in the interim period that includes the enactment date. ASU

2019-12

is effective for years beginning after December 15, 2020, including the interim periods within those reporting periods. Early adoption is permitted. We have determined that this standard will not have a material impact on our financial statements and are not early adopting this ASU.

Recently Adopted Accounting Pronouncements

On January 1, 2020, we adopted ASU

2016-13,

Financial Instruments-Credit Losses (Topic 326) – Measurement of Credit Losses on Financial Instruments

(ASU

2016-13).

The main objective of the standard is to provide financial statement users with more decision-useful information about the expected credit losses on financial instruments and other commitments to extend credit held by a reporting entity at each reporting date. In issuing this standard, the FASB is responding to criticism that prior guidance delayed recognition of credit losses. The standard replaced the prior guidance’s “incurred loss” approach with an “expected loss” model. The new model, referred to as the current expected credit loss (“CECL”) model, applies to: (1) financial assets subject to credit losses and measured at amortized cost, and (2) certain

off-balance

sheet credit exposures. The standard is applicable to loans, accounts receivable, trade receivables, and other financial assets measured at amortized cost, loan commitments and certain other

off-balance

sheet credit exposures, debt securities (including those

and other financial assets measured at fair value through other comprehensive income, and beneficial interests in securitized financial assets. The CECL model does not apply to

debt securities. For

debt securities with unrealized losses, entities measure credit losses in a manner similar to prior guidance, except that the credit losses are recognized as allowances rather than reductions in the amortized cost of the securities. Accordingly, the new methodology is utilized when assessing our financial instruments for impairment. As a result, entities recognize improvements to estimated credit losses immediately in earnings rather than as interest income over time. The ASU also simplified the accounting model for purchased credit-impaired debt securities and loans. ASU

2016-13

also expanded the disclosure requirements regarding an entity’s assumptions, models, and methods for estimating the allowance for loan and lease losses. The adoption of this standard, which is applicable to our trade receivables, notes receivable and

securities did not have a material impact on our consolidated financial statements.

On January 1, 2020, we adopted ASU

2018-13,

Fair Value Measurement (Topic 820) – Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement

(ASU

2018-13),

which modified the disclosure requirements on fair value measurements, including removing the requirement to disclose (1) the amount of and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy, (2) the policy for timing of transfers between levels and (3) the valuation processes for Level 3 fair value measurements. ASU

2018-13

also added new disclosures including the requirement to disclose (a) the changes in unrealized gains and losses for the period included in other comprehensive income for recurring Level 3 fair value measurements held at the end of the reporting period and (b) the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements. This standard only impacted the disclosures pertaining to fair value measurements and were incorporated into the notes to our consolidated financial statements.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The following information, together with information included in other parts of this Management’s Discussion and Analysis of Financial Condition and Results of Operations, describes key aspects of our market risk.

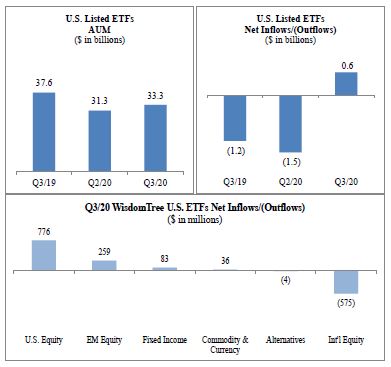

Market risk to us generally represents the risk of changes in the value of our ETPs that results from fluctuations in securities or commodity prices, foreign currency exchange rates against the U.S. dollar, and interest rates. Nearly all our revenues are derived from advisory agreements for the WisdomTree ETPs. Under these agreements, the advisory fee we receive is based on the average market value of the assets in the WisdomTree ETP portfolios we manage.

Fluctuations in the value of the ETPs are common and are generated by numerous factors such as market volatility, the global economy, inflation, changes in investor strategies and sentiment, availability of alternative investment vehicles, domestic and foreign government regulations, emerging markets developments and others. Accordingly, changes in any one or a combination of these factors may reduce the value of investment securities and, in turn, the underlying AUM on which our revenues are earned. These declines may cause investors to withdraw funds from our ETPs in favor of investments that they perceive as offering greater opportunity or lower risk, thereby compounding the impact on our revenues. We believe challenging and volatile market conditions will continue to be present in the foreseeable future.

We invest our corporate cash in short-term interest earning assets, primarily in our WisdomTree ETFs, federal agency debt instruments, money market instruments at a commercial bank and other securities which totaled $33.9 million and $35.7 million as of December 31, 2019 and September 30, 2020, respectively. We do not anticipate that changes in interest rates will have a material impact on our financial condition, operating results or cash flows.