taken to contain or treat COVID-19 as well as the economic impact on local, regional, national and international customers and markets. We have made estimates of the impact of COVID-19 within our condensed consolidated financial statements and there may be changes to those estimates in future periods.

New Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (FASB) or other standard setting bodies that we adopt as of the specified effective date. Unless otherwise discussed below, we do not believe that the adoption of recently issued standards have or may have a material impact on our condensed consolidated financial statements or disclosures.

Credit Losses

In June 2016 the FASB issued Accounting Standards Update (ASU) No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. The FASB subsequently issued amendments to ASU 2016-13, which have the same effective date and transition date of January 1, 2020. This standard requires entities to estimate an expected lifetime credit loss on financial assets ranging from short-term trade accounts receivable to long-term financings and report credit losses using an expected losses model rather than the incurred losses model that was previously used, and establishes additional disclosures related to credit risks. For available-for-sale debt securities with unrealized losses, this standard now requires allowances to be recorded instead of reducing the amortized cost of the investment. This standard limits the amount of credit losses to be recognized for available-for-sale debt securities to the amount by which carrying value exceeds fair value and requires the reversal of previously recognized credit losses if fair value increases.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

This standard became effective for us on January 1, 2020, and based on the composition of our trade receivables, investment portfolio and other financial assets, current economic conditions and historical credit loss activity, the adoption of this standard did not have a material impact on our condensed consolidated financial statements and related disclosures. During the three and nine months ended September 30, 2020, we recorded an immaterial amount associated with expected credit losses related to outstanding trade receivables in certain foreign countries that have been disproportionately impacted by the COVID-19 pandemic.

Fair Value Measurements

In August 2018 the FASB issued ASU No. 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement. This standard modifies certain disclosure requirements on fair value measurements. This standard became effective for us on January 1, 2020, and did not have a material impact on our disclosures. For the new disclosures regarding our Level 3 instruments, please read Note 7, Fair Value Measurements, to these condensed consolidated financial statements.

Internal Use Software

In August 2018 the FASB issued ASU No. 2018-15, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract. This standard clarifies the accounting for implementation costs in cloud computing arrangements. This standard, which became effective for us on January 1, 2020, and was adopted on a prospective basis, resulted in an immaterial amount of additional assets being recorded on our condensed consolidated balance sheets.

Collaborative Arrangements

In November 2018 the FASB issued ASU No. 2018-18, Collaborative Arrangements (Topic 808): Clarifying the Interaction between Topic 808 and Topic 606. This standard makes targeted improvements for collaborative arrangements as follows:

•Clarifies that certain transactions between collaborative arrangement participants should be accounted for as revenue under Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers, when the collaborative arrangement participant is a customer in the context of a unit of account. In those situations, all the guidance in ASC 606 should be applied, including recognition, measurement, presentation and disclosure requirements;

•Adds unit-of-account guidance to ASC 808, Collaborative Arrangements, to align with the guidance in ASC 606 (that is, a distinct good or service) when an entity is assessing whether the collaborative arrangement or a part of the arrangement is within the scope of ASC 606; and

•Precludes a company from presenting transactions with collaborative arrangement participants that are not directly related to sales to third parties with revenue recognized under ASC 606 if the collaborative arrangement participant is not a customer.

This standard became effective for us on January 1, 2020, and did not have a material impact on our condensed consolidated financial statements and related disclosures.

2. Acquisitions

BIIB118 Acquisition

In March 2020 we acquired BIIB118 (formerly known as PF-05251749), a novel CNS-penetrant small molecule inhibitor of casein kinase 1, for the potential treatment of patients with behavioral and neurological symptoms across various psychiatric and neurological diseases from Pfizer Inc. (Pfizer). We plan to develop this Phase 1 asset for the potential treatment of sundowning in Alzheimer's disease and irregular sleep wake rhythm disorder in Parkinson’s disease.

In connection with this acquisition, we made an upfront payment of $75.0 million to Pfizer, which was accounted for as an asset acquisition and recorded as acquired in-process research and development (IPR&D) in our condensed consolidated statements of income as BIIB118 has not yet reached technological feasibility. We may also pay Pfizer up to $635.0 million in potential additional development and commercialization milestone payments as well as tiered royalties in the high single digits to sub-teens.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

Acquisition of Nightstar Therapeutics plc

In June 2019 we completed our acquisition of all of the outstanding shares of Nightstar Therapeutics plc (NST), a clinical-stage gene therapy company focused on adeno-associated virus (AAV) treatments for inherited retinal disorders. As a result of this acquisition, we added 2 mid- to late-stage clinical assets as well as preclinical programs in ophthalmology. These assets include BIIB111 (timrepigene emparvovec), which is in Phase 3 development for the potential treatment of choroideremia, a rare, degenerative, X-linked inherited retinal disorder that leads to blindness and currently has no approved treatments, and BIIB112 (RPGR gene therapy), which is in Phase 2/3 development for the potential treatment of X-linked retinitis pigmentosa, which is a rare inherited retinal disease with no currently approved treatments.

Under the terms of this acquisition, we paid NST shareholders $25.50 in cash for each issued and outstanding NST share, which totaled $847.6 million. In addition, we paid $4.6 million in cash for equity compensation, which is attributable to pre-combination services and was reflected as a component of the total purchase price paid. The fair value of equity compensation attributable to the post-combination service period was $26.2 million, of which $18.4 million was recognized as a charge to selling, general and administrative expense with the remaining $7.8 million as a charge to research and development expense in our condensed consolidated statements of income. These amounts were associated with the accelerated vesting of stock options previously granted to NST employees and were fully paid in cash as of June 30, 2019. We funded this acquisition through available cash and accounted for it as an acquisition of a business. We finalized purchase accounting for this acquisition in the fourth quarter of 2019.

For additional information on our acquisition of NST, please read Note 2, Acquisitions, to our consolidated financial statements included in our 2019 Form 10-K.

