Use these links to rapidly review the document

Table of Contents

Item 8. Financial Statements and Supplementary Data

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

| (Mark One) | | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2012 |

or |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-19658

Tuesday Morning Corporation

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 75-2398532

(I.R.S. Employer

Identification No.) |

6250 LBJ Freeway

Dallas, Texas 75240

(972) 387-3562

(Address, zip code and telephone number, including area code,

of registrant's principal executive offices) |

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.01 par value per share, registered on the Nasdaq Global Select Market Inc.

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a

smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of shares of the registrant's common stock held by non-affiliates of the registrant at December 31, 2011 was approximately $141,935,836 based upon the closing sale price on the Nasdaq Global Select Market Inc. reported for such date.

As of the close of business on August 27, 2012, there were 41,736,680 outstanding shares of the registrant's common stock.

Table of Contents

Table of Contents

Documents Incorporated By Reference:

Portions of the Registrant's Definitive Proxy Statement for the 2012 Annual Meeting of Stockholders are incorporated herein by reference (to the extent indicated) into Part III of this Form 10-K.

| | | | |

Documents Incorporated By Reference | | | 2 | |

Forward-Looking Statements | | | 3 | |

PART I | | | | |

Item 1. Business | | | 4 | |

Item 1A. Risk Factors | | | 12 | |

Risks Related to Our Business | | | 12 | |

Risks Related to Our Common Stock | | | 17 | |

Item 1B. Unresolved Staff Comments | | | 18 | |

Item 2. Properties | | | 18 | |

Item 3. Legal Proceedings | | | 19 | |

Item 4 Mine Safety Disclosures | | | 19 | |

PART II | | | | |

Item 5. Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | 20 | |

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN AMONG TUESDAY MORNING CORPORATION, S&P 500 INDEX AND S&P 500 RETAILING INDEX | | | 22 | |

Item 6. Selected Financial Data | | | 23 | |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation | | | 25 | |

Item 7A. Quantitative and Qualitative Disclosures About Market Risk | | | 35 | |

Item 8. Financial Statements and Supplementary Data | | | 36 | |

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | | | 36 | |

Item 9A. Controls and Procedures | | | 36 | |

Report of Independent Registered Public Accounting Firm | | | 38 | |

Item 9B. Other Information | | | 39 | |

PART III | | | | |

Item 10. Directors, Executive Officers and Corporate Governance | | | 40 | |

Item 11. Executive Compensation | | | 40 | |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | 40 | |

Item 13. Certain Relationships and Related Transactions, Director Independence | | | 41 | |

Item 14. Principal Accountant Fees and Services | | | 41 | |

PART IV | | | | |

Item 15. Exhibits, Financial Statement Schedules | | | 42 | |

SIGNATURES | | | 43 | |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | | | F-1 | |

Report of Independent Registered Public Accounting Firm | | | F-2 | |

Tuesday Morning Corporation Consolidated Balance Sheets (In thousands, except for share data) | | | F-3 | |

Tuesday Morning Corporation Consolidated Statements of Operations (In thousands, except per share data) | | | F-4 | |

Tuesday Morning Corporation Consolidated Statements of Stockholders' Equity (In thousands) | | | F-5 | |

Tuesday Morning Corporation Consolidated Statements of Cash Flows (In thousands) | | | F-6 | |

TUESDAY MORNING CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (All dollar amounts in thousands, except per share amounts) | | | F-7 | |

EXHIBIT INDEX | | | 44 | |

2

Table of Contents

Forward-Looking Statements

This Form 10-K contains forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995, which are based on management's current expectations, estimates and projections. These statements may be found throughout this Form 10-K, particularly under the headings "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operation," among others. Forward-looking statements typically are identified by the use of terms such as "may," "will," "should," "expect," "anticipate," "believe," "estimate," "intend" and similar words, although some forward-looking statements are expressed differently. You should consider statements that contain these words carefully because they describe our expectations, plans, strategies and goals and our beliefs concerning future business conditions, our future results of operations, our future financial positions, and our business outlook or state other "forward-looking" information.

The factors listed below under the heading "Risk Factors" and in other sections of this Form 10-K provide examples of risks, uncertainties and events that could cause our actual results to differ materially from the expectations expressed in our forward-looking statements. These risks, uncertainties and events also include, but are not limited to, the following: uncertainties regarding our ability to open stores in new and existing markets and operate these stores on a profitable basis; conditions affecting consumer spending and the impact, depth and duration of current economic conditions; inclement weather; changes in our merchandise mix; timing and type of sales events, promotional activities and other advertising; increased or new competition; loss or departure of one or more members of our senior management, or experienced buying and management personnel; an increase in the cost or a disruption in the flow of our products; seasonal and quarterly fluctuations; fluctuations in our comparable store results; our ability to operate in highly competitive markets and to compete effectively; our ability to operate information systems and implement new technologies effectively; our ability to generate strong cash flows from our operations; our ability to anticipate and respond in a timely manner to changing consumer demands and preferences; and our ability to generate strong holiday season sales.

The forward-looking statements made in this Form 10-K relate only to events as of the date on which the statements are made. Except as may be required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements were made or to reflect the occurrence of unanticipated events.

The terms "Tuesday Morning," "the Company," "we," "us," and "our" as used in this Form 10-K refer to Tuesday Morning Corporation and its subsidiaries.

3

Table of Contents

PART I

Item 1. Business

Overview

We are a leading closeout retailer of upscale decorative home accessories, housewares, and famous-maker gifts in the United States. We opened our first store in 1974 and operated 852 stores in 43 states as of June 30, 2012. Our stores are generally open seven days a week and focus on periodic "sales events," that occur in each month except January and July, which historically have been weaker months for retailers. Our stores are normally closed for up to five days during the months of January and July as we conduct physical inventories at all of our stores. We purchase first quality, brand name merchandise at closeout pricing and, in turn, sell it at prices significantly below those generally charged by department stores and specialty and catalog retailers. We do not sell seconds, irregulars, refurbished or factory rejects.

We believe that our well recognized, first quality brand name merchandise and value-based pricing have enabled us to establish and maintain strong customer loyalty. Our customers, who are predominantly women from middle to upper-income households, are brand savvy, value-conscious customers seeking quality products at discount pricing. While we offer our customers consistent merchandise categories, each sales event features limited quantities of new and appealing products within these categories, creating a "treasure hunt" atmosphere in our stores.

We believe that our customers are attracted to our stores not by location, but by our advertising and direct or electronic mail programs that emphasize the limited quantities of first quality, brand name merchandise which we offer at attractive prices. This has allowed us to open our stores in secondary locations of major suburban markets, such as strip malls, near our middle and upper-income customers. We are generally able to obtain favorable lease terms because of our flexibility in site selection and our no-frills format, which allow us to use a wide variety of space configurations. Additionally, we offer selected items for sale at our retail website atwww.tuesdaymorning.com.

Key Operating Strengths

Our success is based on the following operating strengths:

- •

- Unique Event-Based Format. We distinguish ourselves from other retailers with a unique "event-based" selling strategy, creating the excitement of multiple "grand openings" and "closeout sales" each year. Merchandise is available in limited quantities and specific items are generally not replenished during a sales event, however, stores continue to receive new merchandise throughout a sales event. We believe that the limited quantities of specific items intensify customers' sense of urgency to buy our merchandise. Accordingly, we have historically generated a majority of an event's sales in the week of the event. We intend to continue to adhere to this strategy, and continue shipments to our stores of new and different merchandise during the later stages of sales events in order to encourage new and repeat customer visits.

- •

- Strong Sourcing Capabilities and Purchasing Flexibility. We have developed strong sourcing capabilities that allow us to gain favorable access to first quality, brand name merchandise at attractive prices. In many cases, we believe we are the retailer of choice to liquidate inventory due to our ability to make purchasing decisions quickly without disrupting the manufacturers' traditional distribution channels or compromising their brand image. Our flexible purchasing strategy allows us to pursue new products and merchandise categories from vendors as opportunities arise. We employ an experienced buying team with an average of over 26 years of retail experience per buyer. Our buyers and our reputation as a preferred, reliable closeout retailer have enabled us to establish long-term relationships with a diverse group of

4

Table of Contents

Growth Strategy

Our growth strategy is to continue to build on our position as a leading closeout retailer of upscale home furnishings, housewares, gifts and related items in the United States by:

- •

- Enhancing Our Store Base. In fiscal year 2013 we plan to focus our efforts on attractive relocation opportunities in our existing store base. See Item 6—Selected Financial Data in this Form 10-K for information regarding our historical store openings and closings. We plan to continue closing underperforming stores by allowing leases to expire where alternative locations in similar trade areas are not available at acceptable lease rates. For both new stores and relocations, we will continue to negotiate for upgraded sites. We will also evaluate expansion opportunities in select high-producing stores to increase the selling square footage, particularly in smaller stores. We believe these strategies will better position us for the long term while still maintaining a low cost per square foot in rent expense. To that end, for the fiscal year ending June 30, 2013 we plan to keep our overall store count constant, but focus our efforts on the relocation of our existing store locations as profitable opportunities present themselves. We do not anticipate any difficulties in identifying suitable additional store locations in areas with our target customer demographics.

5

Table of Contents

- •

- Enhancing Our Sales Productivity. We intend to continue to increase the number of customer transactions by refining our merchandise mix and through other operating initiatives. In addition, we have been selective in our seasonal merchandise purchases and remain focused on high quality, high value items. We are able to increase our merchandise offerings throughout each sales event and on a day-in, day-out basis by delivering new merchandise to the majority of our stores 44 to 50 times per year on average. We believe this attracts new customers, encourages repeat visits by existing customers and increases our average transaction value during the later stages of each sales event. We have increased staffing at some of our high volume stores in an effort to improve our customer service levels and drive our sales volumes while decreasing staffing at stores where customer traffic does not require increased staffing levels.

- •

- Extending Our Customer Reach. Historically, we have used direct mailings, targeted emails, and newspaper and print advertising to attract customers to our stores. We believe that the use of direct mailing and email alerts remains our most effective marketing strategies. We also utilize our e-mail program to provide our customers with an email of our newest weekly arrivals, special offers and our monthly mailer, all in the convenience of their homes or offices. We are continuing to expand our use of online social networking and have gained increased sales momentum through our improved e-commerce site. We piloted a customer loyalty program in the Dallas-Ft. Worth market during the last quarter of fiscal 2012 and plan to rollout nationally in fiscal 2013.

- •

- Improving Systems. We continue to enhance our merchandising systems and have implemented an improved allocation system. We are in the process of upgrading our point of sale systems and have migrated to a more robust e-commerce platform. We will continue to upgrade and improve our systems as required in the ongoing course of business.

Industry Trends

As a closeout retailer of first quality, brand name merchandise, we benefit from attractive characteristics in the closeout industry. Closeout merchandise is generally available to closeout retailers at low prices for a variety of reasons, including the inability of a manufacturer to sell merchandise through regular channels, the discontinuance of merchandise due to a style or color change, the cancellation of orders placed by other retailers and the termination of business by a manufacturer or wholesaler. Occasionally, the closeout retailer may be able to purchase closeout merchandise because a manufacturer has excess raw materials or production capacity. Typically, closeout retailers have lower merchandise costs, capital expenditures and operating costs, which allows for the sale of merchandise at prices lower than other retailers.

In addition, we benefit from several trends in the retailing industry. "Just-in-time" inventory management and retailer consolidation have both resulted in a shift of inventory risk from retailers to manufacturers. In response to an increasingly competitive market, manufacturers continue to introduce new products and new packaging more frequently. We believe that these trends have helped make the closeout retailer an integral part of manufacturers' overall distribution strategies. As a result, we believe manufacturers are increasingly looking for larger, more sophisticated closeout retailers, such as ourselves, that can purchase larger and more varied merchandise and can control the distribution and advertising of specific products in order to minimize disruption to the manufacturers' traditional distribution channels.

Products

We sell first quality, upscale home furnishings, housewares, gifts and related items. We do not sell seconds, irregulars, refurbished or factory rejects. Our merchandise primarily consists of lamps, rugs, furniture, kitchen accessories, small electronics, gourmet housewares, linens, luggage, bedroom and

6

Table of Contents

bathroom accessories, toys, pet products, stationary and silk plants as well as crystal, collectibles, silver serving pieces, men, women and children's apparel and accessories. We specialize in well-recognized, first quality, brand name merchandise, which has included, Viking and Calphalon cookware, Breville, KitchenAid and Cuisinart appliances, Peacock Alley and Sferra linens, Michael Kors bath towels, Travel Pro luggage, Reed and Barton flatware, Lenox and Denby tabletop, Waterford and Riedel crystal, Steinbach and Hummel collectibles, Madame Alexander dolls, Royal Doulton and Wedgwood china and giftware, Couristan rugs and many others.

We differ from discount retailers in that we do not stock continuing lines of merchandise. Because we offer a continuity of merchandise categories with ever-changing individual product offerings, we provide our customers a higher proportion of new merchandise items than general merchandisers. We are continually looking to add new complementary merchandise categories that appeal to our customers.

Purchasing

We provide an outlet for manufactures and other sources looking for effective ways to reduce excess inventory resulting from order cancellations by retailers, manufacturing overruns and excess capacity. Since our inception, we have not experienced any significant difficulty in obtaining first quality, brand name closeout merchandise in adequate volumes and at attractive prices. We use a mix of domestic and international vendors. We make opportunistic purchases at substantial discounts. We buy merchandise direct from manufacturers as well as utilizing other sources such as liquidators and bankruptcies. We pay our vendors timely and generally do not request special consideration for markdowns, advertising or returns. Our distribution processes allow us to stock merchandise in our stores more quickly, which increases our purchasing flexibility. We are positioned and able to take advantage of more, and often larger, buying opportunities as well as offer an enhanced selection of products to our customers. During fiscal 2012, our top ten vendors accounted for approximately 10.9% of total purchases, with no single vendor accounting for more than 1.6% of total purchases.

Pricing

Our pricing policy is to sell all merchandise significantly below the retail prices generally charged by department and specialty stores. Prices are determined centrally and are uniform at all of our stores. Once a price is determined for a particular item, labels displaying three-tiered pricing are affixed to the product. A typical price tag displays a competitor's "regular" price, a competitor's "sale" price and our closeout price. Our management and buyers verify retail prices by reviewing prices published in advertisements and catalogues and manufacturers' suggested retail price lists and by visiting department or specialty stores selling similar merchandise. Our information systems provide daily sales and inventory information, which enables us to mark down unsold merchandise on a timely and periodic basis as dictated by sales volumes and incoming purchases, thereby effectively managing our inventory levels.