3. Divestitures

Divestiture of Hillerød, Denmark Manufacturing Operations

In March 2019 we entered into a share purchase agreement with FUJIFILM Corporation (FUJIFILM) to sell all of the outstanding shares of our subsidiary that owned our biologics manufacturing operations in Hillerød, Denmark. We determined that the assets and liabilities related to our Hillerød, Denmark manufacturing operations met the criteria to be classified as held for sale. For the nine months ended September 30, 2019, we recorded a loss of approximately $160.2 million in our condensed consolidated statements of income. This estimated loss included a pre-tax loss of $95.5 million, which reflected a $17.7 million decrease to our previously recorded pre-tax loss, reflecting our estimated fair value of the assets and liabilities held for sale as of September 30, 2019, adjusted for our expected costs to sell our Hillerød, Denmark manufacturing operations of approximately $11.2 million and included our initial estimate of the fair value of an adverse commitment of approximately $114.0 million associated with the guarantee of future minimum batch production at the Hillerød facility. The value of this adverse commitment was determined using a probability-weighted estimate of future manufacturing activity. In addition, we recorded a tax expense of $64.7 million related to the transaction during the nine months ended September 30, 2019.

In August 2019 this transaction closed and we received approximately $881.9 million in cash, which may be adjusted based on the contractual terms discussed below. We determined that the operations disposed of in this transaction did not meet the criteria to be classified as discontinued operations under the applicable guidance.

As part of this transaction, we provided FUJIFILM with certain minimum batch production commitment guarantees. There is a risk that the minimum contractual batch production commitments will not be met. Our estimate of the adverse commitment obligation is approximately $74.0 million as of September 30, 2020 and December 31, 2019. We developed this estimate using a probability-weighted estimate of future manufacturing activity and may adjust this estimate based upon changes in business conditions, which may result in the increase or reduction of this adverse commitment obligation in subsequent periods. We also may be obligated to indemnify FUJIFILM for liabilities that existed relating to certain business activities incurred prior to the closing of this transaction. Our estimate of the fair value of the adverse commitment obligation is a Level 3 measurement and is based on forecasted batch production at the Hillerød facility.

In addition, we may earn certain contingent payments based on future manufacturing activities at the Hillerød facility. For the disposition of a business, our policy is to recognize contingent consideration when the consideration is realizable. Consistent with our assessment as of the transaction date, we currently believe the probability of earning these payments is remote and therefore we did not include these contingent payments in our calculation of the fair value of the operations.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

As part of this transaction, we entered into certain manufacturing services agreements with FUJIFILM pursuant to which FUJIFILM will use the Hillerød facility to produce commercial products for us, such as TYSABRI, as well as other third-party products. In addition, we sold to FUJIFILM $41.8 million of raw materials that were remaining at the Hillerød facility on the closing date of this transaction in the third quarter of 2019. These materials were sold at cost, which approximated fair value.

4. Revenues

Product Revenues

Revenues by product are summarized as follows:

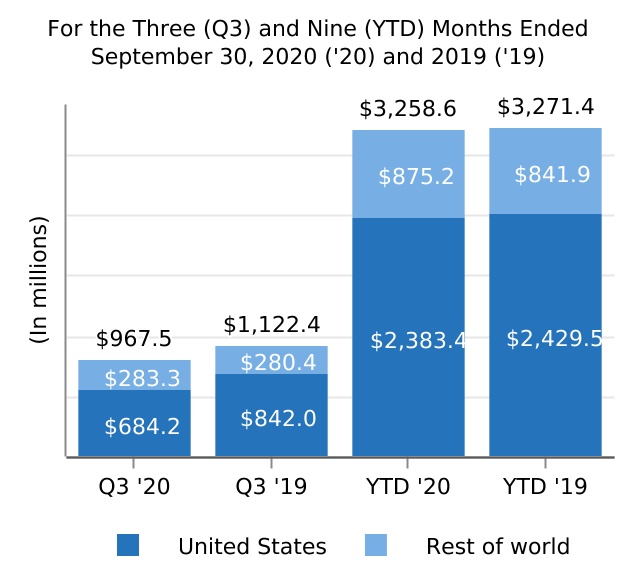

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended September 30, | | | | | | | | | | |

| | 2020 | | | | | | 2019 | | | | |

| (In millions) | | United

States | | Rest of

World | | Total | | United

States | | Rest of

World | | Total |

| Multiple Sclerosis (MS): | | | | | | | | | | | | |

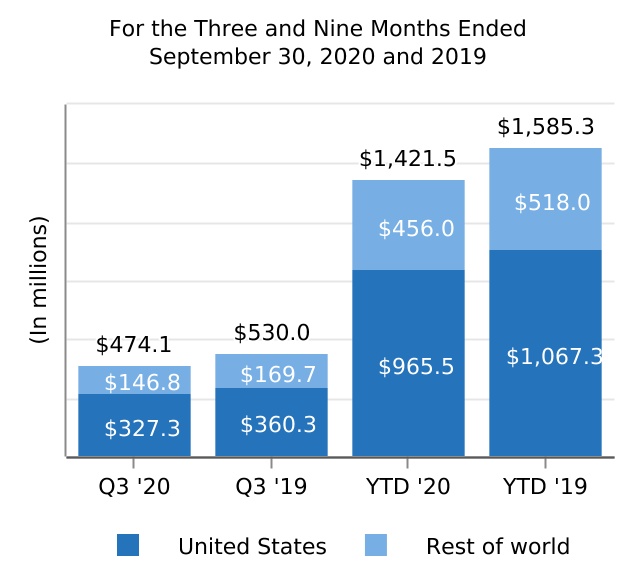

| Fumarate* | | $ | 684.2 | | | $ | 283.3 | | | $ | 967.5 | | | $ | 842.0 | | | $ | 280.4 | | | $ | 1,122.4 | |

| Interferon** | | 327.3 | | | 146.8 | | | 474.1 | | | 360.3 | | | 169.7 | | | 530.0 | |