Advertising

We plan and implement an advertising program for each sales event. Prior to each sales event, we initiate a direct mailing or email to customers on our mailing list, which consists of customers who have previously visited our stores and requested mailings or signed up through our e-commerce site. These direct mailings alert customers to the opening of a sales event and the merchandise and prices we offer. We also communicate with customers by advertising from time to time in local newspapers in each of our markets along with information available on our e-commerce sales website atwww.tuesdaymorning.com.

7

Table of Contents

Stores and Store Operations

Store Locations. As of June 30, 2012, we operated 852 stores in the following 43 states:

| | | | | | |

State | | # of Stores | | State | | # of Stores |

|---|

| Alabama | | 22 | | Montana | | 1 |

| Arizona | | 21 | | Nebraska | | 4 |

| Arkansas | | 14 | | Nevada | | 8 |

| California | | 90 | | New Hampshire | | 1 |

| Colorado | | 23 | | New Jersey | | 9 |

| Delaware | | 2 | | New Mexico | | 7 |

| Florida | | 65 | | New York | | 18 |

| Georgia | | 38 | | North Carolina | | 35 |

| Idaho | | 5 | | North Dakota | | 1 |

| Illinois | | 29 | | Ohio | | 27 |

| Indiana | | 14 | | Oklahoma | | 12 |

| Iowa | | 5 | | Oregon | | 12 |

| Kansas | | 11 | | Pennsylvania | | 23 |

| Kentucky | | 13 | | South Carolina | | 26 |

| Louisiana | | 20 | | South Dakota | | 1 |

| Maine | | 1 | | Tennessee | | 21 |

| Maryland | | 22 | | Texas | | 111 |

| Massachusetts | | 4 | | Utah | | 8 |

| Michigan | | 12 | | Virginia | | 39 |

| Minnesota | | 11 | | Washington | | 18 |

| Mississippi | | 16 | | Wisconsin | | 11 |

| Missouri | | 21 | | | | |

Site Selection. We continually evaluate our current store base regarding potential enhancement or relocation of our store locations. As a result of this ongoing evaluation, we have and intend to continue to pursue attractive relocation opportunities in our existing store base, close certain stores by allowing leases to expire for underperforming stores or where alternative locations in similar trade areas are not available at acceptable lease rates, and open new stores. For both new stores and relocations, we negotiate for upgraded sites. We believe that this strategy will better position us for the long-term while still maintaining a low cost per square foot in rent expense. To that end, for the fiscal year ending June 30, 2013 we plan to keep our overall store count constant, but focus our efforts on the relocation of our existing store locations as profitable opportunities present themselves. We expect our new stores to be similar in appearance and operation to our existing stores and do not anticipate difficulty in identifying suitable additional store locations in areas with our target customer demographics. As we continue our relocation strategy, we expect to incur minimal change in the cost of real estate for those locations.

We believe that our customers are attracted to our stores by our advertising, direct mail and email programs that emphasize the limited quantities of first quality, brand name merchandise that we offer at attractive prices, rather than by location. This has allowed us to open our stores in secondary locations of major suburban markets, such as strip malls, near our middle and upper-income customers. We are able to obtain favorable lease terms because of our flexibility in site selection and our no-frills format, which allow us to effectively use a wide variety of space configurations. As a result of this opportunistic approach to site selection, we believe our real estate costs are lower than many traditional retailers.

8

Table of Contents

Store Leases. Except for one store adjacent to our distribution center, we lease our store locations under non-cancelable operating leases that include optional renewal periods. Some of our leases also provide for contingent rent based upon store sales exceeding stipulated amounts.

Our store leases typically include "kick clauses," which allow us, at our option, to exit the lease 24 to 36 months after entering into the lease if sales at the store do not reach a stipulated amount stated in the lease. These kick clauses, when combined with our inexpensive and portable store fixtures, provide us with flexibility in opening new stores and relocating existing stores by allowing us to quickly and cost-effectively vacate a site that does not meet our sales expectations. As a result, we generally do not operate locations with continued store-level operating losses where our leases provide us this flexibility.

Store Layout. Our opportunistic site selection and "no-frills" approach to presenting merchandise allow us to use a wide variety of space configurations. The size of our stores generally ranges from 5,000 to 31,800 square feet and averages approximately 10,200 square feet as of June 30, 2012. We have designed our stores to be functional, with less emphasis placed upon fixtures and leasehold aesthetics. We display all merchandise at each store by type and size on racks or counters, and we maintain minimum inventory in stockrooms.

Store Operations. Our stores are generally open seven days a week, excluding certain holidays. Our stores, or a portion thereof, are closed for up to five days during the months of January and July as we conduct physical inventories at all store locations. We continue to maintain the frequency of shipments of merchandise during sales events that occur once each month except January and July, which results in improved efficiency of receiving and restocking activities at our stores. We attempt to align our part-time associates' labor hours in the stores closely with current customer demand.

Store Management. Each store has a manager who is responsible for recruiting, training and supervising store personnel and assuring that the store is managed in accordance with our established guidelines and procedures. Store managers are full-time employees. Our store managers are supported by regional field management and zone level support. Store managers are responsible for reviewing store inventory and ensuring their store is continually stocked for sales event and non-sales event periods. The store manager is assisted primarily by part-time employees, with few exceptions, who generally serve as assistant managers, cashiers, and help with merchandise stocking efforts. We believe that on-going training is a critical component to the success of our store management. Each store manager receives training beginning with new manager training upon being hired or promoted, as well as periodic attendance at one or more training sessions held in Dallas, Texas.

Members of our management visit selected stores during sales event and non-sales event periods to review inventory levels and presentation, personnel performance, expense controls, security and adherence to our policies and procedures. In addition, regional and zone field managers periodically meet with senior management to review store policies and to discuss purchasing, merchandising and advertising strategies.

Distribution

An important aspect of our model involves the ability to process, sort and distribute inventory efficiently. Our distribution center, buying, and planning and allocation departments work closely together to ensure that inventory flow is efficient and effective. The majority of merchandise is received, inspected, counted, ticketed and designated for individual stores at our central distribution center in the Dallas, Texas metropolitan area. As a general rule, we carry similar products in each of our stores, but the amount of inventory each store is allocated varies depending upon size, location and sales projections for that store. Consistent with our sales event strategy, we ship most merchandise to our stores within a few weeks of its arrival at our distribution center. We generally do not replenish

9

Table of Contents

specific merchandise during a sales event; though we may ship new and different merchandise to stores throughout a sales event.

We make inventory deliveries to the majority of our stores 44 to 50 times per year on average, which allows us to significantly reduce the amount of inventory stored at our distribution center and maintain consistent in-store inventory levels. This number of shipments also allows our stores to process shipments effectively and keep their shelves stocked with new merchandise during sales events and non-sales event periods. We use a bar-code locator system to track inventory from the time it is received until it is shipped to our stores. This system allows us to locate, price, sort and ship merchandise efficiently from our central distribution center.

Online customer orders are shipped either from our e-commerce fulfillment facility, which is located near our other distribution facilities in Dallas, Texas, or directly to the customer from our supplier. We use a bar-code locator system to track inventory from the time it is received until it is shipped to our customers. This system allows us to locate, price, sort and ship merchandise efficiently from our e-commerce fulfillment center.

Management Information Systems

We have invested significant resources in computers, bar code scanners and radio frequency terminals, software programming and related equipment, technology and training, and we intend to continue updating these systems as necessary. We also have a company-wide local area network computer system, which includes purchase order processing, imports, transportation, distribution, point-of-sale and financial systems that enables us to efficiently control and process our inventory.

At the store level, we have computer-based registers that capture daily sales data at the stock-keeping unit, or "SKU" level. Sales and inventory information, open to buy and other operational data is distributed daily to designated levels of management and to the individuals or groups who have responsibility for specific aspects of the business.

Competition

We believe the principal factors by which we compete are price and product offering. We believe we compete effectively by pricing the merchandise we sell below department and specialty store prices and by offering a broad assortment of high-end, first quality, brand name merchandise. We currently compete against a diverse group of retailers, including department and discount stores, specialty, e-commerce and catalog retailers and mass merchants, which sell, among other products, home furnishings, housewares and related products. We also compete in particular markets with a substantial number of retailers that specialize in one or more types of home furnishing products that we sell. Some of these competitors have substantially greater financial resources that may, among other things, increase their ability to purchase inventory at lower costs or to initiate and sustain aggressive price competition.

We are distinguishable from our competitors in several respects. Unlike our competitors, which primarily offer continuing lines of merchandise, we offer changing lines of merchandise depending on availability at value driven prices. Most retailers in the closeout retailing industry are either general merchandisers or focus on apparel, while our current operations focus primarily on upscale home furnishings, housewares, gifts and related items. In addition, we believe most closeout retailers focus on lower and middle-income consumers, while we generally cater to middle and upper-income customers. Finally, our business model continues to be focused on ten major sales events, which are promoted and advertised to our customers through direct mailings, emails and, from time to time, radio and television advertising. We believe that our sales events create a sense of urgency and excitement on the part of our customers because they know that the availability of merchandise during a sales event is limited.

10

Table of Contents

Seasonality

Our business is subject to seasonality, with a higher level of our net sales and operating income generated during the quarter ended December 31, which includes the holiday shopping season. Net sales in the quarters ended December 31, 2011, 2010, and 2009 accounted for approximately 34%, 34%, and 35%, respectively, of our annual net sales for such fiscal years. Operating income for the quarters ended December 31, 2011, 2010, and 2009, accounted for approximately 343%, 157%, and 150%, respectively, of our annual operating income for such fiscal years.

Employees

As of June 30, 2012, we employed approximately 1,900 persons on a full-time basis and approximately 6,500 on a part-time basis. Our employees are not represented by any labor unions. We have not experienced any work stoppage due to labor disagreements, and we believe that our employee relations are strong.

Trademarks and Tradenames

The tradename "Tuesday Morning" is material to our business. We have registered the name "Tuesday Morning" as a service mark with the United States Patent and Trademark office. We have also registered other trademarks including "Closing Time®" and "eTreasures®" and maintain an e-commerce sales website atwww.tuesdaymorning.com.

Corporate Information

Tuesday Morning Corporation is a Delaware corporation incorporated in 1991. Our principal executive offices are located at 6250 LBJ Freeway, Dallas, Texas 75240, and our telephone number is (972) 387-3562.

We maintain a website atwww.tuesdaymorning.com. Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to such reports filed with, or furnished to, the Securities and Exchange Commission (the "SEC") are available free of charge on our internet website under the Investor Relations section.

The reports we file or furnish to the SEC may be read and copied at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website,www.sec.gov, which contains the reports, proxy and information statements and other information which we file with, or furnish to, the SEC.

11

Table of Contents

Item 1A. Risk Factors

Our business is subject to significant risks. The risks and uncertainties described below and the other information in this Form 10-K, including our consolidated financial statements and the notes to those statements, should be carefully considered. The risks and uncertainties described below may not be the only ones facing us. Additional risks and uncertainties that we do not presently know about or that we currently believe are immaterial may also affect our business operations. If any of the events described below actually occur, our business, financial condition or results of operations could be adversely affected in a material way.

Risks Related to Our Business

Current economic conditions may affect consumer spending and could significantly harm our business.

The success of our business depends to a significant extent upon the level of consumer spending. A number of factors beyond our control affect the level of consumer spending on merchandise that we offer, including, among other things: general economic and industry conditions; unemployment; the housing market; deterioration in consumer confidence; crude oil prices that affect gasoline and diesel fuel, as well as, increases in other fuels used to support utilities; food prices and their effect on consumer discretionary spending; efforts by our customers to reduce personnel debt levels; interest rates; fluctuations in the financial markets; tax rates and policies; war, terrorism and other hostilities; and consumer confidence in future economic conditions.

The merchandise we sell generally consists of discretionary items. Reduced consumer confidence and spending cut backs may result in reduced demand for our merchandise, including discretionary items, and may force us to take significant inventory markdowns. Reduced demand also may require increased selling and promotional expenses. Adverse economic conditions and any related decrease in consumer demand for our merchandise could have a material adverse effect on our business, results of operations and financial condition.

We face a number of risks in opening new stores and relocating or expanding existing stores.

As part of our growth strategy, we intend to pursue relocation opportunities to improve our existing store base as well as open new stores that will offset the closing of lower performing stores as they come up for renewal. For both new stores and relocations, we negotiate for upgraded sites. For the fiscal year ending June 30, 2013 we plan to increase the chain-wide square footage by approximately 1% - 2% if we locate attractive opportunities to do so. However, we cannot assure that we will be able to achieve our relocation goals or that we will be able to operate any new or relocated stores profitably. Further, we cannot assure that any new or relocated store will achieve similar operating results to those of our existing stores or that new, relocated or expanded stores opened in markets in which we operate will not have a material adverse effect on the revenues and profitability of our existing store base. The success of our planned expansion will be dependent upon numerous factors, many of which are beyond our control, including the following: the ability of our personnel to adequately analyze and identify suitable markets and individual store sites within those markets; the competition for suitable store sites; our ability to negotiate favorable lease terms with landlords; our ability to obtain governmental and other third-party consents, permits and licenses needed to operate our stores; the availability of employees to staff new stores and our ability to hire, train, motivate and retain store personnel; the availability of adequate management and financial resources to properly manage a large volume of stores; our ability to adapt our distribution and other operational and management systems to a changing network of stores; and our ability to attract customers and generate sales sufficient to operate new, relocated or expanded stores profitably.

We opened stores in new markets during the fiscal years ended June 30, 2012, 2011, and 2010, and intend to enter into additional new markets in fiscal 2013 and beyond. These markets may have

12

Table of Contents

different competitive conditions, consumer trends and discretionary spending patterns than our existing markets, which may cause our new stores in these markets to be less successful than stores in our existing markets.

Our business is intensely competitive and stronger competition could have a material adverse effect on us.