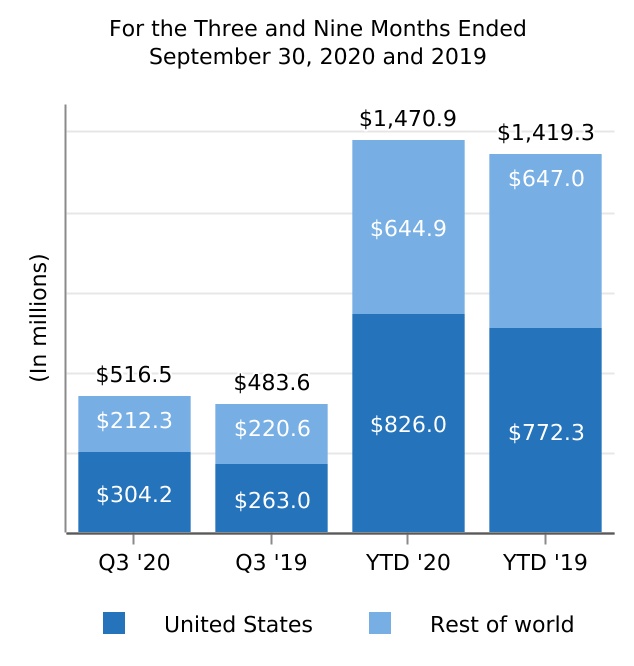

| TYSABRI | | 304.2 | | | 212.3 | | | 516.5 | | | 263.0 | | | 220.6 | | | 483.6 | |

| FAMPYRA | | 0 | | | 26.8 | | | 26.8 | | | 0 | | | 24.2 | | | 24.2 | |

| Subtotal: MS product revenues | | 1,315.7 | | | 669.2 | | | 1,984.9 | | | 1,465.3 | | | 694.9 | | | 2,160.2 | |

| | | | | | | | | | | | |

| Spinal Muscular Atrophy: | | | | | | | | | | | | |

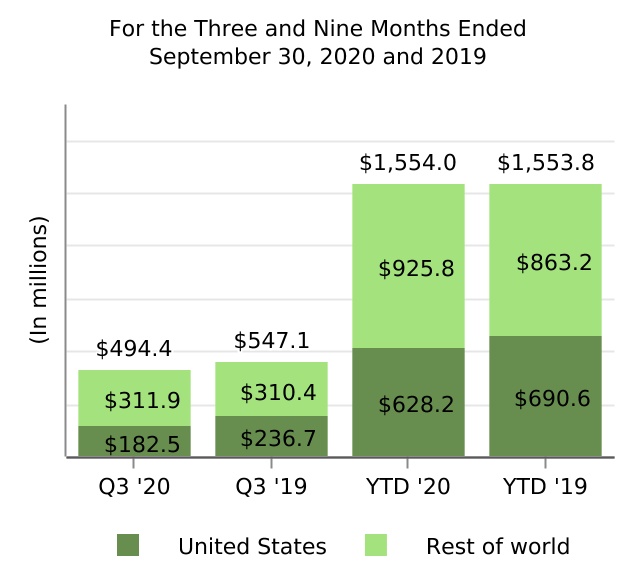

| SPINRAZA | | 182.5 | | | 311.9 | | | 494.4 | | | 236.7 | | | 310.4 | | | 547.1 | |

| | | | | | | | | | | | |

| Biosimilars: | | | | | | | | | | | | |

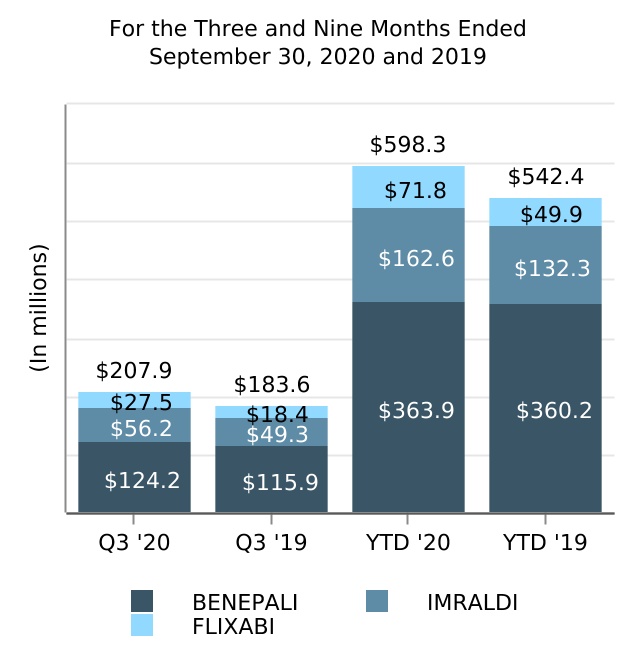

| BENEPALI | | 0 | | | 124.2 | | | 124.2 | | | 0 | | | 115.9 | | | 115.9 | |

| IMRALDI | | 0 | | | 56.2 | | | 56.2 | | | 0 | | | 49.3 | | | 49.3 | |

| FLIXABI | | 0 | | | 27.5 | | | 27.5 | | | 0 | | | 18.4 | | | 18.4 | |

| Subtotal: Biosimilar product revenues | | 0 | | | 207.9 | | | 207.9 | | | 0 | | | 183.6 | | | 183.6 | |

| | | | | | | | | | | | |

| Other: | | | | | | | | | | | | |

| FUMADERM | | 0 | | | 3.1 | | | 3.1 | | | 0 | | | 3.8 | | | 3.8 | |

| Total product revenues | | $ | 1,498.2 | | | $ | 1,192.1 | | | $ | 2,690.3 | | | $ | 1,702.0 | | | $ | 1,192.7 | | | $ | 2,894.7 | |

*Fumarate includes TECFIDERA and VUMERITY. VUMERITY became commercially available in the U.S. in November 2019.

**Interferon includes AVONEX and PLEGRIDY.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Nine Months Ended September 30, | | | | | | | | | | |

| | 2020 | | | | | | 2019 | | | | |

| (In millions) | | United

States | | Rest of

World | | Total | | United

States | | Rest of

World | | Total |

| Multiple Sclerosis (MS): | | | | | | | | | | | | |

| Fumarate* | | $ | 2,383.4 | | | $ | 875.2 | | | $ | 3,258.6 | | | $ | 2,429.5 | | | $ | 841.9 | | | $ | 3,271.4 | |

| Interferon** | | 965.5 | | | 456.0 | | | 1,421.5 | | | 1,067.3 | | | 518.0 | | | 1,585.3 | |

| TYSABRI | | 826.0 | | | 644.9 | | | 1,470.9 | | | 772.3 | | | 647.0 | | | 1,419.3 | |

| FAMPYRA | | 0 | | | 78.1 | | | 78.1 | | | 0 | | | 71.2 | | | 71.2 | |

| Subtotal: MS product revenues | | 4,174.9 | | | 2,054.2 | | | 6,229.1 | | | 4,269.1 | | | 2,078.1 | | | 6,347.2 | |

| | | | | | | | | | | | |

| Spinal Muscular Atrophy: | | | | | | | | | | | | |

| SPINRAZA | | 628.2 | | | 925.8 | | | 1,554.0 | | | 690.6 | | | 863.2 | | | 1,553.8 | |

| | | | | | | | | | | | |

| Biosimilars: | | | | | | | | | | | | |

| BENEPALI | | 0 | | | 363.9 | | | 363.9 | | | 0 | | | 360.2 | | | 360.2 | |

| IMRALDI | | 0 | | | 162.6 | | | 162.6 | | | 0 | | | 132.3 | | | 132.3 | |

| FLIXABI | | 0 | | | 71.8 | | | 71.8 | | | 0 | | | 49.9 | | | 49.9 | |

| Subtotal: Biosimilar product revenues | | 0 | | | 598.3 | | | 598.3 | | | 0 | | | 542.4 | | | 542.4 | |

| | | | | | | | | | | | |

| Other: | | | | | | | | | | | | |

| FUMADERM | | 0 | | | 9.2 | | | 9.2 | | | 0 | | | 11.6 | | | 11.6 | |

| Total product revenues | | $ | 4,803.1 | | | $ | 3,587.5 | | | $ | 8,390.6 | | | $ | 4,959.7 | | | $ | 3,495.3 | | | $ | 8,455.0 | |

*Fumarate includes TECFIDERA and VUMERITY. VUMERITY became commercially available in the U.S. in November 2019.

**Interferon includes AVONEX and PLEGRIDY.

We recognized revenues from 2 wholesalers accounting for 31.2% and 15.6% of gross product revenues for the three months ended September 30, 2020, and 30.9% and 16.0% of gross product revenues for the nine months ended September 30, 2020.

We recognized revenues from 2 wholesalers accounting for 28.7% and 18.4% of gross product revenues for the three months ended September 30, 2019, and 30.1% and 17.0% of gross product revenues for the nine months ended September 30, 2019.

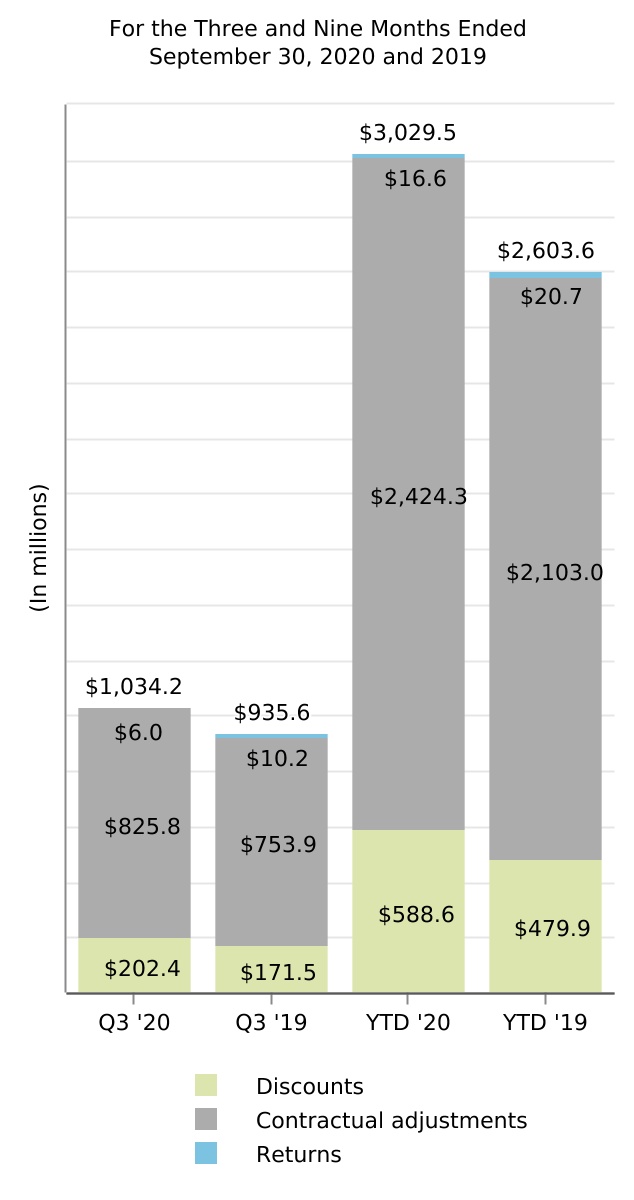

An analysis of the change in reserves for discounts and allowances is summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | | Discounts | | Contractual