The retail home furnishings and housewares industry is intensely competitive. As a closeout retailer of home furnishings and housewares, we currently compete against a diverse group of retailers, including department and discount stores, specialty and e-commerce retailers and mass merchants, which sell, among other products, home furnishing and houseware products similar and often identical to those we sell. We also compete in particular markets with a substantial number of retailers that specialize in one or more types of home furnishing and houseware products that we sell. Many of these competitors have substantially greater financial resources that may allow them to initiate and sustain aggressive price competition. A number of different competitive factors could have a material adverse effect on our business, results of operations and financial condition, including: increased operational efficiencies of competitors; competitive pricing strategies, including deep discount pricing by a broad range of retailers during periods of poor consumer confidence or economic uncertainty; continued and prolonged promotional activity by competitors; liquidation sales by a number of our competitors who have filed or will file for bankruptcy; expansion by existing competitors; entry by new competitors into markets in which we currently operate; and adoption by existing competitors of innovative store formats or retail sales methods.

We cannot assure that we will be able to continue to compete successfully with our existing or new competitors, or that prolonged periods of deep discount pricing by our competitors will not materially harm our business. We compete for customers, associates, locations, merchandise, services and other important aspects of our business with many other local, regional, national and international retailers. We also face competition from alternative retail distribution channels such as catalogues and, increasingly, e-commerce websites. Changes in the merchandising, pricing and promotional activities of those competitors, and in the retail industry, in general, may adversely affect our performance.

Our operating results depend on our website, network infrastructure and transaction-processing systems. Capacity constraints or system failures would harm our business, prospects, results of operations and financial condition.

Any system interruptions that result in the reduced performance of our transaction systems, including our point of sale systems, merchandising systems, or website, could reduce our transaction volume and the attractiveness of the services that we provide to customers and could harm our business, prospects, operating results and financial condition.

We use internally developed systems for our website and certain aspects of transaction processing, including personalization databases utilized for internal analytics, recommendations and order verifications. We have experienced periodic systems interruptions due to server failure and power failure, which we believe will continue to occur from time to time. If the volume of traffic on our website or the number of purchases made by customers increases substantially, we will need to further expand and upgrade our technology, transaction processing systems and network infrastructure. We have experienced and expect to continue to experience temporary capacity constraints due to sharply increased traffic during sales or other promotions and during the holiday shopping season. Capacity constraints can cause unanticipated system disruptions, slower response times, delayed page presentation, degradation in levels of customer service, impaired quality and delays in reporting accurate financial information.

Our transaction processing systems and network infrastructure may be unable to accommodate increases in traffic in the future. We may be unable to project accurately the rate or timing of traffic

13

Table of Contents

increases or successfully upgrade our systems and infrastructure to accommodate future traffic levels on our website. In addition, we may be unable to upgrade and expand our transaction processing systems in an effective and timely manner or to integrate any newly developed or purchased functionality within our existing systems. Any such difficulties with our transaction processing systems or other difficulties upgrading, expanding or integrating various aspects of our systems may cause unanticipated system disruptions, slower response times, and degradation in levels of customer service, additional expense, impaired quality and speed of order fulfillment or delays in reporting accurate financial information.

Failure to adequately maintain security and prevent unauthorized access to electronic and other confidential information could adversely affect our financial condition and operating results

We are heavily dependent upon automated technology processes. Third parties that can penetrate our network security or otherwise misappropriate our customers' personal information or credit card information could subject us to certain negative repercussions. These repercussions could negatively impact our competitive advantage, our customers' confidence level, and subject us to potential litigation and fines/penalties. While we remain in compliance with Payment Card Industry requirements, we cannot assure you that our security measures will prevent security breaches or that failure to prevent such security breaches will not harm our business, prospects, financial condition and results of operations.

Compromises of our data security could materially harm our reputation and business.

In the ordinary course of our business, we collect and store certain personal information from individuals, such as our customers and associates, and we process customer payment card and check information. We may suffer unauthorized intrusions into portions of our computer system that process and store information related to customer transactions. We have taken steps designed to strengthen the security of our computer system and protocols and have instituted an ongoing program with respect to data security. Nevertheless, there can be no assurance that we will not suffer a data compromise. We rely on commercially available systems, software, tools and monitoring to provide security for processing, transmission and storage of confidential information. Further, the systems currently used for transmission and approval of payment card transactions, and the technology utilized in payment cards themselves, all of which can put payment card data at risk, are determined and controlled by the payment card industry, not by us. This is also true for check information and approval. Computer hackers may attempt to penetrate our computer system and, if successful, misappropriate personal information, payment card or check information or confidential Company business information. In addition, a Company associate, contractor or other third party with whom we do business may attempt to circumvent our security measures in order to obtain such information and inadvertently cause a breach involving such information. Advances in computer and software capabilities and encryption technology, new tools and other developments may increase the risk of such a breach. Any such compromise of our data security and loss of personal or business information could disrupt our operations, damage our reputation and customers' willingness to shop in our stores, violate applicable laws, regulations, orders and agreements, and subject us to additional costs and liabilities which could be material.

We must continuously attract buying opportunities for closeout merchandise and anticipate consumer demand as closeout merchandise becomes available.

By its nature, specific closeout merchandise items are available from manufacturers or vendors generally on a non-recurring basis. As a result, we do not have long-term contracts with our vendors for supply, pricing or access to products, but make individual purchase decisions, which are often for large quantities. Due to economic uncertainties, some of our manufacturers and suppliers may cease operations or may otherwise become unable to continue supplying closeout merchandise on terms

14

Table of Contents

acceptable to us. We further cannot assure that manufacturers or vendors will continue to make closeout merchandise available to us in quantities acceptable to us or that our buyers will continue to identify and take advantage of appropriate buying opportunities. In addition, if we misjudge consumer demand for products, we may significantly overstock unpopular products and be forced to take significant markdowns and miss opportunities to sell more popular products. An inability to acquire suitable merchandise in the future or to accurately anticipate consumer demand for such merchandise would have an adverse effect on our business, results of operations and financial condition.

The loss of, or disruption in the operations of, our centralized distribution center would have a material adverse effect on our business and operations.

With few exceptions, all inventory is shipped directly from suppliers to our centralized distribution center in the Dallas, Texas metropolitan area, where the inventory is then processed, sorted and shipped to our stores or shipped directly to our customers who purchase merchandise from our e-commerce website. We depend in large part on the orderly operation of this receiving and distribution process, which depends, in turn, on adherence to shipping schedules and effective management of the distribution center. We cannot assure that we have anticipated all of the changing demands which our expanding operations will impose on our receiving and distribution system or that events beyond our control, such as disruptions in operations due to fire or other catastrophic events, labor disagreements or shipping problems, will not result in delays in the delivery of merchandise to our stores. We also cannot assure that our insurance will be sufficient, or that insurance proceeds will be timely paid to us, in the event our distribution center is shut down for any reason.

Our freight costs and thus our cost of goods sold are impacted by changes in fuel prices.

Our freight cost is impacted by changes in fuel prices through surcharges. Fuel prices and surcharges affect freight cost both on inbound freight from vendors to our distribution center and outbound freight from our distribution center to our stores. In addition, the U.S. government requires drivers of over-the-road trucks to take certain rest periods which reduce the available amount of time they can drive during a 24-hour period. High fuel prices or surcharges, as well as stringent driver regulations, may increase freight costs and thereby increase our cost of goods sold.

The loss or departure of one or more members of our senior management or other key employees could have a material adverse effect on our business.

Our future performance will depend in large part upon the efforts and abilities of our senior management and our other key employees, including our buyers. The loss of service of these persons could have a material adverse effect on our business and future prospects. We do not maintain key person life insurance for our senior management. We only have an employment agreement with Mr. Michael Marchetti, our Interim Chief Executive Officer, President and Chief Operating Officer, and have no such agreements with any other members of senior management or our buyers.