Adjustments | | Returns | | Total |

| Balance, December 31, 2019 | | $ | 131.1 | | | $ | 1,027.3 | | | $ | 40.5 | | | $ | 1,198.9 | |

| Current provisions relating to sales in current year | | 589.6 | | | 2,465.8 | | | 14.8 | | | 3,070.2 | |

| Adjustments relating to prior years | | (1.0) | | | (41.6) | | | 1.8 | | | (40.8) | |

| Payments/credits relating to sales in current year | | (457.9) | | | (1,704.5) | | | 0 | | | (2,162.4) | |

| Payments/credits relating to sales in prior years | | (120.3) | | | (658.4) | | | (15.4) | | | (794.1) | |

| Balance, September 30, 2020 | | $ | 141.5 | | | $ | 1,088.6 | | | $ | 41.7 | | | $ | 1,271.8 | |

The total reserves above, which are included in our condensed consolidated balance sheets, are summarized as follows:

| | | | | | | | | | | | | | |

| (In millions) | | As of September 30, 2020 | | As of December 31, 2019 |

| Reduction of accounts receivable, net | | $ | 227.9 | | | $ | 197.8 | |

| Component of accrued expenses and other | | 1,043.9 | | | 1,001.1 | |

| Total revenue-related reserves | | $ | 1,271.8 | | | $ | 1,198.9 | |

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

Revenues from Anti-CD20 Therapeutic Programs

Revenues from anti-CD20 therapeutic programs are summarized below. For the purposes of this footnote we refer to RITUXAN and RITUXAN HYCELA collectively as RITUXAN.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended September 30, | | | | For the Nine Months Ended September 30, | | |

| (In millions) | | 2020 | | 2019 | | 2020 | | 2019 |

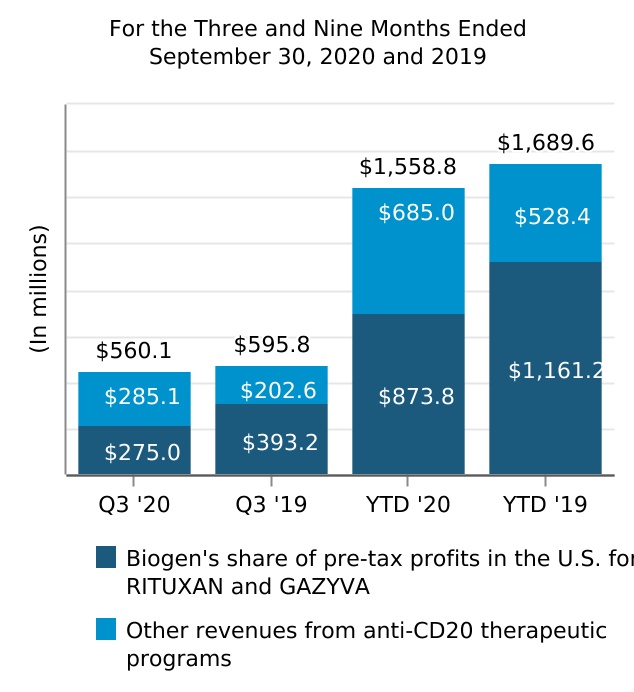

| Biogen’s share of pre-tax profits in the U.S. for RITUXAN and GAZYVA | | $ | 275.0 | | | $ | 393.2 | | | $ | 873.8 | | | $ | 1,161.2 | |

| Other revenues from anti-CD20 therapeutic programs | | 285.1 | | | 202.6 | | | 685.0 | | | 528.4 | |

| Total revenues from anti-CD20 therapeutic programs | | $ | 560.1 | | | $ | 595.8 | | | $ | 1,558.8 | | | $ | 1,689.6 | |

For additional information on our collaboration arrangements with Genentech, please read Note 18, Collaborative and Other Relationships, to our consolidated financial statements included in our 2019 Form 10-K.

Other Revenues

Other revenues are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended September 30, | | | | For the Nine Months Ended September 30, | | |

| (In millions) | | 2020 | | 2019 | | 2020 | | 2019 |

| Revenues from collaborative and other relationships: | | | | | | | | |

| Profit (loss) earned under our 50% share of the co-promotion losses on ZINBRYTA in the U.S. with AbbVie Inc. | | $ | 0 | | | $ | 0.3 | | | $ | 0.7 | | | $ | (0.2) | |

| Revenues earned under our technical development agreement, manufacturing services agreements and royalty revenues on biosimilar products with Samsung Bioepis | | 5.4 | | | 12.9 | | | 13.6 | | | 89.9 | |

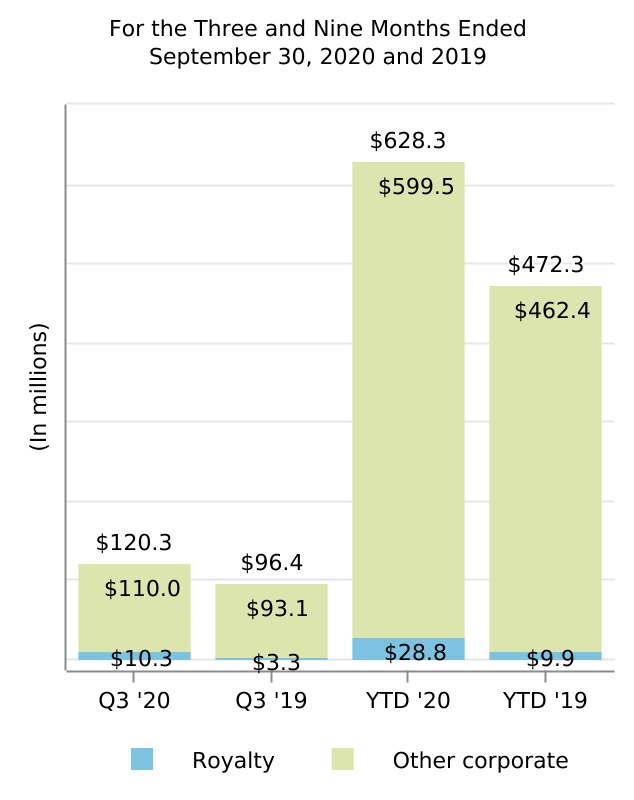

| Other royalty and corporate revenues: | | | | | | | | |

| Royalty | | 10.3 | | | 3.3 | | | 28.8 | | | 9.9 | |

| Other corporate | | 110.0 | | | 93.1 | | | 599.5 | | | 462.4 | |

| Total other revenues | | $ | 125.7 | | | $ | 109.6 | | | $ | 642.6 | | | $ | 562.0 | |

During the third quarter of 2019, we amended our agreement with a contract manufacturing customer pursuant to which we licensed certain of our manufacturing-related intellectual property to the customer. In the second quarter of 2020, the customer received regulatory approval for its product that is being manufactured using certain of our manufacturing-related intellectual property. As a result, we are entitled to $500.0 million in a series of three payments. The first payment became due upon regulatory approval of such product and was received during the second quarter of 2020. Subsequent payments are due on the first and second anniversaries of the regulatory approval.

Other corporate revenues for the nine months ended September 30, 2020, reflect $333.2 million related to the delivery of the license for certain of our manufacturing-related intellectual property under the amended agreement discussed above and the performance of manufacturing product supply services for such customer. We have allocated the remaining $166.8 million of the $500.0 million transaction price to the performance of manufacturing product supply services for the customer, which we expect to perform through 2026. The value allocated to the manufacturing services was based on expected demand for supply and the fair value of comparable manufacturing and development services.

5. Inventory

The components of inventory are summarized as follows:

| | | | | | | | | | | | | | |

| (In millions) | | As of September 30, 2020 | | As of December 31, 2019 |

| Raw materials | | $ | 288.4 | | | $ | 169.7 | |

| Work in process | | 539.9 | | | 460.0 | |

| Finished goods | | 199.4 | | | 174.5 | |

| Total inventory | | $ | 1,027.7 | | | $ | 804.2 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

6. Intangible Assets and Goodwill

Intangible Assets

Intangible assets, net of accumulated amortization, impairment charges and adjustments, are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | As of September 30, 2020 | | | | | | As of December 31, 2019 | | | | |

| (In millions) | Estimated Life | | Cost | | Accumulated

Amortization | | Net | | Cost | | Accumulated

Amortization | | Net |

| Completed technology | 4-28 years | | $ | 7,394.3 | | | $ | (5,077.7) | | | $ | 2,316.6 | | | $ | 7,379.3 | | | $ | (4,881.4) | | | $ | 2,497.9 | |

| In-process research and development | Indefinite until commercialization | | 943.0 | | | 0 | | | 943.0 | | | 965.5 | | | 0 | | | 965.5 | |

| Trademarks and trade names | Indefinite | | 64.0 | | | 0 | | | 64.0 | | | 64.0 | | | 0 | | | 64.0 | |

| Total intangible assets | | | $ | 8,401.3 | | | $ | (5,077.7) | | | $ | 3,323.6 | | | $ | 8,408.8 | | | $ | (4,881.4) | | | $ | 3,527.4 | |

For the three and nine months ended September 30, 2020, amortization and impairment of acquired intangible assets totaled $82.6 million and $215.6 million, respectively, compared to $283.9 million and $422.2 million, respectively, in the prior year comparative periods.

For the three and nine months ended September 30, 2020, amortization and impairment of acquired intangible assets reflects the impact of a $19.3 million impairment charge related to one of our IPR&D intangible assets.

For the three and nine months ended September 30, 2019, amortization and impairment of acquired intangible assets reflects the impact of a $215.9 million impairment charge related to certain IPR&D assets associated with the Phase 2b study of BG00011 (STX-100) for the potential treatment of idiopathic pulmonary fibrosis, which was discontinued in the third quarter of 2019.

For the three and nine months ended September 30, 2020, amortization of acquired intangible assets, excluding impairment charges, totaled $63.3 million and $196.3 million, respectively, compared to $68.0 million and $206.3 million, respectively, in the prior year comparative periods.

Completed Technology

Completed technology primarily relates to our acquisition of all remaining rights to TYSABRI from Elan Pharma International Ltd., an affiliate of Elan Corporation plc, and milestone payments made to Alkermes Pharma Ireland Limited, a subsidiary of Alkermes plc, following the approval of VUMERITY in the U.S. in October 2019, net of accumulated amortization.

IPR&D Related to Business Combinations

IPR&D represents the fair value assigned to research and development assets that we acquired as part of a business combination and had not yet reached technological feasibility at the date of acquisition. Included in IPR&D balances are adjustments related to foreign currency exchange rate fluctuations. We review amounts capitalized as acquired IPR&D for impairment annually, as of October 31, and whenever events or changes in circumstances indicate to us that the carrying value of the assets might not be recoverable. The carrying value associated with our IPR&D assets as of September 30, 2020, relates to the various IPR&D programs we acquired in connection with our acquisitions of NST, Convergence Pharmaceuticals Holdings Ltd. (Convergence) and Biogen International Neuroscience GmbH (BIN). The majority of the balance relates to our acquisition of NST in June 2019 whereby we acquired IPR&D programs with an estimated fair value of approximately $700.0 million.