If we are not able to generate strong cash flows from our operations, we will not be able to support capital expansion, operations and debt repayment.

Our business is dependent upon our operations generating strong cash flows to support capital expansion requirements and general operating activities. Our inability to continue to generate sufficient cash flows to support these activities or the lack of availability of financing in adequate amounts and on appropriate terms could adversely affect our financial performance.

15

Table of Contents

An increase in the cost or a disruption in the flow of our imported products may significantly decrease our sales and profits.

Merchandise manufactured and imported from overseas represents the majority of our total product purchases acquired both domestically and internationally. A disruption in the shipping of imported merchandise or an increase in the cost of those products may significantly decrease our sales and profits. In addition, if imported merchandise becomes more expensive or unavailable, the transition to alternative sources may not occur in time to meet our demands. Products from alternative sources may also be of lesser quality and more expensive than those we currently import. Risks associated with our reliance on imported products include disruptions in the shipping and importation or increases in the costs of imported products because of factors such as: raw material shortages; work stoppages; strikes and political unrest; problems with oceanic shipping, including shipping container shortages; increased customs inspections of import shipments or other factors causing delays in shipments; economic crises; international disputes and wars; loss of "most favored nation" trading status by the United States in relation to a particular foreign country; import duties; import quotas and other trade sanctions; and increases in shipping rates.

The products we buy abroad are sometimes priced in foreign currencies and, therefore, we are affected by fluctuating exchange rates. In the past, we have entered into foreign currency exchange contracts with major financial institutions to hedge these fluctuations. We might not be able to successfully protect ourselves in the future against currency rate fluctuations, and our financial performance could suffer as a result. You should read "Management's Discussion and Analysis of Financial Condition and Results of Operation" and "Quantitative and Qualitative Disclosures About Market Risk" for more information about our foreign currency exchange rate exposure and hedging activities.

Our success depends upon our marketing, advertising and promotional efforts. If we are unable to implement them successfully, or if our competitors are more effective than we are, our revenue may be adversely affected.

We use marketing and promotional programs to attract customers to our stores and to encourage purchases by our customers. We use various media for our promotional efforts, including print, television, database marketing, email, direct marketing, and other electronic communications such as online social networks. If we fail to choose the appropriate medium for our efforts, or fail to implement and execute new marketing opportunities, our competitors may be able to attract some of our customers and cause them to decrease purchases from us and increase purchases elsewhere, which would negatively impact our revenues. Changes in the amount and degree of promotional intensity or merchandising strategy by our competitors could cause us to have difficulties in retaining existing customers and attracting new customers.

If we do not attract and retain quality sales, distribution center and other associates in large numbers, as well as, experienced buying and management personnel, our performance could be adversely affected.

Our performance is dependent on recruiting, developing, training and retaining quality sales, distribution center and other associates in large numbers, as well as, experienced buying and management personnel. Many of our associates are in entry level or part-time positions with historically high rates of turnover. Our ability to meet our labor needs while controlling costs is subject to external factors, such as unemployment levels, prevailing wage rates, minimum wage legislation and changing demographics. In the event of increasing wage rates, if we do not increase our wages competitively, our customer service could suffer because of a declining quality of our workforce, or our earnings would decrease if we increase our wage rates. Changes that adversely impact our ability to attract and retain quality associates and management personnel could adversely affect our performance.

16

Table of Contents

Our results of operations are subject to seasonal and quarterly fluctuations, which could have a material adverse effect on our operating results or the market price of our common stock.

Our business is subject to seasonality with a higher level of net sales and operating income generated during the quarter ended December 31, which includes the holiday shopping season. Net sales in the quarters ended December 31, 2011, 2010, and 2009, accounted for approximately 34%, 34%, and 35%, respectively, of our annual net sales for such years. Operating income for the quarters ended December 31, 2011, 2010, and 2009 accounted for approximately 343%, 157%, and 150%, respectively, of our annual operating income for such years. For more information about our seasonality, please read "Management's Discussion and Analysis of Financial Condition and Results of Operation—Quarterly Results and Seasonality." Because a significant percentage of our net sales and operating income are generated in the quarter ending December 31, we have limited ability to compensate for shortfalls in December quarter sales or earnings by changes in our operations or strategies in other quarters. A significant shortfall in results for the quarter ending December 31 of any year could have a material adverse effect on our annual results of operations and on the market price of our common stock. Our quarterly results of operations may also fluctuate significantly based on such factors as: the timing of new store openings; the amount of net sales contributed by new and existing stores; the success of our store expansion and relocation program; the timing of certain holidays and sales events; changes in our merchandise mix; general economic, industry and weather conditions that affect consumer spending; and actions of competitors, including promotional activity.

A failure to grow or maintain our comparable store sales may adversely affect our results of operations.

Our comparable store sales results have fluctuated in the past, and we believe such fluctuations may continue given the current housing market and uncertainty of consumer spending. Our comparable store sales decreased 3.1% for fiscal year ended June 30, 2012, decreased 1.2% for the fiscal year ended June 30, 2011, and increased 2.2% for the fiscal year ended June 30, 2010. The unpredictability of our comparable store sales may cause our revenue and results of operations to vary from quarter to quarter, and an unanticipated decline in revenues or operating income may cause our stock price to fluctuate significantly. A failure to grow or maintain our comparable store sales results could have a material adverse effect on our results of operations.

A number of factors have historically affected, and will continue to affect, our comparable store sales results, including: competition; general regional and national economic conditions; inclement weather; consumer trends, such as less spending due the impact of high unemployment rates; changes in our merchandise mix; our ability to distribute merchandise efficiently to our stores; timing and type of sales events, promotional activities or other advertising; new merchandise introductions; and our ability to execute our business strategy effectively.

Risks Related to Our Common Stock

Our certificate of incorporation, and bylaws and Delaware law contain provisions that could make it more difficult for a third party to acquire us without the consent of our board of directors.

Provisions in our certificate of incorporation and bylaws will have the effect of delaying or preventing a change of control or changes in our management. These provisions include the following: the ability of our Board of Directors to issue shares of our common stock and preferred stock without stockholder approval (subject to applicable NASDAQ requirements); a requirement that stockholder meetings may only be called by our President and Chief Executive Officer, the Chairman of the Board or at the written request of a majority of the directors then in office and not our stockholders; a prohibition of cumulative voting in the election of directors, which would otherwise allow less than a majority of stockholders to elect director candidates; the ability of our Board of Directors to make, alter or repeal our bylaws without further stockholder approval; and the requirement for advance

17

Table of Contents

notice for nominations for directors to our Board of Directors and for proposing matters that can be acted upon by stockholders at stockholder meetings.

Because we do not presently have plans to pay dividends on our common stock, stockholders must look solely to appreciation of our common stock to realize a gain on their investment.

On February 1, 2008, our Board of Directors voted to terminate the declaration of an annual cash dividend. The Board of Directors will consider the full range of alternatives with regard to the use of any excess cash flow in the future. Our future dividend policy is within the discretion of our Board of Directors and will depend upon various factors, including our business, financial condition, results of operations, capital requirements and investment opportunities. Accordingly, stockholders must look solely to appreciation of our common stock to realize a gain on their investment. This appreciation may not occur.