Vixotrigine

In the periods since we acquired vixotrigine (BIIB074), there have been numerous delays in the initiation of Phase 3 studies for the potential treatment of trigeminal neuralgia (TGN) as we engaged with the U.S. Food and Drug Administration (FDA) regarding the design of the Phase 3 studies and awaited data and insights from mid-stage clinical trials of vixotrigine in other indications that have since been completed. The fair value of the TGN asset is not significantly in excess of carrying value. As of September 30, 2020, the carrying value associated with our vixotrigine IPR&D assets was $167.6 million.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

Estimated Future Amortization of Intangible Assets

The estimated future amortization of finite-lived intangible assets for the next five years is expected to be as follows:

| | | | | | | | |

| (In millions) | | As of September 30, 2020 |

| 2020 (remaining three months) | | $ | 60.0 | |

| 2021 | | 205.0 | |

| 2022 | | 215.0 | |

| 2023 | | 215.0 | |

| 2024 | | 225.0 | |

| 2025 | | 220.0 | |

Goodwill

The following table provides a roll forward of the changes in our goodwill balance:

| | | | | | | | |

| (In millions) | | As of September 30, 2020 |

| Goodwill, December 31, 2019 | | $ | 5,757.8 | |

| | |

| Other | | (2.1) | |

| Goodwill, September 30, 2020 | | $ | 5,755.7 | |

As of September 30, 2020, we had 0 accumulated impairment losses related to goodwill. Other includes adjustments related to foreign currency exchange rate fluctuations.

7. Fair Value Measurements

The tables below present information about our assets and liabilities that are regularly measured and carried at fair value and indicate the level within the fair value hierarchy of the valuation techniques we utilized to determine such fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of September 30, 2020 | | | | | | |

| (In millions) | | Total | | Quoted Prices

in Active

Markets

(Level 1) | | Significant Other

Observable Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) |

| Assets: | | | | | | | | |

| Cash equivalents | | $ | 1,570.3 | | | $ | 0 | | | $ | 1,570.3 | | | $ | 0 | |

| Marketable debt securities: | | | | | | | | |

| Corporate debt securities | | 1,443.8 | | | 0 | | | 1,443.8 | | | 0 | |

| Government securities | | 767.4 | | | 0 | | | 767.4 | | | 0 | |

| Mortgage and other asset backed securities | | 153.6 | | | 0 | | | 153.6 | | | 0 | |

| Marketable equity securities | | 868.5 | | | 276.5 | | | 592.0 | | | 0 | |

| Derivative contracts | | 26.0 | | | 0 | | | 26.0 | | | 0 | |

| Plan assets for deferred compensation | | 26.4 | | | 0 | | | 26.4 | | | 0 | |

| Total | | $ | 4,856.0 | | | $ | 276.5 | | | $ | 4,579.5 | | | $ | 0 | |

| Liabilities: | | | | | | | | |

| Derivative contracts | | $ | 99.6 | | | $ | 0 | | | $ | 99.6 | | | $ | 0 | |

| Contingent consideration obligations | | 322.6 | | | 0 | | | 0 | | | 322.6 | |

| Total | | $ | 422.2 | | | $ | 0 | | | $ | 99.6 | | | $ | 322.6 | |

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2019 | | | | | | |

| (In millions) | | Total | | Quoted Prices

in Active

Markets

(Level 1) | | Significant Other

Observable Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) |

| Assets: | | | | | | | | |

| Cash equivalents | | $ | 2,541.1 | | | $ | 0 | | | $ | 2,541.1 | | | $ | 0 | |

| Marketable debt securities: | | | | | | | | |

| Corporate debt securities | | 1,695.1 | | | 0 | | | 1,695.1 | | | 0 | |

| Government securities | | 1,013.9 | | | 0 | | | 1,013.9 | | | 0 | |

| Mortgage and other asset backed securities | | 261.3 | | | 0 | | | 261.3 | | | 0 | |

| Marketable equity securities | | 337.5 | | | 7.9 | | | 329.6 | | | 0 | |

| Derivative contracts | | 43.8 | | | 0 | | | 43.8 | | | 0 | |

| Plan assets for deferred compensation | | 27.7 | | | 0 | | | 27.7 | | | 0 | |

| Total | | $ | 5,920.4 | | | $ | 7.9 | | | $ | 5,912.5 | | | $ | 0 | |

| Liabilities: | | | | | | | | |

| Derivative contracts | | $ | 8.3 | | | $ | 0 | | | $ | 8.3 | | | $ | 0 | |

| Contingent consideration obligations | | 346.1 | | | 0 | | | 0 | | | 346.1 | |

| Total | | $ | 354.4 | | | $ | 0 | | | $ | 8.3 | | | $ | 346.1 | |

There have been 0 material impairments of our assets measured and carried at fair value during the three and nine months ended September 30, 2020. In addition, there were no changes in valuation techniques during the three and nine months ended September 30, 2020. The fair value of Level 2 instruments classified as cash equivalents and marketable debt securities was determined through third-party pricing services. The fair value of Level 2 instruments classified as marketable equity securities represents our investments in Sangamo Therapeutics, Inc. (Sangamo) common stock and Denali Therapeutics Inc. (Denali) common stock and are valued using an option pricing valuation model as the investments are each subject to certain holding period restrictions. For additional information on our investments in Sangamo and Denali common stock, please read Note 8, Financial Instruments, to these condensed consolidated financial statements.

Our investments in marketable equity securities also include shares of Ionis Pharmaceuticals, Inc. (Ionis) common stock acquired in June 2018. Our shares of Ionis common stock were initially subject to certain holding period restrictions that expired during the first quarter of 2020. The fair value of this investment was a Level 1 measurement as of September 30, 2020.

For a description of our validation procedures related to prices provided by third-party pricing services and our option pricing valuation model, please read Note 1, Summary of Significant Accounting Policies - Fair Value Measurements, to our consolidated financial statements included in our 2019 Form 10-K.