The price of our common stock has fluctuated substantially over the past several years and may continue to fluctuate substantially in the future.

From June 30, 2011 to June 30, 2012, the trading price of our common stock ranged from a low of $3.05 per share to a high of $4.91 per share. We expect our stock to continue to be subject to fluctuations as a result of a variety of factors, including factors beyond our control, which have been included throughout this Annual Report on Form 10-K. We may fail to meet the expectations of our stockholders or securities analysts at some time in the future, and our stock price could decline as a result.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Stores. We lease all of our stores from unaffiliated third parties normally through non-cancelable leases, except one company-owned store located adjacent to our distribution facility. At June 30, 2012, the remaining terms of the majority of our store leases range from six months to five years and only 3.3% of our store leases have remaining terms greater than five years. The average initial term of a store lease is approximately five years with options available for renewal. We intend to continue to lease all of our new stores from unaffiliated third parties. Leases may contain renewal clauses, which are often executed, and may contain additional terms regarding percentage of rent payments. Our store leases typically include "kick clauses," which allow us, at our option, to exit the lease 24 to 36 months after entering the lease if sales at the store do not reach a stipulated amount in the lease.

Distribution Facilities and Corporate Headquarters. We own approximately 1,390,770 square feet of distribution facilities and a 104,675 square foot building which houses our corporate office in Dallas, Texas.

We lease our e-commerce fulfillment center of approximately 59,000 square feet, which expires in April of 2014. Additionally, we have leases on three parcels of land of approximately 444,000 square feet, two of which are for trailer storage and the third parcel is for a 30,000 square foot building. The leases for trailer storage expire in February 2014 and December 2023 and the lease for the third parcel and building expires in February 2016. We believe our current distribution facilities are adequate to meet our requirements for the next several years. We may, however, need to acquire or lease additional warehouse space in approximately three to four years to accommodate our distribution requirements as our store base grows.

18

Table of Contents

Item 3. Legal Proceedings

During 2001 and 2002, we were named as a defendant in three complaints filed in the Superior Court of California in and for the County of Los Angeles. The plaintiffs sought to certify a statewide class made up of some of our current and former employees, which they claim are owed compensation for overtime wages, penalties and interest. The plaintiffs also sought attorney's fees and costs. In October 2003, we entered into a settlement agreement with a sub-class of these plaintiffs consisting of managers-in-training and management trainees which was paid in November 2005 with no material impact to our financial statements. A store manager class was certified. However, in August 2008, our motion for de-certification of the class of store managers was granted, thereby dismissing their class action claim. The California Court of Appeals upheld the trial court's de-certification order and the California Supreme Court has declined to review that decision. We settled the individual claims of two plaintiffs in the lawsuit with no material impact on our financial statements. In addition, approximately 75 individual plaintiffs initially chose to pursue their claims individually and filed separate lawsuits against us alleging overtime violations. In May 2012, the company entered into a settlement and release agreement with the remaining plaintiffs to dismiss all pending lawsuits in the aggregate amount of $463,000, which includes all attorney fees and past decisions, and will release the company from any past manager litigation.

A similar lawsuit, which also alleges claims concerning meal and rest periods, was filed in Orange County, California in 2004, by managers, managers-in-training and assistant managers, and an amended complaint was filed in July 2007. In December 2008, the four plaintiffs abandoned their class action claim and have elected to pursue their individual claims as well as claims under California's Private Attorney General Act with respect to such allegations. The Court has found in our favor on all claims and a final judgment has been entered. The plaintiffs have chosen not to pursue an appeal. A companion lawsuit alleging the same claims was filed in Orange County Superior Court in December 2008 on behalf of approximately thirty-four additional individual plaintiffs. This lawsuit includes a claim under California's Private Attorney General Act. Of the 34 plaintiffs, we have settled 11 cases representing the store manager plaintiffs for approximately, $185,000, including all attorney fees. Trial dates have been set for September 2012 for the remaining cases and settlement negotiations are ongoing.

In December 2008, a class action lawsuit was filed by hourly, non-exempt employees in the Superior Court of California in and for the County of Los Angeles, alleging claims covering meal and rest period violations. The parties are presently conducting discovery. The court has certified the class on a limited issue relating to the use of on-duty meal period agreements.

In July 2009, a lawsuit alleging failure to pay overtime compensation was filed in Alabama by a former store manager. The plaintiff sought to certify a class action made up current and former store managers. In fiscal 2010, we filed a request with the court to deny this motion. The court has not ruled, and no trial date has been set.

In July 2012, a discrimination claim was filed with the Equal Employment Opportunity Commission by our former CEO. The Company believes this charge is without merit and intends to vigorously defend this matter.

We intend to vigorously defend all pending actions. We do not believe these or any other legal proceedings pending or threatened against us would have a material adverse effect on our financial condition or results of operations.

Item 4. Mine Safety Disclosures

Not applicable.

19

Table of Contents

PART II

Item 5. Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is listed on the NASDAQ Global Select Market, Inc. under the symbol "TUES." The following table sets forth for the periods indicated the high and low sales prices per share as reported on the NASDAQ Select Global Market:

| | | | | | | |

| | High | | Low | |

|---|

Fiscal Year Ended June 30, 2012 | | | | | | | |

First quarter | | $ | 4.91 | | $ | 3.35 | |

Second quarter | | $ | 3.93 | | $ | 3.05 | |

Third quarter | | $ | 3.88 | | $ | 3.12 | |

Fourth quarter | | $ | 4.87 | | $ | 3.66 | |

Fiscal Year Ended June 30, 2011 | | | | | | | |

First quarter | | $ | 5.44 | | $ | 3.51 | |

Second quarter | | $ | 5.93 | | $ | 4.58 | |

Third quarter | | $ | 5.52 | | $ | 3.79 | |

Fourth quarter | | $ | 5.23 | | $ | 3.91 | |

On August 27, 2012, the last reported sale price for our common stock on the NASDAQ Global Select Market, Inc. was $5.29 per share. As of August 27, 2012, there were approximately 149 holders of record of our common stock.

Dividend Policy

During the fiscal years ended June 30, 2012 and 2011, we did not declare nor pay any annual cash dividends on our common stock. On February 1, 2008, our Board of Directors voted to terminate our then existing annual cash dividend. The Board of Directors considers a full range of alternatives with regard to the use of any excess cash flow.

Securities Authorized for Issuance Under Equity Compensation Plans

The information contained in Item 12 of this Form 10-K is incorporated herein by reference.

Repurchases of Common Equity

On August 22, 2011, the Company's Board of Directors adopted a share repurchase program pursuant to which the Company is authorized to repurchase from time to time shares of Common Stock, up to a maximum of $5.0 million in aggregate purchase price for all such shares (the "Repurchase Program"). On January 20, 2012, the Company's Board of Directors increased the authorization for stock repurchases under the Repurchase Program from $5.0 million to a maximum of $10.0 million. The Repurchase Program does not have an expiration date and may be suspended or discontinued at any time. The Board will evaluate the Repurchase Program each year and there can be no assurances as to the number of shares of Common Stock the Company will repurchase. During the twelve month period ended June 30, 2012, 1,714,867 shares were repurchased under the Repurchase Program at an average cost of $3.52 per share and for a total cost (excluding commissions) of approximately $6.1 million. All of such shares were purchased by the Company in open-market transactions.