The following table summarizes the significant unobservable inputs in the fair value measurement of our contingent consideration obligations as of September 30, 2020:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of September 30, 2020 | | | | | | | | |

| (In millions) | | Fair Value | | Valuation Technique | | Unobservable Input | | Range | | Weighted Average |

| Liabilities: | | | | | | | | | | |

| Contingent consideration obligation | | $ | 322.6 | | | Discounted cash flow | | Discount rate | | 0.57% to 0.89% | | 0.63% |

| | | | | | Expected timing of achievement of development milestones | | 2021 to 2027 | | — |

The weighted average discount rate was calculated based on the relative fair value of our contingent consideration obligations. In addition, we apply various probabilities of technological and regulatory success, ranging from high single digits to certain probability, to the valuation models to estimate the fair values of our contingent consideration obligations.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

Debt Instruments

The fair and carrying values of our debt instruments, which are Level 2 liabilities, are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of September 30, 2020 | | | | As of December 31, 2019 | | |

| (In millions) | | Fair

Value | | Carrying

Value | | Fair

Value | | Carrying

Value |

2.900% Senior Notes due September 15, 2020(1) | | $ | 0 | | | $ | 0 | | | $ | 1,509.6 | | | $ | 1,495.8 | |

| 3.625% Senior Notes due September 15, 2022 | | 1,058.4 | | | 997.5 | | | 1,038.9 | | | 996.6 | |

| 4.050% Senior Notes due September 15, 2025 | | 1,988.5 | | | 1,740.7 | | | 1,897.2 | | | 1,739.5 | |

| 2.250% Senior Notes due May 1, 2030 | | 1,532.8 | | | 1,491.0 | | | 0 | | | 0 | |

| 5.200% Senior Notes due September 15, 2045 | | 2,286.3 | | | 1,723.3 | | | 2,107.9 | | | 1,722.9 | |

| 3.150% Senior Notes due May 1, 2050 | | 1,470.0 | | | 1,472.5 | | | 0 | | | 0 | |

| Total | | $ | 8,336.0 | | | $ | 7,425.0 | | | $ | 6,553.6 | | | $ | 5,954.8 | |

(1) Our 2.900% Senior Notes due September 15, 2020, were redeemed in full in May 2020 using the net proceeds from the issuance on April 30, 2020, of our senior unsecured notes for an aggregate principal amount of $3.0 billion. For additional information, please read Note 11, Indebtedness, to these condensed consolidated financial statements.

The fair values of each of our series of Senior Notes were determined through market, observable and corroborated sources. For additional information related to our Senior Notes issued on September 15, 2015, please read Note 12, Indebtedness, to our consolidated financial statements included in our 2019 Form 10-K. For additional information related to our Senior Notes issued on April 30, 2020, please read Note 11, Indebtedness, to these condensed consolidated financial statements.

Contingent Consideration Obligations

In connection with our acquisitions of Convergence and BIN, we agreed to make additional payments based upon the achievement of certain milestone events. The following table provides a roll forward of the fair values of our contingent consideration obligations, which includes Level 3 measurements:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended September 30, | | | | For the Nine Months Ended September 30, | | |

| (In millions) | | 2020 | | 2019 | | 2020 | | 2019 |

| Fair value, beginning of period | | $ | 351.6 | | | $ | 401.3 | | | $ | 346.1 | | | $ | 409.8 | |

| Changes in fair value | | (29.0) | | | (57.8) | | | (23.5) | | | (66.3) | |

| Payments | | 0 | | | 0 | | | 0 | | | 0 | |

| Fair value, end of period | | $ | 322.6 | | | $ | 343.5 | | | $ | 322.6 | | | $ | 343.5 | |

As of September 30, 2020 and December 31, 2019, approximately $173.2 million and $197.7 million, respectively, of the fair value of our total contingent consideration obligations was reflected as a component of other long-term liabilities in our condensed consolidated balance sheets with the remaining balance reflected as a component of accrued expenses and other.

For the three and nine months ended September 30, 2020, changes in the fair value of our contingent consideration obligations were primarily due to changes in the probability and the expected timing of the achievement of certain remaining developmental milestones as well as changes in the interest rates used to revalue our contingent consideration liabilities and the passage of time.

For the three and nine months ended September 30, 2019, changes in the fair value of our contingent consideration obligations were primarily due to the discontinuation of the Phase 2b study of BG00011 for the potential treatment of idiopathic pulmonary fibrosis resulting in a reduction of our contingent consideration obligations of $61.2 million, partially offset by a decrease in interest rates used to revalue our contingent consideration liabilities and the passage of time.

BIOGEN INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, continued)

8. Financial Instruments

The following table summarizes our financial assets with maturities of less than 90 days from the date of purchase included in cash and cash equivalents in our condensed consolidated balance sheets:

| | | | | | | | | | | | | | |

| (In millions) | | As of September 30, 2020 | | As of December 31, 2019 |

| Commercial paper | | $ | 649.2 | | | $ | 384.4 | |

| Overnight reverse repurchase agreements | | 465.4 | | | 368.8 | |

| Money market funds | | 270.2 | | | 1,628.5 | |

| Short-term debt securities | | 185.5 | | | 159.4 | |

| Total | | $ | 1,570.3 | | | $ | 2,541.1 | |

The carrying values of our commercial paper, including accrued interest, overnight reverse repurchase agreements, money market funds and short-term debt securities approximate fair value due to their short-term maturities.

Our marketable equity securities gains (losses) are recorded in other income (expense), net in our condensed consolidated statements of income. The following tables summarize our marketable debt and equity securities:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of September 30, 2020 | | | | | | |

| (In millions) | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair

Value |

| Corporate debt securities: | | | | | | | | |

| Current | | $ | 963.5 | | | $ | 1.4 | | | $ | (0.1) | | | $ | 964.8 | |

| Non-current | | 475.9 | | | 3.2 | | | (0.1) | | | 479.0 | |

| Government securities: | | | | | | | | |

| Current | | 389.4 | | | 0.2 | | | 0 | | | 389.6 | |

| Non-current | | 376.4 | | | 1.4 | | | 0 | | | 377.8 | |

| Mortgage and other asset backed securities: | | | | | | | | |

| Current | | 0.6 | | | 0 | | | 0 | | | 0.6 | |

| Non-current | | 152.6 | | | 0.6 | | | (0.2) | | | 153.0 | |