20

Table of Contents

Repurchases of equity securities during the three months ended June 30, 2012 are listed in the following table:

| | | | | | | | | | | | | |

Period | | Total

Number of

Shares

Repurchased(1) | | Average

Price Paid

per Share(2) | | Total

Number of

Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs(3) | | Approximate

Dollar Value of

Shares That

May Yet Be

Purchased Under

the Plans or

Programs(2)(3) | |

|---|

April 1 through April 30 | | | 37,184 | | $ | 3.90 | | | 37,184 | | $ | 3,989,417 | |

May 1 through May 31 | | | 19,063 | | $ | 3.90 | | | 19,063 | | $ | 3,914,608 | |

June 1 through June 30 | | | 1,526 | | $ | 4.01 | | | 1,526 | | $ | 3,908,454 | |

| | | | | | | | | | |

Total | | | 57,773 | | $ | 3.90 | | | 57,773 | | $ | 3,908,454 | |

| | | | | | | | | | |

- (1)

- Includes shares of Common Stock withheld by the Company in connection with the vesting of equity awards under the Company's equity incentive plans.

- (2)

- Excludes commissions.

- (3)

- On August 22, 2011, the Company's Board of Directors adopted a share repurchase program pursuant to which the Company is authorized to repurchase from time to time shares of Common Stock, up to a maximum of $5.0 million in aggregate purchase price for all such shares (the "Repurchase Program"). On January 20, 2012, the Company's Board of Directors increased the authorization for stock repurchases under the Repurchase Program from $5.0 million to a maximum of $10.0 million. The Repurchase Program does not have an expiration date and may be suspended or discontinued at any time. The Board will evaluate the Repurchase Program each year and there can be no assurances as to the number of shares of Common Stock the Company will repurchase. As of June 30, 2012, 1,714,867 shares have been repurchased under the Repurchase Program for a total cost (excluding commissions) of approximately $6.1 million, of which 1,623,507 shares were purchased by the Company in open-market transactions and 91,360 shares were withheld by the Company in connection with the vesting of equity awards under the Company's equity incentive plans.

21

Table of Contents

Stock Price Performance

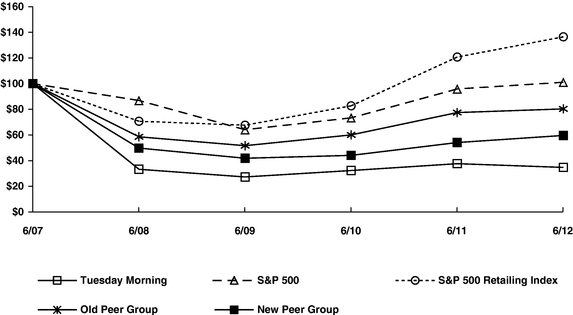

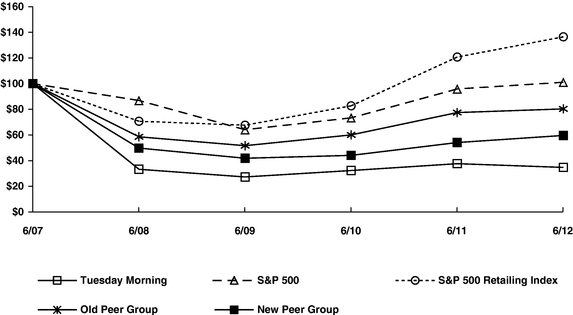

The following graph illustrates a comparison of the cumulative total stockholder return (change in stock price plus reinvested dividends) for the fiscal years ended June 30, 2012, 2011, 2010, 2009 and 2008, of (1) our common stock, (2) the S&P 500 Index, and (3) the S&P 500 retailing index, a pre-established industry index believed by us to have a peer group relationship with the Company. The chart assumes that $100 was invested on July 1, 2008, in our common stock and each of the comparison indices, and assumes that all dividends were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Tuesday Morning, the S&P 500 Index, S&P 500 Retailing Index,

Old Peer Group, and New Peer Group

- *

- $100 invested on 6/30/07 in stock or index, including reinvestment of dividends.

Fiscal year ending June 30.

Copyright© 2012 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

These indices are included for comparative purposes only and do not necessarily reflect management's opinion that such indices are an appropriate measure of the relative performance of the stock involved, and are not intended to forecast or be indicative of possible future performance of the Company's common stock.

22

Table of Contents

Item 6. Selected Financial Data

The following table sets forth the selected consolidated financial and operating data for the twelve months ended June 30, 2012, 2011, 2010, 2009, and 2008.

The selected consolidated financial and operating data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operation" and our consolidated financial statements and related notes thereto included elsewhere in this Form 10-K.

| | | | | | | | | | | | | | | | |

| | Twelve Months Year Ended June 30, | |

|---|

| | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

|---|

| | (in thousands except per share amounts and number of stores)

| |

|---|

Statement of Operations Data: | | | | | | | | | | | | | | | | |

Net sales | | $ | 812,782 | | $ | 821,150 | | $ | 828,265 | | $ | 801,722 | | $ | 885,281 | |

Cost of sales | | | 503,918 | | | 507,834 | | | 514,270 | | | 505,585 | | | 562,578 | |

| | | | | | | | | | | | |

Gross profit | | | 308,864 | | | 313,316 | | | 313,995 | | | 296,137 | | | 322,703 | |

Selling, general and administrative expenses | | | 301,427 | | | 295,273 | | | 293,850 | | | 293,702 | | | 297,852 | |

| | | | | | | | | | | | |

Operating income | | | 7,437 | | | 18,043 | | | 20,145 | | | 2,435 | | | 24,851 | |

Net interest and other expense | | | (2,030 | ) | | (2,496 | ) | | (3,476 | ) | | (2,504 | ) | | (2,719 | ) |

| | | | | | | | | | | | |

Income (loss) before income taxes | | | 5,407 | | | 15,547 | | | 16,669 | | | (69 | ) | | 22,132 | |

Income tax expense (benefit) | | | 1,494 | | | 5,968 | | | 5,921 | | | (25 | ) | | 7,634 | |

| | | | | | | | | | | | |

Net income (loss) | | $ | 3,913 | | $ | 9,579 | | $ | 10,748 | | $ | (44 | ) | $ | 14,498 | |

| | | | | | | | | | | | |

Earnings per share: | | | | | | | | | | | | | | | | |

Basic | | $ | 0.09 | | $ | 0.22 | | $ | 0.25 | | $ | 0.00 | | $ | 0.35 | |

Diluted | | | 0.09 | | | 0.22 | | | 0.25 | | | 0.00 | | | 0.35 | |

Weighted average shares outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 41,986 | | | 42,493 | | | 41,920 | | | 41,505 | | | 41,439 | |

Diluted | | | 42,536 | | | 43,078 | | | 42,483 | | | 41,505 | | | 41,494 | |

Dividends per common share | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | |

Operating Data: | | | | | | | | | | | | | | | | |

Number of stores: | | | | | | | | | | | | | | | | |

Beginning of period | | | 861 | | | 852 | | | 857 | | | 842 | | | 810 | |

Opened during period | | | 24 | | | 44 | | | 26 | | | 35 | | | 48 | |

Closed during period | | | (33 | ) | | (35 | ) | | (31 | ) | | (20 | ) | | (16 | ) |

| | | | | | | | | | | | |